platform was designed to create the largest, most socially responsible and culturally impactful company in California, producing consistently high-quality, well-priced products and culturally relevant brands that are distributed to third-party retailers as well as direct-to-consumer via a delivery service and strategically located retail locations. A full portfolio of products and brands that appeals to a broad range of user groups, need-states and occasions, offered at all price points, and with unique brand value propositions, are produced at low cost and high caliber of quality through vertically-integrated cultivation, sourcing and manufacturing. The Company believes its wholly owned delivery and retail outlets will allow it to achieve high gross-margins on many of its products, forge one-on-one relationships between its brands and consumers and collect proprietary consumer data and insights.

While the Company is focused on the recreational and wellness markets, a small portion (estimated to be less than 1%) of its revenues is derived from cannabis and products containing cannabis used by medical cannabis patients in accordance with applicable state law, but for which no drug approval has been granted by the United States Food and Drug Administration (where use may include inhalation, consumption, or application).

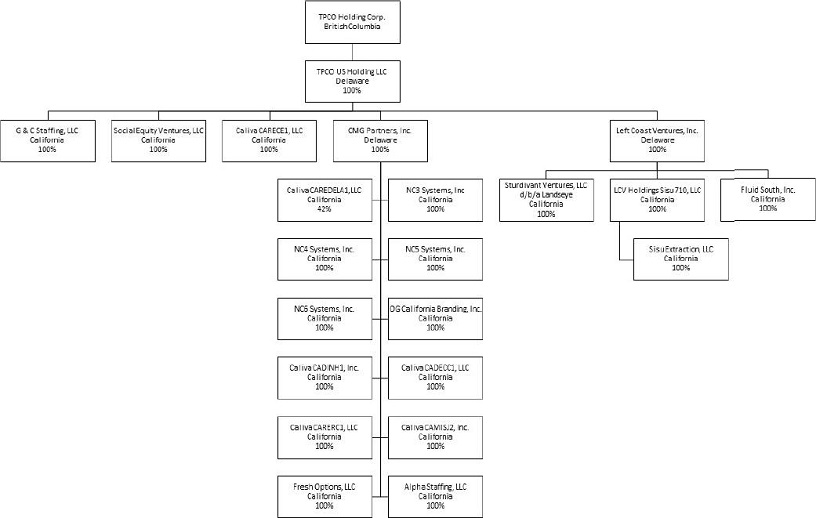

The Company’s operational footprint spans cultivation, extraction, manufacturing, distribution, brands, retail and delivery. The management team and directors of the Company bring together deep expertise in cannabis, consumer packaged goods, investing and finance from start-ups to publicly traded companies. The Company aims to leverage its collective industry experience to ensure a highly synergistic and strategic transaction is executed. Through a combination of professional leadership, vertical operations, technology and data driven practices, brand and product expertise, as well as social justice and equity advocacy, the Company intends to set the example globally as a best-in-class cannabis operation. In addition, the Company plans to pursue an aggressive M&A strategy to accelerate growth, market share gains and profitability.

Recent Developments

On October 1, 2021, the Company entered into definitive agreements (the “Coastal Agreements”) to acquire 100% of the equity securities of Coastal Holding Company, LLC (“Coastal”), a California retail dispensary and delivery operator, for aggregate consideration, subject to adjustments, of up to US$56.2 million (the “Coastal Transaction”), comprised of up to (i) US$16.2 million in cash, (ii) US$20 million in Common Shares, the issuance of which is contingent upon the signing of management services agreements (“Coastal MSAs”) at each Coastal location and (iii) US$20 million in Common Shares, the issuance of which is contingent upon the successful transfer of Coastal’s cannabis licenses. The Company entered into Coastal MSAs for a majority of Coastal’s operating locations concurrently with the signing of the Agreements and anticipates signing Coastal MSAs for the remaining Coastal operating locations in the coming days. The US$16.2 million cash portion of the consideration was paid to Coastal at closing and is secured by a promissory note forgivable upon Coastal satisfying certain closing conditions. The price of the Common Shares forming a portion of the consideration will be determined based on the market price of the Common Shares on the dates such MSAs are executed or regulatory approval milestones are achieved before closing (each, a “Pricing Date”). Common Shares issued in connection with the Transaction will be subject to lock-up provisions that will release upon the later of (i) six months from the applicable Pricing Date; and (ii) satisfaction of certain closing conditions.

Coastal is a retail dispensary license holder and operator with six retail licensed locations, five of which are currently operating, and two delivery depots. Coastal’s operating dispensaries are located in Santa Barbara, Pasadena, West Los Angeles, Stockton and Vallejo. Coastal is also engaged in the construction of another retail license location in Northern California and operating delivery depots in Santa Barbara and San Luis Obispo. Coastal serves over 1,000 people per day, in their stores and online.

As part of the Coastal Transaction the Company will also inherit a minority stake in a southern California dispensary and an option to purchase the remainder of that dispensary for US$9 million in cash (the “Coastal Option”). The Coastal Option may be exercised by the Company following receipt of certain regulatory approvals. US$4.5 million of the exercise price of the Coastal Option was prepaid upon execution of the Coastal Agreements.

Upon completion, the acquisition of Coastal will increase the Company’s current California retail store and delivery depot footprints to eleven and six, respectively, and position the Company with the second largest operating retail dispensary and delivery hub in California expected to have the capacity to reach to over 80% of California’s population. The Coastal Transaction is expected to close in 2022, subject to standard closing conditions and regulatory approvals, including approval of the Exchange.

In addition to the Coastal Transaction, on October 1, 2021, the Company closed the first tranche of the previously announced acquisition of the Calma dispensary, located in West Hollywood, with the acquisition of 85% of Calma’s equity securities. The transfer of the remaining 15% equity of Calma is expected to occur in 2022.

Cultivation

The Company operates over 35,000 square feet of indoor cultivation space producing premium flower for product lines on the higher-end of the price spectrum – Monogram, Caliva, Mind Your Head, Mirayo by Santana and others, as well as potential new brands developed in-house, new brands developed as part of the transactions contemplated by the Brand Strategy Agreement, and new brands that will come into the portfolio via future acquisitions. The Company has a procurement network of over 500 cultivators throughout California to purchase everything from low-cost outdoor, high-quality mid-priced greenhouse, and premium indoor flower as required by its portfolio of brands.

On May 16, 2021, the Company entered into a membership interest purchase agreement (the “Membership Interest Purchase Agreement”) to obtain leasehold interests of approximately 10 years duration in each of four one-acre parcels of land that are licensed for outdoor cannabis grow (collectively, the “Outdoor Grow Properties”). On May 21, 2021 (the “Effective Date”), the Company entered into series of cultivation and supply agreements with each of the leaseholders of the Outdoor Grow Properties and Mosaic. AG, Inc. (“Mosaic.Ag”), pursuant to which Mosaic.Ag agreed to cultivate cannabis on each of the Outdoor Grow Properties on the Company’s behalf for a period commencing on the Effective Date of and ending at least three years from the closing of the transactions contemplated by the Membership Interest Purchase Agreement, with options to extend for up to five years (the “Cultivation and Supply Agreements”). Under the terms of the Membership Interest Purchase Agreement, as of the Effective Date, the Company and Mosaic.Ag obtained access to the Outdoor Grow Properties and began to commence cannabis cultivation activities under the Cultivation and Supply Agreements. The purchase price under the Membership Interest Purchase Agreement is $6,000,000 in cash, $2,500,000 in Common Shares payable on the closing date (with the number of shares issued based on the volume-weighted average price per Common Share for the ten consecutive trading days prior to the closing date) and up to 1,309,263 shares subject to an earnout based on the production value of cannabis grown on the Outdoor Grow Properties over the twenty-four months following the Effective Date. The closing of the transactions contemplated by the Membership Interest Purchase Agreement are dependent on the satisfaction of various closing conditions, which have not been met to date and are not expected to be met until the second quarter of 2022. Pursuant to the terms of the Membership Interest Purchase Agreement, on the Effective Date, the Company advanced to the seller $5,650,000 secured by a promissory note. In the event that the transaction does not close, the promissory note is required to be repaid to the Company. The transactions contemplated by the Membership Interest Purchase Agreement and the Cultivation and Supply Agreements are collectively referred to in this registration statement as the “Mosaic.Ag Transaction”). The Company expects that the Mosaic.Ag Transaction will provide it with approximately 12,000 pounds of outdoor flower a year.

The Company both purchases and sells flower. The pricing of flower has fluctuated significantly and, in particular, has decreased significantly in recent months.

Extraction

The Company operates two extraction facilities in the Eureka/Arcata area with Type-6 extraction licenses that are currently capable of producing 3,400 kg of crude and 2,700 kg of distillate per month. This extraction capacity is utilized for both the production and sale of bulk crude and distillate as well as the production of the Company’s finished goods in the vaporizer and ingestible categories. The Company estimates its extraction business supplies approximately 20% of the distillate sold legally in California. Extraction (oil) markets are also subject to price fluctuations based on pricing of cultivation, which serves as the input material for extraction process. As cultivation pricing drops, pricing of oil from extraction also decreases. Pricing swings have the greatest effect on sales of bulk oil.

Manufacturing

The Company operates three cannabis manufacturing facilities with a total footprint of 20,500 licensed square feet throughout the State of California that are currently producing many form-factors, including jarred and bagged whole flower, pre-rolls, bulk extracts, vape cartridges, ready-to-use vapes, gummies, chocolate, tinctures and capsules. The Company’s estimates that its manufacturing facilities have the operating capacity to meet 20% of California market demand for distillate cannabis oil. These facilities enable the Company to produce a wide range of form-factors for a wide range of differentiated brands, addressing all consumer groups, needs occasions and price points. Having diverse manufacturing capabilities supports a broad range of product and brand strategies including the Company’s relationships with JAY-Z and Roc Nation.

Quality Testing

Prior to release to the commercial market, each batch of packaged cannabis biomass and/or manufactured cannabis products (collectively “cannabis goods”) must have a batch-specific Certificate of Analysis (“COA”) from a testing laboratory (“lab”). Labs are independent, third-party entities licensed by the California’s Department of Cannabis Control (“DCC”). A COA is a legally binding document created by the lab that shows the analytical quality test results of each batch of cannabis goods indicating whether the batch is safe for human consumption. Upon issuance, COAs are uploaded by the lab into the State’s track-and-trace system for version control and may not be amended. As reflected on each COA, a lab tests each batch of cannabis goods for cannabinoid content, presence of foreign materials, heavy metals, microbial impurities, mycotoxins, moisture content and water activity, residual pesticides, and residual solvents and processing chemicals. State regulations stipulate “passing” and “failing” criteria within each of the elements tested and indicated on the COA.

In compliance with applicable regulations, the Company must allow a lab to enter its licensed premises to conduct batch-sampling of cannabis goods. The lab removes a representative sample of each batch of cannabis goods to quality test the elements listed above. Once a representative sample of a batch of cannabis goods is submitted for COA testing, the Company cannot conduct any further manufacturing, packaging, or other activity that may impact the quality, form, or purity of the overall batch. Batches that receive a “failing” COA must be remediated or destroyed in compliance with applicable regulations. Batches that receive a “passing” COA are cleared for entry into the commercial market.

15