As confidentially submitted to the U.S. Securities and Exchange Commission on December 16, 2021. This draft registration statement has not been filed, publicly or otherwise, with the U.S. Securities and Exchange Commission, and all information contained herein remains strictly confidential.

Registration No. 333-[____]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

LA ROSA HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Nevada | | 6531 | | 87-1641189 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1420 Celebration Blvd., 2nd Floor

Celebration, FL 34747

(321) 250-1799

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Joseph La Rosa

Chief Executive Officer

1420 Celebration Blvd., 2nd Floor

Celebration, FL 34747

(321) 250-1799

(Name, address, including zip code and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Ross D. Carmel, Esq.

Philip Magri, Esq.

Carmel, Milazzo & Feil LLP

55 West 39th Street, 18th Floor New York, NY 10018

(646) 838-1310 | | M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 421-4100 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | Accelerated filer ¨ |

| Non-accelerated filer x | Smaller reporting company x |

| | Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered (1) | | Proposed Maximum

Aggregate Offering

Price (2) | | | Amount of

Registration

Fee | |

| Common Stock, $0.0001 par value per share (3) | | $ | 17,250,000 | | | $ | 1,599.08 | |

| Representative’s Warrants (4) | | | — | | | | — | |

| Common Stock underlying Representative’s Warrants (5) | | $ | 990,000 | | | $ | 91.78 | |

| Total (6) | | $ | 18,240,000.00 | | | $ | 1,690.86 | (7) |

| (1) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional shares of common stock that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended, and includes shares of common stock that the underwriters have an option to purchase. |

| (3) | Includes common stock that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (4) | No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act. |

| (5) | The Representative’s Warrants are exercisable into a number of shares of common stock equal to 6% of the number of shares of common stock sold in this offering, excluding shares issuable upon the exercise the underwriters’ option to purchase additional securities, at an exercise price equal to 110% of the public offering price per share. |

| (6) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (7) | Registration fee will be paid when this Registration Statement is publicly filed with the SEC under Section 6(b) of Securities Act. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Pursuant to the applicable provisions of the Fixing America’s Surface Transportation (FAST) Act, we are omitting our combined unaudited financial statements as of September 30, 2021 and for the nine months then ended. While this financial information is otherwise required by Regulation S-X, we reasonably believe that it will not be required to be included in the prospectus at the time of the contemplated offering. We intend to amend this registration statement to include all financial information required by Regulation S-X at the date of such amendment before distributing a preliminary prospectus to investors.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated ____________, 2021

PRELIMINARY PROSPECTUS

LA ROSA HOLDINGS CORP.

[ ] SHARES OF COMMON STOCK

This is our initial public offering of common stock. We are selling shares of common stock. We anticipate the initial public offering price will be between $ and $ per share.

No public market currently exists for our common stock. We intend to list the common stock on the NASDAQ Capital Market, or NASDAQ, under the symbol “LRHC.” Accordingly, while the estimates set forth above represent our bona fide estimate of the range of public offering price per share and number of shares to be issued, consistent with the requirements of the Securities and Exchange Commission and Nasdaq, we may ultimately issue more shares at a lower price or fewer shares at a greater price to achieve such minimum value of unrestricted publicly held shares. We will not consummate the offering unless such minimum value will be achieved and until we receive approval from Nasdaq to list our common stock.

Following the completion of this offering, our Founder, Chairman of the Board and Chief Executive Officer, Mr. Joseph La Rosa, will control approximately [ ]% of the voting power of our voting capital stock with respect to director elections and other matters (or approximately [ ]% of the voting power with respect to director elections if the underwriters exercise in full their 45-day option to purchase additional shares of our common stock to cover over-allotments, if any). Although we are a “controlled company” under the rules of the Nasdaq Capital Market, our board of directors is composed of a majority of independent directors and we will not take advantage of the “controlled company” exemptions provided under such rules. Please see “Security Ownership of Certain Beneficial Owners and Management.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page [•] of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (or the JOBS Act) and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | Price to Public | | | Underwriting

Discounts and

Commissions (1) | | | Proceeds to Us (2) | |

| Per Share | | $ | | | | $ | | | | $ | | |

| Total | | $ | | | | $ | | | | $ | | |

| (1) | Does not include additional compensation payable to the underwriter. We have agreed to reimburse the underwriter for certain expenses incurred relating to this offering. In addition, we will issue to the underwriter a warrant to purchase the number of shares of our common stock equal to six percent (6%) of the number of shares issued at the initial closing of this offering. See “Underwriting” for additional information regarding underwriting compensation. |

| (2) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment option we have granted to the underwriters as described below, or (ii) the warrants being issued to the Representative in this offering. |

This offering is being underwritten on a firm commitment basis. We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 15% of the shares of common stock from us at the public offering price per share of common stock, less the underwriting discounts payable by us, solely to cover over-allotments, if any (the “Over-Allotment Option”).

The underwriters expect to deliver the securities against payment to the investors in this offering on or about [ ], 2022.

| Sole Book-Running Manager |

| |

| Maxim Group LLC |

The date of this prospectus is , 2022.

TABLE OF CONTENTS

Through and including [ ], 2022 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotments or subscriptions.

Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus and any related free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or in any applicable free writing prospectus related thereto is current only as of its date, regardless of its time of delivery or any sale of shares. Our business, financial condition, results of operations and future prospects may have changed since that date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the heading “Where You Can Find More Information.”

BASIS OF PRESENTATION

The combined financial statements include the accounts of La Rosa Realty, LLC and its affiliates La Rosa Coaching, LLC, La Rosa CRE, LLC, La Rosa Franchising, LLC, and La Rosa Property Management which are affiliated by virtue of common management and ownership. All intercompany transactions and accounts have been eliminated.

MARKET DATA

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic. Accordingly, those third-party projections may be overstated and should not be given undue weight. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

TRADEMARKS

The logos, and other trade names, trademarks, and service marks of La Rosa Holdings Corp. appearing in this prospectus are the property of La Rosa Holdings Corp. Other trade names, trademarks, and service marks appearing in this prospectus are the property of their respective holders. Trade names, trademarks, and service marks contained in this prospectus may appear without the “®” or “™” symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to those trade names, trademarks, and service marks.

ABOUT THIS PROSPECTUS

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| · | all references to the “Company,” the “registrant,” “LRHC,” “we,” “our,” or “us” in this prospectus mean La Rosa Holdings Corp., a Nevada corporation, and its subsidiaries; |

| · | “year” or “fiscal year” mean the year ending December 31st; |

| · | all dollar or $ references when used in this prospectus refer to United States dollars; |

| · | all references to the Securities Act means the Securities Act of 1933, as amended and all references to the Exchange Act means the Securities Exchange Act of 1934, as amended; and, |

| · | all references to our common stock means our authorized common stock, $0.0001 par value per share, and all references to our Series X Super Voting Preferred Stock means our authorized Series X Super Voting Preferred Stock, $0.0001 par value per share, that provides 10,000 votes per share. |

PROSPECTUS SUMMARY

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our common stock and should be read in conjunction with the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should carefully read the entire prospectus, including “Risk Factors” beginning on page [•], “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” beginning on page [•] and the combined financial statements and related notes thereto included in this prospectus.

Overview

We operate primarily in the U.S. residential real estate market, which, according to Zillow Research1, totaled $36.2 trillion in December 2020.

We are the holding company for five agent-centric, technology-integrated, cloud-based, multi-service real estate companies. Our primary business, La Rosa Realty, LLC, has been listed in the “Top 75 Residential Real Estate Firms in the United States” from 2016 through 2020 by the National Association of Realtors (or NAR), the leading real estate industry trade association in the United States.

Our business was founded by Mr. Joseph La Rosa, a successful real estate developer, business and life coach, author, podcaster and public speaker. Mr. La Rosa’s self-help book “Do It Now” is a roadmap to personal success and well-being based on his transformative theories of family, passion and growth. His philosophy, seminars and educational forums have attracted numerous successful realtors that have spurred the growth of our business.

In addition to providing person-to-person residential and commercial real estate brokerage services to the public, we cross sell ancillary technology-based products and services primarily to our sales agents and the sales agents associated with our franchisees. Our business is organized based on the services we provide internally to our agents and to the public, which are residential and commercial real estate brokerage, franchising, real estate brokerage education and coaching, and property management. Our real estate brokerage business operates primarily under the trade name La Rosa Realty, which we own, and, to a lesser extent, under the trade name Better Homes Realty which we license. We have five La Rosa Realty corporate real estate brokerage offices located in Florida, [ ] La Rosa Realty franchised real estate brokerage offices in six states in the United States and Puerto Rico, and an international La Rosa Realty franchised office in Peru and in Turkey. Our real estate brokerage offices, both corporate and franchised, are staffed with more than approximately 2,380 licensed real estate brokers and sales associates.

We have built our business by providing the home buying public with well trained, knowledgeable realtors who have access to our proprietary and third party in-house technology tools and quality education and training, and valuable marketing that attracts some of the best local realtors who provide value-added services to our home buyers and sellers that are attracted to our brands. We give our real estate brokers and sales agents who are seeking financial independence a turnkey solution and support them in growing their brokerages while they fund their own businesses. This enables us to maintain a low fixed-cost business with several recurring revenue streams, yielding relatively high margins and cash flow.

Our agent-centric commission model enables our sales agents to obtain higher net commissions than they would otherwise receive from many of our competitors in our local markets. Moreover, we believe that our proprietary technology, training, and the support that we provide to our agents at a minimal cost to them is one of the best offered in the industry.

1 https://www.zillow.com/research/zillow-total-housing-value-2020-28704/

We believe that our focus on the interaction between our in person agents and their clients is a strong weapon against the internet-only commodity websites and the low touch discount brokerages who compete with us. By creating a custom solution offering a unique experience, our agents are able to guide their clients seamlessly through what may the most expensive purchase of their lifetime.

Disruptions related to the COVID-19 pandemic resulted in a downturn in our local residential real estate market in 2020. However, our local real estate market rebounded significantly in 2021 and continues to be strong as the pandemic has caused what appears to be a large migration into our market areas from other states. Because nearly all of our sales agents, who are independent contractors, were working remotely before the pandemic struck, and because Florida did not mandate stay-at-home orders like many other states, the manner in which our business is conducted during the pandemic has not changed significantly and has not affected the productivity of our sales agents in 2021.

In addition, a significant driver of our past, and we believe, our future growth is our ability to create revenue by referring or requiring that our agents and our franchisee’s agents use the different business services that we provide. For example, all agents new to our Company are required to have a “coach” and to attend multi-day training sessions to learn the Company’s philosophy, technology and business practices. Concurrently, the agent works with his or her coach in obtaining listings, working with consumers and closing transactions. All of these activities are run through our La Rosa Coaching, LLC subsidiary. We plan to expand our coaching offerings in the third quarter of 2021 to teach advanced techniques for team building, personal growth and business development, which will provide increased revenue at a nominal increase in cost to us. In addition, unlike other residential real estate brokerages, we encourage our sales agents to pursue commercial real estate transactions and require them to utilize the services of our commercial real estate company. We anticipate acquiring other complementary businesses, such as title and insurance agencies and a mortgage brokerage, after the closing of this offering to enhance our gross revenues and profit margins.

We face competition from established residential real estate companies such as RE/MAX Holdings, Inc., Keller Williams Realty, Inc., HomeSmart, Realogy Holdings, Corp., which franchises the Coldwell Banker and Century 21 brands, as well as from internet-based real estate brokers including Realtor.com, Fathom Holdings Inc., Redfin.com, and Zillow.com, brokers offering deeply discounted commissions like SimpleShowing Holdings, Inc., Houwzer LLC and Real Estate Exchange, Inc. (Rexhomes.com), and “flat fee” brokers such as Homie Technology, Inc., Cottage Street Realty, LLC (FlatFeeGroup.com) and Trelora, Inc. These companies do not provide the same personalized brokerage services that we do and emphasize low price and a do-it-yourself philosophy. We believe that our highly trained agents who work one-on-one with their clients are able to successfully close residential real estate transactions with a high level of consumer satisfaction that redounds to us in future business and referrals.

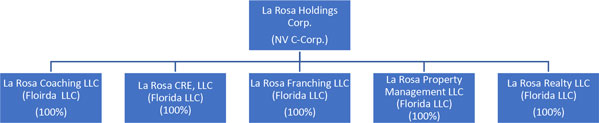

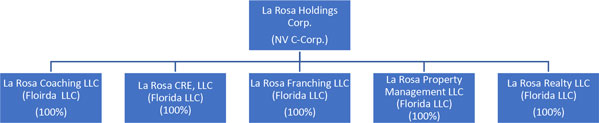

Our Organization

La Rosa Holdings Corp. was incorporated in the State of Nevada on June 14, 2021 by its founder, Mr. Joseph La Rosa, to become the holding company for five Florida limited liability companies of which Mr. La Rosa held a one hundred percent (100%) ownership interest: (i) La Rosa Coaching, LLC, or Coaching; (ii) La Rosa CRE, LLC, or CRE; (iii) La Rosa Franchising, LLC, or Franchising; (iv) La Rosa Property Management, LLC, or Property Management; and (v) La Rosa Realty, LLC, or Realty. All of those limited liability companies are referred to collectively in this prospectus as the “LLCs.”

On August 4, 2021, we effected a corporate reorganization pursuant to a Reorganization Agreement and Plan of Share Exchange dated July 22, 2021 (the Reorganization Agreement) between La Rosa Holdings Corp. and each of the LLCs. Under the Reorganization Agreement, each LLC exchanged 100% of their limited liability company membership interests for one share of Company’s common stock, which share was automatically redeemed for nominal consideration upon the closing of the transaction, resulting in each LLC becoming the direct, wholly-owned subsidiary of the Company.

The following chart illustrates the current corporate structure of our key operating entities:

The Company conducts its operations through its five subsidiaries:

| | · | La Rosa Coaching, LLC is engaged in the coaching, training and education of our real estate agents at every phase of the real estate business; |

| | · | La Rosa CRE, LLC is a commercial real estate brokerage where we represent buyers and sellers in the sale of commercial real estate and the train and support our residential agents who are interested in pursuing commercial real estate sales; |

| | · | La Rosa Franchising, LLC is engaged in the sale, oversight and provision of operating systems of independently owned and operated franchises of La Rosa Realty as well and the ongoing training and support for the franchise owners and staff; |

| | · | La Rosa Property Management, LLC is engaged in providing training, compliance, support and accounting services for La Rosa Realty Agents engaged in long term rental property management; and |

| | · | La Rosa Realty, LLC is engaged in the residential real estate brokerage business and providing systems, accounting, marketing tools and compliance for our real estate agents who conduct residential real estate sales. |

Selected Risks Associated with Our Business

Our business and prospects may be limited by a number of risks and uncertainties that we currently face, including the following:

| · | The outbreak of the COVID-19 coronavirus pandemic had a material effect on our business in 2020, and, if there are significant future outbreaks, could continue to do so. |

| · | The residential real estate market is cyclical and we can be negatively impacted by downturns in this market and general global economic conditions. |

| · | The ability of homebuyers to obtain financing in the U.S. residential real estate market at favorable rates and on favorable terms could have a material effect on our financial performance and results of operations. |

| · | Under the rules of the Nasdaq Capital Market, we will be a “controlled company” within the meaning of the corporate governance rules of The Nasdaq Capital Market and, although we do not presently intend to rely on certain exemptions from the corporate governance requirements of those rules, we may do so in the future. |

| · | We may fail to successfully execute our strategies to grow our business, including acquiring a controlling interest in a number of our current franchisees and growing our agent count. |

| · | Our business depends on a strong brand, and any failure to maintain, protect and enhance our brand would hurt our ability to grow our business, particularly in new markets where we have limited brand recognition. |

| · | Loss of the services of our Founder, Joseph La Rosa, our Chief Executive Officer and our Chairman of the board of directors, and our other current executive officers could adversely affect our operations. |

| · | Competition in the residential real estate business is intense and may adversely affect our financial performance. |

| · | The failure to attract and retain highly qualified and successful franchisees and agents could compromise our ability to pursue our growth strategy. |

| · | Our financial results are affected directly by the operating results of franchisees and agents, over whom we do not have direct control. |

| · | Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of consecutive quarters difficult. |

| · | Our business could be adversely affected if we are unable to expand, maintain, and improve the systems and technologies that we rely on to operate. |

| · | Our business, financial condition and reputation may be substantially harmed by security breaches, cybersecurity incidents, and interruptions, delays and failures in our systems and operations. |

| · | We face significant risk to our brand and revenue if we fail to maintain compliance with the law and regulations of federal, state, foreign, county governmental authorities, or private associations and governing boards. |

| · | Failure to protect our intellectual property rights could adversely affect our business. |

| · | We may evaluate entities in complementary or competitive businesses for acquisition in order to accelerate growth but might not succeed in identifying suitable candidates or may acquire businesses that negatively impact us or may have trouble integrating businesses that we acquire. |

| · | We are subject to certain risks related to litigation filed by or against us, and adverse results may harm our business and financial condition. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition and results of operations. You should consider the risks discussed in “Risk Factors” starting on page [•] and elsewhere in this prospectus before investing in our common stock.

Corporate Information

Our principal executive office is located at 1420 Celebration Boulevard, Suite 200, Celebration, FL 34747. Our telephone number at our principal executive office is (321) 939-3748. Our corporate website is https://www.larosarealty.com. The information on our corporate website is not part of, and is not incorporated by reference into, this prospectus.

Recent Developments

In a private placement conducted from July through October 2021, we entered into Convertible Note Purchase Agreements pursuant to which we issued unsecured convertible promissory notes to certain “accredited investors” under an exemption from the registration requirements of the Securities Act afforded by Section 4(a)(2) of that Act and/or Rule 506(b) of Regulation D promulgated thereunder. In accordance with such purchase agreements, we issued convertible promissory notes in the aggregate principal amount of $481,000 that we used to pay the expenses of our organization and reorganization and for other general corporate purposes. Interest accrues on the principal amount of nine of the convertible promissory notes at 2.5% with a default rate of 3.0% per annum, and interest accrues on the principal amount of seven of the convertible promissory notes at 18.0%, with a default interest rate of 20.0% per annum, and interest accrues on the principal amount of one of the convertible promissory notes at 18.0%, with a default interest rate of 18.0% per annum. The convertible promissory notes rank on a parity with the Company’s other existing debt and mature on the earlier of the date that the Company’s common stock becomes listed for trading on a national securities exchange or one year from the date of issue of each such note. Prior to the maturity date, the convertible promissory notes will convert the outstanding principal and accrued interest automatically into shares of the Company’s common stock on the date of the closing of this offering at a price per share equal to the product of the public offering price multiplied by 0.80. All of the convertible promissory notes are prepayable, in whole or in part, at any time prior to maturity without penalty or premium.

Status as a Controlled Company

Because of the voting control held by Mr. La Rosa, we are considered a “controlled company” within the meaning of the listing standards of Nasdaq. Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements, including the requirement to have a board of directors that is composed of a majority of independent directors. We currently do not intend to take advantage of these exemptions, but could do so at any time in the future provided that we continue to qualify as a “controlled company.”

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, we:

| · | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act; |

| · | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements, and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| · | are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| · | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| · | may present only two years of audited financial statements; and |

| · | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding internal control over financial reporting, are not required to provide a compensation discussion and analysis, are not required to provide a pay-for-performance graph or CEO pay ratio disclosure, and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or such earlier time that we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period. Further, under current SEC rules, we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e., the market value of common equity held by non-affiliates) of less than $250 million as of the last business day of our most recently completed second fiscal quarter.

SUMMARY OF THE OFFERING

| Issuer: | | La Rosa Holdings Corp. |

| Offered securities: | | [ ] shares of common stock. |

| Offering price per share: | | $ [ ] per share. |

| Over-allotment option: | | We have granted a 45-day option to the underwriter to purchase up to [ ] additional shares of common stock equal to 15% of the shares in this offering) at the public offering price per share, less the underwriting discounts payable by us, solely to cover over-allotments, if any. |

| Shares of capital stock outstanding immediately before the offering (1): | | · 30,750,000 shares of common stock; and · 2,000 shares of Series X Super Voting Preferred Stock having 10,000 votes per share, all of which are owned by Mr. Rosa. |

| Shares of capital stock outstanding immediately after the offering (2): | | · [ ] shares of common stock; and · 2,000 shares of Series X Super Voting Preferred Stock having 10,000 votes per share, all of which are owned by Mr. Rosa. |

| Disparate voting rights: | | Our Founder, Chief Executive Officer, President and Chairman, Joseph La Rosa, currently holds 100% of the outstanding common stock of the Company and 2,000 shares of Series X Super Voting Preferred Stock having 10,000 votes per share. Mr. La Rosa will maintain control of the Company after this offering, including the election of our directors and the approval of any change in control transaction. See the sections titled, “Security Ownership of Certain Beneficial Owners and Management” and “Description of Capital Stock” for additional information. |

| Use of Proceeds: | | We estimate that we will receive net proceeds of approximately $ [ ] million from our sale of shares in this offering, after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds we receive from this offering for general corporate purposes, which may include financing our growth by acquiring more agents at a faster pace, developing new services and funding capital expenditures, acquisitions of controlling interest in a number of our franchisees and the acquisition of other independent real estate brokerages, title insurance agencies, mortgage brokerages and other complementary businesses, and the purchase and acquisition of proprietary technology. See “Use of Proceeds” for more information. |

| Representative’s Warrants: | | The registration statement of which this prospectus is a part also registers for sale warrants (the “Representative’s Warrants”) to purchase up to 6.0% of the shares of our common stock sold in this offering to Maxim Group LLC (the “Representative”), as a portion of the underwriting compensation in connection with this offering. The Representative’s Warrants will be exercisable at any time, and from time to time, in whole or in part, during the period commencing 180 days from the first day of sales and expiring five years from the effective date of the offering at an exercise price of $ [ ] (110% of the assumed public offering price per share). Please see “Underwriting-Representative’s Warrants” on page [•] of this prospectus for a description of these Warrants. |

| Underwriter compensation: | | In connection with this offering, the underwriters will receive an underwriting discount equal to seven percent (7.0%) of the offering price of the shares in the offering. In addition, we have agreed to: (i) reimburse certain accountable expenses of the Representative, (ii) reimburse the Representative for certain expenses incurred relating to this offering including a non-accountable expense allowance equal to one percent (1%) of the aggregate public offering price of the common stock in this offering, and (iii) indemnify the underwriters for certain liabilities in connection with this offering. See “Underwriting” starting on page [•] of this prospectus. |

| Proposed Nasdaq Capital Market Listing: | | We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “LRHC.” No assurance can be given that our Nasdaq listing application will be approved, or that a trading market will develop for our common stock. We will not proceed with this offering if our application to list our common stock on Nasdaq is not approved. |

| Lock-up agreements: | | We, and our directors and officers, have agreed with the underwriter not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock, subject to certain exceptions, for a period of 180- days after the date of this prospectus, which restriction may be waived in the discretion of the Representative. See “Underwriting-Lock-Up Agreements” on page [•] of this prospectus. |

| Dividends: | | We do not anticipate paying dividends on our common stock for the foreseeable future. |

| Risk factors: | | Investing in our securities involves a high degree of risk and purchasers of our securities may lose their entire investment. See “Risk Factors” starting on page [•] and the other information included and incorporated by reference into this prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our securities. |

The actual number of shares we will offer will be determined based on the actual public offering price.

| (1) | The number of shares of common stock to be outstanding immediately before this offering excludes any shares of common stock issuable upon the mandatory conversion of the Convertible Promissory Notes issued by us to a number of investors in a private placement on August 18, 2021 at a conversion price equal to eighty percent (80%) of the initial offering price. |

| (2) | The number of shares of common stock to be outstanding immediately following this offering excludes: |

| ● | [ ] shares of common stock issuable upon the exercise of the Over-Allotment Option; |

| ● | [ ] shares of common stock issuable upon the exercise of the Representative’s Warrants; and |

| ● | 200,000 shares of common stock issuable upon the exercise of the warrants granted to Exchange Listing, LLC, a consultant to the Company (“Consultant Warrants”). |

Except as otherwise indicated, all information in this prospectus assumes:

| ● | no exercise of any options under the Company’s 2021 Equity Compensation Plan; |

| ● | no exercise of the Representative’s Warrants; |

| ● | no exercise of the Over-Allotment Option; and |

| ● | no exercise of the Consultant Warrants. |

SUMMARY FINANCIAL DATA

You should read the following selected financial data together with our financial statements and the related notes thereto included elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” Section of this prospectus. We have derived the statement of operations data for the years ended December 31, 2020 and 2019 and the balance sheet data as of December 31, 2020 and 2019 from our audited financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. Our historical results are not necessarily indicative of the results that should be expected in the future and the results for the year ended December 31, 2020 are not necessarily indicative of the results to be expected for the full year ending December 31, 2021 or any other future period.

Combined Summary of Operations

| | | Year Ended December 31, | |

| | | 2020 | | | 2019 | |

| Net Revenue | | $ | 24,012,163 | | | $ | 51,522,615 | |

| | | | | | | | | |

| Cost of revenue | | | 20,936,021 | | | | 46,716,485 | |

| Gross Profit | | | 3,076,142 | | | | 4,806,130 | |

| OPERATING EXPENSES | | | | | | | | |

| General and administrative | | | 2,572,724 | | | | 3,894,623 | |

| Sales and marketing | | | 258,953 | | | | 403,612 | |

| Professional fees | | | 116,811 | | | | 165,040 | |

| OPERATING INCOME | | | 127,654 | | | | 342,855 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | 6,707 | | | | (7,279 | ) |

| | | | | | | | | |

| NET INCOME | | $ | 134,361 | | | $ | 335,576 | |

| | | | | | | | | |

| Income per common share (basic and diluted) | | $ | 0.00 | | | $ | 0.01 | |

Combined Balance Sheet

| | | Actual | | | Pro Forma | |

| | | As of December 31, | | | As of December 31, | |

| | | 2020 | | | 2019 | | | 2020 | |

| Cash | | $ | 175,425 | | | $ | 452,280 | | | $ | [ ] | |

| Working capital | | | 84,603 | | | | 24,103 | | | | [ ] | |

| Restricted cash | | | 1,023,245 | | | | 852,317 | | | | [ ] | |

| Total assets | | | 1,351,362 | | | | 1,471,680 | | | | [ ] | |

| Total liabilities | | | 2,578,316 | | | | 2,273,067 | | | | [ ] | |

| Total stockholder’s deficit | | | (1,226,954 | ) | | | (801,387 | ) | | | [ ] | |

The pro forma column in the balance sheet data above gives effect to the sale of securities for cash in this offering at the assumed public offering price of $[ ] per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us (of seven percent (7%) underwriters discount, one percent (1%) non-accountable expense and $[ ] of estimated offering costs), in the total amount of $[ ], as if the sale had occurred on December 31, 2020.

Each $1.00 increase (decrease) in the assumed public offering price of $[ ] per share (the midpoint of the price range set forth on the cover page of this prospectus), would increase (decrease) our stockholders’ equity, as adjusted, after this offering by approximately $[ ] million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of securities we are offering. An increase (decrease) of [ ] in the number of shares offered by us at the assumed offering price of $[ ] per share (the midpoint of the price range set forth on the cover page of this prospectus) would increase (decrease) our stockholders’ equity, as adjusted, after this offering by approximately $[ ], assuming that the assumed public offering price remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements.” Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| · | the effect of COVID-19 pandemic on our business operations; |

| · | our expectations regarding consumer trends in residential real estate transactions; |

| · | our expectations regarding overall economic and demographic trends, including the continued growth of the U.S. residential real estate market; |

| · | our ability to grow our business organically in the various local markets that we serve; |

| · | our ability to attract and retain additional qualified agents and other personnel; |

| · | our ability to expand our franchises in both new and existing markets; |

| · | our ability to increase the number of closed transactions sides and sides per agent; |

| · | our ability to cross-sell our services among our LLCs; |

| · | our ability to maintain compliance with the law and regulations of federal, state, foreign, county and local governmental authorities, or private associations and governing boards; |

| · | our ability to expand, maintain and improve the information technologies and systems that we rely upon to operate; |

| · | our ability to prevent security breaches, cybersecurity incidents and interruptions, delays and failures of our technology infrastructure; |

| · | our ability to retain our founder and current executive officers and other key employees; |

| · | our ability to identify quality potential acquisition candidates in order to accelerate our growth; |

| · | our ability to manage our future growth and dependence on our contractors; |

| · | our ability to maintain the strength of our brands; |

| · | our ability to maintain and increase our financial performance; |

| · | other factors discussed elsewhere in this prospectus. |

We might not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly under “Risk Factors” starting on page [•] of this prospectus and the documents incorporated herein that we believe could cause actual results or events to differ materially from the forward-looking statements that we make.

You should read this prospectus and the documents that we have filed as exhibits to this prospectus completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus. You also should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our common stock, you should carefully consider the risk factors discussed in this prospectus.

RISK FACTORS

Our business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price of our common stock could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business and Operations

The effects of the COVID-19 pandemic have caused and will likely continue to cause significant disruption to our real estate market, and the severity and duration of these impacts on future financial performance and results of operations remain uncertain.

The COVID-19 pandemic has spread across the globe and is impacting economic activity worldwide. The pandemic poses significant risks to our business and our employees, franchisees and agents. The COVID-19 pandemic negatively impacted our business and that of our franchisees in 2020. The pandemic poses the risk of an extended disruption to our business, that of our franchisees and other business partners, and the housing market generally, due to the impact of the disease itself, actions intended to limit or slow its spread, and other factors. These include government imposed lockdowns, restrictions on travel or transportation, social distancing requirements, limitations on the size of gatherings, policies that ban or severely limit in-person showings of properties, closures of work facilities, schools, public buildings and businesses, cancellation of events, curtailing other activities and quarantines.

In the spring 2020, the pandemic resulted in a significant slowing of residential real estate listings and sales as the population in our market areas endured business shutdowns, work from home requirements, shortages of consumer staples and a general retreat from normal day-to-day social interactions. This slow down, however, reversed in mid-2020, resulting in a substantial increase in listings and sales, which has continued through the date of this prospectus due to a large migration of home buyers from other states.

We applied for and received Federal government grants (“Economic Injury Disaster Loan Advances”) totaling $12,000, Economic Injury Disaster Loan’s totaling $365,100, and received loans totaling $209,200 under the Federal government’s Paycheck Protection Program. We are currently applying for forgiveness on the Paycheck Protection Program loans, but cannot be assured that such loans will be forgiven by the U.S. Small Business Administration. None of those funds were provided to our sales agents or franchisees.

The duration and magnitude of the impact from the COVID-19 pandemic depends on future developments that cannot be predicted at this time. There remains significant uncertainty regarding the continuing impact of COVID-19 on our business and the overall economy as a whole in the United States and internationally where we have, and plan to establish franchise operations. In particular, there is significant concern regarding the possibility of additional waves of COVID-19 variant cases that could cause state and local governments to reinstate more restrictive measures, which could impact our business and the housing markets. There is also uncertainty regarding viable treatment options or the efficacy of vaccines and public health mandates emanating from Federal, State and local governments that have, at times, been confusing and contradictory.

Business disruptions due to the pandemic may continue, particularly if stringent mitigation actions by government authorities are put in place or remain in place for a significant amount of time. The future impact of the COVID-19 pandemic on our liquidity, financial condition and results of operations is unknown, and its impact may be variable over time as government regulations, market conditions and consumer behavior changes in response to developments with respect to the pandemic.

The residential real estate market is cyclical and we can be negatively impacted by downturns in this market and general economic conditions.

The residential real estate market tends to be cyclical and typically is affected by changes in general economic conditions which are beyond our control. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets, levels of unemployment, consumer confidence and the general condition of the U.S. and the global economy. The residential real estate market also depends upon the strength of financial institutions, which are sensitive to changes in the general macroeconomic environment. Lack of available credit or lack of confidence in the financial sector could impact the residential real estate market, which in turn could materially and adversely affect our business, financial condition and results of operations. Due to the cyclicality of the real estate market, we cannot predict whether this period of sustained growth will continue, whether mortgage rates will remain at historically low levels and whether home prices will continue to climb. The U.S. has experienced housing “bubbles” in the past which have burst, resulting in significant price declines, mortgage defaults and home foreclosures by lenders, the last one occurring in the early 2000’s.

Any of the following could be associated with cyclicality in the housing market by halting or limiting the current growth in the housing market, and have a material adverse effect on our business by causing periods of lower growth or a decline in the number of home sales and/or home prices which, in turn, could adversely affect our revenue and profitability:

| · | a period of slow economic growth or recessionary conditions; |

| · | an increase in mortgage interest rates; |

| · | a tightening of credit standards by financial institutions; |

| · | legislative, tax or regulatory changes that would adversely impact the residential real estate market, including but not limited to those relating to mortgage financing, restrictions imposed on mortgage originators as well as retention levels required to be maintained by sponsors to securitize certain mortgages, the elimination of the deductibility of certain mortgage interest expense, the application of the alternative minimum tax, and real property taxes and employee relocation expense; |

| · | insufficient home inventory levels in our markets; |

| · | a continued increase in the acquisition of single family homes by corporate buyers for rental purposes; |

| · | a decrease in the affordability of homes; |

| · | increase in the cost of premiums for home insurance due to recent hurricanes; and, |

| · | natural disasters, such as hurricanes, earthquakes and other disasters that disrupt local or regional real estate markets. |

The lack of financing for homebuyers in the U.S. residential real estate market at favorable rates and on favorable terms could have a material adverse effect on our financial performance and results of operations.

Our business is significantly impacted by the availability of financing at favorable rates or on favorable terms for homebuyers, which may be affected by government regulations and policies. Certain on-going governmental actions or inactions, such as the U.S. federal government’s conservatorship of Fannie Mae and Freddie Mac, capital standards imposed on banks by the Office of the Comptroller of the Currency, the monetary policy of the U.S. government, and any rising interest rate environment may adversely impact the housing industry, including homebuyers’ ability to finance and purchase homes.

The monetary policy of the U.S. government, and particularly the Federal Reserve Board, which regulates the supply of money and credit in the U.S., significantly affects the availability of financing at favorable rates and on favorable terms, which in turn affects the domestic real estate market. Policies of the Federal Reserve Board can affect interest rates available to potential homebuyers. Further, we will be adversely affected by any rising interest rate environment. Changes in the Federal Reserve Board’s policies, the interest rate environment and mortgage market are beyond our control, are difficult to predict and could restrict the availability of financing on reasonable terms for homebuyers, which could have a material adverse effect on our business, results of operations and financial condition. We review all aspects of the current state of legislation, regulations and policies affecting the domestic real estate market and cannot predict whether or not such legislation, regulation and policies may result in increased down payment requirements, increased mortgage costs, and result in increased costs and potential litigation for housing market participants, any of which could have a material adverse effect on our financial condition and results of operations.

We may fail to successfully execute our strategies to grow our business, including increasing our agent count, expanding the number of our franchisees and agents, or we may fail to manage our growth effectively, which could have a material adverse effect on our brand, our financial performance and results of operations.

We intend to pursue a number of different strategies to grow our revenue and earnings. However, we may not be able to successfully execute these strategies. We intend to pursue a strategy of increasing our agent count by increasing our recruiting efforts. Recent history has shown that a strong real estate market brings in more realtors, some of whom have worked in the industry on a part-time basis. As the market continues to grow, we believe that will enable us to sell more franchises and recruit and retain higher numbers of agents, increasing our revenue and profitability. However, competition for qualified and effective agents is intense, and we may be unable to recruit and retain enough qualified and effective agents to satisfy our growth strategies. This competition creates challenges that include:

| · | our ability to discover and recruit independent brokerage firms in new markets and being able to acquire them; |

| · | our ability to increase our brand awareness in new markets in order to penetrate them with our brokerages; |

| · | our ability to effectively train and mentor a larger number of new agents and franchisees; |

| · | our ability to continually improve the performance, features and reliability of our technological developments in response to both evolving demands of the marketplace and competitive product offerings; |

| · | our ability to scale our business services and support quickly enough to meet the growing needs of our real estate agents by improving our internal systems, integrating with third-party systems, and maintaining infrastructure performance; |

| · | our ability to attract and retain senior management to operate and control the expansion of our business, organically and, potentially, through acquisitions; and |

| · | our ability to enhance our financial reporting, internal control, human resources, legal and other administrative areas to effectively manage the growth of our Company. |

If we do not effectively manage our growth, our brand could suffer. In order to successfully expand our business, we must effectively recruit, develop and motivate new franchisees, and we must maintain the beneficial aspects of our three pillars philosophy. We may not be able to hire new agents or employees and our franchisees may not be able to recruit new agents necessary to manage our growth quickly enough to meet our needs. If we fail to effectively manage our hiring needs and successfully develop our franchisees, our franchisee, agent and employee morale, productivity and retention could suffer, and our brand and results of operations could be harmed. These improvements could require significant capital expenditures and place increasing demands on our management. We may not be successful in managing or expanding our operations or in maintaining adequate financial and operating systems and controls. If we do not successfully manage these processes, our results of operations, financial condition and prospects could be adversely affected.

The failure to attract and retain highly qualified franchisees and to acquire and open new corporate offices could compromise our ability to pursue our growth strategy.

The success of our franchisees depends largely on the efforts and abilities of franchisees and their agents, which are subject to numerous factors, including the fees or sales commissions they receive, and our ability to train and oversee their operations to ensure that they provide the quality service promoted by our brands. If our franchisees do not continue to believe in the value proposition we offer with our brand, believe that we are overcharging them for the services we provide, or, for other reasons decide not to renew their franchise agreements with us, our business may be materially adversely affected. Additionally, if our franchisees are not successful, they will fail to attract and retain productive agents and will fail to generate the revenue necessary to pay the contractual fees and dues owed to us.

In addition, if we are unable to organically increase the number of, and acquire new, corporate realty offices in the future, our growth will stagnate and we could lose high producing agents to other competing brokerages, all of which would have a material adverse effect on our results of operations, financial condition and prospects.

We might not be able to attract and retain additional qualified agents and other personnel.

In order to grow our business, we must attract and retain highly qualified agents and other personnel. In particular, we compete with both national and local real estate brokerages for qualified agents who manage our operations in each state and who are our on-the-ground representatives. With the evolving real estate brokerage market, we must find ways to attract and retain these people. And with the change in the way people work that has been accelerated by the Covid-19 pandemic, finding qualified agents and employees has become more difficult. We might have difficulty in finding, hiring and retaining highly skilled personnel with appropriate qualifications. Many of the companies that we compete with for experienced personnel have greater resources than we do. In addition, in making decisions about where to work, in addition to cash compensation, people often consider the value of the stock options or other equity incentives they receive. We currently have an equity incentive a plan to offer stock incentives to our employees and our agents that we believe is competitive with plans offered by other publicly traded real estate brokerage companies. However, if those plans fail to encourage new hires or to motivate our existing staff, we may fail to attract new personnel or fail to retain our current personnel which would severely harm our growth prospects.

Competition in the residential real estate franchising business is intense and may adversely affect our financial performance.

We compete against national and international real estate brokerage franchisors as well as smaller franchisors. Our products are the brands we sell and their reputation in the marketplace. Potential franchisees, when shopping for a brand, look to see the level of support that they can receive compared to the fees and dues that they will have to pay. This is our value proposition. While the national and international brands far exceed us in financial resources, geographic coverage, marketing ability and infrastructure, we believe that our “family-oriented” style of business, based on our three pillars philosophy, is a strong selling point. So, while competing franchisors may offer franchisees monthly ongoing fees that are lower than those we charge, or that are more attractive in particular market environments, we believe that our “high touch” approach is able to overcome many of the factors that competitors sell. Corporate-owned competitors compete primarily on the basis of commission payments to their agents. While we believe that we are competitive in that market, our brand is not as strong as competitors who have been in the market longer and have the financial wherewithal to promote themselves in the media. Our largest competitors in this industry in the U.S. include RE/MAX Holdings, Inc., Keller Williams Realty, Inc., HomeSmart, Realogy Holdings, Corp., which franchises the Coldwell Banker and Century 21 brands, Berkshire Hathaway Homes, among others. See “Prospectus Summary- Competition” and “Business – Competition.”

Our Company owned brokerage business is subject to competitive pressures.

Our Company owned brokerage business, like that of our franchisees, is generally subject to intense competition. We compete with other national and independent real estate organizations including our franchisees and those of other national real estate franchisors, franchisees of local and regional real estate franchisors, regional independent real estate organizations, discount brokerages, internet-based brokerages and smaller niche companies competing in local areas. Competition is particularly intense in the densely populated metropolitan areas in which we operate. In addition, in the real estate brokerage industry, new participants face minimal barriers to entry into the market. We also compete for the services of qualified licensed agents as well as franchisees. The ability of our Company owned brokerage offices to retain agents is generally subject to numerous factors, including the sales commissions, the training and coaching and technological support that they receive and their perception of our brand value. Our largest competitors in the corporate-owned space include Compass Holdings, Inc. and Fathom Holdings, Inc.

Our financial results are affected directly by the operating results of franchisees and agents, over whom we do not have direct control.

Our real estate franchises generate revenue in the form of monthly ongoing royalties and fees, including monthly broker fees tied to gross commissions, training and technology fees charged to our franchisees. Our agents pay us dues out of their income from real estate transactions and new agents split their transaction-based commissions with us. Accordingly, our financial results depend upon the operational and financial success of our franchisees and their agents and our corporate agents, all of whom are independent contractors that we do not control. If industry trends or economic conditions are not sustained or do not continue to improve, our franchisees’, their and our agents’ financial results could worsen and our revenue may decline. We may also have to terminate franchisees more frequently in the future due to non-reporting and non-payment. Further, if franchisees fail to renew their franchise agreements our revenue from ongoing monthly fees may decrease, and profitability may be lower than in the past due to reduced ongoing monthly fees.

Our franchise operations are subject to additional business risks.

Our franchise business is exposed to other business risks which may impact our ability to collect recurring, contractual fees and dues from our franchisees, may harm the goodwill associated with our brand, and/or may materially and adversely impact our business, results of operations, financial condition and prospects. One such risk is that one of our franchisees could declare bankruptcy which could have a substantial negative impact on our ability to collect fees and dues owed under such franchisee’s franchise arrangements. In a franchisee bankruptcy, the bankruptcy trustee may reject its franchise contract pursuant to Section 365 under the U.S. bankruptcy code, in which case there would be no further payments for fees and dues from such franchisee. Other risks include the risk that our franchisees may be uninsured or underinsured against certain business hazards or that insurance may be unavailable, as was hurricane insurance in Florida for a number of years. Any casualty loss happening to our franchisees could put their entire business at risk and potentially result in its failure and the termination of our franchise agreement. Any such loss or delay in an insurance payment could have a material and adverse effect on a franchisee’s ability to satisfy its obligations under its franchise agreement with us, including its ability to make payments for contractual fees and dues or to indemnify us. Each franchise agreement is subject to termination by us in the event that the franchisee breaches its contract, generally after expiration of applicable cure periods, although under certain circumstances a franchise agreement may be terminated by us upon notice without an opportunity to cure. The default provisions under the franchise arrangements are drafted broadly and include, among other things, any failure to meet operating standards and actions that may threaten our brands. In addition, each franchise agreement eventually expires and upon expiration, we or the franchisee may or may not elect to renew the franchise arrangement. If our agreement is renewed, such renewal is generally contingent on the franchisee’s execution of the then-current form of franchise contract (which may include terms the franchisee deems to be more onerous than the prior franchise agreement), the satisfaction of certain conditions and the payment of a renewal fee. If a franchisee is unable or unwilling to satisfy any of the foregoing conditions, the expiring franchise agreement will terminate upon expiration of the term of the franchise arrangement.

Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of successive quarters difficult.

The residential real estate industry is subject to seasonality. Sales activity is typically stronger in the spring and summer months when school is not in session compared to the fall and winter seasons. This is true even in the Southeastern U.S. where weather patterns do not change significantly with the seasons. However, extreme weather does affect our business by keeping people focused on matters other than home buying. We have historically experienced lower revenues during the fall and winter seasons, as well as during periods of unseasonable weather, which reduces our operating income, net income, operating margins and cash flow. Real estate listings precede sales and a period of poor listings activity will negatively impact revenue. Our revenue and operating margins each quarter will remain subject to seasonal fluctuations, which may make it difficult to compare or analyze our financial performance effectively across successive quarters.

A significant increase in private sales of residential property, including through the internet, could have a material adverse effect on our business, prospects and results of operations.

As of 2020, NAR estimated that eighty nine percent (89%) of homes in 2020 were sold with the assistance of a realtor and 5.64 million existing homes were sold in in 2020. Although the NAR survey indicates that the percentage of sales using agents has increased in recent years, a significant increase in the volume of private sales due to, for example, increased access to the internet and the proliferation of websites that facilitate such sales, and a corresponding decrease in the volume of sales through real estate agents could have a material adverse effect on our business, prospects and results of operations.

The real estate brokerage business is highly regulated and any failure to comply with such regulations or any changes in such regulations could adversely affect our business.

Our Company owned real estate brokerage business and our franchising business are highly regulated and must comply with Federal and state the requirements governing the licensing and conduct of real estate brokerage and brokerage-related businesses and franchising in the jurisdictions in which we and they do business. These laws and regulations contain general standards for and prohibitions on the conduct of real estate brokers and agents, including those relating to licensing of brokers and agents, fiduciary and agency duties, administration of trust funds, collection of commissions, advertising and consumer and franchising disclosures. Under state law, the franchisees and our real estate brokers have certain duties to supervise and are responsible for the conduct of their brokerage business.