UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| o | Definitive Proxy Statement |

| |

| x | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in its Charter)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| | | | | |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

EXPLANATORY NOTE

This filing is being made solely to update the column titled “Total Voting Power (%)” in the table included under the heading “Security Ownership of Certain Beneficial Owners and Management” in the definitive proxy statement filed with the U.S. Securities and Exchange Commission on April 25, 2023 (the “Original Proxy Statement”) in order to reflect the operation of Article 4.2(a) of our certificate of incorporation, which stipulates that “Free Float” (as defined under the rules of FTSE Russell relating to the Russell indices) shares of Class A common stock are entitled to at least 5.1% of the aggregate voting power. Except as specifically described in this Explanatory Note, this filing does not otherwise modify or update any other disclosures included in the Original Proxy Statement.

TPG Inc.

301 Commerce Street, Suite 3300

Fort Worth, TX 76102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of TPG Inc.:

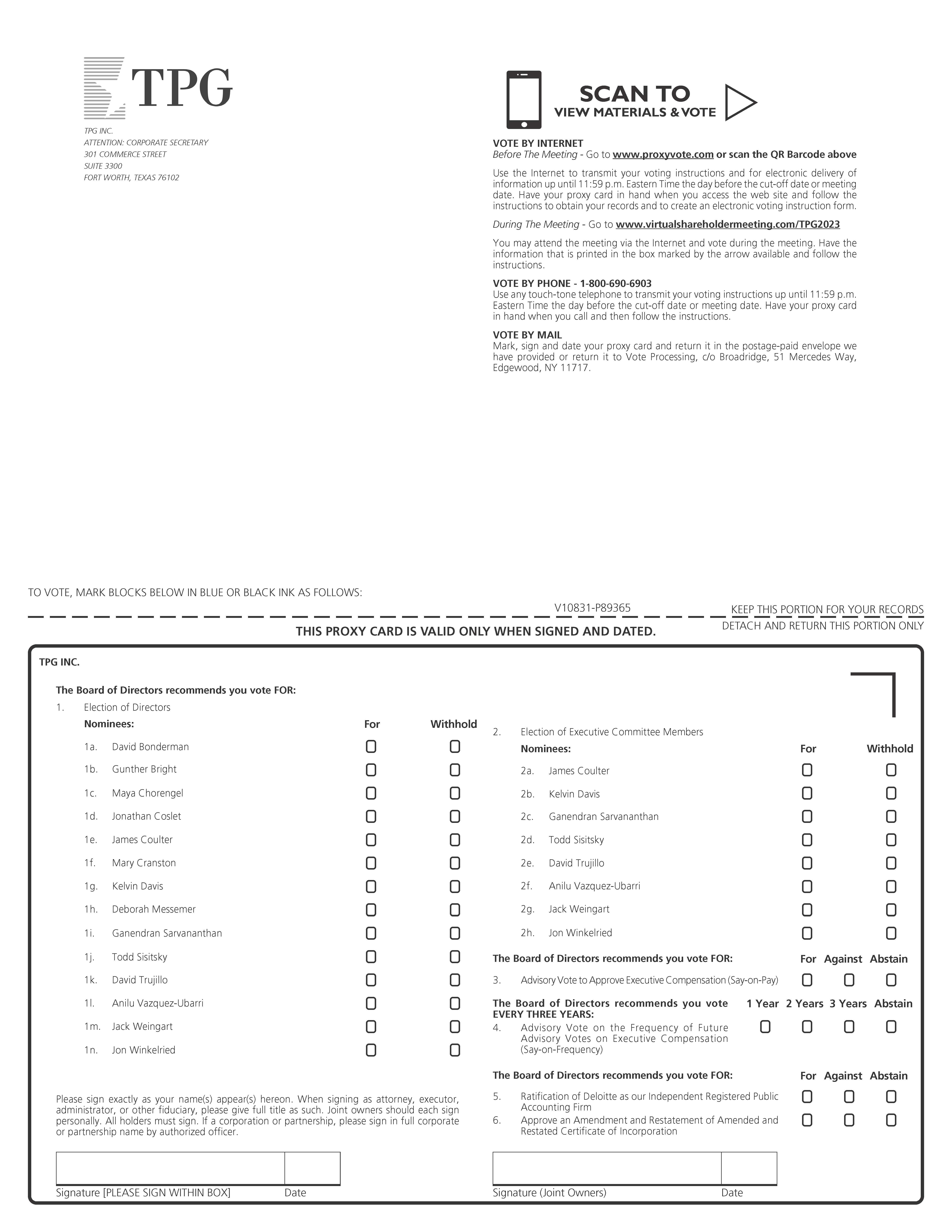

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of TPG Inc. (“TPG”, the “Company”, “we” or “us”) to be held on Thursday, June 8, 2023 at 12:00 p.m. EDT, virtually at www.virtualshareholdermeeting.com/TPG2023, for the following purposes:

1.To elect to the board of directors the fourteen nominees named in the accompanying proxy statement, in each case for a one-year term expiring at the annual meeting of stockholders of TPG to be held in 2024 (Item 1);

2.To elect to the Executive Committee the eight nominees named in the accompanying proxy statement, in each case for a one-year term expiring at the annual meeting of stockholders of TPG to be held in 2024 (Item 2);

3.To consider and vote on a non-binding advisory resolution to approve the compensation paid to our named executive officers for our 2022 fiscal year (commonly known as “say-on-pay”) (Item 3);

4.To consider and vote on a non-binding advisory determination of the frequency of future advisory votes on the compensation paid to our named executive officers (commonly known as “say-on-frequency”) (Item 4);

5.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Item 5);

6.To adopt the amended and restated certificate of incorporation in the form attached as Appendix 2 to the accompanying proxy statement to provide our board of directors with the powers currently reserved solely for the Executive Committee (Item 6); and

7.To transact any other business that may be properly presented at the Annual Meeting or any adjournment or postponement thereof.

We have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting for various reasons. We believe a virtual meeting provides expanded access, improves communication, enables increased stockholder attendance and participation, allows our stockholders around the world to attend the Annual Meeting and provides cost savings for our stockholders and the Company.

Stockholders of record as of the close of business on April 10, 2023 are entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof. Holders of our Class A common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of our Class B common stock are currently entitled to ten votes for each share held of record on all matters submitted to a vote of stockholders. Holders of our Class A and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law.

In reliance on the Securities and Exchange Commission’s “notice and access” rules and in order to expedite our stockholders’ receipt of materials and to reduce the environmental impact of our Annual Meeting, we will furnish our proxy materials via the Internet. Unless you previously requested electronic or paper delivery on an ongoing basis, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (a “Notice”) instead of a printed proxy statement, Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and proxy card or voting instruction card (together, the “proxy materials”). The Notice contains instructions on how to access the proxy materials online. The Notice also contains instructions on how stockholders can receive proxy materials in printed form.

Whether or not you plan to attend, it is important that your shares are represented at the Annual Meeting. We encourage you to read the proxy materials and to submit your votes as soon as possible. You may authorize your proxy via the Internet or telephone or, if you received the proxy materials in printed form, by mail by completing and returning the proxy card. Instructions for voting can be found on your Notice or proxy card. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/TPG2023, you must enter the control number found on your proxy card, voting instruction form or Notice. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

If a bank, brokerage firm or other nominee holds your shares, you should also contact your nominee for additional information.

By Order of the Board of Directors

/s/ Bradford Berenson

Bradford Berenson

General Counsel and Secretary

April 25, 2023

| | |

Important Notice Regarding the Availability of Proxy Materials for our Annual Meeting to be held on June 8, 2023. Our proxy statement and 2022 Annual Report to Stockholders are available at www.proxyvote.com. On or about April 25, 2023, we will send to certain of our stockholders a Notice of Internet Availability of Proxy Materials. The Notice includes instructions on how to access our proxy statement and 2022 Annual Report to Stockholders and vote online. For more information, see Frequently Asked Questions. |

TPG | 2023 Proxy Statement | ii

Table of Contents

TPG | 2023 Proxy Statement | iii

ANNUAL MEETING

OF

TPG Inc.

301 Commerce Street, Suite 3300

Fort Worth, Texas 76102

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by and on behalf of the board of directors of TPG Inc. for use at the Annual Meeting, to be held virtually at www.virtualshareholdermeeting.com/TPG2023 on June 8, 2023, at 12:00 p.m. EDT, and any postponement or adjournment thereof. In accordance with rules and regulations adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide our stockholders access to our proxy materials on the Internet. This proxy statement, the Notice and the accompanying proxy card, together with a copy of our Annual Report on Form 10-K filed for the year ended December 31, 2022 (the “Annual Report on Form 10-K”) with the SEC on February 24, 2023, are first being released to the Company’s stockholders on or about April 25, 2023.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement may contain forward-looking statements. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook of our future business and financial performance, estimated operational metrics, business strategy and plans and objectives of management for future operations. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions, including, but not limited to, those described in “Item 1A.—Risk Factors” and “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Annual Report on Form 10-K, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this proxy statement. Any forward-looking statement made by us in this proxy statement speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

REORGANIZATION AND INITIAL PUBLIC OFFERING

On January 12, 2022, we completed a corporate reorganization (the “Reorganization”), which included a corporate conversion of TPG Partners, LLC to a Delaware corporation named TPG Inc., in conjunction with an initial public offering (the “IPO”) of our Class A common stock. The IPO closed on January 18, 2022. Unless the context suggests otherwise, references in this report to “TPG,” “the Company,” “we,” “us” and “our” refer (i) prior to the completion of the Reorganization and IPO to TPG Group Holdings SBS, L.P. and its consolidated subsidiaries (“TPG Group Holdings”) and (ii) from and after the completion of the Reorganization and IPO to TPG Inc. and its subsidiaries. As of the date of this proxy statement, the Company carries on the business of TPG Operating Group, which is comprised of TPG Operating Group I, L.P., TPG Operating Group II, L.P., TPG Operating Group III, L.P. and their respective consolidated subsidiaries as a publicly traded entity (collectively, the “TPG Operating Group”).

WEBSITE REFERENCES

Website references and their hyperlinks have been provided for convenience only. The content on any referenced websites is not incorporated by reference into this proxy statement, nor does it constitute a part of this proxy statement.

TPG | 2023 Proxy Statement | 1

CORPORATE GOVERNANCE

ITEM 1. ELECTION OF DIRECTORS

Our board of directors is currently composed of fourteen directors, comprised of eleven management directors and three independent directors, each of whom is nominated for re-election at the Annual Meeting.

Pursuant to the Nasdaq Global Select Market (“Nasdaq”) listing standards, as a controlled company we are not required to have a majority of independent directors on our board. Our management directors are Mr. Bonderman, Mr. Coulter, Mr. Winkelried, Mr. Weingart, Mr. Sisitsky, Ms. Vazquez-Ubarri, Ms. Chorengel, Mr. Coslet, Mr. Davis, Mr. Sarvananthan and Mr. Trujillo. Our independent directors are Mr. Bright, Ms. Cranston and Ms. Messemer. Our Founders, Messrs. Bonderman and Coulter, serve as the Non-Executive Chair and Executive Chair of our board of directors, respectively. Consistent with our institutional commitment to good governance, we have established a clear and definite plan for both Founder succession and our long-term corporate governance transition to oversight by an independent board of directors. See “—Corporate Governance Overview—Our Governance Plan” below.

Our directors serve for one-year terms and are elected by the plurality of the votes cast by the holders of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Each director will serve until our next annual meeting and until his or her successor has been duly elected, or until his or her earlier death, resignation or removal. See “—Board Composition—Director Nomination and Election Process” below.

Board Recommendation

| | |

The following biographical information about each director nominee highlights the particular experience, qualifications, attributes and skills possessed by such director nominee that led the board of directors to determine that he or she should serve as a director. Our board of directors unanimously recommends that stockholders vote “FOR” the election of each of the following 14 director nominees. |

TPG | 2023 Proxy Statement | 2

Our Director Nominees

| | | | | |

Age 80 Committees Executive Committee (Non-Voting Observer) | David Bonderman Founder, Non-Executive Chair and Director David Bonderman has been a member of our board of directors since TPG Inc.’s inception. Mr. Bonderman is a Founding Partner and Non-Executive Chair of the board of directors of TPG and has served on the TPG Holdings Committee (as well as its predecessor committee) from its inception until the IPO. He has been a controlling stockholder of TPG since its formation in 1992. Mr. Bonderman currently serves on the board of directors of Allogene Therapeutics, Inc. and has, within the last five years, served on the public company boards of RyanAir Holdings, plc, where he served as chairman of the board, TPG Pace Beneficial Finance Corp., TPG Pace Solutions Corp., TPG Pace Tech Opportunities Corp., TPG Pace Energy Holdings Corp. and TPG Pace Holdings, Inc. Mr. Bonderman has also previously served on the boards of various public companies, including Continental Airlines, where he served as chairman of the board, Ducati Motor Holding, S.p.A., China International Capital Corporation Limited, Co-Star Group, Inc., Energy Future Holdings Corp., General Motors Company, Kite Pharma, Inc., Oxford Health Plans, Inc. and Seagate Technology Holdings plc and private companies, including Paradyne Networks, Inc. and Univision Holdings, Inc. Throughout Mr. Bonderman’s career, he has served as a director on numerous public, private, advisory, academic and charitable boards. Mr. Bonderman received a Bachelor of Arts degree from the University of Washington, cum laude, and a J.D. from Harvard Law School, magna cum laude, where he was a member of the Harvard Law Review and Sheldon Fellow. |

| |

Age 63 Committees Executive Committee | James Coulter Founder, Executive Chair and Director James G. (“Jim”) Coulter has been a member of our board of directors since TPG Inc.’s inception. Mr. Coulter has served as a Founding Partner of TPG since 1992, as well as serving, at various points, in roles including Executive Chair and Co-Chief Executive Officer of TPG, Managing Partner of TPG Rise Climate, Co-Managing Partner of The Rise Funds and served on the TPG Holdings Committee (as well as its predecessor committee) from its inception until the IPO. He has been a controlling stockholder of TPG since its formation in 1992. Mr. Coulter has previously served on the boards of various public companies, including Continental Airlines, America West Airlines, Northwest Airlines, Seagate Technology Holdings plc, Lenovo Group Limited, Globespan, Inc. and Oxford Health Plans, Inc. and various private companies, including J.Crew Group, Inc., Chino Holdings, Inc. and MEMC Electronic Materials, Inc. Throughout Mr. Coulter’s career, he has served on numerous other public, private, advisory, academic and charitable boards. Mr. Coulter received a Bachelor of Arts degree from Dartmouth College, where he graduated summa cum laude, and an M.B.A. from the Stanford Graduate School of Business, where he was named an Arjay Miller Scholar. |

TPG | 2023 Proxy Statement | 3

| | | | | |

Age 63 Committees Executive Committee (Chair) | Jon Winkelried Chief Executive Officer and Director Jon Winkelried has been a member of our board of directors since TPG Inc.’s inception. Mr. Winkelried has been the Chief Executive Officer of TPG since 2021 and has been a Partner of and was the Co-Chief Executive Officer of TPG since 2015. In addition, he served on the TPG Holdings Committee (as well as its predecessor committee) from its inception. Mr. Winkelried has served within the last five years on the public board of McAfee Corp. Mr. Winkelried also currently serves as a director on the boards of various private companies, including Evolution Media Growth, Delos Living LLC and Anastasia Beverly Hills LLC. He has served on the board of trustees at the University of Chicago and Vanderbilt University. Beginning in 1982, Mr. Winkelried spent more than 27 years with the Goldman Sachs Group, Inc. in various roles, including as a Partner from 1990 to 2009, President and Co-Chief Operating Officer from 2006 to 2009, as a member of the board of directors from 2006 to 2009, and as a longstanding member of Goldman’s management committee, partnership committee, capital committee, and as the Founding Chairman of its business practices committee. Prior to joining TPG in 2015, Mr. Winkelried managed JW Capital Partners with investments across a range of industries including technology, real estate, healthcare and natural resources from 2010 to 2013 and was a Strategic Advisor and Partner at Thrive Capital, a New York-based venture capital firm focused on technology investing from 2013 to 2015. Mr. Winkelried received a Bachelor of Arts degree from the University of Chicago and an M.B.A. from the Graduate School of Business at the University of Chicago. |

| |

Age 57 Committees Executive Committee | Jack Weingart Chief Financial Officer and Director Jack Weingart has been a member of our board of directors and has served as our Chief Financial Officer since TPG Inc.’s inception. He previously served as the Co-Managing Partner of TPG Capital from 2017 until his appointment as Chief Financial Officer. Between 2006 and 2017, he served as Managing Partner of the Funding Group, which comprised the firm’s fundraising and capital markets activities. Mr. Weingart currently serves on the private company board of directors of Viking Holdings, Ltd. Mr. Weingart has previously served on the board of directors of several private companies, including J.Crew Group, Inc., Chino Holdings, Inc. and Chobani and the non-profit board of Awaso Hope Foundation. Prior to joining TPG in 2006, Mr. Weingart was a Managing Director at Goldman, Sachs & Co., responsible for managing the firm’s West Coast leveraged finance and financial sponsor business. Mr. Weingart received a Bachelor of Science degree in electrical engineering and computer sciences from the University of California at Berkeley. |

TPG | 2023 Proxy Statement | 4

| | | | | |

Age 51 Committees Executive Committee | Todd Sisitsky President and Director Todd Sisitsky has been a member of our board of directors and has served as our President since TPG Inc.’s inception. Mr. Sisitsky has served as Managing Partner of TPG Capital in the United States and Europe since 2015, where he co-leads the firm’s investment activities in the healthcare services, pharmaceuticals and medical device sectors. He has played leadership roles in connection with TPG’s investments in Allogene Therapeutics, Adare Pharmaceuticals, Aptalis, Biomet, Exactech, Ellodi Pharmaceuticals, Fenwal, Healthscope, IASIS Healthcare, Immucor, IQVIA Holdings, Inc. (and predecessor companies IMS Health and Quintiles), Monogram Health, Par Pharmaceutical and Surgical Care Affiliates. Mr. Sisitsky currently serves on the public company boards of directors of IQVIA Holdings, Inc. and Allogene Therapeutics, Inc. and has, within the last five years, served on the public company boards of Convey Health Solutions, Inc. and Endo International plc. He also serves on the private company boards of directors of Confluent Medical Technologies and Monogram Health. He received a Bachelor of Arts degree from Dartmouth College, where he graduated summa cum laude, and an M.B.A. from the Stanford Graduate School of Business, where he was an Arjay Miller Scholar. Mr. Sisitsky serves on the board of directors of the international non-profit, Grassroot Soccer and the Dartmouth Medical School Board of Advisors, where he serves as chair. |

| |

Age 46 Committees Executive Committee | Anilu Vazquez-Ubarri Chief Human Resources Officer and Director Anilu Vazquez-Ubarri has been a member of our board of directors and has served as our Chief Human Resources Officer since TPG Inc.’s inception. Ms. Vazquez-Ubarri is a Partner of TPG and co-chair of the TPG Diversity Equity and Inclusion Council with Mr. Winkelried. She also served on the TPG Holdings Committee until the IPO. Ms. Vazquez-Ubarri currently serves on the board of directors of the public company Upwork, Inc. and has, within the last five years, served on the board of directors of TPG Pace Beneficial II Corp. Ms. Vazquez-Ubarri also currently serves on the board of directors of Greenhouse Software, Inc., a private company, and certain non-profit companies, including Teach for America-Bay Area, the Vera Institute of Justice and the Charter School Growth Fund. Prior to joining TPG in 2018, Ms. Vazquez-Ubarri worked at Goldman Sachs from 2007 until 2018, where she was most recently the firm’s Global Head of Talent and Chief Diversity Officer. Prior to Goldman Sachs, Ms. Vazquez-Ubarri was an associate at Shearman & Sterling LLP in the Executive Compensation & Employee Benefits group from 2002 to 2007. Ms. Vazquez-Ubarri received a Bachelor of Arts degree in History and Latin American Studies, cum laude, from Princeton University and a J.D. from Fordham University School of Law. |

TPG | 2023 Proxy Statement | 5

| | | | | |

Age 52 | Maya Chorengel Director Maya Chorengel has been a member of our board of directors since TPG Inc.’s inception. Ms. Chorengel is Co-Managing Partner at The Rise Funds, a $6 billion global impact investing fund managed by TPG. She has been with TPG since 2017. Ms. Chorengel currently serves on the boards of various private companies, including Little Leaf Farms, Benevity, Kiva, Nithio, SEO (Seizing Every Opportunity) and Varo Bank and on the advisory boards of the Harvard Business School Social Enterprise Initiative and CASE i3 at Duke University. Ms. Chorengel has over two decades of private equity, venture capital and impact investing experience globally, including co-founding Elevar Equity, a leading impact venture firm, and working at Warburg Pincus. She co-authored “Calculating the Value of Impact Investing” published in the Harvard Business Review. Ms. Chorengel received a Bachelor of Arts degree in Social Studies from Harvard University, where she graduated magna cum laude, and an M.B.A. from Harvard Business School. |

| |

Age 58 | Jonathan Coslet Director Jonathan Coslet has been a member of our board of directors since TPG Inc.’s inception. Mr. Coslet is the Vice Chair of TPG and has been with TPG since 1993, most recently serving as Chief Investment Officer until 2020. Mr. Coslet currently serves on the public company boards of Cushman & Wakefield, LifeTime Fitness and Nextracker Inc. and has, within the last five years, served on the board of IQVIA Holdings, Inc. Mr. Coslet has also previously served on the board of directors of several public and private companies, including Crunch Fitness, Endurance Specialty Holdings Ltd., FIS, IASIS Healthcare LLC, J.Crew Group, Inc., Neiman Marcus, Oxford Health Plans, Inc. Petco Health and Wellness Company Inc. and Quintiles. Prior to joining TPG, Mr. Coslet worked at Donaldson, Lufkin & Jenrette, and before that Drexel Burnham Lambert. He received his Bachelor of Science degree in economics and finance from the Wharton School of the University of Pennsylvania where he was Valedictorian, and his M.B.A. from Harvard Business School, where he was a Baker Scholar. Mr. Coslet currently serves on the boards of Stanford Children’s Hospital, where he is chairman, the Stanford Medicine Board of Fellows and the Stanford Institute for Economic Policy Research. |

TPG | 2023 Proxy Statement | 6

| | | | | |

Age 59 Committees Executive Committee | Kelvin Davis Director Kelvin Davis has been a member of our board of directors since TPG Inc.’s inception. Mr. Davis has been with TPG since 2000 and is the Founder and Co-Head of TPG Real Estate. From 2000 to 2009, Mr. Davis led TPG’s North American Buyout Group, encompassing investments in all non-technology industry sectors. Mr. Davis has, within the last five years, served on the board of Taylor Morrison Home Corporation and TPG RE Finance Trust, Inc. Mr. Davis has also served on the boards of certain private companies, including Catellus Development Corporation and AID Holdings II Management Services, LLC. Prior to joining TPG in 2000, Mr. Davis was President and Chief Operating Officer of Colony Capital, LLC, a private international real estate investment firm based in Los Angeles, which he co-founded in 1991. Mr. Davis earned a Bachelor of Arts degree in Economics from Stanford University and an M.B.A. from Harvard Business School, where he was a Baker Scholar, a John L. Loeb Fellow and a Wolfe Award recipient. He is also a long-time director, and past chairman, of Los Angeles Team Mentoring, Inc., a charitable mentoring organization, and is a trustee of the Los Angeles County Museum of Art. |

| |

Age 48 Committees Executive Committee | Ganendran Sarvananthan Director Ganendran (“Ganen”) Sarvananthan has been a member of our board of directors since TPG Inc.’s inception. Mr. Sarvananthan is the Managing Partner for TPG Asia, Co-Head of Southeast Asia and served on the TPG Holdings Committee until the IPO. He joined TPG in 2014 from Khazanah Nasional Berhad, the Government of Malaysia’s strategic investment fund, where he had been since 2004. As the Head of Investments at Khazanah, Mr. Sarvananthan oversaw an investments team based in Kuala Lumpur, Beijing, Mumbai, San Francisco and Istanbul and managed a $31 billion portfolio across the region and was a member of the Management Committee of the firm. Prior to his time at Khazanah, Mr. Sarvananthan worked at UBS Investment Bank in both corporate finance and equity capital markets in their London, Singapore and Hong Kong offices for over seven years. Mr. Sarvananthan received a Bachelor of Laws (LLB) degree from University College London and is qualified as a Barrister at Law in England and Wales. |

TPG | 2023 Proxy Statement | 7

| | | | | |

Age 47 Committees Executive Committee | David Trujillo Director David Trujillo has been a member of our board of directors since TPG Inc.’s inception. Mr. Trujillo joined TPG in January 2006. He is the Co-Managing Partner of TPG Growth, Co-Managing Partner of TPG Tech Adjacencies and Managing Partner of TPG Digital Media. Mr. Trujillo leads TPG’s Internet, Digital Media and Communications investing efforts across the firm. Mr. Trujillo led TPG’s historic investments in Airbnb, Astound Broadband, Lynda.com and Spotify. Mr. Trujillo currently serves on the public company board of directors of Uber Technologies, Inc. He is also on the private boards of Azoff Music Company, Beauty for All Industries (fka Ipsy), Calm, Creative Artists Agency, DirecTV, Entertainment Partners, Global Music Rights, MusixMatch and Prodigy Education. Mr. Trujillo has been a private equity investor in the technology, media and telecom sector for over 25 years, including working at Golder, Thoma, Cressey, Rauner (now known as GTCR, LLC) prior to joining TPG. Mr. Trujillo received a Bachelor of Arts degree in Economics from Yale University and an M.B.A. from the Stanford Graduate School of Business. |

| |

Age 64 Committees Audit Committee Compensation Committee Conflicts Committee (Chair) | Gunther Bright Independent Director Gunther Bright has been a member of our board of directors since July 2022. Mr. Bright, in the last five years, served on the public boards of McAfee Corp. and Warburg Pincus Capital I-A Corp. Mr. Bright also serves on the boards of certain non-profit companies, including as an executive committee member of the Junior Achievement of New York Board of Directors, vice chairman and executive committee member of the Alvin Ailey American Dance Theater Board of Trustees and a member of the Executive Leadership Council. Since 2020, Mr. Bright has served as Executive Vice President and General Manager of Global and U.S. Large Enterprises at American Express. Prior to this role, he served as Executive Vice President and General Manager of the U.S. Merchant Services business of American Express from 2014 to 2020. Mr. Bright received his Bachelor of Arts degree in economics from Pace University and completed an advanced executive management program at the Wharton School of the University of Pennsylvania. |

TPG | 2023 Proxy Statement | 8

| | | | | |

Age 75 Committees Audit Committee Compensation Committee (Chair) Conflicts Committee | Mary Cranston Independent Director Mary Cranston has been a member of our board of directors since January 2022. Ms. Cranston currently serves on the public company boards of Visa, Inc. and The Chemours Company, and has, within the last five years, served on the board of directors of McAfee Corp. and MyoKardia. In addition, she serves or has served on several private and non-profit boards, including Go Health Urgent Care, Boardspan, Inc., CSAA Insurance, Aretec Inc., Stanford Children’s Health – Lucille Packard Children’s Hospital, Stanford Hospital, Commonwealth Club of California and Catalyst, Inc. In December 2012, Ms. Cranston retired as the Firm Senior Partner and Chair Emeritus of Pillsbury Winthrop Shaw Pittman LLP, an international law firm. Ms. Cranston holds a Bachelor of Arts degree in political science from Stanford University, a J.D. from Stanford Law School and Master of Arts degree in education from the University of California, Los Angeles. |

| |

Age 65 Committees Audit Committee (Chair) Compensation Committee Conflicts Committee | Deborah M. Messemer Independent Director Deborah M. Messemer has been a member of our board of directors since January 2022. Ms. Messemer currently serves on the public company boards of PayPal Holdings, Inc. and Allogene Therapeutics, Inc. Ms. Messemer is a certified public accountant. She joined KPMG LLP (KPMG), the U.S. member firm of KPMG International, in 1982 and was admitted into the partnership in 1995. Most recently, she served as the Managing Partner of KPMG’s Bay Area and Northwest region until her retirement in September 2018. Ms. Messemer spent the majority of her career in KPMG’s audit practice as an audit engagement partner serving public and private clients in a variety of industry sectors. In addition to her operational and audit signing responsibilities, she has significant experience in SEC filings, due diligence, initial public offerings, mergers and acquisitions and internal controls over financial reporting. Ms. Messemer received a Bachelor of Business Administration degree in accounting from the University of Texas at Arlington. |

TPG | 2023 Proxy Statement | 9

Corporate Governance Overview

Our Governance Plan

Consistent with our institutional commitment to good governance, we have established a clear and definite plan for both founder succession and our long-term corporate governance by an independent board of directors. Our approach aims to incrementally increase the participation of senior leaders beyond Messrs. Coulter and Bonderman, our Founders, in our governance and long-term strategic development, and to expand the participation and influence of the next generation of TPG leaders on our growth. Our plan aims to facilitate an orderly transition to oversight by an independent board of directors elected by a majority of our stockholders by no later than the annual meeting of stockholders to be held following the first day of the quarter immediately following the fifth anniversary of our IPO.

Our governance transition is occurring in three phases, of which we are in the first:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | | | 2 | | | | 3 | | |

| | | | | | | |

| | | | | | | | | | | | | | | | |

| | Expansion of the Control Group and Initial Governance by an Internal Executive Committee Expansion of the Control Group to include Mr. Winkelried, in addition to our Founders, which occurred prior to the IPO, and initial oversight by the Executive Committee. | | | | | Further Expansion of the Control Group Further expansion of the Control Group to add two additional TPG partners to a total of five members, who will act by majority vote by not later than the first day of the quarter immediately following the second anniversary of the IPO. | | | | | Transition to Majority Independent Board Election of a majority independent board of directors by our stockholders at the Sunset (as defined below). | |

Phase One: Expansion of the Control Group and Governance by an Internal Executive Committee

Messrs. Bonderman and Coulter have jointly been controlling stockholders of TPG since its founding in 1992. As part of a deliberate and orderly founder succession process, Messrs. Bonderman and Coulter named Mr. Winkelried our sole Chief Executive Officer (CEO) in early 2021, after Mr. Winkelried shared the responsibility for managing TPG with Mr. Coulter, our Executive Chair, since 2015. In connection with the IPO, our “Control Group” of Messrs. Bonderman and Coulter expanded to include Mr. Winkelried.

The Control Group, including Mr. Winkelried, generally acts by consensus. The Control Group’s principal role is to select the nominees to our board of directors and the Executive Committee and constitute the other committees of the board of directors, in each case, in accordance with the limited liability company agreement (the “GP LLC LLCA”) of TPG GP A, LLC (“GP LLC”), an entity indirectly owned by the Control Group. The Control Group also has the ability to elect the members of our board of directors and the Executive Committee by virtue of GP LLC’s voting power, as the general partner of TPG Group Holdings, over the substantial majority of our Class B common stock, each share of which is entitled to ten votes per share.

During this phase and until the Sunset (as defined below), our board of directors will not be comprised of a majority of independent directors. In addition, since our IPO, we have had an Executive Committee of the board of directors comprised of certain management directors who have had all of the powers and authority of our board of directors, except for a small number of powers required by law to be exercised by the full board, certain general oversight responsibilities reserved to the full board, and those powers that are the exclusive responsibility of another committee of the board of directors. The Executive Committee has also delegated certain specific responsibilities to our CEO. See “—Certain Rights of Our Founders and Our CEO Prior to the Sunset” below.

Consistent with our commitment to good governance, subject to the approval of our stockholders at the Annual Meeting, we intend to further our governance transition by providing our board of directors with all the powers and authorities currently reserved solely for our Executive Committee. We are proud of how our board of directors has performed in our first year as a public company. We believe that this incremental step to provide our full board of directors the authority to act on matters previously reserved to our Executive Committee will further support the board of directors’ development and empowerment. As described below, we are seeking stockholder approval of our Amended and Restated

TPG | 2023 Proxy Statement | 10

Certificate of Incorporation to provide our full board of directors with these additional powers and authorities. See “Item 6—Approval of Amendment and Restatement of Our Amended and Restated Certificate of Incorporation” below for additional detail.

Phase Two: Further Expansion of the Control Group

In the second phase of our governance evolution, we will expand the Control Group to five members from the original three members. This expansion will provide additional TPG partners an opportunity to participate directly in our governance as members of the Control Group prior to the transition to a majority independent board of directors at the Sunset. The then-remaining original members of the Control Group will select and appoint from then-active TPG partners the new members by unanimous approval. The expanded Control Group will act by majority vote and each new member will serve on the Control Group until our board of directors is reconstituted in connection with the Sunset (see “—Phase Three: Transition to Majority Independent Board” below), unless removed sooner due to resignation, death, cessation of being an active TPG partner, incapacity, or with or without cause, as determined in the reasonable discretion of a majority of the remaining members of the Control Group (including the unanimous approval of all of the original members of the Control Group who are still members). Subject to any delays in respect of the receipt of any required regulatory approvals, this expansion of the Control Group will occur no later than the first day of the quarter immediately following the second anniversary of the closing of the IPO. The expansion could happen sooner if two of the three original members of the Control Group were to cease being members of the Control Group prior to that time, or if the Control Group were to so decide.

Phase Three: Transition to Majority Independent Board

The third and final phase of our governance evolution will involve a transition to oversight by a majority independent board of directors that will be elected by a majority of all our stockholders. The Control Group will nominate and cause the election of a majority of independent directors not later than the annual meeting held for the election of directors following the first day of the quarter immediately following the fifth anniversary of the closing of the IPO. In addition to reconstituting our board of directors to include a majority of independent directors, at the Sunset, the Control Group will reconstitute our board committees and phase out of controlled company status and into compliance with applicable stock exchange rules. The Sunset could occur earlier if neither Mr. Bonderman nor Mr. Coulter continues to be a member of the Control Group or upon the occurrence of certain other conditions described below (see “—The Sunset”), including a decision to accelerate the Sunset by the Control Group. The size and composition of the reconstituted independent board of directors and the election of additional independent directors will be determined by the Control Group and will include Mr. Bonderman, Mr. Coulter and Mr. Winkelried if they are members of the Control Group at that time.

The Sunset

As noted above, our governance plan is subject to a transition that we call the ��Sunset.” The Sunset will occur on the date that a majority of the independent directors is elected at the first annual meeting of stockholders (or pursuant to a consent of stockholders in lieu thereof) after the earlier of (i) the earliest date specified in a notice delivered to TPG by GP LLC and its members pursuant to the GP LLC LLCA promptly following the earliest of: (a) the date that is three months after the date that neither Founder continues to be a member of GP LLC, (b) a vote of GP LLC to trigger the Sunset and (c) upon 60-days advance notice, the date determined by either Founder who is then a member of the Control Group to trigger the Sunset, if, following a period of at least 60 days, the requisite parties are unable to agree on the renewal of Mr. Winkelried’s employment agreement or the selection of a new CEO in the event that Mr. Winkelried ceases to serve as our CEO, and (ii) the annual meeting of stockholders to be held following the first day of the quarter immediately following the fifth anniversary of the IPO.

We expect that the Control Group will control the majority of the voting power to elect our directors until immediately after the initial election of a majority of the independent directors in connection with the Sunset. In connection with the Sunset, a majority of the directors will be independent and a nominating and corporate governance committee, composed entirely of independent directors, will be established or reconstituted, subject to the controlled company “phase-in” period permitted under Nasdaq rules. Following the Sunset, we will no longer be considered a “controlled company” under Nasdaq rules. See “—Controlled Company Status and Director Independence” below. Additionally, upon the Sunset, all of our stockholders will be entitled to one vote per share (and GP LLC will no longer have the right to vote shares on behalf of the partnerships for which it serves as general partner, with such votes instead being passed through to the applicable partners), including in the election of directors, and we will cease being a controlled company.

TPG | 2023 Proxy Statement | 11

Controlled Company Status and Director Independence

Our Class A common stock is listed on Nasdaq and, as a result, we are subject to its corporate governance listing standards. As discussed above, the Control Group has the ability to elect the members of our board of directors and our Executive Committee by virtue of GP LLC’s voting power over the substantial majority of our Class B common stock until the Sunset. The Control Group, therefore, has a significant influence over our governance. As a “controlled company” with the substantial majority of voting power for the election of our directors controlled by GP LLC, we are entitled to rely upon certain exemptions to the Nasdaq corporate governance rules. In particular, we are not required to have a majority of independent directors on our board of directors and are not required to have fully independent compensation and nominating and corporate governance committees, although we have, and intend to continue to have, an independent compensation committee at all times. The “controlled company” exemption does not modify the independence requirements for our audit committee, and we comply with, and intend to continue to comply with, the requirements of the Sarbanes-Oxley Act and Nasdaq, which require our audit committee to be composed of at least three independent members, subject to permitted phase-in rules for newly public companies. We currently have a board of directors comprised of 14 directors, three of whom are independent under applicable Nasdaq rules, a fully independent Audit Committee, a fully independent Compensation Committee and a fully independent Conflicts Committee, as further described below under “—Board and Committee Structure—Other Board Committees.”

Certain Rights of Our Founders and Our CEO Prior to the Sunset

Prior to the Sunset and so long as a Founder is a member of the Control Group, each of our Founders (Messrs. Bonderman and Coulter) will have certain rights, consisting generally of negative consent rights over certain of our actions or strategic decisions, either with respect to senior leadership or to corporate strategy, such as formation of new committees of the board of directors (unless required by applicable law), issuance of preferred stock, and amendments to organizational documents of any TPG entity if such amendments are adverse to the Founders’ interests. Up to and including the Sunset, for so long as a Founder is a member of the Control Group, he will have a right to serve on our board of directors and on the Executive Committee (for Mr. Bonderman, as a nonvoting observer, and for Mr. Coulter, as a voting member until he is no longer an active TPG partner at which time he will become a nonvoting observer of the Executive Committee) and other committees of the board of directors, unless such committee is comprised solely of independent directors. Our Founders will also have certain rights regarding the hiring, firing, terms of employment of, and changes to the delegation of authority to, Mr. Winkelried. Additionally, for as long as Mr. Coulter remains our Executive Chair of the board of directors, Mr. Coulter will have an approval right with respect to the compensation to be paid to those active TPG partners who serve on the Executive Committee, except for our CEO, Mr. Winkelried, whose compensation will be determined by the independent directors, as discussed below.

Generally, decisions prior to the Sunset concerning the hiring, termination and terms of employment of our CEO (other than compensation) will be determined by the Control Group (excluding our CEO when he is a member) with the approval of the Compensation Committee. Following the expansion of the Control Group to five members and until the Sunset, Mr. Coulter will continue to retain a consent right over the decision whether to renew Mr. Winkelried’s employment as our CEO and the selection of a new CEO if Mr. Winkelried’s employment is not renewed. To the extent our Founders and Mr. Winkelried remain members of the Control Group immediately preceding the Sunset, they will continue to be board members until the regular annual meeting held for the election of directors following the Sunset and will be nominated and recommended to the stockholders for election to the board of directors at such annual meeting.

Mr. Winkelried as our CEO will, in most cases, have rights comparable to those of our Founders.

TPG | 2023 Proxy Statement | 12

Board Composition

Director Nomination and Election Process

Our directors are nominated and recommended for election by our board of directors and elected by stockholders in accordance with our organizational documents and governance policies, including our certificate of incorporation, bylaws and the GP LLCA. Through the Sunset, the Control Group, which, as we note above, currently consists of three of our directors, Messrs. Coulter, Bonderman and Winkelried, selects our director nominees for membership on our board of directors and Executive Committee, and our board of directors nominates such nominees to our board of directors and Executive Committee. In light of this arrangement, we currently do not have a policy with respect to the consideration of director candidates recommended by stockholders. We also do not have a standing nominating committee. See “—Corporate Governance Overview—Our Governance Plan” above.

Furthermore, prior to the Sunset, pursuant to the GP LLC LLCA, (i) for as long as they are members of the Control Group, each of Messrs. Bonderman, Coulter and Winkelried will be nominated and elected by the Control Group at each annual meeting of stockholders until the Sunset, (ii) each of our management directors will be nominated and elected by the Control Group for two consecutive terms, unless the Control Group determines to remove any such director from the board of directors for cause, and (iii) each of our independent directors will be nominated and elected by the Control Group at each annual meeting of stockholders until the expansion of the Control Group to five members, at which time the independent directors will be eligible for nomination and election by a majority of the members of the Control Group. Notwithstanding the foregoing, if, at any time until the Sunset, a majority of the members of GP LLC determine that an independent director engaged in conduct constituting “cause,” such director may be removed (or otherwise not nominated for re-election) and a replacement independent director will be selected upon the approval of a majority of the members of GP LLC.

Following the Sunset, the Control Group will no longer have any right to nominate members of the board of directors or its committees, though members of the Control Group could continue as directors following the Sunset and, therefore, participate in making such determinations.

Director Skills, Experience and Diversity

We believe that our directors should be open and forthright, possess integrity, develop a deep understanding of our business and exercise judgment in fulfilling their oversight responsibilities. We also encourage our directors to embrace our core values and culture. Our directors have diverse and complementary business, leadership and financial experience and expertise. For example, many of our directors have leadership experience on the boards of other companies and organizations, which provides an understanding of different business processes, challenges and strategies that we believe enrich their oversight of the Company.

We do not have a specific diversity policy but rather fully appreciate and value the diversity of our directors’ personal backgrounds, including diversity with respect to gender, race, ethnic and national background, geography, age and sexual orientation.

TPG | 2023 Proxy Statement | 13

In compliance with Nasdaq’s board diversity disclosure requirement, the table below provides diversity information about our directors. The information presented below is based on voluntary self-identification by each director. Each of the categories listed in the table below has the meaning provided under Nasdaq Rule 5605(f).

| | | | | | | | | | | | | | |

Board Diversity Matrix * |

| Total Number of Directors | 14 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 4 | 10 | 0 | 0 |

| Part II: Demographic Background |

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 1 | 0 | 0 |

| Hispanic or LatinX | 1 | 1 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 7 | 0 | 0 |

| Two or More Races or Ethnicities | 1 | 0 | 0 | 0 |

| LGBTQ+ | - | - | | |

| Did Not Disclose Demographic Background | - | - | | |

*As of the date of the filing of this proxy statement

Age / Term Limits

We have not established term limits or retirement ages for directors at this time as we believe that such limits may have the disadvantage of discontinuing the availability and contributions of directors who are otherwise capable and valuable members of our board of directors.

TPG | 2023 Proxy Statement | 14

Board and Committee Structure

We are currently governed by a board of directors and by our Executive Committee. As discussed above, as we continue in the first phase of our governance transition through the Sunset, our board of directors is not comprised of a majority of independent directors, and our Executive Committee has had all of the powers and authority of the board of directors under applicable law, except for a small number of powers and oversight responsibilities required by law to be exercised by our full board of directors and exclusively reserved for our full board of directors in our certificate of incorporation, and those powers that are the exclusive responsibility of another committee of the board of directors. The Executive Committee has also delegated certain specific responsibilities to our CEO.

Consistent with our commitment to good governance, subject to the approval of our stockholders at the Annual Meeting, we intend to further our governance transition by providing our board of directors with all the powers and authorities currently reserved solely for our Executive Committee. We are proud of how our board of directors has performed in our first year as a public company. We believe that this incremental step to provide our full board of directors the authority to act on matters previously reserved to our Executive Committee will further support the board of directors’ development and empowerment. As described below, we are seeking stockholder approval of our Amended and Restated Certificate of Incorporation to provide our full board of directors with these additional powers and authorities. See “Item 6—Approval of Amendment and Restatement of Our Amended and Restated Certificate of Incorporation” below for additional detail.

In addition to our Executive Committee, our board of directors has three other committees—the Audit Committee, Compensation Committee and Conflicts Committee—on which each of our three independent directors serve.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Executive Committee | Audit Committee | Compensation Committee | Conflicts Committee |

| Bonderman |  * * | | | |

| Coulter | | | | |

| Winkelried | | | | |

| Weingart | | | | |

| Sisitsky | | | | |

| Vazquez-Ubarri | | | | |

| Chorengel | | | | |

| Coslet | | | | |

| Davis | | | | |

| Sarvananthan | | | | |

| Trujillo | | | | |

| Bright | | | | |

| Cranston | | | | |

| Messemer | | | | |

| | Chair | | | Member | *Non-Voting Observer | | |

TPG | 2023 Proxy Statement | 15

Board Leadership and the Role of the Executive Committee

Our Founders, Messrs. Bonderman and Coulter, are members of our board of directors and serve as Non-Executive Chair and Executive Chair, respectively, and, until the Sunset, are expected to continue to serve in these roles so long as they continue as directors. As discussed above under “—Corporate Governance Overview—Our Governance Plan,” our approach to governance and oversight aims to incrementally increase the participation of senior leaders in our governance and long-term strategic development, and to expand the participation and influence of the next generation of TPG leaders on our growth.

Executive Committee

| | | | | | | | | | | | | | |

| | | | Roles and Responsibilities: Since our IPO, the Executive Committee generally has had all of the power and authority of the board of directors, except for certain limited powers described under “Board Leadership and the Role of the Executive Committee” above, and has had exclusive responsibility over certain key operational matters consistent with the GP LLCA. As discussed above, after the Sunset, we expect that our board of directors will be comprised of a majority of independent directors. We expect our board of directors to continue to participate in the planned evolution of our governance as we expand the roles of our independent directors and non-Founder inside directors and, following the Sunset, the majority independent board of directors will then determine the appropriate governance structure in light of our then-current strategic needs. See “Item 6—Approval of Amendment and Restatement of Our Amended and Restated Certificate of Incorporation” below for additional detail concerning the proposed expansion of the powers of the full board of directors to include matters previously assigned exclusively to the Executive Committee. |

| | | |

| Members Mr. Winkelried (Chair) Mr. Bonderman (Non-Voting Observer) Mr. Coulter Mr. Weingart Mr. Sisitsky Ms. Vazquez-Ubarri Mr. Davis Mr. Sarvananthan Mr. Trujillo | | |

| | |

TPG | 2023 Proxy Statement | 16

Other Board Committees

In addition to the Executive Committee, our board of directors currently has an Audit Committee, Compensation Committee and Conflicts Committee, each of which is comprised solely of independent directors.

Audit Committee

| | | | | | | | | | | | | | |

| | | | Roles and Responsibilities: The primary purpose of our Audit Committee is to assist our board of directors in overseeing and monitoring: •the audits and integrity of our financial statements; •in coordination with the Executive Committee, our process relating to risk management, including cybersecurity risk, and the conduct and systems of internal control over financial reporting and disclosure controls and procedures; •the qualifications, engagement, compensation, independence and performance of our independent auditor; and •the performance of our internal audit function. Independence and Financial Literacy: Our board of directors has affirmatively determined that each of Ms. Messemer, Mr. Bright and Ms. Cranston qualifies as: •an independent director for the purposes of serving on the Audit Committee under applicable Nasdaq rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and •an “audit committee financial expert” as such term has been defined in Item 407(d) of Regulation S-K. As permitted by Nasdaq transition rules for newly listed companies and Rule 10A-3 under the Exchange Act, one management director, Mr. Sisitsky, previously served on the Audit Committee from our IPO until Mr. Bright was appointed to our board of directors on June 24, 2022. |

| | | |

| Members Ms. Messemer (Chair) Mr. Bright Ms. Cranston | | |

| | |

Compensation Committee

| | | | | | | | | | | | | | |

| | | | Roles and Responsibilities: The primary purpose of our Compensation Committee is to: •determine the compensation of Mr. Winkelried, our CEO, and Mr. Coulter, our Executive Chair, in accordance with, and subject to certain limitations contained in, the executives’ respective employment agreements; and •approve, for purposes of Section 16 of the Exchange Act, all other equity awards granted to our directors and officers (as defined under Rule 16a-1(f) under the Exchange Act). Independence: Our board of directors has affirmatively determined that each of Ms. Cranston, Mr. Bright and Ms. Messemer qualifies as an independent director for the purposes of serving on the Compensation Committee under applicable Nasdaq rules and as a non-employee director under Rule 16b-3 under the Exchange Act. |

| | | |

| Members Ms. Cranston (Chair) Mr. Bright Ms. Messemer | | |

| | |

TPG | 2023 Proxy Statement | 17

Conflicts Committee

| | | | | | | | | | | | | | |

| | | | Roles and Responsibilities: The primary purpose of our Conflicts Committee is to: •review conflicts of interest referred to it by the CEO, the Executive Committee, the General Counsel or the Chief Compliance Officer involving a director, our executive officers or any other TPG partner; •determine whether the resolution of any conflict of interest is fair and reasonable to the Company; and •review and approve or ratify, as appropriate, related person transactions submitted to it in accordance with our related person transaction policy. Independence: Our board of directors has affirmatively determined that each of Mr. Bright, Ms. Cranston and Ms. Messemer qualifies as an independent director for purposes of serving on the Conflicts Committee pursuant to the committee’s charter, which requires that each member qualify as an “independent” director in accordance with the applicable Nasdaq listing standards. |

| | | |

| Members Mr. Bright (Chair) Ms. Cranston Ms. Messemer | | |

| | |

The charters for our Audit Committee and Compensation Committee are available on our website at https://shareholders.tpg.com. The committee charters may not be modified or expanded prior to the Sunset unless specifically permitted by the GP LLC LLCA.

Board and Committee Meetings and Annual Meeting Attendance

During 2022, the board of directors held six meetings, the Audit Committee held four meetings, and the Compensation Committee held eight meetings. In 2022, each incumbent director attended at least 75% of meetings of our board of directors and the committees on which such directors served during the period for which they were a director or committee member, respectively. Directors are encouraged to attend our annual meetings of stockholders, and we expect that all of our directors will attend the Annual Meeting virtually.

Executive Sessions

Executive sessions of non-management directors were held regularly throughout 2022. Executive sessions of independent directors (to the extent non-management directors do not qualify as independent) are held at least twice per year or as otherwise required by applicable law or Nasdaq rules. The independent directors determine the agendas and procedures for the executive sessions and designate which independent director will preside at such sessions.

TPG | 2023 Proxy Statement | 18

Board and Committee Oversight of the Firm

Our board of directors and Executive Committee are responsible for overseeing our business and affairs in support of our long-term interests and those of our stockholders and other stakeholders. Strategy and risk management are two examples of matters subject to board oversight.

| | | | | |

Strategy •Business Plans •Budgets •Growth Strategies •Competitive Landscape •Response to Legal and Regulatory Changes | Risk Management •Strategy •Operational and Financial Risk •Cybersecurity •Reputational Risks •Legal and Regulatory Risks |

Oversight of Strategy

Our board of directors and Executive Committee oversee the establishment and execution of our strategies. Each quarter our CEO and management provide our board of directors and Executive Committee detailed business and strategy updates, including with respect to the competitive landscape and our overall business objectives and plans. Our board of directors and Executive Committee also discuss, among other matters, budgets; financial and operating performance; potential acquisitions, divestitures, investments and partnerships; stockholder interests; risk management overviews and assessments of legal and regulatory changes.

TPG | 2023 Proxy Statement | 19

Oversight of Risk Management

Our board of directors and Executive Committee, together with the committees of our board of directors, oversee our risk management efforts.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board and Executive Committee Oversight of Risk Management •Our Executive Committee coordinates with our board of directors and the other committees of our board of directors, as applicable, to oversee the key risks we face. As discussed above, our Executive Committee, which is comprised of members of our management team, has had substantial responsibility for oversight of our business since our IPO. •Our Executive Committee and board of directors address strategic, operational, financial, cybersecurity, legal and regulatory and reputational risks. •The board of directors and its committees may retain outside advisors and consultants as they, in their discretion, deem appropriate to advise on operational risks, future threats and trends. | |

| | | | | | | | |

| | | | | | | | |

| Audit Committee •Coordinates with our Executive Committee to manage risk, including cybersecurity risk, and to oversee the conduct and systems of internal control over financial reporting and disclosure controls and procedures. •Oversees financial reporting and accounting risks and risks associated with business conduct and ethics. | | | Compensation Committee •Coordinates with our Executive Committee to manage risks relating to our compensation programs. •Reviews compensation policies and practices to determine whether they encourage excessive risk-taking and to assess alignment with our risk management policies and practices. | | | Conflicts Committee •Oversees risks relating to conflicts of interest, including related person transactions, referred to it by the CEO, Executive Committee, General Counsel or Chief Compliance Officer. | |

| | | | | | | | |

| | | | | | | | |

| Management Oversight of Risk Management Our management is responsible for the day-to-day identification, assessment and monitoring of, and decision-making regarding, the risks we face. Management, including business personnel across various disciplines at the Company, regularly reports on relevant risks to the applicable committees or our board of directors, as appropriate, with additional review or reporting on risks completed as needed or requested. Management and our board of directors and committees also regularly engage third-party subject-matter experts and advisors to provide advice on topics of relevance and strategic important to our business and its operations, including with respect to risk matters. Joann Harris, who serves as our Chief Compliance Officer and reports directly to our General Counsel, regularly reports to the board of directors and the Executive Committee on important areas of risk. | |

| |

| | | | | | | | |

Board and Committee Self-Evaluation

Prior to the Sunset, the board of directors will from time-to-time conduct evaluations of its performance and effectiveness, but such an evaluation is not required by applicable Nasdaq governance rules or our governance documents. As required by their charters, each of the Audit Committee and Compensation Committee will periodically conduct a self-evaluation of its performance, including its effectiveness and compliance with its charter.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more of its executive officers serving as a member of our board of directors.

Code of Conduct and Ethics

We have a code of conduct and ethics that applies to all of our directors, employees and officers. A copy of the code is available on our website at http://shareholders.tpg.com. Any amendments or waivers to our code for our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, will be disclosed on our website promptly following the date of such amendment or waiver, as and if required by applicable law.

TPG | 2023 Proxy Statement | 20

Corporate Governance Guidelines

We have adopted corporate governance guidelines in accordance with the corporate governance rules of Nasdaq. These guidelines cover a number of areas including director responsibilities, director elections and re-elections, composition of the board of directors, including director qualifications and diversity and board committees, executive sessions, director access to management and, as necessary and appropriate, independent advisors, director orientation and continuing education, board materials, management succession and evaluations of the board of directors and its committees. A copy of our Corporate Governance Guidelines is available on our website at http://shareholders.tpg.com.

TPG | 2023 Proxy Statement | 21

ITEM 2. ELECTION OF MEMBERS OF THE EXECUTIVE COMMITTEE

Board Recommendation

| | | | | | | | |

| After a review of the particular experience, qualifications, attributes and skills possessed by such director nominees to the Executive Committee of the board of directors and their contributions to our board of directors and Executive Committee, our board of directors unanimously recommends stockholders vote “FOR” the election of each of the following nominees. | |

| | | | | | | | | | | |

| | | |

| Mr. Winkelried (Chair) | Mr. Coulter | Mr. Weingart | Mr. Sisitsky |

| | | |

| Ms. Vazquez-Ubarri | Mr. Davis | Mr. Sarvananthan | Mr. Trujillo |

Background and Nominees

Pursuant to our governance documents, the members of our Executive Committee are elected each year to one-year terms, subject, until the Sunset, to the terms specified in GP LLC LLCA. Pursuant to the GP LLC LLCA, through the Sunset, the Control Group selects our director nominees for membership on the board of directors and the Executive Committee, and TPG nominates such nominees to our board of directors and Executive Committee. See “Item 1—Election of Directors—Board Composition—Director Nomination and Election Process” above.

Consistent with our commitment to good governance, subject to the approval of our stockholders at the Annual Meeting, we intend to further our governance transition by providing our board of directors with all the powers and authorities currently reserved solely for our Executive Committee. We are proud of how our board of directors has performed in our first year as a public company. We believe that this incremental step to provide our full board of directors the authority to act on matters previously reserved to our Executive Committee will further support the board of directors’ development and empowerment. As described below, we are seeking stockholder approval of our Amended and Restated Certificate of Incorporation to provide our full board of directors with these additional powers and authorities. See “Item 6—Approval of Amendment and Restatement of Our Amended and Restated Certificate of Incorporation” below for additional detail.

The biographical information and qualifications of each of the Executive Committee nominees are set forth above under “Item 1—Election of Directors—Our Director Nominees” above.

TPG | 2023 Proxy Statement | 22

DIRECTOR COMPENSATION

Pursuant to our Independent Director Compensation Policy, our independent directors receive the following annual compensation:

•an annual cash retainer of $150,000, payable quarterly;

•an annual equity award in the form of restricted stock units (“RSUs”) with a value of $150,000 pursuant to the Omnibus Plan (as defined below), which will vest on the one-year anniversary of grant or the next annual stockholder meeting after grant if the director remains a director through the day immediately prior to such meeting;

•an additional annual cash retainer of $15,000 to members of the Audit Committee and $10,000 to members of each of the Compensation Committee and Conflicts Committee; and

•an additional annual cash retainer of $25,000 to the chair of our Audit Committee, $20,000 to the chair of our Compensation Committee and $15,000 to the chair of our Conflicts Committee. The committee chair retainers are in addition to the annual cash retainer that each committee member will receive.

Beginning in 2023, directors may elect to receive all or a portion of any cash retainer in shares of the Company’s Class A common stock.

Also pursuant to our Independent Director Compensation Policy, upon initial election to our board of directors, our independent directors receive an initial grant of RSUs pursuant to the Omnibus Plan with a value of $300,000, which will vest in three annual installments beginning on the first anniversary of the grant date or each of the next three annual stockholder meetings after grant if the director remains a director through the day immediately prior to each such meeting.

We reimburse independent directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors or otherwise in the performance of services to the Company, including travel expenses in connection with their attendance in-person at board and committee meetings and in the performance of services to the Company. Our independent directors in place at the time of the IPO are also entitled to participate in side-by-side investments (as defined below). For more information about our side-by-side investments, see “Certain Relationships and Related Party Transactions—Certain Other Transactions or Arrangements—Side-By-Side and Other Investment Transactions.”

In May 2022, the Compensation Committee approved a share retention policy for our non-employee directors that requires our non-employee directors to retain 25% of RSUs and any other shares of the Company granted to them for a two-year period following vesting.

Director Compensation for 2022

The following table provides information regarding compensation paid or accrued by us to or on behalf of non-employee directors for services rendered to us during 2022.

See “—Partner Compensation Paid to Non-Independent Directors for 2022” for information on compensation paid to our directors who are our partners in their capacity as partners.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2) | | All Other Compensation ($) | | Total ($) |

| Gunther Bright | | 100,000 | | 459,685 | (3) | | — | | | 559,685 | |

| Mary Cranston | | 205,403 | | 529,845 | (4) | | — | | | 735,248 | |

| Deborah Messemer | | 203,226 | | 529,845 | (4) | | — | | | 733,071 | |

(1)The amounts reported in this column represent the prorated portions paid or accrued in 2022 of: the annual cash retainer of $150,000 for serving on our board of directors, cash retainers of $15,000, $10,000 and $10,000 for serving on our Audit Committee, Compensation Committee and Conflicts Committee (respectively); and cash retainers of $25,000 for serving as chair of our Audit Committee (in the case of Ms. Messemer), $20,000 for service as chair of our Compensation Committee (in the case of Ms. Cranston) and $15,000 for serving as chair of our Conflicts Committee (in the case of Mr. Bright). All retainers are payable in four quarterly installments.

(2)The amounts reported in this column reflects the aggregate grant date fair value of an initial grant of RSUs, an annual grant of RSUs for the period through our 2023 annual meeting and, for Ms. Cranston and Ms. Messemer, a prorated annual grant of RSUs for the first half of

TPG | 2023 Proxy Statement | 23

2022. In accordance with the Director Compensation Table disclosure rules, the grant date fair value of RSUs is determined in accordance with ASC 718. This differs from the value of the RSUs described above, which was determined based on a ten-day volume weighted average trading price valuation methodology. As of December 31, 2022, all RSUs granted to our non-employee directors were outstanding and unvested.

(3)On July 15, 2022, Mr. Bright received a grant of (i) 12,190 RSUs that represent his initial award for joining the board of directors that will vest 33% on each of the first, second and third anniversaries of the date of grant and (ii) 6,095 RSUs that represent his annual award through TPG’s 2023 annual meeting that will vest on the first anniversary of the grant date, provided that if Mr. Bright serves on the board of directors through the next annual meeting of our stockholders, he will be entitled to retain these RSUs.

(4)On January 13, 2022, Mses. Cranston and Messemer each received a grant of 10,170 RSUs that represent their initial awards for joining the board of directors that will vest 33% on each of the first, second and third anniversaries of the date of grant. On July 15, 2022, Mses. Cranston and Messemer each received a grant of 9,142 RSUs that represents their annual grant through TPG’s 2023 annual meeting and a prorated annual grant for the first half of 2022. Each of the annual RSUs will vest on the first anniversary of the grant date, provided that if they each serve on the board of directors through the next annual meeting of our stockholders, they will each be entitled to retain these RSUs.

Partner Compensation Paid to Non-Independent Directors for 2022

Our directors who are also our partners receive compensation in respect of services to us and our affiliates as described below. For information on compensation paid to our directors who are also our NEOs, see “Executive Compensation—Summary Compensation Table.” Our directors who are our partners and not our NEOs are generally entitled to the same elements of compensation as our NEOs, including perquisites (such as access to aircraft for personal use at no incremental cost to us) and benefits, on consistent terms, and may be entitled to participate in separation benefits. See “Executive Compensation—Compensation Discussion and Analysis—Elements of 2022 Compensation of Named Executive Officers and Return on Equity” for descriptions of these compensation components. In 2022, our directors who are our partners and not NEOs (other than Messrs. Bonderman and Coslet) were issued additional TPG Partner Holdings, L.P. (“TPG Partner Holdings”) interests consistent with the terms described in “Executive Compensation—Narrative Disclosure to the Summary Compensation Table and Grants of Plan-Based Awards Table—TPG Partner Holdings.” The amounts indicated below are calculated consistent with our determination of compensation in the Summary Compensation Table, using the same assumptions. For information about existing pledges of our directors, see “Security Ownership of Certain Beneficial Ownersand Management.”

David Bonderman

Mr. Bonderman is one of our Founders and is our Non-Executive Chair. With respect to 2022, Mr. Bonderman received: $300,000 in fixed cash compensation consistent with the terms of the Bonderman Agreement (defined below); $3,962,503 in distributions from our platform-level program; $45,213 for personal assistants; $15,270 for legal services; and $2,137 for umbrella liability insurance premiums, which includes $520 for tax reimbursements. He also received (directly or indirectly through family or affiliated entities) $692,721 in distributions made on unvested TPG Partner Units (as defined below) and RemainCo (as defined below) interests for 2022.