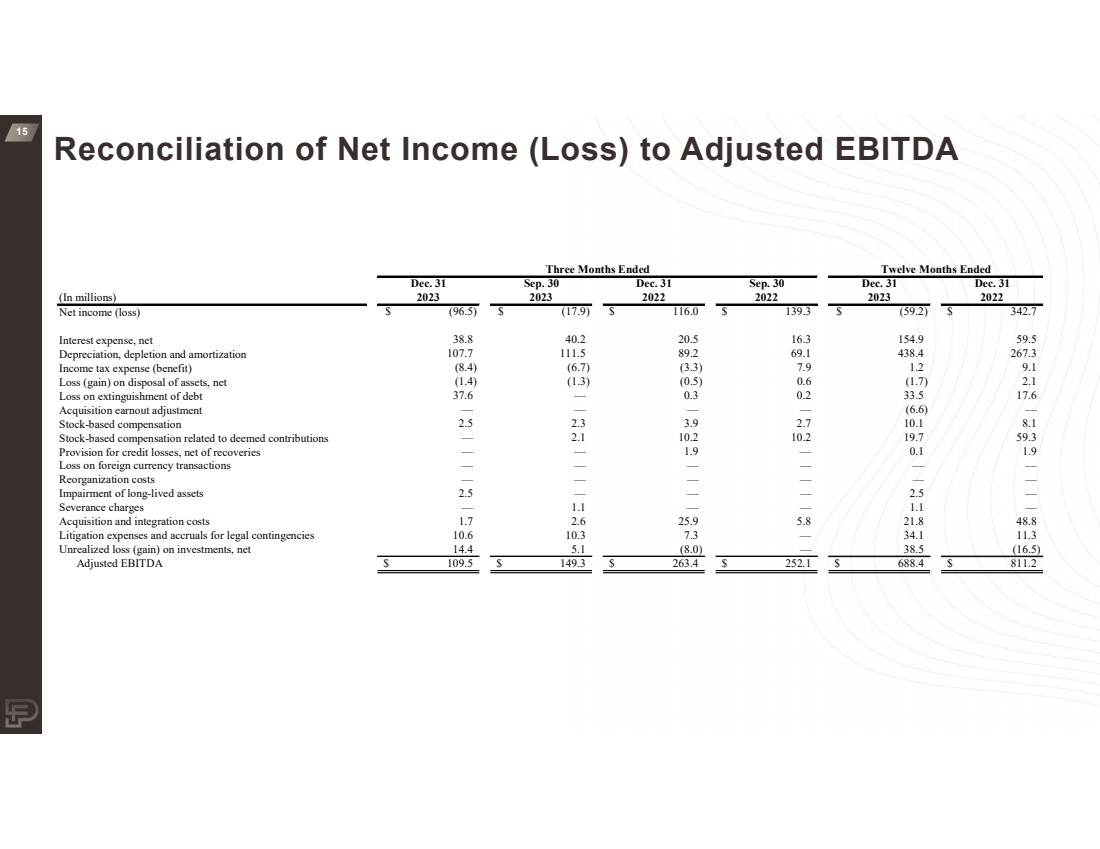

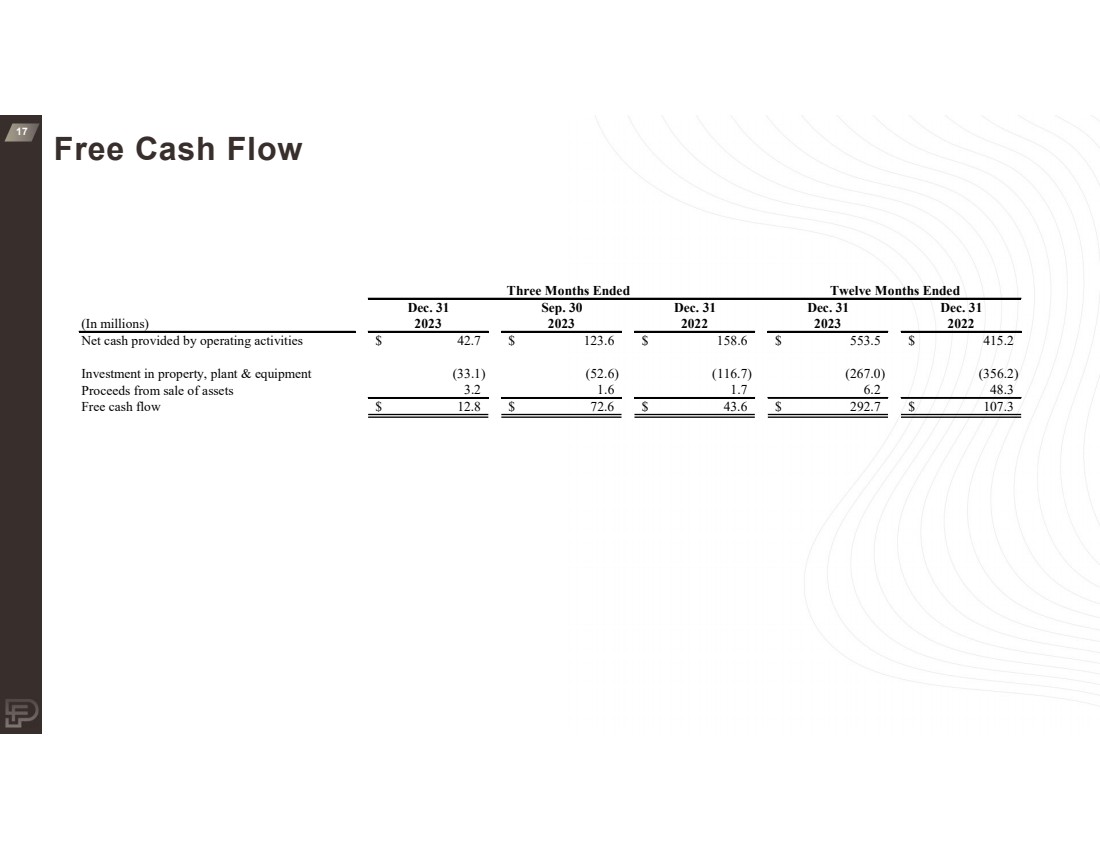

| Cautionary Statements 2 Forward-Looking Statements Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be accompanied by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Forward-looking statements relate to future events or the Company’s future financial or operating performance. These forward-looking statements include, among other things, statements regarding: the Company’s strategies and plans for growth; the Company’s positioning, resources, capabilities, and expectations for future performance; customer, market and industry demand and expectations; the Company’s expectations about price fluctuations, deferred activity from E&P companies, customer budgets and macroeconomic conditions impacting the industry; competitive conditions in the industry; the Company’s ongoing pursuit of dedicated agreements in 2024 with operators under contracted terms; the Company’s continued success in the RFP process; the Company’s ability to increase the utilization of its mining assets and lower our mining costs per ton; success of the Company’s ongoing strategic initiatives; the Company’s intention to increase the number of fully integrated fleets; the Company’s currently expected guidance regarding its 2024 financial and operational results; the Company’s ability to earn its targeted rates of return; pricing of the Company’s services in light of the prevailing market conditions; the Company’s currently expected guidance regarding its planned capital expenditures; statements regarding the Company’s liquidity and debt obligations; the Company’s anticipated timing for operationalizing and amount of contribution from its fleets and its sand mines; expectations regarding pricing per ton range; the amount of capital that may be available to the Company in future periods; any financial or other information based upon or otherwise incorporating judgments or estimates relating to future performance, events or expectations; any estimates and forecasts of financial and other performance metrics; and the Company’s outlook and financial and other guidance. Such forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the ability to achieve the anticipated benefits of the Company’s acquisitions, mining operations, and vertical integration strategy, including risks and costs relating to integrating acquired assets and personnel; risks that the Company’s actions intended to achieve its 2024 financial and operational guidance will be insufficient to achieve that guidance, either alone or in combination with external market, industry or other factors; the failure to operationalize or utilize to the extent anticipated the Company’s fleets and sand mines in a timely manner or at all; the Company's ability to deploy capital in a manner that furthers the Company's growth strategy, as well as the Company's general ability to execute its business plans; the risk that the Company may need more capital than it currently projects or that capital expenditures could increase beyond current expectations; industry conditions, including fluctuations in supply, demand and prices for the Company’s products and services; global and regional economic and financial conditions; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Forward-looking statements are also subject to the risks and other issues described below under “Non-GAAP Financial Measures,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this press release. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved, including without limitation any expectations about the Company’s operational and financial performance or achievements through and including 2024. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law. Non-GAAP Financial Measures Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures and should not be considered as a substitute for net income (loss) or net cash from operating activities, respectively, or any other performance measure derived in accordance with GAAP or as an alternative to net cash provided by operating activities as a measure of our profitability or liquidity. Adjusted EBITDA and Free Cash Flow are supplemental measures utilized by our management and other users of our financial statements such as investors, commercial banks, research analysts and others, to assess our financial performance. We believe Adjusted EBITDA is an important supplemental measure because it allows us to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and items outside the control of our management team (such as income tax rates). We believe Free Cash Flow is an important supplemental liquidity measure of the cash that is available (if any), after purchases of property and equipment, for operational expenses, investment in our business, and to make acquisitions, and Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in excess of our capital investments in property and equipment. We view Adjusted EBITDA and Free Cash Flow as important indicators of performance. We define Adjusted EBITDA as our net income (loss), before (i) interest expense, net, (ii) income tax provision, (iii) depreciation, depletion and amortization, (iv) loss on disposal of assets, (v) stock-based compensation, and (vi) other charges, such as reorganization costs, stock compensation expense and other costs related to our initial public offering, certain credit losses, (gain) or loss on extinguishment of debt, unrealized loss (or gain) on investment, acquisition and integration expenses, litigation expenses and accruals for legal contingencies, and acquisition earn-out adjustments. We define Free Cash Flow as net cash provided by or (used in) operating activities less investment in property, plant and equipment plus proceeds from sale of assets. We believe that our presentation of Adjusted EBITDA and Free Cash Flow will provide useful information to investors in assessing our financial condition and results of operations. Net income (loss) is the GAAP measure most directly comparable to Adjusted EBITDA. Adjusted EBITDA should not be considered as an alternative to net income (loss). Adjusted EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect the most directly comparable GAAP financial measure. Because Adjusted EBITDA may be defined differently by other companies in our industry, our definition of this non-GAAP financial measure may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Net cash provided by operating activities is the GAAP measure most directly comparable to Free Cash Flow. Free Cash Flow should not be considered as an alternative to net cash provided by operating activities. Free Cash Flow has important limitations as an analytical tool including that Free Cash Flow does not reflect the cash requirements necessary to service our indebtedness and Free Cash Flow is not a reliable measure for actual cash available to the Company at any one time. Because Free Cash Flow may be defined differently by other companies in our industry, our definition of this Non-GAAP Financial Measure may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. The presentation of Non-GAAP Financial Measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. The following tables present a reconciliation of the Non-GAAP Financial Measures of Adjusted EBITDA and Free Cash Flow to the most directly comparable GAAP financial measure for the periods indicated. |