UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23757

Goldman Sachs ETF Trust II

(Exact name of registrant as specified in charter)

200 West Street, New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Caroline Kraus, Esq. | | Stephen H. Bier, Esq. |

Goldman Sachs & Co. LLC | | Dechert LLP |

200 West Street | | 1095 Avenue of the Americas |

New York, New York 10282 | | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2023

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 28, 2023 |

| | |

| | | | Goldman Sachs MarketBeta® U.S. 1000 Equity ETF |

MarketBeta® is a registered trademark of GSAM.

Goldman Sachs MarketBeta® ETFs

| ∎ | | GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Goldman Sachs MarketBeta® U.S. 1000 Equity ETF

The following are highlights both of key factors affecting the U.S. equity market and of any key changes made to the Goldman Sachs MarketBeta® U.S. 1000 Equity ETF (the “Fund”) during the six months ended February 28, 2023 (the “Reporting Period”). A fuller review will appear in the Fund’s annual shareholder report covering the 12 months ended August 31, 2023.

Market and Economic Review

| • | | Overall, U.S. equities rose during the Reporting Period. The Standard & Poor’s 500® Index (the “S&P 500 Index”) ended the Reporting Period with a return of 1.26%. The Russell 3000® Index generated a return of 1.51%. |

| • | | The market posted muted returns during the Reporting Period amid a backdrop of ongoing Federal Reserve (“Fed”) interest rate hikes to combat inflation, persistent recession worries, supply-chain disruptions, geopolitical tensions given the Russia/Ukraine war, and elevated concerns around China’s zero-COVID policy. |

| • | | As the Reporting Period began in September 2022, the S&P 500 Index decreased primarily based on the noticeable tightening of financial conditions guided by expectations for a more aggressive global interest rate hiking cycle. Indeed, the Fed increased its “raise and hold” messaging as the end of September approached, a policy that received support on the back of higher than consensus expected August core inflation data and a still-tight labor market that showed only moderate signs of cooling off. |

| • | | During the fourth quarter of 2022, the S&P 500 Index solidly increased, breaking its streak of three consecutive quarterly losses, attributable primarily to gains in October and November. |

| | • | | Investors continued to witness a variety of contradictory macroeconomic developments, highlighted by a noticeably hawkish Fed, consumer resilience, and economic data supporting the themes of slowing economic growth. (Hawkish tends to suggest higher interest rates; opposite of dovish.) |

| | • | | There was a dovish tilt surrounding consensus expectations for a reduction in the pace of monetary policy tightening, which was realized when the Fed announced a 50 basis point interest rate hike in December, following four successive 75 basis point increases. (A basis point is 1/100th of a percentage point.) |

| | • | | Positive inflation developments further supported market aspirations for a peak in the Fed tightening cycle, with October and November inflation data coming in lower than anticipated by most. |

| | • | | Despite the smaller interest rate hike, the Fed maintained its hawkish tone with its relentless higher-for-longer messaging that continued to be a headwind for the U.S. equities market. |

| | • | | Although the third quarter 2022 corporate earnings season provided disappointing results, companies emphasized a strong demand environment even against a backdrop of heightened macroeconomic uncertainty. Companies also focused on cost-cutting measures, as headlines of layoffs remained in the spotlight, especially within the information technology sector. |

| | • | | On the geopolitical front, the most constructive takeaways came from China’s zero-COVID pivot and pro-growth focus as well as Europe’s warmer than anticipated weather that helped settle concerns about an energy crisis there. |

| • | | The S&P 500 Index rose in January 2023, rebounding from December 2022’s losses, gaining on a combination of heightened optimism around disinflationary signals, a cooling job market, positive reports about China’s economic reopening, better than consensus forecasted economic circumstances in Europe, improvements in supply-chain conditions and elevated hopes for the termination of the Fed’s tightening cycle. Collectively, these themes provided a strong case for the Fed’s soft landing scenario and the avoidance of a deep recession resulting from interest rate hikes. (A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing.) |

| • | | However, the S&P 500 Index then fell again in February 2023, giving back a portion of the prior month’s gains. |

| | • | | U.S. equities depreciated as the market’s modified Fed interest rate hike expectations and resilient economic data prompted a reduction in the progress of disinflation and heightened traction around several bearish themes. (Bearish refers to an expected downward movement in the prices of securities.) |

1

MARKET REVIEW

| | • | | Early in February, the Fed raised the targeted federal funds rate by another 25 basis points as expected, and its accompanying statement seemed dovish. Still, Fed Chair Powell’s subsequent statement that further rate hikes will be necessary if economic data continues to come in stronger than expected shifted the Fed narrative more hawkish. |

| • | | During the Reporting Period overall, value stocks meaningfully outperformed growth stocks within the large-cap and small-cap segments of the U.S. equity market, though growth stocks outpaced value stocks within the mid-cap segment. |

| • | | The best performing sectors within the S&P 500 Index during the Reporting Period were materials, industrials, energy and financials, while the weakest performing sectors were utilities, consumer discretionary, real estate and communication services. |

Fund Changes and Highlights

No material changes were made to the Fund during the Reporting Period.

2

FUND BASICS

MarketBeta® U.S. 1000 Equity ETF

as of February 28, 2023

| | | | | | |

| | FUND SNAPSHOT | |

| | |

| | | As of February 28, 2023 | | | |

| | |

| | Market Price1 | | $ | 34.63 | |

| | | Net Asset Value (NAV)1 | | $ | 34.58 | |

| 1 | | The Market Price is the price at which the Fund’s shares are trading on the Cboe NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on Cboe NYSE Arca, Inc. at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

| | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | | |

| | | September 1, 2022–February 28, 2023 | | Fund Total Return

(based on NAV)2 | | | Fund Total Return

(based on Market Price)2 | | | Solactive

GBS

United States

1000 Index3 | |

| | | Shares | | | 1.39 | % | | | 1.39 | % | | | 1.28 | % |

| 2 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees and operating expenses incurred by the Fund. Market Price returns are based upon the last trade as of 4:00 pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 | | The Goldman Sachs MarketBeta® U.S. 1000 Equity ETF is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Solactive GBS United States 1000 Index (“Solactive Index”) and/or Solactive Index trade mark or the Solactive Index Price at any time or in any other respect. The Solactive Indexes are calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Solactive Indexes are calculated correctly. Irrespective of its obligations towards the Fund, Solactive AG has no obligation to point out errors in the Solactive Indexes to third parties including but not limited to investors and/or financial intermediaries of the Fund. Neither publication of a Solactive Index by Solactive AG nor the licensing of the Solactive Index or Solactive Index trade mark for the purpose of use in connection with the Fund constitutes a recommendation by Solactive AG to invest capital in the Fund nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in the Fund. Solactive AG is registered as a benchmark administrator under the Regulation (EU) 2016/2011 (BMR). Solactive appears on the ESMA register of administrators. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

3

FUND BASICS

| | | | | | | | | | |

| | TOP 10 HOLDINGS AS OF 2/28/234 | | |

| | | | |

| | | Holding | | % of Net Assets | | | Line of Business | | Country |

| | | | |

| | Apple, Inc. | | | 6.3 | % | | Information Technology | | United States |

| | Microsoft Corp. | | | 4.9 | | | Information Technology | | United States |

| | Amazon.com, Inc. | | | 2.3 | | | Consumer Discretionary | | United States |

| | Tesla, Inc. | | | 1.5 | | | Consumer Discretionary | | United States |

| | NVIDIA Corp. | | | 1.5 | | | Information Technology | | United States |

| | Alphabet, Inc., Class A | | | 1.4 | | | Communication Services | | United States |

| | Alphabet, Inc., Class C | | | 1.3 | | | Communication Services | | United States |

| | Exxon Mobil Corp. | | | 1.2 | | | Energy | | United States |

| | UnitedHealth Group, Inc. | | | 1.2 | | | Health Care | | United States |

| | | JPMorgan Chase & Co. | | | 1.1 | | | Financials | | United States |

|

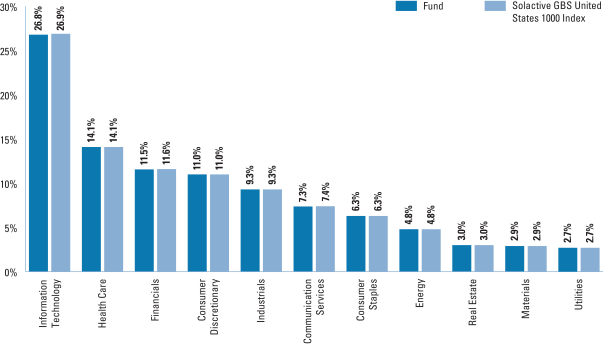

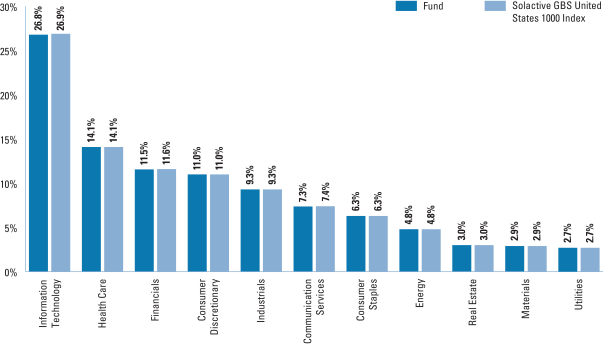

| FUND VS BENCHMARK5 |

|

| February 28, 2023 |

| 4 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| 5 | | Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by Solactive. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.1% of the Fund’s net assets as of February 28, 2023. Figures above may not sum to 100% due to rounding. |

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

4

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

Schedule of Investments

February 28, 2023 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – 99.7% | | | |

| Communication Services – 7.3% | |

| | 23,936 | | | Activision Blizzard, Inc. | | $ | 1,825,120 | |

| | 199,027 | | | Alphabet, Inc., Class A* | | | 17,924,372 | |

| | 175,712 | | | Alphabet, Inc., Class C* | | | 15,866,794 | |

| | 237,967 | | | AT&T, Inc. | | | 4,499,956 | |

| | 2,860 | | | Bumble, Inc., Class A* | | | 69,155 | |

| | 192 | | | Cable One, Inc. | | | 132,597 | |

| | 3,269 | | | Charter Communications, Inc., Class A* | | | 1,201,717 | |

| | 143,250 | | | Comcast Corp., Class A | | | 5,324,602 | |

| | 8,338 | | | DISH Network Corp., Class A* | | | 95,136 | |

| | 9,176 | | | Electronic Arts, Inc. | | | 1,017,985 | |

| | 4,501 | | | Endeavor Group Holdings, Inc., Class A* | | | 100,417 | |

| | 10,048 | | | Fox Corp., Class A | | | 351,881 | |

| | 4,555 | | | Fox Corp., Class B | | | 146,899 | |

| | 8,135 | | | Frontier Communications Parent, Inc.* | | | 222,574 | |

| | 2,602 | | | IAC, Inc.* | | | 135,148 | |

| | 12,864 | | | Interpublic Group of Cos., Inc. (The) | | | 457,186 | |

| | 3,753 | | | Iridium Communications, Inc.* | | | 230,322 | |

| | 533 | | | Liberty Broadband Corp., Class A* | | | 46,227 | |

| | 3,998 | | | Liberty Broadband Corp., Class C* | | | 346,507 | |

| | 785 | | | Liberty Media Corp.-Liberty Formula One, Class A* | | | 47,697 | |

| | 6,453 | | | Liberty Media Corp.-Liberty Formula One, Class C* | | | 437,965 | |

| | 2,530 | | | Liberty Media Corp.-Liberty SiriusXM, Class A* | | | 81,947 | |

| | 5,014 | | | Liberty Media Corp.-Liberty SiriusXM, Class C* | | | 161,551 | |

| | 5,170 | | | Live Nation Entertainment, Inc.* | | | 372,550 | |

| | 34,218 | | | Lumen Technologies, Inc. | | | 116,341 | |

| | 9,290 | | | Match Group, Inc.* | | | 384,792 | |

| | 74,990 | | | Meta Platforms, Inc., Class A* | | | 13,118,751 | |

| | 14,642 | | | Netflix, Inc.* | | | 4,716,627 | |

| | 5,241 | | | New York Times Co. (The), Class A | | | 201,778 | |

| | 12,675 | | | News Corp., Class A | | | 217,376 | |

| | 3,853 | | | News Corp., Class B | | | 66,503 | |

| | 1,200 | | | Nexstar Media Group, Inc. | | | 223,080 | |

| | 6,740 | | | Omnicom Group, Inc. | | | 610,442 | |

| | 305 | | | Paramount Global, Class A(a) | | | 7,497 | |

| | 19,361 | | | Paramount Global, Class B | | | 414,713 | |

| | 19,329 | | | Pinterest, Inc., Class A* | | | 485,351 | |

| | 4,108 | | | Playtika Holding Corp.* | | | 39,437 | |

| | 11,466 | | | ROBLOX Corp., Class A* | | | 420,114 | |

| | 4,056 | | | Roku, Inc.* | | | 262,383 | |

| | 22,472 | | | Sirius XM Holdings, Inc.(a) | | | 98,652 | |

| | 33,406 | | | Snap, Inc., Class A* | | | 339,071 | |

| | 3,974 | | | Spotify Technology SA* | | | 462,176 | |

| | 5,522 | | | Take-Two Interactive Software, Inc.* | | | 604,935 | |

| | 20,724 | | | T-Mobile US, Inc.* | | | 2,946,538 | |

| | 14,756 | | | Trade Desk, Inc. (The), Class A* | | | 825,746 | |

| | 140,332 | | | Verizon Communications, Inc. | | | 5,446,285 | |

| | 60,919 | | | Walt Disney Co. (The)* | | | 6,068,142 | |

| | 73,863 | | | Warner Bros Discovery, Inc.* | | | 1,153,740 | |

| | 3,936 | | | Warner Music Group Corp., Class A | | | 124,220 | |

| | 1,421 | | | World Wrestling Entertainment, Inc., Class A | | | 119,364 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Communication Services – (continued) | |

| | 1,513 | | | Ziff Davis, Inc.* | | | 119,497 | |

| | 9,779 | | | ZoomInfo Technologies, Inc.* | | | 236,358 | |

| | | | | | | | |

| | | | | | | 90,926,214 | |

| | |

| Consumer Discretionary – 11.0% | |

| | 10,761 | | | ADT, Inc. | | | 81,138 | |

| | 1,970 | | | Advance Auto Parts, Inc. | | | 285,571 | |

| | 12,475 | | | Airbnb, Inc., Class A* | | | 1,537,918 | |

| | 297,367 | | | Amazon.com, Inc.* | | | 28,020,892 | |

| | 9,004 | | | Aptiv PLC* | | | 1,046,985 | |

| | 8,507 | | | Aramark | | | 313,058 | |

| | 2,793 | | | Autoliv, Inc. (Sweden) | | | 258,576 | |

| | 1,358 | | | AutoNation, Inc.* | | | 185,381 | |

| | 632 | | | AutoZone, Inc.* | | | 1,571,493 | |

| | 7,423 | | | Bath & Body Works, Inc. | | | 303,378 | |

| | 6,576 | | | Best Buy Co., Inc. | | | 546,531 | |

| | 1,292 | | | Booking Holdings, Inc.* | | | 3,261,008 | |

| | 7,782 | | | BorgWarner, Inc. | | | 391,279 | |

| | 2,409 | | | Boyd Gaming Corp. | | | 156,898 | |

| | 1,908 | | | Bright Horizons Family Solutions, Inc.* | | | 150,427 | |

| | 2,401 | | | Brunswick Corp. | | | 209,895 | |

| | 2,169 | | | Burlington Stores, Inc.* | | | 464,708 | |

| | 6,851 | | | Caesars Entertainment, Inc.* | | | 347,757 | |

| | 4,225 | | | Capri Holdings Ltd.* | | | 209,433 | |

| | 5,260 | | | CarMax, Inc.* | | | 363,150 | |

| | 33,012 | | | Carnival Corp.* | | | 350,587 | |

| | 3,007 | | | Chewy, Inc., Class A* | | | 121,934 | |

| | 919 | | | Chipotle Mexican Grill, Inc.* | | | 1,370,303 | |

| | 1,096 | | | Choice Hotels International, Inc. | | | 129,723 | |

| | 1,114 | | | Churchill Downs, Inc. | | | 273,799 | |

| | 1,080 | | | Columbia Sportswear Co. | | | 94,176 | |

| | 30,162 | | | Coupang, Inc. (South Korea) * | | | 467,813 | |

| | 1,983 | | | Crocs, Inc.* | | | 241,351 | |

| | 4,075 | | | Darden Restaurants, Inc. | | | 582,684 | |

| | 873 | | | Deckers Outdoor Corp.* | | | 363,474 | |

| | 1,914 | | | Dick’s Sporting Goods, Inc. | | | 246,198 | |

| | 128 | | | Dillard’s, Inc., Class A | | | 45,620 | |

| | 7,456 | | | Dollar General Corp. | | | 1,612,733 | |

| | 6,912 | | | Dollar Tree, Inc.* | | | 1,004,175 | |

| | 1,176 | | | Domino’s Pizza, Inc. | | | 345,756 | |

| | 8,772 | | | DoorDash, Inc., Class A* | | | 479,478 | |

| | 10,610 | | | D.R. Horton, Inc. | | | 981,213 | |

| | 12,642 | | | DraftKings, Inc., Class A* | | | 238,428 | |

| | 1,350 | | | Dutch Bros, Inc., Class A*(a) | | | 45,022 | |

| | 18,100 | | | eBay, Inc. | | | 830,790 | |

| | 4,171 | | | Etsy, Inc.* | | | 506,401 | |

| | 5,007 | | | Expedia Group, Inc.* | | | 545,613 | |

| | 1,811 | | | Five Below, Inc.* | | | 369,987 | |

| | 3,319 | | | Floor & Decor Holdings, Inc., Class A* | | | 304,717 | |

| | 131,775 | | | Ford Motor Co. | | | 1,590,524 | |

| | 1,407 | | | Fox Factory Holding Corp.* | | | 165,322 | |

| | 8,673 | | | GameStop Corp., Class A*(a) | | | 166,782 | |

| | 7,726 | | | Gap, Inc. (The) | | | 100,515 | |

| | 5,122 | | | Garmin Ltd. | | | 502,622 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 5 |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

Schedule of Investments (continued)

February 28, 2023 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Consumer Discretionary – (continued) | |

| | 45,730 | | | General Motors Co. | | $ | 1,771,580 | |

| | 7,825 | | | Gentex Corp. | | | 223,404 | |

| | 4,636 | | | Genuine Parts Co. | | | 819,923 | |

| | 5,144 | | | H&R Block, Inc. | | | 189,299 | |

| | 4,437 | | | Harley-Davidson, Inc. | | | 210,979 | |

| | 4,335 | | | Hasbro, Inc. | | | 238,468 | |

| | 8,870 | | | Hilton Worldwide Holdings, Inc. | | | 1,281,804 | |

| | 34,041 | | | Home Depot, Inc. (The) | | | 10,094,518 | |

| | 1,554 | | | Hyatt Hotels Corp., Class A* | | | 180,637 | |

| | 11,036 | | | Las Vegas Sands Corp.* | | | 634,239 | |

| | 1,971 | | | Lear Corp. | | | 275,250 | |

| | 4,327 | | | Leggett & Platt, Inc. | | | 149,238 | |

| | 8,350 | | | Lennar Corp., Class A | | | 807,779 | |

| | 486 | | | Lennar Corp., Class B | | | 39,687 | |

| | 2,910 | | | Levi Strauss & Co., Class A | | | 52,205 | |

| | 3,093 | | | Light & Wonder, Inc.* | | | 193,653 | |

| | 893 | | | Lithia Motors, Inc. | | | 227,876 | |

| | 8,671 | | | LKQ Corp. | | | 496,762 | |

| | 20,109 | | | Lowe’s Cos., Inc. | | | 4,137,427 | |

| | 17,129 | | | Lucid Group, Inc.*(a) | | | 156,388 | |

| | 4,078 | | | Lululemon Athletica, Inc.* | | | 1,260,918 | |

| | 8,950 | | | Macy’s, Inc. | | | 183,117 | |

| | 9,295 | | | Marriott International, Inc., Class A | | | 1,573,086 | |

| | 1,176 | | | Marriott Vacations Worldwide Corp. | | | 179,916 | |

| | 11,780 | | | Mattel, Inc.* | | | 211,922 | |

| | 24,470 | | | McDonald’s Corp. | | | 6,457,878 | |

| | 1,607 | | | MercadoLibre, Inc. (Brazil) * | | | 1,960,540 | |

| | 10,248 | | | MGM Resorts International | | | 440,766 | |

| | 1,771 | | | Mohawk Industries, Inc.* | | | 182,147 | |

| | 696 | | | Murphy USA, Inc. | | | 177,543 | |

| | 12,651 | | | Newell Brands, Inc. | | | 185,843 | |

| | 41,501 | | | NIKE, Inc., Class B | | | 4,929,904 | |

| | 13,956 | | | Norwegian Cruise Line Holdings Ltd.* | | | 206,828 | |

| | 100 | | | NVR, Inc.* | | | 517,362 | |

| | 2,070 | | | O’Reilly Automotive, Inc.* | | | 1,718,307 | |

| | 5,087 | | | Penn Entertainment, Inc.* | | | 155,306 | |

| | 757 | | | Penske Automotive Group, Inc. | | | 109,122 | |

| | 2,780 | | | Planet Fitness, Inc., Class A* | | | 225,319 | |

| | 1,818 | | | Polaris, Inc. | | | 206,797 | |

| | 1,265 | | | Pool Corp. | | | 451,428 | |

| | 7,565 | | | PulteGroup, Inc. | | | 413,579 | |

| | 2,088 | | | PVH Corp. | | | 167,541 | |

| | 1,245 | | | Ralph Lauren Corp. | | | 147,147 | |

| | 595 | | | RH* | | | 177,923 | |

| | 17,288 | | | Rivian Automotive, Inc., Class A* | | | 333,658 | |

| | 11,281 | | | Ross Stores, Inc. | | | 1,247,002 | |

| | 7,312 | | | Royal Caribbean Cruises Ltd.* | | | 516,520 | |

| | 4,957 | | | Service Corp. International | | | 334,746 | |

| | 4,399 | | | Skechers USA, Inc., Class A* | | | 195,799 | |

| | 37,561 | | | Starbucks Corp. | | | 3,834,602 | |

| | 8,011 | | | Tapestry, Inc. | | | 348,559 | |

| | 15,341 | | | Target Corp. | | | 2,584,958 | |

| | 5,559 | | | Tempur Sealy International, Inc. | | | 237,592 | |

| | 89,785 | | | Tesla, Inc.* | | | 18,469,672 | |

| | 2,225 | | | Texas Roadhouse, Inc. | | | 225,927 | |

| | 1,700 | | | Thor Industries, Inc. | | | 154,683 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Consumer Discretionary – (continued) | |

| | 35,992 | | | TJX Cos., Inc. (The) | | | 2,756,987 | |

| | 3,434 | | | Toll Brothers, Inc. | | | 205,834 | |

| | 1,062 | | | TopBuild Corp.* | | | 220,461 | |

| | 3,681 | | | Tractor Supply Co. | | | 858,630 | |

| | 1,674 | | | Ulta Beauty, Inc.* | | | 868,471 | |

| | 6,282 | | | Under Armour, Inc., Class A* | | | 62,380 | |

| | 6,376 | | | Under Armour, Inc., Class C* | | | 56,109 | |

| | 1,334 | | | Vail Resorts, Inc. | | | 311,476 | |

| | 11,641 | | | VF Corp. | | | 288,930 | |

| | 2,522 | | | Wayfair, Inc., Class A* | | | 102,116 | |

| | 5,672 | | | Wendy’s Co. (The) | | | 124,557 | |

| | 1,809 | | | Whirlpool Corp. | | | 249,606 | |

| | 2,197 | | | Williams-Sonoma, Inc. | | | 274,449 | |

| | 2,900 | | | Wyndham Hotels & Resorts, Inc. | | | 223,358 | |

| | 3,197 | | | Wynn Resorts Ltd.* | | | 346,459 | |

| | 13,485 | | | Yum China Holdings, Inc. (China) | | | 791,974 | |

| | 9,406 | | | Yum! Brands, Inc. | | | 1,196,067 | |

| | | | | | | | |

| | | | | | | 135,626,153 | |

| | |

| Consumer Staples – 6.3% | |

| | 4,427 | | | Albertsons Cos., Inc., Class A | | | 88,009 | |

| | 59,829 | | | Altria Group, Inc. | | | 2,777,860 | |

| | 18,244 | | | Archer-Daniels-Midland Co. | | | 1,452,222 | |

| | 4,452 | | | BJ’s Wholesale Club Holdings, Inc.* | | | 319,654 | |

| | 312 | | | Boston Beer Co., Inc. (The), Class A* | | | 101,026 | |

| | 1,630 | | | Brown-Forman Corp., Class A | | | 105,820 | |

| | 10,199 | | | Brown-Forman Corp., Class B | | | 661,609 | |

| | 4,928 | | | Bunge Ltd. | | | 470,624 | |

| | 6,629 | | | Campbell Soup Co. | | | 348,155 | |

| | 1,241 | | | Casey’s General Stores, Inc. | | | 258,066 | |

| | 1,239 | | | Celsius Holdings, Inc.* | | | 112,501 | |

| | 8,136 | | | Church & Dwight Co., Inc. | | | 681,634 | |

| | 4,113 | | | Clorox Co. (The) | | | 639,325 | |

| | 129,608 | | | Coca-Cola Co. (The) | | | 7,712,972 | |

| | 156 | | | Coca-Cola Consolidated, Inc. | | | 86,869 | |

| | 27,857 | | | Colgate-Palmolive Co. | | | 2,041,918 | |

| | 15,941 | | | Conagra Brands, Inc. | | | 580,412 | |

| | 5,519 | | | Constellation Brands, Inc., Class A | | | 1,234,600 | |

| | 14,799 | | | Costco Wholesale Corp. | | | 7,165,380 | |

| | 11,962 | | | Coty, Inc., Class A* | | | 135,171 | |

| | 5,298 | | | Darling Ingredients, Inc.* | | | 335,204 | |

| | 7,101 | | | Estee Lauder Cos., Inc. (The), Class A | | | 1,725,898 | |

| | 6,543 | | | Flowers Foods, Inc. | | | 182,419 | |

| | 19,651 | | | General Mills, Inc. | | | 1,562,451 | |

| | 4,900 | | | Hershey Co. (The) | | | 1,167,768 | |

| | 9,530 | | | Hormel Foods Corp. | | | 422,941 | |

| | 2,110 | | | Ingredion, Inc. | | | 209,734 | |

| | 3,385 | | | J M Smucker Co. (The) | | | 500,608 | |

| | 8,719 | | | Kellogg Co. | | | 574,931 | |

| | 29,365 | | | Keurig Dr Pepper, Inc. | | | 1,014,561 | |

| | 11,262 | | | Kimberly-Clark Corp. | | | 1,408,313 | |

| | 26,028 | | | Kraft Heinz Co. (The) | | | 1,013,530 | |

| | 22,060 | | | Kroger Co. (The) | | | 951,668 | |

| | 4,769 | | | Lamb Weston Holdings, Inc. | | | 479,952 | |

| | 649 | | | Lancaster Colony Corp. | | | 124,595 | |

| | 8,307 | | | McCormick & Co., Inc. | | | 617,376 | |

| | |

| | |

| 6 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Consumer Staples – (continued) | |

| | 5,877 | | | Molson Coors Beverage Co., Class B | | $ | 312,598 | |

| | 45,503 | | | Mondelez International, Inc., Class A | | | 2,965,886 | |

| | 12,363 | | | Monster Beverage Corp.* | | | 1,258,059 | |

| | 2,870 | | | Olaplex Holdings, Inc.* | | | 14,120 | |

| | 45,967 | | | PepsiCo, Inc. | | | 7,976,654 | |

| | 5,124 | | | Performance Food Group Co.* | | | 289,967 | |

| | 51,728 | | | Philip Morris International, Inc. | | | 5,033,134 | |

| | 1,359 | | | Pilgrim’s Pride Corp.* | | | 31,787 | |

| | 1,757 | | | Post Holdings, Inc.* | | | 158,060 | |

| | 79,116 | | | Procter & Gamble Co. (The) | | | 10,883,197 | |

| | 1,811 | | | Reynolds Consumer Products, Inc. | | | 49,694 | |

| | 16,777 | | | Sysco Corp. | | | 1,251,061 | |

| | 9,468 | | | Tyson Foods, Inc., Class A | | | 560,884 | |

| | 6,817 | | | US Foods Holding Corp.* | | | 255,842 | |

| | 23,785 | | | Walgreens Boots Alliance, Inc. | | | 845,081 | |

| | 46,893 | | | Walmart, Inc. | | | 6,664,902 | |

| | | | | | | | |

| | | | | | | 77,816,702 | |

| | |

| Energy – 4.8% | |

| | 10,630 | | | Antero Midstream Corp. | | | 112,040 | |

| | 8,808 | | | Antero Resources Corp.* | | | 230,770 | |

| | 10,708 | | | APA Corp. | | | 410,973 | |

| | 33,288 | | | Baker Hughes Co. | | | 1,018,613 | |

| | 6,603 | | | ChampionX Corp. | | | 201,854 | |

| | 8,243 | | | Cheniere Energy, Inc. | | | 1,296,954 | |

| | 4,267 | | | Chesapeake Energy Corp. | | | 344,816 | |

| | 63,348 | | | Chevron Corp. | | | 10,184,458 | |

| | 1,312 | | | Chord Energy Corp. | | | 176,621 | |

| | 2,430 | | | Civitas Resources, Inc. | | | 170,513 | |

| | 41,582 | | | ConocoPhillips | | | 4,297,500 | |

| | 25,522 | | | Coterra Energy, Inc. | | | 637,284 | |

| | 21,675 | | | Devon Energy Corp. | | | 1,168,716 | |

| | 5,851 | | | Diamondback Energy, Inc. | | | 822,534 | |

| | 3,232 | | | DT Midstream, Inc. | | | 162,246 | |

| | 8,177 | | | EnLink Midstream LLC* | | | 92,073 | |

| | 19,567 | | | EOG Resources, Inc. | | | 2,211,462 | |

| | 11,124 | | | EQT Corp. | | | 369,094 | |

| | 137,094 | | | Exxon Mobil Corp. | | | 15,068,002 | |

| | 27,997 | | | Halliburton Co. | | | 1,014,331 | |

| | 3,133 | | | Helmerich & Payne, Inc. | | | 131,837 | |

| | 9,284 | | | Hess Corp. | | | 1,250,555 | |

| | 1,430 | | | Hess Midstream LP, Class A(a) | | | 39,211 | |

| | 4,976 | | | HF Sinclair Corp. | | | 247,407 | |

| | 65,657 | | | Kinder Morgan, Inc. | | | 1,120,108 | |

| | 5,659 | | | Magnolia Oil & Gas Corp., Class A | | | 123,649 | |

| | 21,159 | | | Marathon Oil Corp. | | | 532,149 | |

| | 15,605 | | | Marathon Petroleum Corp. | | | 1,928,778 | |

| | 3,685 | | | Matador Resources Co. | | | 198,216 | |

| | 4,936 | | | Murphy Oil Corp. | | | 192,603 | |

| | 1,956 | | | New Fortress Energy, Inc. | | | 64,528 | |

| | 3,573 | | | Noble Corp. PLC* | | | 148,958 | |

| | 13,035 | | | NOV, Inc. | | | 285,206 | |

| | 30,290 | | | Occidental Petroleum Corp. | | | 1,773,782 | |

| | 14,840 | | | ONEOK, Inc. | | | 971,278 | |

| | 8,265 | | | Ovintiv, Inc. | | | 353,494 | |

| | 4,209 | | | PBF Energy, Inc., Class A | | | 183,975 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Energy – (continued) | |

| | 3,041 | | | PDC Energy, Inc. | | | 204,082 | |

| | 15,748 | | | Phillips 66 | | | 1,615,115 | |

| | 7,546 | | | Pioneer Natural Resources Co. | | | 1,512,294 | |

| | 6,175 | | | Plains GP Holdings LP, Class A* | | | 85,894 | |

| | 7,813 | | | Range Resources Corp. | | | 210,482 | |

| | 47,309 | | | Schlumberger NV | | | 2,517,312 | |

| | 4,034 | | | SM Energy Co. | | | 119,043 | |

| | 36,694 | | | Southwestern Energy Co.* | | | 194,478 | |

| | 7,427 | | | Targa Resources Corp. | | | 550,341 | |

| | 202 | | | Texas Pacific Land Corp. | | | 359,598 | |

| | 12,834 | | | Valero Energy Corp. | | | 1,690,623 | |

| | 2,477 | | | Viper Energy Partners LP | | | 70,917 | |

| | 633 | | | Vitesse Energy, Inc.* | | | 11,008 | |

| | 40,597 | | | Williams Cos., Inc. (The) | | | 1,221,970 | |

| | | | | | | | |

| | | | | | | 59,899,745 | |

| | |

| Financials – 11.5% | |

| | 1,245 | | | Affiliated Managers Group, Inc. | | | 198,465 | |

| | 18,863 | | | Aflac, Inc. | | | 1,285,513 | |

| | 18,946 | | | AGNC Investment Corp. REIT | | | 205,943 | |

| | 8,690 | | | Allstate Corp. (The) | | | 1,119,098 | |

| | 8,909 | | | Ally Financial, Inc. | | | 267,715 | |

| | 18,283 | | | American Express Co. | | | 3,181,059 | |

| | 2,398 | | | American Financial Group, Inc. | | | 321,596 | |

| | 24,781 | | | American International Group, Inc. | | | 1,514,367 | |

| | 3,543 | | | Ameriprise Financial, Inc. | | | 1,214,788 | |

| | 15,587 | | | Annaly Capital Management, Inc. REIT | | | 322,339 | |

| | 6,573 | | | Aon PLC, Class A | | | 1,998,521 | |

| | 12,929 | | | Apollo Global Management, Inc. | | | 916,666 | |

| | 11,943 | | | Arch Capital Group Ltd.* | | | 836,010 | |

| | 5,128 | | | Ares Management Corp., Class A | | | 413,471 | |

| | 6,968 | | | Arthur J Gallagher & Co. | | | 1,305,455 | |

| | 1,746 | | | Assurant, Inc. | | | 222,423 | |

| | 233,574 | | | Bank of America Corp. | | | 8,011,588 | |

| | 24,700 | | | Bank of New York Mellon Corp. (The) | | | 1,256,736 | |

| | 3,813 | | | Bank OZK | | | 175,512 | |

| | 43,328 | | | Berkshire Hathaway, Inc., Class B* | | | 13,222,839 | |

| | 4,645 | | | BlackRock, Inc. | | | 3,202,402 | |

| | 23,211 | | | Blackstone, Inc. | | | 2,107,559 | |

| | 14,863 | | | Blue Owl Capital, Inc. | | | 183,409 | |

| | 835 | | | BOK Financial Corp. | | | 87,408 | |

| | 7,806 | | | Brown & Brown, Inc. | | | 437,682 | |

| | 12,578 | | | Capital One Financial Corp. | | | 1,372,008 | |

| | 8,521 | | | Carlyle Group, Inc. (The) | | | 293,122 | |

| | 3,529 | | | Cboe Global Markets, Inc. | | | 445,254 | |

| | 50,821 | | | Charles Schwab Corp. (The) | | | 3,959,972 | |

| | 12,881 | | | Chubb Ltd. | | | 2,718,149 | |

| | 5,127 | | | Cincinnati Financial Corp. | | | 618,829 | |

| | 64,604 | | | Citigroup, Inc. | | | 3,274,777 | |

| | 16,333 | | | Citizens Financial Group, Inc. | | | 682,066 | |

| | 11,954 | | | CME Group, Inc. | | | 2,215,793 | |

| | 855 | | | CNA Financial Corp. | | | 37,432 | |

| | 4,810 | | | Coinbase Global, Inc., Class A*(a) | | | 311,832 | |

| | 4,343 | | | Comerica, Inc. | | | 304,444 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

Schedule of Investments (continued)

February 28, 2023 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Financials – (continued) | |

| | 3,818 | | | Commerce Bancshares, Inc. | | $ | 252,561 | |

| | 2,606 | | | Corebridge Financial, Inc. | | | 52,693 | |

| | 207 | | | Credit Acceptance Corp.*(a) | | | 91,978 | |

| | 1,968 | | | Cullen/Frost Bankers, Inc. | | | 259,422 | |

| | 9,006 | | | Discover Financial Services | | | 1,008,672 | |

| | 4,674 | | | East West Bancorp, Inc. | | | 356,206 | |

| | 12,318 | | | Equitable Holdings, Inc. | | | 387,032 | |

| | 840 | | | Erie Indemnity Co., Class A | | | 197,728 | |

| | 3,494 | | | Essent Group Ltd. | | | 150,067 | |

| | 1,290 | | | Everest Re Group Ltd. | | | 495,321 | |

| | 1,272 | | | FactSet Research Systems, Inc. | | | 527,308 | |

| | 8,608 | | | Fidelity National Financial, Inc. | | | 343,115 | |

| | 22,784 | | | Fifth Third Bancorp | | | 827,059 | |

| | 3,304 | | | First American Financial Corp. | | | 187,601 | |

| | 346 | | | First Citizens BancShares, Inc., Class A | | | 253,881 | |

| | 4,573 | | | First Financial Bankshares, Inc. | | | 167,738 | |

| | 17,642 | | | First Horizon Corp. | | | 436,992 | |

| | 2,706 | | | First Interstate BancSystem, Inc., Class A | | | 96,171 | |

| | 5,960 | | | First Republic Bank | | | 733,140 | |

| | 9,639 | | | Franklin Resources, Inc. | | | 284,061 | |

| | 3,684 | | | Glacier Bancorp, Inc. | | | 174,548 | |

| | 2,965 | | | Globe Life, Inc. | | | 360,811 | |

| | 11,263 | | | Goldman Sachs Group, Inc. (The)(b) | | | 3,960,634 | |

| | 1,069 | | | Hanover Insurance Group, Inc. (The) | | | 149,104 | |

| | 10,584 | | | Hartford Financial Services Group, Inc. (The) | | | 828,516 | |

| | 1,664 | | | Houlihan Lokey, Inc. | | | 159,245 | |

| | 47,410 | | | Huntington Bancshares, Inc. | | | 726,321 | |

| | 3,302 | | | Interactive Brokers Group, Inc., Class A | | | 284,335 | |

| | 18,486 | | | Intercontinental Exchange, Inc. | | | 1,881,875 | |

| | 14,954 | | | Invesco Ltd. | | | 264,088 | |

| | 4,419 | | | Janus Henderson Group PLC | | | 121,346 | |

| | 5,380 | | | Jefferies Financial Group, Inc. | | | 203,310 | |

| | 96,924 | | | JPMorgan Chase & Co. | | | 13,894,055 | |

| | 31,053 | | | KeyCorp | | | 567,959 | |

| | 729 | | | Kinsale Capital Group, Inc. | | | 232,332 | |

| | 21,612 | | | KKR & Co., Inc. | | | 1,217,836 | |

| | 3,624 | | | Lazard Ltd., Class A | | | 135,393 | |

| | 5,107 | | | Lincoln National Corp. | | | 161,994 | |

| | 6,623 | | | Loews Corp. | | | 404,599 | |

| | 2,579 | | | LPL Financial Holdings, Inc. | | | 643,615 | |

| | 5,677 | | | M&T Bank Corp. | | | 881,581 | |

| | 423 | | | Markel Corp.* | | | 562,531 | |

| | 1,226 | | | MarketAxess Holdings, Inc. | | | 418,618 | |

| | 16,525 | | | Marsh & McLennan Cos., Inc. | | | 2,679,364 | |

| | 19,523 | | | MetLife, Inc. | | | 1,400,385 | |

| | 5,259 | | | Moody’s Corp. | | | 1,525,899 | |

| | 43,234 | | | Morgan Stanley | | | 4,172,081 | |

| | 853 | | | Morningstar, Inc. | | | 176,852 | |

| | 2,590 | | | MSCI, Inc. | | | 1,352,368 | |

| | 11,378 | | | Nasdaq, Inc. | | | 637,851 | |

| | 22,089 | | | New York Community Bancorp, Inc. | | | 196,150 | |

| | 6,655 | | | Northern Trust Corp. | | | 634,022 | |

| | 9,678 | | | Old National Bancorp | | | 171,010 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Financials – (continued) | |

| | 9,392 | | | Old Republic International Corp. | | | 247,667 | |

| | 3,720 | | | OneMain Holdings, Inc. | | | 160,295 | |

| | 2,474 | | | Pinnacle Financial Partners, Inc. | | | 183,299 | |

| | 13,392 | | | PNC Financial Services Group, Inc. (The) | | | 2,114,865 | |

| | 2,383 | | | Popular, Inc. (Puerto Rico) | | | 170,146 | |

| | 1,225 | | | Primerica, Inc. | | | 235,127 | |

| | 8,125 | | | Principal Financial Group, Inc. | | | 727,675 | |

| | 19,497 | | | Progressive Corp. (The) | | | 2,798,209 | |

| | 2,920 | | | Prosperity Bancshares, Inc. | | | 214,591 | |

| | 12,275 | | | Prudential Financial, Inc. | | | 1,227,500 | |

| | 6,486 | | | Raymond James Financial, Inc. | | | 703,472 | |

| | 31,068 | | | Regions Financial Corp. | | | 724,506 | |

| | 2,193 | | | Reinsurance Group of America, Inc. | | | 316,823 | |

| | 1,435 | | | RenaissanceRe Holdings Ltd. (Bermuda) | | | 308,382 | |

| | 15,728 | | | Rithm Capital Corp. REIT | | | 143,125 | |

| | 1,451 | | | RLI Corp. | | | 200,107 | |

| | 20,718 | | | Robinhood Markets, Inc., Class A* | | | 208,630 | |

| | 3,782 | | | Rocket Cos., Inc., Class A(a) | | | 29,727 | |

| | 2,808 | | | Ryan Specialty Holdings, Inc.* | | | 118,273 | |

| | 10,869 | | | S&P Global, Inc. | | | 3,708,503 | |

| | 4,033 | | | SEI Investments Co. | | | 242,988 | |

| | 1,969 | | | Selective Insurance Group, Inc. | | | 199,913 | |

| | 2,066 | | | Signature Bank | | | 237,693 | |

| | 8,274 | | | SLM Corp. | | | 118,980 | |

| | 25,273 | | | SoFi Technologies, Inc.* | | | 166,802 | |

| | 2,492 | | | SouthState Corp. | | | 201,055 | |

| | 9,736 | | | Starwood Property Trust, Inc. REIT | | | 186,542 | |

| | 11,522 | | | State Street Corp. | | | 1,021,771 | |

| | 3,354 | | | Stifel Financial Corp. | | | 224,148 | |

| | 1,954 | | | SVB Financial Group* | | | 562,967 | |

| | 14,973 | | | Synchrony Financial | | | 534,686 | |

| | 4,620 | | | Synovus Financial Corp. | | | 193,162 | |

| | 7,328 | | | T. Rowe Price Group, Inc. | | | 822,788 | |

| | 1,718 | | | TFS Financial Corp. | | | 24,894 | |

| | 2,053 | | | TPG, Inc. | | | 67,790 | |

| | 3,681 | | | Tradeweb Markets, Inc., Class A | | | 260,946 | |

| | 7,798 | | | Travelers Cos., Inc. (The) | | | 1,443,566 | |

| | 44,057 | | | Truist Financial Corp. | | | 2,068,476 | |

| | 4,402 | | | United Bankshares, Inc. | | | 179,470 | |

| | 5,808 | | | Unum Group | | | 258,746 | |

| | 44,765 | | | US Bancorp | | | 2,136,633 | |

| | 2,725 | | | UWM Holdings Corp.(a) | | | 11,609 | |

| | 14,270 | | | Valley National Bancorp | | | 165,247 | |

| | 3,166 | | | Virtu Financial, Inc., Class A | | | 58,191 | |

| | 3,216 | | | Voya Financial, Inc. | | | 239,560 | |

| | 6,685 | | | W R Berkley Corp. | | | 442,480 | |

| | 5,750 | | | Webster Financial Corp. | | | 305,440 | |

| | 127,224 | | | Wells Fargo & Co. | | | 5,950,266 | |

| | 3,547 | | | Western Alliance Bancorp | | | 263,329 | |

| | 3,587 | | | Willis Towers Watson PLC | | | 840,649 | |

| | 2,002 | | | Wintrust Financial Corp. | | | 184,444 | |

| | 4,924 | | | Zions Bancorp NA | | | 249,253 | |

| | | | | | | | |

| | | | | | | 142,937,022 | |

| | |

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Health Care – 14.1% | |

| | 2,956 | | | 10X Genomics, Inc., Class A* | | $ | 140,469 | |

| | 57,851 | | | Abbott Laboratories | | | 5,884,604 | |

| | 59,040 | | | AbbVie, Inc. | | | 9,086,256 | |

| | 2,985 | | | Acadia Healthcare Co., Inc.* | | | 216,442 | |

| | 9,861 | | | Agilent Technologies, Inc. | | | 1,399,966 | |

| | 7,092 | | | agilon health, Inc.* | | | 150,421 | |

| | 2,444 | | | Align Technology, Inc.* | | | 756,418 | |

| | 4,092 | | | Alnylam Pharmaceuticals, Inc.* | | | 783,413 | |

| | 5,714 | | | AmerisourceBergen Corp. | | | 888,870 | |

| | 17,799 | | | Amgen, Inc. | | | 4,123,316 | |

| | 3,129 | | | Apellis Pharmaceuticals, Inc.* | | | 204,887 | |

| | 3,363 | | | Arrowhead Pharmaceuticals, Inc.* | | | 108,625 | |

| | 21,556 | | | Avantor, Inc.* | | | 525,320 | |

| | 2,258 | | | Azenta, Inc.* | | | 99,104 | |

| | 1,304 | | | Bausch + Lomb Corp.*(a) | | | 22,742 | |

| | 16,811 | | | Baxter International, Inc. | | | 671,599 | |

| | 9,486 | | | Becton Dickinson and Co. | | | 2,224,941 | |

| | 4,781 | | | Biogen, Inc.* | | | 1,290,201 | |

| | 6,169 | | | BioMarin Pharmaceutical, Inc.* | | | 614,371 | |

| | 709 | | | Bio-Rad Laboratories, Inc., Class A* | | | 338,789 | |

| | 5,205 | | | Bio-Techne Corp. | | | 378,091 | |

| | 47,755 | | | Boston Scientific Corp.* | | | 2,231,114 | |

| | 71,011 | | | Bristol-Myers Squibb Co. | | | 4,896,919 | |

| | 3,362 | | | Bruker Corp. | | | 231,709 | |

| | 8,712 | | | Cardinal Health, Inc. | | | 659,585 | |

| | 5,693 | | | Catalent, Inc.* | | | 388,376 | |

| | 18,742 | | | Centene Corp.* | | | 1,281,953 | |

| | 1,681 | | | Charles River Laboratories International, Inc.* | | | 368,711 | |

| | 487 | | | Chemed Corp. | | | 254,009 | |

| | 10,180 | | | Cigna Group (The) | | | 2,973,578 | |

| | 1,641 | | | Cooper Cos., Inc. (The) | | | 536,558 | |

| | 43,788 | | | CVS Health Corp. | | | 3,658,049 | |

| | 22,133 | | | Danaher Corp. | | | 5,478,581 | |

| | 1,705 | | | DaVita, Inc.* | | | 140,253 | |

| | 7,116 | | | DENTSPLY SIRONA, Inc. | | | 270,906 | |

| | 12,824 | | | Dexcom, Inc.* | | | 1,423,592 | |

| | 3,082 | | | Doximity, Inc., Class A* | | | 103,648 | |

| | 20,486 | | | Edwards Lifesciences Corp.* | | | 1,647,894 | |

| | 15,776 | | | Elanco Animal Health, Inc.* | | | 180,951 | |

| | 7,959 | | | Elevance Health, Inc. | | | 3,738,103 | |

| | 29,367 | | | Eli Lilly & Co. | | | 9,139,598 | |

| | 3,256 | | | Encompass Health Corp. | | | 184,029 | |

| | 1,754 | | | Ensign Group, Inc. (The) | | | 156,948 | |

| | 5,422 | | | Envista Holdings Corp.* | | | 209,614 | |

| | 5,884 | | | Exact Sciences Corp.* | | | 366,750 | |

| | 10,537 | | | Exelixis, Inc.* | | | 179,972 | |

| | 12,097 | | | GE HealthCare Technologies, Inc.* | | | 919,372 | |

| | 41,896 | | | Gilead Sciences, Inc. | | | 3,373,885 | |

| | 2,560 | | | Globus Medical, Inc., Class A* | | | 149,350 | |

| | 4,472 | | | Halozyme Therapeutics, Inc.* | | | 214,611 | |

| | 7,033 | | | HCA Healthcare, Inc. | | | 1,712,184 | |

| | 2,766 | | | HealthEquity, Inc.* | | | 180,260 | |

| | 4,464 | | | Henry Schein, Inc.* | | | 349,576 | |

| | 8,112 | | | Hologic, Inc.* | | | 646,040 | |

| | 7,517 | | | Horizon Therapeutics PLC* | | | 823,036 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Health Care – (continued) | |

| | 4,179 | | | Humana, Inc. | | | 2,068,689 | |

| | 2,740 | | | IDEXX Laboratories, Inc.* | | | 1,296,678 | |

| | 5,244 | | | Illumina, Inc.* | | | 1,044,605 | |

| | 6,148 | | | Incyte Corp.* | | | 473,273 | |

| | 949 | | | Inspire Medical Systems, Inc.* | | | 246,674 | |

| | 2,309 | | | Insulet Corp.* | | | 638,115 | |

| | 2,425 | | | Integra LifeSciences Holdings Corp.* | | | 134,878 | |

| | 2,673 | | | Intellia Therapeutics, Inc.* | | | 107,374 | |

| | 2,889 | | | Intra-Cellular Therapies, Inc.* | | | 141,648 | |

| | 11,757 | | | Intuitive Surgical, Inc.* | | | 2,696,938 | |

| | 4,559 | | | Ionis Pharmaceuticals, Inc.* | | | 163,668 | |

| | 6,056 | | | IQVIA Holdings, Inc.* | | | 1,262,494 | |

| | 2,042 | | | Jazz Pharmaceuticals PLC* | | | 286,697 | |

| | 87,307 | | | Johnson & Johnson | | | 13,380,671 | |

| | 923 | | | Karuna Therapeutics, Inc.* | | | 184,065 | |

| | 2,955 | | | Laboratory Corp. of America Holdings | | | 707,309 | |

| | 2,245 | | | Lantheus Holdings, Inc.* | | | 166,040 | |

| | 3,642 | | | Maravai LifeSciences Holdings, Inc., Class A* | | | 53,719 | |

| | 1,633 | | | Masimo Corp.* | | | 273,217 | |

| | 4,627 | | | McKesson Corp. | | | 1,618,571 | |

| | 794 | | | Medpace Holdings, Inc.* | | | 153,941 | |

| | 44,413 | | | Medtronic PLC | | | 3,677,396 | |

| | 84,382 | | | Merck & Co., Inc. | | | 8,964,744 | |

| | 735 | | | Mettler-Toledo International, Inc.* | | | 1,053,777 | |

| | 11,168 | | | Moderna, Inc.* | | | 1,550,230 | |

| | 1,934 | | | Molina Healthcare, Inc.* | | | 532,488 | |

| | 3,381 | | | Natera, Inc.* | | | 164,148 | |

| | 3,177 | | | Neurocrine Biosciences, Inc.* | | | 327,549 | |

| | 3,460 | | | Novocure Ltd.* | | | 266,316 | |

| | 4,264 | | | Oak Street Health, Inc.* | | | 150,946 | |

| | 5,176 | | | Option Care Health, Inc.* | | | 158,748 | |

| | 8,496 | | | Organon & Co. | | | 208,067 | |

| | 1,199 | | | Penumbra, Inc.* | | | 311,728 | |

| | 4,208 | | | PerkinElmer, Inc. | | | 524,191 | |

| | 4,479 | | | Perrigo Co. PLC | | | 168,813 | |

| | 187,443 | | | Pfizer, Inc. | | | 7,604,562 | |

| | 7,560 | | | QIAGEN NV* | | | 347,382 | |

| | 3,777 | | | Quest Diagnostics, Inc. | | | 522,586 | |

| | 1,618 | | | QuidelOrtho Corp.* | | | 140,669 | |

| | 5,110 | | | R1 RCM, Inc.* | | | 72,562 | |

| | 3,483 | | | Regeneron Pharmaceuticals, Inc.* | | | 2,648,543 | |

| | 1,844 | | | Repligen Corp.* | | | 321,538 | |

| | 4,849 | | | ResMed, Inc. | | | 1,032,837 | |

| | 10,979 | | | Roivant Sciences Ltd.* | | | 88,820 | |

| | 12,469 | | | Royalty Pharma PLC, Class A | | | 447,014 | |

| | 2,797 | | | Sarepta Therapeutics, Inc.* | | | 341,598 | |

| | 4,583 | | | Seagen, Inc.* | | | 823,519 | |

| | 1,187 | | | Shockwave Medical, Inc.* | | | 225,815 | |

| | 2,427 | | | Signify Health, Inc., Class A* | | | 69,873 | |

| | 3,326 | | | STERIS PLC | | | 625,388 | |

| | 11,116 | | | Stryker Corp. | | | 2,922,174 | |

| | 3,413 | | | Syneos Health, Inc.* | | | 137,271 | |

| | 4,885 | | | Teladoc Health, Inc.* | | | 129,404 | |

| | 1,564 | | | Teleflex, Inc. | | | 372,592 | |

| | 3,554 | | | Tenet Healthcare Corp.* | | | 208,016 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

Schedule of Investments (continued)

February 28, 2023 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Health Care – (continued) | |

| | 13,088 | | | Thermo Fisher Scientific, Inc. | | $ | 7,090,555 | |

| | 1,498 | | | United Therapeutics Corp.* | | | 368,568 | |

| | 31,121 | | | UnitedHealth Group, Inc. | | | 14,811,729 | |

| | 2,045 | | | Universal Health Services, Inc., Class B | | | 273,151 | |

| | 4,673 | | | Veeva Systems, Inc., Class A* | | | 774,129 | |

| | 8,562 | | | Vertex Pharmaceuticals, Inc.* | | | 2,485,463 | |

| | 40,418 | | | Viatris, Inc. | | | 460,765 | |

| | 1,978 | | | Waters Corp.* | | | 614,940 | |

| | 2,461 | | | West Pharmaceutical Services, Inc. | | | 780,211 | |

| | 7,006 | | | Zimmer Biomet Holdings, Inc. | | | 867,833 | |

| | 15,566 | | | Zoetis, Inc. | | | 2,599,522 | |

| | | | | | | | |

| | | | | | | 174,345,993 | |

| | |

| Industrials – 9.3% | |

| | 18,458 | | | 3M Co. | | | 1,988,665 | |

| | 4,208 | | | A O Smith Corp. | | | 276,171 | |

| | 1,067 | | | Acuity Brands, Inc. | | | 206,955 | |

| | 2,519 | | | Advanced Drainage Systems, Inc. | | | 223,511 | |

| | 4,614 | | | AECOM | | | 398,465 | |

| | 2,064 | | | AGCO Corp. | | | 290,632 | |

| | 3,446 | | | Air Lease Corp. | | | 149,143 | |

| | 4,222 | | | Alaska Air Group, Inc.* | | | 201,938 | |

| | 2,919 | | | Allegion PLC | | | 329,000 | |

| | 21,424 | | | American Airlines Group, Inc.* | | | 342,356 | |

| | 7,632 | | | AMETEK, Inc. | | | 1,080,386 | |

| | 1,611 | | | ASGN, Inc.* | | | 143,057 | |

| | 729 | | | Avis Budget Group, Inc.* | | | 160,132 | |

| | 2,249 | | | Axon Enterprise, Inc.* | | | 450,497 | |

| | 19,894 | | | Boeing Co. (The)* | | | 4,009,636 | |

| | 4,337 | | | Booz Allen Hamilton Holding Corp. | | | 410,844 | |

| | 4,822 | | | Builders FirstSource, Inc.* | | | 408,809 | |

| | 3,036 | | | BWX Technologies, Inc. | | | 185,530 | |

| | 776 | | | CACI International, Inc., Class A* | | | 227,368 | |

| | 1,713 | | | Carlisle Cos., Inc. | | | 442,331 | |

| | 27,898 | | | Carrier Global Corp. | | | 1,256,247 | |

| | 17,371 | | | Caterpillar, Inc. | | | 4,161,223 | |

| | 3,852 | | | C.H. Robinson Worldwide, Inc. | | | 385,046 | |

| | 9,256 | | | ChargePoint Holdings, Inc.*(a) | | | 105,148 | |

| | 1,219 | | | Chart Industries, Inc.* | | | 162,736 | |

| | 2,872 | | | Cintas Corp. | | | 1,259,286 | |

| | 14,630 | | | Clarivate PLC* | | | 148,202 | |

| | 1,681 | | | Clean Harbors, Inc.* | | | 222,010 | |

| | 14,311 | | | Copart, Inc.* | | | 1,008,353 | |

| | 2,400 | | | Core & Main, Inc., Class A* | | | 55,944 | |

| | 13,448 | | | CoStar Group, Inc.* | | | 950,236 | |

| | 1,570 | | | Crane Holdings Co. | | | 188,055 | |

| | 70,069 | | | CSX Corp. | | | 2,136,404 | |

| | 4,694 | | | Cummins, Inc. | | | 1,141,018 | |

| | 1,274 | | | Curtiss-Wright Corp. | | | 222,682 | |

| | 9,159 | | | Deere & Co. | | | 3,839,819 | |

| | 21,359 | | | Delta Air Lines, Inc.* | | | 818,904 | |

| | 4,025 | | | Donaldson Co., Inc. | | | 254,581 | |

| | 4,668 | | | Dover Corp. | | | 699,733 | |

| | 8,719 | | | Dun & Bradstreet Holdings, Inc. | | | 104,715 | |

| | 13,237 | | | Eaton Corp. PLC | | | 2,315,548 | |

| | 1,566 | | | EMCOR Group, Inc. | | | 261,867 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Industrials – (continued) | |

| | 19,703 | | | Emerson Electric Co. | | | 1,629,635 | |

| | 4,074 | | | Equifax, Inc. | | | 825,107 | |

| | 4,008 | | | Evoqua Water Technologies Corp.* | | | 194,628 | |

| | 5,290 | | | Expeditors International of Washington, Inc. | | | 553,122 | |

| | 1,670 | | | Exponent, Inc. | | | 171,843 | |

| | 19,108 | | | Fastenal Co. | | | 985,208 | |

| | 7,765 | | | FedEx Corp. | | | 1,578,003 | |

| | 11,634 | | | Fortive Corp. | | | 775,522 | |

| | 4,258 | | | Fortune Brands Innovations, Inc. | | | 263,783 | |

| | 1,122 | | | FTI Consulting, Inc.* | | | 206,123 | |

| | 2,084 | | | Generac Holdings, Inc.* | | | 250,101 | |

| | 8,041 | | | General Dynamics Corp. | | | 1,832,624 | |

| | 36,160 | | | General Electric Co. | | | 3,063,114 | |

| | 5,507 | | | Graco, Inc. | | | 382,957 | |

| | 3,898 | | | GXO Logistics, Inc.* | | | 193,224 | |

| | 1,408 | | | HEICO Corp. | | | 233,123 | |

| | 2,471 | | | HEICO Corp., Class A | | | 321,601 | |

| | 4,962 | | | Hertz Global Holdings, Inc.* | | | 91,847 | |

| | 2,798 | | | Hexcel Corp. | | | 204,114 | |

| | 22,408 | | | Honeywell International, Inc. | | | 4,290,684 | |

| | 12,503 | | | Howmet Aerospace, Inc. | | | 527,377 | |

| | 1,786 | | | Hubbell, Inc. | | | 449,250 | |

| | 1,308 | | | Huntington Ingalls Industries, Inc. | | | 281,482 | |

| | 4,445 | | | IAA, Inc.* | | | 181,845 | |

| | 2,514 | | | IDEX Corp. | | | 565,600 | |

| | 9,008 | | | Illinois Tool Works, Inc. | | | 2,100,305 | |

| | 13,511 | | | Ingersoll Rand, Inc. | | | 784,584 | |

| | 2,747 | | | ITT, Inc. | | | 249,675 | |

| | 4,182 | | | Jacobs Solutions, Inc. | | | 499,749 | |

| | 2,742 | | | J.B. Hunt Transport Services, Inc. | | | 495,726 | |

| | 22,866 | | | Johnson Controls International PLC | | | 1,434,156 | |

| | 4,534 | | | KBR, Inc. | | | 249,869 | |

| | 5,020 | | | Knight-Swift Transportation Holdings, Inc. | | | 285,337 | |

| | 6,337 | | | L3Harris Technologies, Inc. | | | 1,338,311 | |

| | 1,189 | | | Landstar System, Inc. | | | 214,959 | |

| | 4,520 | | | Leidos Holdings, Inc. | | | 438,756 | |

| | 1,068 | | | Lennox International, Inc. | | | 272,158 | |

| | 1,903 | | | Lincoln Electric Holdings, Inc. | | | 319,571 | |

| | 8,753 | | | Lockheed Martin Corp. | | | 4,151,198 | |

| | 10,331 | | | Lyft, Inc., Class A* | | | 103,310 | |

| | 1,675 | | | ManpowerGroup, Inc. | | | 142,174 | |

| | 7,504 | | | Masco Corp. | | | 393,435 | |

| | 2,045 | | | MasTec, Inc.* | | | 199,837 | |

| | 6,728 | | | MDU Resources Group, Inc. | | | 214,287 | |

| | 1,780 | | | Middleby Corp. (The)* | | | 276,772 | |

| | 1,238 | | | MSA Safety, Inc. | | | 166,325 | |

| | 1,521 | | | MSC Industrial Direct Co., Inc., Class A | | | 128,555 | |

| | 1,702 | | | Nordson Corp. | | | 373,827 | |

| | 7,730 | | | Norfolk Southern Corp. | | | 1,737,859 | |

| | 4,627 | | | Northrop Grumman Corp. | | | 2,147,437 | |

| | 5,533 | | | nVent Electric PLC | | | 253,633 | |

| | 3,335 | | | Old Dominion Freight Line, Inc. | | | 1,131,432 | |

| | 2,165 | | | Oshkosh Corp. | | | 193,096 | |

| | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Industrials – (continued) | |

| | 13,918 | | | Otis Worldwide Corp. | | $ | 1,177,741 | |

| | 3,102 | | | Owens Corning | | | 303,345 | |

| | 15,891 | | | PACCAR, Inc. | | | 1,147,330 | |

| | 4,270 | | | Parker-Hannifin Corp. | | | 1,502,399 | |

| | 5,466 | | | Pentair PLC | | | 305,768 | |

| | 19,169 | | | Plug Power, Inc.* | | | 285,043 | |

| | 4,714 | | | Quanta Services, Inc. | | | 760,840 | |

| | 49,099 | | | Raytheon Technologies Corp. | | | 4,816,121 | |

| | 953 | | | RBC Bearings, Inc.* | | | 219,009 | |

| | 2,200 | | | Regal Rexnord Corp. | | | 346,808 | |

| | 6,881 | | | Republic Services, Inc. | | | 887,167 | |

| | 3,527 | | | Robert Half International, Inc. | | | 284,347 | |

| | 3,827 | | | Rockwell Automation, Inc. | | | 1,128,697 | |

| | 8,620 | | | Rollins, Inc. | | | 303,424 | |

| | 882 | | | Saia, Inc.* | | | 238,907 | |

| | 1,807 | | | Science Applications International Corp. | | | 192,698 | |

| | 5,078 | | | Sensata Technologies Holding PLC | | | 256,845 | |

| | 1,486 | | | SiteOne Landscape Supply, Inc.* | | | 220,433 | |

| | 1,746 | | | Snap-on, Inc. | | | 434,195 | |

| | 19,764 | | | Southwest Airlines Co. | | | 663,675 | |

| | 5,079 | | | Stanley Black & Decker, Inc. | | | 434,813 | |

| | 3,037 | | | Stericycle, Inc.* | | | 144,804 | |

| | 6,905 | | | Sunrun, Inc.* | | | 165,996 | |

| | 1,753 | | | Tetra Tech, Inc. | | | 239,968 | |

| | 6,939 | | | Textron, Inc. | | | 503,286 | |

| | 2,170 | | | Timken Co. (The) | | | 185,427 | |

| | 3,449 | | | Toro Co. (The) | | | 380,908 | |

| | 7,658 | | | Trane Technologies PLC | | | 1,416,500 | |

| | 1,736 | | | TransDigm Group, Inc. | | | 1,291,358 | |

| | 6,413 | | | TransUnion | | | 419,603 | |

| | 3,649 | | | Trex Co., Inc.* | | | 186,573 | |

| | 1,228 | | | TriNet Group, Inc.* | | | 101,764 | |

| | 63,949 | | | Uber Technologies, Inc.* | | | 2,126,944 | |

| | 1,985 | | | UFP Industries, Inc. | | | 169,777 | |

| | 298 | | | U-Haul Holding Co. | | | 19,135 | |

| | 3,347 | | | U-Haul Holding Co. | | | 186,194 | |

| | 20,500 | | | Union Pacific Corp. | | | 4,249,240 | |

| | 10,886 | | | United Airlines Holdings, Inc.* | | | 565,637 | |

| | 24,381 | | | United Parcel Service, Inc., Class B | | | 4,449,289 | |

| | 2,303 | | | United Rentals, Inc. | | | 1,079,025 | |

| | 5,403 | | | Univar Solutions, Inc.* | | | 187,754 | |

| | 696 | | | Valmont Industries, Inc. | | | 220,862 | |

| | 5,177 | | | Verisk Analytics, Inc. | | | 885,836 | |

| | 10,270 | | | Vertiv Holdings Co. | | | 166,888 | |

| | 13,694 | | | Waste Management, Inc. | | | 2,050,813 | |

| | 1,103 | | | Watsco, Inc. | | | 336,095 | |

| | 1,681 | | | WESCO International, Inc.* | | | 278,340 | |

| | 5,819 | | | Westinghouse Air Brake Technologies Corp. | | | 607,096 | |

| | 6,813 | | | WillScot Mobile Mini Holdings Corp.* | | | 350,188 | |

| | 1,975 | | | Woodward, Inc. | | | 195,525 | |

| | 1,504 | | | W.W. Grainger, Inc. | | | 1,005,319 | |

| | 3,724 | | | XPO, Inc.* | | | 124,233 | |

| | 6,002 | | | Xylem, Inc. | | | 616,105 | |

| | | | | | | | |

| | | | | | | 114,787,520 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Information Technology – 26.8% | |

| | 21,986 | | | Accenture PLC, Class A | | | 5,838,382 | |

| | 15,500 | | | Adobe, Inc.* | | | 5,021,225 | |

| | 53,604 | | | Advanced Micro Devices, Inc.* | | | 4,212,202 | |

| | 5,164 | | | Akamai Technologies, Inc.* | | | 374,906 | |

| | 2,152 | | | Allegro MicroSystems, Inc. (Japan) * | | | 93,999 | |

| | 4,038 | | | Amdocs Ltd. | | | 369,921 | |

| | 3,121 | | | Amkor Technology, Inc. | | | 80,397 | |

| | 19,775 | | | Amphenol Corp., Class A | | | 1,532,958 | |

| | 16,962 | | | Analog Devices, Inc. | | | 3,112,018 | |

| | 2,895 | | | ANSYS, Inc.* | | | 878,951 | |

| | 531,175 | | | Apple, Inc. | | | 78,300,507 | |

| | 28,065 | | | Applied Materials, Inc. | | | 3,259,750 | |

| | 3,907 | | | AppLovin Corp., Class A* | | | 52,745 | |

| | 7,870 | | | Arista Networks, Inc.* | | | 1,091,569 | |

| | 2,042 | | | Arrow Electronics, Inc.* | | | 240,936 | |

| | 972 | | | Aspen Technology, Inc.* | | | 206,074 | |

| | 4,913 | | | Atlassian Corp., Class A* | | | 807,353 | |

| | 7,197 | | | Autodesk, Inc.* | | | 1,429,972 | |

| | 13,842 | | | Automatic Data Processing, Inc. | | | 3,042,748 | |

| | 7,192 | | | Bentley Systems, Inc., Class B | | | 290,988 | |

| | 3,355 | | | BILL Holdings, Inc.* | | | 283,934 | |

| | 5,040 | | | Black Knight, Inc.* | | | 300,384 | |

| | 1,833 | | | Blackline, Inc.* | | | 125,304 | |

| | 17,847 | | | Block, Inc.* | | | 1,369,400 | |

| | 13,650 | | | Broadcom, Inc. | | | 8,112,059 | |

| | 3,900 | | | Broadridge Financial Solutions, Inc. | | | 549,042 | |

| | 9,072 | | | Cadence Design Systems, Inc.* | | | 1,750,352 | |

| | 5,438 | | | CCC Intelligent Solutions Holdings, Inc.* | | | 48,724 | |

| | 4,515 | | | CDW Corp. | | | 913,926 | |

| | 4,833 | | | Ceridian HCM Holding, Inc.* | | | 352,471 | |

| | 4,891 | | | Ciena Corp.* | | | 235,844 | |

| | 125,459 | | | Cisco Systems, Inc. | | | 6,074,725 | |

| | 8,839 | | | Cloudflare, Inc., Class A* | | | 530,428 | |

| | 5,575 | | | Cognex Corp. | | | 264,367 | |

| | 17,156 | | | Cognizant Technology Solutions Corp., Class A | | | 1,074,480 | |

| | 3,945 | | | Coherent Corp.* | | | 170,148 | |

| | 1,284 | | | Concentrix Corp. | | | 175,703 | |

| | 4,204 | | | Confluent, Inc., Class A* | | | 102,536 | |

| | 25,514 | | | Corning, Inc. | | | 866,200 | |

| | 7,153 | | | Crowdstrike Holdings, Inc., Class A* | | | 863,296 | |

| | 8,919 | | | Datadog, Inc., Class A* | | | 682,482 | |

| | 7,784 | | | Dell Technologies, Inc., Class C | | | 316,342 | |

| | 2,992 | | | Dlocal Ltd. (Uruguay) * | | | 44,700 | |

| | 6,609 | | | DocuSign, Inc.* | | | 405,462 | |

| | 1,962 | | | Dolby Laboratories, Inc., Class A | | | 161,433 | |

| | 8,954 | | | Dropbox, Inc., Class A* | | | 182,662 | |

| | 7,630 | | | DXC Technology Co.* | | | 211,656 | |

| | 6,715 | | | Dynatrace, Inc.* | | | 285,589 | |

| | 2,581 | | | Elastic NV* | | | 152,331 | |

| | 4,445 | | | Enphase Energy, Inc.* | | | 935,806 | |

| | 4,948 | | | Entegris, Inc. | | | 421,718 | |

| | 1,862 | | | EPAM Systems, Inc.* | | | 572,844 | |

| | 1,567 | | | Euronet Worldwide, Inc.* | | | 170,568 | |

| | 1,065 | | | ExlService Holdings, Inc.* | | | 175,203 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

Schedule of Investments (continued)

February 28, 2023 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Information Technology – (continued) | |

| | 2,006 | | | F5, Inc.* | | $ | 286,818 | |

| | 813 | | | Fair Isaac Corp.* | | | 550,718 | |

| | 19,641 | | | Fidelity National Information Services, Inc. | | | 1,244,650 | |

| | 3,378 | | | First Solar, Inc.* | | | 571,355 | |

| | 19,579 | | | Fiserv, Inc.* | | | 2,253,347 | |

| | 2,313 | | | Five9, Inc.* | | | 152,658 | |

| | 2,389 | | | FleetCor Technologies, Inc.* | | | 513,133 | |

| | 14,996 | | | Flex Ltd.* | | | 341,309 | |

| | 22,063 | | | Fortinet, Inc.* | | | 1,311,425 | |

| | 2,566 | | | Gartner, Inc.* | | | 841,160 | |

| | 19,051 | | | Gen Digital, Inc. | | | 371,685 | |

| | 6,066 | | | Genpact Ltd. | | | 289,530 | |

| | 2,598 | | | Gitlab, Inc., Class A* | | | 114,416 | |

| | 8,952 | | | Global Payments, Inc. | | | 1,004,414 | |

| | 2,501 | | | GLOBALFOUNDRIES, Inc.* | | | 163,415 | |

| | 1,378 | | | Globant SA* | | | 227,480 | |

| | 5,197 | | | GoDaddy, Inc., Class A* | | | 393,465 | |

| | 2,715 | | | Guidewire Software, Inc.* | | | 190,620 | |

| | 2,338 | | | HashiCorp, Inc., Class A* | | | 68,270 | |

| | 42,668 | | | Hewlett Packard Enterprise Co. | | | 666,047 | |

| | 32,762 | | | HP, Inc. | | | 967,134 | |

| | 1,544 | | | HubSpot, Inc.* | | | 597,312 | |

| | 3,702 | | | Informatica, Inc., Class A* | | | 63,860 | |

| | 137,866 | | | Intel Corp. | | | 3,436,999 | |

| | 30,187 | | | International Business Machines Corp. | | | 3,903,179 | |

| | 9,128 | | | Intuit, Inc. | | | 3,716,739 | |

| | 1,011 | | | IPG Photonics Corp.* | | | 124,596 | |

| | 4,312 | | | Jabil, Inc. | | | 358,025 | |

| | 2,423 | | | Jack Henry & Associates, Inc. | | | 397,954 | |

| | 10,713 | | | Juniper Networks, Inc. | | | 329,746 | |

| | 5,931 | | | Keysight Technologies, Inc.* | | | 948,723 | |

| | 4,718 | | | KLA Corp. | | | 1,789,915 | |

| | 4,544 | | | Lam Research Corp. | | | 2,208,429 | |

| | 4,522 | | | Lattice Semiconductor Corp.* | | | 384,189 | |

| | 813 | | | Littelfuse, Inc. | | | 210,348 | |

| | 2,210 | | | Lumentum Holdings, Inc.* | | | 118,920 | |

| | 2,059 | | | Manhattan Associates, Inc.* | | | 295,981 | |

| | 16,364 | | | Marqeta, Inc., Class A* | | | 94,911 | |

| | 28,385 | | | Marvell Technology, Inc. | | | 1,281,583 | |

| | 28,259 | | | Mastercard, Inc., Class A | | | 10,040,140 | |

| | 2,009 | | | Maximus, Inc. | | | 164,899 | |

| | 18,012 | | | Microchip Technology, Inc. | | | 1,459,512 | |

| | 36,361 | | | Micron Technology, Inc. | | | 2,102,393 | |

| | 245,382 | | | Microsoft Corp. | | | 61,203,178 | |

| | 2,209 | | | MKS Instruments, Inc. | | | 214,118 | |

| | 552 | | | Monday.com Ltd.* | | | 85,405 | |

| | 2,229 | | | MongoDB, Inc.* | | | 467,020 | |

| | 1,495 | | | Monolithic Power Systems, Inc. | | | 724,014 | |

| | 5,566 | | | Motorola Solutions, Inc. | | | 1,462,800 | |

| | 4,327 | | | National Instruments Corp. | | | 218,557 | |

| | 7,183 | | | NetApp, Inc. | | | 463,663 | |

| | 1,159 | | | Novanta, Inc.* | | | 181,859 | |

| | 7,634 | | | Nutanix, Inc., Class A* | | | 215,661 | |

| | 78,799 | | | NVIDIA Corp. | | | 18,293,976 | |

| | 4,975 | | | Okta, Inc.* | | | 354,668 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Information Technology – (continued) | |

| | 14,377 | | | ON Semiconductor Corp.* | | | 1,112,924 | |

| | 51,593 | | | Oracle Corp. | | | 4,509,228 | |

| | 57,377 | | | Palantir Technologies, Inc., Class A* | | | 449,836 | |

| | 9,914 | | | Palo Alto Networks, Inc.* | | | 1,867,500 | |

| | 10,761 | | | Paychex, Inc. | | | 1,188,014 | |

| | 1,701 | | | Paycom Software, Inc.* | | | 491,691 | |

| | 2,073 | | | Paycor HCM, Inc.* | | | 51,348 | |

| | 1,368 | | | Paylocity Holding Corp.* | | | 263,490 | |

| | 37,997 | | | PayPal Holdings, Inc.* | | | 2,796,579 | |

| | 2,390 | | | Procore Technologies, Inc.* | | | 160,106 | |

| | 3,624 | | | PTC, Inc.* | | | 454,196 | |

| | 9,457 | | | Pure Storage, Inc., Class A* | | | 269,903 | |

| | 3,365 | | | Qorvo, Inc.* | | | 339,495 | |

| | 37,406 | | | QUALCOMM, Inc. | | | 4,620,763 | |

| | 3,509 | | | Qualtrics International, Inc., Class A* | | | 59,372 | |

| | 1,135 | | | Qualys, Inc.* | | | 134,100 | |

| | 2,816 | | | RingCentral, Inc., Class A* | | | 93,041 | |

| | 3,528 | | | Roper Technologies, Inc. | | | 1,517,746 | |

| | 32,374 | | | Salesforce, Inc.* | | | 5,296,710 | |

| | 3,704 | | | Samsara, Inc., Class A* | | | 61,709 | |

| | 6,409 | | | Seagate Technology Holdings PLC | | | 413,765 | |

| | 7,011 | | | SentinelOne, Inc., Class A* | | | 112,106 | |

| | 6,749 | | | ServiceNow, Inc.* | | | 2,916,715 | |

| | 1,083 | | | Silicon Laboratories, Inc.* | | | 193,348 | |

| | 5,331 | | | Skyworks Solutions, Inc. | | | 594,780 | |

| | 4,257 | | | Smartsheet, Inc., Class A* | | | 187,393 | |

| | 9,104 | | | Snowflake, Inc., Class A* | | | 1,405,476 | |

| | 1,850 | | | SolarEdge Technologies, Inc.* | | | 588,152 | |

| | 5,434 | | | Splunk, Inc.* | | | 556,985 | |

| | 7,339 | | | SS&C Technologies Holdings, Inc. | | | 430,799 | |

| | 1,312 | | | Synaptics, Inc.* | | | 154,304 | |

| | 5,063 | | | Synopsys, Inc.* | | | 1,841,717 | |

| | 1,400 | | | TD SYNNEX Corp. | | | 135,128 | |

| | 10,581 | | | TE Connectivity Ltd. | | | 1,347,173 | |

| | 1,544 | | | Teledyne Technologies, Inc.* | | | 664,028 | |

| | 3,688 | | | Tenable Holdings, Inc.* | | | 163,120 | |

| | 5,185 | | | Teradyne, Inc. | | | 524,411 | |

| | 30,295 | | | Texas Instruments, Inc. | | | 5,194,078 | |

| | 2,952 | | | Thoughtworks Holding, Inc.* | | | 21,727 | |

| | 10,181 | | | Toast, Inc., Class A* | | | 192,625 | |

| | 8,200 | | | Trimble, Inc.* | | | 426,892 | |

| | 5,771 | | | Twilio, Inc., Class A* | | | 387,869 | |

| | 1,373 | | | Tyler Technologies, Inc.* | | | 441,076 | |

| | 138 | | | Ubiquiti, Inc. | | | 37,025 | |

| | 10,376 | | | UiPath, Inc., Class A* | | | 153,980 | |

| | 10,089 | | | Unity Software, Inc.* | | | 307,109 | |

| | 1,458 | | | Universal Display Corp. | | | 198,069 | |

| | 3,071 | | | VeriSign, Inc.* | | | 604,465 | |

| | 54,100 | | | Visa, Inc., Class A | | | 11,898,754 | |

| | 7,582 | | | VMware, Inc., Class A* | | | 835,006 | |

| | 10,535 | | | Western Digital Corp.* | | | 405,387 | |

| | 12,779 | | | Western Union Co. (The) | | | 165,616 | |

| | 1,429 | | | WEX, Inc.* | | | 275,526 | |

| | 4,119 | | | Wolfspeed, Inc.* | | | 304,724 | |

| | 6,671 | | | Workday, Inc., Class A* | | | 1,237,270 | |

| | 1,716 | | | Zebra Technologies Corp., Class A* | | | 515,229 | |

| | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MARKETBETA® U.S. 1000 EQUITY ETF

| | | | | | | | |

| Shares | | | Description | |

Value | |

| |

| Common Stocks – (continued) | | | |

| Information Technology – (continued) | |

| | 7,174 | | | Zoom Video Communications, Inc., Class A* | | $ | 535,109 | |

| | 2,869 | | | Zscaler, Inc.* | | | 376,269 | |

| | | | | | | | |

| | | | | | | 332,036,997 | |

| | |

| Materials – 2.9% | |

| | 7,391 | | | Air Products and Chemicals, Inc. | | | 2,113,678 | |

| | 3,908 | | | Albemarle Corp. | | | 993,844 | |

| | 5,862 | | | Alcoa Corp. | | | 286,886 | |

| | 49,640 | | | Amcor PLC | | | 552,990 | |

| | 2,167 | | | AptarGroup, Inc. | | | 252,932 | |

| | 1,659 | | | Ashland, Inc. | | | 168,853 | |

| | 2,689 | | | Avery Dennison Corp. | | | 489,909 | |

| | 7,352 | | | Axalta Coating Systems Ltd.* | | | 219,090 | |

| | 10,409 | | | Ball Corp. | | | 585,090 | |

| | 4,112 | | | Berry Global Group, Inc. | | | 255,355 | |

| | 3,286 | | | Celanese Corp. | | | 381,932 | |

| | 6,528 | | | CF Industries Holdings, Inc. | | | 560,690 | |

| | 16,928 | | | Cleveland-Cliffs, Inc.* | | | 361,074 | |

| | 3,868 | | | Commercial Metals Co. | | | 200,169 | |

| | 23,651 | | | Corteva, Inc. | | | 1,473,221 | |

| | 3,937 | | | Crown Holdings, Inc. | | | 340,590 | |

| | 23,471 | | | Dow, Inc. | | | 1,342,541 | |

| | 15,209 | | | DuPont de Nemours, Inc. | | | 1,110,713 | |

| | 1,213 | | | Eagle Materials, Inc. | | | 170,208 | |

| | 3,989 | | | Eastman Chemical Co. | | | 339,863 | |

| | 8,431 | | | Ecolab, Inc. | | | 1,343,648 | |

| | 4,188 | | | FMC Corp. | | | 540,880 | |

| | 47,534 | | | Freeport-McMoRan, Inc. | | | 1,947,468 | |

| | 10,156 | | | Graphic Packaging Holding Co. | | | 241,713 | |

| | 5,858 | | | Huntsman Corp. | | | 171,874 | |

| | 8,513 | | | International Flavors & Fragrances, Inc. | | | 793,412 | |

| | 11,840 | | | International Paper Co. | | | 430,858 | |

| | 16,371 | | | Linde PLC (United Kingdom) | | | 5,703,165 | |

| | 5,947 | | | Livent Corp.* | | | 139,457 | |

| | 2,160 | | | Louisiana-Pacific Corp. | | | 126,382 | |

| | 8,604 | | | LyondellBasell Industries NV, Class A | | | 825,898 | |

| | 2,062 | | | Martin Marietta Materials, Inc. | | | 742,052 | |

| | 11,344 | | | Mosaic Co. (The) | | | 603,387 | |

| | 3,440 | | | MP Materials Corp.* | | | 120,400 | |

| | 26,490 | | | Newmont Corp. | | | 1,155,229 | |

| | 8,517 | | | Nucor Corp. | | | 1,426,086 | |

| | 4,557 | | | Olin Corp. | | | 263,167 | |

| | 3,041 | | | Packaging Corp. of America | | | 415,766 | |

| | 7,841 | | | PPG Industries, Inc. | | | 1,035,482 | |

| | 1,942 | | | Reliance Steel & Aluminum Co. | | | 481,305 | |

| | 2,187 | | | Royal Gold, Inc. | | | 259,794 | |

| | 4,256 | | | RPM International, Inc. | | | 377,209 | |

| | 4,798 | | | Sealed Air Corp. | | | 233,279 | |

| | 7,938 | | | Sherwin-Williams Co. (The) | | | 1,757,076 | |

| | 2,779 | | | Silgan Holdings, Inc. | | | 148,399 | |

| | 3,242 | | | Sonoco Products Co. | | | 191,473 | |

| | 2,848 | | | Southern Copper Corp. (Mexico) | | | 209,869 | |

| | 5,519 | | | Steel Dynamics, Inc. | | | 696,001 | |

| | 6,935 | | | United States Steel Corp. | | | 212,419 | |

| | 5,810 | | | Valvoline, Inc. | | | 204,512 | |

| | |

| |

| Common Stocks – (continued) | | | |

| Materials – (continued) | |

| | 4,328 | | | Vulcan Materials Co. | | | 782,978 | |

| | 1,066 | | | Westlake Corp. | | | 127,003 | |

| | 8,391 | | | Westrock Co. | | | 263,477 | |

| | | | | | | | |

| | | | | | | 36,170,746 | |

| | |

| Real Estate – 3.0% | |

| | 2,913 | | | Agree Realty Corp. REIT | | | 206,182 | |

| | 5,435 | | | Alexandria Real Estate Equities, Inc. REIT | | | 814,054 | |

| | 9,577 | | | American Homes 4 Rent, Class A REIT | | | 297,079 | |

| | 15,520 | | | American Tower Corp. REIT | | | 3,073,115 | |

| | 8,988 | | | Americold Realty Trust, Inc. REIT | | | 264,247 | |

| | 5,000 | | | Apartment Income REIT Corp. REIT | | | 189,000 | |

| | 4,575 | | | AvalonBay Communities, Inc. REIT | | | 789,279 | |

| | 4,771 | | | Boston Properties, Inc. REIT | | | 312,405 | |

| | 9,962 | | | Brixmor Property Group, Inc. REIT | | | 225,540 | |

| | 3,525 | | | Camden Property Trust REIT | | | 404,529 | |

| | 10,131 | | | CBRE Group, Inc., Class A* | | | 862,553 | |

| | 5,033 | | | Cousins Properties, Inc. REIT | | | 123,258 | |

| | 14,407 | | | Crown Castle, Inc. REIT | | | 1,883,715 | |

| | 7,459 | | | CubeSmart REIT | | | 350,498 | |

| | 9,599 | | | Digital Realty Trust, Inc. REIT | | | 1,000,504 | |

| | 5,674 | | | Douglas Emmett, Inc. REIT | | | 80,174 | |

| | 1,435 | | | EastGroup Properties, Inc. REIT | | | 234,293 | |

| | 3,083 | | | Equinix, Inc. REIT | | | 2,121,936 | |

| | 5,686 | | | Equity LifeStyle Properties, Inc. REIT | | | 389,548 | |

| | 12,242 | | | Equity Residential REIT | | | 765,370 | |

| | 2,148 | | | Essex Property Trust, Inc. REIT | | | 489,873 | |

| | 4,407 | | | Extra Space Storage, Inc. REIT | | | 725,613 | |

| | 2,681 | | | Federal Realty Investment Trust REIT | | | 286,277 | |

| | 4,398 | | | First Industrial Realty Trust, Inc. REIT | | | 231,995 | |

| | 8,224 | | | Gaming and Leisure Properties, Inc. REIT | | | 443,109 | |

| | 12,636 | | | Healthcare Realty Trust, Inc. REIT | | | 246,402 | |

| | 17,905 | | | Healthpeak Properties, Inc. REIT | | | 430,794 | |

| | 3,465 | | | Highwoods Properties, Inc. REIT | | | 91,823 | |

| | 23,623 | | | Host Hotels & Resorts, Inc. REIT | | | 396,866 | |

| | 20,382 | | | Invitation Homes, Inc. REIT | | | 637,141 | |

| | 9,633 | | | Iron Mountain, Inc. REIT | | | 508,141 | |

| | 1,559 | | | Jones Lang LaSalle, Inc.* | | | 271,983 | |

| | 3,854 | | | Kilroy Realty Corp. REIT | | | 138,821 | |

| | 20,212 | | | Kimco Realty Corp. REIT | | | 416,569 | |

| | 2,891 | | | Lamar Advertising Co., Class A REIT | | | 302,283 | |

| | 2,820 | | | Life Storage, Inc. REIT | | | 339,866 | |

| | 7,128 | | | Macerich Co. (The) REIT | | | 85,180 | |

| | 19,724 | | | Medical Properties Trust, Inc. REIT | | | 203,157 | |

| | 3,834 | | | Mid-America Apartment Communities, Inc. REIT | | | 613,823 | |

| | 5,923 | | | National Retail Properties, Inc. REIT | | | 268,430 | |

| | 2,807 | | | National Storage Affiliates Trust REIT | | | 118,736 | |

| | 7,797 | | | Omega Healthcare Investors, Inc. REIT | | | 208,882 | |

| | 30,767 | | | Prologis, Inc. REIT | | | 3,796,648 | |