Exhibit 99.1

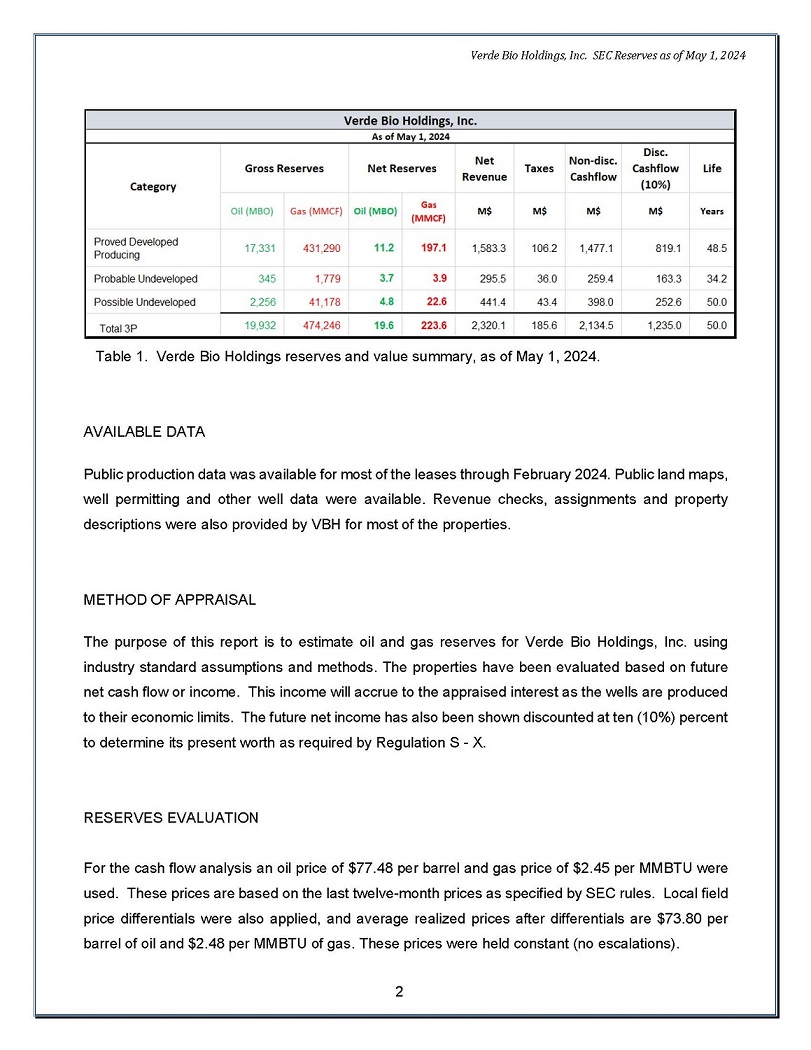

May 22, 2024 Verde Bio Holdings, Inc. 5750 Genesis Court, Suite 220B Frisco, TX 75034 ATTN: MR. SCOTT COX SUBJECT: VERDE BIO HOLDINGS SEC RESERVES EVALUATION AS OF May 1, 2024 Mr . Cox, Mire Petroleum Consultants (MPC) has evaluated the oil and gas reserves as of May 1 , 2024 , for the Verde Bio Holdings, Inc . (VBH) properties in Oklahoma, Louisiana, Ohio, Colorado, Texas, West Virginia, and Wyoming . Reserves and cash flows were generated for the VBH interests using SEC pricing ( $ 77 . 48 /barrel and $ 2 . 45 /MMBTU) . These estimates were done as per the Securities and Exchange Commission’s standards as described in the December 2008 amendment of Section 210 . 4 - 10 of Regulation S – X . This report is provided to VBH to satisfy the requirements contained in Item 1202 (a)( 8 ) of U . S . Securities and Exchange Commission Regulation S - K . As of May 1 , 2024 , we estimate net proved reserves to be 11 , 150 barrels of oil and 197 , 090 MCF of gas . Discounted ( 10 % ) net present value of the proved reserves is $ 819 , 120 . Total proved, probable and possible reserves were also evaluated . These reserves total 19 , 610 barrels of oil and 223 , 620 MCF of gas with a discounted ( 10 % ) value of $ 1 , 235 , 010 . DISCUSSION Verde Bio Holdings, Inc. has mineral and royalty, working interests in several properties across seven (7) U.S. states. A total of three hundred ninety - three (393) reserves cases have been identified and evaluated. These include producing and undeveloped wells or leases. A summary of the proved, probable, and possible reserves and value is shown in Table 1. 1927 Hillgreen Drive Katy, TX 77494 Tel: 713 - 882 - 9598 www.mirepetroleumconsultants.com

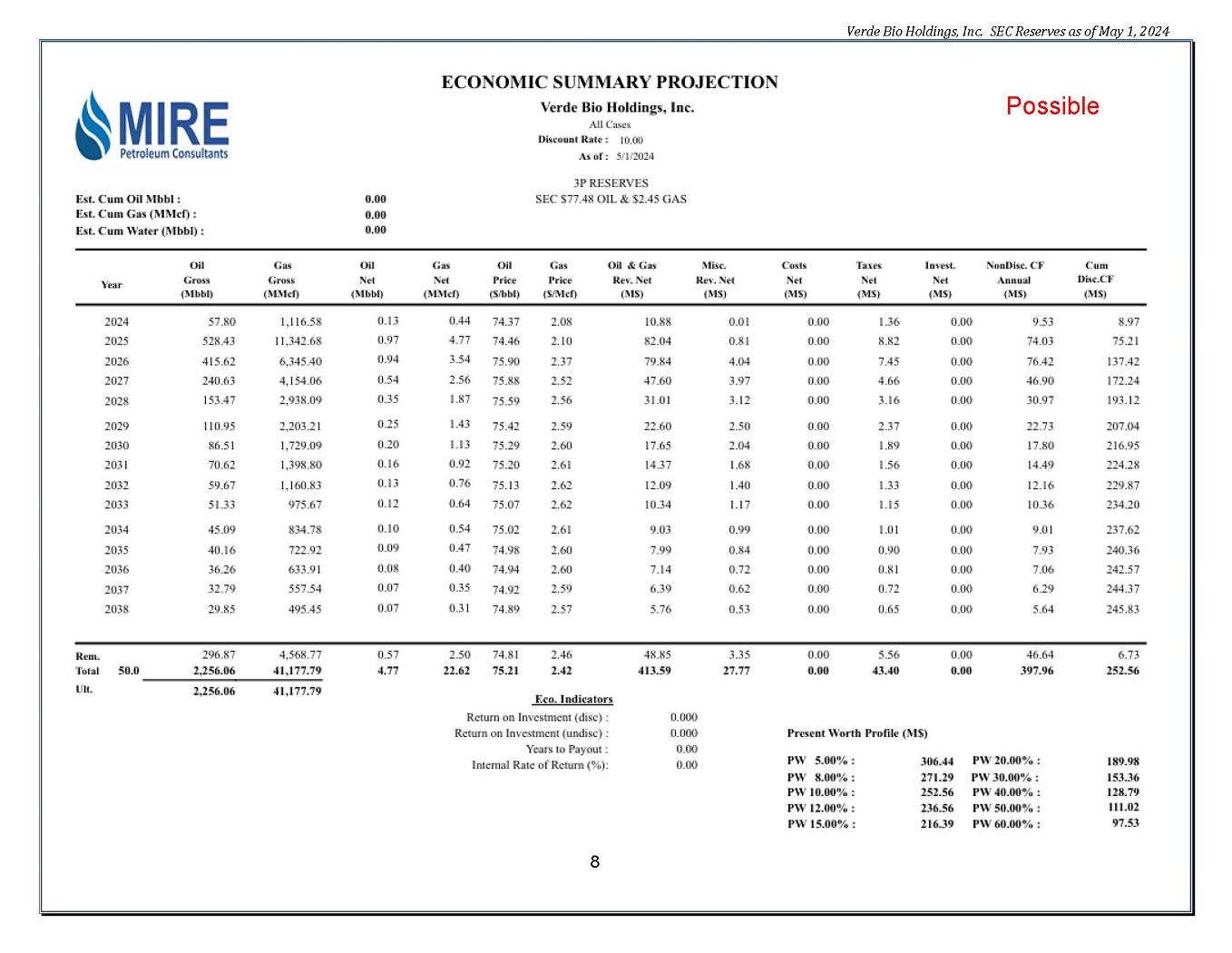

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Table 1. Verde Bio Holdings reserves and value summary, as of May 1, 2024. AVAILABLE DATA Public production data was available for most of the leases through February 2024 . Public land maps, well permitting and other well data were available . Revenue checks, assignments and property descriptions were also provided by VBH for most of the properties . METHOD OF APPRAISAL The purpose of this report is to estimate oil and gas reserves for Verde Bio Holdings, Inc . using industry standard assumptions and methods . The properties have been evaluated based on future net cash flow or income . This income will accrue to the appraised interest as the wells are produced to their economic limits . The future net income has also been shown discounted at ten ( 10 % ) percent to determine its present worth as required by Regulation S - X . RESERVES EVALUATION For the cash flow analysis an oil price of $ 77 . 48 per barrel and gas price of $ 2 . 45 per MMBTU were used . These prices are based on the last twelve - month prices as specified by SEC rules . Local field price differentials were also applied, and average realized prices after differentials are $ 73 . 80 per barrel of oil and $ 2 . 48 per MMBTU of gas . These prices were held constant (no escalations) . 2

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Ownership values for the properties were determined from revenue statements, lease and well assignments and other data by MPC . Verde Bio Holdings confirmed these ownership interests . The estimates shown in this report are for proved, probable and possible reserves . Reserve categorization conveys the relative degree of certainty ; reserves subcategorization is based on development and production status . The estimates of reserves and future revenue included herein have not been adjusted for risk . SUMMARY Reserves were estimated for the wells and leases by using engineering and geologic methods widely accepted in the industry . For producing reservoirs, performance methods were used to estimate reserves . For non - producing or undeveloped cases, volumetric calculations or analogy to similar reserves or wells were used to estimate reserves . Extrapolations were made of various historical data including operating expenses, production taxes, and oil, gas, and water production . MPC have made use of all data, appropriate methods, and procedures that are needed to prepare this report according to SEC regulation S - X Section 210 . 4 - 10 as amended in December 2008 . All estimates are a function of the quality of the available data and are subject to the existing economic conditions, operating methods, and government regulations in effect at the time of the report . The reserves presented in this report are estimates only and should not be interpreted as being exact amounts . Actual volumes recovered could be higher or lower than estimated . Not only are our reserves and revenue estimates based on that information, which is currently available, but also our estimates are subject to the uncertainties inherent in the application of judgmental factors in interpreting such information . New regulations could have an adverse effect on the reserves calculated in this report . Kurt Mire supervised or performed all the relevant technical work during the creation of this report . He is a licensed petroleum engineer and officer of Mire & Associates, Inc . a Texas corporation (DBA Mire Petroleum Consultants) . Kurt Mire has a B . S . degree in Petroleum Engineering from the University of Louisiana at Lafayette . He has over 35 years of experience in creating reserve reports and completing reserves analysis for conventional and unconventional fields in the United States . 3

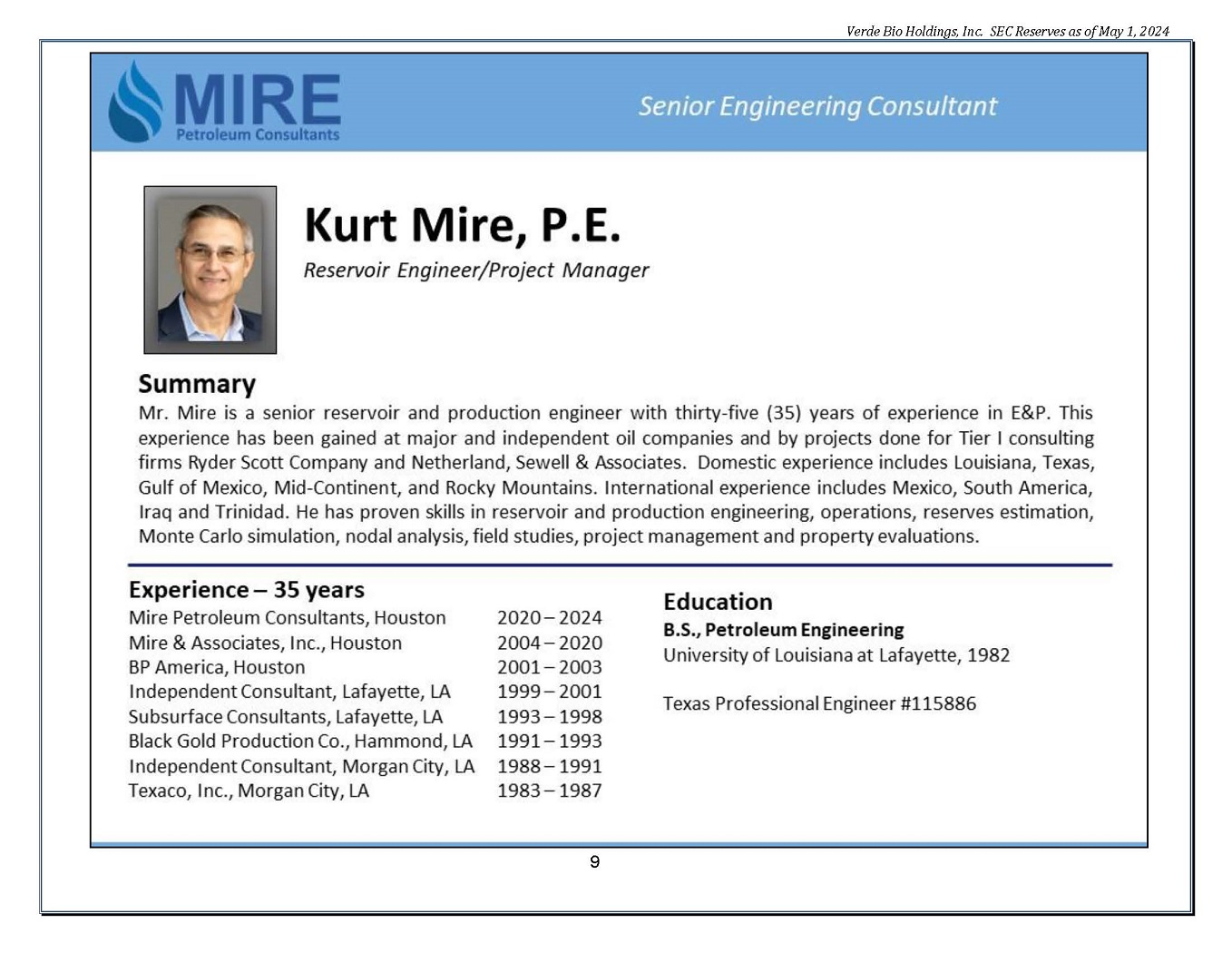

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 As of May 1 , 2024 , we estimate net proved reserves to be 11 , 150 barrels of oil and 197 , 090 MCF of gas . Discounted ( 10 % ) net present value of the proved reserves is $ 819 , 120 . Total proved, probable and possible reserves were also evaluated . These reserves total 19 , 610 barrels of oil and 223 , 620 MCF of gas with a discounted ( 10 % ) value of $ 1 , 235 , 010 . In my opinion, the reserve estimates presented in this report are reasonable and were made with generally accepted engineering and evaluation principles . The Economic Summary Projection tables for total reserves and proved, probable and possible reserves classes are attached . Regards, Kurt Mire, P.E. Mire & Associates, Inc. DBA Mire Petroleum Consultants Texas Reg # F - 15730 4

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Total 5

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Proved Proved 6

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Probable 7

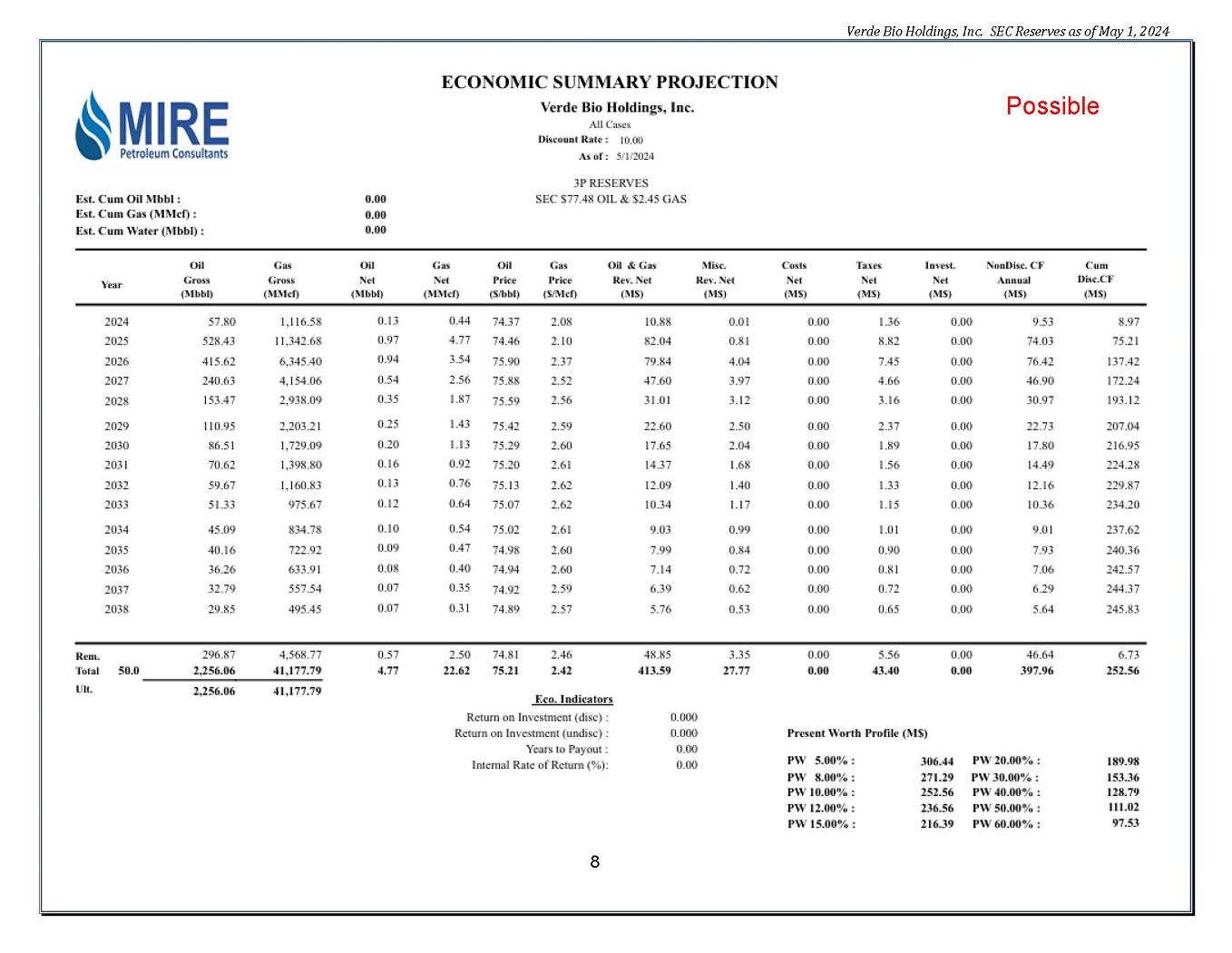

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 Possible 8

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 9

Verde Bio Holdings, Inc. SEC Reserves as of May 1, 2024 10