As filed with the Securities and Exchange Commission on September 17, 2024.

Registration No. 333-276313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EPSIUM ENTERPRISE LIMITED

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| British Virgin Islands | | 5180 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

c/o Companhia de Comércio Luz Limitada

Alameda Dr. Carlos D’assumpcao

Edf China Civil Plaza 235-243, 14 Andar P

Macau, SAR China

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Laura Hemmann, Esq. iTKG Law LLC 103 Carnegie Center, Suite 300 Princeton, NJ 08540 United States +1 (835)-222-4854 | Henry Schlueter, Esq. Celia Velletri, Esq.

Schlueter & Associates, P.C. 5655 South Yosemite Street, Suite 350 Greenwood Village, CO 80111 +1-303-292-3883 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contain two prospectuses, as set forth below:

| - | Public Offering Prospectus. A prospectus to be used for this initial public offering by us of 1,000,000 Ordinary Shares (the “Public Offering Prospectus”) through the underwriter named in the Underwriting section of the public offering prospectus. |

| | |

| - | Resale Prospectus. A prospectus to be used for the potential resale by certain selling shareholders as to 1,159,534 Ordinary Shares of the registrant respectively (the “Resale Prospectus”). The Resale Shares contained in the Resale Prospectus will not be underwritten and sold through the underwriter. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| | ● | they contain different outside and inside front covers and back covers; |

| | | |

| | ● | the Offering section in the Prospectus Summary section on page 14 of the Public Offering Prospectus is removed and replaced with the Offering section on page Alt-1 of the Resale Prospectus; |

| | | |

| | ● | the Use of Proceeds sections on page 45 of the Public Offering Prospectus is removed and replaced with the Use of Proceeds section on page Alt-1 of the Resale Prospectus; |

| | | |

| | ● | the Capitalization and Dilution sections on page 47, page 48 of the Public Offering Prospectus are deleted from the Resale Prospectus respectively; |

| | | |

| | ● | a Resale Shareholders section is included in the Resale Prospectus beginning on page Alt-2 of the Resale Prospectus; |

| | | |

| | ● | references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; |

| | | |

| | ● | the Underwriting section on page 113 of the Public Offering Prospectus is removed and replaced with a Plan of Distribution section on page Alt-3 of the Resale Prospectus; |

| | | |

| | ● | the Legal Matters section on page 118 of the Public Offering Prospectus is removed and replaced with the Legal Matters on page Alt-4 of in the Resale Prospectus; and |

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Resale Shareholders.

The resale offering pursuant to the Resale Prospectus is contingent on the listing of our Ordinary Shares on the Nasdaq and the consummation of the Offering, and the resale offering will not begin until such listing occurs. Thereafter, any sales pertaining to the Resale Prospectus will occur at prevailing market prices or in privately negotiated prices. The distribution of securities offered by the Resale Shareholders may be effected in one or more transactions that may take place in ordinary brokers’ transactions, privately negotiated transactions or through sales to one or more dealers for resale of such securities as principals. Usual and customary or specifically negotiated brokerage fees or commissions may be paid by the relevant Resale Shareholders. No sales of the shares covered by the Resale Prospectus shall occur until the Ordinary Shares sold in our initial public offering begin trading on the Nasdaq.

| The information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED [●], 2024 |

1,000,000 Ordinary Shares

EPSIUM ENTERPRISE LIMITED

This is an initial public offering of the ordinary shares (each, an “Ordinary Share”, collectively, “Ordinary Shares”) of EPSIUM ENTERPRISE LIMITED, a British Virgin Islands company. Prior to the completion of this offering, there has been no public market for our Ordinary Shares. We are offering on a firm commitment basis 1,000,000 Ordinary Shares, par value US$0.00002 per Ordinary Share. The Resale Shareholders are offering 1,159,534 Ordinary Shares in aggregate to be sold pursuant to the Resale Prospectus. We will not receive any proceeds from the sale of the Ordinary Shares to be sold by the Resale Shareholders. We expect the initial public offering price will be between $5.00 and $7.00 per Ordinary Share. This offering is contingent upon us listing our Ordinary Shares on the Nasdaq Capital Market (“Nasdaq”) (or another national exchange). There is no guarantee or assurance that our Ordinary Shares will be approved for listing on Nasdaq (or another national exchange). We have reserved the symbol “EPSM” for purposes of listing the Ordinary Shares on Nasdaq and we plan to apply to list the Ordinary Shares on Nasdaq. We cannot assure you that our application will be approved; however, if it is not approved, we will not complete this offering.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 15 to read about factors you should consider before buying our Ordinary Shares.

EPSIUM ENTERPRISE LIMITED was incorporated as a company limited by shares under the laws of the British Virgin Islands, formerly known as Shengtao Investment Development Limited. As a holding company with no material operations of our own, we conduct our operations through Companhia de Comercio Luz Limitada, our indirectly owned subsidiary incorporated under the laws of Macau Special Administrative Region of the People’s Republic of China (“Macau,” “Macao,” “Macau SAR,” or “Macao SAR”). The Company controls and receives the economic benefits of Luz’s business operations through equity ownership. The Ordinary Shares offered in this offering are shares of the holding company that is incorporated in the British Virgin Islands. Investors of our Ordinary Shares should be aware that they may never directly hold equity interests in our subsidiaries.

Epsium Enterprise Limited is a company organized under the laws of the Hong Kong Special Administration Region of the People’s Republic of China (“Hong Kong”) and an 80%-owned subsidiary of Epsium BVI. Epsium HK is a holding company and does not conduct any substantive operations in Hong Kong except for facilitating inventory procurement in Hong Kong for our only operating subsidiary, which is in Macau. Epsium HK does not maintain any office facility or personnel. Epsium HK has no revenue or expenses other than those associated with inventory procurement in Hong Kong from a few Hong Kong beverage distributors. All of Epsium’s operations are conducted in Macau by Luz, our Macau operating subsidiary. As a Hong Kong registered entity, Epsium HK is subject to Hong Kong laws generally applicable to Hong Kong entities. We believe Epsium HK is compliant with the laws and regulations governing its existence and business operations in Hong Kong, including without limitation, laws and regulations relating to data privacy and anti-monopoly, to the extent such laws and regulations are applicable to Epsium HK. Due to the wholesale nature and limited scale of our overall business and our lack of substantive operations in Hong Kong (except for facilitating inventory procurement), we do not believe laws and regulations relating to data privacy and anti-monopoly in Hong Kong currently have any impact on our ability to conduct business, accept foreign investment, or list on a U.S. or foreign exchange.

Luz is an import trading and wholesaler of primarily alcoholic beverages in Macau. As a Macau registered entity, Luz is subject to Macau laws generally applicable to Macau entities. We believe Luz is compliant with the laws and regulations governing its existence and business operations in Macau, including without limitation, laws and regulations relating to data privacy and unfair competition and anti-monopoly, to the extent such laws and regulations are applicable to Luz. Due to the predominantly wholesale nature and limited scale of our operations solely via Luz in Macau, it is not part of Luz’s business activities, nor does it have any access, to gather private data from the ultimate retail consumers of our downstream distributors such as supermarkets, restaurants, hotel casinos and other retailers in Macau. As such, we do not believe laws and regulations relating to data privacy and anti-monopoly in Macau currently have any impact on our ability to conduct business, accept foreign investment, or list on a U.S. or foreign exchange.

For more details, please see “Prospectus Summary – Summary of Risk Factors – Risks Related to Doing Business in Macau and Risks Related to the PRC” on page 24, “Risk Factors — Risks Related to the PRC” beginning on page 26 and “Risk Factors — Risks Related to Doing Business in Macau” beginning on page 24 and “Regulation” beginning on page 83.

Luz is 80% owned by Epsium HK and 20% owned by Mr. Son I Tam, our founder, CEO, CFO, Chairman, and principal shareholder. Luz operates only in Macau and is subject to Macau laws and regulations, including the Basic Law of the Macao Special Administrative Regions of the People’s Republic of China (the “Basic Law”). Although we and our subsidiaries are not based in China and we have no operations in China, we may be subject to legal and operational risks indirectly by virtue of doing business with parties in China or even directly if we decide to operate in China in the future. We do not have any variable interest entity (“VIE”) and we currently do not have any intention of establishing any VIEs in the future.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “Company”, “Epsium,” or “Epsium BVI” are to EPSIUM ENTERPRISE LIMITED, the ultimate holding company organized as a company limited by shares under the laws of the British Virgin Islands; references in this prospectus to “Epsium HK” are to Epsium Enterprise Limited, a company organized under the laws of the Hong Kong Special Administration Region of the People’s Republic of China (“Hong Kong”) and an 80%-owned subsidiary of Epsium BVI; and references in this prospectus to “Luz”, the “Operating Entity” or the “Macau Subsidiary” are to Companhia de Comercio Luz Limitada, a limited liability company organized under Macau laws and an 80%-owned operating subsidiary of Epsium HK. For more details regarding the risks regarding the Company’s holding company structure, please refer to “Prospectus Summary — Corporate History and Structure” on page 49 and “Risk Factors — Risks Related to our Ordinary Shares and This Offering — We may not be able to pay any dividends on our Ordinary Shares in the future due to BVI law.” on page 36 of the prospectus.

Our company structure is comprised of (i) a British Virgin Island holding entity, Epsium BVI, (ii) a Hong Kong holding entity, Epsium HK, which is majority-owned by Epsium BVI, and (iii) a Macau operating entity, Luz, which is majority-owned by Epsium HK. Each of Macau and Hong Kong is a Special Administrative Region of the People’s Republic of China with its own legal system under the Chinese policy of “one-country, two-systems,” which accords a special legal status to each of them within the People’s Republic of China through their respective local laws. However, because Hong Kong and Macau are constituent parts of the People’s Republic of China, our company structure, which is comprised of entities in Hong Kong and Macau, involves unique risks to our investors. If there is a significant change to current political and legal arrangements in Macau or Hong Kong, or between China and Macau, or China and Hong Kong, or if there is a duly declared state of war or state of emergency endangering national unity or security under the existing respective Basic Law of Hong Kong and Macau, however unlikely, it could potentially impact Macau and Hong Kong companies. Companies operated in Macau or Hong Kong may face the same or similar regulatory risks as those faced by companies operated in the PRC, such as risks relating to the ability to offer securities to investors, list securities on a U.S. or other foreign exchange, or accept foreign investment. Additionally, as a result of the foregoing scenarios, the PRC regulatory authorities could disallow our company structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale in this offering, including that it could cause the value of such securities to significantly decline or become worthless.

We operate only in Macau through our Macau operating entity, Luz. Although we believe that the laws and regulations of the PRC do not currently directly apply to us nor have any direct material negative impact on our business, financial condition or results of operations, and our corporate structure is stable without any interference from current applicable laws in PRC, Hong Kong, or Macau, we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and the economic conditions of the PRC because our business operations rely on the economic growth of the PRC and the smooth functioning of the PRC commercial participants in our industry, including manufacturers, exporters, and PRC tourists to Macau. Additionally, if there is a duly declared state of war or state of emergency endangering national unity or security under the existing Basic Law or that the Basic Law is fundamentally amended by the National People’s Congress of the People’s Republic of China by virtue of Macau being a constituent part of the People’s Republic of China, however unlikely, it could potentially impact Macau’s legal system and may create uncertainty in whether existing PRC laws would be made applicable in Macau. If so, and if the existing PRC laws, such as recent statements and regulatory actions by China’s government related to data security or anti-monopoly concerns, are made applicable in Macau and are negatively applied to our Macau operating entity, or the PRC government exercises its sovereign power by adopting new laws, regulations, or policies to exert more oversight and control over offerings conducted overseas and/or foreign investment in Macau-based issuers and to intervene or influence operations in Macau of Macau entities such as our Macau operating entity, however unlikely in each instance, it may negatively impact our ability to maintain our current corporate structure, conduct business, accept foreign investments, list on a U.S. or other foreign exchange. Various legal and operational risks associated with operations in China, should they become applicable to our operations, and other uncertainties could result in a material change in our operations and/or the value of the securities we are registering for sale or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. If such circumstances arise, relevant risks may arise and the same legal and operational risks associated with operations in China also apply to operations in Macau and/or Hong Kong, as applicable. These risks will become even more prominent and direct if we expand our operations into or develop a physical presence in China.

For more details, please see “Risk Factors — Risks Related to the PRC” beginning on page 26 and “Risk Factors — Risks Related to Doing Business in Macau” beginning on page 24. Please see also “Regulation – The Basic Law of the Macau SAR promulgated by the National People’s Congress of the PRC (“NPC”), the highest body of the PRC legislature, as Macau’s Constitution” on page 83 for more details regarding the Basic Law and the potential application of the PRC national law in Macau.

The PRC government recently initiated a series of statements, regulatory actions and new policies to regulate business operations in China, including cracking down on illegal activities in securities markets, enhancing supervision over China-based companies listed overseas using a VIE structure, exerting more oversight and control over offerings conducted overseas and/or foreign investment in China-based issuers, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On February 17, 2023, China Securities Regulatory Commission (the “CSRC”) promulgated the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five guidelines, which became effective on March 31, 2023, and requires PRC companies that seek to offer securities or list on overseas markets, either directly or indirectly, to fulfill the filing procedure with the CSRC. See “Risk Factors — Risks Related to the PRC — There is no assurance that Macau will not enact local laws like the Trial Measures promulgated by the CSRC, which could subject us to additional compliance requirements in the future.” on page 31 for more details.

Our Macau counsel, Vong Hin Fai Lawyers & Private Notary, has advised that, as of the date of this prospectus, the Company and its Macau subsidiary, (1) are not required to obtain permissions or approvals from any PRC national authorities to operate their businesses or to issue the Ordinary Shares to foreign investors; and (2) are not subject to operational approval from the Cyberspace Administration of China (the “CAC”) or the CSRC, including (i) the Overseas Listing Trial Measures or (ii) the Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the “M&A Rules”, adopted by six PRC regulatory agencies in 2006 and amended in 2009. Specifically, under the currently effective PRC laws and regulations, we are not required to seek approval from the CSRC or any other PRC governmental authorities for our overseas listing plan, nor have we received any inquiry, notice, warning, or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. This conclusion is based on the fact that, as of the date of this prospectus: (1) our Company’s operating subsidiary is located in Macau, (2) we and our subsidiaries have no direct operations in the PRC, and (3) pursuant to the Basic Law of the Macao Special Administrative Regions of the People’s Republic of China (the “Basic Law”), national laws of the PRC shall not be applied in Macau, except for those specified in Annex III of the Basic Law. However, the evolving legal systems of Macau and China, operating under the “One Country, Two Systems” principle, may introduce uncertainties that could potentially impact and cause uncertainties in our business, indirectly through their direct impact on our PRC suppliers and customers, and directly should we expand our business operations into the PRC. Additionally, with respect to the recent statements and regulatory actions by the PRC government, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, should there be fundamental changes to the Basic Law that make such laws and regulations applicable in Macau, although unlikely, we may be subject to these laws and regulations and risks of the uncertainty of any future actions of the PRC government in this regard. If it is determined in the future, however, that the approval of the CSRC, the CAC or any other regulatory authority is required for this offering, the offering will be delayed until we have obtained the relevant approvals. There is also the possibility that we may not be able to obtain or maintain such approval or that we erred in our conclusion that such approval was not required. If the approval was required while we mistakenly concluded that such approval was not required or if applicable laws and regulations or the interpretation of such were modified to require us to obtain approval in the future, we may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations, limit our ability to pay dividends, limit our operations, or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. For additional information, please see “Risk Factors — Risks Related to the PRC — Recent greater oversight by the Cyberspace Administration of China (the “CAC”) over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business should we start an online retail business platform directly targeting our sales at mainland consumers.” on page 30.

Pursuant to the Holding Foreign Companies Accountable Act (the “HFCAA”), if the Public Company Accounting Oversight Board (the “PCAOB”), is unable to inspect an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued a Determination Report on December 16, 2021 (the “Determination Report”) which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. Furthermore, the Determination Report identified the specific registered public accounting firms which are subject to these determinations (“PCAOB Identified Firms”). On June 22, 2021, United States Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), and on December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two. Our current auditor, TAAD, LLP, the independent registered public accounting firm that issues the audit report included elsewhere in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. TAAD, LLP, whose audit report is included in this prospectus, is headquartered in Diamond Bar, California, and, as of the date of this prospectus, was not included in the list of PCAOB Identified Firms in the Determination Report.

Notwithstanding the foregoing, to our knowledge, Macau has not been subject to PCAOB investigations that are conducted in a similar manner to those conducted upon China and Hong Kong, and the PCAOB’s ability to exercise oversight authority over Macau based accounting firms has not been called into questions likely due to the fact there are only limited numbers of Macau based companies listed in the United States, there is no assurance that the designation of Macau would not become an issue in the future. In addition, the above rules and amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our Ordinary Shares could be adversely affected, and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time. See “Risk Factors — Risks Related to the PRC — The newly enacted Holding Foreign Companies Accountable Act and the Accelerating Holding Foreign Companies Accountable Act passed by the U.S. Senate, all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the Public Company Accounting Oversight Board. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor.” on page 28.

As of the date of this prospectus, there has been no distribution of dividends or assets among Epsium BVI (the holding company), Epsium HK (the interim holding company), or the Luz (the Operating Entity) and no transfers, dividends, or distributions to our shareholders. The Company intends to keep any future earnings to finance business operations and does not anticipate that any cash dividends will be paid in the foreseeable future. If the Company determines to pay dividends on any of the Ordinary Shares in the future, as a holding company, the Company will be dependent on receipt of funds from Epsium HK. Epsium HK, in turn, will be dependent on the receipt of funds from the Operating Entity. Payments of dividends by Epsium HK are subject to Hong Kong regulations and Epsium HK is permitted under the relevant laws of Hong Kong to provide funding through dividend distribution without restrictions on the amount of the funds. There are currently no restrictions on dividends transfers from Hong Kong to the British Virgin Islands and to U.S. investors. Current Macau regulations permit the Operating Entity to pay dividends to Epsium HK. According to Macau law, income received in Macau is subject to taxation under Macau’s Complementary Tax provisions, regardless of whether the recipient is an individual or a corporation, their specific industry, or domiciliation. However, taxpayers may be eligible for particular deductions and allowances. Any dividends received by either individuals or corporate shareholders are considered as income and thus are subject to complementary tax as stated above. Non-residents and companies not incorporated in Macau that do not conduct business activities in Macau, are normally not registered with the Macau Financial Services Bureau as taxpayers, and therefore are not required to submit their income tax returns in Macau. However, the Macau taxation authorities may challenge the accuracy of income statements and may calculate the amounts due based on prior results or estimations. In such an event, appeals are available for unsatisfied parties. In addition, in accordance with the Basic Law of Macau, no foreign exchange control policies shall be applied within Macau, allowing for the free flow of capital within, into and out of Macau.

Epsium BVI is permitted under the BVI laws to provide funding to our subsidiaries in Hong Kong and Macau through loans or capital contributions without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under BVI laws. Epsium HK is permitted under the Hong Kong laws to provide funding to Luz, subject to the compliance and satisfaction of applicable government registration, approval and/or filing requirements.

As the Company and Epsium HK are holding companies without substantive operations (except for facilitating inventory procurement for the Operating Entity by Epsium HK as described below), and neither of them generates any income, their respective payment obligations such as fees owned to professional service providers or government administrative fees are met by utilizing cash transfers from the Operating Entity. This includes the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses (if any). If our Macau subsidiary incurs debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. As a British Virgin Islands company, our board of directors has discretion as to whether to pay a dividend on its shares subject to certain restrictions under British Virgin Islands law. Specifically, we may only pay dividends if it is solvent before and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the ordinary course of business; and the value of assets of our company will not be less than the sum of our total liabilities. Even if our board of directors decides to pay dividends, the form, frequency, and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions, and other factors that the board of directors may deem relevant.

Cash is also transferred through our organization by way of intra-group transactions such as the cash transfers between the Company, Epsium HK, and the Operating Entity in 2024 and during the fiscal years ended 2023 and 2022. See “Prospectus Summary — Cash Transfers Between the Company and Our Subsidiaries and Dividend Distribution” beginning on page 5.

In 2024, the Operating Entity transferred to, or paid on behalf of, Epsium BVI a total of $548,787 to pay for professional service fees and other fees in connection with this offering, with amounts ranging between $10 and $140,000. For example, on January 23, 2024, the Operating Entity paid $77,123.25 on behalf of Epsium BVI for our annual audit fee. On March 4, 2024, the Operating Entity paid $140,000 on behalf of Epsium BVI for professional legal service fees. In 2023, Epsium HK facilitated the Operating Entity in procuring inventory in Hong Kong from Hong Kong-based alcoholic beverage suppliers. To help Epsium HK pay for these inventories, the Operating Entity transferred an aggregate of $8,660,442 to Epsium HK with amounts ranging between $12,815 and $1,827,456. In 2023, the Operating Entity also transferred to, or paid on behalf of, Epsium BVI a total of $476,399 to pay for professional service fees and other fees in connection with this offering, with amounts ranging between $12 and $55,560. For example, on January 9, 2023, the Operating Entity transferred $40,170 to Epsium BVI to pay for our annual audit fee. On January 11, 2023, the Operating Entity transferred $50,000 to Epsium BVI to pay for professional legal service fees. In 2022, the Operating Entity transferred a total of $12,500 to Epsium BVI for professional service fees payable to our auditor and legal counsel. We previously had no specific cash management policies and procedures in place that dictate how funds are transferred through our organization.

We adopted a cash management policy on September 27, 2023, to improve our cash management in general, and cash transfers between the Company and its affiliates, in particular. Under our cash management policy, to the extent a cash transfer is a part of a related party transaction, such cash transfer is further subject to our Code of Business Conduct and Ethics governing related party transactions. Please see “Prospectus Summary – Cash Transfers between the Company and Our Subsidiaries and Dividend Distribution” on page 5, “Related Party Transactions - Cash Transfers Between the Company and Our Subsidiaries” on page 94 and “Consolidated Financial Statements - Notes to the Financial Statements – Note 11. Related Party Transactions” on page F-16 for more details.

We are, and will be, a “controlled company” as defined under the Nasdaq Stock Market Rules as long as Mr. Son I Tam, our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), chairman of the Board of Directors, (“Chairman”), and principal shareholder, and his affiliates own and hold more than 50% of our outstanding Ordinary Shares. As of the date of this prospectus, Mr. Tam, as the controlling shareholder of the Company, can decide on all matters requiring shareholder approval or matters which may be approved by shareholders under the Company’s Memorandum and Articles of Association by virtue of his controlling ownership in the Company based on his direct and indirect ownership (through Epsium HK) of the Company’s outstanding Ordinary Shares, including the election of directors, amendment of memorandum and articles of association, and approval or disapproval of major corporate transactions, such as a change in control, a transaction with take-over effect, merger, consolidation, or sale of assets. The Company has adopted a Code of Business Conduct and Ethics to impose certain review procedures that require independent director review and approval of conflict of interests and related party transactions, which applies to all directors, officers, and employees of the Company, including Mr. Tam. Additionally, the Company plans to adopt an Audit Committee Charter effective upon the completion of this offering and the listing of our Ordinary Shares on Nasdaq to include additional internal control and risk management procedures to further address conflicts of interest issues.

For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including, among others:

| ● | an exemption from the rule that a majority of our board of directors must be independent directors; |

| ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and |

| ● | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and compensation committees might not consist entirely of independent directors upon closing of this offering.

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. As such, in this prospectus we have taken advantage of certain reduced public company reporting requirements that apply to emerging growth companies regarding selected financial data and executive compensation arrangements. See sections titled “Prospectus Summary — Implications of Our Being an ‘Emerging Growth Company’” on page 8 and “Prospectus Summary — Implications of Our Being a ‘Foreign Private Issuer’” beginning on page 8 for additional information.

Unless otherwise specified, in the context of describing business and operations, we are referring to the business and operations conducted by Luz. Although we do not currently have cash or assets in the PRC and our Hong Kong subsidiary, Epsium HK, does not have substantive operations other than facilitating inventory procurement in Hong Kong, to the extent cash or assets in the business is in the PRC, Hong Kong or a PRC or Hong Kong entity in the future, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of the Company or our subsidiary by the PRC government to transfer cash or assets. See “Prospectus Summary – Summary of Risk Factors – Risks Related to Doing Business in Macau and Risks Related to the PRC” on page 4 and “Risk Factors – Risks Related to the PRC – Any restrictions of cash flows among Epsium BVI, Epsium Hong Kong, and our Operating Entity in Macau may adversely affect our ability to meet our financial requirements or make dividend or other shareholder distributions to our shareholders.” on page 26.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total(4) | |

| Initial public offering price (1) | | $ | 6.00 | | | $ | 6,000,000 | |

| Underwriter’s discounts (2) | | $ | 0.48 | | | $ | 480,000 | |

| Proceeds to our Company before expenses (3) | | $ | 5.52 | | | $ | 5,520,000 | |

| (1) | Based upon an assumed initial public offering price of US$6 per Ordinary Share, which is the midpoint of the price range set forth on the cover page of this prospectus. The actual initial public offering price will be determined at pricing. |

| (2) | Represents underwriting discounts equal to 8% per Ordinary Share. See “Underwriting” in this prospectus for more information regarding our arrangements with the Underwriter. |

| | |

| (3) | The total estimated expenses related to this offering are set forth in “Underwriting — Discounts and Expenses.” |

| | |

| (4) | Assumes that the underwriter does not exercise any portion of its over-allotment option. |

We expect our total cash expenses for this offering (including cash expenses payable to our underwriter for its out-of-pocket expenses) not to exceed approximately $1.1 million, exclusive of the above discounts. For a detailed description of the compensation to be received by the underwriter, see “Underwriting” beginning on page 113 of this prospectus.

This offering is being conducted on a firm commitment basis. The Underwriter is obligated to take and pay for all of the Ordinary Shares if any such Ordinary Shares are taken. We have granted the underwriter an option for a period of 45 days after the effective date of this registration statement to purchase up to 15% of the total number of the Ordinary Shares to be offered by us pursuant to this offering (excluding Ordinary Shares subject to this option), solely for the purpose of covering over-allotments, if any, at the public offering price less the underwriting discounts. If the underwriter exercises the option in full, and assuming an offering price of $6 per Ordinary Share, which is the midpoint of the range set forth on the cover page of this prospectus, the total gross proceeds to us, before underwriting discounts and expenses, will be approximately $6.9 million.

The Underwriter expects to deliver the Ordinary Shares against payment as set forth under “Underwriting”, on or about [●], 2024.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Prospectus dated [●], 2024.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or in any related free-writing prospectus. We are offering to sell, and seeking offers to buy, the Ordinary Shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares. We have not taken any action to permit a public offering of the Ordinary Shares outside the United States or to permit the possession or distribution of this prospectus or any filed free writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any filed free writing prospectus must inform themselves about and observe any restrictions relating to the offering of the Ordinary Shares and the distribution of this prospectus or any filed free writing prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

Until [●], 2024 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

About this Prospectus

We and the Underwriter have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such an offer or sale. For the avoidance of doubt, no offer or invitation to subscribe for Ordinary Shares is made to the public in the British Virgin Islands. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Conventions that Apply to this Prospectus

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| | ● | “BVI” refers to the British Virgin Islands; |

| | | |

| | ● | “China” or the “PRC” refers to the People’s Republic of China, excluding the special administrative regions of Hong Kong, Macau, and Taiwan for the purposes of this prospectus only; Reference to laws and regulations of “China” or the “PRC” are only to such laws and regulations of mainland China; the term “Chinese” has a correlative meaning for the purpose of this prospectus; |

| | | |

| | ● | “Epsium HK” refers to Epsium Enterprise Limited, a company organized under the laws of the Hong Kong Special Administration Region of the People’s Republic of China and a majority-owned subsidiary of Epsium BVI; |

| | | |

| | ● | “Hong Kong” refers to the Hong Kong Special Administration Region of the People’s Republic of China; |

| | | |

| | ● | “Hong Kong dollars”, or “HKD” refers to the legal currency of Hong Kong; |

| | | |

| | ● | “Luz”, “Operating Entity”, or “Macau Subsidiary” refers to Companhia de Comercio Luz Limitada (also referred to as 光貿易有限公司 in Macau), a limited liability company organized under the Macau Special Administration Region of the People’s Republic of China, which is majority-owned by Epsium HK; |

| | | |

| | ● | “Macau,” “Macao,” “Macao SAR,” or “Macau SAR” refers to the Macau Special Administration Region of the People’s Republic of China; |

| | | |

| | ● | “Macau Patacas”, or “MOP” refers to the legal currency of Macau; |

| | | |

| | ● | “Resale Shareholders” refers to Dragon Rise Development Limited, a British Virgin Islands Company 100% owned by Mr. Chi Seng Lou and Golden Gradon Development Limited, a British Virgin Islands company 100% owned by Mr. Xing Hong Ma, both existing shareholders of the Company that are selling their Ordinary Shares pursuant to the Resale Prospectus. |

| | | |

| | ● | “our subsidiaries” refers to Luz and Epsium HK; |

| | | |

| | ● | “shares”, “Shares”, “ordinary shares”, or “Ordinary Shares” refers to the ordinary shares of Epsium (as defined below), par value US$0.00002 per share; |

| | | |

| | ● | “the Company”, “Epsium”, or “Epsium BVI” refers to EPSIUM ENTERPRISE LIMITED, a company limited by shares under the laws of the British Virgin Islands; |

| | | |

| | ● | “U.S. dollars”, “$”, “US$”, “USD” or “dollars” refers to the legal currency of the United States; |

| | | |

| | ● | “we”, “us”, “our Company”, or “our” are to EPSIUM ENTERPRISE LIMITED, together with its subsidiaries as a group, and, in the context of describing the substantive operations, Luz. |

On February 8, 2024, pursuant to the written resolutions signed by all the directors of the Company, the Company accepted the surrender of shares by each shareholder of the Company (the “Share Surrender”) and approved the cancellation of the surrendered shares (the “Share Cancellation”) such that following the Share Surrender and Share Cancellation, the total number of issued shares held by each shareholder of the Company will be reduced to 20% (or 1/5) of such shareholder’s shareholding before the Share Surrender. As a result of the Share Surrender and the Share Cancellation, the total number of issued shares of the Company reduced from 60,002,670 ordinary shares to 12,000,534 ordinary shares, with a par value of US$0.00002 per share. The maximum number of shares which the Company is authorized to issue and the par value of each share both remain unchanged following the Share Surrender and the Share Cancellation.

All share numbers, warrant numbers, and exercise prices appearing in this registration statement will be adjusted to give effect to the Share Surrender and Share Cancellation, unless otherwise indicated or unless the context suggests otherwise.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our Shares. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. This prospectus contains information from an industry report commissioned by us and prepared by Frost & Sullivan, an independent research firm, to provide information regarding our industry and our market position.

To the extent references to “we”, “us”, and “our” are used in the context of a discussion or description of products, operations, market and other commercial activities, such references relate to Luz, the Operating Entity and not its direct or indirect parent companies unless the context clearly suggests otherwise.

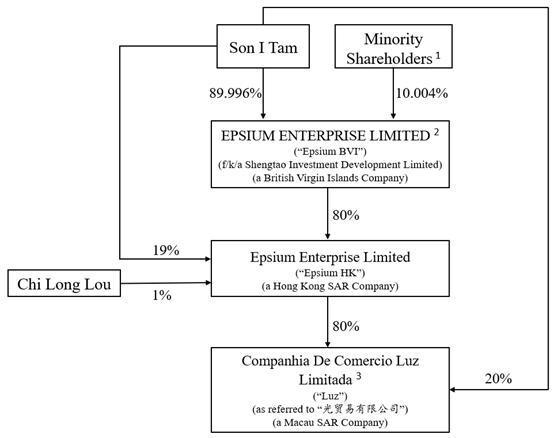

Overview

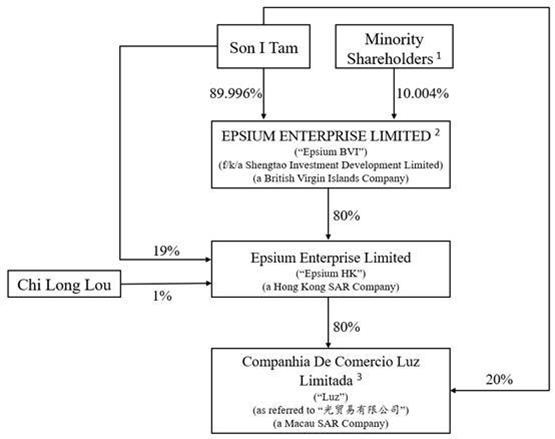

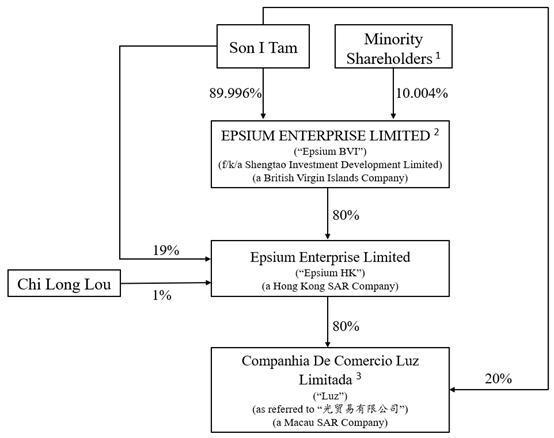

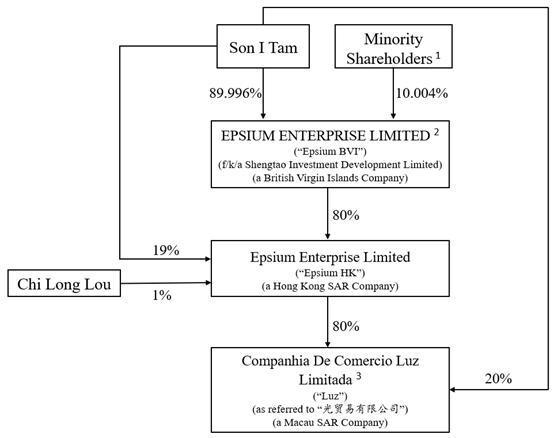

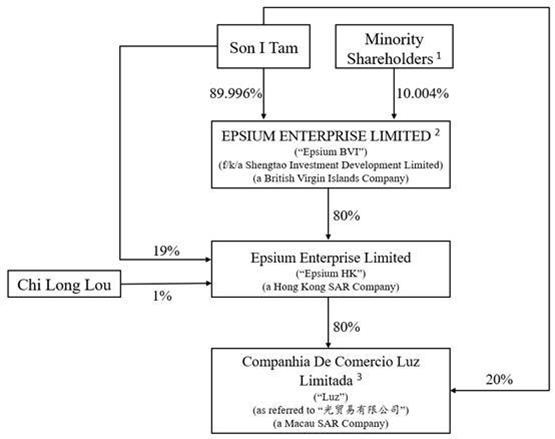

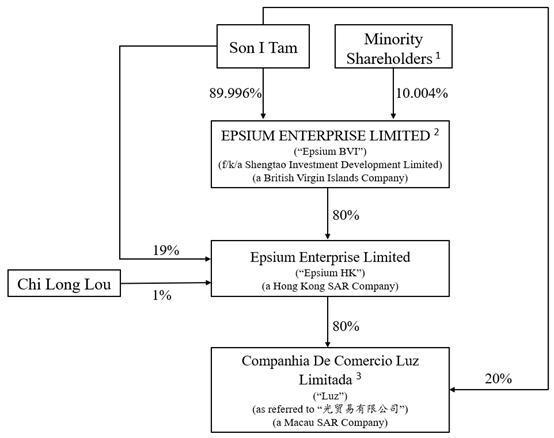

We are a holding company incorporated under the laws of British Virgin Islands. As a holding company with no material operation of its own, we conduct substantially all our operations through an indirect Macau subsidiary, Companhia de Comercio Luz Limitada in Macau, or Luz. Luz is an 80%-owned subsidiary of Epsium Enterprise Limited in Hong Kong, or Epsium HK. Mr. Son I Tam, our CEO, CFO, Chairman, principal shareholder, and the founder of Epsium and Luz directly holds (i) 89.996% ownership interest in Epsium, (ii) 19% interest in Epsium HK, and (iii) 20% ownership interest in Luz.

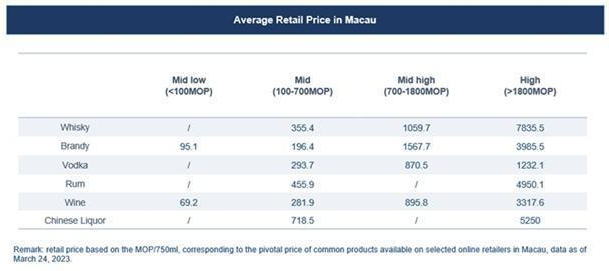

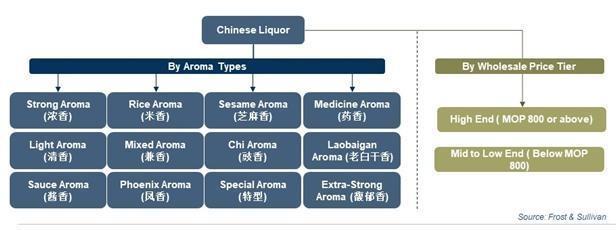

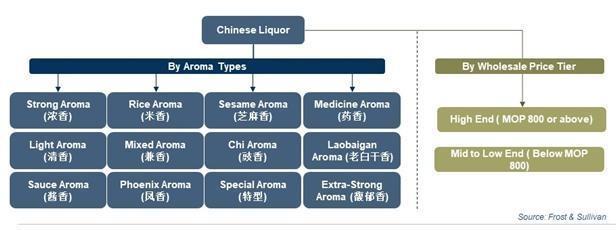

Luz is an import trading and wholesaler of primarily alcoholic beverages in Macau. Through Luz, we import and sell a broad range of premium beverages, primarily alcoholic beverages and, in 2022, a small quantity of tea and fruit juice. The alcoholic beverages we sell include Chinese liquor, French cognac, Scottish whiskey, fine wine, Champagne, and other miscellaneous beverage alcohol. Sales of Chinese liquor is by far our most significant operations, and we are a top wholesaler of high-end Chinese liquor in Macau. We operate only in Macau.

Corporate History and Structure

Epsium BVI was established on March 24, 2020, in British Virgin Islands. Epsium HK was set up on March 12, 2020, in Hong Kong, SAR China. On March 12, 2020, Mr. Chi Long Lou acquired 100% and 10,000 shares of Epsium HK by paying HKD10,000. On May 17, 2021, Epsium BVI purchased 8,000 shares of Epsium HK from Mr. Chi Long Lou by paying HKD8,000. On May 17, 2021, Mr. Son I Tam, our CEO, CFO, Chairman, and principal shareholder, purchased 1,900 shares of Epsium HK from Mr. Chi Long Lou by paying HKD1,900. Mr. Chi Long Lou currently owns 1% of Epsium HK.

On February 8, 2024, pursuant to the written resolutions signed by all the directors of the Company, the Company accepted the surrender of shares by each shareholder of the Company (the “Share Surrender”) and approved the cancellation of the surrendered shares (the “Share Cancellation”) such that following the Share Surrender and the Share Cancellation, the total number of issued shares held by each shareholder of the Company will be reduced to 20% (or 1/5) of such shareholder’s shareholding before the Share Surrender. As a result of the Share Surrender and the Share Cancellation, the total number of issued shares of the Company reduced from 60,002,670 ordinary shares to 12,000,534 ordinary shares, with a par value of US$0.00002 per share. The maximum number of shares which the Company is authorized to issue and the par value of each share both remain unchanged following the Share Surrender and the Share Cancellation.

The following diagram illustrates our corporate structure as of the date of this prospectus, which assumes that the Resale Shareholders have not sold any shares at the time of the offering. For more details on our corporate history, please refer to “Corporate History and Structure” on page 49 of the prospectus.

Notes:

| (1) | Includes Ordinary Shares held by the minority shareholders, each a natural person or entity who, each directly or indirectly, owns less than 5% of the Company’s Ordinary Shares. |

| (2) | EPSIUM ENTERPRISE LIMITED (or Epsium BVI), a holding company without operations, is the company issuing securities sold in the offering. |

| (3) | Companhia de Comercio Luz Limitada (or Luz) is the operating company in Macau through which Epsium BVI conducts its operations. |

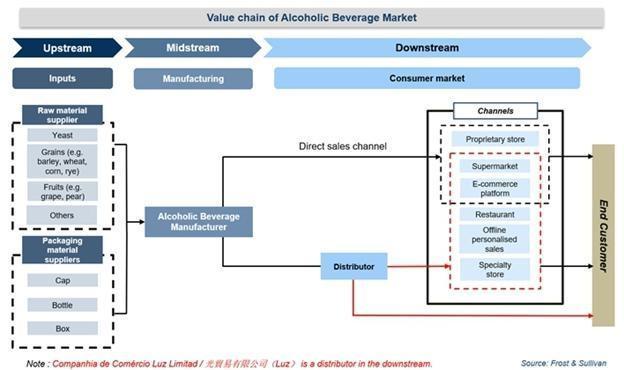

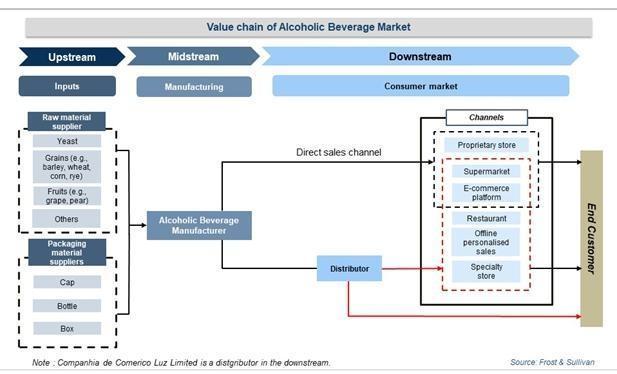

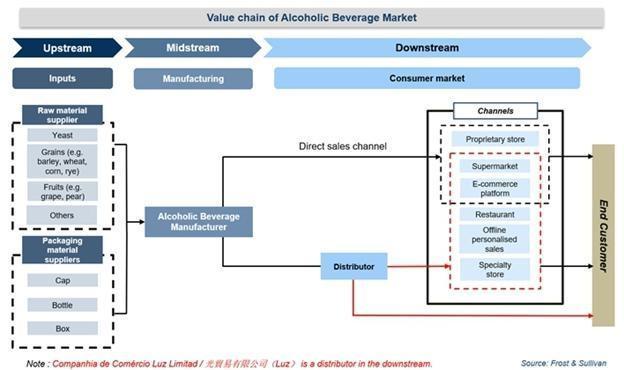

Our Principal Business

As a wholesale seller, we operate in the downstream segment of the value chain of the alcoholic beverage market in Macau. We do not conduct any manufacturing operation, directly contract with manufacturers, or act as a distributor or a sub-distributor for the manufacturers. Instead, we procure alcoholic beverages from the market ad hoc based on our business objectives and the prevailing market conditions. We sell these products to retailers, other sellers, and on-premise locations through consignment arrangements with hotels and casinos.

The three main alcoholic beverages we sell are Chinese liquors, French cognac, and Scottish whiskey. Our sales of these three categories of products accounted for 97.97%, 99.44% and 99.01% of our total percentage of sales revenue for the fiscal years 2021, 2022 and 2023, respectively. We have been in operation since 2010 and are a top wholesaler of high-end Chinese liquor, including famous Chinese liquor brands such as Moutai, Wuliangye, and Xijiu. Sale of Chinese liquors is our most significant operation. For the fiscal years 2021, 2022, and 2023, our sales of Chinese liquors were by far the most significant component of our revenues, accounting for 79.18%, 86.57% and 96.39% of our total percentage of sales revenue in these time periods, respectively. According to the Frost & Sullivan Report, as measured by the aggregate three-year sales revenue of high-end Chinese liquor for the years 2020 through 2022, we ranked as the number one wholesaler with a market share of 30.7% in Macau. In addition to alcoholic beverage products that we sell in our ordinary course of business, we also collect alcoholic beverages that are not readily available in the market. We do not currently sell these products as part of our regular operations. Instead, we plan to sell these products through auctions. We believe collecting and auctioning the right type of rare alcoholic beverages can be very lucrative and a great addition to our wholesale operations.

Our Suppliers and Customers

Luz has been in the business of importing and selling alcoholic beverages in Macau since its inception in 2010. Our founder Mr. Tam also founded Luz and has been an alcoholic beverages distribution and wholesale business veteran for more than 15 years. As such, we have very established supply relationships and sales channels. Our purchases have been concentrated on our major suppliers. We consider a supplier a major supplier if it accounts for more than 10% of our overall purchases. For the fiscal years 2021, 2022, and 2023, our major suppliers of the applicable year supplied 72.9%, 89.6% and 85.4% of our total purchases, respectively. Although we have a high concentration on our major suppliers, there was only one supplier that was consistently a major supplier in each of fiscal years 2021 and 2022. As we procure alcoholic beverages from the market ad hoc based on our business objectives and the prevailing market conditions, we do not normally have long-term supply contracts with our suppliers, including our major suppliers. Instead, in our ordinary course of business, we have an established practice in issuing standard purchase orders to our suppliers for each purchase with simple price, quantity, delivery, and payment terms.

Likewise, and to a lesser extent, our sales are concentrated on our major customers. We consider a customer a major customer if it accounts for more than 10% of our sales revenue. For the fiscal years 2021, 2022, and 2023, sales to our major customers accounted for 47.9%, 48.8% and 33.8% of our total revenues, respectively.

As a wholesale seller, our customer base consists of three primary categories: (i) hotel casinos, (ii) restaurants, and (iii) food and alcoholic beverages distributors and liquor stores. To cater to major hotel casinos, we engage in an annual bid submission process. Once our bids are accepted, hotel casino procurement departments generate purchase orders. After the hotels’ accounting teams have confirmed the delivery by the end of the month, payment is usually processed within 15 to 20 days through either bank transfers or checks. Our interactions with restaurant customers primarily revolve around telephone orders. We receive immediate payment upon delivery of the ordered products to restaurants. Payment is primarily via bank transfers, occasionally in cash. For our food and alcoholic distributor and liquor store customers, the ordering process is initiated through direct phone communication. Upon placing their orders, these customers settle payments via bank transfers or checks after receiving our invoices. Subsequent to the verification of payment receipt, these customers personally visit our warehouse for order retrieval.

In addition to sales through traditional sales channels, we collaborate with major hotel casinos in Macau through consignment arrangements. Although our consignment-based sales are currently insignificant, accounting for 2.50%, 5.89% and 5.06% of our total sales for fiscal years 2021, 2022, and 2023, respectively, we believe such collaborations represent great opportunities and are part of our growth strategies.

Although our sales highly concentrated on our major customers in the fiscal years 2021 through 2023, we did not rely on sales to any single customer. Except for the one customer that was a top customer for both fiscal years 2021 and 2023 (but not a top customer for fiscal year 2022), we did not have any top customer that was consistently a top customer year after year, and we did not have any customer who accounted for more than 18% of our total sales in each of 2022 and 2023. In concentrating on sales to top customers in a given year without having to rely on any single customer consistently year after year, we are better able to streamline and manage our sales operations, maintain a relatively small salesforce and reduce associated administrative costs.

Our Competitive Advantages

We believe that we have the following competitive advantages which enable us to differentiate ourselves from our competitors:

| | ● | Through our long-standing operating history in Macau’s alcoholic beverage market, we have accumulated significant industry expertise, established a successful track record, and built remarkable credibility as a key industry player. |

| | ● | Our deep roots and connections in Macau and our credibility have enabled us to establish stable relationships with suppliers and customers. |

| | ● | Our status as a leading high-end Chinese liquor wholesaler in Macau has enabled us to establish mutually beneficial collaboration with hotel casinos with value-added services. |

For details, please refer to “Business – Our Competitive Advantages” on page 75 of the prospectus.

Growth Strategies

Our objective is to leverage on our deep connections and expertise in Macau’s alcoholic beverage market to pursue the following growth strategies:

| ● | Create and sell highly personalized high-end alcoholic beverage products. |

| ● | Create our own private labeled products. |

| ● | Launch an E-commerce platform for retail sales and marketing. |

For details, please refer to “Business — Challenges and Growth Opportunities and Strategies” on page 80 of the prospectus.

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all the information in this prospectus before making an investment in our Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant headings. The risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business and Industry

| | ● | Our limited history under the current business model and the risk that our historical performance and growth rate may not be indicative of our future performance; |

| | | |

| | ● | the loss of multiple suppliers, lack of long-term contracts with suppliers, or a significant disruption in the supply chain; |

| | | |

| | ● | our ability to maintain and enhance our brand recognition; |

| | ● | our ability to continue to attract consumers with evolving preferences through effective marketing activities; |

| | | |

| | ● | the intense competition in the industry that we operate in; and |

| | | |

| | ● | adverse effects on our business caused by health epidemics and outbreaks such as COVID-19. |

For a detailed description of the risks above, please refer to pages 15 – 23.

Risks Related to Doing Business in Macau and Risks Related to the PRC

We operate in Macau through Luz, an 80%-owned subsidiary of Epsium HK. We are subject to Macau laws and regulations, including the Basic Law. Our company structure is comprised of (i) a British Virgin Island holding entity, Epsium BVI, (ii) a Hong Kong holding entity, Epsium HK, which is majority-owned by Epsium BVI, and (iii) a Macau operating entity, Luz, which is majority-owned by Epsium HK. Each of Macau and Hong Kong is a Special Administrative Region of the People’s Republic of China with its own legal system under the Chinese policy of “one-country, two-systems,” which accords a special legal status to each of them within the People’s Republic of China through their respective local laws. However, because Hong Kong and Macau are constituent parts of the People’s Republic of China, our company structure, which is comprised of entities in Hong Kong and Macau, involves unique risks to our investors.

Although we believe that the laws and regulations of the PRC do not currently directly apply to us nor have any direct material negative impact on our business, financial condition or results of operations, and our corporate structure is stable without any interference from current applicable laws in PRC, Hong Kong, or Macau, we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and the economic conditions of the PRC because our business operations rely on the economic growth of the PRC and the smooth functioning of the PRC commercial participants in our industry, including manufacturers, exporters, and PRC tourists to Macau. Additionally, if there is a duly declared state of war or state of emergency endangering national unity or security under the existing Basic Law or that the Basic Law is fundamentally amended by the National People’s Congress of the People’s Republic of China by virtue of Macau being a constituent part of the People’s Republic of China, however unlikely, it could potentially impact Macau’s legal system and may create uncertainty in whether existing PRC laws would be made applicable in Macau. As a result of the foregoing, the Chinese government may intervene or influence our operations at any time, or may exert more oversight and control over offerings conducted overseas and/or foreign investment in China-based issuers and such risk could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. If the existing PRC laws such as recent statements and regulatory actions by China’s government related to data security or anti-monopoly concerns, are made applicable in Macau and are negatively applied to our Macau operating entity, or the PRC government exercises its sovereign power by adopting new laws, regulations, or policies to exert more oversight and control over offerings conducted overseas and/or foreign investment in Macau-based issuers and to intervene or influence operations in Macau of Macau entities such as our Macau operating entity, however unlikely in each instance, it may negatively impact our ability to maintain our current corporate structure, conduct business, accept foreign investments, list on a U.S. or other foreign exchange. It may also affect our ability to offer or continue to offer securities to investors and significantly affect the value of such securities. If such circumstances arise, relevant risks may arise and the same legal and operational risks associated with operations in China also apply to operations in Macau and/or Hong Kong, as applicable. These risks will become even more prominent and direct if we expand our operations into or develop a physical presence in China. For more details, please see “Regulation – The Basic Law of the Macau SAR promulgated by the National People’s Congress of the PRC (“NPC”), the highest body of the PRC legislature, as Macau’s Constitution” on page 83, “Risk Factors — Risks Related to the PRC” beginning on page 26 and “Risk Factors — Risks Related to Doing Business in Macau” beginning on page 24.

Epsium Enterprise Limited is a company organized under the laws of the Hong Kong and an 80%-owned subsidiary of Epsium BVI. Epsium HK is a holding company and does not conduct any substantive operations in Hong Kong except for facilitating inventory procurement in Hong Kong for our only operating subsidiary, which is in Macau. Epsium HK does not maintain any office facility or personnel. It has no revenue or expenses other than those associated with inventory procurement in Hong Kong from a few Hong Kong beverage distributors. All of Epsium’s operations are conducted in Macau by Luz, our Macau operating subsidiary. As a Hong Kong registered entity, Epsium HK is subject to Hong Kong laws generally applicable to Hong Kong entities. We believe Epsium HK is compliant with the laws and regulations governing its existence, operations, and taxes in Hong Kong, including without limitation, laws and regulations relating to data privacy and anti-monopoly, to the extent such laws and regulations are applicable to Epsium HK. Please see “Enforceability of Civil Liabilities” on page 43 for more details of enforceability of liabilities in Hong Kong.

Luz is an import trading and wholesaler of primarily alcoholic beverages in Macau. Luz’s direct customers primarily consist of supermarkets, restaurants, hotel casinos and other retailers in Macau and it generally does not conduct retail sales. Due to the predominantly wholesale nature and limited scale of our operations solely via Luz in Macau, it is not part of Luz’s business activities, nor does it have any access, to gather private data from the ultimate retail consumers of our downstream distributors such as supermarkets, restaurants, hotel casinos and other retailers in Macau. As a Macau registered entity, Luz is subject to Macau laws generally applicable to Macau entities. We believe Luz is compliant with the laws and regulations governing its existence and operations in Macau, including without limitation, laws and regulations relating to data privacy and unfair competition and anti-monopoly, to the extent such laws and regulations are applicable to Luz. For more details, please see “Regulation” beginning on 83, “Risk Factors — Risks Related to the PRC” beginning on page 26 and “Risk Factors — Risks Related to Doing Business in Macau” beginning on page 24.

Additionally, although we and our subsidiaries are not based in China and we have no operations in China, we may be subject to legal and operational risks indirectly by virtue of doing business with parties in China or even directly if we decide to operate in China in the future.

| | ● | Our business and operations could be affected by changes in China’s economic, political, or social conditions or government policies. |

| | | |

| | ● | The evolving legal systems of Macau and China, operating under the “One Country, Two Systems” principle, introduce uncertainties that may impact and cause uncertainties in our business, as potential changes in the Basic Law or extraordinary circumstances could lead to the application of PRC laws in Macau, affecting our operations and the value of our Ordinary Shares. |

| | ● | While Macau has not faced Public Company Accounting Oversight Board (“PCAOB”) investigations like China and Hong Kong due to limited Macau-based companies being listed in the US, the potential for future concerns regarding Macau’s designation cannot be ruled out. |

| | | |

| | ● | The success of our business relies on the gaming and tourism industries of Macau. |

| | | |

| | ● | Conducting business in Macau involves certain economic and political risks relating to changes in Macau’s and China’s political, economic, and social conditions. |

| | ● | The level of visitor arrivals to Macau from China, Hong Kong, and elsewhere may decline due to, or travel to Macau may be disrupted by, natural disasters, outbreaks of disease, terrorist attacks, security alerts, military conflicts, or other factors. And the number of visitors may also decline due to government restrictions imposed by China and other governments. |

| | | |

| | ● | Epsium BVI is a holding company with no operations of its own and may rely on dividends to be paid by our Macau subsidiary to fund our cash and financing requirements, and our dividend payments and other cash distributions to our shareholders, and to service any debt we may incur and to pay our operating expenses; Although we do not currently have cash or assets in the PRC and our Hong Kong subsidiary, Epsium HK, does not have substantive operations other than facilitating inventory procurement in Hong Kong, to the extent cash or assets in the business is in the PRC, Hong Kong or a PRC or Hong Kong entity in the future, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of the Company or our subsidiary by the PRC government to transfer cash or assets. |

For a detailed description of the risks above, please refer to pages 24 – 31.

Risks Related to Our Ordinary Shares and This Offering

| | ● | Because Epsium BVI is incorporated under the laws of the British Virgin Islands, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. Federal courts may be limited. |

| | ● | There has been no public market for our Ordinary Shares prior to this offering, an active trading market for our Ordinary Shares may not develop after this offering, and the trading price of the Ordinary Shares is likely to be volatile you may not be able to resell our Ordinary Shares at or above the price you paid, or at all. |

| | | |

| | ● | Because our initial public offering price is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. |

| | | |

| | ● | The trading price of our Ordinary Shares is likely to be volatile, which could result in substantial losses to investors. |

| | | |

| | ● | Epsium BVI is an emerging growth company within the meaning of the Securities Act of 1933 (“Securities Act”) and may take advantage of certain reduced reporting requirements. |

| | | |

| | ● | Epsium BVI is a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934 (the “Exchange Act”) and are exempt from certain provisions applicable to U.S. domestic public companies. |

| | | |

| | ● | Epsium BVI is a controlled company within the meaning of the Nasdaq Market Rules and may elect to exempt from corporate governance requirements. |

For a detailed description of the risks above, please refer to pages 32 – 40.

Cash Transfers Between the Company and Our Subsidiaries and Dividend Distribution

As the Company and Epsium HK are holding companies without substantive operations except as described in the paragraph immediately below in this prospectus, and neither of them generates any income, their respective payment obligations such as fees owned to professional service providers or government administrative fees are met by utilizing cash transfers from the Operating Entity.

In 2024, the Operating Entity transferred to, or paid on behalf of, Epsium BVI a total of $407,545 to pay for professional service fees and other fees in connection with this offering, with amounts ranging between $10 and $140,000. For example, on January 23, 2024, the Operating Entity paid $77,123.25 on behalf of Epsium BVI for our annual audit fee. On March 4, 2024, the Operating Entity paid $140,000 on behalf of Epsium BVI for professional legal service fees.

Additionally, in early 2023, Epsium HK facilitated the Operating Entity in procuring inventory in Hong Kong from Hong Kong-based alcoholic beverage suppliers. These suppliers preferred to deal with the Company’s Hong Kong subsidiary as opposed to its Macau subsidiary before we established a business track record in Hong Kong. Epsium HK purchased from these Hong Kong suppliers, and sold to the Operating Entity without gross margin, alcoholic beverages in 32 transactions. To help Epsium HK pay for these inventories, the Operating Entity transferred an aggregate of $8,660,422 to Epsium HK with amounts ranging between $12,815 and $1,827,456.

In 2023, the Operating Entity also transferred to, or paid on behalf of, Epsium BVI a total of $476,399 to pay for professional service fees and other fees in connection with this offering, with amounts ranging between $12 and $55,560. For example, on January 9, 2023, the Operating Entity transferred $40,170 to Epsium BVI to pay for our annual audit fee. On January 11, 2023, the Operating Entity transferred $50,000 to Epsium BVI to pay for professional legal service fees.

In 2022, the Operating Entity transferred a total of $12,500 to Epsium BVI for professional service fees payable to our auditor and legal counsel.

We previously had no specific cash management policies and procedures in place that dictate how funds are transferred through our organization. We adopted a cash management policy on September 27, 2023 to improve our cash management in general, and cash transfers between the Company and its affiliates, in particular. Under our cash management policy, to the extent a cash transfer is a part of a related party transaction, such cash transfer is further subject to our Code of Business Conduct and Ethics governing related party transactions.

Epsium BVI is permitted under the BVI laws to provide funding to our subsidiaries in Hong Kong and Macau through loans or capital contributions without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under BVI laws. Epsium HK is permitted under the Hong Kong laws to provide funding to Luz, subject to the compliance and satisfaction of applicable government registration, approval and/or filing requirements.

As of the date of this prospectus, there has been no distribution of dividends or assets among the holding company (Epsium BVI), the interim holding company (Epsium HK), or the Operating Entity (Luz) and no transfers, dividends, or distributions to our shareholders.

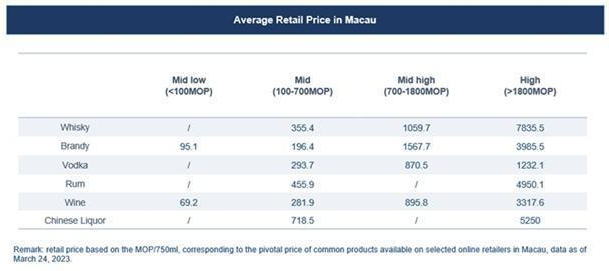

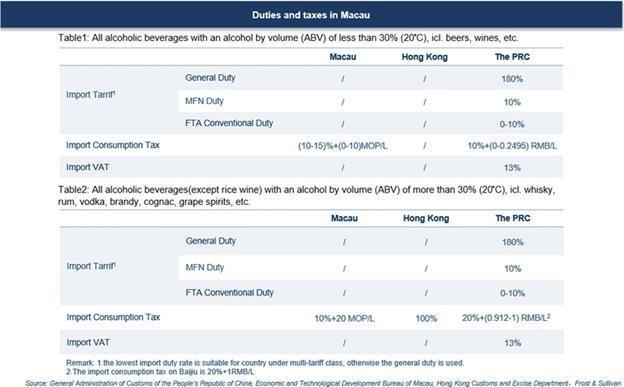

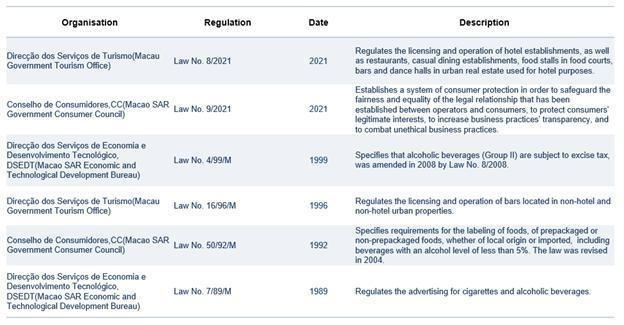

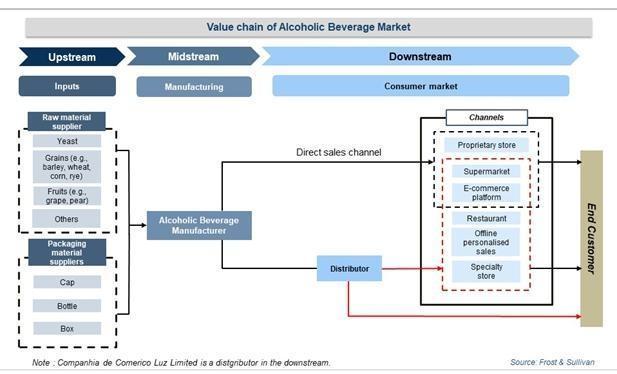

Epsium BVI is a holding company with no operations of its own. We conduct our operations in Macau primarily through our Macau subsidiary. We may rely on dividends to be paid by our Macau subsidiary to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our Macau subsidiary incurs debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.