- ESAB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ESAB (ESAB) 8-KRegulation FD Disclosure

Filed: 21 Mar 22, 7:19am

Exhibit 99.1

DISCLAIMER This document has been prepared by ESAB Corporation, a Delaware corporation (the “Company” or “ESAB”), solely for informational purposes. Upon completion of the intended separation of Colfax Corporation’s (“Colfax”) fabrication technology and specialty medical technology businesses (the “Separation”), ESAB will hold the fabrication technology business and become an independent, publicly traded company. References herein to the terms “ESAB” and the “Company” when used in a historical context, refer to Colfax’s fabrication technology business before giving effect to the Separation and, when used in the future tense, refer to ESAB Corporation and its consolidated subsidiaries after giving effect to the Separation. Forward-Looking Statements This document includes forward-looking statements, including forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning the Company’s plans, goals, objectives, outlook, expectations and intentions, including the Separation, and the timing, method and anticipated benefits of the Separation and other statements that are not historical or current fact. Forward-looking statements are based on the Company’s current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements, including general risks and uncertainties such as market conditions, economic conditions, geopolitical events, changes in laws, regulations or accounting rules, fluctuations in interest rates, terrorism, wars or conflicts, major health concerns, natural disasters or other disruptions of expected business conditions. Factors that could cause the Company’s results to differ materially from current expectations include, but are not limited to, risks related to the impact of the COVID-19 global pandemic, including the rise, prevalence and severity of variants of the virus, actions by governments, businesses and individuals in response to the situation, such as the scope and duration of the outbreak, the nature and effectiveness of government actions and restrictive measures implemented in response; the war in the Ukraine and escalating geopolitical tensions as a result of Russia’s invasion of the Ukraine; macroeconomic conditions; supply chain disruptions; the impact on creditworthiness and financial viability of customers; risks relating to the Separation, including the uncertainty of obtaining regulatory approvals, Colfax’s ability to satisfactorily complete steps necessary for the Separation and related transactions to be generally tax-free for U.S. federal income tax purposes, the ability to satisfy the necessary conditions to complete the Separation on a timely basis, or at all, the ability to realize the anticipated benefits of the Separation, developments related to the impact of the COVID-19 pandemic on the Separation, and the financial and operating performance of the Company following the Separation; other impacts on the Company’s business and ability to execute business continuity plans; and the other factors detailed in the Company’s registration statement on Form 10, as it may be further amended (the “Form 10”), relating to the Separation filed with the U.S. Securities and Exchange Commission. In addition, these statements are based on assumptions that are subject to change. This document speaks only as of the date hereof. The Company disclaims any duty to update the information herein. Non-GAAP Financial Measures This document includes a presentation of adjusted EBITDA (adjusted EBITA plus depreciation and other amortization), adjusted EBITDA margin, organic (core) sales growth, and free cash flow and other financial measures that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), which ESAB uses to measure the performance of its business. The non-GAAP financial measures provided herein are adjusted for certain items as presented in the Appendix and should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measures, and may not be comparable to similarly titled measures reported by other companies. Management believes that these non-GAAP financial measures provide useful information to investors by offering additional ways of viewing ESAB’s results, and represent the following: Adjusted EBITA represents net income excluding the effect of restructuring and other related charges, acquisition-related amortization and other non-cash charges, pension settlement loss, income tax expense, and interest income, net; Adjusted EBITDA represents Adjusted EBITA excluding the effect of depreciation and other amortization; Adjusted net income represents Net income (loss) excluding restructuring and other related charges, pension settlement gain (loss), acquisition-related amortization and other non-cash charges, and the tax impact of the items excluded from pre-tax income; Free cash flow represents Net cash flow from operating activities less purchases of property, plant and equipment; and Cash conversion represents Free cash flow as a percentage of Adjusted net income. Management also believes that presenting these measures allows investors to view its performance using the same measures that ESAB uses in evaluating our financial and business performance and trends. See the Appendix to this presentation for a reconciliation of these non-GAAP measures to their closest equivalent GAAP measures. No Solicitation, No Offer, Additional Information This communication shall not constitute an offer of any securities for sale, nor shall there be any offer, safe or distribution of securities in any jurisdiction in which such offer, sale or distribution would be unlawful prior to appropriate registration or qualification under the securities law of such jurisdiction. For additional information with respect to ESAB and the Separation, please refer to the Form 10. The consummation of the Separation is subject to customary conditions, as further described in the Form 10. The financial information included in this document may not necessarily reflect ESAB’s financial position, results of operations, and cash flows in the future or what ESAB’s financial position results of operations, and cash flows would have been had ESAB been a standalone independent, publicly traded company during the periods presented. Forward Looking Statement & Non-GAAP Disclaimer 2

About ESAB Our Competitive Advantage Delivering for Our Shareholders TODAY’S KEY THEMES TODAY’S PRESENTERS Shyam P. Kambeyanda President and Chief Executive Officer Kevin Johnson Chief Financial Officer 3

ESAB Corporation’s Purpose and Values PURPOSE STATEMENT VALUES

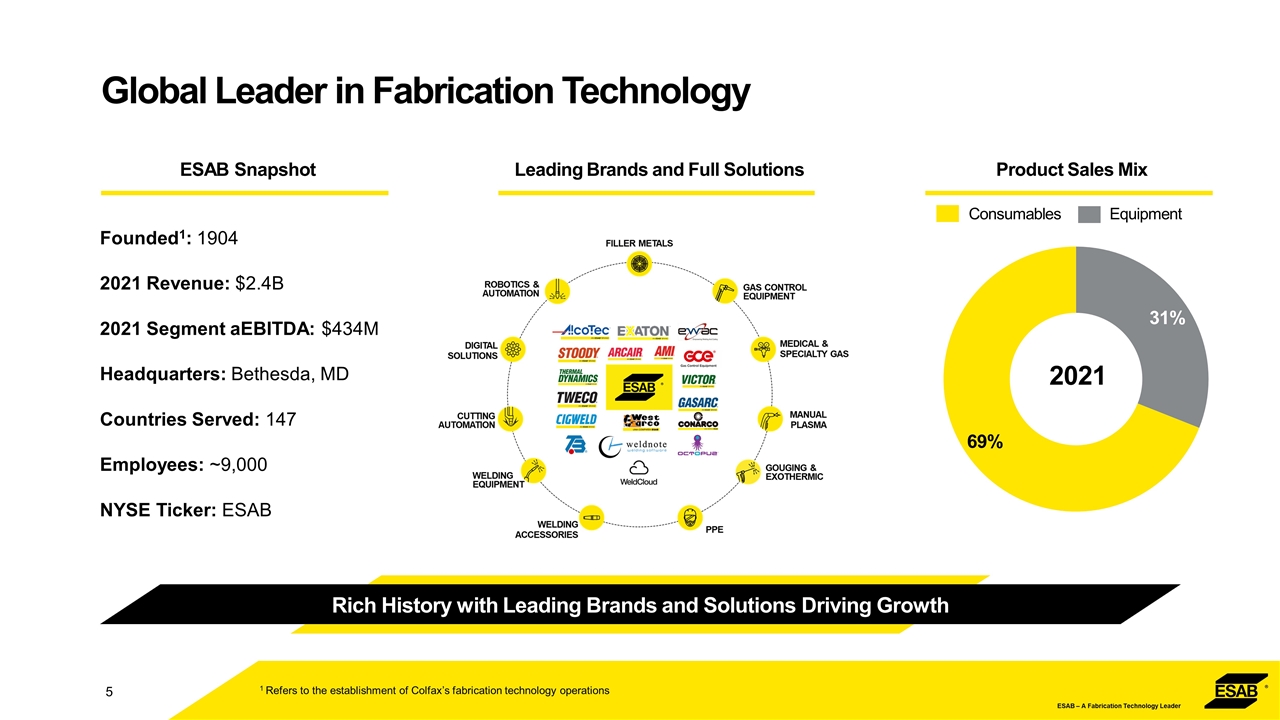

Global Leader in Fabrication Technology 5 Rich History with Leading Brands and Solutions Driving Growth Product Sales Mix 2021 Leading Brands and Full Solutions ESAB Snapshot Founded1: 1904 2021 Revenue: $2.4B 2021 Segment aEBITDA: $434M Headquarters: Bethesda, MD Countries Served: 147 Employees: ~9,000 NYSE Ticker: ESAB 1 Refers to the establishment of Colfax’s fabrication technology operations

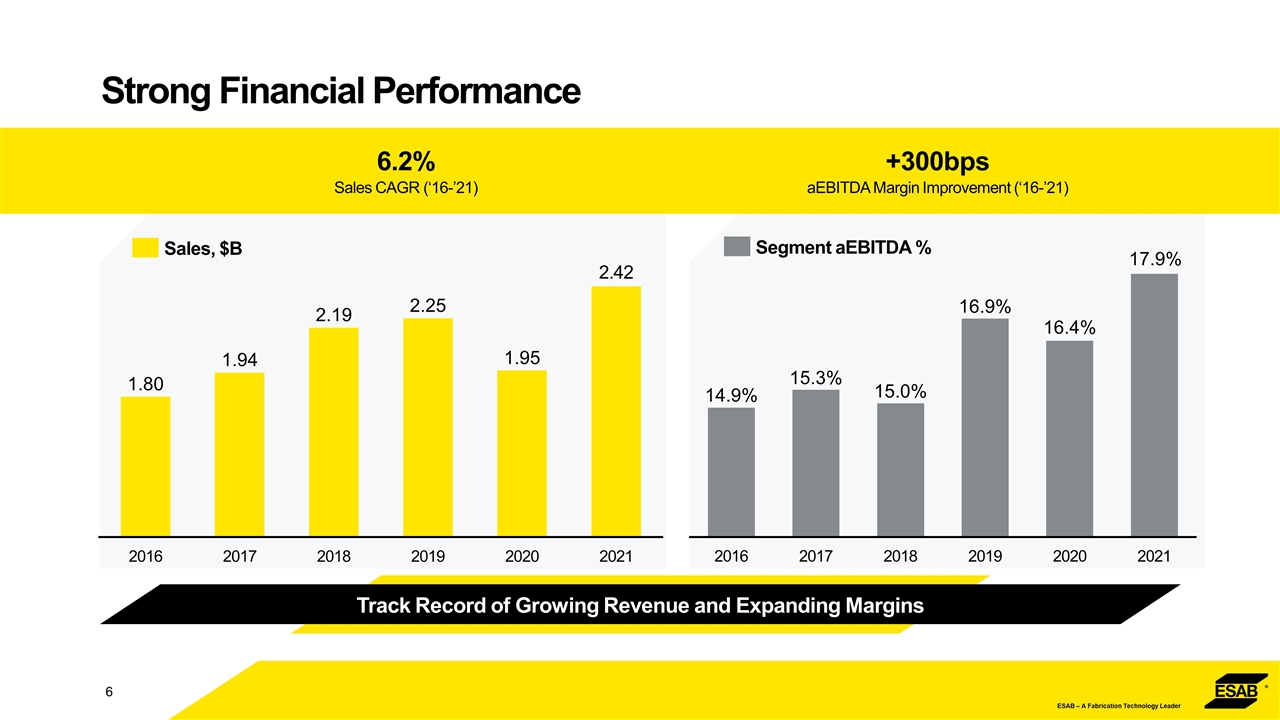

2021 2.42 6.2% Sales CAGR (‘16-’21) +300bps aEBITDA Margin Improvement (‘16-’21) Strong Financial Performance Track Record of Growing Revenue and Expanding Margins Segment aEBITDA % %

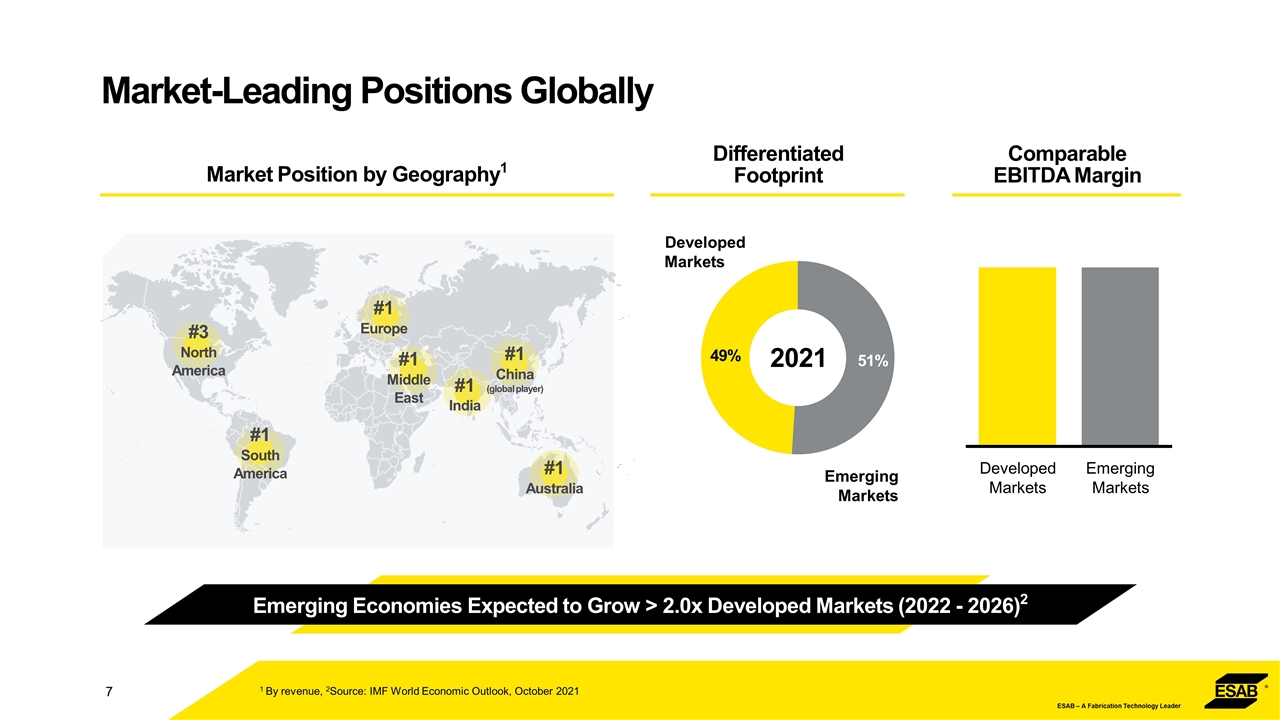

#1 Europe #1 India #1 South America #3 North America #1 China (global player) #1 Middle East #1 Australia Market-Leading Positions Globally Market Position by Geography1 Differentiated Footprint Emerging Economies Expected to Grow > 2.0x Developed Markets (2022 - 2026)2 1 By revenue, 2Source: IMF World Economic Outlook, October 2021 Emerging Markets Developed Markets Comparable EBITDA Margin Emerging Markets Developed Markets 2021

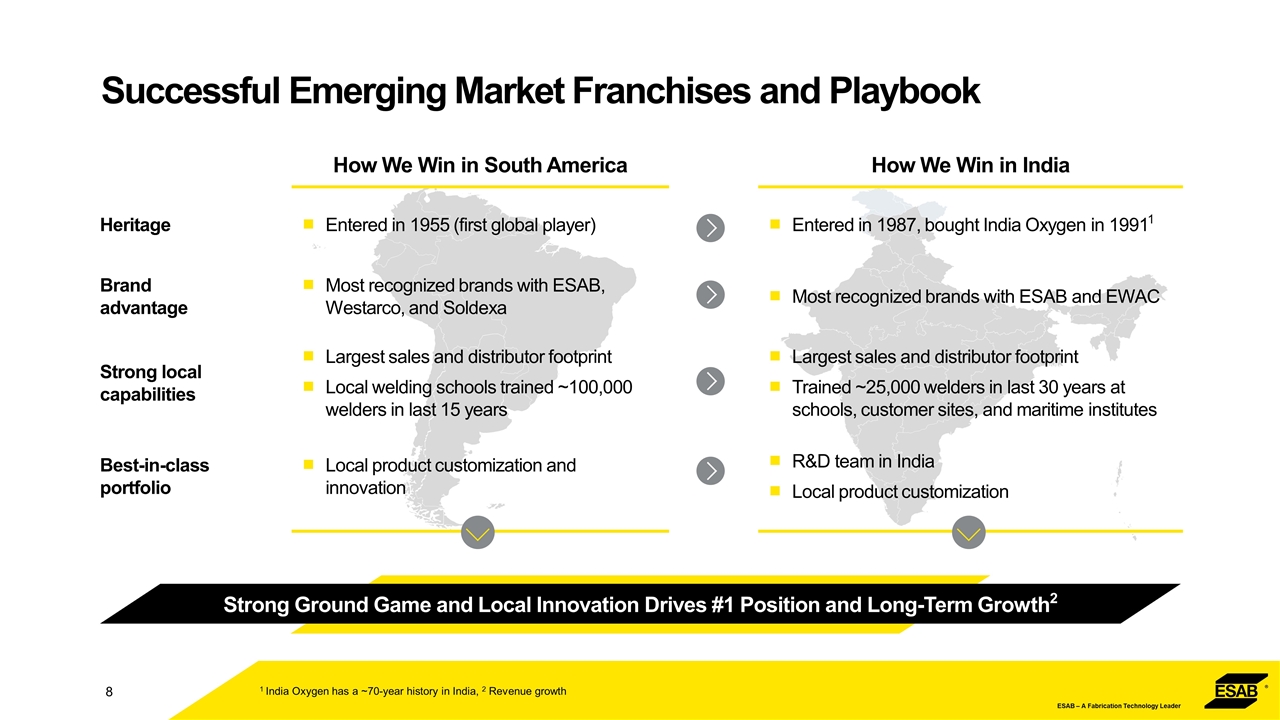

How We Win in South America How We Win in India Heritage Entered in 1955 (first global player) Entered in 1987, bought India Oxygen in 19911 Brand advantage Most recognized brands with ESAB, Westarco, and Soldexa Most recognized brands with ESAB and EWAC Strong local capabilities Largest sales and distributor footprint Local welding schools trained ~100,000 welders in last 15 years Largest sales and distributor footprint Trained ~25,000 welders in last 30 years at schools, customer sites, and maritime institutes Best-in-class portfolio Local product customization and innovation R&D team in India Local product customization Successful Emerging Market Franchises and Playbook Strong Ground Game and Local Innovation Drives #1 Position and Long-Term Growth2 1 India Oxygen has a ~70-year history in India, 2 Revenue growth

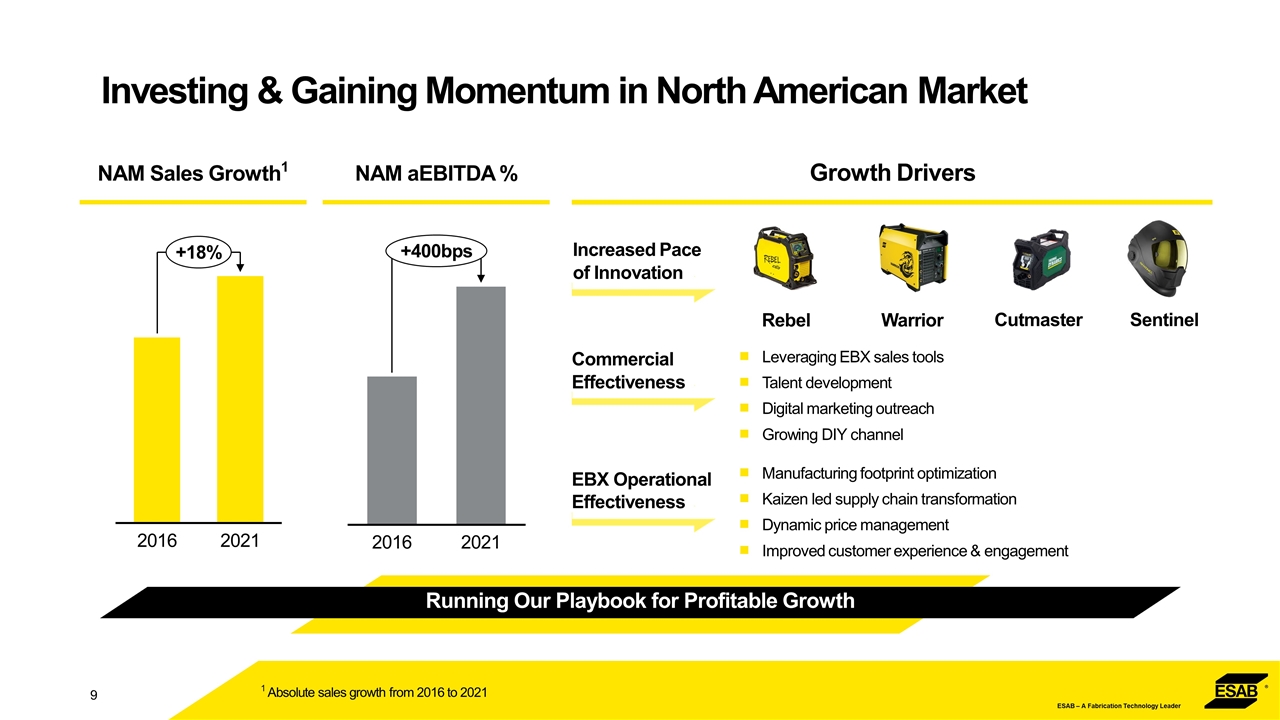

1 Absolute sales growth from 2016 to 2021 Investing & Gaining Momentum in North American Market Growth Drivers Leveraging EBX sales tools Talent development Digital marketing outreach Growing DIY channel +400bps Increased Pace of Innovation Commercial Effectiveness EBX Operational Effectiveness Rebel Warrior Cutmaster Sentinel Manufacturing footprint optimization Kaizen led supply chain transformation Dynamic price management Improved customer experience & engagement NAM Sales Growth1 NAM aEBITDA % Running Our Playbook for Profitable Growth

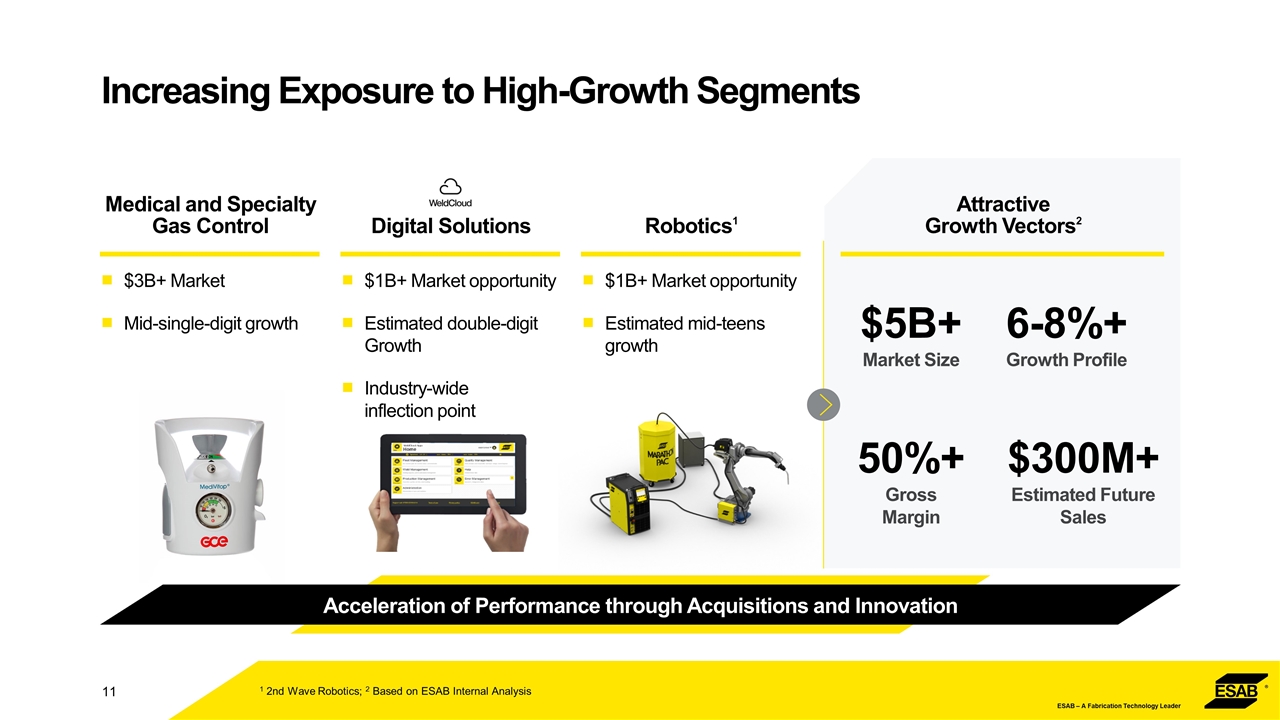

1 Green indicates ESAB overweight to market or key focus area, 2 Source: ESAB Internal Analysis, IHS Markit 2021, 3 Total Addressable Market (TAM) defined as established equipment and consumable products as well as new products in automation, software and services; estimated based on public data from peer companies, customer surveys, and market analysis conducted by ESAB sales function Secular Trends Driving Attractive Growth Opportunities Secular Growth Drivers Welder shortage driving robotics Infrastructure investment Advanced materials and lightweighting Connected devices / IoT Regulatory and safety Welding and cutting Gas management Positioning the Business for Higher Growth in $30B Market3 General Fabrication Infrastructure & Constr. Oil & Gas Healthcare, Laboratory, & Process $25B Market Established Markets Growing 2 - 3% p.a.2 30% 16% 13% Other (Defense, Ship, Rail) Digital Solutions Robotics Automotive & Vehicles 8% 10% $5B Market Expanding TAM Into Faster Growing Markets Est. Market Split1,2: Mobile Machinery Renewable Energy 6% 5% 12% Medical & Specialty Gas Control Increasing Exposure to Higher Growth Segments 6 - 8% p.a.2

Medical and Specialty Gas Control $3B+ Market Mid-single-digit growth 1 2nd Wave Robotics; 2 Based on ESAB Internal Analysis Increasing Exposure to High-Growth Segments Digital Solutions $1B+ Market opportunity Estimated double-digit Growth Industry-wide inflection point Robotics1 $1B+ Market opportunity Estimated mid-teens growth Attractive Growth Vectors2 Acceleration of Performance through Acquisitions and Innovation $5B+ Market Size 6-8%+ Growth Profile 50%+ Gross Margin $300M+ Estimated Future Sales

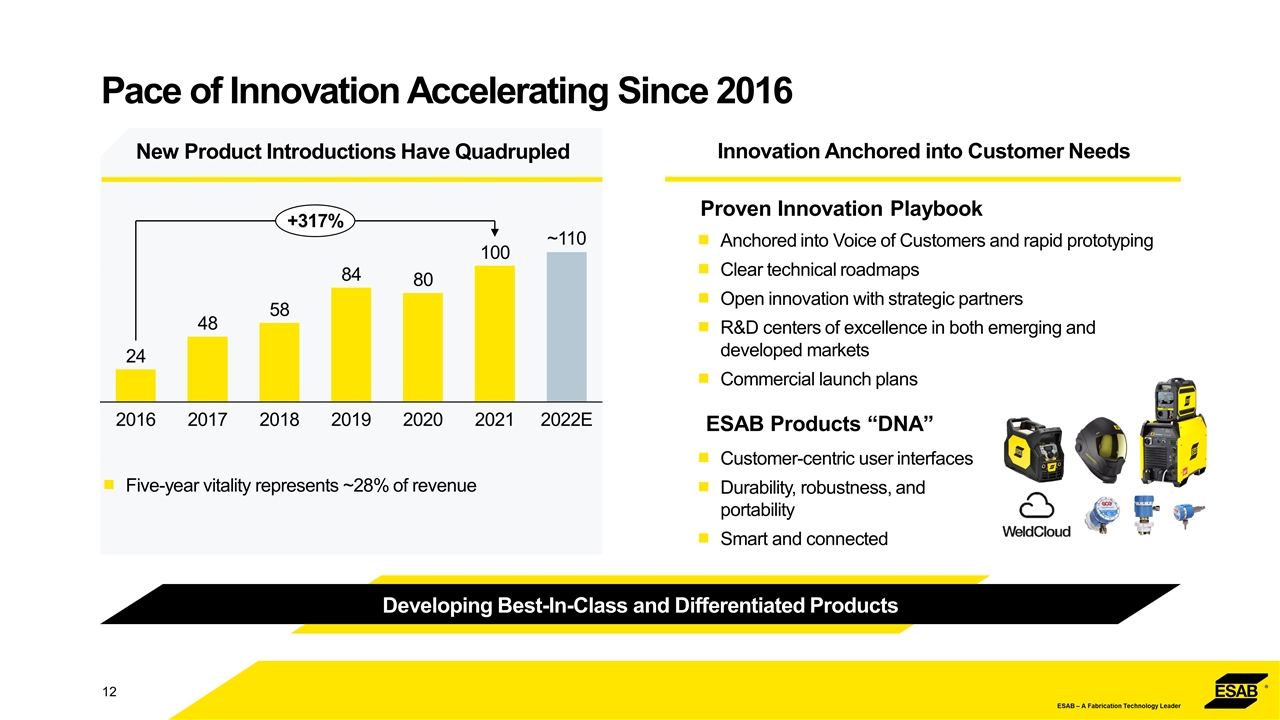

Innovation Anchored into Customer Needs New Product Introductions Have Quadrupled Pace of Innovation Accelerating Since 2016 Customer-centric user interfaces Durability, robustness, and portability Smart and connected Five-year vitality represents ~28% of revenue Anchored into Voice of Customers and rapid prototyping Clear technical roadmaps Open innovation with strategic partners R&D centers of excellence in both emerging and developed markets Commercial launch plans Proven Innovation Playbook ESAB Products “DNA” Developing Best-In-Class and Differentiated Products E ~

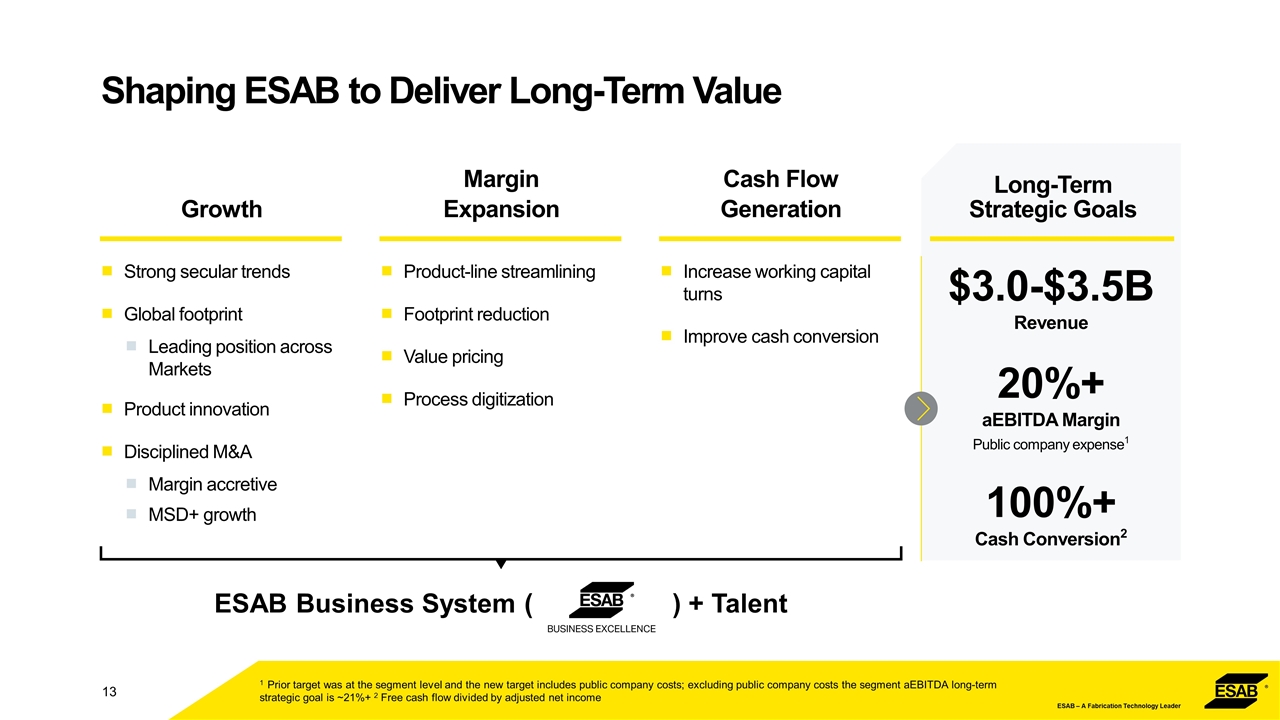

Growth Strong secular trends Global footprint Leading position across Markets Product innovation Disciplined M&A Margin accretive MSD+ growth 1 Prior target was at the segment level and the new target includes public company costs; excluding public company costs the segment aEBITDA long-term strategic goal is ~21%+ 2 Free cash flow divided by adjusted net income Shaping ESAB to Deliver Long-Term Value Margin Expansion Product-line streamlining Footprint reduction Value pricing Process digitization Cash Flow Generation Increase working capital turns Improve cash conversion Long-Term Strategic Goals $3.0-$3.5B Revenue 20%+ aEBITDA Margin Public company expense1 100%+ Cash Conversion2 ESAB Business System ( ) + Talent

Appendix

Innovation

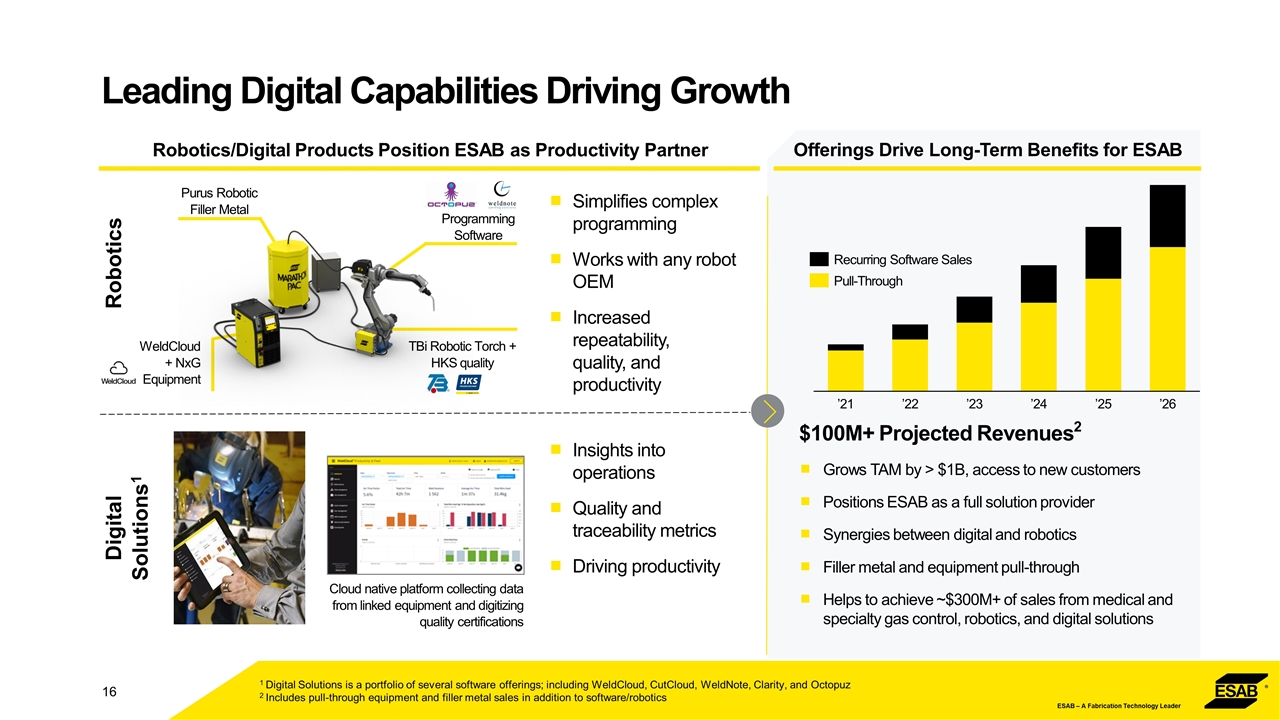

Leading Digital Capabilities Driving Growth Robotics/Digital Products Position ESAB as Productivity Partner WeldCloud + NxG Equipment TBi Robotic Torch + HKS quality Purus Robotic Filler Metal Programming Software Offerings Drive Long-Term Benefits for ESAB $100M+ Projected Revenues2 Robotics Digital Solutions1 1 Digital Solutions is a portfolio of several software offerings; including WeldCloud, CutCloud, WeldNote, Clarity, and Octopuz 2 Includes pull-through equipment and filler metal sales in addition to software/robotics Simplifies complex programming Works with any robot OEM Increased repeatability, quality, and productivity Insights into operations Quality and traceability metrics Driving productivity Cloud native platform collecting data from linked equipment and digitizing quality certifications Grows TAM by > $1B, access to new customers Positions ESAB as a full solution provider Synergies between digital and robotics Filler metal and equipment pull-through Helps to achieve ~$300M+ of sales from medical and specialty gas control, robotics, and digital solutions

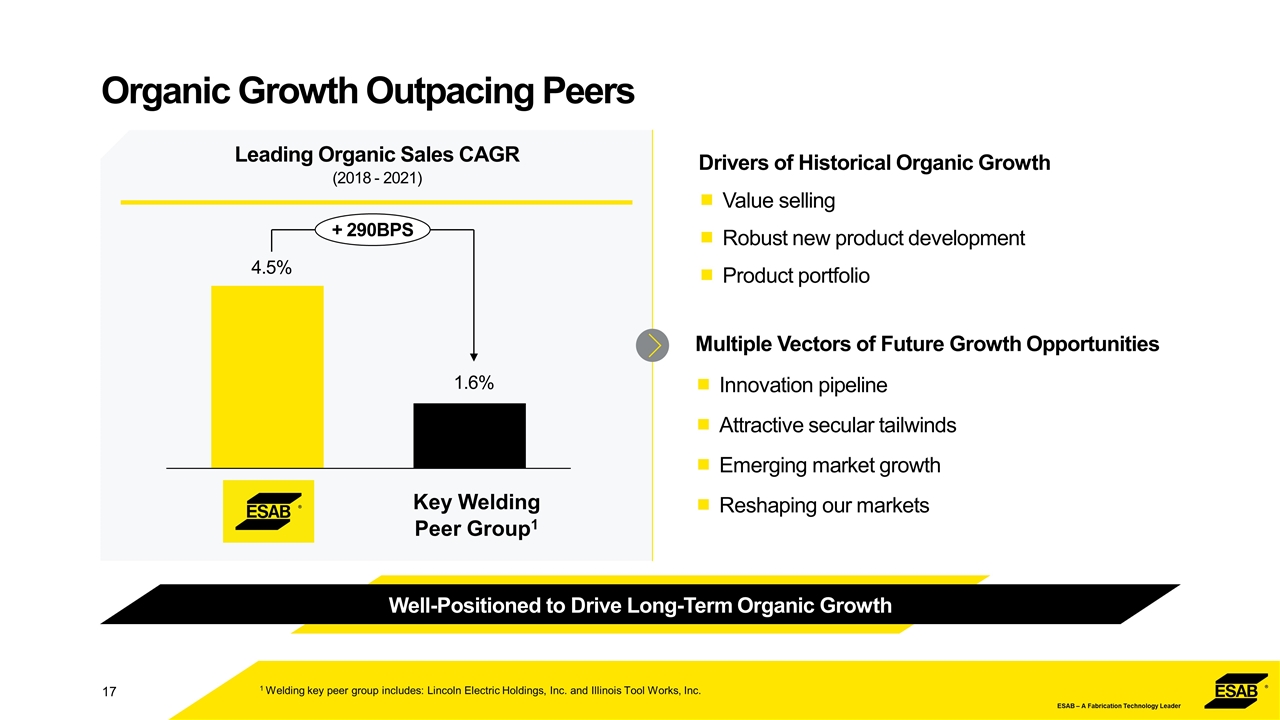

Organic Growth Outpacing Peers 17 Well-Positioned to Drive Long-Term Organic Growth Drivers of Historical Organic Growth Value selling Robust new product development Product portfolio Multiple Vectors of Future Growth Opportunities Innovation pipeline Attractive secular tailwinds Emerging market growth Reshaping our markets Leading Organic Sales CAGR (2018 - 2021) 1.6% + 290BPS Key Welding Peer Group1 1 Welding key peer group includes: Lincoln Electric Holdings, Inc. and Illinois Tool Works, Inc.

M&A Strategy and ESAB Business Excellence (EBX)

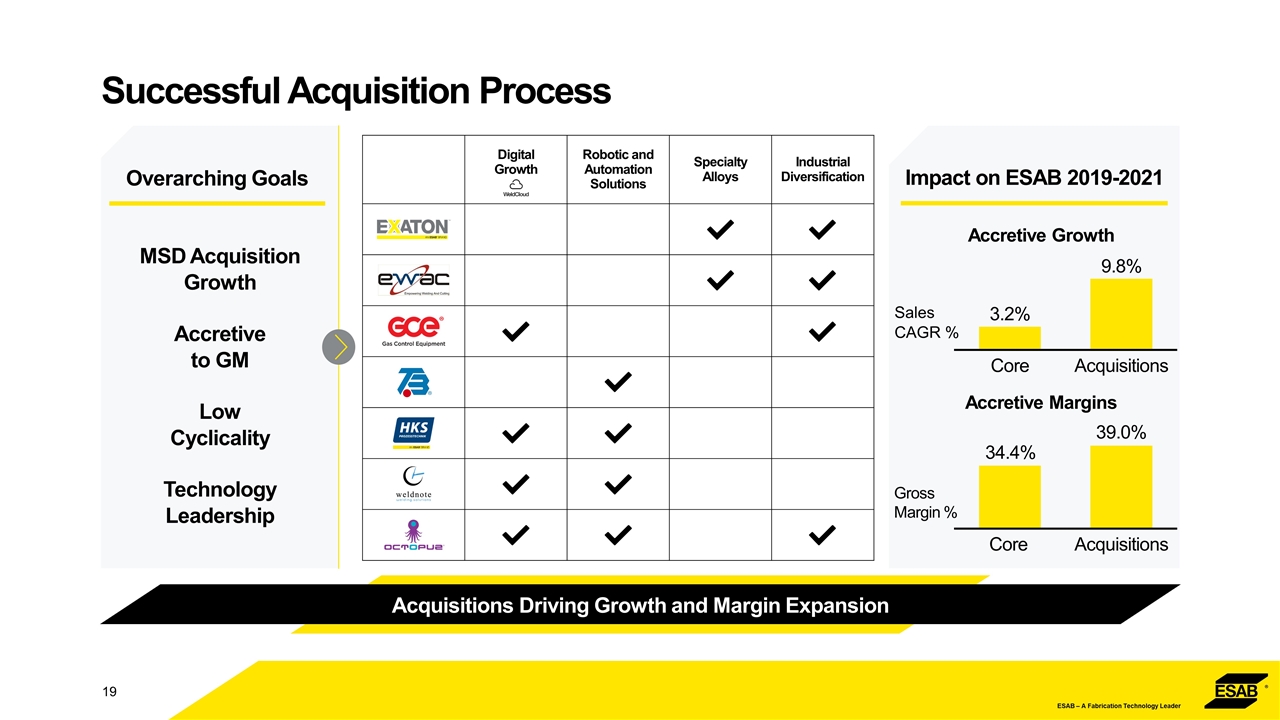

Successful Acquisition Process Acquisitions Driving Growth and Margin Expansion Overarching Goals Accretive to GM MSD Acquisition Growth Low Cyclicality Impact on ESAB 2019-2021 Technology Leadership Digital Growth Robotic and Automation Solutions Specialty Alloys Industrial Diversification Gross Margin % Accretive Margins Sales CAGR % Accretive Growth

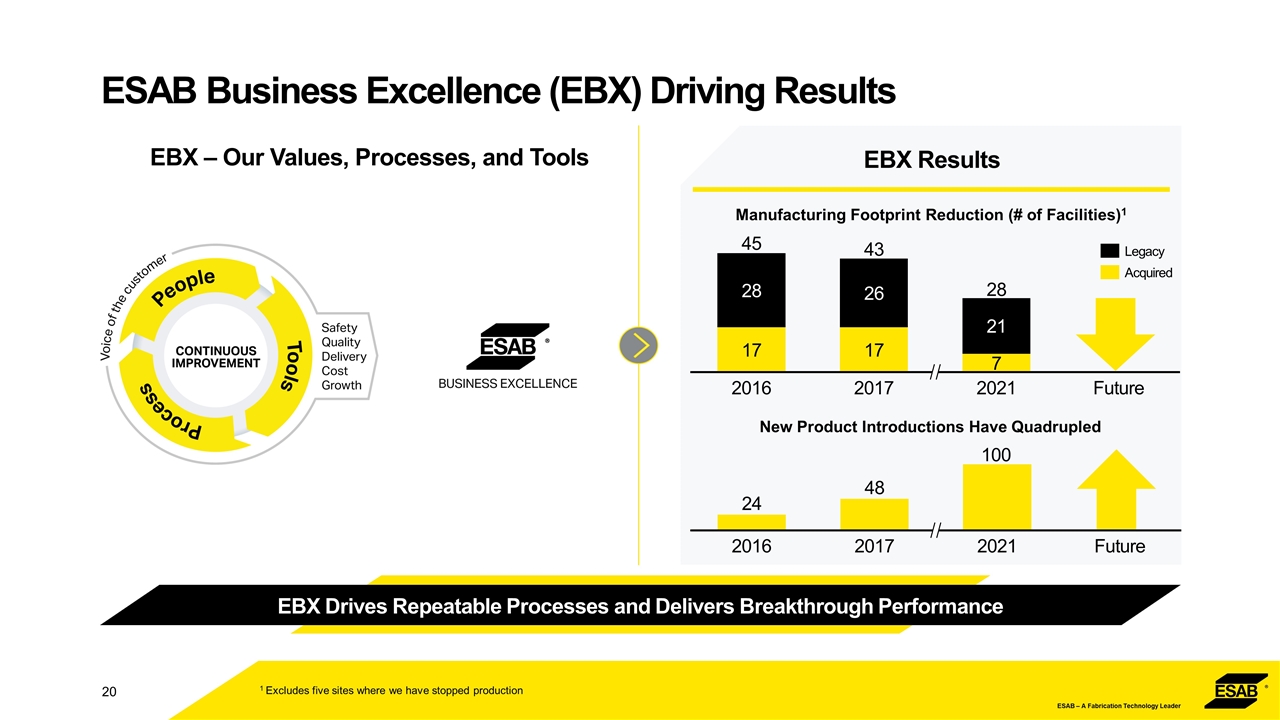

ESAB Business Excellence (EBX) Driving Results EBX Results EBX Drives Repeatable Processes and Delivers Breakthrough Performance EBX – Our Values, Processes, and Tools Manufacturing Footprint Reduction (# of Facilities)1 New Product Introductions Have Quadrupled 1 Excludes five sites where we have stopped production

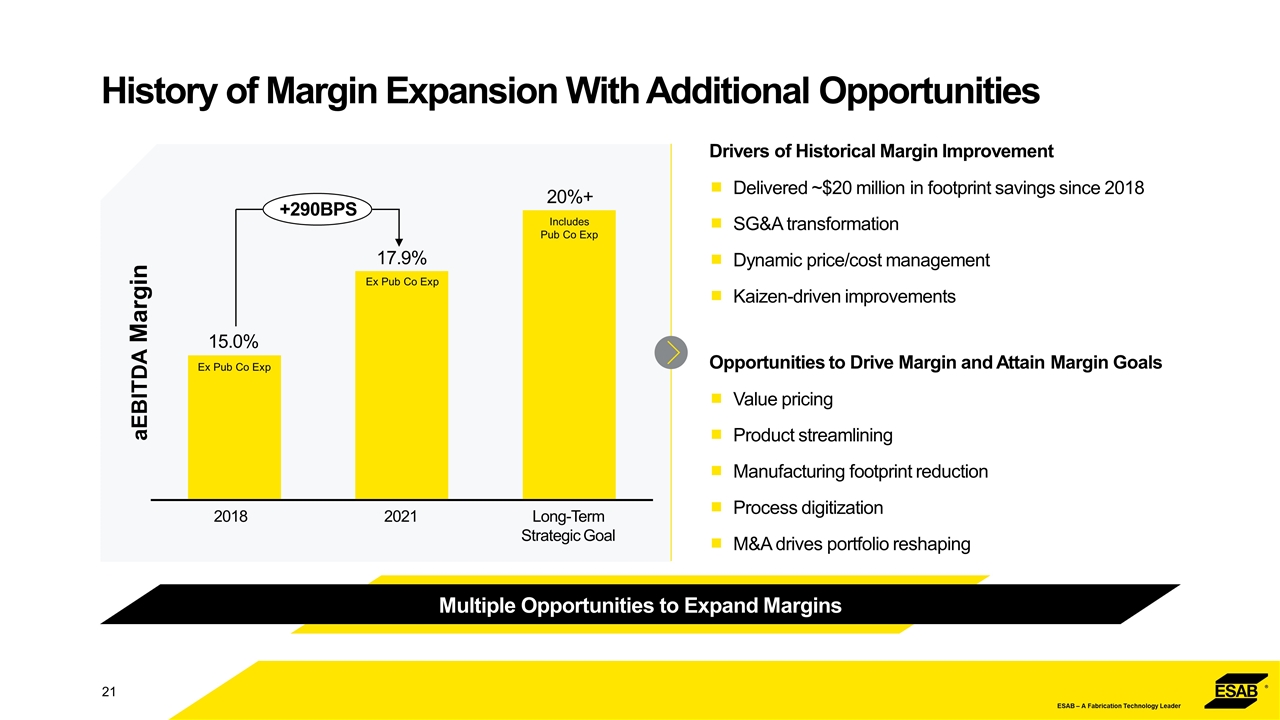

History of Margin Expansion With Additional Opportunities Multiple Opportunities to Expand Margins aEBITDA Margin Long-Term Strategic Goal 20%+ +290BPS Drivers of Historical Margin Improvement Delivered ~$20 million in footprint savings since 2018 SG&A transformation Dynamic price/cost management Kaizen-driven improvements Opportunities to Drive Margin and Attain Margin Goals Value pricing Product streamlining Manufacturing footprint reduction Process digitization M&A drives portfolio reshaping Ex Pub Co Exp Ex Pub Co Exp Includes Pub Co Exp

Financial Performance

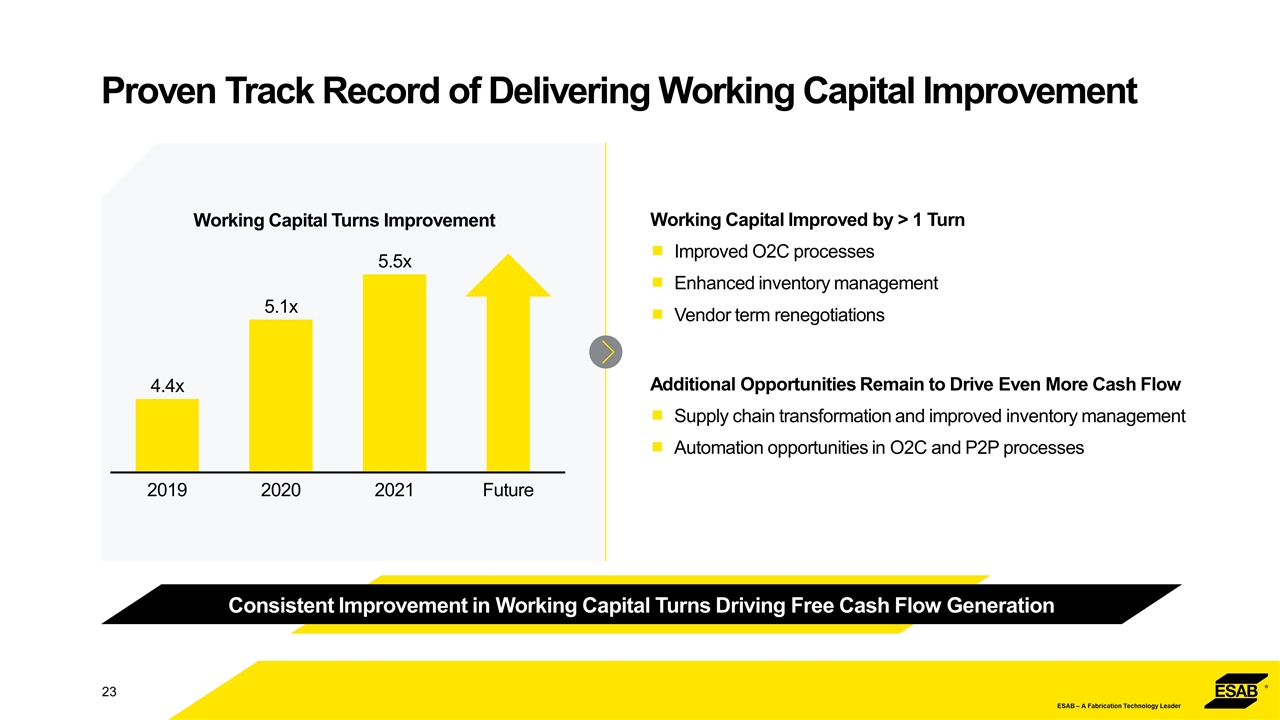

2021 Working Capital Improved by > 1 Turn Improved O2C processes Enhanced inventory management Vendor term renegotiations Proven Track Record of Delivering Working Capital Improvement Consistent Improvement in Working Capital Turns Driving Free Cash Flow Generation Working Capital Turns Improvement Additional Opportunities Remain to Drive Even More Cash Flow Supply chain transformation and improved inventory management Automation opportunities in O2C and P2P processes

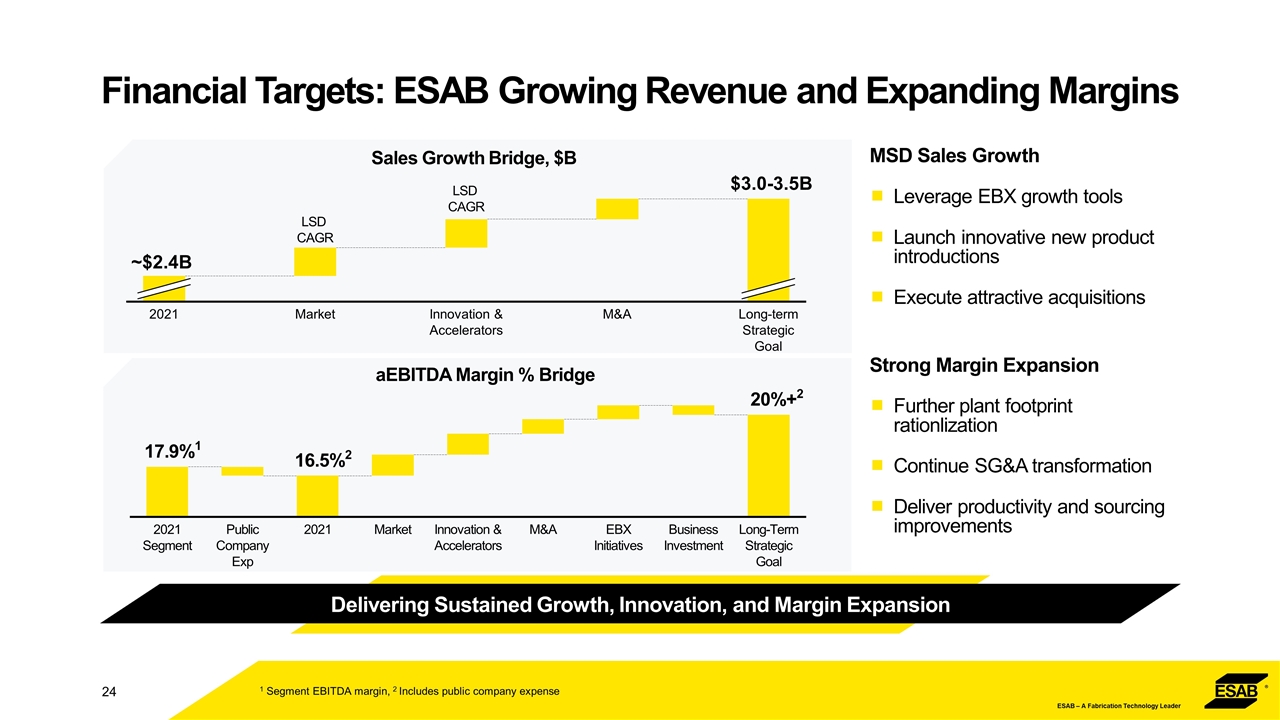

Financial Targets: ESAB Growing Revenue and Expanding Margins MSD Sales Growth Leverage EBX growth tools Launch innovative new product introductions Execute attractive acquisitions Strong Margin Expansion Further plant footprint rationlization Continue SG&A transformation Deliver productivity and sourcing improvements Delivering Sustained Growth, Innovation, and Margin Expansion Sales Growth Bridge, $B 1 Segment EBITDA margin, 2 Includes public company expense aEBITDA Margin % Bridge 20%+2 1 2 ~$B $3.0-3.5B LSD CAGR LSD CAGR

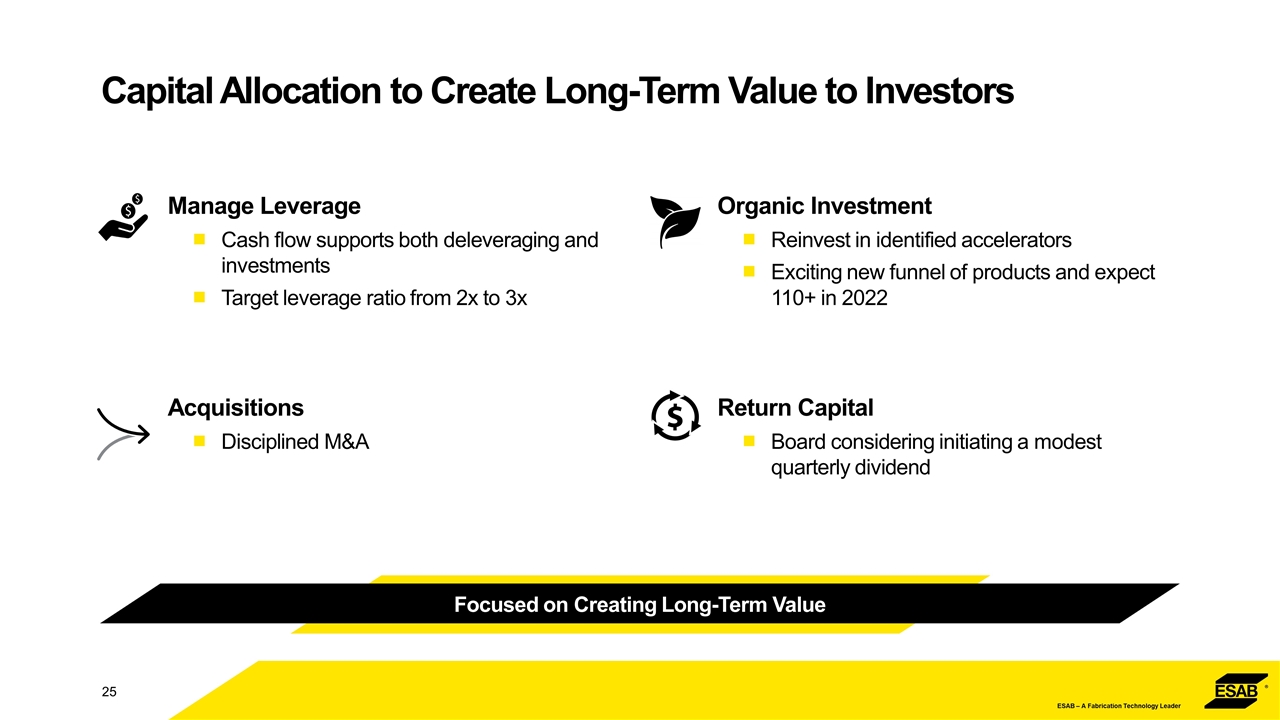

Organic Investment Reinvest in identified accelerators Exciting new funnel of products and expect 110+ in 2022 Manage Leverage Cash flow supports both deleveraging and investments Target leverage ratio from 2x to 3x Acquisitions Disciplined M&A Return Capital Board considering initiating a modest quarterly dividend Capital Allocation to Create Long-Term Value to Investors Focused on Creating Long-Term Value

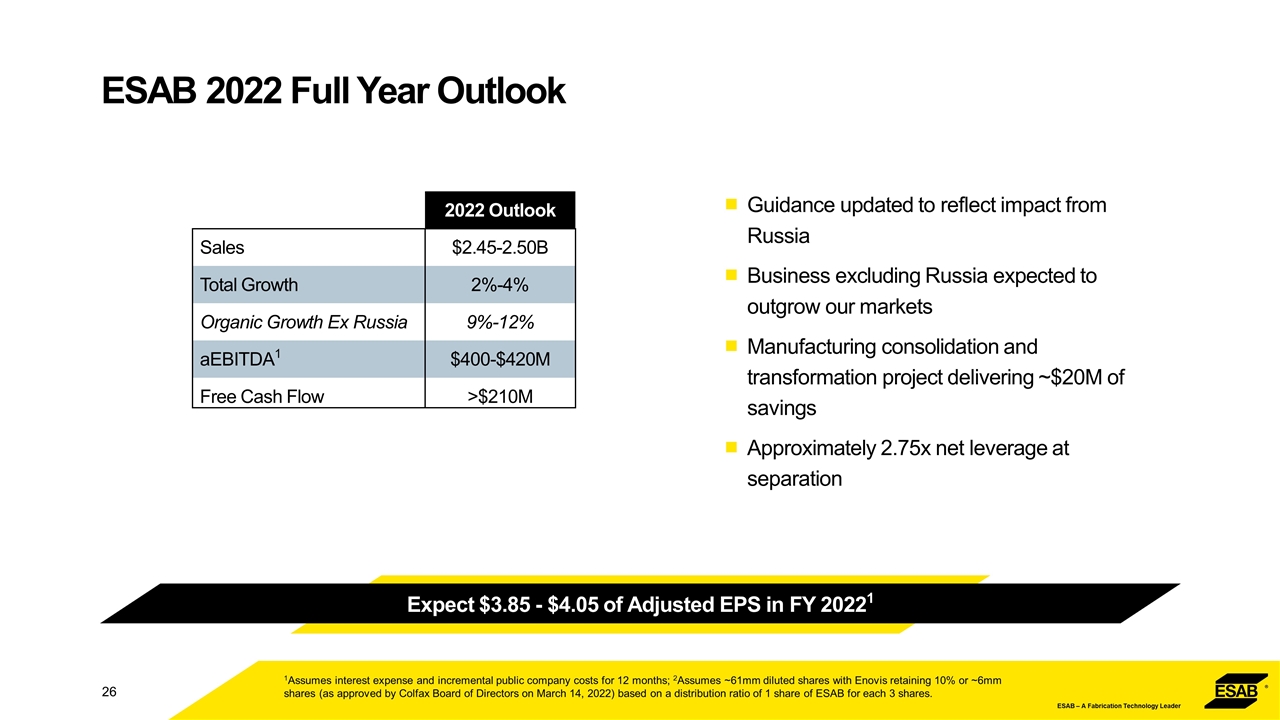

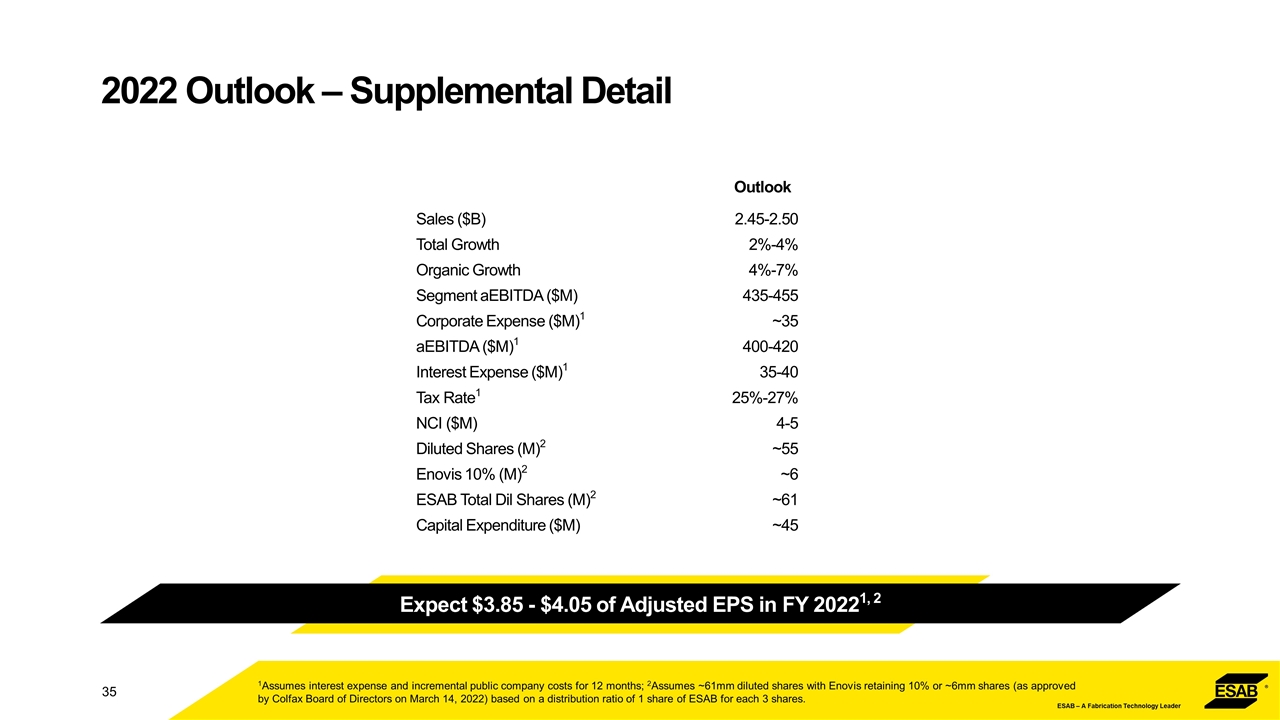

ESAB 2022 Full Year Outlook Expect $3.85 - $4.05 of Adjusted EPS in FY 20221 Guidance updated to reflect impact from Russia Business excluding Russia expected to outgrow our markets Manufacturing consolidation and transformation project delivering ~$20M of savings Approximately 2.75x net leverage at separation 1Assumes interest expense and incremental public company costs for 12 months; 2Assumes ~61mm diluted shares with Enovis retaining 10% or ~6mm shares (as approved by Colfax Board of Directors on March 14, 2022) based on a distribution ratio of 1 share of ESAB for each 3 shares. 1

Environmental, Social & Governance (ESG)

ESAB Committed to ESG Building a Sustainable Business Environmental Committed to reducing ESAB’s impact on climate change Social Responsibility Creating an inclusive culture for all stakeholders Governance Serving our stakeholders the right way today and tomorrow Safety Focused on creating a safe place to work Reduced TRIR from 0.97 in 2016 to 0.33 in 2021 Greenhouse Gas/Waste Management ~35% reduction of manufacturing footprint since 2016, reducing GHG and landfill waste Sustainability R&D investment to increase sustainability

Talent & Summary

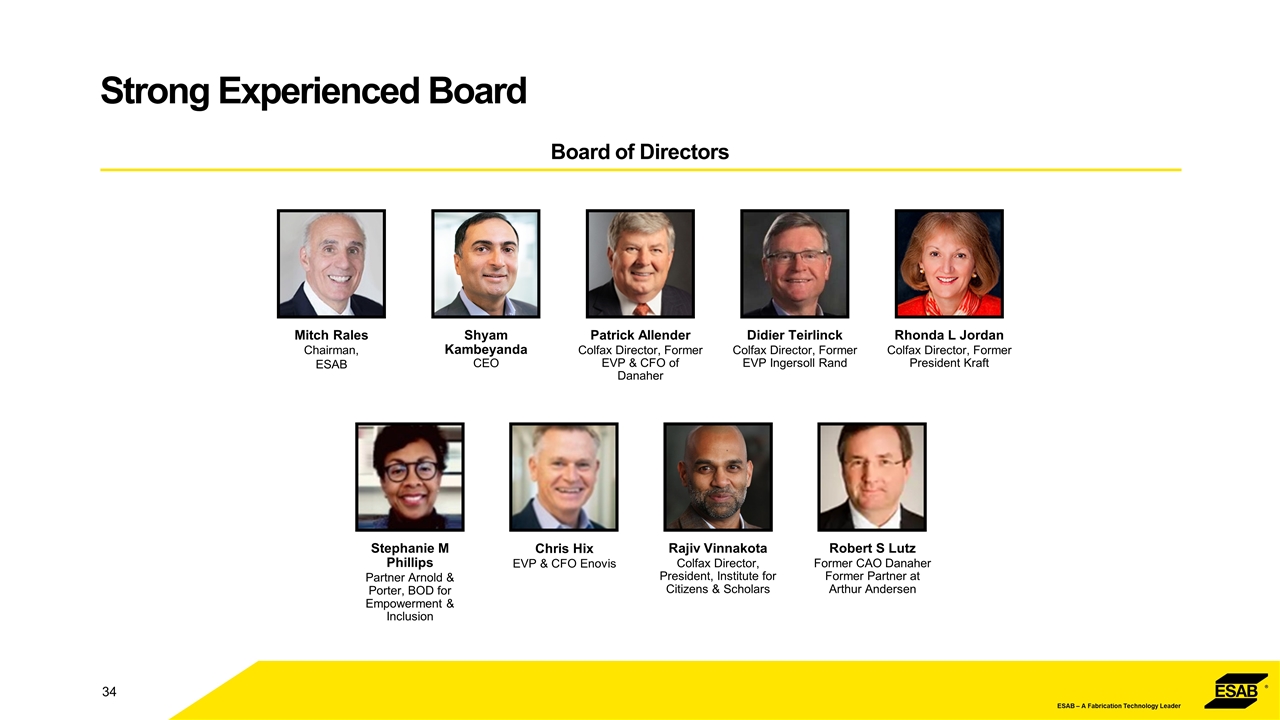

Strong Experienced Leadership Team Significant Industrial Experience Providing Platform for Growth and Expansion Shyam P. Kambeyanda President, Chief Executive Officer Kevin Johnson Chief Financial Officer Executive Officers Vusa Mlingo Senior Vice President, Strategy and Business Development Michele Campion Chief Human Resources Officer Olivier Biebuyck President, EMEA and Global Products Larry Coble Senior Vice President, EBX, Supply Chain Curtis Jewell General Counsel and Corporate Secretary Mitch Rales Chairman

1 Prior target was at the segment level and the new target includes public company costs; excluding public company costs the segment aEBITDA long-term strategic goal is ~21%+ 2 Free cash flow divided by adjusted net income ESAB: A Premier Fabrication Technology Company $3.0-$3.5B Revenue 20%+ aEBITDA Margin Public Company Expense1 100%+ Cash Conversion2 Long-Term Strategic Goals Innovative portfolio winning with customers Focused on growing shareholder value Strong balance sheet Track record of margin expansion and revenue growth Secular tailwinds driving $30B total addressable market

Shyam Kambeyanda Chief Executive Officer Joined ESAB in 2016 Previously worked at Eaton Corporation for 21 years, where he rose to become president of the company's hydraulics business operation in the Americas. Served in key leadership roles, driving the company’s transformation and growth in Asia, Europe and North America. Bachelor’s degrees in physics and general science from Coe College in Iowa, bachelor's of science in electrical engineering from Iowa State University and master’s in business administration from the Kellogg School of Management at Northwestern University. Kevin Johnson Chief Financial Officer Joined ESAB in 2019 Previously Vice President of Finance at Colfax Corporation, which he assumed in 2017. In this role, led investor relations, FP&A, and supported acquisition diligence and integration, including being part of the team that acquired DJO Global. Joined Colfax Corporate from Howden, where he held roles of increasing responsibility including as CFO for its South African publicly-listed company. Bachelor of Science at Queen’s University in Belfast, Ireland, and MBA at the University of Hasselt, Belgium. Master’s degree in accounting at Macquarie University in Sydney, Australia and earned his CPA in Australia. Best Team Wins: ESAB Presenters

Strong Experienced Board Mitch Rales Chairman, ESAB Shyam Kambeyanda CEO Patrick Allender Colfax Director, Former EVP & CFO of Danaher Didier Teirlinck Colfax Director, Former EVP Ingersoll Rand Rhonda L Jordan Colfax Director, Former President Kraft Stephanie M Phillips Partner Arnold & Porter, BOD for Empowerment & Inclusion Chris Hix EVP & CFO Enovis Rajiv Vinnakota Colfax Director, President, Institute for Citizens & Scholars Robert S Lutz Former CAO Danaher Former Partner at Arthur Andersen Board of Directors

2022 Outlook – Supplemental Detail Expect $3.85 - $4.05 of Adjusted EPS in FY 20221, 2 1 1 1 1 2 1Assumes interest expense and incremental public company costs for 12 months; 2Assumes ~61mm diluted shares with Enovis retaining 10% or ~6mm shares (as approved by Colfax Board of Directors on March 14, 2022) based on a distribution ratio of 1 share of ESAB for each 3 shares. 2 2

Non-GAAP Reconciliation Fabrication Technology1 $ $ $2,193.1 $ $ $ $ $ $220.9 10.1% $ $ $ $ $ $29.1 $ $ $ $ $ $250.0 11.4% $ $ $ $ $ $ $40.0 $ $ $ $ $290.0 $ $ $ $ $ $39.9 $ $ $ $ $ $329.9 15.0% $ $ $ 1 Dollars in millions