The inside view from EO Charging

EO was founded in 2015 and has now sold over 50,000 charging station in 35 countries. In August this year [2021], the company announced that it was signing a business combination agreement with a NASDAQ listed SPAC of FRSG Corporation (First Reserve Sustainable Growth), in a deal valued at US$675 million (£490m €573m). This transaction was notable as being the first such acquisition of a UK-based EV charging business by a US SPAC. EO’s rationale for this strategy was clear and simple.

“It comes down to the size of the opportunity,” says Charlie Jardine, CEO and founder of EO Charging – and panellist at inspiratia’s upcoming New Energy Infrastructure and Energy Storage Summit.

“Typically, start-up companies have a significant need to scale quickly. For us, it’s a 10–20-year play. Going public is a great way to get access to sufficient capital to build a global business.”

“We don’t currently sell EO Chargers in the US, but we have big global aspirations and America represents a rapidly growing EV market – so the US will be a focal point for us in the future. FRSG’s experience in not only going public but in the energy transition space is also going to add a significant amount of value to us and our team as we scale globally.”

“One of the strategic advantages of a SPAC is speed to market. We will be able to get to market relatively quickly compared to a traditional IPO. The market for EVs has continually moved towards EO’s fleet-focused mission and value proposition - it’s growing very quickly, and the opportunity is now”

Problems could be looming for New York SPACs

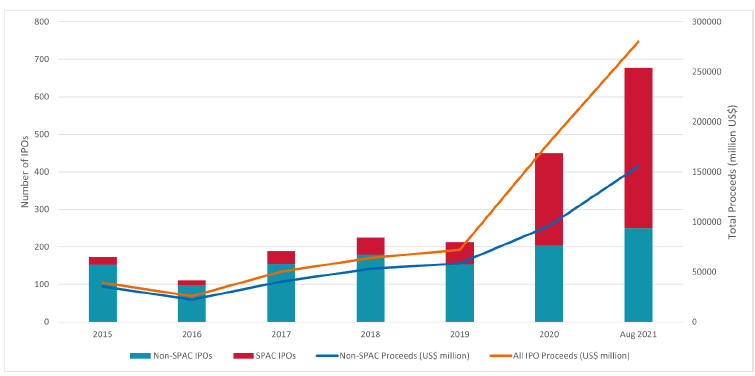

An excess of targetless SPACs on the NASDAQ is a great opportunity for smaller start-ups in the EV space that are looking to raise funds and get themselves on the market quickly. However, some commentators are concerned that this imbalance could lead to problems for the market in the near future.

Most SPAC sponsors have a time limit of around two years to complete a transaction, after which the investors’ money must be returned, minus agreed expenses. Given sponsors typically receive a large equity share of the final company, they are heavily incentivised to find a target and sell it to investors, even if that target company is not the safest bet.

This could lead to a frenzy of activity from late 2022 when the initial wave of US SPAC managers will start to feel the heat. Particularly if the number of private start-ups in the target market continues to lag behind the number of SPACs receiving listings.

So, what sort of companies could rise up and fill this demand?

“It could be that certain companies may have difficulty fulfilling all the requirements for a NASDAQ IPO,” ponders Pinsent Masons’ corporate finance senior associate, Sunjay Malhotra, “or that they simply don’t have the management time or financial resource to complete all necessary formalities for a NASDAQ IPO – my understanding is that SPACs are a slightly quicker route to market in the US than a direct IPO.”

“When you invest in a tech company, it is always speculative because the outcome for that company is usually binary - it will either succeed or it will fail. But the rewards for investors if a tech company is successful are going to be huge.”

The biggest concern with SPACs has historically been the protections afforded to investors as there are less stringent disclosure requirements than a traditional IPO.

Charlie Jardine makes the point that after an agreement is put in place, there is more onus on the investor to scrutinise the companies that they are investing in, something he feels will do no harm to EO Charging.

“You’ve got to look at the company itself. We’ve got real paying customers and a real business that was already profitable last year. That in itself is a really compelling story. Of course, SPACs have taken some criticism. But fundamentally, you have to look beyond just the path to capital markets and into the financial trajectory of the company. We have both emerging and name brand B2B customers who have committed to five, ten, fifteen-year full fleet transitions contributing to a strong base of Annual Recurring Revenue, and this is just the start,” comments Jardin.

“The bottleneck is down to vehicle availability. From a charging point of view, part of our business plan is predicated on deployment of vehicles into the marketplace. That’s a macro trend that’s out of our control. But fundamentally, the market is growing extremely quickly, 300-400% year-on-year. So investors that believe in the future of EVs will also believe in the value of the charging market.”

| | |

| 2 | | Contact us: Phone: +442073519451 | Email: info@inspiratia.com |