Exhibit 25.1

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO

SECTION 305(b) (2)

GLAS TRUST COMPANY LLC

(Exact name of trustee as specified in its charter)

| A New Hampshire Limited Liability Company | 81-4468886 |

| (Jurisdiction of incorporation or | (I.R.S. Employer |

| organization if not a U.S. national | Identification No.) |

| bank) | |

| 3 Second Street, Suite 206 | 07311 |

| Jersey City, NJ | |

| (Address of principal executive offices) | (Zip code) |

GLAS AMERICAS LLC

230 Park Avenue, 3rd floor West

New York, New York 10169

(212) 808-3050

(Name, address and telephone number of agent for service)

IIP Operating Partnership, LP

(Exact name of obligor as specified in its charter)

| Delaware | 61-1800557 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 1389 Center Drive, Suite 200 | |

| Park City, Utah | |

| (858) 997-3332 | 84098 |

| (Address of principal executive offices) | (Zip code) |

$300,000,000 5.50% Senior Notes due 2026

Shelf Indenture – Debt Securities

(Title of the indenture securities)

| Item 1. | General Information. Furnish the following information as to the trustee: |

| (a) | Name and address of each examining or supervising authority to which it is subject. |

Comptroller of the Currency

Treasury Department

Washington, D.C.

Federal Deposit Insurance Corporation

Washington, D.C.

Federal Reserve Bank of San Francisco

San Francisco, California 94120

| (b) | Whether it is authorized to exercise corporate trust powers. |

The trustee is authorized to exercise corporate trust powers.

| Item 2. | Affiliations with Obligor. If the obligor is an affiliate of the trustee, describe each such affiliation. |

None with respect to the trustee.

No responses are included for Items 3-14 of this Form T-1 because the obligor is not in default as provided under Item 13.

| Item 15. | Foreign Trustee. | Not applicable. |

| Item 16. | List of Exhibits. | List below all exhibits filed as a part of this Statement of Eligibility. |

| | Exhibit 1. | | A copy of the Limited Liability Company Agreement of the trustee now in effect. * |

| | | | |

| | Exhibit 2. | | A copy of the State of New Hampshire – Office of the Bank Commissioner Certificate to Conduct Business for GLAS TRUST COMPANY LLC, dated February 23, 2017 * |

| | | | |

| | Exhibit 3. | | A copy of the State of New Hampshire Certificate to Exercise Corporate Trust Powers for GLAS TRUST COMPANY LLC, dtd. February 12, 2016. * |

| | | | |

| | Exhibit 4. | | Copy of By-laws of the trustee as now in effect. * |

| | | | |

| | Exhibit 5. | | Not applicable. |

| | | | |

| | Exhibit 6. | | The consent of the trustee required by Section 321(b) of the Act. |

| | Exhibit 7. | | A copy of the latest State of New Hampshire Call Report with Attestation of the trustee published pursuant to law or the requirements of its supervising or examining authority. |

| | | | |

| | Exhibit 8. | | Not applicable. |

| | | | |

| | Exhibit 9. | | Not applicable. |

* Incorporated by reference to the exhibit of the same number to the trustee’s Form T-1 filed as exhibit to the Filing F-10 dated May 10, 2019 of file number 333-230692.

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, GLAS Trust Company LLC , a New Hampshire Limited Liability Company organized and existing under the laws of the United States of America, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of New York and State of New York on the 06 Day of July 2021.

| | GLAS TRUST COMPANY LLC |

| | |

| | /s/ Diana Gulyan |

| | Diana Gulyan |

| | Assistant Vice President |

EXHIBIT 6

July 6, 2021

Securities and Exchange Commission

Washington, D.C. 20549

Gentlemen:

In accordance with Section 321(b) of the Trust Indenture Act of 1939, as amended, the undersigned hereby consents that reports of examination of the undersigned made by Federal, State, Territorial, or District authorities authorized to make such examination may be furnished by such authorities to the Securities and Exchange Commission upon its request therefor.

| | Very truly yours, |

| | |

| | GLAS TRUST COMPANY LLC |

| | |

| | /s/ Diana Gulyan |

| | Diana Gulyan |

| | Assistant Vice President |

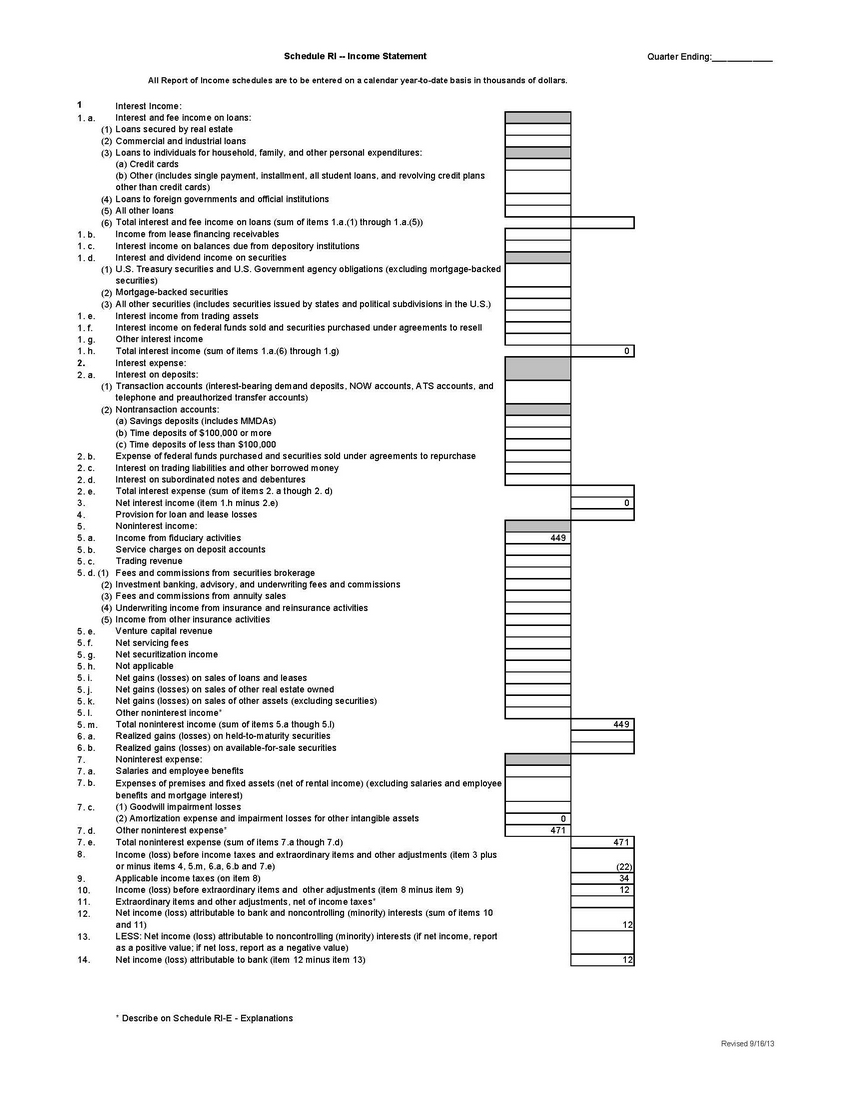

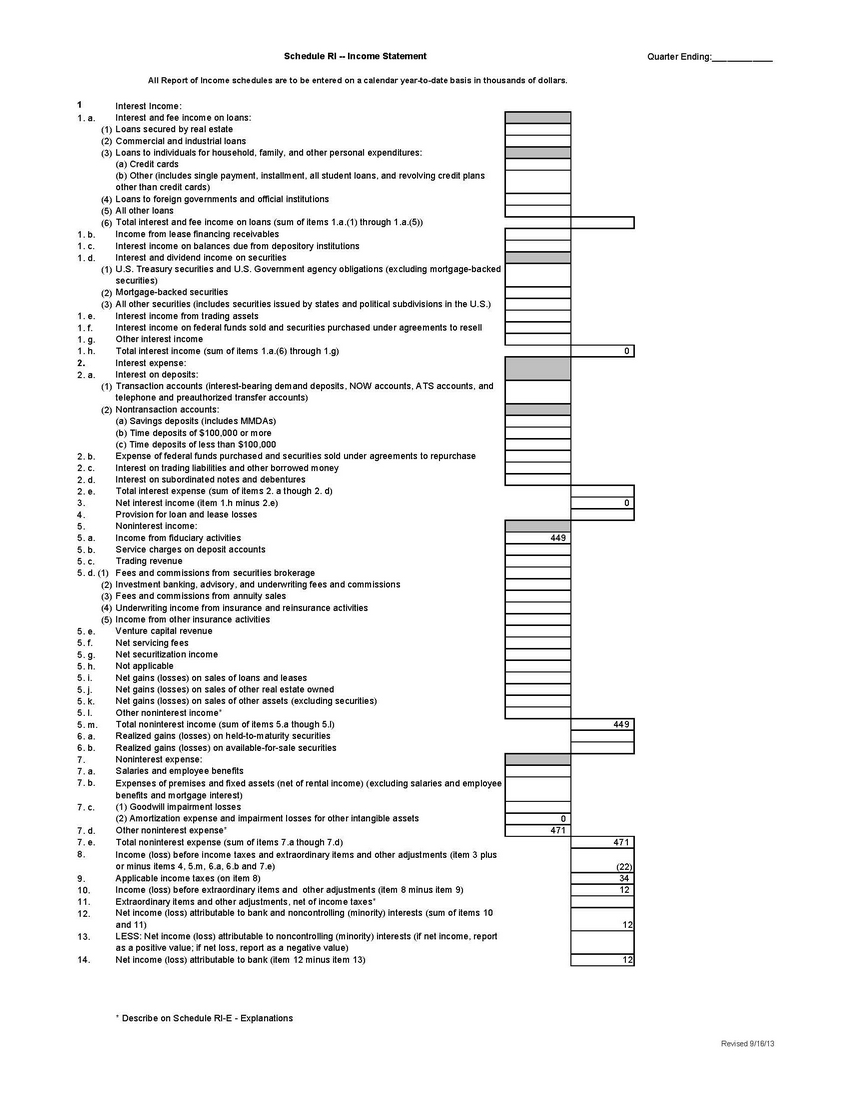

Schedule RI -- Income Statement Quarter Ending:All Report of Income schedules are to be entered on a calendar year-to-date basis in thousands of dollars.1 Interest Income: 1. a. Interest and fee income on loans: (1) Loans secured by real estate (2) Commercial and industrial loans (3) Loans to individuals for household, family, and other personal expenditures: (a) Credit cards (b) Other (includes single payment, installment, all student loans, and revolving credit plans other than credit cards) (4) Loans to foreign governments and official institutions (5) All other loans (6) Total interest and fee income on loans (sum of items 1.a.(1) through 1.a.(5)) 1. b. Income from lease financing receivables 1. c. Interest income on balances due from depository institutions 1. d. Interest and dividend income on securities (1) U.S. Treasury securities and U.S. Government agency obligations (excluding mortgage-backed securities) (2) Mortgage-backed securities (3) All other securities (includes securities issued by states and political subdivisions in the U.S.) 1. e. Interest income from trading assets 1. f. Interest income on federal funds sold and securities purchased under agreements to resell 1. g. Other interest income 1. h. Total interest income (sum of items 1.a.(6) through 1.g) 0 2. Interest expense: 2. a. Interest on deposits: (1) Transaction accounts (interest-bearing demand deposits, NOW accounts, ATS accounts, and telephone and preauthorized transfer accounts) (2) Nontransaction accounts: (a) Savings deposits (includes MMDAs) (b) Time deposits of $100,000 or more (c) Time deposits of less than $100,000 2. b. Expense of federal funds purchased and securities sold under agreements to repurchase 2. c. Interest on trading liabilities and other borrowed money 2. d. Interest on subordinated notes and debentures 2. e. Total interest expense (sum of items 2. a though 2. d) 3. Net interest income (item 1.h minus 2.e) 0 4. Provision for loan and lease losses 5. Noninterest income: 5. a. Income from fiduciary activities 449 5. b. Service charges on deposit accounts 5. c. Trading revenue 5. d. (1) Fees and commissions from securities brokerage (2) Investment banking, advisory, and underwriting fees and commissions (3) Fees and commissions from annuity sales (4) Underwriting income from insurance and reinsurance activities (5) Income from other insurance activities 5. e. Venture capital revenue 5. f. Net servicing fees 5. g. Net securitization income 5. h. Not applicable 5. i. Net gains (losses) on sales of loans and leases 5. j. Net gains (losses) on sales of other real estate owned 5. k. Net gains (losses) on sales of other assets (excluding securities) 5. l. Other noninterest income* 5. m. Total noninterest income (sum of items 5.a though 5.l) 449 6. a. Realized gains (losses) on held-to-maturity securities 6. b. Realized gains (losses) on available-for-sale securities 7. Noninterest expense: 7. a. Salaries and employee benefits 7. b. Expenses of premises and fixed assets (net of rental income) (excluding salaries and employee benefits and mortgage interest) 7. c. (1) Goodwill impairment losses (2) Amortization expense and impairment losses for other intangible assets 0 7. d. Other noninterest expense* 471 7. e. Total noninterest expense (sum of items 7.a though 7.d) 471 8. Income (loss) before income taxes and extraordinary items and other adjustments (item 3 plus or minus items 4, 5.m, 6.a, 6.b and 7.e) (22) 9. Applicable income taxes (on item 8) 34 10. Income (loss) before extraordinary items and other adjustments (item 8 minus item 9) 12 11. Extraordinary items and other adjustments, net of income taxes* 12. Net income (loss) attributable to bank and noncontrolling (minority) interests (sum of items 10 and 11) 12 13. LESS: Net income (loss) attributable to noncontrolling (minority) interests (if net income, report as a positive value; if net loss, report as a negative value) 14. Net income (loss) attributable to bank (item 12 minus item 13) 12* Describe on Schedule RI-E - ExplanationsRevised 9/16/13

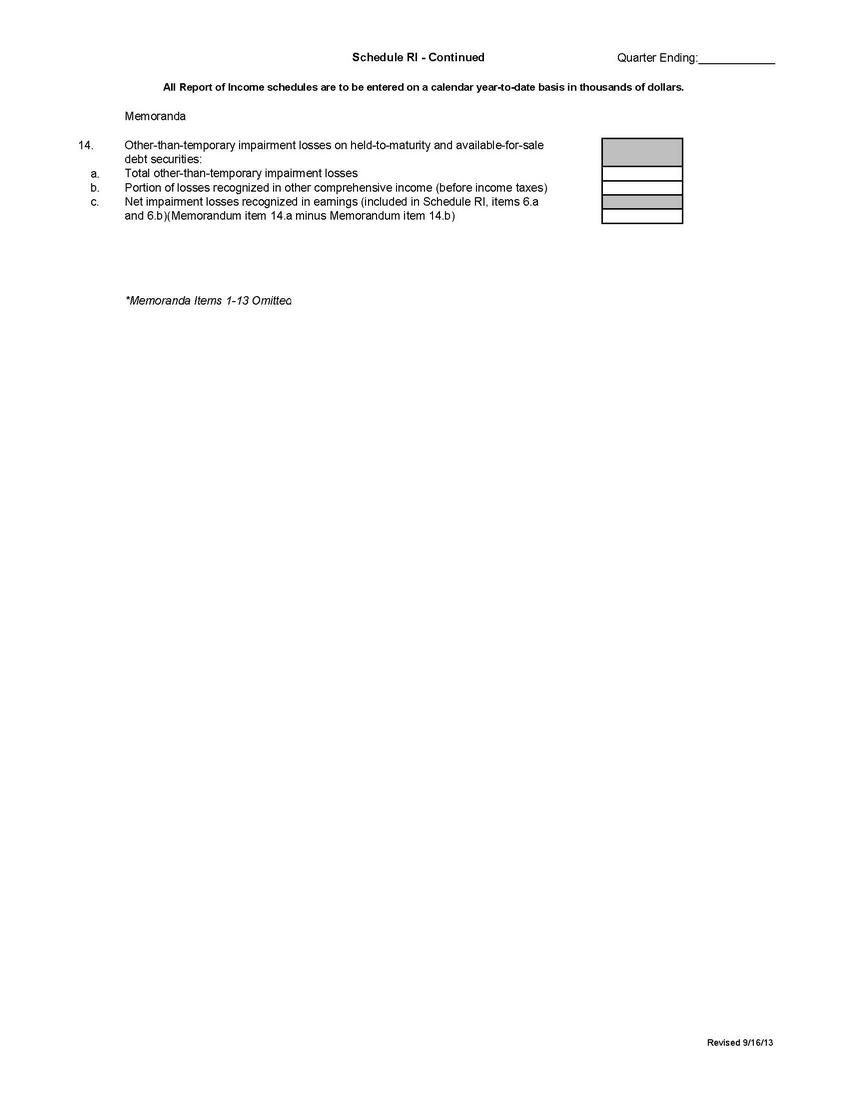

Schedule RI - Continued Quarter Ending: All Report of Income schedules are to be entered on a calendar year - to - date basis in thousands of dollars. Memoranda 14. Other - than - temporary impairment losses on held - to - maturity and available - for - sale debt securities: Total other - than - temporary impairment losses Portion of losses recognized in other comprehensive income (before income taxes) Net impairment losses recognized in earnings (included in Schedule RI, items 6.a and 6.b)(Memorandum item 14.a minus Memorandum item 14.b) a. b. c. *Memoranda Items 1 - 13 Omitted Revised 9/16/13

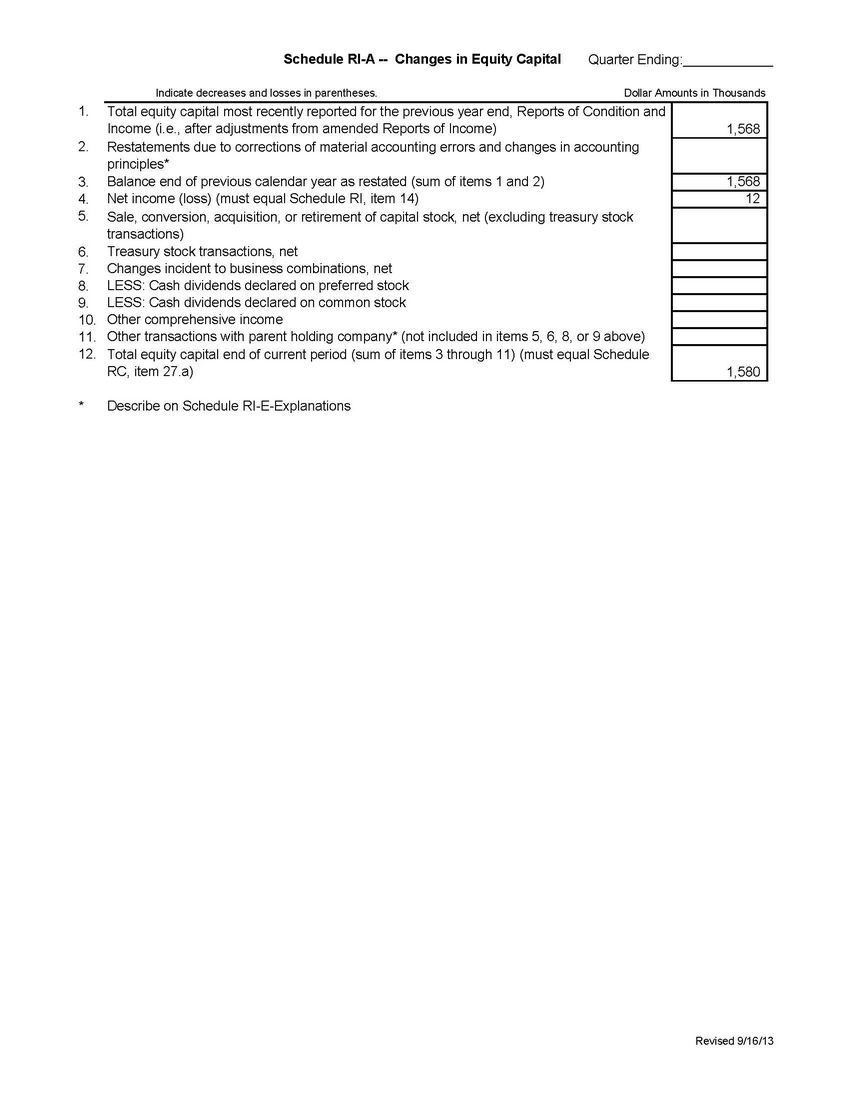

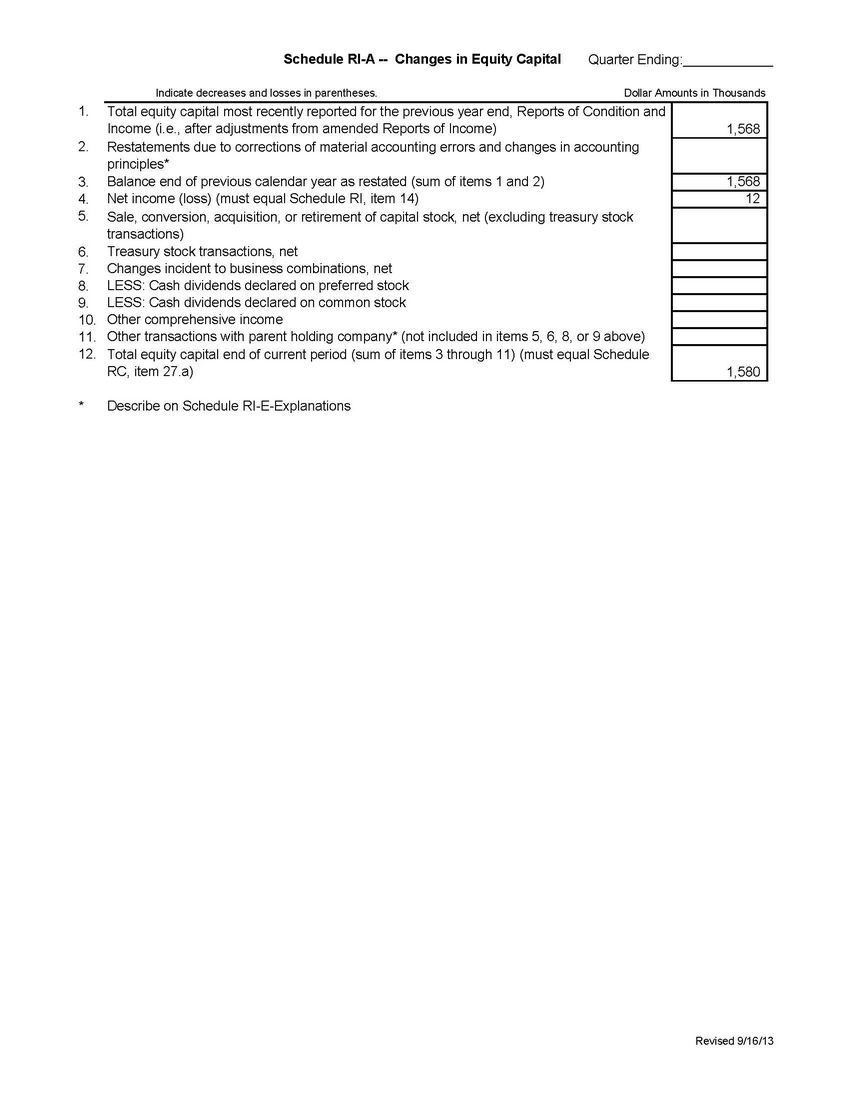

Quarter Ending: Total equity capital most recently reported for the previous year end, Reports of Condition and Income (i.e., after adjustments from amended Reports of Income) Restatements due to corrections of material accounting errors and changes in accounting principles* Balance end of previous calendar year as restated (sum of items 1 and 2) Net income (loss) (must equal Schedule RI, item 14) Sale, conversion, acquisition, or retirement of capital stock, net (excluding treasury stock transactions) Treasury stock transactions, net Changes incident to business combinations, net LESS: Cash dividends declared on preferred stock LESS: Cash dividends declared on common stock Other comprehensive income Other transactions with parent holding company* (not included in items 5, 6, 8, or 9 above) Total equity capital end of current period (sum of items 3 through 11) (must equal Schedule RC, item 27.a) 1,568 1,568 12 1,580 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. * Describe on Schedule RI - E - Explanations Schedule RI - A -- Changes in Equity Capital Indicate decreases and losses in parentheses. Dollar Amounts in Thousands Revised 9/16/13

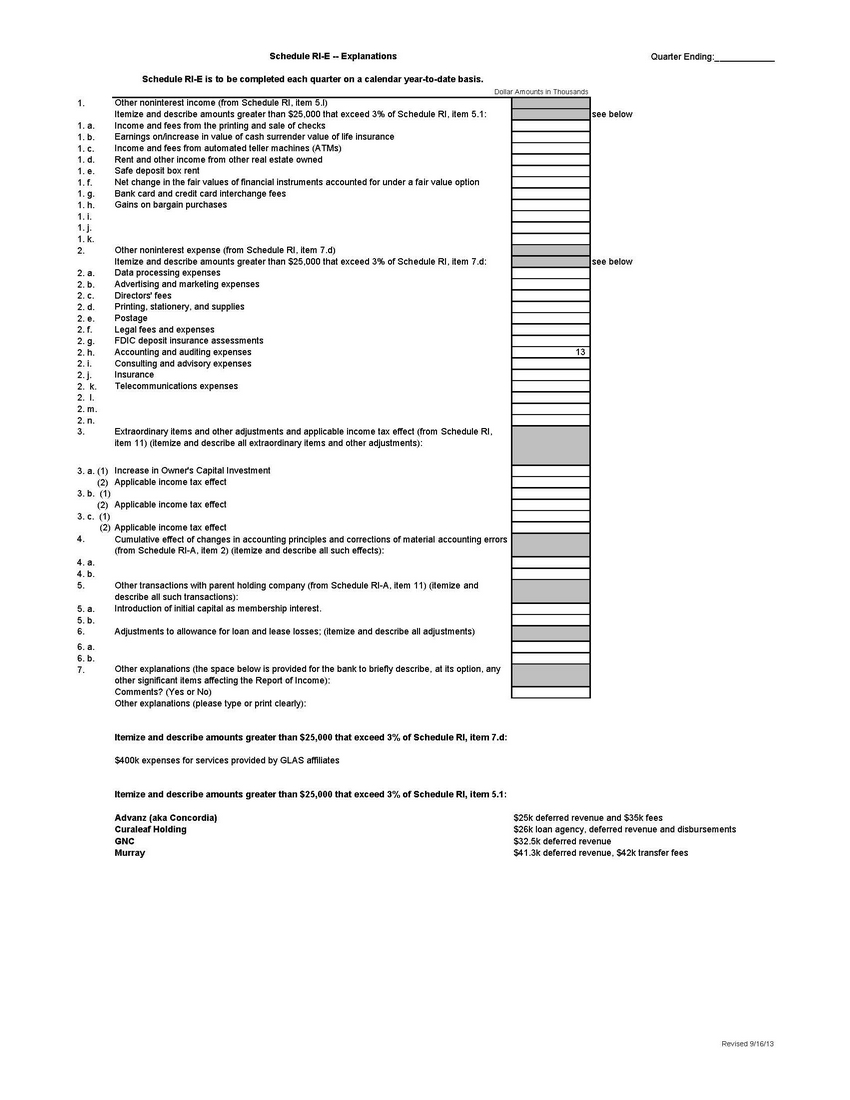

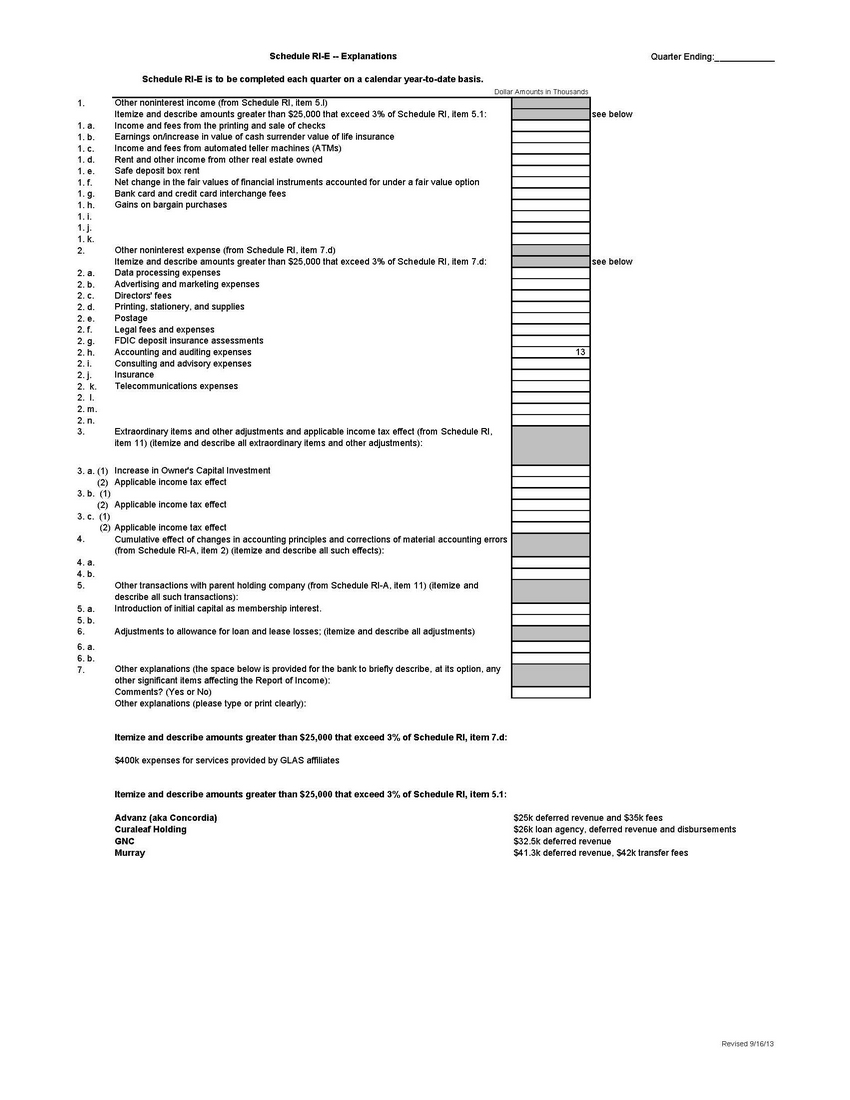

Quarter Ending: 1. see below Other noninterest income (from Schedule RI, item 5.l) Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule RI, item 5.1: Income and fees from the printing and sale of checks Earnings on/increase in value of cash surrender value of life insurance Income and fees from automated teller machines (ATMs) Rent and other income from other real estate owned Safe deposit box rent Net change in the fair values of financial instruments accounted for under a fair value option Bank card and credit card interchange fees Gains on bargain purchases 1. a. 1. b. 1. c. 1. d. 1. e. 1. f. 1. g. 1. h. 1. i. 1. j. 1. k. 2. see below 13 Other noninterest expense (from Schedule RI, item 7.d) Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule RI, item 7.d: 2. a. Data processing expenses 2. b. Advertising and marketing expenses 2. c. Directors' fees 2. d. Printing, stationery, and supplies 2. e. Postage 2. f. Legal fees and expenses 2. g. FDIC deposit insurance assessments 2. h. Accounting and auditing expenses 2. i. Consulting and advisory expenses 2. j. Insurance 2. k. Telecommunications expenses 2. l. 2. m. 2. n. 3. Extraordinary items and other adjustments and applicable income tax effect (from Schedule RI, item 11) (itemize and describe all extraordinary items and other adjustments): 3. a. (1) Increase in Owner's Capital Investment (2) Applicable income tax effect 3. b. (1) (2) Applicable income tax effect 3. c. (1) (2) Applicable income tax effect 4. Cumulative effect of changes in accounting principles and corrections of material accounting errors (from Schedule RI - A, item 2) (itemize and describe all such effects): 4. a. 4. b. 5. Other transactions with parent holding company (from Schedule RI - A, item 11) (itemize and describe all such transactions): Introduction of initial capital as membership interest. 5. a. 5. b. 6. 6. a. 6. b. 7. Adjustments to allowance for loan and lease losses; (itemize and describe all adjustments) Other explanations (the space below is provided for the bank to briefly describe, at its option, any other significant items affecting the Report of Income): Comments? (Yes or No) Other explanations (please type or print clearly): Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule RI, item 7.d: $400k expenses for services provided by GLAS affiliates Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule RI, item 5.1: Schedule RI - E is to be completed each quarter on a calendar year - to - date basis. Dollar Amounts in Thousands Advanz (aka Concordia) Curaleaf Holding GNC Murray $25k deferred revenue and $35k fees $26k loan agency, deferred revenue and disbursements $32.5k deferred revenue $41.3k deferred revenue, $42k transfer fees Schedule RI - E -- Explanations Revised 9/16/13

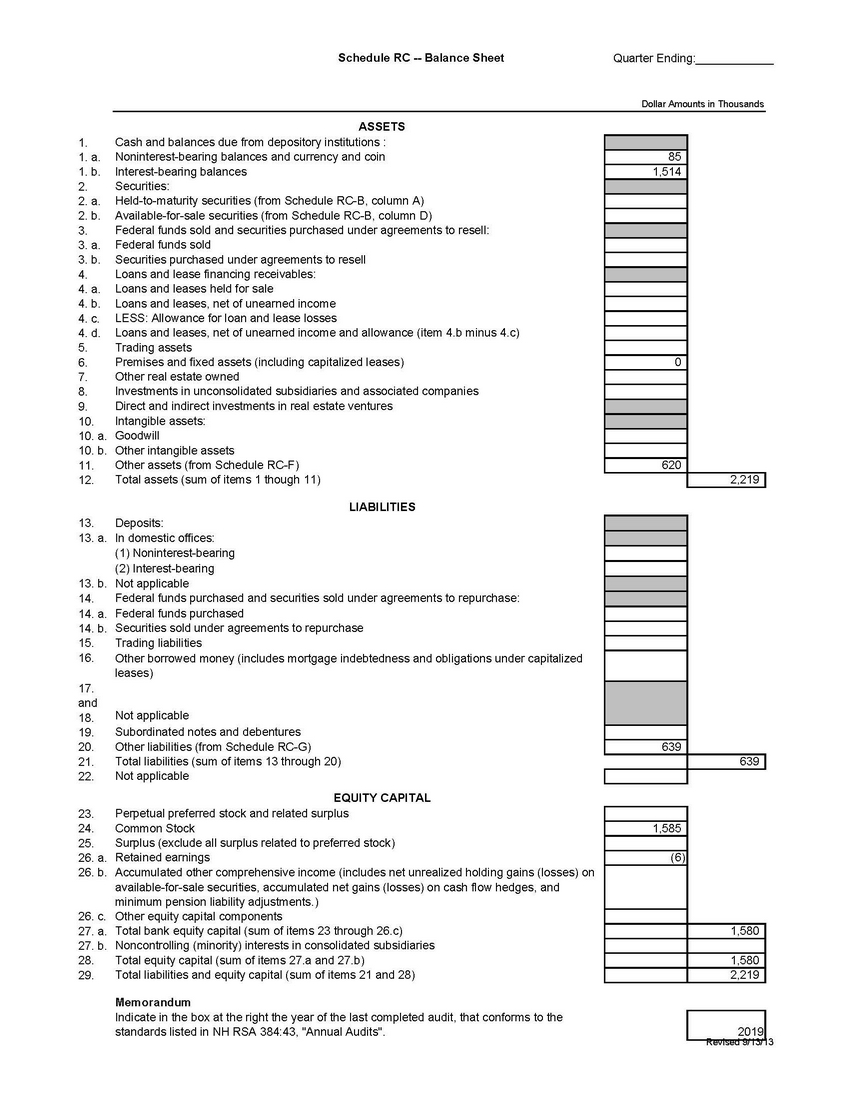

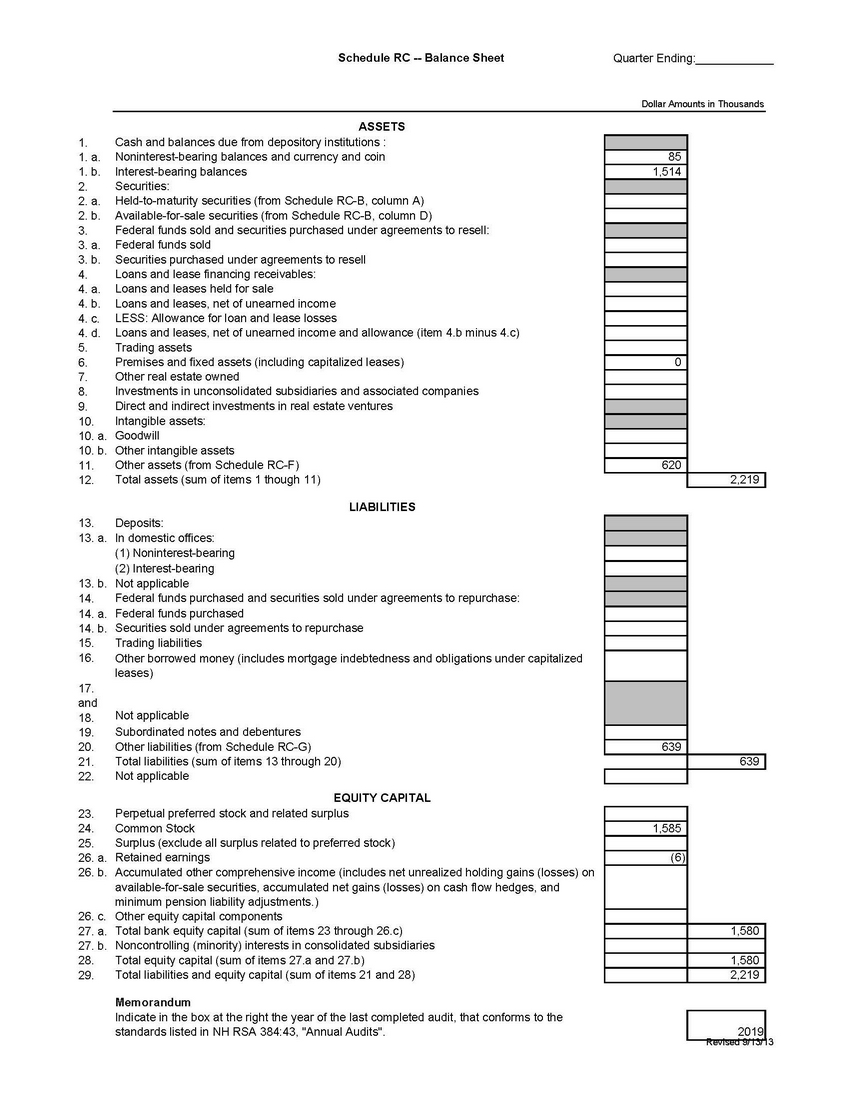

Quarter Ending: 85 1,514 0 620 2,219 639 639 ASSETS 1. Cash and balances due from depository institutions : 1. a. Noninterest - bearing balances and currency and coin 1. b. Interest - bearing balances 2. Securities: 2. a. Held - to - maturity securities (from Schedule RC - B, column A) 2. b. Available - for - sale securities (from Schedule RC - B, column D) 3. Federal funds sold and securities purchased under agreements to resell: 3. a. Federal funds sold 3. b. Securities purchased under agreements to resell 4. Loans and lease financing receivables: 4. a. Loans and leases held for sale 4. b. Loans and leases, net of unearned income 4. c. LESS: Allowance for loan and lease losses 4. d. Loans and leases, net of unearned income and allowance (item 4.b minus 4.c) 5. Trading assets 6. Premises and fixed assets (including capitalized leases) 7. Other real estate owned 8. Investments in unconsolidated subsidiaries and associated companies 9. Direct and indirect investments in real estate ventures 10. Intangible assets: 10. a. Goodwill 10. b. Other intangible assets 11. Other assets (from Schedule RC - F) 12. Total assets (sum of items 1 though 11) LIABILITIES 13. Deposits: 14. a. In domestic offices: (1) Noninterest - bearing (2) Interest - bearing 15. b. Not applicable 16. Federal funds purchased and securities sold under agreements to repurchase: 14. a. Federal funds purchased 14. b. Securities sold under agreements to repurchase 15. Trading liabilities 16. Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) and 18. Not applicable 19. Subordinated notes and debentures 20. Other liabilities (from Schedule RC - G) 21. Total liabilities (sum of items 13 through 20) 22. Not applicable EQUITY CAPITAL 23. Perpetual preferred stock and related surplus 24. Common Stock 25. Surplus (exclude all surplus related to preferred stock) 26. a. Retained earnings 26. b. Accumulated other comprehensive income (includes net unrealized holding gains (losses) on available - for - sale securities, accumulated net gains (losses) on cash flow hedges, and minimum pension liability adjustments.) 26. c. Other equity capital components 27. a. Total bank equity capital (sum of items 23 through 26.c) 28. b. Noncontrolling (minority) interests in consolidated subsidiaries 29. Total equity capital (sum of items 27.a and 27.b) 30. Total liabilities and equity capital (sum of items 21 and 28) 1,585 (6) 1,580 1,580 2 , 219 Memorandum Indicate in the box at the right the year of the last completed audit, that conforms to the standards listed in NH RSA 384:43, "Annual Audits". 2019 Schedule RC -- Balance Sheet Dollar Amounts in Thousands Revised 9/13/13

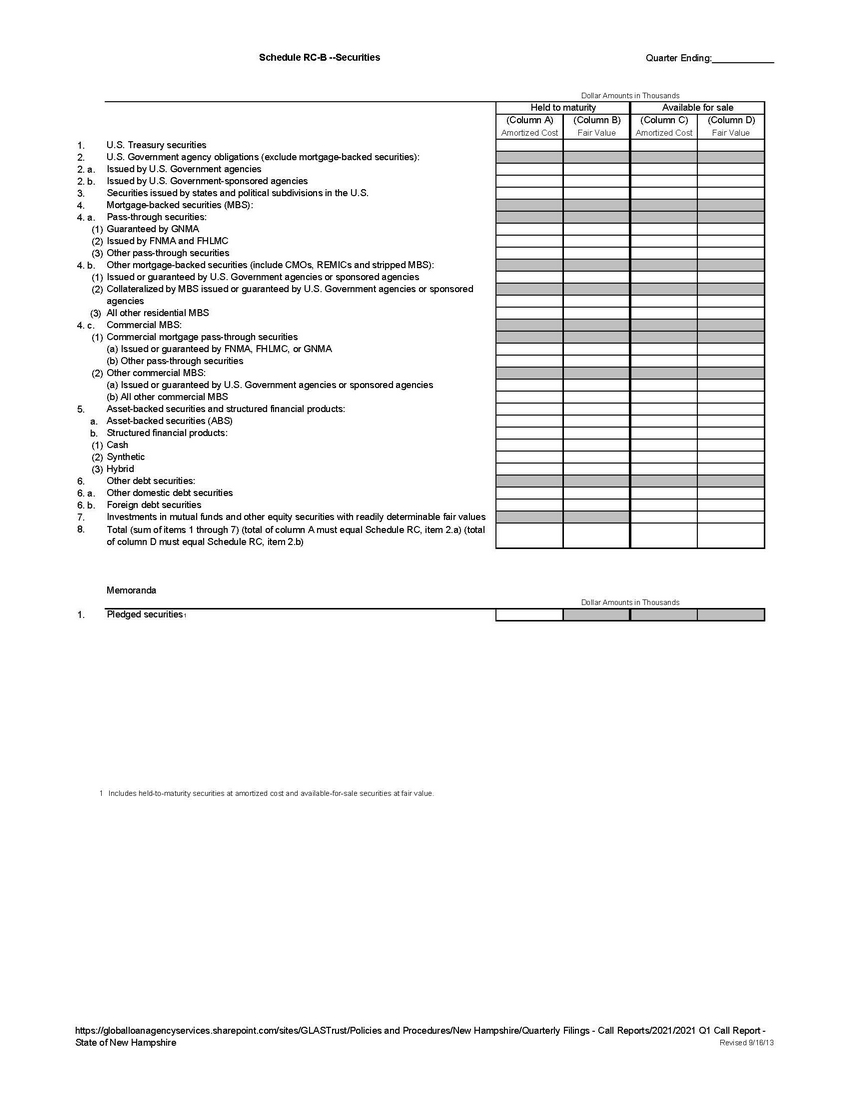

Quarter Ending: 1. 2. 2. a. 2. b. 3. 4. 4. a. (1) (2) (3) 4. b. (1) (2) (3) 4. c. (1) (2) 5. a. b. (1) (2) (3) 6. 6. a. 6. b. 7. 8. U.S. Treasury securities U.S. Government agency obligations (exclude mortgage - backed securities): Issued by U.S. Government agencies Issued by U.S. Government - sponsored agencies Securities issued by states and political subdivisions in the U.S. Mortgage - backed securities (MBS): Pass - through securities: Guaranteed by GNMA Issued by FNMA and FHLMC Other pass - through securities Other mortgage - backed securities (include CMOs, REMICs and stripped MBS): Issued or guaranteed by U.S. Government agencies or sponsored agencies Collateralized by MBS issued or guaranteed by U.S. Government agencies or sponsored agencies All other residential MBS Commercial MBS: Commercial mortgage pass - through securities (a) Issued or guaranteed by FNMA, FHLMC, or GNMA (b) Other pass - through securities Other commercial MBS: (c) Issued or guaranteed by U.S. Government agencies or sponsored agencies (d) All other commercial MBS Asset - backed securities and structured financial products: Asset - backed securities (ABS) Structured financial products: Cash Synthetic Hybrid Other debt securities: Other domestic debt securities Foreign debt securities Investments in mutual funds and other equity securities with readily determinable fair values Total (sum of items 1 through 7) (total of column A must equal Schedule RC, item 2.a) (total of column D must equal Schedule RC, item 2.b) Held to maturity Available for sale (Column A) Amortized Cost (Column B) Fair Value (Column C) Amortized Cost (Column D) Fair Value Memoranda 1. Pledged securities 1 1 Includes held - to - maturity securities at amortized cost and available - for - sale securities at fair value. Dollar Amounts in Thousands Schedule RC - B -- Securities Dollar Amounts in Thousands https://globalloanagencyservices.sharepoint.com/sites/GLASTrust/Policies and Procedures/New Hampshire/Quarterly Filings - Call Reports/2021/2021 Q1 Call Report - State of New Hampshire Revised 9/16/13

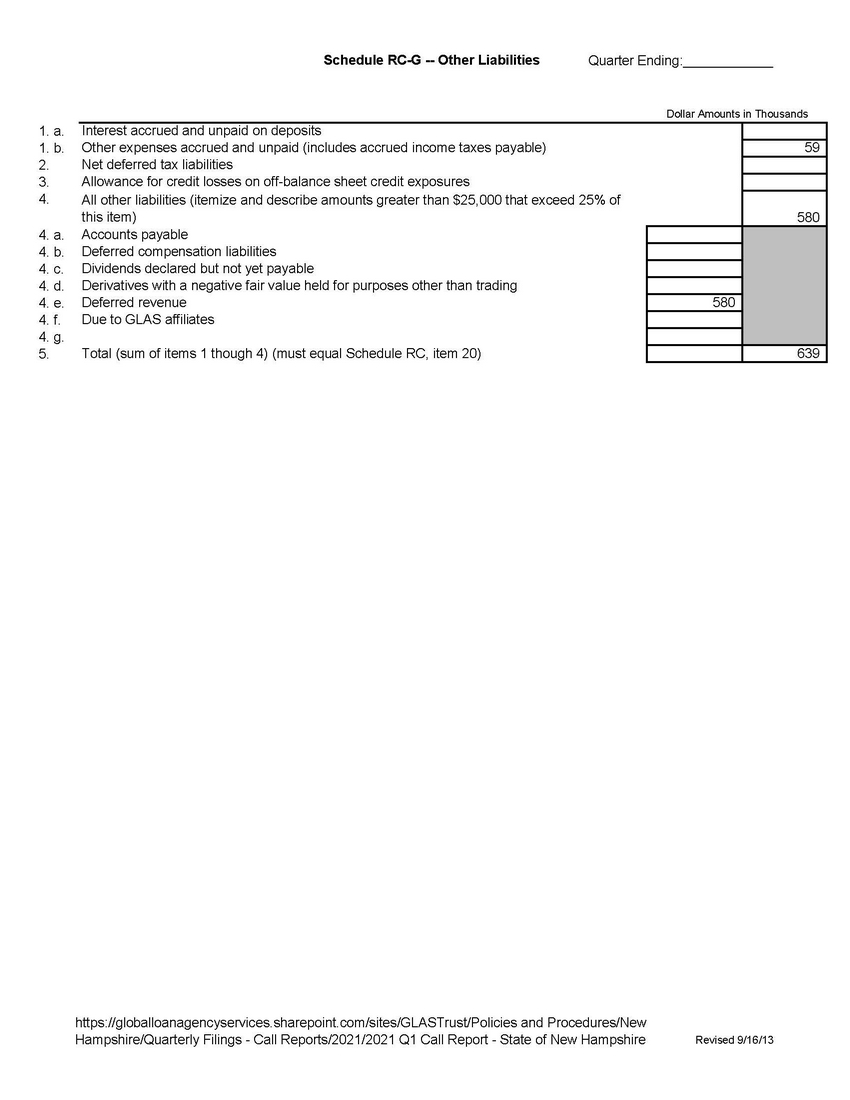

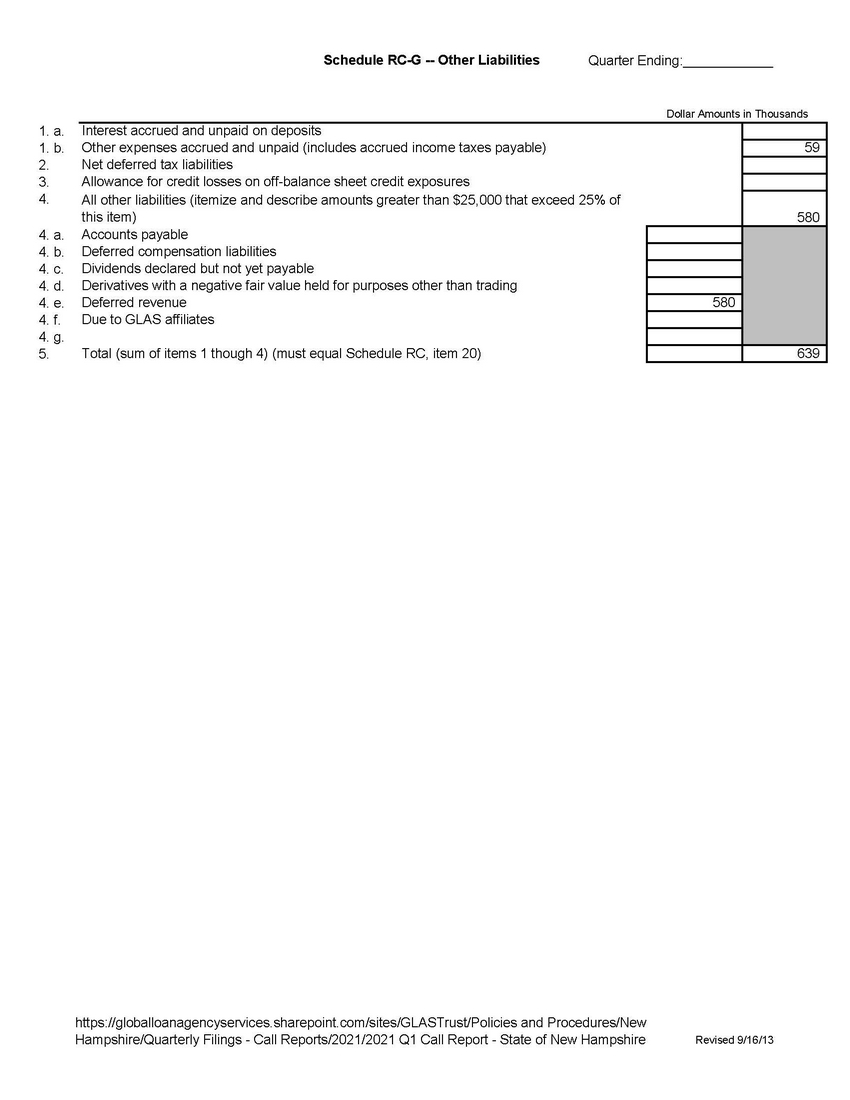

Quarter Ending: Interest accrued and unpaid on deposits Other expenses accrued and unpaid (includes accrued income taxes payable) Net deferred tax liabilities Allowance for credit losses on off - balance sheet credit exposures All other liabilities (itemize and describe amounts greater than $25,000 that exceed 25% of this item) 59 580 Accounts payable Deferred compensation liabilities Dividends declared but not yet payable Derivatives with a negative fair value held for purposes other than trading Deferred revenue Due to GLAS affiliates Total (sum of items 1 though 4) (must equal Schedule RC, item 20) 580 639 1. a. 1. b. 2. 3. 4. 4. a. 4. b. 4. c. 4. d. 4. e. 4. f. 4. g. 5. Schedule RC - G -- Other Liabilities Dollar Amounts in Thousands https://globalloanagencyservices.sharepoint.com/sites/GLASTrust/Policies and Procedures/New Hampshire/Quarterly Filings - Call Reports/2021/2021 Q1 Call Report - State of New Hampshire Revised 9/16/13

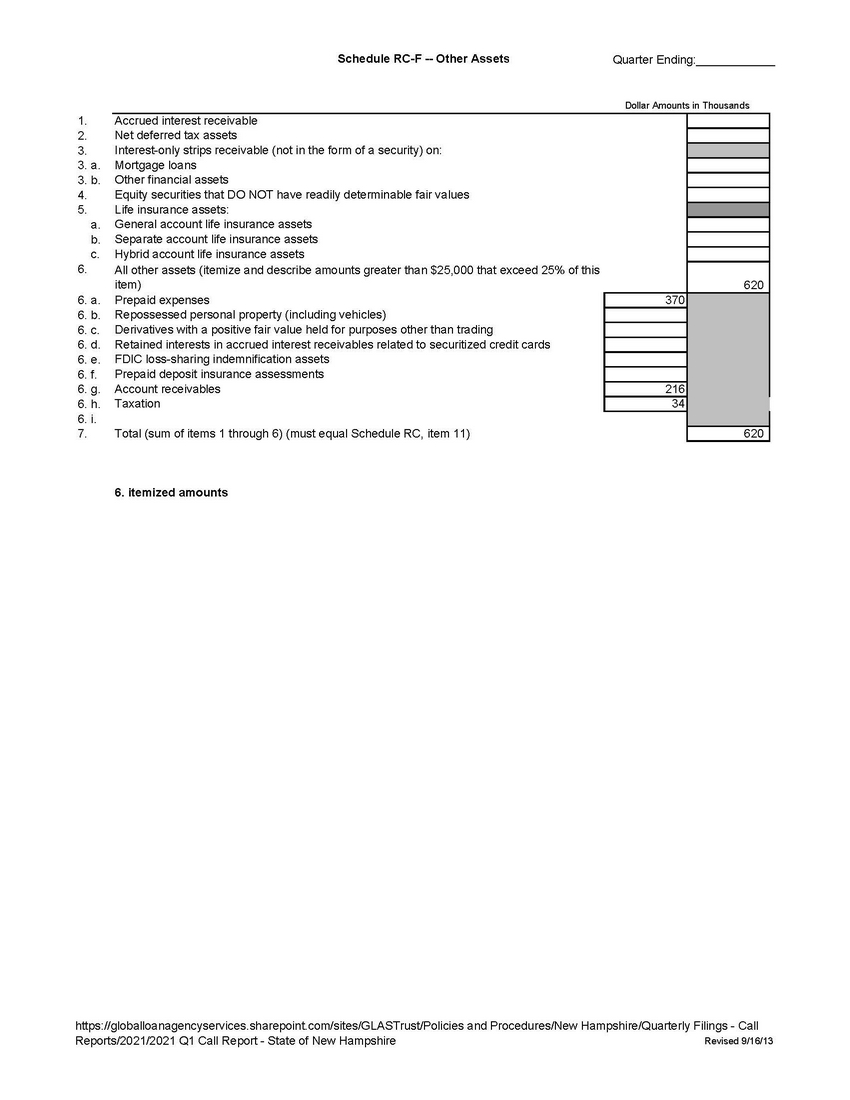

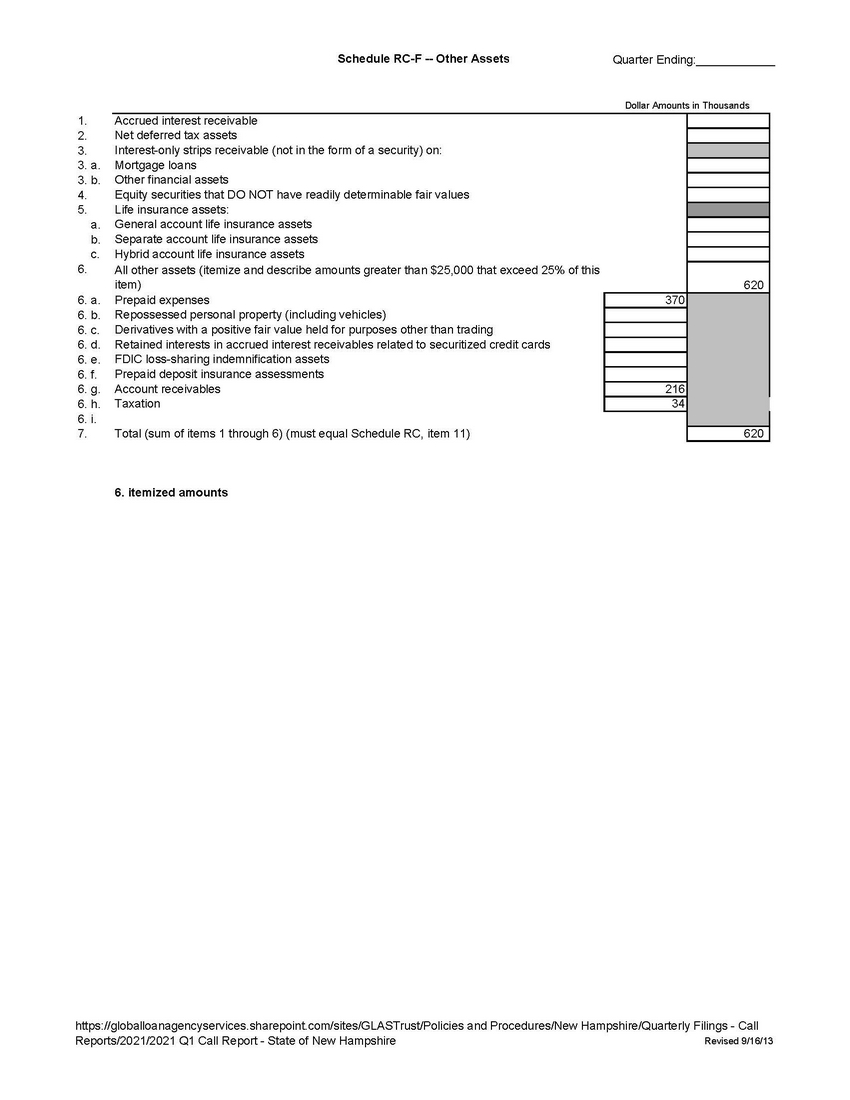

Quarter Ending: Accrued interest receivable Net deferred tax assets Interest - only strips receivable (not in the form of a security) on: Mortgage loans Other financial assets Equity securities that DO NOT have readily determinable fair values Life insurance assets: General account life insurance assets Separate account life insurance assets Hybrid account life insurance assets All other assets (itemize and describe amounts greater than $25,000 that exceed 25% of this item) 620 Prepaid expenses Repossessed personal property (including vehicles) Derivatives with a positive fair value held for purposes other than trading Retained interests in accrued interest receivables related to securitized credit cards FDIC loss - sharing indemnification assets Prepaid deposit insurance assessments Account receivables Taxation 370 216 34 Total (sum of items 1 through 6) (must equal Schedule RC, item 11) 620 1. 2. 3. 3. a. 3. b. 4. 5. a. b. c. 6. 6. a. 6. b. 6. c. 6. d. 6. e. 6. f. 6. g. 6. h. 6. i. 7. 6. itemized amounts Schedule RC - F -- Other Assets Dollar Amounts in Thousands https://globalloanagencyservices.sharepoint.com/sites/GLASTrust/Policies and Procedures/New Hampshire/Quarterly Filings - Call Reports/2021/2021 Q1 Call Report - State of New Hampshire Revised 9/16/13

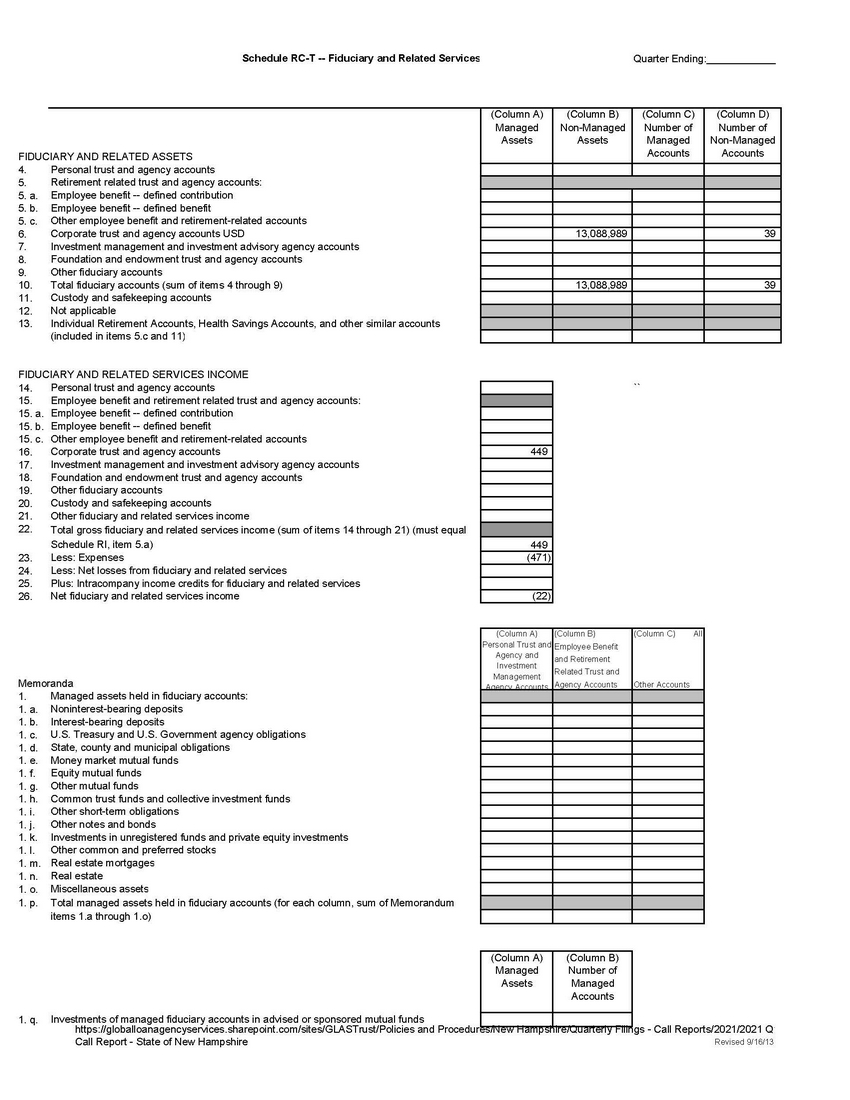

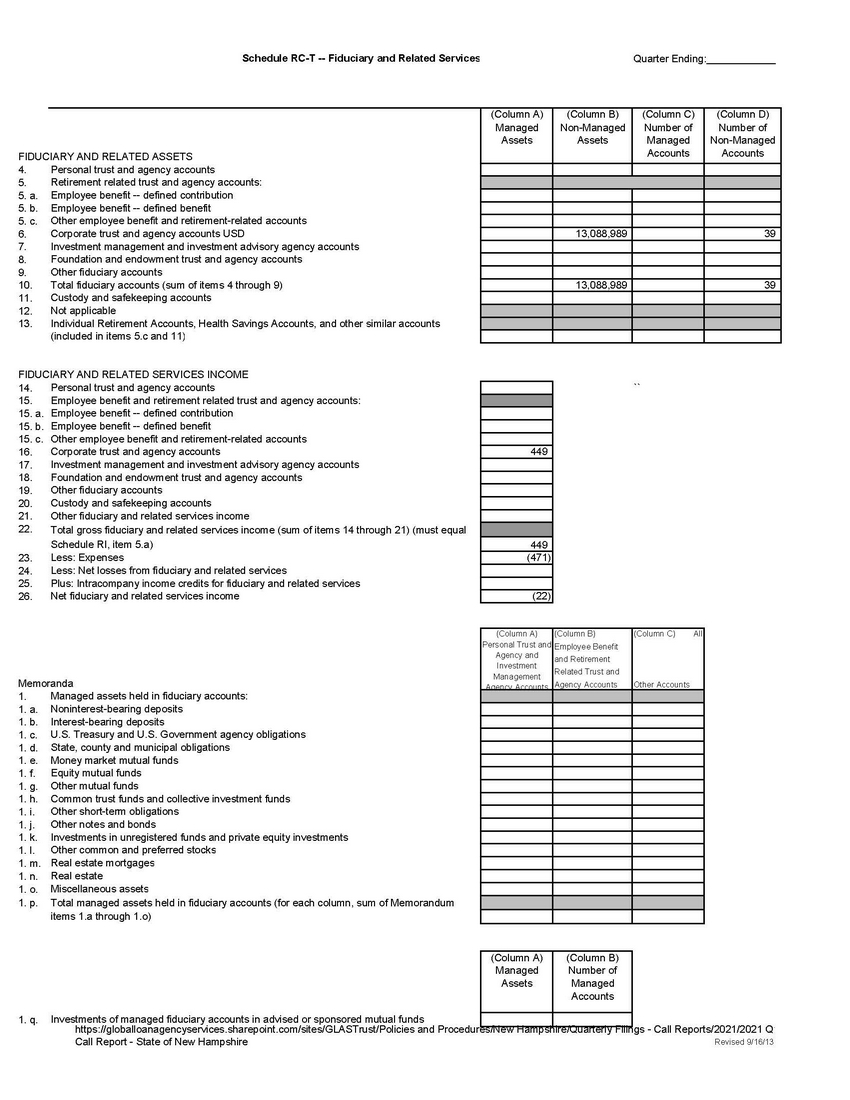

Quarter Ending: (Column A) Managed Assets (Column B) Non - Managed Assets (Column C) Number of Managed Accounts (Column D) Number of Non - Managed Accounts 13,088,989 3 9 13,088,989 39 449 449 (471) (22) (Column A) Personal Trust and Agency and Investment Management Agency Accounts (Column B) Employee Benefit and Retirement Related Trust and Agency Accounts (Column C ) All Other Accounts 14. Personal trust and agency accounts 15. Employee benefit and retirement related trust and agency accounts: `` 15. a. Employee benefit -- defined contribution 15. b. Employee benefit -- defined benefit 15. c. Other employee benefit and retirement - related accounts 16. Corporate trust and agency accounts 17. Investment management and investment advisory agency accounts 18. Foundation and endowment trust and agency accounts 19. Other fiduciary accounts 20. Custody and safekeeping accounts 21. Other fiduciary and related services income 22. Total gross fiduciary and related services income (sum of items 14 through 21) (must equal Schedule RI, item 5.a) 23. Less: Expenses 24. Less: Net losses from fiduciary and related services 25. Plus: Intracompany income credits for fiduciary and related services 26. Net fiduciary and related services income FIDUCIARY AND RELATED ASSETS 4. Personal trust and agency accounts 5. Retirement related trust and agency accounts: 5. a. Employee benefit -- defined contribution 5. b. Employee benefit -- defined benefit 5. c. Other employee benefit and retirement - related accounts 6. Corporate trust and agency accounts USD 7. Investment management and investment advisory agency accounts 8. Foundation and endowment trust and agency accounts 9. Other fiduciary accounts 10. Total fiduciary accounts (sum of items 4 through 9) 11. Custody and safekeeping accounts 12. Not applicable 13. Individual Retirement Accounts, Health Savings Accounts, and other similar accounts (included in items 5.c and 11) FIDUCIARY AND RELATED SERVICES INCOME Memoranda 1. Managed assets held in fiduciary accounts: 1. a. Noninterest - bearing deposits 1. b. Interest - bearing deposits 1. c. U.S. Treasury and U.S. Government agency obligations 1. d. State, county and municipal obligations 1. e. Money market mutual funds 1. f. Equity mutual funds 1. g. Other mutual funds 1. h. Common trust funds and collective investment funds 1. i. Other short - term obligations 1. j. Other notes and bonds 1. k. Investments in unregistered funds and private equity investments 1. l. Other common and preferred stocks 1. m. Real estate mortgages 1. n. 1. o. 1. p. Real estate Miscellaneous assets Total managed assets held in fiduciary accounts (for each column, sum of Memorandum items 1.a through 1.o) (Column A) Managed Assets (Column B) Number of Managed Accounts 1. q. Investments of managed fiduciary accounts in advised or sponsored mutual funds Schedule RC - T -- Fiduciary and Related Services https://globalloanagencyservices.sharepoint.com/sites/GLASTrust/Policies and Procedures/New Hampshire/Quarterly Filings - Call Reports/2021/2021 Q Call Report - State of New Hampshire Revised 9/16/13

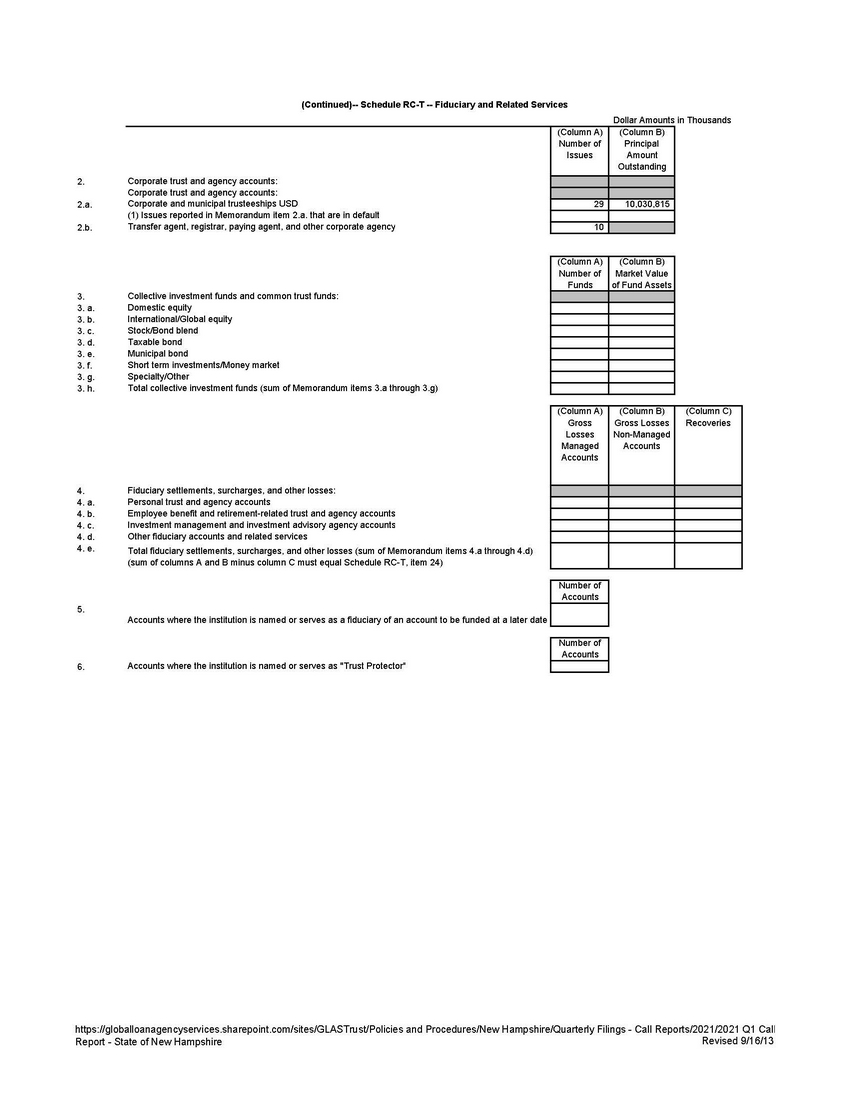

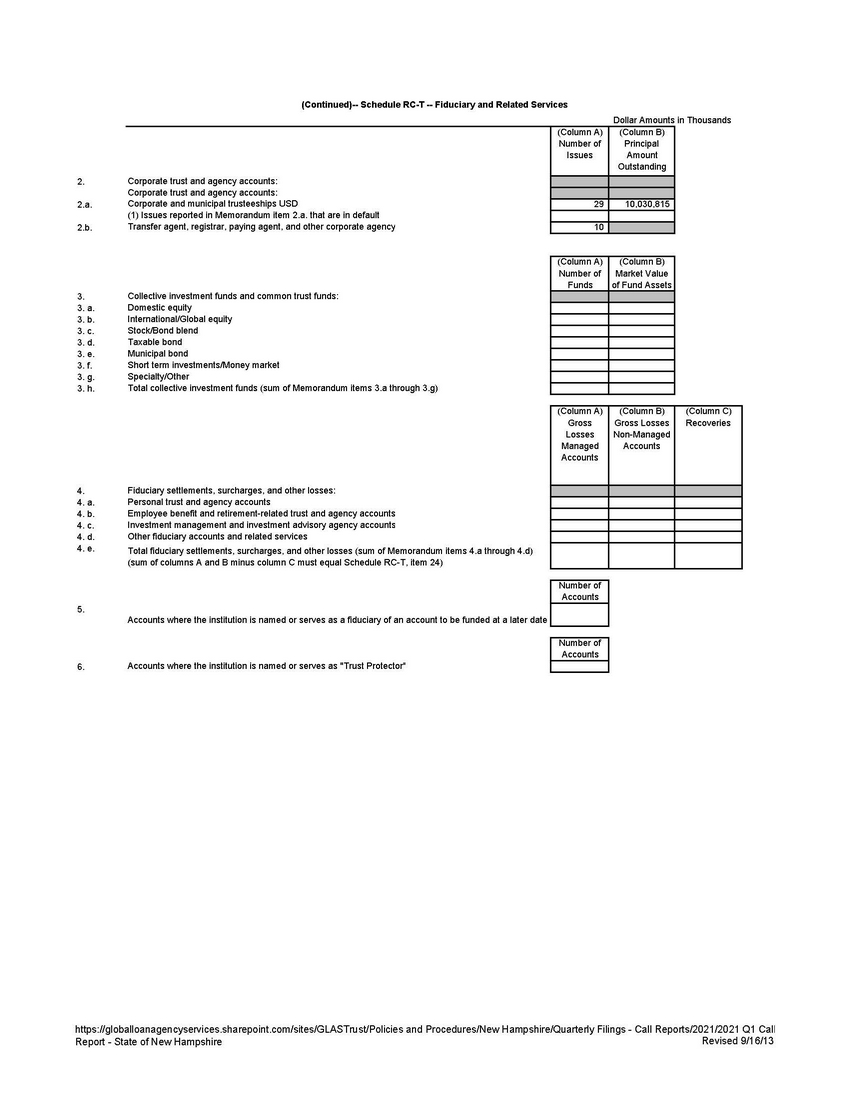

Corporate trust and agency accounts: Corporate trust and agency accounts: Corporate and municipal trusteeships USD (1) Issues reported in Memorandum item 2.a. that are in default Transfer agent, registrar, paying agent, and other corporate agency (Column A) Number of Issues (Column B) Principal Amount Outstanding 29 10,030,815 10 (Column A) Number of Funds (Column B) Market Value of Fund Assets (Column A) (Column B) (Column C) Gross Gross Losses Recoveries Losses Non - Managed Managed Accounts Accounts 2. 2.a. 2.b. 3. 3. a. 3. b. 3. c. 3. d. 3. e. 3. f. 3. g. 3. h. Collective investment funds and common trust funds: Domestic equity International/Global equity Stock/Bond blend Taxable bond Municipal bond Short term investments/Money market Specialty/Other Total collective investment funds (sum of Memorandum items 3.a through 3.g) 4. 4. a. 4. b. 4. c. 4. d. 4. e. Fiduciary settlements, surcharges, and other losses : Personal trust and agency accounts Employee benefit and retirement - related trust and agency accounts Investment management and investment advisory agency accounts Other fiduciary accounts and related services Total fiduciary settlements, surcharges, and other losses (sum of Memorandum items 4 . a through 4 . d) (sum of columns A and B minus column C must equal Schedule RC - T, item 24 ) Number of Accounts 5. Accounts where the institution is named or serves as a fiduciary of an account to be funded at a later date Number of Accounts 6. Accounts where the institution is named or serves as "Trust Protector" (Continued) -- Schedule RC - T -- Fiduciary and Related Services Dollar Amounts in Thousands https://globalloanagencyservices.sharepoint.com/sites/GLASTrust/Policies and Procedures/New Hampshire/Quarterly Filings - Call Reports/2021/2021 Q1 Call Report - State of New Hampshire Revised 9/16/13

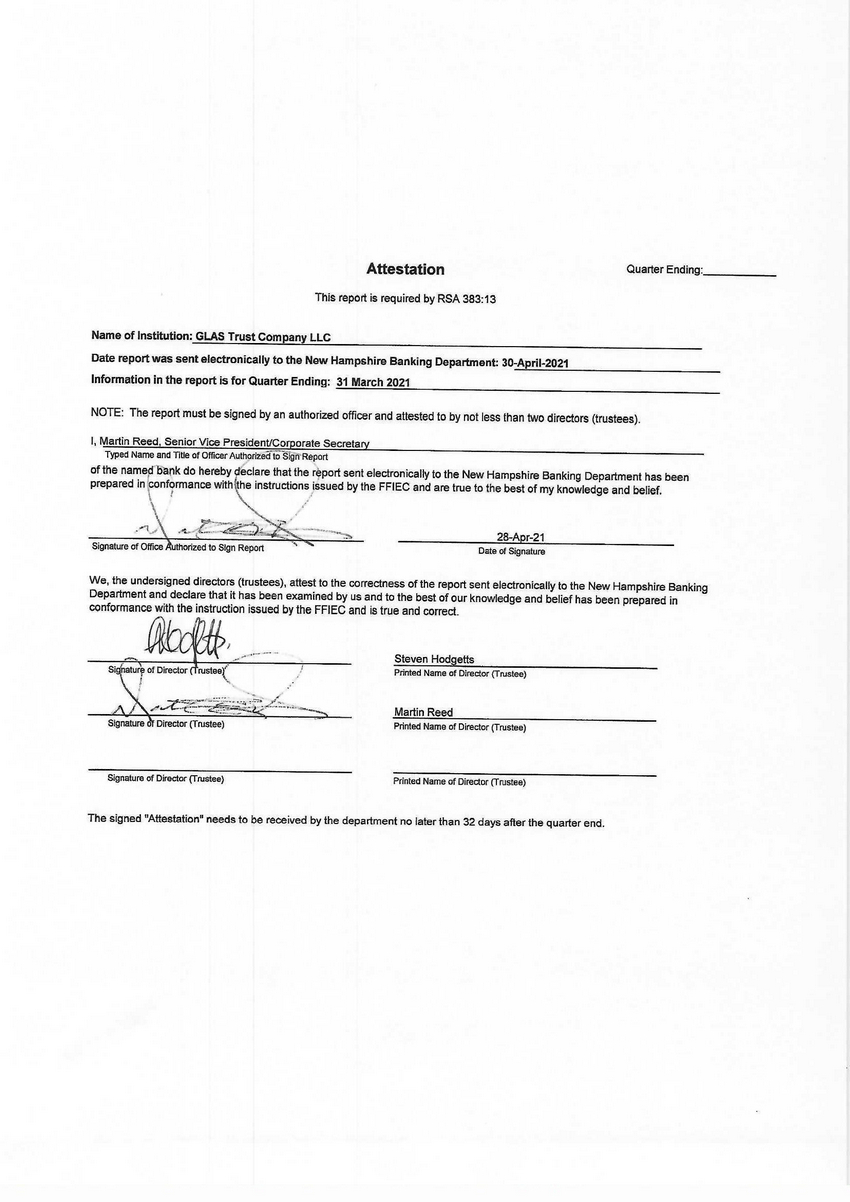

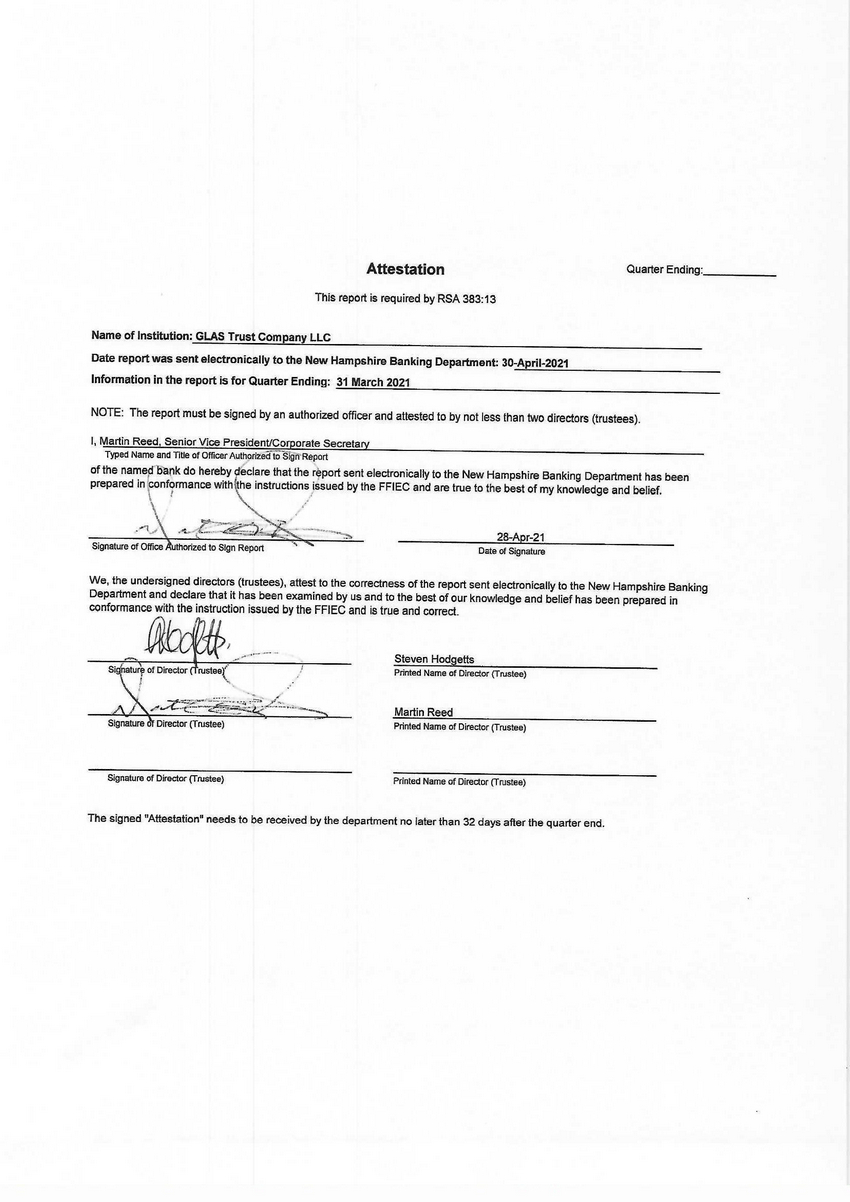

Attestation This report is required by RSA 383:13 Quarte r Endin g : _ Name of Institution: GLAS Trust Company LLC Dat e report wa s sent electronicall y t o th e Ne w Hampshir e Bankin g Departmen t 30 - _ A p_r_il - _2_0_2_ 1 _ Information in the report is for Quarter Ending: ""31"""""Maaaa'"'rc""'h'""2""'0;.a2""'1 NOTE : The report must be signed by an authorized officer and attested to by no t l ess than two directors (tru stees) . I, Martin Reed, Senior Vice PresidenVCorporate Secretary Typed Name and Title or Olftcer Authorized t o SlgltReport of the namecfbaok do hereby eclare that the r port sen t electronically to the New Hampshire Banking Department has been prepared in conformance with !he instructions issued by the FFIEC and are true lo the best of my knowledge and belief. I •.•• 28 - Apr - 21 Date of Signature We, the undersigned d ire ctors (trustees) , attest to the correctness of the report sent electronically to the New Hampshire Ban k ing Department and declare that it h as been examined by us and to the best of our knowledge and be li ef has been prepared in conformance with the i nstructionissued by the FFIEC and is true and correct . Steven Hodgetts Printed Name or D i rector (Trustee) Martin Reed Printed Name or Directo r (Trustee) Signature of D irector (Trustee) Printed Name of Director (frustee) The signed "Attestation" ne e d s to be rece i ved by the department n o later than 32 days after the quarter end.