THIS LETTER IS NOT AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ANY SHARES OF VACASA, INC. OR ANY OTHER SECURITIES AND IS NOT A SOLICITATION OF ANY PROXY OR VOTE WITH RESPECT TO ANY SHARES OF VACASA, INC. OR ANY OTHER SECURITIES.

February 3, 2025

VIA ELECTRONIC MAIL

Vacasa, Inc.

850 NW 13th Avenue

Portland, OR 97209

Dear Members of the Special Committee of the Board of Directors (the “Special Committee”):

On behalf of Davidson Kempner Capital Management LP and certain of its managed funds and affiliates (collectively, “Davidson Kempner”, “we”, “us” or “our”), we are submitting this offer (the “Offer”) to acquire 100% of the outstanding share capital of Vacasa, Inc. (“Vacasa” or the “Company”) not already owned directly or indirectly by Davidson Kempner (the “Proposed Transaction”) at $5.25 per share in cash.

As the Board knows, we were supporters of the evaluation of potential strategic alternatives available to the Company. During that process, we supported the consideration of potential transactions involving third parties and indicated we would support a third-party transaction that provided the best alternative for the Company and all of its stockholders. Unfortunately, this strategic review resulted in the acceptance by the Special Committee and the Board of an inadequate and conditional offer by Casago Holdings, LLC (“Casago”) that undervalues Vacasa, does not treat all stockholders alike, and is not in the best interest of all Vacasa stakeholders.

Having reflected further on the aforementioned events, the Special Committee and the Board could have done more for all stockholders. As a result, we are presenting a significantly more attractive alternative to the Casago offer. We are fully committed to being long-term investors in Vacasa and unlocking the significant underlying contract and going concern value over time, which we agree will be best achieved as a private company.

Our Offer is on terms substantially similar to those in the definitive agreement Vacasa entered into with Casago and its affiliates dated December 30, 2024 (the “Existing Agreement”), except for those terms and improvements set forth herein. As described below, our Offer delivers a significant improvement to the terms and conditions of Casago’s offer to Vacasa stockholders, both due to the enhanced value our Offer would deliver to stockholders and the speed and certainty of consummation of the Proposed Transaction relative to the proposed transaction with Casago. Our Offer also treats all stockholders the same. Given our existing stake in, and familiarity with, the Company, we expect to be able to complete our limited due diligence and finalize definitive transaction documentation within one week (subject to timely receipt of requested information).

Our Offer clearly constitutes a Superior Proposal, as defined in the Existing Agreement, and is in the best interests of all Vacasa stockholders as well as the Company, its employees and its customers. As such, the fiduciary duties of the Board and Special Committee require that you engage with us in good faith to pursue and quickly consummate the transaction we are proposing. We and our external advisors are ready to engage with you towards the expedited consummation of the Proposed Transaction consistent with Vacasa’s obligations under the Existing Agreement with Casago.

Key Terms of the Offer

The terms and conditions of our Offer and the Proposed Transaction are as follows:

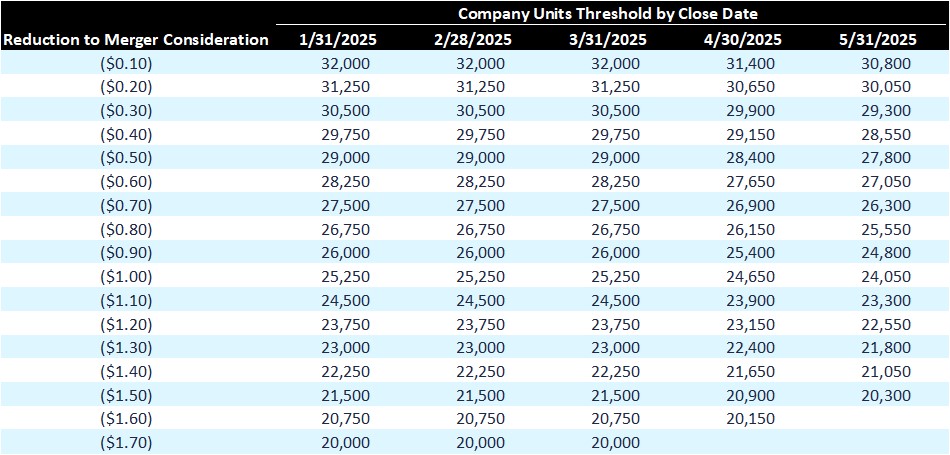

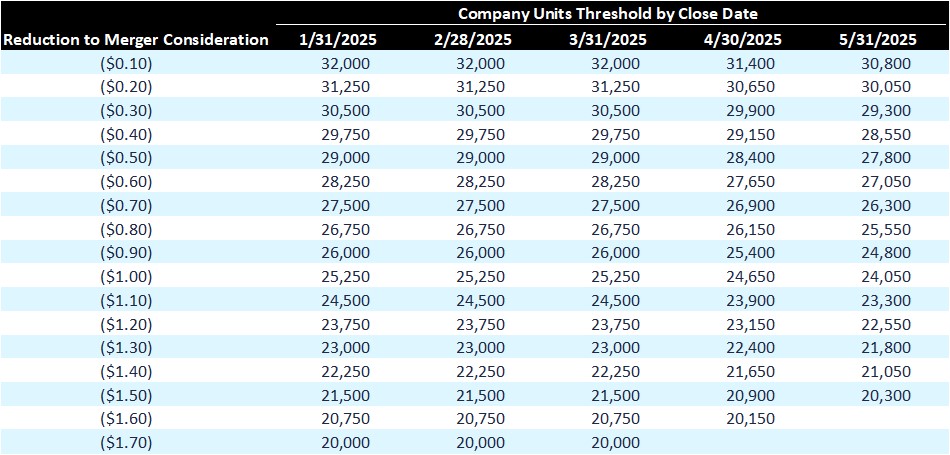

| 1. | Purchase Price. A newly formed entity (“Newco”) will purchase 100% of the outstanding equity of Vacasa not already owned directly or indirectly by Davidson Kempner for $5.25 per share in cash. In addition, we will adjust Annex C-1 to the Merger Consideration Adjustment Schedule attached to the Existing Agreement and replace it with Exhibit A attached hereto, which provides stockholders with more favorable adjustment terms as compared to the Existing Agreement. |

| | |

| 2. | Contractual Terms and Conditions: Our Offer contains substantially the same terms and conditions as those in the Existing Agreement, except for the superior cash price and the material improvement to the Merger Consideration Adjustment Schedule as set forth in Exhibit A attached hereto. We are prepared to enter into the (i) amendment to the Tax Receivable Agreement on the same terms and conditions as those in the Existing Agreement, and (ii) the amendment to the Company Credit Agreement on the same terms and conditions as those described in and attached to the Existing Agreement. |

| | |

| 3. | Financing. The Proposed Transaction will not be subject to any financing condition. We currently manage a family of funds with approximately $36 billion in assets, and we expect Davidson Kempner entities to fund 100% of the new equity required and will provide an equity commitment letter in support of the Proposed Transaction. As a result of the proposed structure, the Proposed Transaction would establish a strong balance sheet and financial backing that allows Vacasa to grow and meet its strategic and financial objectives without causing undue operating pressure on the Company. |

| | |

| 4. | Due Diligence; Timeline to Signing a Definitive Agreement. Due to our investment of resources to date and the due diligence already performed in connection with our prior investment and based on publicly available information, we have substantially completed our due diligence and are confident that our limited remaining due diligence would be completed expeditiously and concurrently with the negotiation of the definitive transaction agreements. Subject to prompt access to requested information, we are confident that due diligence could be completed, and definitive agreements executed in approximately one week. |

| | |

| 5. | Required Approvals and Timeline to Closing. Davidson Kempner Investment Committee members have reviewed this opportunity extensively, and we have significant internal support to move forward with this Offer, subject to the completion of the limited due diligence referred to above and the negotiation of the definitive agreements. Considering our profile as a financial investor and the lack of directly competitive current investments in our portfolio, we do not anticipate any regulatory issues that would be expected to delay consummation of the Proposed Transaction. We, together with our team of external advisors, are committed to devoting our full resources to pursuing the Proposed Transaction in as expeditious a manner as possible and look forward to working with you on a transaction structure that delivers a higher level of speed and certainty compared to your Existing Agreement with Casago. |

Benefits of Our Offer for all Vacasa Stockholders

When compared to the inferior Casago transaction, our Superior Proposal offers:

| · | More value and more certainty for Vacasa stockholders with our all-cash offer. Davidson Kempner offers Vacasa stockholders consideration of $5.25 per share in cash, representing a premium to Casago’s proposal of $5.02 per share, which is subject to negative purchase price adjustments as set forth in the Existing Agreement. The merger consideration provided in the Existing Agreement is subject to significant risks related to retention of key clients and the impacts of a challenging operating environment and market conditions. Additionally, unlike Casago, we have no intention of materially changing Vacasa’s business operations towards a franchise model, which could cause a significant decrease in the number of homes under management prior to a transaction closing, thereby materially reducing the payable merger consideration to Vacasa stockholders per the terms of the Existing Agreement. Further, an all-cash offer ensures that no special deals are given to certain stockholders while neglecting the public stockholders and offering them an insufficient cash price. |

| | |

| · | Enhancements to the potential downward merger consideration adjustments. Our improvement to Annex C-1 to the Merger Consideration Adjustment Schedule as set forth in Exhibit A attached hereto reduces the risk and size of a potential downward adjustment to the merger consideration payable to Vacasa stockholders compared to the Existing Agreement with Casago. This enhancement unequivocally provides superior value to stockholders and reduces the inherent uncertainty of the merger consideration payable under the Casago transaction. |

| | |

| · | A clear, efficient path to consummating the Proposed Transaction. We are uniquely positioned and confident that we will obtain all necessary approvals to close the Proposed Transaction expeditiously. We believe Vacasa stockholders will view our Superior Proposal favorably because of more favorable terms and the fair treatment of all the public stockholders. This higher level of deal certainty and speed to completion will enable Vacasa to more quickly execute its business plan as a privately-held company and drive value creation for its stakeholders sooner. |

Advisors

Davidson Kempner has engaged Moelis & Company LLC as its financial advisor and Dechert LLP as its legal counsel in connection with the Proposed Transaction.

Other Information

This Offer does not constitute a binding commitment by Davidson Kempner or any of our affiliates or representatives, and is intended to serve only as a basis for discussion of the key prospective business terms that would apply to the transaction proposed by Davidson Kempner. Detailed terms that would be incorporated in the definitive transaction documents, if any, will need to be agreed upon during the negotiations between parties and the Proposed Transaction shall be subject to the execution and delivery of such mutually agreeable definitive transaction documents. We are obligated to disclose this Offer promptly in an amended 13D filing, which we expect to do promptly after delivery of this letter.

As clearly noted, the Casago offer is entirely unsatisfactory. Vacasa stockholders deserve better and we are fully committed to pursuing the Proposed Transaction. We and our advisors are confident that our Offer presents a superior financial outcome for Vacasa stockholders with greater value and certainty, and a clear path to consummation. We, therefore, urge you to consider our Superior Proposal, which you are permitted to do under the Existing Agreement and are required to do in the exercise of your fiduciary duties, and negotiate with us in good faith to reach a consensual transaction that will provide the best value for all Vacasa stockholders.

We look forward to hearing from you soon. We are available to offer any clarification with respect to the above.

Sincerely,

/s/ Joshua D. Morris

Joshua D. Morris

Managing Member

Davidson Kempner Capital Management LP, on behalf of certain of its managed funds and affiliates

CC:

Larry Kwon, Moelis & Company LLC, Managing Director

Sam Saifan, Moelis & Company LLC, Managing Director

Anna Tomczyk, Dechert LLP, Partner

Michael Darby, Dechert LLP, Partner

Martin Nussbaum, Dechert LLP, Partner

Rick S. Horvath, Dechert LLP, Partner

Exhibit A – Improved Merger Consideration Adjustment Schedule

Merger Consideration: $5.25