April 10, 2023

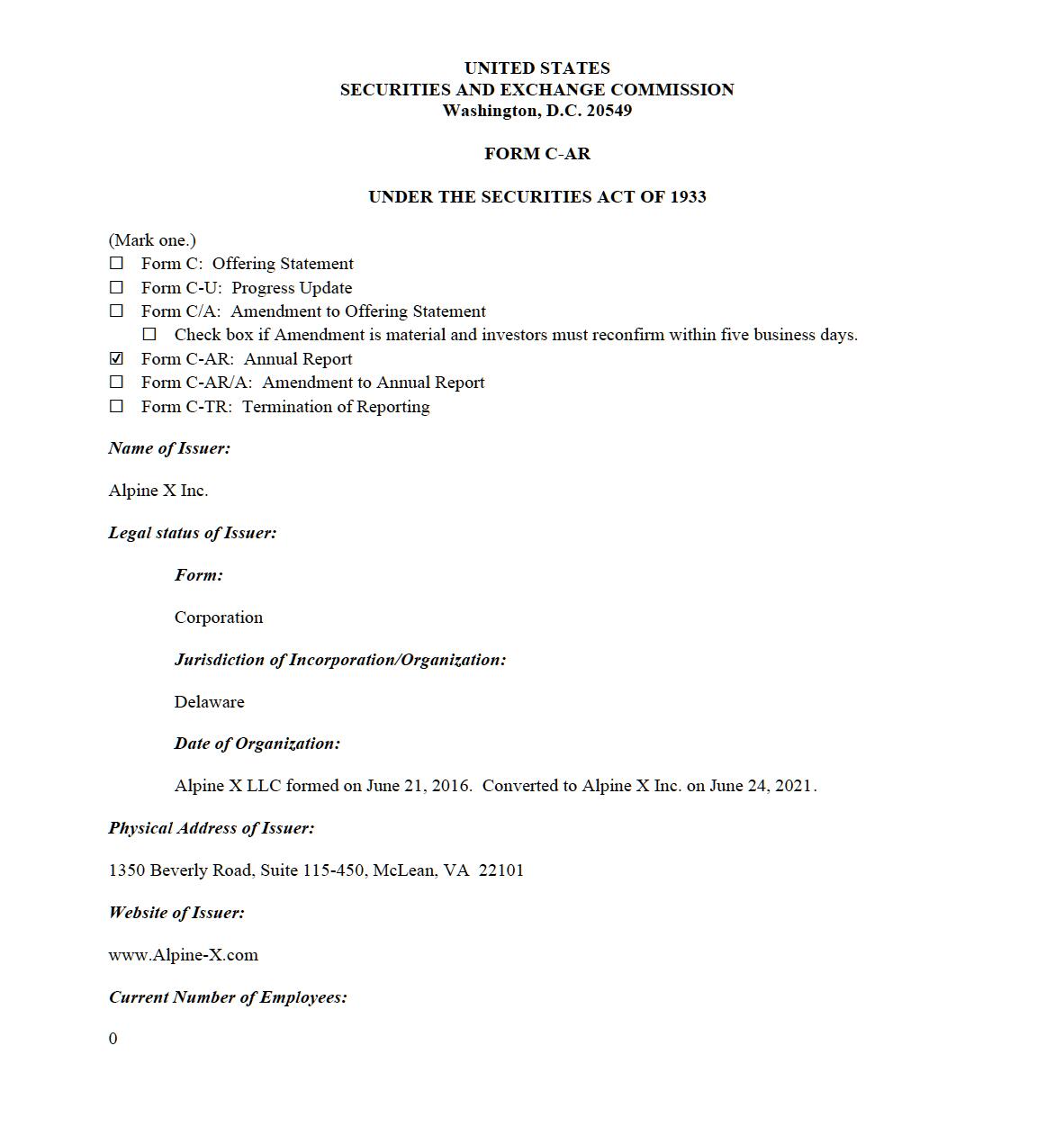

FORM C-AR

Alpine X Inc.

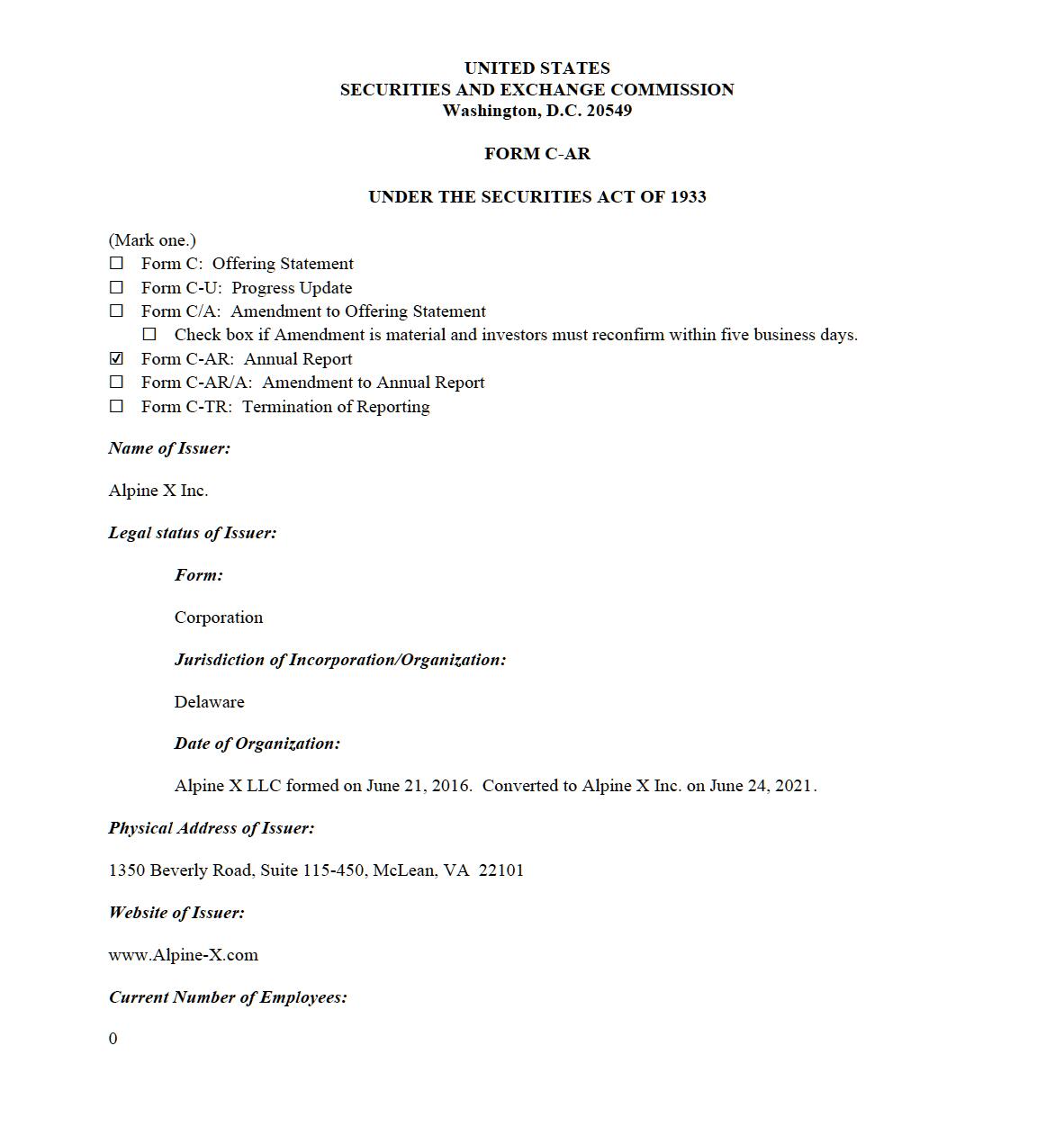

This Form C-AR (including the cover page and all exhibits attached hereto, the "Form C-AR”) is being furnished by Alpine X Inc., a Delaware Corporation (“Alpine-X” or the "Company," as well as references to "we," "us," or "our") for the sole purpose of providing certain information about the Company as required by the Securities and Exchange Commission ("SEC").

No federal or state securities commission or regulatory authority has passed upon the accuracy or adequacy of this document. The U.S. Securities and Exchange Commission does not pass upon the accuracy or completeness of any disclosure document or literature. The Company is filing this Form C-AR pursuant to Regulation CF (§227.100 et seq.), which requires that it must file a report with the Commission annually and post the report on its website at www.alpine-x.com no later than 120 days after the end of each fiscal year covered by the report. The Company may terminate its reporting obligations in the future in accordance with Rule 202(b) of Regulation CF (§ 227.202(b)) by 1) being required to file reports under Section 13(a) or Section 15(d) of the Exchange Act of 1934, as amended, 2) filing at least one annual report pursuant to Regulation CF and having fewer than 300 holders of record, 3) filing annual reports for three years pursuant to Regulation CF and having assets equal to or less than $10,000,000, 4) the repurchase of all the Securities sold pursuant to Regulation CF by the Company or another party, or 5) the liquidation or dissolution of the Company.

The date of this Form C-AR is April 10, 2023.

THIS FORM C-AR DOES NOT CONSTITUTE AN OFFER TO PURCHASE OR SELL SECURITIES.

Forward-Looking Statement Disclosure

This Form C-AR and any documents incorporated by reference herein contain forward-looking statements and are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Form C-AR are forward-looking statements. Forward-looking statements give our current reasonable expectations and projections regarding our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

The forward-looking statements contained in this Form C-AR and any documents incorporated by reference herein are based on reasonable assumptions we have made in light of our industry experience, perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you read and consider this Form C-AR, you should understand that these statements are not guarantees of performance or results. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

Any forward-looking statement made in this Form C-AR or any documents incorporated by reference herein speaks only as of the date of those respective documents. Factors or events that could cause our actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. Except as may be required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, for any reason after the date of this Form C-AR.

.

TABLE OF CONTENTS

ABOUT THIS FORM C-ARi

SUMMARY1

The Company1

RISK FACTORS2

Risks Related to Our Business and Industry2

Risks Related to Regulation20

Risks Related to Our Capital Structure22

BUSINESS25

Description of the Business25

Business Plan25

The Company’s Products and/or Services28

Competition29

Customer Base29

Supply Chain29

Intellectual Property29

Governmental/Regulatory Approval and Compliance29

Litigation31

DIRECTORS, OFFICERS, AND EMPLOYEES 31

Directors and Officers31

Biographical Information30

Indemnification32

Employees32

CAPITALIZATION, DEBT AND OWNERSHIP33

Capitalization33

Outstanding Debt37

Ownership38

FINANCIAL INFORMATION39

Operations39

Cash and Cash Equivalents40

Liquidity and Capital Resources40

Capital Expenditures and Other Obligations41

Material Changes and Other Information42

Critical Accounting Policies42

Restrictions on Transfer45

Previous Offerings of Securities46

TRANSACTIONS WITH RELATED PERSONS AND CONFLICTS OF INTEREST47

OTHER INFORMATION48

Bad Actor Disclosure 48

EXHIBITS51

Exhibit A – Unaudited Financial Statements51

ABOUT THIS FORM C-AR

You should rely only on the information contained in this Form C-AR. We have not authorized anyone to provide any information or make any representations other than those contained in this Form C-AR. You should assume that the information contained in this Form C-AR is accurate only as of the date of this Form C-AR, regardless of the time of delivery of this Form C-AR. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or any other document are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents.

i

SUMMARY

The following summary is qualified in its entirety by more detailed information that may appear elsewhere in this Form C-AR and the Exhibits hereto.

The Company

Alpine X Inc. is a developer of indoor snowsports resorts, incorporated in Delaware as a corporation on June 24, 2021. We were formed in 2021 to succeed to the business activities of Alpine X LLC, a Virginia limited liability company formed on June 21, 2016.

The Company is located at 1350 Beverly Road, Suite 115-450, McLean, VA 22101.

The Company’s website is www.Alpine-X.com.

The information available on or through our website is not a part of this Form C-AR.

1

RISK FACTORS

Risks Related to Our Business and Industry

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

We are still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early-stage companies. We may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

We and the U.S. and global economies have been substantially affected by the coronavirus pandemic.

In late 2019, a novel coronavirus (COVID-19) surfaced, reportedly, in Wuhan, China. The World Health Organization declared a global emergency on January 30, 2020, with respect to the outbreak and many states and countries, including the United States, have initiated significant restrictions on business operations. We face uncertainty as the ongoing aftereffects of the pandemic cause significant disruption to U.S and global markets and business, and the indoor recreational industry in general. The overall and long-term impacts of the outbreak are unknown and evolving.

This pandemic has adversely affected our business as it has most businesses and this or another pandemic, epidemic or outbreak of an infectious disease in the United States or in another country may adversely affect our business. The spread of a disease could lead to unfavorable economic conditions, which would adversely impact our operations. The extent to which the coronavirus impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

The effects of such a widespread infectious disease and epidemic has already caused and may continue to cause or may cause in the future, an overall decline in the U.S. and world economy as a whole. The actual effects of the spread of coronavirus or of another pandemic are difficult to assess as the actual effects will depend on many factors beyond our control and knowledge. However, the spread of the coronavirus, if it continues, and any future similar occurrence may cause an overall decline in the economy as a whole and therefore may materially harm us long term.

At the time of this filing, there is uncertainty as to what long-term restrictions, regulations, or other effects will occur in our industry. There is also uncertainty as to what will happen to in this regard should another health-related outbreak occur in the future.

All of these risks, and many others known or unknown, related to this outbreak, and future outbreaks, pandemics or epidemics, could materially affect our long-term business and your investment.

We will need to raise additional capital to sustain our current business plan.

In order to achieve our near and long-term goals, we will need to procure funds in addition to amount raised through the date of this Form C-AR. There is no guarantee we will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy, and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Our business currently does not generate any material sales and future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

2

Currently, our authorized capital stock consists of 99,000,000 shares of common stock, of which 20,794,000 shares of common stock are issued and outstanding, and 1,000,000 shares of preferred stock, of which no shares are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

Our success depends on the experience and skill of our board of directors, executive officers, and key employees.

In particular, we are dependent on John Emery, our CEO and director, and Jim Calder, our CFO and director. We do not have employment agreements with John Emery or Jim Calder, and there can be no assurance that we will be successful in obtaining employment contracts or that they will continue to be employed by the Company for a particular period of time. The loss of John Emery or Jim Calder, or any member of the board of directors or executive officer, could harm our business, financial condition, cash flow and results of operations.

Although dependent on certain key personnel, we do not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, but we have not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, we will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect us and our operations. We have no way to guarantee key personnel will stay with us, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets; they will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We may continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce

3

or procure from third parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission, and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates, and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

We are not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

We do not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately held (non-public) Company, we are currently not subject to the Sarbanes Oxley Act of 2002, and our financial and disclosure controls and procedures reflect our status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of our financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, our cost of such compliance could be substantial and could have a material adverse effect on our results of operations. We expect to incur additional expenses and diversion of management's time if and when it becomes necessary to perform the system and process evaluation, testing, and remediation required in order to comply with the management certification and auditor attestation requirements.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations, and we expect

4

costs related to compliance with these laws and regulations to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease-and-desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

We have limited operating history.

We have a limited operating history and there can be no assurance that our proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no guarantee that we will ever realize any significant operating revenues or that our operations will ever be profitable. As we have limited operational history, it is extremely difficult to make accurate predictions and forecasts on our finances.

We are dependent upon our management, founders, key personnel, and consultants to execute our business plan, and some of them will have concurrent responsibilities at other companies.

Our success is heavily dependent upon the continued active participation of our current executive officers, as well as other key personnel and contractors. Some of them may have concurrent responsibilities at other entities. Some of the advisors, consultants, and others to whom our ultimate success may be reliant upon have not signed contracts with us and may not ever do so. Loss of the services of one or more of these individuals could have a material adverse effect upon our business, financial condition or results of operations.

Our success and achievement of the Company's growth plans depend on the Company's ability to recruit, hire, train and retain other highly qualified technical and managerial personnel.

Competition for qualified employees and consultants among companies in the applicable industries is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees and consultants required for the initiation and expansion of our activities, could have a materially adverse effect on us. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on our business, financial condition or results of operations.

We are or will be subject to income taxes as well as non-income based taxes, such as payroll, sales, use, value-added, net worth, franchise, property and goods and services taxes.

Significant judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that our tax estimates will be reasonable (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions, expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on our financial position and results of operations in the period or periods for which determination is made.

Changes in laws or regulations related to our employees could harm our performance.

Various federal and state laws, including labor laws, govern our relationship with our employees and affect operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers' compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

Our business plan is speculative.

Our present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that we will generate significant revenues or profits. An investment in our securities is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in us, including the risk of losing their entire investment.

5

We face significant competition in the United States and elsewhere.

We will face significant competition in the United States and elsewhere which could adversely affect your investment.

We have incurred debt and will likely incur additional debt.

We have previously incurred debt and will likely incur additional debt (including secured debt) in the future and in the continuing operations of its business. Complying with obligations under such indebtedness may have a material adverse effect on us and on your investment.

Our revenue could fluctuate from period to period, which could have an adverse material impact on our business.

Our revenue may fluctuate from period-to-period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following events, as well as other factors described elsewhere in this document:

Unanticipated changes to economic terms in contracts with clients, vendors, partners and those with whom the Company does business, including renegotiations

Downward pressure on fees the Company charges for our services, which would therefore reduce our revenue

Failure to obtain new clients and customers for our services

Cancellation or non-renewal of existing contracts with clients and customers

Changes in state and federal government regulations, international government laws and regulations or the enforcement of those laws and regulations

General economic and political conditions, both domestically and internationally, as well as economic conditions specifically affecting industries in which the Company operates

As a result of these and other factors, the results of operations for any quarterly or annual period may differ materially from the results of operations for any prior or future quarterly or annual period and should not be relied upon as indications of our future performance.

Our expenses could increase without a corresponding increase in revenues.

Our operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on our financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, (5) increases in borrowing costs, and (6) unexpected increases in costs of supplies, goods, materials, construction, equipment or distribution.

Our inability to maintain and enhance its image could negatively affect our business.

It is important that we maintain and enhance our image and the image of our products. Our image and reputation of our products may be impacted for various reasons including, but not limited to, lack of success, bad publicity and others. Such problems, even when unsubstantiated, could be harmful to our image and the reputation and our products and services. Any negative publicity and/or litigation could be costly for us, divert management attention, and could result in increased costs of doing business, or otherwise have a material adverse effect on our business, results of operations, and financial condition. Any negative publicity generated could damage our reputation and diminish the value of our brand and its products and services which could have a material adverse effect on our business, results of operations, and financial condition. Deterioration in our brand equity (brand image, reputation, and product quality) or our products and services may have a material adverse effect on our financial results.

Changes in the economy could have a detrimental impact on us.

Changes in the general economic climate, both in the United States and internationally, could have a detrimental impact on consumer expenditure and therefore on our revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment, and tax increases) may decrease the disposable income that customers have available to spend on products and services like

6

those we offer and may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on our financial results.

We may not be able to obtain adequate financing to continue our operations.

We will require additional debt and/or equity financing to pursue our growth and business strategies. These include, but are not limited to, enhancing our operating infrastructure and otherwise respond to competitive pressures. Given our limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to us. Lack of additional funding could force us to curtail substantially our growth plans. Furthermore, the issuance by us of any additional equity securities pursuant to any future fundraising activities undertaken by us would dilute the ownership of existing Shareholders and may reduce the price of the Securities.

Terms of subsequent financing, if any, may adversely impact your investment.

We may have to engage in common equity, debt, or preferred stock financings in the future. Your rights and the value of your investment in our securities could be reduced by the dilution caused by future equity issuances. Interest on debt securities could increase costs and negatively impact operating results. We are permitted to issue preferred stock pursuant to the terms of our organizational documents, and preferred stock could be issued in series from time to time with such designation, rights, preferences, and limitations as needed to raise capital. The terms of preferred stock could be more advantageous to those investors than to the holders of our currently-issued securities. In addition, if we need to raise more equity capital from the sale of additional stock or notes, institutional or other investors may negotiate terms at least as, and possibly more, favorable than the terms of your investment. Shares of stock or notes which we sell could be sold into any market that develops, which could adversely affect the market price.

Our employees, executive officers, directors, and insider shareholders beneficially own or control a substantial portion of our outstanding shares.

Our employees, executive officers, directors, and insider shareholders beneficially own or control a substantial portion of our outstanding stock, which may limit your ability and the ability of our other Shareholders, whether acting alone or together, to propose or direct the management or overall direction of our company. Additionally, this concentration of ownership could discourage or prevent a potential takeover of us that might otherwise result in an investor receiving a premium over the market price for its securities. The majority of our currently outstanding stock is beneficially owned and controlled by a group of insiders, including our employees, directors, executive officers, and inside shareholders. Accordingly, our employees, directors, executive officers and insider shareholders may have the power to control the election of our directors or managers and the approval of actions for which the approval of our shareholders is required. Our principal shareholders may be able to control matters requiring approval by its shareholders, including mergers or other business combinations. Such concentrated control may also make it difficult for our shareholders to receive a premium for their shares in the event that we merge with a third party or enters into different transactions which require shareholder approval.

Our operating plan relies in large part upon assumptions and analyses we develop. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from its forecasted results.

Whether actual operating results and business developments will be consistent with our expectations and assumptions as reflected in our forecast depends on a number of factors, many of which are outside our control, including, but not limited to:

Whether we can obtain sufficient capital to sustain and grow our business

Whether we have the ability to manage our growth

Whether we can manage relationships with key vendors and advertisers

The timing and costs of new and existing marketing and promotional efforts

Competition

Our ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel

The overall strength and stability of domestic and international economies

7

Unfavorable changes in any of these or other factors, most of which are beyond our control, could materially and adversely affect our business, results of operations and financial condition.

To date, the Company has had operating losses and does not expect to be profitable for the foreseeable future, and cannot accurately predict when it might become profitable.

We have been operating at a loss since our inception, and we expect to continue to incur losses for the foreseeable future. Further, we may not be able to generate significant revenues in the future. In addition, we expect to incur substantial operating expenses in order to fund the expansion of our business. As a result, we expect to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, we might become profitable. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout the year, and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We may be unable to manage its growth or implement its expansion strategy.

We may not be able to expand our markets or implement the other features of our business strategy at the rate or to the extent presently planned. Our projected growth will place a significant strain on our administrative, operational, and financial resources. If we are unable to successfully manage our future growth, establish and continue to upgrade our operating and financial control systems, recruit and hire necessary personnel, or effectively manage unexpected expansion difficulties, our financial condition and results of operations could be materially and adversely affected.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we will need to:

Establish definitive business strategies, goals and objectives.

Maintain a system of management controls.

Attract and retain qualified personnel, as well as develop, train, and manage management-level and other employees.

If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed.

Our business model is evolving.

Our business model is unproven and is likely to continue to evolve. Accordingly, our initial business model may not be successful and may need to be changed. Our ability to generate significant revenues will depend, in large part, on our ability to successfully market our products to potential customers and who may not be convinced of the need for our products and services or who may be reluctant to rely upon third parties to develop and provide these products. We intend to continue to develop our business model as our market continues to evolve.

If we fail to maintain and enhance awareness of our brand, our business and financial results could be adversely affected.

We believe that maintaining and enhancing awareness of ours brand and our products is critical to achieving widespread acceptance and success of our business. Maintaining and enhancing the brand awareness of us and our products may require us to spend increasing amounts of money on, and devote greater resources to, advertising, marketing, and other brand-building efforts, and these investments may not be successful. Further, even if these efforts are successful, they may not be cost-effective. If we are unable to continuously maintain and enhance our brand’s and our products’ presence, our market may decrease which could in turn result in lost revenues and adversely affect ours business and financial results.

We need to increase brand awareness.

Due to a variety of factors, our opportunity to achieve and maintain a significant market may be limited. Developing and maintaining awareness of our brand names, among other factors, is critical. Further, the importance of brand recognition will increase as competition in the market increases. Successfully promoting and positioning our brands,

8

products, and services will depend largely on the effectiveness of our marketing efforts. Therefore, we may need to increase our financial commitment to creating and maintaining brand awareness. If we fail to successfully promote our brand names or if we incur significant expenses promoting and maintaining our brand names, it will have a material adverse effect on our results of operations.

We face competition in our markets from various large and small companies, some of which have greater financial, research and development, production, and other resources than we do.

In many cases, our competitors have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical and marketing resources. Our ability to compete depends, in part, upon a number of factors outside our control, including the ability of our competitors to develop alternatives that are superior. If we fail to successfully compete in its markets, or if we incur significant expenses in order to compete, it could have a material adverse effect on our results of operations.

We currently have limited marketing in place.

We currently has limited resources devoted to marketing our brands and our company. If we are unable to establish sufficient marketing and sales capabilities or enter into agreements with third parties, we may not be able to effectively market and generate revenues.

We may provide limitations on director, officer and other’s liability.

We may provide for the indemnification of directors, officers and others to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors, officers and others to us and our shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with previous offerings of securities. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or others controlling or working with us pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. Despite this, should we provide such indemnification, it could have a material adverse effect on us.

We may face significant competition from other similar companies, and our operating results will suffer if we fail to compete effectively.

We may face significant competition from other companies, and our operating results could suffer if we fail to compete effectively. The industries in which we participate are intensely competitive and subject to rapid and significant change. We have competitors both in the United States and internationally. Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development staff and experienced marketing organizations. Additional mergers and acquisitions in our industry may result in even more resources being concentrated in our competitors. As a result, these companies may obtain market acceptance more rapidly than we are able and may be more effective themselves as well. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries.

Our future financial performance and our ability to compete effectively will depend, in part, on our ability to manage any future growth effectively.

As our operations expand, we expect that we will need to manage additional relationships with various strategic partners, suppliers and other third parties. Our future financial performance and our ability to commercialize our business and to compete effectively will depend, in part, on our ability to manage any future growth effectively. To that end, we must be able to manage our development efforts effectively and hire, train and integrate additional management, administrative and sales and marketing personnel. We may not be able to accomplish these tasks, and its failure to accomplish any of them could prevent us from successfully growing.

Our insurance strategy may not be adequate to protect us from all business risks.

9

We may be subject, in the ordinary course of business, to losses resulting from accidents, acts of God and other claims against us, for which we may have no insurance coverage. We currently maintain no automobile, life, disability, workers compensation, health, or property insurance policies. We currently have limited general liability insurance. A loss that is uninsured, or underinsured, or which otherwise exceeds policy limits may require us to pay substantial amounts, which could adversely affect our financial condition and operating results.

The costs for maintaining adequate insurance coverage fluctuate and are generally beyond our control. If insurance rates increase and we are not able to pass along those increased costs to our guests through higher admission fees, room rates, and amenity costs, our operating margins could suffer.

Our resorts are subject to real and personal property taxes. The real and personal property taxes on our resorts may increase or decrease as tax rates change and as our resorts are assessed or reassessed by taxing authorities. If property taxes increase and we are unable to pass these increased costs along to our guests through higher admission fees, room rates, and amenity costs, our financial condition and results of operations may be adversely affected.

Uninsured losses or losses in excess of our insurance coverage could adversely affect our financial condition and our cash flow, and there may be a limited number of insurers that will underwrite coverage for resorts with indoor snowparks.

We expect to maintain comprehensive liability, fire, flood (where appropriate), and extended coverage insurance with respect to our resorts with policy specifications, limits and deductibles that we believe are commercially reasonable for our operations and are available to businesses in our industry. Certain types of losses, however, may be either uninsurable or not economically insurable, such as losses due to earthquakes, riots, acts of war or terrorism, or losses related to the award of punitive damages in a legal action. Should an uninsured loss occur, we could lose both our investment in, and anticipated cash flow from, a resort (including cash flows from our license or management agreements). If any such loss is insured, we may be required to pay a significant deductible on any claim for recovery of such a loss prior to our insurer being obligated to reimburse us for the loss or the amount of the loss may exceed our coverage for the loss. In addition, we may not be able to obtain insurance in the future at acceptable rates, or at all, and insurance may not be available to us on favorable terms or at all, including insurance for the construction and development of our resorts, especially since there may be a limited number of insurance companies that underwrite insurance for indoor snowparks.

A significant decline in real estate values may have an adverse impact on our financial condition.

We expect to own significant amounts of real estate throughout the United States. A significant decline in real estate values may require us to use a significant amount of cash to reduce our debt.

A failure to maintain good relationships with third-party property owners and licensees could have a material, adverse effect on our growth strategies and our business, financial condition, and results of operations.

We may manage and/or license resort properties in which we have limited or no ownership interest, and may increase the number of such properties as we seek to expand our operations both domestically and internationally. The viability of our management and licensing business depends, in part, on our ability to establish and maintain good relationships with third-party property owners and licensees. Third-party developers, property owners, and licensees are focused on maximizing the value of their investment and working with a management company or licensor that can help them be successful. The effectiveness of our management, the value of our brand, and the rapport that we maintain with our third-party property owners and licensees impact our revenue streams from our management and license agreements. If we are unable to maintain good relationships with our third-party property owners and licensees, we may be unable to renew existing agreements or expand our relationships with these owners. Additionally, our opportunities for developing new relationships with additional third parties may be adversely impacted.

The nature of our responsibilities under our management agreements to manage each resort and enforce the standards required for our brands under both management and license agreements may be subject to interpretation and may give rise to disagreements in some instances. Additionally, some courts have applied principles of agency law and related fiduciary standards to managers of third-party resort properties such as us, which means, among other things, that property owners may assert the right to terminate management agreements even where the agreements do not expressly provide for termination. In the event of any such termination, we may need to negotiate or enforce our right to a termination payment that may not equal expected profitability over the term of the agreement. These types of

10

disagreements are more likely during an economic downturn. We seek to resolve any disagreements in order to develop and maintain positive relations with potential joint venture partners but may not always be able to do so. Failure to resolve such disagreements may result in litigation. In addition, the terms of our management agreements and license agreements for some of our facilities may be influenced by contract terms offered by our competitors, among other things. We may not be able to enter into future collaborations, renew agreements, or enter into new agreements in the future on terms that are favorable to us. Finally, we are dependent on the cooperation of the owners or principal owners of our licensed and managed resorts in the development of new resorts and in the renovation of existing resorts. The failure to retain or renew management and licensing agreements or the failure of owners to develop resorts as agreed or on schedule or to make necessary capital expenditures may cause disruptions to our business plan and growth strategies and have a material, adverse effect on our business, financial condition, and results of operations.

We will be dependent on the owners of the resorts we manage and license for third-party owners to fund certain operational expenditures related to those resorts, and if such funds are untimely or not paid, we are required to bear the cost.

We will incur significant expenditures related to the management of our managed resorts, including salary and other benefit related costs and business and employee related insurance costs, for which we are reimbursed by third-party resort owners. In the normal course of business, we make every effort to pay these costs only after receiving payment from an owner for such costs. To the extent an owner would not be able to reimburse these costs, however, due to a sudden and unexpected insolvency situation or otherwise, we would be legally obligated to pay these costs directly until such time as we could make other arrangements. Although we would make every effort to reduce or minimize these costs prior to the point at which an owner could not reimburse us and we would continue to pursue payment through all available legal means, our results of operations and financial condition could be adversely affected if we were forced to bear those costs.

Investing through partnerships or joint ventures may decrease our ability to manage risk. Additionally, our license fee and management fee revenue streams, as well as any joint venture equity investments, will be subject to property-level indebtedness and other risks.

In addition to acquiring or developing resorts, we may from time to time invest as a co-venturer. Joint venturers often have shared control over the operation of the joint venture assets. Therefore, joint venture investments may involve risks such as the possibility that the co-venturer in an investment might become bankrupt or not have the financial resources to meet its obligations, have economic or business interests or goals that are inconsistent with our business interests or goals, or be in a position to take action contrary to our instructions or requests or contrary to our policies or objectives. Consequently, actions by a co-venturer might subject any resorts owned by the joint venture to additional risk. Further, we may be unable to take action without the approval of our joint venture partners. Alternatively, our joint venture partners could take actions binding on the joint venture without our consent. Additionally, should a joint venture partner become bankrupt, we could become liable for our partner’s share of joint venture liabilities.

Furthermore, our managed resorts that are subject to mortgage or construction indebtedness must be serviced by the entities owning those resorts. Future licensed or managed resorts will be subject to such indebtedness. The principal owner of a licensed or managed resort may cause the entity owning the resort to incur indebtedness that may exceed the amount of debt the resort can service. In the event of a failure to service property-level indebtedness that results in a sale or foreclosure, our license and management agreements may be terminated, and any joint venture equity investment we have made in the owner will likely be lost. The loss of these agreements or investments could have a material and adverse effect on our business, financial condition, and results of operations.

We expect that, under certain circumstances, our license and management agreements may be terminated by the property owners. The termination of our current or future license or management agreements would reduce our revenues and have a material adverse effect on our business, financial condition, and results of operations.

Because the land used by our Fairfax County resort we intend to develop will be subject to a ground lease that has not been finalized, a failure to finalize that lease or a termination of that lease by the lessor could cause us to lose the ability to operate this resort altogether and incur substantial costs in restoring the premises.

11

The rights to use the land at the Fairfax County, VA resort are based upon our interest under a long-term ground lease we expect to have with Fairfax County, the owners of the land where we intend to develop our resort. We have not finalized this ground lease, and we may not be able to reach mutually acceptable terms with Fairfax County to allow us to enter into the ground lease. Pursuant to the expected terms of the ground lease for this resort, we will be required to pay all rent due and comply with all other lessee obligations. Any pledge of our interest in this ground lease may also require the consent of the lessor. As a result, we may not be able to sell, assign, transfer, or convey our interest in the resort subject to the ground lease in the future absent consent of such third parties even if such transactions may be in our best interest.

The lessor may require the lessee, at the expiration or termination of the ground lease, to surrender any improvements, alterations, or additions to the land. The ground lease also may require the lessee to restore the premises following a casualty and to apply in a specified manner any proceeds received in connection therewith. The lessee may have to restore the premises if a material casualty, such as a fire or an act of God, occurs and the cost thereof exceeds available insurance proceeds.

If we are unable to effectively protect our intellectual property and trade secrets, it may impair our ability to compete.

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any of our intellectual property. The names and/or logos of our brands may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by us for our brands. Similarly, domains we own and use may be challenged by others who contest our ability to use the domain name or URL. Patents, trademarks and copyrights that have been or may be obtained by us may be challenged by others, or enforcement of the patents, trademarks and copyrights may be required. We also rely upon, and will rely upon in the future, trade secrets. While we use reasonable efforts to protect these trade secrets, we cannot assure that our employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose our trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, our competitors may independently develop equivalent knowledge, methods and know-how. If we are unable to defend our trade secrets from others’ use, or if our competitors develop equivalent knowledge, it could have a material adverse effect on our business.

Any infringement of our patent, trademark, copyright or trade secret rights could result in significant litigation costs, and any failure to adequately protect our trade secret rights could result in the Company's competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenues. Existing patent, copyright, trademark, and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect our rights to the same extent as do the laws of the United States. Therefore, we may not be able to protect our existing patent, copyright, trademark, and trade secret rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using our existing patent, copyright, trademark and trade secret rights could be expensive and time-consuming, and the outcome of such a claim is unpredictable. This litigation could result in diversion of resources and could materially adversely affect our operating results.

We may not be able to adequately protect our intellectual property, which could harm the value of our brands and adversely affect our business.

The success of our resorts depends in part on our brands, logos, and branded merchandise. We rely on registration and enforcement of a combination of service marks, copyrights, trademarks, and similar intellectual property rights to protect our brands, logos, branded merchandise, and other intellectual property. The success of our growth strategy depends on our continued ability to use our existing trademarks and service marks in order to increase brand awareness and further develop our brand in both domestic and international markets. We also use our trademarks and other intellectual property on the Internet. If our efforts to protect our intellectual property are not adequate, or if any third party misappropriates or infringes on our intellectual property, either in print or on the Internet, the value of our brands may be harmed, which could have a material adverse effect on our business, including the failure of our brands, logos, and branded merchandise to achieve and maintain market acceptance. We expect to license our Alpine-X brand and intend to further license the brand in domestic and international markets. While we try to ensure that the quality of our brand is maintained by any future licensees, we cannot assure that these licensees will not take actions that adversely affect the value of our intellectual property or reputation.

12

We have registered certain trademarks in the United States. There is no guarantee that our trademark registration applications will be granted. In addition, the trademarks that we currently use have not been registered in all of the countries in which we intend to do business and may never be registered in all of these countries. We may not be able to adequately protect our trademarks, and our use of these trademarks may result in liability for trademark infringement, trademark dilution or unfair competition.

We may not have taken all the steps necessary to protect our intellectual property in the United States and foreign countries. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as the laws of the United States, and the risks related to foreign laws will increase as we expand internationally.

We rely upon trade secret protection to protect our intellectual property; it may be difficult and costly to protect our proprietary rights and we may not be able to ensure their protection.

We currently rely on trade secrets. While we use reasonable efforts to protect these trade secrets, we cannot assure that our employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose our trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, our competitors may independently develop equivalent knowledge, methods, and know-how. If we are unable to defend our trade secrets from others’ use, or if our competitors develop equivalent knowledge, it could have a material adverse effect on our business. Any infringement of our proprietary rights could result in significant litigation costs, and any failure to adequately protect our proprietary rights could result in our competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenue. Existing patent, copyright, trademark, and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect our proprietary rights to the same extent as do the laws of the United States. Therefore, we may not be able to protect our proprietary rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using our trade secrets could be expensive and time-consuming, and the outcome of such a claim is unpredictable. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. This litigation could result in substantial costs and diversion of resources and could materially adversely affect ours future operating results.

A breakdown in computer, website, or information systems could affect our business.

Computer, website and/or information system breakdowns as well as cyber security attacks could impair our ability to service our customers, leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on our financial results.

A data security breach could expose us to liability and/or protracted and costly litigation, and could adversely affect our reputation and operating revenues.

To the extent our activities involve the storage and transmission of confidential information, we and/or third-party processors will receive, transmit and store confidential customer and other information. Encryption software and the other technologies used to provide security for storage, processing and transmission of confidential customer and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to our or these third parties' systems or databases could result in the theft, publication, deletion or modification of confidential customer and other information. A data security breach of the systems on which sensitive account information are stored could lead to fraudulent activity involving our products and services, reputational damage, and claims or regulatory actions against us. If we are sued in connection with any data security breach, we could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, we might be forced to pay damages and/or change our business practices or pricing structure, any of which could have a material adverse effect on our operating revenues and profitability. We would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

A failure to keep pace with developments in technology could impair our operations or competitive position.

The entertainment resort industry continues to demand the use of sophisticated technology and systems, including those used for our reservation, revenue management and property management systems and technologies we make available to our guests. These technologies and systems must be refined, updated, and/or replaced with more advanced systems on a regular basis. If we are unable to do so as quickly as our competitors or within budgeted costs and time

13

frames, our business could suffer. We also may not achieve the benefits that we anticipate from any new technology or system, and a failure to do so could result in higher than anticipated costs or could impair our operating results.

The illiquidity of real estate may make it difficult for us to dispose of one or more of our resorts.

We may from time to time decide to dispose of one or more of our real estate assets. Because real estate holdings generally, and family entertainment resorts like ours in particular, are relatively illiquid, we may not be able to dispose of one or more real estate assets on a timely basis or at a favorable price. The illiquidity of our real estate assets could mean that we continue to operate a facility that management has identified for disposition. Failure to dispose of a real estate asset in a timely fashion, or at all, could adversely affect our business, financial condition, and results of operations.

Our future financial results could be adversely impacted by asset impairments or other charges.

We are required to test our goodwill and other intangible assets at least yearly for impairment or when circumstances indicate that the carrying value of those assets may be impaired. We are also required to test our long-lived assets (such as resorts) when circumstances indicate that the carrying value of those assets may not be recoverable. The amount of any future annual or interim asset impairment charges could be significant and could have a material adverse effect on our reported financial results for the period in which the charge is taken. Any operating losses resulting from impairment charges could have an adverse effect on the value of our securities.

We will depend on third-party providers for a reliable internet infrastructure as well as other aspects of our technology and applications and the failure of these third parties, or the internet in general, for any reason would significantly impair our ability to conduct our business.

We will outsource some or all of our online presence, server needs, technology development and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, its business would be significantly damaged. As has occurred with many Internet-based businesses, we may be subject to "denial-of-service" attacks in which unknown individuals bombard its computer servers with requests for data, thereby degrading the servers' performance. We cannot be certain we will be successful in quickly identifying and neutralizing these attacks. If either a third-party facility failed, or our ability to access the Internet was interfered with because of the failure of Internet equipment in general or if we become subject to malicious attacks of computer intruders, our business and operating results will be materially adversely affected.

Our actual or perceived failure to adequately protect personal data could harm our business.

A variety of state, national, foreign, and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal data. These privacy and data protection-related laws and regulations are evolving, with new or modified laws and regulations proposed and implemented frequently and existing laws and regulations subject to new or different interpretations. Compliance with these laws and regulations can be costly and can delay or impede the development of new products. Our actual, perceived or alleged failure to comply with applicable laws and regulations or to protect personal data, could result in enforcement actions and significant penalties against us, which could result in negative publicity, increase the Company’s operating costs, subject us to claims or other remedies, and may negatively impact our business.

Our employees may engage in misconduct or improper activities.

We, like any business, are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with laws or regulations, provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose unauthorized activities to us. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and serious harm to our reputation.

14

There are doubts about our ability to continue as a going concern.

Our independent accountants have raised doubts about our ability to continue as a going concern. There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force us to substantially curtail or cease operations and would, therefore, have a material adverse effect on our business. We intend to overcome the circumstances that impact our ability to remain a going concern through a combination of the commencement of revenues, with interim cash flow deficiencies being addressed through additional financings. We anticipate raising additional funds through public or private financing, securities financing, and/or strategic relationships or other arrangements in the near future to support our business operations; however, we may not receive commitments from third parties for a sufficient amount of additional capital. We cannot be certain that any such financing will be available on acceptable terms, or at all, and our failure to raise capital when needed could limit our ability to continue our operations. Our ability to obtain additional funding will determine our ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on our financial performance and results of operations, and require us to curtail or cease operations, sell off our assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of our securities, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary to raise additional funds, and may require that we relinquish valuable rights. Any additional financing could have a negative effect on shareholders.

We will pursue development of resorts located outside of the United States, and international expansion may cause the proportion of our international business to expand. Many factors affecting business activities outside the United States could adversely impact this business.

Our international expansion plan is to license and/or manage resorts that are located in North America outside the United States, foreign countries and are wholly-owned or principally owned by third parties.

Factors that could affect our international business will vary by region and market and generally include:

Instability or changes in social, political and/or economic conditions that could disrupt the trade activity in the countries where our resorts are located

The imposition of additional duties, taxes and other charges on imports and exports

Changes in foreign laws and regulations

Any inability to enforce contracts or intellectual property protections under the laws of the relevant jurisdiction

The availability of qualified labor and other resources in the relevant region

Potential and actual international terrorism and hostilities

The adoption or expansion of trade sanctions or other similar restrictions

Tax laws and other regulations that may impede our ability to receive revenues from international resorts

Recessions in foreign economies or changes in local economic conditions

Changes in currency valuations in specific countries or markets

The occurrence or consequences of any of these risks could affect our ability to operate in the affected regions, which could have a material, adverse effect on our growth strategies and our financial results.

Changes in tax laws, or their interpretation, and unfavorable resolution of tax contingencies could adversely affect our tax expense.

Our future effective tax rates could be adversely affected by changes in tax laws or their interpretation, both domestically and internationally. For example, in December 2017, the Tax Cuts and Jobs Act of 2017 (the “Tax Act”) was enacted into United States law. This legislation is broad and complex, and given its recent enactment, regulations or other interpretive guidance are currently limited. Any change in the interpretation of the Tax Act or other legislative proposals or amendments could have an adverse effect on our financial condition, results of operations, and cash flows. Furthermore, the effect of certain aspects of the Tax Act on state income tax frameworks is currently unclear, and potential changes to state income tax laws or their interpretation could further increase the Company’s income tax expense. Our tax returns and positions (including positions regarding jurisdictional authority of foreign governments to impose tax) are subject to review and audit by federal, state, local, and international taxing authorities. An

15

unfavorable outcome to a tax audit could result in higher tax expense, thereby negatively impacting the Company’s results of operations.

Our financial results could be adversely affected by an economic downturn.

Snowsports, vacation travel, and discretionary spending on recreational activities could be significantly affected by a prolonged period of economic downturn which could reduce consumer spending on recreational activities, result in declines in visits and revenue and could have a material adverse effect on us and our performance and our financial condition, results of operations and cash flows.

We face substantial competition.

The market for recreational activities, travel and experiences such as those offered by us within the United States is highly competitive due to the increasing number of domestic and international options competing for the consumer’s money. Many of our competitors have substantially greater financial resources and marketing strength. Moreover, the introduction of new products or services by competitors that compete directly with our products or services or that diminish the importance of our products or services may have a material adverse effect on our business and financial results.

Our advertising and promotional investments may affect our financial results.

We expect to continue to incur significant advertising, marketing and promotional expenditures to enhance our brands. These expenditures may adversely affect our results of operations and may not result in increased sales. Variations in the levels of advertising, marketing and promotional expenditures are expected to cause variability in our results of operations. While we will attempt to invest only in effective advertising, marketing and promotional activities, it is difficult to correlate such investments with sales results, and there is no guarantee that our expenditures will be effective in building brand equity or growing short term or long-term sales.

Our operating results and cash flow may be adversely affected by unfavorable economic, financial and societal market conditions.

Volatility and uncertainty in the financial markets and economic conditions may directly or indirectly affect our performance and operating results in a variety of ways, including: (a) prices for energy and agricultural products may rise faster than current estimates, including increases resulting from currency fluctuations; (b) our key suppliers may not be able to fund their capital requirements, resulting in disruption in the supplies of our raw and packaging materials; (c) the credit risks of our distributors may increase; (d) the impact of currency fluctuations on amounts owed to us by distributors that may pay in foreign currencies; or (e) our credit facility, or portion thereof, may become unavailable at a time when needed by us to meet critical needs.