Exhibit 99.1

Incannex Healthcare Limited

ABN 93 096 635 246

Appendix 4E

For the year ended 30 June 2023

Information for ASX under listing rule 4.3A

| Reporting Period: | 30 June 2023 | |

| Comparative Period: | 30 June 2022 |

| 2.0 | Results for announcement to the market |

| 2.1 | Revenue |

| 30-Jun-23 | 30-Jun-22 | Amount change | Percentage change | |||||||||||||

| $ | $ | $ | % | |||||||||||||

| Revenues from ordinary activities | - | - | - | nmf |

| 2.2 | Loss for the year |

| 30-Jun-23 | 30-Jun-22 | Amount change | Percentage change | |||||||||||||

| $ | $ | $ | % | |||||||||||||

| Loss from ordinary activities after tax | (19,979,558 | ) | (14,903,909 | ) | (5,075,649 | ) | 34 | |||||||||

| 2.3 | Net loss for the year |

| 30-Jun-23 | 30-Jun-22 | Amount change | Percentage change | |||||||||||||

| $ | $ | $ | % | |||||||||||||

| Loss from ordinary activities after tax | (19,979,558 | ) | (14,903,909 | ) | (5,075,649 | ) | 34 | |||||||||

| 2.4 | Dividends |

No dividends have been paid, declared or proposed in respect of the year ended 30 June 2023 (2022: Nil).

2.6 Results for the year

Refer to the attached financial statements and review of operations in the Directors’ Report for an explanation of the results for the year.

3 Statement of profit and loss and other comprehensive income

Refer to attached financial statements.

4 Statement of financial position

Refer to attached financial statements.

5 Statement of changes in equity

Refer to attached financial statements.

6 Statement of cash flows

Refer to attached financial statements.

7 Details of dividends and distribution payments

Not applicable.

8 Dividend and distribution reinvestment

Not applicable

9 Net tangible asset per security

| Net tangible asset per ordinary security | 30-Jun-23 | 30-Jun-22 | ||||||

| Net tangible assets | 31,411,440 | 35,869,075 | ||||||

| Number of shares on issue at reporting date | 1,587,010,366 | 1,292,334,028 | ||||||

| Net tangible asset per ordinary security | 1.98 cents | 2.78 cents | ||||||

The net tangibles asset backing per security of 1.98 cents presented above is inclusive of right-of-use assets and lease liabilities. The net tangible asset per security, at 30 June 2023, would reduce to 1.93 cents (2022: no change) if right-of use assets were excluded, and lease liabilities were included in the calculation.

10 Controlled entities

The consolidated financial statements include the financial statements of Incannex Healthcare Limited (‘IHL’) and its wholly owned subsidiaries Incannex Pty Ltd (‘IXPL’) and Psychennex Pty Ltd (‘PXPL’). IXPL is incorporated in Australia and IHL owns 100% of the issued ordinary shares in IXPL (2022: 100%). PXPL is incorporated in Australia and IHL owns 100% of the issued ordinary shares in PXPL (2022: 100%).

11 Joint ventures and associates

Not applicable.

12 Other information

Not applicable.

13 Foreign entities

Not applicable.

14 Commentary on results

15 Audit

The figures in this report are based on the attached Financial Report which is audited.

16 Not applicable

17 Audit Opinion

The independent audit report is not subject to any modified opinion, emphasis of matter or other matter paragraph.

| /s/ Troy Valentine |

Troy Valentine

Chairman

Melbourne, Victoria, 30 August 2023

Incannex Healthcare Limited

ABN 93 096 635 246

Annual Financial Report

For the year ended 30 June 2023

Incannex Healthcare Limited

TABLE OF CONTENTS

| Page | |

| Corporate Information | 1 |

| Chairman’s Letter | 2 |

| Directors’ Report | 4 |

| Business Activities and Outlook | 6 |

| Remuneration Report | 27 |

| Auditor’s Independence Declaration | 34 |

| Statement of Comprehensive Income | 35 |

| Statement of Financial Position | 36 |

| Statement of Changes In Equity | 37 |

| Statement of Cash Flows | 38 |

| Notes to the Financial Statements | 39 |

| Directors’ Declaration | 63 |

| Independent Auditor’s Report | 64 |

| Corporate Governance Statement | 71 |

| Securities Exchange Information | 78 |

i

Incannex Healthcare Limited

CORPORATE INFORMATION

Incannex Healthcare Limited

ABN 93 096 635 246

Directors

Mr Joel Latham (Managing Director & CEO)

Mr Troy Valentine (Non-Executive Chairman)

Mr Peter Widdows (Non-Executive Director)

Dr George Anastassov (Non-Executive Director)

Robert B. Clark (Non-Executive Director) (Appointed 17/08/2022)

Company Secretary

Madhukar Bhalla

Registered Office

Level 23, South Tower Rialto

525 Collins Street

Melbourne Victoria 3000

Principal Place of Business

Suite 15 Level 12

401 Docklands Drive

Docklands Victoria 3008

Share Register

Automic Pty Ltd

Level 5 126 Phillip Street

Sydney NSW 2000

Phone: +61 2 9698 5414

Auditors

PKF Brisbane Audit

Level 6, 10 Eagle St

Brisbane 4000, Queensland

Securities Exchange Listing

ASX Limited (Australian Securities Exchange)

Home Exchange: Melbourne Victoria

ASX Codes: IHL

1

Incannex Healthcare Limited

CHAIRMAN’S MESSAGE

On behalf of the Board of Directors, I am pleased to present the Annual Report of Incannex Healthcare Limited (“Incannex” or “IHL”) for the financial year ended 30 June 2023.

The hard work of our team throughout the year elucidated major opportunities to advance our diversified product development pipeline despite challenging capital market conditions for the broader biotech sector.

Financial decisions that Incannex made in 2021 and 2022 to ensure that the Company remained well funded has ensured that we are able to continue our extensive research and development plans unabated.

Operationally we’ve witnessed amazing progress in the clinical development of our portfolio of drug candidate assets. Most biotech companies only have one lead candidate, however, we have three major efficacy trials underway over three different drugs or therapies that have the potential to influence patient treatment protocols and unlock significant shareholder value upon the release of positive trial results.

In our IHL-42X program to treat obstructive sleep apnoea, our phase 2 proof of concept trial demonstrated that the main symptom measure of sleep apnea was more than halved on average for the participants in this trial, truly outstanding results.

After considerable work by the broader team throughout the year, Incannex has successfully opened its Investigational New Drug file after approval from the US Food and Drug Administration, truly a landmark achievement for the company. Incannex is now at the point whereby we will imminently undertake a major multi- site phase 2/3 pivotal clinical trial to assess IHL-42X for potential registration and marketing approval in the United States.

It was also another important year of development for IHL-675A, our multi-use cannabinoid drug candidate for inflammatory disorders. Various pre-clinical assessments of IHL-675A have demonstrated a superior response to inflammation to CBD administer alone, which is highly encouraging to us from a marketability and economic perspective.

Successful clinical results in the Phase 1 trial for IHL-675A were precursory to the extensive multi-site Phase 2 trial that was commenced in February to assess IHL-675A for use in the treatment of pain and function in patients with rheumatoid arthritis.

IHL-675A comprises cannabidiol and hydroxychloroquine. Both compounds are currently used to treat arthritis. By conducting studies on our unique proprietary combination formulation, we intend to open a major new market for prescribing health professionals to help the growing population of sufferers of rheumatoid arthritis.

With the benefit of our partnership with Monash University, Incannex has proved itself to be a sophisticated and advanced participant in the global psychedelic therapy sector. The PsiGAD phase 2 clinical trial assessing the use of our psilocybin assisted psychotherapy treatment protocol for generalised anxiety disorder nears completion with the final readout of results expected in Q1 of 2024.

Psychedelic therapies continue to garner attention from all walks of life and we are delighted to have established Clarion Clinics as the first dedicated clinic in Australia to provide crucial and potentially transformative psychedelic psychotherapy programs for people with PTSD and treatment resistant depression. We’re confident that Incannex has the most experienced people in country to undertake the significant endeavour to create a commercial psychedelic therapy clinic.

From a corporate perspective, the board of directors is unanimous in its decision to redomicile Incannex to the United States. If approved by our shareholders in a general meeting, the effect will be that all our shareholders will become holders of Incannex shares on the Nasdaq exchange. The Nasdaq is internationally respected and one of the largest exchanges in the world. It is a suitable marketplace for the ambitious goals of our company to develop multiple proprietary pharmaceutical products for the prescribing community of healthcare professionals.

2

Incannex Healthcare Limited

I would like to thank CEO and managing director Mr Joel Latham and the entire Incannex team for their energy and commitment that they bring to Incannex each and every day. Their work ethic, motivation and commitment to Incannex and the development of our clinical assets is something that as a shareholder I am extremely grateful. Lastly, I thank our shareholders. From a clinical perspective Incannex has made great strides throughout the year, a year that has been challenging in financial markets. Inevitably success in the clinic and ultimately as a business is largely due to the support of the company via its shareholders, we very much appreciate that support and look forward to our exciting journey together throughout FY2024.

| /s/ Troy Valentine |

Troy Valentine

Chairman

Melbourne, Victoria, 30th August 2023

3

Incannex Healthcare Limited

DIRECTORS’ REPORT

Your directors submit the annual financial report of Incannex Healthcare Limited (“IHL” or “the Company”) and its wholly owned subsidiaries (’the Group”) for the financial year ended 30 June 2023. In order to comply with the provisions of the Corporations Act 2001, the Directors report as follows:

DIRECTORS

The names of directors who held office during or since the end of the year and until the date of this report are as follows. Directors were in office for this entire period unless otherwise stated. No director served as a director of any other listed company during the period of three years immediately before the end of the financial year.

Mr Joel Latham – Managing Director & Chief Executive Officer

Appointed 24 July 2019

Joel Latham is the CEO and Managing Director of Incannex Healthcare and is responsible for the Company’s commercial operations, strategic decision- making, and oversight of all clinical development assets. Joel has over 15 years commercial management and executive experience, working for a range multi-national publicly traded companies.

Mr Troy Valentine – Non-Executive Chairman

B.Comm

Appointed 12 December 2017

Troy Valentine has been Chairman of the Board of Directors since December 2017. Mr. Valentine is a finance professional with managerial and Board experience spanning over 27 years. He commenced his career with Australian brokerage firm Hartley Poynton (now Euroz Hartley’s Limited) in 1994 before moving to Patersons Securities (now Canaccord Genuity) in 2000 and subsequently became an Associate Director. During his time at Patersons, he was responsible for managing both retail and institutional accounts. Mr. Valentine has significant corporate and capital raising experience, especially with start-ups and small to mid-cap size companies.

He is currently a director of Australian boutique corporate advisory firm Alignment Capital Pty Ltd, which he co-founded in 2014.

Mr Peter Widdows – Non-Executive Director

ACA (ICAEW), BTec, MAICD

Appointed 1 March 2018

Peter Widdows is the former Regional CEO of the H. J. Heinz corporation, with responsibility for a large portion of Asia and Australasia. He has extensive experience in Australian and international consumer goods markets and has worked as a senior executive/CEO in numerous geographies, including Europe, the USA and Asia/Pacific. Mr Widdows has a strong track record of driving profitable growth in both small and large companies and turning around poor performing businesses.

He is the current Non-executive Chair of Sunny Queen Australia Ltd - Australia’s largest shell egg and egg based meal producer and a Non-Executive Director of Youi Holdings Ltd - A general insurance company.

Dr George Anastassov – Non-Executive Director

Appointed 29 June 2022

Dr Anastassov is responsible for APIRx commercial operations, strategic decision-making, and oversight of all clinical development assets. He is one of the developers of the first-in-the world cannabinoid-containing chewing gum-based delivery system among a number of other systems and formulations. Previously, he was CEO and co- founder of AXIM Biotechnologies, which achieved an all-time-high market capitalization of approximately US$1.2B.

4

Incannex Healthcare Limited

Robert Clark – Non-Executive Director

Appointed 17 August 2022

Robert Clark is currently the Vice President, Regulatory Affairs for Novo Nordisk in the United States. He joined Novo Nordisk in 2012 after spending over 20 years at Pfizer in roles of increasing responsibility in the regulatory field. Robert has over 35 years of US and global regulatory experience. Under his leadership, his regulatory teams have received US FDA approvals for a large number of medicines across various therapeutic areas.

COMPANY SECRETARY

Madhukar Bhalla

Appointed 7 July 2021

Madhukar “Madhu” is an experienced company secretary who has previously worked with multiple ASX-listed companies and is proficient in corporate governance, company administration, financial management, and corporate law. Madhu also has significant business and management experience having previous job titles including general manager and corporate administrator. Madhu was the managing director of Colortype Press for a period of 8 years until 2004. There, he was responsible for the overall management of the business, including marketing, contracting, procurement and directing over 30 employees.

DIRECTORS’ MEETINGS

The number of meetings of Directors held during the year, and the number of meetings attended by each director were as follows:

| Name | Number of meetings eligible to attend | Number of meetings attended | ||||||

| Mr Troy Valentine | 16 | 16 | ||||||

| Mr Peter Widdows | 16 | 16 | ||||||

| Mr Joel Latham | 16 | 16 | ||||||

| Dr George Anastassov | 16 | 16 | ||||||

| Mr Robert Clark | 13 | 13 | ||||||

PRINCIPAL ACTIVITIES

During the financial year, the principal activity of the Company was research and development associated with medicinal cannabinoid and psychedelic pharmaceutical products and therapies.

REVIEW OF OPERATIONS AND SIGNIFICANT CHANGES IN STATE OF AFFAIRS

Operating result for the year

The Group’s loss for the year to 30 June 2023 after income tax was $19,979,558 (2022 Loss of $14,903,909).

CASH RESOURCES

At 30 June 2023, the Group had total funds, comprising cash at bank and on hand of $33,363,228 (2022: $37,500,93) the majority of which is held in Australian dollars. Total current assets at year-end stand at $34,685,887 (2022: $37,879,608).

5

Incannex Healthcare Limited

BUSINESS ACTIVITIES AND OUTLOOK

IHL-675A: Incannex’s proprietary anti-inflammatory drug product

Incannex are developing IHL-675A, a proprietary fixed dose combination products that contains cannabidiol (CBD) and hydroxychloroquine sulphate (HCQ), for the treatment of inflammatory conditions. Inflammatory conditions occur when the body’s immune system attacks its own tissues and organs causing inflammation, pain, discomfort, and damage to the effected tissues. Inflammatory diseases include rheumatoid arthritis which mostly affects joints, colitis and Crohn’s disease which affect the gastrointestinal tract, and asthma and chronic obstructive pulmonary disease which affect the respiratory system. Although there are anti-inflammatory drugs available, many patients still experience substantial pain and reduced function even when taking the marketed drugs, and some of the approved drugs have associated safety concerns.

CBD and HCQ have anti-inflammatory activity when used independently. Incannex hypothesized that the combination of CBD and HCQ would be synergistic. That is, the combination of the two drugs would reduce inflammation to a greater extent than would be predicted for the combination based on their activities when used independently. The hypothesis of synergistic anti-inflammatory activity was confirmed in a series of preclinical studies including human peripheral blood mononuclear cells and animal models of inflammatory diseases including arthritis, inflammatory bowel disease and inflammatory lung disease. The results of these preclinical models gave Incannex the confidence to develop a unique fixed dose combination product for assessment in clinical trials with the goal of regulatory approval by bodies including the United States Food and Drug Administration (FDA) and Australian Therapeutic Goods Administration (TGA).

Phase 1 clinical trial assessing the safety, tolerability and pharmacokinetics of IHL-675A

To assess the safety, tolerability, and pharmacokinetics of IHL-675A Incannex ran a Phase 1 clinical trial. The key endpoints of the trial were the adverse events reported and the plasma levels of the active pharmaceutical ingredients (APIs), CBD and HCQ, and their major metabolites over a 28-day period. IHL-675A was compared to the reference listed drugs for CBD and HCQ, Epidiolex and Plaquenil respectively, across all endpoints. The trial included three cohorts of twelve participants each (total n = 36), with equal evaluations applied across all three groups. Participants were monitored for adverse events and had blood samples collected for pharmacokinetic analysis over a 28-day period. The study was conducted at CMAX Clinical Research in South Australia and managed by Avance Clinical.

In July 2022, Incannex received approval from the Bellberry Human Research Ethics Committee (HREC) to conduct the Phase 1 clinical trial investigating IHL-675A. Recruitment of participants for the trial commenced in August 2022. Dosing of participants was completed in October 2022.

Safety and Tolerability Results

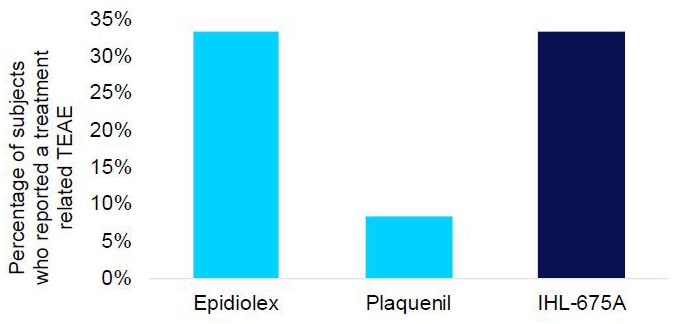

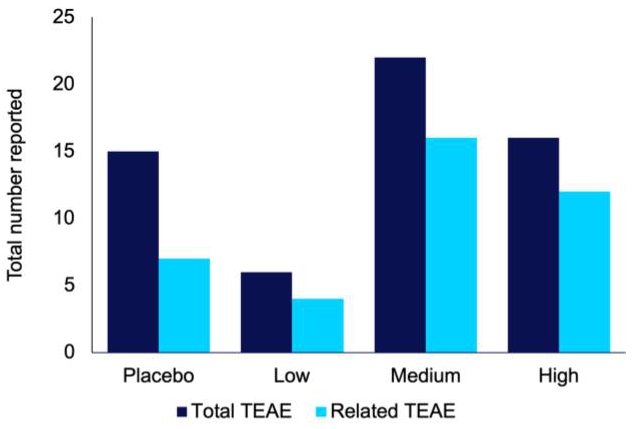

IHL-675A was well tolerated, with no adverse events of concern and no serious adverse events reported (Figure 1). The same number of treatment related treatment emergent adverse events (TEAEs) were reported for IHL- 675A as for Epidiolex. Treatment-related TEAEs included abdominal pain, dizziness, fatigue, frequent bowel movements, headache and somnolence. All TEAEs were minor with the exception of one incidence of moderate severity abdominal cramps which resolved soon after onset.

6

Incannex Healthcare Limited

Figure 1. Percentage of subjects who reported a treatment related treatment emergent adverse event in each of the treatment groups of the IHL-675A Phase 1 clinical trial.

CBD Pharmacokinetic Results

Comparison of the average pharmacokinetics of CBD in participants administered IHL-675A compared to those administered Epidiolex revealed that the CBD was taken up from IHL-675A more quickly and reached a higher maximum concentration than from Epidiolex (Figure 2). The average maximum concentration (Cmax) of CBD from IHL-675A was 1.57 times higher than for Epidiolex. The time to reach the maximum concentration (Tmax) was 26% faster for IHL-675A than Epidiolex. CBD administered in IHL-675A was also cleared more quickly than Epidiolex. The half-life (t1/2) of CBD from IHL-675A was 13% faster than Epidiolex. The total exposure (AUCinf) was similar for CBD administered as IHL-675A and Epidiolex. These patterns are trends at this point (p >0.05). Similar results were observed for CBD metabolites 7-COOH-CBD and 7-OH-CBD. Pharmacokinetic parameters are presented in Table 1.

7

Incannex Healthcare Limited

Figure 2. Average plasma concentrations of CBD over time for the IHL-675A and Epidiolex treatment groups in the IHL-675A Phase 1 clinical trial.

8

Incannex Healthcare Limited

Table 1. CBD and metabolite PK parameters from IHL-675A Phase 1 study

| IHL-675A | Epidiolex | |||||||||||||||||||||||||||||||||

| Cmax | Tmax | AUCinf | T1/2 | Cmax | Tmax | AUCinf | T1/2 | |||||||||||||||||||||||||||

| (ng/mL) | (hr) | (hr*ng/mL) | (hr) | (ng/mL) | (hr) | (hr*ng/mL) | (hr) | |||||||||||||||||||||||||||

| CBD | Mean | 207.04 | 2.13 | 841.08 | 220.17 | 131.89 | 2.88 | 725.9 | 231.22 | |||||||||||||||||||||||||

| SD | 117.44 | 0.91 | 358.63 | 53.85 | 61.92 | 1.21 | 223.98 | 56.45 | ||||||||||||||||||||||||||

| Min | 72.6 | 1.02 | 391 | 113.84 | 45.6 | 1.5 | 355 | 144.41 | ||||||||||||||||||||||||||

| Max | 472 | 4 | 1699 | 301.17 | 241 | 6 | 1121 | 305.88 | ||||||||||||||||||||||||||

| 7-OH-CBD | Mean | 55.24 | 2.17 | 389.18 | 40.54 | 21.06 | 3 | 262.27 | 21.15 | |||||||||||||||||||||||||

| SD | 34.58 | 0.94 | 214.49 | 52.79 | 9.15 | 1.22 | 103.95 | 10.05 | ||||||||||||||||||||||||||

| Min | 14.9 | 1.02 | 220 | 10.78 | 7.7 | 1.5 | 149 | 10.54 | ||||||||||||||||||||||||||

| Max | 116 | 4 | 950 | 202.58 | 38.4 | 6 | 448 | 49.36 | ||||||||||||||||||||||||||

| 7-COOH-CBD | Mean | 479.75 | 2.83 | 18753.9 | 167.87 | 362.17 | 4.97 | 16268 | 153.68 | |||||||||||||||||||||||||

| SD | 218.74 | 1.2 | 8979.02 | 95.47 | 299.63 | 1.3 | 11069.2 | 92.41 | ||||||||||||||||||||||||||

| Min | 209 | 1.5 | 11445 | 46.03 | 116 | 2.5 | 4475 | 18.47 | ||||||||||||||||||||||||||

| Max | 921 | 6 | 43714 | 332.65 | 1180 | 6.05 | 42018 | 317.68 | ||||||||||||||||||||||||||

Hydroxychloroquine Pharmacokinetic Results

Comparison of the average pharmacokinetics of hydroxychloroquine in participants administered IHL-675A compared to those administered Plaquenil revealed that hydroxychloroquine was taken up more slowly from IHL-675A than from Plaquenil but the two drugs had a similar maximum plasma concentration (Figure 3). The time to reach the maximum concentration (Tmax) for HCQ administered as IHL-675A was 46% slower than for Plaquenil. The hydroxychloroquine clearance and total exposure was similar for the two drugs. These patterns are trends at this point (p >0.05). Plasma concentrations of hydroxychloroquine metabolites desethylhydroxychloroquine, bisdesethylhydroxychloroquine and desethylchloroquine were detected only at low levels (<2 ng/mL) at all points in the study. Pharmacokinetic parameters are presented in Table 2.

9

Incannex Healthcare Limited

Figure 3. Average plasma concentrations of hydroxychloroquine over time for the IHL-675A and Plaquenil treatment groups in the IHL-675A Phase 1 clinical trial.

10

Incannex Healthcare Limited

Table 2. Hydroxychloroquine and metabolite PK parameters from IHL-675A Phase 1 study

| IHL-675A | Plaquenil | |||||||||||||||||||||||||||||||||

| Cmax | Tmax | AUCinf | T1/2 | Cmax | Tmax | AUCinf | T1/2 | |||||||||||||||||||||||||||

| (ng/mL) | (hr) | (hr*ng/mL) | (hr) | (ng/mL) | (hr) | (hr*ng/mL) | (hr) | |||||||||||||||||||||||||||

| HCQ | Mean | 54.71 | 5.59 | 2986 | 182.62 | 55.52 | 3.46 | 3430.8 | 251.6 | |||||||||||||||||||||||||

| SD | 23.85 | 2.51 | 1244.46 | 93.7 | 24.81 | 1.94 | 1104.38 | 73.65 | ||||||||||||||||||||||||||

| Min | 22 | 2 | 800 | 35.68 | 26.1 | 1 | 2073 | 163.92 | ||||||||||||||||||||||||||

| Max | 105 | 12.03 | 4217 | 311.57 | 124 | 6 | 5888 | 421.51 | ||||||||||||||||||||||||||

| DESETHYL- | Mean | 1.38 | 81.08 | NA | NA | 1.29 | 17.46 | NA | NA | |||||||||||||||||||||||||

| HYDROXY- | SD | 1.24 | 183.01 | NA | NA | 1.04 | 35.04 | NA | NA | |||||||||||||||||||||||||

| CHLOROQUINE | Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| Max | 4.4 | 673.83 | 0 | 0 | 3.3 | 123.93 | 0 | 0 | ||||||||||||||||||||||||||

| DESETHYL- | Mean | 0.8 | 7.77 | NA | NA | 0.42 | 5.59 | NA | NA | |||||||||||||||||||||||||

| CHLOROQUINE | SD | 0.72 | 13.03 | NA | NA | 0.84 | 13.58 | NA | NA | |||||||||||||||||||||||||

| Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Max | 2 | 49.05 | 0 | 0 | 2.9 | 49.07 | 0 | 0 | ||||||||||||||||||||||||||

| BISDESETHYL- | Mean | 0 | 0 | NA | NA | 0 | 0 | NA | NA | |||||||||||||||||||||||||

| HYDROXY- | SD | 0 | 0 | NA | NA | 0 | 0 | NA | NA | |||||||||||||||||||||||||

| CHLOROQUINE | Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| Max | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

NA- metabolite not detected at levels sufficient to calculate PK parameter

Interpretation of the results from the phase 1 clinical trial.

IHL-675A is well tolerated in healthy volunteers. Adverse events for IHL-675A were consistent with what was observed, and has been publicly reported, for Epidiolex and Plaquenil. Both active pharmaceutical ingredients, CBD and HCQ, are absorbed from IHL-675A. Trends in PK profiles indicate that the uptake of CBD may be more rapid for IHL-675A than Epidiolex and uptake of HCQ may be slower for IHL-675A than Plaquenil. This could be advantageous for IHL-675A. CBD provides immediate relief for inflammation and pain whereas HCQ is a slower acting molecule and provides extended relief.

The safety and pharmacokinetic data from this Phase 1 clinical trial in healthy volunteers adds to the company’s confidence in proceeding with assessment of IHL-675A in patients with inflammatory diseases, with the initial focus on rheumatoid arthritis.

11

Incannex Healthcare Limited

Phase 2 clinical trial assessing the effects of IHL-675A on pain and function in patients with rheumatoid arthritis.

In February 2023, Incannex announced that it had commenced a Phase 2 clinical trial to assess the safety and efficacy of IHL-675A on pain and function in patients with rheumatoid arthritis. In this trial rheumatoid arthritis patients will receive one of IHL-675A, CBD, HCQ or placebo for 24 weeks. The treatments will be double blinded, meaning neither the investigators nor patients will know which treatment an individual is receiving. The study will be managed by Avance Clinical, an Australian and US CRO (Avance), who will identify and onboard 8-13 clinical trial sites with expertise in rheumatoid arthritis to conduct patient recruitment and assessments. Avance Clinical will manage the sites and study conduct, ensure that the data is of the necessary quality, and conduct the analysis of data collected across all the trial sites.

The trial will include 128 participants who meet the eligibility criteria. Participants will be randomised to one of 4 arms: either IHL-675A, CBD alone, HCQ alone or placebo. The primary endpoint for the study is pain and function relative to baseline determined via the score on the RAPID3 assessment at 24 weeks. Participants will also record their pain and function outcomes daily, by completing questionnaires on pain, fatigue, joint stiffness and quality of life, using an electronic Patient Reported Outcomes device (similar to completing a questionnaire on an electronic tablet). The participants will attend monthly visits at the clinical trial site, where blood tests, and physical examinations will monitor additional safety and efficacy outcomes including inflammatory biomarkers. The trial will also include a sub-study examining joint damage via MRI. Subjects will be assessed for eligibility in the MRI study based on their Rheumatoid Arthritis Magnetic Resonance Imaging Score (RAMRIS) at screening.

The results of this study will establish the safety and efficacy of IHL-675A in rheumatoid arthritis and will be a critical component of future regulatory applications, including contributing to the combination rule assessment in the FDA505(b)2 new drug application (NDA) dossier.

After the end of financial year, in July 2023, Incannex received approval from the Human Research Ethics Committee (HREC) for its lead site, Emeritus Research in Camberwell, VIC, to conduct the Phase 2 clinical trial investigating the effect of IHL-675A on pain and reduced function in patients with rheumatoid arthritis. Site selection, approval and HREC submission is ongoing and Incannex anticipates that approval for the remaining sites will be received over the coming months.

IHL-42X: Incannex’s proprietary drug product for treatment of obstructive sleep apnea

Incannex are developing IHL-42X, a proprietary combination of dronabinol and acetazolamide for treatment of obstructive sleep apnea (OSA). OSA is a disease of sleep disordered breathing where the upper airway repeatedly completely or partially collapses during sleep. This disrupts airflow, reduces oxygen uptake and leads to poor sleep quality. Presentation of OSA often includes snoring and waking up gasping for air. The immediate consequences of OSA are daytime sleepiness, negative impacts on mood and cognitive function, including an increased risk of traffic accidents. Long term, patients with untreated OSA have an increased risk of cardiovascular disease, deficits in executive function and mental health issues such as depression and anxiety. Current standard of care for OSA is the use of positive airway pressure (PAP) devices, such as CPAP. Although these devices are effective, patient compliance is less than 50% due to issues with discomfort, inconvenience, cost and safety concerns. There are no approved pharmacotherapies for treatment of OSA.

Incannex hypothesized that the combination of dronabinol, a synthetic form of THC, and acetazolamide, a carbonic anhydrase inhibitor that is used for the treatment of a range of indications would be an effective treatment for OSA. This hypothesis was based on the published observations that each of the drugs had a benefit in patients with OSA. However, the therapeutic effect of the drugs when used alone was limited and there were concerns with side effects at therapeutic doses. IHL-42X is designed to reduce the dose of each component drug, increasing the therapeutic effect, and reducing the side effects.

12

Incannex Healthcare Limited

IHL-42X proof of concept clinical trial.

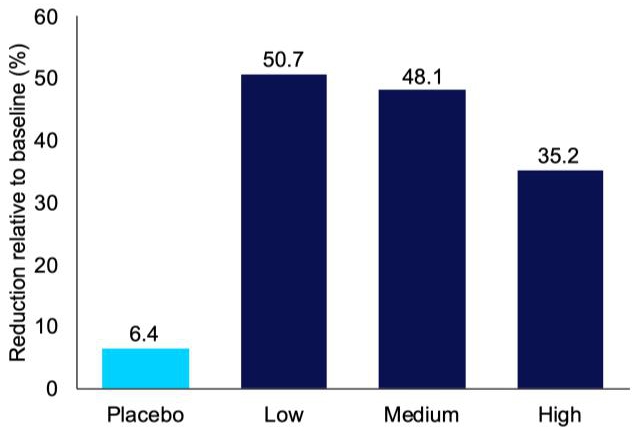

In June 2022, Incannex unveiled promising outcomes from a comprehensive analysis of its Phase 2 clinical trial evaluating the efficacy of IHL-42X in treating patients with obstructive sleep apnea (OSA). Particularly, the low dose of IHL-42X demonstrated superior safety and effectiveness metrics when compared to higher doses. Notably, low-dose IHL-42X led to an average reduction of 50.7% in apnea-hypopnea index (AHI) among trial participants (Figure 4), with 25% experiencing a substantial reduction of over 80% (Figure 5). AHI is the main measure used to diagnose and monitor OSA. A reduction in the AHI indicates an improvement in the disease, which is anticipated to lead to improved sleep quality and decreased daytime sleepiness.

Figure 4. Average reduction in apnea hypopnea index (AHI) for each treatment period, relative to baseline, in the IHL-42X proof of concept phase 2 clinical trial.

13

Incannex Healthcare Limited

Figure 5. Proportion of patients in each IHL-42X proof of concept treatment period who experienced a reduction in AHI of >50% and >80% relative to baseline.

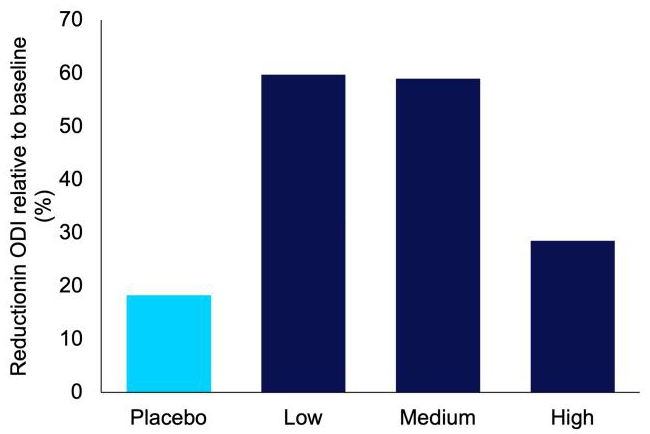

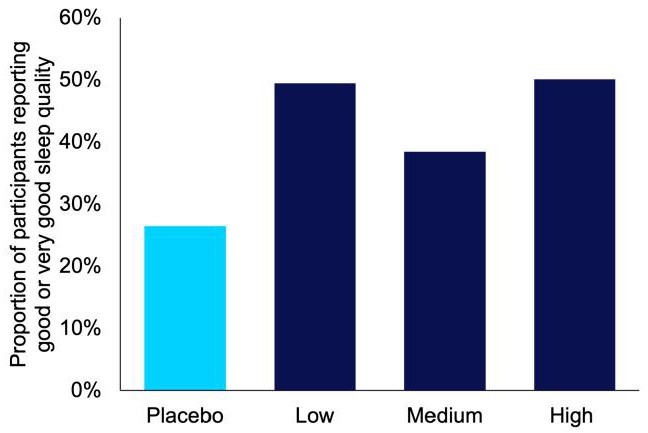

IHL-42X also improved other aspects of OSA. The oxygen desaturation index, which is a measure similar to AHI, but instead measures the number of times there is insufficient blood oxygen levels or desaturation events, dropped by an average of 59.7% (Figure 6). The improvement in AHI and ODI culminated in improved patient reported sleep quality (Figure 7).

14

Incannex Healthcare Limited

Figure 6. Average reduction in oxygen desaturation index (ODI) for each treatment period, relative to baseline, in the IHL-42X proof of concept phase 2 clinical trial.

Figure 7. Proportion of patients in each IHL-42X proof of concept treatment period who reported good or very good sleep quality.

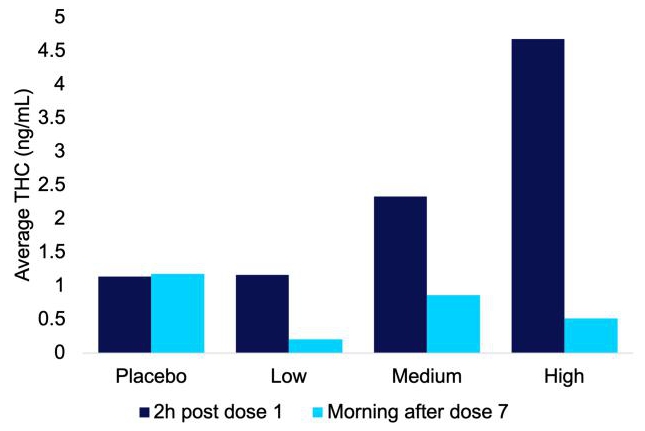

The proof-of-concept study also returned encouraging results from a safety perspective. Of significance, the compound was well-tolerated, with fewer treatment-emergent adverse events in the low-dose group compared to the placebo (Figure 8). Another important result was that low-dose IHL-42X resulted in THC blood concentrations below thresholds for impaired driving (1 ng/mL) on the morning following administration (Figure 9). None of the samples in the low dose treatment period had a THC concentration of greater than 0.45 ng/mL.

15

Incannex Healthcare Limited

Figure 8. Total number of treatment emergent adverse events (TEAE), and TEAE that were probably or possibly related to the treatment, reported during each IHL-42X treatment period.

16

Incannex Healthcare Limited

Figure 9. Average THC concentrations in plasma samples collected the during each of the treatment periods of the IHL-42X proof of concept clinical trial. The average is calculated for samples for which there was THC detected. In the placebo treatment period this was a single sample.

The safety and efficacy data from the IHL-42X proof-of-concept study confirmed the Incannex’s hypothesis that the combination of dronabinol and acetazolamide would be an effective treatment for sleep apnea and has given the company the confidence to continue to develop IHL-42X towards regulatory approval.

Expanded patent position for IHL-42X

In December 2022, Incannex announced that it had filed an additional provisional patent application for protection of IHL-42X. This patent application was based on data from a further analysis of the data from the IHL-42X phase 2 proof of concept clinical trial where IHL-42X was shown to have a dose dependent effect on loop gain and low dose IHL-42X had a statistically significant effect on airway collapsibility. This provided some explanation as to why IHL-42X at low dose was observed to be more effective at reducing AHI than medium or high doses.

Bioavailability/bioequivalence clinical trial

In November 2022, Incannex announced that it had engaged CMAX Clinical Research and Novotech CRO to undertake a bioequivalence/bioavailability (BA/BE) clinical trial for IHL-42X. The BA/BE study focuses on assessing the pharmacokinetics and tolerability of IHL-42X’s active pharmaceutical ingredients (APIs), dronabinol (THC) and acetazolamide, in comparison to FDA reference listed drugs Marinol and Taro acetazolamide tablets respectively. The study will also investigate the effect of food on IHL-42X tolerability and pharmacokinetics. The BA/BE study involves 116 participants and will evaluate the concentrations of APIs and metabolites in blood samples over 48 hours. This study design adheres to FDA recommendations for bioequivalence studies. The outcomes of the BA/BE trial will be a crucial component of a forthcoming New Drug Application (NDA), serving as a bridging mechanism to the reference listed drugs, thereby facilitating regulatory approval via the FDA505(b)2 regulatory pathway.

Approval was received in July 2023 from Bellberry HREC for the conduct of the BA/BE clinical trial.

17

Incannex Healthcare Limited

Phase 2/3 clinical trial investigating IHL-42X in patients with OSA

The next step in the development of IHL-42X is a global Phase 2/3 clinical trial investigating the effect of the drug product in patients with OSA who are non-compliant, intolerant or naïve to positive airway pressure devices, such as CPAP. This study will include at least 385 patients across 45 clinical trial sites located across the world. Feedback from the FDA in a preIND meeting guided the design of this clinical trial. Efficacy of the drug will be assessed by a co-primary endpoint consisting of change in AHI from baseline and change in functional outcomes of sleep score from baseline at 52 weeks. Secondary and exploratory endpoints will include other PSG and sleep parameters, change in cognitive function and a range of safety and efficacy focused biomarkers.

Appointment of lead principal investigators for Phase 2/3 trial.

In June 2023, Incannex announced that Dr John D Hudson of FutureSearch Trials of Neurology, Austin, Texas and Dr Russell Rosenberg, of Neurotrials Research Inc, Atlanta Georgia, had been recruited as co-Lead Principal Investigators for the IHL-42X Phase 2/3 Study.

J. Douglas Hudson, MD, is board certified in Neurology and Sleep Medicine. He serves as the Principal Investigator for FutureSearch Trials of Neurology, Austin, Texas. Dr. Hudson has supervised over 300 clinical trials over the past 20 years mostly related to neurological and sleep disorders and has been a national and international speaker for these disorders.

Dr. Hudson completed his neurology residency at the University of Iowa and was Austin’s first board certified sleep specialist. Past activities include founding the Austin Neurological Clinic and Sleep Medicine Consultants. He held the position of President of the Texas Neurological Society, with a Lifetime Achievement Award and President of the Capital Area American Heart Association.

FutureSearch Trials consists of two clinical research facilities in Austin and Dallas, Texas which have been in operation for over 15 years. The Austin site where Dr. Hudson is the Principal Investigator focuses on clinical research studies for treatment of neurological, pain and sleep disorders and features an on-site sleep lab. Regarding the IHL-42X trial, Dr Hudson said: “Clinical trials for novel formulations of medication are newsworthy for any specialty and sleep medicine is no exception.

Obstructive Sleep Apnea, affecting millions of people, remains under treated. This is due in part to patients not being diagnosed, and in part due to poor patient compliance with current therapeutic modalities. While unheard of a few years ago, oral medications to help reduce the cause of OSA, are now undergoing further investigation. This is more than exciting, it could prove to be life-changing for many patients.”

Dr. Rosenberg is currently Chief Science Officer and CEO of NeuroTrials Research in Atlanta, Georgia. Dr. Rosenberg, a native of St. Louis, obtained his doctorate in clinical and research psychology from The Ohio State University and received specialized training in sleep disorders medicine and research at Rush Presbyterian - St. Luke’s Medical Center in Chicago. He has more than 35 years’ experience in clinical sleep medicine and research, acting as an investigator in over 300 clinical trials including 14 in OSA and 211 in other sleep related disorders. He is a Board-Certified Sleep Specialist and Fellow of the American Academy of Sleep Medicine. Dr. Rosenberg is former Chair and spokesperson for the National Sleep Foundation (NSF) and has appeared frequently on local and national television news shows including the Today Show, Good Morning America, CNN, and MSNBC.

Neurotrials Research Inc is a clinical research facility in Atlanta, Georgia that has been in operation for over 25 years. Neurotrials Research is focused on delivery of trials in neurology/CNS and sleep indications. Regarding the IHL-42X phase 2/3 clinical trial Dr Rosenberg said: “Incannex has developed a sound, rational, scientific protocol to determine the efficacy and safety of IHL-42X in subjects with obstructive sleep apnea.” “Many sleep apnea patients cannot adhere to positive airway pressure therapy, use it for an inadequate period at night or just refuse it. Having a safe, effective pharmacological option for obstructive sleep apnea will be a positive addition to the treatment landscape as it will offer those that struggle to adhere to positive airway pressure therapy an alternative therapy.”

18

Incannex Healthcare Limited

Investigational New Drug Application

Subsequent to the end of the financial year, Incannex submitted an investigational new drug (IND) application to the US FDA for review. The IND dossier compiled by the Incannex team included comprehensive modules on the safety and efficacy of IHL-42X and its component active pharmaceutical ingredients. It also includes detailed information on the development, manufacturing, quality and stability of the IHL-42X drug product, as well as the clinical protocol and investigator information for the Phase 2/3 IND opening clinical trial.

The modules of the IND were:

| ● | Module 1 – Administrative Information and Prescribing Information |

| ● | Module 2 – Nonclinical/Clinical Overviews and Summaries |

| ● | Module 3 – Quality data |

| ● | Module 4 – Nonclinical Study Reports and Key Literature References |

| ● | Module 5 – Clinical Study Reports, Clinical Protocol and Investigator Information |

Submitting and clearing an IND with the FDA is crucial for companies to gain regulatory approval, conduct clinical trials, and engage in scientific dialogue with FDA whilst they progress investigational drugs through the stages of development in the United States. The FDA review process for an IND application involves evaluation of the scientific, clinical, and safety aspects to ensure that the proposed clinical trial meets regulatory requirements.

FDA completed their review of the IND package and Incannex received confirmation from the agency that the IND opening study may proceed. That is, the IND application has cleared.

Clearance of the IND application is a critical milestone that is required to conduct clinical trial in the United States. Incannex are now working with Fortrea, the CRO engaged to manage the Phase 2/3 clinical trial to prepare institutional review board applications for the lead trial sites, complete the selection and approval of the remaining trials sites, and further prepare for patient recruitment and dosing for the clinical trial.

IHL-216A: Incannex’s proprietary drug product for treatment of traumatic brain injury

Incannex are developing IHL-216A, a combination of cannabidiol and isoflurane for treatment of traumatic brain injury. The two drugs are both known to have neuroprotective effects that occur through different mechanisms of action. Incannex hypothesized that the combination of the two drugs would provide a synergistic neuroprotective effect. This hypothesis was confirmed in two separate rodent models of TBI, both mild and moderate/severe injury models.

Incannex Successfully Concludes Constructive Pre-IND Meeting with FDA for IHL-216A Concussion and Traumatic Brain Injury (TBI) Treatment

In October, 2022 Incannex completed a productive pre-Investigational New Drug (pre-IND) meeting with the U.S. Food and Drug Administration (FDA) concerning its proprietary drug product IHL-216A, developed for the treatment of Traumatic Brain Injury (TBI) and concussion. The pre-IND meeting followed the submission of a comprehensive package to the FDA in August 2022, encompassing details about the unique formulation, a comprehensive clinical development plan, and specific regulatory inquiries necessary for opening an Investigational New Drug application (IND). The IND is a crucial step for conducting clinical trials in the United States, ensuring that trial designs align with data requirements for eventual FDA marketing approval.

In response to the pre-IND submission, the FDA provided valuable multidisciplinary feedback regarding the clinical development of IHL-216A. Moreover, the FDA provided guidance on the use of the FDA505(b)2 regulatory pathway, wherein certain data required for marketing approval can be drawn from publicly available studies on the components of IHL-216A.

19

Incannex Healthcare Limited

Upscaling Production of cGMP IHL-216A

During August 2022, Incannex engaged Curia Global, Inc. (Curia) to facilitate the advanced development and cGMP-grade manufacturing of IHL-216A, the company’s inhaled proprietary drug targeted for the treatment of concussion and traumatic brain injury (TBI). This decision comes following successful proof-of-concept studies that identified the optimal inhaled formulation for IHL-216A on an experimental scale. Curia is tasked with scaling up the fill-finish manufacturing processes for IHL-216A, ensuring compliance with Current Good Manufacturing Practice (cGMP) standards while also generating vital data concerning product quality and stability. This information is set to support future regulatory submissions.

Inclusion of FDA Regulatory Affairs Expert, Mr. Robert B. Clark, on the Board of Directors

Incannex proudly announced the appointment of Mr. Robert B. Clark to its Board of Directors in August 2022. Mr. Clark is an accomplished pharmaceutical executive with over 38 years of substantial regulatory experience in both the US and the global landscape. This includes extensive roles at Pfizer Inc. and Novo Nordisk A/S, each exceeding two decades. Mr. Clark’s expertise extends to strategic regulatory affairs, FDA and European Medicines Agency (EMA) interactions, pharmaceutical advertising regulations, and matters pertaining to healthcare professionals and sales activities.

Presently serving as Vice President of US Regulatory Affairs at Novo Nordisk, Mr. Clark offers strategic leadership to a team of over 50 regulatory professionals engaged in new medicine development. His guidance influences global executive decisions, encompassing drug development strategies, FDA engagement strategies, compliance oversight, and vigilance regarding emerging US regulatory trends. Notably, his leadership has led to the FDA approval of a notable twelve (12) significant new drugs since 2012, reflecting his effectiveness in navigating complex regulatory processes.

Mr. Clark’s impressive background and contributions align closely with Incannex’s endeavors, particularly given its diverse mix of drug candidates including cannabinoids and psychedelic pharmacotherapies. In his own words, Mr. Clark emphasized his enthusiasm to contribute to Incannex’s broad portfolio of treatments designed to address conditions with limited therapeutic alternatives.

Psychennex

Psychennex is a wholly owned subsidiary of Incannex that houses all research, development and commercial activities related to psychedelic molecules, such as psilocybin and MDMA. This includes the clinical development of the PsiGAD program that uses psilocybin assisted psychotherapy for treatment of generalised anxiety disorder and the Clarion Clinics Group for administration of psychedelic assisted psychotherapy in major depressive disorder and post traumatic stress disorder.

20

Incannex Healthcare Limited

PsiGAD

PsiGAD is Incannex’s proprietary psilocybin assisted psychotherapy program for treatment of generalised anxiety disorder. The program is being developed in collaboration with Dr Paul Liknaitsky of Monash University.

Generalized anxiety disorder (GAD) is a serious psychiatric condition affecting around 4-6% of the population during their lifetime. GAD is characterised by diffuse, excessive, uncontrollable worry that tends to be more frequent and severe than within other anxiety disorders. GAD has a chronic, unremitting course that is associated with a high public burden, and significant consequences for relationships, work, and quality of life. It is a highly comorbid disorder, with estimations of lifetime mental disorder comorbidity as high as 90%. It is most comorbid with major depression, and also commonly comorbid with other anxiety disorders, other mood disorders, and non-psychiatric disorders such as chronic pain and irritable bowel syndrome.

International guidelines for GAD treatment recommend selective serotonin reuptake inhibitors (SSRIs), serotonin and noradrenaline reuptake inhibitors (SNRIs), and pregabalin as first-line options, with benzodiazepines such as diazepam as second-line options. However, these treatments show limited efficacy, problematic side effects, and other limitations. Psilocybin assisted psychotherapy in PsiGAD is designed to provide an alternative to these patients who’s disease is not adequately controlled by the above mentioned treatments. Psilocybin is thought to facilitate and improve the efficacy of psychotherapy by allowing patient to access the root causes of their anxiety, address those causes and build new neural connections that lead to a lasting treatment effect.

PsiGAD1

PsiGAD1 is a proof-of-concept clinical trial investigating safety and efficacy of psilocybin assisted psychotherapy for treatment of GAD that is being led by principal investigator Dr Paul Liknaitsky and an extended team of clinical scientists, physicians and therapists at Monash University. The trial will recruit 72 patients in total across equivalent, triple blind, psilocybin and placebo arms. Each patient will receive two dosing sessions and a number of preparatory and integration psychotherapy sessions. The endpoints of this trial encompass safety, efficacy, and tolerability, while secondary outcomes include assessments of quality of life, functional limitations, and comorbid conditions. The primary efficacy endpoint is change in Hamilton Anxiety Rating Scale six weeks after the second dosing session.

In March 2023, interim analysis of the study data to date was conducted. An independent Data Safety Monitoring Board reviewed the data and recommended no change to the study design and had no concerns with the safety of the PsiGAD trial. Review of the interim data by Incannex, consisting of primary endpoint data from the first twenty nine participants found that there is a high probability (greater than 85% - alpha error 0.05 or 95% confidence level) that the total study will show a statistically significant benefit for the psilocybin treatment arm over the placebo treatment arm. This projection was made by assuming the effect size observed in the interim analysis for 29 participants is representative of the effect size through the remaining 43 participants. The end point used in this modelling was a reduction in Hamilton Anxiety Rating Scale (HAM-A) score at 11 weeks relative to baseline (six weeks post second dose), which is the primary endpoint in the trial. This modelling was completed internally by the company and did not get verified by the DMSB.

Recruitment for the trial has continued throughout the reporting period and final study results are expected in late 2023 or early 2024.

Development and manufacture of cGMP psilocybin drug product

Based on the promising outcome of the interim analysis from PsiGAD1, Psychennex engaged Catalent for development and cGMP manufacture of Psychennex’s own psilocybin drug product in March 2023. This drug product will be used in Psychennex’s future clinical trials and potential wider commercial use. This development project is ongoing.

21

Incannex Healthcare Limited

Clarion Clinics

In March 2023, Incannex announced the intention to open multiple psychedelic-assisted psychotherapy clinics in Australia and overseas under the leadership of Peter Widdows, a long-standing Director of the Company.

Incannex had been developing the commercialisation plans for psychedelic clinics for some time, well before the TGA decision to down-schedule psilocybin for treatment-resistant depression (TRD) and MDMA for Post-Traumatic Stress Disorder (PTSD) was announced. The announcement from TGA led to an expansion and announcement of these plans.

The Company has entered a partnership with Australia’s leading clinical psychedelic professionals, all of whom have extensive experience within clinical psychedelic research, treatment, and training.

Dr Paul Liknaitzky: Co-Founder, Director, Chief Strategy Officer, and Chief Scientific Officer

Paul has played a central role in establishing the clinical psychedelic field in Australia and leads the largest group of psychedelic researchers and clinicians in the country. Paul is the Chief Principal Investigator on a program of psychedelic trials and collaborates on numerous others nationally. He has led the development of psychedelic trial protocols, treatment design, trial coordination, therapist selection and training, and has established active collaborations with an extensive network of international experts and organisations in the field. Paul’s work is focused on developing innovative psychedelic therapies, evaluating benefits, exploring potential drawbacks, predicting treatment response, mitigating risks, understanding therapeutic mechanisms, and translating research into practice.

Professor Suresh Sundram: Co-Founder, Director, Chief Medical Officer, and Head of Psychiatry

Suresh is a Fellow of the Royal Australian and New Zealand College of Psychiatrists and a consultant psychiatrist. He holds senior leadership positions in academic and clinical psychiatry and has published more than 150 scientific articles, books, book chapters, and conference abstracts. He has presented as plenary and invited speaker at international and national conferences, served as Deputy Editor for the Asian Journal of Psychiatry, and as an advisor to the United Nations (UN), and to national and state governments. Prof. Sundram has led over 50 clinical trials and studies in psychiatric disorders. He has extensive experience with the use of psychedelics within psychotherapy and has overseen multiple research projects in this field.

Sean O’Carroll: Co-Founder, Director, and Head of Psychotherapy

Sean is an integrative psychotherapist and academic – specialising in experiential, relational, and transpersonal psychotherapy. Since 2019, he has developed and delivered psychedelic-assisted psychotherapy training for several clinical psychedelic research teams. He has served as lead psychotherapist on two clinical research trials, continues to supervise one of these teams, and works as a psychedelic-assisted psychotherapy consultant within industry, with an emphasis on psychotherapy training and protocol development. Sean began lecturing in transpersonal psychology in 2011 and has over ten years’ experience working with what he calls “psychedelic casualties”. Through the Wild Mind Institute, he offers training for mental health practitioners in psychedelic-assisted psychotherapy, “bad trip” integration, and eco-psychotherapy.

In May 2023, the company announced that it had signed a lease for the first clinic in Abbottsford, a suburb of Melbourne, Victoria. The clinic is designed as a commercial scale prototype, which can be scaled up and replicated to other locations. It will have capacity to treat over 600 patients per year in normal working hours and substantially more in extended hour operations. The company also announced that it had secured an initial supply of psilocybin and MDMA to facilitate commencement of clinical operations.

22

Incannex Healthcare Limited

The Clarion Clinics Advisory board is made up of world leading clinical psychedelics experts.

| ● | Dr. Bill Richards is among the world’s best known psychedelic researchers and practitioners. He has had a multi-decade career at the forefront of psychedelic research, therapy, and training, and is a mentor and trainer to numerous research groups around the world. He co- founded the psychedelic research group at Johns Hopkins University and is the Director of Therapy at Sunstone Therapies in Maryland, US. |

| ● | Dr. Andrea Jungaberle is the Chief Medical Officer of Ovid Clinics in Berlin and co-founder of the MIND Foundation, Europe’s leading psychedelic research and education group. She has conducted and/or supervised psychedelic-assisted psychotherapy for hundreds of patients and works both within Germany’s largest clinical psilocybin trial and within clinical service delivery. |

| ● | Professor Matthew Johnson is one of the world’s most published psychedelic scientists. He has been central in the establishment and leading track record of the Johns Hopkins Center for Psychedelic & Consciousness Research, and his work has contributed to standards in practice within clinical psychedelic science. As a high-profile scientist in his field, he is frequently interviewed by national and international media outlets. |

In August 2023, after the end of the reporting period, Clarion Clinics announced that they were accepting registrations for Psychedelic treatment interest as part of pre-screening in readiness for opening.

APIRx

In August 2022, Incannex announced that it had completed the acquisition of APIRx Pharmaceuticals to aggregate the world’s largest portfolio of patented medicinal cannabinoid drug formulations. Founders of APIRx, Dr George Anastassov and Mr Lekhram Changoer joined the Incannex team as non-executive director and chief technology officer respectively. Twenty-two (22) additional clinical and pre-clinical research and development projects were transferred to Incannex, representing aggregate addressable markets of approximately US$400B per annum. These projects are underpinned by an intellectual property portfolio that includes 19 granted patents and 23 pending patents.

The foremost drug candidates stemming from this acquisition encompass:

| ● | MedChew Dronabinol for chemotherapy-induced nausea and vomiting | |

| ● | MedChew Rx for pain and spasticity in multiple sclerosis patients | |

| ● | CannQuitN and CannQuitO – chewable products merging nicotine and cannabinoids, and cannabinoids and opioid antagonists, targeting smoking cessation and opioid addiction respectively | |

| ● | CheWell – a high-bioavailability chewable tablet intended for use in adolescent drug addiction studies and other applicable indications | |

| ● | CanChew – a patented high-bioavailability and extended-release CBD chewing gum designed for the over-the-counter market | |

| ● | Renecann - topical cannabinoid development candidates addressing various skin conditions. |

Engagement of Eurofins Scientific for development and manufacture of CannQuitO, CannQuitN and Renecann formulations was announced in Nov 2022.

The CannQuit products are combination drug assets with associated granted patents and patent applications that were transferred to Incannex as a result of the acquisition of APIRx Pharmaceuticals, completed in August of 2022. Eurofins will undertake formulation development and manufacture of CannQuit Nicotine (‘CannQuitN’) and CannQuit Opioid (‘CannQuitO’).

CannQuitN combines nicotine and cannabidiol (‘CBD’) within a controlled-release, functional, medicated chewing gum. CannQuitO combines CBD and an off-patent prescription opioid antagonist, and/or partial agonist-antagonist within the formulation. The cGMP grade products manufactured by Eurofins will be used in clinical trials designed to assess the safety and efficacy of the CannQuit products for smoking cessation and the treatment of opioid addiction.

23

Incannex Healthcare Limited

Data collected on the quality and stability of the CannQuit anti-addiction products during the development and manufacturing of the two drug candidates at Eurofins will be key components of future regulatory packages. These data packages include investigational new drug (IND) applications and new drug application (NDA) filings with the US Food and Drug Administration (FDA).

Medicated chewing gums deliver their active ingredients directly into the circulation of the oral mucosa, ensuring that the effects of the ingredients are delivered rapidly, but also in a sustained manner to reduce cravings for longer than other delivery methods. Rapid onset and sustained effect are both qualities desirable for the treatment of addiction disorders. Furthermore, the act of chewing, known as mastication, also has an multi- action, anti-anxiety effect that has been demonstrated in other scientific assessments.

ReneCann is Incannex’s proprietary topical cannabinoid formulation for treatment of dermatological conditions caused by disorders of the immune system, including vitiligo, psoriasis, and atopic dermatitis, otherwise known as eczema. The ReneCann formulation is commercially protected by granted and pending patents acquired by Incannex as part of the APIRx acquisition that was finalised in August of 2022.

The unique formulation combines Cannabigerol (‘CBG’) and Cannabidiol (‘CBD’). CBG is a non-psychoactive cannabinoid with potent anti-inflammatory properties. A previous version of ReneCann was used in an in-human proof of concept study with dosing over a 6-week period. The study was conducted at the Maurits Clinic, The Netherlands, and led by a world-renowned dermatologist Dr. Marcus Meinardi, MD, PhD.

In the study, ReneCann reduced disease scores in patients with each of the target skin diseases. Patients with vitiligo, psoriasis and atopic dermatitis were observed to experience improvements in symptoms of 10%, 33% and 22% respectively.

In particular, the results for study participants with vitiligo are highly encouraging, partly because the incidence of the disease is high at 0.5-1.0% of the global population and treatments for it are limited. Vitiligo is observed when pigment-producing cells (melanocytes) stop producing melanin, causing the loss of skin colour in patches and the discoloured areas generally become larger over time. ReneCann was associated with diffuse re-pigmentation (usually perifollicular or from the borders of the lesion) and efficacy lasted for weeks eventually before depigmentation recurred.

The ReneCann Drug product that is produced by Eurofins CDMO will be used in clinical trials confirming the safety and therapeutic effect of ReneCann in vitiligo, psoriasis, and atopic dermatitis. Data on the quality and stability of ReneCann generated as part of this project at Eurofins will be used in the chemistry and manufacturing control modules of future regulatory packages with the US Food and Drug Administration (FDA). ReneCann also has the potential to be assessed for efficacy in other diseases where topical application may provide a benefit over conventional oral dosed cannabinoid formulations.

Incannex has chosen Quest Pharmaceutical Services (QPS) as its partner for regulatory guidance and clinical trial management for the advancement of the CannQuit™ and Renecann™ product lines designed for addiction and immune-disordered skin diseases. QPS, established in 1995, has evolved into a prominent contract research organization, offering a range of services in bioanalysis, pharmacology, and clinical research. QPS is in the process of drafting pre-Investigational New Drug (pre-IND) submissions for the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA) for CannQuit™ and Renecann™ products. Subsequent to regulatory clearance, QPS will take a leading role in overseeing clinical trials, collecting relevant evidence of safety and efficacy.

24

Incannex Healthcare Limited

DIRECTORS’ INTERESTS IN THE COMPANY

As at the date of this report, the interests of the directors in the shares and options of the Company were:

| Director | Number of fully paid ordinary shares | Number of options over ordinary shares | No. of performance rights/shares | |||||||||

| Mr Troy Valentine | 36,651,198 | 5,243,413 | - | |||||||||

| Mr Peter Widdows | 16,573,685 | 1,104,913 | - | |||||||||

| Mr Joel Latham | 23,748,413 | 11,683,227 | - | |||||||||

| Dr George Anastassov | 66,972,077 | - | - | |||||||||

| Mr Robert Clark | - | 5,000,000 | - | |||||||||

DIVIDENDS

No dividends have been paid or declared since the start of the financial year and the directors do not recommend the payment of a dividend in respect of the financial year.

AFTER BALANCE DATE EVENTS

No significant events have occurred since the end of the financial year.

SHARE OPTIONS

The Company has the following options on issue as at the date of the Directors’ Report.

| Expiry Date | Exercise Price | Listed/Unlisted | Number | |||||||||

| 30/06/2025 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 30/06/2026 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 30/06/2027 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 30/06/2025 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 30/06/2026 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 30/06/2027 | $ | 0.05 | Unlisted | 750,000 | ||||||||

| 20/11/2023 | $ | 0.15 | Unlisted | 8,200,000 | ||||||||

| 20/11/2023 | $ | 0.25 | Unlisted | 20,000,000 | ||||||||

| 20/11/2023 | $ | 0.20 | Unlisted | 6,650,000 | ||||||||

| 01/07/2025 | $ | 0.26 | Unlisted | 533,333 | ||||||||

| 01/07/2026 | $ | 0.31 | Unlisted | 533,333 | ||||||||

| 01/07/2027 | $ | 0.35 | Unlisted | 533,334 | ||||||||

| 01/07/2025 | $ | 0.26 | Unlisted | 1,399,999 | ||||||||

| 01/07/2026 | $ | 0.31 | Unlisted | 1,399,999 | ||||||||

| 01/07/2027 | $ | 0.35 | Unlisted | 1,400,002 | ||||||||

| 01/07/2025 | $ | 0.26 | Unlisted | 1,399,999 | ||||||||

| 01/07/2026 | $ | 0.31 | Unlisted | 1,399,999 | ||||||||

| 01/07/2027 | $ | 0.36 | Unlisted | 1,400,002 | ||||||||

| 04/08/2025 | $ | 0.612 | Unlisted | 3,000,000 | ||||||||

| 04/08/2025 | $ | 0.69 | Unlisted | 3,000,000 | ||||||||

| 04/08/2025 | $ | 0.765 | Unlisted | 3,000,000 | ||||||||

| 31/12/2025 | $ | 1.00 | Unlisted | 2,500,000 | ||||||||

| 31/05/2024 | $ | 1.50 | Unlisted | 2,500,000 | ||||||||

| 30/04/2026 | $ | 0.25 | Unlisted | 105,800,651 | ||||||||

Unissued Shares under Option

As at the date of this report, there were 169,150,651 unissued ordinary shares under options (2022: 91,995,314)

Option holders do not have any right, by virtue of the options, to participate in any share issue of the Company or any related body corporate.

25

Incannex Healthcare Limited

Shares issued as a result of the exercise of options

During the financial year there were 2,027 ordinary shares issued as a result of the exercise of options (2022: 207,650,638)

INDEMNIFICATION AND INSURANCE OF DIRECTORS AND OFFICERS

Indemnification

The Company has agreed to indemnify the directors of the Company, against all liabilities to another person (other than the Company or a related body corporate) that may arise from their position as directors of the Company, except where the liability arises out of conduct involving a lack of good faith. The agreement stipulates that the Company will meet the full amount of any such liabilities, including costs and expenses.

Insurance premiums

The Company has arranged directors’ and officers’ liability insurance, for past, present or future directors, secretaries, and executive officers. The insurance cover relates to:

| - | costs and expenses incurred by the relevant officers in defending proceedings, whether civil or criminal and whatever their outcome; and |

| - | other liabilities that may arise from their position, with the exception of conduct involving a wilful breach of duty or improper use of information or position to gain a personal advantage. |

The insurance policies outlined above do not contain details of the premiums paid in respect of individual directors or officers of the Company.

ENVIRONMENTAL REGULATIONS

The Group is not subject to any significant environmental regulation.

26

Incannex Healthcare Limited

REMUNERATION REPORT (AUDITED)

This report, which forms part of the Directors’ Report, outlines the remuneration arrangements in place for the key management personnel of Incannex Healthcare Limited (the “Company”) for the financial year ended 30 June 2023.

The key management personnel of the Company are the Directors of the Company including the Managing Director/Chief Executive Officer.

Remuneration philosophy

The performance of the Company depends upon the quality of the directors and executives. The philosophy of the Company in determining remuneration levels is to:

| - | set competitive remuneration packages to attract and retain high calibre employees; |

| - | link executive rewards to shareholder value creation; and |

| - | establish appropriate, demanding performance hurdles for variable executive remuneration. |

Remuneration Structure

In accordance with best practice Corporate Governance, the structure of non-executive director and executive remuneration is separate and distinct.

Non-executive director remuneration

The Board seeks to set aggregate remuneration at a level that provides the Company with the ability to attract and retain directors of the highest calibre, whilst incurring a cost that is acceptable to shareholders. The amount of aggregate remuneration apportioned amongst directors is reviewed annually. The Board considers the fees paid to non-executive directors of comparable companies when undertaking the annual review process. Independent advice is obtained when considered necessary to confirm that remuneration is in line with market practice.

Each director receives a fee for being a director of the Company. Non-executive directors may receive performance rights (subject to shareholder approval) as it is considered an appropriate method of providing sufficient reward whilst maintaining cash reserves.

Executive director remuneration

Remuneration consists of fixed remuneration and variable remuneration (comprising short-term and long-term incentive schemes).

Fixed remuneration

Fixed remuneration is reviewed annually by the Board. The process consists of a review of relevant comparative remuneration in the market and internally and, where appropriate, external advice on policies and practices. The Board has access to external, independent advice where necessary.

The fixed remuneration component of key management personnel is detailed in Tables 1 and 2.

27

Incannex Healthcare Limited

Variable remuneration

The objective of the short-term incentive program is to link the achievement of the Group’s operational targets with the remuneration received by the KMP charged with meeting those targets. The total potential short-term incentive available is set at a level so as to provide sufficient incentive to the KMP to achieve the operational targets and such that the cost to the Group is reasonable in the circumstances.

Actual payments granted to each KMP depend on the extent to which specific operating targets set at the beginning of the financial year are met. A short-term incentive remuneration of $426,000 is payable for the financial year ended 30 June 2023 to Joel Latham.

The Company also makes long term incentive payments to reward senior executives in a manner that aligns this element of remuneration with the creation of shareholder wealth. The long-term incentive is provided in the form of performance rights and options over ordinary shares in the Company.

Employee Share Option Plan (ESOP)

The Incannex Healthcare Limited ESOP provides for the directors to set aside shares in order to reward and incentivise employees. Directors will not set aside more than 5% of the total number of issued shares in the Company at the time of the proposed issue. Officers and employees both full and part-time are eligible to participate in the plan.

No shares and options have been issued under the ESOP during the year (2022:1,600,000 shares and 1,600,000 options).

Performance Rights Plan (PRP)

Shareholders approved the Company’s PRP at the Annual General Meeting held on 23 November 2011. The PRP is designed to provide a framework for competitive and appropriate remuneration so as to retain and motivate skilled and qualified personnel whose personal rewards are aligned with the achievement of the Company’s growth and strategic objectives.

No performance rights have been issued under the PRP during the year (2022: nil).

Executive Employment Contracts

For the year ended 30 June 2023, Mr Joel Latham, was appointed as Chief Executive Officer under an employment agreement. The material terms of the agreement are set out as follows:

| - | Commencement date: 1 July 2018 |

| - | Term: No fixed term |

| - | Fixed remuneration: $770,000 per annum, plus $30,000 Board fees, plus superannuation |

| - | Variable remuneration up to 50% of base salary subject to achieving certain performance hurdles. |

| - | Car allowance: $20,000 per annum. |

| - | Termination for cause: no notice period |

| - | Termination without cause: three-month notice period |

28

Incannex Healthcare Limited

Table 1: Remuneration of key management personnel (KMP) for the year ended 30 June 2023

| Short-term (cash-based payments) | Long-term (share-based payments) | Post-employment | ||||||||||||||||||||||||||

| Salary & fees $ | Bonus $ | Other $ | Performance Rights, Shares and Options $ | Superannuation $ | Total $ | Performance Related % | ||||||||||||||||||||||

| Key Management Personnel name | ||||||||||||||||||||||||||||

| Mr Troy Valentine1 | 231,157 | - | 254,000 | 867,331 | 24,271 | 1,376,759 | 63.0 | |||||||||||||||||||||

| Mr Peter Widdows2 | 141,385 | - | 160,000 | - | 14,845 | 316,230 | - | |||||||||||||||||||||

| Mr Joel Latham | 820,000 | 426,000 | - | 1,760,325 | 27,641 | 3,033,966 | 58.0 | |||||||||||||||||||||

| Dr George Anastassov | 175,866 | - | - | - | - | 175,866 | - | |||||||||||||||||||||

| Mr Robert Clark3 | 88,588 | - | - | 87,500 | - | 176,088 | 49.7 | |||||||||||||||||||||

| Total | 1,456,996 | 426,000 | 414,000 | 2,715,156 | 66,757 | 5,078,909 | ||||||||||||||||||||||

| 1) | Mr Valentine was paid $254,000 for consulting fees invoiced to the Company, outside of Director fees. |

| 2) | Mr Widdows was paid $160,000 for consulting fees invoiced to the Company, outside of Director fees. |

| 3) | Mr Clark was appointed on the 17th of August 2022. During the 2023 financial year the Company obtained shareholder approval to issue a Company Acquisition Incentive to Mr Robert Clark on the terms and conditions set out in the Notice of Annual General Meeting dated 21 October 2022. No amount was recognised in the financial statements in the 2023 financial year in relation to the Company Acquisition Incentive. |

29

Incannex Healthcare Limited

Table 2: Remuneration of key management personnel (KMP) for the year ended 30 June 2022

| Short-term (cash-based payments) | Long-term (share-based payments) | Post-employment | ||||||||||||||||||||||||||

| Salary & fees $ | Bonus $ | Other $ | Performance Rights, Shares and Options $ | Superannuation $ | Total $ | Performance Related % | ||||||||||||||||||||||

| Key Management Personnel name | ||||||||||||||||||||||||||||

| Mr Troy Valentine1 | 92,750 | - | 240,000 | 312,538 | 9,275 | 654,563 | 47.8 | |||||||||||||||||||||

| Mr Peter Widdows2 | 84,742 | - | - | - | 8,474 | 93,216 | - | |||||||||||||||||||||

| Mr Joel Latham3 | 533,500 | 245,000 | - | 716,096 | 24,998 | 1,519,594 | 63.3 | |||||||||||||||||||||

| Dr Sud Agarwal4 | 48,000 | - | 90,000 | - | 4,800 | 142,800 | - | |||||||||||||||||||||

| Dr George Anastassov5 | - | - | - | - | - | - | - | |||||||||||||||||||||

| Total | 758,992 | 245,000 | 330,000 | 1,028,634 | 47,547 | 2,410,173 | ||||||||||||||||||||||

| 1) | Remuneration owed to Mr Valentine at 30 June 2022 is $38,750 included in accrued expenses. |

| Mr Valentine was paid $240,000 for consulting fees invoiced to the Company, outside of Director fees. | |

| 2) | Remuneration owed to Mr Widdows at 30 June 2022 is $42,076 included in accrued expenses. |

| 3) | Remuneration owed to Mr Latham at 30 June 2022 is $245,000 included in accrued expenses. |

| 4) | Remuneration owed to Dr Agarwal at 30 June 2022 is $25,300 is included in accounts payable. |

| Dr Agarwal received $90,000 in fees billed through Medical Life Publishing Pty Ltd, for services provided as Chief Medical Officer. Dr Agarwal resigned on the 28th of June 2022. | |

| 5) | Dr Anastassov was appointed on the 28th of June 2022. |

30

Incannex Healthcare Limited

Performance rights

Each performance right is convertible into one ordinary share upon achievement of the performance hurdles. No performance right will vest if the conditions are not satisfied, hence the minimum value of the performance rights yet to vest is nil.

The assessed fair value at grant date of performance rights granted is expensed according to the performance or market-based conditions attached to the performance hurdle. Performance based hurdles are expensed to each reporting period evenly over the period from grant date to vesting date. Market based hurdles are expensed on the grant date unless there is an explicit or implicit service condition. The relevant amount is included in the remuneration table (Table 1) above. Fair values at grant date are independently determined using a trinomial pricing model that takes into account the exercise price, term, the share price at grant date and expected price volatility of the underlying share, barrier price / performance hurdles, the expected dividend yield and the risk- free interest rate. For details on the valuation of performance rights, including assumptions used, refer to note 17 of these financial statements.

There was no Performance rights activity for KMP for the year ended 30 June 2023 (2022: nil).

31

Incannex Healthcare Limited

Key Management Personnel – Option Holdings

The number of options held by Key Management Personnel of the Group during the financial year is as follows:

30 June 2023 - Options

Name |

Balance at |

Other changes | Balance at 30 June 2023 (or on cessation) |

Exercisable | ||||||||||||

| Mr Troy Valentine1 | 2,800,000 | 2,443,413 | 5,243,413 | 3,843,411 | ||||||||||||

| Mr Peter Widdows1 | - | 1,104,913 | 1,104,913 | 1,104,913 | ||||||||||||