TPG Angelo Gordon Teach-In November 2023 Comment Exhibit 99.1

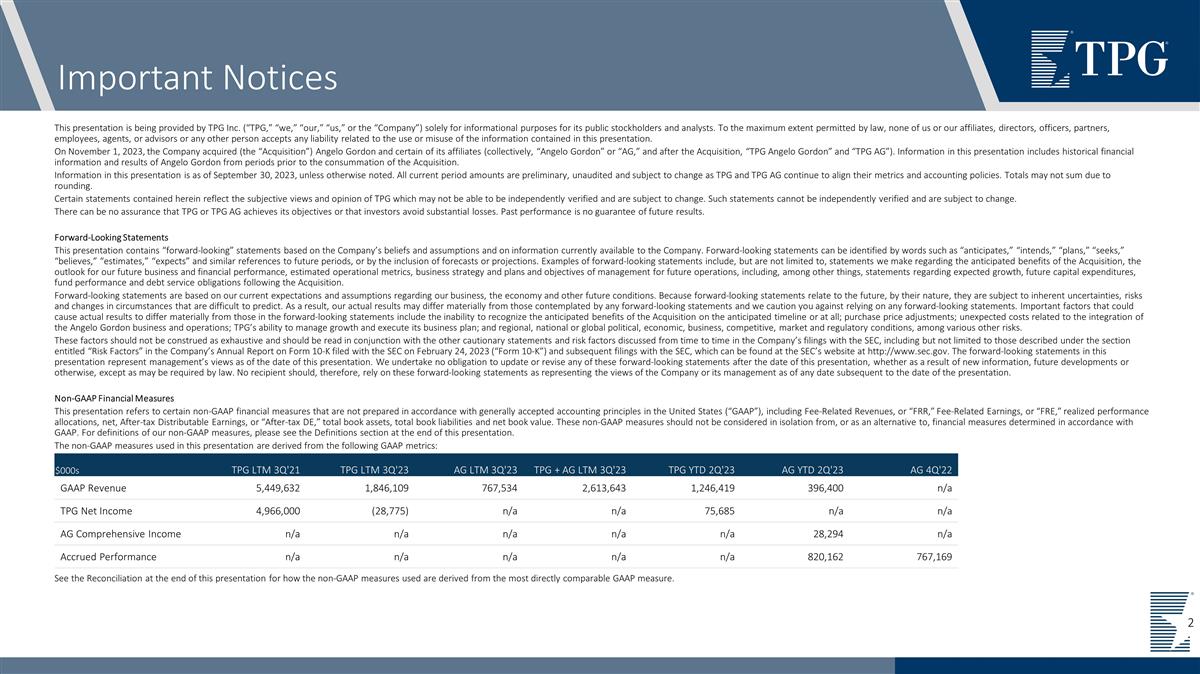

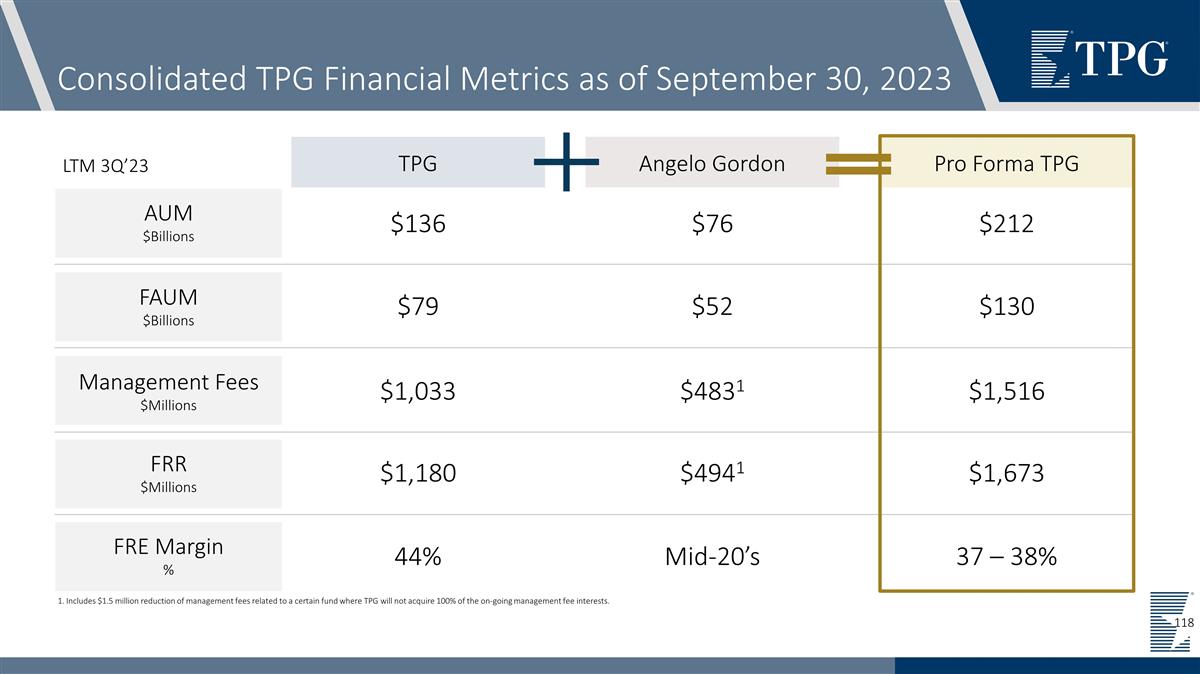

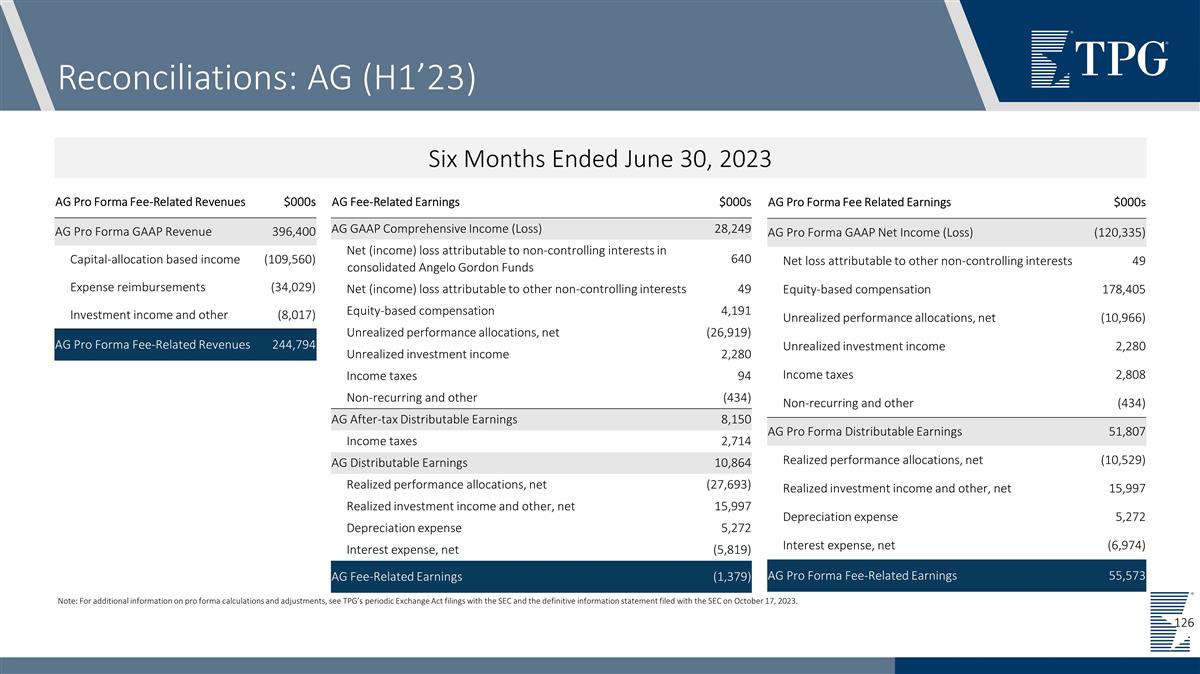

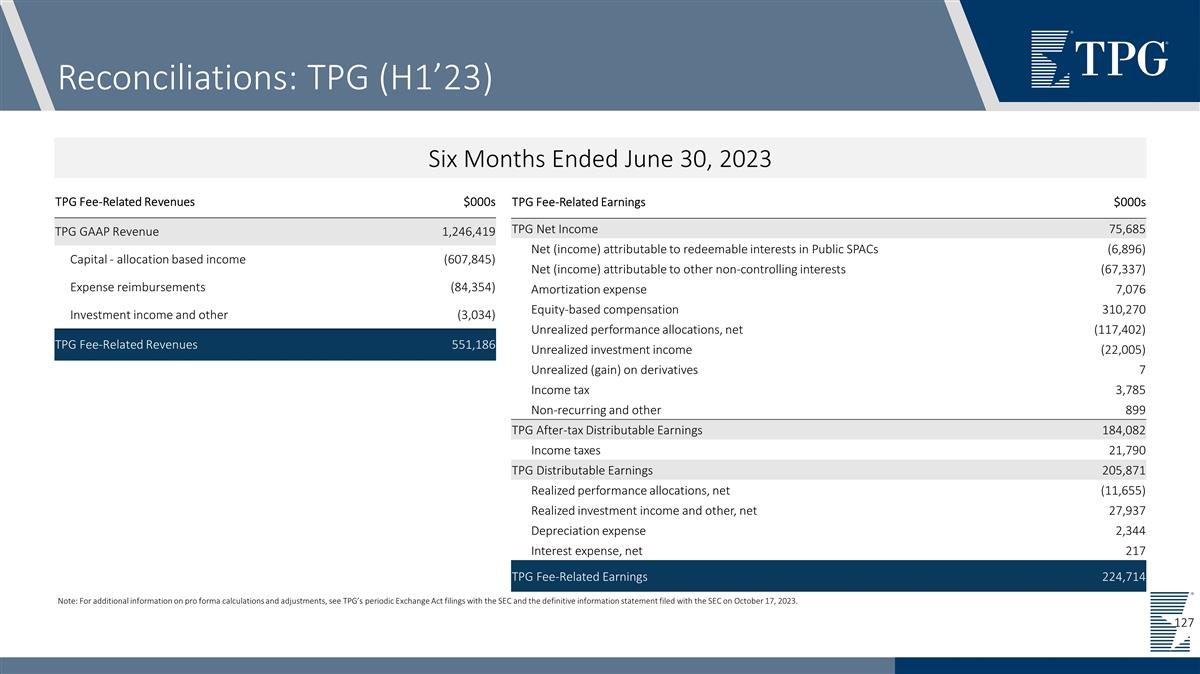

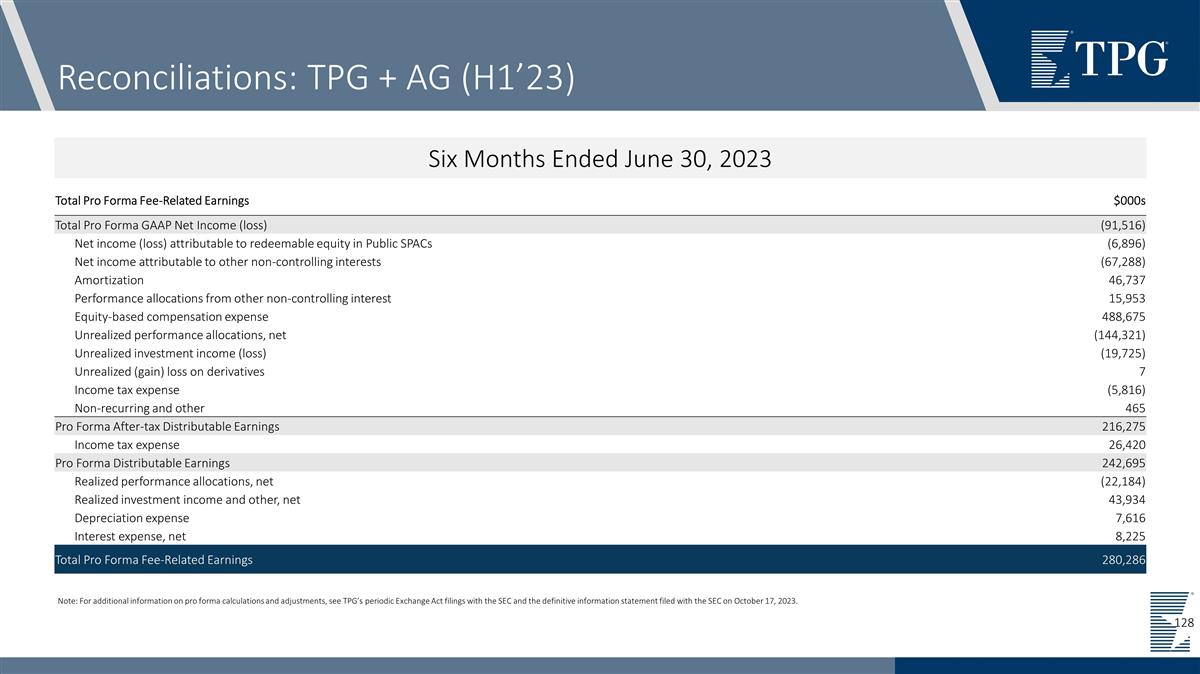

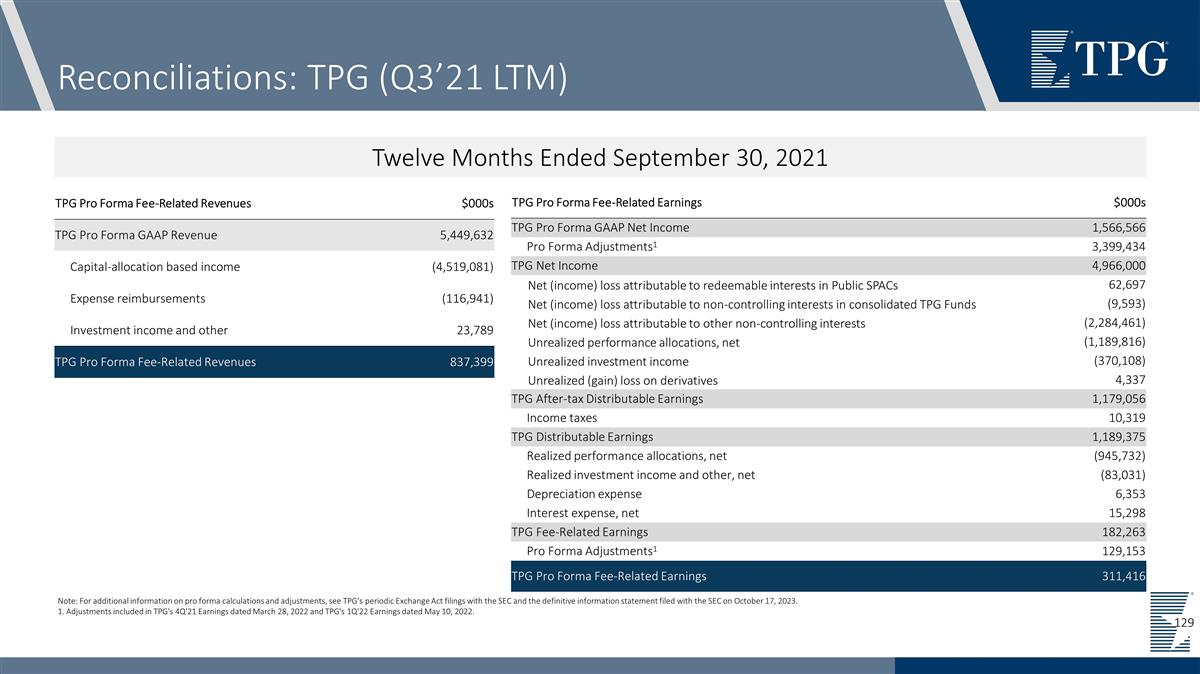

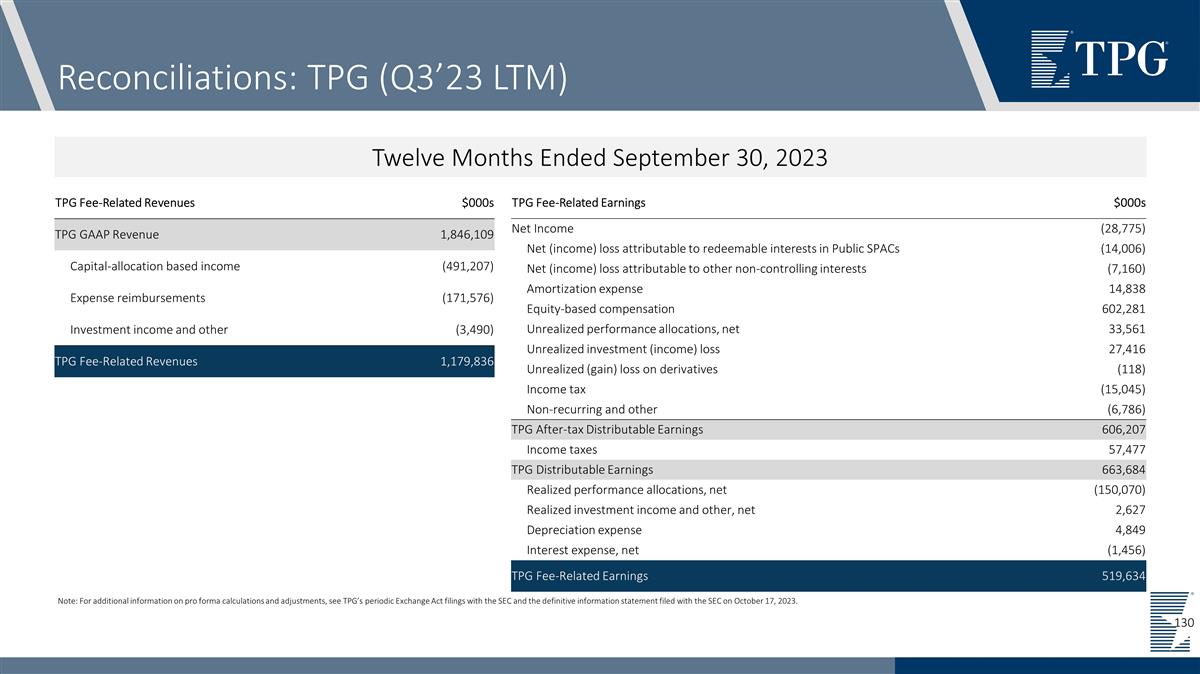

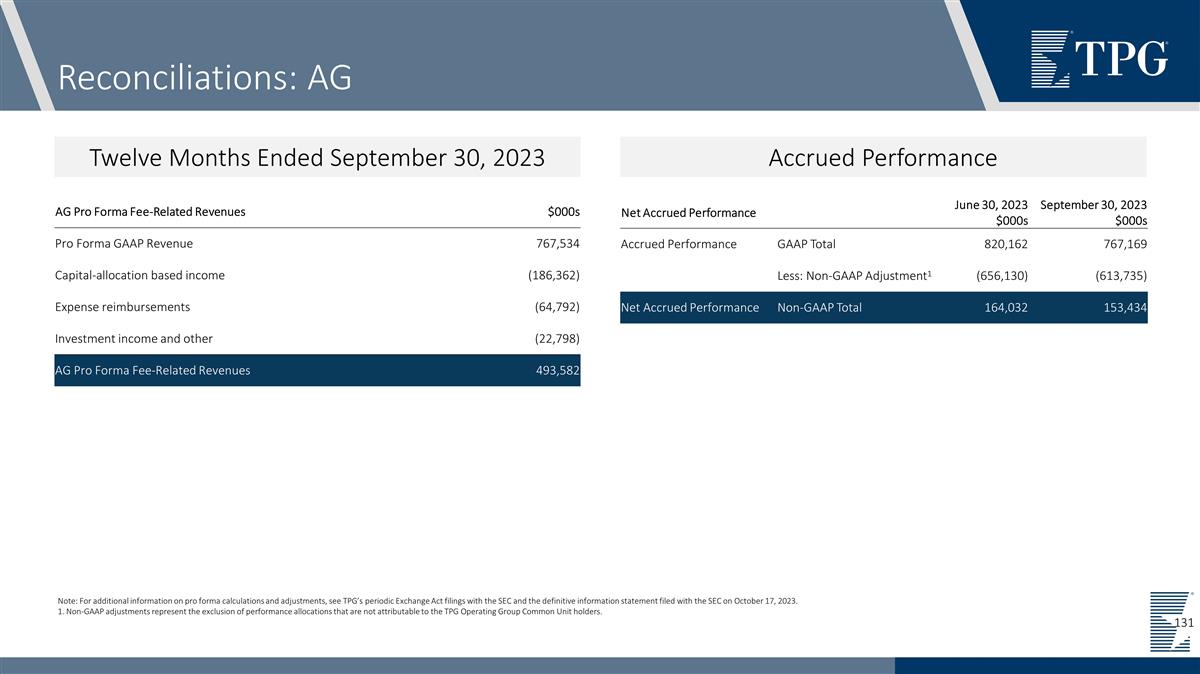

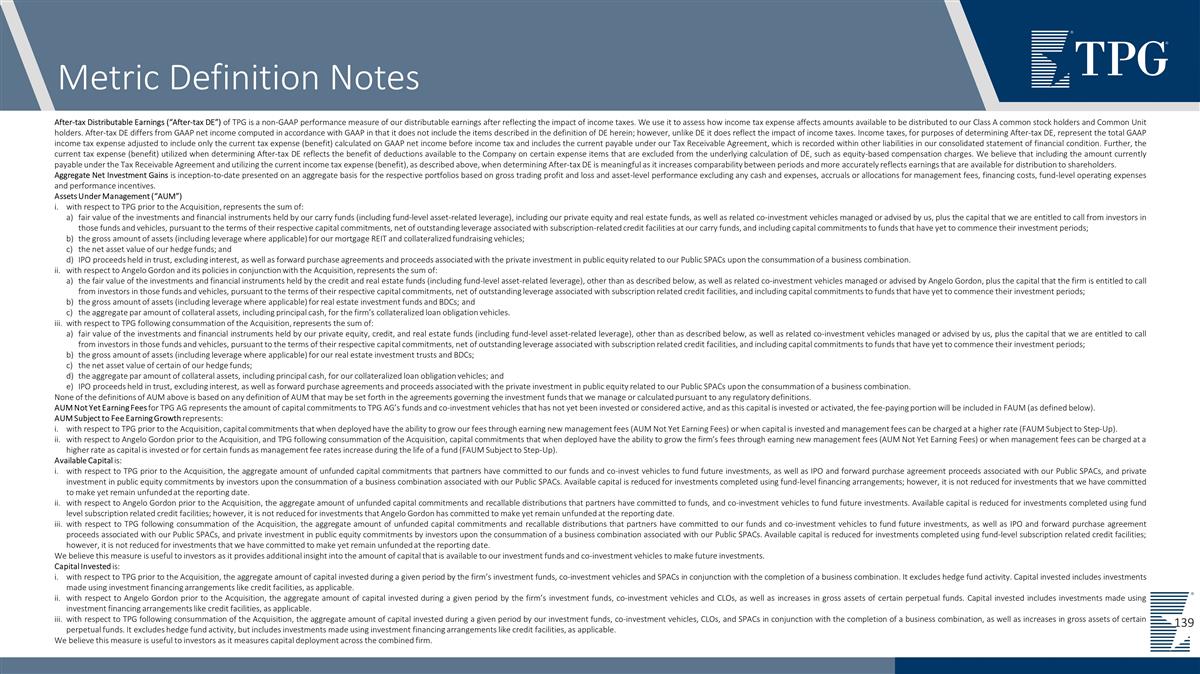

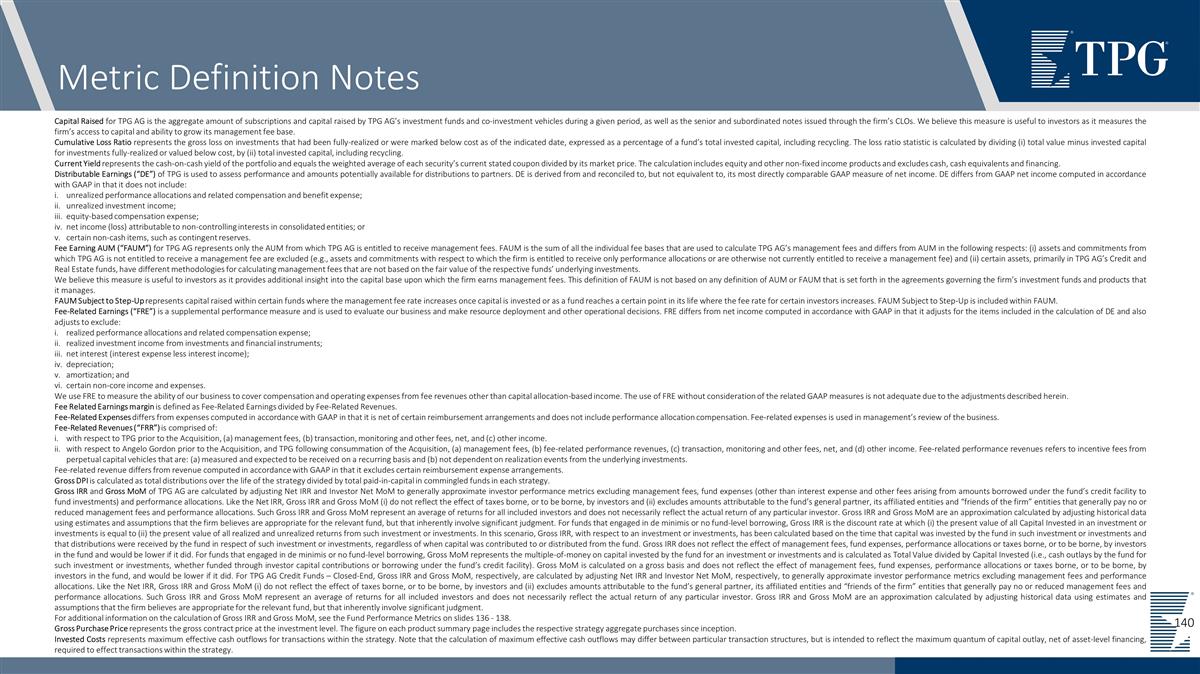

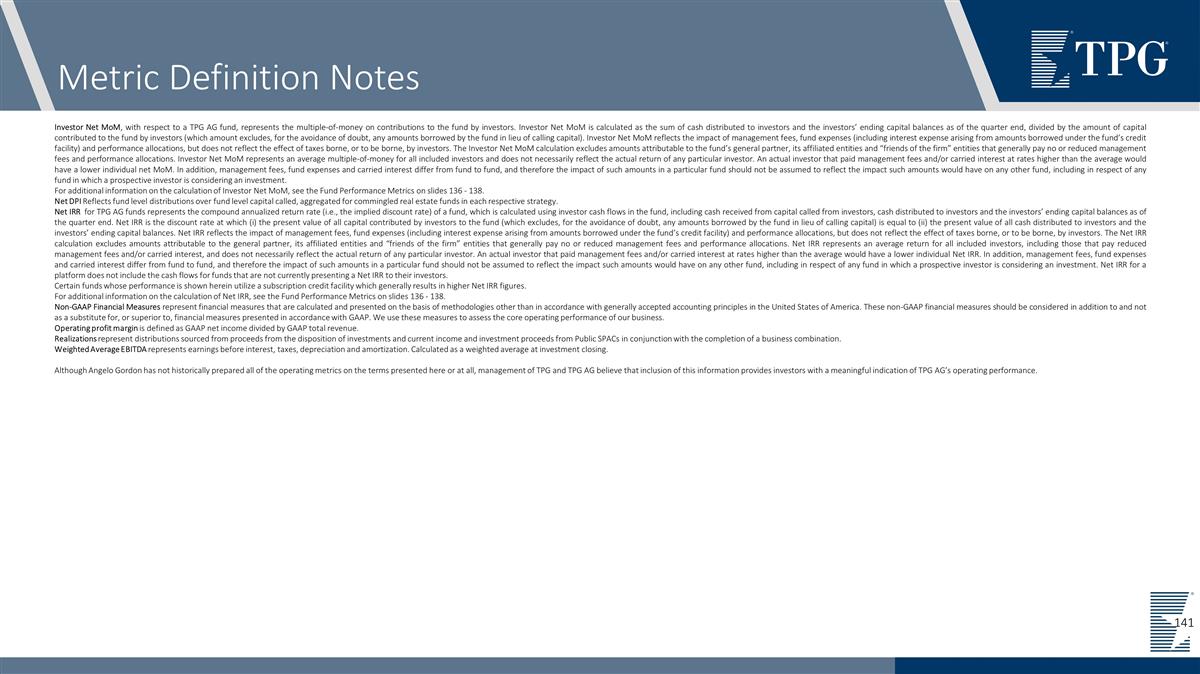

Important Notices This presentation is being provided by TPG Inc. (“TPG,” “we,” “our,” “us,” or the “Company”) solely for informational purposes for its public stockholders and analysts. To the maximum extent permitted by law, none of us or our affiliates, directors, officers, partners, employees, agents, or advisors or any other person accepts any liability related to the use or misuse of the information contained in this presentation. On November 1, 2023, the Company acquired (the “Acquisition”) Angelo Gordon and certain of its affiliates (collectively, “Angelo Gordon” or “AG,” and after the Acquisition, “TPG Angelo Gordon” and “TPG AG”). Information in this presentation includes historical financial information and results of Angelo Gordon from periods prior to the consummation of the Acquisition. Information in this presentation is as of September 30, 2023, unless otherwise noted. All current period amounts are preliminary, unaudited and subject to change as TPG and TPG AG continue to align their metrics and accounting policies. Totals may not sum due to rounding. Certain statements contained herein reflect the subjective views and opinion of TPG which may not be able to be independently verified and are subject to change. Such statements cannot be independently verified and are subject to change. There can be no assurance that TPG or TPG AG achieves its objectives or that investors avoid substantial losses. Past performance is no guarantee of future results. Forward-Looking Statements This presentation contains “forward-looking” statements based on the Company’s beliefs and assumptions and on information currently available to the Company. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the anticipated benefits of the Acquisition, the outlook for our future business and financial performance, estimated operational metrics, business strategy and plans and objectives of management for future operations, including, among other things, statements regarding expected growth, future capital expenditures, fund performance and debt service obligations following the Acquisition. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by any forward-looking statements and we caution you against relying on any forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the inability to recognize the anticipated benefits of the Acquisition on the anticipated timeline or at all; purchase price adjustments; unexpected costs related to the integration of the Angelo Gordon business and operations; TPG’s ability to manage growth and execute its business plan; and regional, national or global political, economic, business, competitive, market and regulatory conditions, among various other risks. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risk factors discussed from time to time in the Company’s filings with the SEC, including but not limited to those described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the SEC on February 24, 2023 (“Form 10-K”) and subsequent filings with the SEC, which can be found at the SEC’s website at http://www.sec.gov. The forward-looking statements in this presentation represent management’s views as of the date of this presentation. We undertake no obligation to update or revise any of these forward-looking statements after the date of this presentation, whether as a result of new information, future developments or otherwise, except as may be required by law. No recipient should, therefore, rely on these forward-looking statements as representing the views of the Company or its management as of any date subsequent to the date of the presentation. Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures that are not prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), including Fee-Related Revenues, or “FRR,” Fee-Related Earnings, or “FRE,” realized performance allocations, net, After-tax Distributable Earnings, or “After-tax DE,” total book assets, total book liabilities and net book value. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. For definitions of our non-GAAP measures, please see the Definitions section at the end of this presentation. The non-GAAP measures used in this presentation are derived from the following GAAP metrics: See the Reconciliation at the end of this presentation for how the non-GAAP measures used are derived from the most directly comparable GAAP measure. $000s TPG LTM 3Q'21 TPG LTM 3Q'23 AG LTM 3Q'23 TPG + AG LTM 3Q'23 TPG YTD 2Q'23 AG YTD 2Q'23 AG 4Q'22 GAAP Revenue 5,449,632 1,846,109 767,534 2,613,643 1,246,419 396,400 n/a TPG Net Income 4,966,000 (28,775) n/a n/a 75,685 n/a n/a AG Comprehensive Income n/a n/a n/a n/a n/a 28,294 n/a Accrued Performance n/a n/a n/a n/a n/a 820,162 767,169 2

Important Notices (Cont’d) Pro Forma Information Pro Forma Information - Acquisition Pro forma figures are on an adjusted basis, assuming the Acquisition occurred on January 1, 2022. Due to the Acquisitions, comparability of prior periods may be limited. The unaudited pro forma condensed combined financial information in this presentation is based on available information and upon assumptions that management believes are reasonable in order to reflect, on a pro forma basis, the effect of the Acquisitions, the related borrowing under TPG’s revolving credit facility and certain changes in compensation arrangements for TPG. The actual results reported by the combined company in periods following the Acquisition may differ materially from that reflected in this unaudited pro forma condensed combined financial information. The unaudited pro forma condensed combined financial information is preliminary, is being furnished solely for informational purposes and is not necessarily indicative of the combined financial position or results of operations that might have been achieved for the periods or dates indicated, nor is it necessarily indicative of the future results of the combined company. It does not reflect potential revenue synergies or cost savings expected to be realized from the Acquisition. No assurance can be given that cost savings or synergies will be realized at all. The adjustments contained in the unaudited pro forma condensed combined financial information are based on currently available information and assumptions that TPG believes are reasonable. Such assumptions include, but are not limited to, the Class A common stock, par value $0.001 per share (“Class A Share”), price, the preliminary purchase price allocation of TPG AG’s assets acquired and liabilities assumed based on fair value and estimated post-combination compensation expense. The final purchase price allocation and grant date fair value of share-based payment awards will be completed in the time period permitted by ASC Topic 805, Business Combinations, and as such, changes to the assumptions used could have a material impact on the unaudited pro forma condensed combined financial information. The unaudited pro forma condensed combined financial information does not project TPG’s results of operations or financial position for any future period or date. Pro Forma Information – IPO and Reorganization Prior to and in connection with our initial public offering (“IPO”), we completed certain transactions as part of a corporate reorganization (the “Reorganization”), which concluded with NASDAQ listing our Class A common stock on January 13, 2022. The Reorganization included certain transfers of economic entitlements and investments that were effectuated December 31, 2021, including the transfer of certain limited partner interests in entities that (i) serve as the general partner of certain TPG funds and (ii) are, or historically were, consolidated by TPG Group Holdings (SBS), L.P. (“TPG general partner entities”) to Tarrant RemainCo I, L.P., Tarrant RemainCo II, L.P. and Tarrant RemainCo III, L.P. (“RemainCo”). The transfer of certain limited partner interests in TPG general partner entities to RemainCo resulted in the deconsolidation of TPG Funds, as the TPG general partner entities are no longer considered the primary beneficiary as of December 31, 2021. While the Reorganization did not affect, on a GAAP or non-GAAP basis, our income statement activity for the fiscal year ended December 31, 2021 or our financial statements for prior periods, this presentation includes pro forma financial data giving effect to the IPO and the Reorganization as though they had occurred on January 1, 2020. As such, the pro forma information reflects certain reorganization adjustments, including, but not limited to, the exclusion of assets that were transferred to RemainCo, increasing the amount of performance allocations our people will receive, the inclusion of an administrative services fee paid by RemainCo to the Company, additional interest on debt incurred as part of the Reorganization, and the step-up of taxes on a public-company basis. Therefore, comparability of the pro forma information included in this presentation to prior financial data or future periods may be limited. No Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Proxies will not be solicited in connection with the Acquisition. This presentation shall also not constitute an offer to sell, or the solicitation of an offer to buy, interests in any of the funds discussed herein.

Welcome Remarks

Presenter Head of Investor Relations Gary Stein

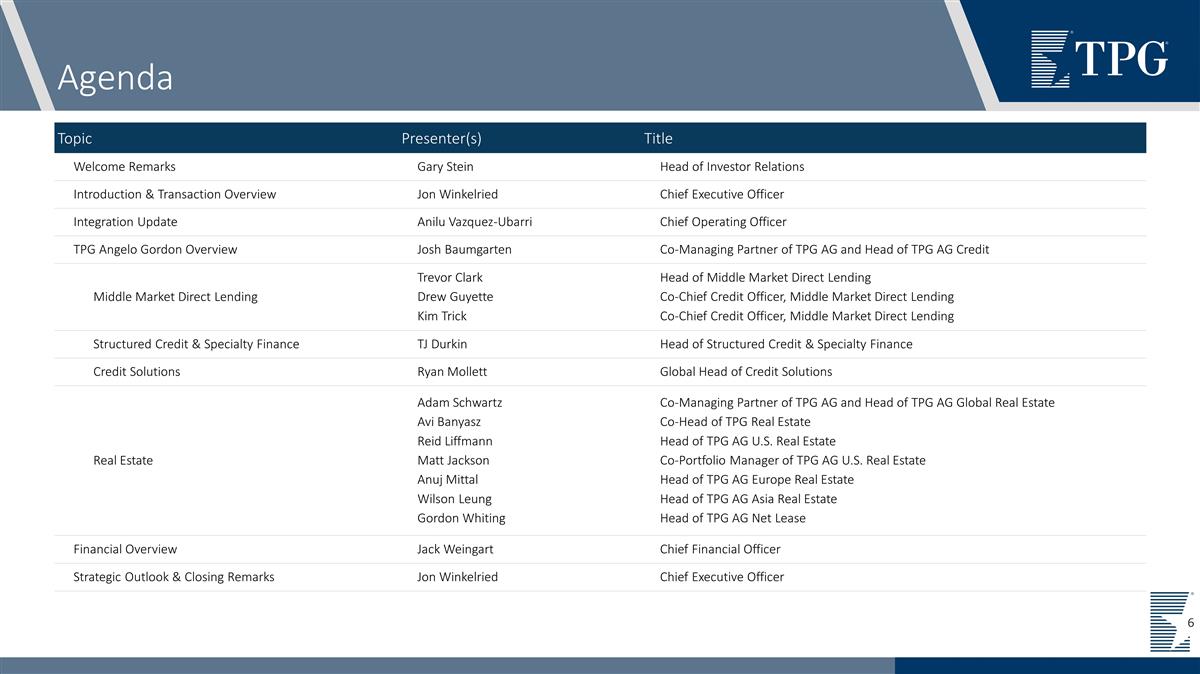

Agenda Topic Presenter(s) Title Welcome Remarks Gary Stein Head of Investor Relations Introduction & Transaction Overview Jon Winkelried Chief Executive Officer Integration Update Anilu Vazquez-Ubarri Chief Operating Officer TPG Angelo Gordon Overview Josh Baumgarten Co-Managing Partner of TPG AG and Head of TPG AG Credit Middle Market Direct Lending Trevor Clark Drew Guyette Kim Trick Head of Middle Market Direct Lending Co-Chief Credit Officer, Middle Market Direct Lending Co-Chief Credit Officer, Middle Market Direct Lending Structured Credit & Specialty Finance TJ Durkin Head of Structured Credit & Specialty Finance Credit Solutions Ryan Mollett Global Head of Credit Solutions Real Estate Adam Schwartz Avi Banyasz Reid Liffmann Matt Jackson Anuj Mittal Wilson Leung Gordon Whiting Co-Managing Partner of TPG AG and Head of TPG AG Global Real Estate Co-Head of TPG Real Estate Head of TPG AG U.S. Real Estate Co-Portfolio Manager of TPG AG U.S. Real Estate Head of TPG AG Europe Real Estate Head of TPG AG Asia Real Estate Head of TPG AG Net Lease Financial Overview Jack Weingart Chief Financial Officer Strategic Outlook & Closing Remarks Jon Winkelried Chief Executive Officer 6

Introduction & Transaction Overview

Presenter Chief Executive Officer Jon Winkelried

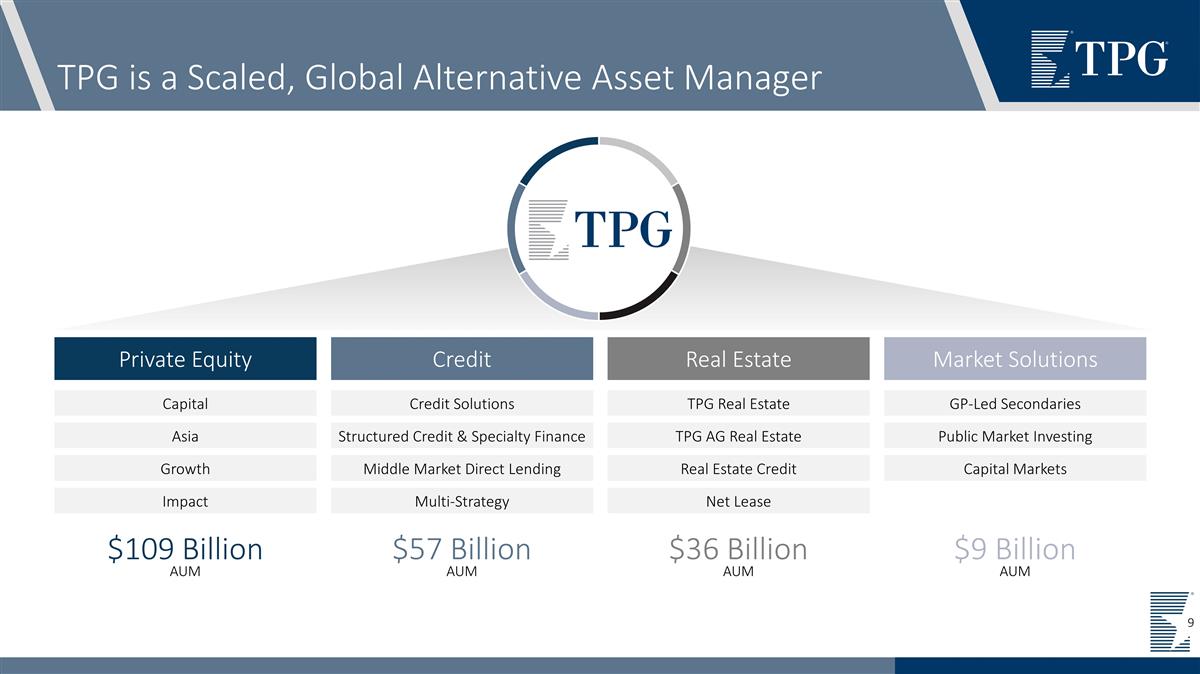

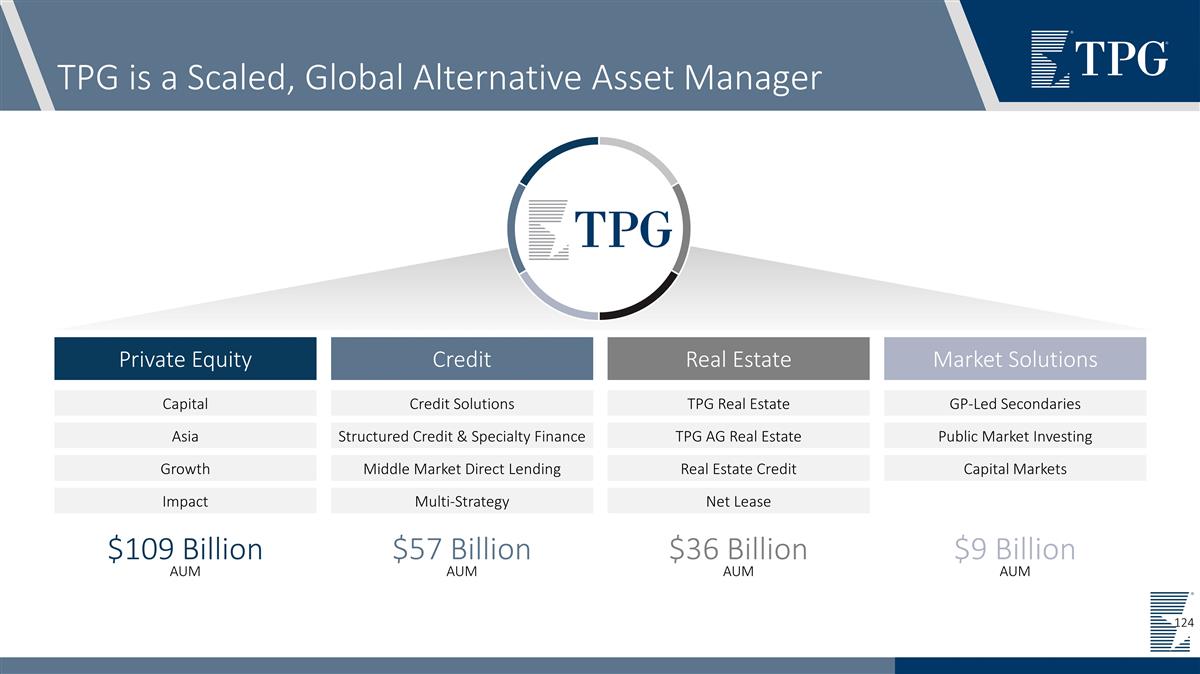

TPG is a Scaled, Global Alternative Asset Manager Private Equity Capital Asia Growth Impact $109 Billion AUM $36 Billion AUM $57 Billion AUM Credit Credit Solutions Structured Credit & Specialty Finance Middle Market Direct Lending Multi-Strategy Real Estate TPG Real Estate TPG AG Real Estate Real Estate Credit Net Lease $9 Billion AUM Market Solutions GP-Led Secondaries Public Market Investing Capital Markets 9

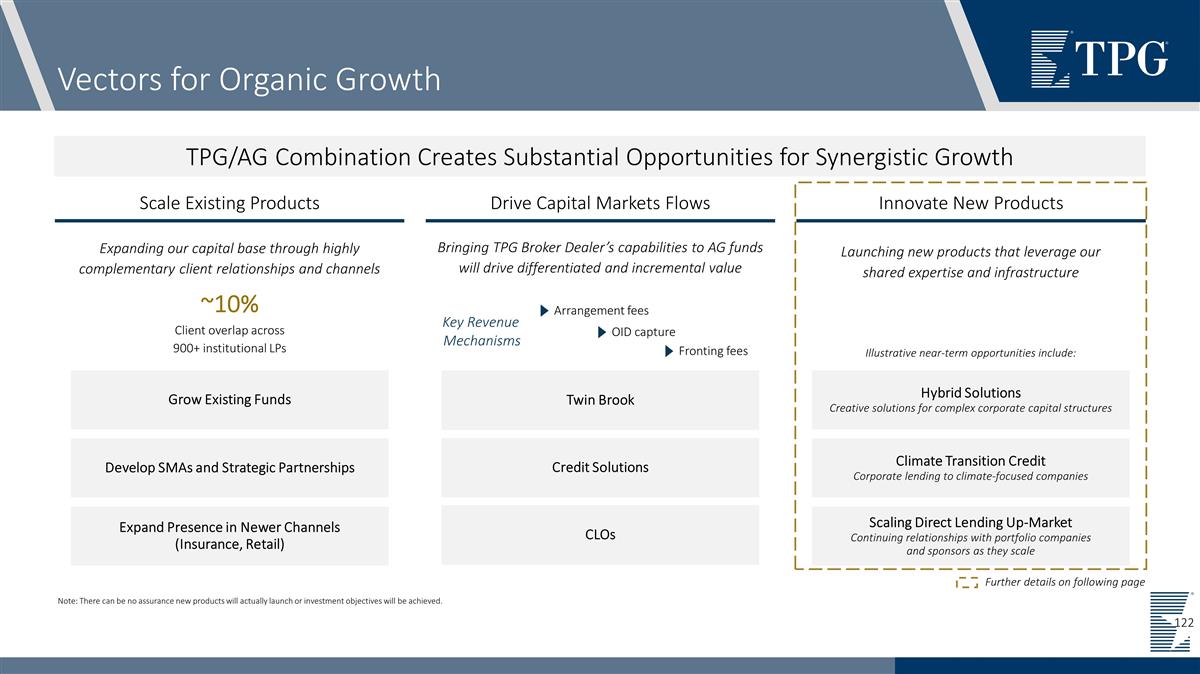

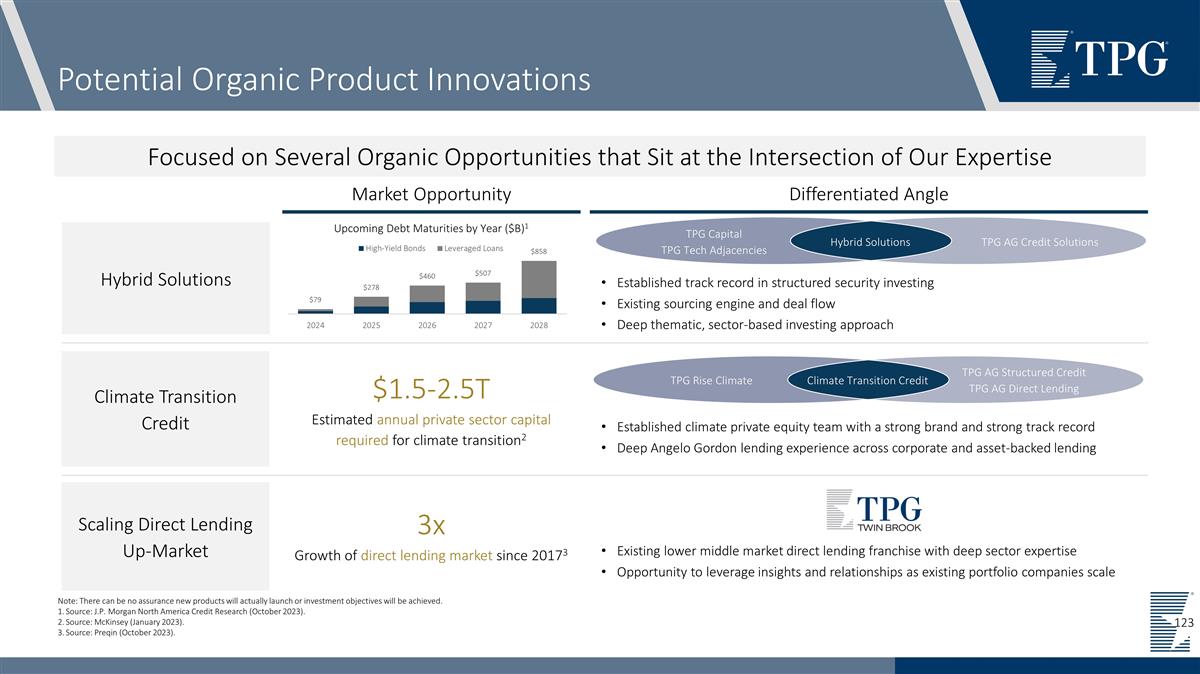

Expand into meaningful untapped whitespace in complementary asset classes such as credit Enhance access to distribution channels such as retail / high net worth and insurance Three Significant Levers of Growth at IPO 1 2 3 Scale Existing Businesses New Adjacent Products Inorganic Growth Raise highly visible pipeline of next generation funds Achieve greater operating leverage as new products scale Generate high FRE margin on incremental AUM Grow platforms through organic product innovation Leverage existing insights and ecosystems TPG Real Estate Credit Rise Climate Infrastructure GP-Led Secondaries TPG NEXT

Post-IPO, TPG Well-Positioned to Play Offense Ability to use equity to fund acquisitions and create alignment Significant Untapped Growth Potential Clean slate in attractive whitespaces Unencumbered by legacy assets or relationships Natural extensions of existing business Enabled By Public Company Currency Balance Sheet Capital IPO proceeds and increased access to capital creating a well-funded and conservative balance sheet

Growth Strategy Capitalizes on Significant Secular Trends 1. Source: Pitchbook – PE firms are acquiring asset managers at record clip (July 2023). 2. Source: Preqin Future of Alternatives 2028 (October 2023). Compares private debt AUM in 2015 and 2022. Limited partners want broader and deeper relationships across fewer fully-integrated solutions providers, driving strategic consolidation among managers to the highest level in over a decade1 Broad Industry Consolidation 1 We believe leading alternative managers are ideally positioned to benefit from rapid evolution of private credit as an asset class, which has nearly tripled since 20152 Accelerated Growth of Private Credit 2 Large and growing sources of capital are increasingly seeking access to alternative asset management capabilities and strategies Channel Expansion in Insurance and Retail 3

LPs Consolidating Relationships Among Largest GPs Source: PEI 300 | Top 300 Private Equity Firms 2018 – 2023. Denotes the cumulative capital raised from January 1st of five years prior through March 31st of the year labeled. For example, the 2023 column represents the amount of private equity direct investment capital raised from third-party investors by firms for funds closed between January 1, 2018 and March 31, 2023, as well as capital raised for funds in market at the end of the counting period. Top 300 GPs by Private Equity Fundraising1 Total private equity direct investment capital raised over the previous 5 years “Top-of-the-House” Relationship Greater leverage with select GPs through more strategic relationships Comprehensive, Total Solutions Providers Investment strategies across the full risk / return spectrum Flight to Safety Well-managed and stable firm, established track record, proven investment style, and robust infrastructure Consolidation More mature, larger GPs with broad offerings are raising a greater portion of capital within alternatives LP Priorities $Trillions >2x

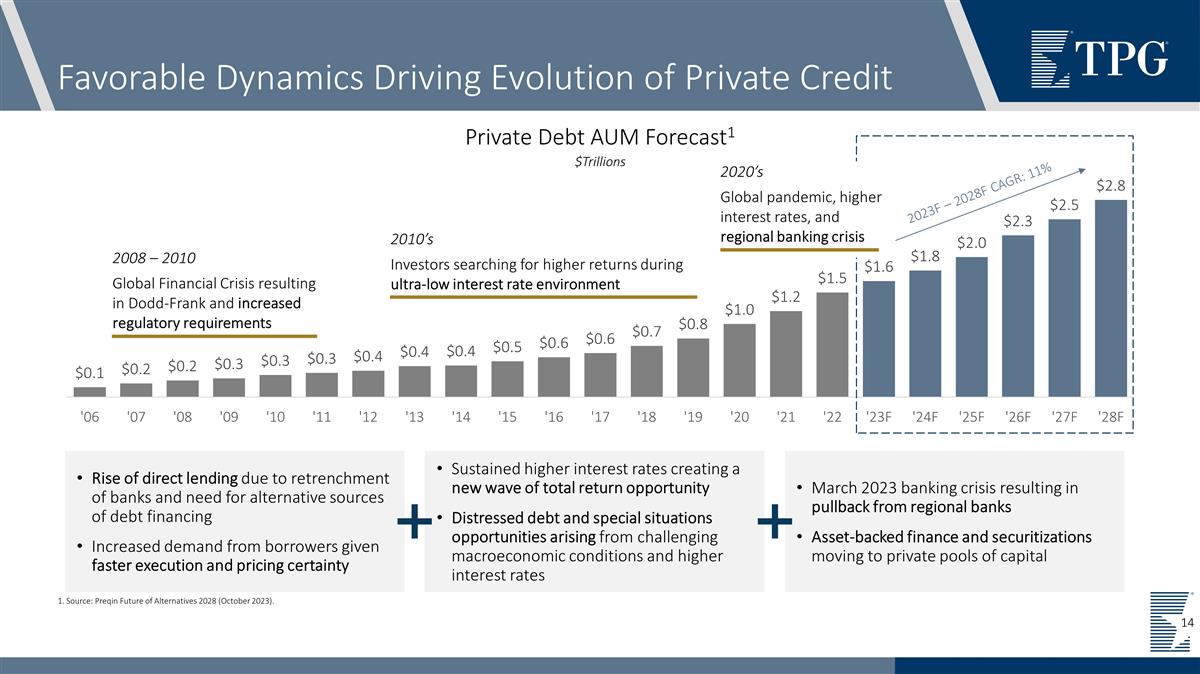

Favorable Dynamics Driving Evolution of Private Credit 1. Source: Preqin Future of Alternatives 2028 (October 2023). $Trillions Private Debt AUM Forecast1 Rise of direct lending due to retrenchment of banks and need for alternative sources of debt financing Increased demand from borrowers given faster execution and pricing certainty 2008 – 2010 Global Financial Crisis resulting in Dodd-Frank and increased regulatory requirements 2010’s Investors searching for higher returns during ultra-low interest rate environment Sustained higher interest rates creating a new wave of total return opportunity Distressed debt and special situations opportunities arising from challenging macroeconomic conditions and higher interest rates March 2023 banking crisis resulting in pullback from regional banks Asset-backed finance and securitizations moving to private pools of capital 2020’s Global pandemic, higher interest rates, and regional banking crisis 2023F – 2028F CAGR: 11%

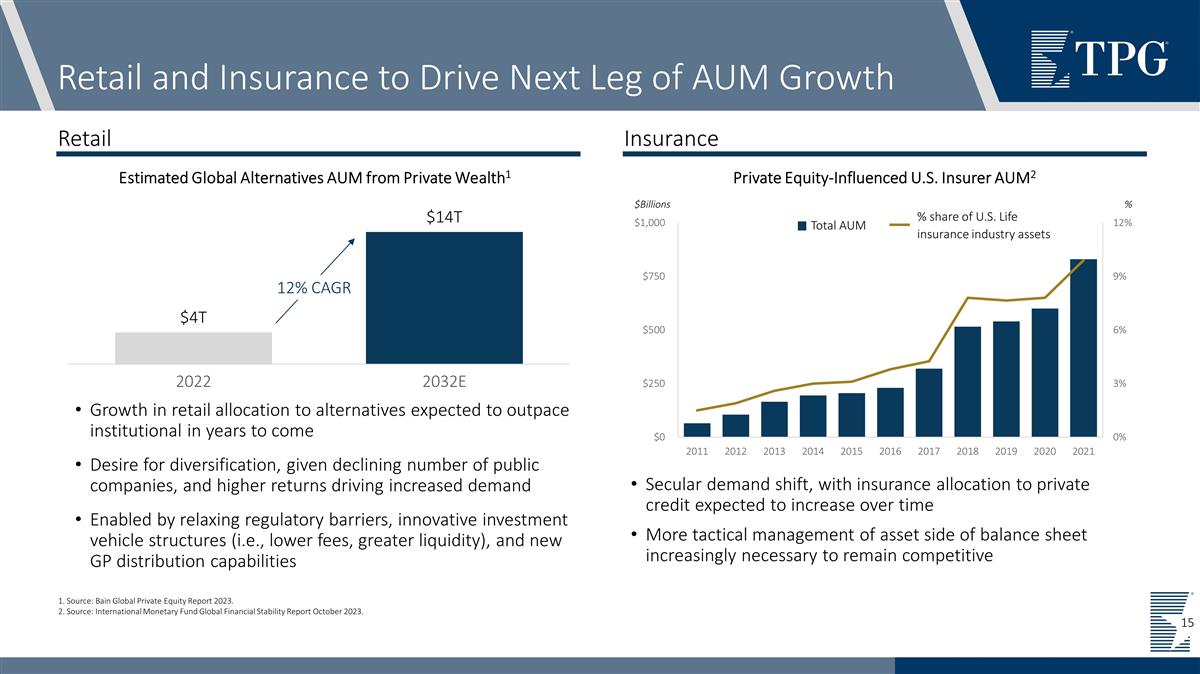

Retail and Insurance to Drive Next Leg of AUM Growth 1. Source: Bain Global Private Equity Report 2023. 2. Source: International Monetary Fund Global Financial Stability Report October 2023. Insurance Retail Growth in retail allocation to alternatives expected to outpace institutional in years to come Desire for diversification, given declining number of public companies, and higher returns driving increased demand Enabled by relaxing regulatory barriers, innovative investment vehicle structures (i.e., lower fees, greater liquidity), and new GP distribution capabilities Estimated Global Alternatives AUM from Private Wealth1 12% CAGR Secular demand shift, with insurance allocation to private credit expected to increase over time More tactical management of asset side of balance sheet increasingly necessary to remain competitive Private Equity-Influenced U.S. Insurer AUM2 Total AUM % share of U.S. Life insurance industry assets $Billions %

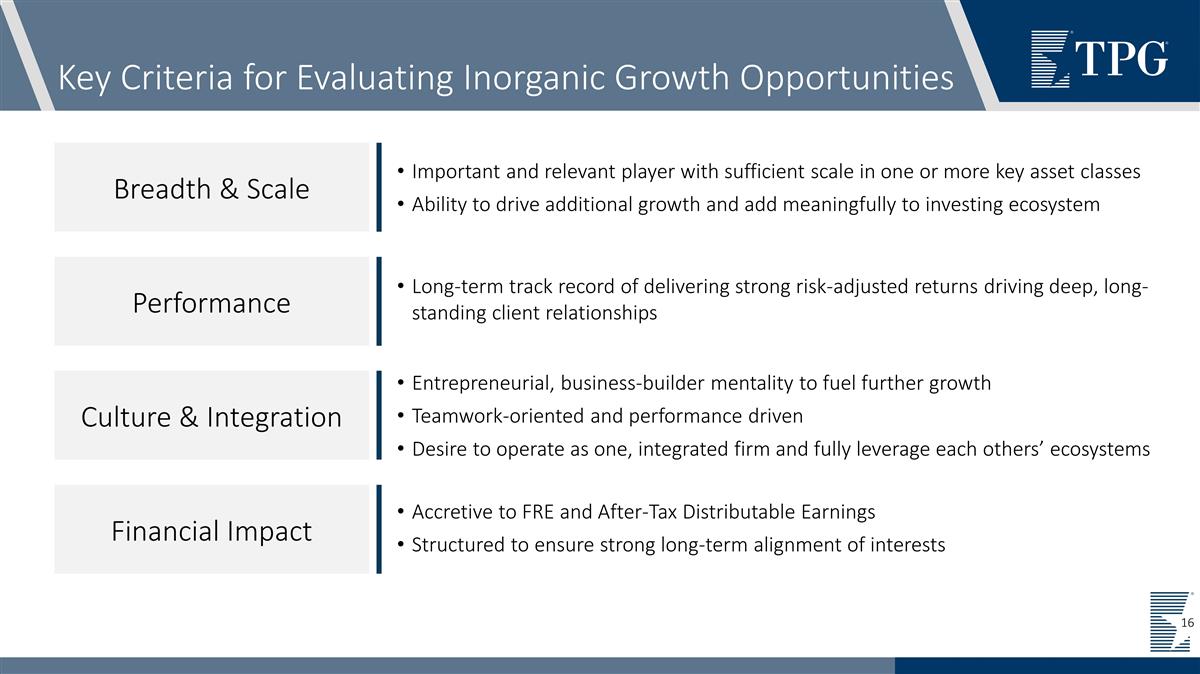

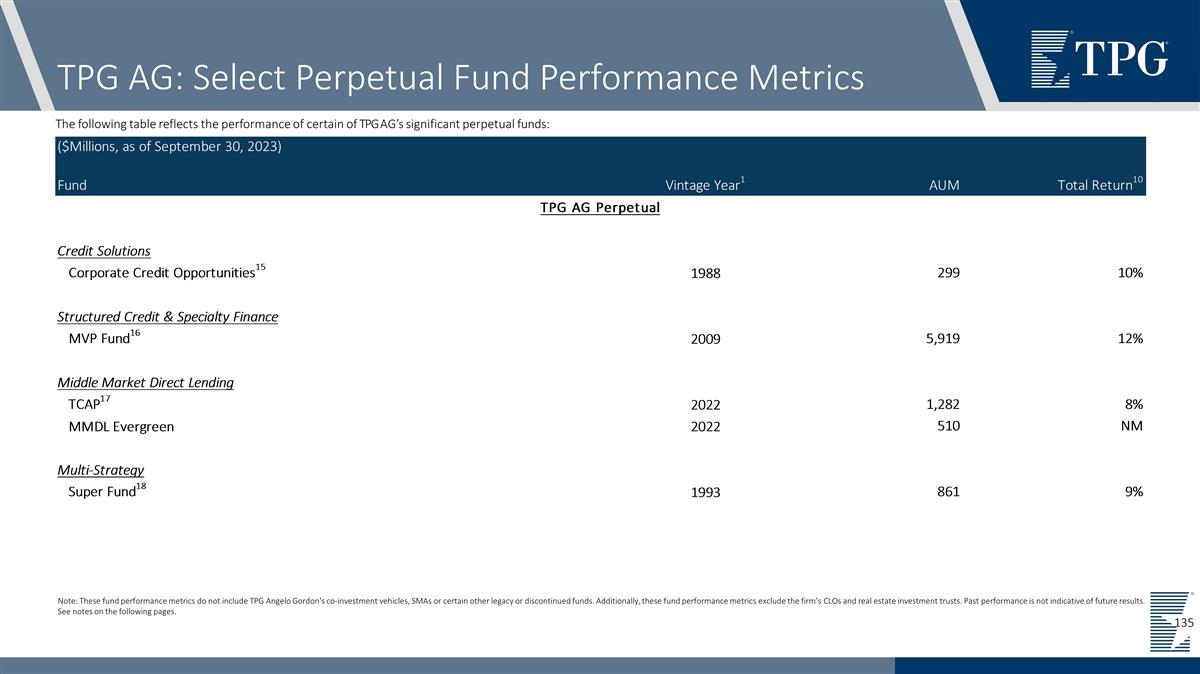

Key Criteria for Evaluating Inorganic Growth Opportunities Important and relevant player with sufficient scale in one or more key asset classes Ability to drive additional growth and add meaningfully to investing ecosystem Breadth & Scale Financial Impact Performance Culture & Integration Accretive to FRE and After-Tax Distributable Earnings Structured to ensure strong long-term alignment of interests Entrepreneurial, business-builder mentality to fuel further growth Teamwork-oriented and performance driven Desire to operate as one, integrated firm and fully leverage each others’ ecosystems Long-term track record of delivering strong risk-adjusted returns driving deep, long-standing client relationships

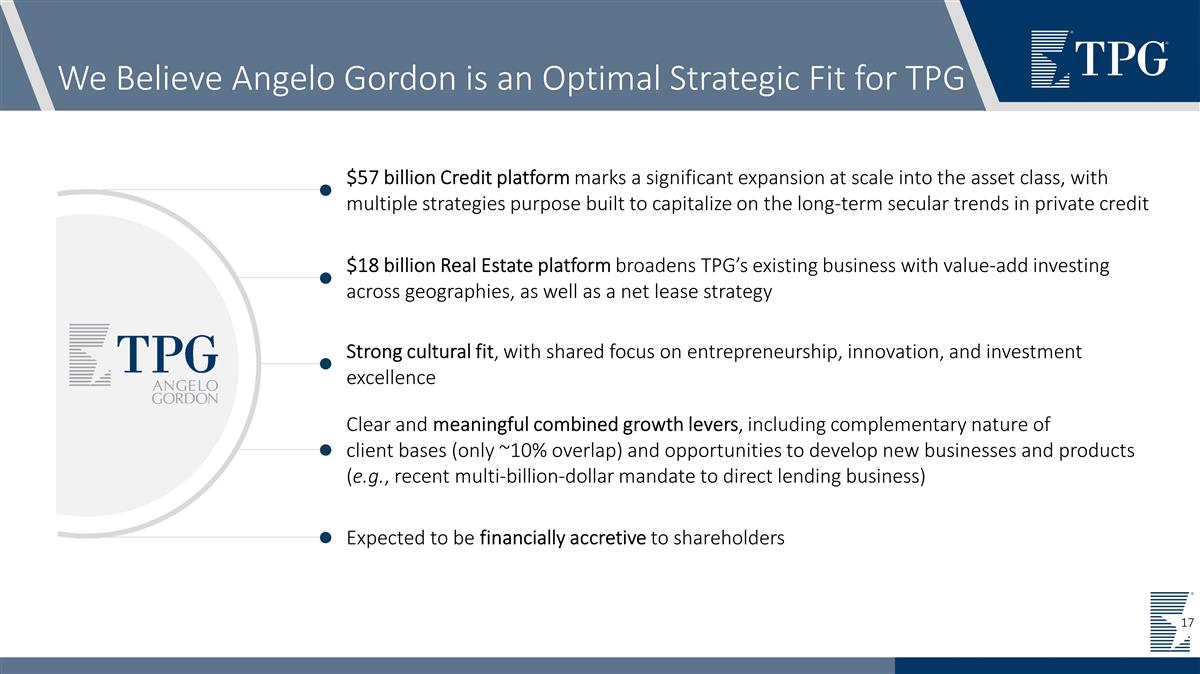

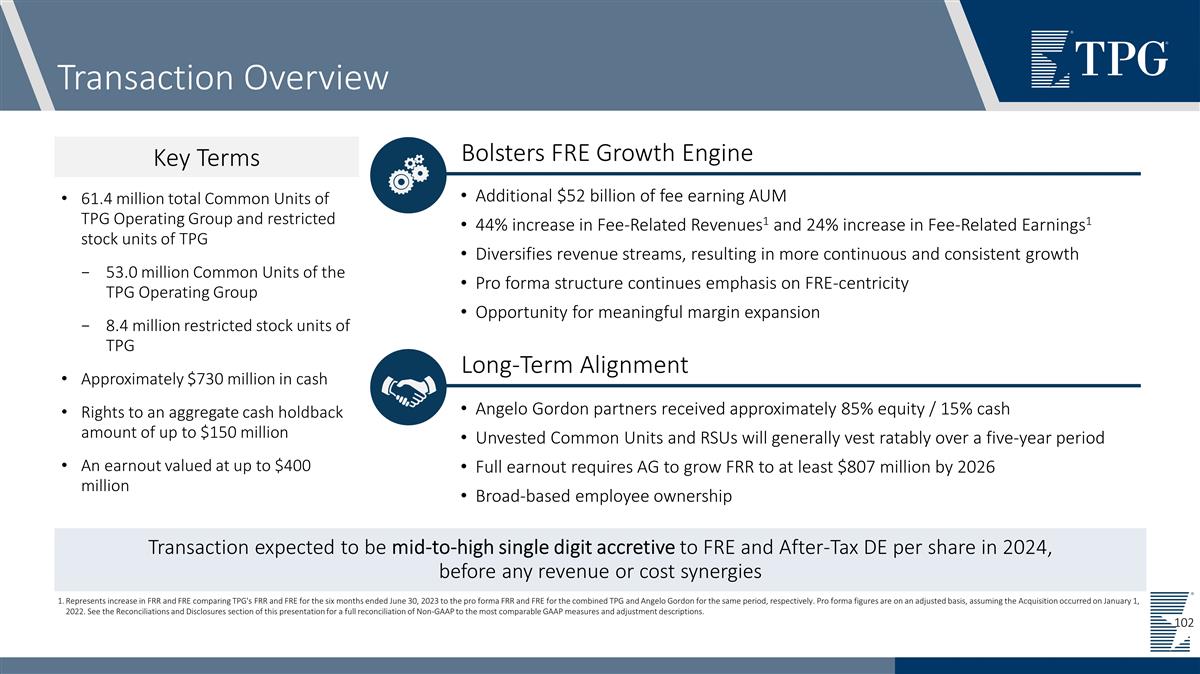

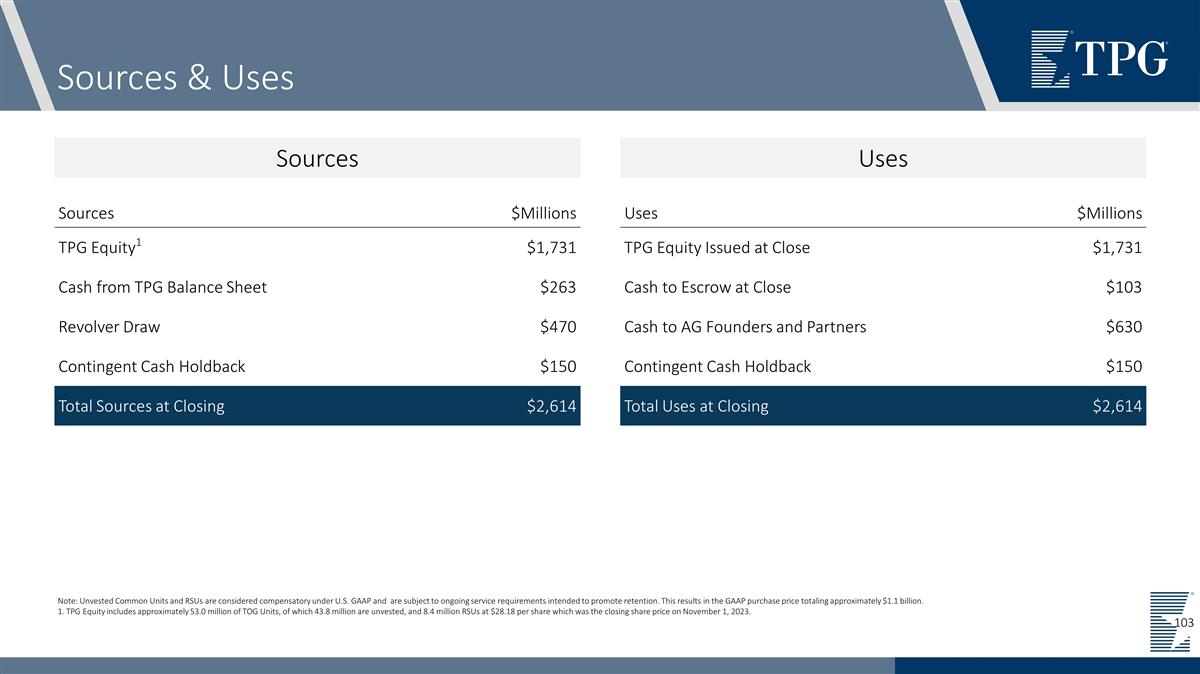

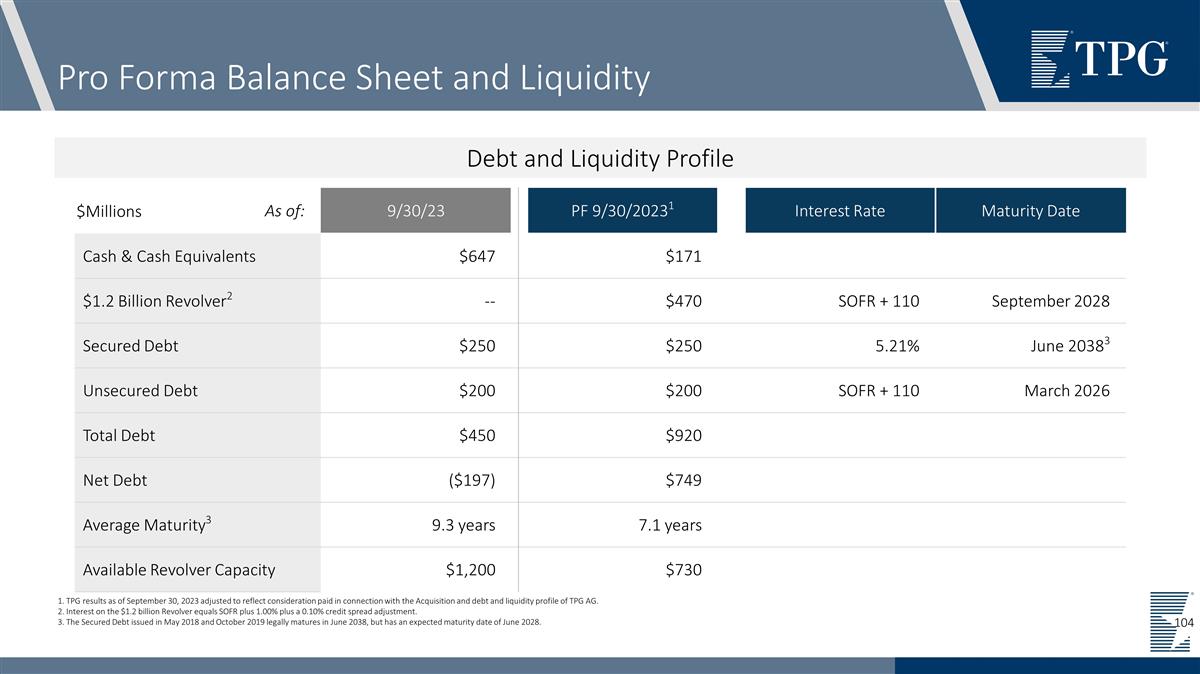

We Believe Angelo Gordon is an Optimal Strategic Fit for TPG $57 billion Credit platform marks a significant expansion at scale into the asset class, with multiple strategies purpose built to capitalize on the long-term secular trends in private credit $18 billion Real Estate platform broadens TPG’s existing business with value-add investing across geographies, as well as a net lease strategy Clear and meaningful combined growth levers, including complementary nature of client bases (only ~10% overlap) and opportunities to develop new businesses and products (e.g., recent multi-billion-dollar mandate to direct lending business) Expected to be financially accretive to shareholders Strong cultural fit, with shared focus on entrepreneurship, innovation, and investment excellence

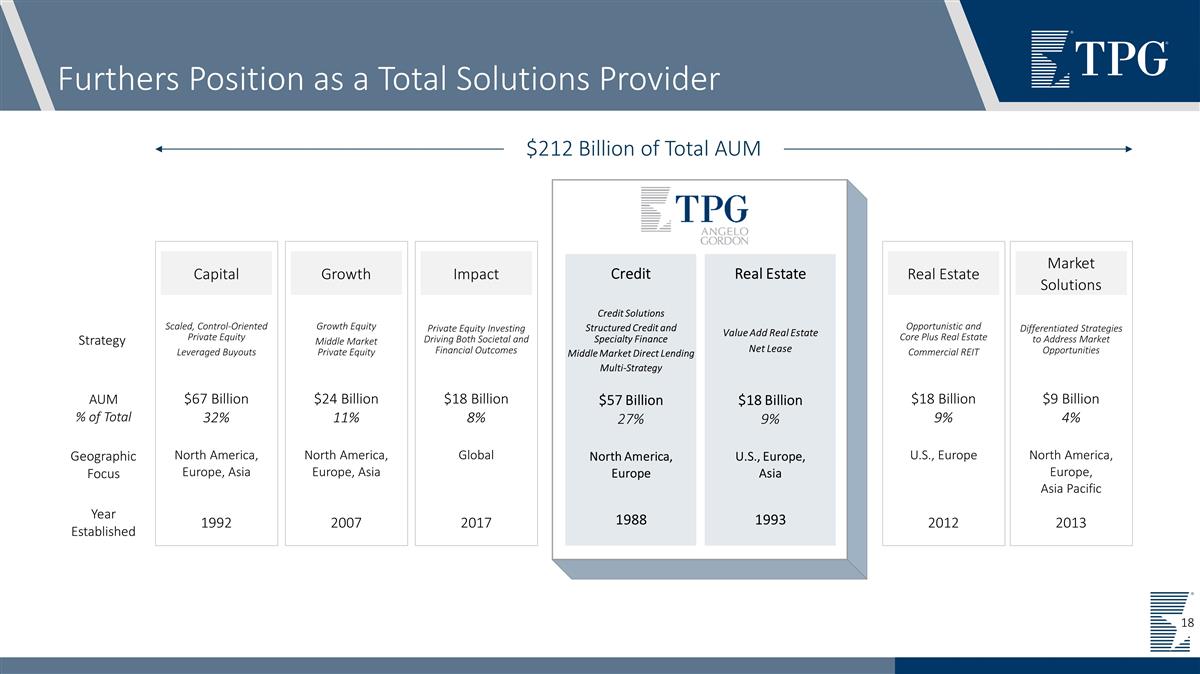

Furthers Position as a Total Solutions Provider Strategy AUM % of Total Geographic Focus Year Established Capital Scaled, Control-Oriented Private Equity Leveraged Buyouts $67 Billion 32% North America, Europe, Asia 1992 Market Solutions Differentiated Strategies to Address Market Opportunities $9 Billion 4% North America, Europe, Asia Pacific 2013 Impact Private Equity Investing Driving Both Societal and Financial Outcomes $18 Billion 8% Global 2017 Growth Growth Equity Middle Market Private Equity $24 Billion 11% North America, Europe, Asia 2007 Opportunistic and Core Plus Real Estate Commercial REIT $18 Billion 9% U.S., Europe 2012 Real Estate $57 Billion 27% North America, Europe 1988 Credit Real Estate $18 Billion 9% Credit Solutions Structured Credit and Specialty Finance Middle Market Direct Lending Multi-Strategy Value Add Real Estate Net Lease U.S., Europe, Asia 1993 $212 Billion of Total AUM

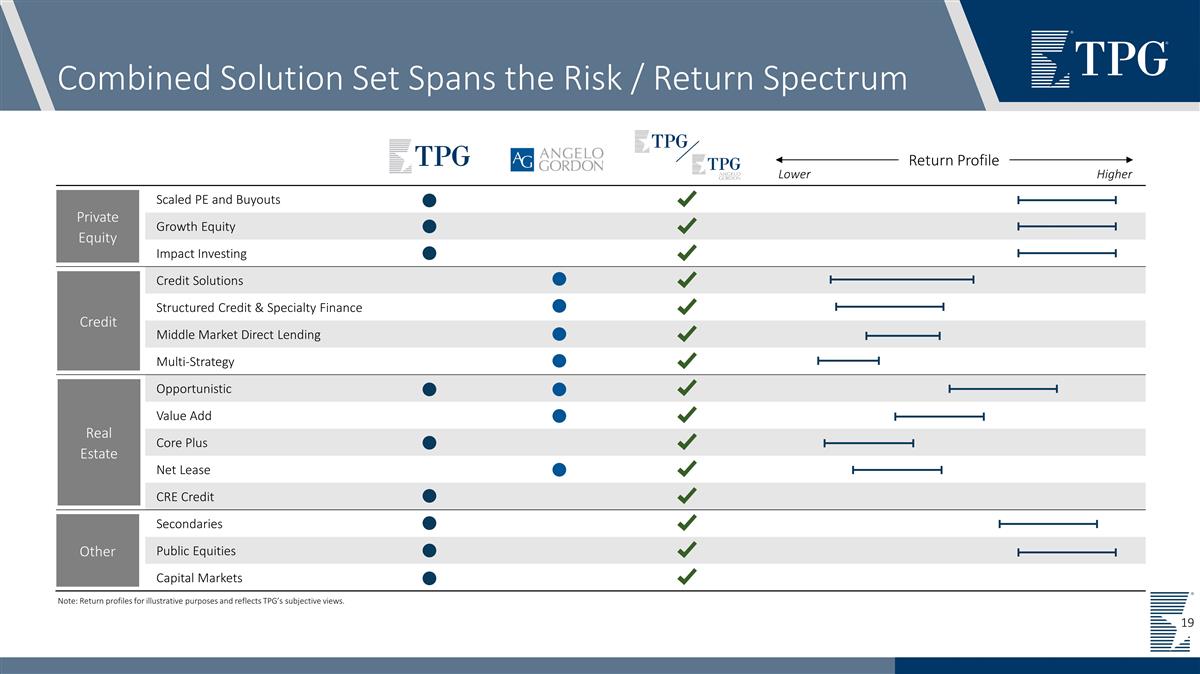

Scaled PE and Buyouts Growth Equity Impact Investing Credit Solutions Structured Credit & Specialty Finance Middle Market Direct Lending Multi-Strategy Opportunistic Value Add Core Plus Net Lease CRE Credit Secondaries Public Equities Capital Markets Combined Solution Set Spans the Risk / Return Spectrum Private Equity Credit Real Estate Other Higher Lower Return Profile Note: Return profiles for illustrative purposes and reflects TPG’s subjective views.

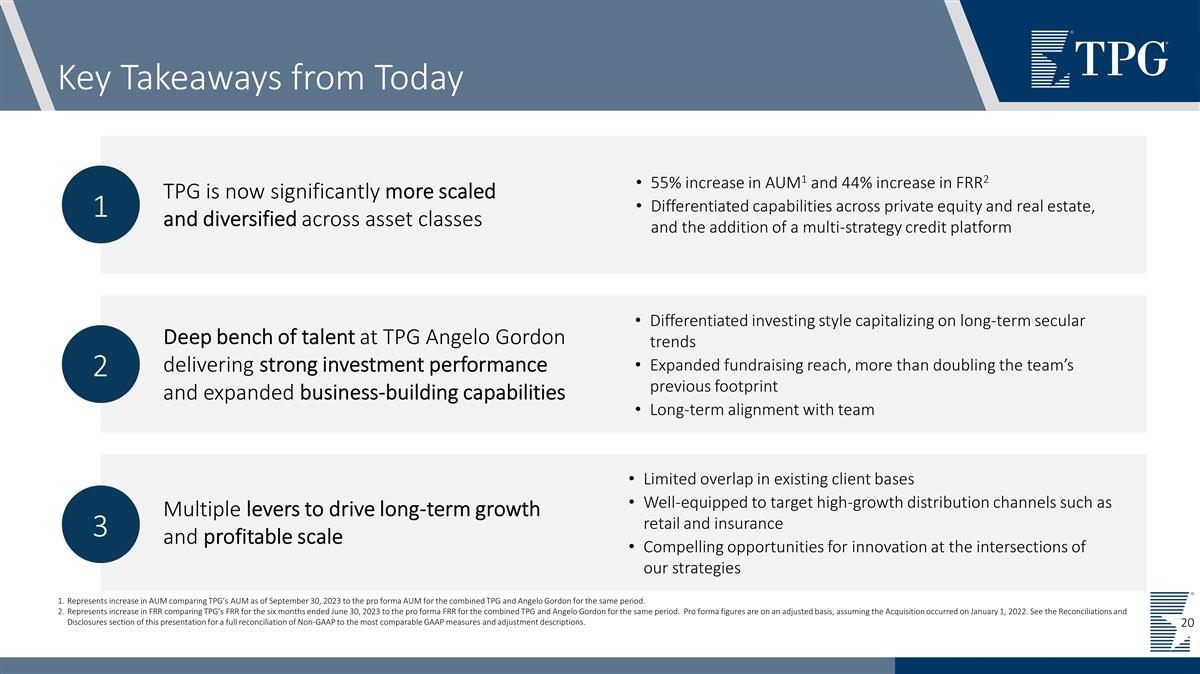

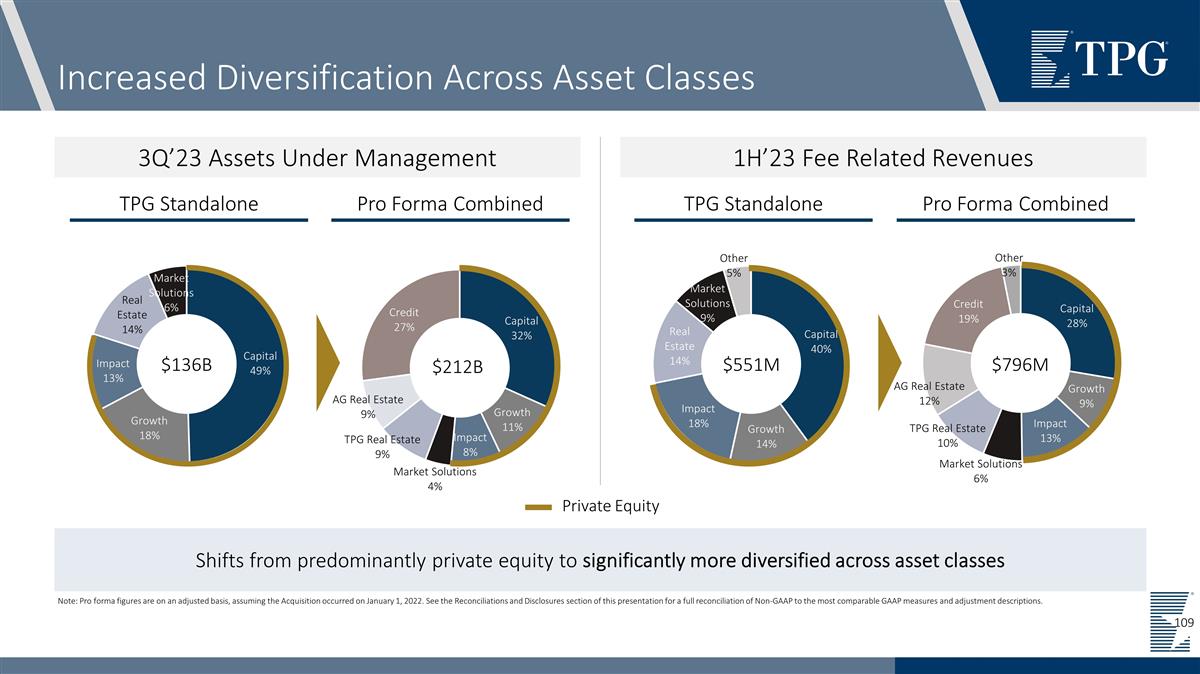

Key Takeaways from Today 1 2 3 TPG is now significantly more scaled and diversified across asset classes 55% increase in AUM1 and 44% increase in FRR2 Differentiated capabilities across private equity and real estate, and the addition of a multi-strategy credit platform Deep bench of talent at TPG Angelo Gordon delivering strong investment performance and expanded business-building capabilities Differentiated investing style capitalizing on long-term secular trends Expanded fundraising reach, more than doubling the team’s previous footprint Long-term alignment with team Multiple levers to drive long-term growth and profitable scale Limited overlap in existing client bases Well-equipped to target high-growth distribution channels such as retail and insurance Compelling opportunities for innovation at the intersections of our strategies Represents increase in AUM comparing TPG’s AUM as of September 30, 2023 to the pro forma AUM for the combined TPG and Angelo Gordon for the same period. Represents increase in FRR comparing TPG’s FRR for the six months ended June 30, 2023 to the pro forma FRR for the combined TPG and Angelo Gordon for the same period. Pro forma figures are on an adjusted basis, assuming the Acquisition occurred on January 1, 2022. See the Reconciliations and Disclosures section of this presentation for a full reconciliation of Non-GAAP to the most comparable GAAP measures and adjustment descriptions.

Integration Update

Presenter Chief Operating Officer Anilu Vazquez-Ubarri

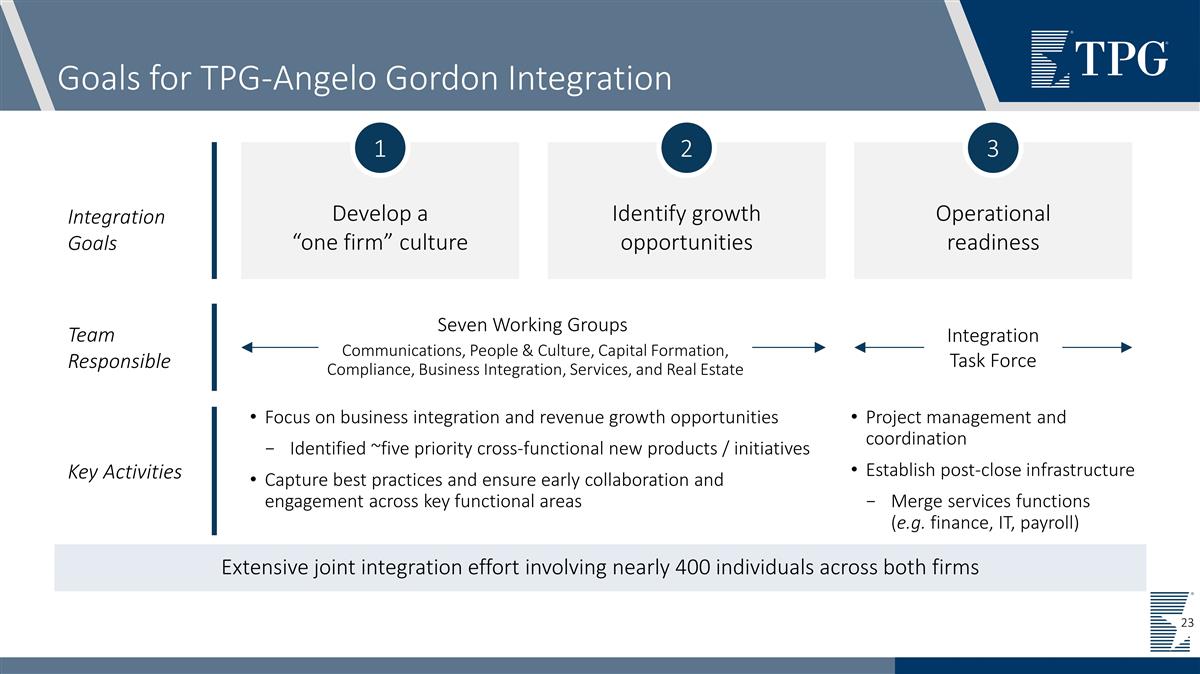

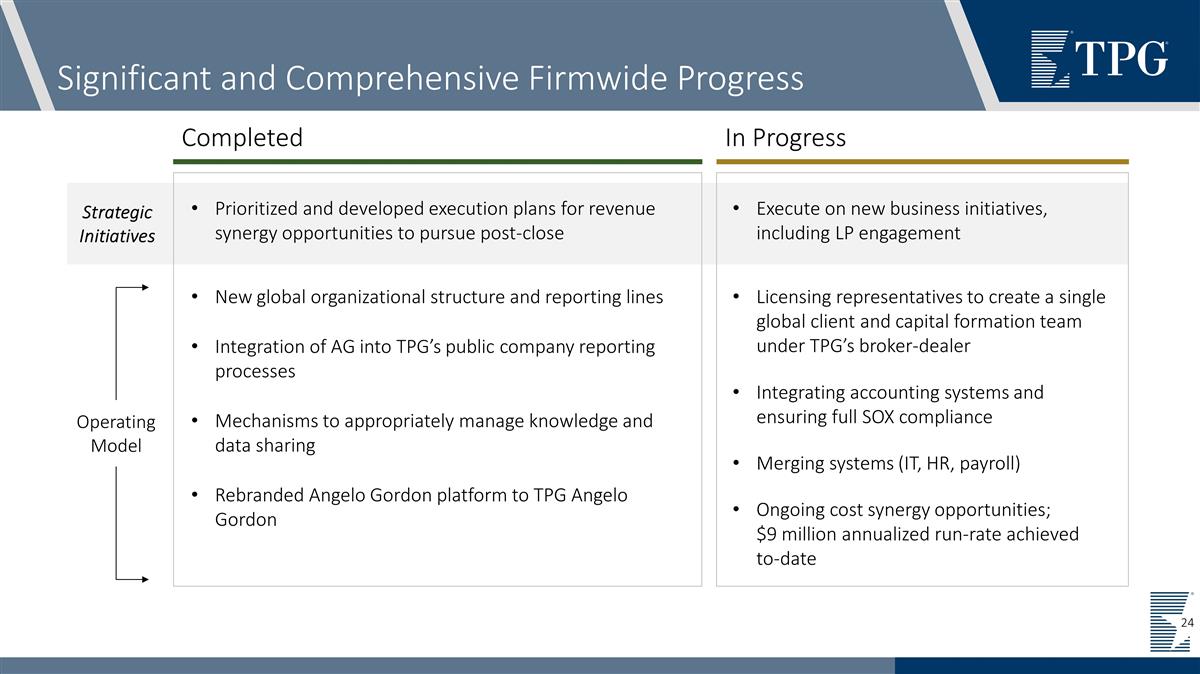

Goals for TPG-Angelo Gordon Integration Extensive joint integration effort involving nearly 400 individuals across both firms Integration Goals Team Responsible Key Activities 1 2 3 Develop a “one firm” culture Identify growth opportunities Operational readiness Integration Task Force Focus on business integration and revenue growth opportunities Identified ~five priority cross-functional new products / initiatives Capture best practices and ensure early collaboration and engagement across key functional areas Project management and coordination Establish post-close infrastructure Merge services functions (e.g. finance, IT, payroll) Communications, People & Culture, Capital Formation, Compliance, Business Integration, Services, and Real Estate Seven Working Groups

Significant and Comprehensive Firmwide Progress Completed In Progress Prioritized and developed execution plans for revenue synergy opportunities to pursue post-close Execute on new business initiatives, including LP engagement Strategic Initiatives Operating Model New global organizational structure and reporting lines Integration of AG into TPG’s public company reporting processes Mechanisms to appropriately manage knowledge and data sharing Rebranded Angelo Gordon platform to TPG Angelo Gordon Licensing representatives to create a single global client and capital formation team under TPG’s broker-dealer Integrating accounting systems and ensuring full SOX compliance Merging systems (IT, HR, payroll) Ongoing cost synergy opportunities; $9 million annualized run-rate achieved to-date 24

TPG Angelo Gordon Overview

Presenter Co-Managing Partner of TPG AG and Head of TPG AG Credit Josh Baumgarten

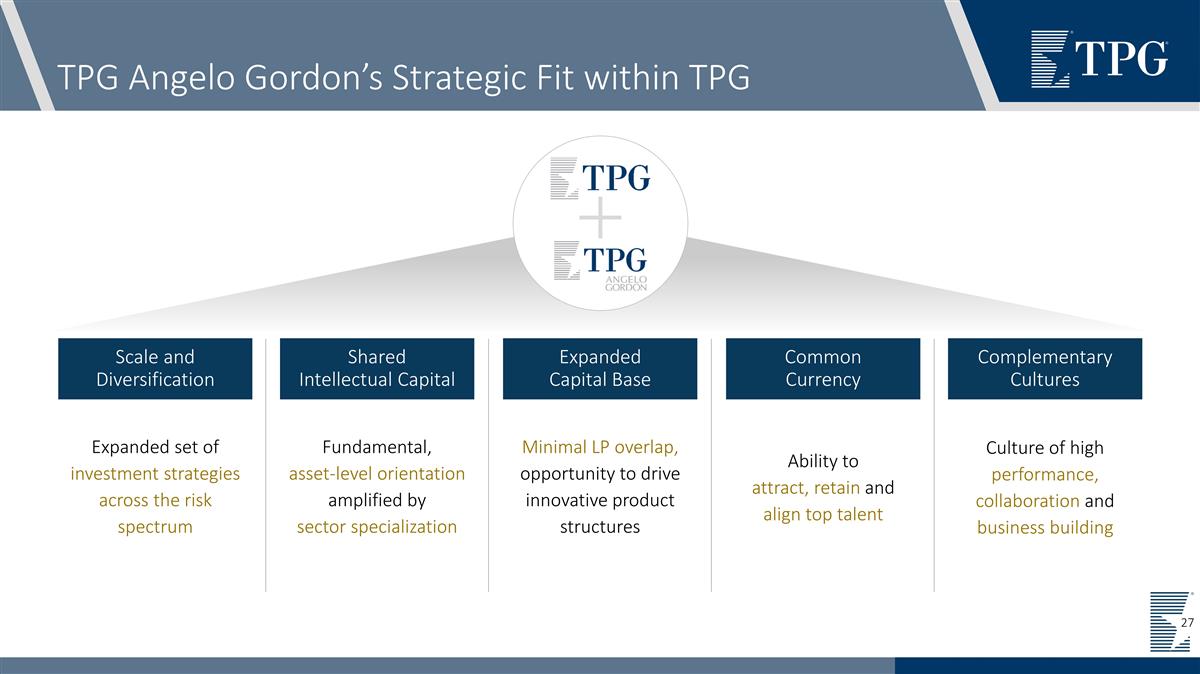

TPG Angelo Gordon’s Strategic Fit within TPG Common Currency Complementary Cultures Scale and Diversification Expanded Capital Base Shared Intellectual Capital Ability to attract, retain and align top talent Culture of high performance, collaboration and business building Fundamental, asset‑level orientation amplified by sector specialization Minimal LP overlap, opportunity to drive innovative product structures Expanded set of investment strategies across the risk spectrum

TPG Angelo Gordon: A Snapshot 1988 Year Founded 700+ Employees 12 Offices Globally A Scaled Leader in Credit and Real Estate 236 Investment Professionals 16 Average Years Portfolio Manager Tenure Diversified credit and real estate investing platform 35 Years Delivering strong risk-adjusted returns Cycle Agnostic, Partnership Driven Investment Solutions Fundamental Investment Philosophy Scalable Infrastructure Poised to drive growth Diverse Client Base $76 Billion AUM

Opportunistic Growth in our First 30 Years… Inception & Heritage Organic Multi-Strategy Platform Development 1993 – 2016 Credit Real Estate Distressed Arbitrage 1988 1993 U.S. Real Estate CLOs Performing Credit 1998 Middle Market Direct Lending 2014 Whole Loans Commercial Real Estate Debt 2006 2009 Europe Real Estate 2005 Asia Real Estate Net Lease Real Estate Residential & Consumer Debt 2008 Complementary investing strategies launched to meet secular demand and market opportunities

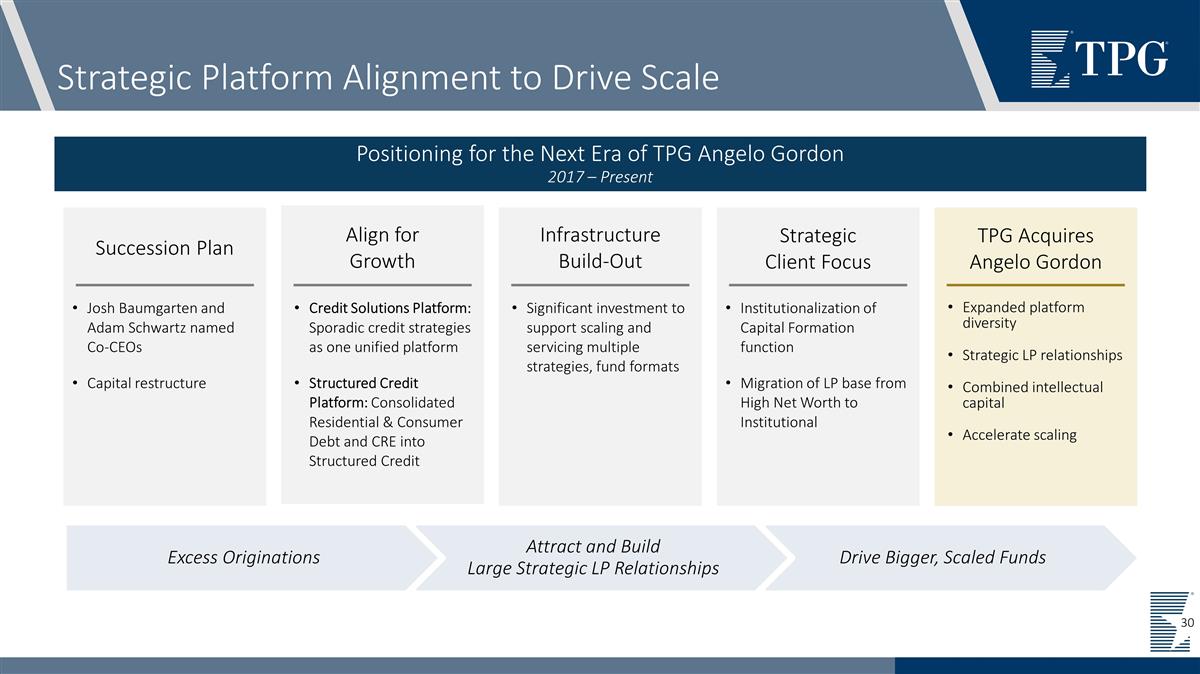

Strategic Platform Alignment to Drive Scale Positioning for the Next Era of TPG Angelo Gordon 2017 – Present Drive Bigger, Scaled Funds Attract and Build Large Strategic LP Relationships Excess Originations Succession Plan Josh Baumgarten and Adam Schwartz named Co-CEOs Capital restructure Align for Growth Credit Solutions Platform: Sporadic credit strategies as one unified platform Structured Credit Platform: Consolidated Residential & Consumer Debt and CRE into Structured Credit Infrastructure Build-Out Significant investment to support scaling and servicing multiple strategies, fund formats Strategic Client Focus Institutionalization of Capital Formation function Migration of LP base from High Net Worth to Institutional TPG Acquires Angelo Gordon Expanded platform diversity Strategic LP relationships Combined intellectual capital Accelerate scaling

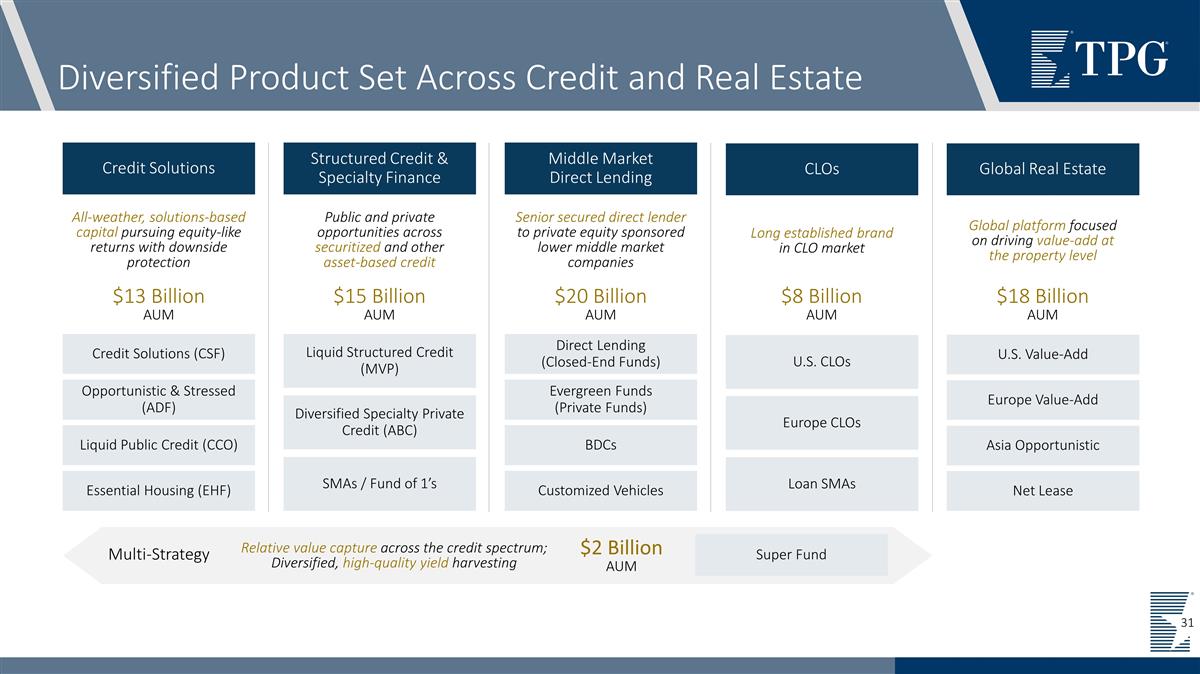

Diversified Product Set Across Credit and Real Estate Source Files AUM: https://tpg.ent.box.com/folder/148770880733 CLOs Global Real Estate Credit Solutions Structured Credit & Specialty Finance Middle Market Direct Lending Long established brand in CLO market Global platform focused on driving value-add at the property level Senior secured direct lender to private equity sponsored lower middle market companies Public and private opportunities across securitized and other asset‑based credit All-weather, solutions-based capital pursuing equity-like returns with downside protection Credit Solutions (CSF) Direct Lending (Closed-End Funds) Opportunistic & Stressed (ADF) Evergreen Funds (Private Funds) Liquid Public Credit (CCO) U.S. CLOs Liquid Structured Credit (MVP) Europe CLOs Diversified Specialty Private Credit (ABC) Loan SMAs SMAs / Fund of 1’s BDCs U.S. Value-Add Europe Value-Add Asia Opportunistic Essential Housing (EHF) Customized Vehicles $13 Billion AUM $18 Billion AUM $20 Billion AUM $15 Billion AUM $8 Billion AUM Net Lease Relative value capture across the credit spectrum; Diversified, high-quality yield harvesting $2 Billion AUM Multi-Strategy Super Fund 31

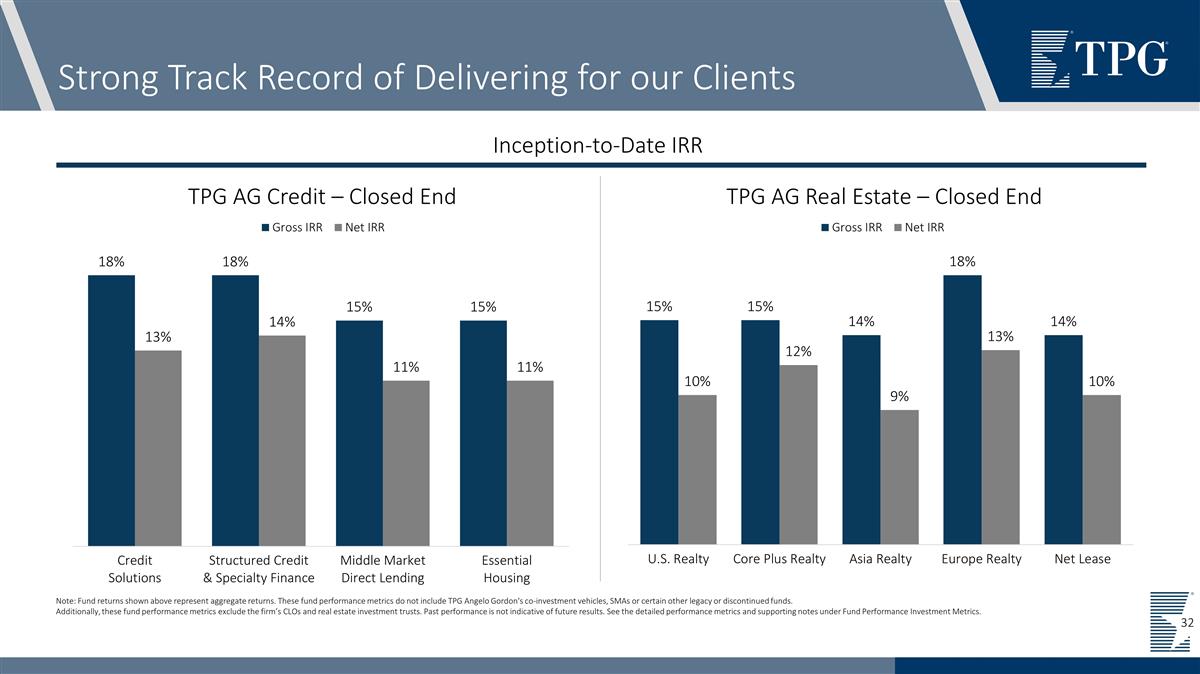

Strong Track Record of Delivering for our Clients Note: Fund returns shown above represent aggregate returns. These fund performance metrics do not include TPG Angelo Gordon's co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See the detailed performance metrics and supporting notes under Fund Performance Investment Metrics. TPG AG Real Estate – Closed End TPG AG Credit – Closed End Inception-to-Date IRR 32

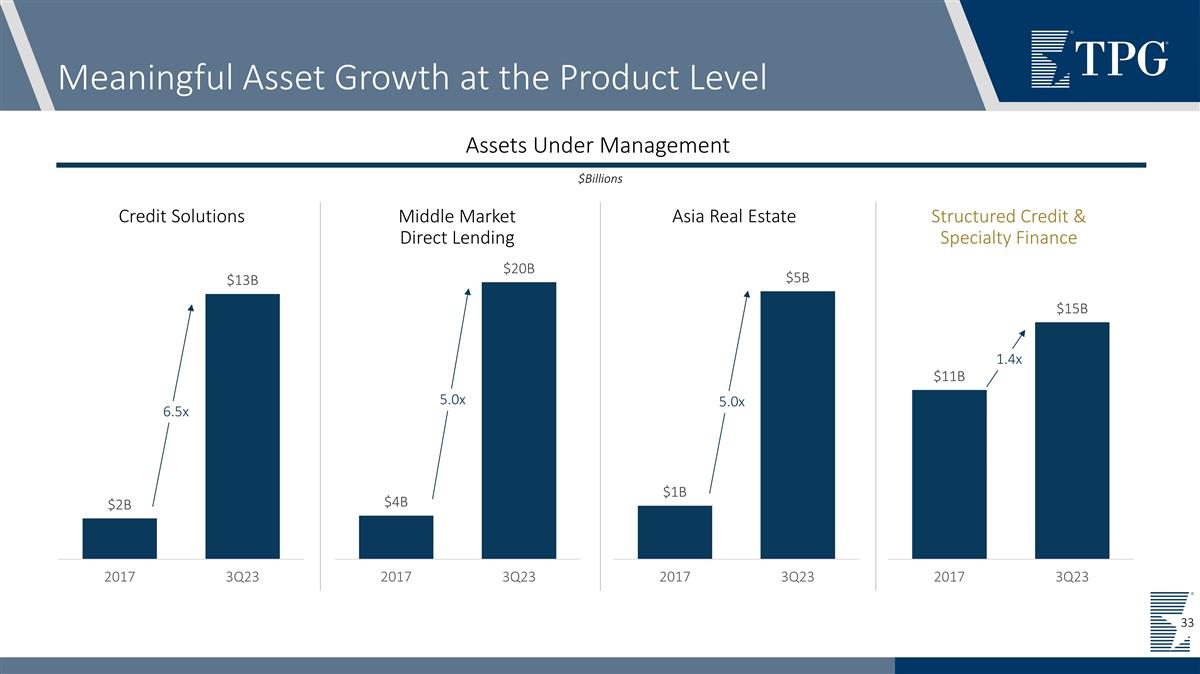

Meaningful Asset Growth at the Product Level 5.0x Assets Under Management 6.5x 5.0x 1.4x Credit Solutions Middle Market Direct Lending Asia Real Estate Structured Credit & Specialty Finance $Billions

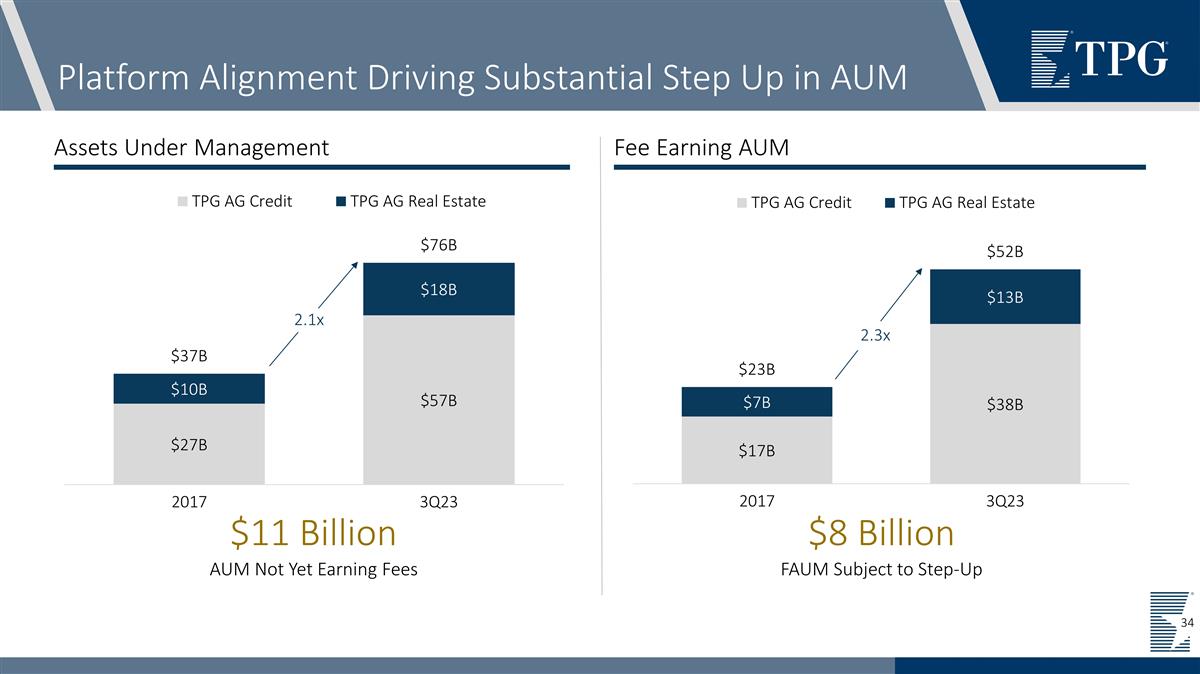

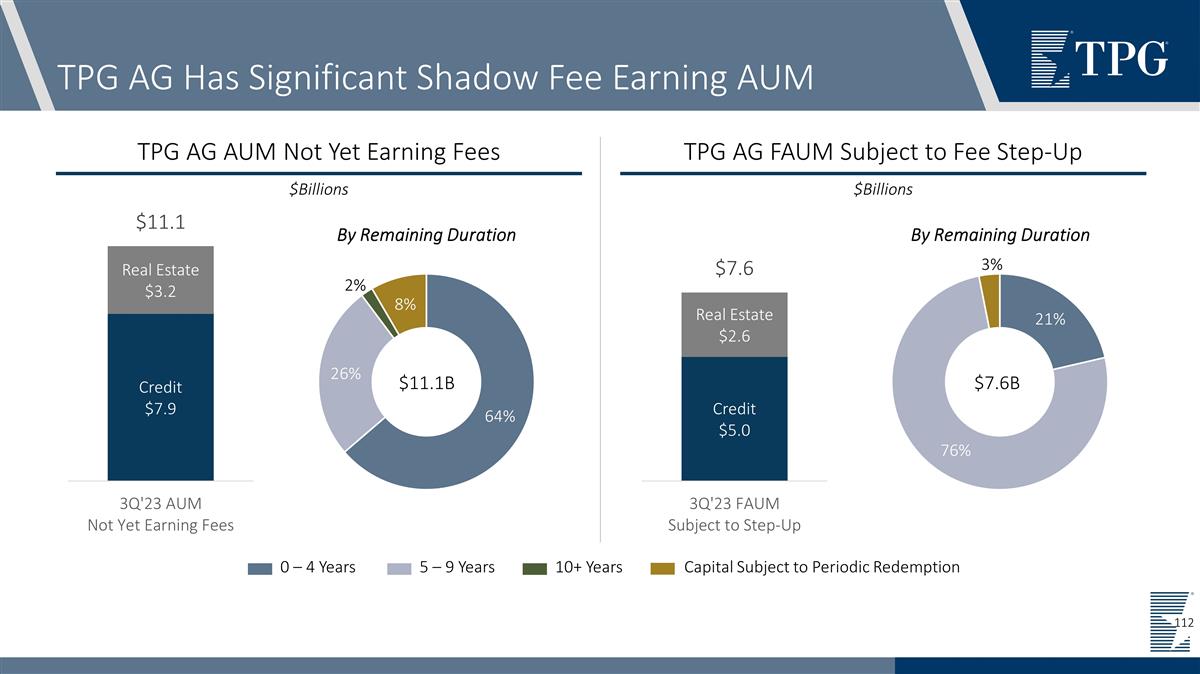

Platform Alignment Driving Substantial Step Up in AUM $11 Billion AUM Not Yet Earning Fees $8 Billion FAUM Subject to Step-Up 2.1x 2.3x Assets Under Management Fee Earning AUM

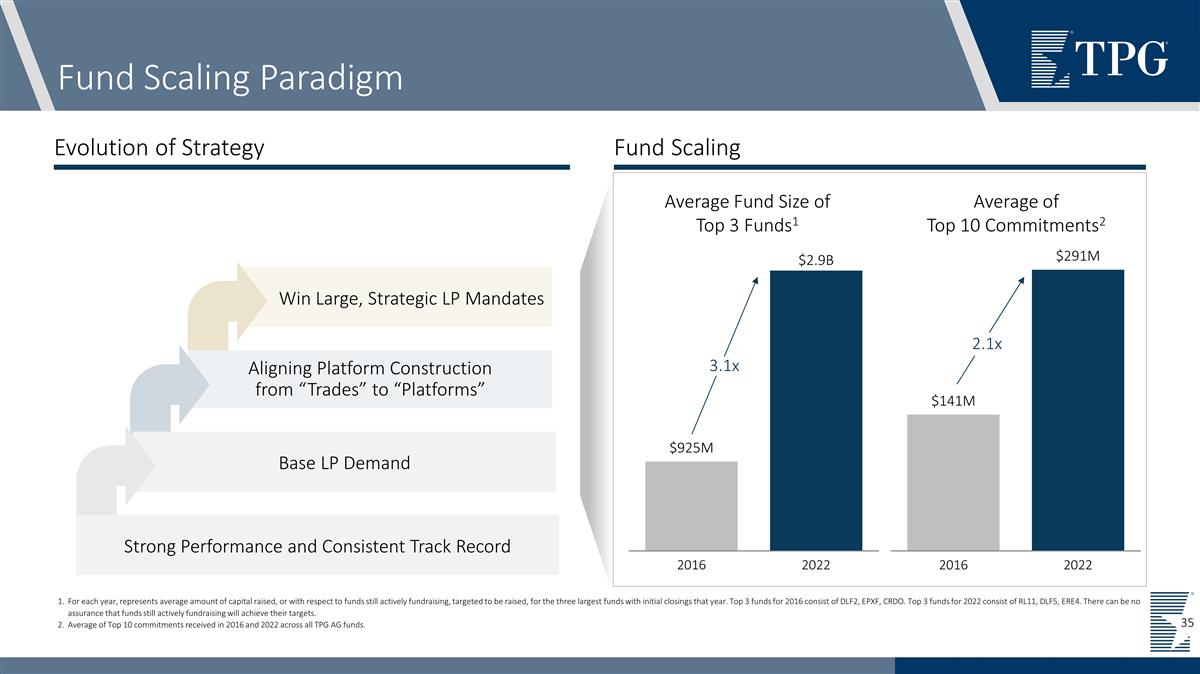

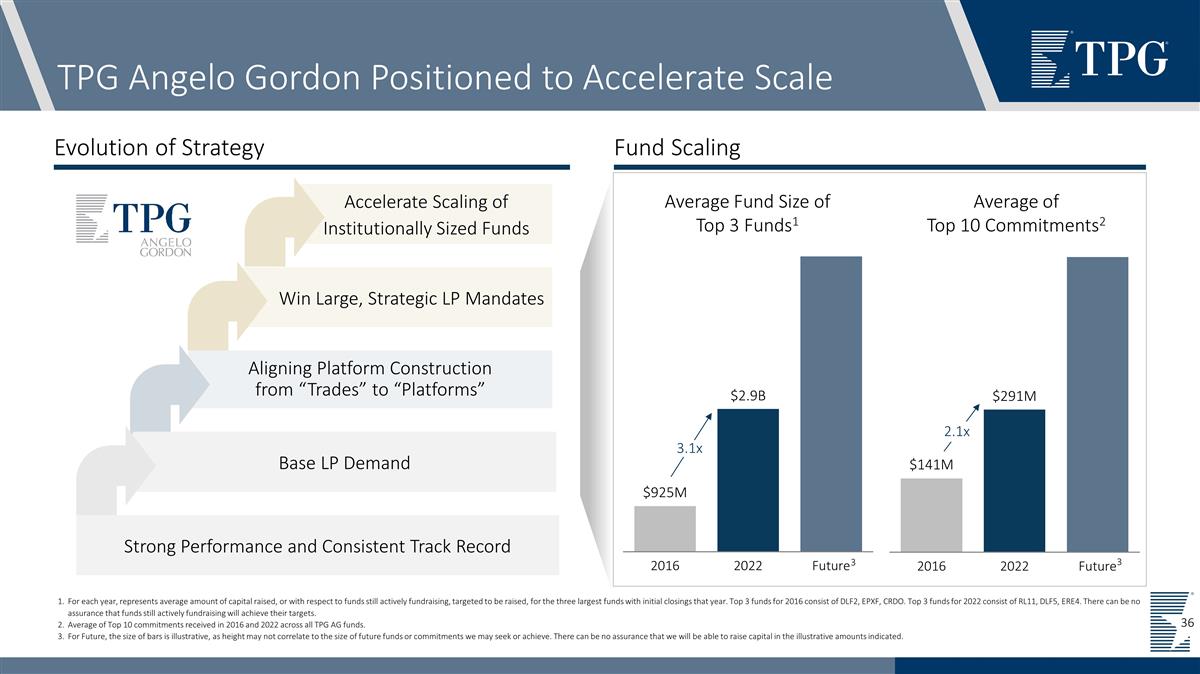

Fund Scaling Paradigm 3.1x 2.1x Aligning Platform Construction from “Trades” to “Platforms” Win Large, Strategic LP Mandates Base LP Demand Strong Performance and Consistent Track Record Average of Top 10 Commitments2 Average Fund Size of Top 3 Funds1 For each year, represents average amount of capital raised, or with respect to funds still actively fundraising, targeted to be raised, for the three largest funds with initial closings that year. Top 3 funds for 2016 consist of DLF2, EPXF, CRDO. Top 3 funds for 2022 consist of RL11, DLF5, ERE4. There can be no assurance that funds still actively fundraising will achieve their targets. Average of Top 10 commitments received in 2016 and 2022 across all TPG AG funds. Evolution of Strategy Fund Scaling 35

Aligning Platform Construction from “Trades” to “Platforms” TPG Angelo Gordon Positioned to Accelerate Scale Win Large, Strategic LP Mandates Accelerate Scaling of Institutionally Sized Funds Average of Top 10 Commitments2 3.1x 2.1x Base LP Demand Average Fund Size of Top 3 Funds1 Strong Performance and Consistent Track Record 3 3 Evolution of Strategy Fund Scaling For each year, represents average amount of capital raised, or with respect to funds still actively fundraising, targeted to be raised, for the three largest funds with initial closings that year. Top 3 funds for 2016 consist of DLF2, EPXF, CRDO. Top 3 funds for 2022 consist of RL11, DLF5, ERE4. There can be no assurance that funds still actively fundraising will achieve their targets. Average of Top 10 commitments received in 2016 and 2022 across all TPG AG funds. For Future, the size of bars is illustrative, as height may not correlate to the size of future funds or commitments we may seek or achieve. There can be no assurance that we will be able to raise capital in the illustrative amounts indicated. 36

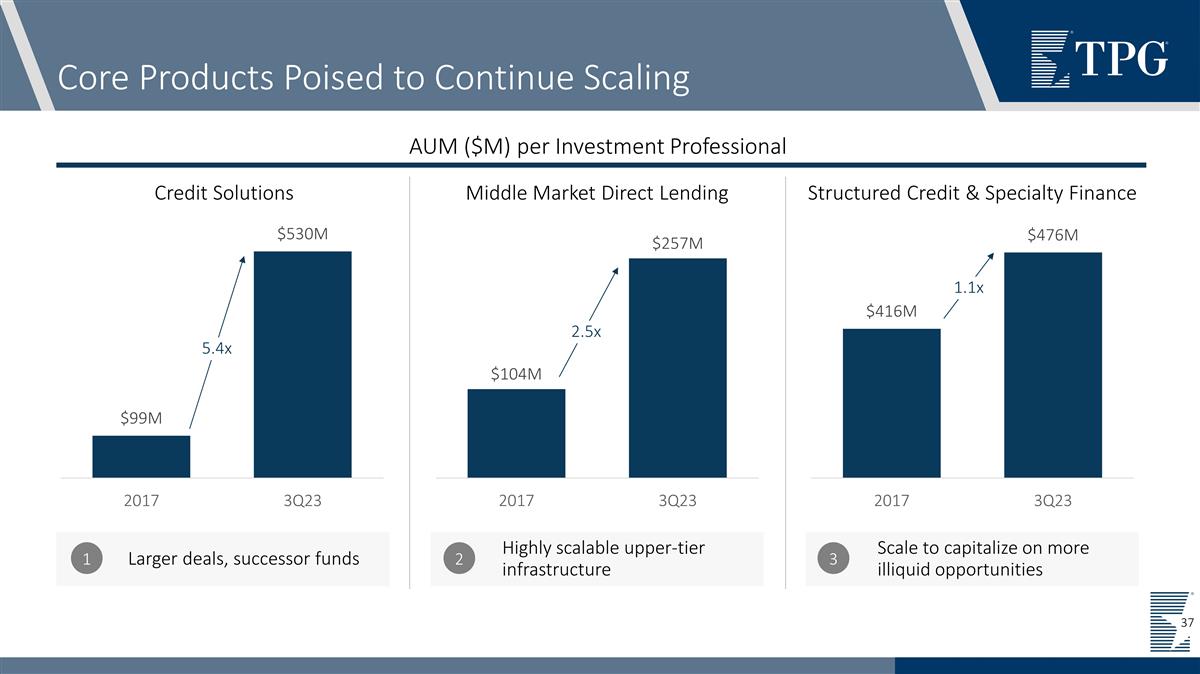

Scale to capitalize on more illiquid opportunities Highly scalable upper-tier infrastructure Core Products Poised to Continue Scaling Larger deals, successor funds 1 2 3 5.4x 2.5x 1.1x Credit Solutions Middle Market Direct Lending Structured Credit & Specialty Finance AUM ($M) per Investment Professional

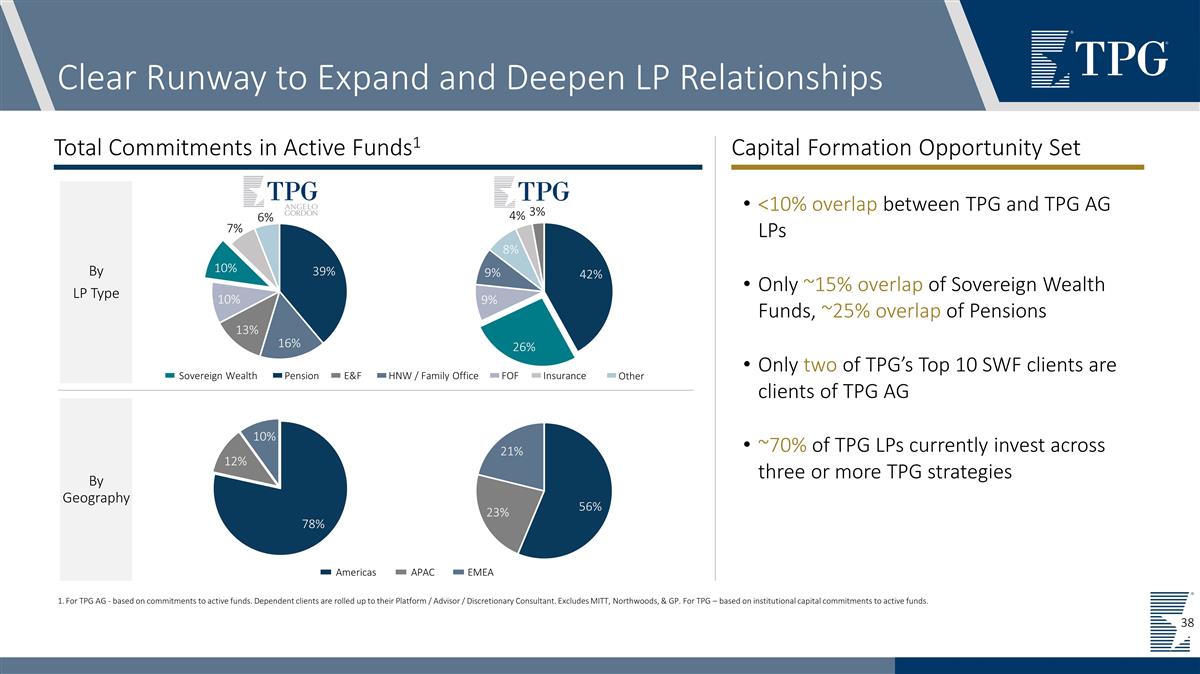

Clear Runway to Expand and Deepen LP Relationships By Geography By LP Type For TPG AG - based on commitments to active funds. Dependent clients are rolled up to their Platform / Advisor / Discretionary Consultant. Excludes MITT, Northwoods, & GP. For TPG – based on institutional capital commitments to active funds. E&F Total Commitments in Active Funds1 Capital Formation Opportunity Set <10% overlap between TPG and TPG AG LPs Only ~15% overlap of Sovereign Wealth Funds, ~25% overlap of Pensions Only two of TPG’s Top 10 SWF clients are clients of TPG AG ~70% of TPG LPs currently invest across three or more TPG strategies Pension HNW / Family Office FOF Insurance Other Sovereign Wealth APAC EMEA Americas 38

TPG Angelo Gordon’s Product Highlights Ahead Positioned for the Largest Secular Tailwinds in Private Credit Growing LP Asset Allocation Diversification in private credit and real estate Partnership Philosophy Cycle Agnostic Solutions Capital Disciplined, yet Nimble and Flexible Investing Approach Commitment to Capital Preservation through Downside Protection Cycle Tested, tenured teams investing together for decades 1 2 3 4 Bias towards Sector Specialization 39

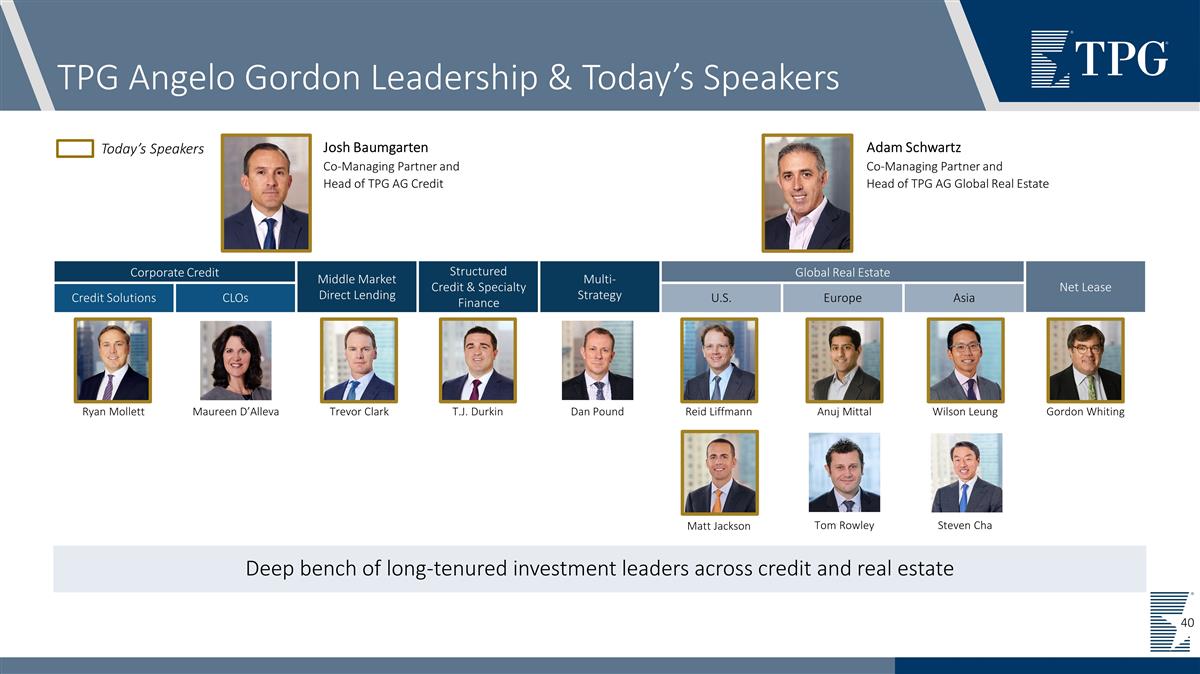

TPG Angelo Gordon Leadership & Today’s Speakers Josh Baumgarten Co-Managing Partner and Head of TPG AG Credit Adam Schwartz Co-Managing Partner and Head of TPG AG Global Real Estate Corporate Credit Middle Market Direct Lending Structured Credit & Specialty Finance Multi- Strategy Global Real Estate Net Lease Credit Solutions CLOs Middle Market Direct Lending U.S. Europe Asia Anuj Mittal Tom Rowley Reid Liffmann Matt Jackson Wilson Leung Gordon Whiting Ryan Mollett Maureen D’Alleva Trevor Clark T.J. Durkin Dan Pound Steven Cha Today’s Speakers Deep bench of long-tenured investment leaders across credit and real estate

TPG Angelo Gordon Credit

Middle Market Direct Lending

Presenters Head of Middle Market Direct Lending Trevor Clark Co-Chief Credit Officer, Middle Market Direct Lending Drew Guyette Co-Chief Credit Officer, Middle Market Direct Lending Kim Trick 43

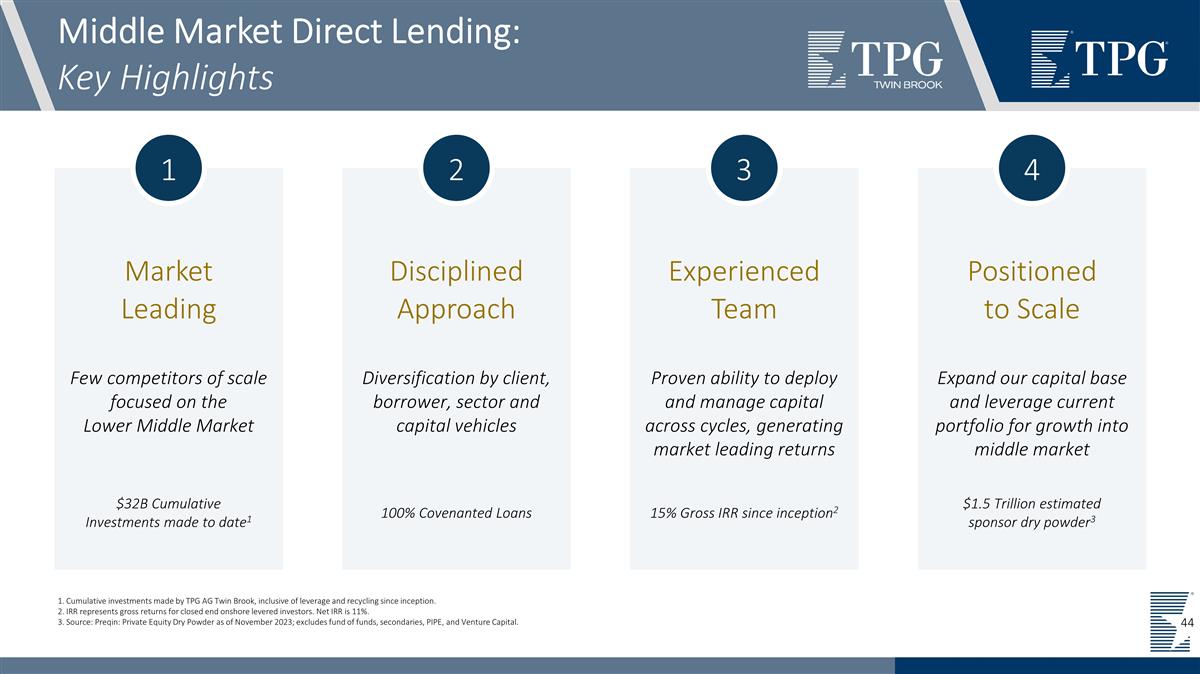

Middle Market Direct Lending: Key Highlights Market Leading 1 Few competitors of scale focused on the Lower Middle Market $32B Cumulative Investments made to date1 Disciplined Approach 2 Diversification by client, borrower, sector and capital vehicles 100% Covenanted Loans Experienced Team 3 Proven ability to deploy and manage capital across cycles, generating market leading returns 15% Gross IRR since inception2 Positioned to Scale 4 Expand our capital base and leverage current portfolio for growth into middle market $1.5 Trillion estimated sponsor dry powder3 1. Cumulative investments made by TPG AG Twin Brook, inclusive of leverage and recycling since inception. 2. IRR represents gross returns for closed end onshore levered investors. Net IRR is 11%. 3. Source: Preqin: Private Equity Dry Powder as of November 2023; excludes fund of funds, secondaries, PIPE, and Venture Capital.

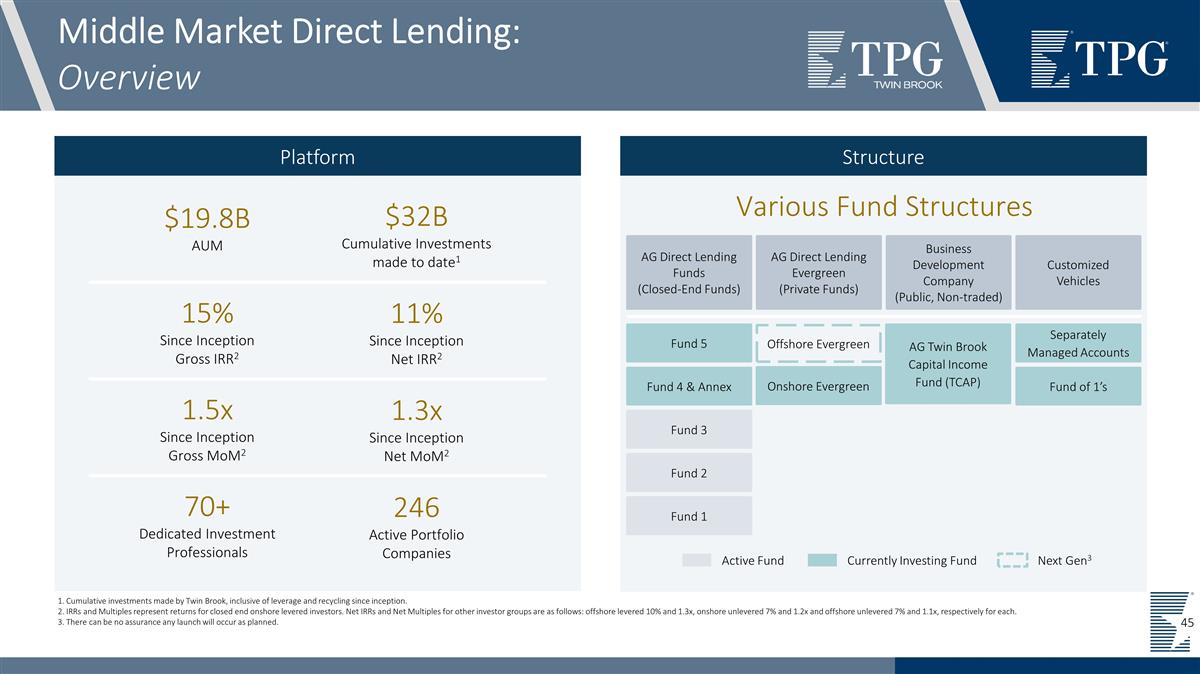

Structure Platform Middle Market Direct Lending: Overview 70+ Dedicated Investment Professionals $19.8B AUM 1.3x Since Inception Net MoM2 15% Since Inception Gross IRR2 11% Since Inception Net IRR2 $32B Cumulative Investments made to date1 246 Active Portfolio Companies 1.5x Since Inception Gross MoM2 Source Files AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 L10Y Track Record: https://tpg.ent.box.com/folder/148774254603 PortCos: https://tpg.ent.box.com/folder/148771306000 Investment Professionals: https://tpg.ent.box.com/folder/148770829303 Various Fund Structures Business Development Company (Public, Non-traded) AG Direct Lending Evergreen (Private Funds) AG Direct Lending Funds (Closed-End Funds) Customized Vehicles Fund 1 Fund 2 Fund 3 Fund 4 & Annex Offshore Evergreen Active Fund Currently Investing Fund Next Gen3 Fund 5 AG Twin Brook Capital Income Fund (TCAP) Onshore Evergreen Separately Managed Accounts Fund of 1’s 1. Cumulative investments made by Twin Brook, inclusive of leverage and recycling since inception. 2. IRRs and Multiples represent returns for closed end onshore levered investors. Net IRRs and Net Multiples for other investor groups are as follows: offshore levered 10% and 1.3x, onshore unlevered 7% and 1.2x and offshore unlevered 7% and 1.1x, respectively for each. 3. There can be no assurance any launch will occur as planned.

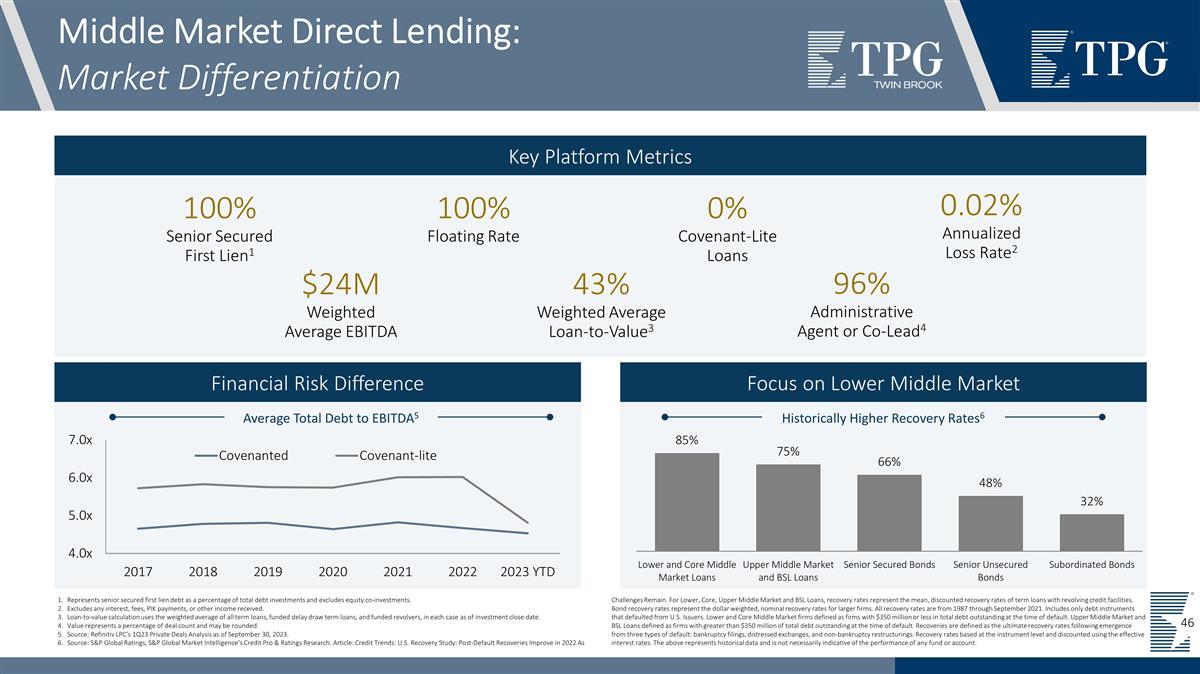

Financial Risk Difference Focus on Lower Middle Market Average Total Debt to EBITDA5 Historically Higher Recovery Rates6 Middle Market Direct Lending: Market Differentiation Source Files AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 L10Y Track Record: https://tpg.ent.box.com/folder/148774254603 PortCos: https://tpg.ent.box.com/folder/148771306000 Investment Professionals: https://tpg.ent.box.com/folder/148770829303 Represents senior secured first lien debt as a percentage of total debt investments and excludes equity co-investments. Excludes any interest, fees, PIK payments, or other income received. Loan-to-value calculation uses the weighted average of all term loans, funded delay draw term loans, and funded revolvers, in each case as of investment close date. Value represents a percentage of deal count and may be rounded. Source: Refinitiv LPC’s 1Q23 Private Deals Analysis as of September 30, 2023. Source: S&P Global Ratings, S&P Global Market Intelligence’s Credit Pro & Ratings Research. Article: Credit Trends: U.S. Recovery Study: Post-Default Recoveries Improve in 2022 As Challenges Remain. For Lower, Core, Upper Middle Market and BSL Loans, recovery rates represent the mean, discounted recovery rates of term loans with revolving credit facilities. Bond recovery rates represent the dollar weighted, nominal recovery rates for larger firms. All recovery rates are from 1987 through September 2021. Includes only debt instruments that defaulted from U.S. Issuers. Lower and Core Middle Market firms defined as firms with $350 million or less in total debt outstanding at the time of default. Upper Middle Market and BSL Loans defined as firms with greater than $350 million of total debt outstanding at the time of default. Recoveries are defined as the ultimate recovery rates following emergence from three types of default: bankruptcy filings, distressed exchanges, and non-bankruptcy restructurings. Recovery rates based at the instrument level and discounted using the effective interest rates. The above represents historical data and is not necessarily indicative of the performance of any fund or account. Key Platform Metrics 100% Senior Secured First Lien1 0.02% Annualized Loss Rate2 0% Covenant-Lite Loans 100% Floating Rate $24M Weighted Average EBITDA 96% Administrative Agent or Co-Lead4 43% Weighted Average Loan-to-Value3

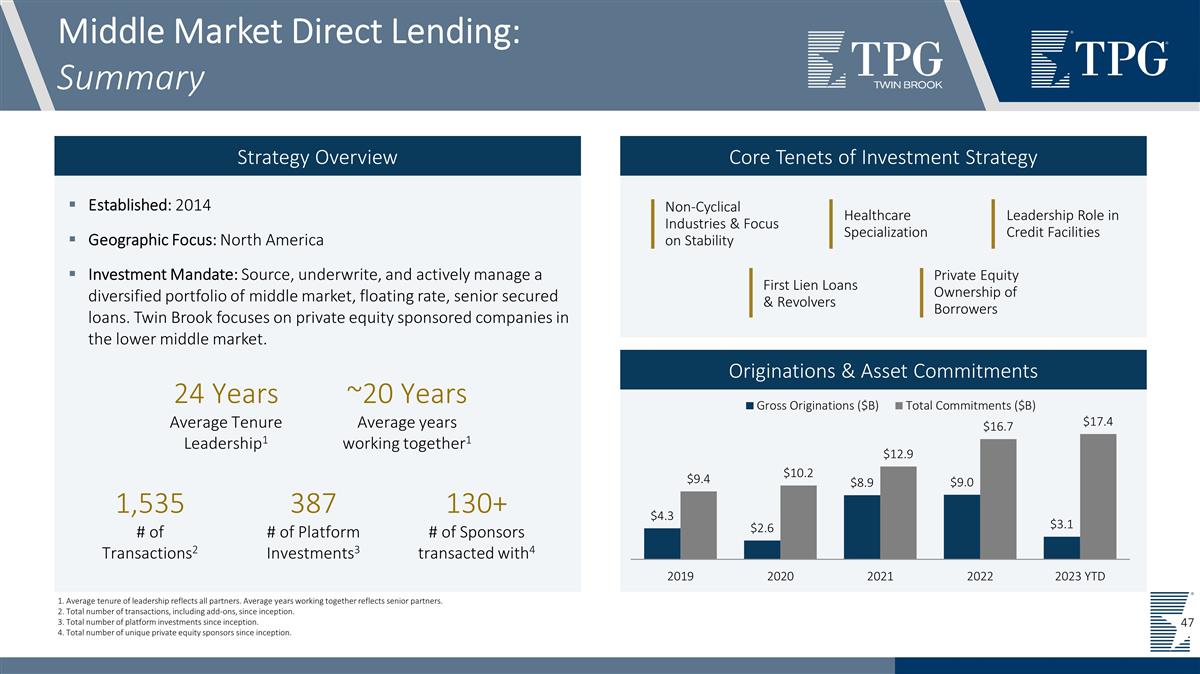

Non-Cyclical Industries & Focus on Stability Healthcare Specialization Leadership Role in Credit Facilities First Lien Loans & Revolvers Private Equity Ownership of Borrowers Core Tenets of Investment Strategy Originations & Asset Commitments Established: 2014 Geographic Focus: North America Investment Mandate: Source, underwrite, and actively manage a diversified portfolio of middle market, floating rate, senior secured loans. Twin Brook focuses on private equity sponsored companies in the lower middle market. Middle Market Direct Lending: Summary Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Strategy Overview 387 # of Platform Investments3 130+ # of Sponsors transacted with4 1,535 # of Transactions2 24 Years Average Tenure Leadership1 ~20 Years Average years working together1 1. Average tenure of leadership reflects all partners. Average years working together reflects senior partners. 2. Total number of transactions, including add-ons, since inception. 3. Total number of platform investments since inception. 4. Total number of unique private equity sponsors since inception.

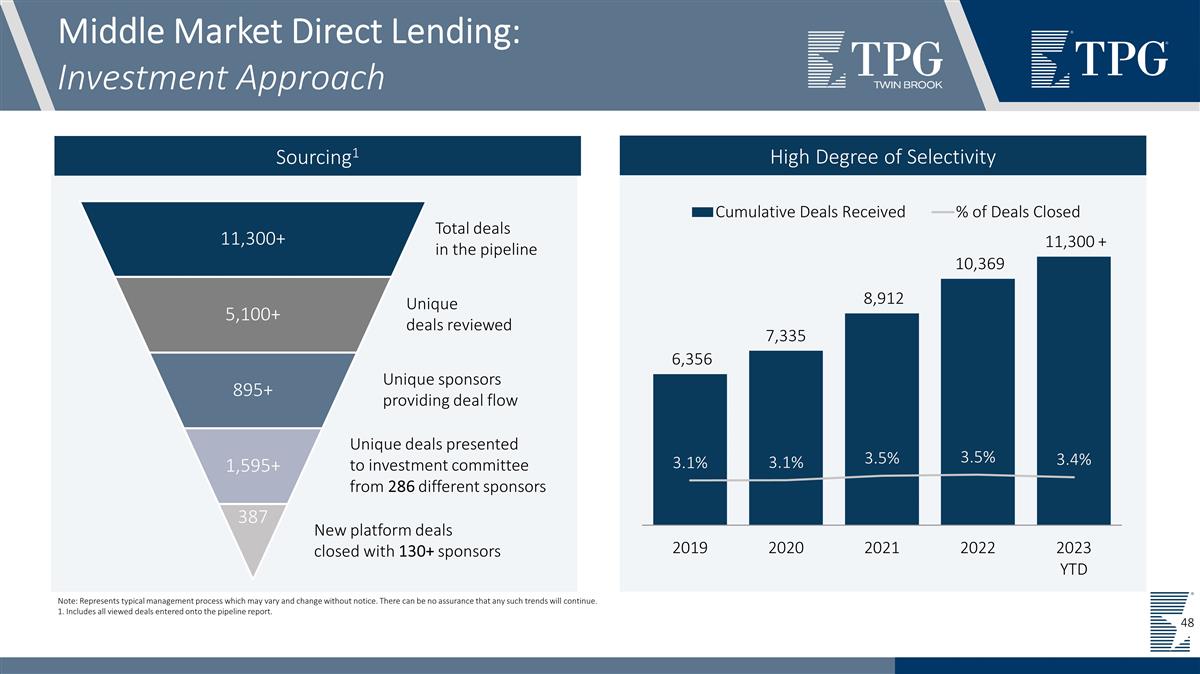

Middle Market Direct Lending: Investment Approach Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Sourcing1 Total deals in the pipeline Unique deals reviewed Unique sponsors providing deal flow Unique deals presented to investment committee from 286 different sponsors New platform deals closed with 130+ sponsors High Degree of Selectivity Note: Represents typical management process which may vary and change without notice. There can be no assurance that any such trends will continue. 1. Includes all viewed deals entered onto the pipeline report.

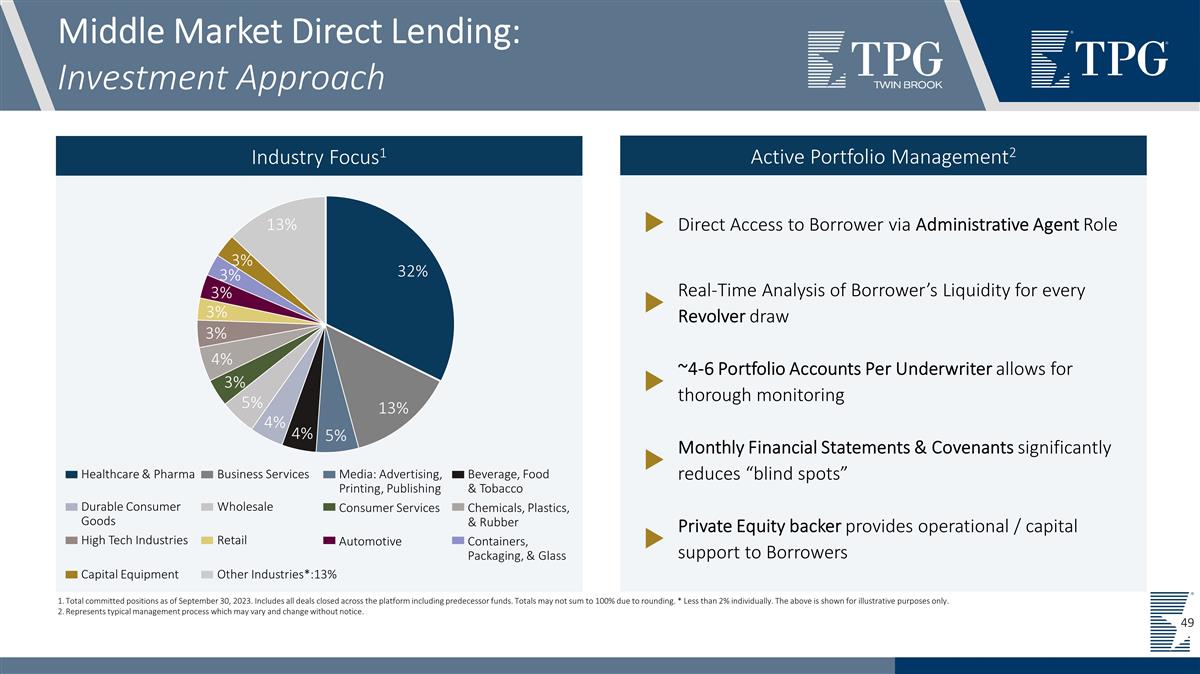

Active Portfolio Management2 Industry Focus1 Middle Market Direct Lending: Investment Approach Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 Total committed positions as of September 30, 2023. Includes all deals closed across the platform including predecessor funds. Totals may not sum to 100% due to rounding. * Less than 2% individually. The above is shown for illustrative purposes only. Represents typical management process which may vary and change without notice. Healthcare & Pharma Business Services Media: Advertising, Printing, Publishing Beverage, Food & Tobacco Durable Consumer Goods Wholesale Consumer Services Chemicals, Plastics, & Rubber High Tech Industries Retail Automotive Containers, Packaging, & Glass Capital Equipment Other Industries*:13% Direct Access to Borrower via Administrative Agent Role Real-Time Analysis of Borrower’s Liquidity for every Revolver draw ~4-6 Portfolio Accounts Per Underwriter allows for thorough monitoring Monthly Financial Statements & Covenants significantly reduces “blind spots” Private Equity backer provides operational / capital support to Borrowers

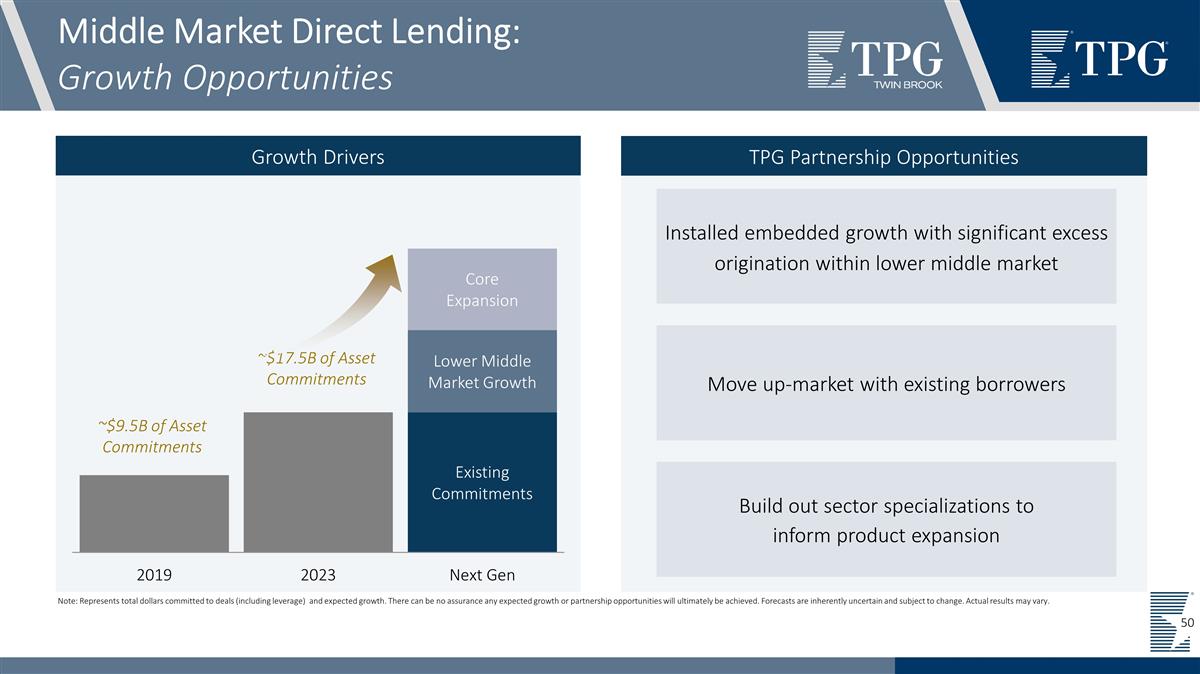

TPG Partnership Opportunities Installed embedded growth with significant excess origination within lower middle market Move up-market with existing borrowers Build out sector specializations to inform product expansion Middle Market Direct Lending: Growth Opportunities Growth Drivers ~$9.5B of Asset Commitments ~$17.5B of Asset Commitments Note: Represents total dollars committed to deals (including leverage) and expected growth. There can be no assurance any expected growth or partnership opportunities will ultimately be achieved. Forecasts are inherently uncertain and subject to change. Actual results may vary.

Structured Credit & Specialty Finance

Presenter Head of Structured Credit & Specialty Finance T.J. Durkin

Structured Credit & Specialty Finance: Key Highlights Significant Complex Market 1 Opportunity to generate alpha Differentiated Competitive Moat 2 Deep bench with long tenure and “public and private” footprint Accelerating LP Demand 3 Resembles direct lending 10 years ago Ready to Scale 4 Fully built, specialized infrastructure

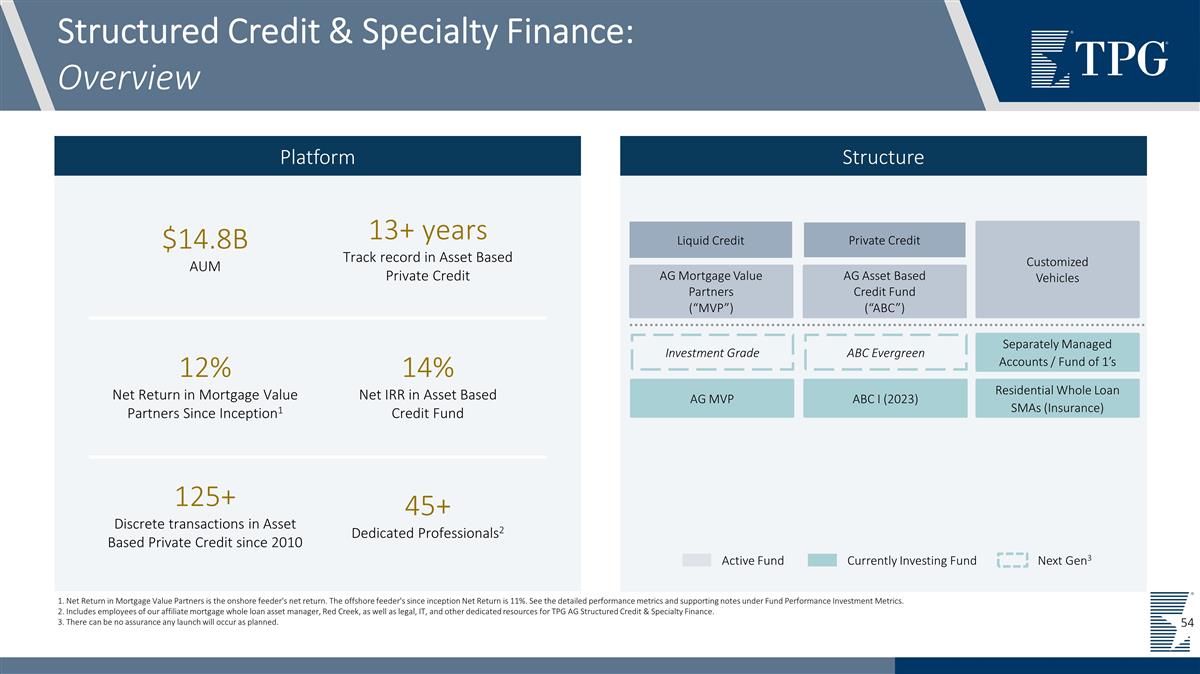

Structured Credit & Specialty Finance: Overview Structure Platform 45+ Dedicated Professionals2 $14.8B AUM 125+ Discrete transactions in Asset Based Private Credit since 2010 13+ years Track record in Asset Based Private Credit Source Files AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 L10Y Track Record: https://tpg.ent.box.com/folder/148774254603 PortCos: https://tpg.ent.box.com/folder/148771306000 Investment Professionals: https://tpg.ent.box.com/folder/148770829303 14% Net IRR in Asset Based Credit Fund AG Asset Based Credit Fund (“ABC”) AG Mortgage Value Partners (“MVP”) Customized Vehicles ABC I (2023) Separately Managed Accounts / Fund of 1’s Residential Whole Loan SMAs (Insurance) Liquid Credit Private Credit ABC Evergreen AG MVP Investment Grade 12% Net Return in Mortgage Value Partners Since Inception1 1. Net Return in Mortgage Value Partners is the onshore feeder's net return. The offshore feeder's since inception Net Return is 11%. See the detailed performance metrics and supporting notes under Fund Performance Investment Metrics. 2. Includes employees of our affiliate mortgage whole loan asset manager, Red Creek, as well as legal, IT, and other dedicated resources for TPG AG Structured Credit & Specialty Finance. 3. There can be no assurance any launch will occur as planned. Active Fund Currently Investing Fund Next Gen3 54

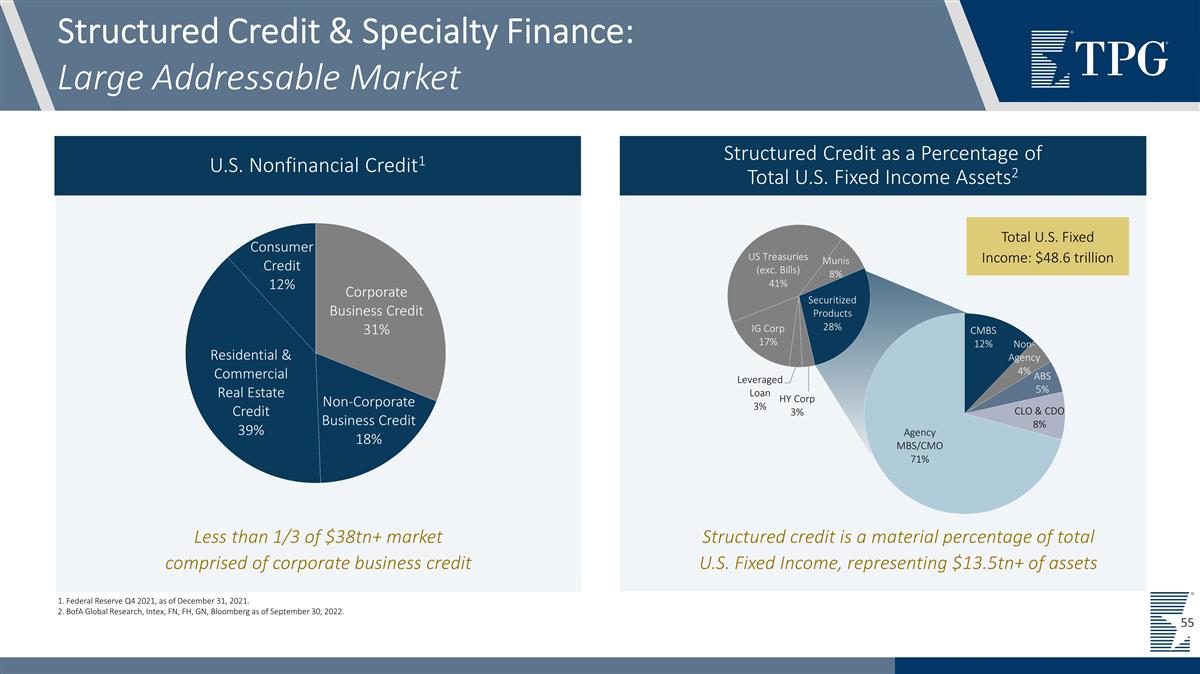

Structured Credit & Specialty Finance: Large Addressable Market U.S. Nonfinancial Credit1 Structured Credit as a Percentage of Total U.S. Fixed Income Assets2 Less than 1/3 of $38tn+ market comprised of corporate business credit Structured credit is a material percentage of total U.S. Fixed Income, representing $13.5tn+ of assets Total U.S. Fixed Income: $48.6 trillion 1. Federal Reserve Q4 2021, as of December 31, 2021. 2. BofA Global Research, Intex, FN, FH, GN, Bloomberg as of September 30, 2022. 55

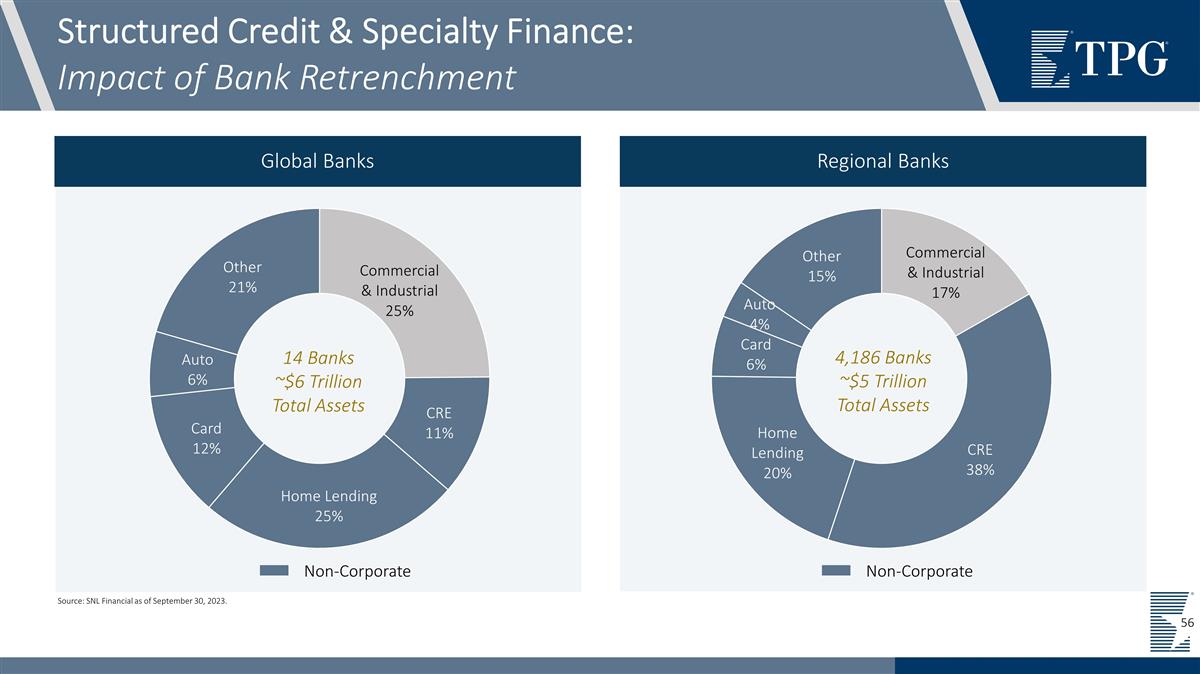

Structured Credit & Specialty Finance: Impact of Bank Retrenchment Global Banks Regional Banks Source: SNL Financial as of September 30, 2023. 14 Banks ~$6 Trillion Total Assets 4,186 Banks ~$5 Trillion Total Assets Non-Corporate Non-Corporate

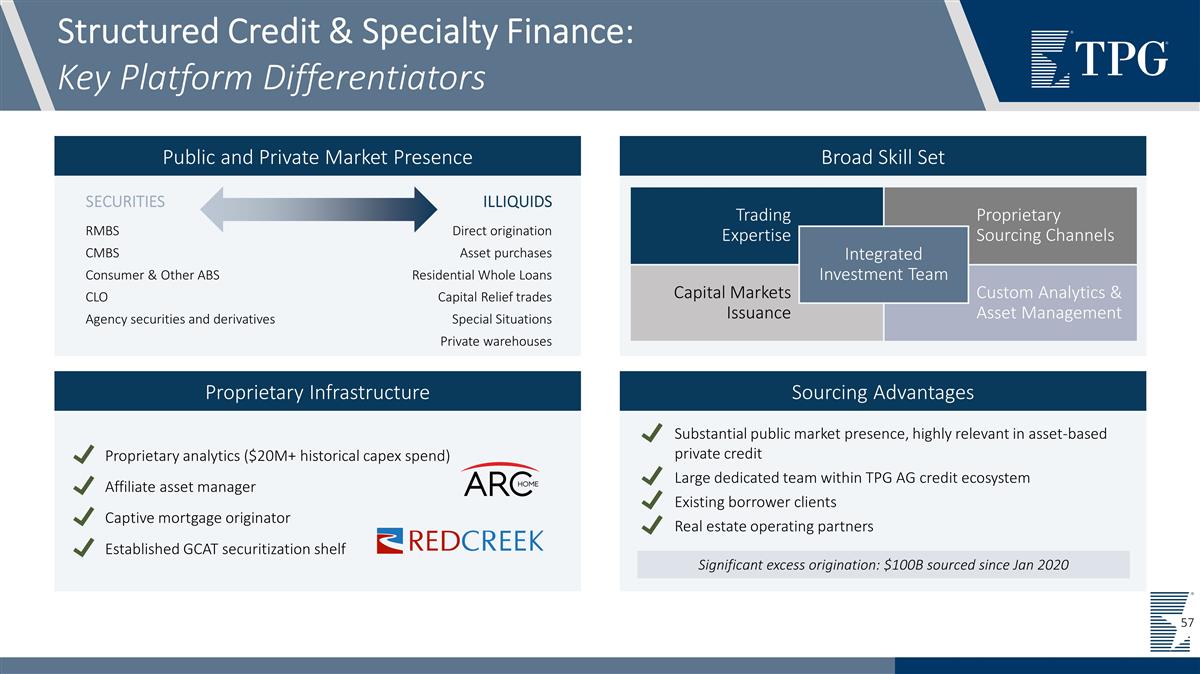

Structured Credit & Specialty Finance: Key Platform Differentiators Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 Public and Private Market Presence Broad Skill Set Trading Expertise Proprietary Sourcing Channels Integrated Investment Team Capital Markets Issuance Custom Analytics & Asset Management SECURITIES ILLIQUIDS RMBS CMBS Consumer & Other ABS CLO Agency securities and derivatives Direct origination Asset purchases Residential Whole Loans Capital Relief trades Special Situations Private warehouses Proprietary Infrastructure Sourcing Advantages Substantial public market presence, highly relevant in asset-based private credit Large dedicated team within TPG AG credit ecosystem Existing borrower clients Real estate operating partners Proprietary analytics ($20M+ historical capex spend) Affiliate asset manager Captive mortgage originator Established GCAT securitization shelf Significant excess origination: $100B sourced since Jan 2020

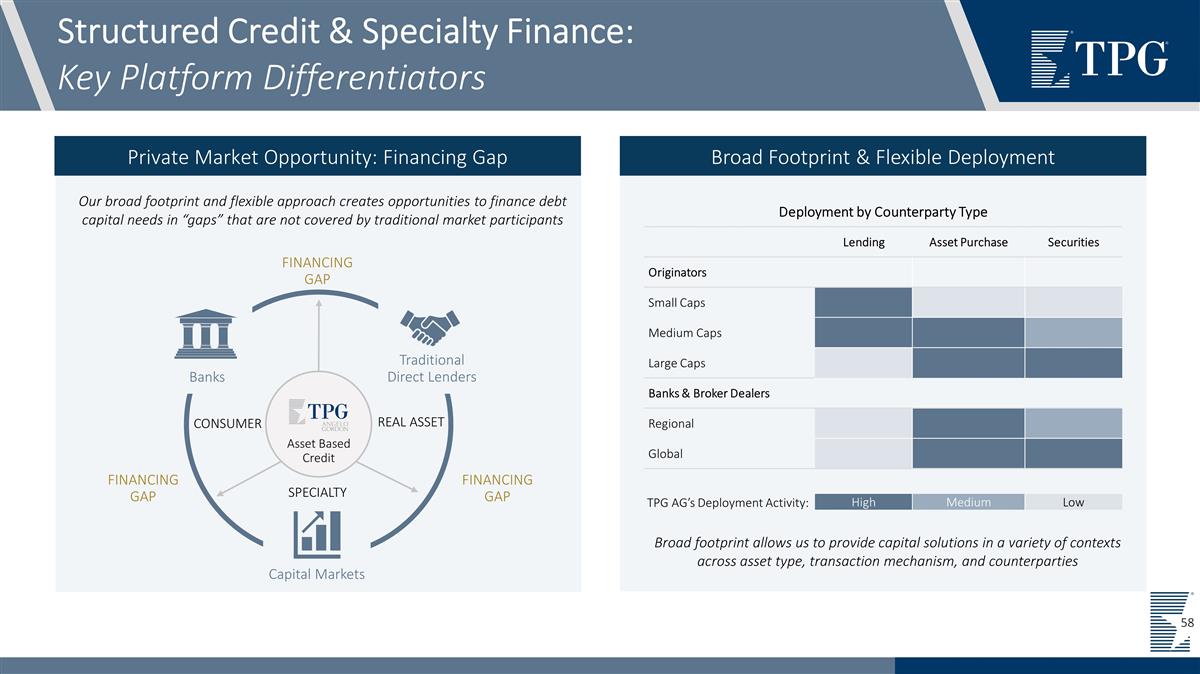

Structured Credit & Specialty Finance: Key Platform Differentiators Our broad footprint and flexible approach creates opportunities to finance debt capital needs in “gaps” that are not covered by traditional market participants Banks Traditional Direct Lenders Capital Markets Asset Based Credit SPECIALTY CONSUMER REAL ASSET FINANCING GAP FINANCING GAP FINANCING GAP Deployment by Counterparty Type Lending Asset Purchase Securities Originators Small Caps Medium Caps Large Caps Banks & Broker Dealers Regional Global Broad footprint allows us to provide capital solutions in a variety of contexts across asset type, transaction mechanism, and counterparties High Medium Low Private Market Opportunity: Financing Gap Broad Footprint & Flexible Deployment TPG AG’s Deployment Activity:

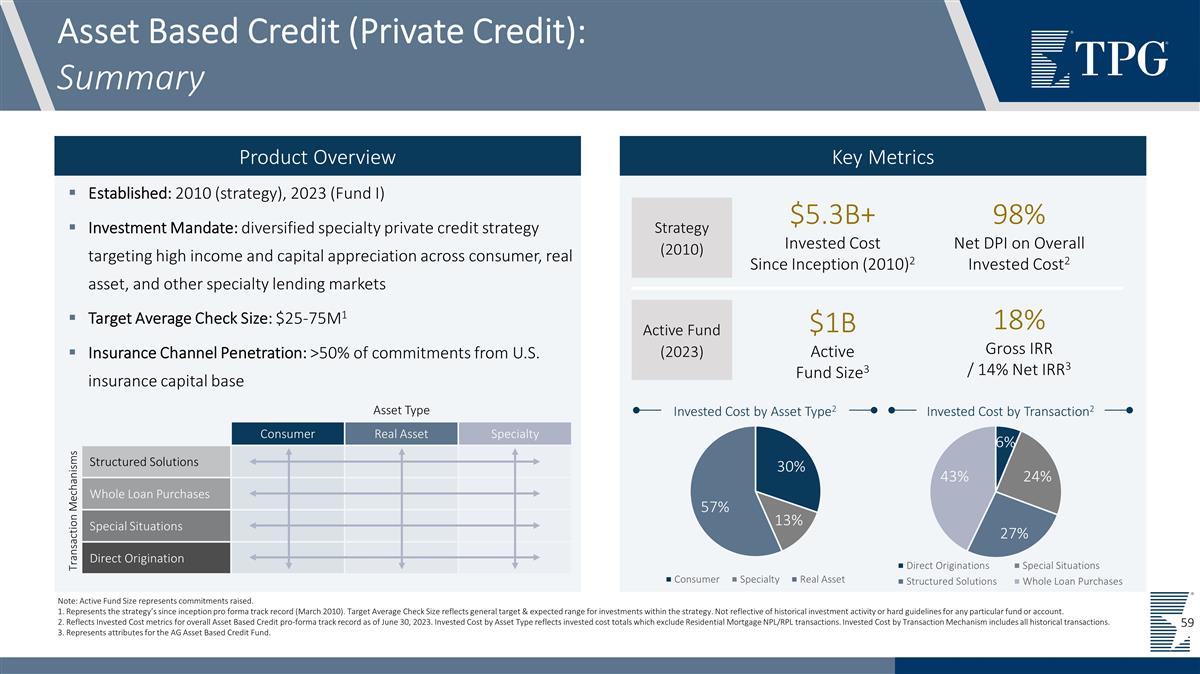

Established: 2010 (strategy), 2023 (Fund I) Investment Mandate: diversified specialty private credit strategy targeting high income and capital appreciation across consumer, real asset, and other specialty lending markets Target Average Check Size: $25-75M1 Insurance Channel Penetration: >50% of commitments from U.S. insurance capital base Asset Based Credit (Private Credit): Summary $5.3B+ Invested Cost Since Inception (2010)2 98% Net DPI on Overall Invested Cost2 $1B Active Fund Size3 18% Gross IRR / 14% Net IRR3 Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Product Overview Key Metrics Note: Active Fund Size represents commitments raised. 1. Represents the strategy’s since inception pro forma track record (March 2010). Target Average Check Size reflects general target & expected range for investments within the strategy. Not reflective of historical investment activity or hard guidelines for any particular fund or account. 2. Reflects Invested Cost metrics for overall Asset Based Credit pro-forma track record as of June 30, 2023. Invested Cost by Asset Type reflects invested cost totals which exclude Residential Mortgage NPL/RPL transactions. Invested Cost by Transaction Mechanism includes all historical transactions. 3. Represents attributes for the AG Asset Based Credit Fund. Transaction Mechanisms Asset Type Real Asset Specialty Consumer Real Asset Specialty Structured Solutions Whole Loan Purchases Special Situations Direct Origination Invested Cost by Asset Type2 Invested Cost by Transaction2 Strategy (2010) Active Fund (2023) 59

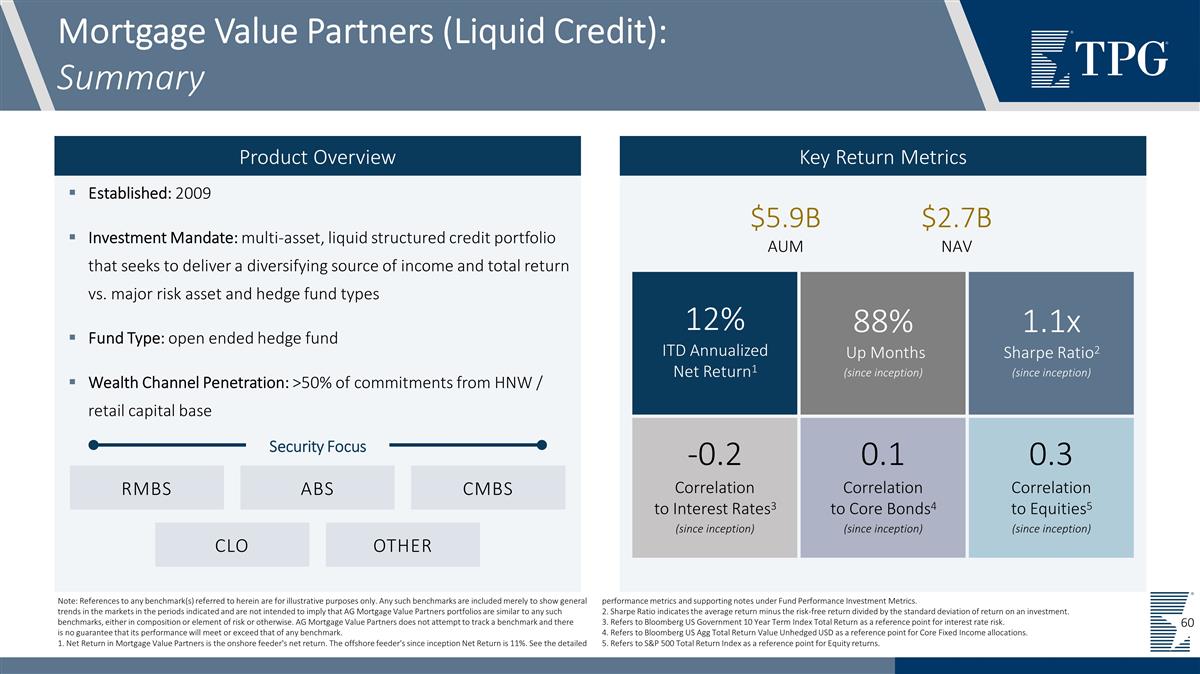

Established: 2009 Investment Mandate: multi-asset, liquid structured credit portfolio that seeks to deliver a diversifying source of income and total return vs. major risk asset and hedge fund types Fund Type: open ended hedge fund Wealth Channel Penetration: >50% of commitments from HNW / retail capital base Mortgage Value Partners (Liquid Credit): Summary Security Focus RMBS ABS CMBS CLO OTHER Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Product Overview Key Return Metrics Note: References to any benchmark(s) referred to herein are for illustrative purposes only. Any such benchmarks are included merely to show general trends in the markets in the periods indicated and are not intended to imply that AG Mortgage Value Partners portfolios are similar to any such benchmarks, either in composition or element of risk or otherwise. AG Mortgage Value Partners does not attempt to track a benchmark and there is no guarantee that its performance will meet or exceed that of any benchmark. 1. Net Return in Mortgage Value Partners is the onshore feeder's net return. The offshore feeder's since inception Net Return is 11%. See the detailed performance metrics and supporting notes under Fund Performance Investment Metrics. 2. Sharpe Ratio indicates the average return minus the risk-free return divided by the standard deviation of return on an investment. 3. Refers to Bloomberg US Government 10 Year Term Index Total Return as a reference point for interest rate risk. 4. Refers to Bloomberg US Agg Total Return Value Unhedged USD as a reference point for Core Fixed Income allocations. 5. Refers to S&P 500 Total Return Index as a reference point for Equity returns. 12% ITD Annualized Net Return1 88% Up Months (since inception) 1.1x Sharpe Ratio2 (since inception) -0.2 Correlation to Interest Rates3 (since inception) 0.1 Correlation to Core Bonds4 (since inception) 0.3 Correlation to Equities5 (since inception) $5.9B AUM $2.7B NAV

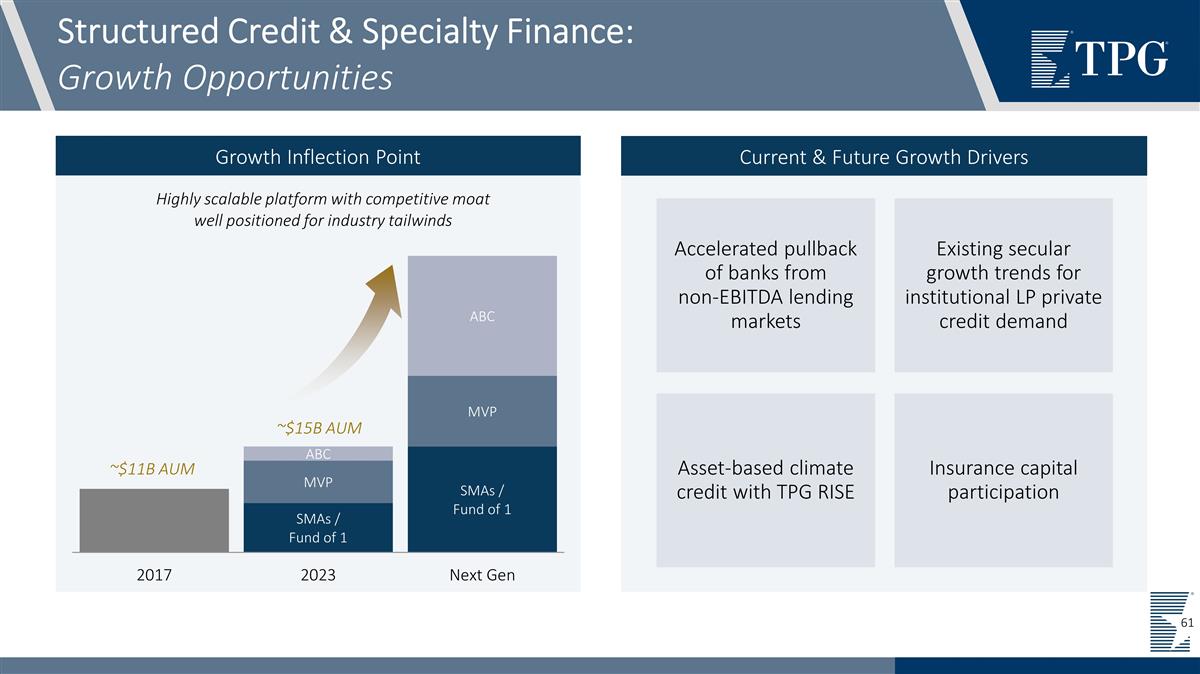

Current & Future Growth Drivers Accelerated pullback of banks from non-EBITDA lending markets Asset-based climate credit with TPG RISE Existing secular growth trends for institutional LP private credit demand Structured Credit & Specialty Finance: Growth Opportunities Growth Inflection Point Highly scalable platform with competitive moat well positioned for industry tailwinds ~$11B AUM ~$15B AUM Insurance capital participation

Credit Solutions

Presenter Global Head of Credit Solutions Ryan Mollett

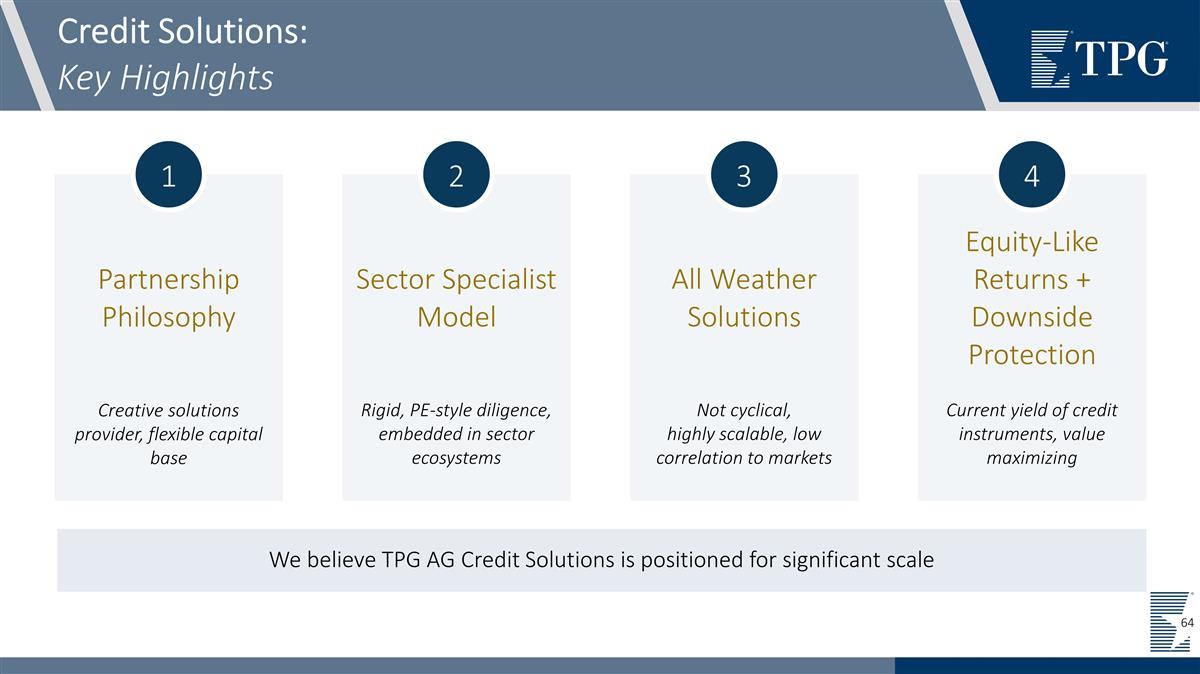

Credit Solutions: Key Highlights Partnership Philosophy 1 Creative solutions provider, flexible capital base Sector Specialist Model 2 Rigid, PE-style diligence, embedded in sector ecosystems All Weather Solutions 3 Not cyclical, highly scalable, low correlation to markets Equity-Like Returns + Downside Protection 4 Current yield of credit instruments, value maximizing We believe TPG AG Credit Solutions is positioned for significant scale

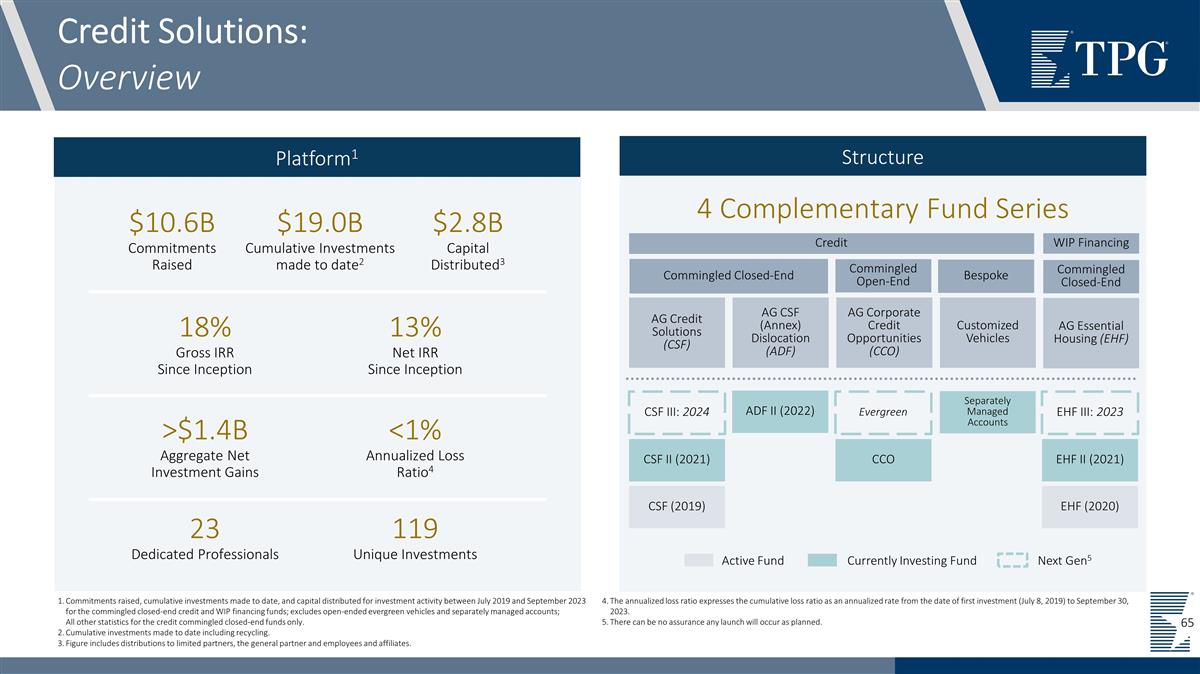

Credit Solutions: Overview Structure 4 Complementary Fund Series AG Credit Solutions (CSF) AG Corporate Credit Opportunities (CCO) AG CSF (Annex) Dislocation (ADF) Customized Vehicles CSF (2019) CSF II (2021) ADF II (2022) CCO CSF III: 2024 Evergreen Commingled Closed-End Commingled Open-End Separately Managed Accounts Bespoke Credit EHF (2020) EHF II (2021) EHF III: 2023 AG Essential Housing (EHF) Commingled Closed-End WIP Financing Platform1 23 Dedicated Professionals $10.6B Commitments Raised <1% Annualized Loss Ratio4 18% Gross IRR Since Inception 13% Net IRR Since Inception $19.0B Cumulative Investments made to date2 119 Unique Investments >$1.4B Aggregate Net Investment Gains $2.8B Capital Distributed3 Commitments raised, cumulative investments made to date, and capital distributed for investment activity between July 2019 and September 2023 for the commingled closed-end credit and WIP financing funds; excludes open-ended evergreen vehicles and separately managed accounts; All other statistics for the credit commingled closed-end funds only. Cumulative investments made to date including recycling. Figure includes distributions to limited partners, the general partner and employees and affiliates. The annualized loss ratio expresses the cumulative loss ratio as an annualized rate from the date of first investment (July 8, 2019) to September 30, 2023. There can be no assurance any launch will occur as planned. Active Fund Currently Investing Fund Next Gen5 65

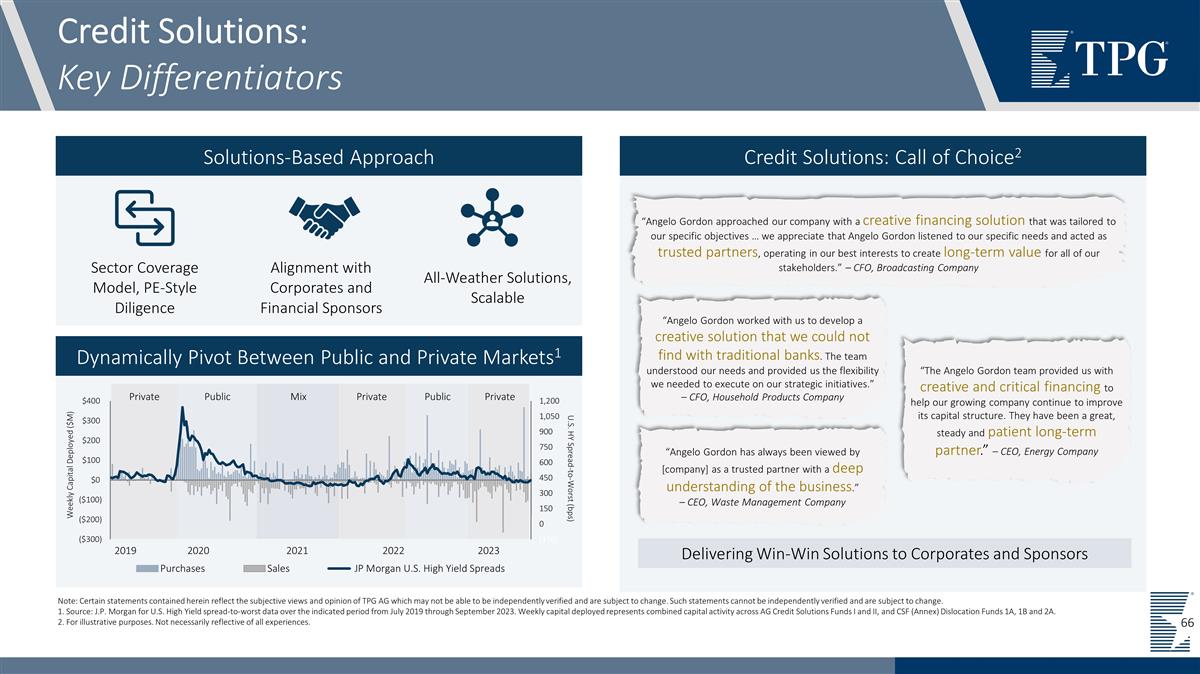

Dynamically Pivot Between Public and Private Markets1 Credit Solutions: Key Differentiators Credit Solutions: Call of Choice2 Solutions-Based Approach Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 All-Weather Solutions, Scalable Sector Coverage Model, PE-Style Diligence Alignment with Corporates and Financial Sponsors “Angelo Gordon worked with us to develop a creative solution that we could not find with traditional banks. The team understood our needs and provided us the flexibility we needed to execute on our strategic initiatives.” – CFO, Household Products Company “Angelo Gordon approached our company with a creative financing solution that was tailored to our specific objectives … we appreciate that Angelo Gordon listened to our specific needs and acted as trusted partners, operating in our best interests to create long-term value for all of our stakeholders.” – CFO, Broadcasting Company “The Angelo Gordon team provided us with creative and critical financing to help our growing company continue to improve its capital structure. They have been a great, steady and patient long-term partner.” – CEO, Energy Company “Angelo Gordon has always been viewed by [company] as a trusted partner with a deep understanding of the business.” – CEO, Waste Management Company Delivering Win-Win Solutions to Corporates and Sponsors Private Public Private Public Mix Private 2019 2020 2021 2022 2023 Note: Certain statements contained herein reflect the subjective views and opinion of TPG AG which may not be able to be independently verified and are subject to change. Such statements cannot be independently verified and are subject to change. 1. Source: J.P. Morgan for U.S. High Yield spread-to-worst data over the indicated period from July 2019 through September 2023. Weekly capital deployed represents combined capital activity across AG Credit Solutions Funds I and II, and CSF (Annex) Dislocation Funds 1A, 1B and 2A. 2. For illustrative purposes. Not necessarily reflective of all experiences. 66

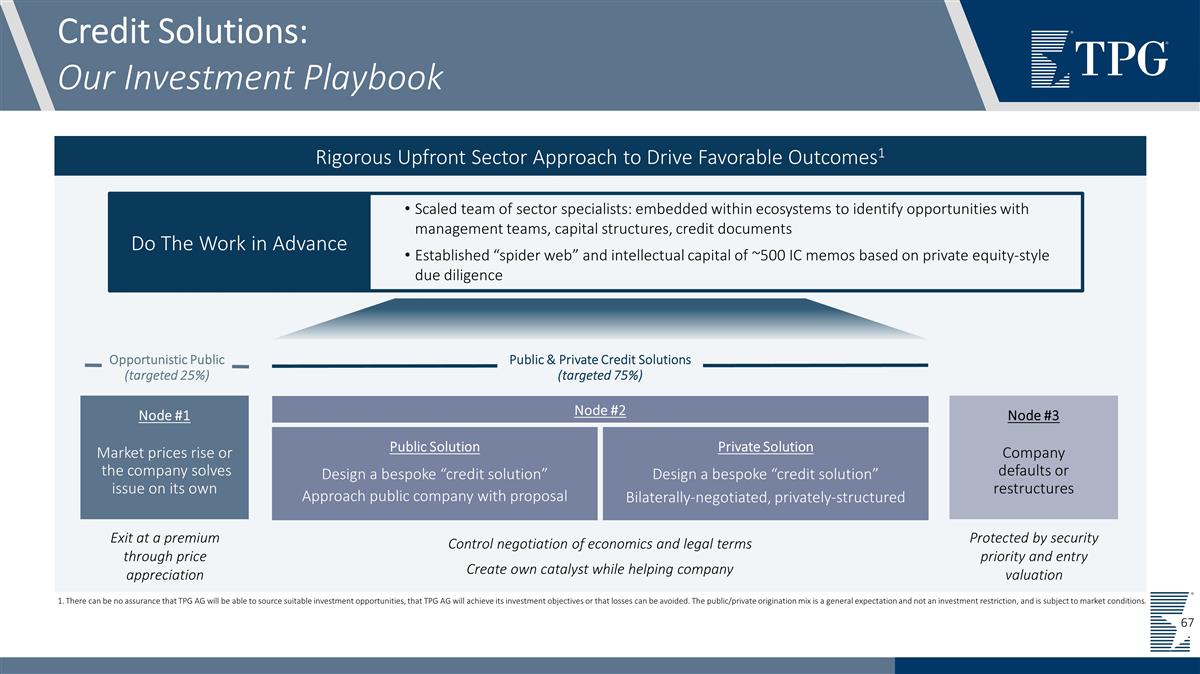

Rigorous Upfront Sector Approach to Drive Favorable Outcomes1 Credit Solutions: Our Investment Playbook Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 Do The Work in Advance Scaled team of sector specialists: embedded within ecosystems to identify opportunities with management teams, capital structures, credit documents Established “spider web” and intellectual capital of ~500 IC memos based on private equity-style due diligence Node #1 Market prices rise or the company solves issue on its own Public Solution Design a bespoke “credit solution” Approach public company with proposal Private Solution Design a bespoke “credit solution” Bilaterally-negotiated, privately-structured Node #3 Company defaults or restructures Public & Private Credit Solutions (targeted 75%) Opportunistic Public (targeted 25%) Node #2 Exit at a premium through price appreciation Control negotiation of economics and legal terms Create own catalyst while helping company Protected by security priority and entry valuation There can be no assurance that TPG AG will be able to source suitable investment opportunities, that TPG AG will achieve its investment objectives or that losses can be avoided. The public/private origination mix is a general expectation and not an investment restriction, and is subject to market conditions.

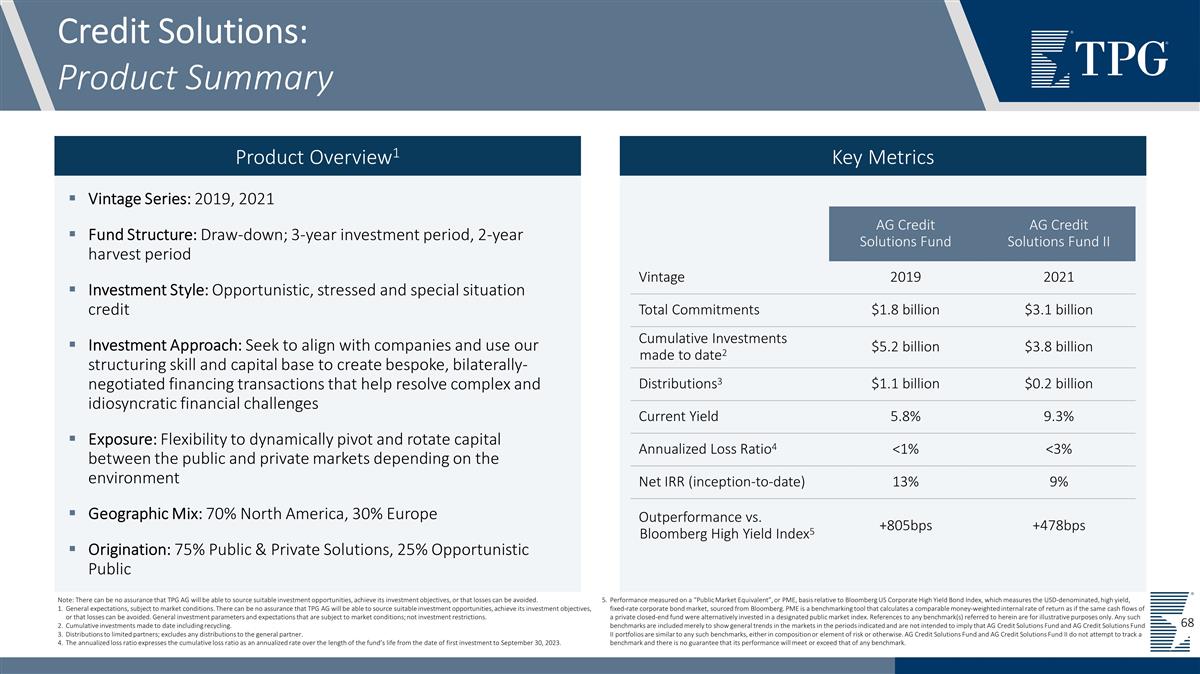

Vintage Series: 2019, 2021 Fund Structure: Draw-down; 3-year investment period, 2-year harvest period Investment Style: Opportunistic, stressed and special situation credit Investment Approach: Seek to align with companies and use our structuring skill and capital base to create bespoke, bilaterally-negotiated financing transactions that help resolve complex and idiosyncratic financial challenges Exposure: Flexibility to dynamically pivot and rotate capital between the public and private markets depending on the environment Geographic Mix: 70% North America, 30% Europe Origination: 75% Public & Private Solutions, 25% Opportunistic Public Credit Solutions: Product Summary Product Overview1 Key Metrics AG Credit Solutions Fund AG Credit Solutions Fund II Vintage 2019 2021 Total Commitments $1.8 billion $3.1 billion Cumulative Investments made to date2 $5.2 billion $3.8 billion Distributions3 $1.1 billion $0.2 billion Current Yield 5.8% 9.3% Annualized Loss Ratio4 <1% <3% Net IRR (inception-to-date) 13% 9% Outperformance vs. Bloomberg High Yield Index5 +805bps +478bps Note: There can be no assurance that TPG AG will be able to source suitable investment opportunities, achieve its investment objectives, or that losses can be avoided. General expectations, subject to market conditions. There can be no assurance that TPG AG will be able to source suitable investment opportunities, achieve its investment objectives, or that losses can be avoided. General investment parameters and expectations that are subject to market conditions; not investment restrictions. Cumulative investments made to date including recycling. Distributions to limited partners; excludes any distributions to the general partner. The annualized loss ratio expresses the cumulative loss ratio as an annualized rate over the length of the fund’s life from the date of first investment to September 30, 2023. Performance measured on a “Public Market Equivalent”, or PME, basis relative to Bloomberg US Corporate High Yield Bond Index, which measures the USD-denominated, high yield, fixed-rate corporate bond market, sourced from Bloomberg. PME is a benchmarking tool that calculates a comparable money-weighted internal rate of return as if the same cash flows of a private closed-end fund were alternatively invested in a designated public market index. References to any benchmark(s) referred to herein are for illustrative purposes only. Any such benchmarks are included merely to show general trends in the markets in the periods indicated and are not intended to imply that AG Credit Solutions Fund and AG Credit Solutions Fund II portfolios are similar to any such benchmarks, either in composition or element of risk or otherwise. AG Credit Solutions Fund and AG Credit Solutions Fund II do not attempt to track a benchmark and there is no guarantee that its performance will meet or exceed that of any benchmark. 68

CSF (Annex) Dislocation & Corporate Credit Opportunities: Product Summary Note: There can be no assurance that TPG AG will be able to source suitable investment opportunities, achieve its investment objectives, or that losses can be avoided. Data and statistics combined for the two parallel vehicles, AG CSF1a (Annex) Dislocation Fund and AG CSF1b (Annex) Dislocation Fund, and presented as if a single fund. Data and statistics for AG CSF2a (Annex) Dislocation Fund. IRR not applicable for periods less than one year. iShares iBoxx $ High Yield Corporate Bond ETF total returns including dividend reinvestment, sourced from Bloomberg. The iShares iBoxx $ High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds. References to any benchmark(s) referred to herein are for illustrative purposes only. Any such benchmarks are included merely to show general trends in the markets in the periods indicated and are not intended to imply that AG Corporate Credit Opportunities' portfolio is similar to any such benchmarks, either in composition or element of risk or otherwise. AG Corporate Credit Opportunities does not attempt to track a benchmark and there is no guarantee that its performance will meet or exceed that of any benchmark. Ryan Mollett was named Portfolio Manager of the Fund in May 2019. Fund Structure: Open-ended evergreen Investment Style: Opportunistic liquid public credit Investment Approach: Enhanced returns over a multi-year period relative to high yield and other fixed income alternatives1 Exposure: Primarily public loans and bonds, primary and secondary, performing and stressed situations, while maintaining a strict emphasis on liquidity Vintage Series: 2020, 2022 Fund Structure: Draw-down; 1-year investment period Investment Style: Opportunistic and stressed credit Investment Approach: In periods of heightened market volatility and stress, tactical investments in public debt securities whose prices have dislocated from long-term fundamentals Exposure: Predominantly public debt securities ADF1 2020 Vintage $1.2B Commitments 26% Fully-Realized Net IRR ADF2 2022 Vintage $1.3B Commitments 21% ITD Time-Weighted Net Return3 Year-to-Date As of 9/30 3-Year Cumulative Current PM Cumulative5 AG CCO (net) 10.3% 24.0% 27.7% Outperformance vs. HYG ETF4 +619bps +2,231bps +2,016bps CSF (Annex) Dislocation Corporate Credit Opportunities 1 2

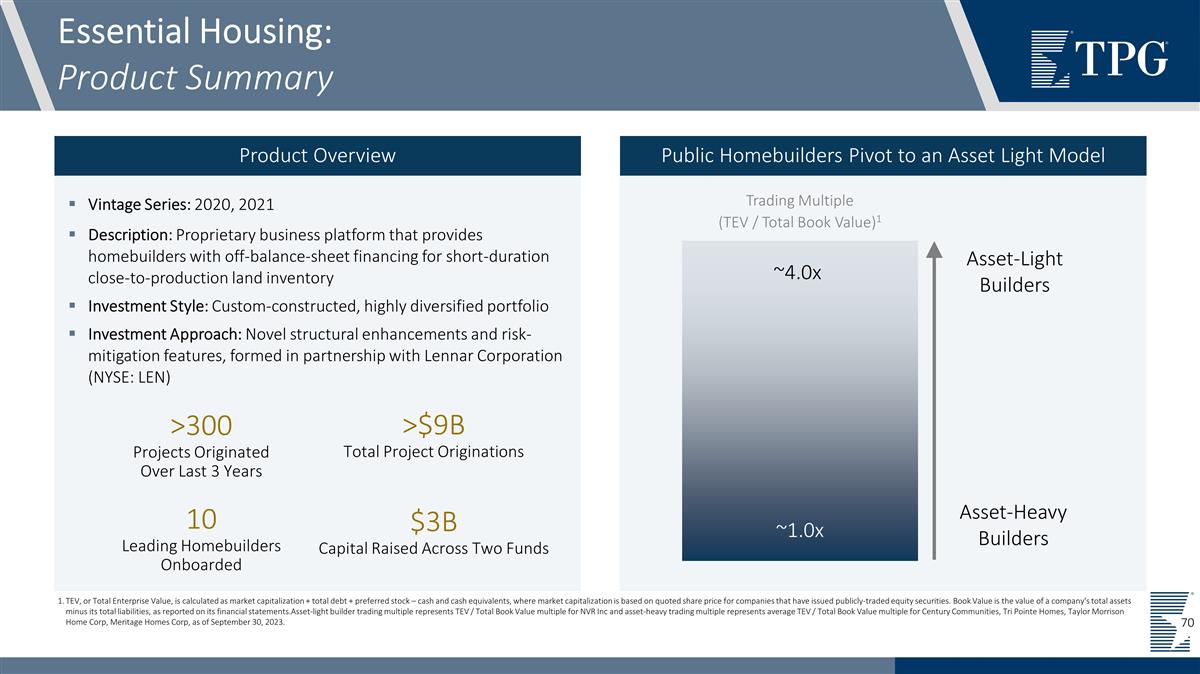

Vintage Series: 2020, 2021 Description: Proprietary business platform that provides homebuilders with off-balance-sheet financing for short-duration close-to-production land inventory Investment Style: Custom-constructed, highly diversified portfolio Investment Approach: Novel structural enhancements and risk-mitigation features, formed in partnership with Lennar Corporation (NYSE: LEN) >300 Projects Originated Over Last 3 Years 10 Leading Homebuilders Onboarded >$9B Total Project Originations $3B Capital Raised Across Two Funds Essential Housing: Product Summary TEV, or Total Enterprise Value, is calculated as market capitalization + total debt + preferred stock – cash and cash equivalents, where market capitalization is based on quoted share price for companies that have issued publicly-traded equity securities. Book Value is the value of a company's total assets minus its total liabilities, as reported on its financial statements.Asset-light builder trading multiple represents TEV / Total Book Value multiple for NVR Inc and asset-heavy trading multiple represents average TEV / Total Book Value multiple for Century Communities, Tri Pointe Homes, Taylor Morrison Home Corp, Meritage Homes Corp, as of September 30, 2023. Product Overview Public Homebuilders Pivot to an Asset Light Model at Q4’20 at Q4’20 at Q4’20 at Q4’20 at Q4’20 Asset-Heavy Builders Asset-Light Builders ~4.0x ~1.0x Trading Multiple (TEV / Total Book Value)1

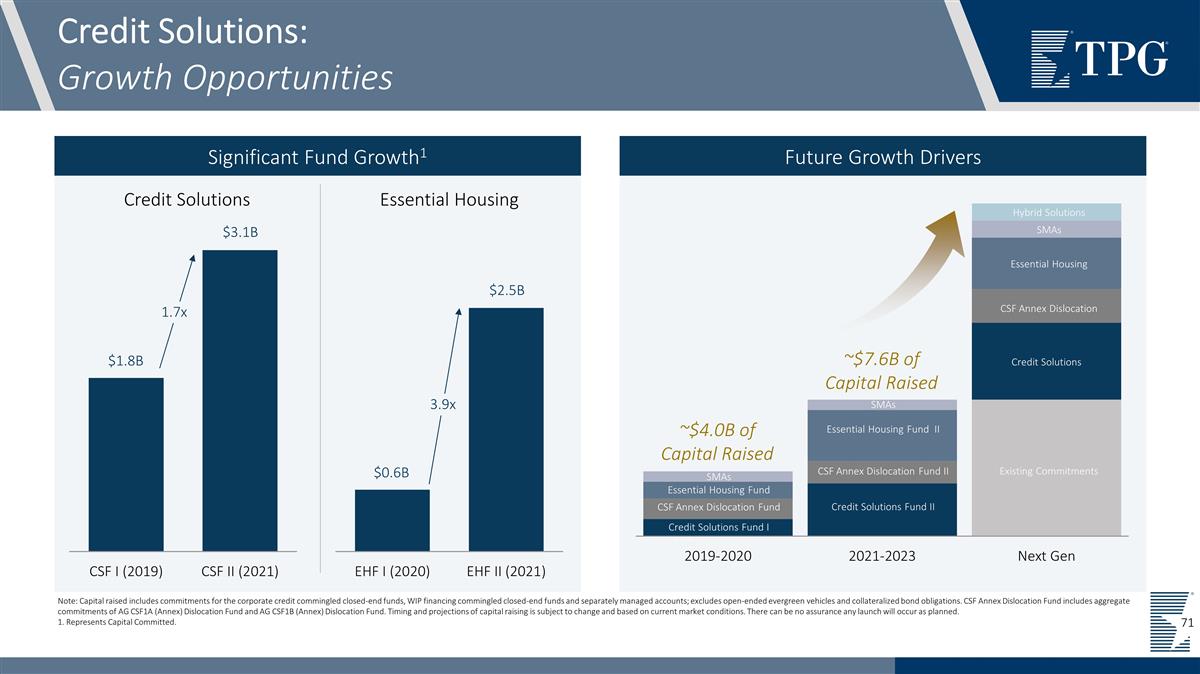

Credit Solutions: Growth Opportunities Note: Capital raised includes commitments for the corporate credit commingled closed-end funds, WIP financing commingled closed-end funds and separately managed accounts; excludes open-ended evergreen vehicles and collateralized bond obligations. CSF Annex Dislocation Fund includes aggregate commitments of AG CSF1A (Annex) Dislocation Fund and AG CSF1B (Annex) Dislocation Fund. Timing and projections of capital raising is subject to change and based on current market conditions. There can be no assurance any launch will occur as planned. 1. Represents Capital Committed. Significant Fund Growth1 Future Growth Drivers ~$1.8 ~$4.0 ~$10.2 ~$11.5 ~$11.5 ~$4.0B of Capital Raised ~$7.6B of Capital Raised Credit Solutions Fund I CSF Annex Dislocation Fund Essential Housing Fund Credit Solutions Fund II CSF Annex Dislocation Fund II Essential Housing Fund II Existing Commitments Essential Housing CSF Annex Dislocation Credit Solutions SMAs Hybrid Solutions SMAs SMAs 1.7x 3.9x Credit Solutions Essential Housing $1.8B $3.1B $0.6B $2.5B 71

TPG Partnership Opportunities Credit Solutions: Growth Opportunities Accelerating Capital Formation Flagship Credit Solutions, Essential Housing Sector-Based Collaboration Sourcing ideas across TPG platforms and teams Future Expansion of New Products TPG Hybrid Solutions 1 2 3

TPG Angelo Gordon Real Estate

Presenters Co-Managing Partner of TPG AG and Head of TPG AG Global Real Estate Adam Schwartz Co-Head of TPG Real Estate Avi Banyasz

TPG AG Real Estate: Key Highlights Cycle Tested 1 30-year track record of generating consistent returns globally Long-Tenured Team 2 Tenured leadership with average 17 years investing together through market cycles Nimble & Diversified Approach 3 Proprietary sourcing network and off-market edge drive maximum flexibility [ ] Multi-Strategy Firm 4 Credit DNA provides differentiated underwriting and sourcing advantage Combined TPG + AG Platform 5 1+1=3 Opportunities to scale through cost of capital expansion

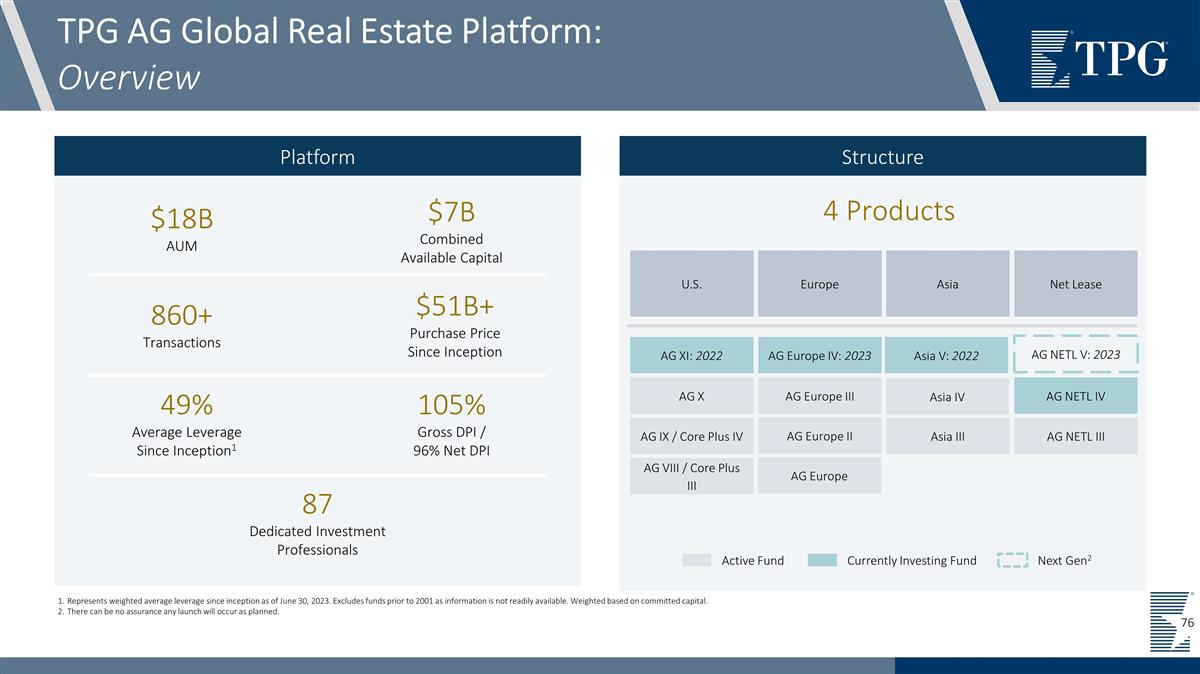

AG NETL V: 2023 TPG AG Global Real Estate Platform: Overview Structure 4 Products U.S. Asia Europe Net Lease AG VIII / Core Plus III AG NETL IV AG NETL III AG IX / Core Plus IV AG X Asia III AG Europe III Asia IV AG XI: 2022 AG Europe IV: 2023 Platform 87 Dedicated Investment Professionals $18B AUM $7B Combined Available Capital 105% Gross DPI / 96% Net DPI 860+ Transactions 49% Average Leverage Since Inception1 Source Files AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 L10Y Track Record: https://tpg.ent.box.com/folder/148774254603 PortCos: https://tpg.ent.box.com/folder/148771306000 Investment Professionals: https://tpg.ent.box.com/folder/148770829303 AG Europe II AG Europe $51B+ Purchase Price Since Inception Asia V: 2022 Represents weighted average leverage since inception as of June 30, 2023. Excludes funds prior to 2001 as information is not readily available. Weighted based on committed capital. There can be no assurance any launch will occur as planned. Active Fund Currently Investing Fund Next Gen2 76

TPG AG Global Real Estate Platform: Platform Development Source Files AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 L10Y Track Record: https://tpg.ent.box.com/folder/148774254603 PortCos: https://tpg.ent.box.com/folder/148771306000 Investment Professionals: https://tpg.ent.box.com/folder/148770829303 1993 - 2005 2006 - 2009 U.S. Real Estate U.S. Real Estate Asia Real Estate Net Lease U.S. Real Estate Asia Real Estate Net Lease Europe Real Estate 2009 - 2023 Today $18B Total Real Estate AUM U.S. Real Estate $7B AUM Asia Real Estate $5B AUM Net Lease $2B AUM Europe Real Estate $4B AUM 77

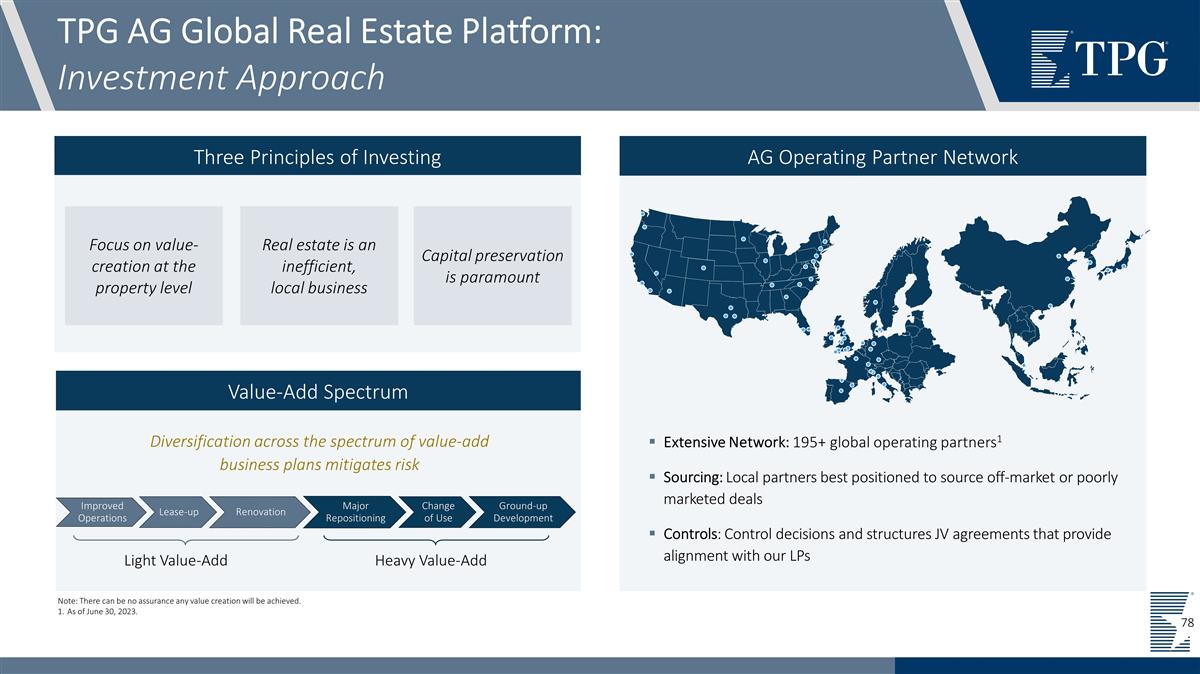

AG Operating Partner Network Three Principles of Investing Focus on value-creation at the property level Real estate is an inefficient, local business Capital preservation is paramount TPG AG Global Real Estate Platform: Investment Approach Value-Add Spectrum Light Value-Add Heavy Value-Add Diversification across the spectrum of value-add business plans mitigates risk Extensive Network: 195+ global operating partners1 Sourcing: Local partners best positioned to source off-market or poorly marketed deals Controls: Control decisions and structures JV agreements that provide alignment with our LPs Note: There can be no assurance any value creation will be achieved. As of June 30, 2023.

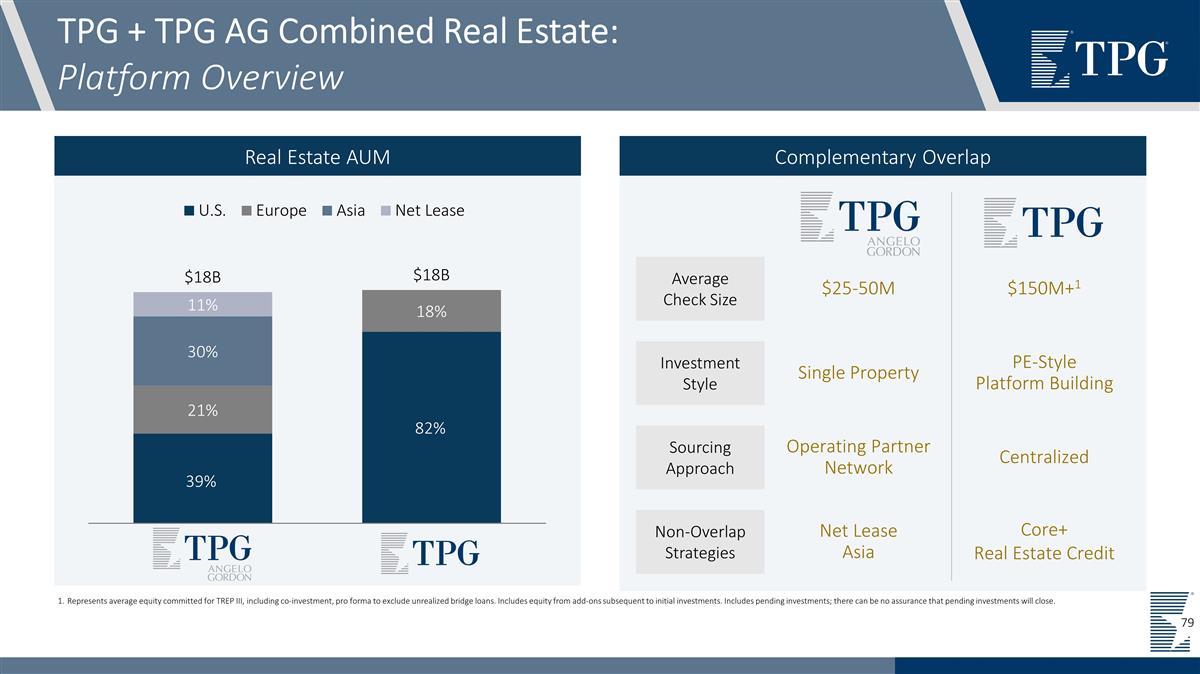

Complementary Overlap Real Estate AUM TPG + TPG AG Combined Real Estate: Platform Overview $25-50M $150M+1 Represents average equity committed for TREP III, including co‐investment, pro forma to exclude unrealized bridge loans. Includes equity from add‐ons subsequent to initial investments. Includes pending investments; there can be no assurance that pending investments will close. Average Check Size Investment Style Sourcing Approach Non-Overlap Strategies Single Property PE-Style Platform Building Operating Partner Network Centralized Net Lease Asia Core+ Real Estate Credit

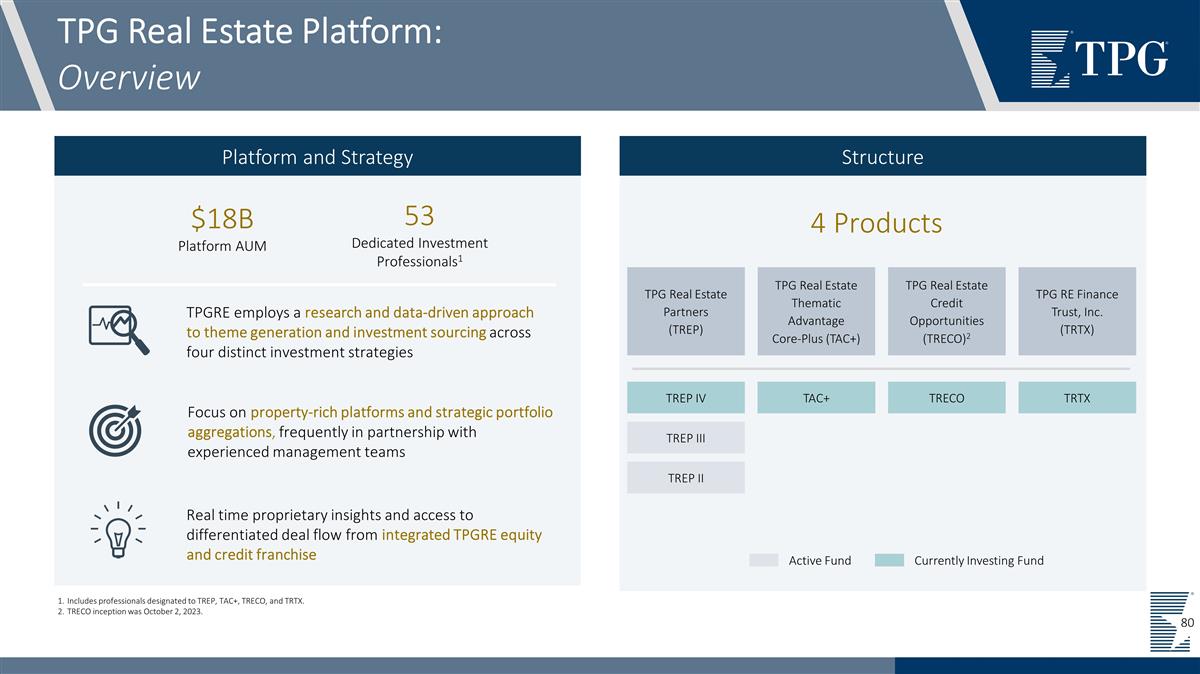

Structure Platform and Strategy TPG Real Estate Platform: Overview 4 Products TPG Real Estate Partners (TREP) TPG Real Estate Thematic Advantage Core-Plus (TAC+) TPG RE Finance Trust, Inc. (TRTX) TRTX TREP III TREP II 53 Dedicated Investment Professionals1 $18B Platform AUM TREP IV TPG Real Estate Credit Opportunities (TRECO)2 TAC+ TRECO TPGRE employs a research and data-driven approach to theme generation and investment sourcing across four distinct investment strategies Focus on property-rich platforms and strategic portfolio aggregations, frequently in partnership with experienced management teams Real time proprietary insights and access to differentiated deal flow from integrated TPGRE equity and credit franchise Includes professionals designated to TREP, TAC+, TRECO, and TRTX. TRECO inception was October 2, 2023. Active Fund Currently Investing Fund

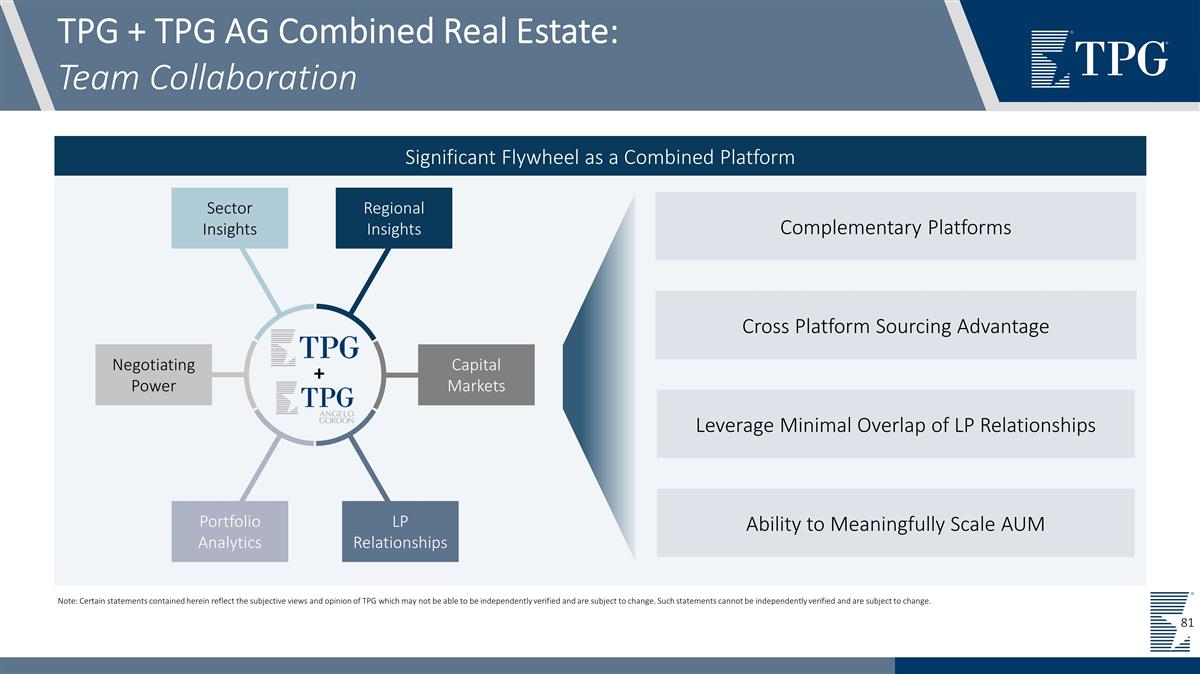

Significant Flywheel as a Combined Platform TPG + TPG AG Combined Real Estate: Team Collaboration Complementary Platforms Cross Platform Sourcing Advantage Ability to Meaningfully Scale AUM LP Relationships Sector Insights Regional Insights Portfolio Analytics Capital Markets Negotiating Power Leverage Minimal Overlap of LP Relationships + Note: Certain statements contained herein reflect the subjective views and opinion of TPG which may not be able to be independently verified and are subject to change. Such statements cannot be independently verified and are subject to change.

Presenters Head of TPG AG U.S. Real Estate Reid Liffmann Co-Portfolio Manager of TPG AG U.S. Real Estate Matt Jackson

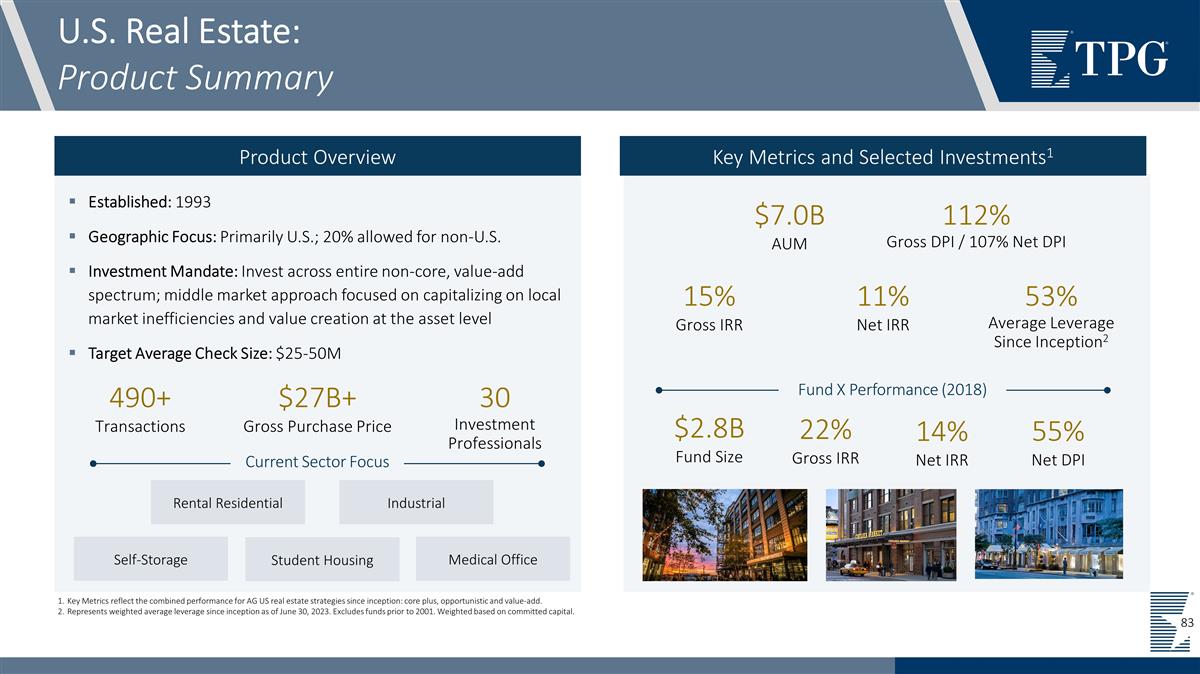

Established: 1993 Geographic Focus: Primarily U.S.; 20% allowed for non-U.S. Investment Mandate: Invest across entire non-core, value-add spectrum; middle market approach focused on capitalizing on local market inefficiencies and value creation at the asset level Target Average Check Size: $25-50M U.S. Real Estate: Product Summary $7.0B AUM 112% Gross DPI / 107% Net DPI 15% Gross IRR 11% Net IRR Current Sector Focus Rental Residential Industrial Product Overview Key Metrics and Selected Investments1 490+ Transactions 30 Investment Professionals 53% Average Leverage Since Inception2 Self-Storage Student Housing Medical Office $27B+ Gross Purchase Price Fund X Performance (2018) 22% Gross IRR 14% Net IRR $2.8B Fund Size 55% Net DPI Key Metrics reflect the combined performance for AG US real estate strategies since inception: core plus, opportunistic and value-add. Represents weighted average leverage since inception as of June 30, 2023. Excludes funds prior to 2001. Weighted based on committed capital.

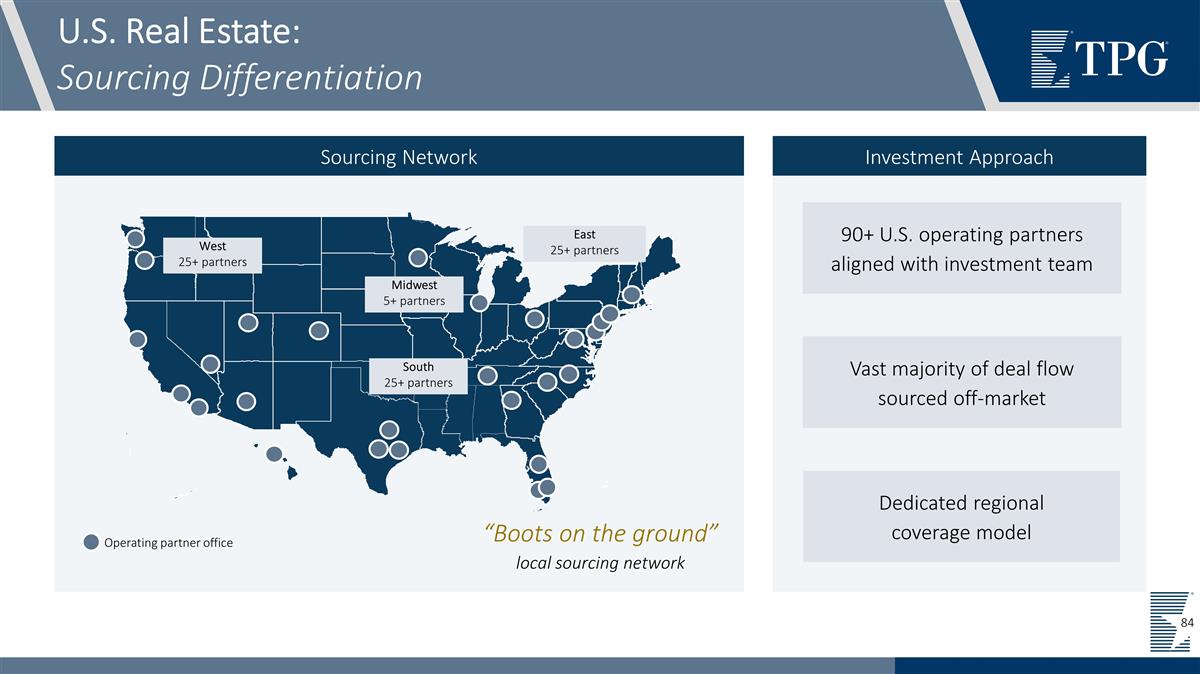

Sourcing Network Investment Approach U.S. Real Estate: Sourcing Differentiation Operating partner office West 25+ partners Midwest 5+ partners East 25+ partners South 25+ partners 90+ U.S. operating partners aligned with investment team Vast majority of deal flow sourced off-market Dedicated regional coverage model “Boots on the ground” local sourcing network

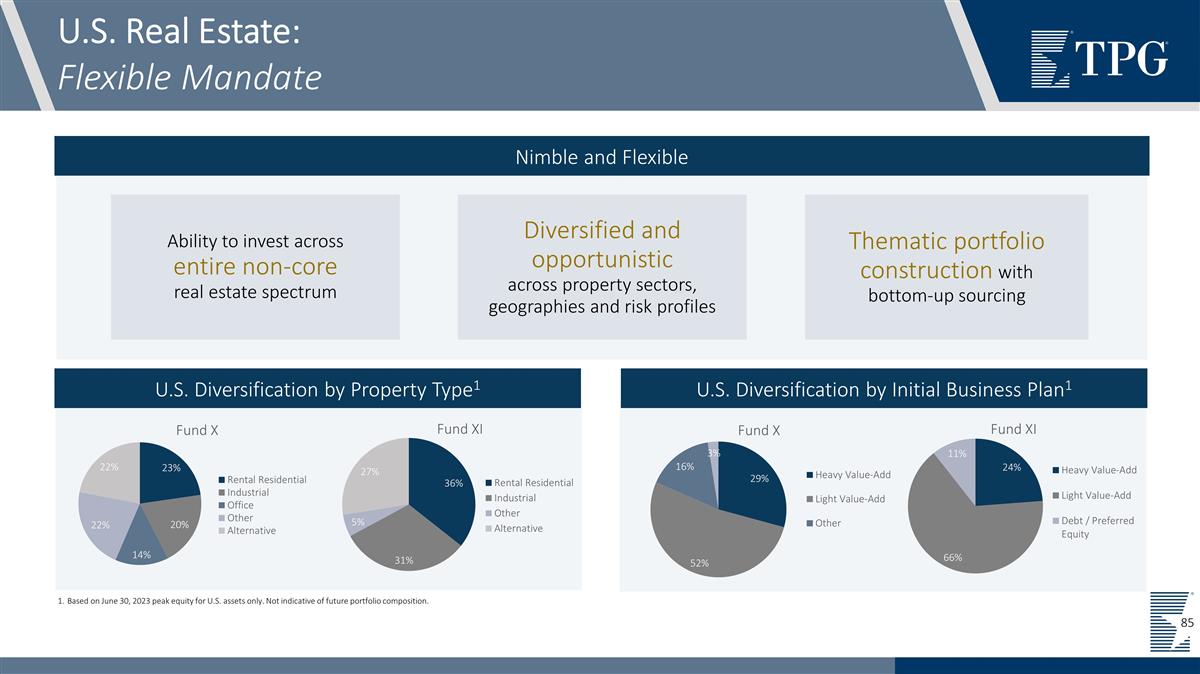

Nimble and Flexible U.S. Real Estate: Flexible Mandate U.S. Diversification by Property Type1 U.S. Diversification by Initial Business Plan1 Ability to invest across entire non-core real estate spectrum Thematic portfolio construction with bottom-up sourcing Diversified and opportunistic across property sectors, geographies and risk profiles Based on June 30, 2023 peak equity for U.S. assets only. Not indicative of future portfolio composition.

Presenter Head of TPG AG Europe Real Estate Anuj Mittal

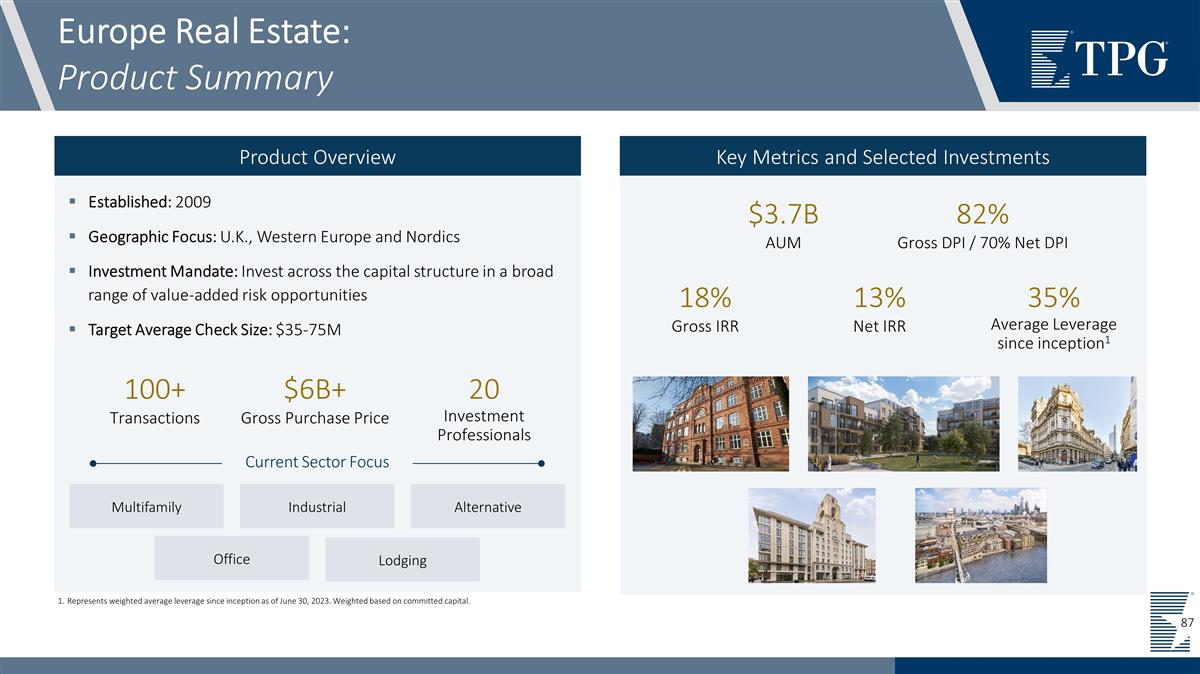

Established: 2009 Geographic Focus: U.K., Western Europe and Nordics Investment Mandate: Invest across the capital structure in a broad range of value-added risk opportunities Target Average Check Size: $35-75M Europe Real Estate: Product Summary $3.7B AUM 82% Gross DPI / 70% Net DPI 18% Gross IRR 13% Net IRR 100+ Transactions 20 Investment Professionals Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Product Overview Key Metrics and Selected Investments Current Sector Focus Multifamily Industrial Alternative Lodging Office 35% Average Leverage since inception1 $6B+ Gross Purchase Price Represents weighted average leverage since inception as of June 30, 2023. Weighted based on committed capital.

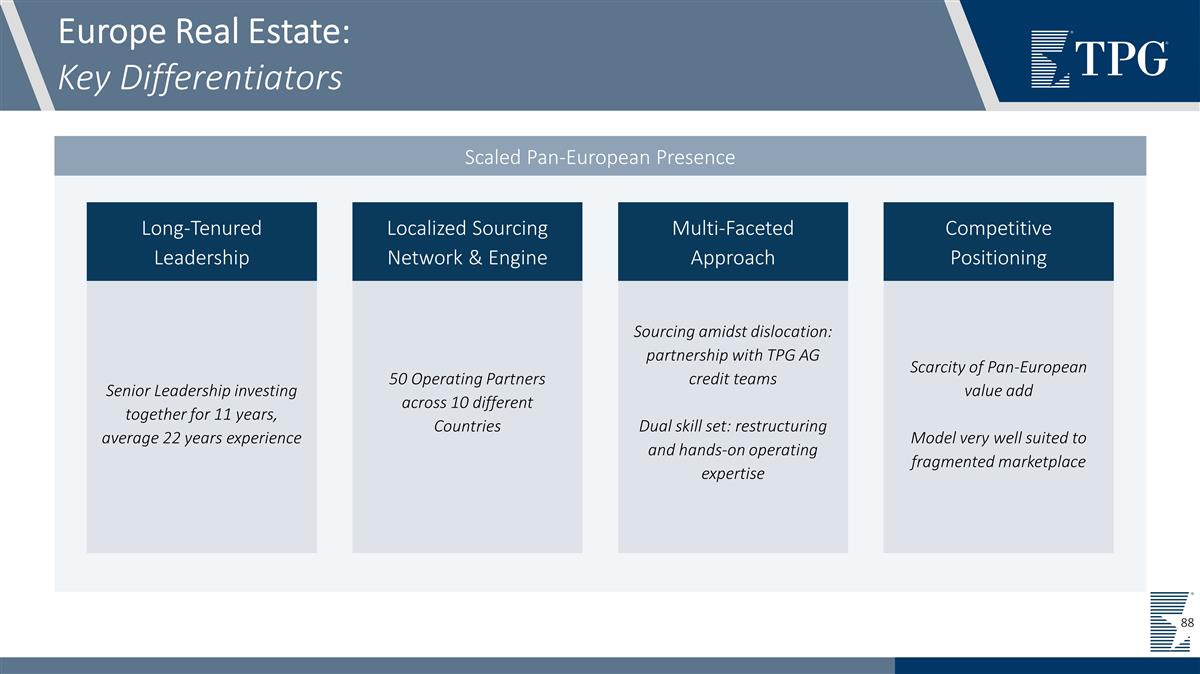

Scaled Pan-European Presence Europe Real Estate: Key Differentiators Senior Leadership investing together for 11 years, average 22 years experience 50 Operating Partners across 10 different Countries Sourcing amidst dislocation: partnership with TPG AG credit teams Dual skill set: restructuring and hands-on operating expertise Scarcity of Pan-European value add Model very well suited to fragmented marketplace Long-Tenured Leadership Localized Sourcing Network & Engine Multi-Faceted Approach Competitive Positioning

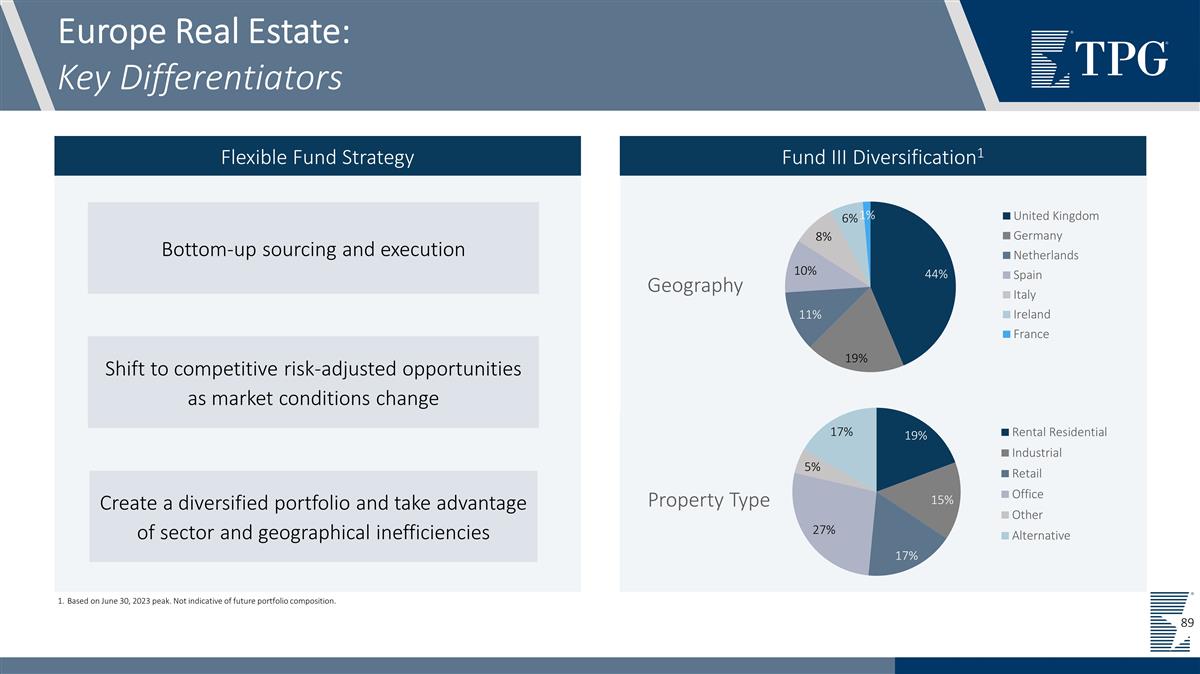

Europe Real Estate: Key Differentiators Flexible Fund Strategy Fund III Diversification1 Bottom-up sourcing and execution Shift to competitive risk-adjusted opportunities as market conditions change Create a diversified portfolio and take advantage of sector and geographical inefficiencies Based on June 30, 2023 peak. Not indicative of future portfolio composition.

Presenter Head of TPG AG Asia Real Estate Wilson Leung

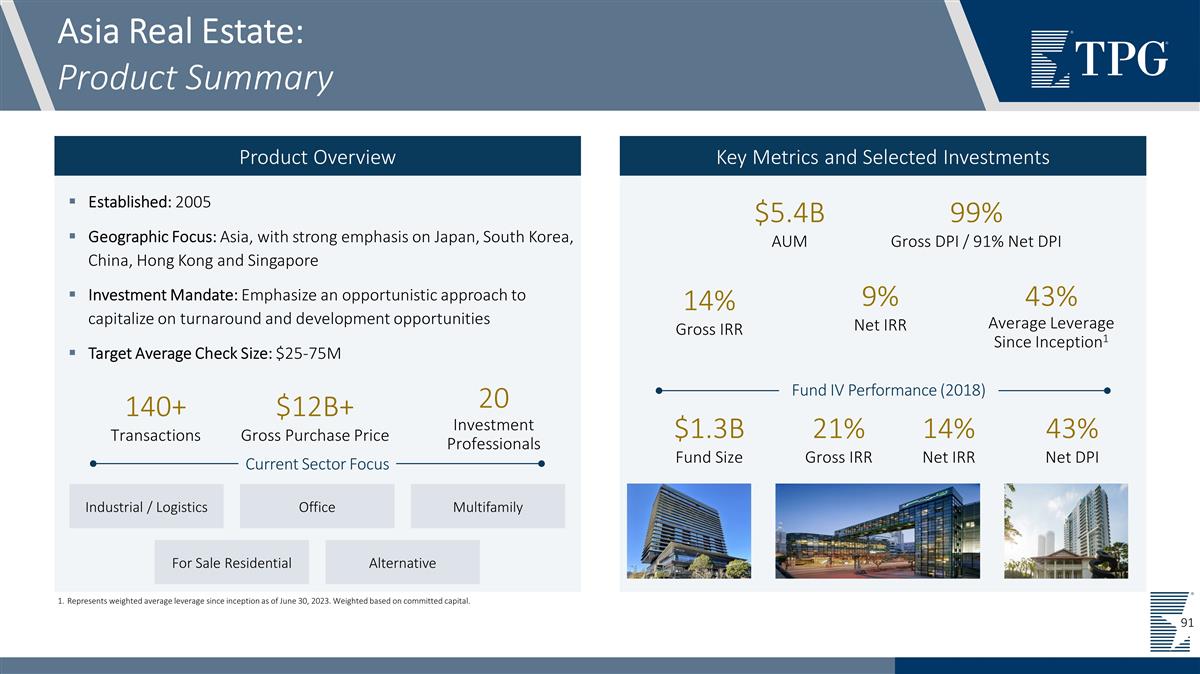

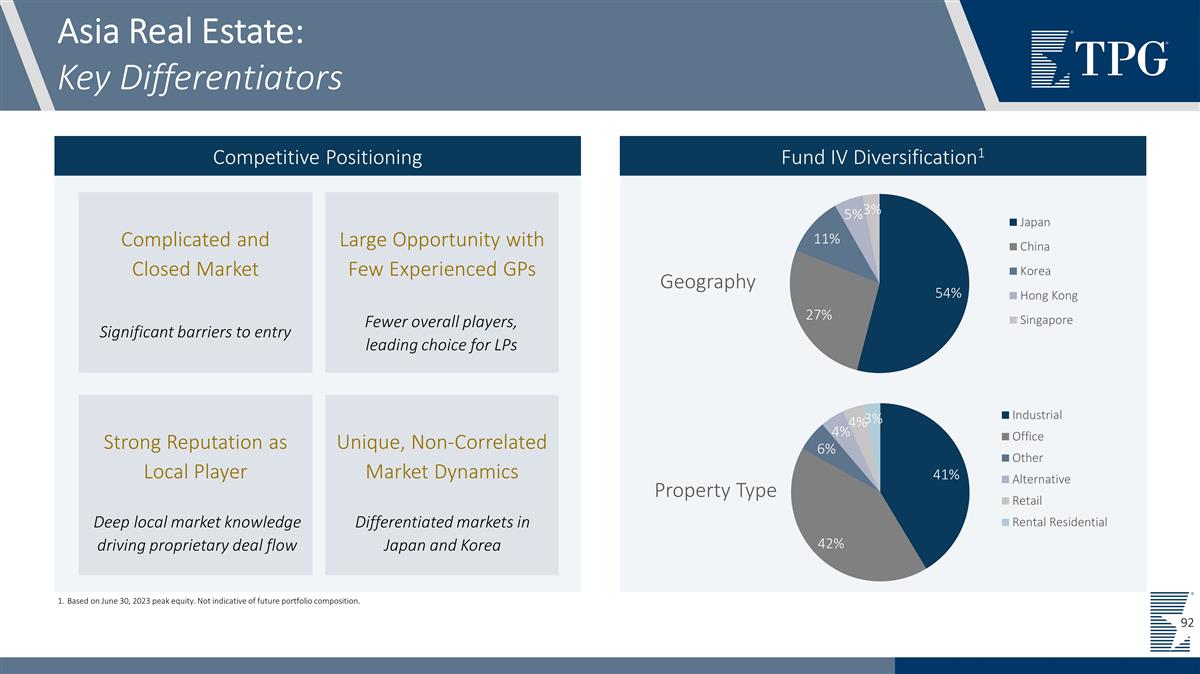

Established: 2005 Geographic Focus: Asia, with strong emphasis on Japan, South Korea, China, Hong Kong and Singapore Investment Mandate: Emphasize an opportunistic approach to capitalize on turnaround and development opportunities Target Average Check Size: $25-75M Asia Real Estate: Product Summary Current Sector Focus 140+ Transactions 20 Investment Professionals Industrial / Logistics Office Multifamily Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Product Overview Key Metrics and Selected Investments For Sale Residential Alternative $12B+ Gross Purchase Price $5.4B AUM 99% Gross DPI / 91% Net DPI 14% Gross IRR 9% Net IRR 43% Average Leverage Since Inception1 Fund IV Performance (2018) 21% Gross IRR 14% Net IRR $1.3B Fund Size 43% Net DPI Represents weighted average leverage since inception as of June 30, 2023. Weighted based on committed capital.

Asia Real Estate: Key Differentiators Competitive Positioning Fund IV Diversification1 Complicated and Closed Market Large Opportunity with Few Experienced GPs Strong Reputation as Local Player Unique, Non-Correlated Market Dynamics Significant barriers to entry Fewer overall players, leading choice for LPs Differentiated markets in Japan and Korea Deep local market knowledge driving proprietary deal flow Based on June 30, 2023 peak equity. Not indicative of future portfolio composition. 92

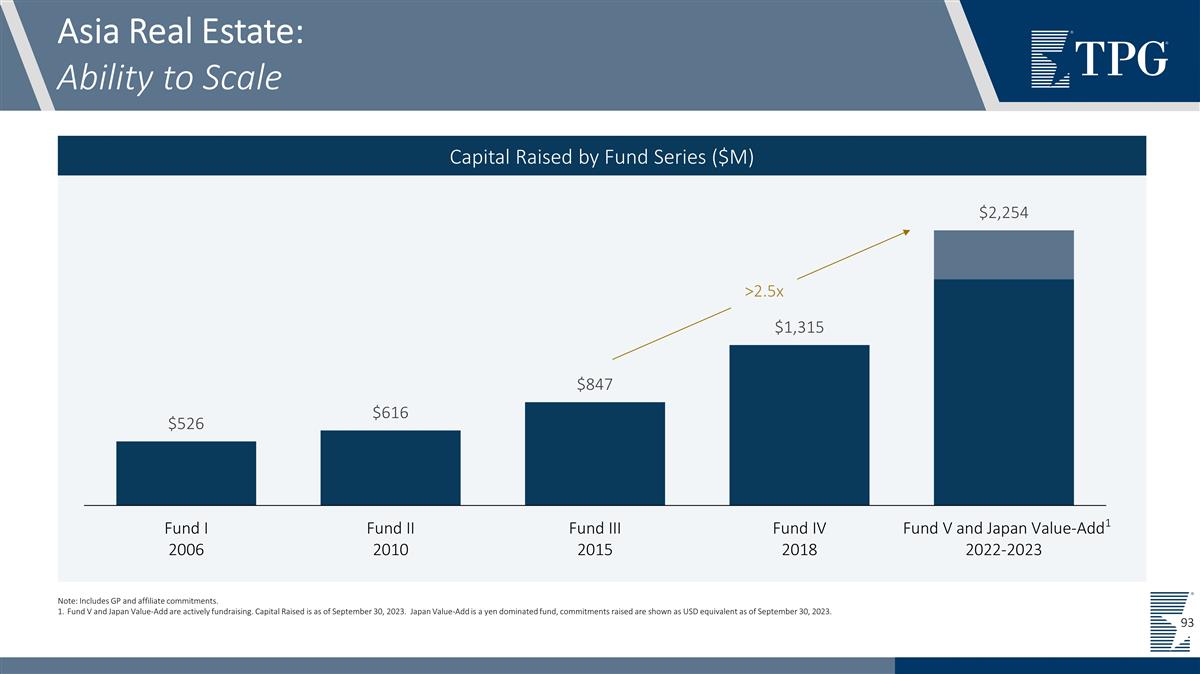

Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 Capital Raised by Fund Series ($M) Asia Real Estate: Ability to Scale Note: Includes GP and affiliate commitments. Fund V and Japan Value-Add are actively fundraising. Capital Raised is as of September 30, 2023. Japan Value-Add is a yen dominated fund, commitments raised are shown as USD equivalent as of September 30, 2023. >2.5x 1

Presenter Head of TPG AG Net Lease Gordon Whiting 94

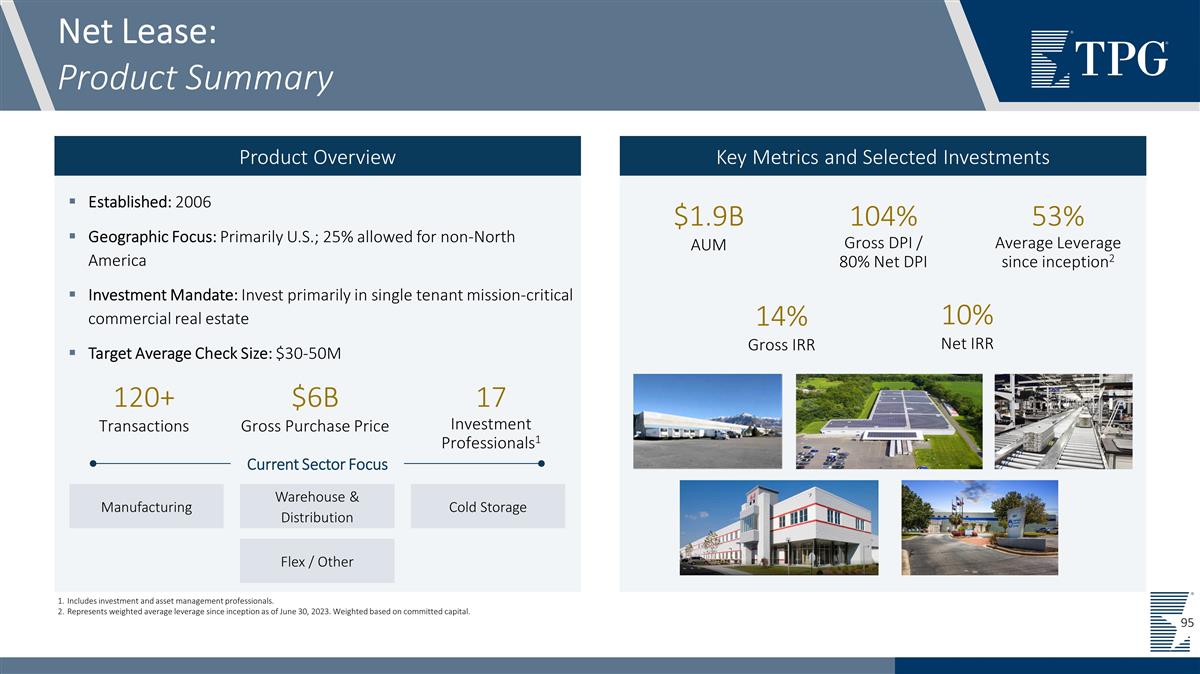

Established: 2006 Geographic Focus: Primarily U.S.; 25% allowed for non-North America Investment Mandate: Invest primarily in single tenant mission-critical commercial real estate Target Average Check Size: $30-50M Net Lease: Product Summary $1.9B AUM 104% Gross DPI / 80% Net DPI 14% Gross IRR 10% Net IRR Current Sector Focus 120+ Transactions 17 Investment Professionals1 Manufacturing Warehouse & Distribution Cold Storage Flex / Other Source Files Avg. Txn Size: https://tpg.ent.box.com/folder/148771405446 AUM: https://tpg.ent.box.com/folder/148770880733 ITD Track Record: https://tpg.ent.box.com/folder/148771683795 Team: https://tpg.ent.box.com/folder/148770829303 LTM Value Creation: https://tpg.ent.box.com/folder/148774617489 Product Overview Key Metrics and Selected Investments 53% Average Leverage since inception2 $6B Gross Purchase Price Includes investment and asset management professionals. Represents weighted average leverage since inception as of June 30, 2023. Weighted based on committed capital. 95

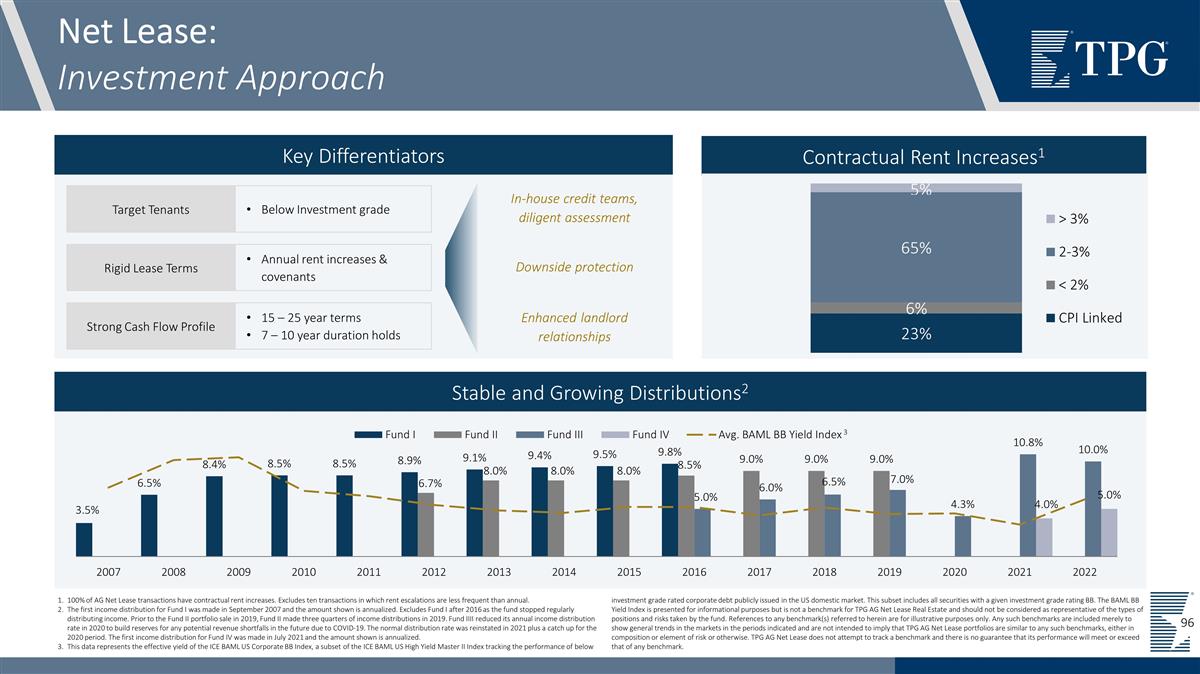

Net Lease: Investment Approach Key Differentiators Contractual Rent Increases1 Stable and Growing Distributions2 Source Files Deal Classifications: https://tpg.ent.box.com/folder/149285310184 Target Tenants Rigid Lease Terms Strong Cash Flow Profile Below Investment grade Annual rent increases & covenants 15 – 25 year terms 7 – 10 year duration holds In-house credit teams, diligent assessment Downside protection Enhanced landlord relationships 3 100% of AG Net Lease transactions have contractual rent increases. Excludes ten transactions in which rent escalations are less frequent than annual. The first income distribution for Fund I was made in September 2007 and the amount shown is annualized. Excludes Fund I after 2016 as the fund stopped regularly distributing income. Prior to the Fund II portfolio sale in 2019, Fund II made three quarters of income distributions in 2019. Fund IIII reduced its annual income distribution rate in 2020 to build reserves for any potential revenue shortfalls in the future due to COVID-19. The normal distribution rate was reinstated in 2021 plus a catch up for the 2020 period. The first income distribution for Fund IV was made in July 2021 and the amount shown is annualized. This data represents the effective yield of the ICE BAML US Corporate BB Index, a subset of the ICE BAML US High Yield Master II Index tracking the performance of below investment grade rated corporate debt publicly issued in the US domestic market. This subset includes all securities with a given investment grade rating BB. The BAML BB Yield Index is presented for informational purposes but is not a benchmark for TPG AG Net Lease Real Estate and should not be considered as representative of the types of positions and risks taken by the fund. References to any benchmark(s) referred to herein are for illustrative purposes only. Any such benchmarks are included merely to show general trends in the markets in the periods indicated and are not intended to imply that TPG AG Net Lease portfolios are similar to any such benchmarks, either in composition or element of risk or otherwise. TPG AG Net Lease does not attempt to track a benchmark and there is no guarantee that its performance will meet or exceed that of any benchmark. 96

Organic growth in successor flagship fund size Expansion into lower cost of capital Ancillary co-investment vehicles or target SMAs Global Real Estate Platform: Growth Opportunities Note: There can be no assurance any expected growth opportunities will ultimately be achieved. 97

Financial Overview

Presenter Chief Financial Officer Jack Weingart

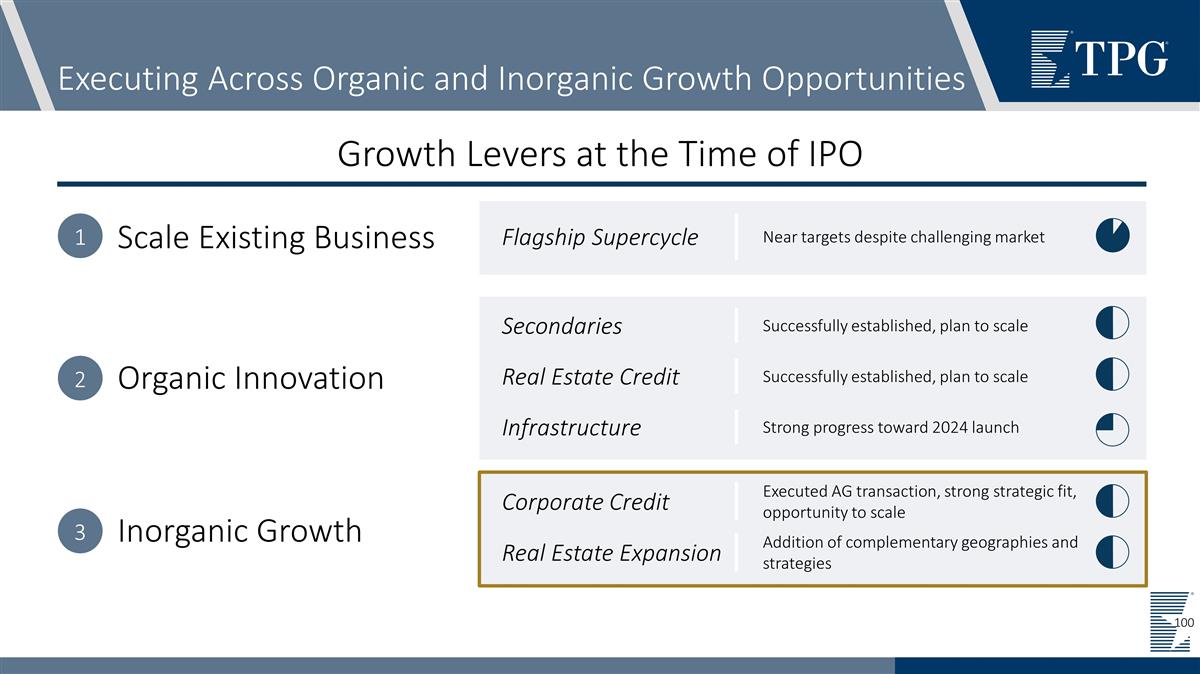

Executing Across Organic and Inorganic Growth Opportunities Organic Innovation Inorganic Growth Growth Levers at the Time of IPO Scale Existing Business Flagship Supercycle Secondaries Real Estate Credit Infrastructure Real Estate Credit Corporate Credit Real Estate Expansion Near targets despite challenging market Successfully established, plan to scale Successfully established, plan to scale Strong progress toward 2024 launch Executed AG transaction, strong strategic fit, opportunity to scale Addition of complementary geographies and strategies 1 2 3

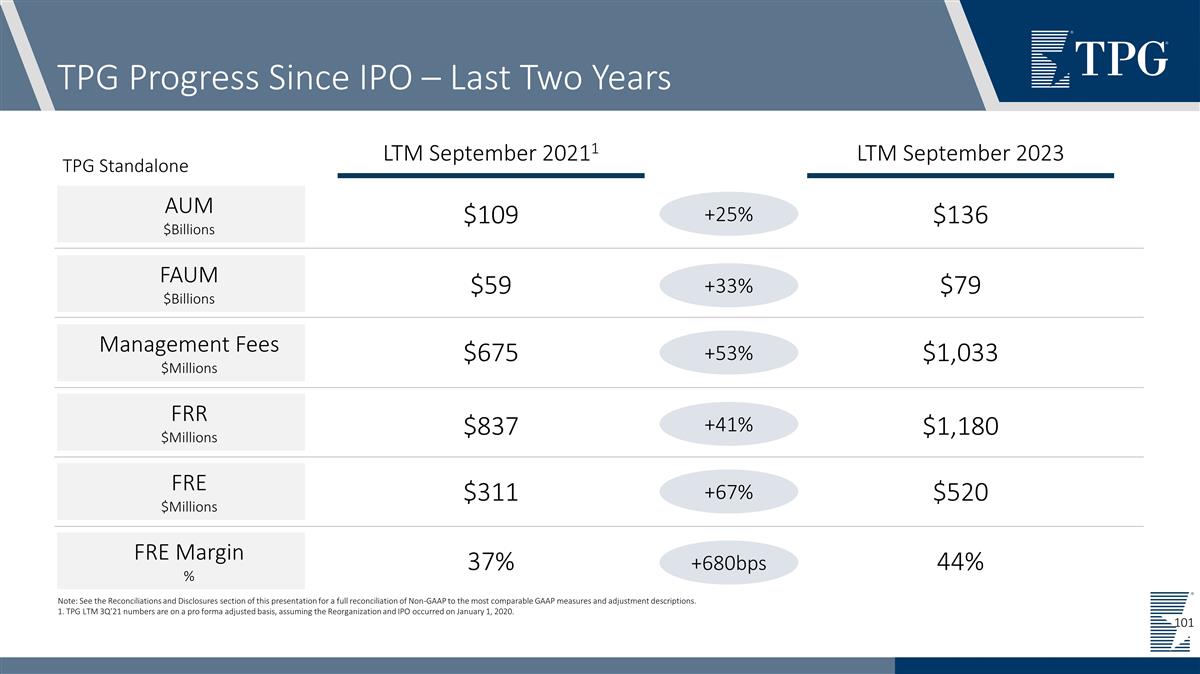

TPG Progress Since IPO – Last Two Years Note: See the Reconciliations and Disclosures section of this presentation for a full reconciliation of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. 1. TPG LTM 3Q’21 numbers are on a pro forma adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020. FRE $Millions FRE Margin % Management Fees $Millions AUM $Billions LTM September 20211 LTM September 2023 $109 $136 FAUM $Billions FRR $Millions $59 $79 $675 $1,033 $837 $1,180 $311 $520 37% 44% +25% +33% +53% +41% +67% +680bps TPG Standalone