November 21, 2024 Annual Meeting Exhibit 99.1

FORWARD-LOOKING STATEMENTS. This presentation contains certain “forward-looking statements” about CFSB Bancorp, Inc. (the “Company”) within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such as statements relating to the Company’s plans, financial condition, results of operations, objectives and prospects. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company’s control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology such as “believe,” “expect,” “estimate,” “anticipate,” “continue,” “plan,” “approximately,” “intend,” “objective,” “goal,” “project,” or other similar terms or variations on those terms, or the future or conditional verbs such as “will,” “may,” “should,” “could,” and “would.” Actual results could differ materially from those expressed or implied by such forward-looking statements as a result of, among other factors, changes in interest rates and real estate values; the effects of inflation; competition; weakness in general economic conditions on a national basis or in the local markets in which the Company operates, including worsening employment levels and labor shortages, a potential recession and supply chain disruptions; monetary and fiscal policies of the U.S. Government, including by the Federal Reserve Board; changes that adversely affect borrowers’ ability to repay the Company’s loans; changes in customer behavior due to changing political, business and economic conditions; our ability to access cost-effective funding; our ability to enter new markets successfully and capitalize on growth opportunities; changes in liquidity; changes in loan, delinquencies, defaults and charge-off rates; changes in the value of securities and other assets; adequacy of credit loss reserves or changes in methodology or assumptions in calculating the allowance for loan losses; changes in government regulation, legislation, or accounting policies; the risk that the Company may not be successful in the implementation of its business strategy; the risk of compromises or breaches of the company's security systems; operational risks including, but not limited to, cybersecurity incidents, fraud, natural disasters, war, military conflict, terrorism, civil unrest, and future pandemics; our ability to attract and retain key employees; changes in assumptions used in making such forward-looking statements; and the other risks and uncertainties. Forward-looking statements speak only as of the date on which they are made. The Company does not undertake any obligation to update or revise any of these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events. Company Disclosures

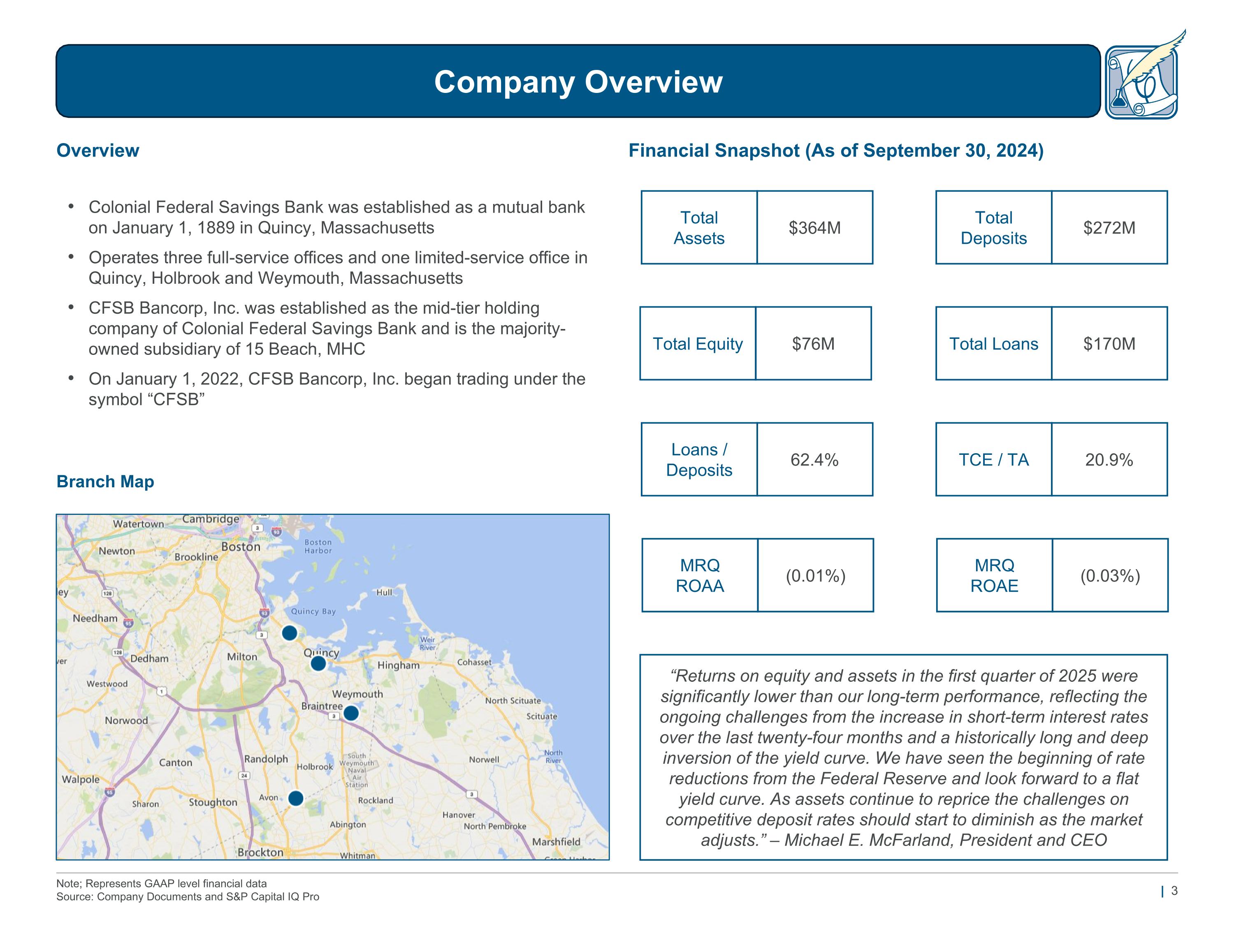

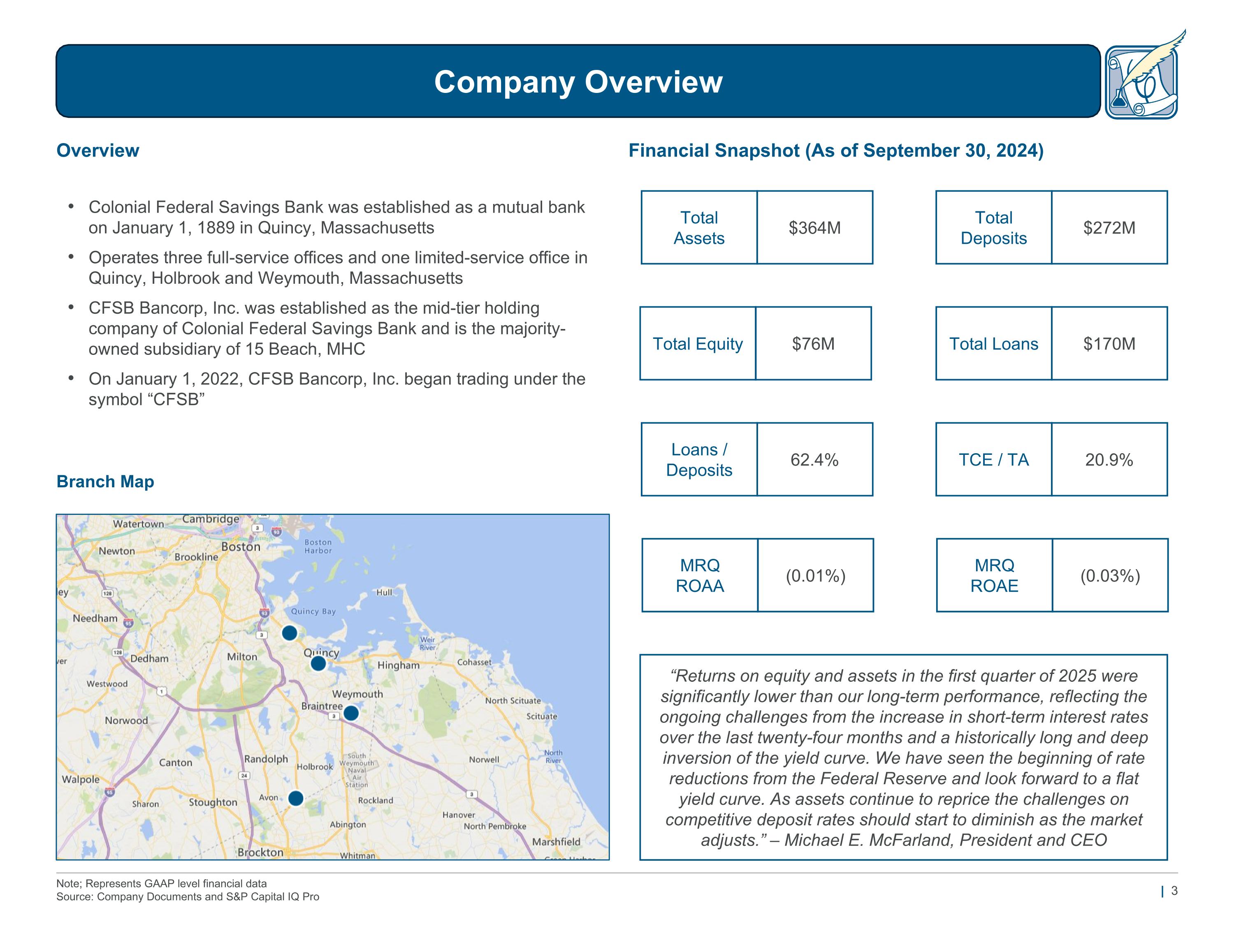

Note; Represents GAAP level financial data Source: Company Documents and S&P Capital IQ Pro Financial Snapshot (As of September 30, 2024) Overview Total Assets $364M Total Equity $76M Loans / Deposits 62.4% Total Deposits $272M Total Loans $170M TCE / TA 20.9% Colonial Federal Savings Bank was established as a mutual bank on January 1, 1889 in Quincy, Massachusetts Operates three full-service offices and one limited-service office in Quincy, Holbrook and Weymouth, Massachusetts CFSB Bancorp, Inc. was established as the mid-tier holding company of Colonial Federal Savings Bank and is the majority-owned subsidiary of 15 Beach, MHC On January 1, 2022, CFSB Bancorp, Inc. began trading under the symbol “CFSB” “Returns on equity and assets in the first quarter of 2025 were significantly lower than our long-term performance, reflecting the ongoing challenges from the increase in short-term interest rates over the last twenty-four months and a historically long and deep inversion of the yield curve. We have seen the beginning of rate reductions from the Federal Reserve and look forward to a flat yield curve. As assets continue to reprice the challenges on competitive deposit rates should start to diminish as the market adjusts.” – Michael E. McFarland, President and CEO Branch Map MRQ ROAA (0.01%) MRQ ROAE (0.03%) Company Overview

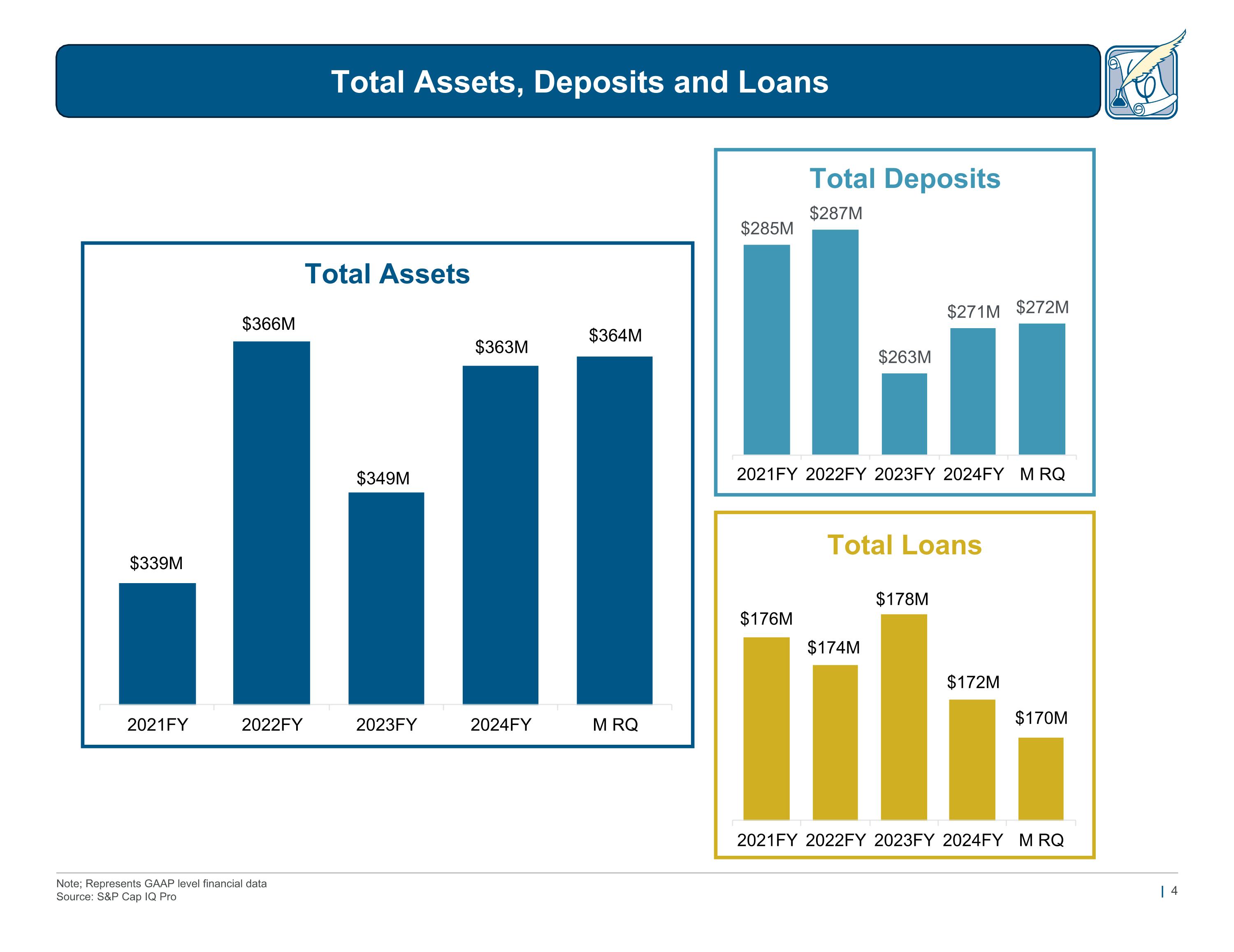

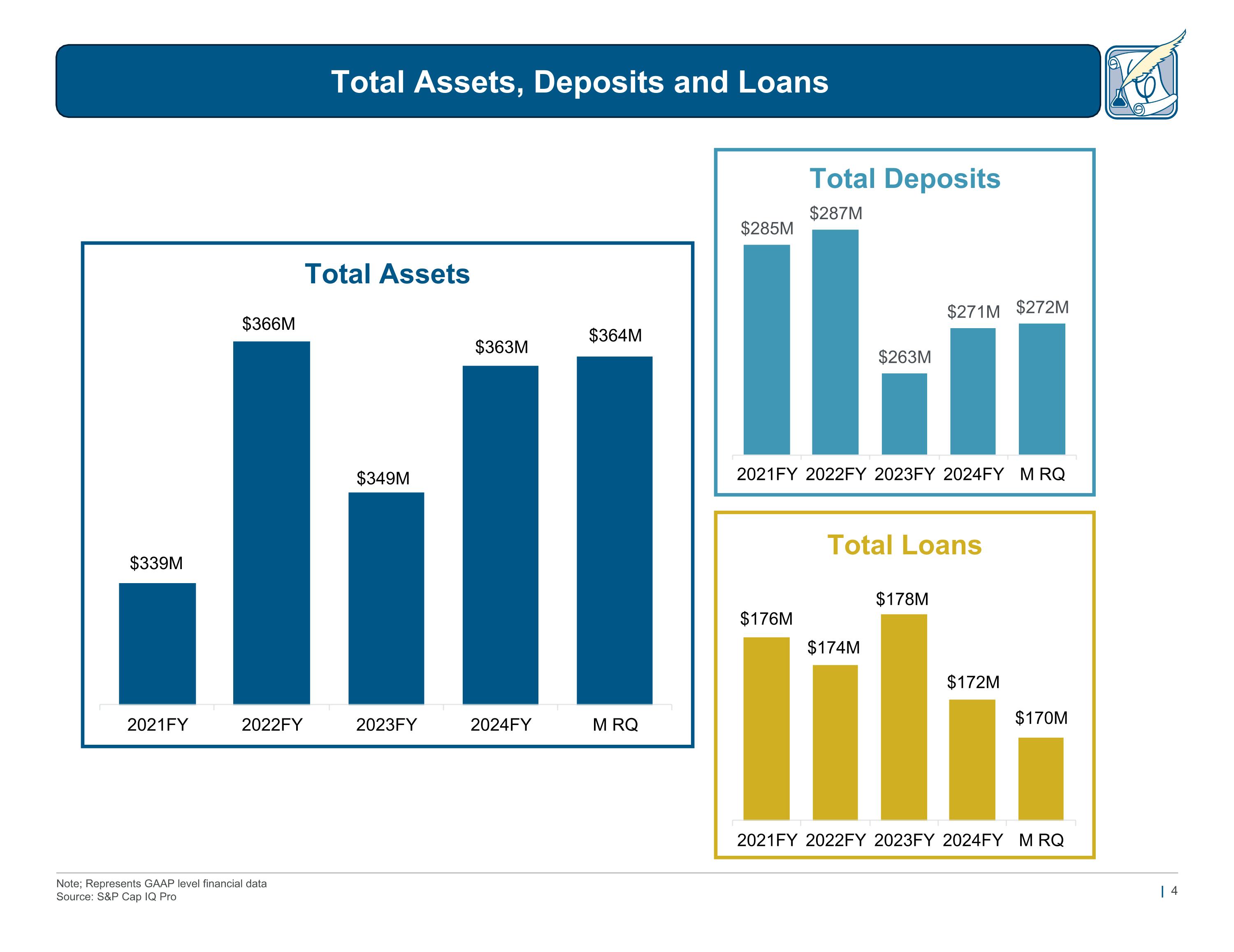

Note; Represents GAAP level financial data Source: S&P Cap IQ Pro Total Assets, Deposits and Loans

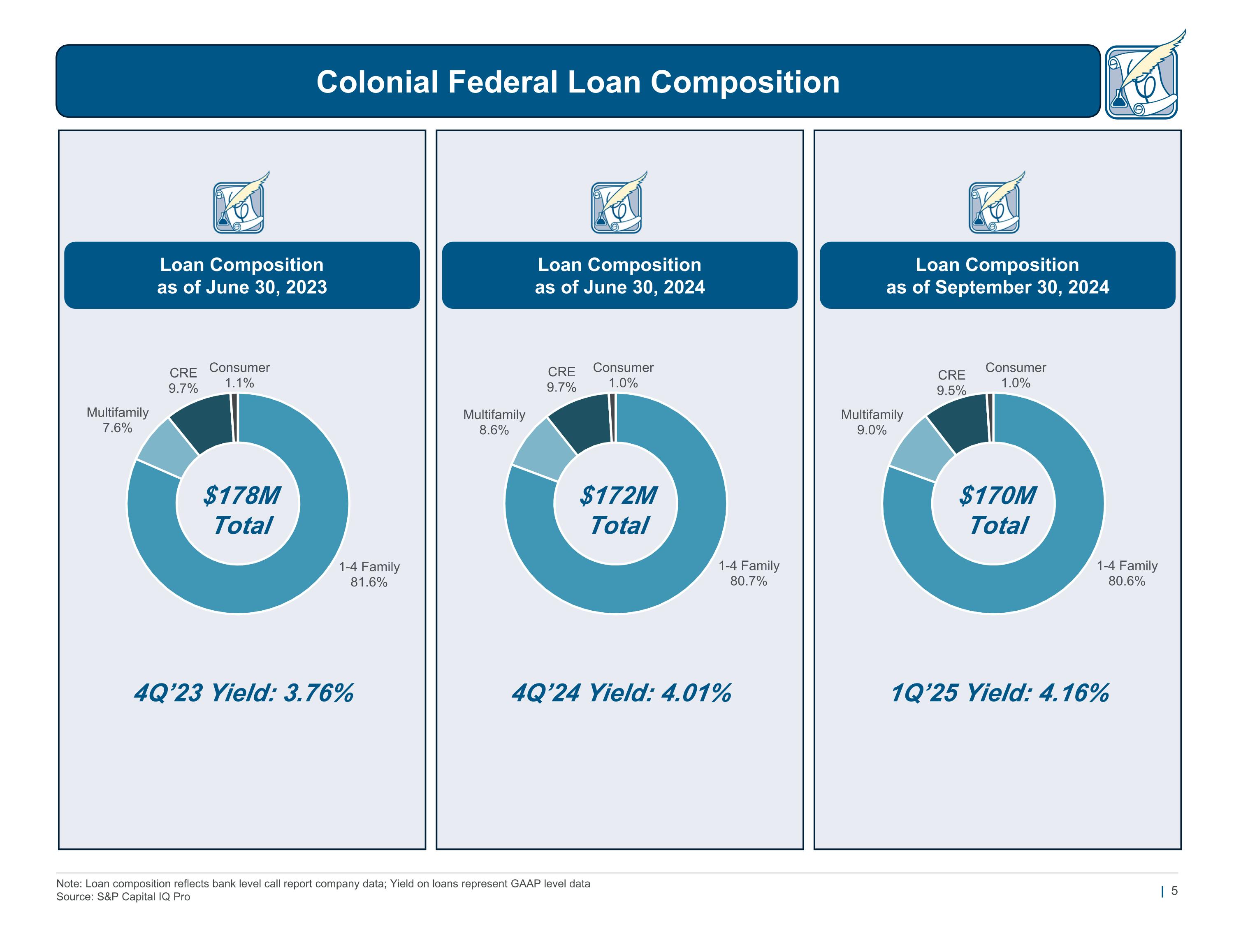

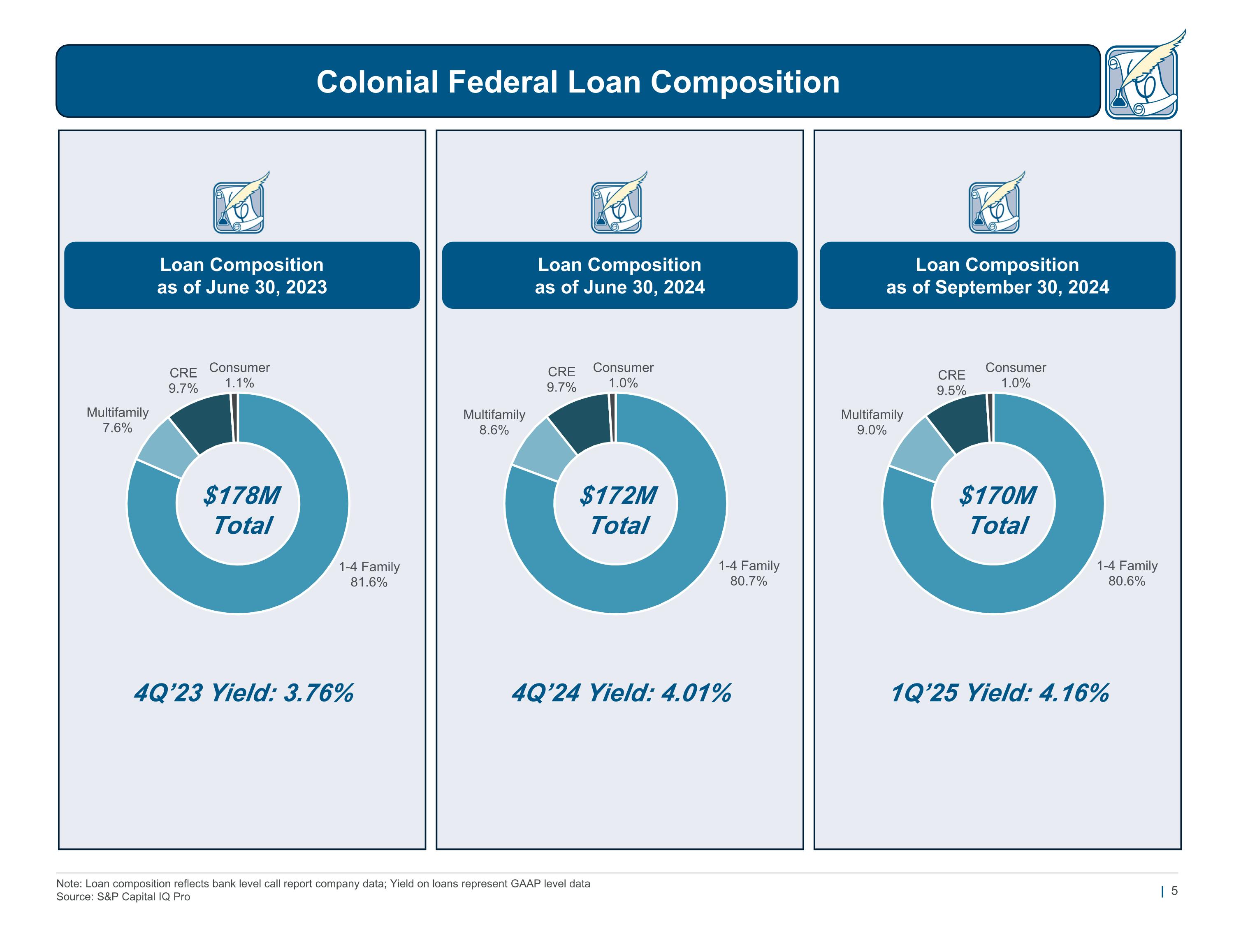

Note: Loan composition reflects bank level call report company data; Yield on loans represent GAAP level data Source: S&P Capital IQ Pro 4Q’23 Yield: 3.76% $178M Total Loan Composition as of June 30, 2023 4Q’24 Yield: 4.01% $172M Total Loan Composition as of June 30, 2024 1Q’25 Yield: 4.16% $170M Total Loan Composition as of September 30, 2024 Colonial Federal Loan Composition

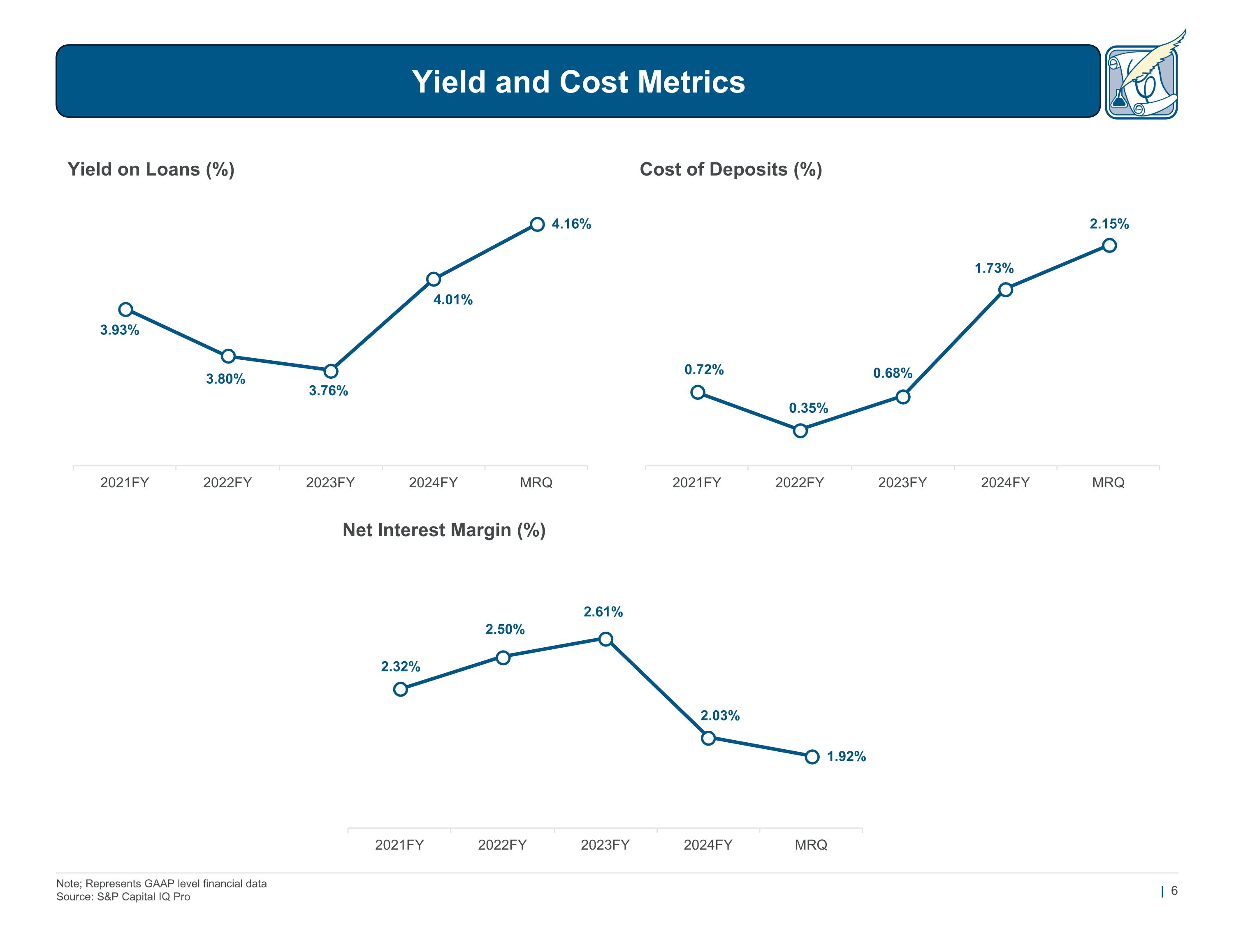

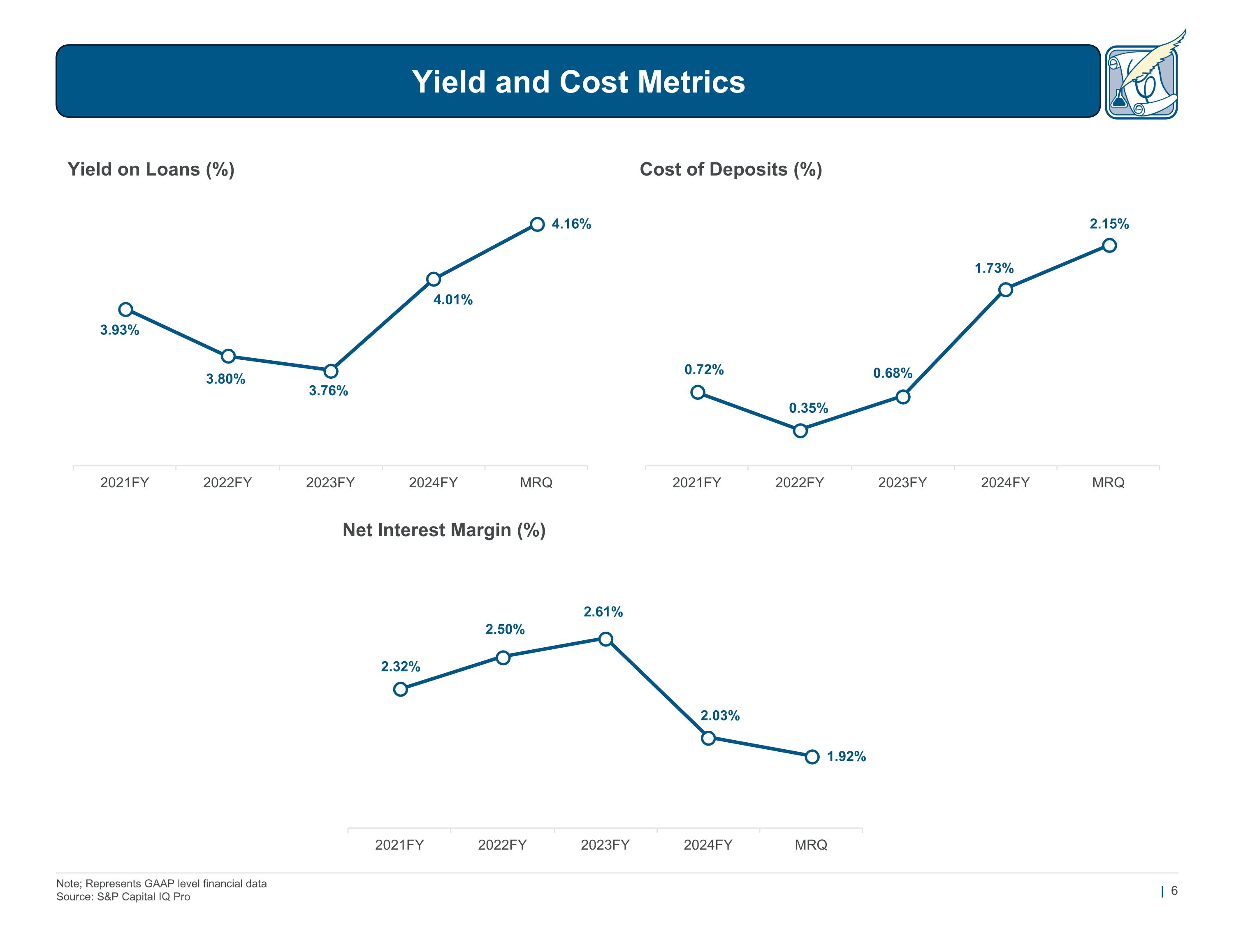

Note; Represents GAAP level financial data Source: S&P Capital IQ Pro Net Interest Margin (%) Cost of Deposits (%) Yield on Loans (%) Yield and Cost Metrics

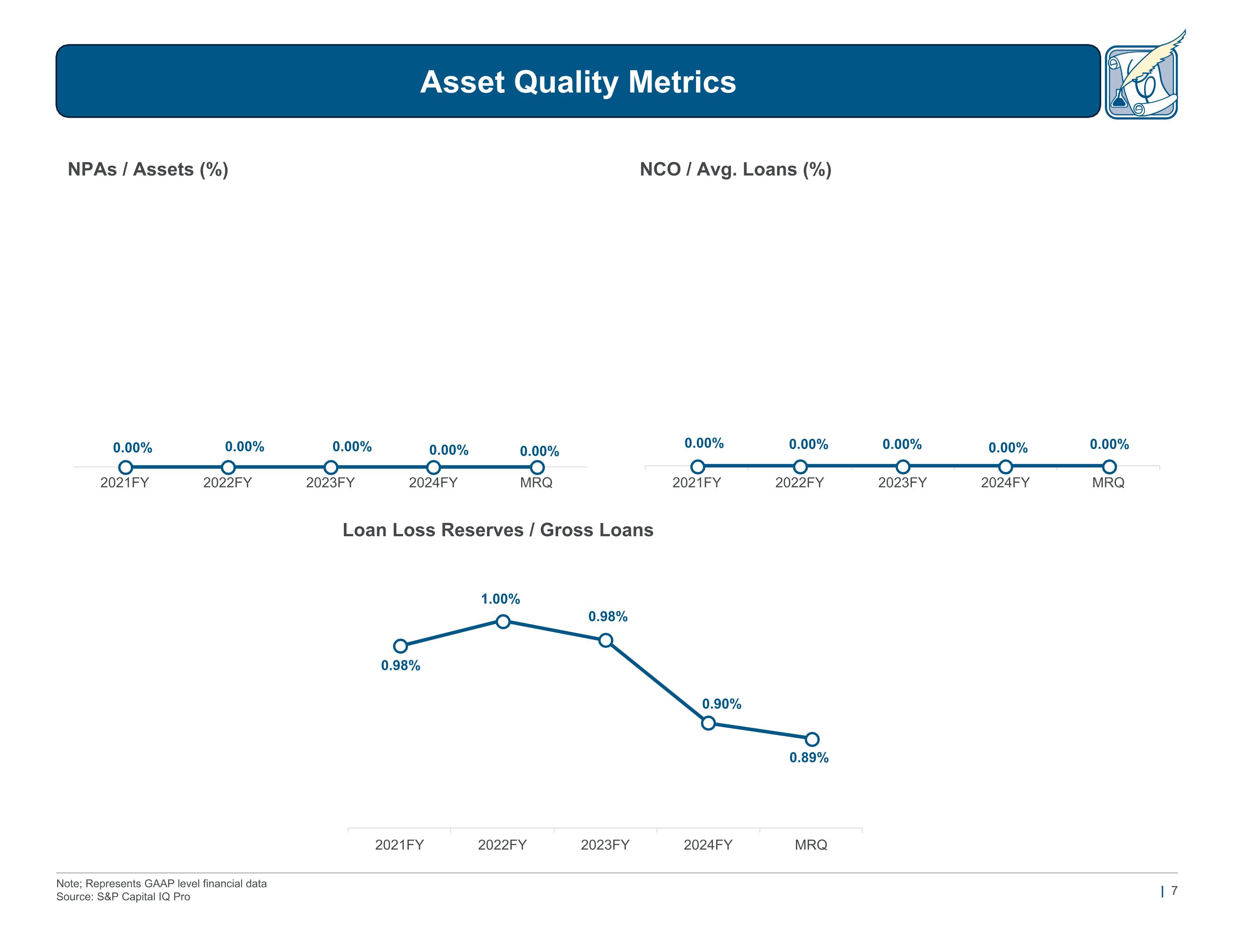

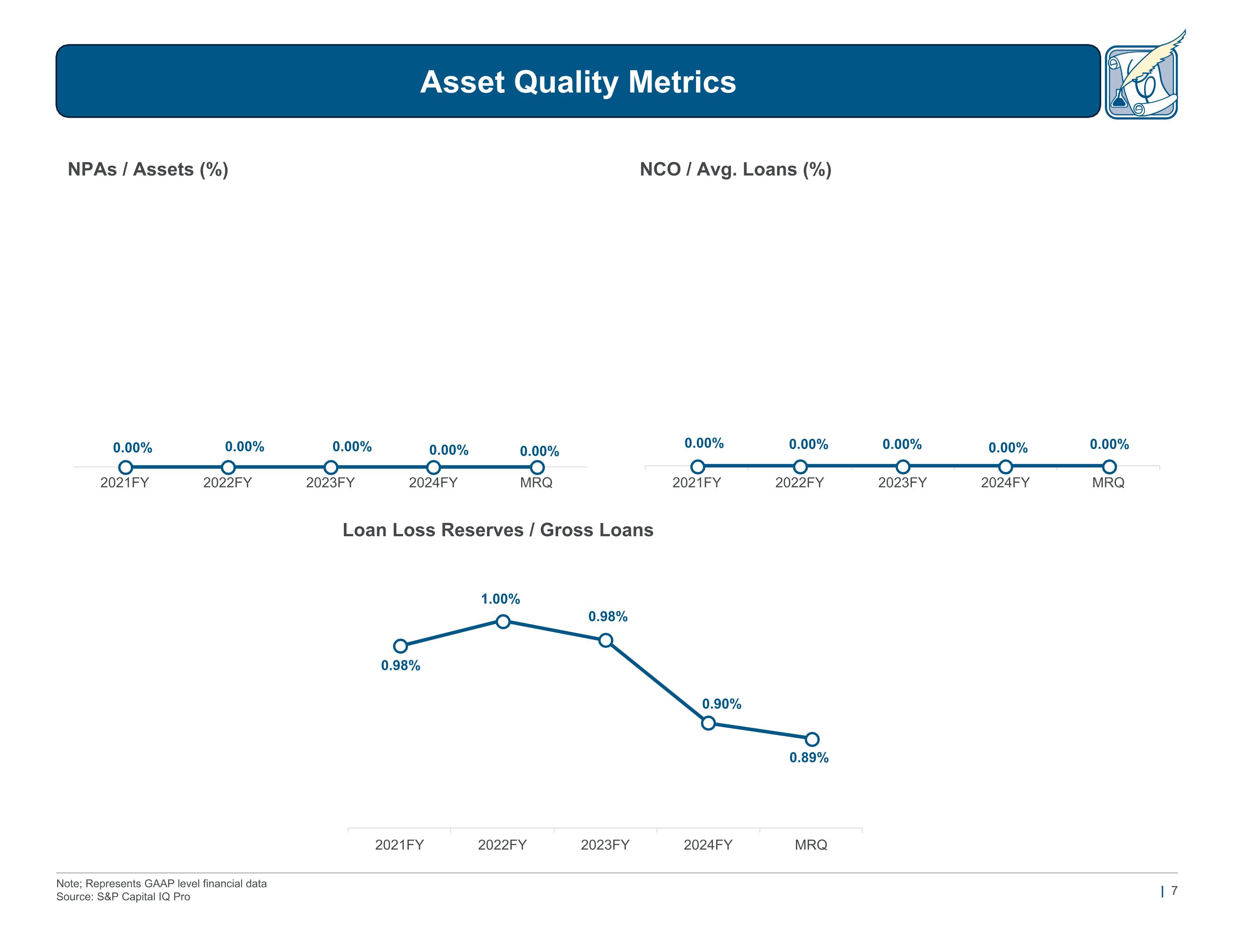

Note; Represents GAAP level financial data Source: S&P Capital IQ Pro Loan Loss Reserves / Gross Loans NCO / Avg. Loans (%) NPAs / Assets (%) Asset Quality Metrics

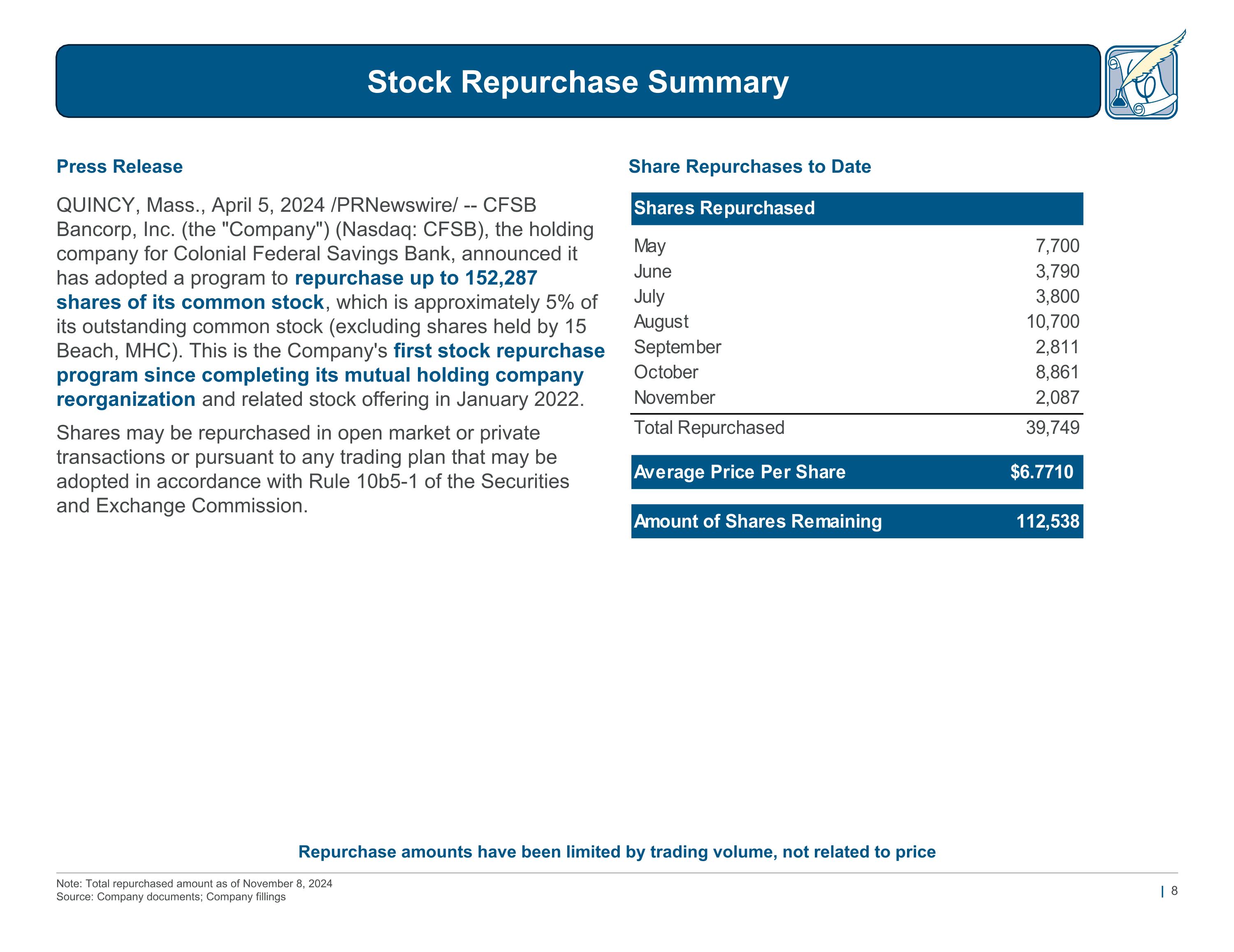

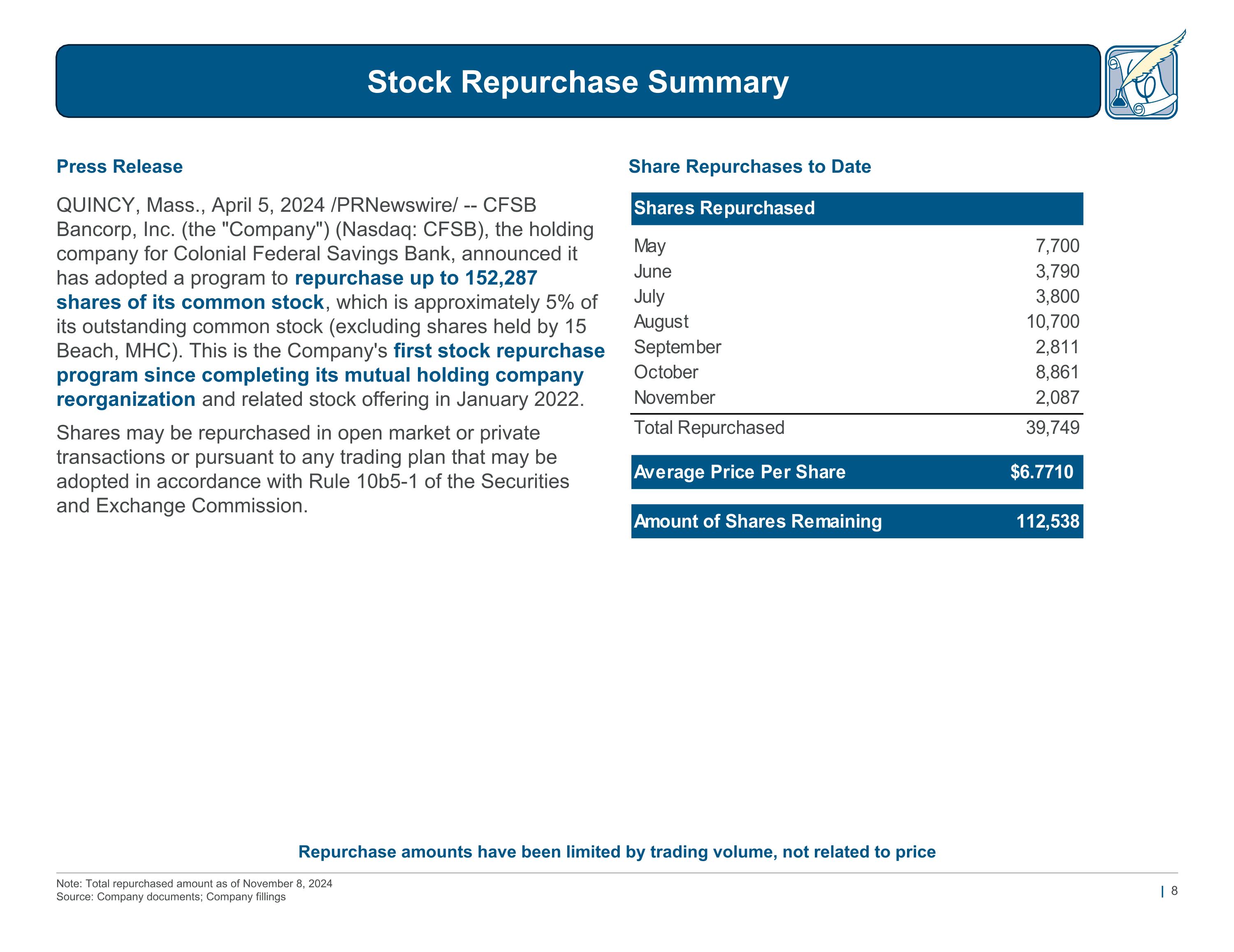

Note: Total repurchased amount as of November 8, 2024 Source: Company documents; Company fillings QUINCY, Mass., April 5, 2024 /PRNewswire/ -- CFSB Bancorp, Inc. (the "Company") (Nasdaq: CFSB), the holding company for Colonial Federal Savings Bank, announced it has adopted a program to repurchase up to 152,287 shares of its common stock, which is approximately 5% of its outstanding common stock (excluding shares held by 15 Beach, MHC). This is the Company's first stock repurchase program since completing its mutual holding company reorganization and related stock offering in January 2022. Shares may be repurchased in open market or private transactions or pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities and Exchange Commission. Share Repurchases to Date Press Release Repurchase amounts have been limited by trading volume, not related to price Stock Repurchase Summary