APPENDIX B: DISTRIBUTION REINVESTMENT PLAN

This Distribution Reinvestment Plan (the “Plan”) is adopted by Apollo Realty Income Solutions, Inc. (the “Company”) pursuant to its Articles of Amendment and Restatement (as amended, restated or otherwise modified from time to time, the “Charter”). Unless otherwise defined herein, capitalized terms shall have the same meaning as set forth in the Charter.

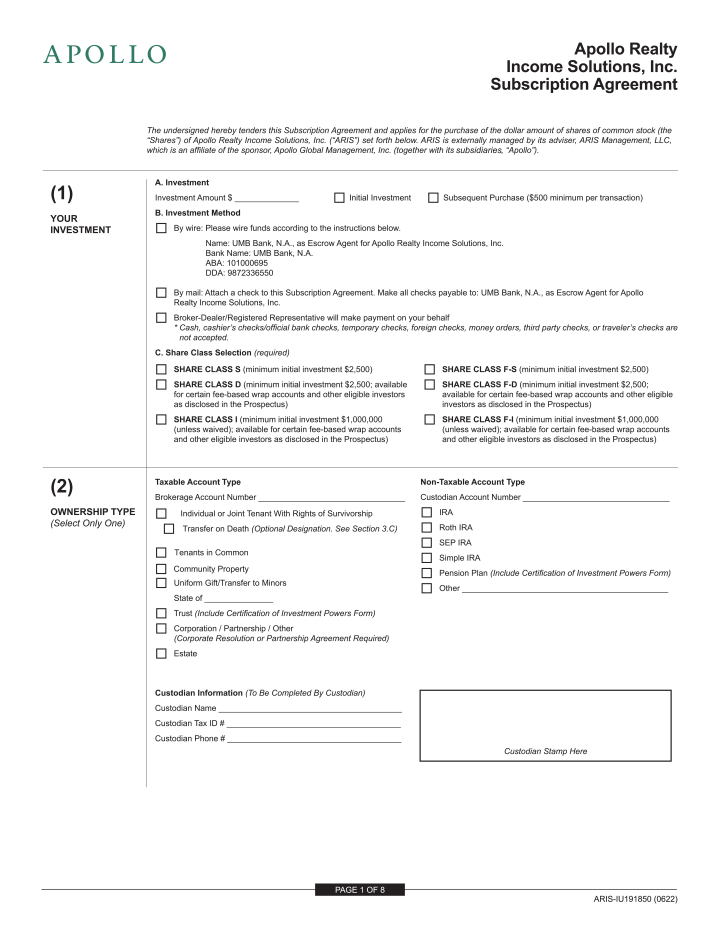

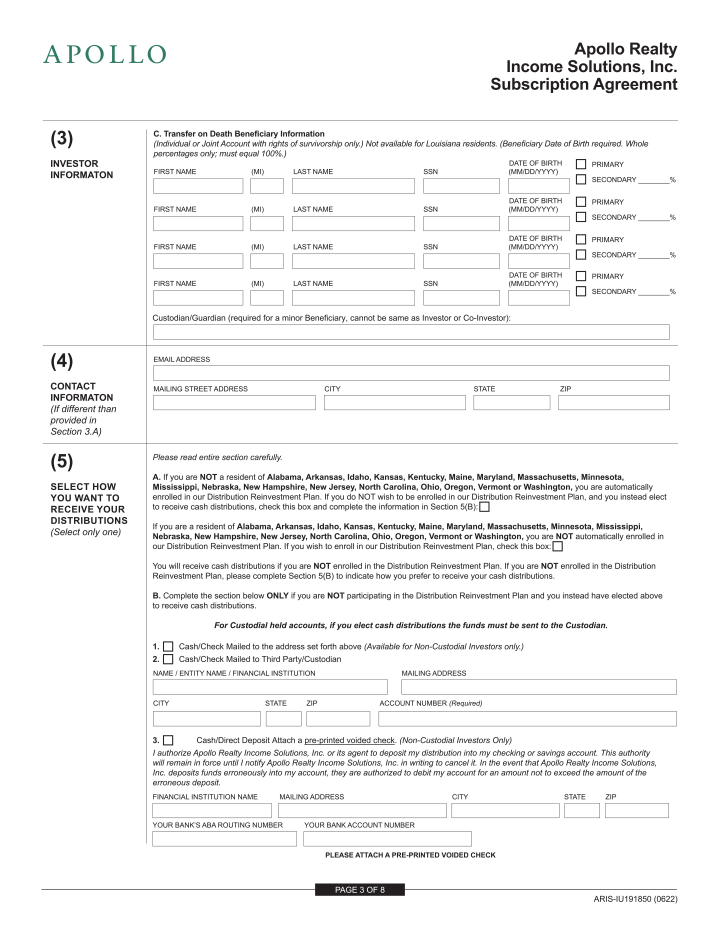

1. Distribution Reinvestment. As agent for the stockholders (the “Stockholders”) of the Company who (i) purchase Class S Common Stock, $0.01 par value per share, Class D Common Stock, $0.01 par value per share, Class I Common Stock, $0.01 par value per share, Class F-S Common Stock, $0.01 par value per share, Class F-D Common Stock, $0.01 par value per share or Class F-I Common Stock, $0.01 par value per share, of the Company (collectively the “Public Shares”) pursuant to the Company’s continuous public offering (the “Public Offering”), (ii) purchase Class E Common Stock, $0.01 par value per share (“Class E Shares” and, together with the Public Shares, the “Shares”) pursuant to an applicable exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”) (the “Class E Private Offering”) or (iii) purchase Shares pursuant to any future offering of the Company (a “Future Public Offering”), and who do not opt out of participating in the Plan (or, in the case of Alabama, Arkansas, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, Ohio, Oregon, Vermont and Washington investors, who opt to participate in the Plan) (the “Participants”), the Company will apply all dividends and other distributions declared and paid in respect of the Shares held by each Participant and attributable to the class of Shares purchased by such Participant (the “Distributions”), including Distributions paid with respect to any full or fractional Shares acquired under the Plan, to the purchase of additional Shares of the same class for such Participant.

2. Effective Date. The effective date of this Plan shall be the date that the minimum offering requirements are met in connection with the Public Offering and the escrowed subscription proceeds are released to the Company.

3. Procedure for Participation. Any Stockholder who has (i) purchased Shares pursuant to the Public Offering (unless such Stockholders is a resident of Alabama, Arkansas, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, Ohio, Oregon, Vermont and Washington) who has received a prospectus, as contained in the Company’s registration statement filed with the Securities and Exchange Commission (the “SEC”) or (ii) purchased Shares pursuant to the Class E Private Offering will automatically become a Participant unless they elect not to become a Participant by noting such election on their subscription agreement. Any Stockholder who is a resident of Alabama, Arkansas, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, Ohio, Oregon, Vermont and Washington who has received a prospectus, as contained in the Company’s registration statement filed with the SEC, will become a Participant if they elect to become a Participant by noting such election on their subscription agreement. If any Stockholder initially elects not to be a Participant, they may later become a Participant by subsequently completing and executing an enrollment form or any appropriate authorization form as may be available from the Company, the Company’s transfer agent, the dealer manager for the Public Offering or any soliciting dealer participating in the distribution of Shares for the Public Offering. Participation in the Plan will begin with the next Distribution payable after acceptance of a Participant’s subscription, enrollment or authorization. Shares will be purchased under the Plan on the date that Distributions are paid by the Company.

4. Suitability. Each Participant is requested to promptly notify the Company in writing if the Participant experiences a material change in his or her financial condition, including the failure to meet the income, net worth, investment concentration, status as an “accredited investor” as defined in Regulation D of the Securities Act (solely with respect to purchasers in the Class E Private Offering), or other investment suitability standards imposed by such Participant’s state of residence and set forth in the Company’s most recent prospectus or the private placement memorandum with respect to the Class E Private Offering, as applicable. For the avoidance of

B-1