UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-23739 |

| |

| Exact name of registrant as specified in charter: | | PGIM Private Real Estate Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 12/31/2023 |

| |

| Date of reporting period: | | 12/31/2023 |

Item 1 – Reports to Stockholders

PGIM PRIVATE REAL ESTATE FUND, INC.

ANNUAL REPORT

DECEMBER 31, 2023

To enroll in e-delivery, go to pgim.com/investments/resource/ edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds and closed-end funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Real Estate is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. ©2024 Prudential Financial, Inc. and its related entities. PGIM Real Estate, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Private Real Estate Fund, Inc. informative and useful. The report covers performance for the 12-month period that ended December 31, 2023. Despite elevated inflation, recession fears, and a banking industry crisis, financial markets rallied and the global economy remained resilient throughout the period. Employers continued hiring, consumers continued spending, and home prices rose as inflation eventually cooled and the economic outlook improved. |

Stocks rose for much of the period and then surged late in the period when the Federal Reserve (the Fed) signaled several potential interest-rate cuts in 2024. For the entire period, equities in both US and international markets posted gains.

After falling much of the period, bond markets rebounded when the Fed began moderating its rate-hiking cycle. Higher interest rates also offered investors an additional cushion from fixed income volatility. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted gains during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President and Principal Executive Officer

PGIM Private Real Estate Fund, Inc.

February 15, 2024

PGIM Private Real Estate Fund, Inc. 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by calling (800) 225-1852.

| | | | | | |

| |

| | | Average Annual Total Returns as of 12/31/23 |

| | |

| | | One Year (%) | | | Since Inception (%) |

| | |

Class D | | | | | | |

| | |

(without sales charges) | | | 8.35 | | | 7.00 (11/3/2022) |

| | |

Class I | | | | | | |

| | |

(without sales charges) | | | 8.63 | | | 7.27 (11/3/2022) |

| | |

Class S | | | | | | |

| | |

(without sales charges) | | | 7.71 | | | 6.39 (11/3/2022) |

| | |

Class T | | | | | | |

| | |

(with sales charges) | | | 3.94 | | | 3.17 (11/3/2022) |

| | |

(without sales charges) | | | 7.71 | | | 6.39 (11/3/2022) |

| | |

Bloomberg US Aggregate Bond Index | | | | | | |

| | |

| | | 5.53 | | | 7.60 |

| | |

S&P 500 Index | | | | | | |

| | |

| | | | 26.29 | | | 21.63 |

Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Without waiver of fees and or expense reimbursements, if any, the returns would have been lower. Total returns are based on changes in net asset value. Net asset value total return assumes the reinvestment of all distributions, including returns of capital, if any.

Since Inception returns for the Indexes are measured from the closest month-end to the funds inception date. All returns exclude the impact of redemption fees on shares purchased and held less than 12 months.

4 Visit our website at pgim.com/investments

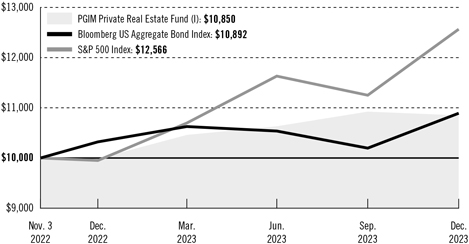

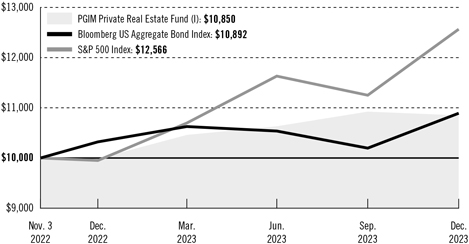

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class I shares with a similar investment in the Bloomberg US Aggregate Bond Index and the S&P 500 Index by portraying the initial account values at the commencement of operations for Class I shares (November 3, 2022) and the account values at the end of the current fiscal year (December 31, 2023) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class I shares only. As indicated in the table provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns in the table and the graph do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

PGIM Private Real Estate Fund, Inc. 5

Your Fund’s Performance (continued)

Benchmark Definitions

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable, and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how large company stocks in the United States have performed.

*The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 12/31/23

| | | | |

| | |

Top Holdings | | Real Estate Sectors | | % of Net Assets |

| | |

Monarch Town Center, Miramar, Florida | | Non-Consolidated Joint Venture — Industrial | | 31.4% |

| | |

East Gate Marketplace, Chantilly, Virginia | | Non-Consolidated Joint Venture — Retail | | 26.5% |

| | |

3730 S. Main St., Pearland, Texas, 6.55%, Maturing 10/03/28 | | Preferred Equity — Industrial | | 23.8% |

| | |

3730 S. Main St., Pearland, Texas | | Non-Consolidated Joint Venture — Industrial | | 14.8% |

Holdings reflect only long-term investments and are subject to change.

6 Visit our website at pgim.com/investments

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Private Real Estate Fund Inc.’s Class I shares returned 8.63% in the 12-month reporting period that ended December 31, 2023.

What were conditions like in the private real estate market?

| ● | The rapid run-up in long-term interest rates during the reporting period froze transactions markets, due both to higher debt costs and net capital flows out of real estate into other asset classes, including fixed income. After raising rates by 425 basis points in 2022 to tackle inflation, the US Federal Reserve (Fed) tacked on another 100 basis points in interest rate hikes in 2023, before pausing from July through year-end. (One basis point equals 0.01%.) |

| ● | Yields for 10-year US Treasury bonds started and ended the year at 3.9%, but climbed as high as 5.0% in October 2023 due to investor concerns regarding geopolitical conflicts, long-run fiscal sustainability, above-target inflation, and tighter financial conditions. After the Fed’s December 2023 meeting, however, markets adopted a more positive outlook, anticipating a soft landing for the economy and three or more rate cuts to begin in 2024. |

| ● | Labor markets remained robust in 2023, sharply defying expectations of recession and supporting real estate demand. The unemployment rate averaged 3.6% during the period, the lowest level on record since the 1960s, as 2.7 million net new jobs were created. Job growth continued at above-trend pace in the Sunbelt, where Miami, Houston, and Raleigh-Durham, among other metropolitan areas, accelerated their rate of job growth above the 2015–2019 pace. Wage growth (according to the Employment Cost Index) moved slightly higher in the third quarter of 2023 to 4.3% annualized. |

| ● | Even though inflation cooled meaningfully over 2023, falling to 3.2% in the fourth quarter, affordability was the main constraint to tenant demand across property types, as housing costs rose faster than incomes. |

| ● | Core real estate equity began the year historically expensive relative to fixed income alternatives, which limited near-term investor demand for private real estate. |

| ● | Improved core real estate equity fundamentals were offset by the increase in both cap rates and discount rates during the period. Private market index returns measured by the NCREIF Property Index declined by 7.9% over 2023—with an 11.8% decrease in appreciation offset by a 4.3% income return. The retail sector and manufacturing uses within industrial properties outperformed, while office properties endured the worst returns across sectors and their worst performance since the 2007–2008 Global Financial Crisis. |

| ● | Same-store net operating income in private real estate averaged 5.4% in 2023, led by the industrial sector at 12.3%. Apartment net operating income (NOI) growth decelerated to 4.4%, impacted by lower occupancy, moderating net absorption, and higher insurance costs. Retail NOI growth reached 2.8%, above its 10-year trend of 1.1%. |

PGIM Private Real Estate Fund, Inc. 7

Strategy and Performance Overview (continued)

| ● | Suppressed by higher interest rates, transaction activity and debt availability were constrained, which created non-core lending opportunities offering attractive risk-adjusted returns. |

| ● | Apartment vacancy pushed higher in 2023, but supply pipelines slowed in response to high construction costs, setting the stage for reduced competition in two-to-three years for newly built housing and logistics properties. |

What worked and didn’t work?

| ● | During the reporting period, the Fund benefited from selectivity and a thoughtful management approach in a difficult market environment. |

| ● | Necessity retail was identified as a target investment sector due to its durable cash flow profile and relatively attractive pricing, as the sector had not been aggressively bid up during previous years of low interest rates. |

| ● | The Fund also selected an industrial property leased on a long-term basis to a credit tenant in a desirable southeast port market. |

| ● | The Fund did not have exposure to legacy assets, in contrast to peer competitor funds, which acquired such assets in a low interest rate environment and experienced downward valuation pressure as investor return expectations expanded with higher interest rates. |

| ● | During the period, the Fund delayed its third-party fundraising efforts due to the shifting interest rate environment and uncertainty in the real estate capital markets. |

What was the impact of the Fund’s distribution policy?

The Fund has a practice of seeking to maintain a relatively stable level of distributions to shareholders. This practice has no impact on the Fund’s investment strategy. The Fund’s manager believes the practice helps maintain the Fund’s competitiveness. For the fiscal year ended December 2023, the tax character of dividends paid include an ordinary income distribution of $553,841 and $276,179 of tax return of capital distribution, which had no material impact on the NAV during the reporting period.

Current outlook

| ● | A soft economic landing remains PGIM Real Estate’s base case as the Fed anticipates beginning to cut interest rates in 2024, while maintaining full employment and notching a win in its battle with inflation. However, alternate scenarios are increasingly likely as geopolitical conflicts could put pressure on energy prices and inflation. |

| ● | Over the near term, new apartment and industrial sector construction may pressure occupancy rates in select markets and submarkets over 2024. Real estate credit fundamentals remain strong, with healthy occupancy and positive NOI growth across most property types. |

| ● | The current real estate market uncertainty is driven primarily by the availability, cost, and predictability of debt financing. While investors largely remained on the sidelines |

8 Visit our website at pgim.com/investments

| | in 2023, avoiding transacting as capitalization rates moved higher, and a bid-ask spread between buyers and sellers persisted, real estate transaction markets may begin to thaw over 2024 if financial conditions ease. |

| ● | Volatility in interest rates has caused a dislocation in the debt capital markets, potentially providing an increasingly attractive entry point to invest in repriced assets and an opportunity to invest in subordinate debt positions (mezzanine debt or preferred equity), as senior loan proceeds are typically lower than 18 months ago. |

| ● | A structural housing shortage, we believe, will likely drive demand for apartments, senior housing, and student housing. In addition, we anticipate that expensive home prices, an historically low inventory of homes available for sale, and higher mortgage rates should support housing rental growth. |

| ● | While industrial vacancy has increased from historical lows, e-commerce should continue to drive demand for industrial real estate. Urban infill and light industrial may offer lower risk and higher rental growth relative to big box assets. |

| ● | In our view, necessity-based investments, such as grocery-anchored retail, offer relatively favorable risk-adjusted returns and stable income. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Private Real Estate Fund, Inc. 9

Consolidated Schedule of Investments

as of December 31, 2023

| | | | | | | | |

| | |

| Description | | | | | Value | |

| | |

LONG-TERM INVESTMENTS 96.5% | | | | | | | | |

| | |

PRIVATE REAL ESTATE | | | | | | | | |

INVESTMENTS IN NON-CONSOLIDATED JOINT VENTURES - INDUSTRIAL(pp) 14.8% | | | | | | | | |

| | |

3730 S. Main St., Pearland, Texas^ | | | | | | $ | 12,632,882 | |

| | | | | | | | |

| | |

INVESTMENTS IN NON-CONSOLIDATED JOINT VENTURES - RETAIL(pp) 57.9% | | | | | | | | |

| | |

East Gate Marketplace, Chantilly, Virginia^ | | | | | | | 22,568,348 | |

| | |

Monarch Town Center, Miramar, Florida^ | | | | | | | 26,691,353 | |

| | | | | | | | |

| | | | | | | 49,259,701 | |

| | |

PREFERRED EQUITY - INDUSTRIAL 23.8% | | | | | | | | |

| | |

3730 S. Main St., Pearland, Texas, 6.55%, Maturing 10/03/28^ | | | | | | | 20,211,817 | |

| | | | | | | | |

| | |

TOTAL LONG-TERM INVESTMENTS

(cost $80,000,082) | | | | | | | 82,104,400 | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| | |

SHORT-TERM INVESTMENT 3.8% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUND | | | | | | | | |

PGIM Core Government Money Market Fund

(cost $3,252,181)(wb) | | | 3,252,181 | | | | 3,252,181 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS 100.3%

(cost $83,252,263) | | | | | | | 85,356,581 | |

Liabilities in excess of other assets (0.3)% | | | | | | | (289,164 | ) |

| | | | | | | | |

| | |

NET ASSETS 100.0% | | | | | | $ | 85,067,417 | |

| | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

ETF—Exchange-Traded Fund

LIBOR—London Interbank Offered Rate

SOFR—Secured Overnight Financing Rate

| ^ | Indicates a Level 3 investment. The aggregate value of Level 3 investments is $82,104,400 and 96.5% of net assets. |

| (pp) | The Fund’s contractual ownership in the joint venture prior to the impact of promote structures ranges from 95.0% to 99.0% of the venture. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical investments.

Level 2—quoted prices for similar investments, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

See Notes to Financial Statements.

PGIM Private Real Estate Fund, Inc. 11

Consolidated Schedule of Investments (continued)

as of December 31, 2023

Level 3—unobservable inputs for investments valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of December 31, 2023 in valuing such portfolio investments:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments | | | | | | | | | | | | |

| | | |

Assets | | | | | | | | | | | | |

Private Real Estate | | | | | | | | | | | | |

Investments in Non-Consolidated Joint Ventures - Industrial | | $ | — | | | | $— | | | $ | 12,632,882 | |

Investments in Non-Consolidated Joint Ventures - Retail | | | — | | | | — | | | | 49,259,701 | |

Preferred Equity - Industrial | | | — | | | | — | | | | 20,211,817 | |

| | | |

Short-Term Investment | | | | | | | | | | | | |

Affiliated Mutual Fund | | | 3,252,181 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 3,252,181 | | | | $— | | | $ | 82,104,400 | |

| | | | | | | | | | | | |

The following is a reconciliation of assets in which unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | |

| | | Private Real Estate

Investments

in Non-Consolidated

Joint Ventures - Industrial | | | Private Real Estate

Investments

in Non-Consolidated

Joint Ventures - Retail | | | Preferred Equity -

Industrial | |

Balance as of 12/31/22 | | $ | — | | | $ | 48,950,256 | | | $ | — | |

Change in unrealized appreciation (depreciation)* | | | (97,118 | ) | | | 309,445 | | | | 111,817 | |

Purchases/Exchanges/Issuances | | | 12,730,000 | | | | — | | | | 20,100,000 | |

| | | | | | | | | | | | |

Balance as of 12/31/23 | | $ | 12,632,882 | | | $ | 49,259,701 | | | $ | 20,211,817 | |

| | | | | | | | | | | | |

Change in unrealized appreciation

(depreciation) relating to securities still

held at reporting period end | | $ | (97,118 | ) | | $ | 309,445 | | | $ | 111,817 | |

| | | | | | | | | | | | |

*Includes adjustments to cost basis including returns of capital and other capital adjustments related to the non-consolidated joint ventures and preferred equity.

Level 3 investments as presented in the table above are being fair valued using pricing methodologies approved by the Board, which contain unobservable inputs as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

Level 3

Investments | | Fair Value as of

December 31,

2023 | | Valuation

Methodology | | Unobservable

Inputs | | Input(s) | | Directional

Impact on

Fair Value

from Input

Increase* |

Private Real Estate Investments in Non-Consolidated Joint Ventures - Retail | | | | | | | | | | | |

East Gate | | | | | | | | | Income/Discounted | | | | | Discount/Terminal | | | | | | | | | | | |

Marketplace | | | | $22,568,348 | | | | | Cash Flow | | | | | Rates | | | | | 7.50 | %/6.50% | | | | Decrease | |

Monarch Town | | | | | | | | | Income/Discounted | | | | | Discount/Terminal | | | | | | | | | | | |

Center | | | | 26,691,353 | | | | | Cash Flow | | | | | Rates | | | | | 6.25 | %/5.50% | | | | Decrease | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | $49,259,701 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

*Altering one or more unobservable inputs may result in a significant change to a Level 3 security’s fair value measurement.

See Notes to Financial Statements.

12

Sector Allocation:

The sector allocation of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of December 31, 2023 were as follows:

| | | | |

Private Real Estate | | | | |

Investments in Non-Consolidated Joint Ventures - Retail | | | 57.9 | % |

Preferred Equity - Industrial | | | 23.8 | |

Investments in Non-Consolidated Joint Ventures - Industrial | | | 14.8 | |

Affiliated Mutual Fund | | | 3.8 | |

| | | | |

| | | 100.3 | |

Liabilities in excess of other assets | | | (0.3 | ) |

| | | | |

| |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

PGIM Private Real Estate Fund, Inc. 13

Consolidated Statement of Assets and Liabilities

as of December 31, 2023

| | | | |

Assets | | | | |

| |

Investments at value: | | | | |

Unaffiliated investments (cost $80,000,082) | | $ | 82,104,400 | |

Affiliated investments (cost $3,252,181) | | | 3,252,181 | |

Due from Manager | | | 37,512 | |

Prepaid expenses and other assets | | | 21,362 | |

| | | | |

| |

Total Assets | | | 85,415,455 | |

| | | | |

| |

Liabilities | | | | |

| |

Pre-acquisition closing cost payable | | | 125,000 | |

Audit fee payable | | | 90,000 | |

Professional fees payable | | | 71,317 | |

Custodian and accounting fees payable | | | 42,257 | |

Pricing fee payable | | | 12,500 | |

Accrued expenses and other liabilities | | | 4,837 | |

Affiliated transfer agent fee payable | | | 2,083 | |

Distribution fee payable | | | 44 | |

| | | | |

| |

Total Liabilities | | | 348,038 | |

| | | | |

Commitment and Contingencies (Note 3) | | | — | |

| | | | |

| |

Net Assets | | $ | 85,067,417 | |

| | | | |

| | | | |

| |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 3,167 | |

Paid-in capital in excess of par | | | 81,558,907 | |

Total distributable earnings (loss) | | | 3,505,343 | |

| | | | |

| |

Net assets, December 31, 2023 | | $ | 85,067,417 | |

| | | | |

See Notes to Financial Statements.

14

| | | | | | | | |

Class I | | | | | | | | |

Net asset value, offering price and repurchase price per share, | | | | | | | | |

($84,986,653 ÷ 3,164,173 shares of common stock issued and outstanding) | | $ | 26.86 | | | | | |

| | | | | | | | |

| | |

Class D | | | | | | | | |

Net asset value, offering price and repurchase price per share, | | | | | | | | |

($27,046 ÷ 1,008 shares of common stock issued and outstanding) | | $ | 26.84 | | | | | |

| | | | | | | | |

| | |

Class S | | | | | | | | |

Net asset value, offering price and repurchase price per share, | | | | | | | | |

($26,859 ÷ 1,003 shares of common stock issued and outstanding) | | $ | 26.77 | | | | | |

| | | | | | | | |

| | |

Class T | | | | | | | | |

Net asset value and repurchase price per share, | | | | | | | | |

($26,859 ÷ 1,003 shares of common stock issued and outstanding) | | $ | 26.77 | | | | | |

Maximum sales charges (3.50% of offering price) | | | 0.97 | | | | | |

| | | | | | | | |

Maximum offering price to public | | $ | 27.74 | | | | | |

| | | | | | | | |

Net asset value per share may not recalculate due to rounding.

See Notes to Financial Statements.

PGIM Private Real Estate Fund, Inc. 15

Consolidated Statement of Operations

Year Ended December 31, 2023

| | | | |

Net Investment Income (Loss) | | | | |

| |

Unaffiliated dividend income | | $ | 2,148,868 | |

Affiliated dividend income | | | 133,258 | |

| | | | |

Total income | | | 2,282,126 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 605,480 | |

Distribution fee(a) | | | 512 | |

Professional fees | | | 1,073,255 | |

Directors’ fees | | | 206,000 | |

Custodian and accounting fees | | | 157,373 | |

Audit fee | | | 90,000 | |

Pricing fees | | | 59,400 | |

Shareholders’ reports | | | 53,910 | |

Registration fees | | | 5,900 | |

Transfer agent’s fees and expenses (including affiliated expense of $2,083)(a) | | | 2,083 | |

Miscellaneous | | | 91,826 | |

| | | | |

Total expenses | | | 2,345,739 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (2,042,487 | ) |

| | | | |

Net expenses | | | 303,252 | |

| | | | |

Net investment income (loss), before income tax benefit and waiver recoupment | | | 1,978,874 | |

| | | | |

Income tax benefit | | | 35,000 | |

| | | | |

Net investment income (loss), after income tax benefit | | | 2,013,874 | |

| | | | |

Add: Recoupment of income tax expense reimbursement | | | (35,000 | ) |

| | | | |

Net investment income (loss), after income tax benefit and waiver recoupment | | | 1,978,874 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net change in unrealized appreciation (depreciation) on investments | | | 2,104,318 | |

| | | | |

Net gain (loss) on investment transactions | | | 2,104,318 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 4,083,192 | |

| | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | |

| | | Class I | | | Class D | | | Class S | | | Class T | |

Distribution fee | | | — | | | | 66 | | | | 223 | | | | 223 | |

Transfer agent’s fees and expenses | | | 521 | | | | 521 | | | | 521 | | | | 520 | |

Fee waiver and/or expense reimbursement | | | (2,039,795 | ) | | | (900 | ) | | | (896 | ) | | | (896 | ) |

See Notes to Financial Statements.

16

Consolidated Statements of Changes in Net Assets

| | | | | | | | | | | | | | | |

| | | |

| | | Year Ended

December 31, 2023 | | November 03, 2022*

through

December 31, 2022 | | |

| | | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | |

Operations | | | | | | | | | | | | | | | |

Net investment income (loss), after income tax benefit/expense and recoupment/reimbursement | | | $ | 1,978,874 | | | | $ | (24,008 | ) | | | | | |

Net change in unrealized appreciation (depreciation) on investments | | | | 2,104,318 | | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | 4,083,192 | | | | | (24,008 | ) | | | | | |

| | | | | | | | | | | | | | | |

Dividends and Distributions | | | | | | | | | | | | | | | |

Distributions from distributable earnings | | | | | | | | | | | | | | | |

Class I | | | | (553,579 | ) | | | | — | | | | | | |

Class D | | | | (136 | ) | | | | — | | | | | | |

Class S | | | | (63 | ) | | | | — | | | | | | |

Class T | | | | (63 | ) | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

| | | | (553,841 | ) | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

Tax return of capital distributions | | | | | | | | | | | | | | | |

Class I | | | | (276,049 | ) | | | | — | | | | | | |

Class D | | | | (68 | ) | | | | — | | | | | | |

Class S | | | | (31 | ) | | | | — | | | | | | |

Class T | | | | (31 | ) | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

| | | | (276,179 | ) | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

Fund share transactions | | | | | | | | | | | | | | | |

Net proceeds from shares sold | | | | 31,000,000 | | | | | 48,408,233 | | | | | | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | | 830,020 | | | | | — | | | | | | |

| | | | | | | | | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | | 31,830,020 | | | | | 48,408,233 | | | | | | |

| | | | | | | | | | | | | | | |

Total increase (decrease) | | | | 35,083,192 | | | | | 48,384,225 | | | | | | |

| | | |

Net Assets: | | | | | | | | | | | | | | | |

Beginning of period | | | | 49,984,225 | | | | | 1,600,000 | | | | | | |

| | | | | | | | | | | | | | | |

End of period | | | $ | 85,067,417 | | | | $ | 49,984,225 | | | | | | |

| | | | | | | | | | | | | | | |

| * | Commencement of operations. |

See Notes to Financial Statements.

PGIM Private Real Estate Fund, Inc. 17

Consolidated Statement of Cash Flows

For Year Ended December 31, 2023

| | | | |

Cash Flows Provided By / (Used For) Operating Activities: | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 4,083,192 | |

| | | | |

| |

Adjustments To Reconcile Net Increase (Decrease) In Net Assets Resulting From

Operations To Net Cash Provided By / (Used For) Operating Activities: | | | | |

Purchases of long-term portfolio investments | | | (32,830,000 | ) |

Net proceeds (purchases) of short-term portfolio investments | | | (2,170,118 | ) |

Net change in unrealized (appreciation) depreciation on investments* | | | (324,144 | ) |

(Increase) Decrease In Assets: | | | | |

Due from Manager | | | 93,419 | |

Prepaid expenses and other assets | | | 27,158 | |

Increase (Decrease) In Liabilities: | | | | |

Pre-acquisition closing cost payable | | | 125,000 | |

Audit fee payable | | | 25,000 | |

Professional fees payable | | | (43,887 | ) |

Custodian and accounting fee payable | | | 12,598 | |

Pricing fee payable | | | 12,500 | |

Accrued expenses and other liabilities | | | (5,811 | ) |

Affiliated transfer agent fee payable | | | 2,083 | |

Distribution fee payable | | | 3 | |

Income Tax Liability | | | (35,000 | ) |

Shareholder reports fee payable | | | (6,994 | ) |

| | | | |

Total adjustments | | | (35,118,193 | ) |

| | | | |

Net cash provided by (used for) operating activities | | | (31,035,001 | ) |

| | | | |

Cash Flows Provided By (Used For) Financing Activities: | | | | |

Proceeds from Fund shares sold | | | 31,000,000 | |

Net asset value of shares issued in reinvestment of dividends | | | 830,020 | |

Cash paid on distributions from distributable earnings | | | (830,020 | ) |

| | | | |

Net cash provided by (used for) financing activities | | | 31,000,000 | |

| | | | |

| |

Net increase (decrease) in cash and restricted cash | | | (35,001 | ) |

| | | | |

Cash and restricted cash at beginning of year | | | 35,001 | |

| | | | |

Cash And Restricted Cash At End Of Year | | $ | — | |

| | | | |

| | | | |

| * | Includes adjustments to cost basis including returns of capital and other capital adjustments related to the non-consolidated joint ventures and preferred equity. |

See Notes to Financial Statements.

18

Consolidated Financial Highlights

| | | | | | | | | | | | | | | |

| | | | |

Class I Shares | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

2023 | | November 03, 2022(a)

through December 31,

2022 | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $24.98 | | | | | $25.00 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.87 | | | | | (0.02 | ) | | | | | |

| Net realized and unrealized gain (loss) on investments | | | | 1.27 | | | | | - | | | | | | |

| Total from investment operations | | | | 2.14 | | | | | (0.02 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.17 | ) | | | | - | | | | | | |

| Tax return of capital distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.26 | ) | | | | - | | | | | | |

| Net asset value, end of period | | | | $26.86 | | | | | $24.98 | | | | | | |

| Total Return(c): | | | | 8.63 | % | | | | (0.08 | )% | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | | $84,987 | | | | | $49,909 | | | | | | |

| Average net assets (000) | | | | $60,469 | | | | | $39,948 | | | | | | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | 0.50 | % | | | | 0.50 | %(e) | | | | | |

| Expenses before waivers and/or expense reimbursement | | | | 3.82 | %(f) | | | | 3.77 | %(e)(g) | | | | | |

| Net investment income (loss) | | | | 3.27 | % | | | | (0.37 | )%(e) | | | | | |

| Portfolio turnover rate(h) | | | | 0 | % | | | | 0 | % | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return does not consider the effects of redemption fees, if any. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | Annualized, with the exception of certain non-recurring expenses. |

| (f) | Includes a non-recurring income tax benefit of 0.06% for the year ended December 31, 2023, which the Manager has recouped from the Fund. |

| (g) | Includes a non-recurring income tax expense of 0.09% for the period ended December 31, 2022, for which the Manager has reimbursed the Fund. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving property investments, short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

19

Consolidated Financial Highlights (continued)

| | | | | | | | | | | | | | | |

| | | | |

Class D Shares | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

2023 | | November 03, 2022(a)

through December 31,

2022 | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $24.97 | | | | | $25.00 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.77 | | | | | (0.03 | ) | | | | | |

| Net realized and unrealized gain (loss) on investments | | | | 1.30 | | | | | - | | | | | | |

| Total from investment operations | | | | 2.07 | | | | | (0.03 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.11 | ) | | | | - | | | | | | |

| Tax return of capital distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.20 | ) | | | | - | | | | | | |

| Net asset value, end of period | | | | $26.84 | | | | | $24.97 | | | | | | |

| Total Return(c): | | | | 8.35 | % | | | | (0.12 | )% | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | | $27 | | | | | $25 | | | | | | |

| Average net assets (000) | | | | $26 | | | | | $25 | | | | | | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | 0.75 | % | | | | 0.75 | %(e) | | | | | |

| Expenses before waivers and/or expense reimbursement | | | | 4.11 | %(f) | | | | 5.34 | %(e)(g) | | | | | |

| Net investment income (loss) | | | | 2.94 | % | | | | (0.74 | )%(e) | | | | | |

| Portfolio turnover rate(h) | | | | 0 | % | | | | 0 | % | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return does not consider the effects of redemption fees, if any. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | Annualized, with the exception of certain non-recurring expenses. |

| (f) | Includes a non-recurring income tax benefit of 0.06% for the year ended December 31, 2023, which the Manager has recouped from the Fund. |

| (g) | Includes a non-recurring income tax expense of 0.09% for the period ended December 31, 2022, for which the Manager has reimbursed the Fund. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving property investments, short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

20

| | | | | | | | | | | | | | | |

| | | | |

Class S Shares | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

2023 | | November 03, 2022(a)

through December 31,

2022 | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $24.95 | | | | | $25.00 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.61 | | | | | (0.05 | ) | | | | | |

| Net realized and unrealized gain (loss) on investments | | | | 1.30 | | | | | - | | | | | | |

| Total from investment operations | | | | 1.91 | | | | | (0.05 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | - | | | | | - | | | | | | |

| Tax return of capital distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Net asset value, end of period | | | | $26.77 | | | | | $24.95 | | | | | | |

| Total Return(c): | | | | 7.71 | % | | | | (0.20 | )% | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | | $27 | | | | | $25 | | | | | | |

| Average net assets (000) | | | | $26 | | | | | $25 | | | | | | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | 1.35 | % | | | | 1.35 | %(e) | | | | | |

| Expenses before waivers and/or expense reimbursement | | | | 4.71 | %(f) | | | | 5.95 | %(e)(g) | | | | | |

| Net investment income (loss) | | | | 2.34 | % | | | | (1.34 | )%(e) | | | | | |

| Portfolio turnover rate(h) | | | | 0 | % | | | | 0 | % | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return does not consider the effects of redemption fees, if any. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | Annualized, with the exception of certain non-recurring expenses. |

| (f) | Includes a non-recurring income tax benefit of 0.06% for the year ended December 31, 2023, which the Manager has recouped from the Fund. |

| (g) | Includes a non-recurring income tax expense of 0.09% for the period ended December 31, 2022, for which the Manager has reimbursed the Fund. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving property investments, short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

21

Consolidated Financial Highlights (continued)

| | | | | | | | | | | | | | | |

| | | | |

Class T Shares | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

2023 | | November 03, 2022(a)

through December 31,

2022 | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $24.95 | | | | | $25.00 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.61 | | | | | (0.05 | ) | | | | | |

| Net realized and unrealized gain (loss) on investments | | | | 1.30 | | | | | - | | | | | | |

| Total from investment operations | | | | 1.91 | | | | | (0.05 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | - | | | | | - | | | | | | |

| Tax return of capital distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.09 | ) | | | | - | | | | | | |

| Net asset value, end of period | | | | $26.77 | | | | | $24.95 | | | | | | |

| Total Return(c): | | | | 7.71 | % | | | | (0.20 | )% | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | | $27 | | | | | $25 | | | | | | |

| Average net assets (000) | | | | $26 | | | | | $25 | | | | | | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | 1.35 | % | | | | 1.35 | %(e) | | | | | |

| Expenses before waivers and/or expense reimbursement | | | | 4.71 | %(f) | | | | 5.95 | %(e)(g) | | | | | |

| Net investment income (loss) | | | | 2.34 | % | | | | (1.34 | )%(e) | | | | | |

| Portfolio turnover rate(h) | | | | 0 | % | | | | 0 | % | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return does not consider the effects of redemption fees, if any. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | Annualized, with the exception of certain non-recurring expenses. |

| (f) | Includes a non-recurring income tax benefit of 0.06% for the year ended December 31, 2023, which the Manager has recouped from the Fund. |

| (g) | Includes a non-recurring income tax expense of 0.09% for the period ended December 31, 2022, for which the Manager has reimbursed the Fund. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving property investments, short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

22

Notes to Consolidated Financial Statements

PGIM Private Real Estate Fund, Inc. (the “Fund”) is a recently organized, non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Fund is organized as a Maryland Corporation and intends to elect to be taxed as a real estate investment trust (a “REIT”) for U.S. federal income tax purposes beginning with the Fund’s taxable year ended December 31, 2023 with the filing of its 2023 federal income tax return. The filing is expected to occur in October of 2024. The Fund invests primarily in private real estate in the United States. The Fund owns and plans to continue to own all or substantially all of its property investments through its wholly-owned operating partnership. The Fund’s property investments in each primary strategy are expected to be structured through privately-owned operating entities or private real estate operating companies which own and operate whole or partial interests in real properties. The Fund directly or through its subsidiaries may also enter into joint ventures with third parties to make investments. The Fund or its subsidiaries may also make investments in partnerships or other co-ownership arrangements or participations arrangements with other investors, including affiliates, to acquire properties.

The financial statements of the Fund are consolidated with its wholly-owned operating partnership and all intercompany transactions have been eliminated in consolidation. For the period ended December 31, 2023, the Fund’s investments were non-consolidated joint ventures, where the Fund does not maintain primary control. For the taxable year ended December 31, 2022 the Fund was taxed as a C corporation for federal, state, and local income taxes. The Fund intends to elect and qualify to be taxed as a REIT beginning with the Fund’s taxable year ended December 31, 2023.

The investment objectives of the Fund are to provide current income and long-term capital appreciation.

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of its consolidated financial statements.

Private Real Estate Valuation: Investments in newly acquired properties may initially be valued at cost. Generally, each property will then be valued by an independent third-party

PGIM Private Real Estate Fund, Inc. 23

Notes to Consolidated Financial Statements

(continued)

appraisal firm. Upon conclusion of the appraisal, limited scope valuations are also performed monthly.

Investments in non-consolidated joint ventures are stated at fair value (which could be the cost of the investment as discussed above). The Fund’s ownership interests are valued based on the Fund’s ownership interest in the underlying entities and the fair value of the underlying real estate. Any other factors such as ownership percentage, ownership rights, buy/sell agreements, distribution provisions, and capital call obligations are also considered. Upon the disposition of all investments in joint ventures by an investee entity, the Fund will continue to state its equity in the remaining net assets of the investee entity during the wind down period, if any, that occurs prior to the dissolution of the investee entity.

Such fair values are typically determined by utilizing the income approach and discounted cash flow methodology. The income approach is the primary approach used to estimate an income stream for a property and discount this income into a present value at a risk adjusted rate. Yield rates and growth assumptions utilized in this approach are derived from market transactions as well as other financial and industry data. The discount rate and terminal capitalization rate are significant inputs to these valuations. Many factors are also considered in the determination of fair value including, but not limited to, the operating cash flows and financial performance of the properties, property types and geographic locations, the physical condition of the asset, prevailing market capitalization rates, prevailing market discount rates, general economic conditions, and any specific rights or terms associated with the investment.

Securities and Other Assets Valuation: The Fund holds securities and other assets and liabilities that are fair valued as of the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. As described in further detail below, the Fund’s investments are valued daily based on a number of factors, such as the type of investment. The Fund’s Board of Directors (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated PGIM Investments LLC (“PGIM Investments” or the “Manager”) as the “Valuation Designee,” as defined by Rule 2a-5(b) under the 1940 Act, to perform the fair value determination. Pursuant to the Board’s delegation, the Valuation Designee has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent valuation agent services. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of

24

Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurement. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy. Altering one or more unobservable inputs may result in a significant change to a Level 3 security’s fair value measurement. The Fund’s real property investments’ fair valuations are classified as Level 3 in the fair value hierarchy.

Investments in open-end funds (other than ETFs) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Investment Transactions and Net Investment Income: Investment transactions are recorded on any of the following: the trade date, the date the Fund obtains a right to the investment, the date the Fund is eligible to collect proceeds from the sale, or the date the Fund incurs an obligation to the price of the investment purchased. Rental income, including tenant reimbursements and recovery charges, earned from real estate investments is recognized on an accrual basis in accordance with the terms of the underlying lease agreement. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event. Operating expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual. Net investment income or loss (other than class specific expenses and waivers, which are allocated as noted below) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day. Class specific expenses and waivers, where applicable, are charged to the respective share classes. Such class specific expenses and waivers may include distribution fees, shareholder servicing fees, transfer agent’s fees and expenses, and fee waivers and/or expense reimbursements, as applicable.

Offering and Organizational Costs: The Manager has agreed to pay all of the Fund’s organizational expenses and offering costs associated with this offering. Additionally, for the Fund’s first year of operations, the Manager paid director expenses on behalf of the Fund of $103,000. The Fund is not obligated to repay any such organizational expenses or offering costs paid by the Manager.

Taxes: For the taxable year ended December 31, 2022 the Fund was taxed as a C corporation for federal, state, and local income taxes. The Fund has entered into an agreement with the Manager under which the Manager has agreed to pay or reimburse the Fund for its U.S. federal, state, and local income taxes incurred as a result of the Fund’s C Corporation status. For the reporting period ended December 31, 2022, the estimated tax liability was $35,000 which the Manager had reimbursed the Fund. Subsequent to the December 31, 2022 fiscal year end, upon finalizing the Fund’s actual tax provision, the Manager determined there was no corporate tax liability for the year ended December 31,

PGIM Private Real Estate Fund, Inc. 25

Notes to Consolidated Financial Statements

(continued)

2022. Accordingly, the estimated tax liability of $35,000 for the year ended 2022 was adjusted during the six months ended June 30, 2023 and reflected as a tax benefit in the Fund’s Consolidated Statement of Operations. As of December 31, 2023, such amount that was previously reimbursed by the Manager has been refunded to the Manager. There was no economic impact to shareholders as a result of tax provisions in both fiscal periods. The Fund intends to elect and qualify to be taxed as a REIT beginning with the Fund’s taxable year ended December 31, 2023 with the filing of the its 2023 federal income tax return. The filing is expected to occur in October 2024. If the Fund qualifies as a REIT, the Fund generally will be permitted to deduct dividends paid to shareholders and, as a result, generally not be subject to US federal income tax on that portion of the Fund’s ordinary income and net capital gain that the Fund annually distributes to it’s shareholders, as long as the Fund meets certain minimum distribution requirements.

Dividends and Distributions: The Fund intends to make distributions to shareholders on a regular basis as necessary to avoid material US federal income tax, and to comply with the REIT distributions requirements. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from GAAP, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified between total distributable earnings (loss) and paid-in capital in excess of par, as appropriate. The chart below sets forth the expected frequency of dividend and capital gains distributions to shareholders. Various factors may impact the frequency of dividend distributions to shareholders, including but not limited to adverse market conditions or portfolio holding-specific events. In conjunction with its election and qualification as a REIT, the Fund makes distributions on a regular basis as necessary to avoid material US federal income tax.

| | | | |

| | |

| Expected Distribution Schedule to Shareholders* | | Frequency |

Net Investment Income | | | Monthly | |

Short-Term Capital Gains | | | Annually | |

Long-Term Capital Gains | | | Annually | |

| * | Under certain circumstances, the Fund may make more than one distribution of short-term and/or long-term capital gains during a fiscal year. |

Estimates: The preparation of consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the consolidated financial statements. Actual results could differ from those estimates.

The Fund has a management agreement with the Manager pursuant to which the Manager has responsibility for all investment advisory services, including supervision of the subadviser’s performance of such services, and for rendering administrative services.

26

The Manager has entered into a subadvisory agreement with PGIM, Inc. (the “Subadviser” or “PGIM”) primarily through PGIM Real Estate, the real estate investment advisory business unit within PGIM. The Manager pays for the services of the Subadviser.

Fees payable under the management agreement are computed daily and paid monthly. For the reporting period ended December 31, 2023, the contractual and effective management fee rates were as follows:

| | |

| | |

| Contractual Management Rate | | Effective Management Fee, before any waivers

and/or expense reimbursements |

1.00% of average daily net assets | | 1.00% |

The Manager has contractually agreed to waive its management fee until June 30, 2025.

Pursuant to the management agreement, an incentive fee is calculated and payable quarterly in arrears in an amount equal to 10.00% of the Fund’s Portfolio Operating Income for the immediately preceding quarter. No incentive fee on Portfolio Operating Income will be payable in any calendar quarter in which the Fund did not achieve a 5% total return over the trailing 12-month period. The Manager has contractually agreed to waive its incentive fee until June 30, 2025. Accordingly, no incentive fee was accrued or payable during the year ended December 31, 2023.

“Portfolio Operating Income” means (1) the Fund’s share of Net Operating Income from the Fund’s real estate equity investments; plus (2) the Funds net investment income (or loss) (i.e., net of fund level expenses) from debt, preferred equity investments and traded real estate-related securities; minus (3) the Fund’s expenses (excluding the Incentive Fee and distribution and servicing fees).

“Net Operating Income” means operating revenue net of operating expenses (inclusive of interest on investment level debt) for the Fund’s operating entities that invest in real estate and excludes (i) gains or losses from sales of depreciable real property, (ii) impairment write-downs on depreciable real property, (iii) real estate-related depreciation and amortization for each real estate operating venture and (iv) adjustments for recognizing straight line rent.

“Total Return” for any 12-month period shall equal the sum of: (i) all distributions accrued or paid (without duplication) on the Fund’s Common Stock (as defined below) since the beginning of the applicable 12-month period plus (ii) the change in aggregate NAV of such Common Stock since the beginning of the year, before giving effect to (x) changes resulting solely from the proceeds of issuances of Common Stock, (y) any allocation/accrual to the performance participation interest and (z) applicable distribution and servicing fee expenses.

The Manager has agreed to waive its fees and/or reimburse expenses of the Fund so that the Fund’s Specified Expenses will not exceed 0.50% of net assets (annualized) through August 15, 2025. The Fund has agreed to repay these amounts, when and if requested by

PGIM Private Real Estate Fund, Inc. 27

Notes to Consolidated Financial Statements (continued)

the Manager, but only if and to the extent that Specified Expenses are less than 0.50% of net assets (annualized) (or, if a lower expense limit is then in effect, such lower limit) within three years. As of December 31, 2023, under the Expense Limitation and Reimbursement Agreement, the amount eligible for potential recoupment is $242,158, expiring in 2025, and $1,437,007, expiring in 2026, for a total of $1,679,165.

“Specified Expenses” includes all expenses incurred in the business of the Fund, including organizational and offering costs (other than Initial Organization and Offering Costs), with the following exceptions: (i) the Management Fee, (ii) the Incentive Fee, (iii) the Servicing Fee, (iv) the Distribution Fee, (v) property level expenses, (vi) brokerage costs or other investment-related out-of-pocket expenses, including with respect to unconsummated investments, (vii) dividend/interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Fund), (viii) taxes, and (ix) extraordinary expenses (as determined in the sole discretion of the Manager).

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class I, Class D, Class S, and Class T shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class S, Class T, and Class D shares pursuant to the plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by PIMS.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution and servicing related activities at an annual rate based on average daily net assets per class. The distribution and servicing fees are accrued daily and payable monthly.

The Fund’s annual gross and net distribution and servicing rates, where applicable, are as follows:

| | | | | | | | | | |

| | | |

| Class | | Gross Distribution and Servicing Fee | | Net Distribution and Servicing Fee |

I | | | | N/A | % | | | | N/A | % |

D | | | | 0.25 | | | | | 0.25 | |

S | | | | 0.85 | | | | | 0.85 | |

T | | | | 0.85 | | | | | 0.85 | |

For the year ended December 31, 2023, PIMS had not sold any shares of the Fund, and accordingly did not receive any front-end sales charges (“FESL”) or early redemption fees resulting from sales of certain class shares.

PGIM Investments, PGIM Inc., and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

28

| 4. | Other Transactions with Affiliates |

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Consolidated Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund may invest its overnight sweep cash in the PGIM Core Government Money Market Fund (the “Core Government Fund”), a series of the Prudential Government Money Market Fund, Inc., registered under the 1940 Act and managed by PGIM Investments. PGIM Investments and/or its affiliates are paid fees or reimbursed for providing their services to the Core Government Fund. In addition to the realized and unrealized gains on investments in the Core Government Fund, earnings from such investments are disclosed on the Consolidated Statement of Operations as “Affiliated dividend income”. Effective December 2023, the Fund changed its overnight cash sweep vehicle from the PGIM Core Ultra Short Bond Fund (the “Core Fund”), a fund of Prudential Investment Portfolios 2, to Core Government Fund.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act that, subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors/trustees, and/or common officers. For the year ended December 31, 2023, no Rule 17a-7 transactions were entered into by the Fund.

The aggregate cost of purchases and proceeds from sales of portfolio securities (excluding short-term investments and U.S. Government securities) for the reporting period ended December 31, 2023, were as follows:

| | | | |

| | | |

| Cost of Purchases | | Proceeds from Sales | | |

| | |

$32,830,000 | | $— | | |

A summary of the cost of purchases and proceeds from sales of shares of affiliated mutual funds for the year ended December 31, 2023, is presented as follows:

| | | | | | | | | | | | | | |

Value,

Beginning of Year | | Cost of

Purchases | | Proceeds

from Sales | | Change in

Unrealized

Gain (Loss) | | Realized Gain (Loss) | | Value, End of Year | | Shares, End of Year | | Income |

| | | |

Short-Term Investments - Affiliated Mutual Funds: | | | | | | |

| | | | | |

PGIM Core Government Money Market Fund(1)(wb) | | | | | | | | | | |

$ — | | $ 3,418,815 | | $ 166,634 | | $— | | $— | | $3,252,181 | | 3,252,181 | | $ 11,695 |

PGIM Private Real Estate Fund, Inc. 29

Notes to Consolidated Financial Statements (continued)

| | | | | | | | | | | | | | |

Value,

Beginning of Year | | Cost of

Purchases | | Proceeds

from Sales | | Change in

Unrealized

Gain (Loss) | | Realized Gain (Loss) | | Value, End of Year | | Shares, End of Year | | Income |

| | | |

PGIM Core Ultra Short Bond Fund(1)(wb) | | | | | | |

$1,082,063 | | $37,029,538 | | $38,111,601 | | $— | | $— | | $ — | | — | | $121,563 |

$1,082,063 | | $40,448,353 | | $38,278,235 | | $— | | $— | | $3,252,181 | | | | $133,258 |

| (1) | The Fund did not have any capital gain distributions during the reporting period. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

| 6. | Distributions and Tax Information |

The timing and characterization of certain income, capital gains, and return of capital distributions are determined annually in accordance with federal tax regulations, which may differ from GAAP. As a result, the net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital, accumulated net investment income (loss) or accumulated net realized gain (loss), as appropriate, in the period in which the differences arise.

GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the current period, the Fund did not have any reclassifications.

For the year ended December 31, 2023, the tax character of dividends paid as reflected in the Statement of Changes in Net Assets were as follows:

| | | | | | |

Ordinary

Income | | Long-Term

Capital Gains | | Tax Return

of Capital | | Total Dividends

and Distributions |

| $553,841 | | $— | | $276,179 | | $830,020 |

The following shows the components of distributable earnings (losses) on a federal income tax basis at December 31, 2023.

| | | | | | | | | | |

| | | Accumulated net operating income | | $ | — | | | | | |

| | | |

| | Net unrealized appreciation (depreciation) | | | 2,104,318 | | | | | |

| | | |

| | Other book/tax temporary differences | | | 1,401,025 | | | | | |

| | | | | | | | | | |

| | Total Distributable Earnings | | | 3,505,343 | | | | | |

30

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of December 31, 2023 were as follows:

| | | | | | |

| | | | |

| Tax Basis | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net

Unrealized

Appreciation |

| $83,984,381 | | $2,775,817 | | $(1,403,617) | | $1,372,200 |

The differences between GAAP and tax basis were primarily attributable to differences between financial and tax reporting treatment of real estate investments.

Taxable income amounts disclosed above are estimates based on the best available information as of the date of this report.

The Fund offers Class I, Class D, Class S, and Class T shares. Class T shares are sold with a maximum front-end sales charge of 3.50%. Class I Shares, Class D Shares, and Class S Shares are not subject to a sales load. Shares redeemed prior to 12 months from the date of issue are subject to a 2% early redemption fee. The redemption fee is accounted for as an addition to paid-in capital.

The Fund is authorized to issue 1,000,000,000 shares of capital stock, $0.001 par value per share. The shares are further classified and designated as follows:

| | |

| | |

| Class | | Number of Shares |

I | | 550,000,000 |

D | | 100,000,000 |

S | | 100,000,000 |

T | | 250,000,000 |

As of December 31, 2023, Prudential, through its affiliated entities, including affiliated funds (if applicable), owned all of the outstanding shares of the Fund as follows:

| | | | | | | | | | |

| | | |

| Class | | Number of Shares | | Percentage of Outstanding Shares |

I | | | | 3,164,173 | | | | | 100.0 | % |

D | | | | 1,008 | | | | | 100.0 | |

S | | | | 1,003 | | | | | 100.0 | |

T | | | | 1,003 | | | | | 100.0 | |

At the reporting period end, the number of shareholders holding greater than 5% of the Fund are as follows:

| | | | | | | | | | |

| | | |

| | | Number of Shareholders | | Percentage of Outstanding Shares |

Affiliated | | | | 1 | | | | | 100.0 | % |

Unaffiliated | | | | — | | | | | — | |

PGIM Private Real Estate Fund, Inc. 31

Notes to Consolidated Financial Statements (continued)

Transactions in shares of common stock were as follows:

| | | | | | | | |

| | | |

| Share Class | | Shares | | | Amount | |

| | |

Class I | | | | | | | | |

| | |

Year ended December 31, 2023: | | | | | | | | |

| | |

Shares sold | | | 1,135,115 | | | $ | 31,000,000 | |

| | |

Shares issued in reinvestment of dividends and distributions | | | 30,899 | | | | 829,628 | |

| | |

Net increase (decrease) in shares outstanding | | | 1,166,014 | | | $ | 31,829,628 | |

| | |

Period ended December 31, 2022*: | | | | | | | | |

| | |

Shares sold | | | 1,998,159 | ** | | $ | 48,333,233 | |

| | |

Net increase (decrease) in shares outstanding | | | 1,998,159 | | | $ | 48,333,233 | |

| | |

Class D | | | | | | | | |

| | |

Year ended December 31, 2023: | | | | | | | | |

| | |

Shares issued in reinvestment of dividends and distributions | | | 8 | | | $ | 204 | |

Net increase (decrease) in shares outstanding | | | 8 | | | $ | 204 | |

| | |

Period ended December 31, 2022*: | | | | | | | | |

| | |

Shares sold | | | 1,000 | ** | | $ | 25,000 | |

Net increase (decrease) in shares outstanding | | | 1,000 | | | $ | 25,000 | |

| | |

Class S | | | | | | | | |

| | |

Year ended December 31, 2023: | | | | | | | | |

| | |

Shares issued in reinvestment of dividends and distributions | | | 3 | | | $ | 94 | |

Net increase (decrease) in shares outstanding | | | 3 | | | $ | 94 | |

| | |

Period ended December 31, 2022*: | | | | | | | | |

| | |

Shares sold | | | 1,000 | ** | | $ | 25,000 | |

Net increase (decrease) in shares outstanding | | | 1,000 | | | $ | 25,000 | |

| | |

Class T | | | | | | | | |

| | |

Year ended December 31, 2023: | | | | | | | | |

| | |

Shares issued in reinvestment of dividends and distributions | | | 3 | | | $ | 94 | |

Net increase (decrease) in shares outstanding | | | 3 | | | $ | 94 | |

| | |

Period ended December 31, 2022*: | | | | | | | | |

| | |

Shares sold | | | 1,000 | ** | | $ | 25,000 | |

Net increase (decrease) in shares outstanding | | | 1,000 | | | $ | 25,000 | |

| * | Commencement of operations was November 03, 2022. |

| ** | Includes seed capital. |

32

The Fund intends, but is not obligated, to conduct quarterly tender offers (also referred to as “repurchases”) for up to 5.0% of the aggregate NAV of its outstanding Common Stock at the applicable NAV per share as of the applicable valuation date, in the sole discretion of the Board. In the event a tender offer is oversubscribed, the Fund may accept for purchase additional outstanding shares of Common Stock representing up to 2.0% of the aggregate NAV of its outstanding Common Stock, without amending or extending the tender offer. There were no repurchases for the year ended December 31, 2023.

A 2.0% early redemption fee payable to the Fund will be charged with respect to the repurchase of a stockholder’s Common Stock at any time prior to the day immediately preceding the one-year anniversary of a stockholder’s purchase of the Common Stock (on a “first in-first out” basis).

| 9. | Investments in Non-consolidated Joint Ventures |

In accordance with requirements under Regulation S-X Rules 3-09 and 4-08(g), the Fund considers its non-consolidated joint venture subsidiaries to be significant subsidiaries under the rules. Below is a summary of financial information and fair values of such non-consolidated joint ventures as of December 31, 2023.

| | | | | | | | | | | | | | | |

| | | 3730

S. Main St. | | Monarch Town

Center | | Total |

| | | |

| Balance Sheet: | | | | | | |

Assets: | | | | | | | | | | | | | | | |

| | | |