suppliers, Nanjing Vazyme Medical Technology Co., Ltd in China for diagnostics test kits and Venus Health Consulting Limited in Hong Kong for medical technology, for product manufacturing. After we receive our ViraxCare and ViraxClear products from our suppliers, we utilize a third party logistic company, namely, Stork Up Limited in Hong Kong, for the distribution of our products to our end-users and strategic partners overseas. However, we believe our products, in particular diagnostic test kits, provide significant value for consumers, through improved detection of diseases, improvements in health, wellness and productivity as well as by reducing other healthcare costs, such as emergency visits and hospitalizations. Our Group also seeks to maximize consumers’ access to our products and services through competitive pricing and regular evaluations of our pricing arrangements and contracts with our distributors.

Previously, the end-users of our distribution partners under our ViraxClear brand include but not limited to, clinics, pharmacies, laboratories, hospitals, and other relevant groups on an international basis, covering more than 10 countries and 4 regions, including but not limited to Europe, South America, Asia Pacific, and Sub-Saharan Africa, and Our Group expects to extend our geographical reach to North America in 2022, while the end-users of our dedicated online platforms sales under our ViraxClear brand are predominately individuals and pharmacies. The end-users of our ViraxCare products are predominately corporations, employees, and individual consumers.

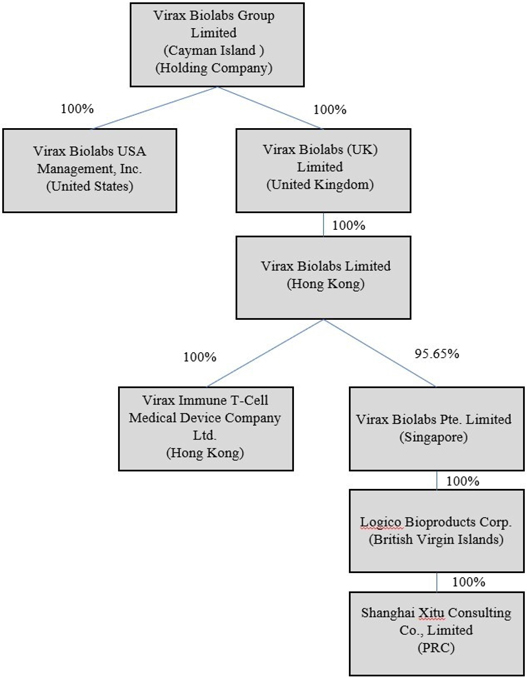

Currently, as stated above, clinical trials and research activities for our T-Cell IVD Test under the upcoming Virax Immune brand are conducted by independent third party science companies in the Netherlands together with our Hong Kong subsidiary, Virax Immune T-Cell. As our Group does not manufacture or develop any product that we sell under the ViraxCare brand, the ViraxClear brand and Sourced Brands because we act as a distributor of third-party suppliers’ products, the trading and sales of these products are primarily conducted through our SingaporeCo with some trading and sales of these products through our Logico BVI which are located in Singapore and British Virgin Islands, respectively. Shanghai Xitu is located in the PRC and is primarily engaged in procurement. Further, the majority of our executive officers and directors are located outside of the United States and are nationals or residents of jurisdictions other than the United States, and all or a substantial portion of their assets are located outside of the United States. Mr. James Foster, our Chief Executive Officer, chairman of the board of directors, holds a British Passport and currently resides in Shanghai, China; Mr. Jason Davis, our Chief Financial Officer, is located in the United States and holds a United States passport; Mr. Mark Ternouth, our Chief Technical Officer, holds a British Passport and currently resides in Shanghai, China; Mr. Tomasz George, our Chief Scientific Officer, holds a British passport and currently resides in the United Kingdom; Mr. Cameron Shaw, our Chief Operating Officer and director, holds a British passport and currently resides in the United Kingdom; Mr. Yair Erez, our independent director, holds a British passport and currently resides in the United Kingdom; Mr. Evan Norton, our independent director, holds a United States passport and currently resides in the United States; and Mr. Nelson Haight, our independent director, holds a United States passport and currently resides in the United States.

Recent Developments

Initial Public Offering

On July 20, 2022, Virax entered into an underwriting agreement with Boustead Securities, LLC, as representatives of the several underwriters, in connection with its initial public offering (“IPO”) of 1,350,000 Ordinary Shares, at a price of $5.00 per share, before deducting underwriting discounts, commissions, and other related expenses. The shares began trading on the Nasdaq Capital Market on July 21, 2022. The Company issued Representative’s Warrant to purchase up to 108,675 ordinary shares at $6.00 per share, dated July 20, 2022, to Boustead Securities, LLC. On July 25, 2022, the Company consummated its IPO generating gross proceeds to the Company of $7,762,500, before deducting underwriting discounts and other related expenses.

PIPE Financing

On November 3, 2022, Virax entered into a Securities Purchase Agreement (the “PIPE Securities Purchase Agreement”) with an accredited investor (the “Purchaser”) for a private placement offering (“Private Placement”), pursuant to which the Company received gross proceeds of approximately $3,844,500, before deducting placement agent fees and other offering expenses, in consideration of (i)1,165,000 Ordinary Shares; (b) 1,165,000 pre-funded warrants (“Pre-Funded Warrants”), and (iii) 3,495,000 warrants (“Ordinary Warrants”) at a combined purchase price of $1.65 per Ordinary Share and one and a half Ordinary Warrant, or approximately $1.65 per Pre-Funded Warrant