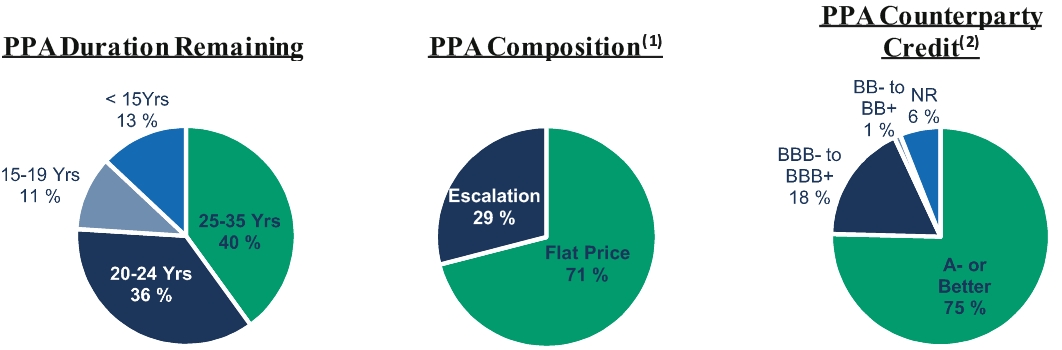

volume of delivery, and may be subject to certain “floor” or “ceiling” provisions; however our PPAs do not require fixed-volume, hedging commitments. Certain PPAs contain non-cancelable off-taker commitments to pay for a specific volume of supply and outline minimum output levels to be delivered by us.

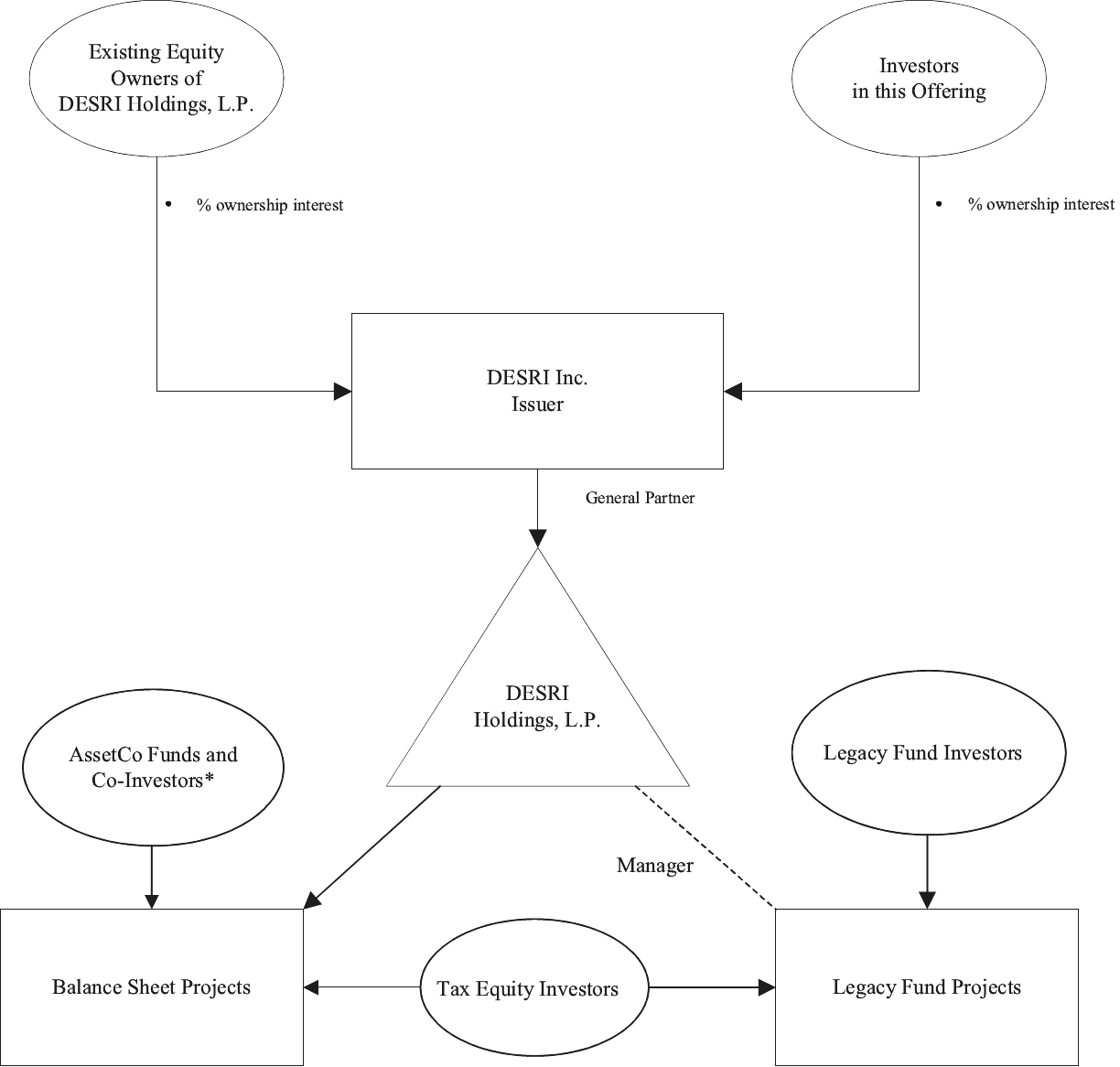

Additionally, but to a smaller extent, we earn management fees and performance fees in consideration for providing investment advisory and management services to our affiliated private investment funds, or funds, which invest in projects owned and operated by us. In accordance with U.S. GAAP, the assets and liabilities of these investments are not consolidated in our financial statements, but are reflective of the principle business strategy deployed by management during 2011 through 2014. The management fee income is typically earned quarterly or annually from the funds and performance fees which are earned upon distributions. For the years ended December 31, 2019 and 2020, we received $4.1 million and $5.7 million, respectively, in management and performance fees on assets under management of $323.2 million and $308.3 million, respectively. As a result of effective management of the assets underlying our projects, the funds have made cash distributions, net of performance fees, of $326.8 million since inception.

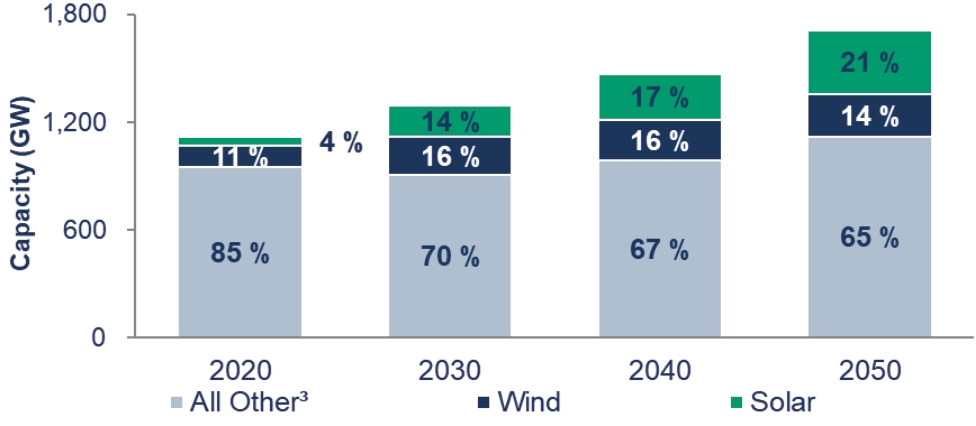

We expect our revenues to increase as we (i) continue to source economically strong projects through a robust and extensive development pipeline and acquisitions and convert such non-operating assets into operational projects and (ii) benefit from contracted, escalating price provisions contained in certain of our PPAs.

Operating Costs and Expenses

Depreciation and amortization

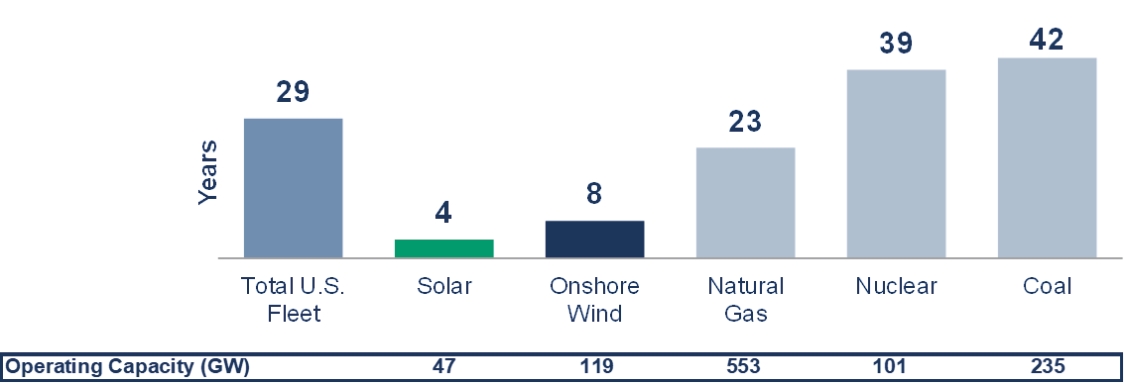

Depreciation and amortization expense primarily reflects depreciation of our assets over their estimated useful lives. We also include in depreciation expense a provision for wind and solar facility retirement and asset removal costs.

Operating and maintenance expenses

O&M expenses include costs associated with routine operations and maintenance of our projects. These include contracted, third-party maintenance costs and interconnection maintenance costs, lease expense, property taxes, insurance, contracted shared service costs, administrative expenses attributable to our projects, such as IT costs, and costs and expenses under administrative service agreements, or ASAs, or management services agreements, or MSAs. O&M expenses also include the cost of repairing and replacing certain parts for the projects in our portfolio to maintain our long-term operating capacity.

We anticipate that, in the near term, our O&M expenses for our portfolio will remain relatively stable on a per-project basis from year to year due to (i) long-term, contracted agreements associated with our O&M services and land rent and (ii) stable, predictable costs such as property taxes, professional fees and site costs. These expenses will increase in absolute dollars as newly, completed construction projects achieve commercial operations.

General and administrative expenses

General and administrative expenses consist primarily of employee compensation and directly attributable or allocated corporate costs including, legal, accounting, treasury, and enterprise information technology expenses, office expenses, professional fees, and other corporate services and infrastructure costs.

We expect our general and administration expenses will increase as a result of (i) becoming a publicly traded entity and (ii) separation from the D. E. Shaw group. This increase will be due, in part, to increased third-party accounting services, compliance costs, independent auditor fees, investor relations activities, directors’ fees, compensation and expenses, directors’ and officers’ insurance, stock exchange listing fees, registrar and transfer agent fees, and other expenses.

Project development expenses

Project development costs include costs that are expensed related to our early development, pre-contracted assets, prior to the attainment of an executed PPA. Project development costs can include interconnection and transmission studies, surveying and project diligence costs, and regulatory compliance studies.

As we continue to further grow a development asset pipeline, we expect these costs to increase; however, any costs incurred after the conversion of an early development, pre-contracted asset to a contracted, pre-construction project will be capitalized as part of the respective project cost.