UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Under Rule 14a-12 |

RumbleOn, Inc.

(Name of Registrant as Specified in Its Charter)

Mark Tkach

William Coulter

WJC Properties, L.L.C.

WRC-2009, L.L.C.

WRC-098 Trust

The WRC 2021 Irrevocable Trust

RideNow Management, LLLP

Kyle Beaird

Melvin Flanigan

Steven Pully

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

William Coulter and Mark Tkach, together with the other participants named herein (collectively, the “Participants”), intend to file a preliminary proxy statement and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) with respect to the election of directors of RumbleOn, Inc., a Nevada corporation (the “Company”) and certain proposals for the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”).

On March 15, 2023, Mr. Coulter and Mr. Tkach issued a public letter to the Company’s stockholders notifying the stockholders of their intention to nominate certain individuals for election at the Annual Meeting and describing their views concerning opportunities to improve the Company’s operational performance and begin restoring stockholder value, which letter is attached hereto as Exhibit 1 and is incorporated herein by reference. In addition, also on March 15, 2023, Mr. Coulter and Mr. Tkach and certain of the Participants filed Amendment No. 1 to Schedule 13D with respect to the Company, which is attached hereto as Exhibit 2 and is incorporated herein by reference.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

THE PARTICIPANTS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES WITH RESPECT TO THE ANNUAL MEETING. THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS RELATED TO THE ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be William Coulter, Mark Tkach, WJC Properties, L.L.C., WRC-2009, L.L.C., WRC-098 Trust, The WRC 2021 Irrevocable Trust, RideNow Management, LLLP, Kyle Beaird, Melvin Flanigan and Steven Pully.

Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the election of directors of the Company and certain proposals, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other proxy materials when they are filed with the SEC.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 5,242,433 shares of Class B Common Stock, par value $0.001 per share, of the Company (“Class B Common Stock”). As of the date hereof, William Coulter beneficially owns 2,621,405 shares of Class B Common Stock, Mark Tkach beneficially owns 2,621,028 shares of Class B Common Stock, WJC Properties, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-2009, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-098 Trust beneficially owns 30,377 shares of Class B Common Stock, The WRC 2021 Irrevocable Trust beneficially owns 593,472 shares of Class B Common Stock, and the remainder of the Participants do not beneficially own any shares of Class B Common Stock.

Exhibit 1

RumbleOn’s Two Largest Stockholders Will be Nominating Five Highly Qualified Candidates for Election to Company’s Board of Directors

Issue Open Letter to Stockholders Detailing Concerns With Company’s Poor Shareholder Return and Highly Deficient Governance

March 15, 2023 - William Coulter and Mark Tkach, who together own approximately 32.5% of the outstanding Class B shares of common stock of RumbleOn, Inc. (“RumbleOn” or the “Company”), today issued an open letter to the Company’s stockholders. Mr. Coulter and Mr. Tkach announced that they have nominated five highly qualified candidates for three Board seats that will be up for election to the Board of Directors of the Company (the “Board”) at its 2023 Annual Meeting of Stockholders.

Below is the full text of the letter:

Dear Fellow RumbleOn Stockholders:

We are William Coulter and Mark Tkach. We are entrepreneurs, not activist investors. Over 32 years, we built a thriving retail business, RideNow Powersports (“RideNow”), which sold motorcycles, all-terrain vehicles, personal watercraft and other powersports equipment, plus accessories. In 2021, we sold RideNow to RumbleOn. RumbleOn used both cash and stock to acquire RideNow, resulting in us obtaining approximately 32.5% of RumbleOn’s outstanding Class B common shares. We also own and lease to the Company 25 properties under 20-year leases, which expire in 2041.

After RumbleOn purchased RideNow, Mr. Coulter joined RumbleOn as Executive Vice Chairman of the Board of Directors, while Mr. Tkach was appointed as a director and the Chief Operating Officer of RumbleOn. Despite those titles and our substantial share ownership, we learned that our influence and voices were considerably less than our roles suggested. Other executives and directors purposely avoided seeking our counsel, or disregarded it outright. We were not provided adequate information to properly fulfill our roles, even after multiple requests. As a result, we resigned from our roles in February 2022.

From February 11, 2022, the last trading day before our resignations were publicly announced, through March 13, 2023, RMBL shares have fallen -80.4%. Over the summer and fall of 2022, the Company’s inventory level and its SG&A/revenue ratio each rose sharply. After witnessing the severe stock price decline and observing operating metrics deteriorate, we reached out to Chairman and CEO Marshall Chesrown and the Board of Directors on December 9, 2022.

In a letter, we asked the Board to articulate to all investors publicly its plans regarding the Company’s bloated cost structure and questionable inventory controls. After being ignored, we reiterated this request in two follow-up letters. However, RumbleOn declined to provide investors with any concrete plans to improve its business. This, as well as several other corporate governance missteps, makes us doubt the current Board’s ability to oversee, and management’s ability to implement, the type of self-improvement plan that will maximize value for all stockholders. Over the past twelve months, even as the share price has fallen and financial metrics have deteriorated dramatically, the Board and management have not reacted proportionally. Instead, when RumbleOn management presented at the ICR Conference in January 2023, it provided investors with a rosy view of the business and its growth prospects.

These events have led us to explore and now seek meaningful changes to RumbleOn’s Board. While the Company did ask Mr. Coulter to rejoin the Board in the past few weeks, the type of change required at RumbleOn will require more than one new director. We know this from first-hand experience. We privately proposed a more significant refreshment of the Board to RumbleOn with the hope that we could reach a settlement before the Company’s nomination deadline of March 16, 2023. In the nearly two weeks since our settlement proposal, the Board has not responded substantively to our proposal or negotiated in good faith to reach mutually acceptable terms to bring about the changes required to maximize shareholder value. Instead, they appear to have decided to entrench themselves further, which will likely result in the Board and management attempting to defend their decisions and poor track record, ignoring the economic value that has been destroyed along the way.

The Board’s seeming attempt to stall us and prevent a proxy contest is consistent with other significant corporate governance deficiencies. For example, corporate governance best practice typically enables only one executive on a board of directors, most commonly the CEO. By contrast, RumbleOn’s Board includes Mr. Chesrown and Chief Operating Officer Peter Levy. During the six months we served as RumbleOn directors, it became clear to us that Mr. Chesrown’s role as Chairman and Mr. Levy’s Board representation only served to defend the types of decisions that emboldened a strategy that has resulted in the Company’s poor total shareholder return and its declining operational metrics.

The Board has at least two other reputedly “independent” directors with close business ties to RumbleOn or longstanding personal ties to Mr. Chesrown. Michael Marchlik is an executive at a subsidiary of B. Riley Financial Inc. (“B. Riley”). When RumbleOn acquired RideNow, another B. Riley subsidiary was RumbleOn’s financial advisor and its investment banker, garnering millions of dollars in fees while leading the Company’s equity offering. Kevin Westfall worked with Mr. Chesrown both at AutoNation in the late 1990s and at Vroom.com nearly a decade ago. In 2013 and 2014, Mr. Westfall was Vroom’s CEO, where Mr. Chesrown reported to him as Vroom’s Chief Operating Officer. In early 2017, Mr. Westfall joined the RumbleOn Board, where his role includes overseeing Mr. Chesrown and other executives.

About one year ago, on February 4, 2022, RumbleOn Board member Sam Dantzler resigned, more than four months before RumbleOn’s 2022 annual meeting. The Company reported the resignation that day in an SEC filing, stating that it “expects to appoint a new independent director in the coming weeks.” That statement suggested that the Company would appoint a director in time for stockholders to vote on that person, as Mr. Dantzler’s Board seat would have been up for election in June 2022. Instead, nine days after the 2022 annual meeting, the Board appointed Shin Lee as a director.

The Company informed our counsel that Ms. Lee replaced Mr. Dantzler on the Board and will not be up for election until 2025. Yet, the Company has never even disclosed to stockholders which class of directors she was appointed to, nor in which year Ms. Lee’s term is due to expire. The Board apparently believes that Ms. Lee should serve a multi-year term on the Board notwithstanding that the Company deliberately sought to avoid shareholder approval on her appointment. The Company could have easily sought shareholder approval for Ms. Lee’s nomination at the 2022 annual meeting. Are we to believe that Ms. Lee was identified as a Board candidate in the nine days between the 2022 annual meeting and her appointment?

Let us be clear. We have no quarrel with Ms. Lee. We presume that she did not control the timing of her appointment to the Board. Furthermore, we do not know how strong a director she has been, as we have never met her. We hope to have the opportunity to meet her in the near term so we can assess whether she can be part of the solution in turning around RumbleOn. The point of course is the timing of her appointment to the Board. This exemplifies a disregard of shareholder rights and utilization of slick maneuvers to avoid shareholder input. Stockholders cannot tolerate such activities, especially if they continue ahead of the 2023 annual meeting.

As referenced earlier, the Company did offer a single Board seat to Mr. Coulter about one month ago. That offer was intended to fill a recently vacated Board seat by Denmar Dixon, who resigned from the Board on January 18, 2023, just shy of the one-year anniversary since we resigned from the Board. Mr. Coulter rejected this offer on the grounds that it was inadequate to support the level of change that we know is necessary to restore and maximize shareholder value. Mr. Coulter urged the Company allow the stockholders to decide how that vacant Board seat should be filled at the upcoming annual meeting. Hopefully, they will listen to the recommendation from their largest stockholders this time around rather than subvert the rights of all stockholders in favor of a friendly face.

As such, we propose that the Company include a proposal at the 2023 annual meeting to invalidate the appointment of any director after March 1, 2023 until such time as the 2023 annual meeting is concluded. If this proposal passes, we believe it is not only appropriate but also important that ALL stockholders have an opportunity to determine who should fill Mr. Dixon’s vacant Board seat.

We have also proposed that the Company include two other separate proposals to be considered by the stockholders at the 2023 annual meeting. One will ask stockholders to approve a proposal to separate the Chairman and CEO roles. Not only is this a well settled hallmark of strong corporate governance but with regard to RumbleOn specifically, we believe that Mr. Chesrown should not be serving in both capacities. Many academics and management consultants agree that the most important role of a Board of Directors is to select and provide oversight to the CEO. Only through a separation of the chairman and CEO roles, as well as with the oversight of a truly independent board of directors, can this be accomplished. In our minds, this is an important point in the turnaround of RumbleOn.

Lastly, we have proposed to include a proposal at the 2023 annual meeting to remove Peter Levy as a Board member. Given his lack of public company board experience, the amount of value destroyed during his tenure in both of his roles, we are seeking to remove him from the Board and replace him with an independent director candidate with extensive public company board experience.

All of the foregoing has led us to seek to replace three RumbleOn directors at the 2023 annual meeting, while enabling all stockholders to fill Mr. Dixon’s seat. We are nominating five individuals for the three board seats – two Class II seats and one for Mr. Levy’s seat. We have nominated two other director candidates in the event another director decides to resign before the 2023 annual meeting or should something unexpectedly happen to one of our nominees. The upcoming 2023 annual meeting is that important.

We have reluctantly undertaken this process and have tried to avoid it via settlement. Again, we are entrepreneurs, not activist investors. However, we believe that the Board needs several new, well-qualified directors to oversee the type of change required to maximize value for all stockholders. Our nominees include:

| · | William Coulter was the co-founder of RideNow and owns 2.62 million RMBL shares (16.2% of total Class B shares outstanding). Mr. Coulter and Mr. Tkach co-founded RideNow in 1989 and expanded the company to include more than 40 stores in eight states. |

| · | Mark Tkach was the co-founder of RideNow and owns 2.62 million RMBL shares (16.2% of total Class B shares outstanding). |

| · | Kyle Beaird is the Chief Financial Officer of SCORE Sports, which designs, manufactures and sells youth sports uniforms and equipment. He has led operations and finance in the action sports industry. |

| · | Mel Flanigan was the Chief Financial Officer of recreational vehicle retailer Camping World Holdings, Inc. and of audio technology firm DTS Inc., both of which were publicly traded. |

| · | Steve Pully is a founding partner of Speyside Partners, which performs consulting, restructuring and investment banking services for companies and investors. He has been a director on many public company boards. |

We look forward to engaging with our fellow stockholders and certain members of the Board to move RumbleOn in the right direction. We are enthusiastic about the opportunity to improve RumbleOn’s operational performance and start restoring stockholder value. We have little confidence that this will occur at the hand of the existing leadership of RumbleOn.

| Sincerely, | |

| | |

| /s/ William Coulter | |

| William Coulter | |

| | |

| /s/ Mark Tkach | |

| Mark Tkach | |

| | |

| Contact information: | |

Bruce Goldfarb/Pat McHugh/Lisa Patel

Okapi Partners LLC

212-297-0720

Info@okapipartners.com

William Coulter and Mark Tkach, together with the other participants named herein (collectively, the “Participants”), intend to file a preliminary proxy statement and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) with respect to the election of directors of RumbleOn, Inc., a Nevada corporation (the “Company”), and certain proposals for the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”).

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

THE PARTICIPANTS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES WITH RESPECT TO THE ANNUAL MEETING. THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS RELATED TO THE ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be William Coulter, Mark Tkach, WJC Properties, L.L.C., WRC-2009, L.L.C., WRC-098 Trust, The WRC 2021 Irrevocable Trust, RideNow Management, LLLP, Kyle Beaird, Melvin Flanigan and Steven Pully.

Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the election of directors of the Company and certain proposals, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other proxy materials when they are filed with the SEC.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 5,242,433 shares of Class B Common Stock, par value $0.001 per share, of the Company (“Class B Common Stock”). As of the date hereof, William Coulter beneficially owns 2,621,405 shares of Class B Common Stock, Mark Tkach beneficially owns 2,621,028 shares of Class B Common Stock, WJC Properties, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-2009, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-098 Trust beneficially owns 30,377 shares of Class B Common Stock, The WRC 2021 Irrevocable Trust beneficially owns 593,472 shares of Class B Common Stock, and the remainder of the Participants do not beneficially own any shares of Class B Common Stock.

Exhibit 2

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

RumbleOn, Inc.

(Name of Issuer)

Class B Common Stock, par value $0.001 per share

(Title of Class of Securities)

781386 206

(CUSIP Number)

Mark Tkach

1188 East Camelback Road

Phoenix, AZ 85014

(602) 532-4600

Travis J. Wofford

Baker Botts L.L.P.

910 Louisiana Street

Houston, Texas 77002

(713) 229-1234

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 15, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨

Note. Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes)

| CUSIP No. 781386 206 | |

| 1 | NAME OF REPORTING PERSONS

William Coulter |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

SC, PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

2,621,405 shares of Class B Common Stock (1) |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

2,621,405 shares of Class B Common Stock (1) |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

2,621,405 shares of Class B Common Stock (1) |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(2) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

16.2% (3) |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | |

| (1) | Includes 593,472 shares of Class B Common Stock held in The WRC 2021 Irrevocable Trust, for which Mr. Coulter serves as Trustee, and 30,377 shares of Class B Common Stock held by WJC Properties, L.L.C., for which Mr. Coulter serves as Manager. |

| (2) | Excludes 2,621,028 shares of Class B Common Stock held by Mark Tkach as to which Mr. Coulter disclaims beneficial ownership. This report shall not be construed as an admission that Mr. Coulter is the beneficial owner of such securities. |

| (3) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

| 1 | NAME OF REPORTING PERSONS

Mark Tkach |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

SC, PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

2,621,028 shares of Class B Common Stock |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

2,621,028 shares of Class B Common Stock |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

2,621,028 shares of Class B Common Stock |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

16.2% (2) |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | |

| (1) | Excludes 2,621,405 shares of Class B Common Stock held by the other Reporting Persons hereto as to which Mr. Tkach disclaims beneficial ownership. This report shall not be construed as an admission that Mr. Tkach is the beneficial owner of such securities. |

| (2) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

| 1 | NAME OF REPORTING PERSONS

WJC Properties, L.L.C. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

WC |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Arizona |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

30,377 shares of Class B Common Stock |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

30,377 shares of Class B Common Stock |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

30,377 shares of Class B Common Stock |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0.2% (2) |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | |

| (1) | Excludes 5,212,056 shares of Class B Common Stock held by the other Reporting Persons hereto as to which WJC Properties, L.L.C. disclaims beneficial ownership. This report shall not be construed as an admission that WJC Properties, L.L.C. is the beneficial owner of such securities. |

| (2) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

| 1 | NAME OF REPORTING PERSONS

WRC-2009, L.L.C. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

30,377 shares of Class B Common Stock (1) |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

30,377 shares of Class B Common Stock (1) |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

30,377 shares of Class B Common Stock (1) |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(2) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0.2% (3) |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | |

| (1) | Includes 30,377 shares of Class B Common Stock held by WJC Properties, L.L.C., for which WRC-2009, L.L.C. is the controlling member. WRC-098 Trust is the sole member of WRC-2009, L.L.C. |

| (2) | Excludes 5,212,056 shares of Class B Common Stock held by the Reporting Persons hereto other than WJC Properties, L.L.C. and WRC-098 Trust, as to which WRC-2009, L.L.C. disclaims beneficial ownership. This report shall not be construed as an admission that WRC-2009, L.L.C. is the beneficial owner of such securities. |

| (3) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

CUSIP No. 781386 206

| 1 | NAME OF REPORTING PERSONS

WRC-098 Trust |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) o |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | o |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Arizona |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

30,377 shares of Class B Common Stock (1) |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

30,377 shares of Class B Common Stock (1) |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

30,377 shares of Class B Common Stock (1) |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x (2) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0.2% (3) |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | |

| (1) | Includes 30,377 shares of Class B Common Stock held by WJC Properties, L.L.C. WRC-098 Trust is the sole member of WRC-2009, L.L.C., which is the controlling member of WJC Properties, L.L.C. |

| (2) | Excludes 5,212,056 shares of Class B Common Stock held by the Reporting Persons hereto other than WJC Properties, L.L.C. and WRC-2009, L.L.C., as to which WRC-098 Trust disclaims beneficial ownership. This report shall not be construed as an admission that WRC-098 Trust is the beneficial owner of such securities. |

| (3) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

CUSIP No. 781386 206

| 1 | NAME OF REPORTING PERSONS

The WRC 2021 Irrevocable Trust |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Arizona |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

593,472 shares of Class B Common Stock |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

593,472 shares of Class B Common Stock |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

593,472 shares of Class B Common Stock |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

3.7% (2) |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | |

| (1) | Excludes 4,648,961 shares of Class B Common Stock held by the other Reporting Persons hereto as to which The WRC 2021 Irrevocable Trust disclaims beneficial ownership. This report shall not be construed as an admission that The WRC 2021 Irrevocable Trust is the beneficial owner of such securities. |

| (2) | Based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by RumbleOn, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022. |

| 1 | NAME OF REPORTING PERSONS

Kyle Beaird |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) ¨

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

0 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | |

| (1) | Excludes 5,242,433 shares of Class B Common Stock held by the other Reporting Persons hereto as to which Mr. Beaird disclaims beneficial ownership. This report shall not be construed as an admission that Mr. Beaird is the beneficial owner of such securities. |

| 1 | NAME OF REPORTING PERSONS

Melvin Flanigan |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) ¨

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

0 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | |

| (1) | Excludes 5,242,433 shares of Class B Common Stock held by the other Reporting Persons hereto as to which Mr. Flanigan disclaims beneficial ownership. This report shall not be construed as an admission that Mr. Flanigan is the beneficial owner of such securities. |

| 1 | NAME OF REPORTING PERSONS

Steven Pully |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) ¨

(b) ¨ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) | ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

0 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x(1) |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | |

| (1) | Excludes 5,242,433 shares of Class B Common Stock held by the other Reporting Persons hereto as to which Mr. Pully disclaims beneficial ownership. This report shall not be construed as an admission that Mr. Pully is the beneficial owner of such securities. |

The following constitutes Amendment No. 1 (“Amendment No. 1”) to the Schedule 13D originally filed on March 6, 2023 (the “Schedule 13D” and together with Amendment No. 1, the “Amended Schedule 13D”) with the Securities and Exchange Commission by William Coulter (“Mr. Coulter”) and Mark Tkach (“Mr. Tkach”) with respect to the Class B Common Stock, par value $0.001 per share (the “Class B Common Stock”), of RumbleOn, Inc., a Nevada corporation (the “Issuer”). This Amendment No. 1 amends the Schedule 13D as specifically set forth herein to, among other reasons, include WJC Properties, LLC, an Arizona limited liability company (“WJC Properties”), WRC-2009, L.L.C., a Delaware limited liability company (“WRC LLC”), WRC-098 Trust, a trust created under the laws of Arizona (“098 Trust”), The WRC 2021 Irrevocable Trust, a trust created under the laws of Arizona (the “2021 Trust”), Kyle Beaird (“Mr. Beaird”), Melvin Flanigan (“Mr. Flanigan”), and Steven Pully (“Mr. Pully”) as reporting persons because they may be deemed to be members of a “group” within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Act”), as a result of the matters described in Item 4 below. Other than as set forth below, the Schedule 13D is unmodified. Capitalized terms not defined herein have the meanings given to such terms in the Schedule 13D.

| Item 2. | Identity and Background. |

The information contained in Item 2 of the Schedule 13D is hereby amended and restated as follows:

| (a) | This statement is filed by: |

| i. | Mr. Coulter with respect to shares directly owned by him, as Trustee of 098 Trust, which is the sole member of WRC LLC, which is the controlling member of WJC Properties, as Manager of WJC LLC, as Trustee of the 2021 Trust and as nominee for the Board of Directors of Issuer (the “Board”); |

| ii. | Mr. Tkach, with respect to shares directly owned by him and as nominee for the Board; |

| iii. | WJC Properties, with respect to shares directly owned by it; |

| iv. | WRC LLC, as controlling member of WJC Properties; |

| | | |

| | v. | 098 Trust, as the sole member of WRC LLC, which is the controlling member of WJC Properties; |

| vi. | The 2021 Trust, with respect to shares directly owned by it; |

| vii. | Mr. Beaird, as nominee for the Board; |

| viii. | Mr. Flanigan, as nominee for the Board; and |

| ix. | Mr. Pully, as nominee for the Board. |

Each of the foregoing is referred to as a “Reporting Person” and collectively the “Reporting Persons.” Each of the Reporting Persons is party to that certain Joint Filing Agreement, as further described in Item 6.

| (b) | The residence or business address of each of Mr. Coulter, Mr. Tkach, WJC Properties, WRC LLC, 098 Trust, and the 2021 Trust is 1188 East Camelback Road, Phoenix, AZ 85014. The residence or business address of Mr. Beaird is 726 E. Anaheim St., Wilmington, CA 90744. The residence or business address of Mr. Flanigan is 29538 Ridgeway Dr., Agoura Hills, CA 91301. The residence or business address of Mr. Pully is 4564 Meadowood Road, Dallas, TX 75220. |

| (c) | Mr. Coulter is the founder and Manager of Coulter Management Group LLLP and Mr. Tkach is a Consultant for Coulter Management Group LLLP. The address of Coulter Management Group LLLP is 1188 East Camelback Road, Phoenix, AZ 85014. The principal business of Coulter Management Group LLLP is managing multiple auto dealerships and investments in real estate. WJC Properties is an Arizona limited liability company organized to transact all lawful business for which a limited liability company may be organized under Arizona law. WRC LLC is a Delaware limited liability company organized to transact all lawful business for which a limited liability company may be organized under Delaware law and is the controlling member of WJC Properties. The 098 Trust is a trust created under laws of Arizona for the benefit of Mr. Coutler. The 2021 Trust is a trust created under the laws of Arizona for the benefit of Mr. Coulter. Mr. Beaird is the Chief Financial Officer of SCORE Sports. Mr. Flanigan previously served as Camping World Holdings, Inc.'s Chief Financial Officer and is now retired. Mr. Pully is a co-founder of the investment banking firm, Speyside Partners, and is the Chairman and Chief Executive Officer of Harvest Oil and Gas. |

| (d) | None of the Reporting Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| (e) | None of the Reporting Persons has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| (f) | Mr. Coulter, Mr. Tkach, Mr. Beaird, Mr. Flanigan and Mr. Pully are citizens of the United States. |

| Item 3. | Source and Amount of Funds or Other Consideration. |

The information contained in Item 3 of the Schedule 13D is hereby amended and restated as follows:

On August 31, 2021, the Issuer completed its business combination with RideNow Powersports, the nation’s largest powersports retailer group (collectively, “RideNow”), creating the first omnichannel customer experience in powersports (the “RideNow Transaction”). Pursuant to the Plan of Merger and Equity Purchase Agreement among the Mr. Coulter, Mr. Tkach, the Issuer and the other parties thereto, dated as of March 12, 2021 (the “RideNow Agreement”), RideNow equity holders, including Mr. Coulter and Mr. Tkach, received cash and shares of Class B Common Stock, of which Mr. Coulter received 2,701,813 shares, a portion of which are held by The 2021 Trust, and Mr. Tkach received 2,480,243 shares. On December 30, 2021, Mr. Tkach purchased 110,785 shares of Class B Common Stock from Mr. Coulter at a price of $30.00 per share pursuant to a Stock Purchase Agreement dated December 29, 2021 using personal funds. On May 27, 2022, Mr. Coulter purchased 30,377 shares of Class B Common Stock, through WJC Properties, on the open market at a price of $16.51 per share using personal funds. On May 31, 2022, Mr. Tkach purchased 30,000 shares of Class B Common Stock on the open market at a price of $15.91 per share using personal funds.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended to add the following:

The Reporting Persons are filing this Amendment No. 1 to disclose that Mr. Coulter and Mr. Tkach intend to deliver a notice to the Issuer (the “Nomination Notice”) (i) nominating a slate of director candidates comprised by Mr. Coulter, Mr. Tkach, Mr. Beaird, Mr. Flanigan and Mr. Pully (collectively, the “Nominees”) for election to the Board at the Issuer’s 2023 annual meeting of stockholders (the “Annual Meeting”) and (ii) setting forth other stockholder proposals regarding changes to the Issuer’s bylaws and other corporate governance matters. The Nominees have backgrounds spanning finance, law, private equity, restructuring, strategic transformation and public company governance and Mr. Coulter and Mr. Tkach believe that the Nominees have the necessary skills and experience to help set the Issuer on the right path towards maximizing value for all stockholders.

On March 15, 2023, Mr. Coulter and Mr. Tkach issued a public letter to the Issuer’s stockholders notifying the stockholders of their intention to nominate the Nominees for election at the Annual Meeting and describing their views concerning opportunities to improve the Issuer’s operational performance and begin restoring stockholder value. The full text of the letter is filed as Exhibit 99.5 hereto and is incorporated by reference herein.

THE REPORTING PERSONS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES WITH RESPECT TO THE 2023 ANNUAL MEETING OF STOCKHOLDERS OF THE ISSUER. THE REPORTING PERSONS STRONGLY ADVISE ALL STOCKHOLDERS OF THE ISSUER TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS RELATED TO THE 2023 ANNUAL MEETING OF STOCKHOLDERS OF THE ISSUER WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

No Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D, except as set forth in the Amended Schedule 13D or such as would occur upon or in connection with completion of, or following, any of the actions discussed the Amended Schedule 13D. The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors including, without limitation, the Issuer’s financial position and investment strategy, the price levels of the shares of Class B Common Stock, conditions in the securities markets and general economic and industry conditions, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation, continuing to engage in communications with management and the Board, engaging in discussions with stockholders of the Issuer or other third parties about the Issuer and the Reporting Persons’ investment, making recommendations or proposals to the Issuer concerning changes to the capitalization, ownership structure, board structure (including board composition), potential business combinations or dispositions involving the Issuer or certain of its businesses, or suggestions for improving the Issuer’s financial and/or operational performance, purchasing additional shares of Class B Common Stock, selling some or all of their shares of Class B Common Stock, or changing their intention with respect to any and all matters referenced in Item 4 of Schedule 13D.

| Item 5. | Interest in Securities of Issuer. |

The information contained in Item 3 of the Schedule 13D is hereby amended and restated as follows:

The aggregate percentage of the shares of Class B Common Stock reported owned by each Reporting Person is based on 16,143,685 shares of Class B Common Stock outstanding as of November 8, 2022, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the Securities and Exchange Commission on November 9, 2022.

| (a) | As of the date hereof, Mr. Coulter beneficially owned 2,621,405 shares of Class B Common Stock. Mr. Coulter’s beneficial ownership includes 593,472 shares of Class B Common Stock held in the 2021 Trust, for which Mr. Coulter serves as Trustee, and 30,377 shares of Class B Common Stock held by WJC Properties, LLC, for which he serves as Manager. Mr. Coulter is the Trustee of 098 Trust, which is the sole member of WRC LLC, which is the controlling member of WJC Properties. |

Percentage: 16.2%

| 1. | Sole power to vote or direct vote: 2,621,405 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 2,621,405 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, Mr. Tkach beneficially owned 2,621,028 shares of Class B Common Stock. |

Percentage: 16.2%

| 1. | Sole power to vote or direct vote: 2,621,028 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 2,621,028 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, WJC Properties beneficially owned 30,377 shares of Class B Common Stock. |

Percentage 0.2%

| 1. | Sole power to vote or direct vote: 30,377 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 30,377 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, WRC LLC beneficially owned 30,377 shares of Class B Common Stock, as controlling member of WJC Properties. |

Percentage 0.2%

| 1. | Sole power to vote or direct vote: 30,377 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 30,377 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, 098 Trust beneficially owned 30,377 shares of Class B Common Stock, as the sole member of WRC LLC, which is the controlling member of WJC Properties. |

| | | |

| | | Percentage: 0.2% |

| 1. | Sole power to vote or direct vote: 30,377 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 30,377 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, the 2021 Trust beneficially owned 593,472 shares of Class B Common Stock. |

Percentage 3.7%

| 1. | Sole power to vote or direct vote: 593,472 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 593,472 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, Mr. Beaird did not own any shares of Class B Common Stock. |

Percentage 0%

| 1. | Sole power to vote or direct vote: 0 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 0 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, Mr. Flanigan did not own any shares of Class B Common Stock. |

Percentage 0%

| 1. | Sole power to vote or direct vote: 0 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 0 |

| 4. | Shared power to dispose or direct disposition: 0 |

| (a) | As of the date hereof, Mr. Pully did not own any shares of Class B Common Stock. |

Percentage 0%

| 1. | Sole power to vote or direct vote: 0 |

| 2. | Shared power to vote or direct vote: 0 |

| 3. | Sole power to dispose or direct disposition: 0 |

| 4. | Shared power to dispose or direct disposition: 0 |

Each Reporting Person may be deemed to be a member of a “group” with the other Reporting Person for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and such group may be deemed to beneficially own 5,242,433 shares of Class B Common Stock owned in the aggregate by all of the Reporting Persons, totaling 32.5% of the outstanding Class B Common Stock. Each Reporting Person disclaims beneficial ownership of such shares of Class B Common Stock except to the extent of their pecuniary interest therein.

| (c) | As of the date hereof, the Reporting Persons have not effected any transactions in the Class B Common Stock during the past sixty days. |

| (d) | No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the shares of the Class B Common Stock described herein. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is hereby amended to add the following:

On March 15, 2023, the Reporting Persons entered into a Joint Filing Agreement pursuant to which they agreed to the joint filing on behalf of each of them of a Statement on Schedule 13D (and any amendments thereto) with respect to the Class B Common Stock of the Issuer. Such Joint Filing Agreement is filed as Exhibit 99.4 hereto.

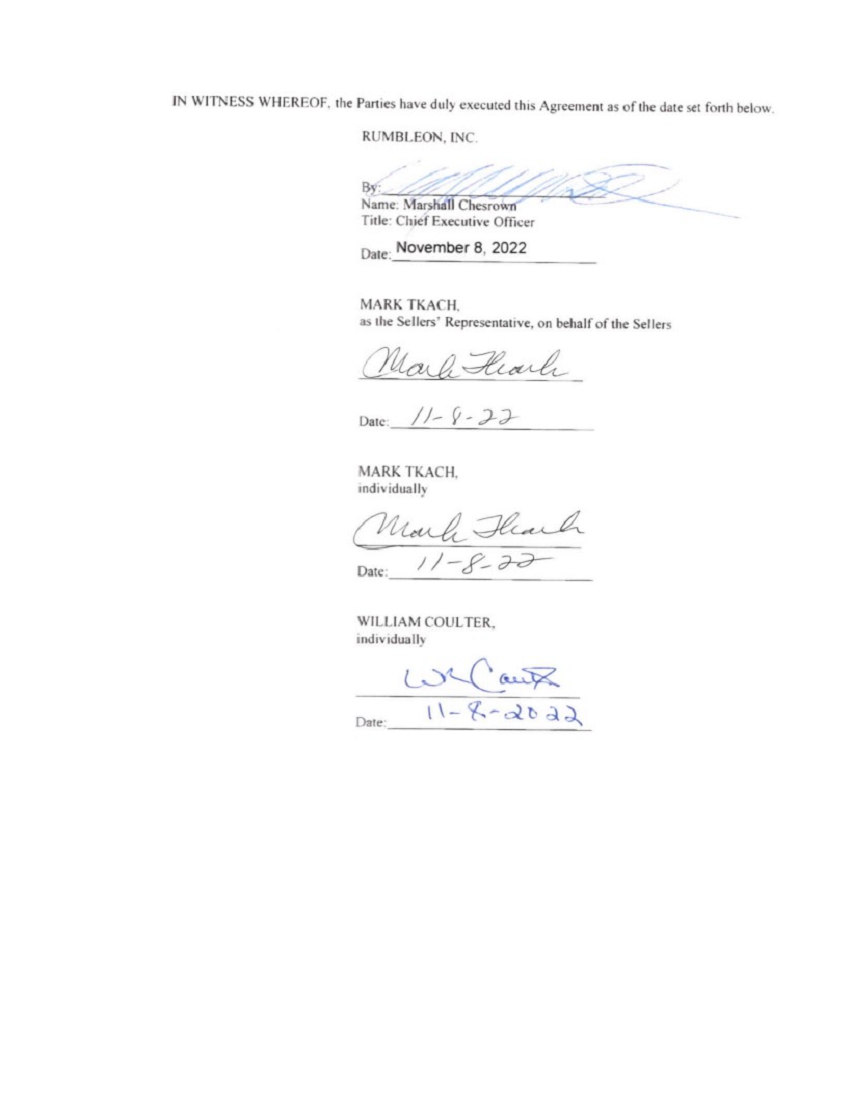

On November 8, 2022, Mr. Coulter and Mr. Tkach (with Mr. Tkach also acting in his capacity as Sellers’ Representative under the RideNow Agreement) and the Issuer entered into a Settlement Agreement (the “Settlement Agreement”) to resolve the following lawsuits: (1) Mark Tkach, et al. v. RumbleOn, Inc., Case No. 2022-0405-PAF (Del. Ch.); (2) Mark Tkach, et al. v. RumbleOn, Inc., Case No. 2022-0791-PAF (Del. Ch.); and RumbleOn, Inc. v. Mark Tkach, et al., Case No. 2022-0992-PAF (Del. Ch.) (together, the “Actions”). In connection with that Settlement Agreement, the Issuer, on one hand, and Mr. Coulter and Mr. Tkach, on the other hand, provided each other with broad mutual releases of any and all known or unknown claims that each had or may have had against the other, from the beginning of time to the date of the Settlement Agreement. The Issuer further agreed to release the Adjustment Escrow Amount and the Escrow Shares (as those terms are defined in the RideNow Agreement) to Mr. Coulter and Mr. Tkach. Mr. Coulter and Mr. Tkach further agreed to certain restrictions on their ability to dispose of their shares of the Issuer’s Class B Common Stock, including in some instances providing the Issuer with a right of first refusal for such sales. The Settlement Agreement is filed as Exhibit 99.6 hereto and is incorporated by reference herein.

| Item 7. | Material to Be Filed as Exhibits. |

Item 7 is hereby amended to add the following:

Exhibit 99.4 – Joint Filing Agreement, dated March 15, 2023

Exhibit 99.5 – Press Release and Letter to Stockholders, dated March 15, 2023

Exhibit 99.6 – Settlement Agreement, dated November 8, 2022

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 15, 2023

| | /s/ William Coulter |

| | William Coulter |

| | |

| | /s/ Mark Tkach |

| | Mark Tkach |

| | |

| | WJC PROPERTIES, LLC |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Manager |

| | |

| | WRC-2009, L.L.C. |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Manager |

| | |

| | WRC-098 Trust |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Trustee |

| | |

| | THE WRC 2021 Irrevocable Trust |

| | |

| | / s/ William Coulter |

| | By: William Coulter |

| | Title: Trustee |

| | |

| | /s/ Kyle Beaird |

| | Kyle Beaird |

| | |

| | /s/ Melvin Flanigan |

| | Melvin Flanigan |

| | |

| | /s/ Steven Pully |

| | Steven Pully |

Exhibit 99.4

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of a Statement on Schedule 13D (including additional amendments thereto) with respect to the shares of Class B Common Stock, $0.001 par value, of RumbleOn, Inc., a Nevada corporation. This Joint Filing Agreement shall be filed as an Exhibit to such Statement.

Dated: March 15, 2023

| | /s/ William Coulter |

| | William Coulter |

| | |

| | /s/ Mark Tkach |

| | Mark Tkach |

| | |

| | WJC PROPERTIES, LLC |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Manager |

| | |

| | WRC-2009, L.L.C. |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Manager |

| | |

| | WRC-098 Trust |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Trustee |

| | |

| | THE WRC 2021 Irrevocable Trust |

| | |

| | /s/ William Coulter |

| | By: William Coulter |

| | Title: Trustee |

| | |

| | /s/ Kyle Beaird |

| | Kyle Beaird |

| | |

| | /s/ Melvin Flanigan |

| | Melvin Flanigan |

| | |

| | /s/ Steven Pully |

| | Steven Pully |

Exhibit 99.5

RumbleOn’s Two Largest Stockholders Will be Nominating Five Highly Qualified Candidates for Election to Company’s Board of Directors

Issue Open Letter to Stockholders Detailing Concerns With Company’s Poor Shareholder Return and Highly Deficient Governance

March 15, 2023 - William Coulter and Mark Tkach, who together own approximately 32.5% of the outstanding Class B shares of common stock of RumbleOn, Inc. (“RumbleOn” or the “Company”), today issued an open letter to the Company’s stockholders. Mr. Coulter and Mr. Tkach announced that they have nominated five highly qualified candidates for three Board seats that will be up for election to the Board of Directors of the Company (the “Board”) at its 2023 Annual Meeting of Stockholders.

Below is the full text of the letter:

Dear Fellow RumbleOn Stockholders:

We are William Coulter and Mark Tkach. We are entrepreneurs, not activist investors. Over 32 years, we built a thriving retail business, RideNow Powersports (“RideNow”), which sold motorcycles, all-terrain vehicles, personal watercraft and other powersports equipment, plus accessories. In 2021, we sold RideNow to RumbleOn. RumbleOn used both cash and stock to acquire RideNow, resulting in us obtaining approximately 32.5% of RumbleOn’s outstanding Class B common shares. We also own and lease to the Company 25 properties under 20-year leases, which expire in 2041.

After RumbleOn purchased RideNow, Mr. Coulter joined RumbleOn as Executive Vice Chairman of the Board of Directors, while Mr. Tkach was appointed as a director and the Chief Operating Officer of RumbleOn. Despite those titles and our substantial share ownership, we learned that our influence and voices were considerably less than our roles suggested. Other executives and directors purposely avoided seeking our counsel, or disregarded it outright. We were not provided adequate information to properly fulfill our roles, even after multiple requests. As a result, we resigned from our roles in February 2022.

From February 11, 2022, the last trading day before our resignations were publicly announced, through March 13, 2023, RMBL shares have fallen -80.4%. Over the summer and fall of 2022, the Company’s inventory level and its SG&A/revenue ratio each rose sharply. After witnessing the severe stock price decline and observing operating metrics deteriorate, we reached out to Chairman and CEO Marshall Chesrown and the Board of Directors on December 9, 2022.

In a letter, we asked the Board to articulate to all investors publicly its plans regarding the Company’s bloated cost structure and questionable inventory controls. After being ignored, we reiterated this request in two follow-up letters. However, RumbleOn declined to provide investors with any concrete plans to improve its business. This, as well as several other corporate governance missteps, makes us doubt the current Board’s ability to oversee, and management’s ability to implement, the type of self-improvement plan that will maximize value for all stockholders. Over the past twelve months, even as the share price has fallen and financial metrics have deteriorated dramatically, the Board and management have not reacted proportionally. Instead, when RumbleOn management presented at the ICR Conference in January 2023, it provided investors with a rosy view of the business and its growth prospects.

These events have led us to explore and now seek meaningful changes to RumbleOn’s Board. While the Company did ask Mr. Coulter to rejoin the Board in the past few weeks, the type of change required at RumbleOn will require more than one new director. We know this from first-hand experience. We privately proposed a more significant refreshment of the Board to RumbleOn with the hope that we could reach a settlement before the Company’s nomination deadline of March 16, 2023. In the nearly two weeks since our settlement proposal, the Board has not responded substantively to our proposal or negotiated in good faith to reach mutually acceptable terms to bring about the changes required to maximize shareholder value. Instead, they appear to have decided to entrench themselves further, which will likely result in the Board and management attempting to defend their decisions and poor track record, ignoring the economic value that has been destroyed along the way.

The Board’s seeming attempt to stall us and prevent a proxy contest is consistent with other significant corporate governance deficiencies. For example, corporate governance best practice typically enables only one executive on a board of directors, most commonly the CEO. By contrast, RumbleOn’s Board includes Mr. Chesrown and Chief Operating Officer Peter Levy. During the six months we served as RumbleOn directors, it became clear to us that Mr. Chesrown’s role as Chairman and Mr. Levy’s Board representation only served to defend the types of decisions that emboldened a strategy that has resulted in the Company’s poor total shareholder return and its declining operational metrics.

The Board has at least two other reputedly “independent” directors with close business ties to RumbleOn or longstanding personal ties to Mr. Chesrown. Michael Marchlik is an executive at a subsidiary of B. Riley Financial Inc. (“B. Riley”). When RumbleOn acquired RideNow, another B. Riley subsidiary was RumbleOn’s financial advisor and its investment banker, garnering millions of dollars in fees while leading the Company’s equity offering. Kevin Westfall worked with Mr. Chesrown both at AutoNation in the late 1990s and at Vroom.com nearly a decade ago. In 2013 and 2014, Mr. Westfall was Vroom’s CEO, where Mr. Chesrown reported to him as Vroom’s Chief Operating Officer. In early 2017, Mr. Westfall joined the RumbleOn Board, where his role includes overseeing Mr. Chesrown and other executives.

About one year ago, on February 4, 2022, RumbleOn Board member Sam Dantzler resigned, more than four months before RumbleOn’s 2022 annual meeting. The Company reported the resignation that day in an SEC filing, stating that it “expects to appoint a new independent director in the coming weeks.” That statement suggested that the Company would appoint a director in time for stockholders to vote on that person, as Mr. Dantzler’s Board seat would have been up for election in June 2022. Instead, nine days after the 2022 annual meeting, the Board appointed Shin Lee as a director.

The Company informed our counsel that Ms. Lee replaced Mr. Dantzler on the Board and will not be up for election until 2025. Yet, the Company has never even disclosed to stockholders which class of directors she was appointed to, nor in which year Ms. Lee’s term is due to expire. The Board apparently believes that Ms. Lee should serve a multi-year term on the Board notwithstanding that the Company deliberately sought to avoid shareholder approval on her appointment. The Company could have easily sought shareholder approval for Ms. Lee’s nomination at the 2022 annual meeting. Are we to believe that Ms. Lee was identified as a Board candidate in the nine days between the 2022 annual meeting and her appointment?

Let us be clear. We have no quarrel with Ms. Lee. We presume that she did not control the timing of her appointment to the Board. Furthermore, we do not know how strong a director she has been, as we have never met her. We hope to have the opportunity to meet her in the near term so we can assess whether she can be part of the solution in turning around RumbleOn. The point of course is the timing of her appointment to the Board. This exemplifies a disregard of shareholder rights and utilization of slick maneuvers to avoid shareholder input. Stockholders cannot tolerate such activities, especially if they continue ahead of the 2023 annual meeting.

As referenced earlier, the Company did offer a single Board seat to Mr. Coulter about one month ago. That offer was intended to fill a recently vacated Board seat by Denmar Dixon, who resigned from the Board on January 18, 2023, just shy of the one-year anniversary since we resigned from the Board. Mr. Coulter rejected this offer on the grounds that it was inadequate to support the level of change that we know is necessary to restore and maximize shareholder value. Mr. Coulter urged the Company allow the stockholders to decide how that vacant Board seat should be filled at the upcoming annual meeting. Hopefully, they will listen to the recommendation from their largest stockholders this time around rather than subvert the rights of all stockholders in favor of a friendly face.

As such, we propose that the Company include a proposal at the 2023 annual meeting to invalidate the appointment of any director after March 1, 2023 until such time as the 2023 annual meeting is concluded. If this proposal passes, we believe it is not only appropriate but also important that ALL stockholders have an opportunity to determine who should fill Mr. Dixon’s vacant Board seat.

We have also proposed that the Company include two other separate proposals to be considered by the stockholders at the 2023 annual meeting. One will ask stockholders to approve a proposal to separate the Chairman and CEO roles. Not only is this a well settled hallmark of strong corporate governance but with regard to RumbleOn specifically, we believe that Mr. Chesrown should not be serving in both capacities. Many academics and management consultants agree that the most important role of a Board of Directors is to select and provide oversight to the CEO. Only through a separation of the chairman and CEO roles, as well as with the oversight of a truly independent board of directors, can this be accomplished. In our minds, this is an important point in the turnaround of RumbleOn.

Lastly, we have proposed to include a proposal at the 2023 annual meeting to remove Peter Levy as a Board member. Given his lack of public company board experience, the amount of value destroyed during his tenure in both of his roles, we are seeking to remove him from the Board and replace him with an independent director candidate with extensive public company board experience.

All of the foregoing has led us to seek to replace three RumbleOn directors at the 2023 annual meeting, while enabling all stockholders to fill Mr. Dixon’s seat. We are nominating five individuals for the three board seats – two Class II seats and one for Mr. Levy’s seat. We have nominated two other director candidates in the event another director decides to resign before the 2023 annual meeting or should something unexpectedly happen to one of our nominees. The upcoming 2023 annual meeting is that important.

We have reluctantly undertaken this process and have tried to avoid it via settlement. Again, we are entrepreneurs, not activist investors. However, we believe that the Board needs several new, well-qualified directors to oversee the type of change required to maximize value for all stockholders. Our nominees include:

| · | William Coulter was the co-founder of RideNow and owns 2.62 million RMBL shares (16.2% of total Class B shares outstanding). Mr. Coulter and Mr. Tkach co-founded RideNow in 1989 and expanded the company to include more than 40 stores in eight states. |

| · | Mark Tkach was the co-founder of RideNow and owns 2.62 million RMBL shares (16.2% of total Class B shares outstanding). |

| · | Kyle Beaird is the Chief Financial Officer of SCORE Sports, which designs, manufactures and sells youth sports uniforms and equipment. He has led operations and finance in the action sports industry. |

| · | Mel Flanigan was the Chief Financial Officer of recreational vehicle retailer Camping World Holdings, Inc. and of audio technology firm DTS Inc., both of which were publicly traded. |

| · | Steve Pully is a founding partner of Speyside Partners, which performs consulting, restructuring and investment banking services for companies and investors. He has been a director on many public company boards. |

We look forward to engaging with our fellow stockholders and certain members of the Board to move RumbleOn in the right direction. We are enthusiastic about the opportunity to improve RumbleOn’s operational performance and start restoring stockholder value. We have little confidence that this will occur at the hand of the existing leadership of RumbleOn.

| Sincerely, | |

| | |

| /s/ William Coulter | |

| William Coulter | |

| | |

| /s/ Mark Tkach | |

| Mark Tkach | |

| | |

| Contact information: | |

Bruce Goldfarb/Pat McHugh/Lisa Patel

Okapi Partners LLC

212-297-0720

Info@okapipartners.com

William Coulter and Mark Tkach, together with the other participants named herein (collectively, the “Participants”), intend to file a preliminary proxy statement and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) with respect to the election of directors of RumbleOn, Inc., a Nevada corporation (the “Company”), and certain proposals for the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”).

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

THE PARTICIPANTS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES WITH RESPECT TO THE ANNUAL MEETING. THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS RELATED TO THE ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be William Coulter, Mark Tkach, WJC Properties, L.L.C., WRC-2009, L.L.C., WRC-098 Trust, The WRC 2021 Irrevocable Trust, RideNow Management, LLLP, Kyle Beaird, Melvin Flanigan and Steven Pully.

Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the election of directors of the Company and certain proposals, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other proxy materials when they are filed with the SEC.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 5,242,433 shares of Class B Common Stock, par value $0.001 per share, of the Company (“Class B Common Stock”). As of the date hereof, William Coulter beneficially owns 2,621,405 shares of Class B Common Stock, Mark Tkach beneficially owns 2,621,028 shares of Class B Common Stock, WJC Properties, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-2009, L.L.C. beneficially owns 30,377 shares of Class B Common Stock, WRC-098 Trust beneficially owns 30,377 shares of Class B Common Stock, The WRC 2021 Irrevocable Trust beneficially owns 593,472 shares of Class B Common Stock, and the remainder of the Participants do not beneficially own any shares of Class B Common Stock.