Exhibit 99.2

To Our Stakeholders,

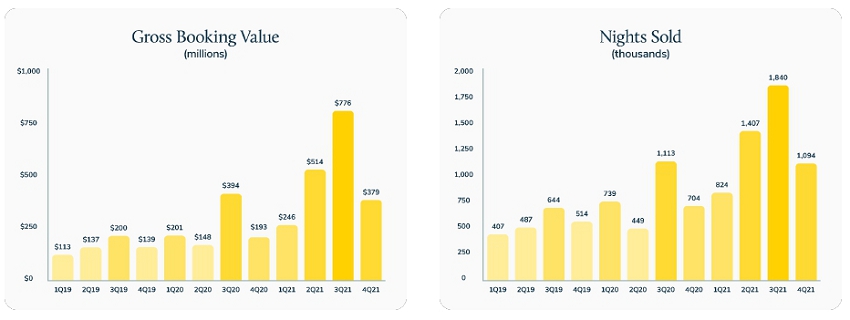

We had a tremendous finish to 2021, as we delivered fourth quarter Revenue and Adjusted EBITDA well ahead of our guidance, extended our scale and national leadership position with $1.9 billion of Gross Booking Value for the full year and finished with approximately 37,000 homes on our platform, expanded our sales capacity by adding nearly 200 new sales executives, and launched a number of differentiated, proprietary technology products. Our business has great momentum, as evidenced by our consistently strong performance relative to our previously announced targets, and we’re pleased to now raise our 2022 outlook and announce that we expect to achieve Adjusted EBITDA profitability for full year 2023.

For those of you new to our story, Vacasa is reinventing the vacation rental industry by leveraging proprietary, purpose-built technology to deliver significant value to everyone involved: homeowners, guests, and distribution partners. Our primary focus is on the supply side of the vacation rental ecosystem, which is highly constrained and ripe for innovation. As the only scaled national vacation rental management platform, we are playing a critical role in fueling the alternative accommodations growth engine.

We operate in a massive market with more than 5 million vacation homes in the United States alone and more than 20 million globally. From a guest demand perspective, alternative accommodations are growing at about twice the rate of traditional accommodations, with annual spend expected to reach $200 billion globally this year. This shift in consumer preference started over a decade ago, driven by both technology enablement and expanding appeal of the category across multiple use cases.

The vacation rental industry is a local marketplace ripe for disruption, with many homeowners either doing it themselves, relying on a local property manager that lacks technological sophistication, or not renting at all. We believe the disruption opportunity is similar to how the real estate, mobility, and on-demand delivery markets have been redefined over the past decade.

Our proprietary technology platform serves as the foundation of our business and has been crucial to our success. All key aspects of our platform were purpose-built, addressing specific needs and pain points of the vacation rental management process, resulting in a truly differentiated and elevated experience for homeowners, guests, and distribution partners. In the past year alone, we invested nearly $50 million on enhancing and creating new technology products, an amount we believe is greater than the spend of the combined entire population of competitive local vacation rental managers.

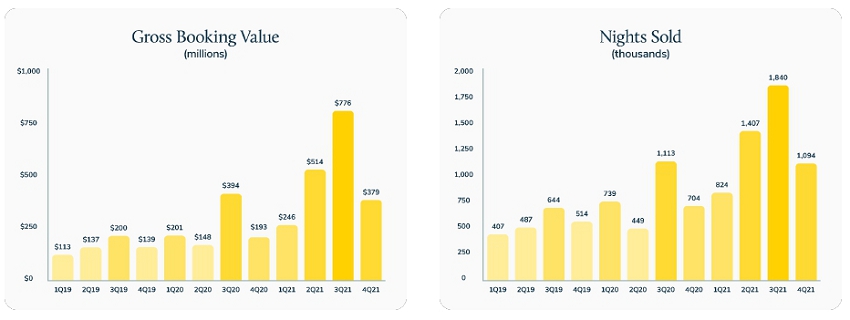

Our approach is working. For the full year 2021, Vacasa outperformed across all of the company’s key metrics: Gross Booking Value, Nights Sold, Gross Booking Value per Night Sold, Revenue, and Adjusted EBITDA. In the following pages, we detail the substantial progress we made in 2021 - including adding homes to our platform, growing our sales force, and introducing new products - and provide a discussion of our financial results and outlook.

Supply Additions

We finished 2021 with approximately 37,000 homes on our platform, representing an increase of more than 60% year-over-year through our growth engine playbook as well as through the strategic acquisition of TurnKey Vacation Rentals. We add homes to our platform with two complementary playbooks - an individual approach and a portfolio approach. The individual approach is a direct sales model where we create leads through direct response marketing and then leverage predominantly local sales representatives to sign up individual homeowners. This approach is used in existing markets and accounts for the majority of our new home additions. Under the portfolio approach, we buy local vacation rental managers, bringing on dozens of homes at once. Through this approach we are able to efficiently enter new markets and build density at a faster rate, allowing us to accelerate our margin expansion in those markets.

New home additions under the individual approach ramped throughout the year as we successfully added nearly 200 new sales executives. To put this in context, in the fourth quarter of 2021, our sales force added nearly 2.5 times more homes than it did in the first quarter of the year. We also expect to benefit from continued productivity improvements, as sales representatives that have been with Vacasa more than 12 months have been shown to be about twice as productive as sales representatives that have been with us for three to six months. Finally, under this approach we typically target a lifetime value (“LTV”) to customer acquisition cost (“CAC”) ratio between 4x and 5x. We ended 2021 at the high end of that range and expect to do so again in 2022.

We also successfully leveraged the portfolio approach in 2021, onboarding 29 portfolios during the year, including seven in the fourth quarter. The portfolio approach is a highly efficient way to enter new markets. For example, in December we signed agreements with Beach Pros Realty and Sandbridge Realty, marking our entry into Virginia Beach. With the addition of these homes, we are now a leader in this popular vacation market and can use the individual approach to grow our inventory in the years ahead.

Technology and Products

We have multiple vectors for growth beyond supply. Constant product innovation is at the core of our business. The following examples of recent innovation are designed to further drive satisfaction among homeowners and guests and operational efficiencies within our business.

| · | Homeowner App. The Vacasa Homeowner app was announced for both iOS and Android devices in November 2021. In just four months, about 40% of our homeowners have already downloaded and begun using the new app and we are seeing more than 60% of those homeowners log into the app weekly. We’ve received positive feedback from homeowners and the app has a 4.9 rating in Apple’s App Store. This strong engagement in such a short amount of time demonstrates that keeping homeowners updated on the care and performance of their vacation home is just as important as optimizing their income. |

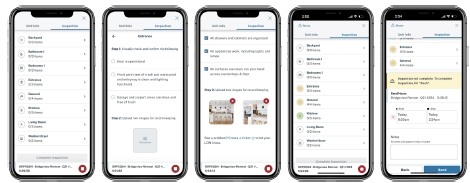

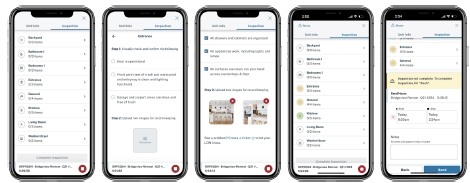

| · | Clean Inspection Tool. The clean inspection tool is designed to improve guest and homeowner satisfaction by ensuring a standardized, efficient cleaning process across the tens of thousands of homes on our platform. Accessible in the Vacasa Field App, housekeepers use the tool to document cleans by going through a checklist and taking several photos of each area cleaned. Local market managers have the ability to review the photos in the HomeCare Hub replacing manual inspections, one of the ways we are creating efficiencies in our housekeeping labor. The tool also allows housekeepers to flag potential issues, such as a broken light, before the guest arrives. During beta testing in the second half of 2021, we observed a lift in guest clean scores when the tool was used and the tool was fully rolled out in February. |

Technology and Products (continued)

| · | Itinerary-Based Pricing. Our newest yield management innovation takes dynamic pricing beyond just considering a nightly rate by giving each itinerary, as defined by a start date and end date, its own price. The price of the itinerary incorporates how each unique reservation, or itinerary, affects a property’s entire calendar. For example, the AI-powered algorithm may display a higher effective nightly rate if the itinerary is likely to result in “stranded nights”. Or, it might display a lower effective nightly rate for nights that typically go unbooked, such as an open Monday and Tuesday between two existing reservations. In each example, we generate more income for our homeowners. We began testing itinerary-based pricing in the summer of 2021 and now use the tool to price hundreds of millions of itineraries per day. |

| · | Vacasa Smart Home Management System. Following extensive testing, we announced that homes on our platform will feature our smart home management system, including proprietary keyless locks, WiFi router with custom connectivity experience, and a patented noise monitoring system. These technologies will be provided at no additional cost to Vacasa homeowners and will be rolled out to homes throughout 2022. |

Traveler Trends

Booking demand remains strong on our platform, with our own data pointing towards a consumer who exhibits a strong desire to travel and feels more confident managing the ongoing COVID-19 risk. During the fourth quarter, we experienced favorable trends across our key booking metrics, including the median booking window, cancellations, occupancy, and Gross Booking Value per Night Sold.

When the Omicron variant news first began to circulate near the end of November and case counts and headlines increased throughout December, we did not see a material volume of cancellations or a change in future bookings volume, leading us to believe COVID-19 is becoming less of a concern among travelers.

Guidance

For the first quarter 2022, we expect Revenue to be in the range of $245 million to $255 million, which implies 89% to 97% year-over-year growth, and Adjusted EBITDA to be in the range of negative $25 million to negative $20 million.

For full year 2022, we expect Revenue to be in the range of $1,125 million to $1,175 million, which implies 27% to 32% year-over-year growth, and Adjusted EBITDA to be in the range of negative $21 million to negative $14 million.

Finally, given the strong execution by our teams and the success of our growth investments, we expect to reach Adjusted EBITDA profitability for the full year 2023.

Our guidance includes estimated amounts from the recognition of Revenue associated with the expiration and estimated breakage of Future Stay Credits (FSC), which we began to issue in March 2020 during the onset of the pandemic. While we will recognize Revenue from the breakage of FSCs as part of our ordinary course of business in future periods, there will be an outsized impact in the first quarter of 2022 as a significant amount of credits issued during the onset of COVID-19 expire. During the first quarter of 2022, we expect to recognize about $13 million of incremental Revenue as these credits expire. The Revenue benefit will also flow through to Adjusted EBITDA. We expect Revenue associated with the breakage of FSCs to be significantly lower in future periods.

Extremely strong consumer demand over the past year allowed us to achieve record occupancy and accelerate year-over-year growth in Gross Booking Value per Night Sold every quarter in 2021, including 19% year-over-year growth in the third quarter and 27% year-over-year growth in the fourth quarter. Our fiscal year 2022 guidance assumes that the combination of occupancy and Gross Booking Value per Night Sold takes a slight step back from the record levels we observed in 2021, especially in the second half of the year, but remains ahead of the pre-pandemic levels from 2019.

As a reminder, our business does experience seasonality where we have historically generated our highest Revenue in the third quarter, followed by the second quarter, and relatively lower Revenue levels in the first and fourth quarters.

Fourth Quarter Financial Discussion

Gross Booking Value

Gross Booking Value reached $379 million in the fourth quarter of 2021, up 96% year-over-year, and our strongest fourth quarter to date. Nights Sold of 1.1 million were up 55% year-over-year, largely driven by the addition of inventory to the platform. Gross Booking Value per Night Sold reached $347 in the fourth quarter, up 27% year-over-year and representing our fourth consecutive quarter of accelerating growth.

Revenue

Gross Booking Value drove fourth quarter Revenue of $192 million, an increase of 76% year-over-year, which finished ahead of our fourth quarter guidance range of $175 million to $180 million.

Cost of Revenue

Cost of Revenue was $108 million, or 56% of Revenue, in the fourth quarter, compared to $69 million, or 63% of Revenue, in the year ago period. Cost of Revenue as a percentage of Revenue decreased by 700 basis points year-over-year due to improved operating leverage from the strong year-over-year growth of Gross Booking Value per Night Sold and increased density and scale of the business.

Fourth Quarter Financial Discussion (continued)

Operations and Support

Operations and Support expense was $54 million in the fourth quarter compared to $29 million in the year ago period. Excluding equity-based compensation, Operations and Support expense was $52 million, or 27% of Revenue, in the fourth quarter compared to $29 million, or 27% of Revenue, in the year ago period. As we outlined in our third quarter shareholder letter, we made planned investments in higher local market staffing during the fourth quarter supporting our higher reservation volume.

Technology and Development

Technology and Development expense was $18 million in the fourth quarter compared to $8 million in the year ago period. Excluding equity-based compensation, Technology and Development expense was $15 million, or 8% of Revenue, in the fourth quarter compared to $7 million, or 7% of Revenue, in the year ago period. We are excited with the progress we’ve made to expand our industry leading technology capabilities that drives operating efficiency in our business, optimizes income generation for our homeowners, and delivers enhanced hospitality for guests.

Sales and Marketing

Sales and Marketing expense was $73 million in the fourth quarter compared to $17 million in the year ago period. Excluding equity-based compensation, Sales and Marketing expense was $66 million, or 34% of Revenue, in the fourth quarter compared to $17 million, or 16% of Revenue, in the year ago period. In the fourth quarter, Sales and Marketing spend included advertising cost associated with our inaugural brand advertising campaign. In addition, throughout 2021 we increased our direct homeowner marketing and added hundreds of new sales representatives to scale our individual approach growth engine.

Fourth Quarter Financial Discussion (continued)

General and Administrative

General and Administrative expense was $29 million in the fourth quarter compared to $19 million in the year ago period. Excluding equity-based compensation and business combination costs, General and Administrative expense was $19 million, or 10% of Revenue, in the fourth quarter compared to $18 million, or 16% of Revenue, in the year ago period.

Net Loss and Adjusted EBITDA

Net Loss was $118 million in the fourth quarter compared to $45 million in the same year-ago period.

Adjusted EBITDA was negative $68 million and finished above our fourth quarter guidance range of negative $85 million to negative $80 million primarily on stronger than expected revenue and operating expenses registering at the lower end of our expectations. See “Use of Non-GAAP Financial Measures” for a discussion of Adjusted EBITDA, and “Adjusted EBITDA Reconciliation” for a reconciliation to Net Income, the most directly comparable GAAP financial performance measure.

Fourth Quarter Financial Discussion (continued)

Liquidity and Capital Resources

We exited 2021 well capitalized to execute on our significant growth opportunities. We have a truly asset-lite business model, in which our full-service offering gains us exclusive control of a home’s calendar without needing to spend hundreds of millions of dollars to buy supply or enter into long-term lease agreements. Advance deposits on future reservations also create a favorable working capital dynamic.

For the 12 months ended December 31, 2021, our operating cash flow was $63 million and we had capital expenditures of $11 million. Our business generated meaningful cash flow in 2021 and we self-funded the significant investments in our sales force, technology team, advertising, and public company infrastructure. In addition, we used $117 million of cash for business combinations related to our portfolio approach.

We closed our transaction with TPG Pace Solutions on December 6, which provided Vacasa with over $340 million of gross proceeds. As of December 31, 2021, we had $519 million of Cash and Cash Equivalents and Restricted Cash. We also had $214 million in Funds Payable to Homeowners.

Finally, we increased the aggregate commitments under our existing revolving credit agreement from $55 million to $105 million. Currently, we do not have any borrowings under the facility.

Closing

We will host an earnings call on March 16, 2022 at 2:00 p.m. PT / 5:00 p.m. ET. A link to the live webcast will be made available on Vacasa’s Investor Relations website at investors.vacasa.com. A replay of the webcast will be available for one year beginning approximately two hours after the close of the call.

We had a strong fourth quarter to close out a banner year for Vacasa and look forward to updating you on our progress.

Sincerely,

Matt Roberts, CEO

Jamie Cohen, CFO

Condensed Consolidated Statements of Operations

(in thousands, except per share data, unaudited)

| | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, | |

| | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| Revenue | | $ | 192,104 | | | $ | 108,909 | | | $ | 889,058 | | | $ | 491,760 | |

| Costs and expenses: | | | | | | | | | | | | | | | | |

| Cost of revenue (1) | | | 108,298 | | | | 68,997 | | | | 440,753 | | | | 256,086 | |

| Operations and support (1) | | | 54,148 | | | | 28,999 | | | | 186,984 | | | | 116,192 | |

| Technology and development (1) | | | 17,774 | | | | 7,578 | | | | 48,709 | | | | 27,030 | |

| Sales and marketing (1) | | | 73,247 | | | | 17,236 | | | | 187,904 | | | | 79,971 | |

| General and administrative (1) | | | 29,163 | | | | 18,597 | | | | 88,835 | | | | 57,587 | |

| Depreciation | | | 4,389 | | | | 4,102 | | | | 17,110 | | | | 15,483 | |

| Amortization of intangible assets | | | 13,385 | | | | 4,298 | | | | 44,163 | | | | 18,817 | |

| Total costs and expenses | | | 300,404 | | | | 149,807 | | | | 1,014,458 | | | | 571,166 | |

| Loss from operations | | | (108,300 | ) | | | (40,898 | ) | | | (125,400 | ) | | | (79,406 | ) |

| Interest income | | | 4 | | | | 6 | | | | 36 | | | | 385 | |

| Interest expense | | | (22,504 | ) | | | (3,135 | ) | | | (31,723 | ) | | | (7,907 | ) |

| Other income (expense), net | | | 13,479 | | | | (1,350 | ) | | | 3,280 | | | | (5,725 | ) |

| Loss before income tax | | | (117,321 | ) | | | (45,377 | ) | | | (153,807 | ) | | | (92,653 | ) |

| Income tax benefit (expense) | | | (860 | ) | | | 79 | | | | (784 | ) | | | 315 | |

| Net loss | | $ | (118,181 | ) | | $ | (45,298 | ) | | $ | (154,591 | ) | | $ | (92,338 | ) |

| Loss attributable to remeasurement of redeemable convertible preferred units | | | — | | | | (157,424 | ) | | | (426,101 | ) | | | (202,433 | ) |

| Net loss including remeasurement of redeemable convertible preferred units | | | (118,181 | ) | | | (202,722 | ) | | | (580,692 | ) | | | (294,771 | ) |

| Less: Net loss including remeasurement of redeemable convertible preferred units prior to Reverse Recapitalization | | | (92,926 | ) | | | (202,722 | ) | | | (555,437 | ) | | | (294,771 | ) |

| Less: Net loss attributable to redeemable noncontrolling interests | | | (12,558 | ) | | | — | | | | (12,558 | ) | | | — | |

| Net loss attributable to Class A Common Stockholders | | $ | (12,697 | ) | | $ | — | | | $ | (12,697 | ) | | $ | — | |

| Net loss per share of Class A Common Stock (2): | | | | | | | | | | | | | | | | |

| Basic and diluted | | $ | (0.06 | ) | | | N/A | | | $ | (0.06 | ) | | | N/A | |

| Weighted-average shares of Class A Common Stock outstanding (2): | | | | | | | | | | | | | | | | |

| Basic and diluted | | | 214,794 | | | | N/A | | | | 214,794 | | | | N/A | |

(1) Includes equity-based compensation expense as follows:

| Cost of revenue | | $ | 113 | | | $ | — | | | $ | 113 | | | $ | — | |

| Operations and support | | | 2,488 | | | | 28 | | | | 2,574 | | | | 252 | |

| Technology and development | | | 2,543 | | | | 234 | | | | 3,032 | | | | 641 | |

| Sales and marketing | | | 7,223 | | | | 274 | | | | 8,270 | | | | 372 | |

| General and administrative | | | 9,338 | | | | 941 | | | | 12,989 | | | | 2,084 | |

| Total equity-based compensation expense | | $ | 21,705 | | | $ | 1,477 | | | $ | 26,978 | | | $ | 3,349 | |

(2) Basic and diluted net loss per share of Class A Common Stock is applicable only for the period from December 6, 2021 through December 31, 2021, which is the period following the closing of our business combination with TPG Pace Solutions Corp.

| Fourth Quarter 2021 | 16 |

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

| | | As of December 31, | |

| | | 2021 | | | 2020 | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 353,842 | | | $ | 218,484 | |

| Restricted cash | | | 165,294 | | | | 72,528 | |

| Accounts receivable, net | | | 48,989 | | | | 10,161 | |

| Prepaid expenses and other current assets | | | 19,325 | | | | 10,191 | |

| Total current assets | | | 587,450 | | | | 311,364 | |

| Property and equipment, net | | | 67,186 | | | | 65,087 | |

| Intangible assets, net | | | 216,499 | | | | 77,426 | |

| Goodwill | | | 754,506 | | | | 121,487 | |

| Other long-term assets | | | 11,269 | | | | 11,888 | |

| Total assets | | $ | 1,636,910 | | | $ | 587,252 | |

| Liabilities, Temporary Equity, and Equity (Deficit) | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 34,786 | | | $ | 15,648 | |

| Funds payable to owners | | | 214,301 | | | | 92,707 | |

| Hospitality and sales taxes payable | | | 46,958 | | | | 20,721 | |

| Deferred revenue | | | 107,252 | | | | 49,992 | |

| Future stay credits | | | 30,995 | | | | 35,140 | |

| Accrued expenses and other current liabilities | | | 71,833 | | | | 44,022 | |

| Total current liabilities | | | 506,125 | | | | 258,230 | |

| Long-term debt, net of current portion | | | 512 | | | | 111,689 | |

| Other long-term liabilities | | | 112,123 | | | | 22,204 | |

| Total liabilities | | | 618,760 | | | | 392,123 | |

| Redeemable convertible preferred units | | | – | | | | 771,979 | |

| Redeemable noncontrolling interests | | | 1,770,096 | | | | – | |

| Equity (Deficit): | | | | | | | | |

| Vacasa Holdings LLC Class A and Class B Common Units | | | – | | | | – | |

| Class A Common Stock (1) | | | 21 | | | | – | |

| Class B Common Stock | | | 21 | | | | – | |

| Additional paid-in capital | | | – | | | | – | |

| Accumulated deficit | | | (751,929 | ) | | | (577,091 | ) |

| Accumulated other comprehensive income (loss) | | | (59 | ) | | | 241 | |

| Total deficit: | | | (751,946 | ) | | | (576,850 | ) |

| Total liabilities, temporary equity, and equity (deficit) | | $ | 1,636,910 | | | $ | 587,252 | |

(1) As of December 31, 2021, we had approximately 214.8 million shares of Class A Common Stock outstanding, which excludes up to approximately 236.4 million shares of Class A Common Stock issuable as of such date upon the redemption, exercise or exchange of certain securities as follows:

| • | approximately 212.8 million shares of Class A Common Stock issuable upon the redemption of common units of Vacasa Holdings LLC (and the cancellation of an equal number of shares of Class B Common Stock in connection therewith); |

| • | approximately 5.0 million additional shares of Class A Common Stock issuable upon the redemption of common units of Vacasa Holdings LLC following the satisfaction of certain time-based vesting requirements; |

| • | approximately 10.5 million shares of Class A Common Stock issuable upon the exercise of stock appreciation rights and options; and |

| • | up to approximately 8.2 million shares of Class A Common Stock issuable upon the conversion of shares of our Class G Common Stock. |

| Fourth Quarter 2021 | 17 |

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)

| | | Twelve Months Ended

December 31, | |

| | | 2021 | | | 2020 | |

| Cash from operating activities: | | | | | | | | |

| Net loss | | $ | (154,591 | ) | | $ | (92,338 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

| Bad debt expense | | | 4,689 | | | | 6,403 | |

| Depreciation | | | 17,110 | | | | 15,483 | |

| Amortization of intangible assets | | | 44,163 | | | | 18,817 | |

| Deferred income taxes | | | (55 | ) | | | (556 | ) |

| Other gains and losses | | | 77 | | | | (36 | ) |

| Fair value adjustment on derivative liabilities | | | (2,889 | ) | | | 6,636 | |

| Non-cash interest expense | | | 27,496 | | | | 5,145 | |

| Equity-based compensation expense | | | 26,978 | | | | 3,349 | |

| Change in operating assets and liabilities, net of assets acquired and liabilities assumed: | | | | | | | | |

| Accounts receivable | | | 35,400 | | | | 2,295 | |

| Prepaid expenses and other assets | | | (6,178 | ) | | | 13,384 | |

| Accounts payable | | | 8,288 | | | | (3,491 | ) |

| Funds payable to owners | | | 40,199 | | | | (17,250 | ) |

| Hospitality and sales taxes payable | | | 11,076 | | | | 3,952 | |

| Deferred revenue and future stay credits | | | 3,576 | | | | 24,980 | |

| Accrued expenses and other liabilities | | | 7,926 | | | | 10,800 | |

| Net cash provided by (used in) operating activities | | | 63,265 | | | | (2,427 | ) |

| Cash from investing activities: | | | | | | | | |

| Purchases of property and equipment | | | (5,853 | ) | | | (1,619 | ) |

| Cash paid for internally developed software | | | (5,387 | ) | | | (7,856 | ) |

| Cash paid for business combinations, net of cash and restricted cash acquired | | | (103,393 | ) | | | (3,519 | ) |

| Other investing activities | | | – | | | | 323 | |

| Net cash used in investing activities | | | (114,633 | ) | | | (12,671 | ) |

| Cash from financing activities: | | | | | | | | |

| Proceeds from Reverse Recapitalization, net | | | 302,638 | | | | – | |

| Payments of Reverse Recapitalization costs | | | (7,937 | ) | | | – | |

| Cash paid for business combinations | | | (13,647 | ) | | | (9,461 | ) |

| Proceeds from issuance of long-term debt | | | – | | | | 115,931 | |

| Payments of long term debt | | | (125 | ) | | | (10,169 | ) |

| Proceeds from issuance of preferred units, net of issuance costs | | | – | | | | 500 | |

| Other financing activities | | | (1,318 | ) | | | (339 | ) |

| Net cash provided by financing activities | | | 279,611 | | | | 96,462 | |

| Effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash | | | (119 | ) | | | 159 | |

| Net increase in cash, cash equivalents and restricted cash | | | 228,124 | | | | 81,523 | |

| Cash, cash equivalents and restricted cash, beginning of period | | | 291,012 | | | | 209,489 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 519,136 | | | $ | 291,012 | |

| Fourth Quarter 2021 | 18 |

Key Business Metrics

(in thousands, except GBV per Night Sold, unaudited)

| | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, | |

| | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| Gross Booking Value ("GBV") (1) | | $ | 379,363 | | | $ | 193,087 | | | $ | 1,915,591 | | | $ | 935,447 | |

| Nights Sold (2) | | | 1,094 | | | | 704 | | | | 5,165 | | | | 3,005 | |

| GBV per Night Sold (3) | | $ | 347 | | | $ | 274 | | | $ | 371 | | | $ | 311 | |

(1) Gross Booking Value represents the dollar value of bookings from our distribution partners as well as those booked directly on our platform related to Nights Sold during the period and cancellation fees for bookings cancelled during the period (which may relate to bookings made during prior periods). GBV is inclusive of amounts charged to guests for rent, fees, and the estimated taxes a guest pays when we are responsible for collecting tax.

(2) Nights Sold is defined as the total number of nights stayed by guests on our platform in a given period.

(3) GBV per Night Sold represents the dollar value of each night stayed by guests on our platform in a given period. GBV per Night Sold reflects the pricing of rents, fees, and estimated taxes a guest pays.

Reconciliations of Non-GAAP Financial Measures

Adjusted EBITDA Reconciliation

(in thousands, unaudited)

| | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, | |

| | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| Net Loss | | $ | (118,181 | ) | | $ | (45,298 | ) | | $ | (154,591 | ) | | $ | (92,338 | ) |

| Add back: | | | | | | | | | | | | | | | | |

| Depreciation and amortization of intangible assets | | | 17,774 | | | | 8,400 | | | | 61,273 | | | | 34,300 | |

| Interest income | | | (4 | ) | | | (6 | ) | | | (36 | ) | | | (385 | ) |

| Interest expense | | | 22,504 | | | | 3,135 | | | | 31,723 | | | | 7,907 | |

| Other income (expense), net | | | (13,479 | ) | | | 1,350 | | | | (3,280 | ) | | | 5,725 | |

| Income tax benefit (expense) | | | 860 | | | | (79 | ) | | | 784 | | | | (315 | ) |

| Equity-based compensation | | | 21,705 | | | | 1,477 | | | | 26,978 | | | | 3,349 | |

| Business combination costs (1) | | | 703 | | | | – | | | | 8,382 | | | | – | |

| Restructuring costs (2) | | | 1 | | | | 1,843 | | | | 250 | | | | 6,805 | |

| Adjusted EBITDA | | $ | (68,117 | ) | | $ | (29,178 | ) | | $ | (28,517 | ) | | $ | (34,952 | ) |

(1) Represents third party costs associated with the strategic acquisition of TurnKey and third party costs associated with our merger with TPG Pace Solutions Corp.

(2) Represents costs associated with an internal reorganization and workforce reductions in response to the COVID-19 pandemic and costs associated with the wind-down of a significant portion of our international operations.

| Fourth Quarter 2021 | 19 |

About Vacasa

Vacasa is the leading vacation rental management platform in North America, transforming the vacation rental experience by integrating purpose-built technology with expert local and national teams. Homeowners enjoy earning significant incremental income on one of their most valuable assets, delivered by the company’s unmatched technology that adjusts rates in real time to maximize revenue. Guests can relax comfortably in Vacasa’s 35,000+ homes across more than 400 destinations in North America, Belize and Costa Rica, knowing that 24/7 support is just a phone call away. In addition to enabling guests to search, discover and book its properties on Vacasa.com and the Vacasa Guest App, Vacasa provides valuable, professionally managed inventory to top channel partners, including Airbnb, Booking.com and Vrbo.

For more information, visit https://www.vacasa.com/press.

Forward-Looking Statements

Certain statements made in this shareholder letter are considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect Vacasa’s current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements.

Due to known and unknown risks, actual results may differ materially from Vacasa’s expectations and projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: Vacasa’s ability to achieve profitability; Vacasa’s ability to manage and sustain its growth; the effects of the novel coronavirus (COVID-19) pandemic, including as a result of new strains or variants of the virus, on Vacasa’s business, the travel industry, travel trends, and the global economy generally; Vacasa’s expectations regarding its financial performance, including its revenue, costs, and Adjusted EBITDA; Vacasa’s ability to attract and retain homeowners and guests; Vacasa’s ability to compete in its industry; Vacasa’s expectations regarding the resilience of its model, including in areas such as domestic travel, short-distance travel, and travel outside of top cities; the effects of seasonal trends on its results of operations; Vacasa’s ability to make required payments under its credit agreement and to comply with the various requirements of its indebtedness; its ability to effectively manage the Company’s exposure to fluctuations in foreign currency exchange rates; the anticipated increase in expenses associated with being a public company; anticipated trends, developments, and challenges in Vacasa’s industry, business, and the highly competitive markets in which it operates; the sufficiency of its cash and cash equivalents to meet its liquidity needs; Vacasa’s ability to anticipate market needs or develop new or enhanced offerings and services to meet those needs; its ability to expand into new markets and businesses, expand its range of homeowner services and pursue strategic acquisition and partnership opportunities; Vacasa’s ability to manage expansion into international markets; Vacasa’s ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to its business both in the United States and internationally and its expectations regarding various laws and restrictions that relate to its business; Vacasa’s expectations regarding its tax liabilities and the adequacy of its reserves; Vacasa’s ability to effectively manage its growth and expand its infrastructure and maintain its corporate culture; the Company’s ability to identify, recruit, and retain skilled personnel, including key members of senior management; the effects of labor shortages and increases in wage and labor costs in its industry; the safety, affordability, and convenience of Vacasa’s platform and its offerings; its ability to keep pace with technological and competitive developments; its ability to maintain and enhance brand awareness; Vacasa’s ability to successfully defend litigation brought against it and its ability to secure adequate insurance coverage to protect the business and operations; and Vacasa’s ability to maintain, protect, and enhance its intellectual property.

You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the final prospectus filed by Vacasa with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Rule 424(b)(3) on December 30, 2021, as such factors may be updated from time to time in the Company’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 to be filed later this month. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Use of Non-GAAP Financial Measures

This shareholder letter includes Adjusted EBITDA, which is a financial measure that is not defined by or presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Adjusted EBITDA is defined as net loss excluding: (1) depreciation and acquisition-related items consisting of amortization of intangible assets and impairments of goodwill and intangible assets, if applicable; (2) interest income and expense; (3) any other income or expense not earned or incurred during our normal course of business; (4) any income tax benefit or expense; (5) equity-based compensation costs; (6) one-time costs related to strategic business combinations; and (7) restructuring costs. We believe this measure is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature or the amount and timing of these items is unpredictable or one-time in nature, not driven by the performance of our core business operations and renders comparisons with prior periods and competitors less meaningful. Adjusted EBITDA as a percentage of Revenue is calculated by dividing Adjusted EBITDA for a period by Revenue for the same period.

Adjusted EBITDA is not defined by or presented in accordance with GAAP, has significant limitations as an analytical tool, should be considered as supplemental in nature, and is not meant as a substitute for net loss or any other financial information prepared in accordance with GAAP. We believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations, is frequently used by these parties in evaluating companies in our industry, and provides a useful measure for period-to-period comparisons of our business performance. Moreover, we present Adjusted EBITDA in this shareholder letter because it is a key measurement used by our management internally to make operating decisions, including those related to analyzing operating expenses, evaluating performance, and performing strategic planning and annual budgeting.

Although we use Adjusted EBITDA as described above, Adjusted EBITDA has significant limitations as an analytical tool, including that it:

| • | does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect the interest expense, or the cash required to service interest or principal payments, on our debt; |

| • | does not reflect our tax expense or the cash required to pay our taxes; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and such measure does not reflect any cash requirements for such replacements. |

Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. In addition, other companies in our industry may calculate this measure differently than we do, thereby further limiting its usefulness as a comparative measure. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only on a supplemental basis.

A reconciliation of the Company’s Adjusted EBITDA guidance to the most directly comparable GAAP financial measure cannot be provided without unreasonable efforts and is not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that are made for depreciation and amortization of intangible assets, equity-based compensation expense, business combination costs, restructuring charges and other adjustments reflected in our reconciliation of historical Adjusted EBITDA, the amounts of which could be material.