- ZIMV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ZimVie (ZIMV) 8-KZimVie Reports Second Quarter 2024 Financial Results

Filed: 1 Aug 24, 4:12pm

A Global Dental Leader August 2024 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Measures Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements within the meaning of federal securities laws, including, among others, any statements about our expectations, plans, intentions, strategies, or prospects. We generally use the words “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “sees,” “seeks,” “should,” “could,” “would,” “predicts,” “potential,” “strategy,” “future,” “opportunity,” “work toward,” “intends,” “guidance,” “confidence,” “positioned,” “design,” “strive,” “continue,” “track,” “look forward to,” “optimistic” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are or may be deemed to be forward-looking statements. Such statements are based upon the current beliefs, expectations, and assumptions of management and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of our products and services; supply and prices of raw materials and products; pricing pressures from competitors, customers, dental practices and insurance providers; changes in customer demand for our products and services caused by demographic changes or other factors; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the U.S. Food and Drug Administration and foreign government regulators, such as more stringent requirements for regulatory clearance of products; competition; the impact of healthcare reform measures; reductions in reimbursement levels by third-party payors; cost containment efforts sponsored by government agencies, legislative bodies, the private sector and healthcare group purchasing organizations, including the volume-based procurement process in China; control of costs and expenses; dependence on a limited number of suppliers for key raw materials and outsourced activities; the ability to obtain and maintain adequate intellectual property protection; breaches or failures of our information technology systems or products, including by cyberattack, unauthorized access or theft; the ability to retain the independent agents and distributors who market our products; our ability to attract, retain and develop the highly skilled employees we need to support our business; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and businesses generally; the ability to form and implement alliances; changes in tax obligations arising from tax reform measures, including European Union rules on state aid, or examinations by tax authorities; product liability, intellectual property and commercial litigation losses; changes in general industry and market conditions, including domestic and international growth rates; changes in general domestic and international economic conditions, including inflation and interest rate and currency exchange rate fluctuations; the effects of global pandemics and other adverse public health developments on the global economy, our business and operations and the business and operations of our suppliers and customers, including the deferral of elective procedures and our ability to collect accounts receivable; and the impact of the ongoing financial and political uncertainty on countries in the Euro zone on the ability to collect accounts receivable in affected countries. You are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures This presentation contains financial measures which have not been calculated in accordance with United States generally accepted accounting principles (“GAAP”), because they are a basis upon which our management assesses our performance. Although we believe these measures may be useful for investors for the same reason, these financial measures should not be considered as an alternative to GAAP financial measures as a measure of our financial condition, performance or liquidity. In addition, these financial measures may not be comparable to similar measures used by other companies. In the Appendix to this presentation, we provide further descriptions of these non-GAAP measures and reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

ZimVie: A Global Dental Leader Powerful, market-leading portfolio of premium implants, restorative implant solutions, biomaterials solutions, and digital dentistry technologies 8 Million 8 million U.S. patients seek treatment for tooth loss annually 25% Only 25% receive tooth replacement Focused on driving greater adoption of dental implants through training, education, and digital workflow Leading with differentiated solutions and continuing to invest in innovation

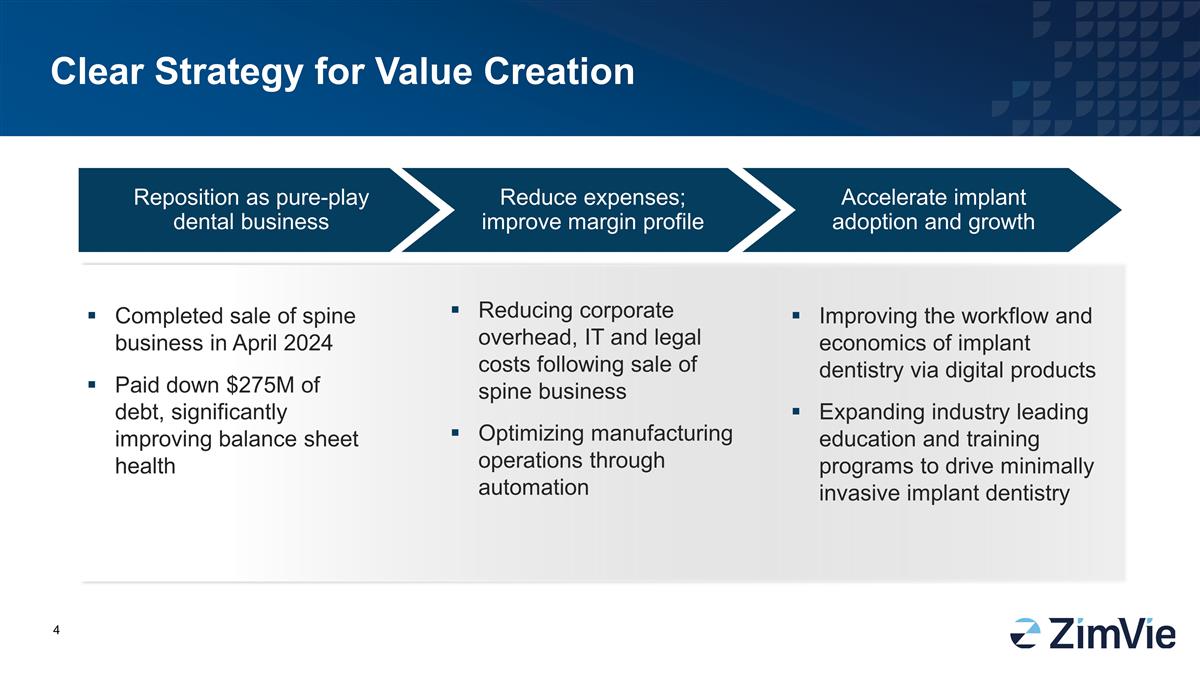

Clear Strategy for Value Creation Completed sale of spine business in April 2024 Paid down $275M of debt, significantly improving balance sheet health Reducing corporate overhead, IT and legal costs following sale of spine business Optimizing manufacturing operations through automation Improving the workflow and economics of implant dentistry via digital products Expanding industry leading education and training programs to drive minimally invasive implant dentistry Reposition as pure-play dental business Reduce expenses; improve margin profile Accelerate implant adoption and growth

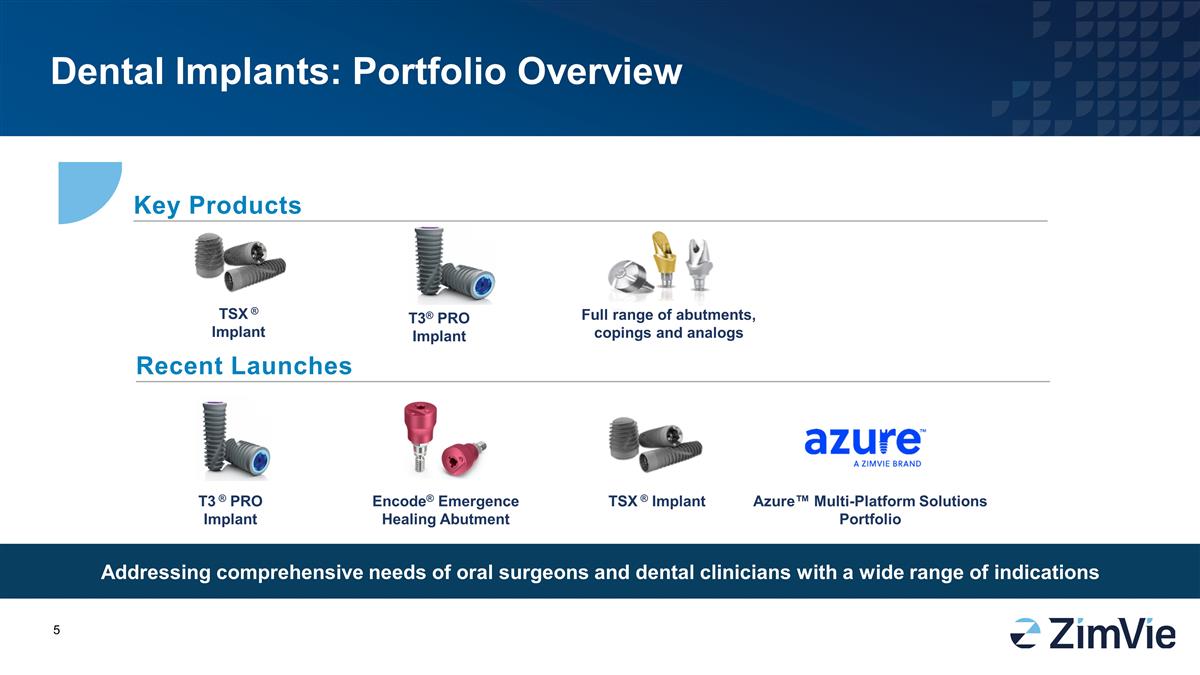

Addressing comprehensive needs of oral surgeons and dental clinicians with a wide range of indications Key Products Full range of abutments, copings and analogs TSX ® Implant T3® PRO Implant Recent Launches T3 ® PRO Implant Encode® Emergence Healing Abutment TSX ® Implant Azure™ Multi-Platform Solutions Portfolio Dental Implants: Portfolio Overview

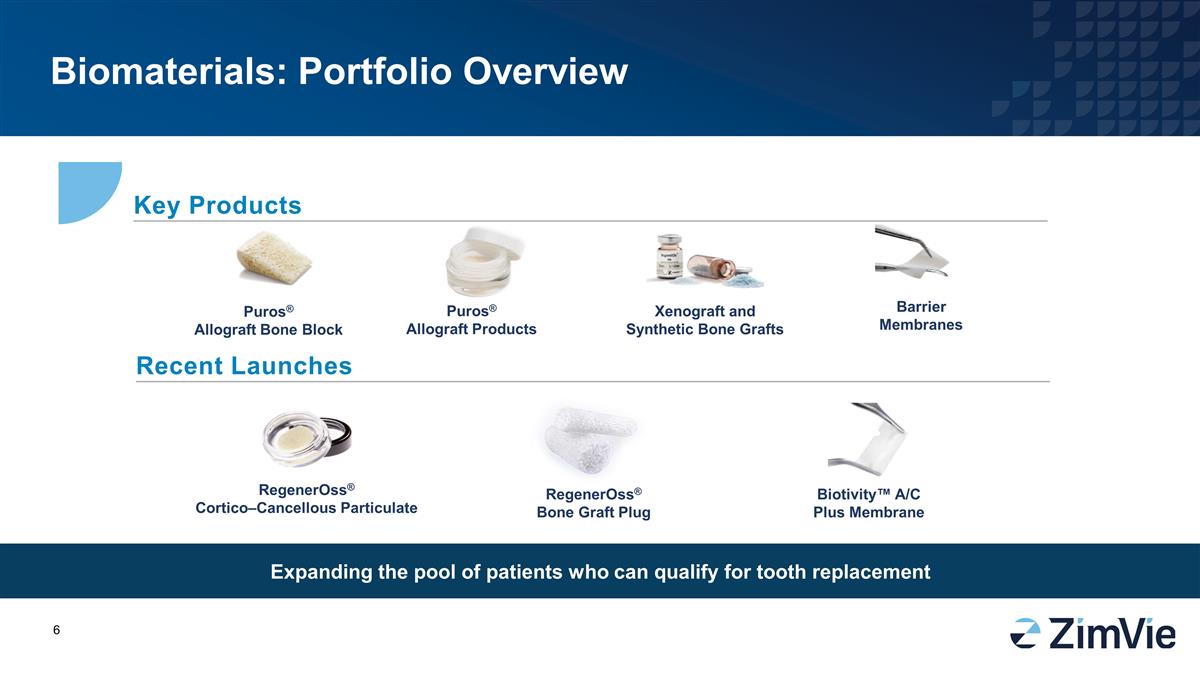

Key Products Recent Launches Puros® Allograft Bone Block Barrier Membranes Xenograft and Synthetic Bone Grafts RegenerOss® Cortico–Cancellous Particulate RegenerOss® Bone Graft Plug Puros® Allograft Products Biotivity™ A/C Plus Membrane Biomaterials: Portfolio Overview Expanding the pool of patients who can qualify for tooth replacement

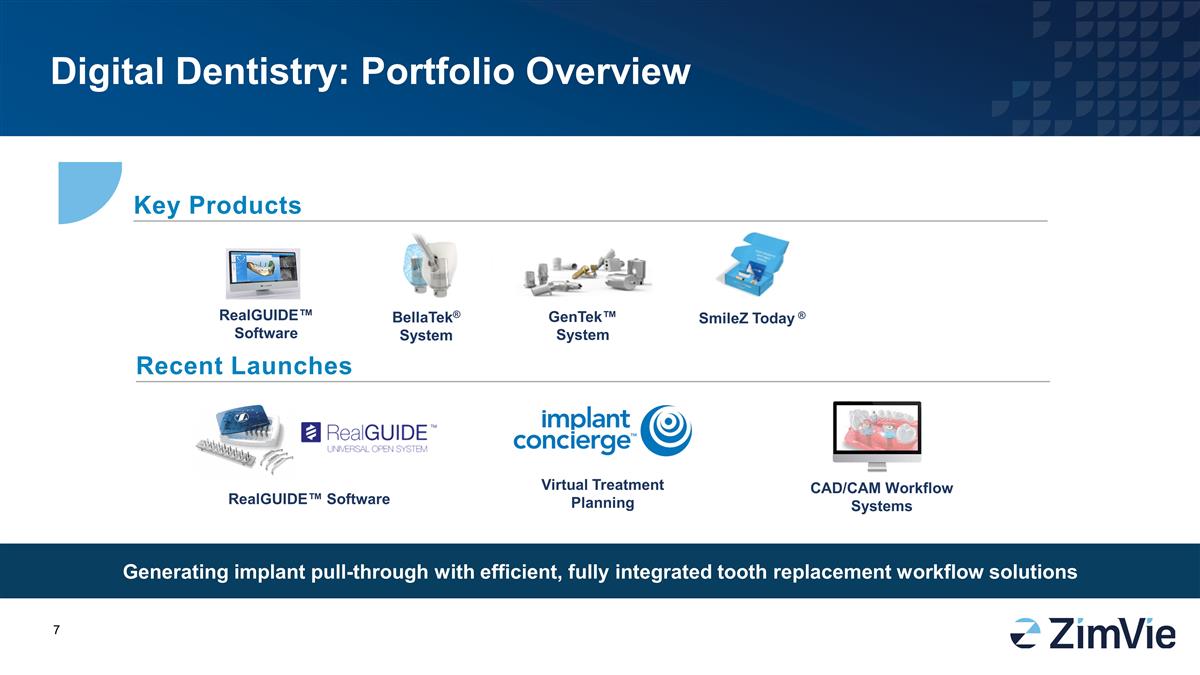

Key Products Recent Launches Digital Dentistry: Portfolio Overview Generating implant pull-through with efficient, fully integrated tooth replacement workflow solutions BellaTek® System GenTek™ System SmileZ Today ® RealGUIDE™ Software RealGUIDE™ Software Virtual Treatment Planning CAD/CAM Workflow Systems

Virtual Treatment Planning Custom Surgical Guide Kits Delivering digital workflow enhancements to save clinician time and improve patient satisfaction AI facilitated reconstruction procedures require 3 fewer hours of human labor* ZimVie Encode Emergence workflow reduces chair time and saves one restorative impression appointment Seeing rapid growth in sales of guided surgery software End-to-End Solutions Save Time and Improve the Clinician and Patient Experience *Internal data

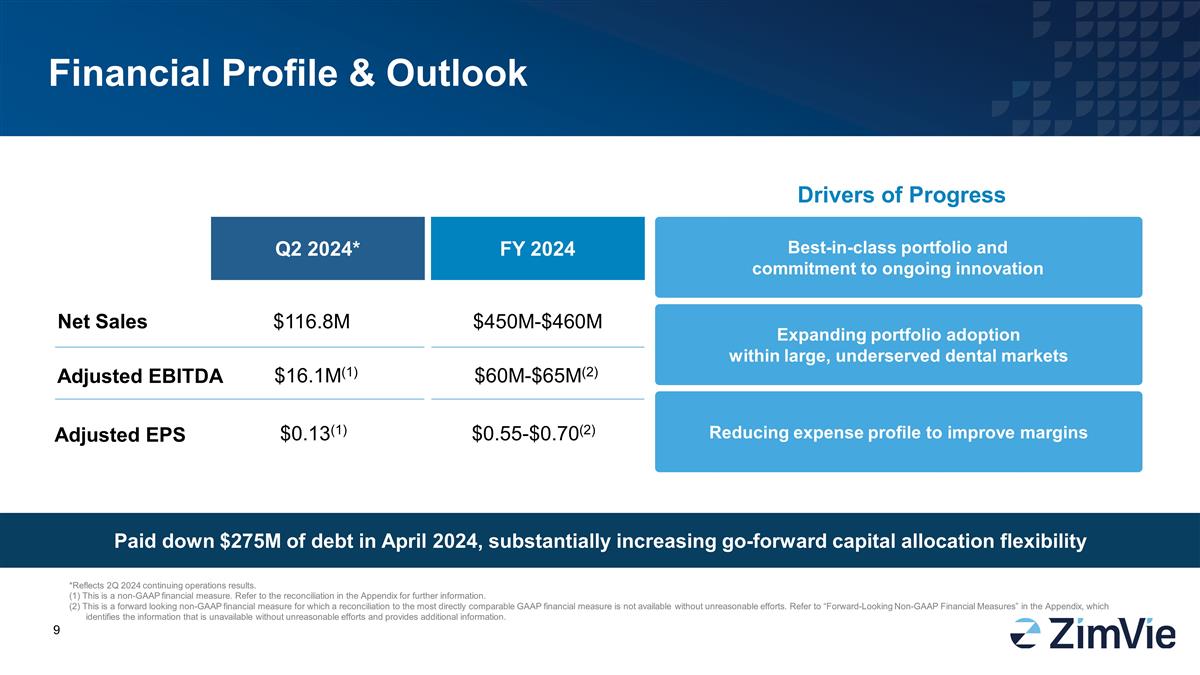

Financial Profile & Outlook Net Sales Adjusted EBITDA Q2 2024* FY 2024 $116.8M $16.1M(1) $450M-$460M $60M-$65M(2) Drivers of Progress Expanding portfolio adoption within large, underserved dental markets Reducing expense profile to improve margins Best-in-class portfolio and commitment to ongoing innovation Adjusted EPS $0.13(1) $0.55-$0.70(2) Paid down $275M of debt in April 2024, substantially increasing go-forward capital allocation flexibility *Reflects 2Q 2024 continuing operations results. (1) This is a non-GAAP financial measure. Refer to the reconciliation in the Appendix for further information. (2) This is a forward looking non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Non-GAAP Financial Measures” in the Appendix, which identifies the information that is unavailable without unreasonable efforts and provides additional information.

Committed to Executing Strategic Transformation Address and reduce stranded costs Optimize manufacturing & supply chain capabilities Position the business for sustainable growth Continue innovating and driving digital adoption to optimize our customer experience and increase total patient implant procedures Expand product offerings across geographies Transformed to pure-play dental business Launched next-generation TSX Implant in Japan RealGUIDE software updates Recent Accomplishments Current Priorities Market Expansion Opportunities

Appendix

Note on Non-GAAP Financial Measures This presentation includes non-GAAP financial measures that differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may not be comparable to similar measures reported by other companies and should be considered in addition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP. Adjusted EBITDA is a non-GAAP financial measure provided in this presentation for certain periods and is calculated by excluding certain items from net loss from Continuing Operations on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Adjusted EBITDA margin is Adjusted EBITDA divided by third party net sales from Continuing Operations for the applicable period. Adjusted diluted earnings (loss) per share is a non-GAAP financial measure provided in this presentation for certain periods and is calculated by excluding the effects of certain items from diluted earnings (loss) per share on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are included in this presentation. Management uses non-GAAP financial measures internally to evaluate the performance of the business. Additionally, management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating the performance of the company. Management believes these measures offer the ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income but that do not impact the fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be masked or distorted by these types of items that are excluded from the non-GAAP measures. Forward-Looking Non-GAAP Financial Measures This presentation also includes certain forward-looking non-GAAP financial measures for the year ending December 31, 2024. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management’s plans may change. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is probable that these forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures.

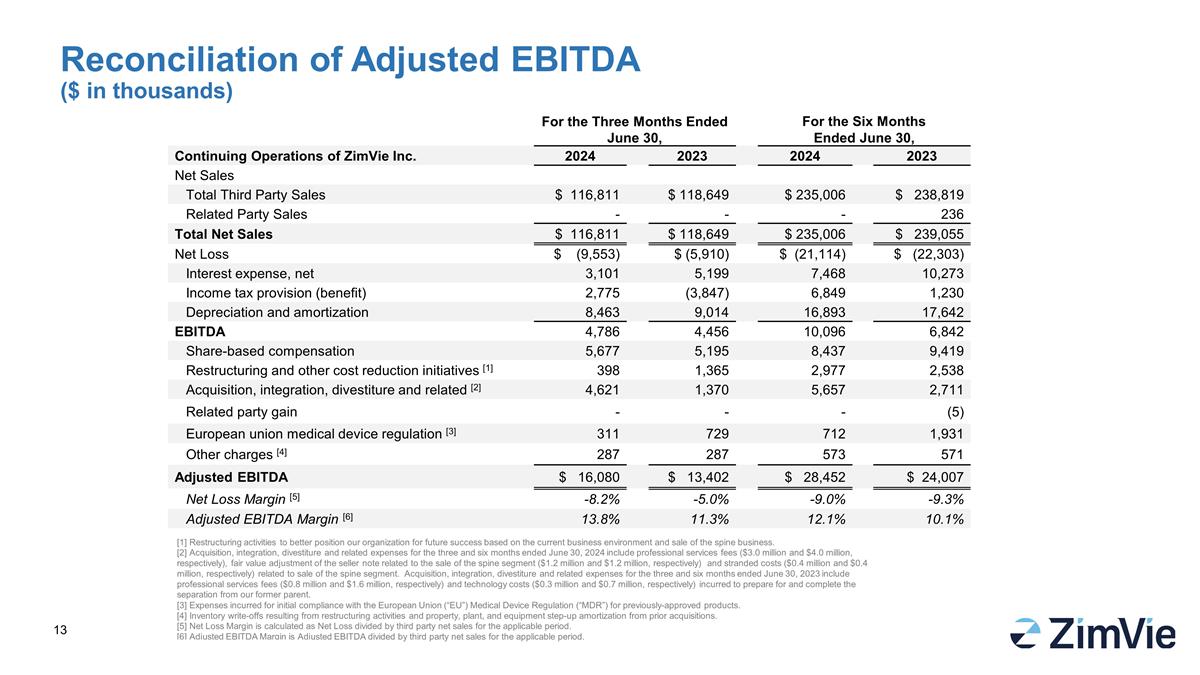

Reconciliation of Adjusted EBITDA ($ in thousands) [1] Restructuring activities to better position our organization for future success based on the current business environment and sale of the spine business. [2] Acquisition, integration, divestiture and related expenses for the three and six months ended June 30, 2024 include professional services fees ($3.0 million and $4.0 million, respectively), fair value adjustment of the seller note related to the sale of the spine segment ($1.2 million and $1.2 million, respectively) and stranded costs ($0.4 million and $0.4 million, respectively) related to sale of the spine segment. Acquisition, integration, divestiture and related expenses for the three and six months ended June 30, 2023 include professional services fees ($0.8 million and $1.6 million, respectively) and technology costs ($0.3 million and $0.7 million, respectively) incurred to prepare for and complete the separation from our former parent. [3] Expenses incurred for initial compliance with the European Union (“EU”) Medical Device Regulation (“MDR”) for previously-approved products. [4] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [5] Net Loss Margin is calculated as Net Loss divided by third party net sales for the applicable period. [6] Adjusted EBITDA Margin is Adjusted EBITDA divided by third party net sales for the applicable period. For the Three Months Ended June 30, For the Six Months Ended June 30, Continuing Operations of ZimVie Inc. 2024 2023 2024 2023 Net Sales Total Third Party Sales $ 116,811 $ 118,649 $ 235,006 $ 238,819 Related Party Sales - - - 236 Total Net Sales $ 116,811 $ 118,649 $ 235,006 $ 239,055 Net Loss $ (9,553) $ (5,910) $ (21,114) $ (22,303) Interest expense, net 3,101 5,199 7,468 10,273 Income tax provision (benefit) 2,775 (3,847) 6,849 1,230 Depreciation and amortization 8,463 9,014 16,893 17,642 EBITDA 4,786 4,456 10,096 6,842 Share-based compensation 5,677 5,195 8,437 9,419 Restructuring and other cost reduction initiatives [1] 398 1,365 2,977 2,538 Acquisition, integration, divestiture and related [2] 4,621 1,370 5,657 2,711 Related party gain - - - (5) European union medical device regulation [3] 311 729 712 1,931 Other charges [4] 287 287 573 571 Adjusted EBITDA $ 16,080 $ 13,402 $ 28,452 $ 24,007 Net Loss Margin [5] -8.2% -5.0% -9.0% -9.3% Adjusted EBITDA Margin [6] 13.8% 11.3% 12.1% 10.1%

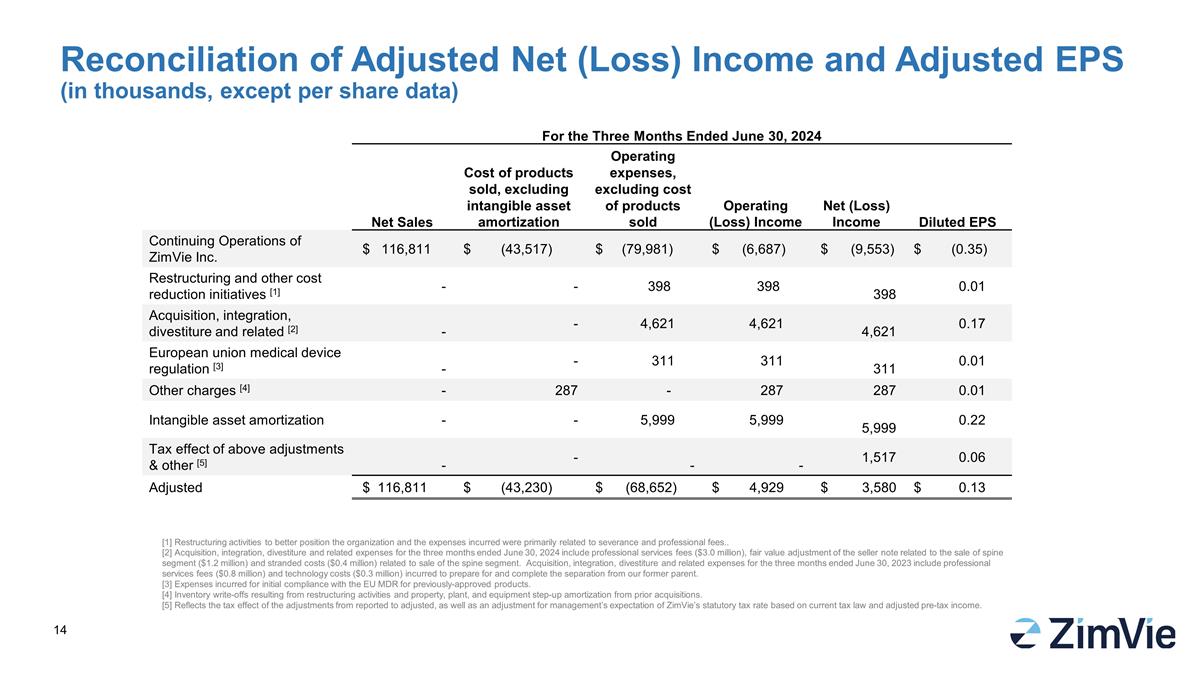

Reconciliation of Adjusted Net (Loss) Income and Adjusted EPS (in thousands, except per share data) [1] Restructuring activities to better position the organization and the expenses incurred were primarily related to severance and professional fees.. [2] Acquisition, integration, divestiture and related expenses for the three months ended June 30, 2024 include professional services fees ($3.0 million), fair value adjustment of the seller note related to the sale of spine segment ($1.2 million) and stranded costs ($0.4 million) related to sale of the spine segment. Acquisition, integration, divestiture and related expenses for the three months ended June 30, 2023 include professional services fees ($0.8 million) and technology costs ($0.3 million) incurred to prepare for and complete the separation from our former parent. [3] Expenses incurred for initial compliance with the EU MDR for previously-approved products. [4] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [5] Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. For the Three Months Ended June 30, 2024 Net Sales Cost of products sold, excluding intangible asset amortization Operating expenses, excluding cost of products sold Operating (Loss) Income Net (Loss) Income Diluted EPS Continuing Operations of ZimVie Inc. $ 116,811 $ (43,517) $ (79,981) $ (6,687) $ (9,553) $ (0.35) Restructuring and other cost reduction initiatives [1] - - 398 398 398 0.01 Acquisition, integration, divestiture and related [2] - - 4,621 4,621 4,621 0.17 European union medical device regulation [3] - - 311 311 311 0.01 Other charges [4] - 287 - 287 287 0.01 Intangible asset amortization - - 5,999 5,999 5,999 0.22 Tax effect of above adjustments & other [5] - - - - 1,517 0.06 Adjusted $ 116,811 $ (43,230) $ (68,652) $ 4,929 $ 3,580 $ 0.13