Villa De La Mar Nokomis, FL Second Quarter 2023 Highlights

To Our Stakeholders, We are pleased to share an update on the recent progress we’ve made in the business and review our second quarter 2023 financial results. We are in our summer peak season, the three-month period from June through August that is our busiest time of the year. During these months, we will facilitate about 500,000 reservations, and some weekends over 30,000 reservations—a reminder of the size and scale of Vacasa today and the incredible dedication of our team. The short-term rental industry has drawn the attention of the national and local press in recent months, with articles discussing market dynamics such as travel demand returning to urban and international destinations, an uptick in hybrid and in-office work, and increased vacation rental supply. With the benefit of our scale and data-driven approach, we were able to identify the impact of these changing dynamics on the market starting in the fall of last year. We have adjusted our revenue management stance to address these shifts, as we aim to deliver strong economics for our homeowners. We remain sharply focused on execution and are seeing some early progress against the priorities we set, which are a result of the changes we made starting last year, particularly in operations. However, we are not sacrificing service levels to achieve these efficiencies, as guest satisfaction continues to be in-line with last year. Throughout 2023, Vacasa has been guided by four priorities: • improving execution in local markets and customer support functions; • unlocking the potential of the individual sales approach; • developing the right technology products and service offerings; and • prioritizing our business needs to drive profitable growth. 2Second Quarter 2023

Second Quarter Financials & Operational Highlights We’ve spent the past several quarters becoming more tactical in the way we operate in our local markets, particularly with regard to our alignment of staffing levels within a dynamic reservation environment. In 2021 and 2022, our teams were staffing in anticipation of growing demand. Now, we are more closely watching demand and bookings intakes and adjusting resources in local markets accordingly. The initial progress we saw in the first quarter from these changes carried into the second quarter. In our local markets, we are working to remove layers of management and empower the homeowner- and guest-experience teams who take care of customers. We are establishing processes that drive closer alignment across all the functions to support our local operations teams, and improve analytics and real-time support from revenue management, human resources and finance. We have also released technology enhancements for key workflows during the first half of the year, with the goal of decreasing the cost of managing homes and guest stays, while providing homeowners and guests with an even better experience. These include: • an automated daily scheduling tool for our field operations teams; • the Homecare Dashboard, which we mentioned last quarter, that allows homeowners to track maintenance issues online and see reports and photos of recent inspections; and • SMS and webchat as communication tools for homeowners and guests. 3Second Quarter 2023

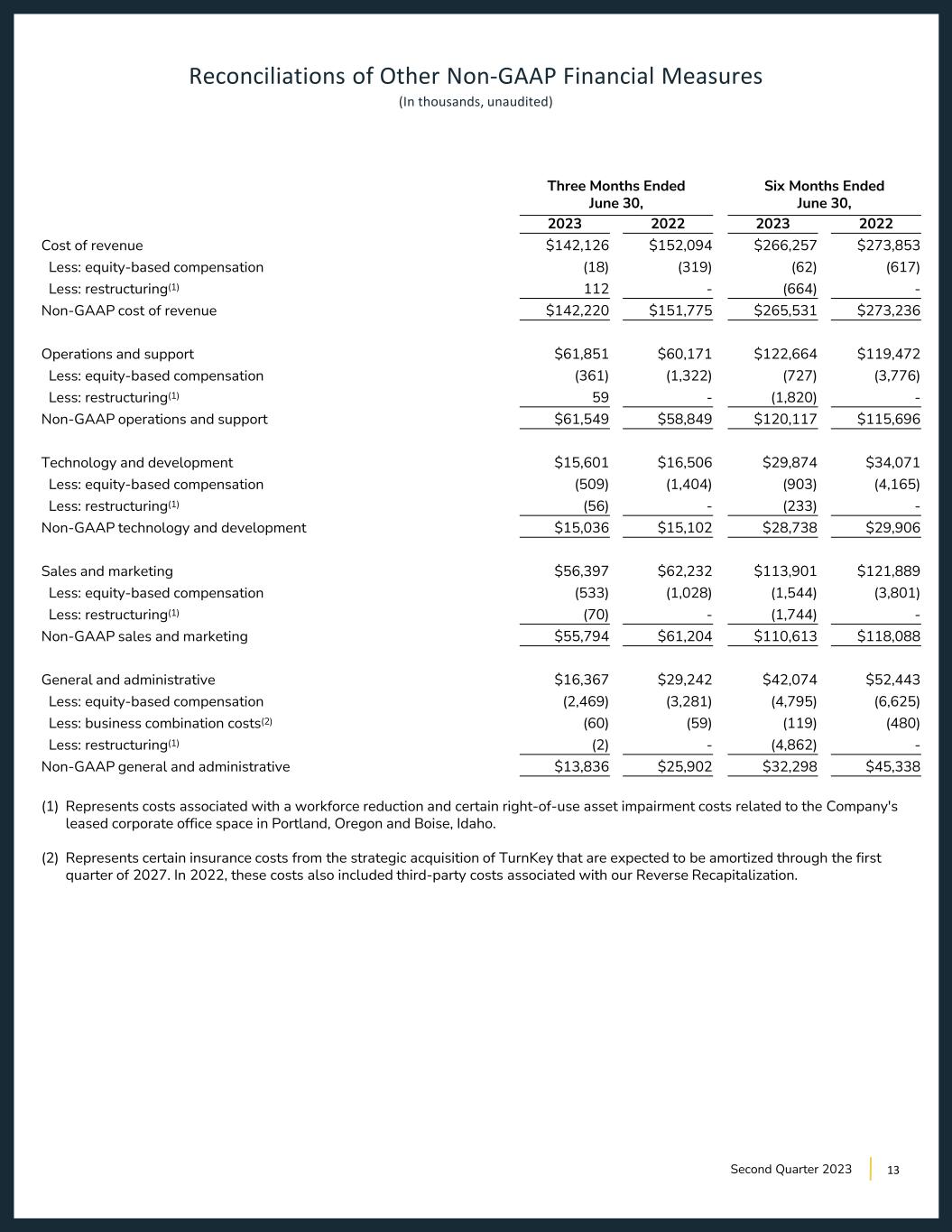

Second Quarter Financials & Operational Highlights On the individual sales approach—the primary way in which we add homes to our platform—we have been streamlining and simplifying how we work. Some of the changes we have implemented include: • focusing each sales representative on a single market, allowing them to develop and build local market expertise; • simplifying the pricing structures we offer to homeowners; • improving the onboarding experience for new homeowners through product enhancements; and • recalibrating sales incentive compensation. In the second half of the year, our focus will continue to be on solidifying the productivity improvements we have made in recent months. On the technology front, we have changed our product development process, working to release smaller product enhancements more frequently, instead of shipping a few significant products each year. As a result, we are putting better tools in front of our homeowners, guests and colleagues faster. We believe these advancements are improving experiences and are having a positive, meaningful impact on our business. For example, guests have resoundingly opted for the “click to SMS" feature we introduced earlier this year. This lets guests transfer to SMS rather than waiting to speak to an agent, allowing them to more easily communicate with Vacasa and resolve questions faster, while also improving the efficiency of our customer service representatives. SMS inbounds now exceed phone inbounds. We continue to prioritize our business needs to drive profitable growth and are carefully managing our operating expenses. Our technology and development, sales and marketing, and general and administrative expenses are all down in the second quarter of 2023, compared to the same period last year. 4Second Quarter 2023

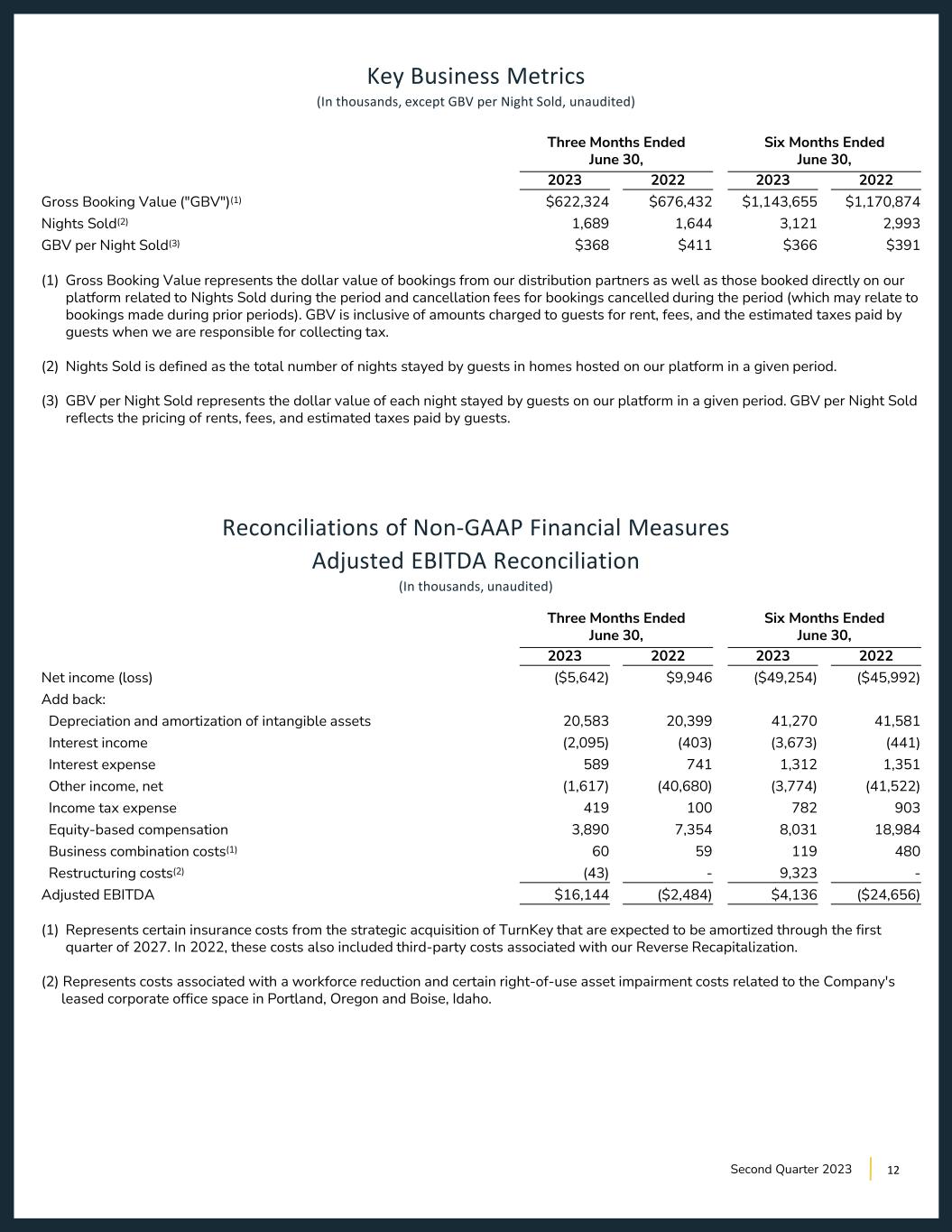

Financial Discussion During the second quarter of 2023, Gross Booking Value reached $622 million, down 8% year-over-year, driven by a 10% year-over-year decrease in Gross Booking Value per Night Sold, partially offset by a 3% year-over-year increase in Nights Sold. Revenue, which consists primarily of our commission on the rents we generate for homeowners, the fees we collect from guests, and revenue from home care solutions provided directly to our homeowners, was $305 million in the second quarter, a 2% decrease year-over-year. Our continued progress in improving local market operations and customer support functions is evidenced by the year-over-year reduction in our cost of revenue, exclusive of depreciation and amortization, as a percentage of Revenue, and the measured year- over-year growth in our operations and support expense in the second quarter of 2023. We are demonstrating operating discipline in our central operations, as other operating expenses—including technology and development, sales and marketing, and general and administrative—declined on a year-over-year basis in the second quarter of 2023. Net Loss was $6 million for the second quarter of 2023. Adjusted EBITDA was $16 million for the second quarter compared to a $2 million loss in the same period last year. We believe the $19 million year-over-year improvement is indicative of the progress our teams are making in operating the business with increased discipline. Villa De La Mar Nokomis, FL 5Second Quarter 2023

Outlook The changing booking patterns we have seen recently, as the industry comes off of two record years, persist. However, given that we are well into our summer peak season, we currently expect to end 2023 at the higher end of the Revenue range we guided to in the first quarter. We now anticipate 2023 Revenue will decline by a high-single digit percentage year-over-year. For full-year Adjusted EBITDA, we continue to realize operating efficiencies and currently believe we will achieve slight Adjusted EBITDA profitability in 2023. Villa De La Mar Nokomis, FL 6Second Quarter 2023

Villa De La Mar Nokomis, FL Closing We will host a call on August 8, 2023, at 2:00 p.m. PT / 5:00 p.m. ET to discuss these results in more detail. A link to the live webcast will be made available on Vacasa’s Investor Relations website at investors.vacasa.com. A replay of the webcast will be available for one year beginning approximately two hours after the close of the call. We would like to thank our employees for all their efforts this past quarter, and especially the dedication and hard work of all of our colleagues in our local markets serving our guests and homeowners. We would also like to thank our homeowners for trusting us with their homes. We look forward to updating you on our continued progress. Sincerely, Rob Greyber, CEO Bruce Schuman, CFO 7Second Quarter 2023

About Vacasa Vacasa is the leading vacation rental management platform in North America, transforming the vacation rental experience by integrating purpose-built technology with expert local and national teams. Homeowners enjoy earning significant incremental income on one of their most valuable assets, delivered by the company’s unmatched technology that is designed to adjust rates in real time to maximize revenue. Guests can relax comfortably in Vacasa’s 40,000+ homes across more than 500 destinations in the United States, Belize, Canada, Costa Rica, and Mexico, knowing that 24/7 support is just a phone call away. In addition to enabling guests to search, discover and book its properties on Vacasa.com and the Vacasa Guest App, Vacasa provides valuable, professionally managed inventory to top channel partners, including Airbnb, Booking.com and Vrbo. For more information, visit https://investors.vacasa.com 8Second Quarter 2023

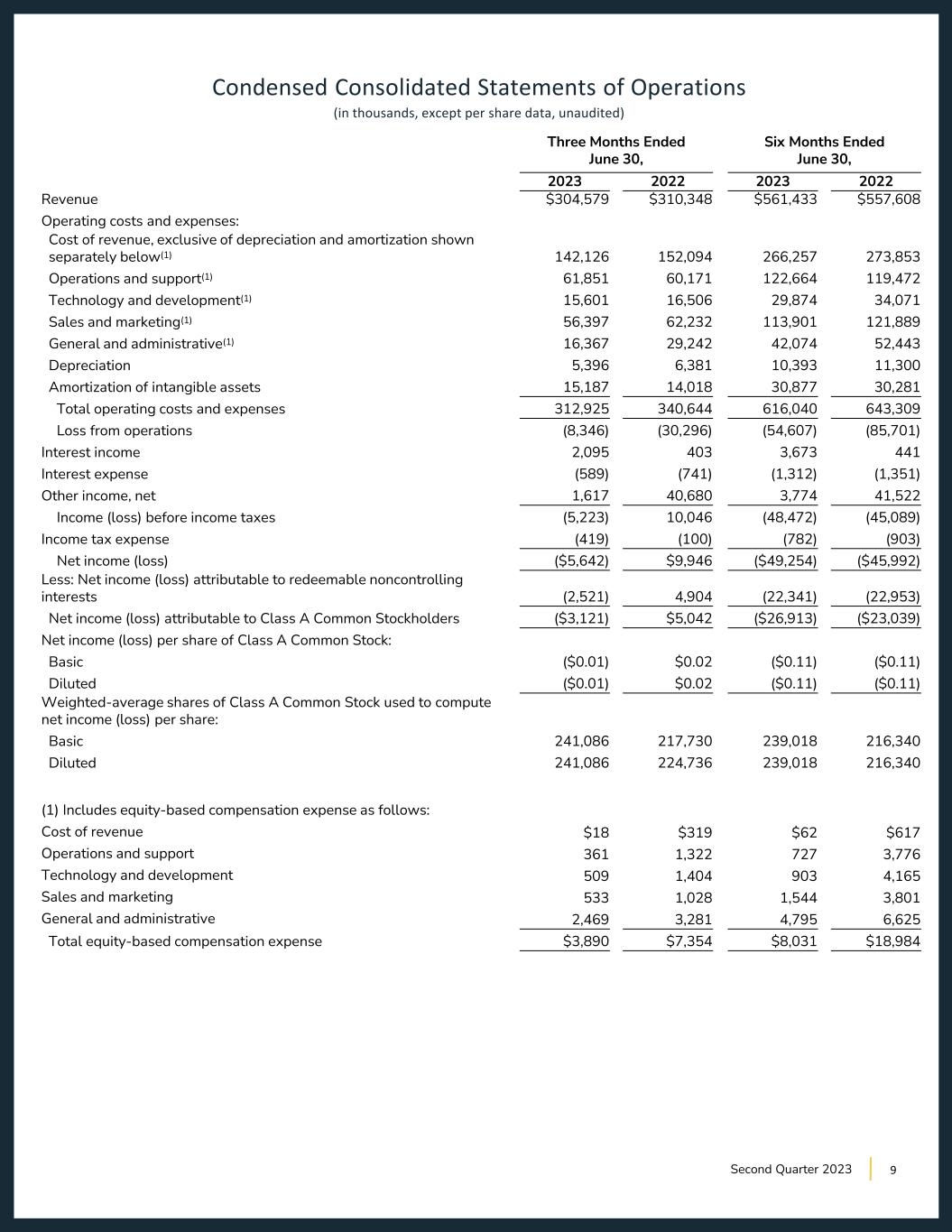

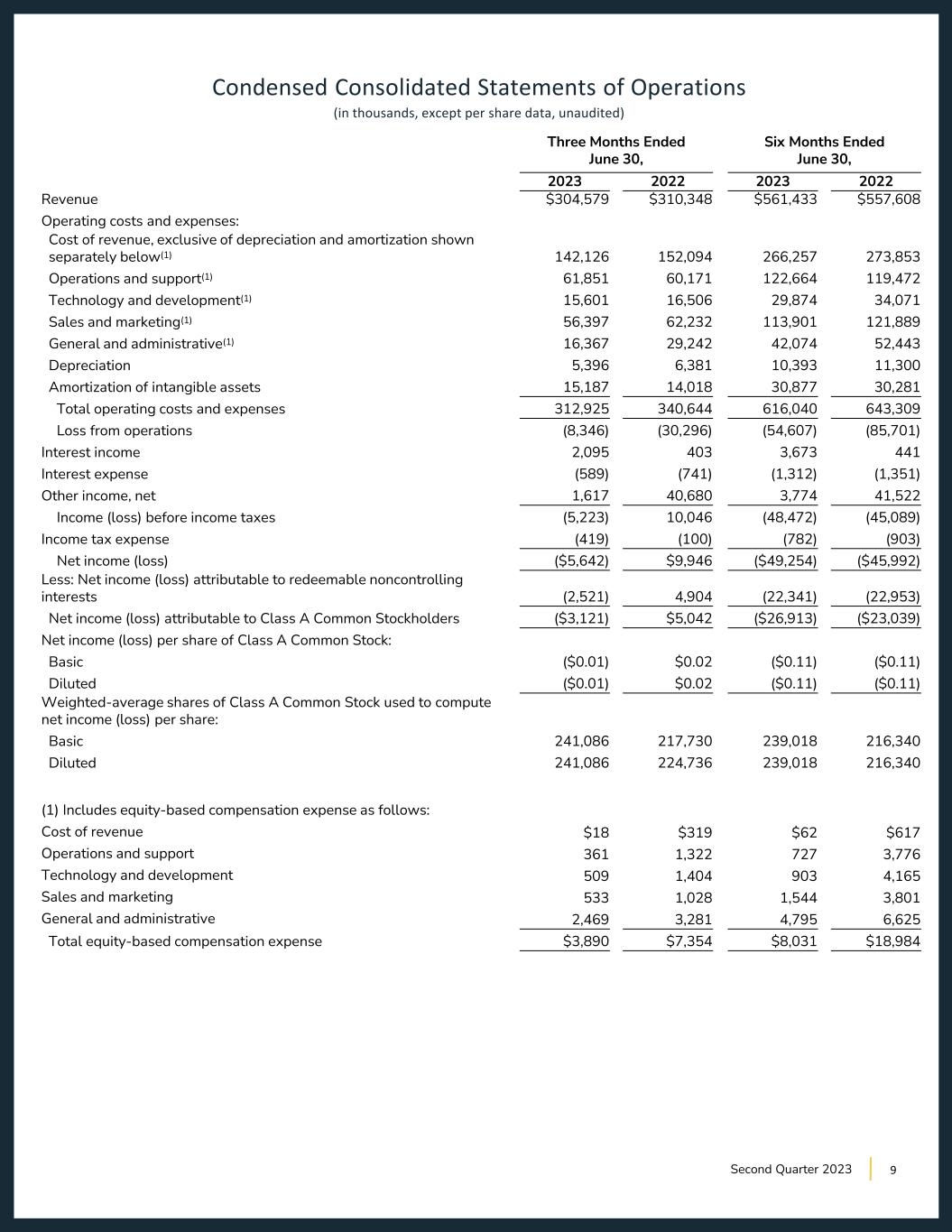

Condensed Consolidated Statements of Operations (in thousands, except per share data, unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenue $304,579 $310,348 $561,433 $557,608 Operating costs and expenses: Cost of revenue, exclusive of depreciation and amortization shown separately below(1) 142,126 152,094 266,257 273,853 Operations and support(1) 61,851 60,171 122,664 119,472 Technology and development(1) 15,601 16,506 29,874 34,071 Sales and marketing(1) 56,397 62,232 113,901 121,889 General and administrative(1) 16,367 29,242 42,074 52,443 Depreciation 5,396 6,381 10,393 11,300 Amortization of intangible assets 15,187 14,018 30,877 30,281 Total operating costs and expenses 312,925 340,644 616,040 643,309 Loss from operations (8,346) (30,296) (54,607) (85,701) Interest income 2,095 403 3,673 441 Interest expense (589) (741) (1,312) (1,351) Other income, net 1,617 40,680 3,774 41,522 Income (loss) before income taxes (5,223) 10,046 (48,472) (45,089) Income tax expense (419) (100) (782) (903) Net income (loss) ($5,642) $9,946 ($49,254) ($45,992) Less: Net income (loss) attributable to redeemable noncontrolling interests (2,521) 4,904 (22,341) (22,953) Net income (loss) attributable to Class A Common Stockholders ($3,121) $5,042 ($26,913) ($23,039) Net income (loss) per share of Class A Common Stock: Basic ($0.01) $0.02 ($0.11) ($0.11) Diluted ($0.01) $0.02 ($0.11) ($0.11) Weighted-average shares of Class A Common Stock used to compute net income (loss) per share: Basic 241,086 217,730 239,018 216,340 Diluted 241,086 224,736 239,018 216,340 (1) Includes equity-based compensation expense as follows: Cost of revenue $18 $319 $62 $617 Operations and support 361 1,322 727 3,776 Technology and development 509 1,404 903 4,165 Sales and marketing 533 1,028 1,544 3,801 General and administrative 2,469 3,281 4,795 6,625 Total equity-based compensation expense $3,890 $7,354 $8,031 $18,984 9Second Quarter 2023

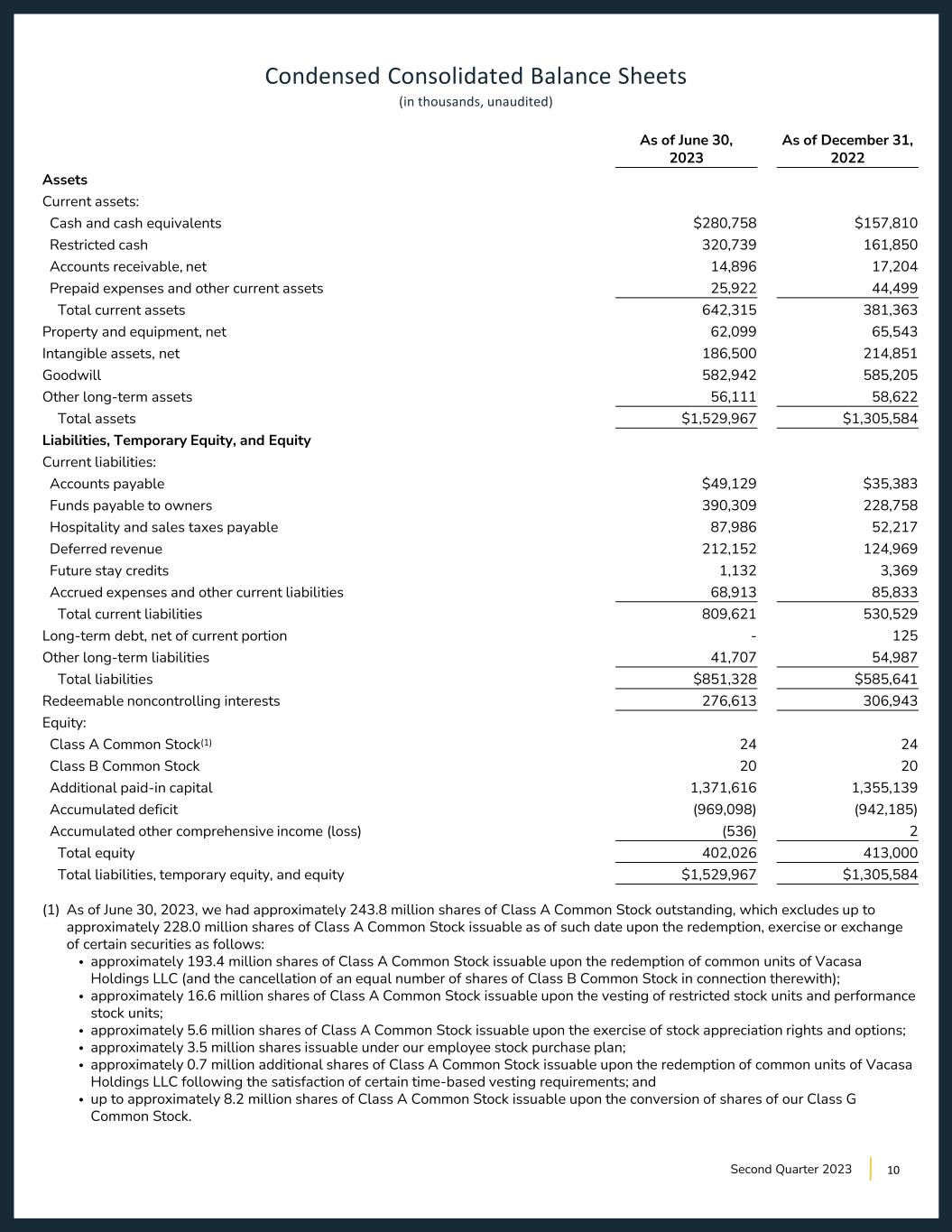

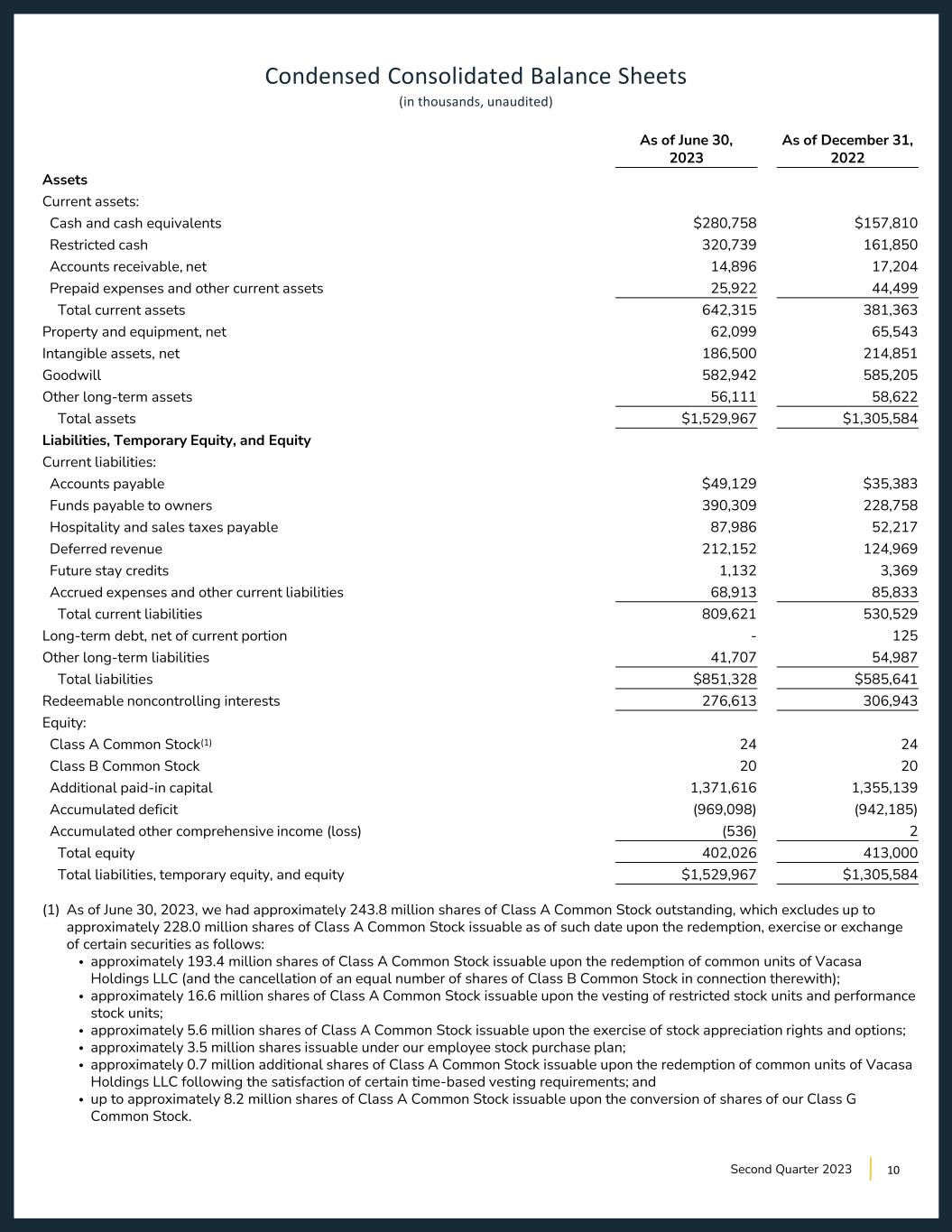

Condensed Consolidated Balance Sheets (in thousands, unaudited) As of June 30, As of December 31, 2023 2022 Assets Current assets: Cash and cash equivalents $280,758 $157,810 Restricted cash 320,739 161,850 Accounts receivable, net 14,896 17,204 Prepaid expenses and other current assets 25,922 44,499 Total current assets 642,315 381,363 Property and equipment, net 62,099 65,543 Intangible assets, net 186,500 214,851 Goodwill 582,942 585,205 Other long-term assets 56,111 58,622 Total assets $1,529,967 $1,305,584 Liabilities, Temporary Equity, and Equity Current liabilities: Accounts payable $49,129 $35,383 Funds payable to owners 390,309 228,758 Hospitality and sales taxes payable 87,986 52,217 Deferred revenue 212,152 124,969 Future stay credits 1,132 3,369 Accrued expenses and other current liabilities 68,913 85,833 Total current liabilities 809,621 530,529 Long-term debt, net of current portion - 125 Other long-term liabilities 41,707 54,987 Total liabilities $851,328 $585,641 Redeemable noncontrolling interests 276,613 306,943 Equity: Class A Common Stock(1) 24 24 Class B Common Stock 20 20 Additional paid-in capital 1,371,616 1,355,139 Accumulated deficit (969,098) (942,185) Accumulated other comprehensive income (loss) (536) 2 Total equity 402,026 413,000 Total liabilities, temporary equity, and equity $1,529,967 $1,305,584 (1) As of June 30, 2023, we had approximately 243.8 million shares of Class A Common Stock outstanding, which excludes up to approximately 228.0 million shares of Class A Common Stock issuable as of such date upon the redemption, exercise or exchange of certain securities as follows: • approximately 193.4 million shares of Class A Common Stock issuable upon the redemption of common units of Vacasa Holdings LLC (and the cancellation of an equal number of shares of Class B Common Stock in connection therewith); • approximately 16.6 million shares of Class A Common Stock issuable upon the vesting of restricted stock units and performance stock units; • approximately 5.6 million shares of Class A Common Stock issuable upon the exercise of stock appreciation rights and options; • approximately 3.5 million shares issuable under our employee stock purchase plan; • approximately 0.7 million additional shares of Class A Common Stock issuable upon the redemption of common units of Vacasa Holdings LLC following the satisfaction of certain time-based vesting requirements; and • up to approximately 8.2 million shares of Class A Common Stock issuable upon the conversion of shares of our Class G Common Stock. 10Second Quarter 2023

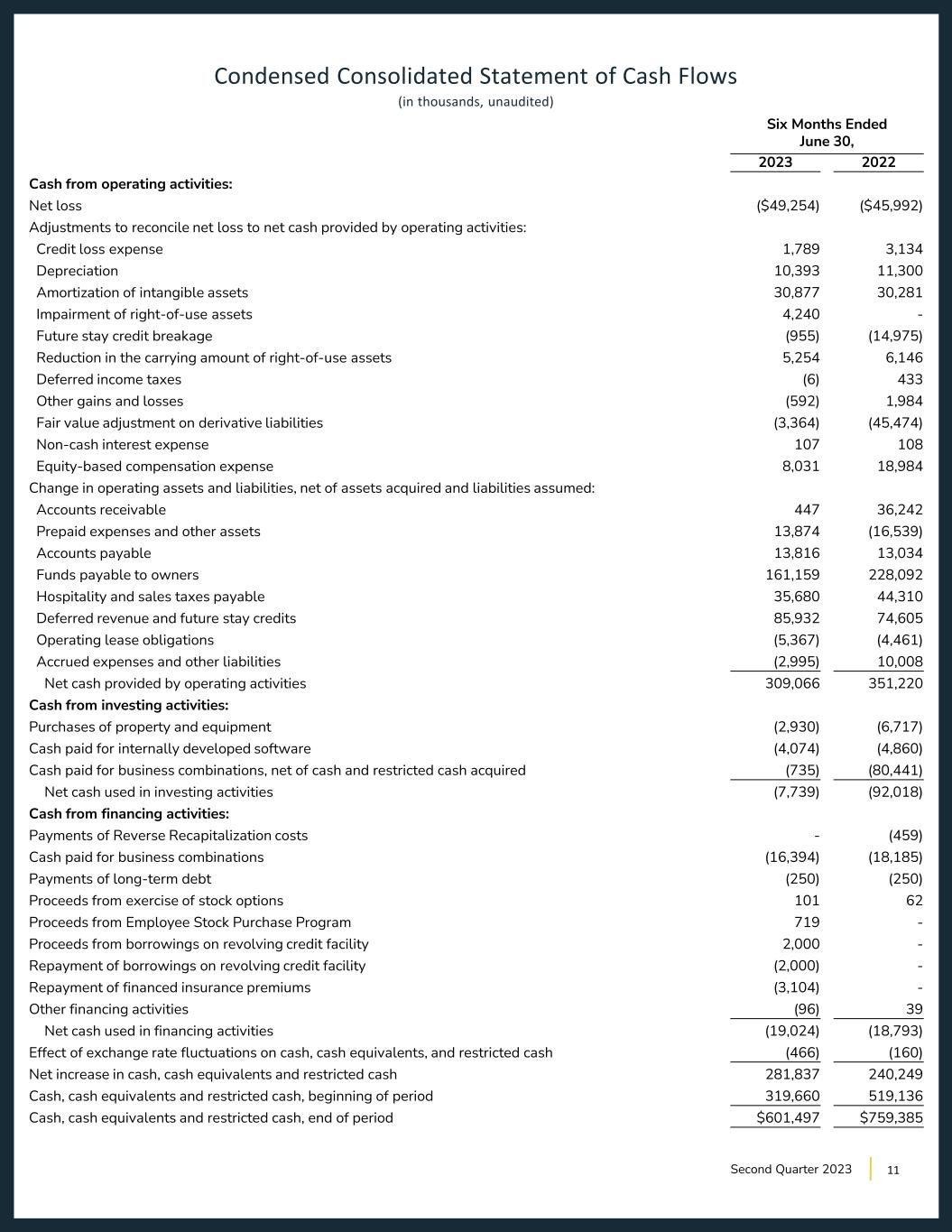

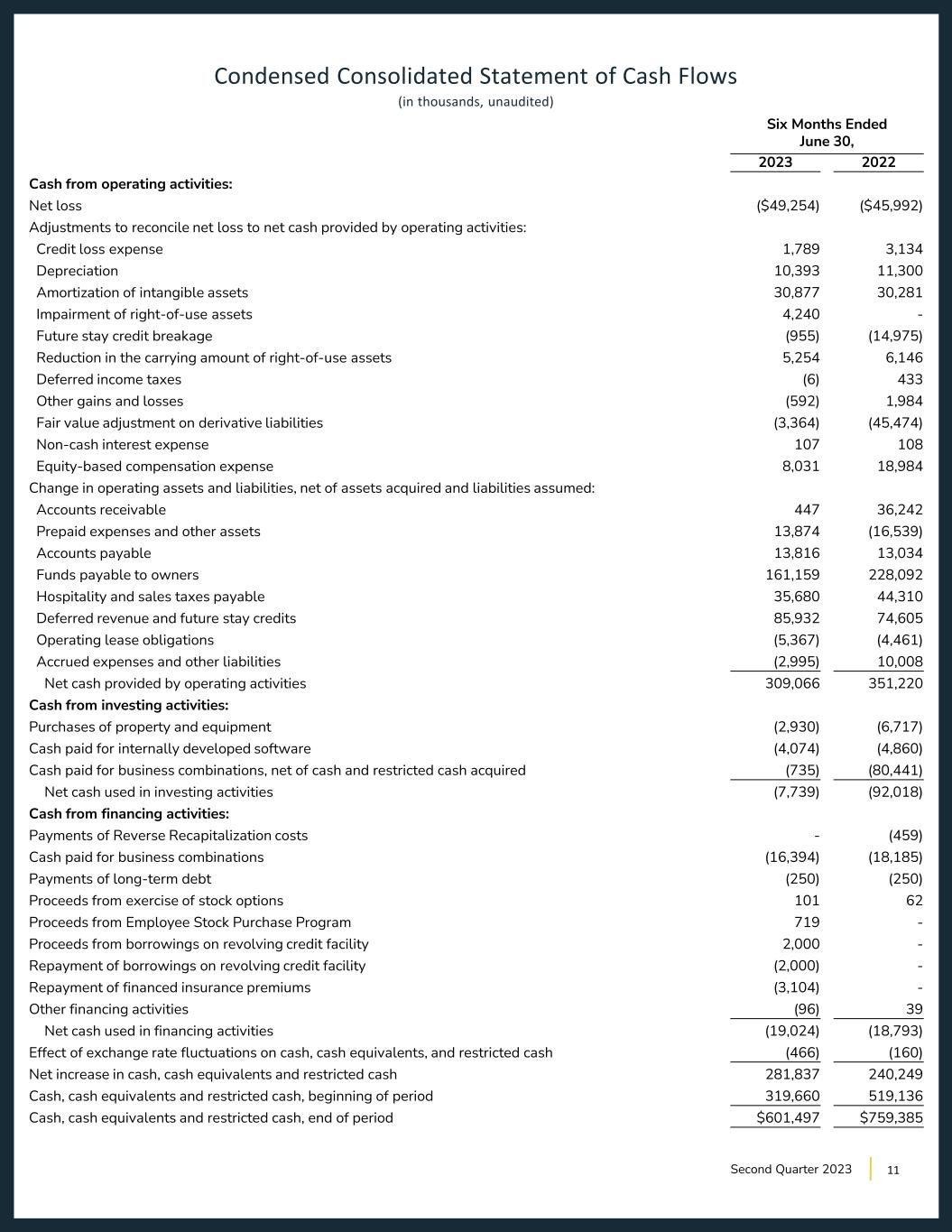

Condensed Consolidated Statement of Cash Flows (in thousands, unaudited) Six Months Ended June 30, 2023 2022 Cash from operating activities: Net loss ($49,254) ($45,992) Adjustments to reconcile net loss to net cash provided by operating activities: Credit loss expense 1,789 3,134 Depreciation 10,393 11,300 Amortization of intangible assets 30,877 30,281 Impairment of right-of-use assets 4,240 - Future stay credit breakage (955) (14,975) Reduction in the carrying amount of right-of-use assets 5,254 6,146 Deferred income taxes (6) 433 Other gains and losses (592) 1,984 Fair value adjustment on derivative liabilities (3,364) (45,474) Non-cash interest expense 107 108 Equity-based compensation expense 8,031 18,984 Change in operating assets and liabilities, net of assets acquired and liabilities assumed: Accounts receivable 447 36,242 Prepaid expenses and other assets 13,874 (16,539) Accounts payable 13,816 13,034 Funds payable to owners 161,159 228,092 Hospitality and sales taxes payable 35,680 44,310 Deferred revenue and future stay credits 85,932 74,605 Operating lease obligations (5,367) (4,461) Accrued expenses and other liabilities (2,995) 10,008 Net cash provided by operating activities 309,066 351,220 Cash from investing activities: Purchases of property and equipment (2,930) (6,717) Cash paid for internally developed software (4,074) (4,860) Cash paid for business combinations, net of cash and restricted cash acquired (735) (80,441) Net cash used in investing activities (7,739) (92,018) Cash from financing activities: Payments of Reverse Recapitalization costs - (459) Cash paid for business combinations (16,394) (18,185) Payments of long-term debt (250) (250) Proceeds from exercise of stock options 101 62 Proceeds from Employee Stock Purchase Program 719 - Proceeds from borrowings on revolving credit facility 2,000 - Repayment of borrowings on revolving credit facility (2,000) - Repayment of financed insurance premiums (3,104) - Other financing activities (96) 39 Net cash used in financing activities (19,024) (18,793) Effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash (466) (160) Net increase in cash, cash equivalents and restricted cash 281,837 240,249 Cash, cash equivalents and restricted cash, beginning of period 319,660 519,136 Cash, cash equivalents and restricted cash, end of period $601,497 $759,385 11Second Quarter 2023

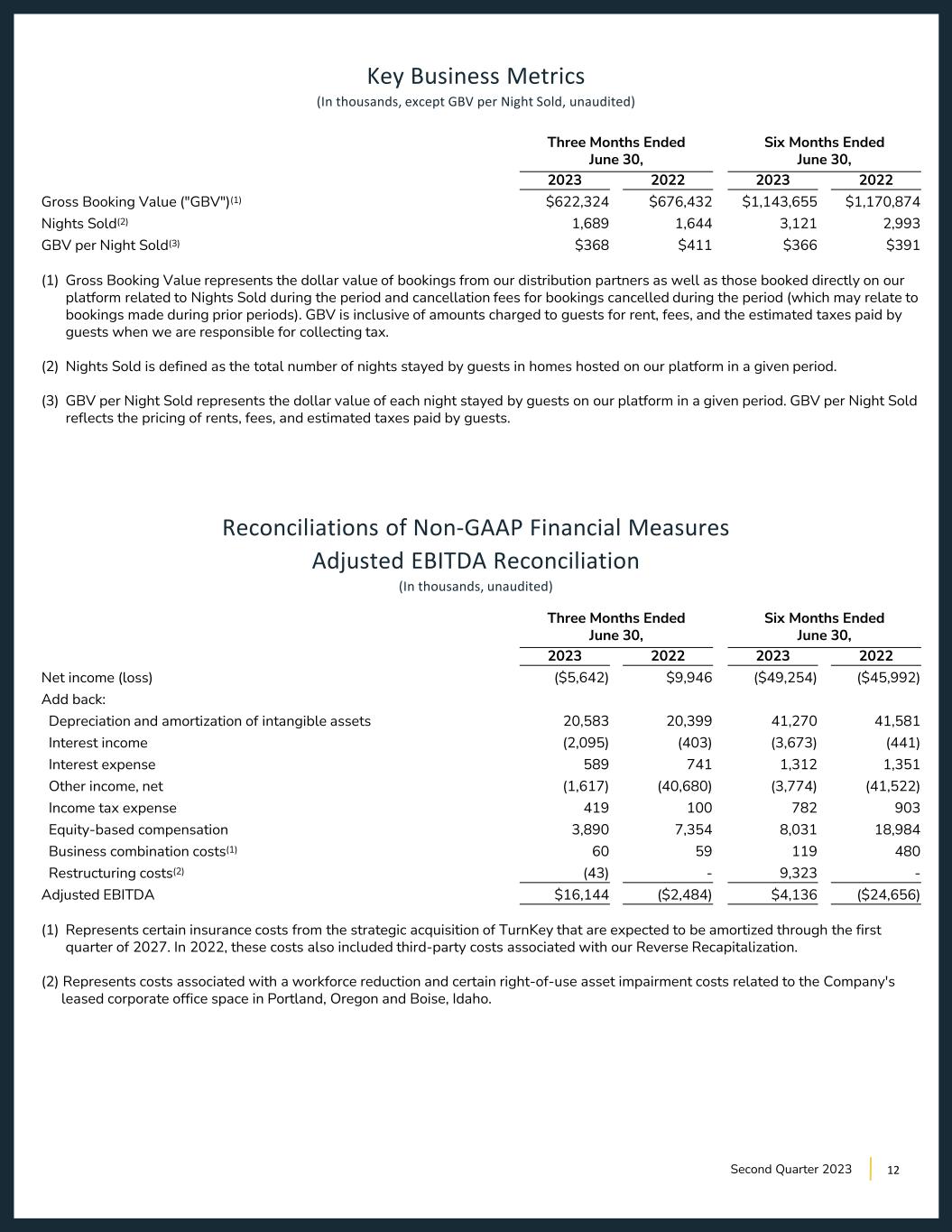

Key Business Metrics (In thousands, except GBV per Night Sold, unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Gross Booking Value ("GBV")(1) $622,324 $676,432 $1,143,655 $1,170,874 Nights Sold(2) 1,689 1,644 3,121 2,993 GBV per Night Sold(3) $368 $411 $366 $391 (1) Gross Booking Value represents the dollar value of bookings from our distribution partners as well as those booked directly on our platform related to Nights Sold during the period and cancellation fees for bookings cancelled during the period (which may relate to bookings made during prior periods). GBV is inclusive of amounts charged to guests for rent, fees, and the estimated taxes paid by guests when we are responsible for collecting tax. (2) Nights Sold is defined as the total number of nights stayed by guests in homes hosted on our platform in a given period. (3) GBV per Night Sold represents the dollar value of each night stayed by guests on our platform in a given period. GBV per Night Sold reflects the pricing of rents, fees, and estimated taxes paid by guests. Reconciliations of Non-GAAP Financial Measures Adjusted EBITDA Reconciliation (In thousands, unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net income (loss) ($5,642) $9,946 ($49,254) ($45,992) Add back: Depreciation and amortization of intangible assets 20,583 20,399 41,270 41,581 Interest income (2,095) (403) (3,673) (441) Interest expense 589 741 1,312 1,351 Other income, net (1,617) (40,680) (3,774) (41,522) Income tax expense 419 100 782 903 Equity-based compensation 3,890 7,354 8,031 18,984 Business combination costs(1) 60 59 119 480 Restructuring costs(2) (43) - 9,323 - Adjusted EBITDA $16,144 ($2,484) $4,136 ($24,656) (1) Represents certain insurance costs from the strategic acquisition of TurnKey that are expected to be amortized through the first quarter of 2027. In 2022, these costs also included third-party costs associated with our Reverse Recapitalization. (2) Represents costs associated with a workforce reduction and certain right-of-use asset impairment costs related to the Company's leased corporate office space in Portland, Oregon and Boise, Idaho. 12Second Quarter 2023

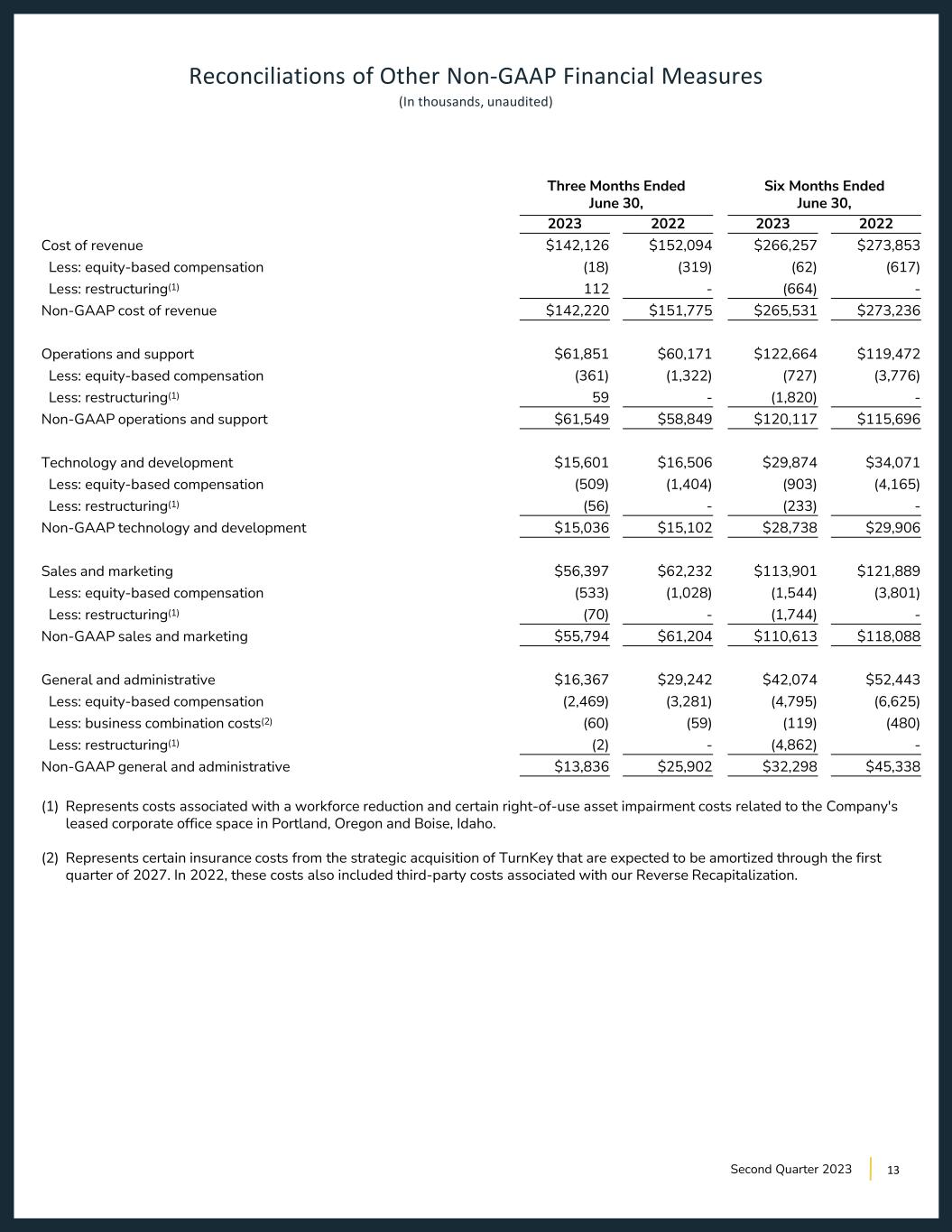

Reconciliations of Other Non-GAAP Financial Measures (In thousands, unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Cost of revenue $142,126 $152,094 $266,257 $273,853 Less: equity-based compensation (18) (319) (62) (617) Less: restructuring(1) 112 - (664) - Non-GAAP cost of revenue $142,220 $151,775 $265,531 $273,236 Operations and support $61,851 $60,171 $122,664 $119,472 Less: equity-based compensation (361) (1,322) (727) (3,776) Less: restructuring(1) 59 - (1,820) - Non-GAAP operations and support $61,549 $58,849 $120,117 $115,696 Technology and development $15,601 $16,506 $29,874 $34,071 Less: equity-based compensation (509) (1,404) (903) (4,165) Less: restructuring(1) (56) - (233) - Non-GAAP technology and development $15,036 $15,102 $28,738 $29,906 Sales and marketing $56,397 $62,232 $113,901 $121,889 Less: equity-based compensation (533) (1,028) (1,544) (3,801) Less: restructuring(1) (70) - (1,744) - Non-GAAP sales and marketing $55,794 $61,204 $110,613 $118,088 General and administrative $16,367 $29,242 $42,074 $52,443 Less: equity-based compensation (2,469) (3,281) (4,795) (6,625) Less: business combination costs(2) (60) (59) (119) (480) Less: restructuring(1) (2) - (4,862) - Non-GAAP general and administrative $13,836 $25,902 $32,298 $45,338 (1) Represents costs associated with a workforce reduction and certain right-of-use asset impairment costs related to the Company's leased corporate office space in Portland, Oregon and Boise, Idaho. (2) Represents certain insurance costs from the strategic acquisition of TurnKey that are expected to be amortized through the first quarter of 2027. In 2022, these costs also included third-party costs associated with our Reverse Recapitalization. 13Second Quarter 2023

Forward-Looking Statements Certain statements made in this letter are considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect Vacasa’s current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from Vacasa’s expectations and projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: Vacasa’s ability to achieve profitability; Vacasa’s ability to manage and sustain its growth; Vacasa’s expectations regarding its financial performance, including its revenue, costs, and Adjusted EBITDA; Vacasa’s ability to attract and retain homeowners and guests; Vacasa’s ability to compete in its industry; Vacasa’s expectations regarding the health of the travel and hospitality industries, including in areas such as domestic travel, short-distance travel, and travel outside of top cities; the effects of seasonal and other trends on Vacasa’s results of operations; anticipated trends, developments, and challenges in Vacasa’s industry, business, and the highly competitive markets in which it operates, including changes in guest booking patterns and levels of supply of vacation rental homes; the sufficiency of its cash and cash equivalents, revolving credit facility and other sources of liquidity to meet liquidity needs; declines or disruptions to the travel and hospitality industries or general economic downturns; Vacasa’s ability to anticipate market needs or develop new or enhanced offerings and services to meet those needs; Vacasa’s ability to expand into new markets and businesses, expand its range of homeowner services, and pursue strategic partnership and acquisition opportunities; any future impairment of its long- lived assets or goodwill; Vacasa’s ability to manage any further expansion into international markets; Vacasa’s ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to its business both in the United States and internationally and its expectations regarding the impact of various laws, regulations and restrictions that relate to its business; Vacasa’s expectations regarding its tax liabilities and the adequacy of its reserves; Vacasa’s ability to effectively manage and expand its infrastructure, and maintain its corporate culture; Vacasa’s ability to identify, recruit, and retain skilled personnel, including key members of senior management; the effects of labor shortages and increases in wage and labor costs in its industry; the safety, affordability, and convenience of its platform and its offerings; Vacasa’s ability to keep pace with technological and competitive developments; Vacasa’s ability to maintain and enhance brand awareness; Vacasa’s ability to successfully defend litigation brought against it and its ability to secure adequate insurance coverage to protect the business and its operations; Vacasa’s ability to make required payments under its credit agreement and to comply with the various requirements of its indebtedness; Vacasa’s ability to effectively manage its exposure to fluctuations in foreign currency exchange rates; the anticipated increase in expenses associated with being a public company; Vacasa’s ability to return to and remain in compliance with Nasdaq listing requirements; Vacasa’s ability to maintain, protect, and enhance its intellectual property; and Vacasa’s use of artificial intelligence in its business. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Vacasa’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and of its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 filed with the Securities and Exchange Commission (the “SEC”), as well as its other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. 14Second Quarter 2023

Use of Non-GAAP Financial Measures This letter includes Adjusted EBITDA, Non-GAAP cost of revenue, Non-GAAP operations and support expense, Non-GAAP technology and development expense, Non-GAAP sales and marketing expense and Non-GAAP general and administrative expense (collectively, the “Non-GAAP Financial Measures”), which are financial measures that are not defined by or presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Reconciliation of the Non-GAAP Financial Measures to their most directly comparable GAAP measure is contained in tabular format below. We use the Non-GAAP Financial Measures to evaluate our performance, identify trends, formulate financial projections, and make strategic decisions. Adjusted EBITDA is defined as net income (loss) excluding: (1) depreciation and acquisition-related items consisting of amortization of intangible assets and impairments of goodwill and intangible assets, if applicable; (2) interest income and expense; (3) any other income or expense not earned or incurred during our normal course of business; (4) any income tax benefit or expense; (5) equity-based compensation costs; (6) one-time costs related to strategic business combinations; and (7) costs related to restructuring programs, including certain right-of-use asset impairment costs. We calculate each of Non-GAAP costs of revenue, Non-GAAP operations and support expense, Non-GAAP technology and development expense, Non-GAAP sales and marketing expenses and Non-GAAP general and administrative expense by excluding, as applicable, the non-cash expenses arising from the grant of equity-based awards, one-time costs related to strategic business combinations, and restructuring costs. We believe these Non-GAAP Financial Measures, when taken together with their corresponding comparable GAAP financial measures, are useful for analysts and investors. These Non-GAAP Financial Measures allow for more meaningful comparisons of our performance by excluding items that are non-cash in nature or when the amount and timing of these items is unpredictable or one-time in nature, not driven by the performance of our core business operations and/or renders comparisons with prior periods less meaningful. The Non-GAAP Financial Measures have significant limitations as analytical tools, should be considered as supplemental in nature, and are not meant as a substitute for any financial information prepared in accordance with GAAP. We believe the Non-GAAP Financial Measures provide useful information to investors and others in understanding and evaluating our results of operations, are frequently used by these parties in evaluating companies in our industry, and provide useful measures for period-to-period comparisons of our business performance. Moreover, we present the Non-GAAP Financial Measures in this letter because they are key measurements used by our management internally to make operating decisions, including those related to analyzing operating expenses, evaluating performance, and performing strategic planning and annual budgeting. The Non-GAAP Financial Measures have significant limitations as analytical tools, including that: • these measures do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; • these measures do not reflect changes in, or cash requirements for, our working capital needs; • Adjusted EBITDA does not reflect the interest expense, or the cash required to service interest or principal payments, on our debt; • some of these measures exclude equity-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense in our business and an important part of our compensation strategy; • Adjusted EBITDA and Non-GAAP general and administrative expense do not include one-time costs related to strategic business combinations; • these measures do not reflect costs related to restructuring programs, including certain right-of-use asset impairment costs; • these measures do not reflect our tax expense or the cash required to pay our taxes; and • with respect to Adjusted EBITDA, although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and such measure does not reflect any cash requirements for such replacements. The Non-GAAP Financial Measures are supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. These Non-GAAP Financial Measures should not be considered as substitutes for GAAP financial measures such as net income (loss), operating expenses or any other performance measures derived in accordance with GAAP. Also, in the future, we may incur expenses or charges such as those being adjusted in the calculation of these Non-GAAP Financial Measures. Our presentation of these Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or nonrecurring items, and these Non-GAAP measures may be different from similarly titled metrics or measures presented by other companies. Our guidance may also include Adjusted EBITDA. A reconciliation of the Company’s Adjusted EBITDA guidance to the most directly comparable GAAP financial measure cannot be provided without unreasonable efforts and is not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that are made for depreciation and amortization of intangible assets, equity-based compensation expense, business combination costs, restructuring charges and other adjustments reflected in our reconciliation of historical Adjusted EBITDA, the amounts of which could be material. 15Second Quarter 2023

Key Business Metrics Definitions We collect key business metrics to assess our performance. Our key business metrics include Gross Booking Value (“GBV”), Nights Sold, and Gross Booking Value per Night Sold. GBV represents the dollar value of bookings from our distribution partners as well as those booked directly on our platform related to Nights Sold during the period and cancellation fees for bookings cancelled during the period (which may relate to bookings made during prior periods). GBV is inclusive of amounts charged to guests for rent, fees, and the estimated taxes paid by guests when we are responsible for collecting tax. Changes in GBV reflect our ability to add homes by attracting homeowners through our individual sales approach, and through portfolio transactions or strategic acquisitions, to retain homeowners and guests, and to optimize the availability and utilization of the homes on our platform. Changes in GBV also reflect changes in the pricing of rents, fees, and estimated taxes paid by guests. Changes in utilization of the homes on our platform and pricing of those homes are generally reflective of changes in guest demand. We define Nights Sold as the total number of nights stayed by guests in homes hosted on our platform in a given period. Nights Sold is a key measure of the scale and quality of homes on our platform and our ability to generate demand and manage yield on behalf of our homeowners. We experience seasonality in the number of Nights Sold. Typically, the second and third quarters of the year each have higher Nights Sold than the first and fourth quarters, as guests tend to travel more during the peak summer travel season. GBV per Night Sold represents the dollar value of each night stayed by guests on our platform in a given period. GBV per Night Sold reflects the pricing of rents, fees, and estimated taxes paid by guests. There is a strong relationship between GBV and Nights Sold, and these two variables are managed in concert with one another. 16Second Quarter 2023