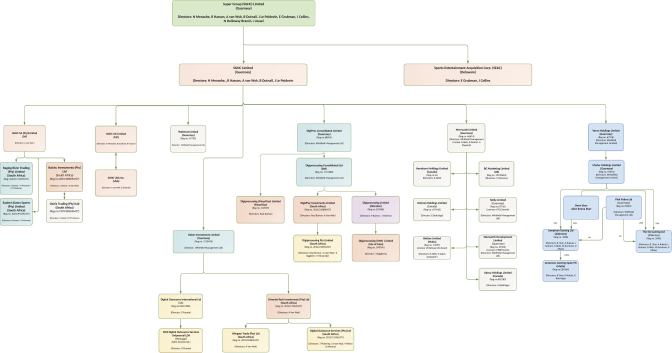

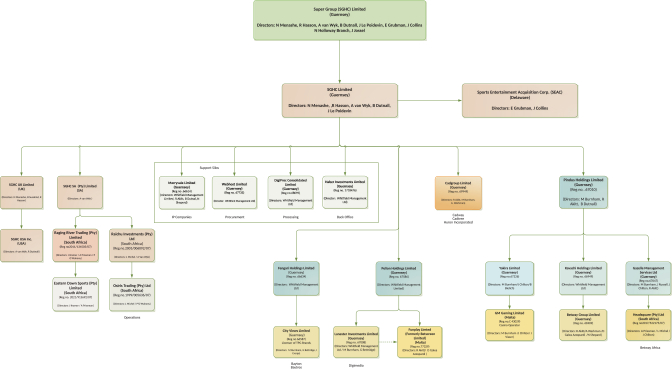

(SGHC) Limited, the parent company of SGHC Limited effective immediately following the Closing, was incorporated on March 29, 2021. The first entity to form part of the reorganization was Pindus Holdings Limited (“Pindus”) and its subsidiaries. Pindus was incorporated on May 16, 2018, and subsequently acquired Kavachi Holdings Limited, the latter being the legal entity that houses the business known as Betway. Pindus is the acquiring entity for the purposes of this reorganization.

Fengari Holdings Limited (“Fengari”) was incorporated on July 26, 2019. On July 31, 2019, Fengari acquired City Views Limited (parent of the trading companies within that group) for a cash consideration, from which point Fengari was incorporated under SGHC. On October 7, 2020, Fengari became a subsidiary of Super Group as part of the reorganization.

Pelion Holdings Limited (“Pelion”) was incorporated as a holding company on April 1, 2020, and shortly thereafter, on May 4, 2020, acquired Lanester Investments Limited (parent of the trading companies within that group (“City Views”)) for a cash consideration. At the time of the incorporation of Pelion the ownership structure was identical to that of Super Group and Pelion was consequently incorporated under Super Group on October 7, 2020, as part of the reorganization. Fengari and Pelion and their subsidiaries are also collectively referred to as Spin.

On September 30, 2020, Pindus purchased 100% of the issued share capital of Yakira Limited (“Yakira”) and Gazelle Management Holdings Limited (“Gazelle”). Yakira and Gazelle and their subsidiaries are entities to which the Betway brand had been licensed for trading in a number of jurisdictions.

Following the conclusion of the reorganization and transactions stated above, Super Group now comprises Pindus, Yakira, Gazelle and Raging River Trading Proprietary Limited (“Raging River”) (collectively analogous with / known as Betway) and Fengari and Pelion (collectively analogous with / known as Spin).

As of the date of this prospectus, Super Group subsidiaries are licensed in over 20 jurisdictions (not including DGC USA’s market access deals in the United States) and manage approximately 3,800 employees. Over the six months ended June 30, 2022, on average, over 2.6 million customers per month have yielded in excess of €2.5 billion in wagers per month. During the period from January 1, 2022 to June 30, 2022, total wagers amounted to €15.6 billion. Super Group’s business generated €655 million on a pro forma consolidated basis of net gaming revenue between January 1, 2022 and June 30, 2022 in different geographic regions, including the Americas, Europe, Africa and the rest of the world, such regions accounting for approximately 46%, 10%, 20% and 24%, respectively, of Super Group’s total revenue in 2022. Over the twelve months of 2021, on average, over 2.8 million customers per month have yielded in excess of €3.2 billion in wagers per month. During the period January 1, 2021 to December 31, 2021, total wagers amounted to €38 billion. Super Group’s business generated €1.26 billion ($1.48 billion) on a pro forma consolidated basis of net gaming revenue between January 1, 2021 and December 31, 2021 in different geographic regions, including the Americas, Europe, Africa and the rest of the world, such regions accounting for approximately 47%, 11%, 17% and 25%, respectively, of Super Group’s total revenue in 2021.

On January 27, 2022 (the “Closing date”) the Company completed the merger pursuant to the Business Combination Agreement (as it may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”) dated April 23, 2021, by and among itself SGHC, the Company, Sports Entertainment Acquisition Corp (“SEAC”), a New York Stock Exchange (“NYSE”) publicly traded special purpose acquisition company based in the United States, Super Group Holding Company Merger Sub, Inc (“Merger Sub”), a Delaware corporation and a wholly-owned subsidiary of the Company, which resulted in the public listing of the Group, described in this section and in note 4 to the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus.

Prior to the Closing date, SGHC shareholders (Pre-Closing Holders) exchanged all issued shares in SGHC for newly issued shares in the Company at an agreed ratio. This ratio resulted in each individual SGHC shareholder

121