Corporate Overview February 2024 Exhibit 99.2

Forward-looking statements and Non-GAAP measures Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements concerning ZimVie’s expectations, plans, prospects and product and service offerings, including expected benefits, opportunities and other prospects if the spine business is divested. Such statements are based upon the current beliefs, expectations, and assumptions of management and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: uncertainties as to the timing of the sale of the spine business and the risk that the transaction may not be completed in a timely manner or at all; the possibility that any or all of the conditions to the consummation of the sale of the spine business may not be satisfied or waived; the effect of the announcement or pendency of the transaction on ZimVie’s ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; and risks related to diverting management’s attention from ZimVie’s ongoing business operations and uncertainties and matters beyond the control of management. For a list and description of other such risks, uncertainties, and changes in circumstances, see ZimVie’s periodic reports filed with the U.S. Securities and Exchange Commission (the “SEC”). These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in ZimVie’s filings with the SEC. Forward-looking statements speak only as of the date they are made, and ZimVie disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. You are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary note is applicable to all forward-looking statements contained in this presentation. Forward-Looking Non-GAAP Financial Measures This presentation also includes certain forward-looking non-GAAP financial measures including adjusted EBITDA margin, net debt, and free cash flow conversion for the period ending one year after the proposed closing of the sale of our spine business, and over the long-term following the proposed closing of the sale of our spine business. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the GAAP measures cannot be reliably estimated and the reconciliations cannot be performed without unreasonable effort due to their dependence on future uncertainties, such as the timing of certain transactions, including the proposed sale of our spine business, and adjusting items that the Company cannot reasonably predict at this time but which may have a material impact on our future GAAP results.

ZimVie: A global dental leader Powerful, market-leading portfolio of premium implants, biomaterials, and digital dentistry with exposure to MSD/HSD growth end-markets Well positioned to accelerate growth within large, attractive, and underserved markets through differentiated technologies Opportunity to improve operating leverage through leaner cost structure and optimized product manufacturing Opportunity to improve cash flow conversion rates through a disciplined financial framework Continue to build customer intimacy and expand portfolio adoption through our global direct sales force & specialty partners

Addressing a significant, unmet need for tooth replacement 8 Million An estimated 8 million US patients seek treatment for tooth loss annually 25% Only 25% receive tooth replacement Leading player in the following attractive dental segments 2021 Market Opportunity 2021-2026E(1) CAGR Dental implants Biomaterials Digital solutions $5B $2B $1B Mid Single Digit Mid Single Digit High Single Digit (1) Estimates are not precise and based on company estimates.

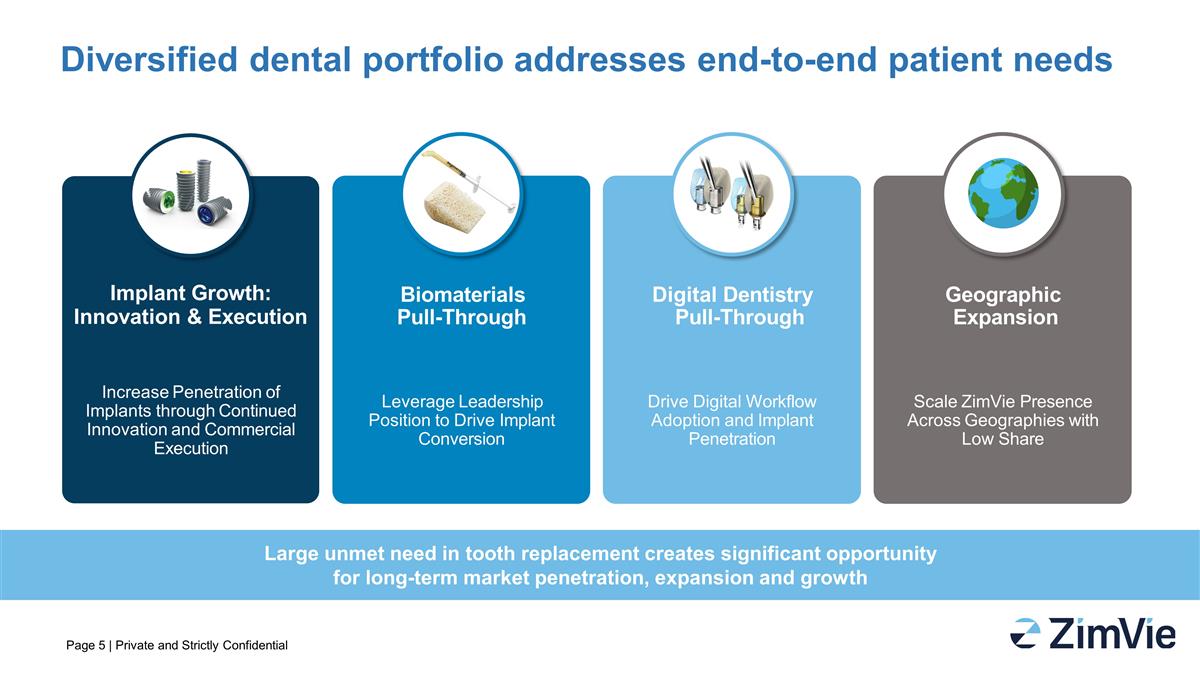

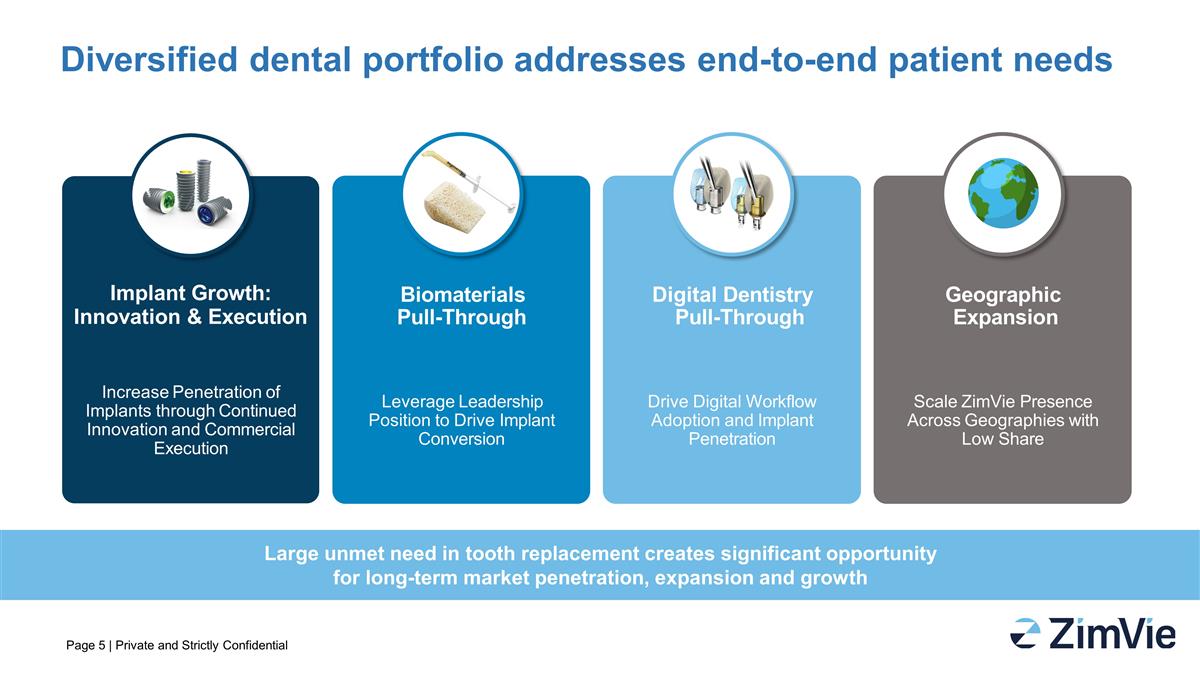

Diversified dental portfolio addresses end-to-end patient needs Increase Penetration of Implants through Continued Innovation and Commercial Execution Implant Growth: Innovation & Execution Leverage Leadership Position to Drive Implant Conversion Biomaterials Pull-Through Scale ZimVie Presence Across Geographies with Low Share Geographic Expansion Drive Digital Workflow Adoption and Implant Penetration Digital Dentistry Pull-Through Large unmet need in tooth replacement creates significant opportunity for long-term market penetration, expansion and growth

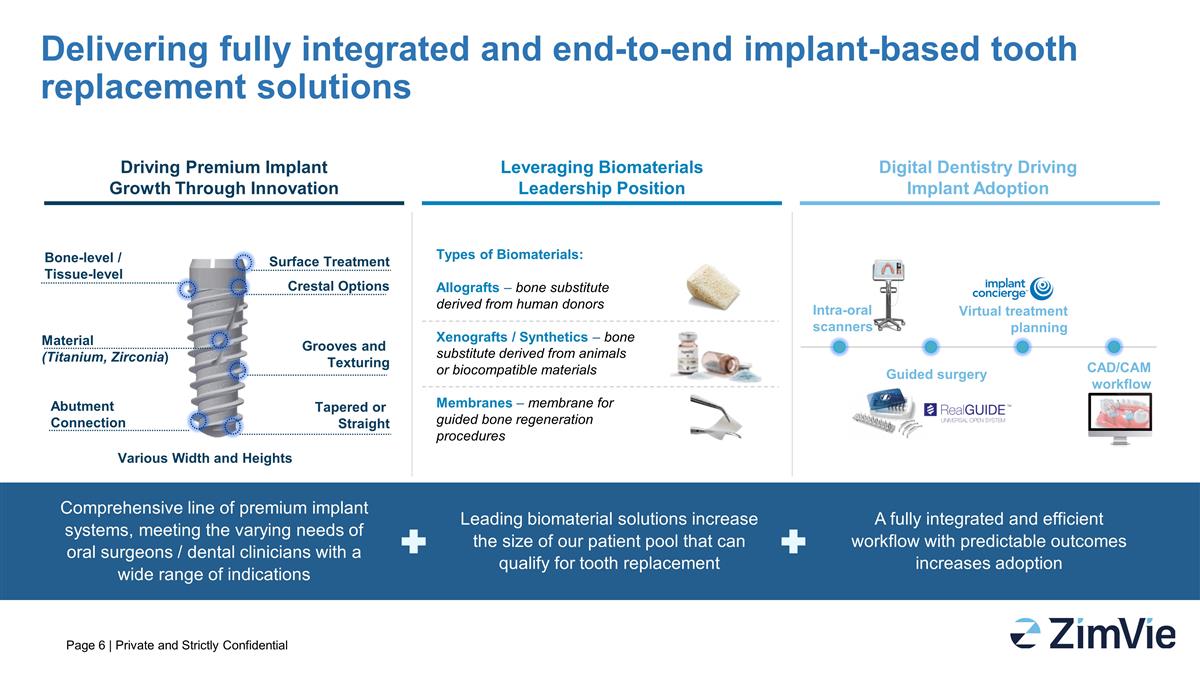

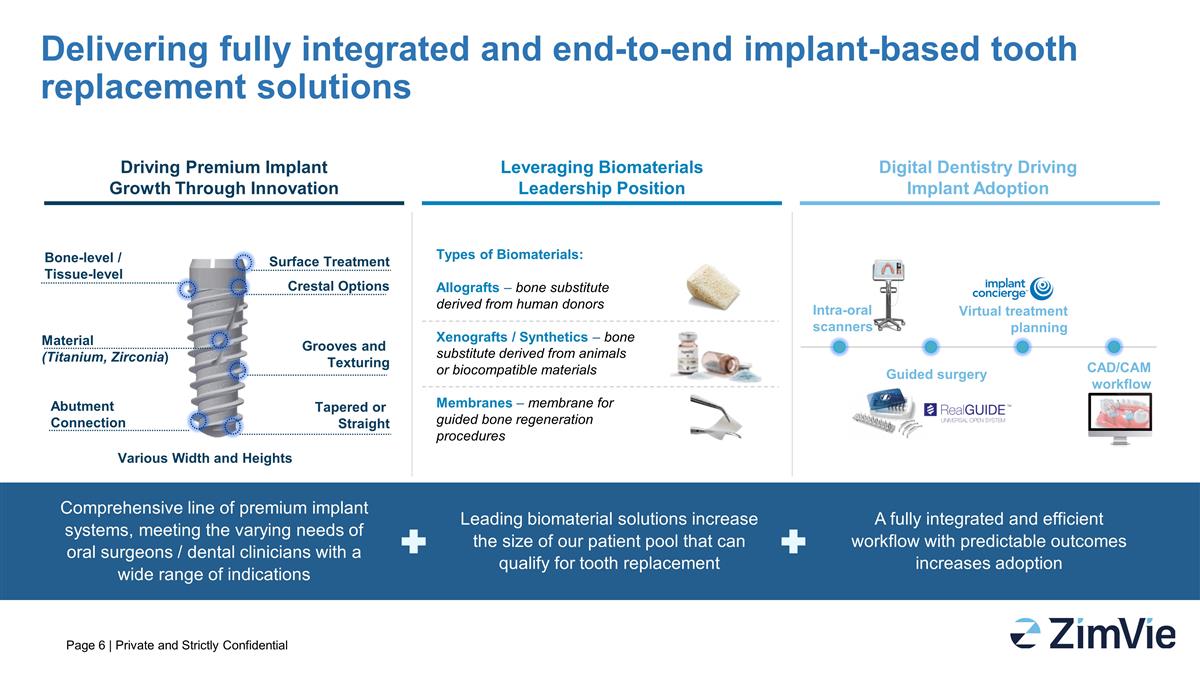

Delivering fully integrated and end-to-end implant-based tooth replacement solutions Driving Premium Implant Growth Through Innovation Leveraging Biomaterials Leadership Position Digital Dentistry Driving Implant Adoption Comprehensive line of premium implant systems, meeting the varying needs of oral surgeons / dental clinicians with a wide range of indications Leading biomaterial solutions increase the size of our patient pool that can qualify for tooth replacement A fully integrated and efficient workflow with predictable outcomes increases adoption Surface Treatment Bone-level / Tissue-level Tapered or Straight Material (Titanium, Zirconia) Abutment Connection Various Width and Heights Types of Biomaterials: Allografts – bone substitute derived from human donors Xenografts / Synthetics – bone substitute derived from animals or biocompatible materials Membranes – membrane for guided bone regeneration procedures Virtual treatment planning CAD/CAM workflow systems Guided surgery Intra-oral scanners Grooves and Texturing Crestal Options

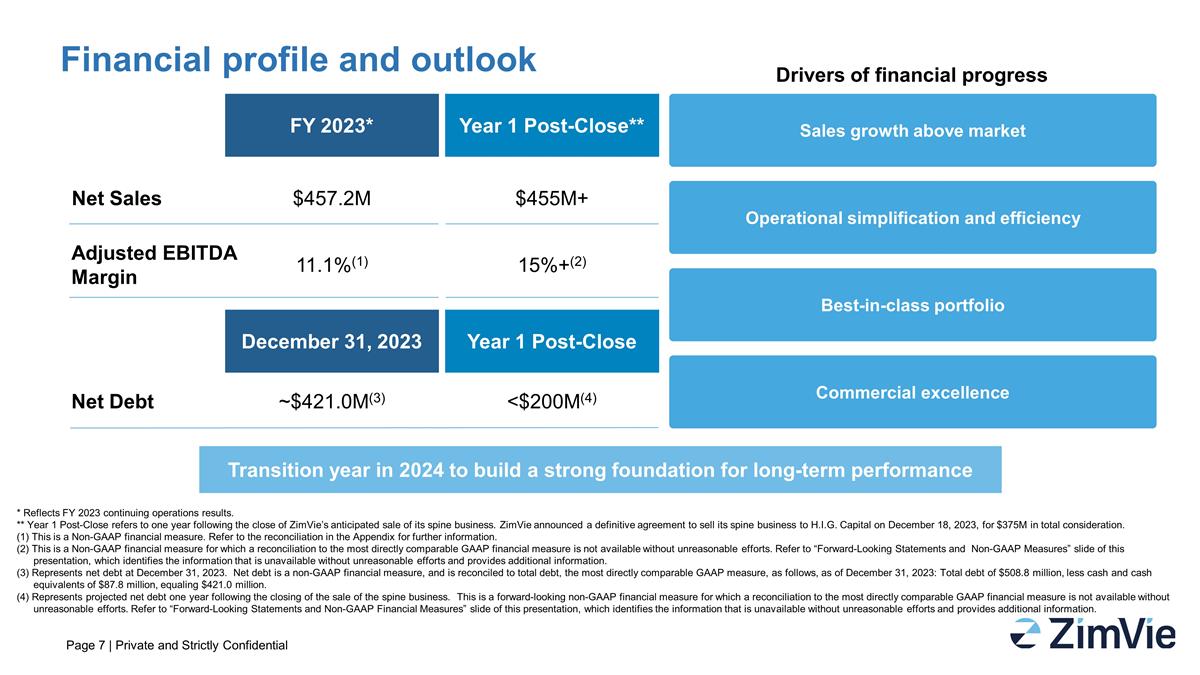

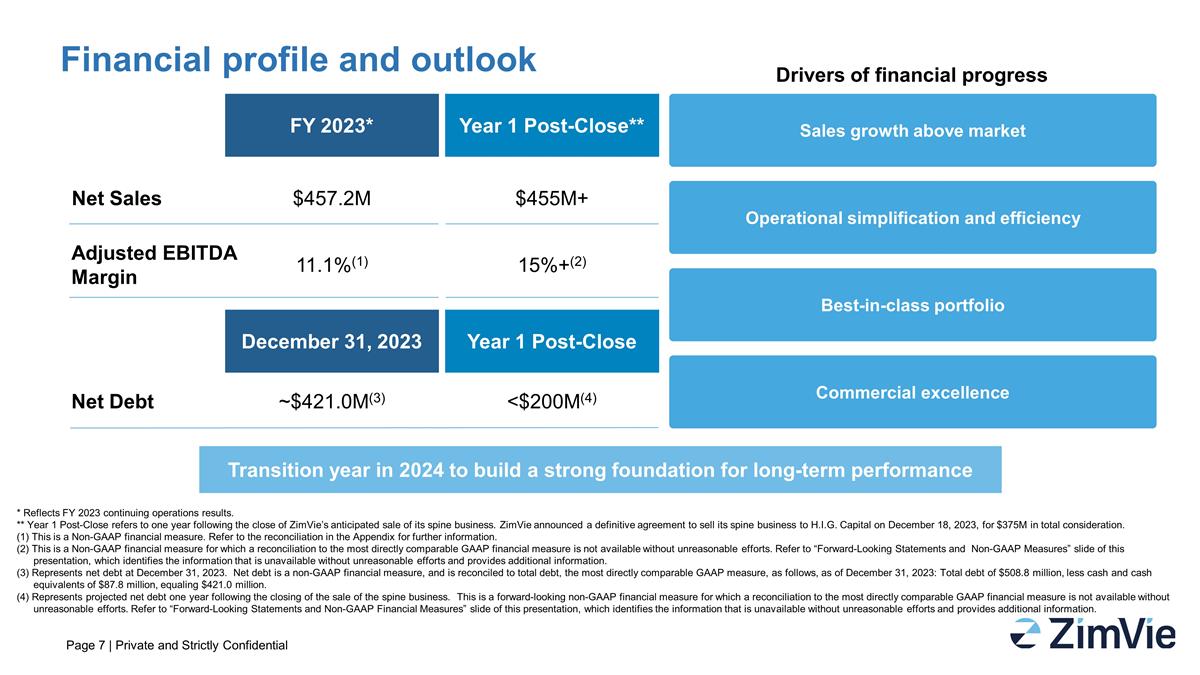

Financial profile and outlook Net Sales Adjusted EBITDA Margin FY 2023* Year 1 Post-Close** Transition year in 2024 to build a strong foundation for long-term performance $457.2M 11.1%(1) $455M+ 15%+(2) Net Debt ~$421.0M(3) Drivers of financial progress Sales growth above market Operational simplification and efficiency Best-in-class portfolio Commercial excellence <$200M(4) * Reflects FY 2023 continuing operations results. ** Year 1 Post-Close refers to one year following the close of ZimVie’s anticipated sale of its spine business. ZimVie announced a definitive agreement to sell its spine business to H.I.G. Capital on December 18, 2023, for $375M in total consideration. (1) This is a Non-GAAP financial measure. Refer to the reconciliation in the Appendix for further information. (2) This is a Non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Statements and Non-GAAP Measures” slide of this presentation, which identifies the information that is unavailable without unreasonable efforts and provides additional information. (3) Represents net debt at December 31, 2023. Net debt is a non-GAAP financial measure, and is reconciled to total debt, the most directly comparable GAAP measure, as follows, as of December 31, 2023: Total debt of $508.8 million, less cash and cash equivalents of $87.8 million, equaling $421.0 million. (4) Represents projected net debt one year following the closing of the sale of the spine business. This is a forward-looking non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Statements and Non-GAAP Financial Measures” slide of this presentation, which identifies the information that is unavailable without unreasonable efforts and provides additional information. December 31, 2023 Year 1 Post-Close

Long-term outlook Leverage innovation to grow above market Drive progress across the business to create long-term shareholder value Achieve 20%+ Adj EBITDA margin(1) 80%+ FCF Conversion(1)(2) Achieve 2x operating leverage Innovation pipeline poised to accelerate growth in faster growing end markets Focused operational and commercial efficiency programs underway Build upon already solid Dental free cash flow conversion profile Enable flexible capital allocation strategy This is a non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Statements and Non-GAAP Financial Measures” slide of this presentation, which identifies the information that is unavailable without unreasonable efforts and provides additional information. Excluding corporate costs.

Appendix

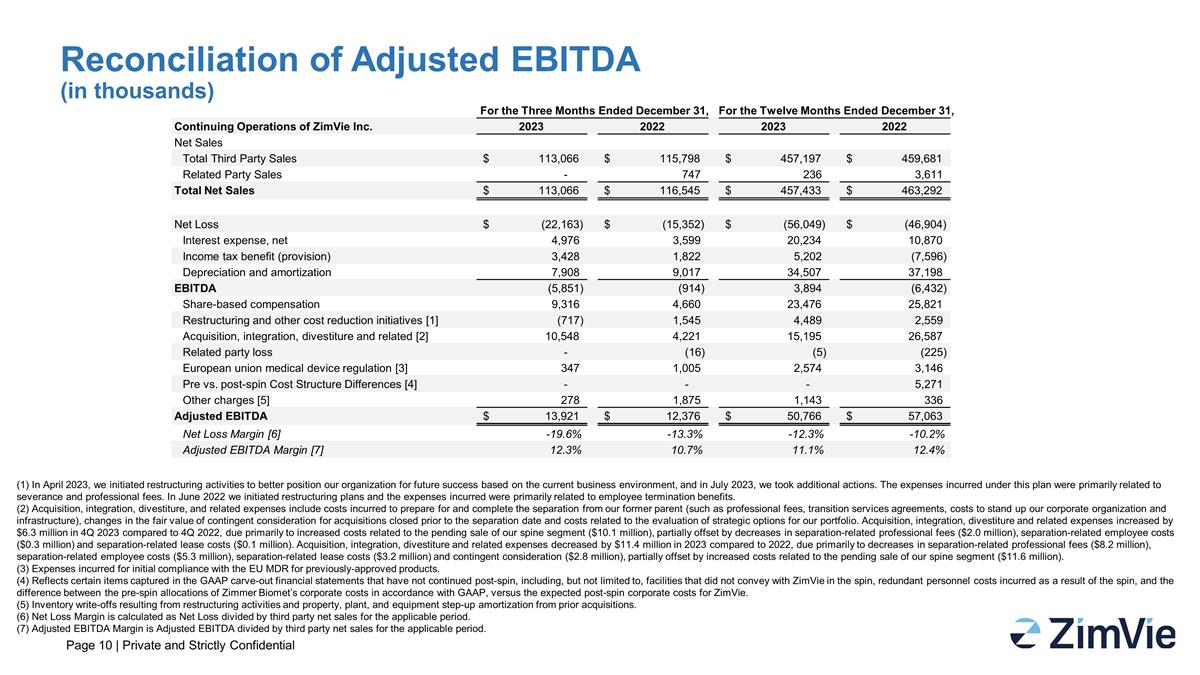

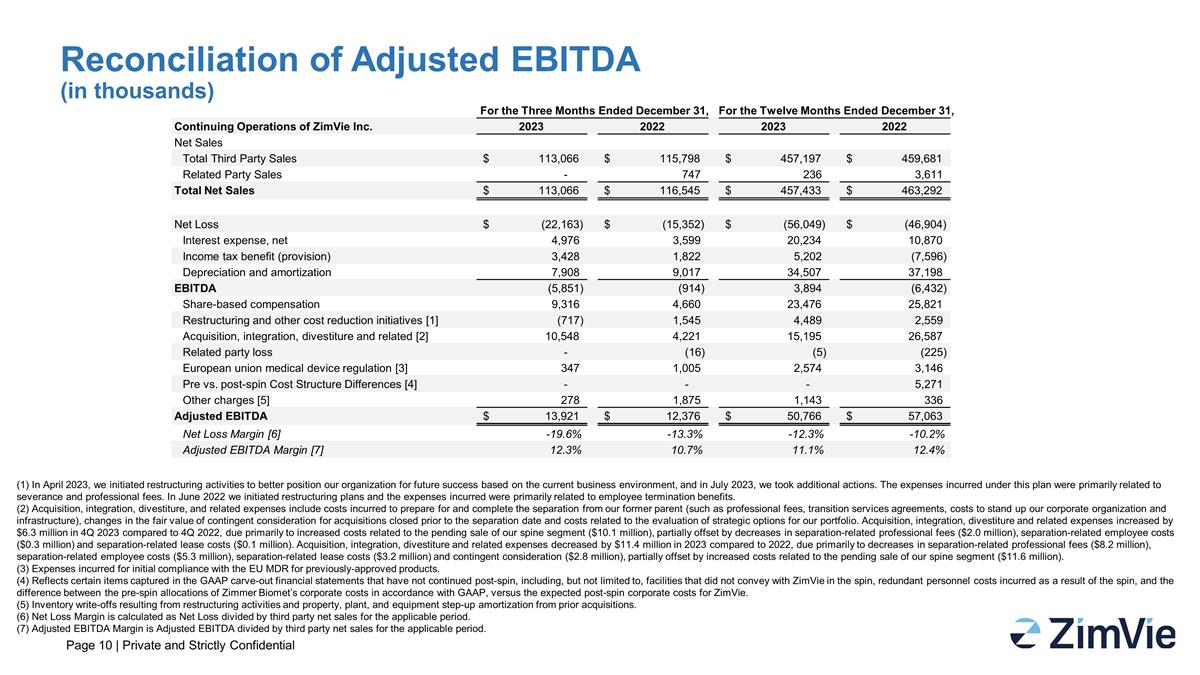

Reconciliation of Adjusted EBITDA (in thousands) (1) In April 2023, we initiated restructuring activities to better position our organization for future success based on the current business environment, and in July 2023, we took additional actions. The expenses incurred under this plan were primarily related to severance and professional fees. In June 2022 we initiated restructuring plans and the expenses incurred were primarily related to employee termination benefits. (2) Acquisition, integration, divestiture, and related expenses include costs incurred to prepare for and complete the separation from our former parent (such as professional fees, transition services agreements, costs to stand up our corporate organization and infrastructure), changes in the fair value of contingent consideration for acquisitions closed prior to the separation date and costs related to the evaluation of strategic options for our portfolio. Acquisition, integration, divestiture and related expenses increased by $6.3 million in 4Q 2023 compared to 4Q 2022, due primarily to increased costs related to the pending sale of our spine segment ($10.1 million), partially offset by decreases in separation-related professional fees ($2.0 million), separation-related employee costs ($0.3 million) and separation-related lease costs ($0.1 million). Acquisition, integration, divestiture and related expenses decreased by $11.4 million in 2023 compared to 2022, due primarily to decreases in separation-related professional fees ($8.2 million), separation-related employee costs ($5.3 million), separation-related lease costs ($3.2 million) and contingent consideration ($2.8 million), partially offset by increased costs related to the pending sale of our spine segment ($11.6 million). (3) Expenses incurred for initial compliance with the EU MDR for previously-approved products. (4) Reflects certain items captured in the GAAP carve-out financial statements that have not continued post-spin, including, but not limited to, facilities that did not convey with ZimVie in the spin, redundant personnel costs incurred as a result of the spin, and the difference between the pre-spin allocations of Zimmer Biomet’s corporate costs in accordance with GAAP, versus the expected post-spin corporate costs for ZimVie. (5) Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. (6) Net Loss Margin is calculated as Net Loss divided by third party net sales for the applicable period. (7) Adjusted EBITDA Margin is Adjusted EBITDA divided by third party net sales for the applicable period. For the Three Months Ended December 31, For the Twelve Months Ended December 31, Continuing Operations of ZimVie Inc. 2023 2022 2023 2022 Net Sales Total Third Party Sales 113,066 $ 115,798 $ 457,197 $ 459,681 $ Related Party Sales - 747 236 3,611 Total Net Sales 113,066 $ 116,545 $ 457,433 $ 463,292 $ Net Loss (22,163) $ (15,352) $ (56,049) $ (46,904) $ Interest expense, net 4,976 3,599 20,234 10,870 Income tax benefit (provision) 3,428 1,822 5,202 (7,596) Depreciation and amortization 7,908 9,017 34,507 37,198 EBITDA (5,851) (914) 3,894 (6,432) Share-based compensation 9,316 4,660 23,476 25,821 Restructuring and other cost reduction initiatives [1] (717) 1,545 4,489 2,559 Acquisition, integration, divestiture and related [2] 10,548 4,221 15,195 26,587 Related party loss - (16) (5) (225) European union medical device regulation [3] 347 1,005 2,574 3,146 Pre vs. post-spin Cost Structure Differences [4] - - - 5,271 Other charges [5] 278 1,875 1,143 336 Adjusted EBITDA 13,921 $ 12,376 $ 50,766 $ 57,063 $ Net Loss Margin [6] -19.6% -13.3% -12.3% -10.2% Adjusted EBITDA Margin [7] 12.3% 10.7% 11.1% 12.4%