Inflation could adversely affect our business and results of operations.

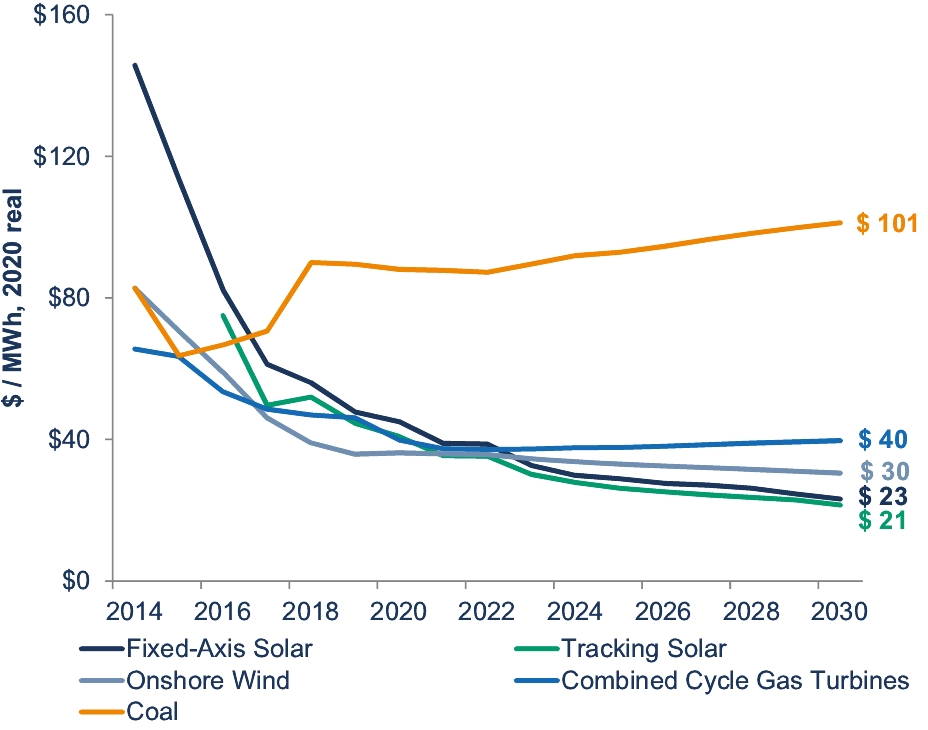

The renewable energy industry has seen long periods of declining costs, which may not continue, or may reverse. Inflation or the absence of cost decreases could adversely affect us by increasing the actual or expected costs of land, raw materials, and labor, and other goods and services needed to operate our business, which in turn may raise our cost of capital and the costs of developing, constructing, and operating a project, making it more difficult to develop and operate our projects. Should cost increases occur, prospective counterparties may also choose to forego or delay signing PPAs or other agreements with us. Significant increases in actual or expected costs may have an adverse impact on our business, NAV, financial condition, and results of operations.

Our ability to effectively operate our business could be impaired if we fail to attract and retain key personnel.

Our ability to operate our business and implement our strategies effectively depends on the efforts of our executive officers and other key employees. Our management team has significant industry experience and would be difficult to replace. These individuals possess development, construction, operational, management, legal, engineering, financial, and administrative skills that are critical to the operation of our business. With the growth of the renewable energy industry, we have seen an increase in the need for experienced personnel with applicable experiences. In addition, the market for personnel with the required industry and technical expertise to succeed in our business is highly competitive, and we may be unable to attract and retain qualified personnel to replace or succeed key employees should the need arise. In order to remain competitive in attracting and retaining such personnel, we may need to increase the compensation of our employees, including new hires, beyond our current expectations. The loss of the services of any of our key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on our business, NAV, financial condition, and results of operations.

We are not able to insure against all potential risks and we may become subject to higher insurance premiums or may not obtain insurance at all.

We are exposed to numerous risks inherent in the operation of renewable energy projects, including equipment failure, manufacturing defects, natural disasters, pandemics, terrorist attacks, cyber-attacks, sabotage, theft, vandalism, and environmental risks. Further, with respect to any projects that are under construction or development, we are, or will be, exposed to risks inherent in the construction and development of these projects. The occurrence of any one of these events may result in us being named as a defendant in lawsuits asserting claims for substantial monetary damages, including those associated with environmental cleanup costs, personal injury, property damage, fines, and penalties.

Some of the risks to which we are exposed are generally not insurable, including risks related to terrorism. Even if the risks are generally insurable, we may not maintain or obtain insurance of the type and amount we desire at reasonable rates or at all, and we may elect to self-insure a portion of our portfolio. The insurance coverage we do obtain may contain large deductibles or insufficient coverage or fail to cover certain risks or potential losses. We often cannot obtain full coverage at economic rates and are instead limited to probable maximum loss coverage subject to commercially reasonable limits. In addition, our insurance policies are subject to annual review by our insurers and may not be renewed on similar or favorable terms, including with respect to coverage, deductibles, or premiums, or at all.

As the renewable energy industry grows, insurance providers may reassess the risks associated with solar and wind projects and we may experience higher insurance costs, including as the result of industry-wide increases in insurance premiums. Industry-wide increases in insurance premiums have recently and may in the future arise as the result of cost spreading efforts from major insurance providers following major natural disasters such as hurricanes or widespread wildfires. Finally, even if we believe that insurance should cover any particular claim, there may be litigation with insurance companies or others regarding the claim, and we may not prevail. The occurrence of any such natural disaster may result in our being named as a defendant in lawsuits asserting claims for substantial monetary damages, including those associated with environmental cleanup costs, personal injury, property damage, fines, and penalties. If a significant accident or event occurs for which we are not fully insured, or if we are unable to obtain or retain a sufficient level of insurance, which could constitute a breach under our PPAs, we may experience a material adverse effect on our business, NAV, financial condition, and results of operations.

We are subject to risks associated with litigation or administrative proceedings that could materially affect us.

We are subject to risks and costs, including potential negative publicity, associated with lawsuits, claims, or administrative proceedings, including lawsuits, claims, or proceedings relating to our business or the, development,