June 2021 / Confidential Investor Presentation May 2022

2 Disclaimer This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any securities or other instruments of Douglas Elliman Inc. (“Douglas Elliman Inc.”, “DOUG” or “the Company”) or its subsidiaries and nothing contained herein or its presentation shall form the basis of any contract or commitment whatsoever. The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction. The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information. You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the information. The following presentation may contain "forward-looking statements,” including any statements that may be contained in the presentation that reflect the Company’s expectations or beliefs with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of the Company, including the risk that changes in Douglas Elliman Inc.’s capital expenditures impact its expected free cash flow and the other risk factors described in Douglas Elliman Inc.’s annual report on Form 10-K for the year ended December 31, 2021 and Form 10-Q for the quarterly period ended March 31, 2022, as filed with the SEC. Please also refer to Douglas Elliman Inc.'s Current Reports on Form 8- K, filed on March 1, 2022 and May 10, 2022 (Commission File Number 1-41054) as filed with the SEC for information, including cautionary and explanatory language, relating to Non-GAAP Financial Measures in this Presentation labeled "Adjusted". Results actually achieved may differ materially from expected results included in these forward-looking statements as a result of these or other factors. Due to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date on which such statements are made. The Company disclaims any obligation to, and does not undertake to, update or revise and forward- looking statements in this presentation.

3 Investment Highlights Cutting-edge property technology supportive of agent recruitment, retention and productivity Strong platform for continued growth Favorable dynamics in the U.S. residential real estate marketExperienced management team with substantial real estate expertise and a track record of driving growth Attractive financial profile with significant operating leverage and balance sheet strength Comprehensive solution provides for multiple revenue streams and monetization of valuable agent relationships Industry-leading brand name with a strong presence in most major U.S. luxury markets Unique Investment Opportunity in Tech-Enabled Residential Real Estate Brokerage with Comprehensive Suite of Real Estate Solutions, Industry-leading Brand Name and Talented Team of Employees and Agents

4 Founded in 1911 as a pioneer in the real estate industry that has continued to challenge the status quo through innovation and high- quality service provided by best-in-class real estate agents Leading brand associated with service, luxury and forward thinking operating in markets that are primarily densely populated international finance and technology hubs offering housing inventory at premium price points Core residential real estate brokerage and new development sales and marketing (“DEDM”) services complemented with ancillary services including property management, title and escrow services Comprehensive suite of technology-enabled real estate solutions that bring efficiency, market intelligence and competitive advantage to our agents while supporting agent recruitment, retention and productivity Technology powered by leading providers and our investments in innovative PropTech companies keeps our agents on the cutting edge with solutions that can be quickly integrated into our infrastructure, while also allowing us to remain asset-light Strong market share gains and top-line growth along with recent cost savings have driven an increase in profitability Well-positioned to capitalize on attractive opportunities in the large and growing U.S. residential real estate market Douglas Elliman at a Glance Bryant Kirkland Senior Vice President, Treasurer and Chief Financial Officer Marc Bell Senior Vice President, Secretary and General Counsel David Ballard Senior Vice President, Enterprise Efficiency and Chief Technology Officer Howard Lorber Chairman, President and Chief Executive Officer Richard Lampen Director, Executive Vice President and Chief Operating Officer Scott Durkin President and Chief Executive Officer, Douglas Elliman Realty LLC Experienced and Skilled Management Team

5 Douglas Elliman’s Geographical Footprint ~6,700 affiliated agents across approximately 110 U.S. offices Alliance with Knight Frank provides an international network of approximately 370 offices across, 50 countries and 17,000 agents #6 Nationally One of the Largest in New York California(3) Colorado(2) Texas Florida(5) New York City New York New Jersey Massachusetts(1) Connecticut GTV: $7.3b Market Share: 5.8% GTV: $1.4b Market Share: 27.1% Entered Market in 2021 GTV: $14.7b Market Share: 20.4% New York City GTV: $17.3b Market Share: 21.3% NYC Metro(4) GTV: $10.9b Market Share: 16.9% Massachusetts GTV: $400m Market Share: 7.3% Source: Miller Samuel reports. Note: Market share and rankings represent LTM 3/31/2022 based on gross transaction value (“GTV”). Figures based on transaction close date. GTV in each selected region represents LTM 3/31/2022. 1) Includes Boston. Does not include 2022 expansion market of Nantucket. 2) Includes Aspen and Snowmass Village. 3) Includes Los Angeles (Westside and Downtown), Malibu, Malibu Beach, Orange County and San Diego County. 4) Includes Long Island, North Fork, Hamptons, Greenwich and Westchester County. 5) Includes Boca Raton / Highland Beach, Coral Gables, Delray Beach, Fort Lauderdale, Palm Beach Gardens, Jupiter, Manalapan, Miami, Palm Beach, St. Petersburg, Tampa, Wellington and West Palm Beach. Does not include 2022 expansion markets of Vero Beach and Ponte Vedra Beach. Entered Market in 2022 Las Vegas

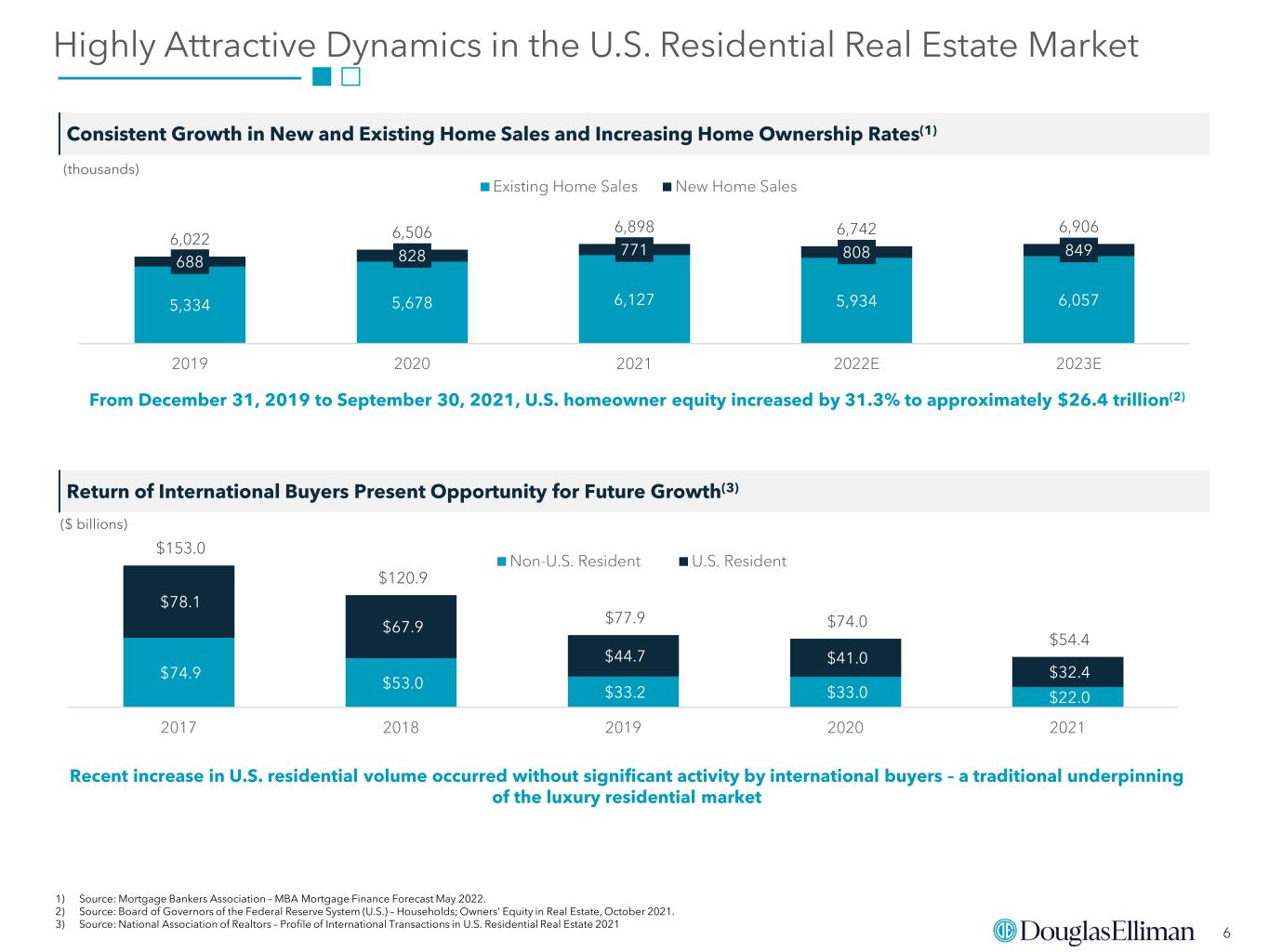

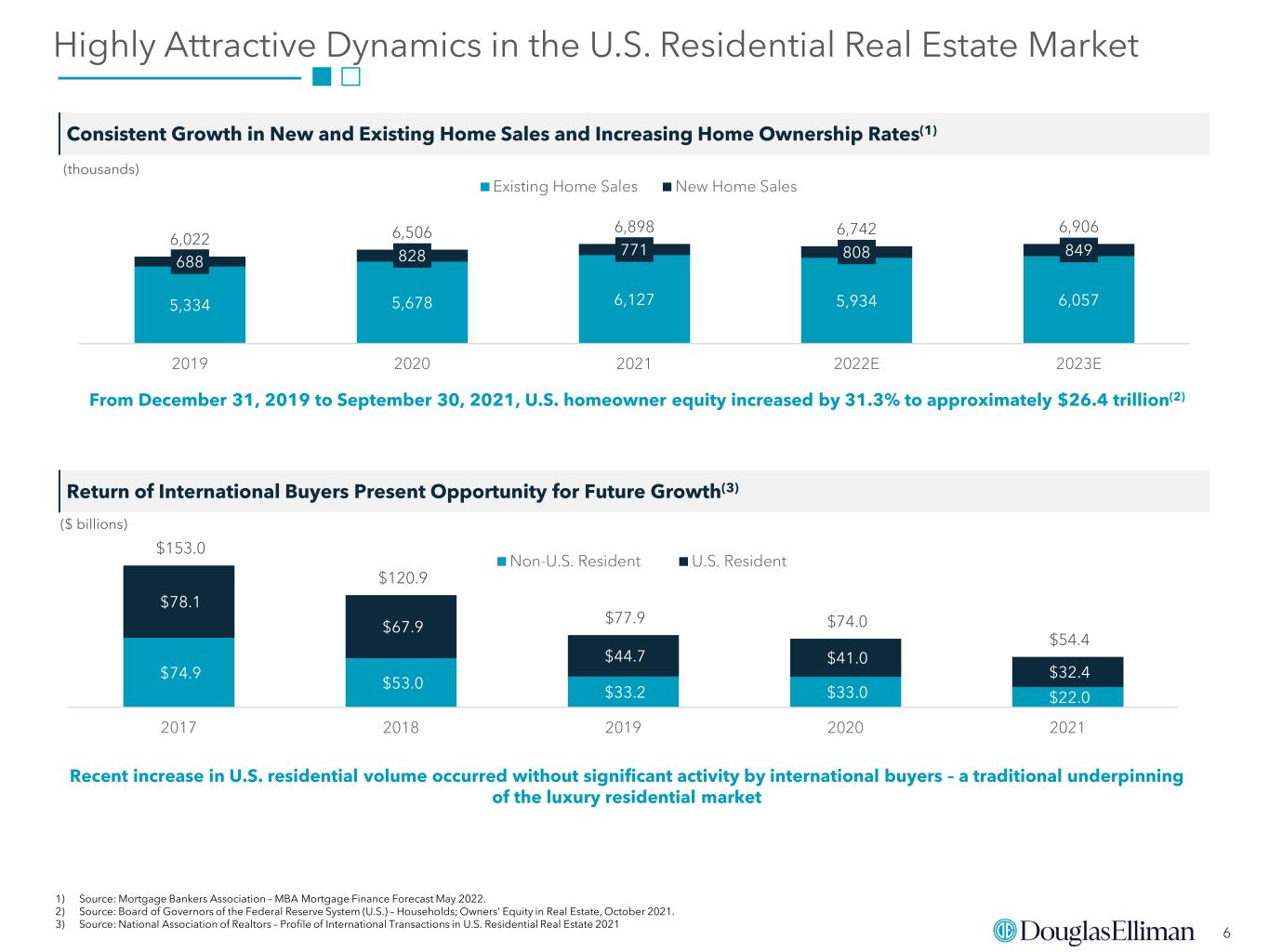

6 1) Source: Mortgage Bankers Association – MBA Mortgage Finance Forecast May 2022. 2) Source: Board of Governors of the Federal Reserve System (U.S.) – Households; Owners' Equity in Real Estate, October 2021. 3) Source: National Association of Realtors – Profile of International Transactions in U.S. Residential Real Estate 2021 Highly Attractive Dynamics in the U.S. Residential Real Estate Market Consistent Growth in New and Existing Home Sales and Increasing Home Ownership Rates(1) 5,334 5,678 6,127 5,934 6,057 688 828 771 808 849 6,022 6,506 6,898 6,742 6,906 2019 2020 2021 2022E 2023E Existing Home Sales New Home Sales (thousands) From December 31, 2019 to September 30, 2021, U.S. homeowner equity increased by 31.3% to approximately $26.4 trillion(2) $74.9 $53.0 $33.2 $33.0 $22.0 $78.1 $67.9 $44.7 $41.0 $32.4 $153.0 $120.9 $77.9 $74.0 $54.4 2017 2018 2019 2020 2021 Non-U.S. Resident U.S. Resident Return of International Buyers Present Opportunity for Future Growth(3) ($ billions) Recent increase in U.S. residential volume occurred without significant activity by international buyers – a traditional underpinning of the luxury residential market

7 4.9% 9.1% 16.9% 5.1% 3.7% 2019 2020 2021 2022E 2023E 1) Source: National Association of Realtors – 2021 Home Buyers and Sellers Generational Trends Report. 2) Source: National Association of Realtors – Q1 2022 Economic Outlook. Represents existing home price appreciation. Highly Attractive Dynamics in the U.S. Residential Real Estate Market (Cont.) Significant Home Price Appreciation(2) Benefiting from aforementioned increased demand as well as supply constraints given record low inventories Millennials Represent Largest Homebuying Generation in the Housing Market(1) 2% 37% 24% 18% 14% 5% Gen Z Millennials Gen X Younger Baby Boomers (1955 - 1964) Older Baby Boomers (1946 - 1954) Silent Generation (% of home buyers) Recent Home Buying Trends Indicate a Desire for Increased Mobility Remote Work Flexibility Increased Demand for Greater Space Increased Demand for Multiple Homes

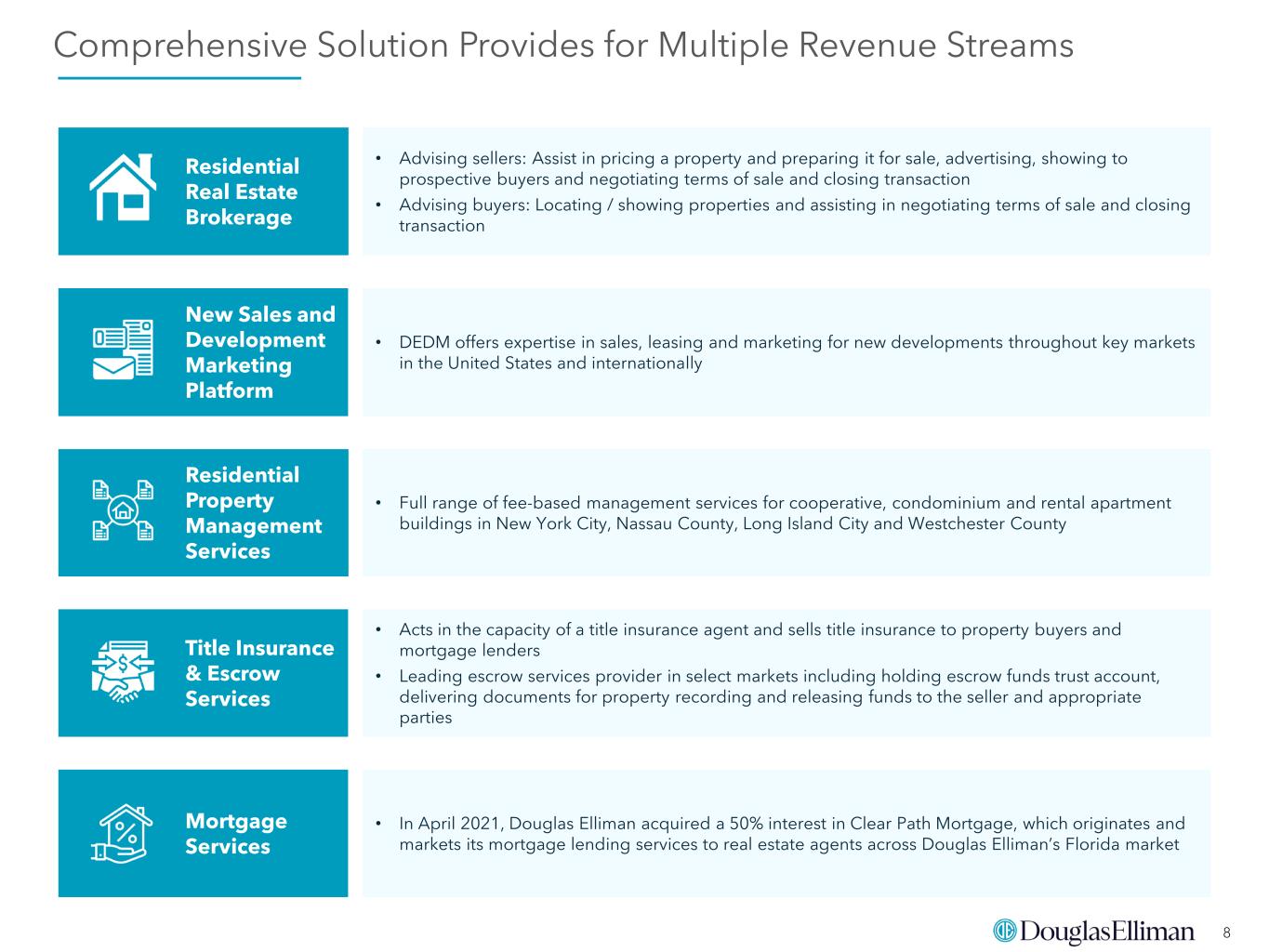

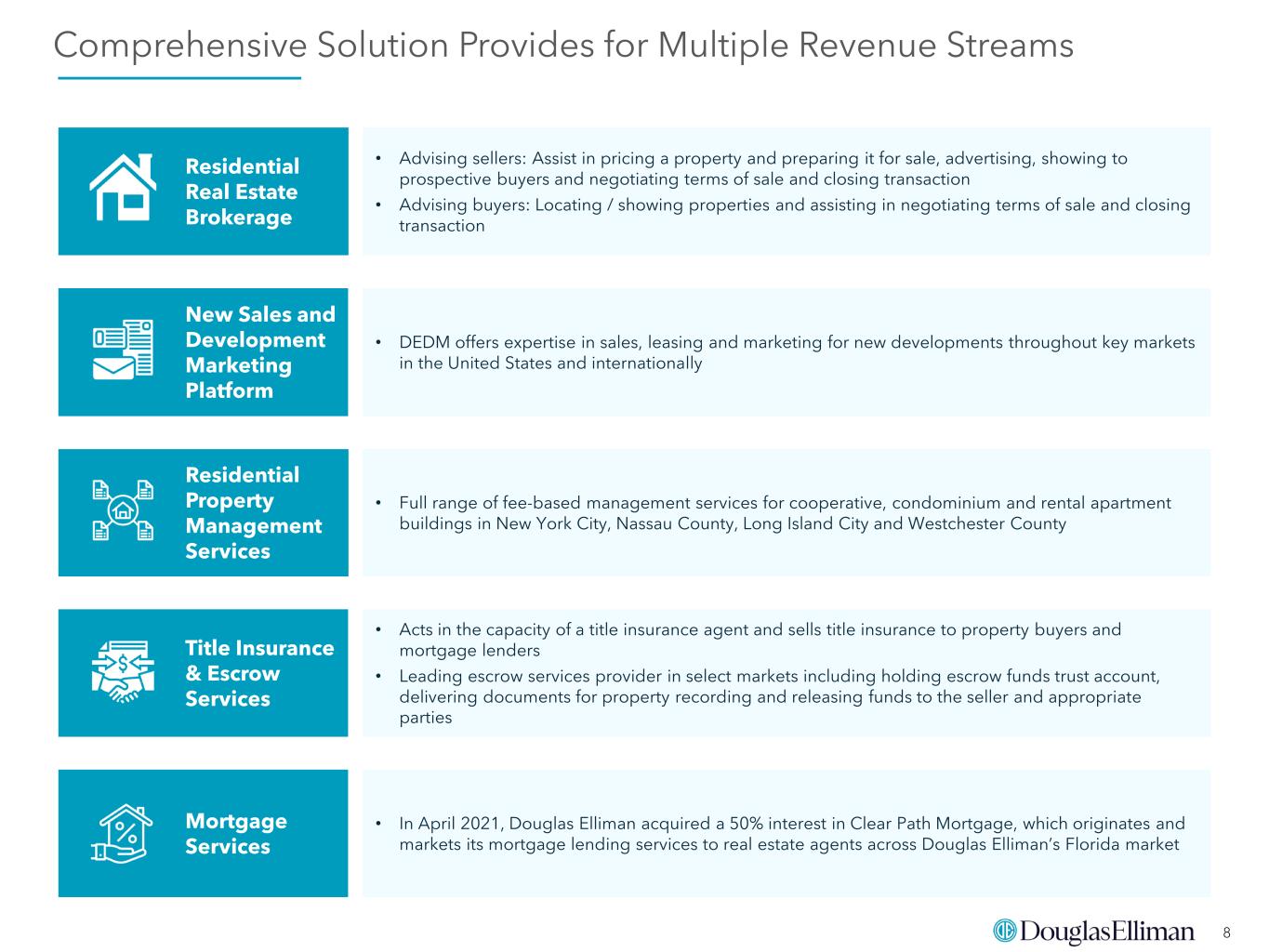

8 Comprehensive Solution Provides for Multiple Revenue Streams • DEDM offers expertise in sales, leasing and marketing for new developments throughout key markets in the United States and internationally New Sales and Development Marketing Platform • Advising sellers: Assist in pricing a property and preparing it for sale, advertising, showing to prospective buyers and negotiating terms of sale and closing transaction • Advising buyers: Locating / showing properties and assisting in negotiating terms of sale and closing transaction Residential Real Estate Brokerage • Acts in the capacity of a title insurance agent and sells title insurance to property buyers and mortgage lenders • Leading escrow services provider in select markets including holding escrow funds trust account, delivering documents for property recording and releasing funds to the seller and appropriate parties Title Insurance & Escrow Services • Full range of fee-based management services for cooperative, condominium and rental apartment buildings in New York City, Nassau County, Long Island City and Westchester County Residential Property Management Services Mortgage Services • In April 2021, Douglas Elliman acquired a 50% interest in Clear Path Mortgage, which originates and markets its mortgage lending services to real estate agents across Douglas Elliman’s Florida market

9 LTM 3/31/22 Average(4): $1,622.3 Industry-leading Brand Name with a Strong Presence in U.S. Luxury Markets $1,580.0 $1,128.4 $684.7 $657.3 $351.3 Douglas Elliman Compass Redfin Realogy eXp Realty Highest Transaction Values in the Industry Average Selling Price (2021)(3) ($ thousands) Leading Presence in Large Luxury Markets Markets are primarily international finance and technology hubs that are densely populated and offer inventory at premium prices Large national presence augmented by alliance with Knight Frank, providing an international network of approximately 370 offices across 50 countries with approximately 17,000 agents Gaining share in several luxury markets including New York, Florida, California, Texas and Colorado, among others Douglas Elliman is the sixth largest brokerage nationally and one of the largest in New York by sales volume 19% 20% 11% 1% 22% 0% 21% 17% 20% 6% 27% 7% NYC Long Island Florida California Colorado Boston 2017 LTM 3/31/22 Market Share by Volume(1) (2) 1) Source: Miller Samuel reports. 2) Includes Long Island, North Fork, Hamptons, Greenwich and Westchester County. 3) Represents average selling price for publicly traded real estate brokerage firms by volume. 4) Represents average for LTM ended 3/31/2022.

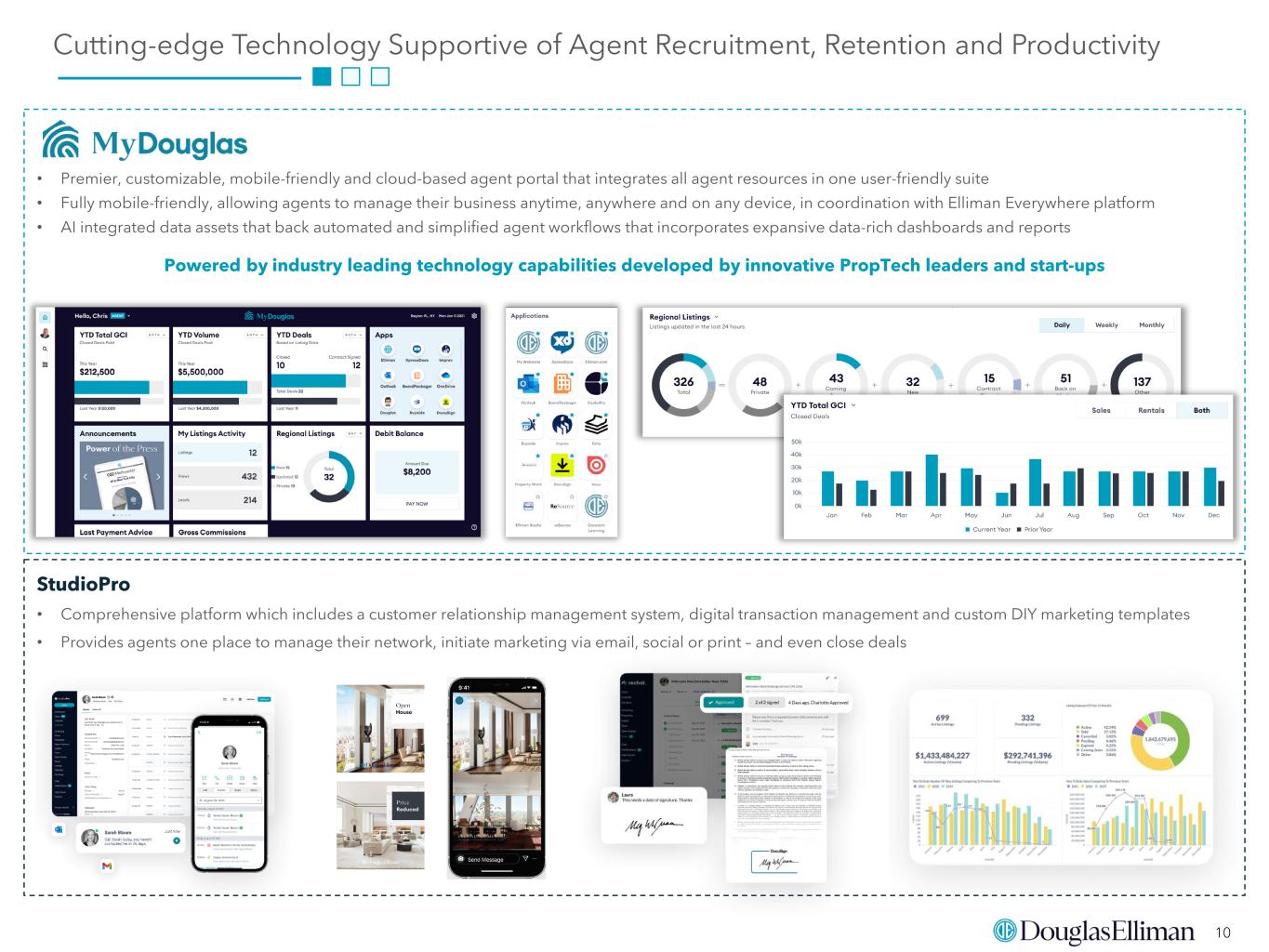

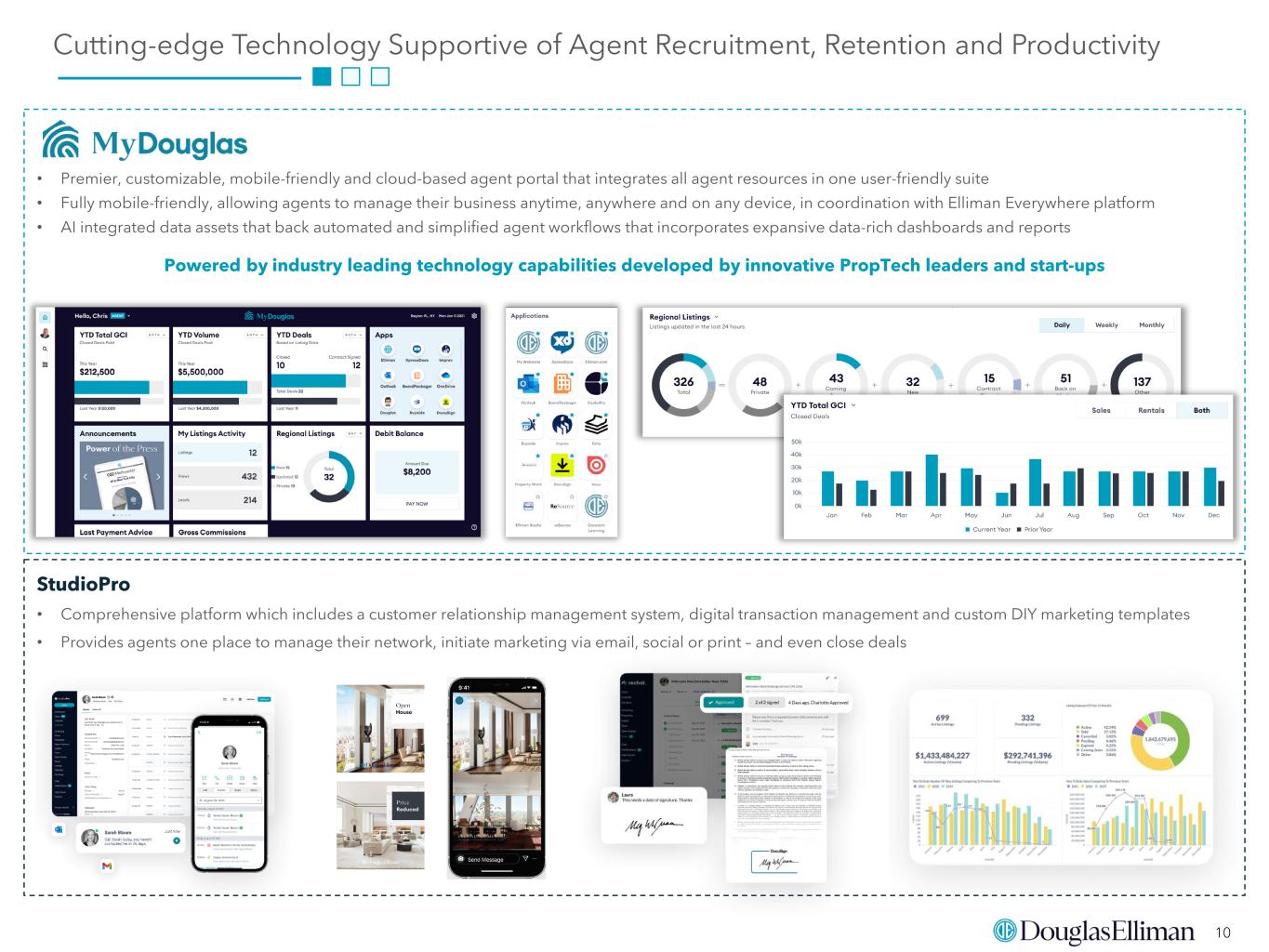

10 Cutting-edge Technology Supportive of Agent Recruitment, Retention and Productivity Powered by industry leading technology capabilities developed by innovative PropTech leaders and start-ups • Premier, customizable, mobile-friendly and cloud-based agent portal that integrates all agent resources in one user-friendly suite • Fully mobile-friendly, allowing agents to manage their business anytime, anywhere and on any device, in coordination with Elliman Everywhere platform • AI integrated data assets that back automated and simplified agent workflows that incorporates expansive data-rich dashboards and reports StudioPro • Comprehensive platform which includes a customer relationship management system, digital transaction management and custom DIY marketing templates • Provides agents one place to manage their network, initiate marketing via email, social or print – and even close deals

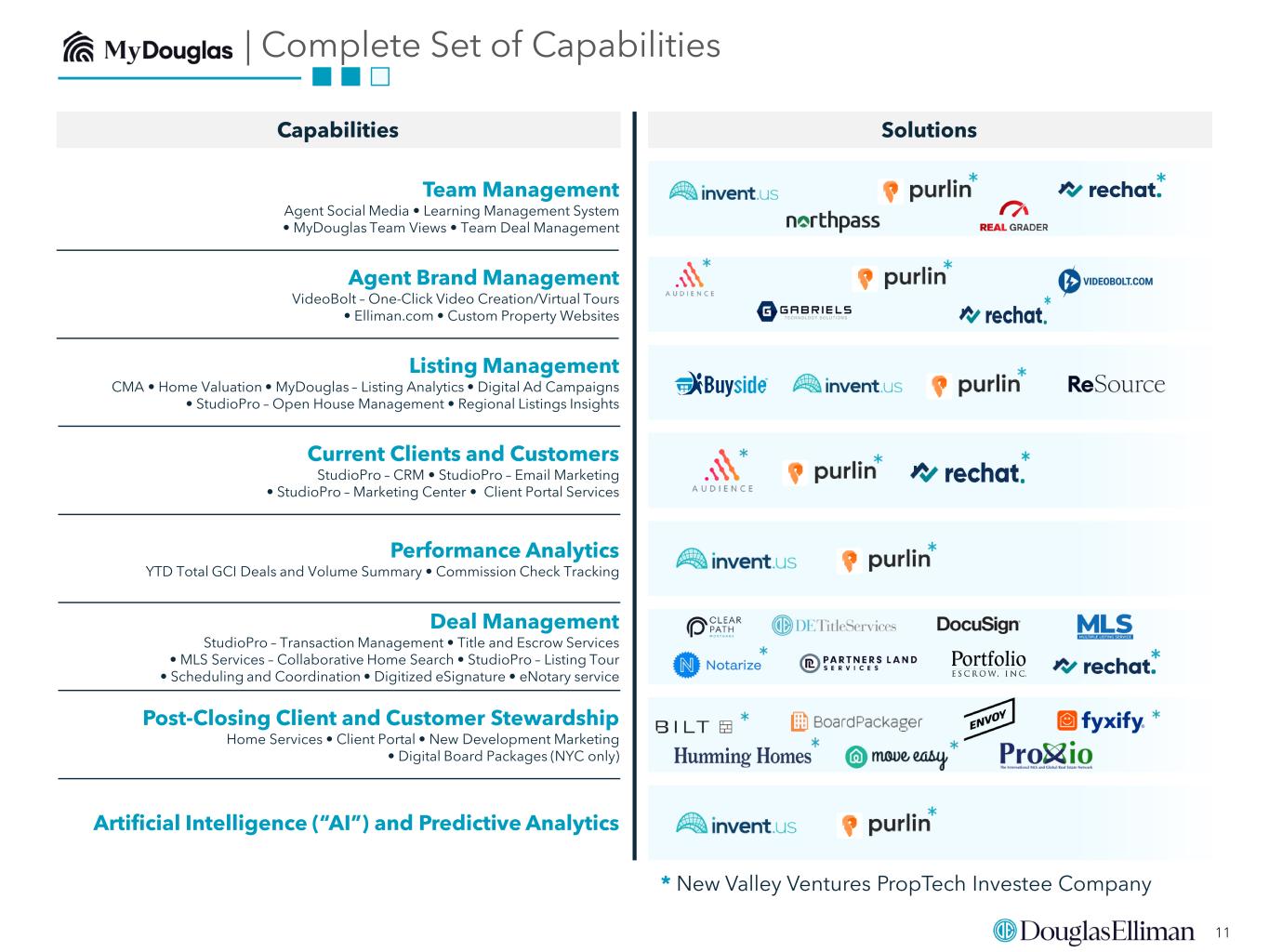

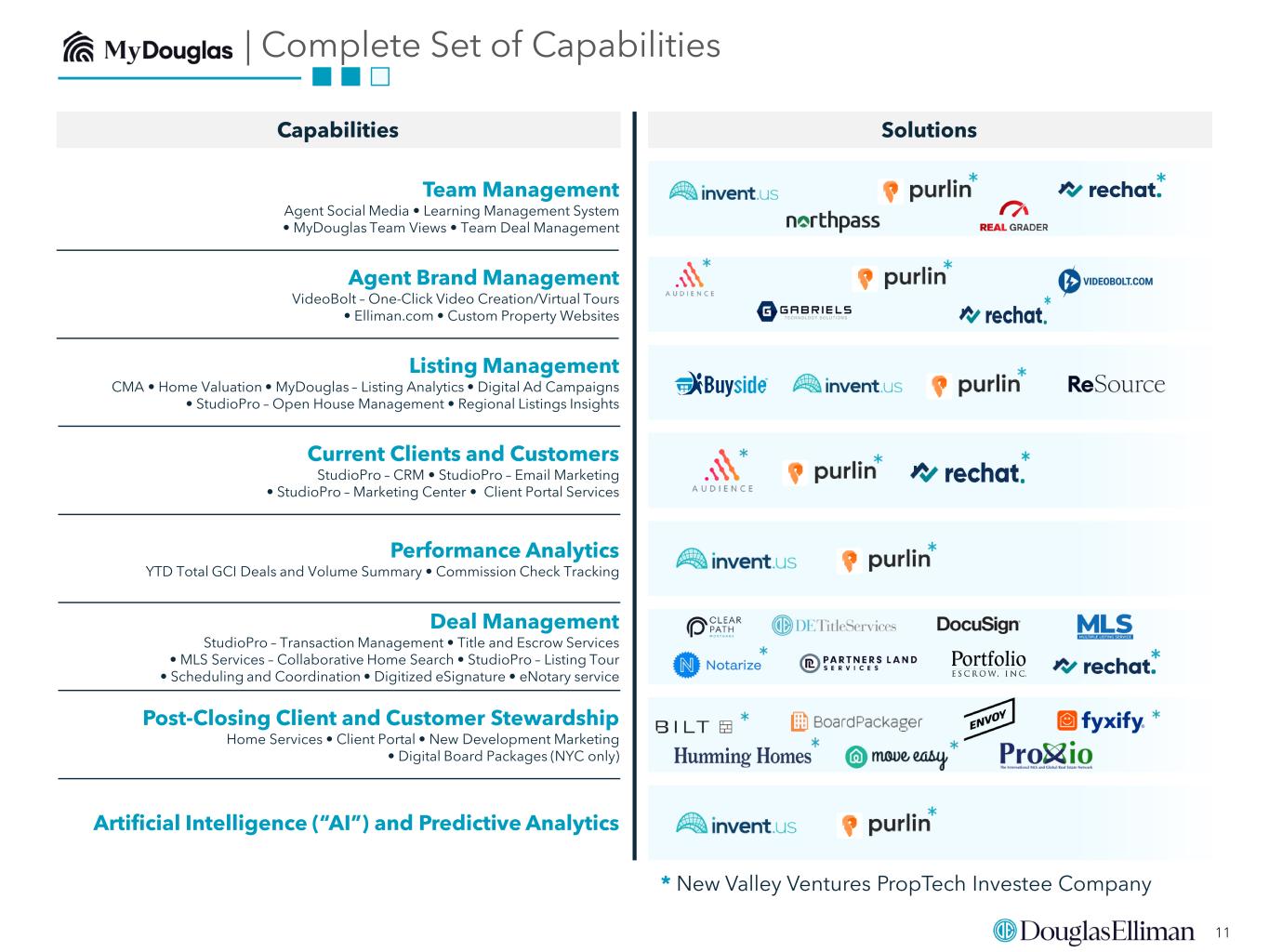

11 * New Valley Ventures PropTech Investee Company MyDouglas | Complete Set of Capabilities Capabilities Solutions Artificial Intelligence (“AI”) and Predictive Analytics Team Management Agent Social Media • Learning Management System • MyDouglas Team Views • Team Deal Management Agent Brand Management VideoBolt – One-Click Video Creation/Virtual Tours • Elliman.com • Custom Property Websites Listing Management CMA • Home Valuation • MyDouglas – Listing Analytics • Digital Ad Campaigns • StudioPro – Open House Management • Regional Listings Insights Current Clients and Customers StudioPro – CRM • StudioPro – Email Marketing • StudioPro – Marketing Center • Client Portal Services Performance Analytics YTD Total GCI Deals and Volume Summary • Commission Check Tracking Deal Management StudioPro – Transaction Management • Title and Escrow Services • MLS Services – Collaborative Home Search • StudioPro – Listing Tour • Scheduling and Coordination • Digitized eSignature • eNotary service Post-Closing Client and Customer Stewardship Home Services • Client Portal • New Development Marketing • Digital Board Packages (NYC only)

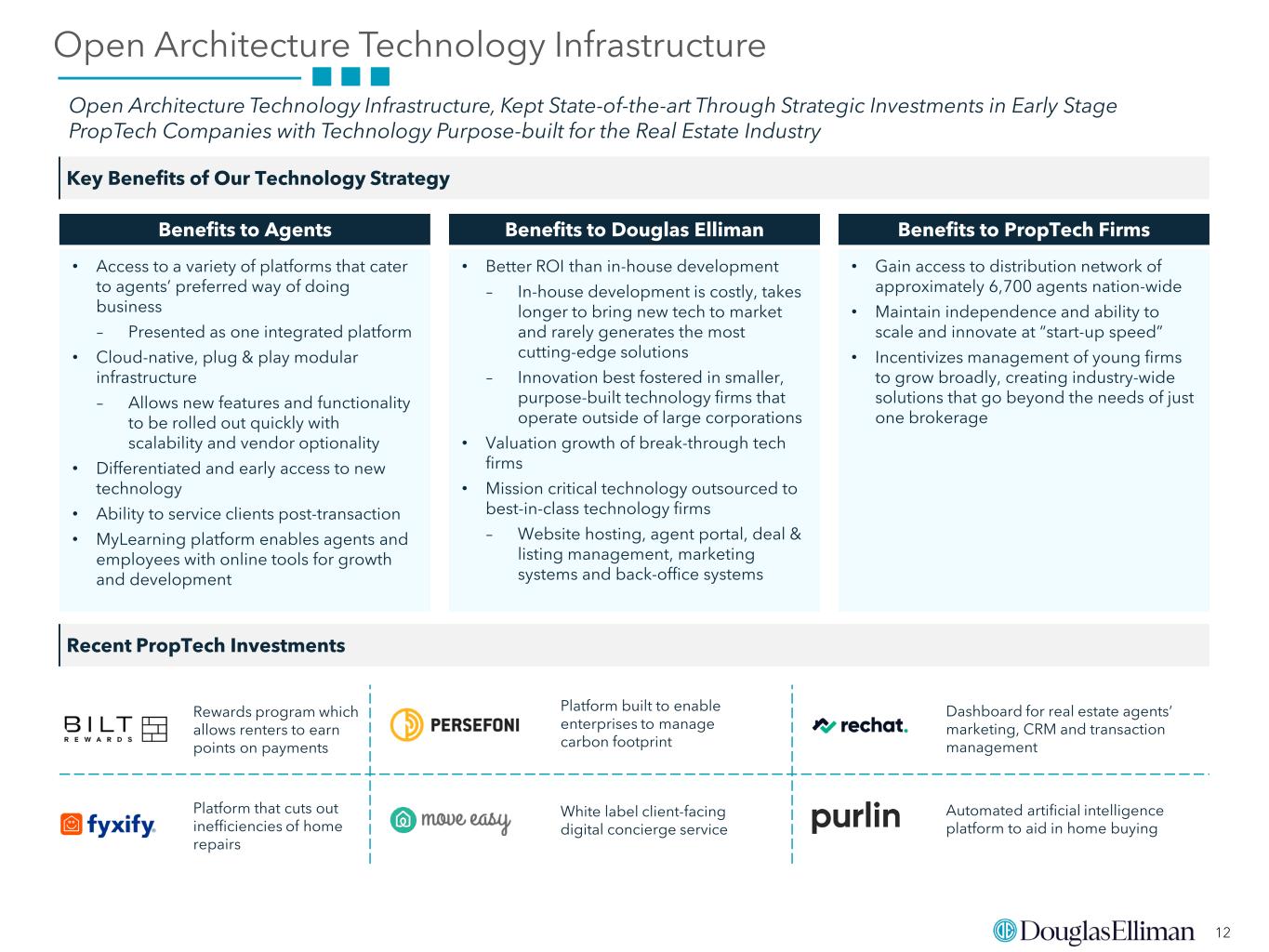

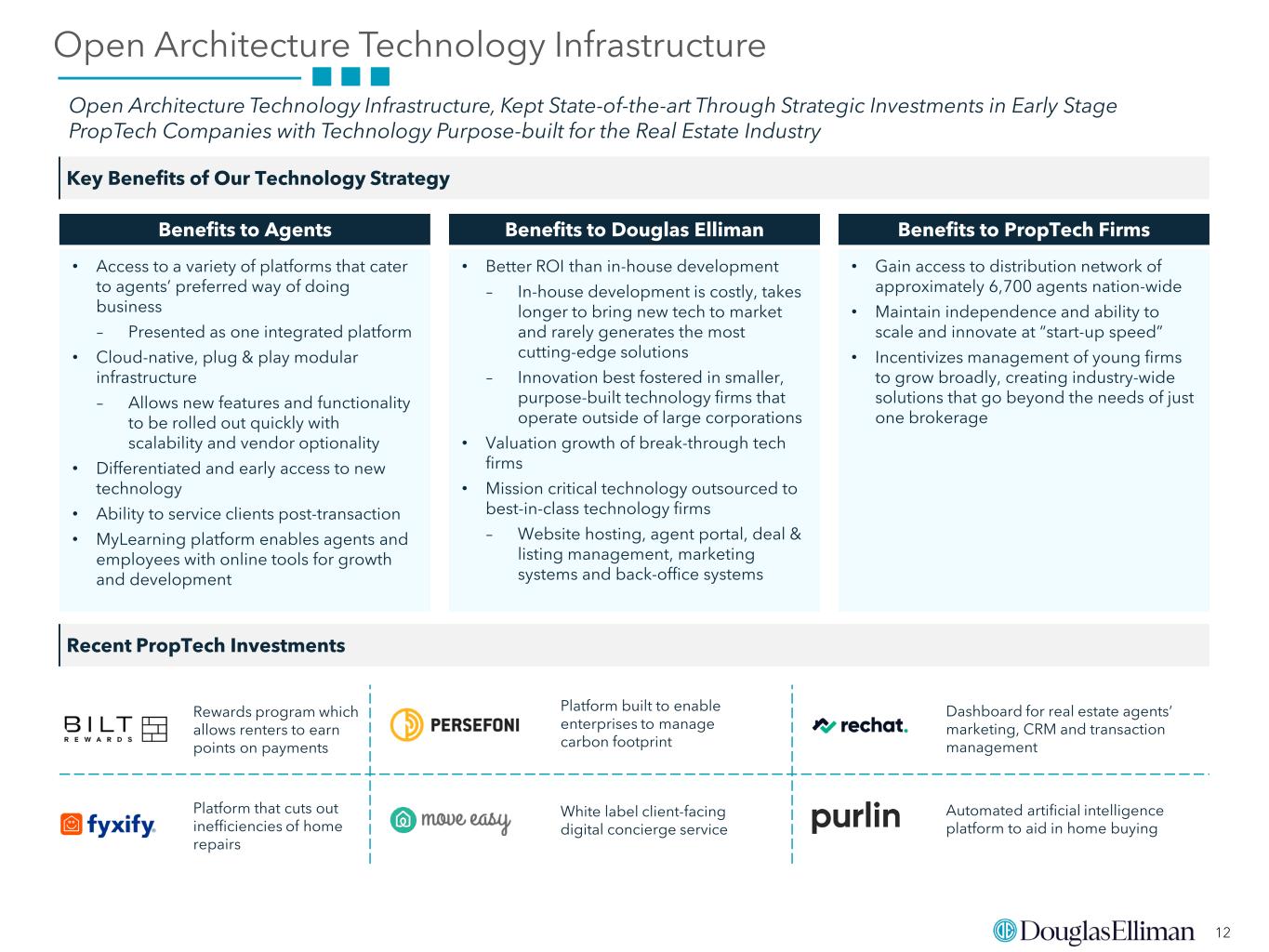

12 Open Architecture Technology Infrastructure Open Architecture Technology Infrastructure, Kept State-of-the-art Through Strategic Investments in Early Stage PropTech Companies with Technology Purpose-built for the Real Estate Industry Key Benefits of Our Technology Strategy Recent PropTech Investments Platform built to enable enterprises to manage carbon footprint Rewards program which allows renters to earn points on payments Dashboard for real estate agents’ marketing, CRM and transaction management Platform that cuts out inefficiencies of home repairs White label client-facing digital concierge service Automated artificial intelligence platform to aid in home buying Benefits to Agents Benefits to Douglas Elliman • Access to a variety of platforms that cater to agents’ preferred way of doing business – Presented as one integrated platform • Cloud-native, plug & play modular infrastructure – Allows new features and functionality to be rolled out quickly with scalability and vendor optionality • Differentiated and early access to new technology • Ability to service clients post-transaction • MyLearning platform enables agents and employees with online tools for growth and development • Better ROI than in-house development – In-house development is costly, takes longer to bring new tech to market and rarely generates the most cutting-edge solutions – Innovation best fostered in smaller, purpose-built technology firms that operate outside of large corporations • Valuation growth of break-through tech firms • Mission critical technology outsourced to best-in-class technology firms – Website hosting, agent portal, deal & listing management, marketing systems and back-office systems • Gain access to distribution network of approximately 6,700 agents nation-wide • Maintain independence and ability to scale and innovate at “start-up speed” • Incentivizes management of young firms to grow broadly, creating industry-wide solutions that go beyond the needs of just one brokerage Benefits to PropTech Firms

13 • Further grow leadership position in NY while entering and expanding into adjoining markets where the Douglas Elliman brand has strong awareness and brand equity, including Florida, California, Colorado and Texas • Recent entry into the Dallas, Austin, Jacksonville and Las Vegas markets • Disciplined regional expansion to protect our luxury brand and keep focus on premium markets • Opportunity to expand markets currently served by more than 50% in terms of annual transaction value Strong Platform for Continued Growth Continue Executing on DEDM Growth Strategy Expand Footprint into Adjoining Markets Expand Ancillary Services to Enhance Client Experience and Drive Growth • Highly successful hybrid platform of matching experienced new development experts with skilled brokerage professionals provides differentiated expertise and real-time market intelligence to clients • Strong pipeline provides clear path to significant growth in near-term and expansion into new markets (e.g., Texas) provides exciting opportunities for medium to long term growth • Technology to be key differentiator in terms of adoption by agents, delivery to clients and disruption of traditional business models $50.9 $64.3 $72.9 $47.4 $81.9 $85.8 2017 2018 2019 2020 2021 LTM 3/31/22 DEDM Revenue ($ millions) Negative COVID-19 Impact Ancillary Offerings Current Future Renovation StagingProperty Management Title Insurance Escrow Security Home Services Market Expansion Opportunity Less than $4bn $4bn - $16bn Greater than $16bn Austin Charleston Clearwater Dallas Denver Jacksonville Las Vegas Nashville Raleigh-Durham Charlotte Sacramento County Salt Lake City San Antonio San Francisco Santa Fe Scottsdale St. Petersburg Tampa Annual Transaction Value 18 markets representing $180bn of Combined Annual Transaction Value(1) 1) Source: Miller Samuel reports. Aggregate annual transaction volume based on 3Q’21 annualized figures for selected growth regions. Mortgage Services

14 California Texas Florida Overview • Purchased Teles Properties in 2017 • Purchased interest in Texas brokerage in 2021 • High profile recruitment of team in Naples, Vero Beach and Ponte Vedra Beach in 2021 Benefits to Douglas Elliman • Ability to expand in southern California’s luxury markets, such as Beverly Hills, Newport and Brentwood • Added over $65M Gross Commission Income (“GCI”) and ~600 agents in over 20 offices • Ability to expand in luxury markets in Texas such as Houston, Dallas and Austin both in residential sales and new development marketing • Added over $30M GCI and ~180 in agents in 4 offices • Ability to expand in luxury markets in southwest Florida • Added ~$10M GCI Strong Platform for Continued Growth (Cont.) Continue to Recruit Best-in- class Agents Opportunistically Pursue Acquisitions and Aqui-hires 91% 90% 94% 94% 2019 2020 2021 LTM 3/31/2022 1) Retention, in any particular period, is calculated as the quotient of the prior year revenue generated by agents retained in the subject year period divided by the prior year period revenue generated by all agents, whether or not retained. We use retention as a measure of the stability of the agents that are on the Douglas Elliman platform. • We will continue to seek through M&A attractive groups of agents from core and adjacent markets that fit with our brand and accelerate our growth Retention(1) High profile recruitmentHigh retention Long-tenured agents • In 2021, 86% of revenue was attributable to agents with more than 3 years of tenure • In 2019, 2020 and 2021, average retained agent was ~2.5x to ~3.0x more productive than departed agents

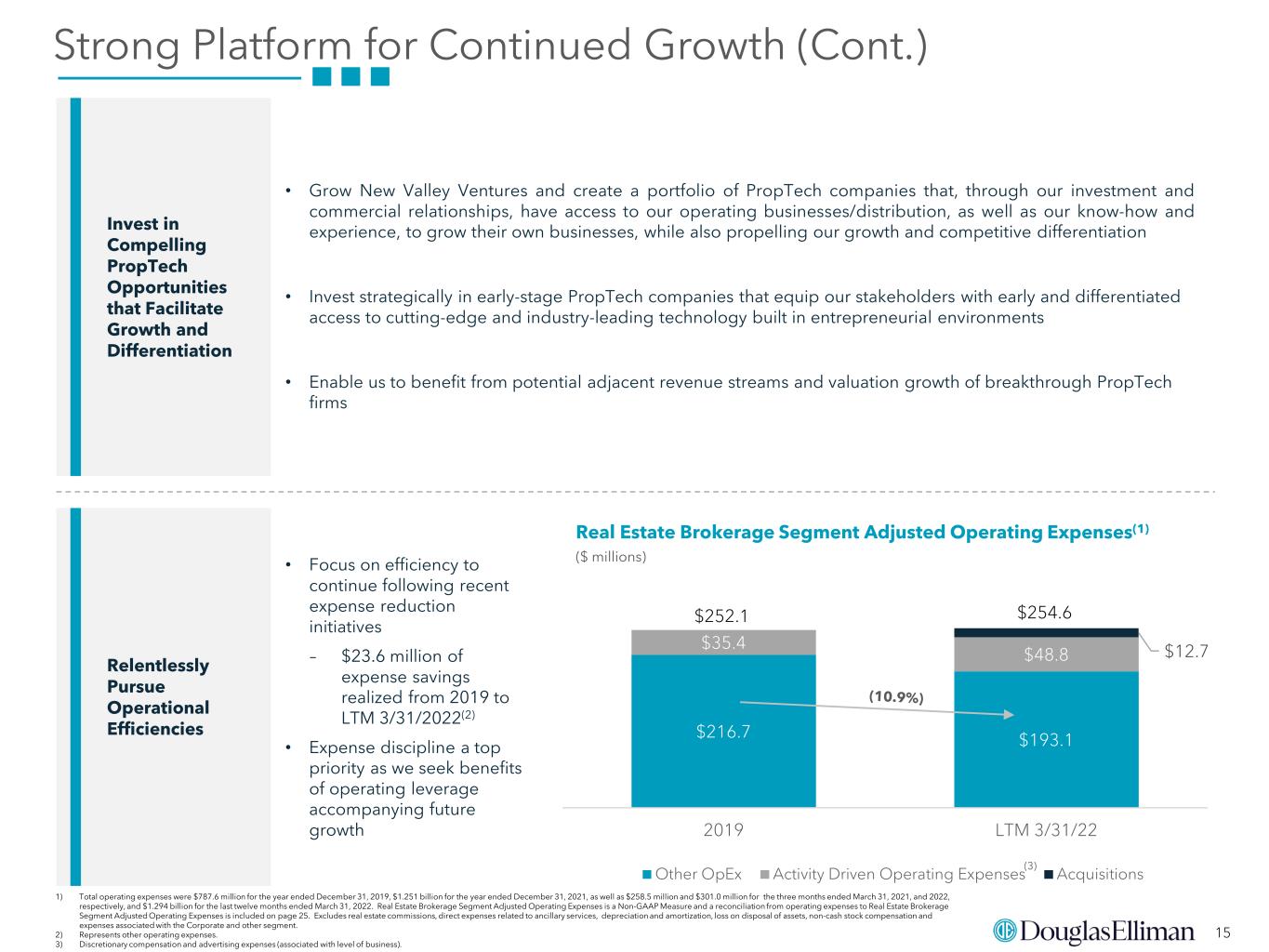

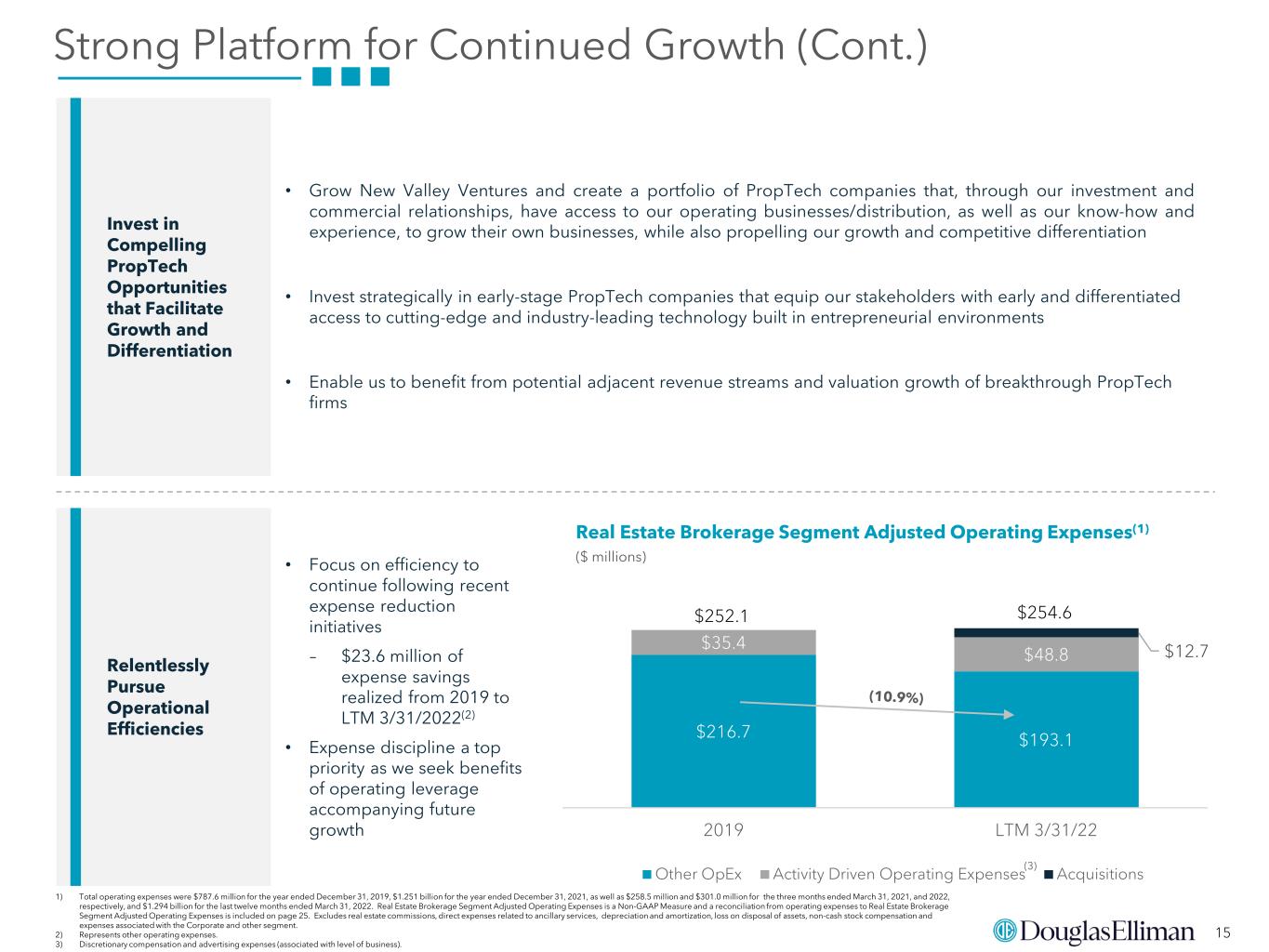

15 $216.7 $193.1 $35.4 $48.8 $12.7 2019 LTM 3/31/22 Other OpEx Activity Driven Operating Expenses Acquisitions Strong Platform for Continued Growth (Cont.) Invest in Compelling PropTech Opportunities that Facilitate Growth and Differentiation Relentlessly Pursue Operational Efficiencies • Grow New Valley Ventures and create a portfolio of PropTech companies that, through our investment and commercial relationships, have access to our operating businesses/distribution, as well as our know-how and experience, to grow their own businesses, while also propelling our growth and competitive differentiation • Invest strategically in early-stage PropTech companies that equip our stakeholders with early and differentiated access to cutting-edge and industry-leading technology built in entrepreneurial environments • Enable us to benefit from potential adjacent revenue streams and valuation growth of breakthrough PropTech firms • Focus on efficiency to continue following recent expense reduction initiatives – $23.6 million of expense savings realized from 2019 to LTM 3/31/2022(2) • Expense discipline a top priority as we seek benefits of operating leverage accompanying future growth Real Estate Brokerage Segment Adjusted Operating Expenses(1) ($ millions) 1) Total operating expenses were $787.6 million for the year ended December 31, 2019, $1.251 billion for the year ended December 31, 2021, as well as $258.5 million and $301.0 million for the three months ended March 31, 2021, and 2022, respectively, and $1.294 billion for the last twelve months ended March 31, 2022. Real Estate Brokerage Segment Adjusted Operating Expenses is a Non-GAAP Measure and a reconciliation from operating expenses to Real Estate Brokerage Segment Adjusted Operating Expenses is included on page 25. Excludes real estate commissions, direct expenses related to ancillary services, depreciation and amortization, loss on disposal of assets, non-cash stock compensation and expenses associated with the Corporate and other segment. 2) Represents other operating expenses. 3) Discretionary compensation and advertising expenses (associated with level of business). (3) $254.6$252.1

DOUGLAS ELLIMAN FINANCIAL OVERVIEW

17 Attractive Financial Profile 1) As of March 31, 2022. Please see page 23, "Balance Sheet" of Douglas Elliman Inc. The Balance Sheet reports $203.7 million of cash and $9.4 million of Notes Payable and Other Obligations. Disciplined expense management drives significant operating leverage Strong performance across KPIs Healthy margins and limited Capital Expenditures requirements drive cash flow conversion, supporting future growth initiatives and stockholder dividends Strong balance sheet with approximately $195 million of net cash(1)

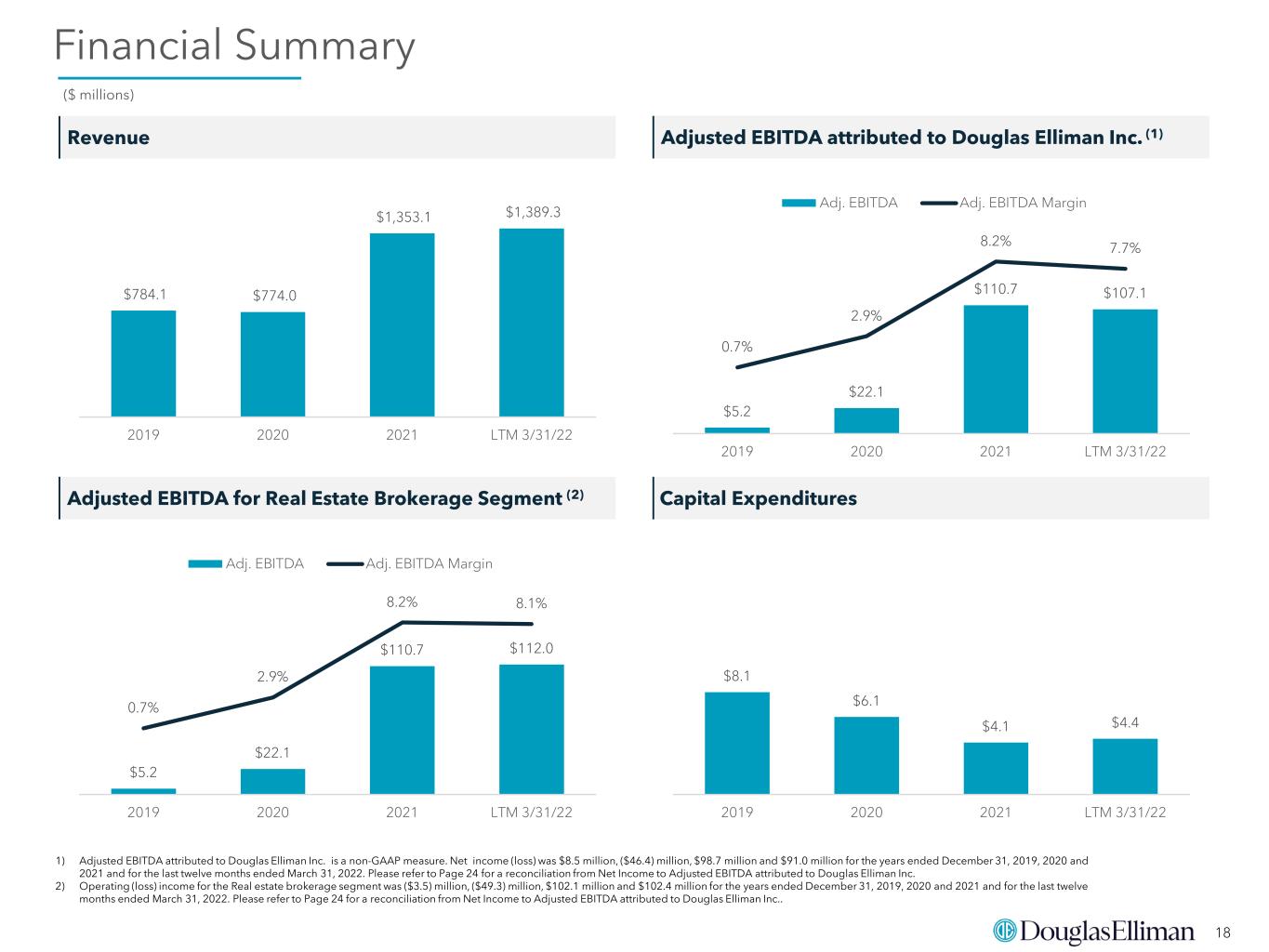

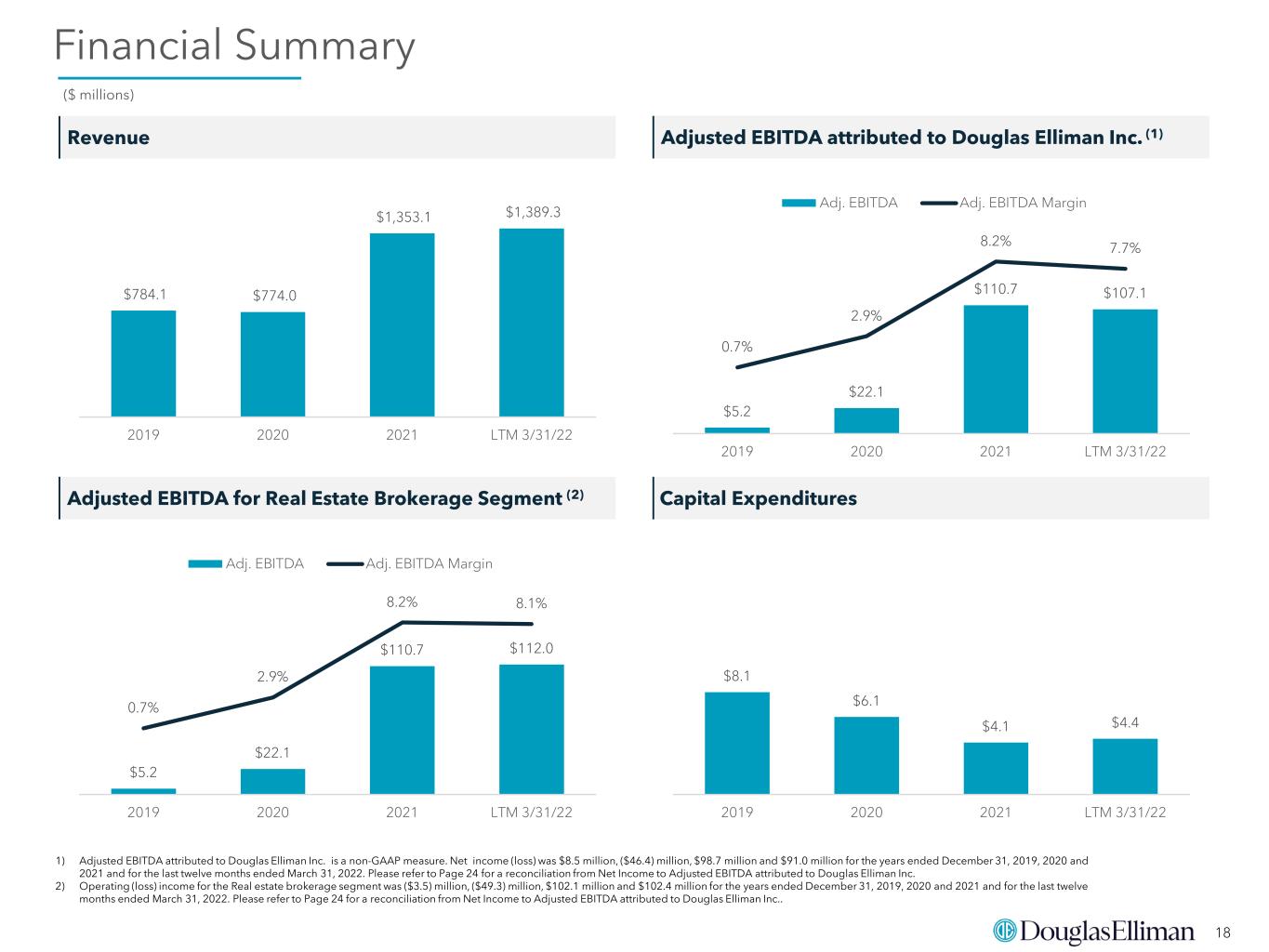

18 Financial Summary 1) Adjusted EBITDA attributed to Douglas Elliman Inc. is a non-GAAP measure. Net income (loss) was $8.5 million, ($46.4) million, $98.7 million and $91.0 million for the years ended December 31, 2019, 2020 and 2021 and for the last twelve months ended March 31, 2022. Please refer to Page 24 for a reconciliation from Net Income to Adjusted EBITDA attributed to Douglas Elliman Inc. 2) Operating (loss) income for the Real estate brokerage segment was ($3.5) million, ($49.3) million, $102.1 million and $102.4 million for the years ended December 31, 2019, 2020 and 2021 and for the last twelve months ended March 31, 2022. Please refer to Page 24 for a reconciliation from Net Income to Adjusted EBITDA attributed to Douglas Elliman Inc.. Revenue Capital Expenditures ($ millions) $8.1 $6.1 $4.1 $4.4 2019 2020 2021 LTM 3/31/22 $784.1 $774.0 $1,353.1 $1,389.3 2019 2020 2021 LTM 3/31/22 Adjusted EBITDA attributed to Douglas Elliman Inc. (1) $5.2 $22.1 $110.7 $107.1 0.7% 2.9% 8.2% 7.7% 2019 2020 2021 LTM 3/31/22 Adj. EBITDA Adj. EBITDA Margin Adjusted EBITDA for Real Estate Brokerage Segment (2) $5.2 $22.1 $110.7 $112.0 0.7% 2.9% 8.2% 8.1% 2019 2020 2021 LTM 3/31/22 Adj. EBITDA Adj. EBITDA Margin

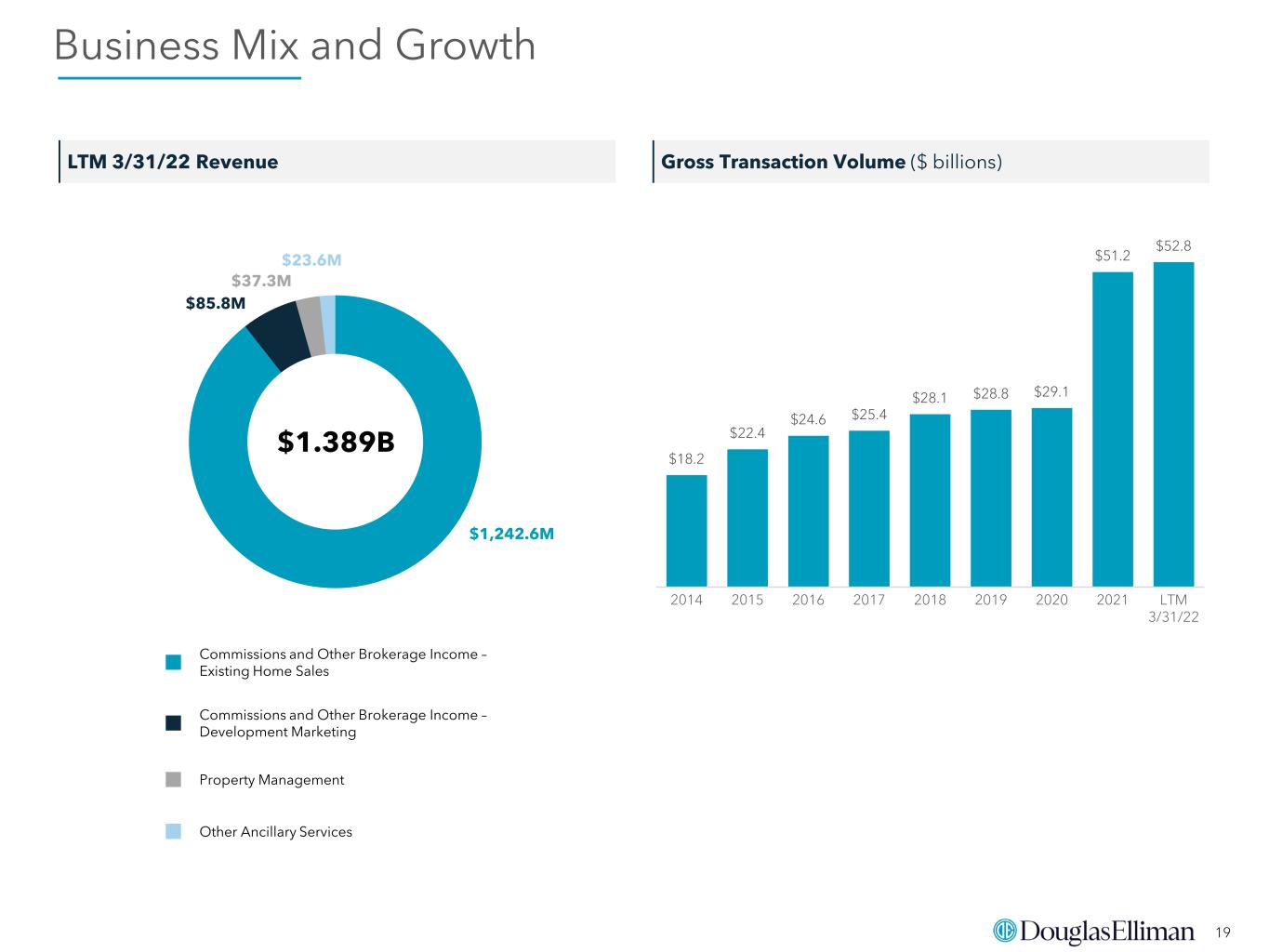

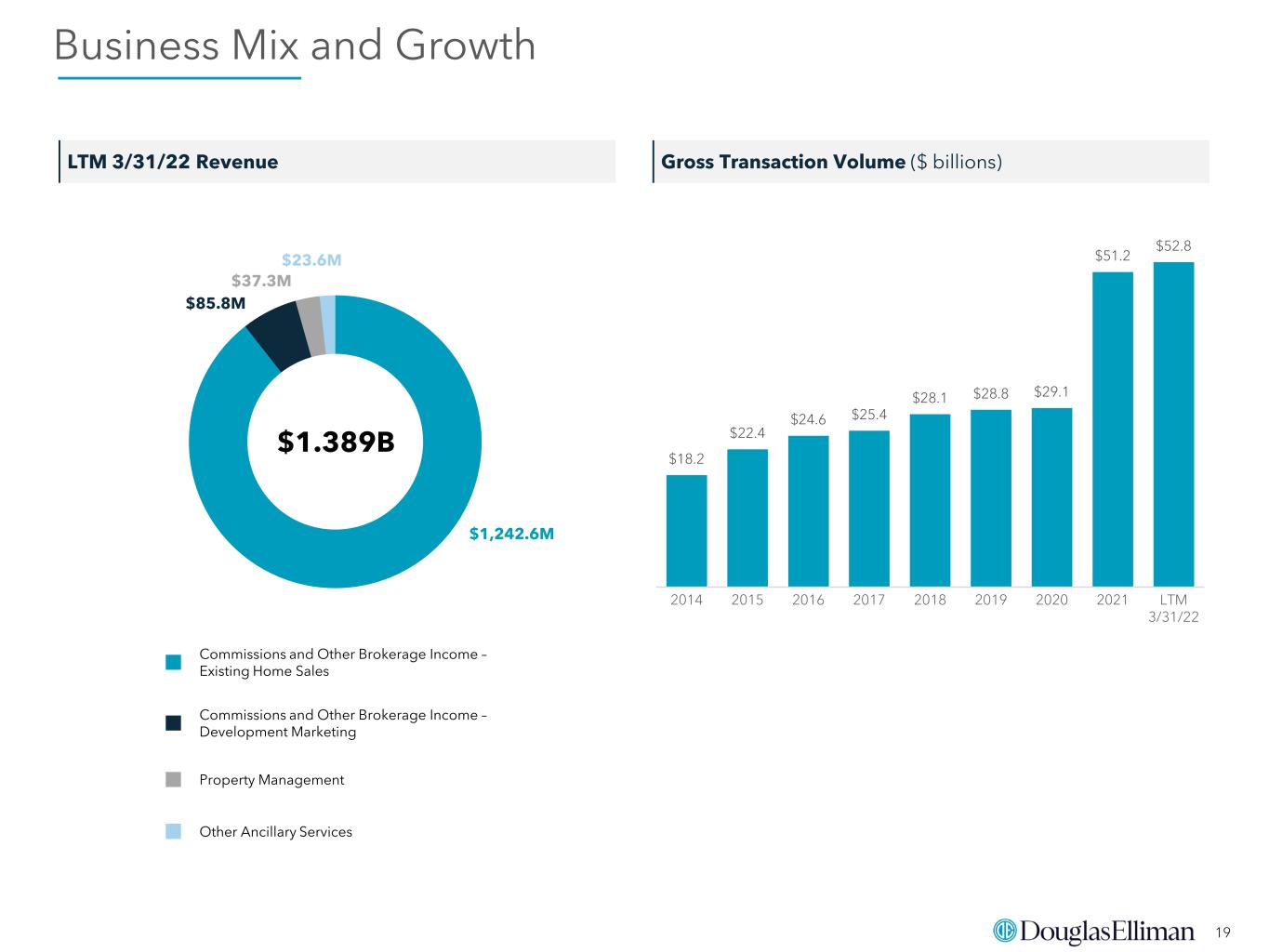

19 Business Mix and Growth $18.2 $22.4 $24.6 $25.4 $28.1 $28.8 $29.1 $51.2 $52.8 2014 2015 2016 2017 2018 2019 2020 2021 LTM 3/31/22 LTM 3/31/22 Revenue Gross Transaction Volume ($ billions) $1,242.6M $85.8M $37.3M $23.6M $1.389B Commissions and Other Brokerage Income – Existing Home Sales Commissions and Other Brokerage Income – Development Marketing Property Management Other Ancillary Services

20 Investment Highlights Cutting-edge property technology supportive of agent recruitment, retention and productivity Strong platform for continued growth Favorable dynamics in the U.S. residential real estate marketExperienced management team with substantial real estate expertise and a track record of driving growth Attractive financial profile with significant operating leverage and balance sheet strength Comprehensive solution provides for multiple revenue streams and monetization of valuable agent relationships Industry-leading brand name with a strong presence in most major U.S. luxury markets Unique Investment Opportunity in Tech-Enabled Residential Real Estate Brokerage with Comprehensive Suite of Real Estate Solutions, Industry-leading Brand Name and Talented Team of Employees and Agents

APPENDIX

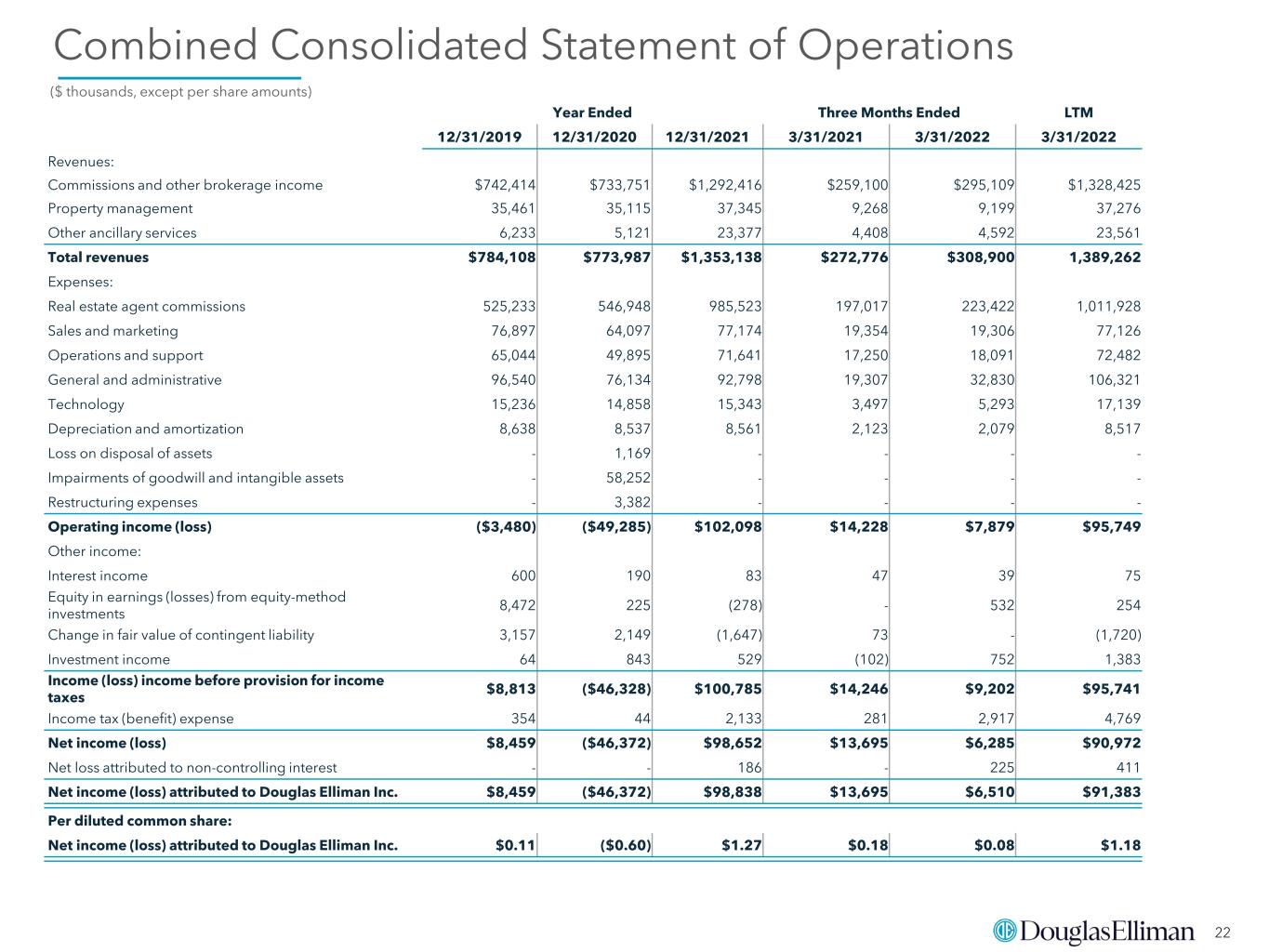

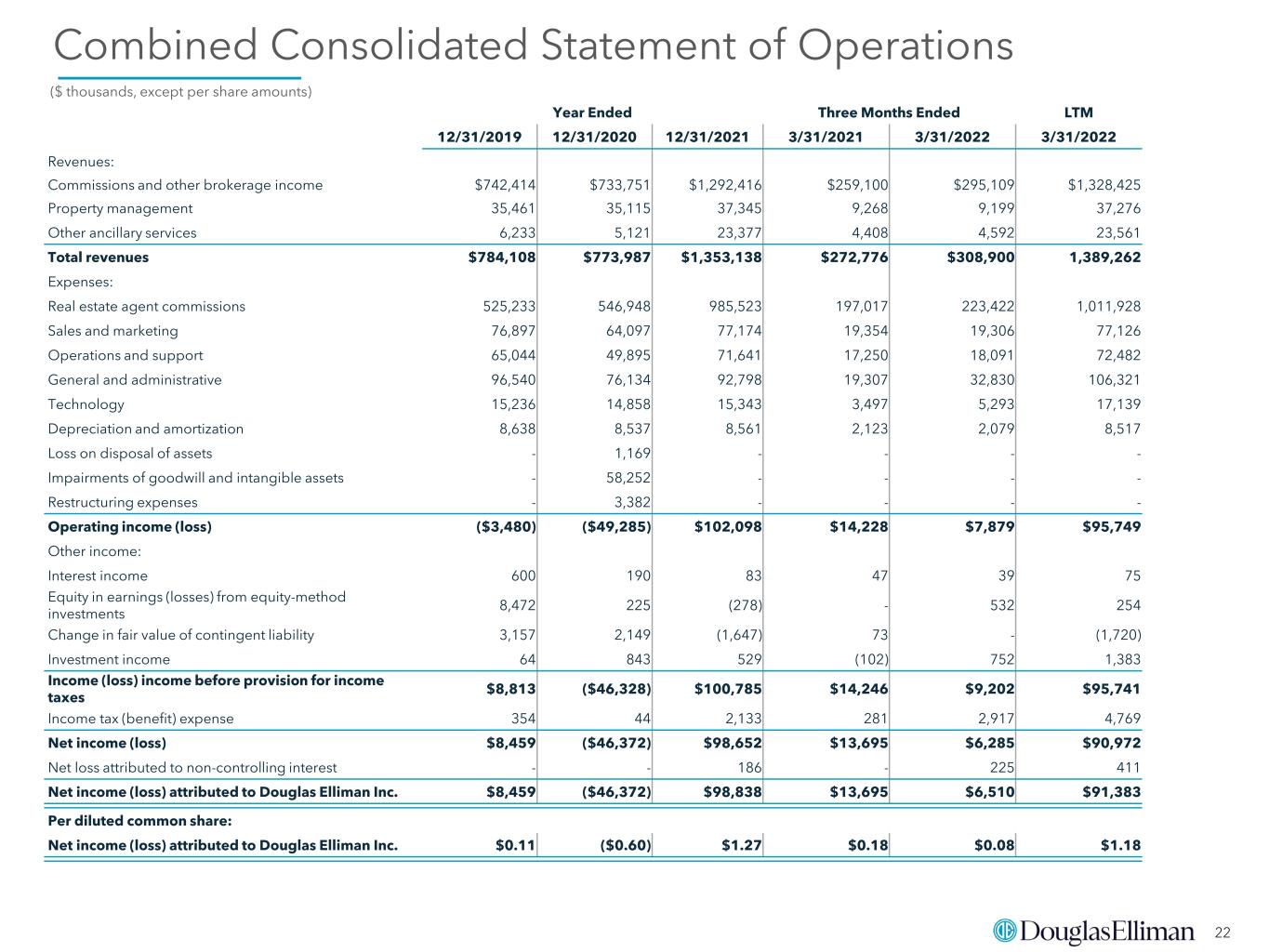

22 Combined Consolidated Statement of Operations Year Ended Three Months Ended LTM 12/31/2019 12/31/2020 12/31/2021 3/31/2021 3/31/2022 3/31/2022 Revenues: Commissions and other brokerage income $742,414 $733,751 $1,292,416 $259,100 $295,109 $1,328,425 Property management 35,461 35,115 37,345 9,268 9,199 37,276 Other ancillary services 6,233 5,121 23,377 4,408 4,592 23,561 Total revenues $784,108 $773,987 $1,353,138 $272,776 $308,900 1,389,262 Expenses: Real estate agent commissions 525,233 546,948 985,523 197,017 223,422 1,011,928 Sales and marketing 76,897 64,097 77,174 19,354 19,306 77,126 Operations and support 65,044 49,895 71,641 17,250 18,091 72,482 General and administrative 96,540 76,134 92,798 19,307 32,830 106,321 Technology 15,236 14,858 15,343 3,497 5,293 17,139 Depreciation and amortization 8,638 8,537 8,561 2,123 2,079 8,517 Loss on disposal of assets - 1,169 - - - - Impairments of goodwill and intangible assets - 58,252 - - - - Restructuring expenses - 3,382 - - - - Operating income (loss) ($3,480) ($49,285) $102,098 $14,228 $7,879 $95,749 Other income: Interest income 600 190 83 47 39 75 Equity in earnings (losses) from equity-method investments 8,472 225 (278) - 532 254 Change in fair value of contingent liability 3,157 2,149 (1,647) 73 - (1,720) Investment income 64 843 529 (102) 752 1,383 Income (loss) income before provision for income taxes $8,813 ($46,328) $100,785 $14,246 $9,202 $95,741 Income tax (benefit) expense 354 44 2,133 281 2,917 4,769 Net income (loss) $8,459 ($46,372) $98,652 $13,695 $6,285 $90,972 Net loss attributed to non-controlling interest - - 186 - 225 411 Net income (loss) attributed to Douglas Elliman Inc. $8,459 ($46,372) $98,838 $13,695 $6,510 $91,383 Per diluted common share: Net income (loss) attributed to Douglas Elliman Inc. $0.11 ($0.60) $1.27 $0.18 $0.08 $1.18 ($ thousands, except per share amounts)

23 Consolidated Balance Sheet December 31, March 31, 2021 2022 ASSETS: Current assets: Cash and cash equivalents $211,623 $203,669 Receivables 32,488 27,404 Agent receivables, net 9,192 14,597 Restricted cash and cash equivalents 15,336 7,861 Other current assets 12,166 22,728 Total current assets $280,805 $276,259 Property, plant and equipment, net 39,381 38,390 Operating lease right-of-use assets 123,538 125,646 Long-term investments at fair value 8,094 7,396 Contract assets, net 28,996 25,723 Goodwill 32,571 32,571 Other intangible assets, net 74,421 74,224 Equity-method investments 2,521 2,508 Other assets 4,842 5,510 Total assets $595,169 $588,227 LIABILITIES AND STOCKHOLDERS’ EQUITY: Current liabilities: Current portion of notes payable and other obligations $12,527 $9,405 Current operating lease liabilities 22,666 23,207 Income taxes payable, net 1,240 2,407 Accounts payable 5,874 6,301 Commissions payable 35,766 30,796 Accrued salaries and benefits 25,446 7,376 Contract liabilities 6,689 16,774 Other current liabilities 22,259 28,048 Total current liabilities $132,467 $124,314 Notes payable and other obligations less current portion 176 169 Deferred income taxes, net 11,412 11,412 Non-current operating lease liability 129,496 130,071 Contract liabilities 39,557 34,950 Other liabilities 188 188 Total liabilities $313,296 $301,104 Commitments and contingencies - - Stockholders’ equity Common stock and additional paid-in-capital 279,312 281,964 Retained earnings 622 3,070 Non-controlling interest 1,939 2,089 Total stockholders’ equity $281,873 $287,123 Total liabilities and net investment $595,169 $588,227 ($ thousands)

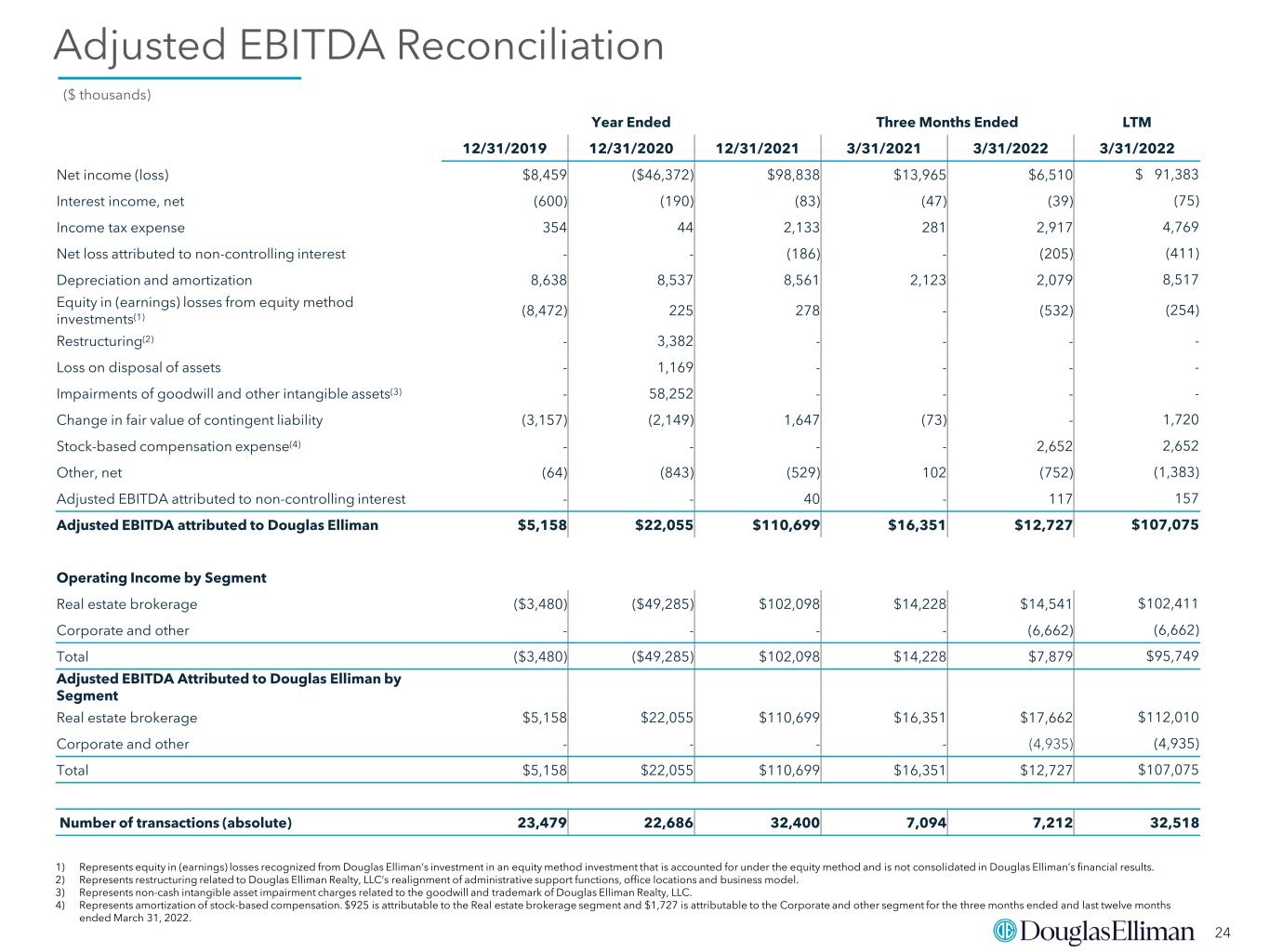

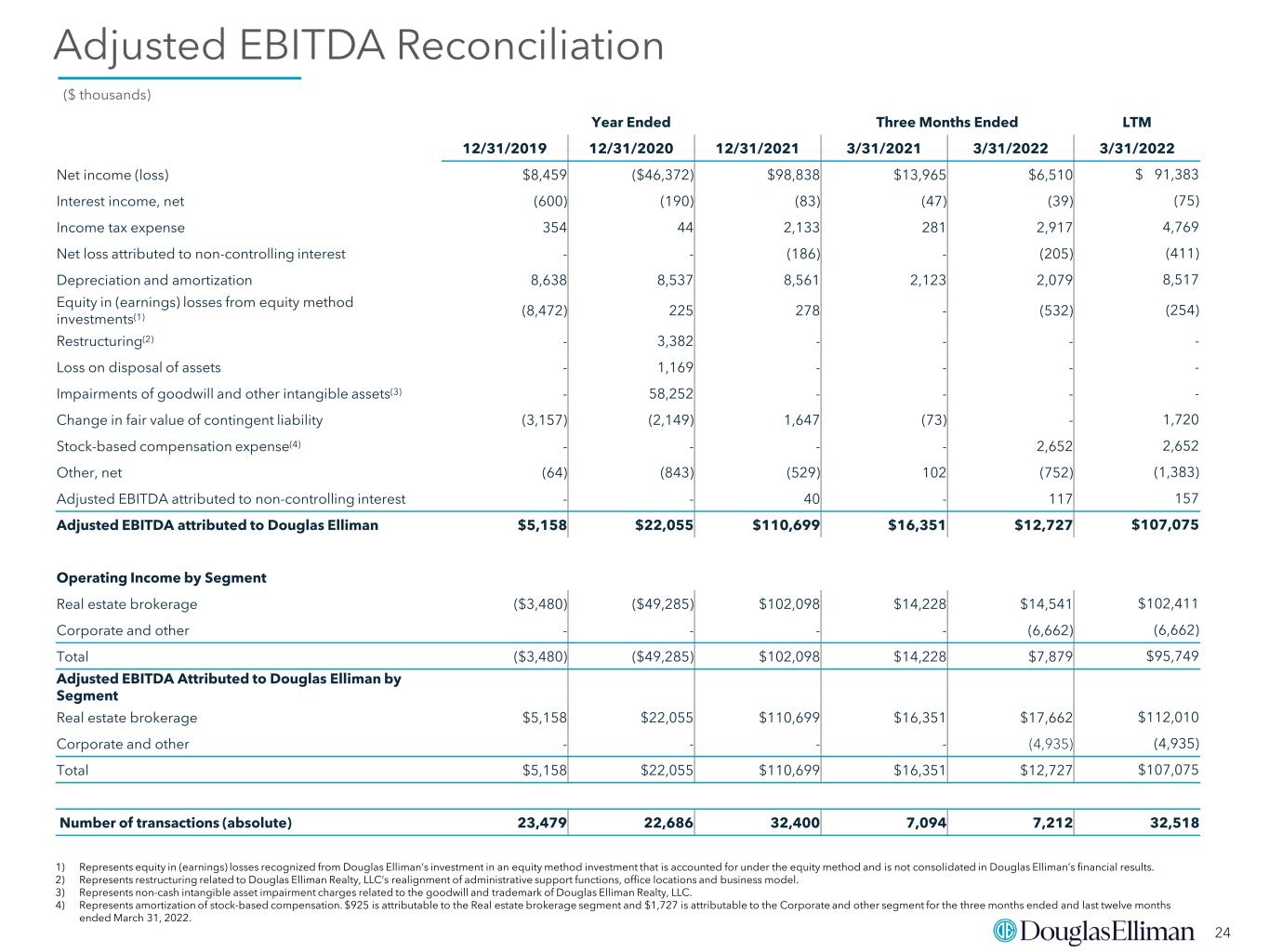

24 1) Represents equity in (earnings) losses recognized from Douglas Elliman’s investment in an equity method investment that is accounted for under the equity method and is not consolidated in Douglas Elliman’s financial results. 2) Represents restructuring related to Douglas Elliman Realty, LLC’s realignment of administrative support functions, office locations and business model. 3) Represents non-cash intangible asset impairment charges related to the goodwill and trademark of Douglas Elliman Realty, LLC. 4) Represents amortization of stock-based compensation. $925 is attributable to the Real estate brokerage segment and $1,727 is attributable to the Corporate and other segment for the three months ended and last twelve months ended March 31, 2022. Adjusted EBITDA Reconciliation Year Ended Three Months Ended LTM 12/31/2019 12/31/2020 12/31/2021 3/31/2021 3/31/2022 3/31/2022 Net income (loss) $8,459 ($46,372) $98,838 $13,965 $6,510 $ 91,383 Interest income, net (600) (190) (83) (47) (39) (75) Income tax expense 354 44 2,133 281 2,917 4,769 Net loss attributed to non-controlling interest - - (186) - (205) (411) Depreciation and amortization 8,638 8,537 8,561 2,123 2,079 8,517 Equity in (earnings) losses from equity method investments(1) (8,472) 225 278 - (532) (254) Restructuring(2) - 3,382 - - - - Loss on disposal of assets - 1,169 - - - - Impairments of goodwill and other intangible assets(3) - 58,252 - - - - Change in fair value of contingent liability (3,157) (2,149) 1,647 (73) - 1,720 Stock-based compensation expense(4) - - - - 2,652 2,652 Other, net (64) (843) (529) 102 (752) (1,383) Adjusted EBITDA attributed to non-controlling interest - - 40 - 117 157 Adjusted EBITDA attributed to Douglas Elliman $5,158 $22,055 $110,699 $16,351 $12,727 $107,075 Operating Income by Segment Real estate brokerage ($3,480) ($49,285) $102,098 $14,228 $14,541 $102,411 Corporate and other - - - - (6,662) (6,662) Total ($3,480) ($49,285) $102,098 $14,228 $7,879 $95,749 Adjusted EBITDA Attributed to Douglas Elliman by Segment Real estate brokerage $5,158 $22,055 $110,699 $16,351 $17,662 $112,010 Corporate and other - - - - (4,935) (4,935) Total $5,158 $22,055 $110,699 $16,351 $12,727 $107,075 Number of transactions (absolute) 23,479 22,686 32,400 7,094 7,212 32,518 ($ thousands)

25 Adjusted Operating Expenses Reconciliation Year Ended Year Ended Three Months Ended LTM 12/31/2019 12/31/2021 3/31/2021 3/31/2022 3/31/2022 Total Operating Expenses(1) $787,588 $1,251,040 $258,548 $301,021 $1,293,513 Items excluded from total expenses to determine Real Estate Brokerage Segment Adjusted Operating Expenses Real estate agent commissions (525,233) (985,523) (197,017) (223,422) (1,011,928) Variable expenses related to ancillary services(2) (1,461) (10,334) (1,633) (2,028) (10,729) Depreciation and amortization (8,638) (8,561) (2,123) (2,079) (8,517) Loss on disposal of assets(3) (136) (186) (7) (10) (189) Non-cash stock compensation - real estate brokerage segment - - - (925) (925) Operating expenses - Corporate and other segment - - - (6,662) (6,662) Real Estate Brokerage Segment Adjusted Operating Expenses $252,120 $246,436 $57,768 $65,895 $254,563 ($ thousands) 1) Operating expenses include expenses reflected in the Company's Combined Consolidated Statements of Operations (for all periods presented) under the category "Expenses" and classified as "Real estate agent commissions", "Sales and marketing", "Operations and support", "General and administrative", "Technology", "Depreciation and amortization", "Loss on disposal of assets", "Impairments of goodwill and other intangible assets" and "Restructuring". 2) Included in "Operations and support" in the Company's Combined Consolidated Statements of Operations for all periods presented. 3) Included in "General and administrative” on the Company's Combined Consolidated Statements of Operations for all periods presented.