Prince George update (2.4 EH/s, 85MW) – BC, Canada

Full site grading and civil works are in progress at the Company’s site in Prince George, readying the site for the commencement of foundation work for the data center buildings by March.

The first 1.4 EH/s (50MW) remains on track to be energized by the end of Q3 2022 with the additional 1.0 EH/s (35MW) anticipated to come online in 2023.

Upon completion, the specialized data centers are expected to power an additional ~25,000 Bitmain S19j Pro and S19j miners (already secured) generating 2.4 EH/s of incremental hashrate and adding approximately 20 direct full-time local jobs in Prince George.

Site grading at Prince George (2.4 EH/s, 85MW)

Site grading at Prince George (2.4 EH/s, 85MW)

Community engagement

In addition to targeting markets with abundant and/or under-utilized renewable energy, Iris Energy seeks to partner with the local communities in which we operate.

Iris Energy has committed to an annual contribution of C$500,000 to four indigenous Ktunaxa First Nations communities who are the traditional landowners of our first 30MW operating site in Canal Flats (BC, Canada). The Company will continue to engage with the First Nations communities at Canal Flats as well as its two additional BC sites in Mackenzie and Prince George to deepen these relationships in several areas, including by providing employment and training opportunities.

Iris Energy is proud to continue to support, and provide funding to, local sporting teams and emergency services groups.

Furthermore, the Company is pleased to announce that it will be implementing an annual community grants program where the community will be involved in determining where the available grant funding will be deployed. Further updates on this new development will be provided in due course.

Future development sites

Development works continued across additional sites in Canada, the USA and Asia-Pacific, which are expected to support an additional >1GW of aggregate power capacity and are expected to be capable of powering growth well beyond the Company’s 15 EH/s2 of secured miners (~530MW) and 765MW of announced power capacity.

Further details will be provided in due course including as and when development sites transition to the construction phase.

Operating and Financial Results

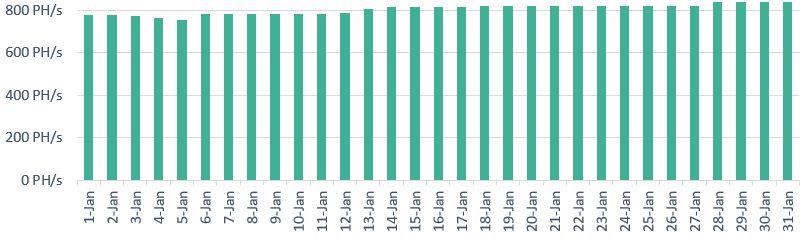

Daily average operating hashrate chart

Technical commentary

The Company’s average operating hashrate increased 8% in January 2022, attributable to the installation of new latest generation hardware to replace existing lower efficiency hardware.

Revenue decreased from December 2021 due to macro factors, i.e., a decrease in the average Bitcoin price (from ~US$50k to ~US$41k) and an increase in the network difficulty (average implied global hashrate increased from 169 EH/s to 180 EH/s). These macro factors were partially offset by the 8% increase in the Company’s average operating hashrate.

| Operating* | Nov-21 | Dec-21 | Jan-22 | |

| Operating renewable power usage (MW) | 23 | 26 | 27 | |

Avg operating hashrate (PH/s) | 657 | 748 | 804 | |

* Reflects actual recorded operating power usage and hashrate (not nameplate). Note: 30MW nameplate capacity is higher than actual operating power usage at Canal Flats due to features of the Company’s specialized data center design which utilizes variable speed fans to reduce power consumption during cooler months, as well as the Company maintaining a buffer within its infrastructure capacity that can be also directed to other site uses (e.g. in-house fabrication shop at Canal Flats is currently operating as Iris Energy has the advantage of saving time and costs by internally constructing certain components for its expansion sites).

| Financial (unaudited) | Nov-21 | Dec-21 | Jan-22 | |

Bitcoin mined* | 113 | 124 | 126 | |

Mining revenue (US$'000)5 | 6,593 | 6,170 | 5,015 | |

Electricity costs (US$'000)5 | 822 | 945 | 970 | |

| Revenue per Bitcoin (US$) | 58,328 | 49,700 | 39,935 | |

| Electricity costs per Bitcoin (US$) | 7,275 | 7,612 | 7,727 | |

* Reflects Bitcoin mined post deduction of mining pool fees (currently 0.5% x total Bitcoin mined).

| Miner Shipping Schedule | Hardware | Units | PH/s (incremental) | PH/s (cumulative) |

Operating (January 2022) | S19j Pro / Other6 | 8,539 | 804 | 804 |

Inventory – in transit | S19j Pro / S19j | 2,605 | 245 | 1,049 |

Inventory – pending deployment | S19j / Other7 | 7,337 | 634 | 1,683 |

Q1 2022 | S19j Pro / S19j | 9,126 | 881 | 2,564 |

Q2 2022 | S19j Pro / S19j | 11,660 | 1,119 | 3,683 |

Q3 2022 | S19j Pro / S19j | 7,063 | 659 | 4,342 |

Q4 2022 | S19j Pro / S19j | 27,973 | 2,781 | 7,123 |

Q1 2023 | S19j Pro | 26,577 | 2,658 | 9,781 |

Q2 2023 | S19j Pro | 26,765 | 2,676 | 12,457 |

Q3 2023 | S19j Pro | 26,952 | 2,695 | 15,152 |

| Total | | 154,597 | 15,152 | |

| Site Overview | Capacity (MW) | Capacity (EH/s) | Timing | Status |

Canal Flats (BC, Canada) | 30 | 0.8 | Complete | Operating |

Mackenzie (BC, Canada) | 50 | 1.5 | Q2-Q3 2022 | Under construction |

Prince George (BC, Canada) | 50 | 1.4 | Q3 2022 | Under construction |

| 35 | 1.0 | 2023 | Under construction |

Panhandle (Texas, USA) | 100 | 3.0 | Q4 20228 | Under construction |

| 265 | 7.5 | 2023 | Under construction |

| Total (miners secured) | 530 | 15.2 | | |

Panhandle (Texas, USA) | 235 | ~71 | | Potential capacity |

| Total (potential expansion) | 765 | ~221 | | |

5 Monthly U.S. dollar values shown have been translated from Australian dollars (A$) at the noon buying rate of the Federal Reserve Bank of New York on the last working day of each month. The rate applied for January 2022 is A$1 to US$0.6998.

6 Includes mix of lower efficiency hardware, which is estimated to represent less than 2.5% of the operating 804 PH/s.

7 Includes mix of lower efficiency hardware.

8 Data center buildings targeted for completion by end of 2022; energization of data centers targeted for Q1 2023.

About Iris Energy

Iris Energy is a sustainable Bitcoin mining company that supports local communities, as well as the decarbonization of energy markets and the global Bitcoin network.

| • | Focus on low-cost renewables: Iris Energy targets entry into regions where there are low-cost, abundant and attractive renewable energy sources, and where the Company can support local communities |

| • | Long-term security over infrastructure, land and power supply: Iris Energy owns its electrical infrastructure and data centers, providing security and operational control over its assets. Iris Energy also focuses on grid-connected power access which helps to ensure it is able to utilize a reliable, long-term supply of power |

| • | Seasoned management team: Iris Energy’s team has an impressive track record of success across energy, infrastructure, renewables, finance, digital assets and data centers |

Forward Looking Statements

This investor update includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Iris Energy’s future financial or operating performance. For example, forward-looking statements include but are not limited to the expected increase in the Company’s power capacity and the Company’s business plan. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “predict,” “potential,” “continue,” “scheduled” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause Iris Energy’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: Iris Energy’s limited operating history with operating losses; electricity outage, limitation of electricity supply or increase in electricity costs; long term outage or limitation of the internet connection at Iris Energy’s sites; Iris Energy’s evolving business model and strategy; Iris Energy’s ability to successfully manage its growth; Iris Energy’s ability to raise additional capital; competition; bitcoin prices; risks related to health pandemics including those of COVID-19; changes in regulation of digital assets; and other important factors discussed under the caption “Risk Factors” in Iris Energy’s final prospectus filed pursuant to Rule 424(b)(4) with the SEC on November 18, 2021, as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of Iris Energy’s website at https://investors.irisenergy.co.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that Iris Energy makes in this investor update speaks only as of the date of such statement. Except as required by law, Iris Energy disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.