UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

NRI Real Token Inc.

(Exact name of registrant as specified in its charter)

| Maryland | | 87-1031361 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 1340 South Dixie Highway, Suite 612, Coral Gables, Florida | | 33146 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number including area code (305) 529-9928

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be so registered | | Name of each exchange on which each

class is to be registered |

| None | | None |

Securities to be registered pursuant to Section 12(g) of the Act:

Common stock, $0.01 par value per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Smaller reporting company ☒ Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10 of NRI Real Token Inc., a Maryland corporation (the “Company”), other than historical facts are forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “could,” “intend,” “anticipate,” “plan,” “estimate,” “believe,” “potential,” “continue,” or other similar words. Specifically, we consider, among others, statements concerning future operating results and cash flows, our ability to meet future obligations, and the amount and timing of any future distributions to stockholders to be forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the SEC. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this Form 10, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to unknown risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered.

The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking statements:

| ● | We have a limited operating history and may not be successful at operating our business as a real estate investment trust for U.S. federal income tax purposes (a “REIT”), which may adversely affect our ability to make distributions to our stockholders. |

| ● | Failure to qualify as or maintain qualification as a REIT would reduce our net earnings available for investment or distribution to our stockholders. |

| ● | Our advisor, its executive officers and other key personnel, as well as certain of our officers and directors, whose services are essential to the Company, are involved in other business ventures, and will face a conflict in allocating their time and other resources between us and the other activities in which they are or may become involved. Failure of our advisor, its executive officers and key personnel, and our officers and directors to devote sufficient time or resources to our operations could result in reduced returns to our stockholders. |

| ● | We will pay certain prescribed fees to our advisor and its affiliates regardless of our performance. |

| ● | We have utilized and may continue to utilize substantial debt financing from third parties to acquire properties and to maintain and make capital improvements at our existing Property (as defined herein). |

| ● | As of this date, our only Property is in Miami-Dade, Florida. As a result, any adverse economic, real estate or business conditions in this geographic area could affect our operating results. |

| ● | Demand for our Property may be affected by various factors, including the demand for hospitality derived from the University of Miami, business travelers, and transient customers, and price competition from other hotels in the Coral Gables and greater Miami, Florida market; demand for the Property’s apartments, and price competition from other apartment facilities and other residential alternatives; the demand for commercial retail space; and demand for our food and beverage facilities. If demand does not increase or if demand weakens, our operating results and growth prospects could be adversely affected. |

ITEM 1. BUSINESS.

We are filing this Form 10 to register shares of our common stock, $0.01 par value per share, pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result of our voluntary registration of our common stock pursuant to the Exchange Act, following the effectiveness of this Form 10, we will be subject to the requirements of the Exchange Act and the rules promulgated thereunder. In particular, we will be required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K and otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements to register a class of securities pursuant to Section 12(g) of the Exchange Act. We are voluntarily registering shares of our common stock pursuant to Section 12(g) of the Exchange Act to provide our stockholders with access to public disclosure regarding our business and operations of the type required in the reports filed under the Exchange Act.

General

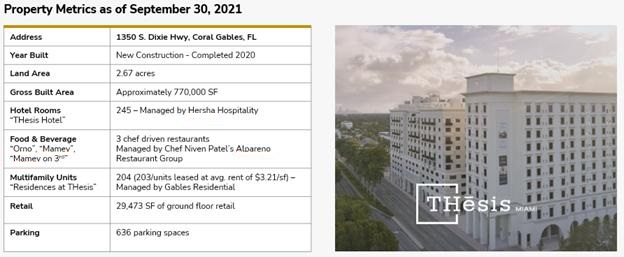

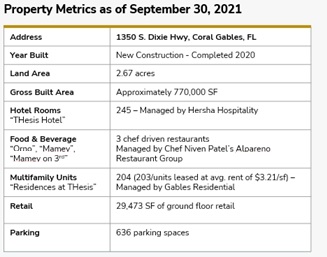

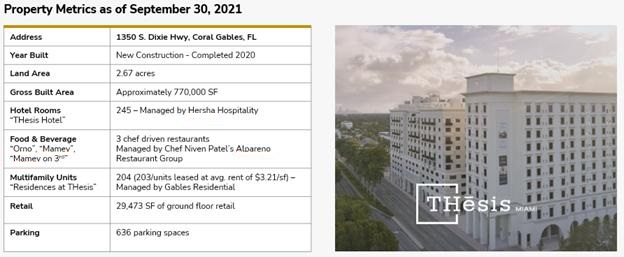

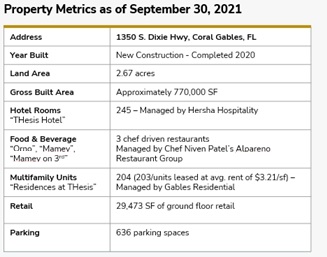

NRI Real Token Inc. is a Maryland corporation incorporated on June 2, 2021 for the initial purpose of owning, developing and managing THesis Miami, located at 1350 S Dixie Highway, Coral Gables, Florida 33146. THesis Miami includes a hotel, apartments, retail (restaurants and shopping) units and a parking garage which we refer to herein as the Property. We intend to elect to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), beginning with the taxable year ended December 31, 2022. We believe that, commencing with such taxable year, we have been organized and operated in such a manner, but can provide no assurance that we will operate in a manner so as to remain qualified as a REIT. We have not requested an opinion of counsel regarding our status under the Code as a REIT.

We conduct substantially all of our business through our operating partnership, NRI Real Token LP, a Delaware limited partnership (the “Operating Partnership”). We and NRI Real Token Thesis LLC (the “Sponsor General Partner”), which is an affiliate of Nolan Reynolds International, LLC (“NRI” or the “Sponsor”) are the general partners of the Operating Partnership. We and the Operating Partnership are advised by NRI Real Token Advisors LLC, a Delaware limited liability company (the “Advisor”) pursuant to an agreement (the “Advisory Agreement”) under which the Advisor performs advisory services regarding acquisition, asset management, accounting, financing and disposition of the Property, and is responsible for managing, operating and maintaining the Property and day-to-day management of the Company. Where applicable in this Form 10, “we,” “our,” “us,” and “the Company” refers to NRI Real Token Inc., the Operating Partnership and their subsidiaries except where the context otherwise requires.

Prior to the formation of the Company, the Property was owned and operated by 1350 S Dixie Holdings LLC (the “Property Owner”) which was acquired by the Operating Partnership. Our financial statements are those of 1350 S Dixie Holdings LLC.

On July 9, 2021, we commenced an offering (the “Offering”) of up to $85,000,000 limited partnership units (the “OP Units”) under a private placement to qualified purchasers who meet the definition of “accredited investors,” as provided in Regulation D of the Securities Act of 1933, as amended (the “Securities Act”). Upon election of the limited partner, subject to certain limitations, each OP Unit is convertible into one share of common stock of the Company, to be issued in the form of digital securities (distributed ledger shares) which are designated as NRI Real Token Security Tokens (the “Security Tokens”), or, at the election of the Company, cash in an equivalent value. Each Security Token will represent one share of common stock of the Company. Pursuant to the Offering, which concluded on December 31, 2021, the Operating Partnership issued 7,742,309 OP Units resulting in gross offering proceeds of approximately $79.4 million. The net proceeds from the Offering, approximately $73 million, were used to redeem approximately $73 million of interests of a prior investor and to pay corresponding closing costs.

No public market exists for the shares of our common stock. Subject to this Form 10 becoming effective, and the Company becoming a reporting company under the Exchange Act, we intend to facilitate the trading of the Security Tokens on certain alternative trading systems (“ATS”). There is no guarantee that we will be successful in listing on an ATS and, there is the possibility that no public market for our common stock may develop.

As of the date of this Form 10, we own only the Property. See Item 3, “Properties” for a more detailed description of our current portfolio.

Our principal executive offices are located at 1340 South Dixie Highway, Suite 612, Coral Gables, Florida 33146. Our telephone number is (305) 529-9928.

Our REIT Status

To qualify as a REIT, we must comply with a number of organizational and operational requirements, including a requirement that we distribute annually to our stockholders at least 90% of our REIT taxable income (which does not equal net income as calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”)), determined without regard for any deduction for dividends paid and excluding any net capital gain. If we qualify as a REIT, we generally will not be subject to U.S. federal income tax on the REIT taxable income we distribute to our stockholders. Even if we qualify as a REIT, we may still be subject to certain state and local taxes on our income and property, and federal income and excise tax on our undistributed income. If we fail to qualify as a REIT in any taxable year, including the current year, we will be subject to U.S. federal income tax at the regular corporate rate.

Our Operating Partnership

We are using an “umbrella partnership real estate investment trust,” or “UPREIT” structure, in which substantially all of our real estate investments are owned through the Operating Partnership. The Company is a general partner of the Operating Partnership.

Our Taxable REIT Subsidiary (TRS) Structure

The Property, and any future additional properties, will be indirectly owned by the Operating Partnership through wholly-owned limited liability companies or other subsidiaries. In order for the income from our hotel operations to constitute “rents from real property” for purposes of the gross income tests required for REIT qualification, we cannot directly or indirectly operate any of the hotel-related operations. Instead, we must lease the hotel portion of the Property in order to derive REIT-qualified income from rents. Rather than leasing the Property to third-party operators not owned or controlled by us, we opted to integrate the hotel lessee into our REIT by forming NRI Real Token Tenant, LLC (“TRS Lessee”) to act as the lessee of the hotel portion of the Property. By integrating the hotel lessee within our REIT structure, we will capture for our stockholders’ benefit not only net lease income from the Property owner subsidiaries, but also the income from hotel operations, subject to the discussion in the next paragraph.

Our TRS Lessee has entered into a management agreement with Hersha Hospitality Management, L.P. to operate the hotel portion of the Property. We anticipate that the rent paid to us by TRS Lessee will qualify as “rents from real property,” provided that it has engaged an “eligible independent contractor” (within the meaning of Section 856(d)(9)(A) of the Code) to operate the hotel portion of the Property. We believe that Hersha has qualified and will continue to qualify as an eligible independent contractor. Because TRS Lessee has jointly elected with us for it to be treated as a “taxable REIT subsidiary” within the meaning of Section 856(1) of the Code (a “TRS”), income earned by TRS Lessee will be fully subject to federal, state and local corporate income tax.

Ownership Structure

The following chart shows our current ownership structure and incorporates the steps taken prior to the closing of our private offering to create the current ownership structure.

Investment Objectives and Operations

We intend to own, develop and manage mixed-use residential and hospitality developments, initially in the greater Miami, Florida area. The only property currently owned is the Property. The Property includes the Thesis Hotel, a 245 room hotel with 8,000 square feet of meeting spaces and three owned restaurants: Mamey, Mamey on Third and Orno. The Property also includes 204 residential apartment rental units, approximately 30,000 square feet of additional retail space and a 636 space parking garage.

Our investment objectives are:

| ● | to preserve, protect and return investor capital contributions; |

| ● | to pay regular cash distributions; and |

| ● | to realize appreciation in the value of our investments upon the ultimate sale of such investments. |

We may not attain these objectives or produce any dividends or return of capital to investors. Investment results may vary substantially over time and from period to period. Our board of directors may, from time to time, change our investment objectives if it determines it is advisable and in the best interest of our Company.

Our Investment Strategy

At this time, we intend to focus solely on the Property. However, we may consider additional acquisition opportunities from time to time utilizing our strategy of developing and managing mixed-use commercial real estate in specific locations with stable, long-term demand generators, including, but not limited to, well-established large universities, thriving urban cores and major transit hubs.

We believe growth occurs in locations and markets with multiple stabilized demand generators, areas with high competitive barriers and/or markets that have analytical data that demonstrate stabilized growth. In addition, we may from time to time come across other opportunities and elect to apply our structure to other real estate investments. At such time, we may consider recommending to stockholders that it consolidate the Company with another structure. Should any transaction materialize, the Company’s stockholders would have the rights provided by operative law with respect to any such proposal.

Any future investments will embody one or more of the above attributes. We believe multifamily housing, especially in Florida, will continue to benefit from a supply/demand imbalance.

Our investment activities have been delegated to the Advisor under the Advisory Agreement. The Advisor will originate investment opportunities for the Company, negotiate and structure any acquisitions and related debt financing, and present its investment recommendations to our board of directors for its consideration and approval. Once an opportunity has been identified, the Advisor will oversee the due diligence process. During this process, the Advisor will request, review and evaluate various materials and documents relating to the opportunity, and obtain reports, where appropriate, concerning the value of contemplated investments of the Company.

We currently have indebtedness on the Property and may in the future obtain lines of credit or other financings secured by our assets in order to bridge the acquisition of, or acquire additional properties, to fund property improvements and other capital expenditures, to make distributions, and for other purposes. In addition, we may borrow as necessary or advisable to ensure that we maintain our qualification as a REIT, including borrowings to satisfy the REIT requirement that we distribute annually to our stockholders at least 90% of our REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain).

As of the date of this Form 10, the Property is subject to a senior secured loan in the principal amount of $116,250,000.00 (the “Senior Loan”) with an affiliate of Starwood Property Trust. In addition, we, through another subsidiary, have entered into a $33,750,000.00 mezzanine loan agreement (the “Mezzanine Loan”) with an affiliate of Starwood Property Trust. See “Item 2, Financial Information—Liquidity and Capital Resources—Debt” for a description of these loans.

We plan to hold and manage the Property until such point that the Property has stabilized, and full value is attained. Our board of directors has discretion to extend this holding period indefinitely. Circumstances may arise, however, that make it beneficial to sell the Property. The Advisor will continually evaluate the Property’s performance based on market conditions and our overall objectives to determine an appropriate time, if any, to sell the Property in an effort to maximize total returns to our stockholders. Any sale of all or substantially all of the Company’s assets will require stockholder approval.

About Our Sponsor, Nolan Reynolds International, LLC

NRI is a real estate investment, development and hospitality company. It acquires, constructs and manages a diverse portfolio of landmark properties in the United States and Latin America. NRI is a leader in delivering award-winning projects by marrying quality design and innovative programming that ultimately become cultural epicenters for the destinations they serve.

NRI and its predecessor companies, with more than 120 years of operations, have developed and constructed properties throughout the United States and Latin America in excess of approximately $6.5 billion in total present day value. As of September 30, 2021, it has over $175 million and $350 million in predevelopment and under construction, respectively.

Investment Company Act Limitations

We intend to conduct our operations so that neither we nor any of our subsidiaries will be required to register as an “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Company’s only asset is its General Partnership Interest in the Operating Partnership. As a result, the Company’s interest in the Operating Partnership has significant incidents of a true general partnership interest and does not fall within the definition of a “security” for purposes of the Investment Company Act. The Operating Partnership intends to rely on exclusion from the Investment Company Act based on the type of assets it owns. We anticipate that at least 55% of the Operating Partnership’s assets will consist of direct interests in real estate and at least 25% of the Operating Partnership’s assets (reduced to the extent the Operating Partnership’s investment in direct interests in real estate exceed 55%) will consist of real estate-related assets so that the Operating Partnership will not be required to register under the Investment Company Act. The Advisor will attempt to the monitor our portfolio of investments to ensure we do not come within the definition of an “investment company” under the Investment Company Act. If at any time the character of our investments may cause us to be deemed an investment company, we will take all necessary actions to ensure that we are not deemed an investment company for purposes of the Investment Company Act.

Additional Investment Limitations

In addition to the investment limitations described above, we will not:

| ● | make any investment that is inconsistent with our objectives of qualifying and remaining qualified as a REIT unless and until our board of directors determines, in its sole discretion, that REIT qualification is not in our best interests; |

| ● | engage in securities trading or engage in the business of underwriting or the agency distribution of securities issued by other persons; or |

| ● | acquire interests or securities in any entity holding investments or engaging in activities prohibited by our charter except for investments in which we hold a non-controlling interest and investments in entities having securities listed on a national securities exchange. |

Employees

NRI Real Token Inc. has no direct employees. The employees of the Sponsor, acting in their capacity as affiliates of the Advisor, perform substantially all of the services related to our asset management, accounting, investor relations, and other administrative activities. See Item 7, “Certain Relationships and Related Transactions, and Director Independence” for a summary of the fees paid to the Advisor and its affiliates during the year ended December 31, 2020 and the nine months ended September 30, 2021.

Competition

The hospitality and residential industries are highly competitive. Our hotel competes on the basis of location, brand, room rates, quality, amenities, reputation and reservations systems, among many factors. There are many competitors in the hotel industry, and many of these competitors may have substantially greater marketing and financial resources than we have. This competition could reduce occupancy levels and room revenue at our hotel We also face competition from services such as home sharing companies and apartment operators offering short-term rentals.

With respect to residential units, we will compete on the basis of location, brand, pricing, amenities, services, size and quality. Leasing retail space is also competitive. The Coral Gables market has numerous retail properties which will compete to lease space to our target tenants that can potentially reduce rental rates.

Dependency on Third Parties

We depend on the Advisor and its affiliates to provide certain services essential to the Company, including asset management services, supervision of the management of the Property, asset acquisition and disposition services, as well as other administrative responsibilities for the Company, including accounting services, investor communications and investor relations. As a result of these relationships, we are dependent upon our Advisor and its affiliates. We also are dependent upon Hersha to manage the hotel operations of the Property, Alpareno Restaurant Group, LLC to manage the food and beverage operations of the Property, Legacy Parking Company, LLC to manage the parking facilities and Gables Residential Services, Inc. to provide residential management services.

Environmental

As an owner of real estate, we are subject to various environmental laws of federal, state, and local governments. Compliance with existing laws has not had a material adverse effect on our financial condition or results of operations, and management does not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on properties we currently own, or on properties that may be acquired in the future.

Seasonality

Some hotel properties have business that is seasonal in nature. This seasonality can be expected to cause quarterly fluctuations in revenues. Quarterly earnings may be adversely affected by factors outside our control, including weather conditions and poor economic factors. As a result, we may have to enter into short-term borrowings in order to offset these fluctuations in revenue and to make distributions to our stockholders.

ITEM 1A. RISK FACTORS.

Risks Related Our Organizational Structure

The Operating Partnership will rely on its General Partners.

Control over the operation of the Operating Partnership will be vested entirely with the General Partners, and the Operating Partnership’s profitability will depend largely upon the business and investment acumen of the Sponsor’s management team. The loss of service of one or more of them could have an adverse impact on the Operating Partnership’s ability to realize its investment objectives. Neither limited partners of the Operating Partnership nor stockholders of our Company have the right or power to take part in the management of the Operating Partnership and as a result, the investment performance of the Operating Partnership will depend entirely on the actions of the General Partners.

The Operating Partnership may be unable to achieve and sustain profitability in future periods.

The Operating Partnership’s ability to achieve and maintain profitability depends on a number of factors, including our ability to attract hotel guests and keep the hotel occupied at favorable room revenues, our ability to maintain a high occupancy rate within our residential units at favorable rents, and our ability to generate revenue from leasing or operating attractive and successful restaurants and shops. The Operating Partnership’s inability to achieve and sustain profitability may require the Operating Partnership to delay, scale back, or eliminate some or all of its operations.

The Operating Partnership may need additional capital.

The development and expansion of the Operating Partnership’s business may require funds to make investments in accordance with our investment strategy and policies and for general corporate purposes (which may include repayment of our debt or any other corporate purposes we deem appropriate).

The Operating Partnership may seek additional equity or debt financing to provide for additional operating funds. Such financing may not be available or may not be available on satisfactory terms. If financing is not available on satisfactory terms, the Operating Partnership may be unable to continue or expand operations. In addition, if financing is not available on satisfactory terms, the Operating Partnership may require additional capital from our Sponsor or Sponsor General Partner in exchange for a fee or a priority interest in the return of its capital. There is no obligation on the part of the Sponsor or any limited partner to provide such funds. While debt financing may enable the Operating Partnership to expand its business more rapidly than it otherwise would be able to do, debt financing increases expenses and the debt must be repaid regardless of operating results.

Future equity financings of the Operating Partnership could result in dilution to securityholders of the Operating Partnership. The Operating Partnership’s inability to obtain adequate capital resources, whether in the form of equity or debt, to fund business and growth strategies, may require the Operating Partnership to delay, scale back, or eliminate some or all of its operations.

The hospitality and residential industries are highly competitive.

The hospitality and residential industries are highly competitive. Our hotel competes on the basis of location, brand, room rates, quality, amenities, reputation and reservations systems, among many factors. There are many competitors in the hotel industry, and many of these competitors may have substantially greater marketing and financial resources than we have. This competition could reduce occupancy levels and room revenue at our hotel. In addition, in periods of weak demand, as may occur during a general economic recession, profitability is negatively affected by the fixed costs of operating a hotel. We also face competition from services such as home sharing companies and apartment operators offering short-term rentals.

With respect to residential units, we will compete on the basis of location, brand, pricing, amenities, services, size and quality. Leasing retail space is also competitive. The Coral Gables market has numerous retail properties which will compete to lease space to our target tenants that can potentially reduce rental rates.

Because we depend upon our Sponsor and its affiliates to conduct our operations, any adverse changes in the financial condition of our Sponsor or its affiliates, the unavailability of management or our relationship with them could hinder our operating performance.

We depend on our Sponsor or its affiliates to manage our assets and operations. Any adverse changes in the financial condition of our Sponsor or its affiliates or our relationship with them could hinder their ability to manage us and our operations successfully. Our success depends, to a significant extent, upon the continued services of our Sponsor’s management team and the extent and nature of the relationships they have developed with residential and retail brokers and hotel operators. The loss of services of one or more members of our Sponsor’s management team could harm our business and our prospects.

We are required to make minimum base advisory fee payments to our Advisor under our Advisory Agreement, which must be paid even if our performance declines.

Pursuant to the Advisory Agreement among the Company, the Operating Partnership, the Sponsor General Partner and the Advisor, we must pay our Advisor an asset management, accounting and other administrative services fee of 1.00% of the Company’s Gross Revenues (as defined in the Advisory Agreement). Thus, even if our performance declines, including as a result of the impact of COVID-19, we will still be required to make payments to our Advisor, which could adversely impact our liquidity and financial condition.

In addition, under the Advisory Agreement, our Advisor is entitled to (i) acquisition fees in connection with the possible acquisition of additional real property investment of 1% of the initial asset value and such 1% charge shall be reflected on the transaction closing statement and paid as of closing on the property, (ii) a debt financing fee equal to $1 million for the Operating Partnership’s current debt financing and 1% of the amount of any future debt financings, and (iii) a disposition fee equal to 1% of the sales price of a real estate investment sold.

Your investment return may be reduced if we are required to register as an investment company under the Investment Company Act.

We intend to continue to conduct our operations so that we and our subsidiaries are not investment companies under the Investment Company Act. However, there can be no guarantee that we and our subsidiaries will be able to successfully avoid operating as an investment company.

If we were required to register as an investment company, we would become subject to substantial regulation with respect to our capital structure (including our ability to use borrowings), management, operations, transactions with affiliated persons (as defined in the Investment Company Act), and portfolio composition, including disclosure requirements and restrictions with respect to diversification and industry concentration, and other matters. Compliance with the Investment Company Act would, accordingly, limit our ability to make certain investments and require us to significantly restructure our business plan, which could materially adversely affect our operations.

Certain provisions in the Operating Partnership Agreement and our charter may delay or prevent our unsolicited acquisition.

Certain provisions in the Operating Partnership Agreement may delay or make more difficult unsolicited acquisitions or changes in control. These provisions could discourage third parties from making proposals involving an unsolicited acquisition or change of control, although some stockholders might consider such proposals, if made, desirable. These provisions also make it more difficult for third parties to alter the management structure of our Operating Partnership without the concurrence of the board of directors of the Company. These provisions include, among others:

| ● | redemption rights of limited partners and certain assignees of OP Units; |

| ● | transfer restrictions on our OP Units and other partnership interests; |

| ● | a requirement that any general partner may not be removed as the general partner of our Operating Partnership without its consent; |

| ● | our ability to amend the Operating Partnership Agreement and to cause our Operating Partnership to issue preferred and other classes of partnership interests in our Operating Partnership with terms that we may determine, in either case, without the approval or consent of any limited partner; and |

| ● | the right of limited partners to consent to certain transfers of our general partnership interest (whether by sale, disposition, statutory merger or consolidation, liquidation or otherwise). |

The Company’s charter and bylaws, the Operating Partnership Agreement, Delaware law and Maryland law also contain other provisions that may delay, defer or prevent a transaction or a change of control that might involve a premium price for our securities or that our securityholders otherwise believe to be in their best interests. See Item 11 “Description of Registrant’s Securities to be Registered.”

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (IT) networks and related systems.

We face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, persons inside our organization or persons with access to systems inside our organization, and other significant disruptions of our IT networks and related systems. In addition, our hotel is subject to risks of security breaches, which could include disclosures of hotel guests’ personal information. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Although we make efforts to maintain the security and integrity of these types of IT networks and related systems, our security efforts and measures may not be effective. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in such attempted security breaches evolve and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected.

A security breach or other significant disruption involving our IT networks and related systems could:

| ● | disrupt the proper functioning of our networks and systems and therefore our operations; |

| ● | result in misstated financial reports, violations of loan covenants and/or missed reporting deadlines; |

| ● | result in the Company’s inability to properly monitor its compliance with the rules and regulations regarding its qualification as a REIT; |

| ● | result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of, proprietary, confidential, sensitive or otherwise valuable information of ours or others, which could expose us to damage claims by third-parties; |

| ● | require significant management attention and resources to remedy any damages that result; |

| ● | subject us to claims for breach of contract, damages, credits, penalties or termination of leases or other agreements; or |

| ● | damage our reputation among our securityholders. |

Any or all of the foregoing could have a material adverse effect on our results of operations, financial condition and cash flows.

A financial crisis, economic slowdown, or epidemic or other economically disruptive event may harm the operating performance of the hospitality, residential and retail industries. We also face risks related to changes in the domestic and global political and economic environment, including capital and credit markets.

The industries we operate in have been closely linked with the performance of the general economy and, specifically, growth in the U.S. gross domestic product. Our hotel, residences and tenants are, and any future properties would be, classified as upscale. In an economic downturn, these properties may be more susceptible to a decrease in revenue, as compared to other properties in other categories that are available at more affordable rates. This characteristic may result from the fact that upscale properties generally target business and high-end leisure travelers and residents. If the U.S. or global economy experiences volatility or significant disruptions, our business could be negatively impacted by reduced demand for business and leisure travel related to a slowdown in the general economy.

The COVID-19 pandemic, including the resulting economic slowdown, travel restrictions and decrease in demand for hotel rooms, has adversely impacted and disrupted, and is expected to continue to adversely impact and disrupt, our business, financial performance and condition, operating results and cash flows.

The outbreak of COVID-19 has had and continues to have, and another pandemic in the future could similarly have, significant repercussions across regional and global economies and financial markets. The global and sustained impact of the outbreak and resulting control measures, including states of emergency, mandatory quarantines, “shelter in place” orders, border closures, and travel and large gatherings restrictions, have significantly decreased the demand for travel. We have been and expect to continue to be negatively affected by these and other governmental regulations and travel advisories to fight the pandemic, including recommendations by the U.S. Department of State, the Center for Disease Control and Prevention and the World Health Organization. In addition, the COVID-19 pandemic has triggered a global economic slowdown.

COVID-19 has disrupted and has had a significant adverse effect on, and will continue to significantly adversely impact and disrupt, our business, financial performance and condition, operating results and cash flows. The effects of the pandemic on the hotel industry are unprecedented. Global demand for lodging has been drastically reduced and occupancy levels have reached historic lows in 2020. Since the Property opened in August 2020, we have experienced reductions in both our hotel’s occupancy and revenue per available room when compared with our pre-pandemic projections. Additionally, the vast majority of the group business we had anticipated from activities related to the University of Miami has yet to materialize. Additionally, travel, especially business and leisure travel in the United States has continued to be adversely affected as result of COVID-19. It is not currently known when, or if, our hotel will return to regular operations. It is also unclear when demand for travel (including business and leisure travel and demand for conference space) will increase or if we will need to suspend operations or decrease capacity at our hotel in the future, including as a result of increase or changes to government regulations, an increase in the number of COVID-19 cases or changes in business and other consumer preferences for travel.

Additional factors that would negatively impact our ability to successfully operate during or following COVID-19 or another pandemic, or that could otherwise significantly adversely impact and disrupt our business, financial performance and condition, operating results and cash flows, include:

| ● | sustained negative consumer or business sentiment, economic metrics (including unemployment levels, discretionary spending and declines in personal wealth) or demand for travel, including beyond the end of the COVID-19 pandemic and the lifting of travel restrictions and advisories, which could further adversely impact demand for lodging; |

| ● | unexpected increase in our cash burn rate, which is subject to numerous risks and uncertainties, including related to hotel working capital needs as well as the terms of any financing available to us, which could mean we do not have sufficient liquidity to withstand any sustained decreases in occupancy or revenue in 2022 or thereafter from historical levels; |

| ● | our ability to obtain bank lending or access the capital markets could deteriorate as a result of the pandemic, including its impact on our business and the economy; |

| ● | our increased indebtedness and decreased operating revenues, which could increase our risk of default on our loans; |

| ● | we may require additional indebtedness, which may contain even more restrictive covenants than our existing indebtedness or may require incremental collateral; |

| ● | our dependence on our hotel manager, who are facing similar challenges from the COVID-19 pandemic; |

| ● | disruptions in our supply chains, including disruptions to labor force availability, which may impact our hotel; |

| ● | disruptions as a result of corporate employees working remotely, including risk of cybersecurity incidents and disruptions to internal control procedures; and |

| ● | benefits of government action to provide financial support to affected industries, including the travel and hospitality industry, may not be available to us or our operators. |

The distribution of COVID-19 vaccines that began in December 2020 and the reports of their effectiveness have resulted in an improvement in traveler and general consumer sentiment. However, the significance, extent and duration of the impacts caused by the COVID-19 outbreak on our business, financial condition, operating results and cash flows, remains largely uncertain and dependent on future developments that cannot be accurately predicted at this time, such as the continued severity, duration (including the extent of any resurgences in the future), transmission rate and geographic spread of COVID-19 in the United States and globally, the extent and effectiveness of the containment measures taken, the timing of and manner in which containment efforts are reduced or lifted, the timing, efficacy, and availability and deployment of vaccinations and other treatments to combat COVID-19, and the response of the overall economy, the financial markets and the population, particularly in the area in which we operate, once the current or any future containment measures are reduced or lifted. As a result, we cannot provide an estimate of the overall impact of the COVID-19 pandemic on our business or when, or if, we will be able to achieve normal, pre-COVID-19 projected level operations.

Because of the concentration of our assets in Miami-Dade County, Florida, any adverse economic, real estate or business conditions in these geographic areas could affect our operating results and our ability to pay distributions to our securityholders.

The Property is the Operating Partnership’s sole investment and the value of your investment will fluctuate with the performance of this investment. The Property is located in the greater Miami, Florida area. As such, the geographic concentration of our portfolio makes us particularly susceptible to adverse economic developments in the Florida real estate markets. Any adverse economic or real estate developments in this geographic market, such as business layoffs or downsizing, industry slowdowns, relocations of businesses, changing demographics and other factors could adversely affect our operating results.

Further, the geographic concentration of our portfolio makes us particularly susceptible to adverse economic developments in the South Florida real estate market. Any adverse economic or real estate developments in this market, such as business layoffs or downsizing, industry slowdowns, relocations of businesses, changing demographics and other factors could adversely affect our operating results and our ability to pay distributions to our securityholders.

You will not have the opportunity to evaluate our future investments before the Company makes them, which makes your investment more speculative.

For at least the following 12 months, our portfolio will consist of only the Property. Thereafter, subject to providing the holders of OP Units the opportunity to redeem their OP Units based on certain metrics contained in the Operating Partnership Agreement, we may consider additional future investments. See Item 11 “Description of Registrant’s Securities to be Registered—Description of the Operating Partnership Agreement.” You will be unable to evaluate the economic merit of any future investments before they are made and will have to rely entirely on the ability of our Sponsor and Advisor to select suitable and successful investment opportunities. Furthermore, the Company and its board of directors will have broad discretion in selecting the properties we will invest in. These factors increase the risk that your investment may not generate returns comparable to other real estate investment alternatives.

Changes in laws, regulations, or policies may adversely affect our business.

The laws and regulations governing our business or the regulatory or enforcement environment at the federal level or in any of the states in which we may operate may change at any time and may have an adverse effect on our business. We are unable to predict how this or any other future legislative or regulatory proposals or programs will be administered or implemented or in what form, or whether any additional or similar changes to statutes or regulations, including the interpretation or implementation thereof, will occur in the future. Any such action could affect us in substantial and unpredictable ways and could have an adverse effect on our results of operations and financial condition. Our inability to remain in compliance with regulatory requirements in a particular jurisdiction could have a material adverse effect on our operations in that market and on our reputation generally. Applicable laws or regulations may be amended or construed differently and new laws and regulations may be adopted, either of which could materially adversely affect our business, financial condition or results of operations.

We may experience losses caused by severe weather conditions, natural disasters or the physical effects of climate change.

Our Property is susceptible to revenue loss, cost increase or damage caused by severe weather conditions or natural disasters such as hurricanes and floods, as well as the effects of climate change. To the extent climate change causes changes in weather patterns, we could experience increases in storm intensity. Over time, these conditions could result in declining hotel, residential and retail demand, significant damage to our Property or our inability to operate the hotel, residences and retail at all.

We believe that our Property is adequately insured, consistent with industry standards, to cover reasonably anticipated losses that may be caused by natural disasters, including the effects of climate change. Nevertheless, we are subject to the risk that insurance will not fully cover all losses and, depending on the severity of the event and the impact on our Property, insurance may not cover a significant portion of the losses. In addition, we may not purchase insurance under certain circumstances if the cost of insurance exceeds, in our judgment, the value of the coverage relative to the risk of loss. Also, changes in federal and state legislation and regulation relating to climate change could result in increased capital expenditures to improve the energy efficiency and resiliency of our Property without a corresponding increase in revenue.

Risks Related to Hotel Investments

We are subject to general risks associated with operating hotels.

Our hotel is subject to various operating risks common to the hotel industry, many of which are beyond our control, including, among others, the following:

| ● | adverse effects of the COVID-19 pandemic, including a potential general reduction in business and personal travel; |

| ● | competition from other hotels in our market; |

| ● | over-building of hotels in our market, which results in increased supply and adversely affects occupancy and revenues at our hotel; |

| ● | dependence on business and commercial travelers and tourism; |

| ● | increases in operating costs due to inflation, increased energy costs and other factors that may not be offset by increased room rates; |

| ● | changes in interest rates and in the availability, cost and terms of debt financing; |

| ● | increases in assessed property taxes from changes in valuation or real estate tax rates; |

| ● | increases in the cost of property insurance; |

| ● | changes in governmental laws and regulations and the related costs of compliance with laws and regulations; |

| ● | unforeseen events beyond our control, such as terrorist attacks, travel-related health concerns which could reduce travel, including pandemics and epidemics such as COVID-19 and other future outbreaks of infectious diseases, travel-related accidents, and travel infrastructure interruptions; |

| ● | adverse effects of international, national, regional and local economic and market conditions and increases in energy costs or labor costs and other expenses affecting travel, which may affect travel patterns and reduce the number of business and commercial travelers and tourists; and |

| ● | risks generally associated with the ownership of hotel properties and real estate, as we discuss in more detail below. |

These factors could adversely affect our hotel revenues and expenses, which in turn could adversely affect our financial condition, results of operations, the market price of our Securities and our ability to make distributions.

Declines in or disruptions to the travel industry could adversely affect our business and financial performance.

Our business and financial performance are affected by the health of the worldwide travel industry. Travel expenditures are sensitive to personal and business-related discretionary spending levels, tending to decline or grow more slowly during economic downturns. For example, during regional or global recessions, domestic and global economic conditions can deteriorate rapidly, resulting in increased unemployment and a reduction in expenditures for both business and leisure travelers. Because these events or concerns, and the full impact of their effects, are largely unpredictable, they can dramatically and suddenly affect travel behavior by consumers and decrease demand.

The hotel business is seasonal, which affects our results of operations from quarter to quarter.

The hotel industry is seasonal in nature. This seasonality can cause quarterly fluctuations in our financial condition and operating results, including in any distributions on our Securities. Our quarterly operating results may be adversely affected by factors outside our control, including weather conditions and poor economic factors. As a result, we may have to reduce distributions or enter into short-term borrowings in certain quarters in order to make distributions if such borrowings are not available on favorable terms.

Many real estate costs are fixed, even if revenue from the hotel decreases.

Many costs, such as real estate taxes, insurance premiums and maintenance costs, generally are not reduced even when a hotel is not fully occupied, room rates decrease or other circumstances cause a reduction in revenues. If we are unable to offset real estate costs with sufficient revenues, we may be adversely affected.

Our operating expenses may increase in the future, which could cause us to raise our room rates, which may reduce room occupancy, or cause us to realize lower net operating income as a result of increased expenses that are not offset by increased room rates, in either case decreasing our cash flow and our operating results.

Operating expenses, such as expenses for utilities, technology, labor and insurance, are not fixed and may increase in the future. To the extent such increases affect our room rates and therefore room occupancy at our hotel, our cash flow and operating results may be negatively affected.

We may be adversely affected by increased use of business-related technology, which may reduce the need for business-related travel.

The increased use of teleconference and video-conference technology by businesses could result in decreased business travel as companies increase the use of technologies that allow multiple parties from different locations to participate at meetings without traveling to a centralized meeting location. To the extent that such technologies play an increased role in day-to-day business and the necessity for business-related travel decreases, hotel room demand may decrease, and we may be adversely affected.

We rely on, and plan to rely on, third party hotel managers to employ the personnel required to operate our hotel. As a result, we have less ability in the COVID-19 environment to reduce staffing at our hotel than we would if we employed such personnel directly. We are also subject to risks associated with the employment of hotel personnel, particularly if the employees at our hotel unionize.

We currently contract Hersha Hospitality Management L.P., a third-party hotel manager, to operate and employ the personnel required to operate the THesis Hotel. Hersha determines appropriate staffing levels; we are required to reimburse them for the cost of these employees. As a result, we are dependent on the hotel manager to make appropriate staffing decisions and to appropriately reduce staffing when market conditions are poor. As a result, we have less ability to reduce staffing than we would if we employed such personnel directly.

Furthermore, the term of our agreement with our hotel manager expires on August 5, 2030. We may not be able to negotiate new contracts with the same or similar terms, including the same fee structure. To the extent we are unable to renew our hotel manager contracts or find new third party hotel managers at favorable terms, our expenses may increase and our performance may be materially affected.

Changes in labor laws may negatively impact us. For example, the implementation of new occupational health and safety regulations, minimum wage laws, and overtime, working conditions status and citizenship requirements and the Department of Labor’s proposed regulations expanding the scope of non-exempt employees under the Fair Labor Standards Act to increase the entitlement to overtime pay could significantly increase the cost of labor in the workforce, which would increase the operating costs of our hotel and may have a material adverse effect on us.

Risks Related to Mixed-Use Development Investments

Our performance will depend on the collection of rent from our tenants, those tenants’ individual financial condition and the ability of those tenants to maintain their leases.

A substantial portion of our income is derived from rental income from real property. As a result, our performance will depend on the collection of rent. Our income would be negatively affected if a significant number of our tenants, among other things: (1) decline to extend or renew leases upon expiration; (2) renew leases at lower rates; (3) fail to make rental payments when due; or (4) become bankrupt or insolvent. We cannot be certain that any tenant whose lease expires will renew or that we will be able to re-lease space on economically advantageous terms. The loss of rental revenues from a number of tenants and difficulty replacing such tenants may adversely affect our profitability and our ability to meet our financial obligations.

Lease defaults or terminations or landlord-tenant disputes may adversely reduce our income from our Property.

Lease defaults or terminations by one or more of our tenants may reduce our revenues unless a default is cured or a suitable replacement tenant is found promptly. In addition, disputes may arise between the landlord and tenant that result in the tenant withholding rent payments, possibly for an extended period. These disputes may lead to litigation or other legal proceedings to secure payment of the rent withheld or to evict the tenant. In other circumstances, a tenant may have a contractual right to abate or suspend rent payments. Even without such right, a tenant might determine to do so. Any of these situations may result in extended periods during which there is a significant decline in revenues or no revenues generated by our Property. If this were to occur, it could adversely affect our results of operations.

Competition from other apartment communities for tenants could reduce our profitability and the return on the Securities.

The apartment industry is highly competitive. We face competition from other apartment communities and overbuilding of apartment communities may occur. If so, this will increase the number of apartment units available and may decrease occupancy and apartment rental rates. This competition could reduce occupancy levels and revenues at our Property, which would adversely affect our operations. In addition, increases in operating costs due to inflation may not be offset by increased apartment rental rates.

We face significant competition for retail tenants, which may limit our ability to achieve our investment objectives or pay distributions.

The U.S. commercial real estate investment and leasing markets are competitive. We face competition from various entities for prospective tenants and to retain our current tenants. Many of our competitors have substantially greater financial resources and may be able to accept more risk than we can prudently manage, including risks with respect to the creditworthiness of a tenant.

We depend upon the performance of our property manager in the selection of tenants and negotiation of leasing arrangements. We have offered and may have to offer inducements, such as free rent and tenant improvements, to compete for attractive tenants. Further, as a result of their greater resources, competitors may have more flexibility than we do in their ability to offer rental concessions, which could put additional pressure on our ability to maintain or raise rents and could adversely affect our ability to attract or retain tenants. In the event we are unable to find new tenants and keep existing tenants, or if we are forced to offer significant inducements to such tenants, we may not be able to meet our investment objectives and our financial condition, results of operations, cash flow, ability to satisfy our debt service obligations and ability to pay distributions to our securityholders may be adversely affected.

If a major tenant defaults or declares bankruptcy, we may be unable to collect balances due under relevant leases, which could have a material adverse effect on our financial condition and ability to pay distributions.

The default, bankruptcy or insolvency of a tenant may adversely affect the income produced by our properties. Under bankruptcy law, a tenant cannot be evicted solely because of its bankruptcy and has the option to assume or reject any unexpired lease. If the tenant rejects the lease, any resulting claim we have for breach of the lease (other than to the extent of any collateral securing the claim) will be treated as a general unsecured claim. Our claim against the bankrupt tenant for unpaid and future rent will be subject to a statutory cap that might be substantially less than the remaining rent actually owed under the lease, and it is unlikely that a bankrupt tenant that rejects its lease would pay in full amounts it owes us under the lease. Even if a lease is assumed and brought current, we still run the risk that a tenant could condition lease assumption on a restructuring of certain terms, including rent, that would have an adverse impact on us. Any shortfall resulting from the bankruptcy of one or more of our tenants could adversely affect our business, financial condition, results of operations, cash flow or our ability to satisfy our debt service obligations or to maintain our level of distributions.

Risks Related to the Real Estate and Real Estate Industry

The illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our Property and harm our financial condition.

Real estate investments are historically relatively illiquid, and our ability to sell promptly our current and future properties for reasonable prices in response to changing economic, financial, and investment conditions could be limited.

We may decide to sell our Property in the future. We may be unable to sell the Property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We may sell the Property at a loss as compared to carrying value. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property. We may be required to expend funds to correct defects or to make improvements before a property can be sold.

Increases in property taxes would increase our operating costs, reduce our income and adversely affect our ability to make distributions.

Our Property will be subject to real and personal property taxes. These taxes may increase as tax rates change and as our property is assessed or reassessed by taxing authorities. If property taxes increase and we are unable to pass through costs through to our tenants, our financial condition, results of operations and our ability to make distributions could be materially and adversely affected and the market price of our Securities could decline.

Our Property may contain or develop harmful mold, which could lead to liability for adverse health effects and costs of remediating the problem.

When excessive moisture accumulates in buildings or on building materials, mold growth may occur, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. Concern about indoor exposure to mold has been increasing as exposure to mold may cause a variety of adverse health effects and symptoms, including allergic or other reactions. Properties may contain microbial matter such as mold and mildew. As a result, the presence of significant mold at a property could require us to undertake a costly remediation program to contain or remove the mold. In addition, the presence of significant mold could expose us to liability from property guests, residents, tenants, employees, and others if property damage or health concerns arise.

Compliance with the Americans with Disabilities Act and fire, safety, and other regulations may require us or our borrowers to incur substantial costs.

Our Property is, and any future property will be, required to comply with the ADA. The ADA requires that “public accommodations” such as hotels, restaurants, and retail stores be made accessible to people with disabilities. Compliance with the ADA’s requirements could require removal of access barriers and non- compliance could result in imposition of fines by the U.S. government or an award of damages to private litigants, or both. In addition, we are required to operate the property in compliance with fire and safety regulations, building codes, and other land use regulations as they may be adopted by governmental agencies and bodies and become applicable to our property. Any requirement to make substantial modifications to our Property, whether to comply with the ADA or other changes in governmental rules and regulations, could be costly.

We may experience uninsured or underinsured losses.

We have property and casualty insurance with respect to our Property and other insurance, in each case, with loss limits and coverage thresholds deemed reasonable by our management team. In doing so, we have made decisions with respect to what deductibles, policy limits, and terms are reasonable based on management’s experience, our risk profile, the loss history of our third-party managers, the nature of a specific property and our business, our loss prevention efforts, the cost of insurance and other factors.

Various types of catastrophic losses may not be insurable or may not be economically insurable. In the event of a substantial loss, our insurance coverage may not cover the full current market value or replacement cost of our lost investment, including losses incurred in relation to the COVID-19 pandemic. Inflation, changes in building codes and ordinances, environmental considerations, and other factors might cause insurance proceeds to be insufficient to fully replace or renovate a property after it has been damaged or destroyed.

Accordingly, the following may occur:

| ● | the insurance coverage thresholds that we have obtained will not fully protect us against insurable losses (i.e., losses may exceed coverage limits); |

| ● | we will incur large deductibles that will adversely affect our earnings; |

| ● | we will incur losses from risks that are not insurable or that are not economically insurable; or |

| ● | current coverage thresholds will not continue to be available at reasonable rates. |

Our current lenders require us to maintain certain insurance coverage thresholds, and we anticipate that future lenders will have similar requirements. We believe that we have complied with the insurance maintenance requirements under the current governing loan documents and we intend to comply with any such requirements in any future loan documents. However, a lender may disagree, in which case the lender could obtain additional coverage thresholds and seek payment from us, or declare us in default under the loan documents if we fail to obtain additional coverage. In the former case, we could spend more for insurance than we otherwise deem reasonable or necessary or, in the latter case, subject us to a foreclosure on properties securing one or more loans.

If we set aside insufficient reserves, we may be required to defer necessary or desirable property improvements.

If we do not establish sufficient reserves to supply necessary funds for capital improvements or similar expenses, we may be required to defer necessary or desirable improvements to our Property. If we defer such improvements, our Property may decline in value, it may be more difficult for us to attract or retain tenants and hotel guests, or the amount of rent or hotel room rate we can charge may decrease.

Risks Related to Conflicts of Interest

Our agreements with our Sponsor and its affiliates were not negotiated on an arm’s-length basis, and we may pursue less vigorous enforcement of their terms because of conflicts of interest with certain of our executive officers and key employees of our Sponsor.

Because each of our executive officers are also key employees of our Sponsor and have ownership interests in NRI, our Advisory Agreement was not negotiated on an arm’s-length basis, and we did not have the benefit of arm’s-length negotiations of the type normally conducted with an unaffiliated third party. As a result, the terms, including fees and other amounts payable, may not be as favorable to us as an arm’s-length agreement. Furthermore, we may choose not to enforce, or to enforce less vigorously, our rights under these agreements because of our desire to maintain our ongoing relationship with our Sponsor and its affiliates.

Our Sponsor manages other entities and may direct attractive investment opportunities away from us. Neither our Sponsor nor its affiliates are restricted from advising clients with similar investment guidelines.

Our executive officers also serve as key employees and as officers of our Sponsor and will continue to do so. Our Advisory Agreement requires our Advisor to use commercially reasonable efforts to present a continuing and suitable investment program to us which is consistent with our investment policies and objectives, but neither our Sponsor nor its affiliates are obligated generally to present any particular investment opportunity to us even if the opportunity is of a character which, if presented to us, could be taken. Additionally, in the future our Sponsor or its affiliates may advise other clients, some of which may have investment guidelines substantially similar to ours.

Our Sponsor and its key employees, who are NRI and our executive officers, face competing demands relating to their time and this may adversely affect our operations.

We rely on an affiliate of our Sponsor for the day-to-day operation of our business. Certain key employees of our Sponsor are executive officers of NRI. Because our Sponsor’s and Advisor’s key employees have duties to NRI as well as to us, we do not have their undivided attention and they face conflicts in allocating their time and resources between us and NRI. Our Sponsor or our Advisor may also manage other entities in the future. During turbulent market conditions or other times when we need focused support and assistance from our Sponsor, other entities for which our Sponsor also acts as an external advisor will likewise require greater focus and attention as well, placing competing high levels of demand on the limited time and resources of our Sponsor’s key employees. We may not receive the necessary support and assistance we require or would otherwise receive if we were internally managed by persons working exclusively for us.

Risks Related to our common stock and the Security Tokens (collectively, the “Securities”)

There is currently no trading market for the Securities, and a market may never develop.

Since there has been no prior public trading market for the Security Tokens, there may never be an active or liquid market and/or their price may be highly volatile and token holders may be unable to sell or otherwise engage in Security Token transactions at any time. ATSs may lack substantial liquidity, limiting the feasibility of selling or exchanging the Security Tokens. The valuation of digital tokens in a secondary market, if any, is usually not transparent and is highly speculative. In addition, it is possible due to unforeseen future changes in ATS listing requirements, that we may lose trading privileges on the ATSs. In addition, we may decide to voluntarily delist from the ATSs. In the event that the Security Tokens are removed from the ATSs, you would still hold your equity interest in the Company, but there would no longer be a secondary trading market. Neither the Company nor the Operating Partnership are under any obligation to provide Security Token valuations to investors. Neither the Company nor the Operating Partnership are now and will not be responsible or liable for the market value of the Security Tokens, the transferability and/or liquidity of the Security Tokens, and/or the availability of any market for the Security Tokens through third parties or otherwise.

The Security Tokens may not hold their value or increase in value. Numerous factors, including but not limited to the risks set out herein, will influence this outcome, many of which are not under the Operating Partnership’s or the Company’s control.

The further development and acceptance of distributed ledger networks, which are part of a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate.

The growth of the distributed ledger industry in general, as well as virtual currencies and digital securities, is uncertain. The factors affecting the further development of the virtual currency and digital security industry, as well as distributed ledger networks, include, without limitation:

| ● | Worldwide growth in the adoption and use of Bitcoin (“BTC”) and other distributed ledger technologies; |

| ● | Government and quasi-government regulation of BTC and other distributed ledger assets and their use, or restrictions on or regulation of access to and operation of distributed ledger networks or similar systems; |

| ● | The maintenance and development of the open-source software protocol of distributed ledger networks; |

| ● | General economic conditions and the regulatory environment relating to virtual currencies and digital securities; and/or |

| ● | A decline in the popularity or acceptance of BTC or other distributed ledger-based tokens or coins. |

The slowing or stopping of the development, general acceptance and adoption and usage of distributed ledger networks and distributed ledger or digital assets may deter or delay the acceptance of the Security Tokens.

There are various regulatory risks for the Company associated with its Security Tokens.

Any Security Tokens issued in exchange for OP Units will be offered in reliance upon exemptions from the registration requirements of the Securities Act and its foreign equivalents, if applicable. As a result, unless we successfully register our common stock on this Form 10 under the Exchange Act, there will be substantial restrictions on the transferability of the Security Tokens, which may not be offered, sold or transferred in the United States absent such registration or an applicable exemption from the registration requirements. In particular, as an example, it may be that the Security Tokens may not be transferred within the United States or to a “U.S. person” unless such transfer is made to an “accredited investor” in compliance with applicable securities law and may only be transferred in a transaction outside the United States to non-U.S. persons, subject to applicable law. Any transfer of a Security Token made in violation of these restrictions or comparable restrictions in other jurisdictions will be void.

In addition, the Operating Partnership does not believe it is acting as a money transmitter (“MT”) or a money services business (“MSB”). If the Operating Partnership were deemed to be a MT and/or MSB, however, it would be subject to significant additional regulation, including registration and licensing at the state and federal level. This could lead to significant changes in how the Security Tokens are structured, how they are purchased and sold, and other issues, and could greatly increase the costs in creating and facilitating transactions in the Security Tokens.

In addition, the Operating Partnership believes that it is not acting as a broker-dealer and is not registered as such with the SEC or FINRA, nor is it registered with any other Self-Regulatory Organization (“SRO”) as a broker-dealer, exchange or transfer agent. If the Operating Partnership were deemed a broker-dealer, exchange or transfer agent, however, it would be subject to significant additional regulation. This could lead to significant changes with respect to the how the Security Tokens are structured, how they are purchased and sold, and other issues, and could greatly increase the Company’s costs in creating and facilitating transactions in the Security Tokens if such transactions are allowed at all. Further, a regulator could take action against the Company if it views the Security Tokens as a violation of existing law. Any of these outcomes could negatively affect the value of the Security Tokens.

Changes in international, federal, state, or local laws may impact the value of the Security Tokens and/or the Company’s ability to develop the Security Tokens.

Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of the Security Tokens. The regulatory status of the Security Tokens and similar digital assets continues to evolve and is unclear or unsettled in many jurisdictions, including the United States. It is difficult to predict how or whether regulatory agencies may apply existing or new regulations with respect to such technology and its applications, including the Security Tokens. Further, it is difficult to predict how or whether legislatures or regulatory agencies may implement changes to law and regulation affecting distributed ledger technology and its applications. Regulatory actions could negatively impact the Security Tokens in various ways, including, for example, through a determination that the Security Tokens are regulated financial instruments required to be registered with the appropriate regulatory agency. Any of these outcomes could negatively affect an investment in the Security Tokens.