Exhibit 96.2

S-K 1300 Initial Assessment Technical report Summary

For the

Fiel rosita

Copper-Molybdenum-Gold-Silver-Zinc

Poly Metallic Mineral Deposit

Region III

Atacama, Chile

Dated July 17, 2023

Revised December 6, 2023

PREPARED FOR

KEY MINING CORP.

BY

RESOURCE DEVELOPMENT ASSOCIATES INC.

Highlands Ranch, CO 80126

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page I |

| | |

Table of Contents

| 1 | | Executive Summary | 1 |

| 1.1 | | Introduction | 1 |

| 1.2 | | Key Project Outcomes | 1 |

| 1.3 | | Land Tenure | 2 |

| 1.4 | | Geology and Mineralization | 2 |

| 1.5 | | Drilling and Sampling | 2 |

| 1.6 | | Mineral Resources | 2 |

| 1.7 | | Mining Methods | 3 |

| 1.8 | | Recovery Methods | 4 |

| 1.9 | | Infrastructure | 4 |

| 1.10 | | Capital Cost and Operating Cost Estimate | 4 |

| 1.10.1 | | Capital Costs | 4 |

| 1.10.2 | | Operating Costs | 4 |

| 1.11 | | Project Economics | 5 |

| 1.12 | | Interpretations and Conclusions | 9 |

| 1.13 | | Recommendations | 9 |

| 1.13.1 | | Exploration Recommendations | 9 |

| 1.13.2 | | Recommended Work Program to Support a Pre-Feasibility Study | 10 |

| 2 | | Introduction | 11 |

| 2.1 | | Overview | 11 |

| 2.2 | | QP Qualifications | 11 |

| 2.3 | | Terms Of Reference | 11 |

| 2.4 | | Personal Inspection of the Fiel Rosita Property | 11 |

| 2.5 | | Effective Date | 11 |

| 2.6 | | Declaration | 11 |

| 2.7 | | Sources of Information | 12 |

| 2.8 | | Currency and Calculations | 12 |

| 2.9 | | Important Notice | 12 |

| 2.10 | | Acknowledgements | 12 |

| 3 | | Property Description and Location | 13 |

| 3.1 | | Mineral Property and Title in Chile | 13 |

| 3.2 | | Chilean Regulations | 13 |

| 3.3 | | Chilean Mineral Tenure | 13 |

| 3.3.1 | | Pedimento (EXPLORATION CONCESSION) | 13 |

| 3.3.2 | | Manifestacion (EXPLOITATION CONCESSION) | 13 |

| 3.3.3 | | Mensura (SURVEY) | 14 |

| 3.3.4 | | Chilean Claim Process | 14 |

| 3.3.5 | | Surface Rights | 14 |

| 3.3.6 | | Rights of Way | 14 |

| 3.3.7 | | Water Rights | 15 |

| 3.3.8 | | Environmental Regulations | 15 |

| 3.3.9 | | Land Use | 15 |

| 3.3.10 | | Foreign Investment | 16 |

| 3.3.11 | | CURRENT Mining Royalty | 17 |

| 3.3.12 | | The New Mining Royalty | 17 |

| 3.3.13 | | Fraser Institute Study | 19 |

| 3.4 | | Fiel Rosita Property Location | 19 |

| 3.5 | | Fiel Rosita Ownership | 20 |

| 3.5.1 | | Mineral Exploration and Joint Venture Agreement | 20 |

| 3.6 | | Mineral Tenure | 23 |

| 3.7 | | Surface Rights | 34 |

| 3.8 | | Water Rights | 34 |

| 4 | | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 35 |

| 4.1 | | Access and Infrastructure | 35 |

| 4.2 | | Physiography | 35 |

| 4.3 | | Climate | 35 |

| 5 | | History | 39 |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page II |

| | |

| 6 | | Geological Setting, Mineralization and Deposit | 40 |

| 6.1 | | Geological Setting | 40 |

| 6.1.1 | | Regional Geology | 40 |

| 6.1.2 | | Local/Property Geology | 41 |

| 6.2 | | Mineralization | 50 |

| 6.3 | | Deposit | 51 |

| 7 | | Exploration | 52 |

| 7.1 | | Exploration History | 52 |

| 7.2 | | Drilling | 52 |

| 8 | | Sample Preparation, Analyses and Security | 55 |

| 8.1 | | Database | 55 |

| 8.2 | | Coarse Blanks | 55 |

| 8.3 | | Standards | 56 |

| 8.4 | | Duplicates | 58 |

| 8.4.1 | | Coarse Duplicates (CD) | 58 |

| 8.4.2 | | Fine Duplicates | 59 |

| 8.4.3 | | Laboratory Duplicates | 59 |

| 8.5 | | Sufficiency of Procedures | 60 |

| 9 | | Data Verification | 61 |

| 9.1 | | Summary | 61 |

| 9.2 | | Data Verification Procedures | 61 |

| 10 | | Mineral Processing and Metallurgy | 62 |

| 11 | | Mineral Resource Estimation | 69 |

| 11.1 | | Copper Equivalent Formula | 69 |

| 11.2 | | Grade Estimates | 69 |

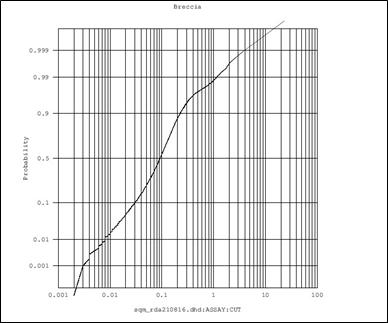

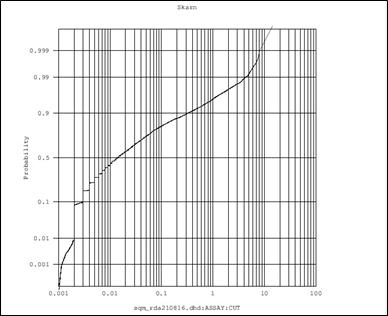

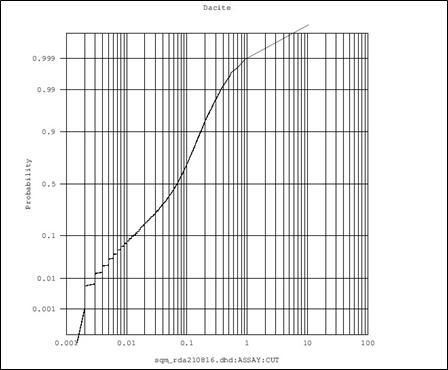

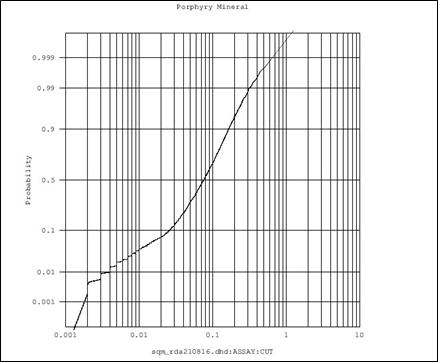

| 11.2.1 | | Exploratory Data Analysis | 69 |

| 11.2.2 | | Grade Capping | 73 |

| 11.3 | | Block Model | 74 |

| 11.3.1 | | Mineral Classification | 74 |

| 11.3.2 | | Grade Estimates and Sensitivity to Cut Off Grade | 74 |

| 11.4 | | Mineral Resource Estimate | 78 |

| 12 | | Mineral Reserve Estimates | 81 |

| 13 | | Mining Methods | 82 |

| 13.1 | | Selection of Mining Method | 82 |

| 13.2 | | Rock Mass Quality Model | 84 |

| 13.3 | | Hydrogeology | 90 |

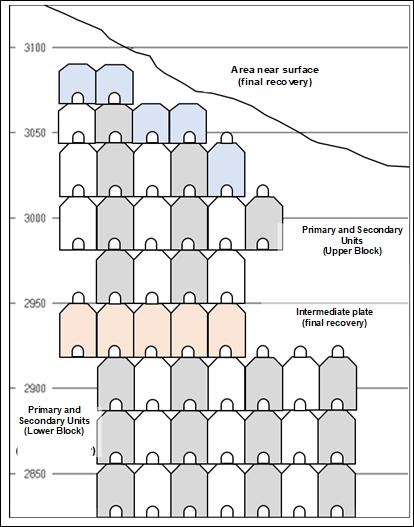

| 13.4 | | Mine Design | 91 |

| 13.5 | | Production | 93 |

| 14 | | Processing and Recovery Methods | 95 |

| 14.1 | | Flow Sheet | 95 |

| 15 | | Infrastructure | 97 |

| 16 | | Market Studies | 99 |

| 17 | | Environmental Studies, permitting and plans, negotiations, or agreements with local individuals or groups | 100 |

| 18 | | Capital and Operating Costs | 101 |

| 18.1 | | Capital Cost | 101 |

| 18.1.1 | | Mining Capital | 101 |

| 18.1.2 | | Process Plant CAPEX | 102 |

| 18.1.3 | | Other Capital Costs | 103 |

| 18.2 | | Operating Costs (OPEX) | 103 |

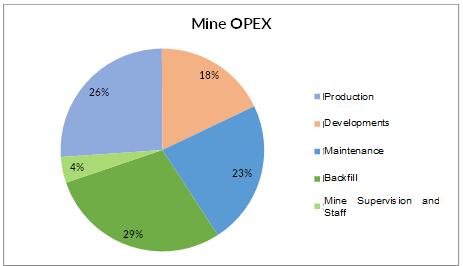

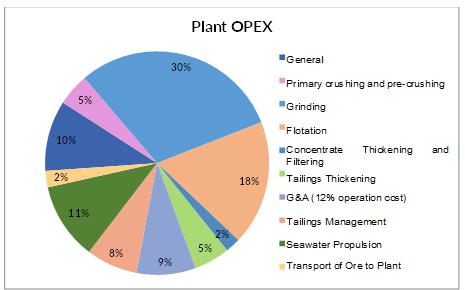

| 18.2.1 | | Mining OPEX | 103 |

| 18.2.2 | | Plant OPEX | 104 |

| 18.2.3 | | OPEX Summary | 105 |

| 19 | | Economic Analysis | 107 |

| 20 | | Adjacent Properties | 114 |

| 21 | | Other Relevant Data and Information | 115 |

| 22 | | Interpretation and Conclusions | 116 |

| 22.1 | | Mineral Resources Interpretations and Conclusions. | 116 |

| 22.2 | | Initial Assessment | 116 |

| 23 | | Recommendations | 117 |

| 23.1 | | Exploration Program | 117 |

| 23.2 | | Recommended Work Program to Support a Pre-Feasibility Study | 117 |

| 24 | | References | 119 |

| 25 | | Reliance on Information Provided by the Registrant | 120 |

| 26 | | Date and Signature Page | 121 |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page III |

| | |

List of Tables

| Table 1-1 | Fiel Rosita Project Indicated Mineral Resource | 3 |

| Table 1-2 | Fiel Rosita Inferred Mineral Resources | 3 |

| Table 1-3 | Initial capital and sustaining capital costs by major area (US$ Millions) | 4 |

| Table 1-4 | Total operating cost breakdown (LOM average) | 5 |

| Table 1-5 | Financial model inputs | 6 |

| Table 1-6 | Summary of the economic analysis of underground mining of the Project | 7 |

| Table 1-7 | Proposed Exploration Work Program to Delineate Fiel Rosita Mineral Resources | 9 |

| Table 1-8 | Pre-Feasibility Cost Breakdown | 10 |

| Table 3-1 | NSR Based Royalty | 23 |

| Table 3-2 | Summary of Mineral Tenure for the Fiel Rosita Concessions | 24 |

| Table 6-1 | Minor joint system orientations | 47 |

| Table 7-1 | Total Drill Hole Database | 52 |

| Table 7-2 | Drilling Assays with Mineralization Above Detection | 52 |

| Table 8-1 | Comparison of database entries versus assay certificates | 55 |

| Table 8-2 | Number of coarse blanks submitted for QAQC | 55 |

| Table 8-3 | Samples beyond acceptable limits | 56 |

| Table 8-4 | TCu, Mo, Au & Zn Standards, from the Laboratories of Ore Research & Exploration (OREAS), Geostats Pty Ltd. and Verilab | 57 |

| Table 8-5 | Summary of results from standards by element | 58 |

| Table 8-6 | Number of CD Analyses by Element and Area | 58 |

| Table 8-7 | Number of CD Analyses by Element and Area | 59 |

| Table 8-8 | Number of FD Analyses Assessed and Conducted by Element and Area | 59 |

| Table 8-9 | Summary of FD by Variable | 59 |

| Table 8-10 | Number of LD Analyses and Element by Area | 60 |

| Table 8-11 | Number of LD Analyses by Element and Area | 60 |

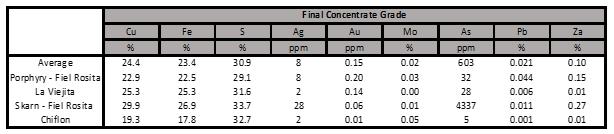

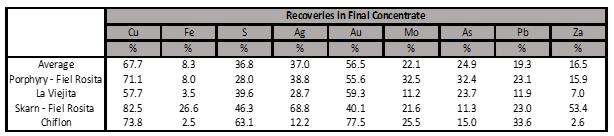

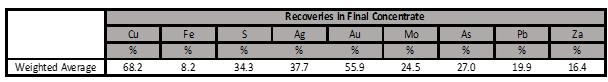

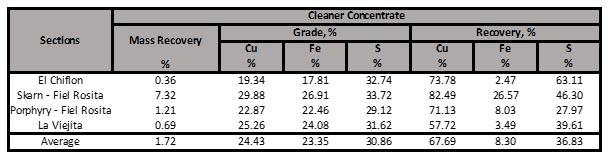

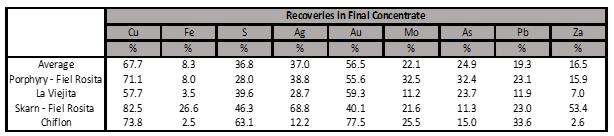

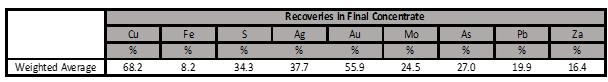

| Table 10-1 | Recoveries and grades of the rougher concentrate by sample. | 64 |

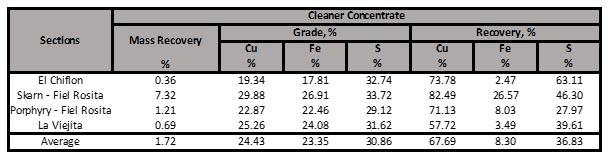

| Table 10-2 | Recoveries and grades of the rougher concentrate by sample. | 64 |

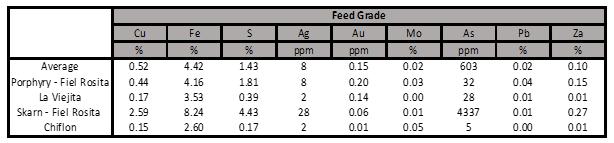

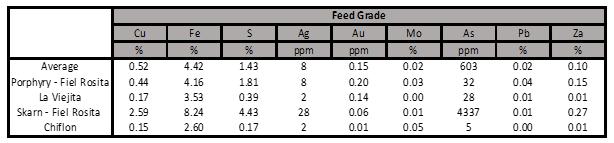

| Table 10-3 | Feed grade, by sample and average. | 65 |

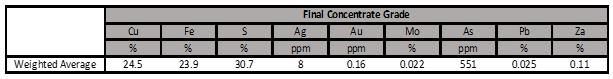

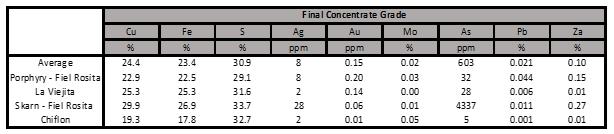

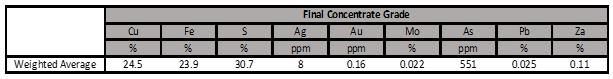

| Table 10-6 | Grade of the weighted final concentrate, by sample and average | 66 |

| Table 11-1 | Cu General Statistics | 70 |

| Table 11-2 | Cu Outliers | 73 |

| Table 11-3 | Search Radii for Mineralization | 74 |

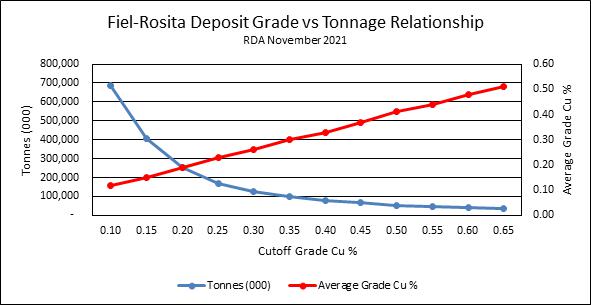

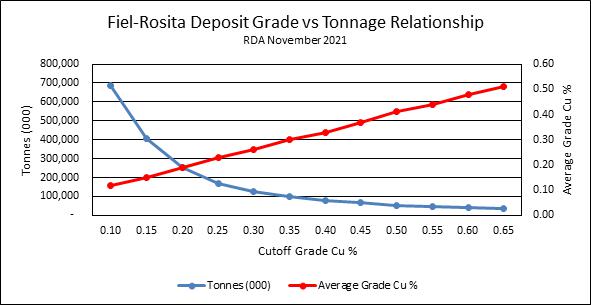

| Table 11-4 | Grade / Tonnage Relationship of Fiel Rosita Deposit | 75 |

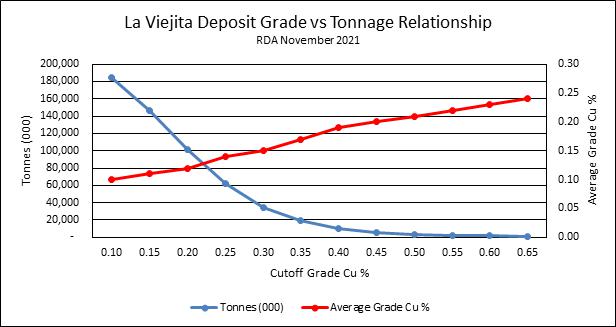

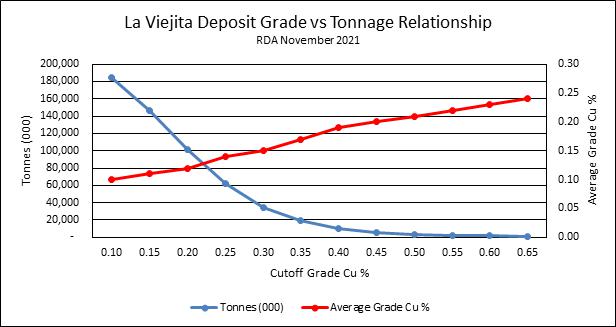

| Table 11-5 | Grade Tonnage Relationship of La Viejita Deposit | 76 |

| Table 11-6 | Grade / Tonnage Relationship for El Chiflon Deposit | 77 |

| Table 11-7 | Fiel Rosita Project Grade Tonnage Relationship | 78 |

| Table 11-8 | Fiel Rosita Project Indicated Mineral Resource | 79 |

| Table 11-9 | Fiel Rosita Inferred Mineral Resources | 79 |

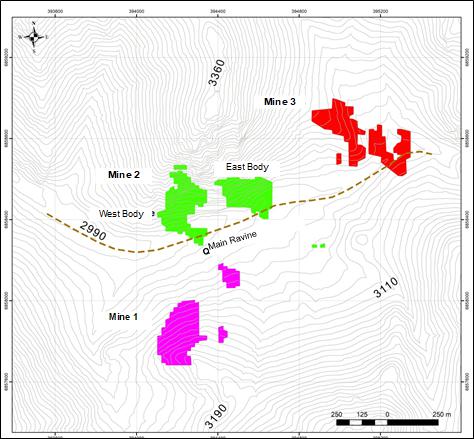

| Table 13-1 | Dimensions of Mineralized Zones | 83 |

| Table 13-2 | Summary of Geotechnical Units | 86 |

| Table 13-3 | Summary of horizontal tasks | 93 |

| Table 13-4 | Summary of vertical tasks | 93 |

| Table 13-5 | Underground Mining Fleet | 94 |

| Table 18-1 | Mining CAPEX | 102 |

| Table 18-2 | Plant CAPEX | 103 |

| Table 18-3 | Mining OPEX | 104 |

| Table 18-4 | Plant OPEX | 105 |

| Table 19-1 | Summary Mining Plan and Criteria for the Economic Analysis Including Inferred Mineral Resources | 107 |

| Table 19-2 | Summary Mining Plan and Criteria for the Economic Analysis Excluding Inferred Mineral Resources | 108 |

| Table 19-3 | Summary of the economic analysis of underground mining of the Project Including Inferred Mineral Resources | 109 |

| Table 19-3 | Summary of the economic analysis of underground mining of the Project Excluding Inferred Mineral Resources | 110 |

| Table 19-5 | Sensitivity Analysis Summary | 111 |

| Table 19-6 | Sensitivities to NPV by varying metallurgical recoveries | 113 |

| Table 23-1 | Proposed Exploration Work Program to Delineate Fiel Rosita Mineral Resources | 117 |

| Table 23-2 | Pre-Feasibility Cost Breakdown | 118 |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page IV |

| | |

List of Figures

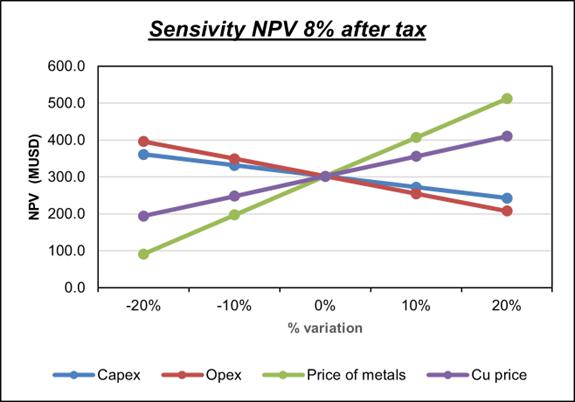

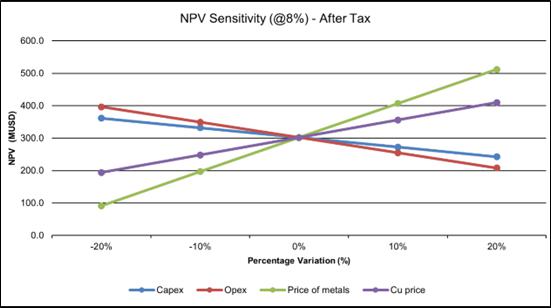

| Figure 1-1 | Sensitivity of Fiel Rosita to varying metal prices, OPEX and CAPEX. | 8 |

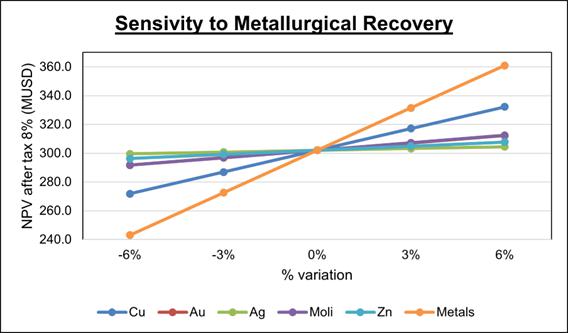

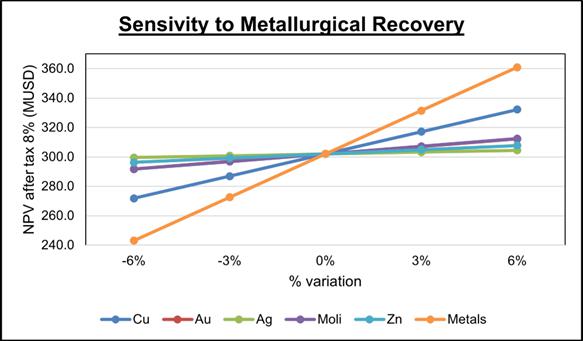

| Figure 1-2 | Sensitivity of Fiel Rosita to varying metallurgical recoveries. | 8 |

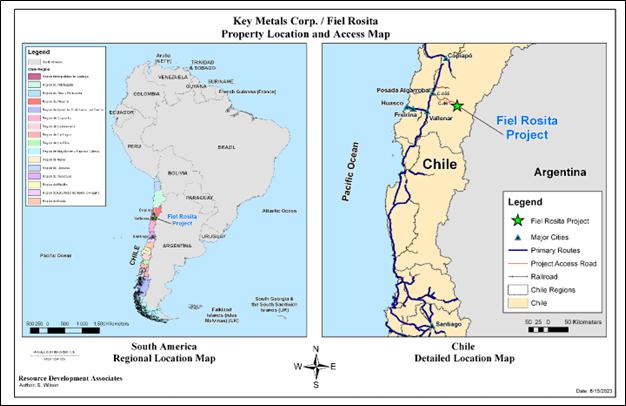

| Figure 3-1 | Location of the Fiel Rosita Project | 20 |

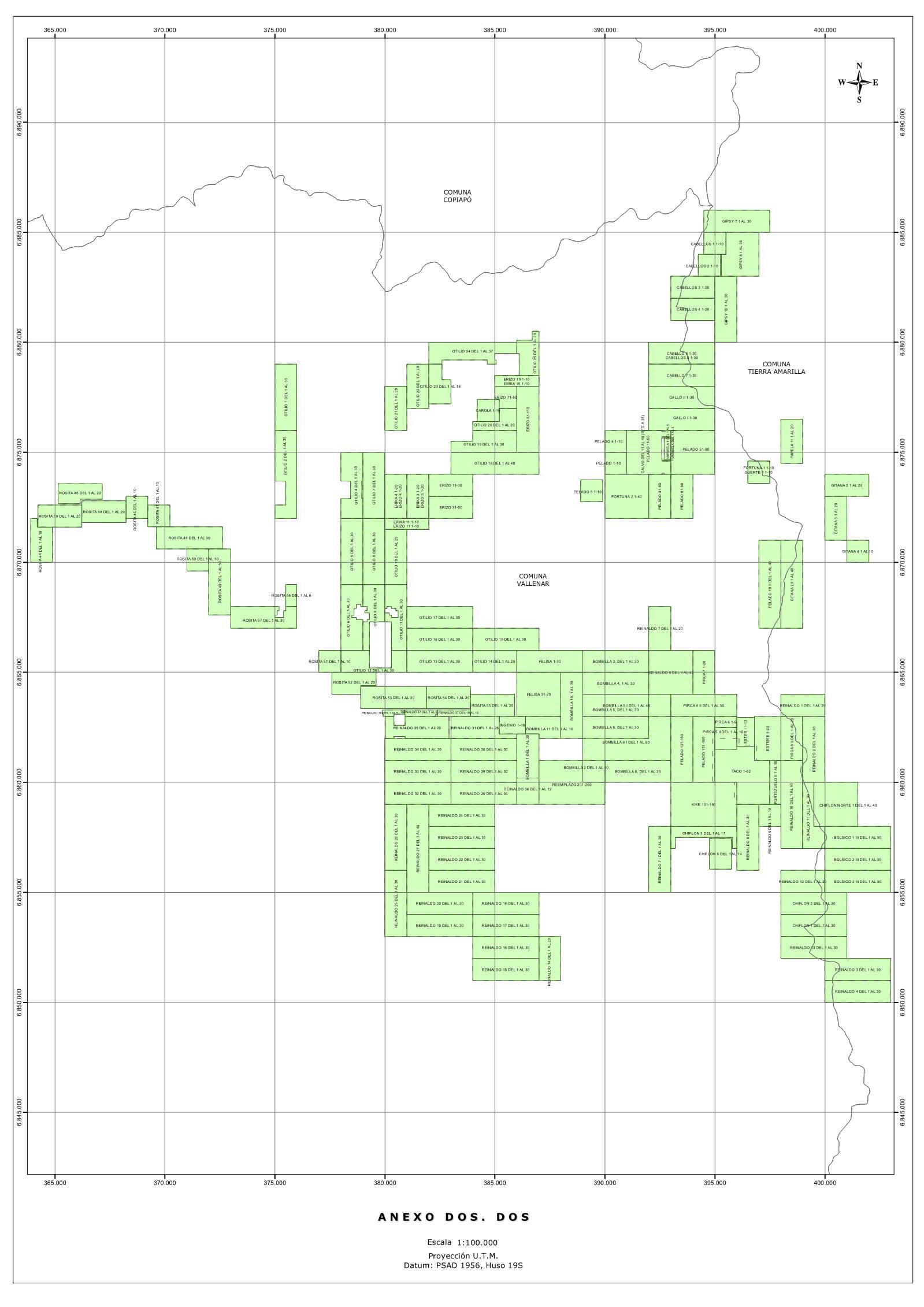

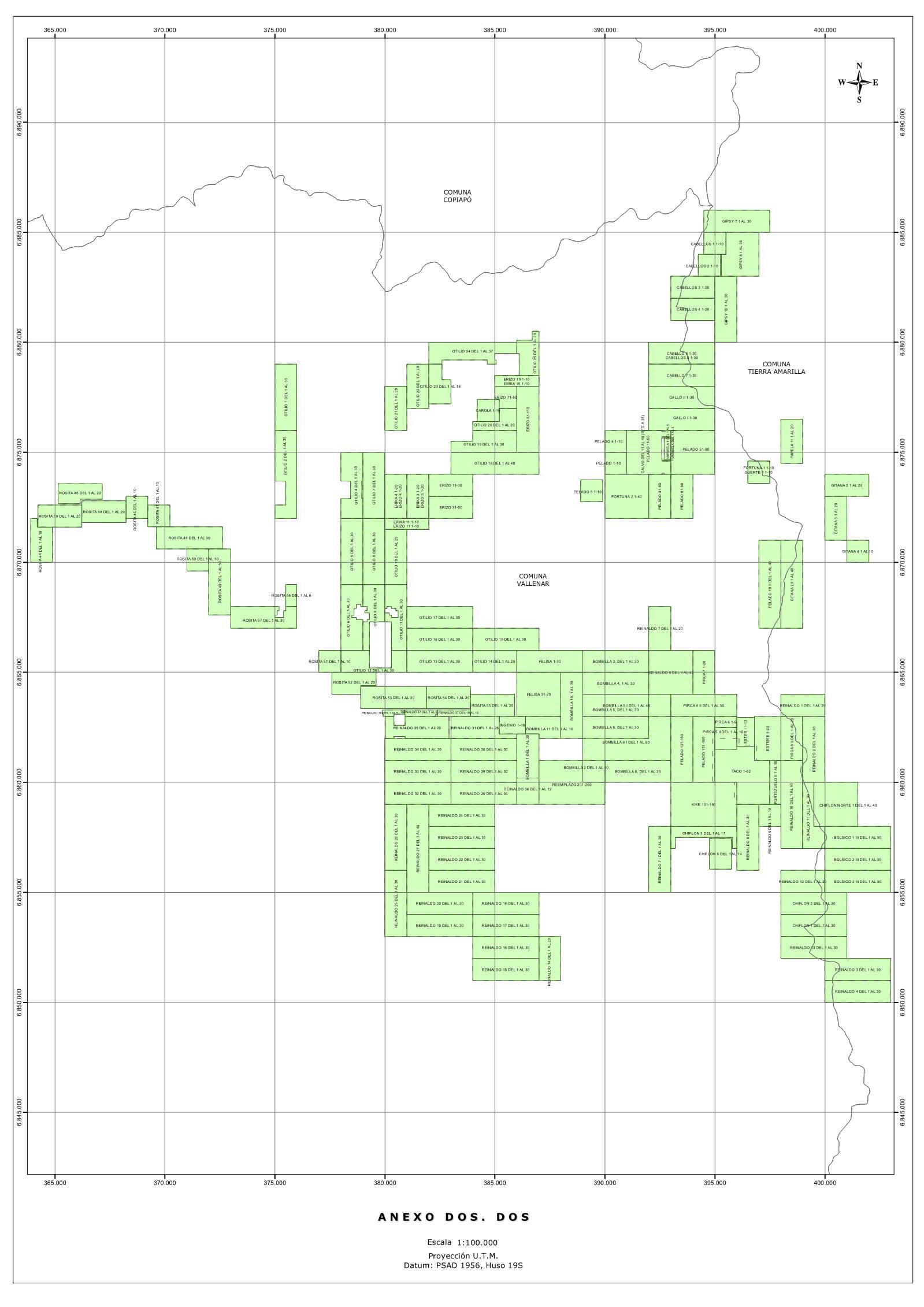

| Figure 3-2 | Layout and Location of the Concessions | 33 |

| Figure 4-1 | Overview and cross section showing the morpho-structural units and topography in the Atacama Region in relation to Fiel Rosita | 36 |

| Figure 4-2 | Climate zones of the Atacama region with Koppen Climate Classification scheme. | 37 |

| Figure 4-3 | Monthly precipitation in the Tierra Amarilla Sector Years 2013-2022 | 38 |

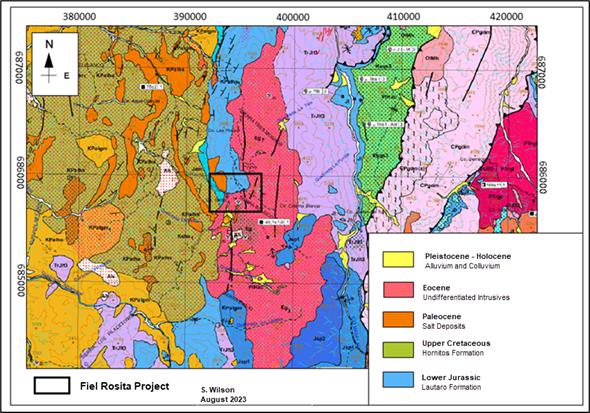

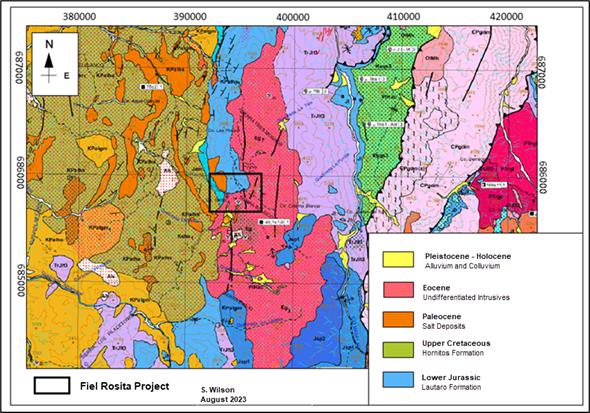

| Figure 6-1 | Geologic Map showing the regional geology of the Fiel Rosita Project | 41 |

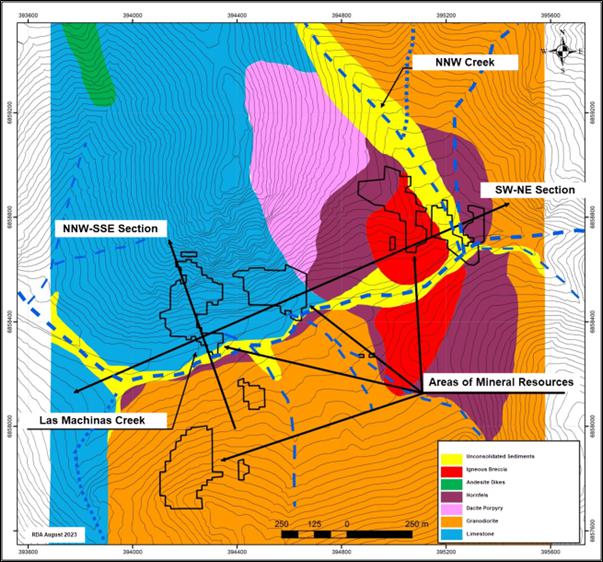

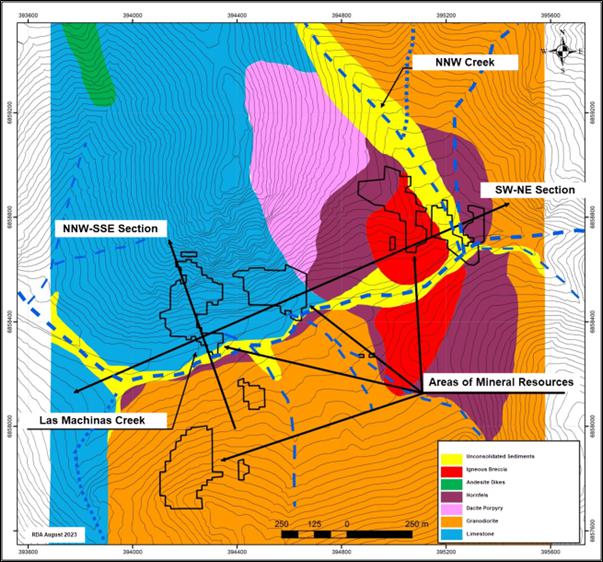

| Figure 6-2 | Lithologic map of the Fiel Rosita Project | 42 |

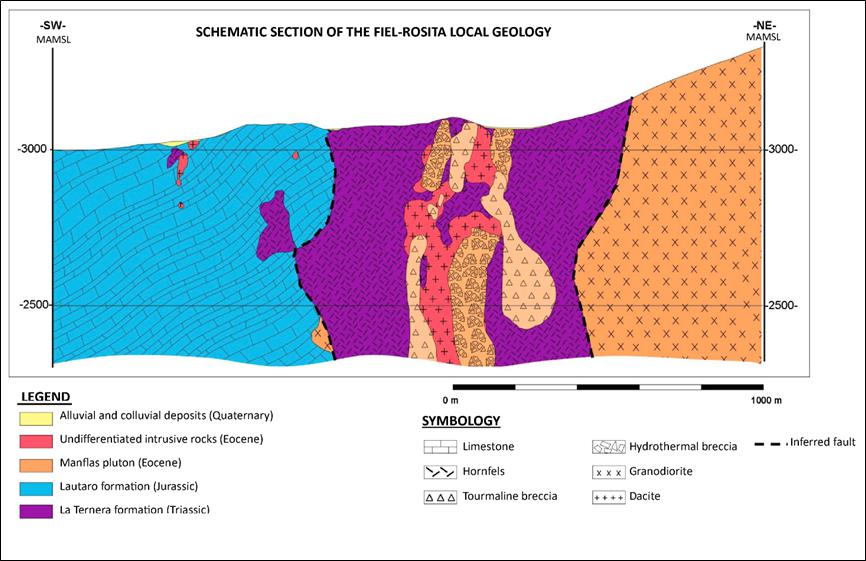

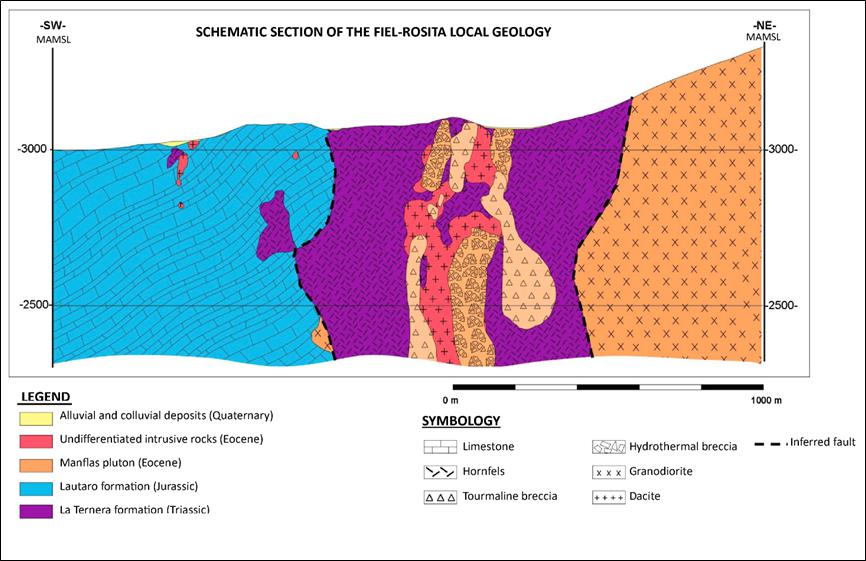

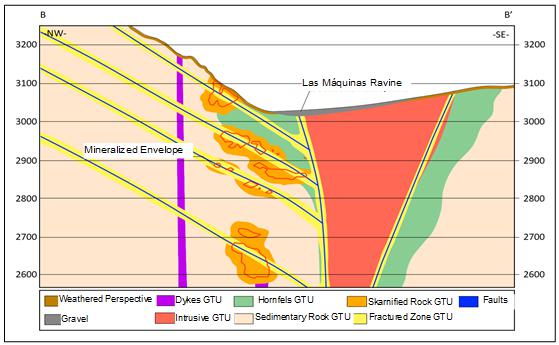

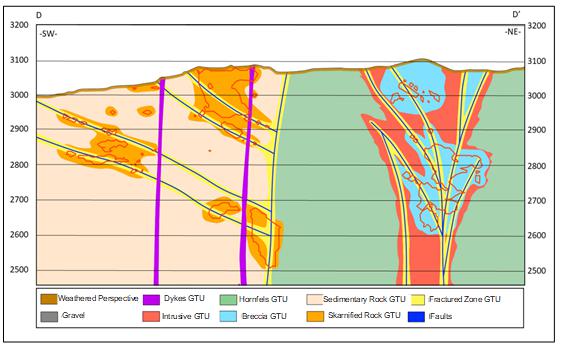

| Figure 6-3 | Fiel-Rosita Cross Section | 43 |

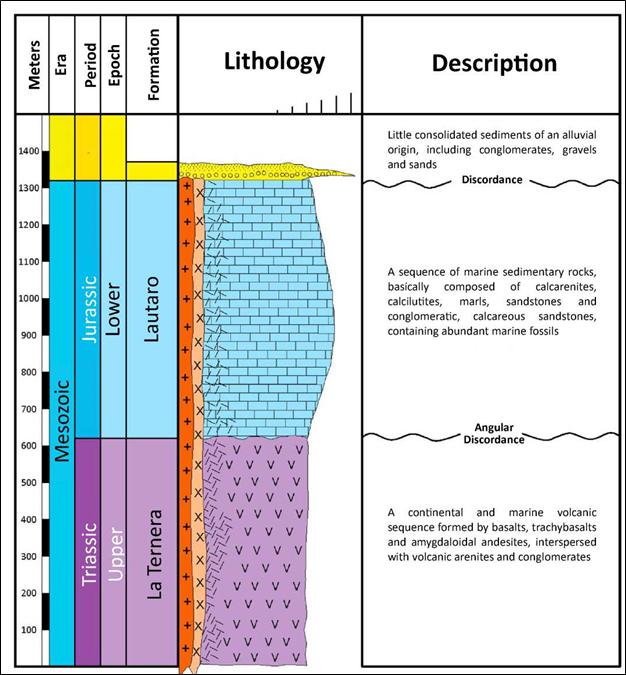

| Figure 6-4 | Stratigraphic Section for Fiel Rosita | 44 |

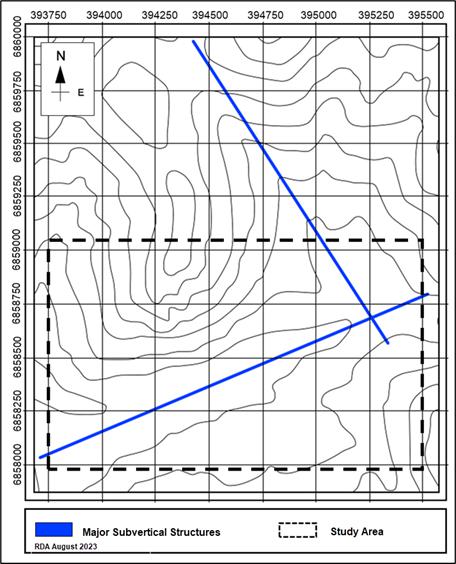

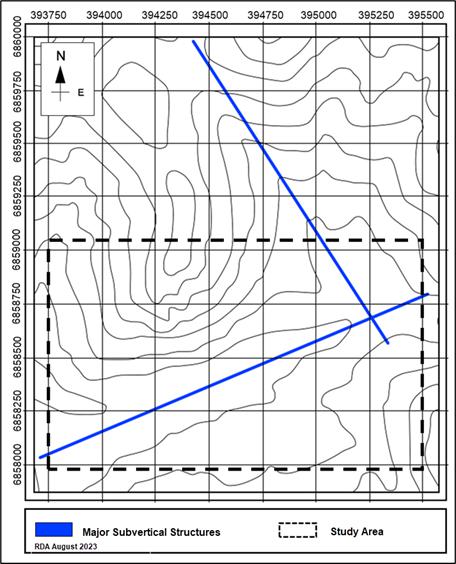

| Figure 6-5 | Major fault structures of the deposit | 45 |

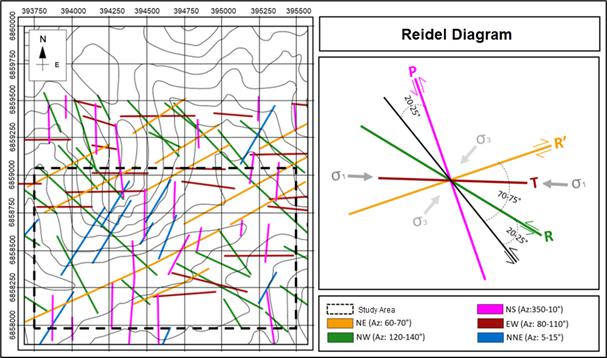

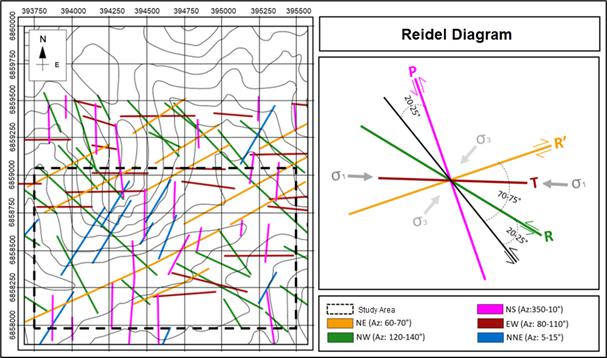

| Figure 6-6 | Left: Aerial interpretation of structural domains. Right: Interpretations of the structures using the Riedel model. | 46 |

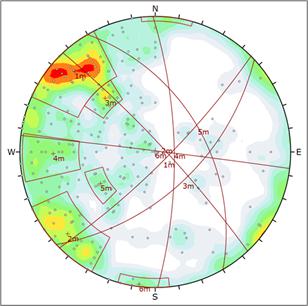

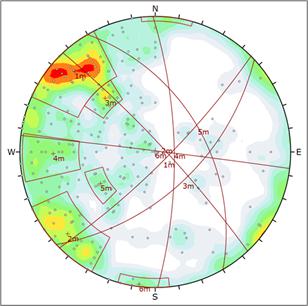

| Figure 6-7 | Minor joint systems | 46 |

| Figure 6-8 | Fiel Rosita Prospect Alteration Map | 48 |

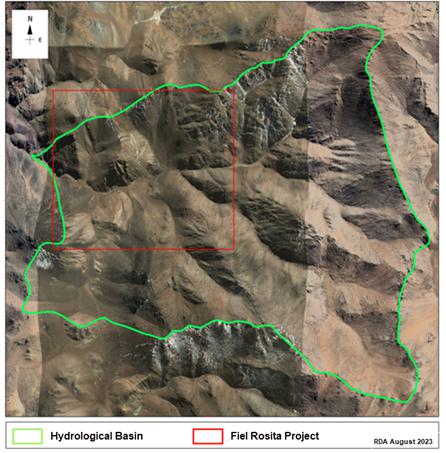

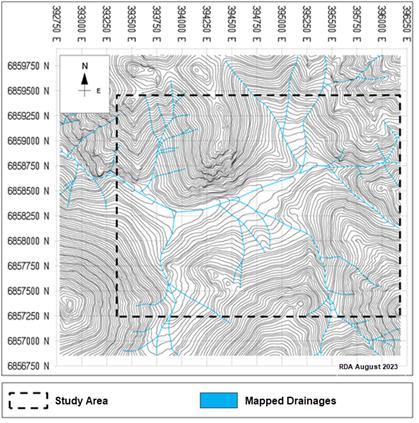

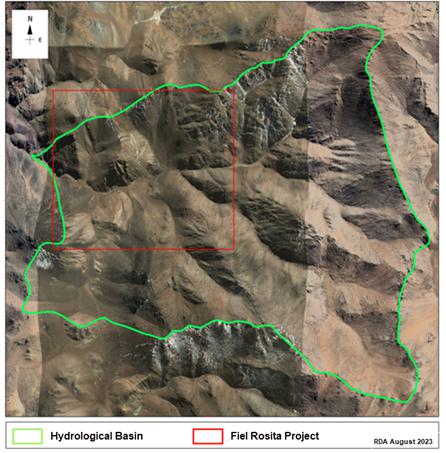

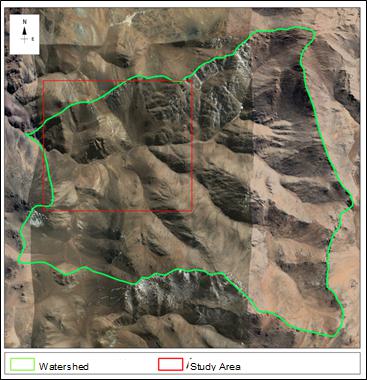

| Figure 6-9 | Fiel Rosita hydrogeological basin | 49 |

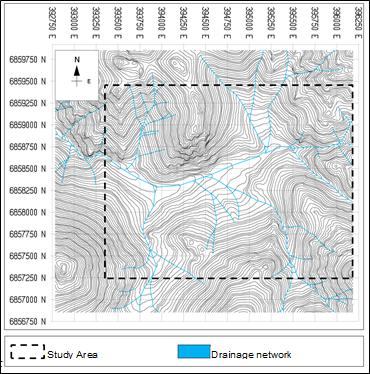

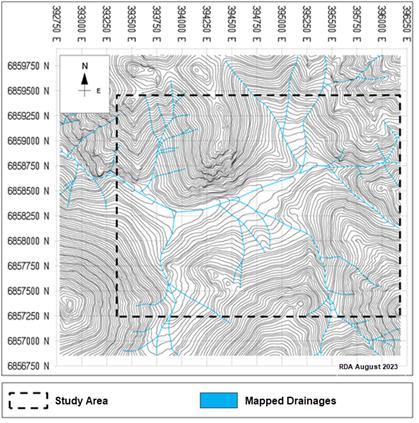

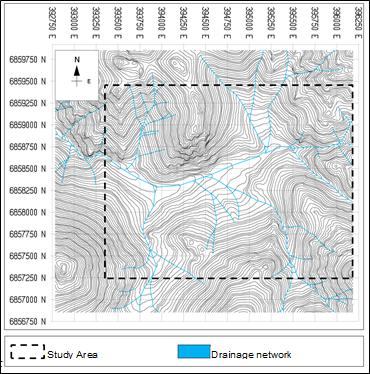

| Figure 6-10 | Drainage network of the Project area | 50 |

| Figure 7-1 | A) Drill Platform; B) Interpretation Section; C) Detail of a Mineralized Nucleus; D) Reject Storage; E) RC-DDH Core-Sample Storage, and F) El Chiflón and Camp. Storage facilities and Camp have been dismantled and no longer exist at the Project site. | 53 |

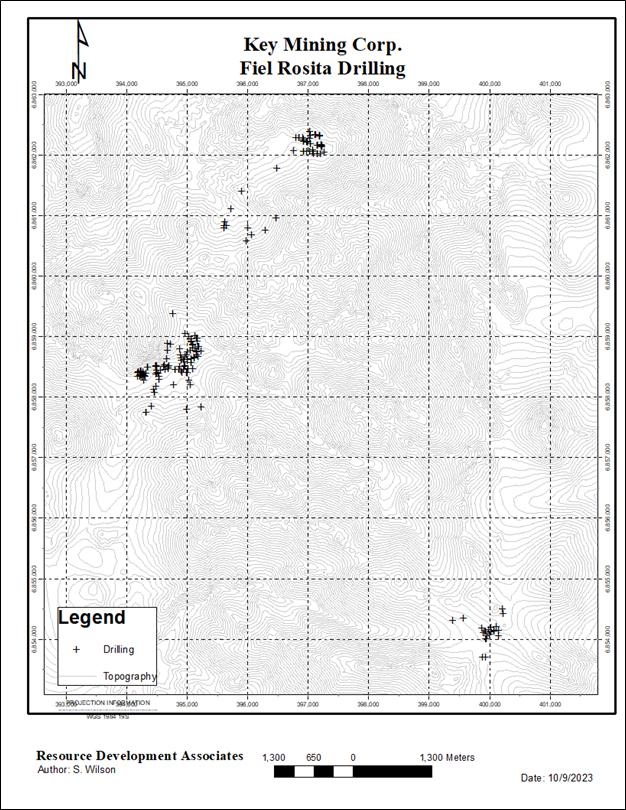

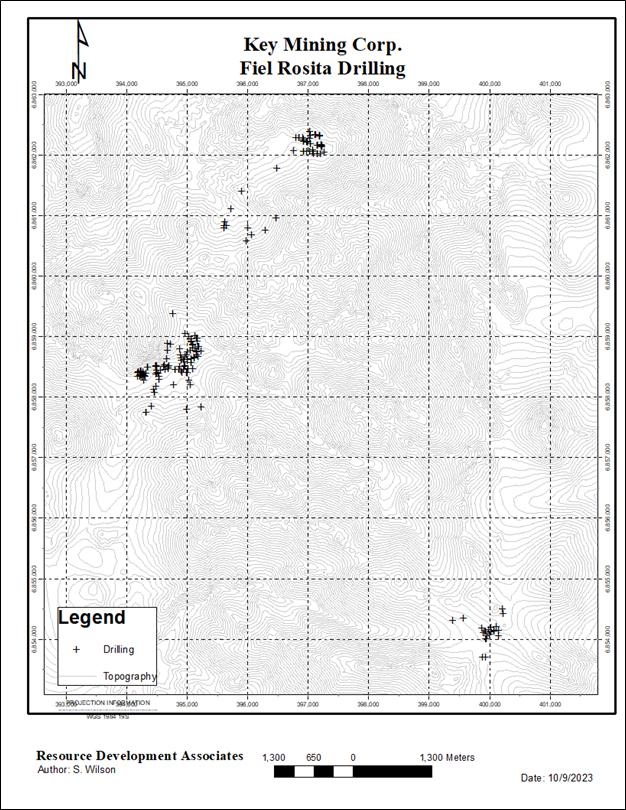

| Figure 7-2 | Fiel Rosita Drilling Plan Map | 54 |

| Figure 10-1 | Average mineralogy of variability compounds for flotation | 63 |

| Figure 10-2 | Average distribution of copper sulfides of variability compounds for flotation. | 63 |

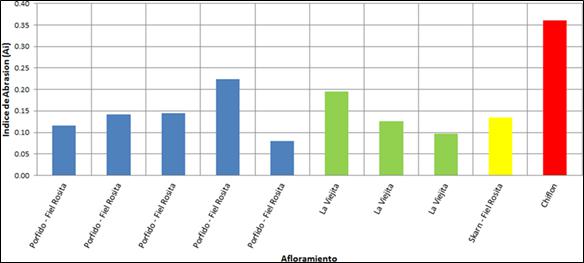

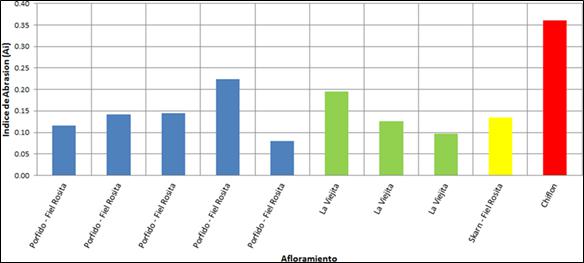

| Figure 10-3 | Abrasion Index, Ai, by sample. | 66 |

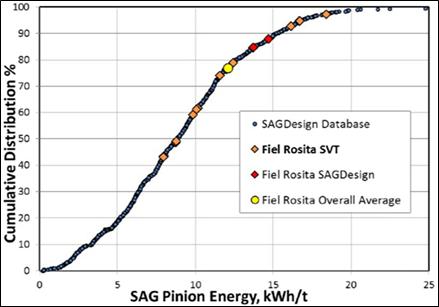

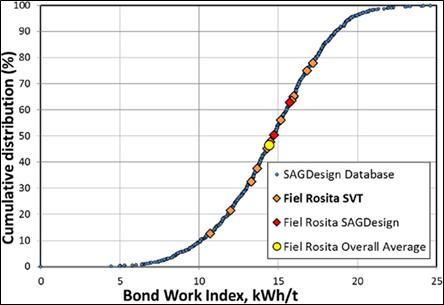

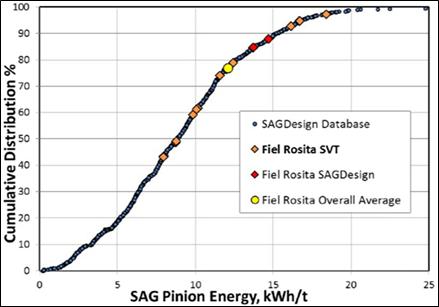

| Figure 10-4 | SAG Design results, for Fiel Rosita, compared to the S&A database | 67 |

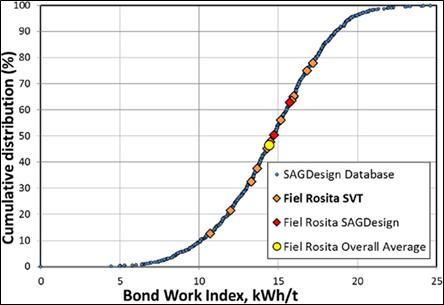

| Figure 10-5 | SVT results, for Fiel Rosita, compared to the S&A database | 67 |

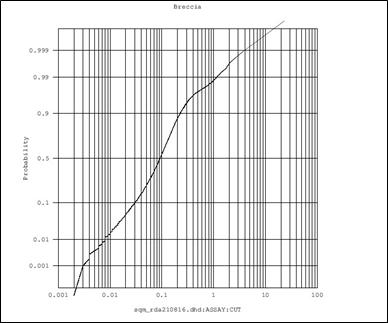

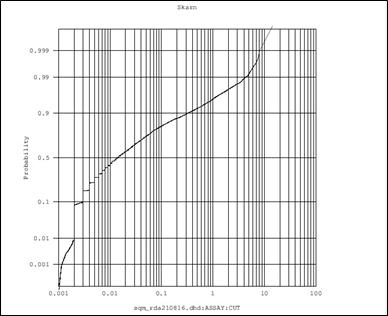

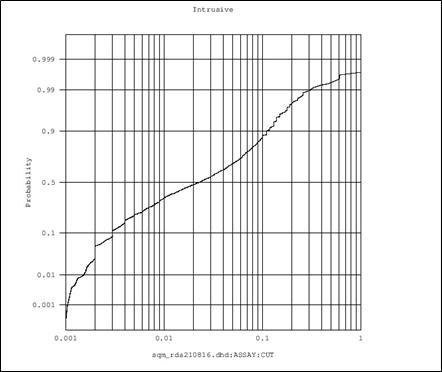

| Figure 11-1 | Breccia Log Prob Plot | 70 |

| Figure 11-2 | Skarn Log Prob Plot | 71 |

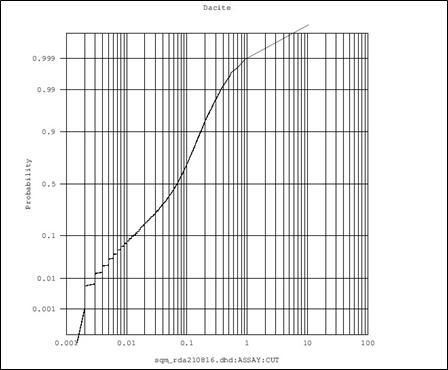

| Figure 11-3 | Hornfels Log Prob Plot | 71 |

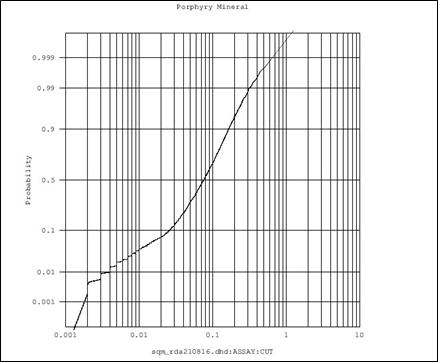

| Figure 11-4 | Dacite Log Prob Plot | 72 |

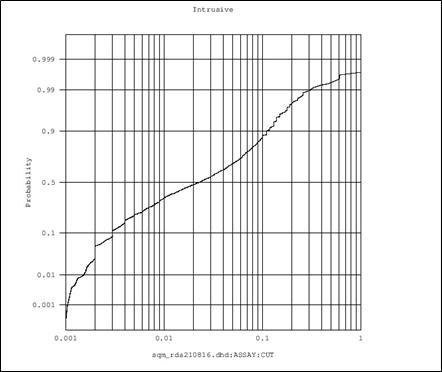

| Figure 11-5 | Porphyry Log Plot | 72 |

| Figure 11-6 | Intrusive Log Plot | 73 |

| Figure 11-7 | Distribution of Cu Estimation Domains | 74 |

| Figure 11-8 | Fiel Rosita Grade Tonnage Relationship | 75 |

| Figure 11-9 | Cu-Equivalent Tonne/Grade Curve El Chiflon | 77 |

| Figure 11-10 | Fiel Rosita Area Grade / Tonnage Relationship | 78 |

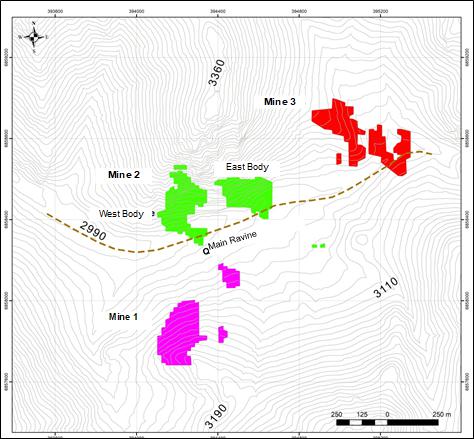

| Figure 13-1 | Mineralized Zones of the Fiel Rosita Deposit | 82 |

| Figure 13-2 | Mining Layout | 84 |

| Figure 13-3 | Geotechnical unit construction layout of the Project | 85 |

| Figure 13-4 | Overview showing geotechnical sections | 87 |

| Figure 13-5 | Representative section of the geotechnical units for the west mineral body | 88 |

| Figure 13-6 | Representative section of the geotechnical units for the central mineral body | 88 |

| Figure 13-7 | Representative section of the geotechnical units for the central mineral body | 89 |

| Figure 13-8 | Representative section of the geotechnical units for the Fiel Rosita Project | 89 |

| Figure 13-9 | Fiel Rosita hydrogeological basin | 90 |

| Figure 13-10 | Drainage network of the Project | 91 |

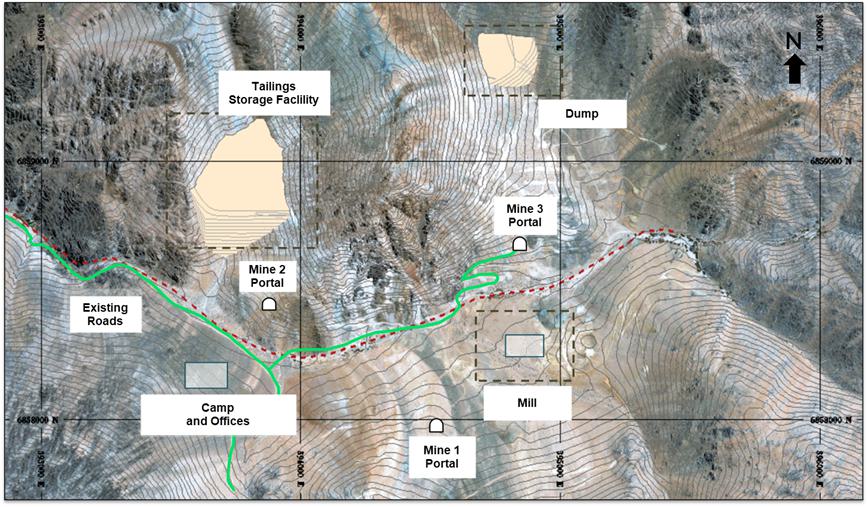

| Figure 13-11 | Overview of mining access and infrastructure | 92 |

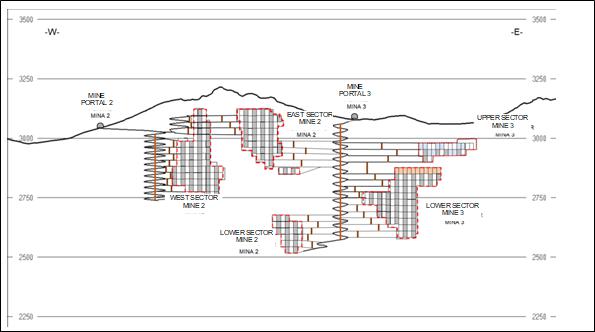

| Figure 13-12 | Underground Mining Layout | 93 |

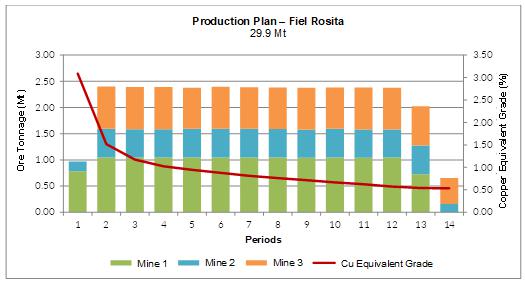

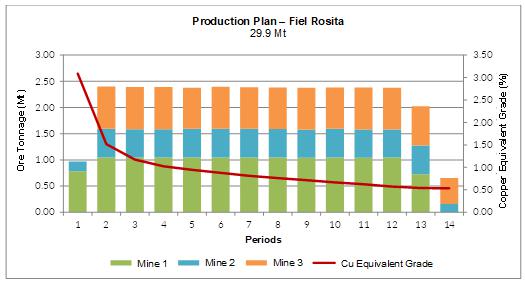

| Figure 13-13 | Fiel Rosita Mine Production Plan | 94 |

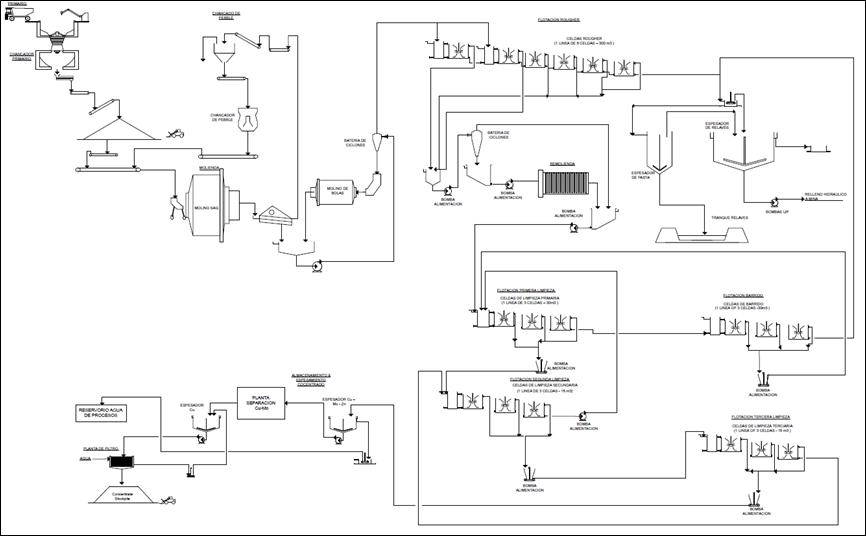

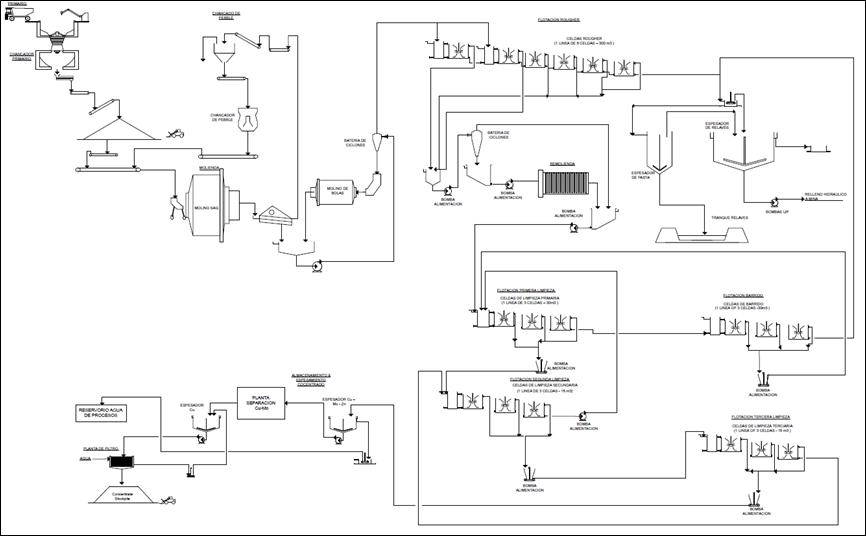

| Figure 14-1 | Processing Flow Diagram | 96 |

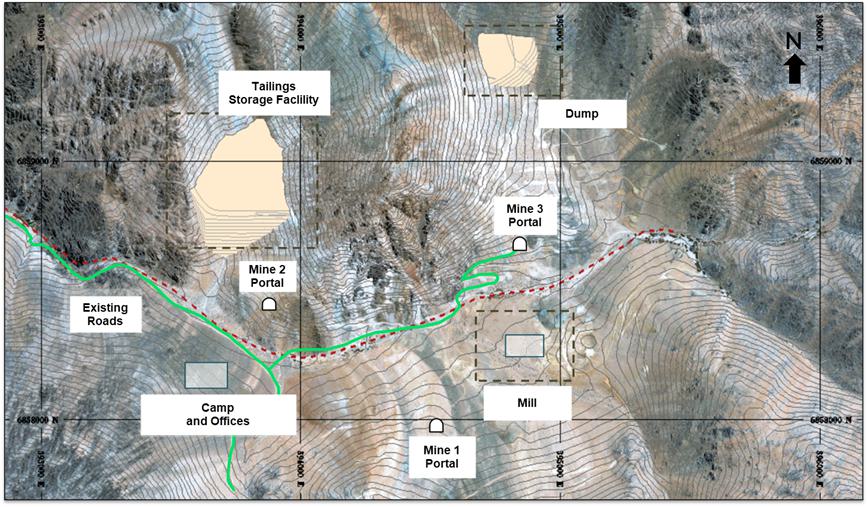

| Figure 15-1 | General layout of the Fiel Rosita Infrastructure | 98 |

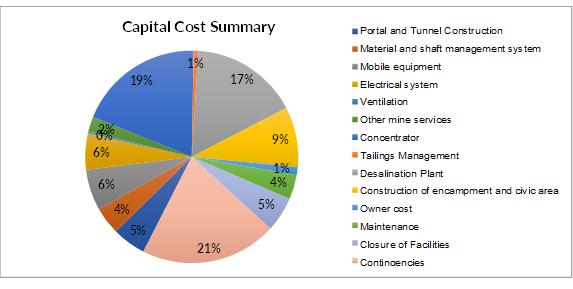

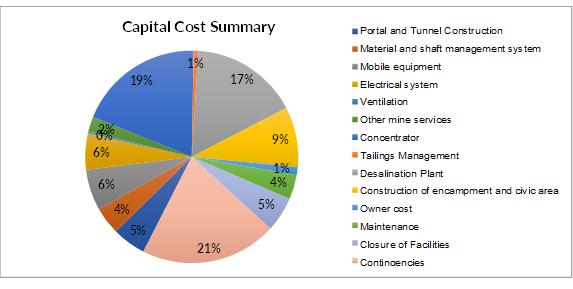

| Figure 18-1 | Distribution of Project Capital Expenditures | 103 |

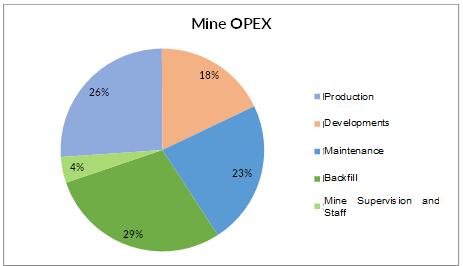

| Figure 18-2 | Distribution of mining OPEX | 106 |

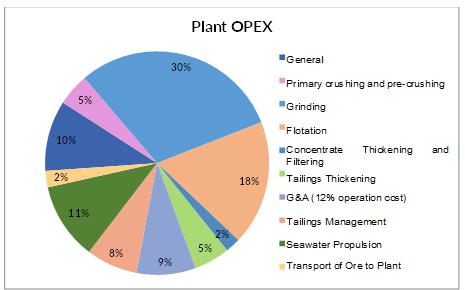

| Figure 18-3 | Distribution of processing OPEX | 106 |

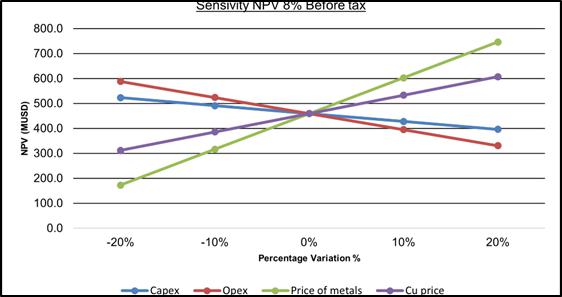

| Figure 19-1 | Sensitivity Analysis (Pre-Tax) | 111 |

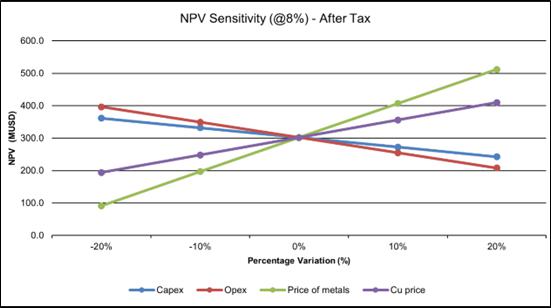

| Figure 19-2 | Sensitivity Analysis (Post-Tax) | 112 |

| Figure 19-3 | Sensitivity of varying metallurgical recoveries | 113 |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page V |

| | |

| TABLE OF ABBREVIATIONS |

| Abbreviation | Description |

| m | Meters(s) |

| km | Kilometer(s) |

| g/t | Grams / tonne |

| oz | Ounces |

| au | Gold |

| ag | Silver |

| cu | Copper |

| zn | Zinc |

| pb | Lead |

| AA | Atomic absorption |

| AuEq | Gold equivalent |

| AOI | Area of Influence |

| AMR | Advanced Mineral Royalties |

| CuEq | Copper Equivalent |

| FA | Fire Assay with Atomic Absorption Finish |

| GPS | Global Positioning System |

| ICP | Inductively Coupled Plasma (Geochemical analytical method) |

| LOM | Life of Mine |

| NSR | Net Smelter return |

| RQD | Rock quality designation |

| RC | Reverse circulation |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page VI |

| | |

| COMMON UNITS OF MEASUREMENT |

| Unit | Description |

| g | Gram |

| k | Kilo (thousand) |

| < | Less than |

| M | Million |

| ppb | Parts per billion |

| ppm | Parts per million |

| % | Percent |

| m2 | Square meter |

| t | Tonne |

| Tonne | 2,204.62 pounds |

| tpd | Tonnes per day |

| tph | Tonnes per hour |

| tpy | Tonnes per year |

| CHEMICAL SYMBOLS |

| Abbreviation | Description |

| Cu | Copper |

| CN | Cyanide |

| Au | Gold |

| H | Hydrogen |

| Fe | Iron |

| Pb | Lead |

| Ag | Silver |

| Na | Sodium |

| S | Sulfur |

| Zn | Zinc |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 1 |

| | |

The Fiel Rosita Project (herein also referred to as “the Project” or “Fiel-Rosita”) is a polymetallic exploration project located in Region III, Chile, South America. The Project is located some 200 km southeast of Copiapó in a mining district that has been actively exploited for decades.

This Technical Report Summary (“TRS”) was prepared and compiled by Resource Development Associates Inc. (“RDA”) at the request of Key Mining Corp. (“KM US”). The purpose of this report is to summarize the results of an initial assessment and scoping study for the Project mineral deposit. This TRS has been prepared in accordance with §§229.1300 through 229.1305 (subpart 229.1300 of Regulation S-K).

This TRS includes an initial assessment based on a scoping, effective as of March 31, 2023 which has an optimized configuration of 7,000 t/d from an underground blast/load/haul, sub-level open stope mining operation. Mill feed would be processed in a 7,000 t/d comminution circuit consisting of primary and secondary crushing, wet grinding in a single semi-autogenous (SAG) mill and single ball mill, followed by conventional selective flotation and separation of three concentrates. Concentrates will be trucked to a nearby port and shipped to smelters worldwide. Refined metals will be sold at contract prices.

For financial modeling tonnages are reported in metric tonnes and all costs are reported in $/t.

All monetary units are in United States dollars ($, US$), unless otherwise specified. Costs are based on first quarter (Q1) 2023 dollars.

The reader is advised that the results of the Initial Assessment (“IA”) summarized in this TRS are intended to provide an initial, high-level review of the proposed project configuration and design options. The IA mining plan and economic model include numerous assumptions. There is no guarantee the Project economics described herein will be achieved.

The key outcomes of the IA are the following:

| ● | The Fiel Rosita Project Mineral Resource is estimated at 195 M Indicated tonnes at average grades of 0.18% Cu (348 Kmt), 100 ppm Mo (43,197 Klbs), 0.15 ppm Au (942 Koz), 2.83 ppm Ag (17,715 Koz) and 0.12% Zn (233 Kmt). Inferred Mineral Resources are estimated at 168 M tonnes at average grades of 0.16% Cu (267 Kmt), 254 ppm Mo (93,82 Klbs), 0.09 ppm Au (503 Koz), 2.83 ppm Ag (15,311 Koz) and 0.11% Zn (179 Kmt). |

| ● | The mine plan developed for the IA provides sufficient feed to support an annual production rate of 19.8 Mlb Cu, 2.3 Mlb Mo, 11 Koz Au, 273 Koz Ag and 12.7 Mlb Zn over 14 years. |

| ● | The initial capital cost (-50% / + 50% accuracy) of the underground mine, processing plant and general site infrastructure is estimated at US$342.95M, including contingency of US$64.81M. |

| | | |

| ● | LOM project sustaining capital costs total US$14.1M and closure costs are estimated at US$20.0M. |

| | | |

| ● | The mining cost (including G&A) is estimated at US$19.2/t mined, processing plant operating cost (including G&A) is estimated at an average of US$10.08/t processed. |

| | | |

| ● | All-in sustaining cost of production is estimated at US$1.36/Cu Lb including sustaining capital and before royalties, mining and income taxes. |

| | | |

| ● | Scheduled Mineral Resources are based on 29.9M tonnes of combined indicated and inferred mineralization. There are 15.25Mt of Inferred Mineral Resources which accounts for 51% of the tonnage. |

| | | |

| ● | The annual production for the project excluding Inferred Mineral Resources is 22.6 Mlb Cu, 0.89 Mlb Mo, 0.01 Koz Au, 0.3 Koz Ag and 12.3 Mlb Zn over 8 years. |

| | | |

| ● | Base Case (US$4.10/Cu lb) Including Inferred Mineral Resources has positive Project NPV of US$302M at an 8% discount rate and an IRR of 37% after mining and income taxes. Payback period is two years. |

| | | |

| ● | Base Case (US$4.10/Cu lb) excluding Inferred Mineral Resources has positive Project NPV of US$82M at an 8% discount rate and an IRR of 18% after mining and income taxes. Payback period is three years. |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 2 |

| | |

KM US operates the Fiel Rosita Project in Chile through its wholly owned Chilean subsidiary, Key Metals Corporation Chile (“KM Chile”), an agreement with Sociedad Química y Minera de Chile S.A. (“SQM”) which calls for KM Chile to spend $20 million in qualified exploration and development expenditures and make $10 million in payments plus a variable royalty to SQM over the next five years to earn an eighty percent (80%) interest the Fiel Rosita Project.

| 1.4 | Geology and Mineralization |

The Fiel Rosita district is located between the Lower Cretaceous to Paleocene metallogenic belt to the west and that of the Eocene to Miocene to the east. Within the project area the primary geologic feature recognized is formed by the contact between the Eocene age Manflas composite pluton containing several porphyritic intrusions and younger breccias, on the east, and the stratified sequences of the Lautaro Formation (Lower-Middle Jurassic) and the Picudo Formation (Upper Jurassic) on the west. This contact runs in a north-south direction.

The district includes the Fiel Rosita Skarn and Porphyry, La Viejita and El Chiflón porphyry style deposits and several other copper and precious metals prospects.

The first two deposits are located in contact with a volcanic-sedimentary series (referred to as a skarn) with the Manflas pluton. La Viejita and El Chiflón deposits are each sub-vertical porphyry and breccia bodies hosted within the Manflas pluton. A thin overburden partly covers the various deposits.

The borehole database received from KM Chile contains 201 boreholes, with a total of 63,706.84 m drilled, 191 of which are in the areas of interest, providing information on a total of 51,713.36m. Most of this available information includes an analysis of %Cu, Mo ppm, Au ppm, Ag ppm and % Zn.

The current sample collection, assaying and certification of assays are consistent with current operating practices. The sampling methods were standardized and tracked. Sample preparation, analysis and security are handled by reputable laboratories. All data had been verified by Golder and Associates before being entered into the drill hole database for grade estimation.

Industry accepted standard practices were used during all drilling programs on the Project. Drill holes were oriented to cross the mineralized zones based on surface and geologic mapping and other geological investigative techniques.

RDA generated the mineralized resource calculation for the Fiel Rosita Project using industry accepted standards. Mineralization has been categorized as either 1) Indicated Mineral Resources or 2) Inferred Mineral Resources.

Three-meter length composites were used for the estimation of Mineral Resources. The results were calculated using Vulcan software and stored in a Vulcan block model. Inverse Distance Cubed estimation techniques were used to estimate mineralization throughout the deposit. Resources were classified as Indicated or Inferred based on the drilling density of the Fiel Rosita drilling data. Resources are reported at a copper equivalent cutoff grade of 0.2% based on selling prices of $3.50/lb Cu, $14.00/lb Mo, $1,750/oz Au, $23.00/oz Ag and $1.10/lb Zn, at the date of July 17,2023.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 3 |

| | |

Table 1-1 Fiel Rosita Project Indicated Mineral Resource

| Deposit | CuEq Cutoff | K mt | CuEq% | Cu % | Mo ppm | Au ppm | Ag ppm | Zn % |

| Fiel Rosita | 0.25% | 66,092 | 0.61 | 0.29 | 173 | 0.12 | 5.89 | 0.29 |

| La Viejita | 0.25% | 58,520 | 0.34 | 0.14 | 31 | 0.24 | 1.21 | 0.02 |

| El Chiflon | 0.25% | 5,039 | 0.55 | 0.19 | 765 | 0.02 | 0.92 | 0.01 |

| Total | | 129,651 | 0.49 | 0.22 | 132 | 0.17 | 3.58 | 0.16 |

| | | | Metal | Cu Kmt | Mo Klbs | Au Koz | Ag Koz | Zn Kmt |

| | | | Fiel Rosita | 192 | 25,168 | 255 | 12,517 | 192 |

| | | | La Viejita | 82 | 4,032 | 452 | 2,277 | 12 |

| | | | El Chiflon | 10 | 8,504 | 3 | 149 | 1 |

| | | | Total | 283 | 37,703 | 710 | 14,943 | 204 |

Table 1-2 Fiel Rosita Inferred Mineral Resources

| Deposit | CuEq Cutoff | K mt | CuEq% | Cu % | Mo ppm | Au ppm | Ag ppm | Zn % |

| Fiel Rosita | 0.25% | 104,429 | 0.51 | 0.19 | 363 | 0.12 | 3.59 | 0.12 |

| La Viejita | 0.25% | 3,442 | 0.32 | 0.19 | 28 | 0.21 | 1.20 | 0.02 |

| El Chiflon | 0.25% | 144 | 0.46 | 0.28 | 352 | 0.01 | 1.08 | 0.01 |

| Total | | 108,015 | 0.50 | 0.19 | 352 | 0.12 | 3.51 | 0.12 |

| | | | Metal | Cu Kmt | Mo Klbs | Au Koz | Ag Koz | Zn Kmt |

| | | | Fiel Rosita | 198 | 83,603 | 403 | 12,055 | 125 |

| | | | La Viejita | 5 | 216 | 23 | 133 | 1 |

| | | | El Chiflon | 1 | 112 | 0 | 5 | 0 |

| | | | Total | 203 | 83,930 | 426 | 12,192 | 126 |

The date of the mineral resource estimate is July 17, 2023.

Mineral resources for the Project are enumerated as per §229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K).

Mineral resources are not mineral reserves and do not meet the threshold for reserve modifying factors, such as economic viability, that would allow for conversion to mineral reserves. There is no certainty that any part of the Mineral Resources estimated will be converted to mineral reserves.

Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Three areas within the Fiel Rosita mineral body have been selected for this scoping study. Sub Level Open Stoping (SLOS) mining methods will be utilized for the Project. Cement backfilling of the stopes will aid in this mining method. Stope dimensions will vary depending on rock mass quality. Backfilling will be accomplished through a network of shafts and piping that connect the cement plant with the mine.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 4 |

| | |

Mineralization will be accessed by three portals; one for each mine. Production will be carried out using drilling/ blasting/hauling underground mining methods.

Processing at the Project will be accomplished by conventional flotation of three processing streams:

| 1. | Copper concentrates which also recover gold and silver |

Comminution will be through primary crushing followed by a SAG mill and ball mill. Three separate concentrates will be produced through selective flotation and stockpiled. Water will be recycled and tailings stored in a properly designed tailings storage facility.

The infrastructure to support the Fiel Rosita Project will consist of the mine site, facilities, offices, and workshops, water management systems, tailings storage, waste material disposal, and electric power distribution. The mine and plant facilities will have potable water, compressed air, power, diesel, communication and sanitary systems, as required.

| 1.10 | Capital Cost and Operating Cost Estimate |

The total estimated preproduction capital cost (+/- 50%) to design, procure, construct and commission the Project facilities, including reclamation activities, is estimated to be US$260.27M. The estimated sustaining capital cost required by the Project is US$14.1M. Contingencies and indirect costs are estimated to be US$82.69M. Closure costs are estimated at US$20.0M. The cumulative LOM capital expenditures (preproduction and sustaining capital) are estimated to be US$377.06M. Table 1-3 summarizes the initial capital and sustaining capital costs by major area.

Table 1-3 Initial capital and sustaining capital costs by major area (US$ Millions)

| Cost Item | Initial US$M | Sustaining US$M |

| Mine Equipment | 23.47 | |

| Mine Development | 35.15 | |

| Processing Facilities | 74.92 | 14.1 |

| Infrastructure | 84.61 | |

| Power Supply | 14.85 | |

| Construction | 27.27 | |

| Contingency | 64.81 | |

| Owner’s Cost | 4.61 | |

| Total | 325.69 | |

Note: Rounding of some figures may lead to minor discrepancies in totals

The operating cost estimate for the Project includes all expenses incurred to operate the mine and process plant from the start of Year 1 through Year 14 at a daily average production rate of 7,000 mt/d. The expected accuracy for the operating cost estimate is that of an initial assessment study level (+/- 50%). Any process material excavated during the preproduction period is considered as a capital expense. The average operating cost over the life of mine is estimated to be US$36.09/t.

The total operating cost estimate summaries are shown in Table 1-4 for the three major operating cost areas: mining, processing and general and administrative (G&A). The unit costs areas are shown in terms of total cost LOM per processed tonne milled and total cost per pound of copper produced.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 5 |

| | |

Table 1-4 Total operating cost breakdown (LOM average)

| Cost Item/Area | Total $M | Average ($/t milled) | Average ($lb Cu Recovered) | Average ($lb CuEq Recovered) |

| Mining | 602.6 | 20.15 | 2.17 | 0.92 |

| Processing | 316.7 | 10.59 | 1.14 | 0.48 |

| General and Administrative | 24.2 | 0.81 | 0.09 | 0.04 |

| Total Onsite Mine Operating Costs | 943.5 | 31.55 | 3.40 | 1.44 |

| Treatment and Sales | 135.7 | 4.54 | 0.49 | 0.21 |

| Total | 1,079.2 | 36.09 | 3.89 | 1.65 |

The following section discusses an initial economic assessment for the Project. This economic assessment is preliminary in nature, it includes Inferred Mineral Resources that are considered too speculative geologically to have modifying factors applied to them that would enable them to be categorized as mineral reserves, there is no certainty that this economic assessment will be realized. Fifty percent (50%) of the Mineral Resources used in the cash flow analysis are classified as Inferred Mineral Resources.

A financial analysis for the Project was carried out using a discounted cash flow approach. The internal rate of return (IRR) on total investment was calculated based on the initial investment of US$342.96. The net present value (NPV) was calculated from the cash flow generated by the Project based on a discount rate of 8%. The payback period based on the undiscounted annual cash flow of the Project was also indicated as a financial measure.

No inflation or escalation exists in the economic model. KM Chile compiled the taxation calculations for the Project with assistance from third-party taxation experts. The model calculates pre-tax and after-tax returns and is based on the current Chilean tax system applicable to mineral resource income. The model includes provisions for transportation, insurance, refining and payable charges. The major inputs and assumptions used for the development of the financial model are listed in Table 1-5.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 6 |

| | |

Table 1-5 Financial model inputs

| Execution Plan |

| Construction Period | 18 months |

| Mine Life (after pre-production) | 14 years |

| LOM Plan Feed Tonnes (millions) | 29.0 |

| LOM Copper Grade (%) | 0.47 |

| LOM Gold Grade (g/mt Au) | 0.27 |

| LOM Silver Grade (g/mt Ag) | 8.80 |

| LOM Molybdenum Grade (g/mt Mo) | 706.2 |

| LOM Zinc Grade (g/mt Zn) | 0.33 |

| LOM Copper Equivalent Grade (%) | 0.91 |

| Metallurgical Recovery |

| Copper (%) | 90 |

| Gold (%) | 62 |

| Silver (%) | 45 |

| Molybdenum (%) | 68 |

| Zinc (%) | 80 |

| Metal Pricing |

| Copper Price (US$/lb) | 4.10 |

| Gold Price (US$/oz) | 1802.00 |

| Silver Price (US$/oz) | 23.50 |

| Molybdenum Price (US$/lb) | 12.70 |

| Zinc Price (US$/lb) | 1.50 |

| Cost and Tax Criteria |

| Estimate Basis | Q1 2023 |

| Inflation/Currency Fluctuation | None |

| Income Tax | 27% Chilean Federal |

| Metal Transportation, Smelting and Payable Charges |

| Copper Price (US$/t Diluted Plant Feed) | 5.005 |

| Gold Price (US$/t Diluted Plant Feed) | 0.001 |

| Silver Price (US$/t Diluted Plant Feed) | 0.100 |

| Molybdenum Price (US$/t Diluted Plant Feed) | 0.006 |

| Zinc Price (US$/t Diluted Plant Feed) | 4.058 |

| Payable Terms |

| Concentrate | 100% |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 7 |

| | |

Table 1-6 below presents the results of the economic analysis

Table 1-6 Summary of the economic analysis of underground mining of the Project

| | Value | Unit |

| Production Metrics |

| Mill Throughput | 7,000 | Dry tonnes/day |

| Head Grade – LOM | 0.91 | % Copper Equivalent |

| Mine Life (including pre-production) | 15.5 | Years |

| Total Copper Produced | 277,600,000 | Pounds |

| Total Gold Produced | 159,000 | Ounces |

| Total Silver Produced | 3,823,000 | Ounces |

| Total Molybdenum Produced | 31,626,000 | Pounds |

| Total Zinc Produced | 178,350,000 | Pounds |

| Capital and Operating Costs | |

| CAPEX – Initial | 342.96 | US$Million |

| CAPEX – Sustaining | 14.1 | US$Million |

| Reclamation | 20 | US$Million |

| OPEX – Mining | 17.50 | US$/t mined |

| OPEX – Processing | 9.22 | US$/t processed |

| OPEX – G&A | 2.56 | US$/t mined/processed |

| Pre-Tax Financial Metrics |

| Pre-Tax NPV (@8%) | 459.8 | US$Million |

| Pre-Tax IRR | 48 | % |

| Pre-Tax Payback | 1.4 | Years |

| Post-Tax Financial Metrics |

| Post-Tax NPV (@8%) | 302.0 | US$Million |

| Post-Tax IRR | 40 | % |

| Post-Tax Payback | 2.2 | Years |

The pre-tax internal rate of return (IRR) is 48% and the pre-tax net present value (NPV) using an 8% discount rate over the life of mine is US$459M. The after-tax IRR is 40% and the pre-tax NPV using an 8% discount rate over the life of mine is US$302M.

Excluding Inferred Resources, the pre-tax internal rate of return is 30% and the pre-tax NPV 8% is US$184M. On an after-tax basis the post-tax IRR is 20% and the post-tax NPV 8% is UD$94M

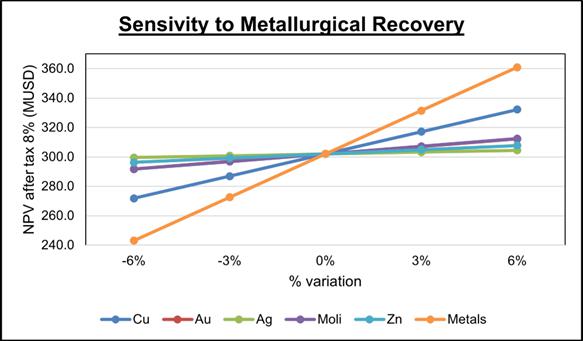

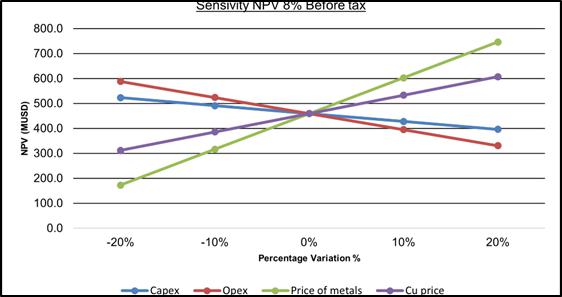

The results of the after-tax sensitivity analysis performed are summarized in Figure 1-1 and Figure 1-2. The Figure 1-1 sensitivity analyses demonstrate that metal values are most sensitive to selling price and recovery. A 20% increase in the metal selling prices would yield an NPV of US$410M. A 20% decrease in metal selling prices would yield a reduced NPV of US$194M. The impact of variations in operating and capital cost on both financial metrics is similar with the operating cost changes resulting in marginally larger project returns than capital cost changes, meaning reducing operating expenses would benefit the Project more than reducing capital costs by the same percentage.

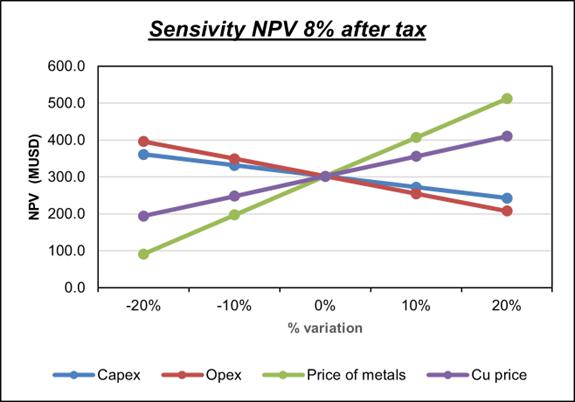

Figure 1-2 is a sensitivity to varying metallurgical recoveries. Fiel-Rosita is a polymetallic deposit. Metal recoveries are highly impactful on revenue. An increase of 6% recovery would yield a NPV of US$361M. A 6% decrease in those same recoveries would yield a reduced NPV of US$243M.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 8 |

| | |

Figure 1-1 Sensitivity of Fiel Rosita to varying metal prices, OPEX and CAPEX.

Figure 1-2 Sensitivity of Fiel Rosita to varying metallurgical recoveries.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 9 |

| | |

| 1.12 | Interpretations and Conclusions |

This TRS was prepared to initially assess the economic viability of an underground mine and process plant complex based on indicated and inferred mineral resource at the Fiel Rosita Project. Processing of 7,000 t/d is planned. The assessment provides a summary of the results and findings from each major area of investigation to a level that is equivalent and normally expected for an initial assessment of a resource development project. Standard industry practices were used in this study. The Project contributors, on the date of publication, are not aware of any unusual or significant risks or uncertainties that could affect the reliability or confidence in the Project or the disclosed economic outcomes.

The results of the economic analysis suggest the proposed project warrants further expenditures that would allow the Company to develop a Pre-Feasibility study. This would require resource development drilling (in addition to exploration drilling) which may increase resource confidence from Inferred Mineral Resources to Indicated Mineral Resources. Geotechnical drilling is required to develop a robust rock mass quality model for the mineral deposit. Recovery results from the metallurgical tests have yielded positive results. However, additional pre-feasibility supporting metallurgical testing is required to support the proposed processing method. More importantly, a better understanding of the metallurgical recoveries is required to convert Indicated Mineral Resources to Measured Mineral Resources.

A detailed pit optimization analysis and strategic mine planning for both open pit and underground mining should be completed. The surrounding area is suitable for developing an open pit and a milling operation.

There have been successive exploration campaigns, which have continued to contribute additional resources to the project. Mineralization has not yet been closed off by drilling. Additional exploration drilling is recommended.

RDA is recommending two separate work programs for the development of the Project: an exploration work program of US$6.9M and pre-feasibility development program of US$6.7M. Neither program is contingent on the other, nor are the programs successive to one another. KM Chile may choose to implement one, or the other, or both.

| 1.13.1 | Exploration Recommendations |

It is recommended that Fiel Rosita warrants further exploration including drilling to upgrade and delimit Mineral Resources, project-wide geological mapping with additional soil sampling. Geological models need to be improved in three dimensions to better define high grade zones of mineralization.

RDA recommends that a soil sampling program be implemented across the Fiel Rosita project area. This program would identify the existence of additional Cu bearing mineral deposits within the project area. Additionally, a drilling program consisting of 10,000 meters, tentatively distributed across ten, 500-to-1,500-meter-deep core holes, should be drilled to expand known mineralization and to infill portions of the current block models.

Table 1-7 Proposed Exploration Work Program to Delineate Fiel Rosita Mineral Resources

| Activity | Amount US$ (*1,000) |

| Core Drilling Program 10,000 meters @ $300US per meter | 3,000 |

| Assaying | 200 |

| Technical Services | 400 |

| Soil Sampling & Interpretation Program | 500 |

| Resource Modeling | 500 |

| License, Fees & Taxes | 300 |

| G&A | 1,000 |

| Calculated Exploration Development Cost | 5,900 |

| Contingency (17%) | 1,019 |

| Total | 6,919 |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 10 |

| | |

Monte Carlo simulations suggest there is a 55% probability that the recommended work program will exceed US$5,900,000. A contingency of 17% has been added to the suggested work program cost.

| 1.13.2 | Recommended Work Program to Support a Pre-Feasibility Study |

The Fiel Rosita initial assessment suggests an economically viable mining project may be developed. An infill drilling program is recommended. Additional drilling is required to characterize rock mechanics and to collect samples for metallurgical testing. Table 1-8 delineates the cost breakdown to develop a pre-feasibility study.

Table 1-8 Pre-Feasibility Cost Breakdown

| Activity | Amount US$ (*1,000) |

| Geotechnical Drilling Program 4,000 meters @ US$300 | 1,200 |

| Assaying | 100 |

| Metallurgical Testing Program | 1,000 |

| Hydro-geological modeling | 700 |

| Geotechnical Mapping | 200 |

| Infrastructure Layout Assessment | 400 |

| Mill Flowsheet | 700 |

| Technical Services and Economic Analysis | 1,180 |

| Site General Costs | 500 |

| G&A | 1,000 |

| Calculated Project Cost | 5,700 |

| Contingency (17%) | 971 |

| Total | 6,671 |

Monte Carlo simulations suggest there is a 49% probability that the recommended work program will exceed US$5,700,000. A contingency of 17% has been added to the suggested work program cost.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 11 |

| | |

This revised Technical Report Summary updates a prior version of the Technical Report Summary “S-K 1300 Technical Report Summary for the Fiel Rosita Copper-Molybdenum-Gold-Silver-Zinc Ploy Metallic Mineral Deposit, Region III, Atacama, Chile” dated July 17, 2023.

Revisions:

| ● | Resource Estimates were adjusted to reflect a change in the cutoff grade (Tables 1-1, 1-2, 11-8, 11-9) |

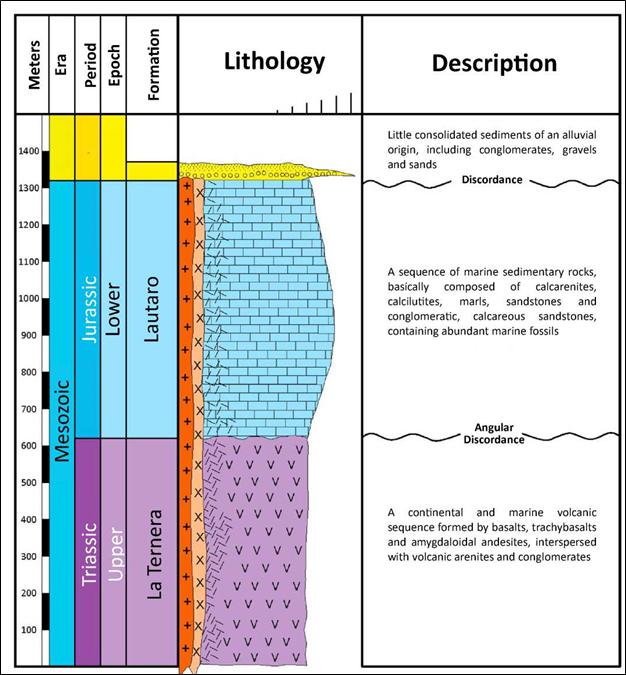

| ● | A stratigraphic column was added to page 45 |

| ● | A plan view showing drilling was added to page 55 |

| ● | The opinion of the qualified person regarding the adequacy of sample preparation, security, and analytical procedures was added to page 61 |

| ● | The degree to which metallurgical test samples is representative was described on page 69 |

| ● | The point of reference for mineral resources was added to page 81 |

| ● | The estimated recoveries used in the mineral resource estimate were added to page 81 |

| ● | A description of the cut-off grade, commodity price, reasons for selecting the commodity price, and unit costs associated with the cut-off grade can be found on page 81 |

| ● | A discussion of uncertainties in the estimates of mineralization, covering sources and explaining how these were considered, also identifying underlying factors contributing to the final conclusions, was added to page 81 |

| ● | The opinion of the qualified person as to whether all issues relating to all relevant technical and economic factors that are likely to influence the prospect of economic extraction can be resolved with further work can be found at the end of page 81 |

An economic analysis, using inferred resource only, is presented with equal prominence in Table 19-2 on page 109

This Technical Report Summary (this “TRS”) was prepared and compiled by RDA at the request of Key Mining Corp. (“KM US”). RDA is an independent engineering consulting firm headquartered in Highlands Ranch, Colorado, USA.

The purpose of this report is to summarize the results of an initial assessment for the Fiel-Rosita polymetallic mineral deposit. This TRS has been prepared in accordance with §§229.1300 through 229.1305 (subpart 229.1300 of Regulation S-K).

KM Chile acquired the Project in 2021 based on the geological setting and its strategic location near several major producing copper mines and development projects.

This report describes the property, geology, mineralization, exploration activities and exploration potential, and a scoping study to support an initial economic assessment of Fiel-Rosita. RDA has been provided documents, maps, reports and analytical results from KM Chile. This report is based on the information provided, field observations and RDA’s familiarity with mineral occurrences and mining projects worldwide. All references are cited at the end of the report.

The Consultants preparing this technical report are specialists in the fields of geology, exploration, mineral resource and mineral reserve estimation and classification, surface and underground mining and operating cost estimation, and mineral economics.

This TRS was completed under the direction and supervision of RDA. RDA is a third-party QP as defined by Regulations S-K 1300. Additionally, RDA has approved the technical disclosure contained in this TRS.

This report fulfills the requirements of KM US to list a publicly traded company in the United States. The reader of this report can rely on its contents to represent an accurate assessment of the technical information regarding the Fiel Rosita Project.

This TRS is intended to be used by KM Chile. The QP consents to the filing of the TRS with US SEC. Except for the purposes legislated, any other use of this report by any third party is at that party’s sole risk.

| 2.4 | Personal Inspection of the Fiel Rosita Property |

RDA conducted a personal inspection of the Project November 8, 2022.

The report has three effective dates:

| ● | Date of the mineral resource estimate: July 17, 2023 |

| | | |

| ● | Date of the mine planning and project scoping study: March 31, 2023 |

| | | |

| ● | Date of the final financial analysis July 17, 2023 |

The overall effective date of the TRS is taken to be the date of completion of the economic analysis which is July 17, 2023.

As of the effective date of this TRS, RDA is not aware of any known litigation potentially affecting the Project. RDA did not verify the legality or terms of any underlying agreement(s) that may exist concerning the permits, royalties or other agreement(s) between third parties.

The results of this TRS are not dependent upon any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings between KMC and RDA. RDA is being paid a fee for their work in accordance with normal professional consulting practices.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 12 |

| | |

The opinions contained herein are based on information collected through the course of the investigations by RDA, which in turn reflect various technical and economic conditions at the time of writing. Given the nature of the mining business, these conditions can change significantly over short periods of time. Consequently, actual results can be significantly more or less favorable.

| 2.7 | Sources of Information |

The reports and documentation listed in this TRS were used to support the preparation of this TRS. Additional information was sought from KM Chile personnel where required.

| 2.8 | Currency and Calculations |

Unless otherwise stated or noted this TRS uses the following assumptions and

| ● | Currency is in US dollars (US$ or $); |

| ● | All ounce units are reported in troy ounces, unless otherwise stated: 1 oz (troy) = 31.1 g; |

| ● | All pound units are reported in avoirdupois (advp) units: 1 tonne = 2204.623 pounds |

| ● | All metal prices are reported in US dollars (US$ or $) |

| ● | All cost estimates have a base date of March 31, 2023 |

| ● | CuEq is defined as the copper grade that yields the revenue from all five metals (Cu, Au, Ag, Mo, Zn) accounting for metallurgical recovery, treatment and refining costs. |

This TRS includes technical information that required subsequent calculations to derive subtotals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, the QPs consider them immaterial.

This TRS is intended to be used by KM US subject to the terms and conditions of its agreements with Resource Development Associates Inc. and its associated consulting firms. Such agreements permit KM US to file this TRS as a Technical Report Summary and Initial Assessment with the SEC’s mining rules under subpart 1300 and item 601 (96)(B)(iii) of the Regulation S-K (SK-1300). Any other use of this TRS by any third party is at that party’s sole risk. The user of this document should ensure that this is the most recent TRS for the property as it is not valid if a new TRS has been issued.

The authors would like to acknowledge the general support provided by the KM US and KM Chile management and development team personnel for this assignment. The TRS benefited from the knowledge and specific input from the following individuals:

| ● | Cesar Lopez – Chief Executive Officer |

| | | |

| ● | Enrique Correa – Managing Director |

| | | |

| ● | Reinaldo Reyes – Chief Mining Engineer |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 13 |

| | |

| 3 | Property Description and Location |

| 3.1 | Mineral Property and Title in Chile |

Chile’s current mining policy is based on legal provisions founded in Spanish law with modifications via a series of prior Mining Codes leading to the revised Mining Code of 1982. These were established to stimulate the development of mining and to guarantee the property rights of both local and foreign investors. According to the law, the state owns all Mineral Resources, but exploration and exploitation of these resources by private parties is permitted through mining concessions, which are granted to any claimant to mineral rights who follows the required procedures.

Mining concessions have both rights and obligations as defined by a Constitutional Organic Law of Mining as enacted in 1982. Concessions can be mortgaged or transferred, and the holder has full ownership rights and is entitled to obtain the rights of way for exploration and exploitation. The concession holder has the right to use, for mining purposes, any water flows which infiltrate any mining workings. In addition, the concession holder has the right to defend his ownership against state and third parties. An exploration concession is obtained by a claim filing and includes all minerals that may exist within the claim area.

Information in this subsection is based on data in the public domain and Chilean law (Chilean Civil Code, Chilean Mining Code, Chilean Tax Law, Fraser Institute, 2022), and has not been independently verified by RDA.

Chile’s mining industry is regulated by the following laws:

| ● | Constitution of the Republic of Chile |

| | | |

| ● | Constitutional Organic Law of Mining |

| | | |

| ● | Code and Regulations governing Mining |

| | | |

| ● | Code and Regulations governing Water Rights |

| | | |

| ● | Laws and Regulations governing Environmental Protection as related to mining. |

| 3.3 | Chilean Mineral Tenure |

Chilean mineral concessions have both rights and obligations as defined by a Constitutional Organic Law (enacted in 1982). Concessions can be mortgaged or transferred, and the holder has full ownership rights and is entitled to obtain the rights of way for exploration (pedimentos) and exploitation (mensuras). In addition, the concession holder has the right to defend ownership of the concession against state and third parties. A concession is obtained through a claim filing and includes all minerals that may exist within its area.

Mining rights in Chile are acquired in the following stages:

| 3.3.1 | Pedimento (EXPLORATION CONCESSION) |

A pedimento is an initial exploration claim whose position is well defined by Universal Transverse Mercator (UTM) coordinates which define north-south and east-west boundaries. The minimum size of a pedimento is 100 ha and the maximum is 5,000 ha with a maximum length-to-width ratio of 5:1.

The duration of validity is for a maximum period of two years; however, at the end of this period, and provided that no overlying claim has been staked, the claim may be reduced in size by at least 50% and renewed for an additional two years. If the yearly claim taxes are not paid on a pedimento, the claim can be restored to good standing by paying double the annual claim tax the following year.

New pedimentos are allowed to overlap with pre-existing ones; however, the underlying (previously staked) claim always takes precedent, providing the claim holder avoids letting the claim lapse due to a lack of required payments, corrects any minor filing errors, and converts the pedimento to a manifestación within the initial two-year period.

| 3.3.2 | Manifestacion (EXPLOITATION CONCESSION) |

Before a pedimento expires, or at any stage during its two-year life, it may be converted to a manifestación or exploitation concession.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 14 |

| | |

Within 220 days of filing a manifestación, the applicant must file a “Request for Survey” (Solicitud de Mensura) with the court of jurisdiction, including official publication to advise the surrounding claim holders, who may raise objections if they believe their pre-established rights are being encroached upon.

A manifestation may also be filed on any open ground without going through the pedimento filing process.

The owner is entitled to explore and to remove materials for study only (i.e. sale of the extracted material is forbidden). If an owner sells material from a manifestation or exploration concession, the concession will be terminated.

Within nine months of the approval of the “Request for Survey” by the court, the claim must be surveyed by a government licensed surveyor. Surrounding claim owners may be present during the survey. Once surveyed, presented to the court, and reviewed by the National Mining Service (Sernageomin), the application is adjudicated by the court as a permanent property right (a mensura), which is equivalent to a “patented claim” or exploitation right. Exploitation concessions are valid indefinitely and are subject to the payment of annual fees. Once an exploitation concession has been granted, the owner can remove materials for sale. There is a mining tax that provides protection of rights; it is calculated as a percentage of the Unidad Tributaria Mensual (UTM or monthly tax unit) and applies to each hectare of land included in the mining exploration and/or mining exploitation concessions. This tax is paid annually in a single payment before 31 March of each year. For mining exploitation concessions, the tax rate is currently 10% of a UTM per hectare; for mining exploration concessions the tax rate is currently 2% of a UTM per hectare. The value of the UTM is adjusted monthly according to the consumer price index (IPC) in Chile.

| 3.3.4 | Chilean Claim Process |

At each of the stages of the claim acquisition process, several steps are required (application, publication, registration fees, notarization, tax payments, patent payment, legal fees, publication of the extract, etc.) before the application is finally converted to a declaratory sentence by the court constituting the new mineral property. A full description of the process is documented in Chile’s mining code.

Many of the steps involved in establishing the claim are published in Chile’s official mining bulletin for the appropriate region (published weekly). At the manifestación and mensura stages, a process for resolution of conflicting claims is allowed.

Most companies in Chile retain a mining claim specialist to review the weekly mining bulletins and ensure that their land position is kept secure.

Legislation is being considered that seeks to further streamline the process for better management of natural resources. Under the new proposed law, mining and exploration companies will have to declare their reserves and resources and report drilling results. The legislation also aims to facilitate funds for mining projects across the country. In addition to the mining law, the Organic Constitutional Law on Mining Concessions (1982) and the Mining Code of 1983 are the two key mechanisms governing mining activities in Chile.

Ownership rights to the subsoil are governed separately from surface ownership. Articles 120 to 125 of the Chilean Mining Code regulate mining easements. The Mining Code grants to the owner of any mining exploitation or exploration concessions full rights to use the surface land, provided that reasonable compensation is paid to the owner of the surface land.

The Mining Code also grants the holder of the mining concession general rights to establish a right of way (RoW), subject to payment of reasonable compensation to the owner of the surface land. Rights of way are granted through a private agreement or legal decision which indemnifies the owner of the surface land. A RoW must be established for a particular purpose and will expire after cessation of activities for which the right of way was obtained. The owners of mining easements are also obliged to allow owners of other mining properties the benefit of the RoW, as long as this does not affect their own exploitation activities.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 15 |

| | |

Article 110 of the Chilean Mining Code establishes that the owner of record of a mining concession is entitled, by operation of law, to use waters found in the works within the limits of the concession, as required for exploratory work, exploitation and processing, according to the type of concession the owner might engage in. These rights are inseparable from the mining concession.

Water is considered part of the public domain and is considered to be independent of the land ownership. Individuals can obtain the rights to use public water in accordance with the Water Code. In accordance with the Code (updated in 1981), water rights are expressed in liters per second (L/s) and usage rights are granted on the basis of total water reserves.

| 3.3.8 | Environmental Regulations |

Environmental impact statements are required for projects such as dams, thermo- electric and hydroelectric plants, nuclear power plants, mining, oil and gas, roads and highways, ports, development of real estate in congested areas, water pipelines, manufacturing plants, forestry projects, sanitary projects, production, storage and recycling of toxic, and flammable and hazardous substances. Developments not covered by these categories must submit a sworn statement of environmental impact indicating that the project or activity does not affect the environment and does not violate environmental laws. All projects must be approved by the national Environmental Commission (Comisión Nacional del Medio Ambiente, CONAMA) or regional Environmental Commission (Comisión Regional del Medio Ambiente, COREMA).

Decree No. 40/2012, 30 October 2012 Regulations for the System of Environmental Impact Assessment (Reglamento del Sistema de Evaluación de Impacto Ambiental, RSEIA) was approved and published in the Official Gazette on 12 August 2013. In general terms, the new regulation updates the assessment procedure in accordance with the legal and regulatory changes enacted in Chile from 2001 to date. It redefines the information that must be submitted when entering an Environmental Impact Statement (EIA) or an Environmental Impact Declaration (DIA), seeking to give greater certainty to those regulated and to the citizens. The RSEIA seeks to make assessments early, to raise the standard of information and evaluation, and to reduce time to complete the process. The changes are consolidated in Law 19.300, especially with regard to public participation in EIAs. Indigenous consultation is included for projects entering the system, complying with ILO Agreement 169 in force in Chile since 2009.

Chile’s zoning and urban planning are governed by the General Law of Urban Planning and Construction (Ley General de Urbanismo y Construcción). This law contains several administrative provisions that are applicable to different geographical and hierarchical levels and sets specific standards for both urban and inter-urban areas.

In addition to complying with the Environmental Law (Ley Ambiental) and other legal environmental requirements, projects must also comply with urban legislation governing the different types of land use. Land use regulations are considered part of the Chilean environmental legal framework.

Land use regulatory requirements are diverse and operate at different levels, the main instruments are the inter-community regulatory plans (Planos Reguladores Intercomunales, PRI) and the community regulatory plans (Planos Reguladores Comunales, PRC). The PRIs regulate territories of more than one municipality, including urban and rural territory.

Law 20.551, Law of Mine Closure, enacted in October 2011, took effect in November 2012 and imposes on the mining industry the obligation to execute closure of its operations, incorporating closure as part of the life cycle of a mining project.

To comply with these regulations, the owner of the project must submit a Closure Plan to Sernageomin, prior to starting construction of a mining project, with an approval procedure that depends on the mine capacity. The main procedure is applicable to mining projects with a mine capacity greater than 10,000 tonnes per month. A simplified procedure is allowed for projects with a mine capacity equal to or less than 10,000 tonnes per month or which are exploration projects.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 16 |

| | |

The differences between these procedures are the type of information required to be submitted for evaluation of the Closure Plan. Closure Plans for larger operations must provide more detailed information and must also provide a monetary guarantee to ensure the full and timely compliance with the Closure Plans. The guarantee must cover the costs of the measures associated with closure and post-closure. Each five years, to comply with the Closure Plan, the execution of any closure activities and an update of the Closure Plan must be audited as a complementary instrument of control by Sernageomin. For smaller mining projects or exploration projects that are subject to the simplified procedure, no financial guarantee is required and no audit of the Closure Plan is required.

The following are the requirements for the guarantee:

| ● | The amount of the guarantee must cover the total value of the cost for the Closure Plan including post-closure, and is determined by an estimate of the current costs of the plan. The guarantee is periodically updated |

| | | |

| ● | The guarantee must be paid in full within the first two-thirds of the estimated life of the project if less than 20 years, or within a period of 15 years if the estimated life of the project is more than 20 years |

| | | |

| ● | The payment of the guarantee must begin within the first year of the start of operations, and the value must be equal to 20% of the total closure cost. From the second year on, the payment must be proportional to the period which remains for the complete amount. The guarantee increases until the total value of the closure costs is deposited. The instruments of guarantee must be liquid and easy to execute |

| | | |

| ● | The financial guarantee can be gradually released as the Closure Plan is executed. Once the closure is complete and a certificate of final closure is issued by Sernageomin all guarantees will be released. |

Mining companies that are obliged to provide a guarantee have a period of two years to estimate the cost of the Closure Plan. The Closure Plan must be approved under the regulation of Mining Safety Regulations and Environmental Qualification Resolution (RCA). After this period the company must submit the cost of executing the Closure Plan as well as the guarantee to Sernageomin. Sernageomin will then confirm that the company is in compliance.

In Chile, foreign investors may own 100% of a company based in Chile with no limit of duration for property rights. Within the limits of the Chilean law, investors can undertake any type of economic activity.

Potential foreign investors must comply with the administrative system described in Chapter XIV of the Chilean Central Bank’s Compendium of Foreign Exchange Regulations in order to register the entry of foreign capital into Chile. Under the administrative system of Chapter XIV of the Chilean Central Bank, the entry of foreign capital must be registered by commercial banks which, in turn, must coordinate with the Central Bank of Chile. A minimum of $10,000 can be brought in through this mechanism in the form of currency or loans. This mechanism does not require a contract of any type. Capital entering Chile under Chapter XIV is not subject to any tax benefit and foreign investors using this regime are subject to the general taxation established by the Chilean Income Tax Law and the VA (VAT) Law.

Foreign investors complying with the above may freely choose to apply for the Foreign Investment Legal Framework established in Law No. 20.848 of 2015, which entered into force on 1 January 2016. The Foreign Investment Legal Framework regulates investments made by an individual or legal entity incorporated overseas, not residing or domiciled in Chile, whose investment is equal to or greater than $5 million, or the equivalent in other currencies.

Foreign investments authorized under this legal framework are entitled to:

| ● | Remit abroad the equity invested and the net profits generated by the investment in Chile, when all tax obligations have been fulfilled according to the local regulations |

| | | |

| ● | Access the formal exchange market to liquidate the currency constituting the investment. |

| | | |

| ● | Access the formal exchange market in order to obtain the foreign currency required to remit the equity invested or the net profits generated by the investment in Chile |

| | | |

| ● | A VAT exemption on the import of capital goods in projects worth over $5 million, as long as certain requirements are met |

| | | |

| ● | No arbitrary discrimination, the foreign investor is subject to the same legal regime as local investors. |

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 17 |

| | |

In order to qualify as a foreign investor and access the rights available under the Foreign Investment Legal Framework of Law 20.848 described above, the investor must request a certificate from the Agency for the Promotion of Foreign Investments demonstrating the investor’s foreign status. The request submitted to the Agency must provide evidence (in a form determined by the Agency) that the investment will be materialized in the country; a detailed description of the investment; and the amount, purpose and nature of the investment.

Law 20.848 states that, for a period of four years from 1 January 2016, a foreign investor may request authorization to sign a tax invariability contract according to the terms, time frames and conditions established in Articles 7 and 11 of Decree Law No. 600 (DL 600 was replaced by Law 20.780 from 1 January 2016).

| ● | Article 7 of Decree Law 600 establishes a tax invariability system that grants, for a period of 10 years, a total effective tax rate of 44.45% for investments of no less than $5 million for any investment purposes in Chile |

| | | |

| ● | Article 11 of Decree Law 600 establishes a tax invariability system that grants, for a period of 15 years, specific rights for investments of no less than $50 million for mining projects. |

| 3.3.11 | CURRENT Mining Royalty |

Government royalties are levied in the form of a mining tax.

The general tax regime applicable to mining activity is dependent on the size of the operation.

Small mining operations with a maximum of five employees are subject to an overall income tax with a fixed rate calculated according to a formula that considers the average price of copper and the company’s sales.

Larger companies, for instance stock corporations or limited responsibility partnerships, whose annual sales do not exceed 36,000 tonnes of metallic non-ferrous minerals or 2,000 annual tax units, regardless of the type of mineral, are considered to be medium-scale.

Medium-scale mining operations are subject to a presumptive tax regime, under which the taxable income of the period is presumed to be a certain percentage of their net sales, being subject to the general tax rates. This percentage ranges from 4 per cent to 20 per cent according to the average copper price during the tax period.

Companies exceeding the previous criteria are considered large mining operations. These entities will be subject to the general income tax regime. As such, they are subject to income tax, which since 2016 is 24 per cent, and a global complementary or additional tax, depending on whether the contributor is a Chilean or foreign national.

There is a royalty, or specific mining tax, over mining activities that covers any concessionaire who extracts and commercializes minerals in any type of production. The rate of this tax is progressive and follows the volume of the company’s production. The rule is the following:

| ● | companies whose annual sales exceed the equivalent of 50,000 tonnes of fine copper pay a progressive rate of between 5 per cent and 14 per cent; |

| | | |

| ● | companies whose annual sales are between the equivalent of 12,000-50,000 tonnes of fine copper pay a progressive rate of between 0.5 per cent and 4.5 per cent; and |

| | | |

| ● | companies whose annual sales are equal to or less than 12,000 tonnes of fine copper are exempt from the royalty. |

The value upon the tonnes of fine copper is calculated as according to the average value of grade A copper registered at the London Metal Exchange.

Finally, other duties and fees applying to any business are also applicable to mining activities. As such, these companies are subject to municipal and stamp duties and VAT.

| 3.3.12 | The New Mining Royalty |

On May 17, 2023, the Chilean Congress approved a new mining royalty tax, which replaces the existing specific mining activity tax and introduces a new ad valorem component for large-sized mining operators, largely retaining what was regulated in the existing law regarding the mining operating margin. It also includes a maximum tax burden limitation.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 18 |

| | |

The new royalty tax has two main components: (i) an ad valorem component, applicable only to big-sized mining operations; and (ii) a mining operating margin component. The applicability of the different components of the royalty, its taxable base, and its rates depend on the Metric Tonnes of Fine Copper (“MTFC”) (or equivalent) sold annually by each operator.

Large-Sized Mining Operators: Large sized operators have annual sales greater than 50,000 MTFC (or equivalent) based on average annual sales for the last 6 fiscal years (current rules only considered the taxed year).

The two main changes of the new royalty tax applicable to large sized operators are as follows:

The ad valorem component is equivalent to 1% on the annual copper sales (including qualifying sales made by related parties). If an operator has a negative operational taxable income from mining (ie. a loss), this component is reduced by the amount of the loss.

The previous version of the royalty did not include ad valorem tax in addition to the mining operating margin component. Most of the additional changes in this bill (e.g., imposing a maximum tax burden limitation) are a result of political compromise to pass this ad valorem component of the royalty.

| (ii) | Mining Operator Component |

The mining operating margin component is an additional progressive tax rate applied to the existing mining operational taxable income. The rate of this component depends on whether the operator’s percentage of copper sales exceeds 50% of its total sales, including qualifying sales made by related parties. The net result of this amendment is that mining operators will be subject to higher tax rates than previously.

| a) | Mining operators whose copper sales are more than 50% of their total sales are subject to a rate based on the mining operating margin (i.e., the taxable mining income on gross sales) of each company, ranging from a minimum rate of 8% reaching to a maximum effective average rate (i.e., after applying the progressive rates of each bracket) of 26%. |

| b) | Mining operators whose copper sales are less than 50% of their total sales will be subject to a rate based on the mining operating margin of each operator (ranging from 5% to 34,5%, with a maximum average rate of 14%). These rates are the same as the rates in the current legislation, which is currently applicable to every mining operator selling more than 50.000 MTF (regardless of the composition of those sales). |

The changes of the new royalty tax applicable to medium and small sized operators are as follows:

Medium sized Mining Operators: Medium sized operators have annual sales greater than the equivalent value of 12,000 MTFC and do not exceed the equivalent value of 50,000 MTFC. Medium-sized operators would be subject to a progressive rate between 0.4% and 4.4%.

Small sized Mining Operators: Small sized operators are those annual sales less than the equivalent value of 12,000 MTFC. Small sized operators would be exempt from the tax. This exemption is not changed when compared with the current rules.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 19 |

| | |

| 3.3.12.1 | MAXIMUM TAX BURDEN LIMITATION |

There is a maximum tax burden imposed on a mining business. The maximum potential tax burden is set at 46.5% of the net mining operational taxable income. This limit considers the (a) mining royalty tax (including both components) and (b) income taxes, that is corporate income tax (27%) and potential shareholder’s taxation on dividends (35%). If the aggregate of these taxes exceeds the burden cap, the royalty tax shall be reduced accordingly. For mining operators with sales for up to 80,000 MTFC (or equivalent) (considering the average sales of the last 6 years), the maximum potential tax burden will be 45.5%.

| 3.3.12.2 | AUDITED FINANCIAL STATEMENTS |

Mining operators subject to the royalty tax shall submit audited financial statements to the Comisión para el Mercado Financiero (Chilean Securities and Banking authority) annually.

The new tax rate will become effective January 1, 2024. For mining operators who currently benefit from a tax invariability agreement (the new tax rate will apply on the date of expiry of the invariability tax regime agreement).

| 3.3.13 | Fraser Institute Study |

KM Chile has used the 2022 Fraser Institute Annual Survey of Mining Companies report (the Fraser Institute survey) as a credible source for the assessment of the overall political risk facing an exploration or mining project in Chile. Each year, the Fraser Institute sends a questionnaire to selected mining and exploration companies globally. The survey is an attempt to assess how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration investment. In 2022, 1,966 companies were approached, and 180 companies responded providing sufficient data to evaluate 62 jurisdictions.

DGCS has used the Fraser Institute survey because it is globally regarded as an independent report-card style assessment to governments on how attractive their policies are from the point of view of an exploration or mining company and forms a proxy for the assessment by industry of political risk in Chile from the mining perspective.

Chile has a Policy Perception Index rank of 38th out of the 62 jurisdictions in the Fraser Institute survey. Chile’s Investment Attractiveness Index rating is 35th out of the 62 jurisdictions, and it is ranked 26th on the Best Practices Mineral Potential Index (out of 47).

| 3.4 | Fiel Rosita Property Location |

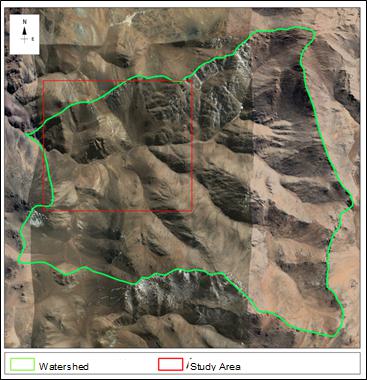

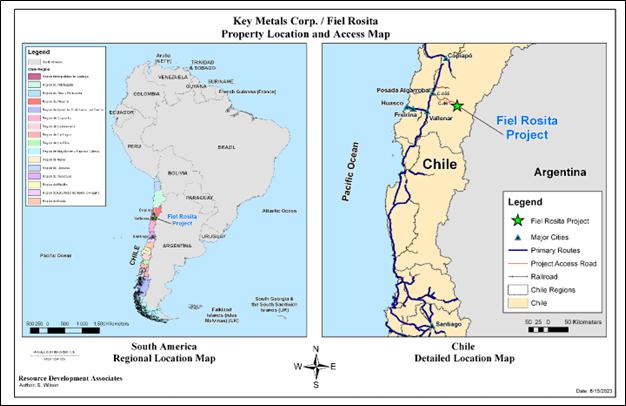

The Fiel Rosita district is located Chile Region III, Atacama, northeast of Vallenar and southeast Copiapó, west of the Manflas River, and more specifically, from 28°21’ to 28°22’ south latitude, and from 70°02’ to 70°04’ west longitude. Access to the district is by Route 5 north of Vallenar, turning east on C-455. Route C-455 forks at C-461. Fiel Rosita is located near the terminus of C-461 near the El-Donkey and El Bolsico area (Figure 3-1). Within this TRS, reference is made in several figures to the “study area”. The study area hereinafter refers to the project area of the Fiel Rosita Project.

| Key Mining Corp. | |

| S-K 1300 - Technical Report Summary – Fiel Rosita | Page 20 |

| | |

Figure 3-1 Location of the Fiel Rosita Project

This study discusses four initially discovered polymetallic mineralization deposits and leaves additional exploration targets still to be explored.

| 3. | La Viejita Porphyry, and |

| | | |

| 4. | El Chiflón Mineralized Breccia |

Key Metals Corporation Chile SpA (“KM Chile”) is a wholly owned subsidiary of KM US. KM Chile has an exclusive option to acquire an 80% stake in the Concessions, for a total of 158 concessions (all mining), covering a total of 37,755 hectares, and including the proposed project site. As part of the process, the concessions have been inspected by a government-authorized surveyor and are protected by Chilean law through the payment of annual mining license fees.

| 3.5.1 | Mineral Exploration and Joint Venture Agreement |

| 3.5.1.1 | Terms and Conditions |

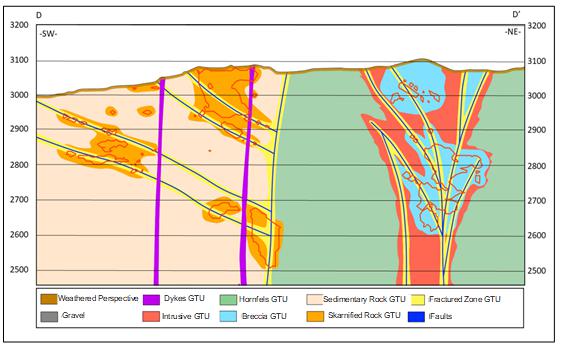

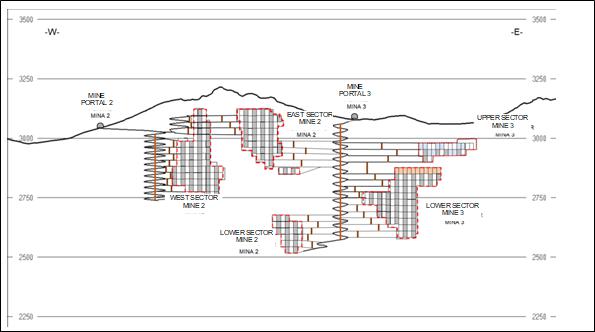

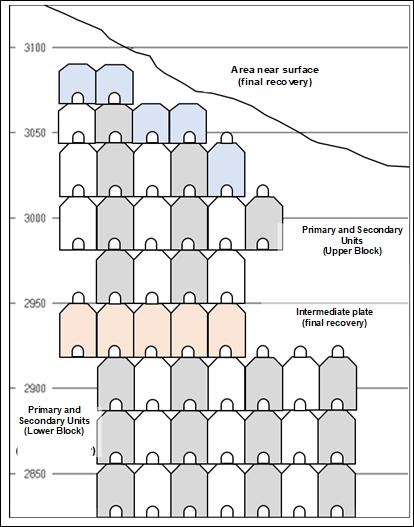

On August 30th, 2021, KM Chile entered into a Mineral Exploration and Joint Venture Agreement with SQM, by which KM Chile has the exclusive option to acquire up to 80% of the Fiel Rosita Project (the remaining 20% will be held by SQM), by entering into a Joint Venture company with SQM, for and in consideration of the payment of the sum of USD 10,000,000 to SQM, and fulfill exploration expenditures on the Fiel Rosita Project for at least USD 20,000,000, both by December 31st, 2027, as follows: