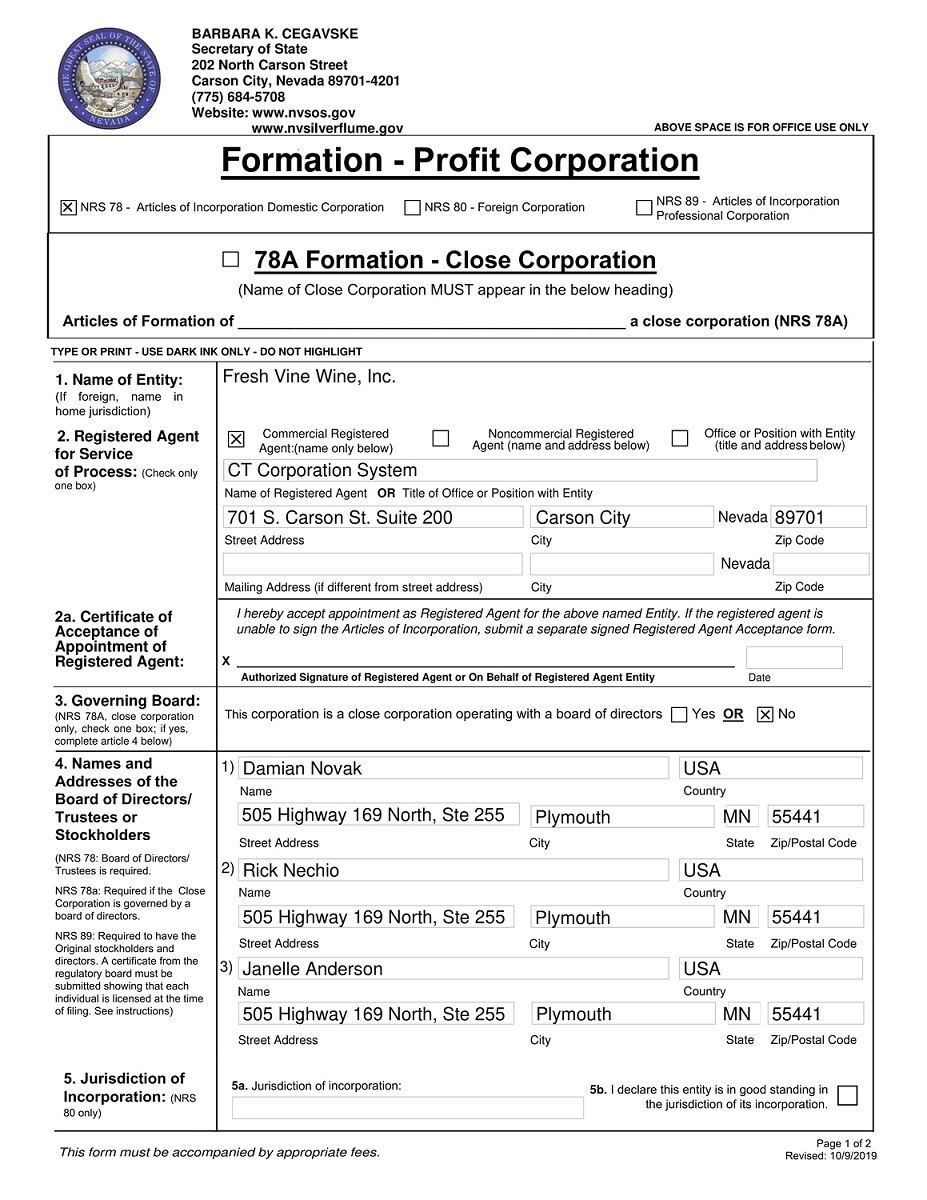

Exhibit 3.1

Addendum to the Articles of Incorporation

of

Fresh Vine Wine, Inc.

3. NAMES AND ADDRESSES OF THE BOARD OF DIRECTORS/TRUSTEES OR STOCKHOLDERS

The members of the governing board of the Corporation are styled as directors. The Board of Directors shall be elected in such manner as shall be provided in the Bylaws of the Corporation. The number of directors may be changed from time to time in such manner as shall be provided in the Bylaws of the Corporation, provided the number of directors shall not be reduced to less than one.

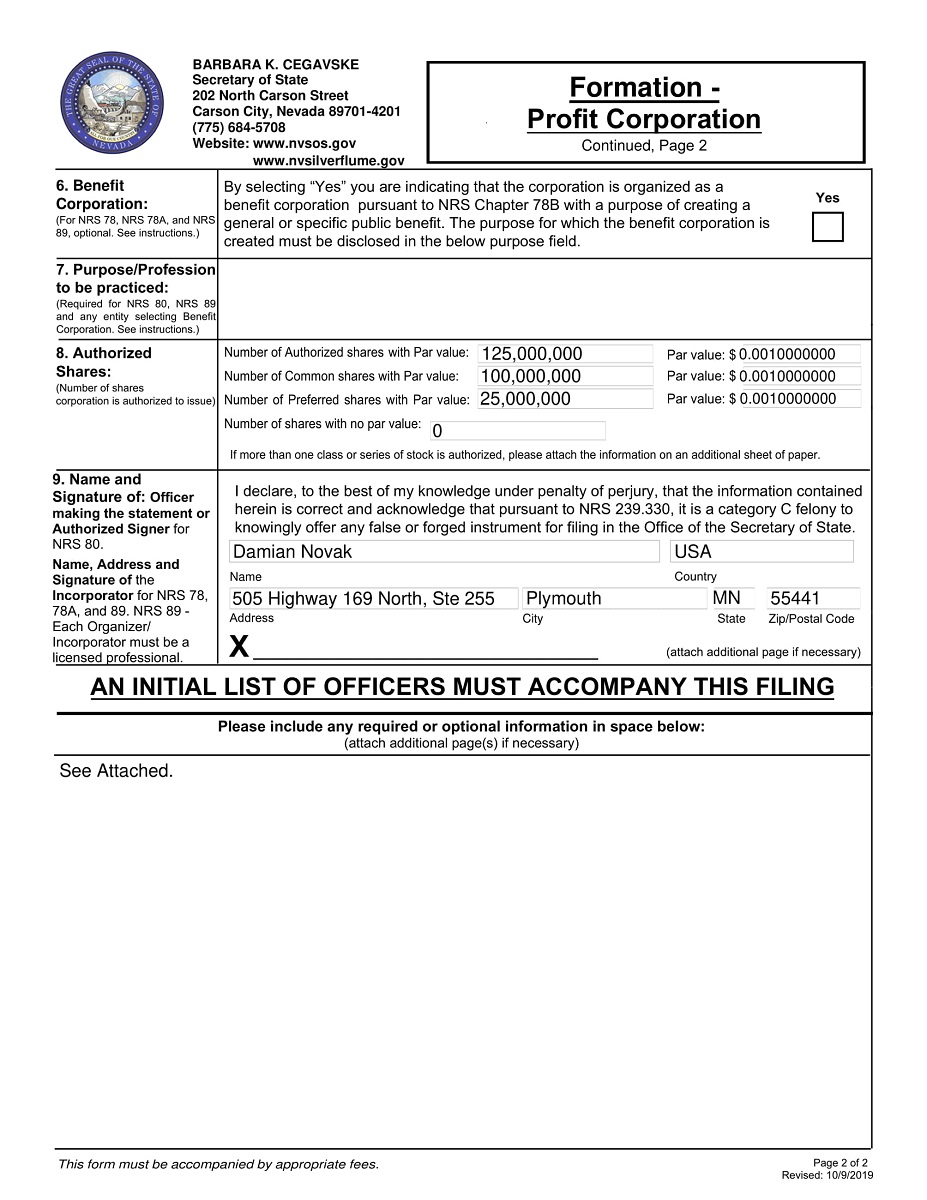

8. AUTHORIZED SHARES

8.1 Authorized Stock. The total number of shares of all stock which the Corporation shall have authority to issue is 125,000,000 shares, consisting of: (i) 100,000,000 shares of common stock, par value $.001 per share (the “Common Stock”) and (ii) 25,000,000 shares, $.001 par value per share, designated as preferred stock (the “Preferred Stock”).

8.2 Preferred Stock.

(a) Designation. The shares of Preferred Stock are hereby authorized to be issued from time to time in one or more series, the shares of each series to have such voting powers, full or limited, or no voting powers, and such designations, preferences and relative, participating, optional or other special rights and qualifications, limitations or restrictions as are specified in the resolution or resolutions adopted by the board of directors of the Corporation (the “Board of Directors”) providing for the issue thereof. Such Preferred Stock may be convertible into, or exchangeable for, at the option of either the holder or the Corporation or upon the happening of a specified event, shares of any other class or classes or any other series of the same or any other class or classes of capital stock of the Corporation at such price or prices or at such rate or rates of exchange and with such adjustments as shall be stated and expressed in these Articles of Incorporation, as amended from time to time (these “Articles of Incorporation”) or in the resolution or resolutions adopted by the Board of Directors providing for the issue thereof.

(b) Authority Vested in the Board of Directors. Authority is hereby expressly vested in the Board of Directors, subject to the provisions of this ARTICLE 8 and to the limitations prescribed by law, to authorize the issue from time to time of one or more series of Preferred Stock and, with respect to each such series, to fix by resolution or resolutions adopted by the affirmative vote of a majority of the whole Board of Directors providing for the issue of such series the voting powers, full or limited, if any, of the shares of such series and the designations, preferences and relative, participating, optional or other special rights and the qualifications, limitations or restrictions thereof. The authority of the Board of Directors with respect to each series shall include, but not be limited to, the determination of the following:

| (i) | The designation of such series; |

| (ii) | The dividend rate of such series, the conditions and dates upon which such dividends shall be payable, the relation which such dividends shall bear to the dividends payable on any other class or classes or series of the Corporation’s capital stock, and whether such dividends shall be cumulative or noncumulative; |

| (iii) | Whether the shares of such series shall be subject to redemption by the Corporation at the option of either the Corporation or the holder or both or upon the happening of a specified event and, if made subject to any such redemption, the times or events, prices and other terms and conditions of such redemption; |

| (iv) | The terms and amount of any sinking fund provided for the purchase or redemption of the shares of such series; |

| (v) | Whether the shares of such series shall be convertible into, or exchangeable for, at the option of either the holder or the Corporation or upon the happening of a specified event, shares of any other class or classes or of any other series of the same or any other class or classes of the Corporation’s capital stock, and, if provision is made for conversion or exchange, the times or events, prices, rates, adjustments and other terms and conditions of such conversions or exchanges; |

| (vi) | The restrictions, if any, on the issue or reissue of any additional Preferred Stock; |

| (vii) | The rights of the holders of the shares of such series upon the voluntary or involuntary liquidation, dissolution or winding up of the Corporation; |

| (viii) | The provisions as to voting, optional and/or other special rights and preferences, if any; and |

| (ix) | Such other designations, powers, preference and relative, participating, optional or other special rights and qualifications, limitations or restrictions thereof. |

The shares of each class or series of the Preferred Stock may vary from the shares of any other class or series thereof in any respect. The Board of Directors may increase the number of shares of the Preferred Stock designated for any existing class or series by a resolution adding to such class or series authorized and unissued shares of the Preferred Stock not designated for any existing class or series of the Preferred Stock and the shares so subtracted shall become authorized, unissued and undesignated shares of the Preferred Stock.

10. INDEMNIFICATION AND ADVANCEMENT OF EXPENSES

10.1 Expenses for Actions Other Than By or In The Right of the Corporation. The Corporation shall indemnify to the fullest extent under Nevada law, any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that he is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with which action, suit or proceeding, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, that he had reasonable cause to believe that his conduct was unlawful.

10.2 Expenses for Actions By or In the Right of the Corporation. The Corporation shall indemnify to the fullest extent under Nevada law, any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit, if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Corporation unless and only to the extent that the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the court shall deem proper.

10.3 Non-Exclusivity. The rights to indemnification and to the advancement of expenses conferred in this Article 10 shall not be deemed exclusive of any other rights to which any person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or under any other bylaw, agreement, insurance policy, vote of stockholders or disinterested directors, statute or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office.

10.4 Repeal and Modification. Any repeal or modification of this Article 10 shall not adversely affect any rights to indemnification and to the advancement of expenses of a director or officer of the Corporation existing at the time of such repeal or modification with respect to any acts or omissions occurring prior to such repeal or modification.

11. LIMITATION OF LIABILITY

No director shall be personally liable to the Corporation, any of its stockholders or its creditors for money damages for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the NRS as the same exists or may hereafter be amended. If the NRS is hereafter amended to authorize the further elimination or limitation of the liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent authorized by the NRS, as so amended. Any repeal or modification of this Article 11 shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification with respect to acts or omissions occurring prior to such repeal or modification.

12. BYLAWS

In furtherance and not in limitation of the powers conferred upon it by law, the Board shall have the power to adopt, amend, alter or repeal the Bylaws. The affirmative vote of a majority of the Board shall be required to adopt, amend, alter or repeal the Bylaws. The Bylaws also may be adopted, amended, altered or repealed by the stockholders; provided, however, that in addition to any vote of the holders of any class or series of capital stock of the Corporation required by law or by these Articles of Incorporation, the affirmative vote of the holders of at least a majority of the voting power of all then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required for the stockholders to adopt, amend, alter or repeal the Bylaws.

13. AMENDMENTS

The Corporation reserves the right to amend, alter, change or repeal any provision contained in these Articles of Incorporation in the manner now or hereafter prescribed by law, and, except as set forth in Articles 10, 11 and 14, all rights and powers conferred herein on stockholders, directors and officers are subject to this reserved power.

14. RENOUNCEMENT OF CORPORATE OPPORTUNITY

14.1 Scope. The provisions of this Article 14 are set forth to define, to the extent permitted by applicable law, the duties of Exempted Persons (as defined below) to the Corporation with respect to certain classes or categories of business opportunities. “Exempted Persons” means each of the N&N Entities (as defined below) (other than the Corporation and its subsidiaries) and all of their respective partners, principals, directors, officers, members, managers, managing directors and/or employees, including any of the foregoing who serve as employees, officers or directors of the Corporation. “N&N Entities” means Nechio & Novak FV, LLC and its successors, Transferees and Affiliates. “Transferee” means any Person who (i) becomes a beneficial owner of Common Stock upon having purchased or otherwise acquired such shares of Common Stock from an N&N Entity and (ii) is designated in writing by the transferor as a “Transferee” and a copy of such writing is provided to the Corporation at or prior to the time of such purchase; provided, however, that a purchaser of Common Stock in a registered offering or in a transaction effected pursuant to Rule 144 under the Securities Act of 1933, as amended, (or any similar or successor provision thereto) shall not be a “Transferee.” “Affiliate” means, with respect to any Person, any other Person that controls, is controlled by, or is under common control with such Person; the term “control,” as used in this definition, means the power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise. “Person” means an individual, any general partnership, limited partnership, limited liability company, corporation, trust, business trust, joint stock company, joint venture, unincorporated association, cooperative or association or any other legal entity or organization of whatever nature, and shall include any successor (by merger or otherwise) of such entity.

14.2 Competition and Allocation of Corporate Opportunities. Except as otherwise provided in the second sentence of this Section 14.2, (a) no Exempted Person shall have any duty to communicate or present an investment or business opportunity or prospective economic advantage to the Corporation in which the Corporation may, but for the provisions of this Section 14.2, have an interest or expectancy (a “Corporate Opportunity”), and (b) no Exempted Person (even if such Exempted Person is also an officer or director of the Corporation) shall be deemed to have breached any fiduciary or other duty or obligation to the Corporation by reason of the fact that any such Exempted Person pursues or acquires a Corporate Opportunity for itself or its Affiliates or directs, sells, assigns, or transfers such Corporate Opportunity to another Person or does not communicate information regarding such Corporate Opportunity to the Corporation. The Corporation renounces any interest in a Corporate Opportunity and any expectancy that a Corporate Opportunity will be offered to the Corporation; provided, that the Corporation does not renounce any interest or expectancy it may have in any Corporate Opportunity that is offered to an officer or director of the Corporation whether or not such individual is also a director or officer of an Exempted Person, if such opportunity is expressly offered to such Exempted Person in such Exempted Person’s capacity as an officer or director of the Company.

14.3 Certain Matters Deemed Not Corporate Opportunities. In addition to and notwithstanding the foregoing provisions of this Article 14, a Corporate Opportunity shall not be deemed to belong to the Corporation if it is a business opportunity that the Corporation is not financially able or contractually permitted or legally able to undertake, or that is, from its nature, not in the line of the Corporation’s business or is of no practical advantage to it or that is one in which the Corporation has no interest or reasonable expectancy.

14.4 Amendment of this Article. No amendment or repeal of this Article 14 in accordance with the provisions of Article 13 shall apply to or have any effect on the liability or alleged liability of any Exempted Person for or with respect to any activities or opportunities of which such Exempted Person becomes aware prior to such amendment or repeal. This Article 14 shall not limit any protections or defenses available to, or indemnification or advancement rights of, any director or officer of the Corporation under these Articles of Incorporation, the Corporation’s bylaws or applicable law.

15. SEVERABILITY

If any provision or provisions of these Articles of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (i) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of these Articles of Incorporation (including, without limitation, each portion of any Section or paragraph of these Articles of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (ii) to the fullest extent possible, the provisions of these Articles of Incorporation (including, without limitation, each such portion of any paragraph of these Articles of Incorporation containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service to or for the benefit of the Corporation to the fullest extent permitted by law.

4