As filed with the Securities and Exchange Commission on September 6, 2023

Registration No. 333-269755

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

PRE-EFFECTIVE AMENDMENT NO. 4

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

Harden Technologies Inc.

(Exact Name of Registrant as Specified in its Charter)

____________________

British Virgin Islands | | 3559 | | Not applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

____________________

Building 8, No. 6 Jingye Road Torch Development Zone Zhongshan City PR China 528400 +86-760-89935422 | | Vcorp Agent Services, Inc. 25 Robert Pitt Dr., Suite 204 Monsey, New York 10952 (888) 528-2677 |

(Address, including zip code, and telephone number,

including area code, of principal executive offices) | | (Name, address, including zip code, and telephone

number, including area code, of agent for service) |

____________________

Copies to:

Bradley A. Haneberg, Esq.

Haneberg Hurlbert PLC

1111 East Main Street

Suite 2010

Richmond, Virginia 23220 Telephone: 804-554-4941 | | Fang Liu, Esq. VC Law LLP 1945 Old Gallows Road Suite 630 Vienna, Virginia 22182 Telephone: (301) 760-7393 |

____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED SEPTEMBER 6, 2023 |

2,500,000 Ordinary Shares

Harden Technologies Inc.

This is the initial public offering of Harden Technologies Inc. We expect the initial public offering price will be between $5.00 to $7.00 per ordinary share. No public market currently exists for our ordinary shares. We have applied for approval of the listing our ordinary shares on the Nasdaq Capital Market and have reserved the symbol “HARD” for such listing for the ordinary shares we are offering. We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing our securities on Nasdaq; however, we will not complete this offering unless we are so listed.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startup Act of 2012, and will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Risk Factors — We are an ‘emerging growth company,’ and we cannot be certain if choosing to elect the reduced reporting requirements applicable to emerging growth companies will make our ordinary shares less attractive to investors.”

Investing in our ordinary shares involves significant risks. See “Risk Factors” beginning on page 20 of this prospectus for a discussion of information that should be considered before making a decision to purchase our ordinary shares.

We are a holding company incorporated in the British Virgin Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our subsidiaries in the PRC. The ordinary shares offered in this offering are shares of the British Virgin Islands holding company. Investors of our ordinary shares should be aware that they may never directly hold equity interests in our subsidiaries in the PRC.

As all our operations are conducted in China through our subsidiaries, the Chinese government may exercise significant oversight and discretion over the conduct of our business. Such governmental actions:

• could result in a material change in our operations;

• could hinder our ability to continue to offer securities to investors; and

• may cause the value of our securities to significantly decline or be worthless.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to government review could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and made several public statements on the regulation of business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We believe that we are not directly subject to these regulatory actions or statements, as we do not have a variable interest entity structure and our business belongs to the waste management and recycling equipment manufacturing industry in China, which does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. Based on the advice of our PRC counsel, King & Wood Mallesons, and our understanding of currently applicable PRC laws and regulations, our registered public offering in the U.S. is not subject to the review or prior approval of the Cyberspace Administration of China (the “CAC”) or the China Securities Regulatory Commission (the “CSRC”). Uncertainties still exist, however, due to the possibility that laws, regulations, or policies in the PRC will be modified from time to time in the future. As these statements and regulatory actions are new, it

Table of Contents

is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. Any future action by the PRC government expanding the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

On February 17, 2023, the CSRC issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”) and relevant supporting guidelines (collectively, the “New Administrative Rules Regarding Overseas Listings”), which came into effect since March 31, 2023, and the Circular on Arrangements for Record-filing Administration of Overseas Offering and Listing of Domestic Companies, pursuant to which, a PRC domestic company shall file with the CSRC within 3 working days after the relevant application with initial public offerings or listings in overseas markets is submitted overseas. If the indirect overseas securities offering and listing by a domestic company had been approved by the overseas regulator or stock exchange, such as the registration statement had been declared effective in the case of the U.S. market, prior to the effectuation of the Trial Administrative Measures, and the indirect overseas securities offering and listing will be completed before September 30, 2023 without the need to go through the regulatory procedure of the overseas regulator or stock exchange for offering and listing once again, then such company is not required to file with the CSRC in accordance with the Trial Administrative Measures immediately but shall be required to do so if it involves in re-financing and other filing matters in the future. While the PRC domestic companies that have submitted valid applications for overseas issuance and listing but have not been approved by overseas regulatory authorities or overseas stock exchanges before March 31, 2023 can reasonably arrange the timing of filing applications and should complete the filing before the overseas issuance and listing. We plan to file with the CSRC in accordance with the Trial Administrative Measures immediately. Further, under the New Administrative Rules Regarding Overseas Listings, if an issuer offers securities in the same overseas market where it has previously offered and listed securities subsequently, filings shall be made with the CSRC within 3 working days after the offering is completed. Upon the occurrence of any material event, such as change of control, investigations or sanctions imposed by overseas securities regulatory agencies or other relevant competent authorities, change of listing status or transfer of listing segment, or voluntary or mandatory delisting, after an issuer has offered and listed securities in an overseas market, the issuer shall submit a report thereof to CSRC within 3 working days after the occurrence and public disclosure of such event. Further, an overseas securities company that serves as a sponsor or lead underwriter for overseas securities offering and listing by the PRC domestic companies shall file with the CSRC within 10 working days after signing its first engagement agreement for such business, and submit to the CSRC, no later than January 31 each year, an annual report on its business activities in the previous year associated with overseas securities offering and listing by the PRC domestic companies. If an overseas securities company has entered into engagement agreements before the effectuation of the Trial Administrative Measures and is serving in practice as a sponsor or lead underwriter for overseas securities offering and listing by domestic companies, it shall file with the CSRC within 30 working days after the Trial Administrative Measures take effect. Since the New Administrative Rules Regarding Overseas Listings are newly promulgated, and the interpretation and implementation thereof involves uncertainties, we cannot assure that we will be able to complete the relevant filings in a timely manner or fulfil all the regulatory requirements thereunder.

As of the date of this prospectus, we are in the process of preparing a report and other required materials in connection with the CSRC filing, which will be submitted to the CSRC in due course. We expect to submit any additional materials as subsequently requested by and/or respond to questions from the CSRC on a timely basis as they occur, and expect to complete filing with the CSRC prior to our proposed initial public offering and listing on the Nasdaq Stock Market. However, if we do not comply with the filing procedures according to the Administration Measures or if our filing materials contain false records, misleading statements or material omissions, the CSRC may order rectify such non-compliance, issue a warning, and impose a fine of not less than RMB1 million and not more than RMB10 million.

On February 24, 2023, the CSRC promulgated the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Confidentiality and Archives Administration Provisions”), which also became effective on March 31, 2023. The Confidentiality and Archives Administration Provisions set out rules, requirements and procedures relating to provision of documents, materials and accounting archives for securities companies, securities service providers, overseas regulators and other entities and individuals in connection with overseas offering and listing, including without limitation to, domestic companies that carry out overseas offering and listing (either in direct or indirect means) and the securities companies and securities service providers (either incorporated domestically or overseas) that undertake relevant businesses shall not leak any state secret and working secret of government agencies, or harm national security and public interest, and a domestic company shall first obtain approval from competent authorities according to law, and

Table of Contents

file with the secrecy administrative department at the same level, if it plans to, either directly or through its overseas listed entity, publicly disclose or provide any documents and materials that contain state secrets or working secrets of government agencies. Working papers produced in the Chinese mainland by securities companies and securities service providers in the process of undertaking businesses related to overseas offering and listing by domestic companies shall be retained in the Chinese mainland. Where such documents need to be transferred or transmitted to outside the Chinese mainland, relevant approval procedures stipulated by regulations shall be followed. While we believe we do not involve leaking any state secret and working secret of government agencies, or harming national security and public interest in connection with provision of documents, materials and accounting archives, there is uncertainty how the new provisions will be interpreted and implemented in the future, and we may be required to perform additional procedures in connection with the provision of accounting archives.

Any failure of us to fully comply with these new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer the ordinary shares, cause significant disruption to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations, and cause the ordinary shares to significantly decline in value or become worthless. See “Risk Factor — Risks Related to Doing Business in China — Our failure to obtain prior approval of the CSRC for the listing and trading of our ordinary shares on a foreign stock exchange, or our failure to comply with the new filing-based administrative rules for overseas offering and listing by domestic companies in China, could delay this offering or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.”

Our ordinary shares may be prohibited to trade on a national exchange or in the over-the-counter trading market in the United States under the Holding Foreign Companies Accountable Act (the “HFCA Act”) and the Accelerating Holding Foreign Companies Accountable Act (the “AHFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) determines that it cannot inspect or fully investigate our auditors for two consecutive years beginning in 2021. As a result, an exchange may determine to delist our securities. Additionally, our securities may be prohibited from trading if our auditor cannot be fully inspected as more stringent criteria have been imposed by the SEC and the PCAOB recently. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act, which became effective on January 10, 2022. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions. For example, on December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in the Chinese mainland and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions. On December 15, 2022, however, the PCAOB vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in the Chinese mainland and Hong Kong. As of the date of the prospectus, our auditor prior to November 24, 2022, Friedman LLP (“Friedman”), had been inspected by the PCAOB on a regular basis in the audit period, and our current auditor, Marcum Asia CPAs LLP (“Marcum Asia”), has been inspected by the PCAOB on a regular basis, both with the last inspection in 2020. Neither Friedman nor Marcum Asia is subject to the determinations announced by the PCAOB on December 16, 2021. As a result, we do not expect to be identified as a “Commission — Identified Issuer” under the HFCA as of the date of this prospectus. Friedman LLP was merged with Marcum LLP on September 1, 2022 and filed its application to withdraw the PCAOB registration on December 30, 2022. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in the Chinese mainland and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in the Chinese mainland and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. While our auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction, then such inability could cause trading in our securities to be prohibited under the HFCA Act and the AHFCA Act, and ultimately result in a determination by a securities exchange to delist our securities. If trading in our ordinary shares is prohibited under the HFCA Act and the AHFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our ordinary shares, which may cause the value of our securities to decline or become worthless. See. “Risk Factors — Our ordinary shares may be prohibited from being trading on and would require delisting from a national exchange under the HFCA Act and the AHFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Table of Contents

Cash dividends, if any, on our ordinary shares will be paid in U.S. dollars. As of the date of this prospectus, (1) no cash transfers nor transfers of other assets have occurred among the Company, and its subsidiaries, except that we transferred $12,990 from Harden International to WFOE as a working capital loan during the year ended December 31, 2021, (2) no dividends nor distributions have been made by a subsidiary, and (3) the Company has not paid any dividends nor made any distributions to U.S. investors. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future, or any funds will be transferred from one entity to another. As such, we have not installed any cash management policies that dictate how funds are transferred among Harden, its subsidiaries, or investors. For further details, please refer to the consolidated financial statements included elsewhere in this registration statement of which this prospectus is a part. Under British Virgin Islands law, the directors of the Company may, by resolution of directors, authorize a dividend by the Company to the members at such time and of such an amount, as the directors think fit if they are satisfied, or reasonable grounds, that the company will, immediately after the payment of the dividend, satisfy the solvency test. A BVI company satisfies the solvency test if (a) the value of the company’s assets exceeds its liabilities, and (b) the company is able to pay its debts as they fall due.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share | | Total Without

Over-Allotment

Option | | Total With

Over-Allotment

Option |

Initial public offering price(1) | | $ | 6.00 | | $ | 15,000,000 | | $ | 17,250,000 |

Underwriting discounts and commissions(2) | | $ | 0.39 | | $ | 975,000 | | $ | 1,121,250 |

Proceeds to us, before expenses | | $ | 5.61 | | $ | 14,025,000 | | $ | 16,128,750 |

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately $1,400,000, exclusive of the above discounts and commissions. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, (“FINRA”), as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the ordinary shares, if any such shares are taken. We have granted the underwriters an option for a period of forty-five (45) days after the closing of this offering to purchase up to 15% of the total number of our ordinary shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts and commissions. If the underwriters exercise the option in full and originate all investors in the offering, the total underwriting discounts and commissions payable will be $1,121,250 based on an assumed initial public offering price of $6.00 per ordinary share (the midpoint of the price range set forth on the cover page of this prospectus), and the total gross proceeds to us, before underwriting discounts and commissions and expenses, will be $17,250,000. If we complete this offering, net proceeds will be delivered to us on the closing date. We will not be able to use such proceeds in China, however, until we complete capital contribution procedures which require prior approval from each of the respective local counterparts of China’s Ministry of Commerce, the State Administration for Market Regulation, and the State Administration of Foreign Exchange. See remittance procedures in the section titled “Use of Proceeds” beginning on page 50.

We have agreed to issue to the underwriter ordinary share purchase warrants, exercisable from the date of commencement of sales of this offering for a period of three years after such date, to purchase ordinary shares equal to 5% of the total number of ordinary shares sold in this offering, exercisable at a per share price equal to 125% of the public offering price (the “Warrants”). The registration statement of which this prospectus is a part covers the ordinary shares issuable upon the exercise thereof.

The underwriters expect to deliver the ordinary shares to purchasers in this offering on or about __________, 2023.

US Tiger Securities, Inc.

Prospectus dated , 2023

Table of Contents

TABLE OF CONTENTS

Through and including , 2023 (25 days after the commencement of this offering), all dealers effecting transaction in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus and any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside the United States.

i

Table of Contents

We are incorporated under the laws of the British Virgin Islands as a company limited by shares, and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission (the “SEC”) we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

ii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our consolidated financial statement and related notes, and especially the risks described under “Risk Factors” beginning on page 20 hereof. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Our Company

Harden is a waste management and recycling equipment manufacturer in China, specializing in the manufacture of customized industrial shredders and material sorting machines and production lines. We were founded on May 10, 2010 by our chairman of the board of directors, director and chief executive officer, Mr. Jiawen Miao. We are located in Zhongshan City in China’s Guangdong Province. We currently employ 238 people on a full time basis — 21 people in management positions; 33 in sales and marketing positions; 28 in research and development positions; 36 people in technical engineering positions; 29 in after-sale service positions and 91 in manufacturing and installation positions.

Industry and Market Background

According to Grand View Research, an international market research company, the global industrial recycling equipment market size was estimated at $852 million in 2019 and is anticipated to reach $1.3 billion by 2027, expanding at a compound annual growth rate (“CAGR”) of 5.8%. The Asia Pacific region’s market is forecast to exceed $450 million by 2025, with China as a major revenue earner.

We expect growing awareness pertaining to the economic and environmental benefits of recycled processed materials to significantly impact our market. In addition, we expect growing concerns over the increasing carbon footprint along with rising government efforts in numerous countries in order to promote recycling of material to create significant opportunities for manufacturers. Industrial recycling equipment plays a significant role in this process. Scrap materials including discarded electrical and electronic goods, automobile parts, paper, and construction materials are collected from numerous sources for further processing. Industrial recycling equipment, including baler presses, granulators, shredders, and shears are then used to reduce the shape and size of the waste materials, which are further used for recycling.

Due to the increasing awareness towards the sustainable advantages and benefits of reusing and recycling waste materials, we believe the end-use utilization of recycled materials will further benefit the industry. We anticipate that recycled material such as steel, iron, plastic, rubber, and concrete in the industries including automotive, electrical and electronics, building and construction, and packaging will drive the market.

Our Products

We manufacture industrial shredders and waste sorting equipment for waste management and material recycling industries. We create equipment for customers according to their requirements depending upon applications and needs.

Samples of our industrial recycling equipment include the following:

Single Shaft Shredders — Single shaft shredders are often referred to as grinders and efficiently shred large quantities of materials unattended.

Dual Shaft Shredders — Dual shaft industrial shredders have opposite rotating rotors that pull the material between the two rotors. In a dual-shaft shredder, the cutters or knives cut the material when it passes over the cutter and the opposing counter-knife.

Quad Shaft Shredders — Quad shaft shredders can shred a wide-range of materials and produce a consistent small material. Quad shaft shredders are able to shred and recirculate material within the machine until it is reduced to the proper size to pass through a filtering screen.

1

Table of Contents

Primary Shredders — Primary shredders allow for the reduction of tough materials and are made with a hydraulic transmission. The shredders can be adjusted to different sizes to obtain the desired size of the shredded product.

Mobile Shredders — Mobile shredders are equipped with the same shredding units as stationary shredders. However, different mobile shredder models are built either on crawlers or a trailer, which makes them easy to move at a production site or transport between sites when needed.

Granulators — Granulators turn materials into flakes or granules, which can be sold as raw material for remanufacturing.

Disk Screens — Disk screens are used to separate waste according to piece size.

Air Separators — Air separators employ blowers and other mechanisms to separate lighter fractions of recyclable material.

Our Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors and contribute to our ongoing success.

Focus on Technology and Research and Development. We believe we employ a strong research and development team. We own 103 patents that we utilize in the production of our products, and we are committed to researching and developing new industrial recycling equipment, and an additional 39 patents that are pending approval.

Ability to Grow Our Brand Awareness. We believe that the Harden brand is a well-known, respected global brand in our industry. Our brand name and image are integral to the growth of our business and to the implementation of our strategies for expanding our business.

Strong Cash Flow Management. We believe that our cash flow management, driven by our low accounts receivable balance as compared to our competitors, allows us to compete effectively in a rapidly changing and increasingly complex Chinese market.

Effective Quality Control. In every step, we have fully trained, experienced and skilled employees that are working in concert to ensure the quality of our industrial recycling equipment.

Experienced Management Team and Personnel with a Demonstrated Track Record. Our management team, led by our chairman of the board, director and chief executive officer, Mr. Jiawen Miao, has extensive industry experience and a demonstrated track record of developing new products, adapting to changing market conditions, and managing manufacturing companies.

Pricing Strategy. We strive to provide our customers with the best value proposition by offering our industrial recycling equipment at competitive prices on our platform.

Our Challenges and Risks

We recommend that you consider carefully the risks discussed below and under the heading “Risk Factors” beginning on page 20 of this prospectus before purchasing our ordinary shares. If any of these risks occur, our business, prospects, financial condition, liquidity, results of operations and ability to make distributions to our shareholders could be materially and adversely affected. In that case, the trading price of our ordinary shares could decline and you could lose some or all of your investment. These risks include, among others, the following:

• Since China does not have any treaties or other agreements with the British Virgin Islands or the United States that provide for the reciprocal recognition and enforcement of foreign judgments as of the date of this prospectus, you may experience difficulties in effecting service of legal process, enforcing foreign judgments or brining actions in China against us or our management named in the prospectus based on foreign laws;

• We must remit the offering proceeds to China before they may be used to benefit our business in China, this process may take a number of months and we will be unable to use the proceeds to grow our business in the meantime.

2

Table of Contents

• We face a wide range of competition that could affect our ability to operate profitably, and we believe that our European competitors are searching for opportunities to enter the China market;

• If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed China-based companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, this offering and our reputation and could result in a loss of your investment in our shares, especially if such matter cannot be addressed and resolved favorably;

• In the jurisdictions where we operate, for example in China, we cannot predict how laws and regulations will be interpreted and enforced;

• Our ordinary shares may be prohibited from being traded on and would require delisting from a national exchange under the HFCA Act and the AHFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. Our auditor is currently subject to PCAOB inspections, and the PCAOB is able to inspect our auditor.

• Additionally, our securities may be prohibited from trading if our auditor cannot be fully inspected as more stringent criteria have been imposed by the SEC and the PCAOB recently. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act, which became effective on January 10, 2022. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

• Any decline in the availability or increase in the cost of raw materials, including steel and copper, could materially impact our earnings;

• We are an “emerging growth company,” and we cannot be certain if choosing to elect the reduced reporting requirements applicable to emerging growth companies will make our ordinary shares less attractive to investors; and

• The novel coronavirus could have a material adverse impact upon our business, results of operations, financial condition, cash flows or liquidity.

Our Strategies

Increase Our Revenue and Market Share by Expanding Our Business Network internationally. In the short term, we intend to increase our revenue and market share by expanding our business network to other provinces in China. Over the long term, however, we believe that significant business opportunities exist outside of China — particularly in the United States and Europe.

Pursue Strategic Acquisitions. We intend to continue to pursue expansion opportunities in existing and new markets, as well as in core and adjacent categories through strategic acquisitions.

Market Opportunity. China’s 14th Five Year Plan (2021-2025) promotes the reduction on the reliance on foreign technology and dependence on imported resources, and to increase industrial modernization and technological innovation. We plan to capitalize on the opportunities presented by the 14th Five Year Plan by assisting in the recycling and reuse of materials along with lowering waste disposal fees of our existing and potential customers through the use of our shredder equipment.

Continue to Develop New Products. We are committed to researching and developing new products according to market trends.

Target the Solid Waste Management and Recycling Industry Market. According to IBISWorld, an international market research company, the solid waste recycling industry in China has developed rapidly over the past five years and industry revenue is expected to increase at an annualized 9.6% over the five years through 2022, to $25.2 billion. In addition to the China market, the global waste management market is also growing at a rapid rate in both developed and developing countries. According to Allied Market Research, a market research company based in the US, global waste management market is expected to grow from approximately $1.6 trillion in 2020

3

Table of Contents

to approximately $2.5 trillion by 2030, growing at a CAGR of 3.4%. As a result of such growth, Allied Market Research also determined that the global waste management equipment market, in which we compete, will increase from $45.75 billion in 2019 to $55.63 billion by 2027, growing at a CAGR of 4.1%.

Foreign Private Issuer Status

We are incorporated in the British Virgin Islands, and more than 50 percent of our outstanding voting securities are not directly or indirectly held by residents of the United States. Therefore, we are a “foreign private issuer” as defined in Rule 405 under the Securities Act and Rule 3b-4(c) under the Exchange Act. As a result, in accordance with the rules and regulations of The Nasdaq Stock Market, we may comply with home country governance requirements and certain exemptions thereunder rather than complying with Nasdaq corporate governance standards. We may choose to take advantage of the following exemptions afforded to foreign private issuers:

• Exemption from filing quarterly reports on Form 10-Q, from filing proxy solicitation materials on Schedule 14A or 14C in connection with annual or special meetings of shareholders, or from providing current reports on Form 8-K disclosing significant events within four (4) days of their occurrence, and from the disclosure requirements of Regulation FD.

• Exemption from Section 16 rules regarding sales of ordinary shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act.

• Exemption from the Nasdaq rules applicable to domestic issuers requiring disclosure within four (4) business days of any determination to grant a waiver of the code of business conduct and ethics to directors and officers. Although we will require board approval of any such waiver, we may choose not to disclose the waiver in the manner set forth in the Nasdaq rules, as permitted by the foreign private issuer exemption.

• Exemption from the requirement that our board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

• Exemption from the requirements that director nominees are selected, or recommended for selection by our board of directors, either by (i) independent directors constituting a majority of our board of directors’ or independent directors in a vote in which only independent directors participate, or (ii) a committee comprised solely of independent directors, and that a formal written charter or board resolution, as applicable, addressing the nominations process is adopted.

Furthermore, Nasdaq Rule 5615(a)(3) provides that a foreign private issuer, such as us, may rely on our home country corporate governance practices in lieu of certain of the rules in the Nasdaq Rule 5600 series and Rule 5250(d), provided that we nevertheless comply with Nasdaq’s Notification of Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640) and that we have an audit committee that satisfies Rule 5605(c)(3), consisting of committee members that meet the independence requirements of Rule 5605(c)(2)(A)(ii). If we rely on our home country corporate governance practices in lieu of certain of the rules of Nasdaq, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. If we choose to do so, we may utilize these exemptions for as long as we continue to qualify as a foreign private issuer.

Although we are permitted to follow certain corporate governance rules that conform to British Virgin Island requirements in lieu of many of the Nasdaq corporate governance rules, we intend to comply with the Nasdaq corporate governance rules applicable to foreign private issuers, including the requirement to hold annual meetings of shareholders.

Corporate Information

Our principal executive office is located at Xingda Street, Torch Development Zone, Zhongshan City, Guangdong Province, 528400, PR China. Our telephone number is +86-760-89935422. Our registered office in the British Virgin Islands is located at the office of Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands, VG 1110.

4

Table of Contents

Our agent for service of process in the United States is Vcorp Agent Services, Inc. 25 Robert Pitt Dr., Suite 204, Monsey, New York 10952. Our websites are located at www.industrial-shredder.info and www.siruide.com. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

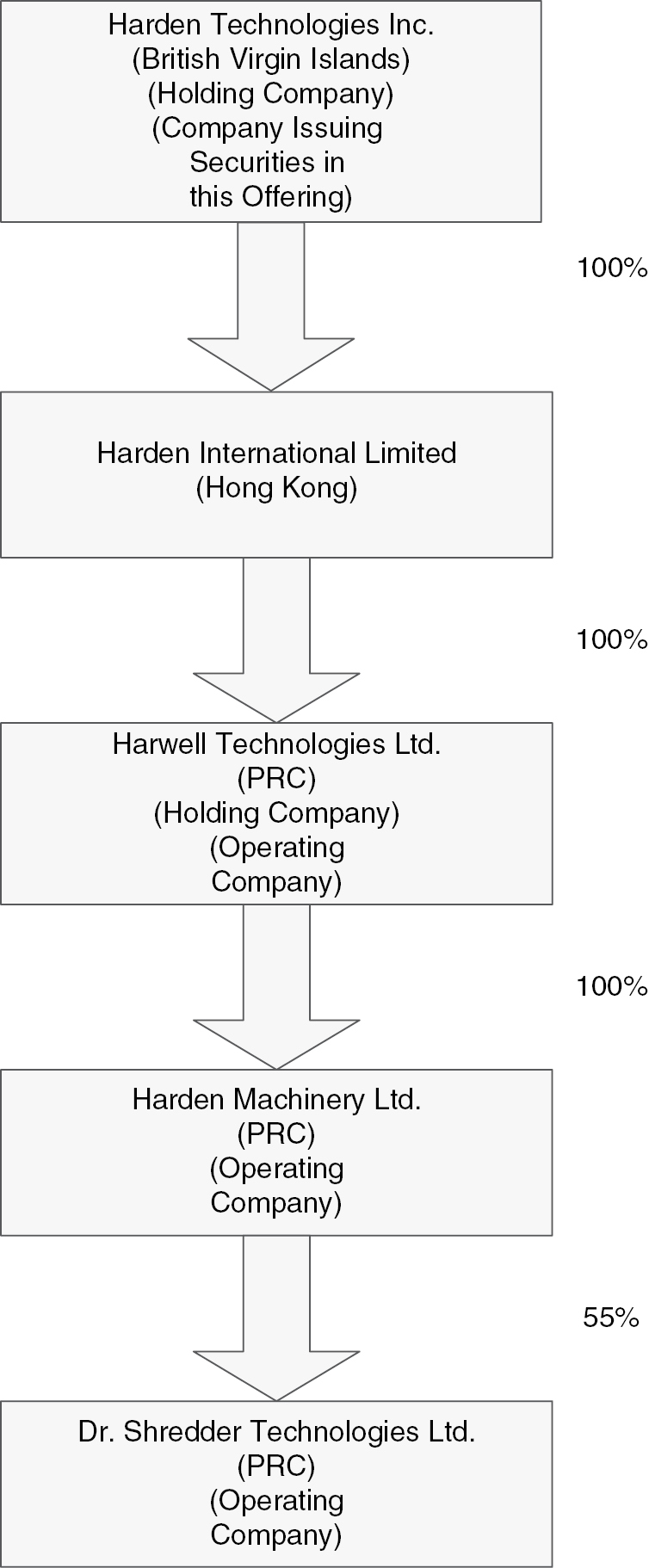

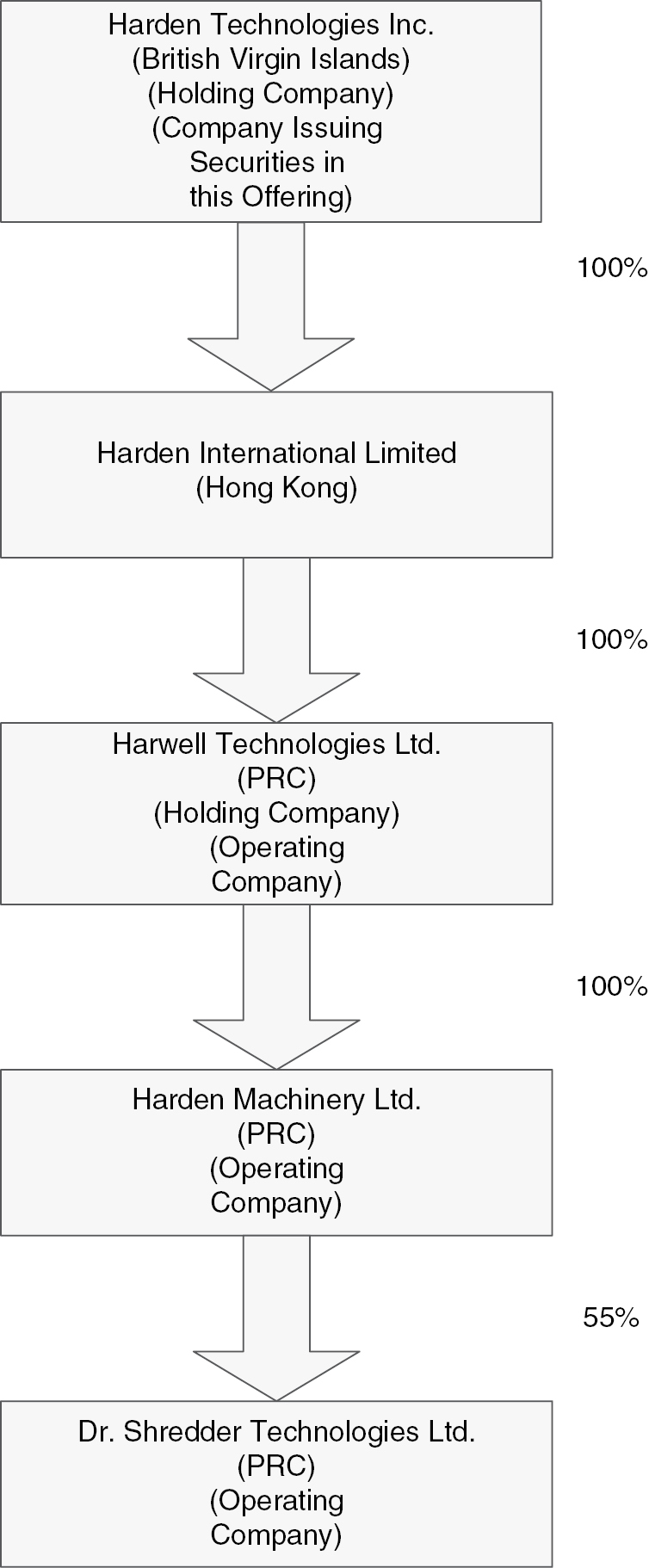

Corporate Structure

Harden Technologies Inc (“Harden”). — We formed Harden Technologies Inc., our British Virgin Islands holding company, on April 8, 2021.

Harden International Limited (“Harden International”) — We formed Harden International, our wholly-owned Hong Kong subsidiary, on April 20, 2021. Harden International serves as a holding company for WOFE.

Harwell Technologies Ltd. (“WFOE”) — We formed WFOE, our principal operating company in China and wholly-owned subsidiary of Harden International, on May 13, 2021. WFOE serves as a holding company for Harden Machinery.

5

Table of Contents

Harden Machinery Ltd. (“Harden Machinery”) — We formed Harden Machinery, our former operating company in China and wholly-owned subsidiary of WFOE on May 10, 2010. Its business scope includes the design and manufacture of customized industrial recycling equipment.

Dr. Shredder Technologies Ltd. (“Dr. Shredder”) — Dr. Shredder is a company incorporated on September 29, 2017 in China and is a 55% owned subsidiary of Harden Machinery. The remaining 45% of Dr. Shredder is owned by three former employees of Harden. Dr. Shredder is engaged in the manufacture and sale of small and medium-sized industrial shredders and data destruction shredders.

As used herein the term “China Operating Companies” shall refer to WFOE, Harden Machinery and Dr. Shredder.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jobs Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including but not limited to, being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the SEC, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We have not decided whether to take advantage of any or all of these exemptions. If we do take advantage of any of these exemptions, we do not know if some investors will find our ordinary shares less attractive as a result. The result may be a less active trading market for our ordinary shares and the price of our ordinary shares may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We will remain an “emerging growth company” until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed US$1.07 billion, (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iv) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Implications of the HFCA Act

Our ordinary shares may be prohibited to trade on a national exchange or in the over-the-counter trading market in the United States under the HFCA Act and the AHFCA Act if the PCAOB determines that it cannot inspect or fully investigate our auditors for two consecutive years beginning in 2021. As a result, an exchange may determine to delist our securities. Additionally, our securities may be prohibited from trading if our auditor cannot be fully inspected as more stringent criteria have been imposed by the SEC and the PCAOB recently. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act, which became effective on January 10, 2022. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions. For example, on December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in the Chinese mainland and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions. On December 15, 2022, the PCAOB vacated its previous 2021 determinations that the PCAOB

6

Table of Contents

was unable to inspect or investigate completely registered public accounting firms headquartered in the Chinese mainland and Hong Kong. Our auditor prior to November 24, 2022, Friedman, had been inspected by the PCAOB on a regular basis in the audit period with last inspection in 2020, and our current auditor, Marcum Asia, has been inspected by the PCAOB on a regular basis, with the last inspection in 2020. Neither Friedman nor Marcum Asia is subject to the determinations announced by the PCAOB on December 16, 2021. As a result, we do not expect to be identified as a “Commission — Identified Issuer” under the HFCA as of the date of this prospectus. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in the Chinese mainland and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in the Chinese mainland and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. While our auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction, then such inability could cause trading in our securities to be prohibited under the HFCA Act and the AHFCA Act, and ultimately result in a determination by a securities exchange to delist our securities. If trading in our ordinary shares is prohibited under the HFCA Act and the AHFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our ordinary shares, which may cause the value of our securities to decline or become worthless. See “Risk Factors — Our ordinary shares may be prohibited from being traded on and would require delisting from a national exchange under the HFCA Act and the AHFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Implications of Chinese Regulations

As of the date of this prospectus, each of our Chinese subsidiaries has received all requisite permissions and approvals from Chinese authorities to conduct and operate our business as currently conducted under relevant PRC laws and regulations, and none of our Chinese subsidiaries has been denied by relevant Chinese authorities due to its business qualifications. The following table provides details on the licenses and permissions held by our Chinese subsidiaries.

Company | | License/Permission | | Issuing Authority | | Validity/Expiration |

Harwell Technologies, Inc. | | Business License | | Zhongshan Market Supervision Administration | | Unlimited |

Harden Machinery Ltd. | | Business License | | Zhongshan Market Supervision Administration | | Unlimited |

Dr. Shredder Technologies Ltd. | | Business License | | Zhongshan Market Supervision Administration | | Unlimited |

Harden Machinery Ltd. | | Safety Production Permit | | Guangdong Provincial Department of Housing and Urban-rural Development | | January 20, 2025 |

Harden Machinery Ltd. | | Third-grade Professional Contracting Qualification for Environmental Protection Projects | | Zhongshan Housing and Urban-rural Development Bureau | | June 30, 2026 |

Harden Machinery Ltd. | | High-tech Enterprise Certificate | | Science & Technology Department of Guangdong Province Guangdong Provincial Finance Department Guangdong Provincial Tax Service, State Taxation Administration | | December 20, 2024 |

7

Table of Contents

Neither we nor our subsidiaries are currently required to obtain permissions or approvals from Chinese authorities, including the CSRC, the CAC, or any other Chinese authorities to list on a foreign stock exchange or issue securities to foreign investors. However, we are required to file with the CSRC for the Company’s IPO in accordance with the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and relevant supporting guidelines. See “Risk Factor — Risks Related to Doing Business in China — Our failure to obtain prior approval of the CSRC for the listing and trading of our ordinary shares on a foreign stock exchange, or our failure to comply with the new filing-based administrative rules for overseas offering and listing by domestic companies in China, could delay this offering or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.” and “Regulations — New M&A Regulations and Overseas Listings”. As of the date of this prospectus, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC, CAC or any other Chinese authorities.

However, if our subsidiaries or the holding company were required to obtain permissions or approvals in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. It is uncertain when and whether the Company will be required to obtain permissions or approvals from Chinese authorities to list on a foreign stock exchange in the future, and even when such permission is obtained, whether it will be denied or rescinded. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC, CAC or other Chinese authorities. However, there remains uncertainty as to the interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital market activities.

Although the Company is currently not required to obtain permission from any of Chinese authorities and has not received any denial to list on the U.S. exchange, our operations and financial conditions could be adversely affected, and our ability to offer securities to investors could be significantly limited, directly or indirectly, by existing or future laws and regulations relating to its business or industry; if we inadvertently conclude that such permissions or approvals are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain permissions or approvals in the future.

The New “M&A Rule”

On August 8, 2006, six Chinese regulatory agencies, including the Ministry of Commerce of the PRC (“MOFCOM”), jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “New M&A Rule”), which became effective on September 8, 2006, and was amended on June 22, 2009. The New M&A Rule contains provisions that require that an offshore special purpose vehicle (“SPV”) formed for the purpose of seeking a public listing on an overseas stock exchange through acquisitions of PRC domestic companies and controlled directly or indirectly by Chinese companies or individuals to obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published procedures specifying documents and materials required to be submitted to it by an SPV seeking CSRC approval of overseas listings.

However, the application of the New M&A Rule remains unclear with no consensus currently existing among leading Chinese law firms regarding the scope and applicability of the CSRC approval requirement. Our Chinese counsel, King & Wood Mallesons, has given us the following advice, based on their understanding of current Chinese laws and regulations:

• WFOE was established by means of direct investment and not through a merger or requisition of the equity or assets of a “PRC domestic company” as defined under the New M&A Rule, and at the time of our equity interest acquisition, Harden was a foreign-invested enterprise rather than a “PRC domestic company” before it was acquired by WFOE; and

• In spite of the lack of clarity on this issue, the CSRC currently has not issued any definitive rule or interpretation regarding whether offerings like the one contemplated by this prospectus are subject to the New M&A Rule.

The CSRC has not issued any such definitive rule or interpretation, and we have not chosen to voluntarily request approval under the New M&A Rule. If the CSRC requires that we obtain its approval prior to the completion of this offering, the offering will be delayed until we obtain CSRC approval, which may take several months. There

8

Table of Contents

is also the possibility that we may not be able to obtain such approval. If prior CSRC approval was required, we may face regulatory actions or other sanctions from the CSRC or other Chinese regulatory authorities. These authorities may impose fines and penalties upon our operations in China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from this offering into China, or take other actions that could have a material adverse effect upon our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares. The CSRC or other Chinese regulatory agencies may also take actions requiring us, or making it advisable for us, to terminate this offering prior to closing.

The Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law

On July 6, 2021, The General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law (“Opinions”) which require (i) speeding up the revision of the provisions on strengthening the confidentiality and archives management relating to overseas issuance and listing of securities and (ii) improving the laws and regulations relating to data security, cross-border data flow, and management of confidential information. As of the date of this prospectus, no official guidance or related implementation rules have been issued. As of the date of this prospectus, it remains unclear as to how the Opinions will be interpreted, amended and implemented by the relevant Chinese authorities.

The Measures for Cybersecurity Review

On December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the Revised Review Measures. According to the Revised Review Measures, if an “online platform operator” that is in possession of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Given the recency of the issuance of the Revised Review Measures, there is a general lack of guidance and uncertainties exist with respect to their interpretation and implementation.

Our business belongs to the waste management and recycling equipment manufacturing industry in China, which does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. Based on the advice of our PRC counsel, King & Wood Mallesons, and our understanding of currently applicable PRC laws and regulations, our registered public offering in the U.S. is not subject to the review or prior approval of the CAC. Uncertainties still exist, however, due to the possibility that laws, regulations, or policies in the PRC will be modified from time to time in the future. As these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. Any future action by the PRC government expanding the categories of industries and companies whose foreign securities offerings are subject to review by the CAC could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

The New Administrative Rules Regarding Overseas Listings

On February 17, 2023, the CSRC issued the New Administrative Rules Regarding Overseas Listings, which came into effect since March 31, 2023, and the Circular on Arrangements for Record-filing Administration of Overseas Offering and Listing of Domestic Companies, pursuant to which, a PRC domestic company shall file with the CSRC within 3 working days after the relevant application with initial public offerings or listings in overseas markets is submitted overseas. If the indirect overseas securities offering and listing by a domestic company had been approved by the overseas regulator or stock exchange, such as the registration statement had been declared effective in the case of the U.S. market, prior to the effectuation of the Trial Administrative Measures, and the indirect overseas securities offering and listing will be completed before September 30, 2023 without the need to go through the regulatory procedure of the overseas regulator or stock exchange for offering and listing once again, then such company is not required to file with the CSRC in accordance with the Trial Administrative Measures immediately but shall be required to do so if it involves in re-financing and other filing matters in the future. While the PRC domestic companies that have submitted valid applications for overseas issuance and listing but have not been approved by overseas regulatory authorities or overseas stock exchanges before March 31, 2023 can reasonably

9

Table of Contents

arrange the timing of filing applications and should complete the filing before the overseas issuance and listing. We plan to file with the CSRC in accordance with the Trial Administrative Measures immediately. Further, under the New Administrative Rules Regarding Overseas Listings, if an issuer offers securities in the same overseas market where it has previously offered and listed securities subsequently, filings shall be made with the CSRC within 3 working days after the offering is completed. Upon the occurrence of any material event, such as change of control, investigations or sanctions imposed by overseas securities regulatory agencies or other relevant competent authorities, change of listing status or transfer of listing segment, or voluntary or mandatory delisting, after an issuer has offered and listed securities in an overseas market, the issuer shall submit a report thereof to CSRC within 3 working days after the occurrence and public disclosure of such event. Further, an overseas securities company that serves as a sponsor or lead underwriter for overseas securities offering and listing by the PRC domestic companies shall file with the CSRC within 10 working days after signing its first engagement agreement for such business, and submit to the CSRC, no later than January 31 each year, an annual report on its business activities in the previous year associated with overseas securities offering and listing by the PRC domestic companies. If an overseas securities company has entered into engagement agreements before the effectuation of the Trial Administrative Measures and is serving in practice as a sponsor or lead underwriter for overseas securities offering and listing by domestic companies, it shall file with the CSRC within 30 working days after the Trial Administrative Measures take effect. Since the New Administrative Rules Regarding Overseas Listings are newly promulgated, and the interpretation and implementation thereof involves uncertainties, we cannot assure that we will be able to complete the relevant filings in a timely manner or fulfil all the regulatory requirements thereunder.

On February 24, 2023, the CSRC promulgated the Confidentiality and Archives Administration Provisions, which also became effective on March 31, 2023. The Confidentiality and Archives Administration Provisions set out rules, requirements and procedures relating to provision of documents, materials and accounting archives for securities companies, securities service providers, overseas regulators and other entities and individuals in connection with overseas offering and listing, including without limitation to, domestic companies that carry out overseas offering and listing (either in direct or indirect means) and the securities companies and securities service providers (either incorporated domestically or overseas) that undertake relevant businesses shall not leak any state secret and working secret of government agencies, or harm national security and public interest, and a domestic company shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level, if it plans to, either directly or through its overseas listed entity, publicly disclose or provide any documents and materials that contain state secrets or working secrets of government agencies. Working papers produced in the Chinese mainland by securities companies and securities service providers in the process of undertaking businesses related to overseas offering and listing by domestic companies shall be retained in the Chinese mainland. Where such documents need to be transferred or transmitted to outside the Chinese mainland, relevant approval procedures stipulated by regulations shall be followed. While we believe we do not involve leaking any state secret and working secret of government agencies, or harming national security and public interest in connection with provision of documents, materials and accounting archives, there is uncertainty how the new provisions will be interpreted and implemented in the future, and we may be required to perform additional procedures in connection with the provision of accounting archives.

Any failure of us to fully comply with these new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer the ordinary shares, cause significant disruption to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations, and cause the ordinary shares to significantly decline in value or become worthless.

For more detailed information, see “Risk Factors — Risks Associated with this Offering and Ownership of Our Ordinary shares — Our failure to obtain prior approval of the CSRC for the listing and trading of our ordinary shares on a foreign stock exchange, or our failure to comply with the new filing-based administrative rules for overseas offering and listing by domestic companies in China, could delay this offering or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.” “Risk Factors — Risks Related to Doing Business in China — If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China based issuers, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.” and “Risk Factors — Risks Related to Doing Business in China — We are subject to a variety of laws and other obligations regarding privacy, data security, cybersecurity, and data protection, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations.”

10

Table of Contents

The Offering(1)

Ordinary shares offered by us: | | 2,500,000 ordinary shares |

Ordinary shares outstanding immediately prior to this offering: | |

10,000,000 ordinary shares

|

Ordinary shares outstanding immediately after this offering: | |

12,500,000 ordinary shares

|

Offering price per ordinary share: | | We estimate the initial public offering price per share to be in the range of $5.00 to $7.00 per ordinary share |

Use of proceeds: | | We expect to receive gross proceeds of approximately $15.0 million in the offering, assuming an initial public offering price of $6.00 per ordinary share, the midpoint of the estimated price range set forth on the cover page of this prospectus. In addition, we expect to receive net proceeds of approximately $13.2 million in this offering, assuming an initial public offering price of $6.00 per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and offering expenses payable by us. The net proceeds from this offering must be remitted to China before we will be able to use the funds to grow our business. |

| | | We intend to use the net proceeds of this offering as follows after we complete the remittance process: |

| | | • approximately $7.0 million for the development of a new manufacturing facility; • approximately $3.0 million for research and development related to design of mobile shredding and mobile screening machines, waste robotic sorting technologies and pilot recycling plant development; • and any remaining balance for additional working capital. |

| | | For more information on the use of proceeds, see “Use of Proceeds” on page 50. |

Risk factors: | | Investing in our ordinary shares involves a high degree of risk. Below is a summary of material factors that make an investment in our ordinary shares speculative or risky. Importantly, this summary does not address all the risks that we face. Please refer to the information contained in and incorporated by reference under the heading “Risk Factors” on page 20 of this prospectus. |

| | | Risks Relating to Our Business • The impact of a novel strain of coronavirus (“COVID-19”) has significantly impacted China and the rest of the world. We are currently unable to predict the full effect of COVID-19 upon our business and operations. |

11

Table of Contents

| | • To the extent the Chinese economy slows, our business may be materially and negatively impacted. • We may not be able to maintain effective business relationships with our suppliers and customers with whom we have an interdependent relationship. • Wage increases in China may prevent us from maintaining competitive advantages and could reduce our profit margins. • Our senior executives have not managed a publicly traded company in the past, and they have no prior experience with legal compliance issues related to U.S. or British Virgin Islands law. • We may require additional financing in the future, and there can be no guarantee that such financing will be available when needed. • We may not be able to attract and retain qualified and skilled employees. • Our bank accounts in China are not insured or protected against loss. |

| | | Risks Relating to Our Corporate Structure • Our subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business. See “Risk Factors — We will likely not pay dividends in the foreseeable future” and “Dividend Policy.” |

| | | Risks Relating to Doing Business in China • There are uncertainties in the interpretation and enforcement of PRC laws and regulations that could limit the legal protection available to you and us. • Since China does not have any treaties or other agreements with the British Virgin Islands or the United States that provide for the reciprocal recognition and enforcement of foreign judgments as of the date of this prospectus, you may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against us or our management named in the prospectus based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China. • Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on our business and operations. |

12

Table of Contents

| | • As a business operating in China, we are subject to the laws and regulations of the PRC, which will be modified from time to time. The PRC government has the power to exercise significant oversight and discretion over the conduct of our business, and the regulations to which we are subject will be modified from time to time. See “Risk Factors — Because all our operations are in China, our business is subject to the applicable laws and regulations, as amended from time to time, there. Government policies and measures adopted by the PRC government may have material impact on how we conduct our business, and we may need to adjust our operations from time to time to comply with regulatory requirements, which could result in material adverse impacts on our operations and the value of our ordinary shares.” |

| | | • Under Chinese law, the proceeds of this offering must be sent back to China, and the process for sending such proceeds back to China may take several months after the closing of this offering. In order to remit the offering proceeds to China, we must: • open a special foreign exchange account for capital account transactions. To open this account, we must submit to State Administration of Foreign Exchange approval (“SAFE”) certain application forms, identity documents, transaction documents, form of foreign exchange registration of overseas investments by domestic residents, and foreign exchange registration certificate of the invested company; • remit the offering proceeds into this special foreign exchange account; and • apply for settlement of the foreign exchange. In order to do so, we must submit to SAFE certain application forms, identity documents, payment order to a designated person, and a business certificate. See “Risk Factors — We must remit the offering proceeds to China before they may be used to benefit our business in China, this process may take a number of months and we will be unable to use the proceeds to grow our business in the meantime.” |