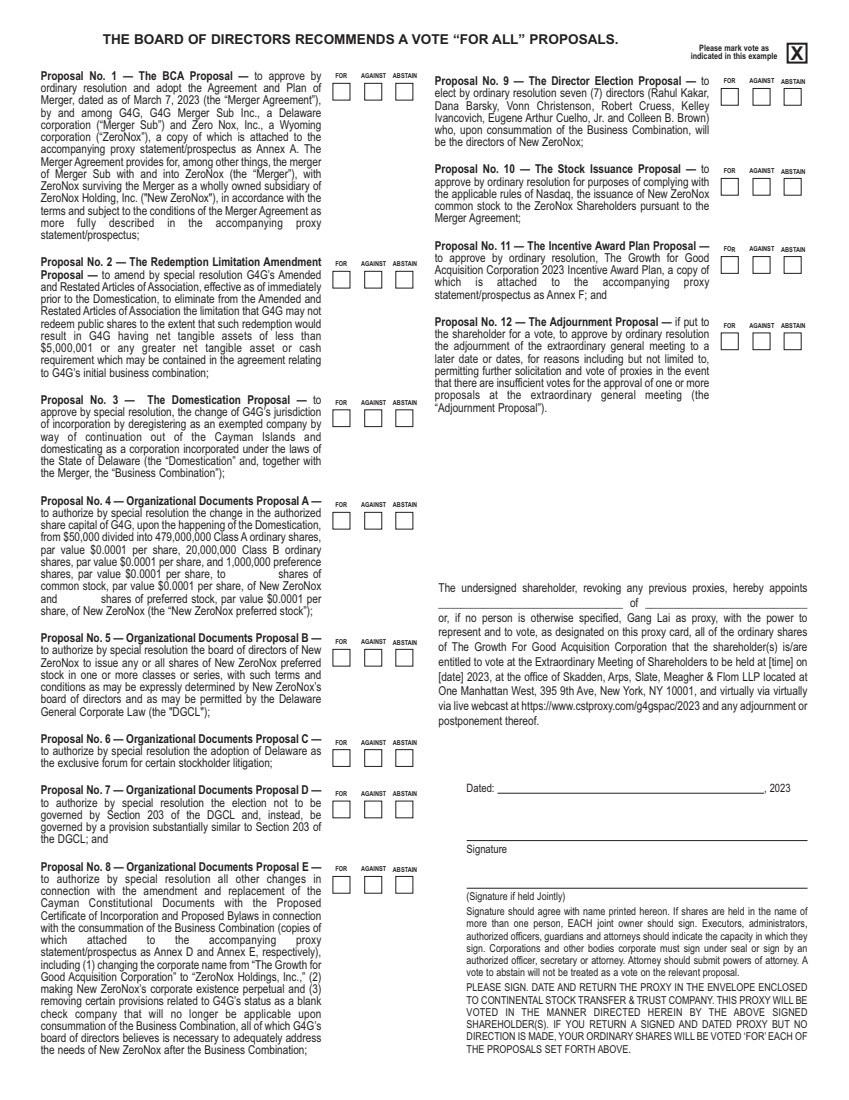

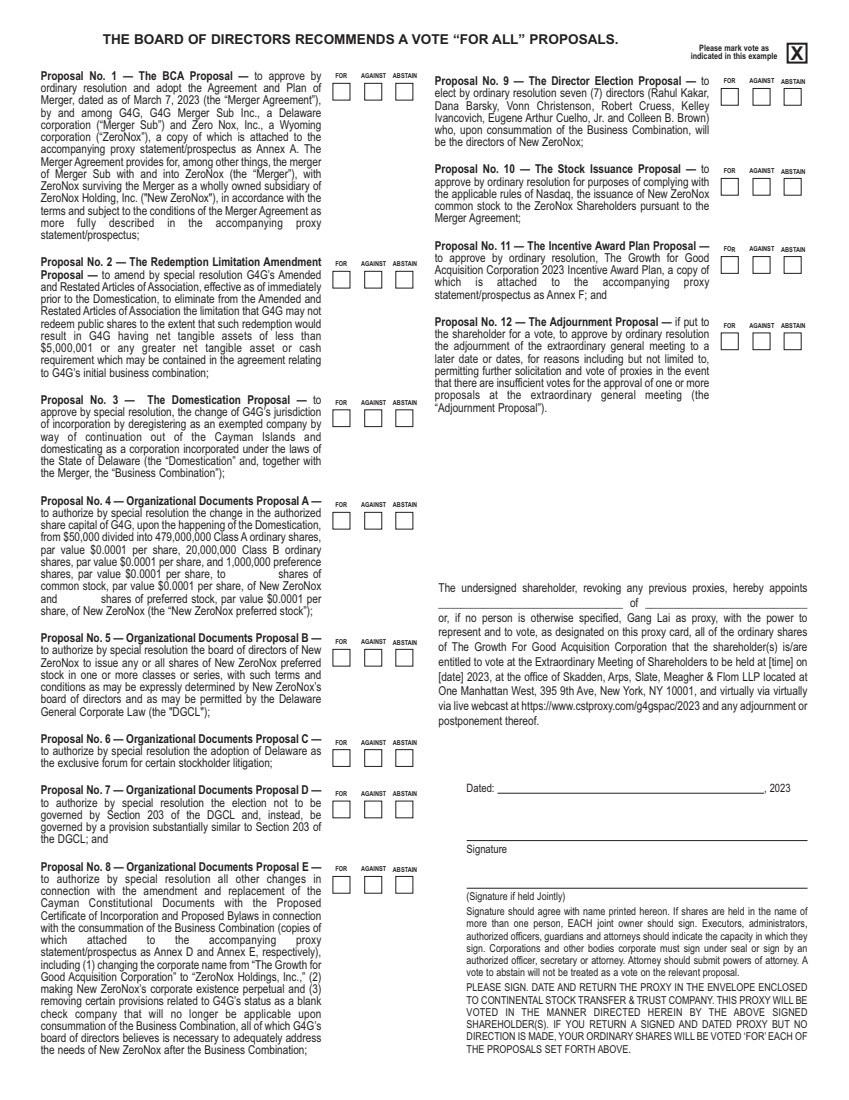

| Please mark vote as indicated in this example X THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL” PROPOSALS. Proposal No. 1 — The BCA Proposal — to approve by FOR AGAINST ABSTAIN ordinary resolution and adopt the Agreement and Plan of Merger, dated as of March 7, 2023 (the “Merger Agreement”), by and among G4G, G4G Merger Sub Inc., a Delaware corporation (“Merger Sub”) and Zero Nox, Inc., a Wyoming corporation (“ZeroNox”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex A. The Merger Agreement provides for, among other things, the merger of Merger Sub with and into ZeroNox (the “Merger”), with ZeroNox surviving the Merger as a wholly owned subsidiary of ZeroNox Holding, Inc. ("New ZeroNox"), in accordance with the terms and subject to the conditions of the Merger Agreement as more fully described in the accompanying proxy statement/prospectus; Proposal No. 2 — The Redemption Limitation Amendment Proposal — to amend by special resolution G4G’s Amended and Restated Articles of Association, effective as of immediately prior to the Domestication, to eliminate from the Amended and Restated Articles of Association the limitation that G4G may not redeem public shares to the extent that such redemption would result in G4G having net tangible assets of less than $5,000,001 or any greater net tangible asset or cash requirement which may be contained in the agreement relating to G4G’s initial business combination; Proposal No. 3 — The Domestication Proposal — to approve by special resolution, the change of G4G’s jurisdiction of incorporation by deregistering as an exempted company by way of continuation out of the Cayman Islands and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication” and, together with the Merger, the “Business Combination”); Proposal No. 4 — Organizational Documents Proposal A — to authorize by special resolution the change in the authorized share capital of G4G, upon the happening of the Domestication, from $50,000 divided into 479,000,000 Class A ordinary shares, par value $0.0001 per share, 20,000,000 Class B ordinary shares, par value $0.0001 per share, and 1,000,000 preference shares, par value $0.0001 per share, to shares of common stock, par value $0.0001 per share, of New ZeroNox and shares of preferred stock, par value $0.0001 per share, of New ZeroNox (the “New ZeroNox preferred stock”); Proposal No. 5 — Organizational Documents Proposal B — to authorize by special resolution the board of directors of New ZeroNox to issue any or all shares of New ZeroNox preferred stock in one or more classes or series, with such terms and conditions as may be expressly determined by New ZeroNox’s board of directors and as may be permitted by the Delaware General Corporate Law (the "DGCL"); Proposal No. 6 — Organizational Documents Proposal C — to authorize by special resolution the adoption of Delaware as the exclusive forum for certain stockholder litigation; Proposal No. 7 — Organizational Documents Proposal D — to authorize by special resolution the election not to be governed by Section 203 of the DGCL and, instead, be governed by a provision substantially similar to Section 203 of the DGCL; and Proposal No. 8 — Organizational Documents Proposal E — to authorize by special resolution all other changes in connection with the amendment and replacement of the Cayman Constitutional Documents with the Proposed Certificate of Incorporation and Proposed Bylaws in connection with the consummation of the Business Combination (copies of which attached to the accompanying proxy statement/prospectus as Annex D and Annex E, respectively), including (1) changing the corporate name from “The Growth for Good Acquisition Corporation” to “ZeroNox Holdings, Inc.,” (2) making New ZeroNox’s corporate existence perpetual and (3) removing certain provisions related to G4G’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which G4G’s board of directors believes is necessary to adequately address the needs of New ZeroNox after the Business Combination; Proposal No. 9 — The Director Election Proposal — to elect by ordinary resolution seven (7) directors (Rahul Kakar, Dana Barsky, Vonn Christenson, Robert Cruess, Kelley Ivancovich, Eugene Arthur Cuelho, Jr. and Colleen B. Brown) who, upon consummation of the Business Combination, will be the directors of New ZeroNox; Proposal No. 10 — The Stock Issuance Proposal — to approve by ordinary resolution for purposes of complying with the applicable rules of Nasdaq, the issuance of New ZeroNox common stock to the ZeroNox Shareholders pursuant to the Merger Agreement; Proposal No. 11 — The Incentive Award Plan Proposal — to approve by ordinary resolution, The Growth for Good Acquisition Corporation 2023 Incentive Award Plan, a copy of which is attached to the accompanying proxy statement/prospectus as Annex F; and Proposal No. 12 — The Adjournment Proposal — if put to the shareholder for a vote, to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates, for reasons including but not limited to, permitting further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting (the “Adjournment Proposal”). Dated: , 2023 Signature (Signature if held Jointly) Signature should agree with name printed hereon. If shares are held in the name of more than one person, EACH joint owner should sign. Executors, administrators, authorized officers, guardians and attorneys should indicate the capacity in which they sign. Corporations and other bodies corporate must sign under seal or sign by an authorized officer, secretary or attorney. Attorney should submit powers of attorney. A vote to abstain will not be treated as a vote on the relevant proposal. PLEASE SIGN. DATE AND RETURN THE PROXY IN THE ENVELOPE ENCLOSED TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY. THIS PROXY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE ABOVE SIGNED SHAREHOLDER(S). IF YOU RETURN A SIGNED AND DATED PROXY BUT NO DIRECTION IS MADE, YOUR ORDINARY SHARES WILL BE VOTED ‘FOR’ EACH OF THE PROPOSALS SET FORTH ABOVE. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN The undersigned shareholder, revoking any previous proxies, hereby appoints _________________________________ of _____________________________ or, if no person is otherwise specified, Gang Lai as proxy, with the power to represent and to vote, as designated on this proxy card, all of the ordinary shares of The Growth For Good Acquisition Corporation that the shareholder(s) is/are entitled to vote at the Extraordinary Meeting of Shareholders to be held at [time] on [date] 2023, at the office of Skadden, Arps, Slate, Meagher & Flom LLP located at One Manhattan West, 395 9th Ave, New York, NY 10001, and virtually via virtually via live webcast at https://www.cstproxy.com/g4gspac/2023 and any adjournment or postponement thereof. FOR AGAINST ABSTAIN |