dollars, substantially all of our direct and indirect operating expenses are denominated in and incurred in local currency. Capital expenditures may be linked to U.S. dollars in some instances, but are also incurred in local currency, providing further resilience to macroeconomic volatility.

We have a track record of both organic and inorganic growth.

We have a number of organic growth opportunities. There are a number of avenues that have driven our historical organic growth and that we believe will continue to drive future organic growth, including Colocation, Lease Amendments and New Sites. These opportunities are typically the result of our customers looking to densify their networks, improve their network coverage and capacity and upgrade their networks with new technologies, in response to growing populations and data demand from end users in our markets. Our MLAs also typically include annual inflation-linked escalations, ensuring contractual increases to revenue.

In response to these growing needs, we benefit from customers choosing Colocation in order to get to market quickly on an existing site of ours. Colocations are a highly attractive opportunity as they enable us to lease-up our existing assets with minimal incremental capital expenditure and operating expenses required. As of December 31, 2022, 2021 and 2020, we achieved a Colocation Rate of 1.48x, 1.50x and 1.54x, respectively. When we acquire towers from mobile operators, these typically have a low Colocation Rate that reduces our overall Colocation Rate, but at the same time these towers result in a further Colocation opportunity for our other customers.

Lease Amendments represent an opportunity for existing Tenants to enhance their existing position or upgrade technology at a Tower by installing additional equipment on that Tower or requesting certain ancillary services. For the years ended December 31, 2022, 2021 and 2020, we added 4,550, 9,141 and 4,379 Lease Amendments, respectively. Colocation and Lease Amendments both support our growth by increasing our operating leverage.

We typically construct New Sites after obtaining a commitment for a long-term lease with an initial tenant and, in general, if we are aware of, or believe there is, commercial potential for Colocation. Since our inception, we have built over 8,750 New Sites. For the years ended December 31, 2022, 2021 and 2020, we built 1,184, 1,348 and 362 New Sites, respectively.

We also benefit from the opportunity to generate revenue from adjacent services, including fiber, DAS, small cells and data centers. In terms of fiber services, through I-Systems, we provide FTTH connectivity to our customers through a neutral network infrastructure solution for broadband service, and in Nigeria we provide FTTT connectivity to our customers. These opportunities do not constitute a material contribution to our revenue today, although we look to continue to expand these opportunities as an area of growth in the future, particularly in Brazil, Nigeria, South Africa, and Kuwait, where 5G roll-out has already commenced.

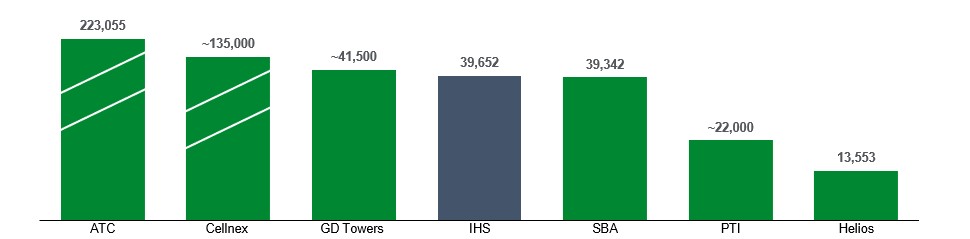

We have a track record of inorganic growth through acquiring, consolidating and integrating tower portfolios. Since our inception, we have completed 22 transactions for more than 32,500 Towers and fiber assets across ten countries. These transactions have enabled us to achieve our strong in-market positioning, which is key to both our ability to provide high quality services and to ensure the sustainability of the fundamentals of our business. Our recently completed acquisitions demonstrate our desire to expand into structurally favorable emerging and less developed markets around the world.

Our inorganic growth strategy focuses on entering carefully selected growth oriented markets with compelling underlying fundamentals. A key component of this inorganic growth lies in our strategy to then develop each of the markets that we enter. We aim to execute follow-on, in-market transactions upon entering a new market, in order to solidify our presence as well as extract cost synergies from our operational platform across our large asset base. In addition to building our market presence, this strategy has allowed us to better service our customers through our extensive platform.

We have an established history of delivering high quality service to our customers.

We have long-term relationships with leading MNOs. Our sites are, for most of our customers, the primary tower infrastructure that supports their operations, making us a key long-term partner of our customers. Through these partnerships, we have developed deep ties with our customers’ key decision makers.

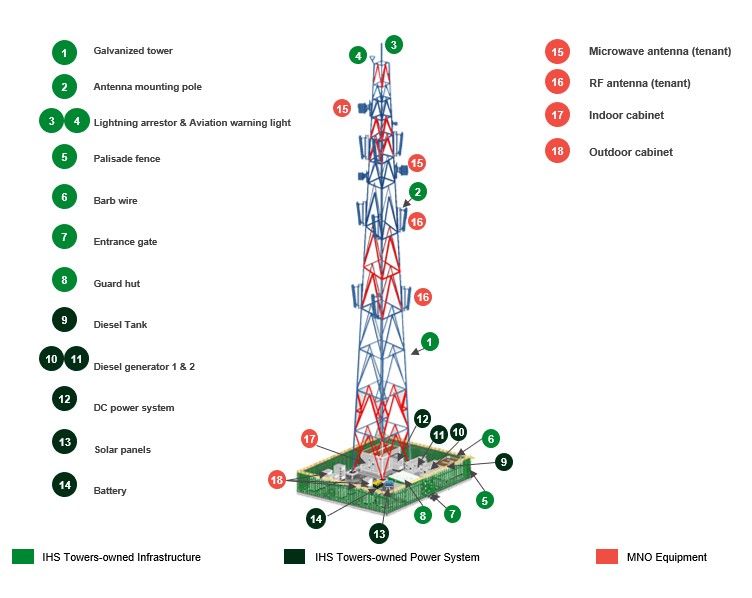

We have a long track record of delivering quality service to MNOs through deeply integrated relationships. Our customers entrust us with this critical infrastructure in part due to our proven record. For example, in our African businesses (excluding South Africa), we had average power uptimes of 99.9% and average time to repair below two hours for the year ended December 31, 2022. In our African businesses, our innovative power availability solutions are a critical component of our