Exhibit 99.27

DEFI TECHNOLOGIES INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF COMMON

SHAREHOLDERS

You are invited to the 2024 annual and special meeting (the “Meeting”) of common shareholders (the “Shareholders”) of DeFi Technologies Inc. (the “Corporation”).

| When: | Tuesday, June 20, 2023 at 10:00 a.m. (Toronto time) |

| Where: | 198 Davenport Road, Toronto, Ontario, Canada, M5R 1J2 |

The purpose of the Meeting is as follows:

| 1. | Financial Statements. Receive and consider the audited consolidated financial statements as at and for the fiscal year ended December 31, 2022; |

| 2. | Auditor Appointment. Appoint BF Borgers CPA PC as auditor of the Corporation; |

| 3. | Elect Directors. Consider and elect the directors for the ensuing year; |

| 4. | Name Change. The Corporation is proposing to change its name to “DeFi Technologies Inc.”; and |

| 5. | Other Business. Consider other business as may properly come before the Meeting or any postponement(s) or adjournment(s) thereof. |

The details of all matters proposed to be put before the Shareholders at the Meeting are set forth in the management information circular (the “Circular”), under “Matters to be Considered”, accompanying this Notice of Meeting. At the Meeting, Shareholders will be asked to approve each of the foregoing items.

The board of directors of the Corporation unanimously recommends that the Shareholders vote FOR each of the appointment of BF Borgers CPA PC as auditor of the Corporation, the election of the directors of the Corporation for the ensuing year, and the Name Change.

Each common share of the Corporation (a “Common Share”) will entitle the holder thereof to one (1) vote at the Meeting.

The directors of the Corporation have fixed the close of business on May 9, 2023 as the record date, being the date for the determination of the registered Shareholders entitled to notice and to vote at the Meeting and any adjournments(s) or postponement(s) thereof.

Shareholders and/or their appointees may participate in the Meeting by way of conference call however votes cannot be cast on the conference call. Please register at https://us02web.zoom.us/meeting/register/tZAkd-6opz8vGdWDgKlwGoayED4TehafgdWk to receive conference call details. Electronic copies of the Meeting materials may be obtained at https://valour.com/investor-relations or under the Corporation’s profile on www.SEDAR.com.

The Corporation has elected to use the notice-and-access rules (“Notice and Access”) under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations for distribution of the Circular, this Notice of Meeting, the form of proxy and the voting instruction form (collectively, the “Meeting Materials”) to holders of Common Shares. Notice and Access is a set of rules that allows issuers to post electronic versions of its proxy-related materials on SEDAR and on one additional website, rather than mailing paper copies to shareholders.

Shareholders may obtain paper copies of the Meeting Materials by contacting the Corporation’s transfer agent, Odyssey Trust Company (“Odyssey”), at 1-587-885-0960 and 1-888-290-1175 (toll-free) from outside of North America. A request for paper copies should be received by Odyssey by June 6, 2023 in order to allow sufficient time for the shareholder to receive the paper copy and return the proxy by its due date.

Proxies are being solicited by management of the Corporation. A form of proxy for the Meeting accompanies this notice (the “Proxy”). Shareholders who are entitled to vote at the Meeting may vote either in person or by Proxy. Shareholders who are unable to be present in person at the Meeting are requested to complete, execute and deliver the enclosed Proxy to the Corporation’s registrar and transfer agent, Odyssey Trust Company, #702-67 Yonge Street, Toronto ON M5E 1J8 by no later than 10:00 a.m. (Toronto time) on June 16, 2023, or if the Meeting is adjourned or postponed, by no later than 48 hours prior to the time of such reconvened meeting (excluding Saturdays, Sundays and holidays). The Chairman of the Meeting may waive or extend the time limit for the deposit of Proxies. Beneficial owners of Common Shares registered in the name of a broker, custodian, nominee or other intermediary should follow the instructions provided by their broker, custodian, nominee or other intermediary in order to vote their Common Shares.

Registered holders of the potash stream preferred shares of the Corporation are hereby provided with notice of, and are entitled to attend, the Meeting and be heard at such Meeting.

DATED at Toronto, Ontario as of the 11th day of May, 2023

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | (signed) “Olivier Roussy Newton” |

| | Chief Executive Officer and Executive Chairman |

VALOUR INC.

MANAGEMENT INFORMATION CIRCULAR

May 11, 2023

FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 20, 2023

INFORMATION REGARDING CONDUCT OF MEETING

Solicitation of Proxies

This management information circular (“Circular”) is furnished in connection with the solicitation by the management of Valour Inc. (the “Corporation” or “Valour”) of proxies to be used at the annual general and special meeting (the “Meeting”) of holders of common shares of the Corporation to be held at 198 Davenport Road, Toronto, Ontario, Canada, M5R 1J2 on June 20, 2023 at 10:00 a.m. and at any postponement(s) or adjournment(s) thereof for the purposes set forth in the accompanying notice of meeting (“Notice of Meeting”). References in this Circular to the “Meeting” include references to any postponement(s) or adjournment(s) thereof. It is expected that the solicitation will be primarily by mail but proxies may also be solicited through other means by employees, consultants and agents of the Corporation. The cost of solicitation by management will be borne by the Corporation.

The Corporation is sending proxy-related materials to holders (the “Shareholders”) of common shares (the “Common Shares”) using the notice-and-access rules (“Notice and Access”) under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations. Notice and Access is a set of rules for reducing the volume of materials that must be physically mailed to Shareholders by posting the circular and additional materials online. Shareholders will still receive a hard copy of the Notice of Meeting and form of proxy or voting instruction form, as the case may be, and may choose to receive a hard copy of this Circular (collectively, the “Meeting Materials”). Details are included in the Notice of Meeting. The Meeting Materials are available online at https://valour.com/investor-relations and under the Corporation’s profile on SEDAR at www.sedar.com. Shareholders are reminded to review the Meeting Materials before voting.

The board of directors of the Corporation (the “Board”) has by resolution fixed the close of business on May 9, 2023 as the record date for the meeting (the “Record Date”) being the date for the determination of the registered Shareholders entitled to notice of and to vote at the Meeting and any postponement(s) or adjournment(s) thereof. The Board has by resolution fixed 10:00 a.m. (Toronto time) on June 16, 2023, or 48 hours (excluding Saturdays, Sundays and holidays) before any postponement(s) or adjournment(s) of the Meeting, as the time by which proxies to be used or acted upon at the Meeting or any adjournment(s) thereof shall be deposited with the Corporation’s transfer agent, Odyssey Trust Company (“Odyssey”). The proxy cut-off time may be waived or extended by the Board or a person authorized by the Board in its sole discretion without notice.

The Corporation shall make a list of all persons who are registered holders of Common Shares on the Record Date and the number of Common Shares registered in the name of each person on that date. Each Shareholder is entitled to one (1) vote on each matter to be acted on at the Meeting for each Common Share registered in his or her name as it appears on the list.

These materials are being sent to both registered and non-registered owners of Common Shares. If you are a non-registered owner, and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with the applicable securities regulatory requirements from the Intermediary (as defined below) holding on your behalf. By choosing to send these materials to you directly, the Corporation (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Unless otherwise stated, the information contained in this Circular is as of May 11, 2023. All dollar amount references in this Circular, unless otherwise indicated, are expressed in Canadian dollars.

Shareholders and/or their appointees may participate in the Meeting by way of conference call however votes cannot be cast on the conference call. Please register at https://us02web.zoom.us/meeting/register/tZAkd-6opz8vGdWDgKlwGoayED4TehafgdWk to receive conference call details. Electronic copies of the Meeting materials may be obtained under the Corporation’s profile on www.SEDAR.com.

Appointment and Revocation of Proxies

The persons named in the enclosed form of proxy are officers and/or directors of the Corporation. A Shareholder desiring to appoint some other person or entity to represent him at the Meeting may do so by inserting such person’s name in the blank space provided in that form of proxy or by completing another proper form of proxy and, in either case, depositing the completed proxy at the office of Odyssey, the transfer agent of the Corporation, as indicated on the enclosed envelope not later than the times set out above.

In addition to revocation in any other manner permitted by law, a Shareholder may revoke a proxy given pursuant to this solicitation by depositing an instrument in writing (including another proxy bearing a later date) executed by the Shareholder or by an attorney authorized in writing at 198 Davenport Road, Toronto, Ontario M5R 1J2 at any time up to and including the last business day preceding the day of the Meeting.

Voting of Proxies

Common Shares represented by properly executed proxies in favour of persons designated in the printed portion of the enclosed form of proxy will be voted for each of the matters to be voted on by Shareholders as described in this Circular or withheld from voting or voted against if so indicated on the form of proxy and in accordance with the instructions of the Shareholder on any ballot that may be called for and that, if the Shareholder specifies a choice with respect to any matter to be acted upon, the securities will be voted accordingly. In the absence of such election, the proxy will confer discretionary authority to be voted in favour of each matter for which no choice has been specified. The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting or other matters which may properly come before the Meeting. At the time of printing this Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters that are not now known to management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgement of the named proxies.

Non-Registered Holders

Only registered Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, Common Shares beneficially owned by a holder who is not a registered Shareholder (a “Non-Registered Holder”) are registered either: (i) in the name of an intermediary with whom the Non-Registered Holder deals in respect of the Common Shares such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans (an “Intermediary”); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited of which the Intermediary is a participant). In accordance with the requirements of National Instrument 54-101 of the Canadian Securities Administrators, the Corporation will distribute copies of the Notice of Meeting, forms of proxy and this Circular to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are then required to forward the Meeting materials to Non-Registered Holders unless the Non-Registered Holder has waived the right to receive them. Non-Registered Holders will be given, in substitution for the proxy otherwise contained in proxy-related materials, a request for voting instructions (the “VIF”) which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary, will constitute voting instructions which the Intermediary must follow.

The purpose of this procedure is to permit Non-Registered Holders to direct the voting of the Common Shares they beneficially own. Should a Non-Registered Holder who receives the VIF wish to vote at a Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should so indicate in the place provided for that purpose in the VIF and a form of legal proxy will be sent to the Non-Registered Holder. In any event, Non-Registered Holders should carefully follow the instructions of their Intermediary set out in the VIF.

The Corporation intends to pay Intermediaries to forward the Meeting materials to objecting Non- Registered Holders.

Interest of Persons in Matters to be Acted Upon

No director or executive officer of the Corporation, nor any person who had held such a position since the beginning of the last completed financial year end of the Corporation, no nominee director nor any respective associates or affiliates of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise in any matter to be acted upon at the Meeting other than the election of directors and as possible recipients of stock options (“Stock Options”) under the Corporation’s stock option plan (the “Stock Option Plan”) and/or deferred share units (“DSUs”) under the Corporation’s deferred share unit plan (the “DSU Plan”).

Voting Securities and Principal Holder Thereof

The authorized capital of the Corporation consists of an unlimited number of Common Shares and 20,000,000 non-voting potash stream preferred shares. As of the Record Date, the Corporation had 219,010,501 Common Shares issued and outstanding. Each Common Share will entitle the holder thereof to one (1) vote at the Meeting.

To the knowledge of the directors and officers of the Corporation, as at the Record Date, no person beneficially owns, directly or indirectly, or exercises control or direction over securities carrying more than 10% of the voting rights attached to the Common Shares.

DIRECTOR AND EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Named Executive Officers

For the financial year ended December 31, 2022, the objectives of the Corporation’s compensation strategy were to ensure that compensation for its Named Executive Officers (as defined herein) is sufficiently attractive to recruit, retain and motivate high performing individuals to assist the Corporation in achieving its goals. The Corporation also ensures that compensation is fair, balanced and linked to the performance of the Corporation and the individual Named Executive Officer.

Compensation for the Named Executive Officers is composed primarily of three components: base fees, performance bonuses and the granting of Stock Options and DSUs. Performance bonuses are awarded from time to time having regard to the performance of the Corporation and the individual Named Executive Officer. In establishing the levels of monthly base fees, the award of Stock Options, the award of DSUs and performance bonuses, the Corporation takes into consideration individual performance, responsibilities, length of service and previous grants of Stock Options and DSUs. Performance is discussed informally by the directors in light of achievement of the Corporation’s strategic objective of growth and the enhancement of Shareholder value through increases in the trading price of its Common Shares.

The Compensation, Nomination and Governance Committee (the “CNG Committee”) recommends the monthly base fees, performance bonus, Stock Options and DSUs to be granted to the Named Executive Officers to the Board for approval. The CNG Committee and the Board does not have a pre-determined compensation plan, but rather reviews informally the performance of the Named Executive Officers when determining compensation levels. Factors considered include: the long-term interests of the Corporation and its Shareholders, the financial and operating performance of the Corporation and each Named Executive Officers individual performance, contribution towards meeting corporate objectives, responsibilities and length of service; however, these factors were informally discussed and there are no formal pre-determined goals or formal measures, nor does the CNG Committee or the Board conduct any survey of competitors or have any defined benchmarks.

The CNG Committee and the Board believes that an informal process for determining compensation of Named Executive Officers is appropriate for a company of its size and that the compensation paid to each Named Executive Officer during the last fiscal year was commensurate with the Named Executive Officer’s position, experience and performance.

Directors

Compensation of directors of the Corporation is determined on a case-by-case basis with reference to the role that each director provides to the Corporation. Directors may receive cash bonuses and in addition, are entitled to participate in the Stock Option Plan and the DSU Plan, which is designed to give each option holder an interest in preserving and maximizing Shareholder value. Such grants are determined by an informal assessment of an individual’s current and expected future performance, level of responsibilities and the importance of his/her position and contribution to the Corporation.

The Corporation does not currently prescribe a set of formal objective measures to determine discretionary bonus entitlements. Rather, the Corporation uses informal goals natural to development companies such as strategic acquisitions, advancement of exploration and development, equity and debt financing and other transactions and developments that serve to increase the Corporation’s valuation. Such goals are not pre-set.

Officers who also act as directors of the Corporation do not receive any additional compensation for services rendered in their capacity as directors.

Risks Associated with Compensation

In light of the Corporation’s size and the balance between long-term objectives and short-term financial goals with respect to the Corporation’s executive compensation program, the CNG Committee and the Board does not deem it necessary to consider at this time the implications of the risks associated with its compensation policies and practices.

Financial Instruments

The Corporation does not currently have a policy that restricts directors or NEOs from purchasing financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity. However, to the knowledge of the Corporation as of the date hereof, no director or NEO of the Corporation has participated in the purchase of such financial instruments.

Performance Graph

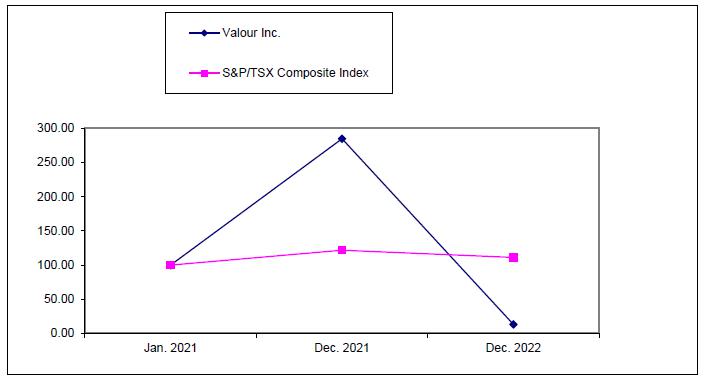

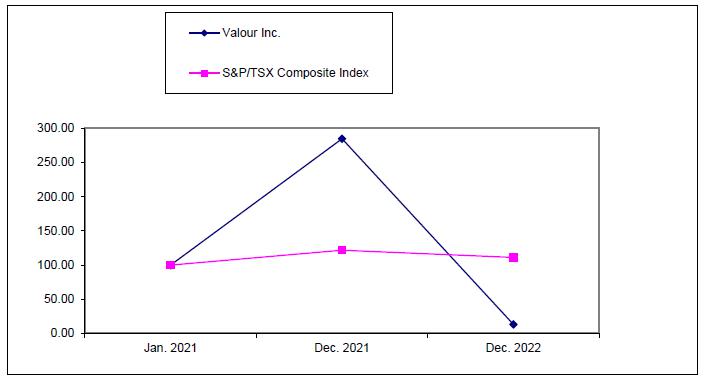

The following graph compares the yearly percentage change in the cumulative total shareholder return for C$100 invested in Common Shares on the S&P/TSX Composite Index for the period of January 31, 2021 (the month on which the Common Shares were listed on the Cboe Canada (formerly NEO Exchange Inc. (“Cboe Exchange”) to December 31, 2022, assuming the reinvestment of any dividends

The Common Shares were listed on the Cboe Exchange in January 2021. Since listing on the Cboe Exchange, the Corporation has expanded its management team to account for the growth of its business to sustain its operations in Europe and Canada as well as attracting new talent to develop its decentralized finance business. The value of the Common Shares have also corresponded to the fluctuations in the cryptocurrency market over the past few years.

NEO Summary Compensation Table

The following table summarizes the compensation paid during the three most recently completed financial years in respect of the individuals who were carrying out the role of the President & Chief Executive Officer (“CEO”) of the Corporation, Chief Financial Officer (“CFO”) or the Corporation, and the three most highly compensated executive officers of the Corporation (together with the CEO and CFO, the “Named Executive Officers” or “NEOs”). No other officer, employee or consultant of the Corporation received total compensation of $150,000 or greater.

| | | | | | | | | | | | | | | Non-equity incentive

plan compensation ($) | | | | | | | |

| Name and Principal Position | | | Year

Ended | | | | Salary

($)1 | | | | Share

Awards

($)2 | | | | Option

Awards

($)3 | | | | Annual

incentive

plans(4) | | | | Long-term

incentive

plans | | | | All other

compensation

($)6 | | | | Total

compensation

($) | |

| Olivier Roussy Newton | | | 2022 | | | | 75,000 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | 75,000 | |

| Chief Executive Officer | | | 2021 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell Starr(2) | | | 2022 | | | | 300,000 | | | | Nil | | | | 1,745,821 | | | | 300,000 | | | | Nil | | | | Nil | | | | 2,345,821 | |

| Former Chief Executive Officer | | | 2021 | | | | 150,000 | | | | 1,511,270 | | | | 548,693 | | | | NIL | | | | NIL | | | | NIL | | | | 2,209,963 | |

| and Executive Chairman | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wouter Witvoet(2) | | | 2022 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| Former Chief Executive Officer | | | 2021 | | | | 249,003 | | | | NIL | | | | NIL | | | | 150,000 | | | | NIL | | | | NIL | | | | 399,003 | |

| | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ryan Ptolemy(6) | | | 2022 | | | | 120,000 | | | | 567,998 | | | | Nil | | | | 50,000 | | | | Nil | | | | Nil | | | | 737,998 | |

| Chief Financial Officer | | | 2021 | | | | 80,000 | | | | 251,878 | | | | 1,714,586 | | | | 20,000 | | | | NIL | | | | NIL | | | | 2,066,464 | |

| | | | 2020 | | | | 17,500 | | | | N/A | | | | 2,031 | | | | N/A | | | | N/A | | | | Nil | | | | 19,531 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diana Biggs | | | 2022 | | | | 224,219 | | | | 171,285 | | | | 231,615 | | | | Nil | | | | Nil | | | | Nil | | | | 627,119 | |

| Former Chief Strategy Officer | | | 2021 | | | | 95,704 | | | | 62,970 | | | | 2,014,533 | | | | NIL | | | | NIL | | | | NIL | | | | 2,173,207 | |

| | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Johan Wattenstrom | | | 2022 | | | | 234,318 | | | | 101,520 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | 335,838 | |

| Former Chief Operating Officer | | | 2021 | | | | 75,618 | | | | 50,376 | | | | Nil | | | | NIL | | | | NIL | | | | NIL | | | | 125,994 | |

| | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kenny Choi(7) | | | 2022 | | | | 120,000 | | | | 567,998 | | | | Nil | | | | 50,000 | | | | Nil | | | | Nil | | | | 737,998 | |

| Corporate Secretary | | | 2021 | | | | 74,000 | | | | 251,878 | | | | 1,339,870 | | | | 20,000 | | | | NIL | | | | NIL | | | | 1,685,748 | |

| | | | 2020 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Notes:

| 1. | Compensation has been paid as consulting fees under the independent contractor agreement with the Named Executive Officer as described under the heading “Executive Compensation – Termination of Employment, Change in Responsibilities and Employment Contracts” of this Circular. |

| 2. | Share-based awards comprise of DSUs. Value is based on the fair value of the award on the grant date. |

| | |

| 3. | The value ascribed to option grants represents non-cash consideration and has been estimated using the Black-Sholes Models as at the date of grant, as follows: expected dividend yield — April 9, 2021 - 0%; expected volatility — 145.2%; risk-free interest rate — 0.95%; and expected life — 5 years, May 18, 2021 - 0%; expected volatility — 145.6%; risk-free interest rate — 0.95%; and expected life — 5 years, August 13, 2021 - 0%; expected volatility — 143.7%; risk-free interest rate — 0.84%; and expected life — 5 years,. This is consistent with the accounting values used in the Corporation’s financial statements. The Corporation selected the Black-Scholes model given its prevalence of use in North America. |

| | |

| 4. | Compensation paid in the form of discretionary performance based bonuses. |

| | |

| 5. | Other benefits did not exceed the lesser of $50,000 and 10% of the total annual compensation for the Named Executive Ostanfficer |

Incentive Plan Awards

The following table provides information regarding the incentive plan awards for each Named Executive Officer outstanding as of December 31, 2022.

Outstanding Share-Based Awards and Option-Based Awards

| | | Option-Based Awards | | | Share-Based Awards | |

| Name | | Number of securities underlying unexercised options (#) | | | Option

exercise

price ($) | | | Option expiration date | | | Value of unexercised in-the-money options

($) (1)(2) | | | Number of shares or units of shares that have not vested (#) | | | Market or payout value of share awards that have not vested ($)(3) | | | Market or payout value of vested share-based awards not paid out or distributed ($) | |

Olivier Roussy Newton

Chief Executive Officer | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | | | Nl | |

| | | | | | | | | | | | | | | | | | | | | | |

Russell Starr

Former Chief Executive Officer and Executive Chairman | | 650,000

1,200,000 | | | 650,000 options at $1.58

1,200,000 options at $1.11 | | | August 13, 2026

May 9, 2027 | | | Nil | | | Nil | | | Nil | | | Nil | |

| | | | | | | | | | | | | | | | | | | | | | |

Wouter Witvoet

Former Chief Executive Officer | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | |

| | | | | | | | | | | | | | | | | | | | | | |

Ryan Ptolemy

Chief Financial Officer | | | 100,000 300,000 1,300,000 | | | | 100,000 options at $0.09 300,000 options at $1.58 1,300,000 options at $1.22 | | | | November 16, 2025 April 9, 2026 May 18, 2026 | | | | 5,000 | | | | 250,000 | | | | 35,000 | | | | 37,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diana Biggs

Former Chief Strategy Officer | | | 1,500,000 1,000,000 | | | | 1,500,000 options at $1.58 1,000,000 options at $1.22 | | | | April 9, 2026 May 18, 2026 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Johan Wattenstrom

Former Chief Operating Officer | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | 50,000 | | | | 7,000 | | | | 9,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kenny Choi

Corporate Secretary | | | 150,000 300,000 1,000,000 | | | | 150,000 options at $0.09 300,000 options at $1.58 1,000,000 options at $1.22 | | | | November 16, 2025 April 9, 2026 May 18, 2026 | | | | 7,500 | | | | 250,000 | | | | 35,000 | | | | 37,800 | |

Notes:

| 1. | Based on the closing market price of $0.14 of the Common Shares on December 30, 2022 and subtracting the exercise price of the options. |

| | |

| 2. | These options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | |

| 3. | Share-based awards comprise of DSUs. Value is based on the fair value of the award on the grant date. |

Value on Pay-Out or Vesting of Incentive Plan Awards

| Name | | Option-based

awards – Value

vested during

2022 fiscal

year ($) | | Share-based

awards – Value

vested during

the 2022 fiscal

year ($) | | Non-equity

incentive plan compensation – Value earned during the 2022 fiscal year ($) | |

| Olivier Roussy Newton | | Nil | | Nil | | | Nil | |

| Ryan Ptolemy | | Nil | | Nil | | | 50,000 | |

| Russell Starr | | Nil | | Nil | | | 300,000 | |

| Diana Biggs | | Nil | | Nil | | | Nil | |

| Johan Wattenstrom | | Nil | | Nil | | | Nil | |

| Kenny Choi | | Nil | | Nil | | | 50,000 | |

None of the Named Executive Officers exercised any Stock Options or had his or her DSUs pay-out during the year ended December 31, 2022.

Employment, Consulting and Management Agreements

The following describes the respective consulting and employment agreements entered into by the Corporation and its NEOs as of the date hereof.

| Name | | Termination Notice Period | | | Monthly

Fees | | Severance on Termination | | Severance on Change of Control(1) |

Olivier Roussy Newton

Chief Executive Officer | | 30 days | | | US$ | 25,000 | | 12 months | | 36 months base fees plus aggregate cash bonuses paid in the 36 months prior to the Change of Control. |

| | | | | | | | | | | |

Russell Starr

Former Chief Executive Officer and Executive Chairman | | 30 days | | | $ | 25,000 | | 24 months | | 36 months base fees plus aggregate cash bonuses paid in the 36 months prior to the Change of Control. |

| | | | | | | | | | | |

Ryan Ptolemy

Chief Financial Officer | | 30 days | | | $ | 10,000 | | 6 months’ fees | | 24 months base fees plus aggregate cash bonuses paid in the 24 months prior to the Change of Control. |

| | | | | | | | | | | |

| Johan Wattenstrom Former Chief Operating Officer | | 30 days | | | US$ | 20,000 | | 1 months fees | | NIL |

| | | | | | | | | | | |

Kenny Choi

Corporate Secretary | | 30 days | | | $ | 10,000 | | 6 months’ fees | | 24 months base fees plus aggregate cash bonuses paid in the 24 months prior to the Change of Control. |

Notes:

| (1) | Severance upon a change of control becomes payable In the event of a Change of Control of the Corporation and within one year following the date of the Change of Control the Corporation or the officer elects to terminate the agreement. |

For the purpose of the agreements set forth above, “Change of Control” shall be defined as (1) the acquisition, directly or indirectly, by any person (person being defined as an individual, a corporation, a partnership, an unincorporated association or organization, a trust, a government or department or agency thereof and the heirs, executors, administrators or other legal representatives of an individual and an associate or affiliate of any thereof as such terms are defined in the Business Corporations Act (Ontario)) or group of persons acting jointly or in concert, as such terms are defined in the Securities Act, Ontario of: (A) shares or rights or options to acquire shares of the Corporation or securities which are convertible into shares of the Corporation or any combination thereof such that after the completion of such acquisition such person would be entitled to exercise 50% (or 25% in the case of Mr. Ptolemy’s consulting agreement) or more of the votes entitled to be cast at a meeting of the shareholders of the Corporation; (B) shares or rights or options to acquire shares, or their equivalent, of any material subsidiary of the Company or securities which are convertible into shares of the material subsidiary or any combination thereof such that after the completion of such acquisition such person would be entitled to exercise 50% (or 25% in the case of Mr. Ptolemy’s consulting agreement) or more of the votes entitled to be cast a meeting of the shareholders of the material subsidiary; or (C) more than 50% (or 25% in the case of Mr. Ptolemy’s consulting agreement) of the material assets of the Corporation, including the acquisition of more than 50% (or 25% in the case of Mr. Ptolemy’s consulting agreement) of the material assets of any material subsidiary of the Corporation; or (2) as a result of or in connection with: (A) a contested election of directors; or (B) a consolidation, merger, amalgamation, arrangement or other reorganization or acquisitions involving the Corporation or any of its Affiliates and another corporation or other entity, the nominees named in the most recent management information circular of the Corporation for election to the Corporation’s board of directors do not constitute a majority of the Corporation’s board of directors.

Summary of Termination Payments

The estimated incremental payments, payables and benefits that might be paid to the Named Executive Officers pursuant to the above noted agreements in the event of termination without cause or after a Change of Control (assuming such termination or Change of Control is effective as of the Record Date) are detailed below:

| Named Executive Officer | | Termination not for Cause ($) | | | Value of Unvested Options ($) upon termination not for cause | | Termination on a Change of Control ($) | | | Value of Unvested Options Vested ($) upon Change in Control |

| Olivier Roussy Newton | | | | | | | | | | |

| Salary and Quantified Benefits | | US$ | 300,000 | | | Nil | | US$ | 900,000 | | | Nil |

| Bonus | | | Nil | | | Nil | | | Nil | | | Nil |

| Total | | US$ | 300,000 | | | Nil | | US$ | 900,000 | | | Nil |

| Russell Starr | | | | | | | | | | | | |

| Salary and Quantified Benefits | | | 600,000 | | | Nil | | | 900,000 | | | Nil |

| Bonus | | | Nil | | | Nil | | | 300,000 | | | Nil |

| Total | | | 600,000 | | | Nil | | | 1,200,000 | | | Nil |

| Ryan Ptolemy | | | | | | | | | | | | |

| Salary and Quantified Benefits | | | 60,000 | | | Nil | | | 240,000 | | | Nil |

| Bonus | | | Nil | | | Nil | | | 50,000 | | | Nil |

| Total | | | 60,000 | | | Nil | | | 290,000 | | | Nil |

| Johan Wattenstrom | | | | | | | | | | | | |

| Salary and Quantified Benefits | | US$ | 20,000 | | | Nil | | | Nil | | | Nil |

| Bonus | | | Nil | | | Nil | | | Nil | | | Nil |

| Total | | US$ | 20,000 | | | Nil | | | Nil | | | Nil |

| Kenny Choi | | | | | | | | | | | | |

| Salary and Quantified Benefits | | | 60,000 | | | Nil | | | 240,000 | | | Nil |

| Bonus | | | Nil | | | Nil | | | 50,000 | | | Nil |

| Total | | | 60,0000 | | | Nil | | | 290,00 | | | Nil |

Notes:

| (1) | Severance upon a change of control becomes payable in the event of a Change of Control of the Corporation and within one year following the date of the Change of Control the Corporation or the officer elects to terminate the agreement. |

Other Arrangements

Other than as disclosed below or elsewhere in this Circular, none of the officers or directors of the Corporation have compensation arrangements pursuant to any other arrangement or in lieu of any standard compensation arrangement.

Indebtedness of Directors and Executive Officers

As at the date of this Circular and during the financial year ended December 31, 2022, no director or executive officer of the Corporation (and each of their associates and/or affiliates) was indebted, including under any securities purchase or other program, to (i) the Corporation or its subsidiaries, or (ii) any other entity which is, or was at any time during the financial year ended December 31, 2022, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or its subsidiaries.

Directors’ and Officers’ Insurance and Indemnification

The Corporation maintains insurance for the benefit of its directors and officers against liability in their respective capacities as directors and officers. The Corporation has purchased in respect of directors and officers an aggregate of US$2,500,000 in coverage. The approximate amount of premiums paid by the Corporation in 2022 in respect of such insurance was US$106,848.

Interest of Informed Persons in Material Transactions

No informed person (as such term is defined under applicable securities laws) of the Corporation or nominee (and each of their associates or affiliates) has had any direct or indirect material interest in any transaction involving the Corporation since January 1, 2022 or in any proposed transaction which has materially affected or would materially affect the Corporation or its subsidiaries other than as may be disclosed herein.

Director Compensation

Compensation of directors for the financial year ended December 31, 2022 was determined on a case-by- case basis with reference to the role that each director provided to the Corporation. Executive officers who also act as directors of the Corporation do not receive any additional compensation for services rendered in their capacity as directors. The following information details compensation paid in the recently completed financial year.

Director Summary Compensation Table

The following table provides information regarding the compensation awarded to each director during the year ended December 31, 2022, other than any NEOs who are also directors, whose compensation was included above.

| Name | | Fees

earned ($) | | | Share

awards ($) | | | Option

awards ($) | | | Non-equity incentive plan compensation ($)(1) | | | All other

compensation ($)(2) | | | Total ($) | |

| Bernard Wilson(1) | | | Nil | | | | 104,754 | | | | 47,163 | | | | 50,000 | | | | NIL | | | | 201,917 | |

| Tito Gandhi | | | Nil | | | | 104,754 | | | | 28,715 | | | | 50,000 | | | | Nil | | | | 183,469 | |

| William C. Steers | | | Nil | | | | 104,754 | | | | 47,163 | | | | 50,000 | | | | Nil | | | | 201,917 | |

| Krisztian Toth | | | Nil | | | | 104,754 | | | | 67,329 | | | | 50,000 | | | | Nil | | | | 222,083 | |

| TOTALS | | | Nil | | | | 419,016 | | | | 190.371 | | | | 200,000 | | | | NIL | | | | 809,386 | |

Notes:

| 1. | Bernard Wilson resigned as director on November 14, 2022 |

Incentive Plan Awards

The following table provides information regarding the incentive plan awards for each director outstanding as of December 31, 2022, other than any NEOs who are also directors, whose compensation was included above.

Outstanding Share-Based Awards and Option-Based Awards

| | | | Option-Based Awards | | | Share-Based Awards | |

| Name | | | Number of securities underlying unexercised options (#) | | | Option exercise price ($) | | Option expiration date | | Value of unexercised

in-the-money

options ($)(1)(2) | | | Number of shares or units of shares that have not vested (#) | | | | Market or payout value of share awards that have not vested ($)(3) | | | | Market or payout value of vested share-based awards not paid out or distributed | |

| Bernard Wilson(4) | | | 450,000 | | | 250,000 options at $1.58 100,000 options at $1.58 100,000 options at $1.22 | | February 24, 2026

April 9, 2026

May 18, 2026 | | Nil | | | 25,000 | | | | 3,500 | | | | 6,300 | |

| Tito Gandhi | | | 100,000 100,000 | | | 100,000 options at $1.58 100,000 options at $1.22 | | April 9, 2026

May 18, 2026 | | Nil | | | 25,000 | | | | 3,500 | | | | 6,300 | |

| William C. Steers | | | 450,000 | | | 250,000 options at $1.58 100,000 options at $1.58 100,000 options at $1.22 | | February 24, 2026

April 9, 2026

May 18, 2026 | | Nil | | | 25,000 | | | | 3,500 | | | | 6,300 | |

| Krisztian Toth | | | 450,000 | | | 450,000 options at $1.11 | | May 25, 2025 | | Nil | | | 25,000 | | | | 3,500 | | | | 6,300 | |

Notes:

| (1) | Based on the closing market price of $0.14 of the Common Shares on December 30, 2022 and subtracting the exercise price of the options. |

| | |

| (2) | These options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | |

| (3) | Share-based awards comprise of DSUs. Value is based on the fair value of the award on the grant date. |

| | |

| (4) | Bernard Wilson resigned as director on November 14, 2022. |

Value on Pay-Out or Vesting of Incentive Plan Awards

| Name | | Option-based awards – Value vested during 2022 fiscal

year ($) | | Share-based awards – Value vested during the 2022 fiscal year ($) | | Non-equity incentive plan compensation – Value earned during the 2022 fiscal year ($) | |

| Bernard Wilson(1) | | Nil | | Nil | | | 50,000 | |

| Tito Gandhi | | Nil | | Nil | | | 50,000 | |

| William C. Steers | | Nil | | Nil | | | 50,000 | |

| Krisztian Toth | | Nil | | Nil | | | 50,000 | |

Notes:

| (1) | Bernard Wilson resigned as director on November 14, 2022. |

No director exercised his or her Stock Options or were paid out his or her DSUs during the year ended December 31, 2022.

Stock Option Plan

The Corporation believes that granting stock options to officers, directors, consultants and employees encourages retention and more closely aligns the interests of such key personnel with the interests of shareholders while at the same time not drawing on the limited cash resources of the Corporation.

The Stock Option Plan is designed to advance the interests of the Corporation by encouraging employees, officers and consultants to have equity participation in the Corporation through the acquisition of Common Shares. The following is a summary of the terms of the proposed Stock Option Plan, which is qualified in its entirety by the provisions of the Stock Option Plan.

The Stock Option Plan is a “evergreen” stock option plan under NEO Exchange Listing Manual as under the Stock Option Plan the Corporation is authorized to grant Stock Options of up to 10% of its issued and outstanding Common Shares at the time of the Stock Option grant, from time to time, with no vesting provisions. As of the date hereof, there is an aggregate of 3,689,557 Stock Options outstanding under the Stock Option Plan, which represents approximately 1.7% of the outstanding Common Shares.

The terms and conditions of each Stock Option granted under the Stock Option Plan will be determined by the Board. Stock Options will be priced in the context of the market and in compliance with applicable securities laws and NEO Exchange guidelines. Consequently, the exercise price for any Stock Option shall not be lower than the market price of the underlying Common Shares at the time of grant. Vesting terms will be determined at the discretion of the Board. The Board shall also determine the term of Stock Options granted under the Stock Option Plan, provided that no Stock Option shall be outstanding for a period greater than five years. The Board shall also have complete discretion to set the terms of any vesting schedule of each Stock Option granted.

The Stock Option Plan provides for amendment procedures that specify the kind of amendments to the Stock Option Plan that will require Shareholder approval. The Board believes that except for certain material changes to the Stock Option Plan, it is important that the Board has the flexibility to make changes to the Stock Option Plan without Shareholder approval. Such amendments could include making appropriate adjustments to outstanding Stock Options in the event of certain corporate transactions, the addition of provisions requiring forfeiture of options in certain circumstances, specifying practices with respect to applicable tax withholdings and changes to enhance clarity or correct ambiguous provisions.

The Stock Option Plan does not provide for the transformation of Stock Options granted under the Stock Option Plan into stock appreciation right involving the issuance of securities from the treasury of the Corporation.

The Stock Option Plan provides that holders of Stock Options who are restricted from trading in securities of the Corporation during periodic black-out periods imposed by the Corporation shall be entitled to exercise a Stock Option that was set to expire during a black-out period imposed by the Corporation until the day that is five business days following the expiry of the black-out period.

Directors, officers, employees and certain consultants shall be eligible to receive Stock Options under the Stock Option Plan. Upon the termination of an optionholder’s engagement with the Corporation, the cancellation or early vesting of any Stock Option shall be in the discretion of the Board. In general, the Corporation expects that Stock Options will be cancelled 90 days following an optionholder’s termination from the Corporation. Stock Options granted under the Stock Option Plan shall not be assignable.

The Corporation will not provide financial assistance to any optionholder to facilitate the exercise of Stock Options under the Stock Option Plan.

Pursuant to Section 10.13 – Security Based Compensation of the NEO Exchange Listing Manual, the Corporation is required to obtain the approval of its Shareholders to any stock option plan that is a “evergreen” plan every three years at the Corporation’s annual meeting of Shareholders. The Stock Option Plan was last approved by Shareholders at the annual and special meeting of Shareholders held on September 13, 2021.

The table below sets out the outstanding options under the Stock Option Plan, being the Corporation’s only compensation plan under which Common Shares are authorized for issuance, as of the Record Date.

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available under equity compensation plans (excluding securities reflected in column (a)) | |

| | | | (a) | | | | (b) | | | | (c) | |

| Equity compensation plans approved by security holders | | | 18,211,493 | | | $ | 1.27 | | | | 3,689,557 | |

| Equity compensation plans not approved by security holders | | | N/A | | | | N/A | | | | N/A | |

| TOTAL | | | 18,211,493 | | | | 1.27 | | | | 3,689,557 | |

Corporate Governance Policies

Management of the Corporation and the Board recognize the importance of corporate governance in effectively managing the Corporation, protecting employees and Shareholders, and enhancing Shareholder value.

The Board fulfills its mandate directly and through its Audit Committee and its Compensation, Nomination and Governance Committee (“CNG Committee”) and other ad hoc committees at regularly scheduled meetings or as required. The directors are kept informed regarding the Corporation’s operations at regular meetings and through reports and discussions with management on matters within their particular areas of expertise. Frequency of meetings may be increased and the nature of the agenda items may be changed depending upon the state of the Corporation’s affairs and in light of opportunities or risks that the Corporation faces.

The Corporation believes that its corporate governance practices are in compliance with applicable Canadian requirements. The Corporation is committed to monitoring governance developments to ensure its practices remain current and appropriate.

Board of Directors

Pursuant to National Instrument 58-101 – Corporate Governance, a director is independent if the director has no direct or indirect relationship with the issuer which could, in the view of the issuer’s board of directors, be reasonably expected to interfere with the exercise of a member’s independent judgment. Certain directors are deemed to have a material relationship with the issuer by virtue of their position or relationship with the Corporation. The Board is currently comprised of three members, all of are independent. In assessing whether a director is independent for these purposes, the circumstances of each director have been examined in relation to a number of factors.

Other Public Corporation Directorships

To the best of the Corporation’s knowledge and based on publicly available information, as of the date hereof, the directors of the Corporation hold directorship positions with the following reporting issuers:

| Director | | Reporting Issuer |

| Tito Gandhi | | Q-Gold Resources Ltd. |

| William C. Steers | | Lara Exploration Ltd

Jade Power Trust

ARHT Media Inc.

Sulliden Mining Capital Inc. |

| Krisztián Tóth | | Trillium Gold Mines Inc.

Leviathan Gold Ltd.

Voyager Digital Ltd.

Pasofino Gold Limited |

Board Mandate

The duties and responsibilities of the Board are to supervise the management of the business and affairs of the Corporation, and to act with a view towards the best interests of the Corporation. In discharging its mandate, the Board is responsible for the oversight and review of:

| ● | the strategic planning process of the Corporation; |

| ● | identifying the principal risks of the Corporation’s business and ensuring the implementation of appropriate systems to manage these risks; |

| ● | succession planning, including appointing, training and monitoring senior management; |

| ● | a communications policy for the Corporation to facilitate communications with investors and other interested parties; and |

| ● | the integrity of the Corporation’s internal control and management information systems. |

The Board discharges its responsibilities directly and through its committees, currently consisting of the Audit Committee and the Compensation, Nomination and Governance Committee.

Orientation and Continuing Education

Directors are expected to attend all meetings of the Board and are also expected to prepare thoroughly in advance of each meeting in order to actively participate in the deliberations and decisions.

The Board recognizes the importance of ongoing director education and the need for each director to take personal responsibility for this process. The Board notes that it has benefited from the experience and knowledge of individual members of the Board in respect of the evolving governance regime and principles. The Board ensures that all directors are apprised of changes in the Corporation’s operations and business. All Board members are provided with copies of periodic reports on the business and operations of the Corporation.

Nomination of Directors

The Board is largely responsible for identifying new candidates for nomination to the Board. The process by which candidates are identified is through recommendations presented to the Board, which establishes and discusses qualifications based on corporate law and regulatory requirements as well as education and experience related to the business of the Corporation.

Compensation

The CNG Committee is responsible for recommending to the Board the compensation of the directors and Chief Executive Officer of the Corporation. The process for determining executive compensation is relatively informal, in view of the size and stage of the Corporation and its operations. The Corporation does not maintain specific performance goals or use benchmarks in determining the compensation of executive officers. Upon the recommendation of the CNG Committee, the Board may at its discretion award either a cash bonus or stock options for high achievement or for accomplishments that the Board deems as worthy of recognition.

The CNG Committee reviews and discusses proposals received by the Chief Executive Officer of the Corporation regarding the compensation of management and the directors. Please refer to the section “Compensation and Corporate Governance Committee”.

Board Assessments

The Board and its individual directors are assessed on an informal basis continually as to their effectiveness and contribution. The Chair of the Board encourages discussion amongst the Board as to evaluation of the effectiveness of the Board as a whole and of each individual director. All directors are free to make suggestions for improvement of the practice of the Board at any time and are encouraged to do so.

Majority Voting Policy

The Corporation has adopted a Majority Voting Policy to provide a meaningful way for the Corporation’s shareholders to hold individual directors accountable and to require the Corporation to closely examine directors that do not have the support of a majority of Shareholders who vote at the Meeting. The policy provides that forms of proxy for the election of directors will permit a Shareholder to vote in favour of, or to withhold from voting, separately for each director nominee and that where a director nominee has more votes withheld than are voted in favour of him or her, the nominee will be considered not to have received the support of the shareholders, even though duly elected as a matter of corporate law. Pursuant to the policy, such a nominee will forthwith submit his or her resignation to the Board, such resignation to be effective on acceptance by the Board. The Board will then establish an advisory committee (the “Committee”) to which it shall refer the resignation for consideration within an 90 day period. In such circumstances, the Committee will make a recommendation to the Board as to the director’s suitability to serve as a director after reviewing, among other things, the results of the voting for the nominee and the Board will consider such recommendation. Any director subject to the Majority Voting Policy will not be a member of the Committee or participate in any Board level discussion where his or her resignation is being considered. Absent exceptional circumstances the Committee and the Board will accept the resignation of the nominee director. Once the Board has made a final decision regarding the resignation, the Company will publicly disclose the Board’s decision regarding the resignation, including the reasons for not accepting the resignation, if applicable. If the resignation is accepted, the Board may leave the vacancy unfilled or appoint a new director to fill the vacancy.

This policy does not apply where an election involves a proxy battle (i.e., where proxy material is circulated in support of one or more nominees who are not part of the director nominees supported by the management of the Corporation).

Audit Committee

The purposes of the Audit Committee are to assist the Board’s oversight of: the integrity of the Corporation’s financial statements; the Corporation’s compliance with legal and regulatory requirements; the qualifications and independence of the Corporation’s independent auditors; and the performance of the independent auditors and the Corporation’s internal audit function.

Please see Schedule “A” for the text of the Audit Committee Charter.

Composition of the Audit Committee

The Corporation’s Audit Committee is comprised of three directors, William C Steers (Chair), Tito Ghandi and Krisztian Toth. Each member of the Audit Committee is considered to be financially literate and are considered independent, as such term is defined in NI 52-110.

Relevant Education and Experience

Please see page 19 for the biographies of each member of the Audit Committee.

Audit Committee Oversight

At no time since the commencement of the Corporation’s most recently completed financial year has there been a recommendation of the Audit Committee to nominate or compensate an external auditor which was not adopted by the Board.

Reliance on Certain Exemptions

At no time since the commencement of the Corporation’s most recently completed financial year has the Corporation relied on either (a) an exemption in section 2.4 of NI 52-110; or (b) an exemption from NI 52- 110, in whole or in part, granted under Part 8 (Exemptions) of NI 52-110.

Pre-Approval Policies and Procedures

The Audit Committee has not adopted specific policies and procedures for the engagement of non-audit services.

External Auditor Service Fees

BF Borgers CPA PC are the current external auditors of the Corporation and were appointed on February 3, 2023. RSM Canada LLP were the former external auditors of the Corporation for the fiscal year ended December 31, 2022 and were appointed on August 13, 2021. The aggregate fees billed and estimated to be billed by the external auditors for the last two (2) fiscal years is set out in the table below. “Audit Fees” includes fees for audit services including the audit services completed for the Corporation’s subsidiaries. “Audit Related Fees” includes fees for assurance and related services by the Corporation’s external auditor that are reasonably related to the performance of the audit or review of the Corporation’s financial statements and not reported under Audit Fees including the review of interim filings and travel related expenses for the annual audit. “Tax Fees” includes fees for professional services rendered by the external auditor for tax compliance, tax advice, and tax planning. “All Other Fees” includes all fees billed by the external auditors for services not covered in the other three categories.

| Year | | Audit

Fees ($) | | | Audit Related Fees | | | Tax

Fees ($) | | | All Other Fees | |

| 2022 | | | 297,177 | | | | Nil | | | | Nil | | | | Nil | |

| 2021 | | | 224,160 | | | | NIL | | | | 9,583 | | | | Nil | |

Compensation, Nomination and Governance Committee

The Compensation, Nomination and Governance Committee (the “CNG Committee”) is comprised of Mr. Krisztian Toth, Mr. Tito Gandhi and Mr. William C. Steers, each of whom is an independent director. Please see page 19 for the biographies of each member of the CNG Committee.

The CNG Committee’s responsibilities are twofold. First, with respect to compensation, the CNG Committee’s responsibility include (i) discharging the Board’s responsibilities relating to the compensation of the Corporation’s executive officers, (ii) administering the Corporation’s incentive compensation and equity-based plans, and (iii) assisting the Board with respect to management succession and development. In carrying out its duties with respect to compensation, the CNG Committee reviews and makes recommendations to the Board on an annual basis regarding (A) company-wide compensation programs and practices, (B) all aspects of the remuneration of the Corporation’s executive officers and directors, and (C) equity-based plans and any material amendments thereto (including increases in the number of securities available for grant as options or otherwise thereunder).

The primary function of the CNG Committee with respect to nomination and governance matters is to exercise the responsibilities and duties set forth below, including but not limited to: (i) advising the Board on corporate governance in general, (ii) identifying candidates to act as directors of the Corporation, (iii) recommending to the Board qualified candidates to nominate as a director of the Corporation for consideration by the shareholders of the Corporation at the next annual meeting of shareholders (iv) overseeing and assessing the functioning of the Board and the committees of the Board, and (v) developing and recommending to the Board, and overseeing the implementation and assessment of, effective corporate governance principles.

MATTERS TO BE CONSIDERED

Financial Statements

The financial statements for the fiscal year ended December 31, 2022 will be presented to Shareholders for review at the Meeting. No vote by the Shareholders is required with respect to this matter.

Election of Directors

The Board currently consists of four directors. The Corporation has nominated four persons (the “Nominees”) for election as a director at the Meeting. At the Meeting, Shareholders will be asked to elect each individual Nominee as a director. All directors so elected will hold office until the end of the next annual general meeting of shareholders of the Corporation or until their successors are elected or appointed, unless their office is vacated earlier in accordance with the by-laws of the Corporation or with the provisions of the Business Corporations Act (Ontario).

The following table provides the names of the Nominees and information concerning such Nominees. The persons in the enclosed form of proxy intend to vote for the election of the Nominees. Management does not contemplate that any of the Nominees will be unable to serve as a director.

Information in the table below regarding the number of Common Shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised by the Nominees is based upon information furnished by the respective Nominee and is as at the Record Date.

| Name and Municipality of Residence | | Principal Occupation | | Director Since | | Number of Common Shares Beneficially Owned or Over which Control is Exercised(1) | |

William Steers(2)(3)

Toronto, Ontario

Canada | | International Business Consultant | | March 14, 2018 | | | Nil | |

Krisztian Tóth(2)(3)

Toronto, Ontario

Canada | | Partner at Fasken Martineau DuMoulin LLP | | May 14, 2021 | | | Nil | |

Olivier Roussy

Newton

Zug, Switzerland | | Chief Executive Officer of the Corporation | | N/A | | | Nil. | |

Mikael Tandetnik Geneva,

Switzerland | | Founder of Ariane Group SA | | N/A | | | 215,000 | |

Stefan Hascoet Geneva,

Switzerland | | Managing Partner of Deep Knowledge Ventures Suisse | | N/A | | | 268,000 | |

Notes:

| (1) | The Corporation has relied exclusively on the respective Nominee for this information. |

| | |

| (2) | Member of the Audit Committee |

| | |

| (3) | Member of the Compensation, Nomination and Governance Committee. |

Biographical information for each of the nominated directors are set out below:

Mr. Steers has over 40 years of international business development and management experience. While resident in Rio de Janeiro, he was a Director and senior manager of Docas Investimentos, a Brazilian controlled investment group involved in real estate, ship building, telecoms and more recently, oil and gas. He is a partner at IMC Consultoria Representacao Com. Int. Ltda. that among other activities, successfully introduced IMAX to Brazil. Mr. Steers is an Independent Director of Brazilian oil and gas producer Petro Rio and Toronto based Lara Exploration Ltd. Formerly, Mr. Steers was Managing Partner at Weatherhaven Brasil (private manufacturer of temporary shelters). Mr. Steers holds an Honors BA from the Richard Ivey School of Business at Western University.

Mr. Tóth, is an experienced M&A lawyer and partner at the law firm of Fasken Martineau DuMoulin LLP, which is a leading international business law and litigation firm with eight offices with more than 700 lawyers across Canada and in the UK and South Africa. Mr. Tóth began his career at Fasken in 2003, eventually becoming a partner of the firm in 2009. He has been recognized by IFLR1000 for his capital markets work. Mr. Tóth holds a bachelor of arts in Politics Sociology from Queen’s University and an LLB from Dalhousie University.

Mr. Roussy Newton is the Chief Executive Officer of the Corporation. He is a technology entrepreneur who has made significant contributions to the fields of FinTech, Quantum Computing and Capital Markets. Mr. Roussy Newton founded and served as president of HIVE Blockchain Technologies, which made history by becoming the first crypto mining company to go public in 2017, and has also been involved in a number of other highly successful ventures. Mr. Roussy Newton also serves as the Managing Director of BTQ AG, where he is responsible for overseeing the company’s operations on research focused on post quantum technologies.

Mr. Tandetnik is a seasoned wealth manager and CEO with a strong background in finance. He embarked on his career as a Salesperson for equity and structured products at BNP Paribas, gaining valuable experience in the field. Subsequently, he transitioned to various brokerage firms, honing his expertise in investment management. After founding LS Advisor in Paris and driven by his passion for the cryptocurrency industry, Mr. Tandetnik established Ariane Group SA in Geneva, a wealth management companies specializing in catering to cryptocurrency clients and investments. He played a pivotal role in numerous fundraising initiatives for both listed and unlisted private crypto companies, demonstrating his deep involvement in the crypto space. Mr. Tandetnik’s academic qualifications include a Bachelor’s degree in Business from the Ecole Supérieure de Gestion et Finance (ESGF) in France and a Master’s degree from ESLSCA, where he specialized in Trading and Options.

Mr. Hascoet is a capital markets professional who spent 12 years in the City of London in the field of equity derivatives and cross-asset structured products working for three global investment banks, including at RBC Capital Markets, leading a team covering Swiss clients. After his initial training in the institutional finance world, Mr. Hascoet decided to focus on the dual fields of finance & blockchains through various entrepreneurial endeavors, focusing on making blockchain assets investible and building bridges with the established banking systems and capital markets frameworks. Mr. Hascoet is a Swiss resident, based in Geneva, Managing Partner of Deep Knowledge Ventures Suisse, a data-driven investment holding of commercial and non-profit organizations active in the fields of DeepTech, Fintech and Longevity. Mr. Hascoet is a graduate of the French Grande Ecole system, having studied at l’Ecole Ste Genevieve in Versailles and ESCP Business School in Paris.

Unless authority to do so is withheld, the persons named in the accompanying proxy intend to vote for the election of each of the Nominees. If prior to the Meeting any of such Nominees is unable to or unwilling to serve, the persons named in the accompanying form of proxy will vote for another nominee or nominees in their discretion if additional nominations are made at the Meeting. Each Nominee elected will hold office until his successor is elected at the next annual meeting of the Corporation, or any postponement(s) or adjournment(s) thereof, or until his successor is elected or appointed.

No proposed director is to be elected under any arrangement or understanding between the proposed director and any other person or corporation, except the directors and executive officers of the Corporation acting solely in such capacity.

The Board of Directors recommends that Shareholders vote in favour of electing each of the directors as set forth above. PROXIES RECEIVED IN FAVOUR OF MANAGEMENT WILL BE VOTED FOR THE ELECTION OF EACH DIRECTOR.

Cease Trade Orders or Bankruptcies

No director or executive officer of the Corporation is, or within ten years prior to the date hereof has been, a director, chief executive officer or chief financial officer of any company (including the Corporation) that, (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Except as provided below, no director or executive officer of the Corporation is or has been, within the ten years before the date of this Circular, a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Mr. Tóth is a director of Voyager Digital Ltd. (“Voyager”). On July 5, 2022, Voyager commenced a voluntary Chapter 11 bankruptcy process with the U.S. Bankruptcy Court of the Southern District of New York and recognition of this order was obtained in the Ontario Superior Court of Justice (Commercial List) pursuant to the Companies’ Creditors Arrangement Act.

No director or executive officer has, within the ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director or executive officer.

No proposed director has been subject to (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director.

Appointment of Auditors

On February 3, 2023, the board of directors of the Corporation appointed BF Borgers CPA PC (“Borgers”) as auditors of the Corporation following the resignation of RSM Canada LLP as auditors of the Corporation. At the Meeting, Shareholders will be asked to re-appoint Borgers as auditors of the Corporation until the close of the next annual meeting of and to authorize the directors to fix their remuneration.

PROXIES RECEIVED IN FAVOUR OF MANAGEMENT WILL BE VOTED FOR THE APPROVAL OF THE APPOINTMENT OF BF BORGERS CPA PC AS THE CORPORATION’S AUDITORS AND AUTHORIZING THE BOARD OF DIRECTORS TO FIX THEIR REMUNERATION, UNLESS THE SHAREHOLDER HAS SPECIFIED IN THE PROXY THAT HIS OR HER COMMON SHARES ARE TO BE VOTED AGAINST SUCH A RESOLUTION.

Name Change

The Corporation is proposing to change its name to “DeFi Technologies Inc.” Accordingly, at the Meeting, Shareholders will be asked to consider and, if thought fit, to pass a special resolution as set forth below authorizing the Board, in its sole discretion, to change the name of the Corporation to “DeFi Technologies Inc.”, or such other name as the Board, in its sole discretion, deems appropriate (the “Name Change”). Notwithstanding approval of the Name Change by the Shareholders, the Board may, in its sole discretion, revoke this special resolution, and abandon the Name Change without further approval or action by or prior notice to Shareholders. Any Name Change of the Corporation will be subject to the approval of the NEO Exchange.

At the Meeting, Shareholders will be asked to consider, and if deemed to be advisable approve, the following special resolution, which must be passed by two-thirds of the votes cast by the Shareholders in person or by proxy at the Meeting, subject to such amendments, variations or additions as may be approved at the Meeting:

“BE IT RESOLVED THAT:

| 1. | subject to the Corporation first receiving all required regulatory and the Cboe Canada approvals, the name of the Corporation be changed to “DeFi Technologies Inc.” or such other name as may be approved by the directors of the Corporation and applicable regulatory authorities; |

| | | |

| 2. | the articles of the Corporation be amended to reflect the foregoing; |

| | | |

| 3. | the Board be and are authorized to file articles of amendment and all other requisite documents with all applicable regulatory authorities in order to give effect to the name change; |

| | | |

| 4. | notwithstanding the passage of this resolution by the shareholders of the Corporation, the Board of the Corporation may, without any further notice or approval of the shareholders of the Corporation, decide not to proceed with the name change or to otherwise give effect to this resolution at any time prior to the sale becoming effective and may revoke this resolution without further approval of the shareholders at any time prior to the completion of the transactions authorized by this resolution; and |

| | | |

| 5. | any one or more of the directors or officers of the Corporation is hereby authorized and directed, acting for, in the name of and on behalf of the Corporation, to execute or cause to be executed, under the seal of the Corporation or otherwise, and to deliver or cause to be delivered, such other documents and instruments, and to do or cause to be done all such other acts and things, as may in the opinion of such director or officer of the Corporation be necessary or desirable to carry out the intent of the foregoing resolution, the execution of any such document or the doing of any such other act or thing by any director or officer of the Corporation being conclusive evidence of such determination.” |

PROXIES RECEIVED IN FAVOUR OF MANAGEMENT WILL BE VOTED FOR THE APPROVAL OF THE NAME CHANGE RESOLUTION UNLESS A SHAREHOLDER HAS SPECIFIED IN THE PROXY THAT THE COMMON SHARES ARE TO BE VOTED AGAINST SUCH SPECIAL RESOLUTION.

Additional Information

Additional information relating to the Corporation may be found under the profile of the Corporation on SEDAR at www.sedar.com. Additional financial information is provided in the Corporation’s audited financial statements and related management’s discussion and analysis for the financial year ended December 31, 2022, which can be found at https://valour.com/investor-relations or under the profile of the Corporation on SEDAR. Shareholders may also request these documents by emailing kenny.choi@fmresources.ca or by telephone at (416) 861-2262.

Board of Directors Approval

The contents of this Circular and the sending thereof to the Shareholders of the Corporation have been approved by the Board.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | (signed) “Olivier Roussy Newton” |

| | Chief Executive Officer |

| | Toronto, Ontario May 11, 2023 |

SCHEDULE “A”

VALOUR INC. AUDIT

COMMITTEE CHARTER

Mandate

The primary function of the audit committee (the “Committee”) is to assist the board of directors in fulfilling its financial oversight responsibilities by reviewing the financial reports and other financial information provided by the Company to regulatory authorities and shareholders, the Company’s systems of internal controls regarding finance and accounting and the Company’s auditing, accounting and financial reporting processes. Consistent with this function, the Committee will encourage continuous improvement of, and should foster adherence to, the Company’s policies, procedures and practices at all levels. The Committee’s primary duties and responsibilities are to

(i) serve as an independent and objective party to monitor the Company’s financial reporting and internal control system and review the Company’s financial statements; (ii) review and appraise the performance of the Company’s external auditors; and (iii) provide an open avenue of communication among the Company’s auditors, financial and senior management and the board of directors.

Composition

The Committee shall be comprised of three directors as determined by the board of directors, the majority of whom shall be free from any relationship that, in the opinion of the board of directors, would interfere with the exercise of his or her independent judgment as a member of the Committee.

At least one member of the Committee shall have accounting or related financial management expertise. All members of the Committee that are not financially literate will work towards becoming financially literate to obtain a working familiarity with basic finance and accounting practices. For the purposes of this Charter, the definition of “financially literate” is the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can presumably be expected to be raised by the Company’s financial statements.