- ESAB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ESAB (ESAB) DEF 14ADefinitive proxy

Filed: 31 Mar 23, 4:44pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Proxy Statement

and

Notice of Annual Meeting

May 11, 2023 at 3:00 p.m. Eastern Time

Notice of 2023 Annual Meeting of Stockholders

|

Thursday, May 11, 2023

3:00 p.m. Eastern Time

Via live webcast at

www.virtualshareholdermeeting.com/ESAB2023

To Our Stockholders:

Notice is hereby given that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of ESAB Corporation will be held via live webcast at www.virtualshareholdermeeting.com/ESAB2023 on Thursday, May 11, 2023 at 3:00 p.m. Eastern Time, for the following purposes:

| 1. | To elect Mr. Mitchell P. Rales, Ms. Stephanie M. Phillipps and Mr. Didier Teirlinck to serve as Class I Directors, each for a three-year term expiring at the 2026 annual meeting of stockholders and until their successors are elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | To approve the compensation of our named executive officers on an advisory basis (“say-on-pay”); |

| 4. | To approve the frequency of future stockholder advisory votes on the compensation of our named executive officers on an advisory basis; and |

| 5. | To consider any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof. |

The accompanying proxy statement describes the matters to be considered at the Annual Meeting. Only stockholders of record at the close of business on March 20, 2023 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow us to furnish our proxy materials and our annual report to stockholders on the Internet. We believe that posting these materials on the Internet enables us to provide our stockholders with the information that they need more quickly while lowering our costs of printing and delivery and reducing the environmental impact of our Annual Meeting.

We are holding the Annual Meeting in a virtual-only format this year. We believe that this is the right choice for ESAB and its stockholders, as it provides expanded stockholder access, improves communications, alleviates the environmental impact of traveling to an in-person meeting and, given the ongoing COVID-19 pandemic, promotes the health and safety of participants by allowing them to participate from any location. To attend, participate in, and vote during the Annual Meeting and view the list of stockholders of record, stockholders of record must go to the meeting website at www.virtualshareholdermeeting.com/ESAB2023 and enter the control number found on their proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”). If you are a beneficial stockholder who owns common stock in street name, meaning through a bank, broker or other nominee, and your voting instruction form or Notice indicates that you may vote those shares through the http://www.proxyvote.com website, then you may attend, participate in, and vote during the Annual Meeting and view the list of stockholders of record using the 16-digit control number indicated on that voting instruction form or Notice. Otherwise, stockholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting.

As a stockholder of ESAB, your vote is important. Whether or not you plan to attend the Annual Meeting virtually, we urge you to vote your shares at your earliest convenience and thank you for your continued support of ESAB Corporation.

Dated: March 31, 2023

By Order of the Board of Directors

Curtis E. Jewell

Secretary

Table of Contents

| 1 | ||||

| 6 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

Identification of Director Candidates and Director Nomination Process | 21 | |||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 28 | |||

Independent Registered Public Accounting Firm Fees and Services | 28 | |||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

Determination of Executive Compensation and Performance Criteria | 36 | |||

| 37 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

PROPOSAL 4 ADVISORY VOTE ON THE FREQUENCY OF FUTURE SAY-ON-PAY VOTES | 67 | |||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

Annual Meeting of Stockholders

| Date and Time: | Thursday, May 11, 2023 at 3:00 p.m., Eastern Time | |

| Location: | Via live webcast at www.virtualshareholdermeeting.com/ESAB2023 | |

| Record Date: | March 20, 2023 | |

Separation and Company Overview

On April 4, 2022, we completed our separation from Enovis Corporation, formerly known as Colfax Corporation (the “Separation”), creating a premier, publicly-traded global fabrication technology and gas control solutions company.

Today we are a world leader in connected fabrication technology and gas control solutions, providing our partners with advanced equipment, consumables, gas control solutions, robotics, and digital solutions which enable the everyday and extraordinary work that shapes our world. Our world headquarters are in North Bethesda, Maryland and we employ approximately 9,000 associates and serve customers in approximately 150 countries.

Availability of Proxy Materials – Use of Notice and Access

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 11, 2023: Our Annual Report to Stockholders and this Proxy Statement are available at www.proxyvote.com.

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide stockholders access to our proxy materials primarily over the Internet. Accordingly, on or about March 31, 2023, we first sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders entitled to vote at the Annual Meeting as of the close of business on March 20, 2023, the record date of the meeting. The Notice includes instructions on how to access our proxy materials over the Internet and how to request a printed copy of these materials. In addition, by following the instructions in the Notice, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of our annual meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Who May Vote

You may vote if you were a stockholder of record at the close of business on March 20, 2023, the record date.

How to Cast Your Vote

You can vote by any of the following methods:

| Via the internet (www.proxyvote.com) through May 10, 2023; | |

| By telephone (1-800-690-6903) through May 10, 2023;

| |

| By completing, signing and returning your proxy by mail in the envelope provided or to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NJ 11717, by May 10, 2023; or | |

✓ | Via virtual attendance and voting at the Annual Meeting. To attend the Annual Meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/ESAB2023 and enter your control number. Once admitted, you may vote by following the instructions available on the meeting website. If you are a beneficial stockholder who owns shares in street name and have questions about your control number or how to obtain one, please contact the bank, broker or other nominee who holds your shares. | |

2023 Proxy Statement

|

|

1 |

If you are a beneficial stockholder who owns your shares in street name, the availability of online or telephone voting may depend on the voting procedures of the organization that holds your shares.

Voting Matters

We are asking you to vote on the following proposals at the Annual Meeting:

| Proposal | Board Vote Recommendation | |

Proposal 1: Election of Class I Directors (page 11)

|

FOR each Class I Director nominee | |

Proposal 2: Ratification of the appointment of the independent registered accounting firm (page 28)

|

FOR | |

Proposal 3: Approval on an advisory basis of our named executive officer compensation (page 66)

|

FOR | |

Proposal 4: Approval on an advisory basis of the frequency of stockholder advisory votes to approve our named executive officer compensation (page 67)

|

EVERY ONE YEAR |

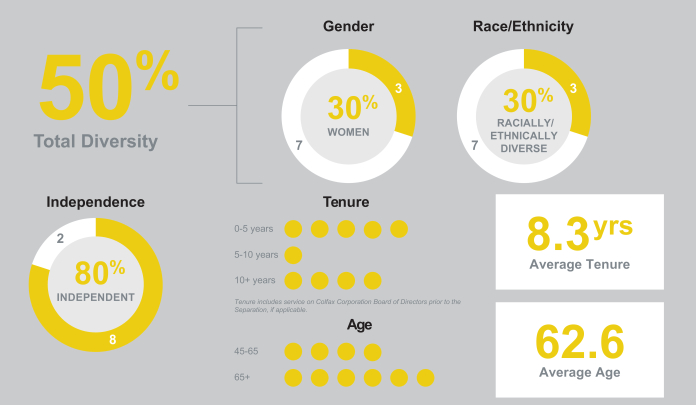

Board and Governance Highlights

| ◾ | 80% independent Board including an independent Chairman of the Board |

| ◾ | 50% of Board is female and/or racially or ethically diverse |

| ◾ | Majority vote for directors in uncontested elections with director resignation policy |

| ◾ | Active Board oversight of strategy, risk management and environmental, social and governance matters |

| ◾ | No “overboarded” directors |

| ◾ | Phase-out for staggered Board with all directors to be elected annually beginning in 2026 |

| ◾ | Rigorous stock ownership requirements for officers and directors |

| ◾ | Anti-hedging, anti-pledging, and clawback policies |

2 |

|

2023 Proxy Statement

|

Board of Directors (page 11)

The following table provides summary information about our Board of Directors, including our Class I Director nominees:

| Name | Age | Director Since | Occupation | Independent | Committee Memberships | Other Public Boards | ||||||

Mitchell P. Rales | 66 | 2022 | Chairman of the Executive Committee, Danaher Corporation | ü | None | Danaher Corporation | ||||||

Shyam P. Kambeyanda | 52 | 2022 | President and Chief Executive Officer, ESAB Corporation | None | None | |||||||

Patrick W. Allender | 76 | 2022 | Former Executive Vice President and Chief Financial Officer, Danaher Corporation | ü | Audit (Chair) Nominating | Brady Corporation | ||||||

Melissa Cummings | 47 | 2022 | Executive Vice President, Strategic Marketing, Westinghouse Electric Company | ü | Audit | None | ||||||

Christopher M. Hix | 61 | 2021 | Former Executive Vice President, Finance, Chief Financial Officer of Enovis Corporation | None | None | |||||||

Rhonda L. Jordan | 65 | 2022 | Former President, Kraft Foods Inc. | ü | Compensation (Chair) Nominating | Ingredion, Inc. | ||||||

Robert S. Lutz | 65 | 2022 | Senior Vice President, Finance and Former Chief Accounting Officer, Danaher Corporation | ü | Audit | None | ||||||

Stephanie M. Phillipps | 71 | 2022 | Former Partner at Arnold & Porter | ü | Compensation | None | ||||||

Didier Teirlinck | 66 | 2022 | Former Executive Vice President, Climate Segment, Ingersoll Rand | ü | Audit | None | ||||||

Rajiv Vinnakota | 52 | 2022 | President, Institute for Citizens & Scholars (formerly the Woodrow Wilson National Fellowship Foundation) | ü | Nominating (Chair) Compensation | Enovis Corporation | ||||||

2023 Proxy Statement

|

|

3 |

Our ten directors have diverse backgrounds, skills and experiences, which the Board believes contributes to the effective oversight of the Company. The following charts summarize the diversity, skills and experience of our Board members:

4 |

|

2023 Proxy Statement

|

| ||||||||||||||||||||||||||

Current or Former CEO. CFO or COO |

|

|

|

|

|

|

|

|

|

| 5/10 | |||||||||||||||

| ||||||||||||||||||||||||||

Other public company board experience |

|

|

|

|

|

|

|

|

|

| 6/10 | |||||||||||||||

| ||||||||||||||||||||||||||

Broad international experience |

|

|

|

|

|

|

|

|

|

| 8/10 | |||||||||||||||

| ||||||||||||||||||||||||||

Extensive MAA or capital markets experience |

|

|

|

|

|

|

|

|

|

| 6/10 | |||||||||||||||

|

| |||||||||||||||||||||||||

Diverse (female or racially/ethnically diverse) |

|

|

|

|

|

|

|

|

|

| 5/10 | |||||||||||||||

| Human capital/talent management experience | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| 2/10 | ||||||||||||||||

| ||||||||||||||||||||||||||

Related industry/manufacturing experience |

|

|

|

|

|

|

|

|

|

| 7/10 | |||||||||||||||

| ||||||||||||||||||||||||||

| Sales/marketing experience |

|

|

|

|

|

|

|

|

|

| 3/10 | |||||||||||||||

| ||||||||||||||||||||||||||

| Technology/IT experience |

|

|

|

|

|

|

|

|

|

| 2/10 | |||||||||||||||

| ||||||||||||||||||||||||||

| Innovation experience |

|

|

|

|

|

|

|

|

|

| 4/10 | |||||||||||||||

|

| |||||||||||||||||||||||||

| Organizational management and leadership development |

|

|

|

|

|

|

|

|

|

| 7/10 | |||||||||||||||

|

| |||||||||||||||||||||||||

| Finance, accounting or risk management experience |

|

|

|

|

|

|

|

|

|

| 4/10 | |||||||||||||||

|

| |||||||||||||||||||||||||

| Corporate social responsibility/sustainability/ESG experience |

|

|

|

|

|

|

|

|

|

| 3/10 |

In accordance with the Company’s Amended and Restated Bylaws (the “Bylaws”), to be elected each director nominee must receive more votes cast for than against his or her nomination for election or re-election in order to be elected or re-elected to the Board. Our Corporate Governance Guidelines provide that incumbent directors nominated for election by the Board are required to tender, prior to the mailing of the relevant proxy statement, a conditional, irrevocable letter of resignation to the Board. In the event that a nominee for director does not receive the required vote for re-election at the Annual Meeting, the Board will promptly consider whether to accept or reject the conditional resignation of that nominee, or whether other action should be taken. The Board will then take action within 90 days following the certification of election results and will promptly disclose its decision by filing a Current Report on Form 8-K with the SEC.

2023 Proxy Statement

|

|

5 |

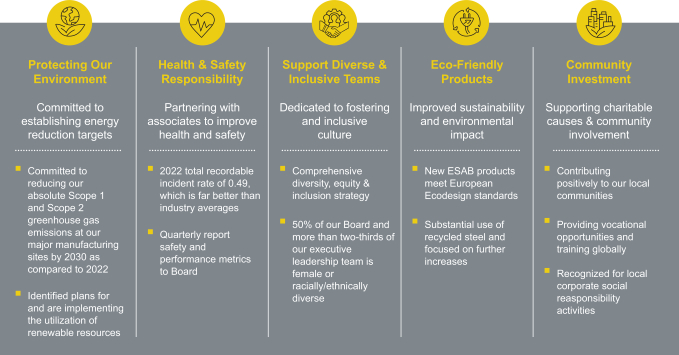

Our Approach to Sustainability

Sustainable Business Practices Align with Our Purpose, Values and Long-Term Strategy

Our sustainability program is organized around identifying, assessing and managing on an ongoing basis the environmental, social and governance (“ESG”) factors that are relevant to our long-term financial performance. Our program is grounded in our Purpose, to Shape the world we imagine, and Values. We believe the progress we make today makes the world we imagine possible.

While we are a newly independent corporation, consideration of relevant ESG factors has always been fundamental to our Company. Responsible operations are core to our business. In our first year as an independent company, we have reiterated and accelerated our commitment to shaping a more sustainable world.

We conducted a materiality assessment to ensure our ESG program takes into account the interests of our key stakeholder constituencies, including our employees, customers, communities and stockholders. At the direction of our Board of Directors and Chief Executive Officer, we developed a strategic vision for our ESG program aligned with our corporate Purpose and Values and laid the groundwork for an even more ambitious impact in the future.

In particular, we recently announced our commitment to reducing our absolute Scope 1 and Scope 2 greenhouse gas emissions at our major manufacturing sites by 2030 as compared to 2022. Our major manufacturing sites represent over 80% of our global real estate portfolio. We are proud of our ability to make this commitment at this point in our Company’s ESG journey. It is a testament to our business’s strategic alignment with ESG as well as the extensive groundwork completed by our team over the past many years.

This work, as well as our strategic approach to ESG, is highlighted in our inaugural sustainability report, which can be accessed on our website at www.esabcorporation.com. The information on our website is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated into any other filings we make with the SEC.

6 |

|

2023 Proxy Statement

|

| Environment

The progress we make today makes the world we imagine possible. |

| ¾ | We are committed to reducing our absolute Scope 1 and Scope 2 greenhouse gas emissions at our major manufacturing sites by 2030 as compared to 2022. Our major manufacturing sites represent over 80% of our global real estate portfolio. |

| ¾ | We conducted energy management workshops at 18 of our manufacturing sites to generate actionable energy projects to reduce our energy consumption and boost efficiency. |

| ¾ | We completed a renewable energy mapping project to develop a strategy for utilizing renewable resources that aligns with our goals and objectives. |

| ¾ | We incorporate recycled materials into our finished products where feasible. The primary raw materials used in the production of welding consumables—steel, aluminum, copper and brass—often incorporate recycled metals. |

| ¾ | In 2022, we launched products designed specifically to meet the standards outlined in the European Ecodesign for Sustainable Products Regulation, with our globally available Warrior Edge 500, our Renegade VOLT, and our Marathon Pac Ultra with our Purus wire. |

| Social

We empower our associates to shape their world. |

| ¾ | We developed a comprehensive diversity, equity and inclusion (DE&I) strategy to embrace diversity and inclusion in our everyday actions while empowering and elevating others, leading inclusively, learning about and celebrating our differences and ensuring every voice is valued. |

| ¾ | We are committed to promoting diversity at all levels of our company. Over two-thirds of our executive leadership team and 50% of our board of directors is female or racially/ethnically diverse. |

| ¾ | The health and safety of our associates is an utmost priority. Our total recordable incident rate for 2022 was 0.49 which is far better than industry averages. |

| ¾ | In 2022, we launched our year-long “Safety Is In Your Hands” to raise awareness about hand safety at ESAB by minimizing risk and reducing hand-related incidents and reinforced our commitment to the health and safety of all workers. As part of this campaign, over 1,170 associates took our pledge to improve hand safety. |

| ¾ | We believe shaping a better future requires investment in the communities where our associates live and work and where we do business. We encourage our associates to make positive contributions, through financial gifts and volunteerism, in the community. From holding team-building events in support of the Boys & Girls Club in Phoenix, Arizona to volunteering at dog shelters in Hermosillo, Mexico, our associates are constantly finding new and innovative ways to create positive changes in our communities. |

| ¾ | We have publicly stated our commitment to respecting human rights across all of our business operations in accordance with the Universal Declaration of Human Rights, the UN Guiding Principles on Business and Human Rights and the ILO Declaration on Fundamental Principles and Rights at Work. |

| Without limiting the foregoing, we do not utilize or permit: u Child labor, u Forced labor, or u Other abusive or unsafe working conditions. | |

2023 Proxy Statement

|

|

7 |

| Governance

We are committed to shaping our world through responsible corporate governance by taking ESG-related risks and opportunities into account in our strategic decision-making. |

| ¾ | The Board exercises oversight over ESG matters at the full Board level and through its committees. ESG matters are managed and monitored by senior management throughout the year. The full Board participates in ESG educational sessions designed to enhance ESG oversight. |

| • | Under its charter, our Nominating and Corporate Governance Committee is expressly tasked with reviewing the Company’s undertakings with respect to ESG matters, including our role as a corporate citizen and policies and programs relating to health, safety and sustainability matters. |

| • | Our Compensation and Human Capital Management Committee has direct oversight of our strategies and policies related to human capital management including with respect to matters such as diversity, inclusion, pay equity, corporate culture, talent development and retention. |

| • | Our Audit Committee oversees our policies with respect to risk assessment and risk management, including risks related to the Company’s financial statements and financial reporting processes and information technology and cybersecurity. The Audit Committee also oversees the Company’s compliance with legal and regulatory requirements and its ethics program, including our Code of Business Conduct. |

| ¾ | We hold ourselves to the highest standards and we expect the same of our business partners. We have adopted a framework of policies which set forth our requirements for our business partners, including a Code of Conduct for Business Partners, Anti-Slavery and Human Trafficking Statement, Humans Rights Policy and Conflict Minerals Policy, among others. |

| ¾ | We maintain a global ethics hotline, available 24 hours a day, seven days a week via internet or phone, for any employee, supplier, or business partner to ask questions, report violations, or raise concerns without fear of retaliation. |

| ¾ | ESAB is committed to protecting the security and integrity of its products, data, and systems. We expect all ESAB associates to use the Company’s technology resources responsibly and in compliance with all ESAB policies and applicable laws and regulations. |

Auditor Ratification (page 28)

We are asking our stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2023. Below is summary information about fees paid to Ernst & Young LLP for services provided in 2022. For the fiscal year ended December 31, 2021, we did not pay any fees for professional services to Ernst & Young LLP as Enovis paid any audit, audit related, tax or other fees related to the Company’s business prior to the Separation.

| Fee Category (fees in thousands) | 2022 | |||

Audit Fees | $ | 4,287 | ||

Audit-Related Fees | – | |||

Tax Fees | 192 | |||

All Other Fees | – | |||

TOTAL | $ | 4,479 | ||

8 |

|

2023 Proxy Statement

|

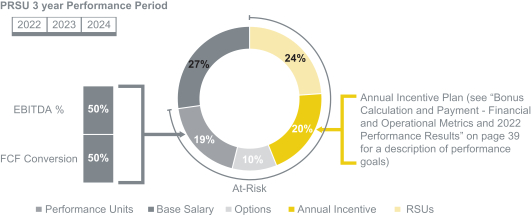

Executive Compensation (page 49)

We strive to create a compensation program for our associates, including our executives, that provides a compelling and engaging opportunity to attract, retain and motivate the industry’s best talent. We believe this results in performance-driven leadership that is aligned to achieve our financial and strategic objectives with the intention to deliver superior long-term returns to our stockholders. Our compensation program includes the following key features:

| ¾ | We directly link rewards to performance and foster a team-based approach by setting clear objectives that, if achieved, we believe will contribute to our overall success; |

| ¾ | We emphasize long-term stockholder value creation by using stock options and performance-based restricted stock units (“PRSUs”), in combination with a robust stock ownership policy, to deliver long-term compensation incentives while minimizing risk-taking behaviors that could negatively affect long-term results; |

| ¾ | We set annual incentive plan operational and financial performance targets based on the results of our Board’s strategic planning process and corporate budget, and provide payouts that vary significantly from year-to-year based on the achievement of those targets; and |

| ¾ | We believe the design of our overall compensation program, as well as our internal controls and policies, serve to limit excessive risk-taking behavior, as described further on page 45. |

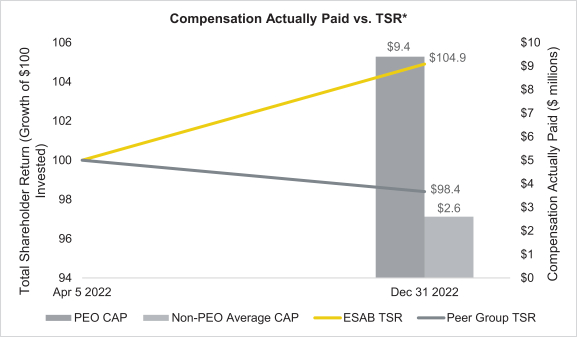

Say-on-Pay: Advisory Vote to Approve the Compensation of our Named Executive Officers (page 66)

We are asking our stockholders to approve on an advisory basis the compensation of our named executive officers. We believe our compensation programs and practices are appropriate and effective in implementing our compensation philosophy, and our focus remains on linking compensation to performance while aligning the interests of management with those of our stockholders.

Say-on-Frequency: Advisory Vote to Approve the Frequency of Future Say-on-Pay Votes (page 67)

We are asking our stockholders to vote on an advisory basis on whether the advisory vote to approve the compensation of our named executive officers should occur every one, two or three years. Our Board of Directors has recommended an advisory vote to approve executive compensation each year as the appropriate frequency for ESAB and its stockholders.

2023 Proxy Statement

|

|

9 |

Proxy Statement for Annual Meeting of Stockholders

2023 Annual Meeting

We are furnishing this Proxy Statement (the “Proxy Statement”) in connection with the solicitation by the Board of Directors (the “Board”) of ESAB Corporation (hereinafter, “ESAB,” “we,” “us” and the “Company”) of proxies for use at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, May 11, 2023, at 3:00 p.m. Eastern Time, and at any adjournments or postponements thereof. The Board has made this Proxy Statement and the accompanying Notice of Annual Meeting available on the Internet. We first made these materials available to the Company’s stockholders entitled to vote at the Annual Meeting on or about March 31, 2023.

About ESAB Corporation

ESAB is a world leader in connected fabrication technology and gas control solutions, providing our partners with advanced equipment, consumables, specialty gas control, robotics, and digital solutions, which enable the everyday and extraordinary work that shapes our world. Our products are utilized to solve challenges in a wide range of industries, including cutting, joining and automated welding.

We formulate, develop, manufacture and supply consumable products and equipment for use in cutting, joining and automated welding, as well as gas control solutions. Products are marketed under several brand names, most notably ESAB, which we believe is well known in the international welding industry. ESAB’s comprehensive range of welding consumables includes electrodes, cored and solid wires and fluxes using a wide range of specialty and other materials, and cutting consumables includes electrodes, nozzles, shields and tips. ESAB’s fabrication technology equipment ranges from portable welding machines to large customized automated cutting and welding systems. ESAB also offers a range of software and digital solutions to help its customers increase their productivity, remotely monitor their welding operations and digitize their documentation. Our gas control equipment business is a leading provider of specialty gas solutions, developing and manufacturing all types of equipment for pressure and flow control of high-pressure gasses across various industries. Products are sold into a wide range of global end markets, including general industry, construction, infrastructure, transportation, energy, renewable energy, and medical & life sciences. Our sales channels include both independent distributors and direct salespeople who, depending on geography and end market, sell our products to our end users.

Integral to our operations is the ESAB Business Excellence system (“EBX”), our business management system. EBX is our culture and includes our Purpose and Values, a comprehensive set of tools, and repeatable, teachable processes that we use to drive continuous improvement and create superior value for our customers, stockholders and associates. We believe that our management team’s access to, and experience in, the application of the EBX methodology is one of our primary competitive strengths.

Our principal executive office is located at 909 Rose Avenue, 8th Floor, North Bethesda, Maryland 20852. Our telephone number is (301) 323-9099 and our website is located at www.esabcorporation.com. Our common stock trades on the New York Stock Exchange (“NYSE”) under the ticker “ESAB.”

Separation from Enovis Corporation

On April 4, 2022, Enovis Corporation (formerly Colfax Corporation) (“Enovis”) completed the separation of its fabrication technology business and certain other corporate entities through a tax-free, pro rata distribution of 90% of the outstanding common stock of ESAB to Enovis stockholders. ESAB began trading as a standalone public company on the NYSE under the ticker “ESAB” on April 5, 2022. On November 18, 2022, Enovis completed the disposition of its remaining 10% stake in ESAB through an underwritten offering of our common stock.

Although ESAB and Enovis currently operate as separate companies, the rules and regulations of the SEC and the NYSE require that we provide certain information, including compensation information for our directors and named executive officers, for the period of time prior to the Separation. We have sought to clearly indicate throughout this Proxy Statement what information relates to ESAB prior to the Separation, when it was operating as a subsidiary of Enovis, and what information relates to ESAB following the Separation.

Concurrently with the Separation, Colfax Corporation changed its name from “Colfax Corporation” to “Enovis Corporation.” For the sake of consistency, we refer to our former parent company and its successor Enovis Corporation as “Enovis” throughout this Proxy Statement.

10 |

|

2023 Proxy Statement

|

| Proposal 1 | Election of Directors |

All current members of the Board were appointed by Enovis, as ESAB’s then sole stockholder, prior to the Separation.

Pursuant to the Company’s Amended and Restated Certificate of Incorporation, the Company’s Board is divided into three classes as follows:

| ¾ | Class I: Mitchell P. Rales, Stephanie M. Phillipps and Didier Teirlinck, whose terms expire at the Annual Meeting; |

| ¾ | Class II: Patrick W. Allender, Christopher M. Hix and Rhonda L. Jordan, whose terms expire at the 2024 Annual Meeting of Stockholders; and |

| ¾ | Class III: Melissa Cummings, Shyam P. Kambeyanda, Robert S. Lutz and Rajiv Vinnakota, whose terms expire at the 2025 Annual Meeting of Stockholders. |

At the Annual Meeting, stockholders will be asked to elect each of the current Class I director nominees identified below (each of whom has been recommended by the Nominating and Corporate Governance Committee, nominated by the Board and currently serves as a Class I Director of ESAB) to serve until the 2026 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified.

Our Amended and Restated Certificate of Incorporation provides that we will transition to an annually elected board through a gradual phase-out such that by 2026 all of our directors will stand for election each year for one-year terms, and our Board will no longer be divided into three classes.

Director Qualifications

Nominating Committee Criteria for Board Members

The Nominating and Corporate Governance Committee considers, among other things, the following criteria in selecting and reviewing director nominees:

| ¾ | personal and professional integrity; |

| ¾ | skills, business experience and industry knowledge useful to the oversight of the Company based on the perceived needs of the Company and the Board at any given time; |

| ¾ | the ability and willingness to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings; |

| ¾ | the interest, capacity and willingness to serve the long-term interests of the Company and its stockholders; and |

| ¾ | the lack of any personal or professional relationships that would adversely affect a candidate’s ability to serve the best interests of the Company and its stockholders. |

Pursuant to its charter, the Nominating and Corporate Governance Committee also reviews, among other qualifications, the perspective, broad business judgment and leadership, business creativity and vision, and diversity of potential directors, all in the context of the needs of the Board at that time. We believe that Board membership should reflect diversity in its broadest sense, including persons diverse in geography, gender, and ethnicity, and we seek independent directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions.

The charter of the Nominating and Corporate Governance Committee affirmatively recognizes diversity as one of the criteria for consideration in the selection of director nominees, and in its deliberations and discussions concerning potential director appointments the Nominating and Corporate Governance Committee has paid particular attention to diversity together with all other qualifying attributes. The Nominating and Corporate Governance Committee is committed to actively seeking out highly qualified women and

2023 Proxy Statement

|

|

11 |

minority director candidates, as well as candidates with diverse backgrounds, experiences and skills, as part of each director search that our Company undertakes. In addition, the Nominating and Corporate Governance Committee annually considers its effectiveness in achieving these objectives as a part of its assessment of the overall composition of the Board and as part of the annual Board evaluation process described further below, which includes a director skills matrix to identify areas of director knowledge and experience that may benefit the Board in the future. That information is used as a part of the director search and nomination process. The Nominating and Corporate Governance Committee looks for candidates with the expertise, skills, knowledge and experience that, when taken together with that of other members of the Board, will lead to a Board that is effective, collegial and responsive to the needs of the Company. As further discussed below, certain members of our Board have experience with the business systems that are an integral part of our Company culture. In addition, we feel that the familiarity of certain Board members with our business system from their work experiences at Danaher Corporation, Enovis Corporation and at our Company, combined with strong input from varied and sophisticated business backgrounds, provides us with a Board that is both functional and collegial while able to draw on a broad range of expertise in the consideration of complex issues.

Board Member Service

The biographies of each of our directors and director nominees below contain information regarding the experiences, qualifications, attributes or skills that the Nominating and Corporate Governance Committee and the Board considered in determining that the person should serve as a director of the Company. The Board has been informed that all of the nominees listed below are willing to serve as directors, but if any of them should decline or be unable to act as a director, the individuals named in the proxies may vote for a substitute designated by the Board. The Company has no reason to believe that any nominee will be unable or unwilling to serve.

Board of Directors

The names of each director nominee and director continuing in office, their ages as of March 31, 2023, principal occupations, employment and other public company board service during at least the last five years, periods of service as a director of the Company, and the experiences, qualifications, attributes and skills of each nominee or director are set forth below:

Nominees for Director

Class I Directors, New Term Expiring in 2026

| MITCHELL P. RALES | ||

Age 66

Director since: 2022

INDEPENDENT

CHAIRMAN OF THE BOARD

Committees:

• None

Key skills:

• Senior leadership experience

• Public company board experience

• Broad international experience

• M&A/capital markets experience

• Related industry experience

• Organizational management experience | Mitchell P. Rales is a co-founder of Enovis and served as a director of Enovis from its founding in 1995 until his retirement from the Enovis Board later this year. Mr. Rales is a co-founder and has served as a member of the board of directors of Danaher Corporation, a global science and technology company, since 1983, as Chairman of Danaher’s Executive Committee since 1984, and served as a member of the board of directors of Fortive Corporation, a diversified industrial growth company that was spun off from Danaher in 2016, from 2016 to June 2021. He has been a leader in a number of private business entities with interests in manufacturing, technology and high growth companies for over 25 years.

Qualifications: The strategic vision and leadership of Mr. Rales helped create the foundation for our Company. His critical guidance to ESAB, both before and after its separation from Enovis, facilitates its continued development and growth. In addition, Mr. Rales helped create the Danaher Business System, on which EBX is modeled. As a result of Mr. Rales’ substantial ownership stake in ESAB, he is well-positioned to understand, articulate and advocate for the rights and interests of ESAB’s stockholders.

| |

12 |

|

2023 Proxy Statement

|

| STEPHANIE M. PHILLIPPS | ||

| Age 71

Director since: 2022

INDEPENDENT

Committees:

• Compensation and Human Capital Management

Key skills:

• Public company board experience

• M&A/capital markets experience | Stephanie M. Phillipps has served as a member of our Board since April 2022. Ms. Phillipps was a partner at Arnold & Porter, an international law firm, from 1984 until her retirement in 2019. While at Arnold & Porter, Ms. Phillipps advised wireless, cable, satellite, media, and internet service providers on a broad range of transactions, mergers and acquisitions, and regulatory issues. She also advised clients on real estate and corporate governance issues. From January 2021 until December 2022, Ms. Phillipps served on the board of directors and nominating and corporate governance committee of Empowerment and Inclusion Capital I Corp. Ms. Phillipps currently serves as a senior advisor to Grain Management LLC, Treasurer and board member of the Clara Elizabeth Jackson Carter Foundation, co-founder and board member of the Harvard Law School Black Alumni Network, board member of The Ellington Fund and the Ellington School, and founder and Chief Executive Officer of Genkast LLC.

Qualifications: Ms. Phillipps brings to the Board strong experience providing strategic and legal advice to large, global corporations on a variety of complex transactions and corporate governance matters. Ms. Phillipps’s ability to comprehend dynamic business models as well as her substantial experience with mergers and acquisitions, technology-driven transactions and regulatory issues offers key insights to our Board. The Board also benefits from her broad corporate governance experience gained through her service on public and private company boards.

| |

| DIDIER TEIRLINCK | ||

| Age 66

Director sinace: 2022

INDEPENDENT

Committees:

• Audit

Key skills:

• Public company board experience

• Broad international experience

• Related industry experience

• Innovation experience

• Organizational management experience

• Finance/accounting/risk management experience

• Corporate social responsibility experience | Didier Teirlinck retired from Ingersoll Rand, a diversified industrial manufacturing company, in September 2018. He has been a strategic advisor to the CEO of Ingersoll Rand since 2017, and previously served from November 2013 as executive vice president for Ingersoll Rand’s Climate segment, overseeing climate businesses around the world and enhancing competitive position and market share. After joining Ingersoll Rand in 2005, Mr. Teirlinck served as president of Climate Control in Europe before becoming President of the global Climate Solutions sector in 2009. Before joining Ingersoll Rand, he was President of Volvo Construction Equipment’s Compact Business Line worldwide and was previously general manager of DANISCO Flexible Group for southern Europe. Mr. Teirlinck served as a director of Enovis from September 18, 2017 until the Separation.

Qualifications: Mr. Teirlinck’s international operating history and wealth of knowledge in the climate sector brings key geographic and market experience to our Board. The Company benefits from his broad experience in sales and corporate responsibility as well as knowledge of manufacturing operations. Mr. Teirlinck’s long career in industrial environments gives him a unique and valuable perspective with respect to continuous improvement, lean manufacturing and implementing business operating systems. Mr. Teirlinck also has public-company board experience and a long-term familiarity with our business due to his prior service on the board of directors of Enovis.

| |

Vote Required

The affirmative vote of the holders of a majority of the votes cast is required for election of each director.

Board Recommendation

The Board unanimously recommends that stockholders vote “FOR” the election of each of the nominees for director listed above. |

2023 Proxy Statement

|

|

13 |

Continuing Directors

Class II Directors, Current Term Expiring in 2024

| PATRICK W. ALLENDER | ||

| Age 76

Director since: 2022

INDEPENDENT

Committees:

• Audit (Chair)

• Nominating and Corporate Governance

Key skills:

• Senior leadership experience

• Public company board experience

• Broad international experience

• M&A/capital markets experience

• Related industry experience

• Organizational management experience

• Finance/accounting/risk management experience | Patrick W. Allender is the former Executive Vice President and Chief Financial Officer of Danaher Corporation, a global science and technology company, where he served from 1987 until his retirement in 2007. Prior to joining Danaher, Mr. Allender was an audit partner with a large international accounting firm. Mr. Allender is a director of Brady Corporation, where he is a member of the audit and corporate governance committees and the chairman of the finance committee. Mr. Allender served as a director of Enovis from May 13, 2008 until the Separation.

Qualifications: Mr. Allender has substantial experience in financial reporting, risk management, strategy development and execution and business transformation gained from a 30-year career at Danaher Corporation. Mr. Allender’s almost 15 years of service on the Enovis board of directors give him a deep familiarity of our Company’s history and EBX, allowing him to provide targeted insight on the nature of ESAB’s operations to our Board.

| |

| CHRISTOPHER M. HIX | ||

| Age 61

Director since: 2021

Committees:

• None

Key skills:

• Senior leadership experience

• Broad international experience

• M&A/capital markets experience

• Related industry experience

• Technology/IT experience

• Organizational management experience

• Finance/accounting/risk management experience | Christopher M. Hix served as Executive Vice President, Finance, Chief Financial Officer of Enovis Corporation from December 2019 until his retirement on December 31, 2022, and prior to such position served as Senior Vice President, Finance, of Enovis since July 2016. Prior to joining Enovis, Mr. Hix was the Chief Financial Officer of OM Group, Inc., a global, publicly-listed diversified industrial company, from 2012 until the company’s acquisition in late 2015. Previously, Mr. Hix was the Chief Financial Officer of Robbins & Myers, a diversified industrial company, from 2006 to 2011, a period of significant expansion and business portfolio changes. Prior to that, Mr. Hix spent 14 years in a variety of operating, financial and strategic roles within Roper Industries (now Roper Technologies), a global, diversified industrial and technology company that underwent rapid growth and transitioned from private to public ownership during his tenure.

Qualifications: Mr. Hix brings to the Board significant experience in both finance and operations management at industrial companies through his service as the chief financial officer of publicly-traded companies, including Enovis. The Board also benefits from his extensive background in risk management, mergers and acquisitions and debt and equity markets. Mr. Hix offers the Board a unique perspective with respect to technology, as he directly managed IT functions at several companies for over a decade. Mr. Hix is also deeply familiar with ESAB’s business as well as EBX.

| |

14 |

|

2023 Proxy Statement

|

| RHONDA L. JORDAN | ||

| Age 65

Director since: 2022

INDEPENDENT

Committees:

• Compensation and Human Capital Management (Chair)

• Nominating and Corporate Governance

Key skills:

• Public company board experience

• Broad international experience

• M&A/capital markets experience

• Human capital management experience

• Sales/marketing experience

• Innovation experience

• Organizational management experience

• Corporate social responsibility experience | Rhonda L. Jordan served as President, Global Health & Wellness, and Sustainability for Kraft Foods Inc. a food manufacturing and processing conglomerate, until 2012 and in that role led the development of Kraft’s health & wellness and sustainability strategies and plans for the company, including marketing, product development, technology, alliances and acquisitions. Prior to being named President, Health & Wellness in 2010, she held positions as President of Kraft’s Cheese and Dairy business unit and its Grocery unit. She also served as Senior Vice President, Global Marketing of Kraft Cheese and Dairy. Ms. Jordan is a director of Ingredion Incorporated, where she is chair of the compensation committee, and the private companies Bush Brothers & Company and G&L Holdings. Ms. Jordan served as a director of Enovis from February 17, 2009 until the Separation.

Qualifications: Ms. Jordan’s management and operations experience within a large, global corporation gives her an important strategic voice in Board deliberations, and her knowledge and decision making with respect to business unit development and sustainable top-line performance makes her a valued member of our Board. Ms. Jordan also brings an important perspective from her service of other public company boards, including her long tenure as a director of Enovis, as well as her background in developing sustainability strategies.

| |

Class III Directors, Current Term Expiring in 2025

| ||

| MELISSA CUMMINGS | ||

| Age 47

Director since: 2022

INDEPENDENT

Committees:

• Audit

Key Skills:

• Broad international experience

• Related industry experience

• Sales/marketing experience

• Technology/IT experience

• Innovation experience

• Corporate social responsibility experience | Melissa Cummings has been Executive Vice President in several capacities at Westinghouse Electric company since June 2020. She currently serves as Executive Vice President of Strategic Marketing for Westinghouse Electric Company, a leading energy company where she is responsible for strategy, product management, and digital initiatives for nuclear and non-nuclear plant operations products and services. Prior to joining Westinghouse, she worked with Signant Healthcare as an executive consultant from December 2019 to June 2020, supporting business profitability, strategic planning, and operational transformation efforts. Ms. Cummings previously served as Senior Vice President of Digital Solutions and Services at Baker Hughes from 2016 to December 2019 and has also held leadership positions with GE and ABB, driving digital and technology solutions for industrial customers around the world.

Qualifications: Ms. Cummings brings to the Board significant marketing, strategy and innovation experience as a result of her tenure as a senior executive at leading industrial companies. The Company also benefits from her technology innovation expertise, as Ms. Cummings offers an important perspective on cybersecurity as well as digital and technology solutions in industrial sectors.

| |

2023 Proxy Statement

|

|

15 |

| ROBERT S. LUTZ | ||

| Age 65

Director since: 2022

INDEPENDENT

Committees:

• Audit

Key Skills:

• Broad international experience

• M&A/capital markets experience

• Related industry experience

• Finance/accounting/risk management experience | Robert S. Lutz has been with Danaher Corporation, a global science and technology company, since 2002 and has served as its Senior Vice President, Finance since January 2022 in an advisory role to Danaher’s global finance organization. Prior to this role, Mr. Lutz served as Danaher’s Chief Accounting Officer from March 2003 through December 2021. In that role, Mr. Lutz was responsible for Danaher’s internal and external financial reporting as well as Danaher’s maintenance of internal controls. Prior to being named Chief Accounting Officer, Mr. Lutz was Vice President, Audit & Reporting at Danaher from 2002 to March 2003. Prior to joining Danaher, Mr. Lutz held various positions, including partner, for more than 20 years at a large international accounting firm.

Qualifications: Mr. Lutz’s responsibility for leading the accounting operations and financial reporting functions of a global, multi-industry publicly-traded company for almost twenty years enables him to bring extensive audit, financial reporting and corporate governance experience to our Board. He also offers a valuable perspective due his deep experience with the Danaher Business System.

| |

| SHYAM P. KAMBEYANDA | ||

| Age 52

Director since: 2022

Committees:

• None

Key Skills:

• Senior leadership experience

• Broad international experience

• Related industry experience

• Sales/marketing experience

• Innovation experience

• Organizational management experience | Shyam P. Kambeyanda has been President and Chief Executive Officer of ESAB since May 2016 and was Executive Vice President of Enovis from December 2019 until the Separation. As the leader of ESAB, Mr. Kambeyanda has overseen the growth of the fabrication technology business, expanding ESAB’s global operations, improving financial performance and driving EBX throughout the business. Prior to joining Enovis, Mr. Kambeyanda most recently served as the President Americas for Eaton Corporation’s Hydraulics Group. Mr. Kambeyanda joined Eaton in 1995 and held a variety of positions of increasing responsibility in engineering, quality, e-commerce, product strategy, and operations management in the United States, Mexico, Europe and Asia. Mr. Kambeyanda maintains a keen international perspective on driving growth and business development in emerging markets.

Qualifications: As our President and Chief Executive Officer, Mr. Kambeyanda has a broad understanding of the Company’s business as well as a deep familiarity with EBX. Mr. Kambeyanda has demonstrated leadership qualities, knowledge of our operations and industry and a long-term strategic perspective. In addition, he has many years of international and domestic industrial experience, including in sales and innovation.

| |

16 |

|

2023 Proxy Statement

|

| RAJIV VINNAKOTA | ||

| Age 52

Director since: 2022

INDEPENDENT

Committees:

• Nominating and Corporate Governance (Chair)

• Compensation and Human Capital Management

Key Skills:

• Senior leadership experience

• Public company board experience

• Human capital management experience

• Innovation experience

• Organizational management experience | Rajiv Vinnakota has served as President of the Institute for Citizens & Scholars (formerly the Woodrow Wilson National Fellowship Foundation), a 75 year-old non-profit organization that has played a significant role in shaping higher education, since July 2019. With an expanded mission, Citizens & Scholars is now rebuilding how we develop citizens in our country. From 2015 to September 2018 he was an Executive Vice-President at the Aspen Institute, leading a division focused on youth and engagement. Prior to this role, Mr. Vinnakota was the Co-Founder and Chief Executive Officer of The SEED Foundation, a non-profit educational organization, at which he served from 1997 to 2015. Mr. Vinnakota was the chairman of The SEED Foundation board from 1997 until 2006. Prior to co-founding SEED, Mr. Vinnakota was an associate at Mercer Management Consulting. He was also a trustee of Princeton University from 2004 until 2007 and a member of the Executive Committee of the Princeton University board of directors from 2006 to 2007, and he served as the national chairman of Annual Giving at Princeton from 2007 until 2009. Mr. Vinnakota has served as a director of Enovis since May 13, 2008.

Qualifications: Mr. Vinnakota brings to the Board broad leadership experience in areas such as human capital and organizational management. His experience in the non-profit sector also provides him with valuable perspective on important public policy, societal and economic issues relevant to our Company. Mr. Vinnakota’s engagement with leaders across the non-profit landscape (philanthropists, policymakers, practitioners, researchers, and young people ages 14-24) gives him constant understanding of key social issues, ideological debates and educational needs in our society. Mr. Vinnakota’s almost 15 years of service on the Enovis board of directors give him board-level experience on matters such as corporate governance and executive compensation and a deep familiarity of our Company’s history.

| |

2023 Proxy Statement

|

|

17 |

| ∎ | CORPORATE GOVERNANCE |

Director Independence

Our Corporate Governance Guidelines require that a majority of our Board members be “independent” under the NYSE’s listing standards. In addition, the respective charters of the Audit Committee, Compensation and Human Capital Management Committee and Nominating and Corporate Governance Committee require that each member of these committees be “independent” under the NYSE’s listing standards and, with respect to the Audit Committee, under the applicable SEC rules. In order for a director to qualify as “independent,” our Board must affirmatively determine that the director has no material relationship with the Company that would impair the director’s independence. Our Board undertook its annual review of director independence in March 2023. The Board determined that Mr. Rales, Mr. Allender, Ms. Cummings, Ms. Jordan, Mr. Lutz, Ms. Phillipps, Mr. Teirlinck and Mr. Vinnakota each qualify as “independent” under the NYSE’s listing standards. In assessing Mr. Rales’ independence in 2023, the Board took into account that, although Mr. Rales is a significant stockholder of the Company, he has never served as an employee of the Company and is not otherwise involved in managing the daily business operations of the Company. Accordingly, the Board concluded that Mr. Rales is independent under NYSE’s listing standards. None of the other independent directors nor their immediate family members have within the past three years had any direct or indirect business or professional relationships with the Company other than in their capacity as directors.

The independent members of our Board must hold at least two “executive session” meetings each year without the presence of management. In general, the meetings of independent directors are intended to be used as a forum to discuss such topics as they deem necessary or appropriate. Mr. Rales, as independent Chairman, typically serves as the presiding director of the independent director executive sessions and leads the independent directors during these sessions.

Board of Directors and its Committees

The current Board was not fully constituted until April 4, 2022. Prior to that time the Board was composed entirely of officers of Enovis Corporation, ESAB’s parent company prior to the Separation.

The Board and its committees meet regularly throughout the year, and may also hold special meetings and act by written consent from time to time. The Board held a total of five meetings during the year ended December 31, 2022 and acted by written consent seven times. During 2022, all of our directors attended all Board meetings and meetings of the committees of the Board on which such directors served (during the periods that he or she served). Our Corporate Governance Guidelines request Board members to make every effort to attend our annual meeting of stockholders.

18 |

|

2023 Proxy Statement

|

The Board has a standing Audit Committee, Compensation and Human Capital Management Committee, and Nominating and Corporate Governance Committee. The charters for the Audit Committee, Compensation and Human Capital Management Committee and Nominating and Corporate Governance Committee are available on the Company’s website at www.esabcorporation.com on the Investors page under the Governance tab. These materials also are available in print to any stockholder upon request to: Corporate Secretary, ESAB Corporation, 909 Rose Avenue, 8th Floor, North Bethesda, Maryland 20852. The Board committees review their respective charters on an annual basis. The Nominating and Corporate Governance Committee oversees an annual evaluation of the Board and each committee’s operations and performance.

| Name | Audit Committee | Nominating and Corporate Governance Committee | Compensation Committee | |||

Mitchell P. Rales | ||||||

Shyam P. Kambeyanda | ||||||

Patrick W. Allender |  | ✓ | ||||

Melissa Cummings | ✓ | |||||

Christopher M. Hix | ||||||

Rhonda L. Jordan | ✓ |  | ||||

Robert S. Lutz | ✓ | |||||

Stephanie M. Phillipps | ✓ | |||||

Didier Teirlinck | ✓ | |||||

Rajiv Vinnakota |  | ✓ | ||||

| Chair |

| ✓ | Member |

Audit Committee

Our Audit Committee met six times during the year ended December 31, 2022. The Audit Committee is responsible, among its other duties and responsibilities, for overseeing our accounting and financial reporting processes, the audits of our financial statements, the qualifications of our independent registered public accounting firm, and the performance of our internal audit function and independent registered public accounting firm. The Audit Committee reviews and assesses the qualitative aspects of our financial reporting, our processes to manage business and financial risks, and our compliance with significant applicable legal, ethical and regulatory requirements. The Audit Committee is updated periodically on management’s process to assess the adequacy of the Company’s system of internal control over financial reporting, the framework used to make the assessment, and management’s conclusions on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm.

The members of our Audit Committee are Mr. Allender, Chair, Ms. Cummings, Mr. Lutz and Mr. Teirlinck. The Board has determined that each of Mr. Allender and Mr. Lutz qualify as an “audit committee financial expert,” as that term is defined under the SEC rules. The Board has determined that each member of our Audit Committee is independent and financially literate under the NYSE’s listing standards and that each member of our Audit Committee is independent under the standards of Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”).

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee met four times during the year ended December 31, 2022. The Nominating and Corporate Governance Committee is responsible for recommending candidates for election to the Board. In making its recommendations, the committee will review a candidate’s qualifications and any potential conflicts of interest and assess contributions of current directors in connection with his or her renomination. The committee is also responsible, among its other duties and responsibilities, for making recommendations to the Board or otherwise acting with respect to corporate governance policies and practices, including Board size and membership qualifications, new director orientation, committee structure and membership, related person transactions, and communications with stockholders and other interested parties. The Nominating and Corporate Governance

2023 Proxy Statement

|

|

19 |

Committee is also responsible for reviewing the Company’s undertakings with respect to environmental, social, and governance matters, including the Company’s role as a corporate citizen and the Company’s policies and programs relating to health, safety and sustainability matters.

The members of our Nominating and Corporate Governance Committee are Mr. Vinnakota, Chair, Mr. Allender and Ms. Jordan. The Board has determined that each member of our Nominating and Corporate Governance Committee is independent under the NYSE’s listing standards.

Compensation and Human Capital Management Committee

Our Compensation and Human Capital Management Committee met four times during the year ended December 31, 2022. The Compensation and Human Capital Management Committee is responsible, among its other duties and responsibilities, for determining and approving the compensation and benefits of our Chief Executive Officer and other executive officers, monitoring compensation arrangements applicable to our Chief Executive Officer and other executive officers in light of their performance, effectiveness and other relevant considerations and adopting and administering our equity and incentive plans.

The members of our Compensation and Human Capital Management Committee are Ms. Jordan, Chair, Ms. Phillipps and Mr. Vinnakota. The Board has determined that each member of our Compensation and Human Capital Management Committee is a “non-employee director” within the meaning of SEC Rule 16b-3, and is independent under the NYSE’s listing standards for directors and compensation committee members.

The Compensation and Human Capital Management Committee annually reviews and approves the corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluates his performance in light of those goals and objectives, and determines his compensation level based on that analysis. The Compensation and Human Capital Management Committee also annually reviews and approves all elements of the compensation of our other executive officers. Our Chief Executive Officer plays a significant role in developing and assessing achievement against the goals and objectives for other executive officers and makes compensation recommendations to the Compensation and Human Capital Management Committee based on these evaluations. The Compensation and Human Capital Management Committee also administers all of the Company’s management incentive compensation plans and equity-based compensation plans. The Compensation and Human Capital Management Committee makes recommendations to the Board regarding compensation of all executive officer hires, all elements of director compensation, and the adoption of certain amendments to incentive or equity-based compensation plans. The Compensation and Human Capital Management Committee also assists the Board in its oversight of risk related to the Company’s compensation policies and practices applicable to all ESAB associates. Additionally, the Compensation and Human Capital Management Committee periodically reviews the Company’s strategies and policies related to human capital management, including with respect to matters such as diversity, inclusion, pay equity, corporate culture, talent development and retention. For further information on our compensation practices, including a description of our processes and procedures for determining compensation, the scope of the Compensation and Human Capital Management Committee’s authority and management’s role in compensation determinations, please see the Compensation Discussion and Analysis section of this Proxy Statement, which begins on page 31.

Since 2022, our Compensation and Human Capital Management Committee has engaged Frederic W. Cook & Co. (“FW Cook”) as its independent compensation consultant to, among other things, formulate an appropriate peer group to be used by the Compensation and Human Capital Management Committee and to provide competitive comparison data and for other compensation consulting services as requested by the Compensation and Human Capital Management Committee. Additional information on the nature of the information and services provided by this independent compensation consultant can be found below in the Compensation Discussion and Analysis.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation and Human Capital Management Committee is or has ever been an officer or an employee of the Company or any of its subsidiaries, and no Compensation and Human Capital Management Committee member has any interlocking or insider relationship with the Company which is required to be reported under the rules of the SEC.

20 |

|

2023 Proxy Statement

|

Identification of Director Candidates and Director Nomination Process

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as by management and stockholders. The Nominating and Corporate Governance Committee may also use outside consultants to assist in identifying candidates. The Nominating and Corporate Governance Committee is responsible for assessing whether a candidate may qualify as an independent director. Each possible candidate is discussed and evaluated in detail before being recommended to the Board. The Nominating and Corporate Governance Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral.

The Nominating and Corporate Governance Committee recommends, and the Board nominates, candidates to stand for election as directors. Stockholders may nominate persons to be elected as directors and, as noted above, may suggest candidates for consideration by the Nominating and Corporate Governance Committee. If a stockholder wishes to suggest a person to the Nominating and Corporate Governance Committee for consideration as a director candidate, he or she must provide the same information as required of a stockholder who intends to nominate a director pursuant to the procedures contained in Section 2.5 of our Bylaws, in accordance with the same deadlines applicable to director nominations, as described below under “General Matters—Stockholder Proposals and Nominations.” All of the current directors were originally identified, nominated and elected by Enovis prior to the Separation.

Board Leadership Structure

Our Corporate Governance Guidelines specify that the positions of Chairman of the Board and Chief Executive Officer shall be held by separate persons. We believe that this structure is appropriate given the differences between the two roles in our current management structure. Our Chief Executive Officer, among other duties, is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of our Board, among other responsibilities, provides guidance to the Chief Executive Officer, takes an active role in setting the agenda for Board meetings and presides over meetings of the full Board. Our current Chairman, Mr. Rales, is an independent director.

Board Evaluation Process

The Board and its committees conduct self-assessments annually at their February/March meetings. The Chair of the Nominating and Corporate Governance Committee oversees the process. The annual evaluation procedure is summarized below.

Action and Timeframe | Description | |

Preparation – November/December | Each director receives draft materials for the annual evaluation of (i) the Board’s performance and (ii) the performance of his or her committee(s). The materials include the Board and committee self-assessment questionnaires. In advance of the assessment, questions are revised and supplemented based on the input received from the Board members and, prior to distribution, the Chair of the Nominating and Corporate Governance Committee leads a final review in the December Board and committee meetings. | |

Assessment – December/January | Each director is asked to consider a list of questions to assist with the evaluation of the Board and its committees, covering topics such as Board composition, the conduct and effectiveness of meetings, quality of discussions, roles and responsibilities, quality and quantity of information provided, and other opportunities for improvement. | |

Review and Discussion – February/March | The Board and its committees receive a report summarizing the annual evaluations as well as a year-over-year comparison. The reports are distributed for consideration in advance of and discussed at the February Board meeting. The committee chairs report to the Board on their respective committee evaluations, noting any actionable items. Past evaluations have addressed a wide range of topics such as Board materials, director education and on-boarding, and allocation of meeting times. | |

Actionable Items and Follow-Up – Ongoing | The Board and committees address any actionable items throughout the year, including a mid-year check-in and end of year assessment against the actionable items identified in February. |

2023 Proxy Statement

|

|

21 |

As part of the Board’s first self-assessment process, in February 2023, the Chair of the Nominating and Corporate Governance Committee held one-on-one meetings with each member of our Board to collect verbal feedback from our directors. The Chair of the Nominating and Corporate Governance Committee then incorporated this additional input into the annual evaluation materials presented to the Board and its committees during the February and March meetings.

Board’s Role in Risk Oversight

The Board maintains responsibility for oversight of risks that may affect the Company. The Board discharges this duty primarily through its standing committees and also considers risk in its strategic planning for the Company and in its consideration of acquisitions. The Board engages in discussions about risk at each quarterly meeting, where it receives reports from its committees, as applicable, about the risk oversight activities within their respective areas of responsibility. Specifically, the Audit Committee (i) receives reports from and discusses with management, our internal audit team, and our independent registered public accounting firm all major risk exposures (whether financial, operating or otherwise), (ii) reviews the Company’s policies with respect to risk assessment and enterprise risk management, including with respect to cybersecurity risks, and (iii) oversees compliance with legal and regulatory requirements and our ethics program, including our Code of Business Conduct. In addition, the Nominating and Corporate Governance Committee oversees the corporate governance principles and governance structures that contribute to successful risk oversight and management. The Compensation Committee oversees certain risks associated with compensation policies and practices, as discussed below.

The Audit, Nominating and Corporate Governance and Compensation and Human Capital Management Committees each make full reports to the Board of Directors at each regularly scheduled meeting regarding each committee’s considerations and actions, and risk considerations are presented to and discussed with the Board by management as part of strategic planning sessions and when considering potential acquisitions.

Standards of Conduct

Corporate Governance Guidelines and Pledging

The Board has adopted Corporate Governance Guidelines, which set forth a framework to assist the Board in the exercise of its responsibilities. The Corporate Governance Guidelines cover, among other things, the composition and certain functions of the Board and its committees, executive sessions, Board responsibilities, expectations for directors, director orientation and continuing education, our director resignation policy and our policy prohibiting pledging.

Our Corporate Governance Guidelines prohibit any future pledging of ESAB’s common stock as security under any obligation by our directors and executive officers. The Board excepted from the policy shares of ESAB common stock that were already pledged as of the Separation in accordance with Enovis’ pledging policy. Pledged shares of ESAB common stock do not count toward our stock ownership requirements. As of the date of this proxy statement, no shares of ESAB common stock were pledged by our directors and executive officers.

Policies on Insider Trading, Hedging and Stock Ownership

The Company has an Insider Trading Policy and associated procedures which, in addition to mandating compliance with insider trading laws, prohibit any director, officer or employee of the Company from engaging in short sales, hedging or monetization transactions and transactions in publicly-traded options on the Company’s securities, such as puts, calls and other derivatives. Further, we have stock ownership policies applicable to our directors and executives to promote alignment of interests between our stockholders, directors and management.

Code of Business Conduct

As part of our system of corporate governance, the Board adopted a Code of Business Conduct (the “Code of Conduct”) that is applicable to all directors, officers and employees of the Company. The Code of Conduct sets forth Company policies, expectations and procedures on a number of topics, including but not limited to conflicts of interest, compliance with laws, rules and regulations (including insider trading laws), honesty and ethical conduct, and quality. The Code of Conduct also sets forth procedures for reporting violations of the Code of Conduct and investigations thereof. If the Board grants any waivers from our Code of Conduct to any of our directors or executive officers, or if we amend our Code of Conduct, we will, if required, disclose these matters through our website within four business days following such waiver or amendment.

22 |

|

2023 Proxy Statement

|

Where to Find Our Key Governance Policies