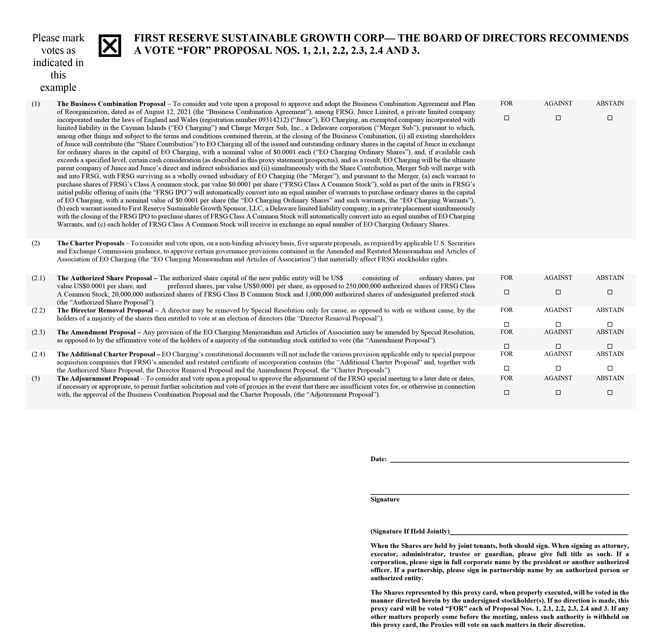

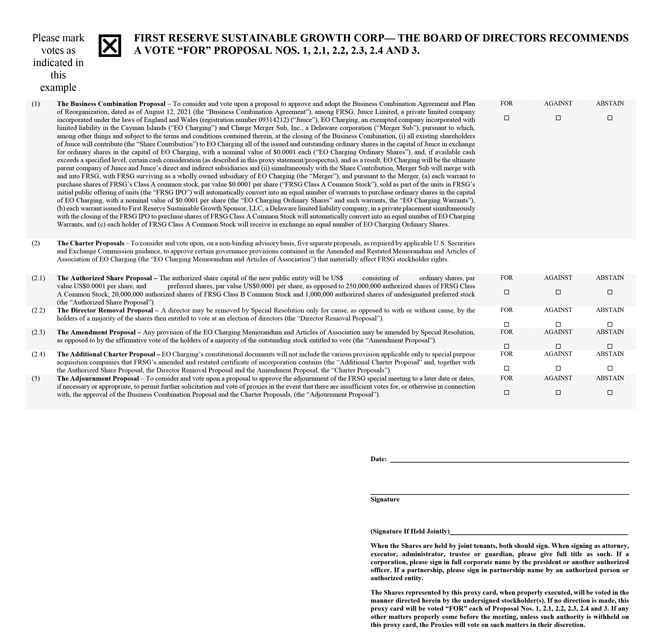

Please mark votes as indicated in this example FIRST RESERVE SUSTAINABLE GROWTH CORP— THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NOS. 1, 2.1, 2.2, 2.3, 2.4 AND 3. (1) The Business Combination Proposal – To consider and vote upon a proposal to approve and adopt the Business Combination Agreement and Plan of Reorganization, dated as of August 12, 2021 (the “Business Combination Agreement”), among FRSG, Juuce Limited, a private limited company incorporated under the laws of England and Wales (registration number 09314212) (“Juuce”), EO Charging, an exempted company incorporated with limited liability in the Cayman Islands (“EO Charging”) and Charge Merger Sub, Inc., a Delaware corporation (“Merger Sub”), pursuant to which, among other things and subject to the terms and conditions contained therein, at the closing of the Business Combination, (i) all existing shareholders of Juuce will contribute (the “Share Contribution”) to EO Charging all of the issued and outstanding ordinary shares in the capital of Juuce in exchange for ordinary shares in the capital of EO Charging, with a nominal value of $0.0001 each (“EO Charging Ordinary Shares”), and, if available cash exceeds a specified level, certain cash consideration (as described in this proxy statement/prospectus), and as a result, EO Charging will be the ultimate parent company of Juuce and Juuce’s direct and indirect subsidiaries and (ii) simultaneously with the Share Contribution, Merger Sub will merge with and into FRSG, with FRSG surviving as a wholly owned subsidiary of EO Charging (the “Merger”), and pursuant to the Merger, (a) each warrant to purchase shares of FRSG’s Class A common stock, par value $0.0001 per share (“FRSG Class A Common Stock”), sold as part of the units in FRSG’s initial public offering of units (the “FRSG IPO”) will automatically convert into an equal number of warrants to purchase ordinary shares in the capital of EO Charging, with a nominal value of $0.0001 per share (the “EO Charging Ordinary Shares” and such warrants, the “EO Charging Warrants”), (b) each warrant issued to First Reserve Sustainable Growth Sponsor, LLC, a Delaware limited liability company, in a private placement simultaneously with the closing of the FRSG IPO to purchase shares of FRSG Class A Common Stock will automatically convert into an equal number of EO Charging Warrants, and (c) each holder of FRSG Class A Common Stock will receive in exchange an equal number of EO Charging Ordinary Shares. FOR AGAINST ABSTAIN (2) The Charter Proposals – To consider and vote upon, on a non-binding advisory basis, five separate proposals, as required by applicable U.S. Securities and Exchange Commission guidance, to approve certain governance provisions contained in the Amended and Restated Memorandum and Articles of Association of EO Charging (the “EO Charging Memorandum and Articles of Association”) that materially affect FRSG stockholder rights. (2.1) The Authorized Share Proposal – The authorized share capital of the new public entity will be US$ consisting of ordinary shares, par value US$0.0001 per share, and preferred shares, par value US$0.0001 per share, as opposed to 250,000,000 authorized shares of FRSG Class A Common Stock, 20,000,000 authorized shares of FRSG Class B Common Stock and 1,000,000 authorized shares of undesignated preferred stock (the “Authorized Share Proposal”). FOR AGAINST ABSTAIN (2.2) The Director Removal Proposal – A director may be removed by Special Resolution only for cause, as opposed to with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors (the “Director Removal Proposal”). FOR AGAINST ABSTAIN (2.3) The Amendment Proposal – Any provision of the EO Charging Memorandum and Articles of Association may be amended by Special Resolution, as opposed to by the affirmative vote of the holders of a majority of the outstanding stock entitled to vote (the “Amendment Proposal”). FOR AGAINST ABSTAIN (2.4) The Additional Charter Proposal – EO Charging’s constitutional documents will not include the various provision applicable only to special purpose acquisition companies that FRSG’s amended and restated certificate of incorporation contains (the “Additional Charter Proposal” and, together with the Authorized Share Proposal, the Director Removal Proposal and the Amendment Proposal, the “Charter Proposals”). FOR AGAINST ABSTAIN (3) The Adjournment Proposal – To consider and vote upon a proposal to approve the adjournment of the FRSG special meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposal and the Charter Proposals, (the “Adjournment Proposal”). FOR AGAINS ABSTAIN Date: Signature (Signature If Held Jointly) When the Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person or authorized entity. The Shares represented by this proxy card, when properly executed, will be voted in the manner directed herein by the undersigned stockholder(s). If no direction is made, this proxy card will be voted “FOR” each of Proposal Nos. 1, 2.1, 2.2, 2.3, 2.4 and 3. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion.