UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

AIB ACQUISITION CORPORATION

(Name of Registrant as Specified In Its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

AIB ACQUISITION CORPORATION

AND

PROSPECTUS FOR UP TO 25,711,650 ORDINARY SHARES

OF

PS INTERNATIONAL GROUP LTD.

The board of directors of AIB Acquisition Corporation, a Cayman Islands exempted company (“AIB”), has unanimously approved the business combination agreement, dated as of December 27, 2023 (as it may be amended or supplemented from time to time, the “Business Combination Agreement”), by and among AIB, PSI Group Holdings Ltd 利航國際控股有限公司, a Cayman Islands exempted company (“PSI”), PS International Group Ltd., a Cayman Islands exempted company (“Pubco”), AIB LLC, a Delaware limited liability company (the “Sponsor”), PSI Merger Sub I Limited, a Cayman Islands exempted company (“PSI Merger Sub I”), and PSI Merger Sub II Limited, a Cayman Islands exempted company (“PSI Merger Sub II”), and the transactions contemplated by the Business Combination Agreement (collectively, the “Business Combination”).

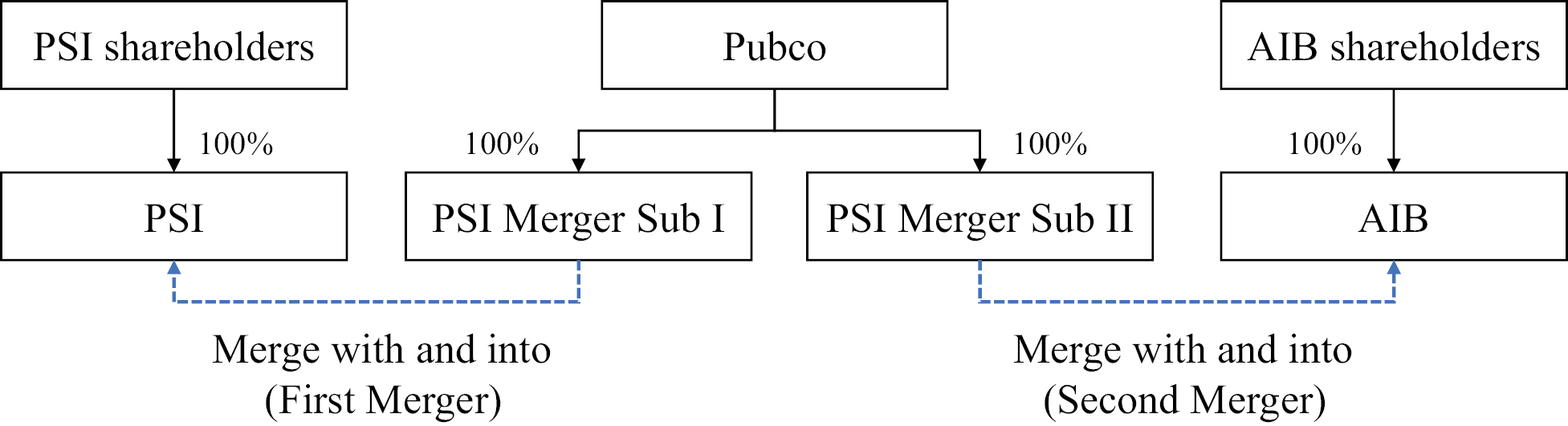

Pursuant to the Business Combination Agreement, subject to the terms and conditions set forth therein, at the closing of the Business Combination (the “Closing”), (a) PSI Merger Sub I will merge with and into PSI (the “First Merger”), with PSI surviving the First Merger as a wholly-owned subsidiary of the Pubco and the outstanding shares of PSI being converted into the right to receive ordinary shares of the Pubco (“Pubco Ordinary Shares”), and (b) one business day following the First Merger, PSI Merger Sub II will merge with and into AIB (the “Second Merger”, and together with the First Merger, the “Mergers”), with AIB surviving the Second Merger as a wholly-owned subsidiary of the Pubco and the outstanding securities of AIB being converted into the right to receive substantially equivalent securities of the Pubco.

Under the Business Combination Agreement, the total consideration to be received by shareholders of PSI at the Closing will be newly issued Pubco Ordinary Shares, with each share valued at $10.00, and with an aggregate value equal to $200,000,000, subject to adjustments for PSI’s Net Working Capital, Closing Debt and Transaction Expenses (as defined in the Business Combination Agreement attached as Annex A).

Upon consummation of the Business Combination, Pubco will be an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, as amended, and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the consummation of the Business Combination.

Pubco will also be a “foreign private issuer” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, Pubco will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission (“SEC”) as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

PSI is a Cayman Islands holding company with operations conducted by its operating subsidiaries based in Hong Kong, namely Profit Sail Int’l Express (H.K.) Limited and Business Great Global Supply Chain Limited (collectively, the “Operating Subsidiaries” and each, an “Operating Subsidiary”). Following the Closing, PSI will become a wholly-owned subsidiary of Pubco, another Cayman Islands holding company; as a result, holders of Pubco Ordinary Shares are not holding equity securities of the Operating Subsidiaries, but instead are holding equity securities of a Cayman Islands holding company. This structure involves unique risks to investors. For further discussions of these risks, see “Risk Factors — Risks Related to Doing Business in the Jurisdictions in Which PSI’s Operating Subsidiaries Operate” and “Risk Factors — Risk Related to PSI’s Corporate Structure.”

Cash is transferred through PSI’s organization in the following manner: (i) funds may be transferred from PSI to the Operating Subsidiaries in Hong Kong through PSI’s BVI subsidiaries in the form of capital contributions or shareholder loans, as the case may be, and (ii) dividends or other distributions may be paid by the Operating Subsidiaries to PSI through its BVI subsidiaries. As a holding company without any operations of its own, PSI relies on dividends and other distributions on equity paid by the Operating Subsidiaries for its cash and financing requirements. In November 2023, PSI declared and made dividends in the amount of approximately $4.0 million to its shareholders and assigned its Operating Subsidiary to pay out such dividends. Except for this, for the years ended

December 31, 2022 and 2023, PSI did not declare or make any dividends or other distribution to its shareholders, including U.S. investors, nor were any dividends or distributions made by the Operating Subsidiaries to PSI. In addition, PSI does not intend to distribute earnings or pay cash dividends in the foreseeable future to settle amounts or otherwise. Instead, the Operating Subsidiaries generate and retain cash generated from operating activities and re-invest it in their respective businesses. There are currently no restrictions under the laws of the Cayman Islands, BVI and/or Hong Kong on foreign exchange and the ability of PSI or its subsidiaries to transfer cash between entities, across borders, and to U.S. investors. Further, subject to PSI having sufficient legally available funds and being able to pay its debts as they fall due in the ordinary course of business, there are no restrictions or limitations under the laws of Cayman Islands on the payment of dividends by PSI to its shareholders. There are also no restrictions or limitations under the laws of the BVI on the distribution of earnings from a subsidiary to the parent company or investors, so long as the value of the assets of the BVI subsidiary declaring the dividends will exceed its liabilities and the BVI subsidiary will be able to pay its debts as they fall due. Similarly, there are no restrictions or limitations under the laws of Hong Kong on the distribution of the available profits from a Hong Kong subsidiary to the parent company or investors. In addition, dividend payments are not subject to withholding tax in Cayman Islands, BVI or Hong Kong. Notwithstanding the foregoing, the ability of the Operating Subsidiaries to pay dividends to PSI (or Pubco following the Business Combination) may be restricted by the debt they incur on their own behalf. For further details, see “Risk Factors — Risk Related to PSI’s Corporate Structure — We rely on dividends and other distributions on equity paid by the Operating Subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of the Operating Subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business.”

All of PSI’s operations are located in Hong Kong. Laws and regulations in the People’s Republic of China (“PRC”) in general are not applicable or enforceable in Hong Kong. However, due to the potential long arm application of these laws and regulations, PSI may face various legal and operational risks associated with its operations in Hong Kong. The PRC government may exercise significant direct oversight and discretion over the conduct of PSI’s business and may intervene or influence its operations, which could result in a material change in PSI’s operations, its ability to operate profitably, and/or the value of PSI’s ordinary shares (or Pubco Ordinary Shares following the closing of the Business Combination). Furthermore, changes in policies, rules, regulations, and enforcement of laws of the PRC may occur with little notice. PSI may be subject to complex and evolving laws and regulations in China, and it is unclear as to whether and to what extent the recent PRC government statements and regulatory developments (such as those relating to the use of variable interest entities, data and cyberspace security, and anti-monopoly concerns) would apply to companies like the Operating Subsidiaries and PSI, whose operations are all located in Hong Kong. In addition, the Chinese government may exert more oversight and control over offerings that are conducted overseas and/or foreign investment in PRC-based issuers, and there is no guarantee that such oversight and control will not be extended to Hong Kong in the future. The Chinese government has also initiated various regulatory actions and made various public statements, some of which are published with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. These recently enacted measures, and additional pending or future new measures which may be implemented, could materially and adversely affect PSI’s operations. Furthermore, the Chinese government has significant authority to exert influence on the ability of a China-based company to conduct its business, make or accept foreign investments or list on a U.S. stock exchange. The PRC government may also intervene with or influence PSI’s operations at any time as the government deems appropriate to further regulatory, political and societal goals. These risks could result in a material change in PSI’s operations, and/or the value of the securities of PSI (or Pubco following the closing of the Business Combination) or could significantly limit or completely hinder PSI’s (or Pubco’s) ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Furthermore, as more stringent criteria have been imposed by the SEC and the Public Company Accounting Oversight Board (the “PCAOB”) recently, and in particular the SEC’s adoption of amendments to finalize rules implementing the submission and disclosure requirements in the Holding Foreign Companies Accountable Act (“HFCAA”) on December 2, 2021, Pubco’s securities may be prohibited from trading if PSI’s auditor (who will become Pubco’s auditors following the consummation of the Business Combination) cannot be fully inspected. A termination in the trading of Pubco’s securities or any restriction on the trading in Pubco’s securities would be expected to have a negative impact on Pubco as well as on the value of its securities. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible

complete inspections and investigations by the PCAOB of audit firms based in mainland China (“Mainland China”) and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in Mainland China and Hong Kong. The PCAOB vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in Mainland China and Hong Kong. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”) was signed into law, which amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

WWC, P.C., the independent registered public accounting firm of PSI, is headquartered in California. As of the date of this proxy statement/prospectus, WWC, P.C. is not subject to the determinations as to inability to inspect or investigate registered firms completely announced by the PCAOB on December 16, 2021. While PSI’s auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely PSI’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in Pubco’s securities to be prohibited under the HFCAA, and ultimately result in a determination by a securities exchange to delist the Pubco’s securities.

Upon consummation of the Business Combination, Mr. Yee Kit Chan, the chairman of the board of directors of Pubco, will, assuming a no redemption scenario, control approximately 61.6% of the voting power of outstanding Pubco Ordinary Shares (or 64.1% assuming a maximum redemption scenario), without taking into account of potential source of dilution. As a result, Pubco will be a “controlled company” within the meaning of applicable Nasdaq listing rules. See “Management of Pubco Following the Business Combination — Controlled Company Status” for further information.

This proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the extraordinary general meeting of holders of ordinary shares of AIB (the “Extraordinary General Meeting”). We encourage you to carefully read this entire document. You should, in particular, carefully consider the risk factors described in “Risk Factors” beginning on page 49 of this proxy statement/prospectus.

The board of directors of AIB (the “AIB Board”) has unanimously approved and adopted the Business Combination Agreement and unanimously recommends that the AIB shareholders vote “FOR” all of the proposals presented to the shareholders at the Extraordinary General Meeting. When you consider the AIB Board’s recommendation of these proposals, you should keep in mind that AIB’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated June 24, 2024, and is first being mailed to AIB shareholders on or about June 24, 2024.

You may request copies of this proxy statement/prospectus and any other publicly available information concerning AIB, without charge, by written request to Advantage Proxy, Inc., AIB’s proxy solicitor, at P.O. Box 13581, Des Moines, WA 98198 or email at ksmith@advantageproxy.com, or banks and brokers can call collect at (206) 870-8565, or from the SEC through the SEC website at http://www.sec.gov.

In order for holders of ordinary shares of AIB to receive timely delivery of the documents in advance of the Extraordinary General Meeting to be held on July 15, 2024 you must request the information no later than five business days prior to the date of the Extraordinary General Meeting, by July 8, 2024.

i

AIB Acquisition Corporation

875 Third Avenue, Suite M204A

New York, New York, 10022

LETTER TO SHAREHOLDERS

TO THE SHAREHOLDERS OF AIB ACQUISITION CORPORATION:

You are cordially invited to attend the extraordinary general meeting (the “Meeting”) of AIB Acquisition Corporation (“AIB”), which will be held at 10:00 a.m., Eastern Time, on July 15, 2024. For the purposes of AIB’s Second Amended and Restated Memorandum and Articles of Association, as amended, the physical place of the Meeting will be at the office of AIB at 875 Third Avenue, Suite M204A, New York, NY 10022. The Meeting will also be conducted via live webcast. You or your proxyholder will be able to attend and vote at the Meeting by visiting https://www.cstproxy.com/aibspac/2024 and using a control number assigned by Continental Stock Transfer & Trust Company (“Continental”). To register and receive access to the virtual meeting, registered shareholders and beneficial shareholders (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in the accompanying proxy statement/prospectus.

On December 27, 2023, AIB entered into a Business Combination Agreement with AIB LLC, a Delaware limited liability company, in the capacity as the representative of AIB and the shareholders of AIB immediately prior to the Second Merger (as defined below) (the “AIB Representative”), PS International Group Ltd., an exempted company incorporated with limited liability in the Cayman Islands (“Pubco”), PSI Merger Sub I Limited, an exempted company incorporated with limited liability in the Cayman Islands and a wholly-owned subsidiary of Pubco (“PSI Merger Sub I”), PSI Merger Sub II Limited, an exempted company incorporated with limited liability in the Cayman Islands and a wholly-owned subsidiary of Pubco (“PSI Merger Sub II”), and PSI Group Holdings Ltd (利航國際控股有限公司), an exempted company incorporated with limited liability in the Cayman Islands (“PSI”) (as it may be amended or supplemented from time to time, the “Business Combination Agreement”). Pursuant to the Business Combination Agreement, subject to the terms and conditions set forth therein, at the closing of the transactions contemplated by the Business Combination Agreement (the “Closing”), (a) the PSI Merger Sub I will merge with and into PSI (the “First Merger”), with PSI surviving the First Merger as a wholly-owned subsidiary of Pubco and the outstanding shares of PSI being converted into the right to receive ordinary shares of Pubco (“Pubco Ordinary Shares”); and (b) one business day following the First Merger, the PSI Merger Sub II will merge with and into AIB (the “Second Merger,” and together with the First Merger, the “Mergers”), with AIB surviving the Second Merger as a wholly-owned subsidiary of Pubco and the outstanding securities of AIB being converted into the right to receive substantially equivalent securities of Pubco (the Mergers together with the other transactions contemplated by the Business Combination Agreement and other ancillary documents, the “Business Combination”). You are being asked to vote on the Business Combination.

Under the Business Combination Agreement, the total consideration to be received by shareholders of PSI at the Closing will be newly issued Pubco Ordinary Shares, with each share valued at $10.00, and with an aggregate value equal to $200,000,000, subject to adjustments for PSI’s Net Working Capital, Closing Debt and Transaction Expenses (as defined in the Business Combination Agreement attached as Annex A).

As a result of the Mergers, (a) each of the ordinary shares of PSI that are issued and outstanding immediately prior to the First Merger will be cancelled and converted into (i) the right to receive 90% of such number of Pubco Ordinary Shares equal to the Exchange Ratio (as defined in the Business Combination Agreement), and (ii) the contingent right to receive 10% of such number of Pubco Ordinary Shares equal to the Exchange Ratio in accordance with the Business Combination Agreement and the escrow agreement entered into by Pubco, the AIB Representative, and Continental (or such other escrow agent mutually acceptable by AIB and PSI). Each AIB ordinary share that is issued and outstanding immediately prior to the Second Merger shall be cancelled and converted automatically into the right to receive one Pubco Ordinary Share. Each issued and outstanding right of AIB (“AIB Right”) shall be automatically converted into one-tenth of one Pubco Ordinary Share, provided that Pubco will not issue fractional shares in exchange for the AIB Rights.

At a hearing on February 22, 2024, AIB presented a compliance plan before the Nasdaq Hearings Panel (the “Panel”), to assess and appeal AIB’s noncompliance with the following listing requirements: (i) its Market Value of Listed Securities (“MVLS”) was below the $50 million minimum requirement for continued inclusion on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(b)(2)(A) (the “MVLS Requirement”), and (ii) public holders of AIB Class A ordinary shares (such shares, “AIB Class A Ordinary Shares,” such holders, “Public Holders”) were below the 400 Public Holders minimum requirement for continued inclusion on The Nasdaq Global Market pursuant

ii

to the Nasdaq Listing Rule 5450(a)(2) (the “Public Holders Requirement”). On March 14, 2024, the Panel issued its decision, which granted AIB’s request for continued listing until May 20, 2024, subject to certain conditions, including that (i) on or before May 1, 2024, AIB shall advise the Panel on the status of the SEC review of the Form F-4, (ii) on or before May 15, 2024, AIB shall hold a shareholder meeting and obtain approval for completion of its initial business combination, and (iii) on or before May 20, 2024, AIB shall close its initial business combination and the new entity shall demonstrate compliance with Nasdaq Listing Rule 5505. On May 1, 2024, AIB notified the Panel that it would not close an initial business combination by the Panel’s May 20, 2024 deadline. On May 7, 2024, AIB received a written notice from the Panel indicating that the Panel had decided to delist AIB’s securities from Nasdaq, and trading of AIB securities would be suspended at the open of trading on May 9, 2024, due to AIB’s failure to comply with the terms of the Panel’s decision issued on March 14, 2024 (the “Trading Suspension”). Despite this decision, a formal delisting would not take effect until all applicable Nasdaq review and appeal periods have expired and Nasdaq files a Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities and Exchange Act of 1934 on Form 25 with the SEC (the “Form 25”) after the applicable Nasdaq review and appeal periods have lapsed and/or upon the closing of AIB’s initial Business Combination. AIB did not appeal the Panel’s decision to the Nasdaq Listing and Hearing Review Council (the “Council”), and, as of the date of this proxy statement/prospectus, AIB has not received notice from the Council of any review of the Panel’s decision, and the Trading Suspension is still in place. There can be no assurance that the Trading Suspension will be lifted prior to the Closing. Further, although the parties intend to complete the Business Combination before a Form 25 is filed, it is uncertain if Pubco will be able to meet Nasdaq’s initial listing requirements to list its securities on Nasdaq, which is a condition to the Closing. While such condition can be waived mutually by the parties to the Business Combination Agreement, PSI does not intend to waive such condition.

AIB Units (“AIB Units”), AIB Class A Ordinary Shares and AIB Rights were traded on The Nasdaq Global Market under the symbols “AIBBU,” “AIB” and “AIBBR,” respectively. However, as described above, each of these securities is subject to the Trading Suspension. On May 8, 2024, the last day of trading prior to the Trading Suspension, the closing sale prices of AIB Units, AIB Class A Ordinary Shares and AIB Rights were $12.50, $11.73 and $0.10, respectively. Since the Trading Suspension, AIB Units, AIB Class A Ordinary Shares and AIB Rights have been eligible to trade on the OTC Markets under the tickers “ACCUF,” “AIBAF” and “AACRF,” respectively. As of May 22, 2024, the closing sales prices of AIB Units, AIB Class A Ordinary Shares and AIB Rights were $10.01, $11.53 and $0.14, respectively. Pubco intends to apply for the listing, to be effective upon the Closing, of its Pubco Ordinary Shares on The Nasdaq Stock Market under the symbol “PSIG.”

Holders of record of AIB Class A Ordinary Shares, par value $0.0001 per share, and AIB Class B ordinary shares (“AIB Class B Ordinary Shares”), par value $0.0001 per share, at the close of business on June 25, 2024, are entitled to notice of the Meeting and the right to vote and have their votes counted at the Meeting and any adjournments of the Meeting.

This proxy statement/prospectus provides AIB shareholders with detailed information about the Business Combination and other matters to be considered at the Meeting. AIB urges its shareholders to carefully read this entire document and the documents incorporated herein by reference. AIB shareholders should also carefully consider the risk factors described in “Risk Factors” beginning on page 49 of this proxy statement/prospectus.

This proxy statement/prospectus incorporates by reference important business and financial information about AIB from documents AIB has filed with the U.S. Securities and Exchange Commission (“SEC”) that are not included in or delivered with this proxy statement/prospectus and other filings of AIB with the SEC by visiting its website at www.sec.gov or requesting them in writing or by telephone from AIB at the following address:

AIB Acquisition Corporation

875 Third Avenue

Suite M204A

New York, NY 10022

Telephone at (212) 380-8128

Attn: Eric Chen, Chief Executive Officer

You will not be charged for any of these documents that you request. Shareholders requesting documents should do so by July 8, 2024 in order to receive them before the Meeting.

iii

After careful consideration, AIB’s board of directors (“AIB Board”) has approved the Business Combination Agreement and the transactions contemplated thereby and determined that each of the proposals to be presented at the Meeting (the “Proposals”) is in the best interests of AIB and recommends that you vote or give instruction to vote “FOR” each of those Proposals.

The existence of financial and personal interests of AIB’s directors and officers may result in conflicts of interest, including a conflict between what may be in the best interests of AIB and what may be best for an AIB director’s personal interests when determining to recommend that AIB shareholders vote for the Proposals presented at the Meeting. See the sections titled “Proposal No. 1 — The Business Combination Proposal — Interests of AIB’s Initial Shareholders and Advisors in the Business Combination” and “Beneficial Ownership of AIB Securities Before the Business Combination” in the accompanying proxy statement/prospectus for a further discussion.

Your vote is very important. To ensure your representation at the Meeting, please complete and return the enclosed proxy card or submit your proxy by following the instructions contained in the accompanying proxy statement/prospectus and on your proxy card. Please submit your proxy promptly whether or not you expect to participate in the Meeting. Submitting a proxy now will NOT prevent you from being able to vote online during the virtual Meeting. If you hold your shares in “street name,” you should instruct your broker, bank or other nominee how to vote in accordance with the voting instruction form you receive from your broker, bank or other nominee.

On behalf of AIB Board, I would like to thank you for your support of AIB and look forward to successful completion of the Business Combination.

Very truly yours,

/s/ Eric Chen | ||||

Eric Chen |

If you return your proxy card signed and without an indication of how you wish to vote, your shares will be voted in favor of each of the Proposals on which you are entitled to vote.

TO EXERCISE YOUR REDEMPTION RIGHTS FOR PUBLIC SHARES, YOU MUST SUBMIT A WRITTEN REQUEST TO THE TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE MEETING, THAT YOUR PUBLIC SHARES BE REDEEMED FOR CASH, AND DELIVER YOUR SHARE CERTIFICATES (IF ANY) AND OTHER REDEMPTION FORMS TO THE TRANSFER AGENT, PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN) SYSTEM, IN EACH CASE IN ACCORDANCE WITH THE PROCEDURES AND DEADLINES DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. IF THE BUSINESS COMBINATION IS NOT CONSUMMATED, THEN THE PUBLIC SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “EXTRAORDINARY GENERAL MEETING OF AIB SHAREHOLDERS — REDEMPTION RIGHTS” IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS FOR MORE SPECIFIC INSTRUCTIONS.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the accompanying proxy statement/prospectus or determined that the accompanying proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated June 24, 2024, and is first being mailed to the shareholders of AIB on or about June 24, 2024.

iv

AIB Acquisition Corporation

875 Third Avenue, Suite M204A

New York, New York, 10022

NOTICE OF EXTRAORDINARY GENERAL MEETING

TO BE HELD ON JULY 15, 2024

TO THE SHAREHOLDERS OF AIB ACQUISITION CORPORATION:

NOTICE IS HEREBY GIVEN that an extraordinary general meeting (the “Meeting”) of AIB Acquisition Corporation, a Cayman Islands exempted company (“AIB”), will be held at 10:00 a.m., Eastern Time, on July 15, 2024. For the purposes of AIB’s Second Amended and Restated Memorandum and Articles of Association, as amended (the “Current Charter”), the physical place of the Meeting will be at the office of AIB at 875 Third Avenue, Suite M204A, New York, NY 10022. The Meeting will also be conducted via live webcast. You are cordially invited to attend the Meeting online by visiting https://www.cstproxy.com/aibspac/2024 and using a control number assigned by Continental Stock Transfer & Trust Company. The Meeting will be held for the purpose of considering and voting on the proposals (the “Proposals”) described below and in the accompanying proxy statement/prospectus. To register and receive access to the virtual meeting, registered shareholders and beneficial shareholders of AIB (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in the accompanying proxy statement/prospectus. Only registered shareholders will be able to submit questions through the virtual meeting format, as further described in the accompanying proxy statement/prospectus. AIB’s shareholders will have the opportunity to present questions to the management of AIB at the Meeting.

At the Meeting, AIB shareholders will be asked to consider and vote on the following Proposals:

• Proposal No.1 — The Business Combination Proposal — To consider and vote upon a Proposal (the “Business Combination Proposal”) by ordinary resolution to approve the business combination agreement, dated as of December 27, 2023 (as it may be amended or supplemented from time to time, the “Business Combination Agreement”), by and among AIB, PSI Group Holdings Ltd 利航國際控股有限公司, a Cayman Islands exempted company, PS International Group Ltd., a Cayman Islands exempted company, AIB LLC, a Delaware limited liability company, PSI Merger Sub I Limited, a Cayman Islands exempted company, and PSI Merger Sub II Limited, a Cayman Islands exempted company, and the transactions contemplated by the Business Combination Agreement (collectively, the “Business Combination”).

A copy of the Business Combination Agreement is appended to the accompanying proxy statement/prospectus as Annex A. The Business Combination Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.1 — The Business Combination Proposal.”

• Proposal No.2 — The Merger Proposal — To consider and vote on a Proposal (the “Merger Proposal”) by special resolution to approve, in connection with the Business Combination, the merger of PSI Merger Sub II with and into AIB (the “Second Merger”), the plan of the Second Merger (the “Plan of Second Merger”) and any and all transactions provided in the Plan of Second Merger. The Merger Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.2 — The Merger Proposal.”

• Proposal No.3 — The Adjournment Proposal — To consider and vote upon a Proposal (the “Adjournment Proposal”) by ordinary resolution to adjourn the Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if it is determined by the AIB board of directors (the “AIB Board”) that more time is necessary or appropriate to approve one or more Proposals at the Meeting. The Adjournment Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.3 — The Adjournment Proposal.”

The Proposals being submitted for a vote at the Meeting are more fully described in the accompanying proxy statement/prospectus, which also includes, as Annex A, a copy of the Business Combination Agreement. AIB urges you to read carefully the accompanying proxy statement/prospectus in its entirety, including the annexes and accompanying financial statements.

v

After careful consideration, the AIB Board has approved the Business Combination Agreement and the Business Combination and determined that each of the Proposals to be presented at the Meeting is in the best interests of AIB and recommends that each of the AIB shareholders vote or give instruction to vote “FOR” each of the above Proposals on which each such shareholder is entitled to vote.

The existence of financial and personal interests of AIB’s directors and officers may result in conflicts of interest, including a conflict between what may be in the best interests of AIB and what may be best for a director’s personal interests when determining to recommend that AIB shareholders vote for the Proposals. See “Proposal No.1 — The Business Combination Proposal — Interests of AIB’s Initial Shareholders and Advisors in the Business Combination” and “Beneficial Ownership of AIB Securities Before the Business Combination” in the accompanying proxy statement/prospectus for a further discussion.

The record date for the Meeting is June 25, 2024. Only holders of record of AIB Class A Ordinary Shares and AIB Class B Ordinary Shares at the close of business on the record date are entitled to notice of and to vote and have their votes counted at the Meeting and any adjournments of the Meeting.

At a hearing on February 22, 2024, AIB presented a compliance plan before the Nasdaq Hearings Panel (the “Panel”), to address and appeal AIB’s noncompliance with the following listing requirements: (i) its Market Value of Listed Securities (“MVLS”) was below the $50 million minimum requirement for continued inclusion on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(b)(2)(A) (the “MVLS Requirement”), and (ii) public holders of AIB Class A Ordinary Shares (“Public Holders”) were below the 400 Public Holders minimum requirement for continued inclusion on The Nasdaq Global Market pursuant to the Nasdaq Listing Rule 5450(a)(2) (the “Public Holders Requirement”). On March 14, 2024, the Panel issued its decision, which granted AIB’s request for continued listing until May 20, 2024, subject to certain conditions, including that (i) on or before May 1, 2024, AIB shall advise the Panel on the status of the SEC review of the Form F-4, (ii) on or before May 15, 2024, AIB shall hold a shareholder meeting and obtain approval for completion of its initial business combination, and (iii) on or before May 20, 2024, AIB shall close its initial business combination and the new entity shall demonstrate compliance with Nasdaq Listing Rule 5505. On May 1, 2024, AIB notified the Panel that it would not close an initial business combination by the Panel’s May 20, 2024 deadline. On May 7, 2024, AIB received a written notice from the Panel indicating that the Panel had decided to delist AIB’s securities from Nasdaq, and trading of AIB securities would be suspended at the open of trading on May 9, 2024, due to AIB’s failure to comply with the terms of the Panel’s decision issued on March 14, 2024 (the “Trading Suspension”). Despite this decision, a formal delisting would not take effect until all applicable Nasdaq review and appeal periods have expired and Nasdaq files a Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities and Exchange Act of 1934 on Form 25 with the SEC (the “Form 25”) after the applicable Nasdaq review and appeal periods have lapsed and/or upon the Closing. AIB did not appeal the Panel’s decision to the Nasdaq Listing and Hearing Review Council (the “Council”), and, as of the date of this proxy statement/prospectus, AIB has not received notice from the Council of any review of the Panel’s decision, and the Trading Suspension is still in place. There can be no assurance that the Trading Suspension will be lifted prior to the Closing. Further, although the parties intend to complete the Business Combination before a Form 25 is filed, it is uncertain if Pubco will be able to meet Nasdaq’s initial listing requirements to list its securities on Nasdaq, which is a condition to the Closing. While such condition can be waived mutually by the parties to the Business Combination Agreement, PSI does not intend to waive such condition.

AIB Units, AIB Class A Ordinary Shares and AIB Rights were traded on The Nasdaq Global Market under the symbols “AIBBU,” “AIB” and “AIBBR,” respectively. However, as described above, each of these securities is subject to the Trading Suspension. On May 8, 2024, the last day of trading prior to the Trading Suspension, the closing sale prices of AIB Units, AIB Class A Ordinary Shares and AIB Rights were $12.50, $11.73 and $0.10, respectively. Since the Trading Suspension, AIB Units, AIB Class A Ordinary Shares and AIB Rights have been eligible to trade on the OTC Markets under the tickers “ACCUF,” “AIBAF” and “AACRF,” respectively. As of May 22, 2024, the closing sales prices of AIB Units, AIB Class A Ordinary Shares and AIB Rights were $10.01, $11.53 and $0.14, respectively. Pubco intends to apply for the listing, to be effective upon the Closing, of its ordinary shares on The Nasdaq Stock Market under the symbol “PSIG.”

vi

Pursuant to AIB’s Current Charter, a public shareholder of AIB holding the AIB Class A Ordinary Shares included in the AIB Units issued in the IPO (an “AIB Public Shareholder”) may request that AIB redeem all or a portion of AIB Class A Ordinary Shares sold as part of the units in AIB’s initial public offering (“Public Shares”) for cash if the Business Combination is consummated. Holders of Public Shares will be entitled to receive cash for their Public Shares to be redeemed only if they:

• hold Public Shares; and

• prior to 5:00 p.m., Eastern Time, on July 11, 2024 (two business days prior to the vote at the Meeting), submit a written request to AIB’s transfer agent, Continental Stock Transfer & Trust Company (the “Transfer Agent”) that AIB redeem the applicable Public Shares for cash and deliver share certificates (if any) and other redemption forms to the Transfer Agent, physically or electronically through The Depository Trust Company.

AIB Public Shareholders may elect to redeem all or a portion of their Public Shares regardless of whether they vote affirmatively for or against the Business Combination Proposal, or do not vote at all, provided that any beneficial holder of Public Shares on whose behalf a redemption right is being exercised must identify itself to AIB in connection with any redemption election in order to validly redeem such Public Shares. If the Business Combination is not consummated, the Public Shares will not be redeemed for cash. If a public shareholder properly exercises its right to redeem its Public Shares and timely delivers its share certificates (if any) and other redemption forms to the Transfer Agent, AIB will redeem each Public Share for a per share price, payable in cash, equal to the aggregate amount then on deposit in the trust account established in connection with AIB’s initial public offering (“Trust Account”) calculated as of two business days prior to the consummation of the Business Combination, including interest earned on the funds held in the Trust Account (net of taxes payable), divided by the number of then-issued and outstanding Public Shares. As of May 22, 2024, this would have amounted to approximately $11.53 per Public Share. If an AIB Public Shareholder exercises its redemption rights, then such shareholder will be exchanging its redeemed Public Shares for cash and will no longer own such shares. Any request to redeem Public Shares, once made, may not be withdrawn once submitted to AIB unless the AIB Board determines (in its sole discretion) to permit the withdrawal of such redemption request (which it may do in whole or in part). An AIB Public Shareholder can make such request by contacting the Transfer Agent at the address or email address listed in the accompanying proxy statement/prospectus. AIB will be required to honor such request only if made prior to the deadline for exercising redemption requests. See “Extraordinary General Meeting of AIB Shareholders — Redemption Rights” in the accompanying proxy statement/prospectus for a detailed description of the procedures to be followed if an AIB Public Shareholder wishes to redeem its Public Shares for cash.

Notwithstanding the foregoing, a holder of Public Shares, together with any affiliate of such public shareholder or any other person with whom such public shareholder is acting in concert or as a “group” (as defined in Section 13 of the U.S. Securities Exchange Act of 1934, as amended), will be restricted from redeeming its Public Shares with respect to more than an aggregate of 15% of the Public Shares. Accordingly, if a public shareholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the Public Shares, then any such shares in excess of that 15% limit would not be redeemed for cash.

Except as follows, each of the Business Combination Proposal and the Merger Proposal is interdependent on each other. The Adjournment Proposal is not conditioned on the approval of any other Proposal. If AIB’s shareholders do not approve each of the Proposals, the Business Combination may not be consummated.

The Business Combination Proposal must be approved by ordinary resolution under Cayman Islands law, being the affirmative vote of a simple majority of the votes which are cast by those holders of AIB Class A Ordinary Shares and AIB Class B Ordinary Shares (collectively, “AIB Ordinary Shares”) who, being present and entitled to vote on such Proposals at the Meeting, vote at the Meeting.

The Merger Proposal must be approved by special resolution under Cayman Islands law, being the affirmative vote of a majority of at least two-thirds of the votes which are cast by those holders of Ordinary Shares who, being present and entitled to vote at the Meeting, vote at the Meeting.

vii

Your attention is directed to the proxy statement/prospectus accompanying this notice (including the annexes thereto) for a more complete description of the proposed Business Combination and related transactions and each of the Proposals. AIB urges its shareholders to read the accompanying proxy statement/prospectus carefully.

If you have any questions or need assistance voting your AIB Ordinary Shares, please contact AIB’s proxy solicitor, Advantage Proxy, Inc., at:

Advantage Proxy, Inc.

P.O. Box 13581

Des Moines, WA 98198

Toll Free: (877) 870-8565

Collect: (206) 870-8565

Email: ksmith@advantageproxy.com

By Order of the Board of Directors

/s/ Eric Chen | ||||

Eric Chen |

viii

Page | ||

i | ||

1 | ||

2 | ||

3 | ||

8 | ||

25 | ||

47 | ||

49 | ||

104 | ||

THE BUSINESS COMBINATION AGREEMENT AND OTHER TRANSACTION DOCUMENTS | 109 | |

114 | ||

142 | ||

143 | ||

144 | ||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 152 | |

159 | ||

161 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION OF AIB | 170 | |

175 | ||

194 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF PSI | 204 | |

227 | ||

229 | ||

BENEFICIAL OWNERSHIP OF AIB SECURITIES BEFORE THE BUSINESS COMBINATION | 236 | |

BENEFICIAL OWNERSHIP OF PUBCO SECURITIES FOLLOWING THE BUSINESS COMBINATION | 237 | |

238 | ||

242 | ||

253 | ||

259 | ||

260 | ||

260 | ||

260 | ||

260 | ||

261 | ||

263 | ||

264 | ||

F-1 | ||

ANNEXES | ||

A-1 | ||

B-1 | ||

C-1 | ||

D-1 |

ix

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Pubco, constitutes a prospectus of Pubco under Section 5 of the U.S. Securities Act of 1933, as amended (the “Securities Act”), with respect to ordinary shares of Pubco (“Pubco Ordinary Shares”) to be issued to AIB shareholders and Pubco Ordinary Shares to be issued to certain PSI shareholders, if the Business Combination described herein is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to the extraordinary general meeting (the “Meeting”) of AIB shareholders at which AIB shareholders shall be asked to consider and vote upon proposals to approve the Business Combination Proposal and the Merger Proposal (each as defined herein) and to adjourn the Meeting, if necessary, to permit further solicitation of proxies because there are not sufficient votes to adopt the Business Combination Proposal or the Merger Proposal.

References to “U.S. Dollars” and “$” in this proxy statement/prospectus are to United States dollars, the legal currency of the United States. Certain monetary amounts, percentages and other figures included in this proxy statement/prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them. In particular, in certain cases, percentage changes are based on a comparison of the actual values recorded in the relevant financial statements and not rounded values shown in this proxy statement/prospectus.

1

The industry and market position information that appears in this proxy statement/prospectus is from independent market research carried out by China Insights Consultancy (“CIC”), which was commissioned by PSI. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Such information is supplemented where necessary with PSI’s own internal estimates and information obtained taking into account publicly available information about other industry participants and PSI’s management’s judgment where information is not publicly available. This information appears in “Summary of the Proxy Statement/Prospectus,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of PSI,” “Information Related to PSI” and other sections of this proxy statement/prospectus.

Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this proxy statement/prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of PSI.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

Certain monetary amounts, percentages and other figures included in this proxy statement/prospectus have been subject to rounding adjustments. Certain other amounts that appear in this proxy statement/prospectus may not sum due to rounding.

2

Unless otherwise stated or unless the context otherwise requires, the term “PSI” refers to PSI Group Holdings Ltd, a Cayman Islands exempted company, the term “AIB” refers to AIB Acquisition Corporation, a Cayman Islands exempted company, and “Pubco” refers to PS International Group Ltd., a newly incorporated Cayman Islands exempted company.

In addition, in this document:

“Accounting Principles” means in accordance with U.S. GAAP, as in effect at the date of the financial statement to which it refers or if there is no such financial statement, then as of the date of Closing, using and applying the same accounting principles, practices, procedures, policies and methods (with consistent classifications, judgments, elections, inclusions, exclusions and valuation and estimation methodologies) used and applied by PSI and/or the Target Companies in the preparation of the latest audited PSI financials statements (if any).

“Adjournment Proposal” means the proposal to adjourn the Extraordinary General Meeting to a later date or dates or sine die, if necessary, to permit further solicitation and vote of proxies.

“Adjustment Amount” means (x) the Aggregate Merger Consideration Amount as finally determined in accordance with the Business Combination Agreement, less (y) the Aggregate Merger Consideration Amount that was issued at the Closing (including to the Escrow Account) pursuant to the Estimated Closing Statement.

“AIB Board” means the board of directors of AIB.

“AIB Charter” or “Current Charter” means the current amended and restated memorandum and articles of association of AIB.

“AIB Class A Ordinary Shares” or “Class A Ordinary Shares” means Class A ordinary share, $0.0001 par value per share, of AIB.

“AIB Class B Ordinary Shares” or “Class B Ordinary Shares” means Class B ordinary share, $0.0001 par value per share, of AIB.

“AIB Initial Shareholders” means the AIB Insiders with respect to the holding of the Private Shares, and/or its designees.

“AIB Insiders” means the Sponsor, officers and directors of AIB.

“AIB Ordinary Shares” or “AIB Shares” means AIB Class A Ordinary Shares and AIB Class B Ordinary Shares.

“AIB Public Shareholders” or “Public Shareholders” means the public shareholders of AIB holding the AIB Class A Ordinary Shares included in the AIB Units issued in the IPO.

“AIB Public Shares” means the AIB Class A Ordinary Shares included in the units issued in the AIB IPO.

“AIB Representative” mean the Sponsor in the capacity as the representative of AIB and the shareholders of AIB immediately prior to the effective time of the Second Merger.

“AIB Rights” means Public Rights and Private Rights.

“AIB shareholders” means the shareholders of AIB Ordinary Shares.

“AIB Units” means the units issued in the AIB IPO, each consisting of one AIB Public Share and one Public Right.

“Amended Pubco Charter” means Pubco Charter amended and restated and become effective at the First Merger Effective Time.

“Ancillary Documents” means each agreement, instrument or document including certain lock-up agreements, non-competition agreement, shareholder support agreements, registration rights agreement, employment agreements, the amended and restated memorandum and articles of association of Pubco, the Escrow Agreement, the new equity incentive plan of Pubco and the other agreements, certificates and instruments to be executed or delivered by any of the Parties hereto in connection with or pursuant to this Agreement.

3

“BGG” means Business Great Global Supply Chain Limited, an operating subsidiary of PSI.

“Business Combination Agreement” means that certain business combination agreement, among PSI, AIB, Pubco, Sponsor, PSI Merger Sub I and PSI Merger Sub II, dated December 27, 2023 (as the same may be amended, restated or supplemented).

“Business Combination Proposal” means proposal to (a) adopt and approve the Business Combination Agreement and other Transaction Documents, and (b) approve the Business Combination.

“Business Combination” means the Mergers and each of the other transactions contemplated by the Business Combination Agreement or any of the other relevant Transaction Documents.

“Cayman Companies Act” means Companies Act (Revised) of the Cayman Islands.

“Closing Company Cash” means, as of the Reference Time, the aggregate cash and cash equivalents of PSI and its direct and indirect subsidiaries (the “Target Companies”) on hand or in bank accounts, including deposits in transit, minus the aggregate amount of outstanding and unpaid checks issued by or on behalf of the Target Companies as of such time.

“Closing Date” means the date on which the Closing occurs.

“Closing Net Debt” means as of the Reference Time, (i) the aggregate amount of all Indebtedness of the Target Companies, less (ii) the Closing Company Cash, in each case of clauses (i) and (ii), on a consolidated basis and as determined in accordance with the Accounting Principles.

“Closing” means closing of the transactions contemplated by the Business Combination Agreement.

“Code” means the Internal Revenue Code of 1986, as amended from time to time, or any successor thereto.

“Company Merger Shares” means a number of Pubco Ordinary Shares equal to the quotient obtained by dividing (a) the Aggregate Merger Consideration Amount by (b) the Per Share Price.

“Continental” or “Transfer Agent” means Continental Stock Transfer & Trust Company.

“DTC” means the Depository Trust Company.

“Exchange Ratio” means the quotient obtained by dividing (i) Company Merger Shares by (ii) the total number of outstanding ordinary shares of PSI.

“Extensions” means the January 2023 Extension and the October 2023 Extension.

“Extraordinary General Meeting” or “Meeting” means the extraordinary general meeting of AIB shareholders in connection with the Business Combination.

“First Merger” means the merger of PSI Merger Sub I with and into PSI.

“Founder Shares” means 2,156,249 AIB Class A Ordinary Shares and 1 AIB Class B Ordinary Share, all of which are currently issued and outstanding and were issued to the Sponsor prior to the AIB IPO (with the Class A Ordinary Shares having been converted from Class B Ordinary Shares).

“HK$” means Hong Kong dollars, the legal currency of Hong Kong.

“Indebtedness” means of any person means, without duplication, (a) all indebtedness of such person for borrowed money (including the outstanding principal and accrued but unpaid interest), (b) all obligations for the deferred purchase price of property or services (other than trade payables incurred in the ordinary course of business), (c) any other indebtedness of such person that is evidenced by a note, bond, debenture, credit agreement or similar instrument, (d) all obligations of such person under leases that should be classified as capital leases in accordance with U.S. GAAP (as applicable to such person), (e) all obligations of such person for the reimbursement of any obligor on any line or letter of credit, banker’s acceptance, guarantee or similar credit transaction, in each case, that has been drawn or claimed against and not settled, (f) all obligations of such person in respect of acceptances issued or created, (g) all interest rate and currency swaps, caps, collars and similar agreements or hedging devices under which payments are obligated to be made by such person, whether periodically or upon the happening of a contingency,

4

(h) all obligations secured by an Lien on any property of such person, (i) any premiums, prepayment fees or other penalties, fees, costs or expenses associated with payment of any Indebtedness of such person and (j) all obligation described in clauses (a) through (i) above of any other person which is directly or indirectly guaranteed by such person or which such person has agreed (contingently or otherwise) to purchase or otherwise acquire or in respect of which it has otherwise assured a creditor against loss.

“Insider Letter Agreement” means the letter agreement, dated as of January 18, 2022, by and among AIB, the Sponsor and certain parties thereto, as amended from time to time.

“IPO” or “AIB IPO” means the initial public offering of AIB Units of AIB, which was consummated on January 21, 2022.

“IRS” means the U.S. Internal Revenue Service.

“January 2023 Extension” means the extension of the date by which AIB must consummate an initial business combination from January 21, 2023 to October 21, 2023, which was approved by AIB shareholders at an extraordinary general meeting on January 18, 2023.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“KKG” means King Kee Appraisal and Advisory Limited.

“Maxim” or the “Representative” means Maxim Group LLC and its affiliates.

“Nasdaq” means The Nasdaq Stock Market.

“Net Working Capital” means as of the Reference Time, (i) all current assets of the Target Companies (excluding, without duplication, Closing Company Cash), on a consolidated basis, minus (ii) all current liabilities of the Target Companies (excluding, without duplication, Indebtedness and unpaid Transaction Expenses), on a consolidated basis and as determined in accordance with the Accounting Principles; provided, that, for purposes of this definition, whether or not the following is consistent with the Accounting Principles, “current assets” will exclude any receivable from a PSI shareholder.

“October 2023 Extension” means the extension of the date by which AIB must consummate an initial business combination from October 21, 2023 to January 21, 2025, which was approved by AIB shareholders at an extraordinary general meeting on October 19, 2023.

“Per Share Price” means $10.00.

“Plan of First Merger” means the plan of merger with respect to the First Merger.

“Plan of Second Merger” means the plan of merger with respect to the Second Merger as set forth in Annex C.

“Private Placement Units” means the private units, each consisting of one AIB Class A Ordinary Share and one Private Right issued in a private placement concurrently with the AIB IPO.

“Private Rights” means the rights included in the Private Placement Units, each entitling its holder to receive one-tenth (1/10) of one AIB Class A Ordinary Share upon the completion of an initial business combination.

“Private Shares” means the AIB Class A Ordinary Shares included in the Private Placement Units.

“PSI Merger Sub I” means PSI Merger Sub I Limited, an exempted company with limited liability incorporated under the laws of Cayman Islands and a direct wholly-owned subsidiary of Pubco.

“PSI Merger Sub II” means PSI Merger Sub II Limited, an exempted company with limited liability incorporated under the laws of Cayman Islands and a direct wholly-owned subsidiary of Pubco.

“PSIHK” means Profit Sail Int’l Express (H.K.) Limited, an operating subsidiary of PSI.

“Pubco” means PS International Group Ltd., a Cayman Islands exempted company.

“Pubco Board” means the board of directors of Pubco.

“Pubco Ordinary Shares” means the ordinary shares of Pubco, par value $0.0001 per share.

“Public Rights” or “AIB Public Rights” means the rights included in the units issued in the AIB IPO, each entitling its holder to receive one-tenth (1/10) of one AIB Class A Ordinary Share at the closing of a business combination.

5

“Record Date” means June 25, 2024.

“redemption” means the redemption of the AIB Ordinary Shares held by AIB Public Shareholders in accordance with AIB’s then effective memorandum and articles of association and the final prospectus of its IPO.

“Reference Time” means the close of business of PSI on the date of the Closing (but without giving effect to the transactions contemplated by the Business Combination Agreement, including any payments by AIB hereunder to occur at the Closing, but treating any obligations in respect of Indebtedness, Transaction Expenses or other liabilities that are contingent upon the Closing as currently due and owing without contingency as of the Reference Time).

“Representative Shares” means an aggregate of 82,225 AIB Class A Ordinary Shares held by Maxim Partners LLC and/or its designees.

“Rule 144” means Rule 144 under the Securities Act.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Merger” means the merger of PSI Merger Sub II with and into AIB.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means AIB LLC, a Delaware limited liability company.

“Trading Suspension” means the suspension of the trading of AIB’s securities on Nasdaq as determined by the Nasdaq Hearings Panel on May 9, 2024.

“Target Net Working Capital Amount” means an amount equal to $5,000,000.

“Transaction Documents” means, collectively, the Business Combination Agreement, the Plan of First Merger, the Plan of Second Merger, and Ancillary Documents, and the expression “Transaction Document” means any one of them.

“Transaction Expenses” means (i) all fees and expenses of any of the Target Companies, Pubco, the PSI Merger Sub I or the PSI Merger Sub II incurred or payable as of the Closing and not paid prior to the Closing in connection with the consummation of the transactions contemplated by the Business Combination Agreement, including any amounts payable to professionals (including investment bankers, brokers, finders, attorneys, accountants and other consultants and advisors) retained by or on behalf of any Target Company, Pubco, the PSI Merger Sub I or the PSI Merger Sub II, (ii) any change in control bonus, transaction bonus, retention bonus, termination or severance payment or payment relating to terminated options, warrants or other equity appreciation, phantom equity, profit participation or similar rights, in any case, to be made to any current or former employee, independent contractor, director or officer of any Target Company at or after the Closing pursuant to any agreement to which any Target Company is a party prior to the Closing which become payable (including if subject to continued employment) as a result of the execution of this Agreement or the consummation of the transactions contemplated hereby, and (iii) any sales, use, real property transfer, stamp, share transfer or other similar transfer taxes imposed on AIB, Pubco, the PSI Merger Sub I, the PSI Merger Sub II or any Target Company in connection with the Business Combination.

“Trust Account” means the trust account maintained by Continental, acting as trustee, established for the benefit of AIB Public Shareholders in connection with the IPO.

“Trust Agreement” means the Investment Management Trust Agreement between AIB and Continental, as trustee, dated January 18, 2022.

“Underwriting Agreement” means the underwriting agreement entered into by and between AIB and Maxim on January 18, 2022, which was amended on December 21, 2023.

“U.S. Dollars” and “$” means United States dollars, the legal currency of the United States.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“Working Capital Loans” means funds that, in order to provide working capital or finance transaction costs in connection with a business combination, the Sponsor or an affiliate of the Sponsor or certain of AIB directors and officers may, but are not obligated to, loan AIB.

“2024 Plan” means the 2024 share incentive plan adopted by Pubco to be effective upon Closing.

6

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

PSI owns or has rights to trademarks and trade names that it uses in connection with the operation of its business. This proxy statement/prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this proxy statement/prospectus may appear without the®, ™ or SM symbols, but such references are not intended to indicate, in any way, that PSI will not assert, to the fullest extent permitted under applicable law, its rights or the right of the applicable licensor to these trademarks, trade names and service marks. PSI does not intend its use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of PSI by, any other parties.

7

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS

The following questions and answers briefly address some commonly asked questions about the Proposals to be presented at the Meeting, including the Proposal to approve the Business Combination, as further described below. The following questions and answers do not include all the information that is important to AIB shareholders. AIB shareholders are urged to read carefully this entire proxy statement/prospectus, including the annexes and other documents referred to herein.

Q: Why am I receiving this proxy statement/prospectus?

A: You are receiving this proxy statement/prospectus in connection with the Meeting. AIB is holding the Meeting to consider and vote upon the Proposals described below. Your vote is important. You are encouraged to vote as soon as possible after carefully reviewing this proxy statement/prospectus.

• Proposal No.1 — The Business Combination Proposal — To consider and vote upon a Proposal by ordinary resolution to approve the business combination agreement, dated as December 27, 2023 (as it may be amended or supplemented from time to time, the “Business Combination Agreement”), among PSI, AIB, Pubco, Sponsor, PSI Merger Sub I, and PSI Merger Sub II, and the transactions contemplated by the Business Combination Agreement (collectively, the “Business Combination”).

A copy of the Business Combination Agreement is appended to the accompanying proxy statement/prospectus as Annex A. The Business Combination Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.1 — The Business Combination Proposal.”

• Proposal No.2 — The Merger Proposal — To consider and vote on a Proposal by special resolution to approve, in connection with the Business Combination, the merge of PSI Merger Sub II with and into AIB (the “Second Merger”), the plan of the Second Merger (the “Plan of Second Merger”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex C, and any and all transactions provided in the Plan of Second Merger. The Merger Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.2 — The Merger Proposal.”

• Proposal No.3 — The Adjournment Proposal — To consider and vote upon a Proposal by ordinary resolution to adjourn the Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if it is determined by the AIB board of directors (the “AIB Board”) that more time is necessary or appropriate to approve one or more Proposals at the Meeting. The Adjournment Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “Proposal No.3 — The Adjournment Proposal.”

The Business Combination Proposal and the Merger Proposal are conditional upon each other. The Adjournment Proposal is not conditioned on the approval of any other Proposal. If AIB shareholders do not approve each of the Proposals submitted at the Meeting, the Business Combination may not be consummated.

Each of the Proposals other than the Merger Proposal must be approved by ordinary resolution under Cayman Islands law, being the affirmative vote of a simple majority of the votes which are cast by those holders of AIB Ordinary Shares who, being present and entitled to vote on such Proposals at the Meeting, vote at the Meeting.

The Merger Proposal must be approved by special resolution under Cayman Islands law, being the affirmative vote of a majority of at least two-thirds of the votes which are cast by those holders of AIB Ordinary Shares who, being present and entitled to vote at the Meeting, vote at the Meeting.

Q: Are any of the Proposals conditioned on one another?

A: Yes. Each of the Business Combination Proposal and the Merger Proposal is conditioned on the approval and adoption of each other. The Adjournment Proposal is not conditioned upon the approval of any other Proposals.

Q: Why is AIB proposing the Business Combination?

A: AIB was incorporated for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities. Since AIB’s incorporation, the AIB Board has sought to identify suitable candidates in order to effect such transaction. In its review of PSI, the AIB Board considered a variety of factors weighing positively

8

and negatively in connection with the Business Combination. After careful consideration, the AIB Board has determined that the Business Combination presents a highly attractive business combination opportunity and is in the best interests of AIB. The AIB Board believes that, based on its review and consideration, the Business Combination presents an opportunity to increase shareholder value. However, there can be no assurance that the anticipated benefits of the Business Combination will be achieved. Shareholder approval of the Business Combination is required by the Business Combination Agreement and the Current Charter.

Q: Who is PSI?

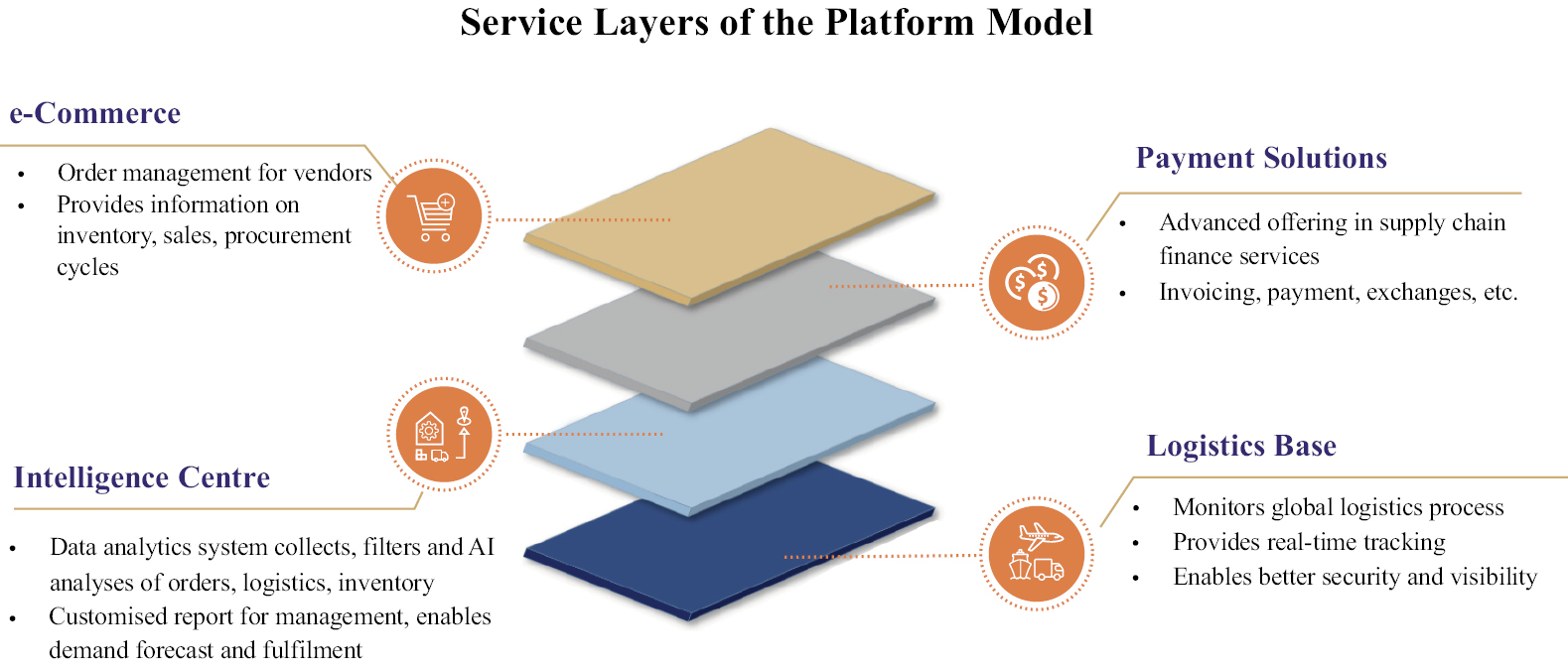

A: PSI is a long-established global logistics and supply chain solution provider, specialized in air freight forwarding services, connecting businesses from Asian transportation hubs to the United States and the rest of the world. PSI operates through its subsidiaries in Hong Kong which derive revenue from air freight forwarding services, ocean freight forwarding services and supply chain ancillary services.

PSI is one of the renowned air freight and end-to-end supply chain solution providers in Hong Kong, with a focus on providing cross border logistics services. According to the report of CIC (“CIC Report”), in 2020, PSI ranked the sixth among 1,300 Tier-2 freight forwarders in Hong Kong, in terms of revenue. Based in Hong Kong, a prominent logistics hub in Asia, PSI benefits from geographical advantages in providing integrated solutions that combine ocean, air, and overland logistics.

PSI is positioning itself as a global e-Commerce logistic service specialist, delivering solutions that are not only cost-effective but also sufficiently fast to compete with local alternatives. Its ability to accommodate adaptive service models is crucial for serving cross-border merchants, brands and e-Commerce platforms. This flexibility and adaptability are underpinned by PSI’s expertise in traditional services, which include air freight forwarding and ocean freight forwarding.

Q: What will happen in the Business Combination?

A: Pursuant to the Business Combination Agreement, and upon the terms and subject to the conditions set forth therein, AIB will acquire PSI in a transaction referred to in this proxy statement/prospectus as the Business Combination. At the Closing, among other things, (a) PSI Merger Sub I will merge with and into PSI (the “First Merger”), with PSI surviving the First Merger as a wholly-owned subsidiary of Pubco and the outstanding shares of PSI being converted into the right to receive shares of Pubco; and (b) one business day following the First Merger, PSI Merger Sub II will merge with and into AIB (the “Second Merger”, and together with the First Merger, the “Mergers”), with AIB surviving the Second Merger as a wholly-owned subsidiary of Pubco and the outstanding securities of AIB being converted into the right to receive substantially equivalent securities of Pubco (the Mergers together with the other transactions contemplated by the Business Combination Agreement and other Ancillary Documents, the “Transactions”). The cash held in the Trust Account and the proceeds from any financing transactions in connection with the Business Combination will be used by Pubco for working capital and general corporate purposes following the consummation of the Business Combination. A copy of the Business Combination Agreement is attached to this proxy statement/prospectus as Annex A. For Pubco’s organizational structure chart upon consummation of the Business Combination, see “Proposal No. 1 — The Business Combination Proposal — Post-Business Combination Corporate Structure.”

Q: What will PSI Securityholders receive in the Business Combination?

A: Subject to the terms of the Business Combination Agreement and customary adjustments, including for net working capital, indebtedness, and transaction expenses, as set forth therein, the aggregate consideration to be delivered to PSI Securityholders in connection with the Business Combination will be a number of Pubco Ordinary Shares equal to the quotient obtained by dividing $200,000,000 by the Per Share Price of $10.00.

Q: Will AIB obtain new financing in connection with the Business Combination?

A: AIB may enter into and consummate subscription agreements with investors relating to a private equity investment in the AIB to purchase shares of AIB in connection with a private placement, and/or enter into backstop arrangements with potential investors, in either case on terms mutually agreeable to PSI and AIB, acting reasonably (a “PIPE”). If AIB elects to seek a PIPE investment, AIB and PSI shall, and shall cause their respective representatives to, cooperate with each other and their respective representatives in connection with such PIPE investment and use their respective commercially reasonable efforts to cause such PIPE investment to occur.

9

Q: Did the AIB Board obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination?

A: Yes, AIB Board obtained a fairness opinion in connection with its determination as to whether to proceed with the business combination. For a description of the opinion issued by King Kee Appraisal and Advisory Limited (“KKG”) to the AIB Board, see “Proposal No.1 — The Business Combination Proposal — Opinion of KKG.”

Q: What equity stake will current Public Shareholders, Sponsor and the PSI shareholders hold in Pubco immediately after the completion of the Business Combination?

A: Upon the completion of the Business Combination (assuming, among other things, that no Public Shareholders exercise redemption rights with respect to their Public Shares upon completion of the Business Combination and the other assumptions described in this proxy statement/prospectus), on a diluted and as-converted basis assuming exercise and conversion of all securities, PSI Shareholders will own approximately 72.9% of the outstanding Pubco Ordinary Shares, Public Shareholders will own approximately 6.7% of the outstanding Pubco Ordinary Shares and Sponsor will own approximately 9.3% of the outstanding Pubco Ordinary Shares, as illustrate in the table below.