Investor Presentation The future of Boron is 5E March 2023

Disclaimer FORWARD-LOOKING STATEMENTS The information in this Presentation includes “forward looking statements”. All statements other than statements of historical fact included in this Presentation regarding our business strategy, plans, goals and objectives are forward looking statements. When used in this Presentation, the words “believe”, “project”, “expect”, “anticipate”, “estimate”, “intend”, “budget”, “target”, “aim”, “strategy”, “estimate”, “plan”, “guidance”, “outlook”, “intend”, “may”, “should”, “could”, “will”, “would”, “will be”, “will continue”, “will likely result” and similar expressions are intended to identify forward looking statements, although not all forward looking statements contain such identifying words. These forward looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and the fact that we have not yet realized any revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and expectations to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the 5E Boron Americas Complex, including our ability to timely and successfully complete Phase 1 of our 5E Boron Americas Complex; and other risks. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein. You are cautioned not to place undue reliance on any forward looking statements, which speak only as of the date of this Presentation. Except as otherwise required by applicable law, we disclaim any duty to update and do not intend to update any forward looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Presentation. MARKET AND INDUSTRY DATA This Presentation has been prepared by 5E and includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although 5E believes these third party sources are reliable as of their respective dates for the purposes used herein, neither we nor any of our affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although we believe the sources are reliable, we have not independently verified the accuracy or completeness of data from such sources. Some data is also based on 5E’s good faith estimates, which are derived from our review of internal sources as well as the third party sources described above. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only there can be no assurance that such conditions will actually occur or result in positive returns. CAUTIONARY NOTE REGARDING RESERVES Unless otherwise indicated, all mineral resource estimates included in this Presentation have been prepared in accordance with, and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) - based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code”. While the SEC now recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all of the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves. For additional information regarding these various risks and uncertainties, you should carefully review the risk factors and other disclosures in our Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) on September 28, 2022, as amended by our Form 10-K/A filed on October 31, 2022, as well as our Form 10-Qs filed on November 10, 2022 and February 9, 2023. Additional risks are also disclosed by 5E in its filings with the Securities and Exchange Commission throughout the year, as well as its filings under the Australian Securities Exchange.

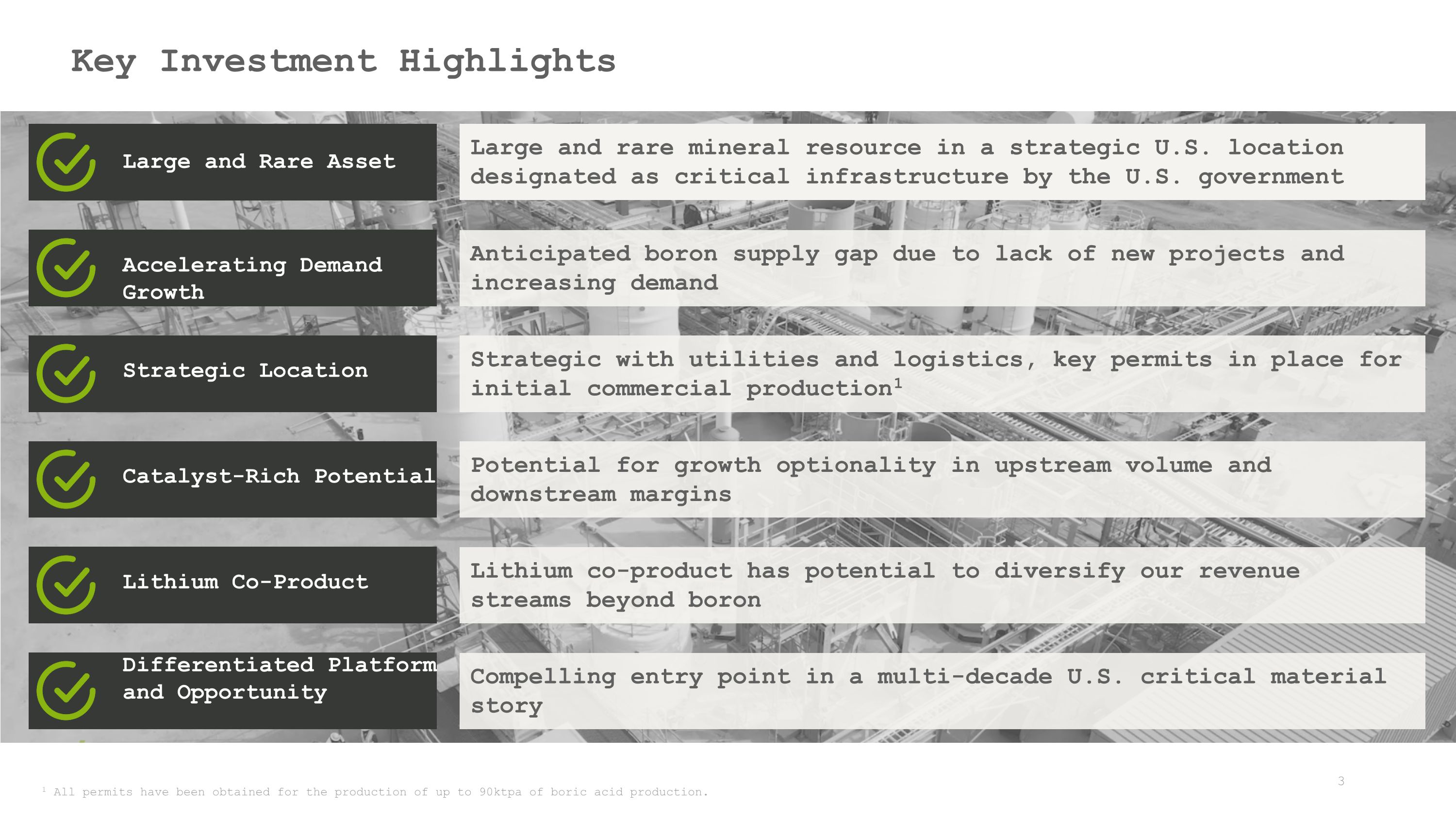

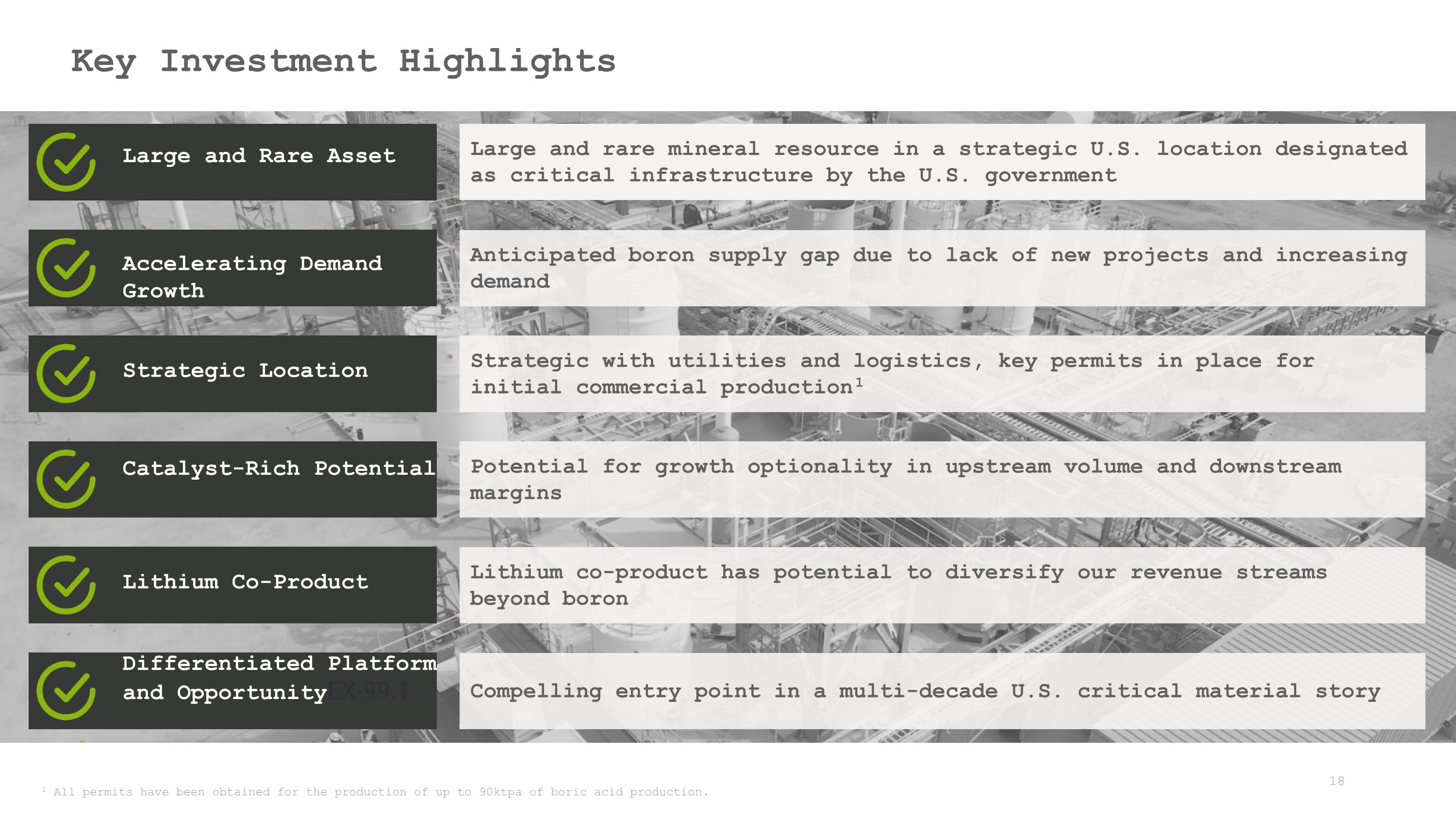

Key Investment Highlights Large and Rare Asset Large and rare mineral resource in a strategic U.S. location designated as critical infrastructure by the U.S. government Anticipated boron supply gap due to lack of new projects and increasing demand Accelerating Demand Growth Strategic with utilities and logistics, key permits in place for initial commercial production1 Strategic Location Potential for growth optionality in upstream volume and downstream margins Catalyst-Rich Potential Lithium co-product has potential to diversify our revenue streams beyond boron Lithium Co-Product Compelling entry point in a multi-decade U.S. critical material story Differentiated Platform and Opportunity 1 All permits have been obtained for the production of up to 90ktpa of boric acid production. 3

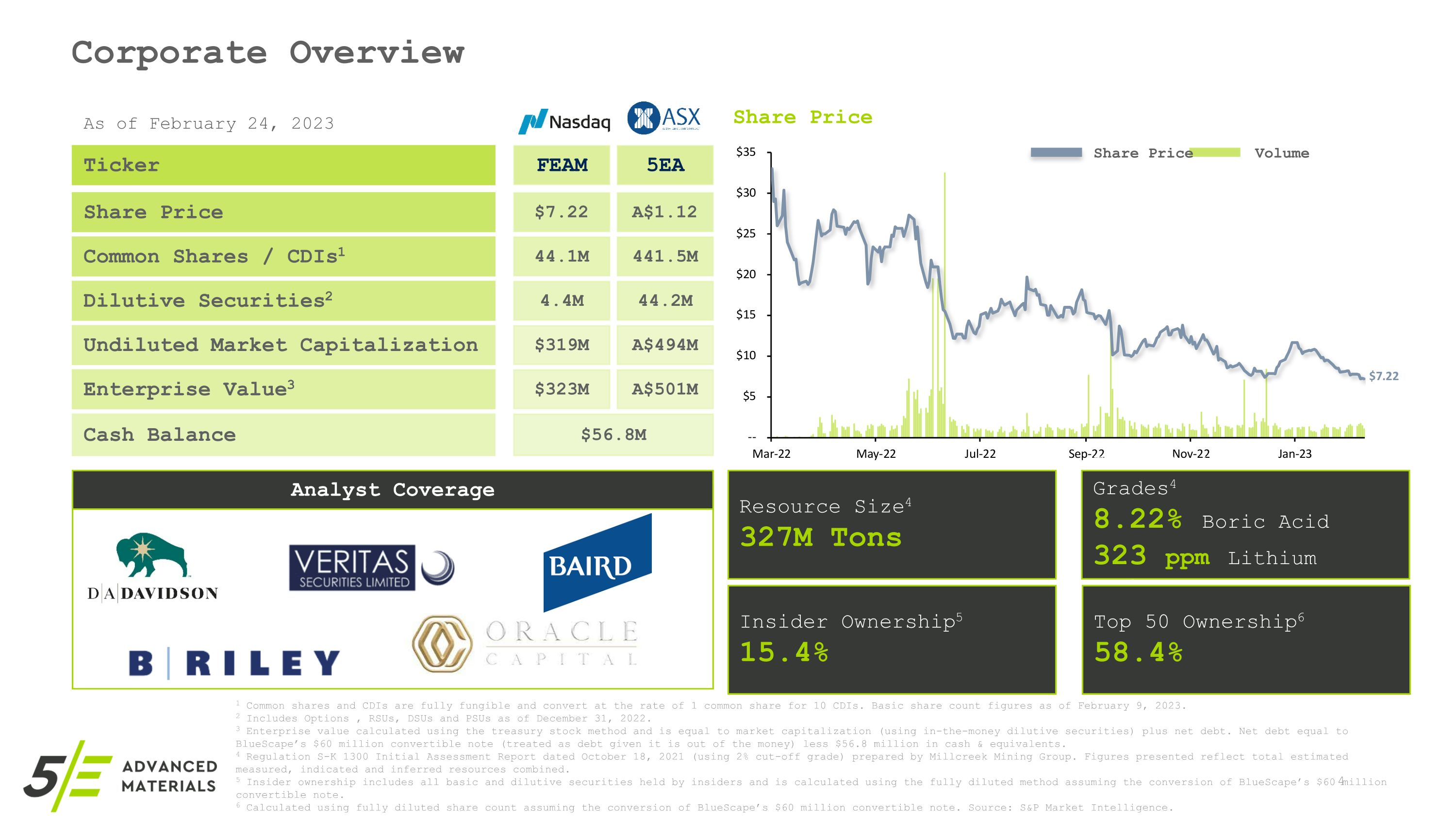

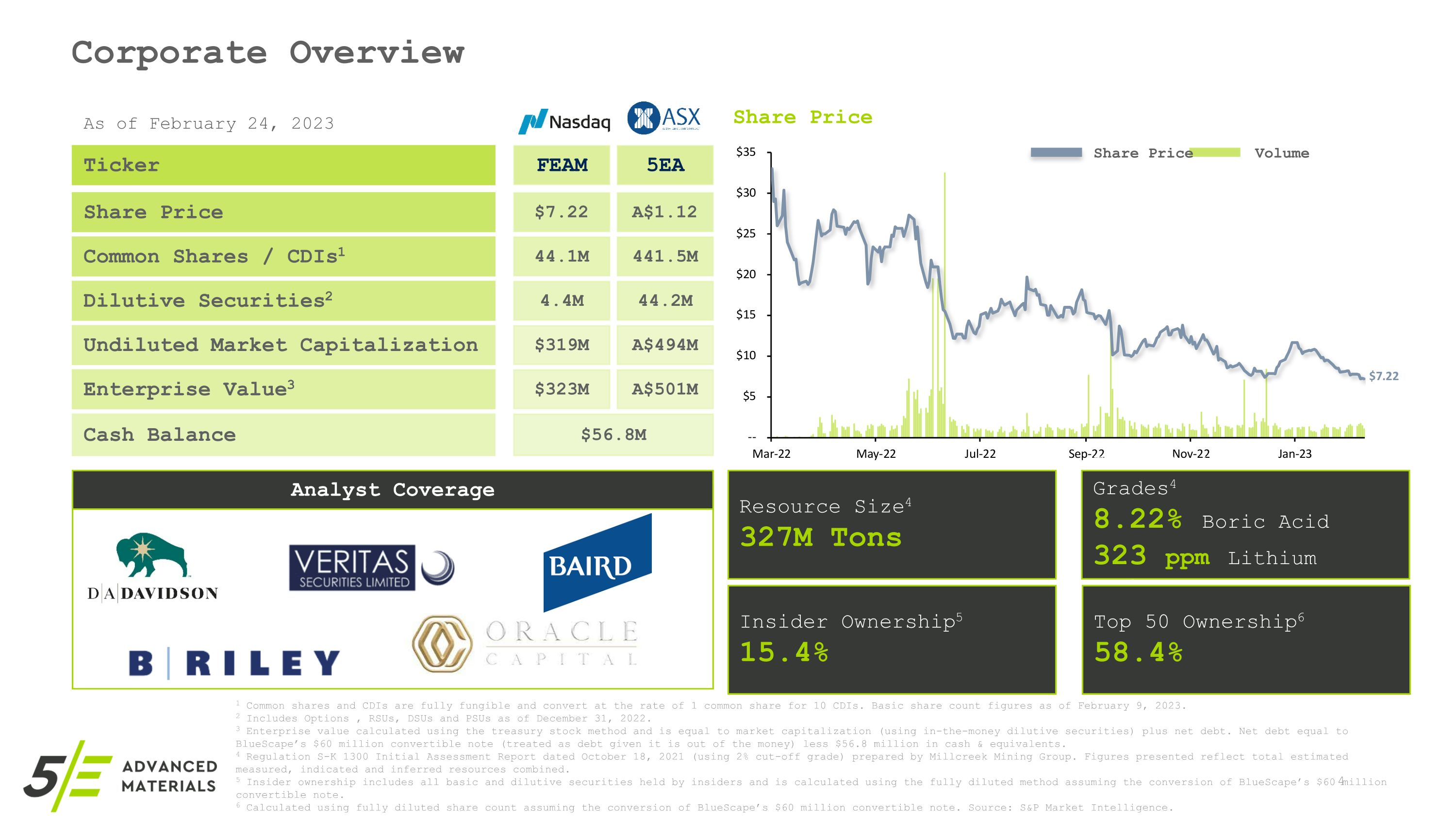

Corporate Overview Ticker FEAM Cash Balance $56.8M 5EA Share Price $7.22 A$1.12 Common Shares / CDIs1 44.1M 441.5M Dilutive Securities2 4.4M 44.2M Undiluted Market Capitalization $319M A$494M Analyst Coverage Resource Size4 327M Tons Estimated Resource Grades4 8.22% Boric Acid 323 ppm Lithium Carbonate Insider Ownership5 15.4% Top 50 Ownership6 58.4% Share Price Volume Share Price As of February 24, 2023 1 Common shares and CDIs are fully fungible and convert at the rate of 1 common share for 10 CDIs. Basic share count figures as of February 9, 2023. 2 Includes Options , RSUs, DSUs and PSUs as of December 31, 2022. 3 Enterprise value calculated using the treasury stock method and is equal to market capitalization (using in-the-money dilutive securities) plus net debt. Net debt equal to BlueScape’s $60 million convertible note (treated as debt given it is out of the money) less $56.8 million in cash & equivalents. 4 Regulation S-K 1300 Initial Assessment Report dated October 18, 2021 (using 2% cut-off grade) prepared by Millcreek Mining Group. Figures presented reflect total estimated measured, indicated and inferred resources combined. 5 Insider ownership includes all basic and dilutive securities held by insiders and is calculated using the fully diluted method assuming the conversion of BlueScape’s $60 million convertible note. 6 Calculated using fully diluted share count assuming the conversion of BlueScape’s $60 million convertible note. Source: S&P Market Intelligence. Enterprise Value3 $323M A$501M

Pillars of the Boron Opportunity Critical material used in wide range of decarbonization technologies (EVs, clean energy production) Demand and pricing growth currently outpacing inflation Propelling�Decarbonization Sectors Pivotal time when demand for transition-enabling materials is expected to accelerate, critical supply chains are �expected to be increasingly constrained, and a fundamental supply gap is expected to emerge Today’s Challenge Approximately 60%2 of global supply is controlled by Eti Maden (Turkish SOE) Opportunity for domestic U.S supply leader with potential for reduced environmental footprint Enabling �Onshore, Critical �Supply Chains Limited number of new supply sources of scale to meet anticipated growing demand We believe 5E has one of the largest known new conventional colemanite deposits globally not owned by the Turkish Government controlled entity, Eti Maden Solution�to the Asset �Scarcity Challenge >40% of lands to experience severe yield reduction by 2050 due to nutrient depletion1 Boron is an essential micro nutrient driving crop health Empowering�Global Food Security Efforts 5 1 Source: Center for Strategic & International Studies; Climate Change and Food Security: A test of U.S. Leadership in a Fragile World (2019; Sova, Flowers and Man). 2 Source: Millcreek Mining Group.

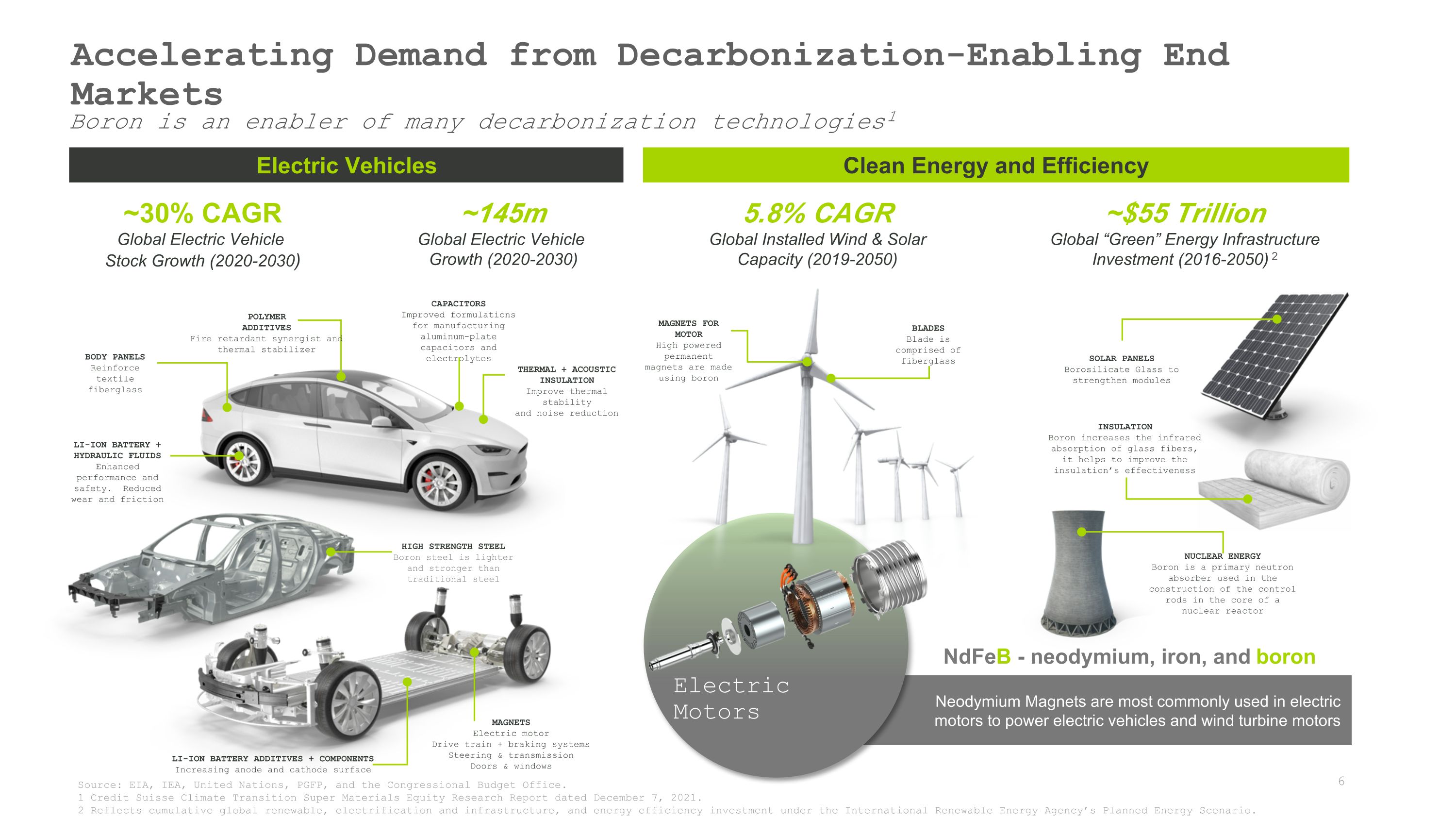

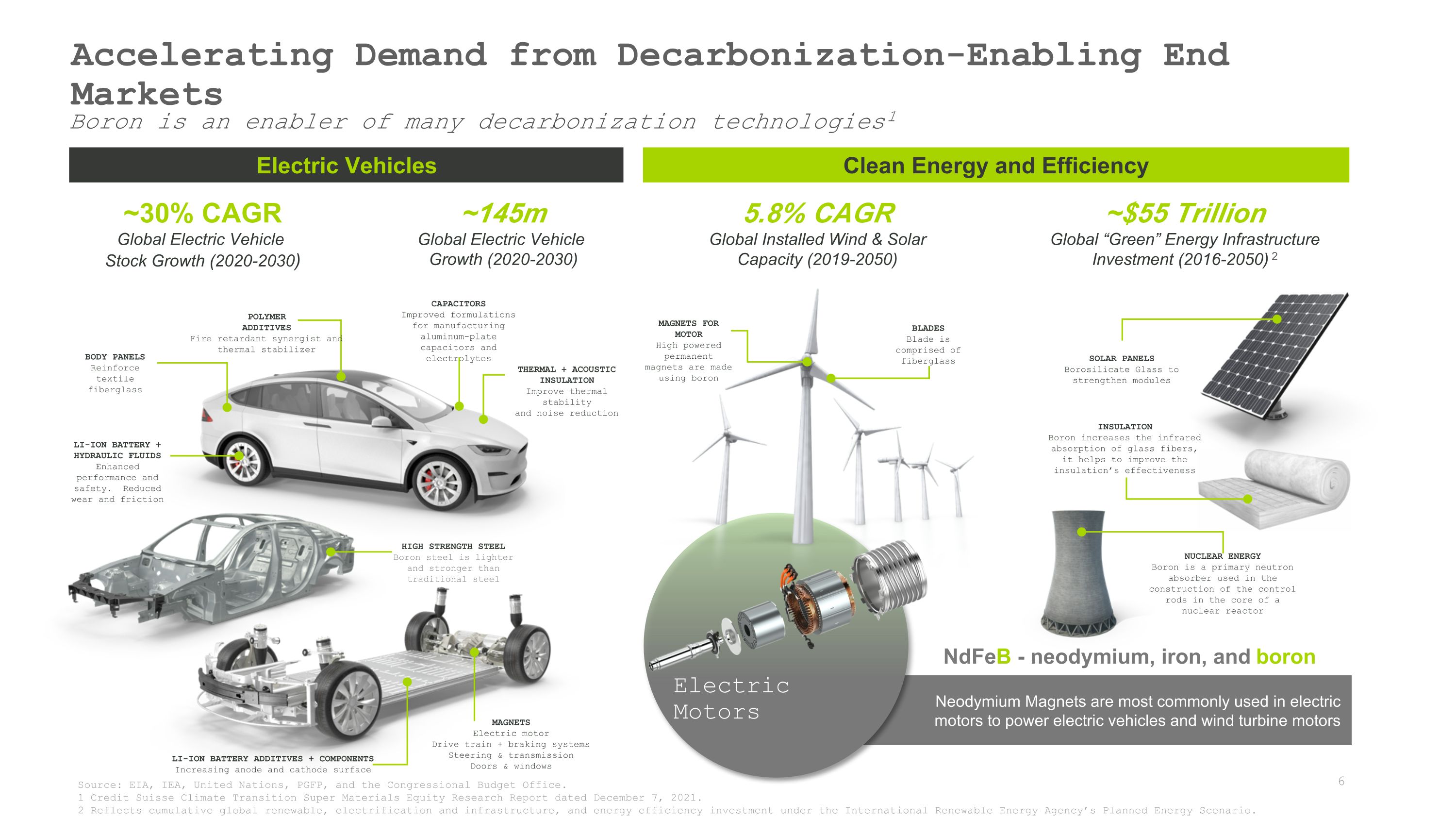

Neodymium Magnets are most commonly used in electric motors to power electric vehicles and wind turbine motors Electric Motors NdFeB - neodymium, iron, and boron SOLAR PANELS�Borosilicate Glass to strengthen modules INSULATION�Boron increases the infrared absorption of glass fibers, it helps to improve the insulation’s effectiveness Boron is an enabler of many decarbonization technologies1 NUCLEAR ENERGY�Boron is a primary neutron absorber used in the construction of the control rods in the core of a nuclear reactor BODY PANELS�Reinforce textile �fiberglass POLYMER �ADDITIVES�Fire retardant synergist and�thermal stabilizer CAPACITORS�Improved formulations for manufacturing aluminum-plate capacitors and electrolytes HIGH STRENGTH STEEL�Boron steel is lighter and stronger than traditional steel THERMAL + ACOUSTIC INSULATION�Improve thermal stability �and noise reduction LI-ION BATTERY ADDITIVES + COMPONENTS�Increasing anode and cathode surface LI-ION BATTERY + HYDRAULIC FLUIDS�Enhanced performance and safety. Reduced wear and friction MAGNETS�Electric motor �Drive train + braking systems�Steering & transmission�Doors & windows BLADES�Blade is comprised of fiberglass MAGNETS FOR MOTOR�High powered permanent magnets are made using boron Source: EIA, IEA, United Nations, PGFP, and the Congressional Budget Office. 1 Credit Suisse Climate Transition Super Materials Equity Research Report dated December 7, 2021. 2 Reflects cumulative global renewable, electrification and infrastructure, and energy efficiency investment under the International Renewable Energy Agency’s Planned Energy Scenario. Accelerating Demand from Decarbonization-Enabling End Markets 6 ~30% CAGR�Global Electric Vehicle �Stock Growth (2020-2030) ~145m�Global Electric Vehicle �Growth (2020-2030) 5.8% CAGR�Global Installed Wind & Solar Capacity (2019-2050) ~$55 Trillion�Global “Green” Energy Infrastructure Investment (2016-2050) 2 Electric Vehicles Clean Energy and Efficiency

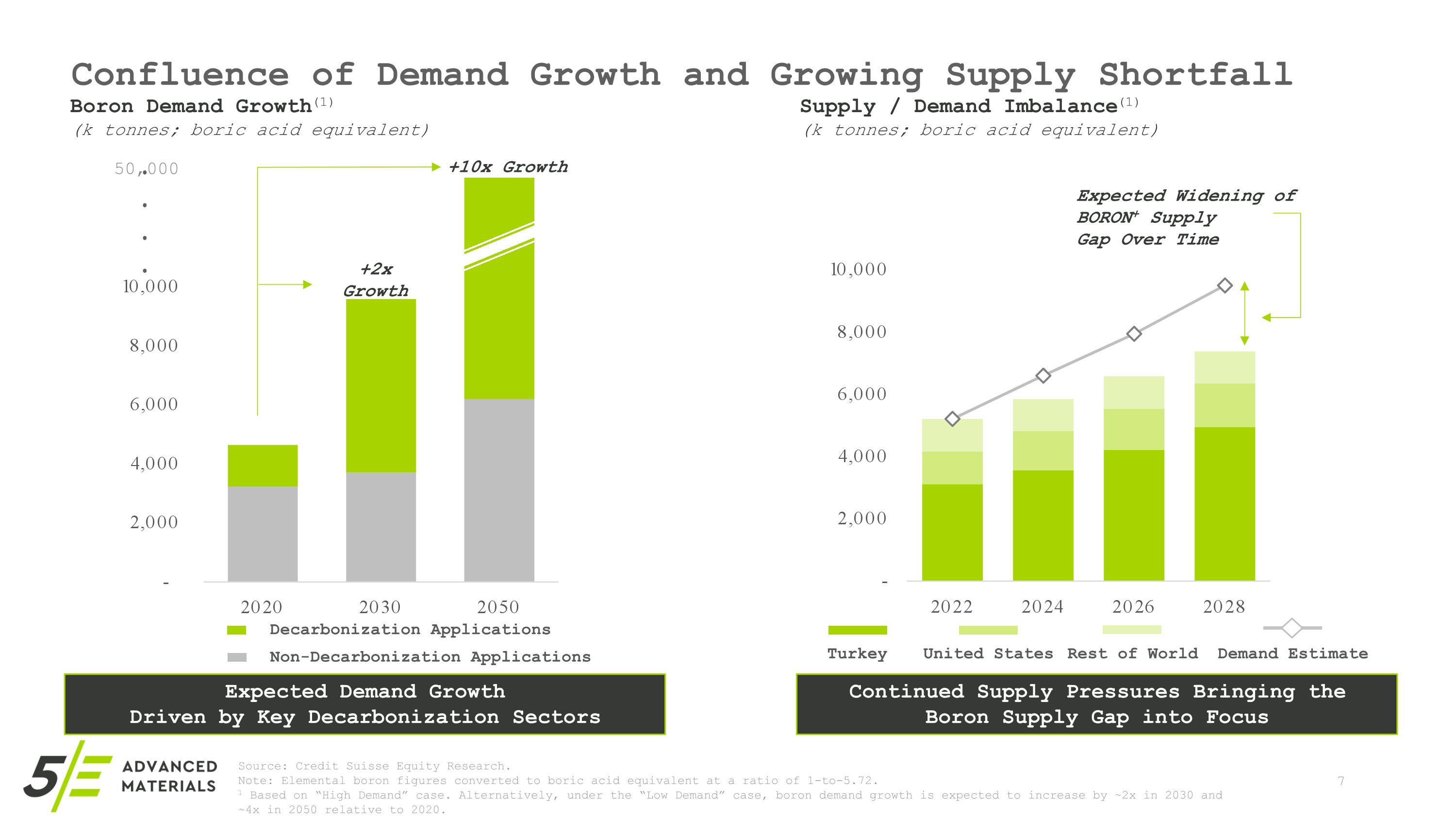

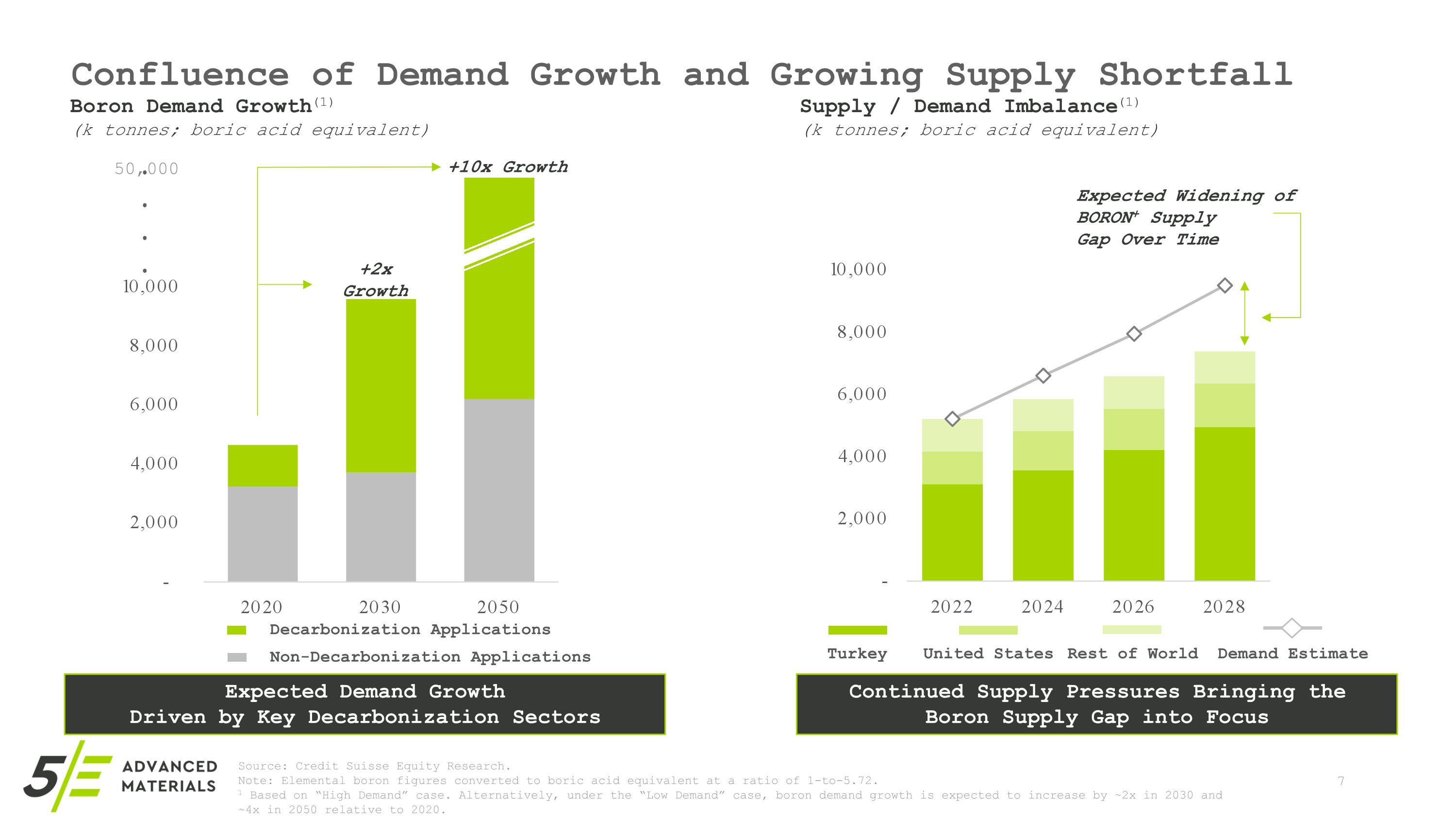

Confluence of Demand Growth and Growing Supply Shortfall 7 Continued Supply Pressures Bringing the �Boron Supply Gap into Focus Supply / Demand Imbalance(1)�(k tonnes; boric acid equivalent) Expected Widening of �BORON+ Supply �Gap Over Time Expected Demand Growth �Driven by Key Decarbonization Sectors Turkey United States Rest of World Demand Estimate Decarbonization Applications Non-Decarbonization Applications . . . . 50,000 +10x Growth +2x Growth Source: Credit Suisse Equity Research. Note: Elemental boron figures converted to boric acid equivalent at a ratio of 1-to-5.72. 1 Based on “High Demand” case. Alternatively, under the “Low Demand” case, boron demand growth is expected to increase by ~2x in 2030 and ~4x in 2050 relative to 2020. Boron Demand Growth(1)�(k tonnes; boric acid equivalent)

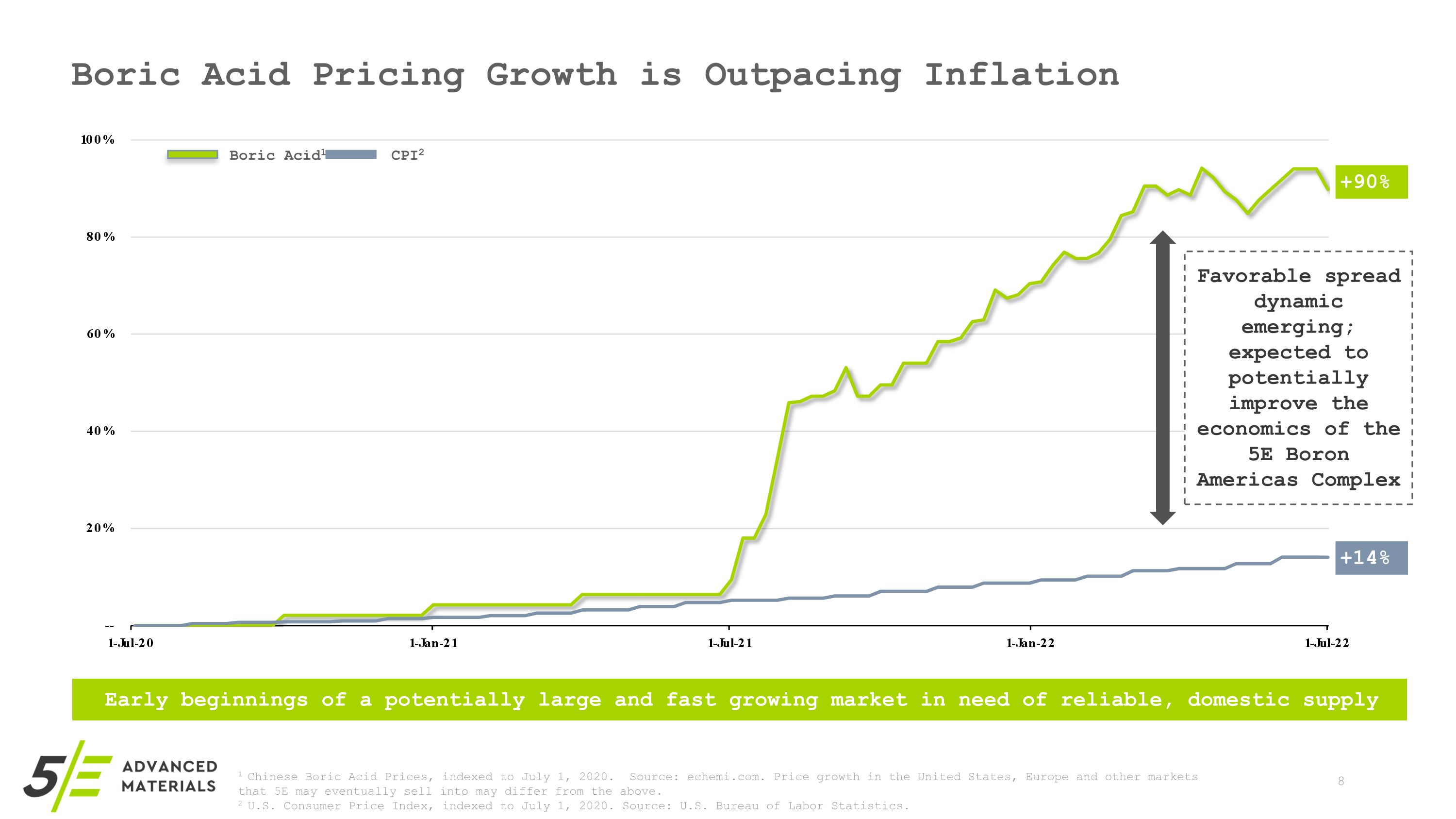

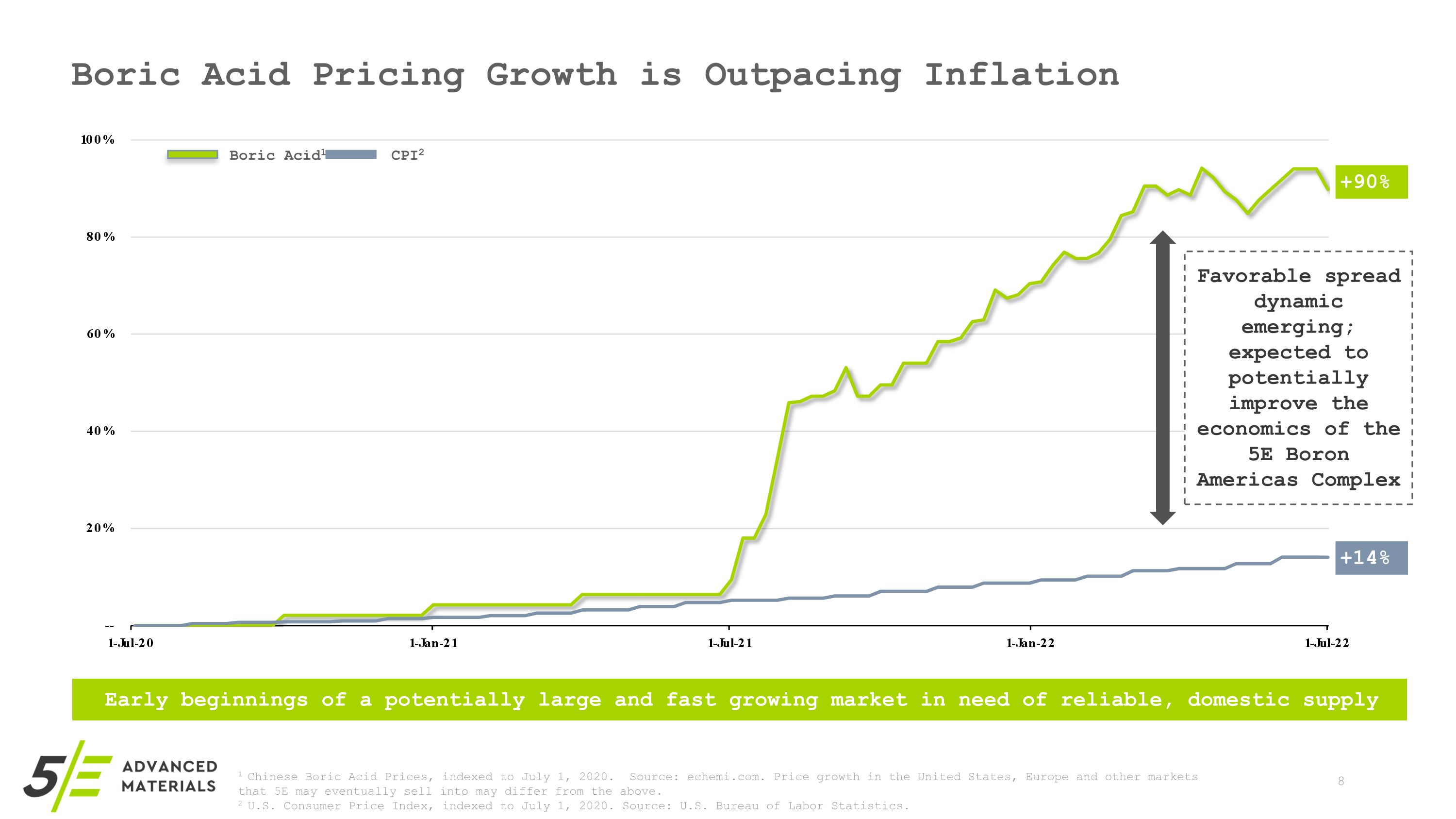

Boric Acid Pricing Growth is Outpacing Inflation Early beginnings of a potentially large and fast growing market in need of reliable, domestic supply 1 Chinese Boric Acid Prices, indexed to July 1, 2020. Source: echemi.com. Price growth in the United States, Europe and other markets that 5E may eventually sell into may differ from the above. 2 U.S. Consumer Price Index, indexed to July 1, 2020. Source: U.S. Bureau of Labor Statistics. Boric Acid1 CPI2 +90% +14% Favorable spread dynamic emerging; expected to potentially improve the economics of the 5E Boron Americas Complex

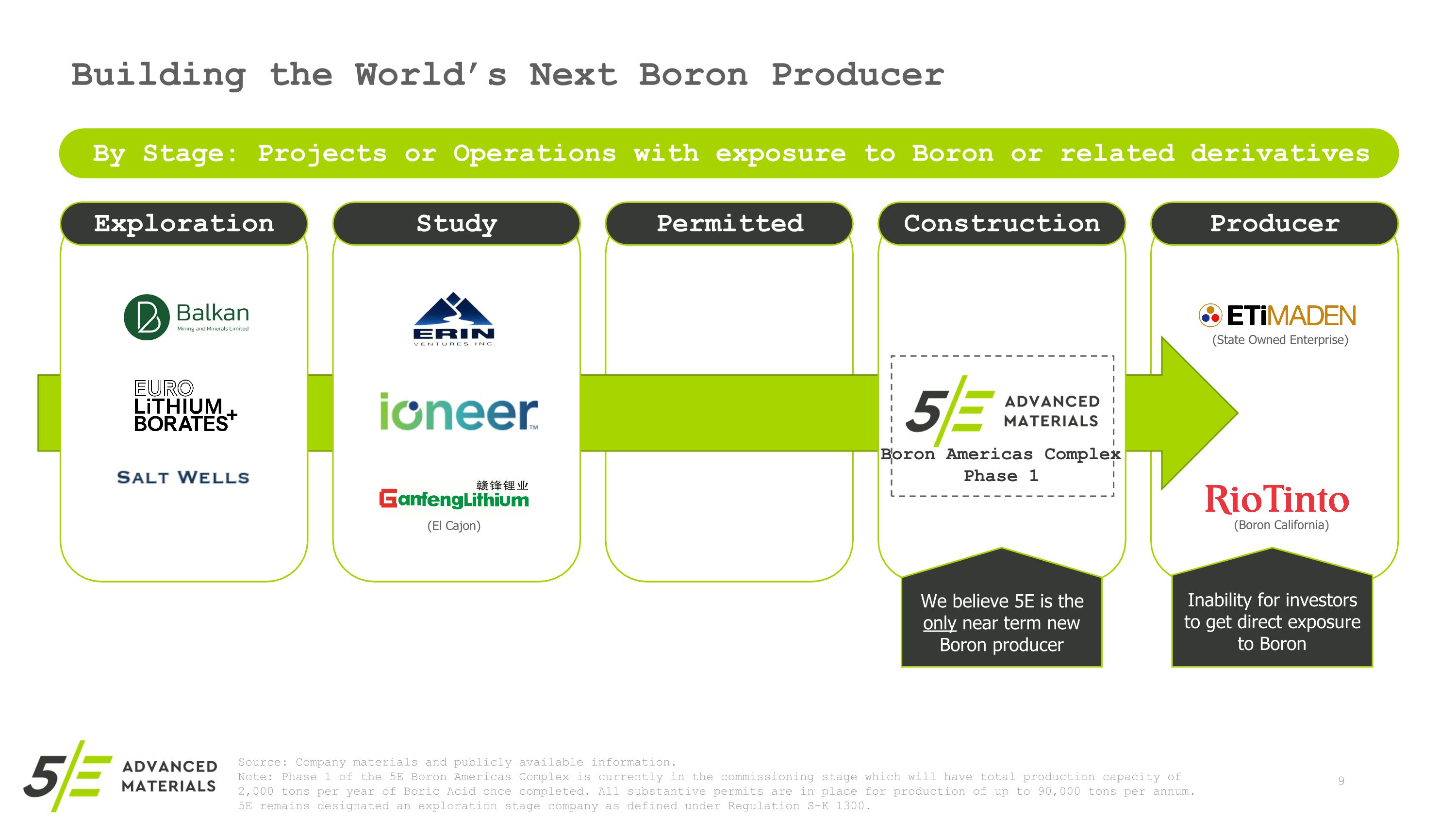

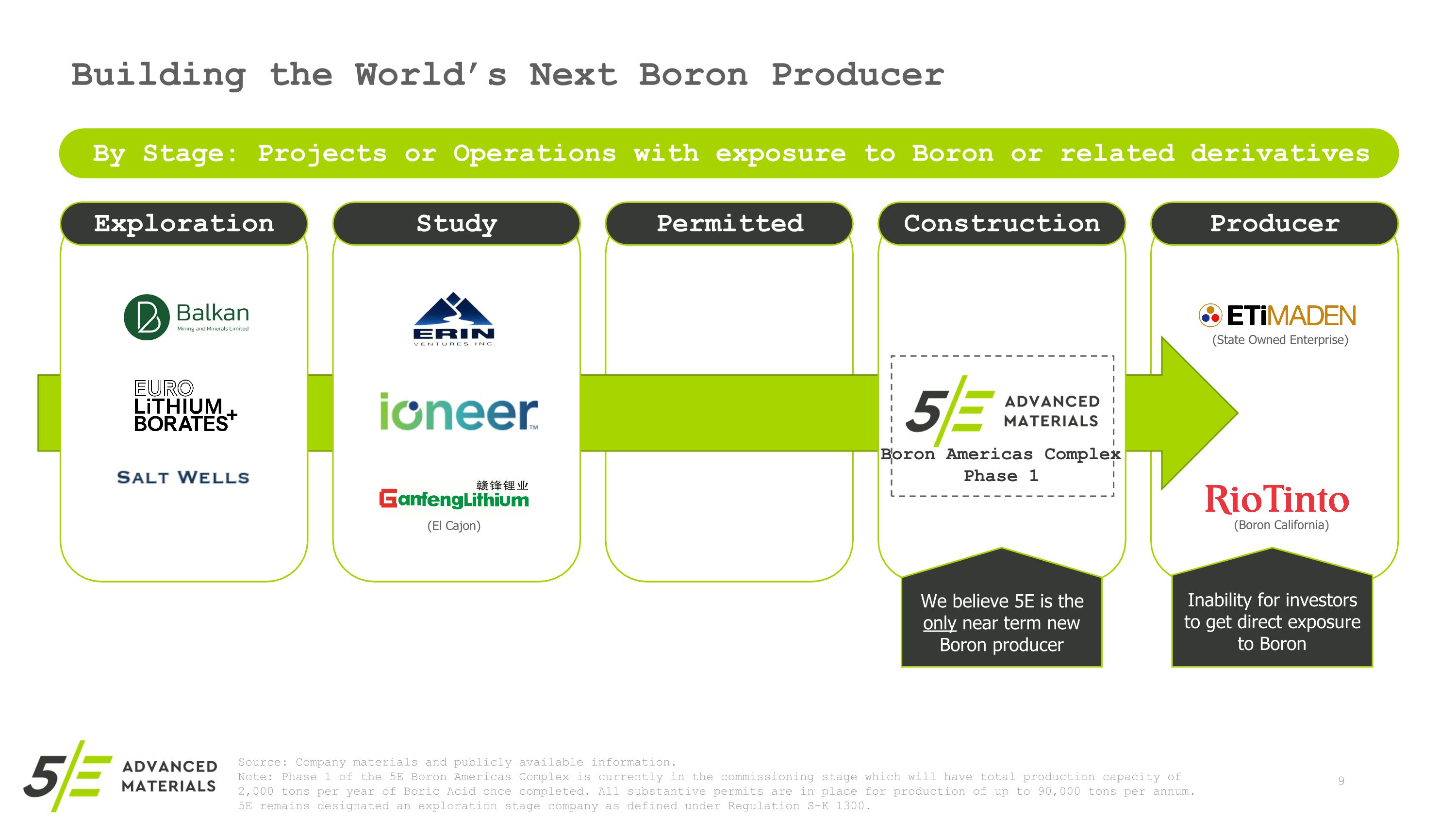

Permitted Producer Building the World’s Next Boron Producer 4 Exploration Study Construction We believe 5E is the only near term new Boron producer By Stage: Projects or Operations with exposure to Boron or related derivatives Source: Company materials and publicly available information. Note: Phase 1 of the 5E Boron Americas Complex is currently in the commissioning stage which will have total production capacity of 2,000 tons per year of Boric Acid once completed. All substantive permits are in place for production of up to 90,000 tons per annum. 5E remains designated an exploration stage company as defined under Regulation S-K 1300. Inability for investors to get direct exposure to Boron (State Owned Enterprise) (Boron California) Boron Americas Complex�Phase 1 (El Cajon)

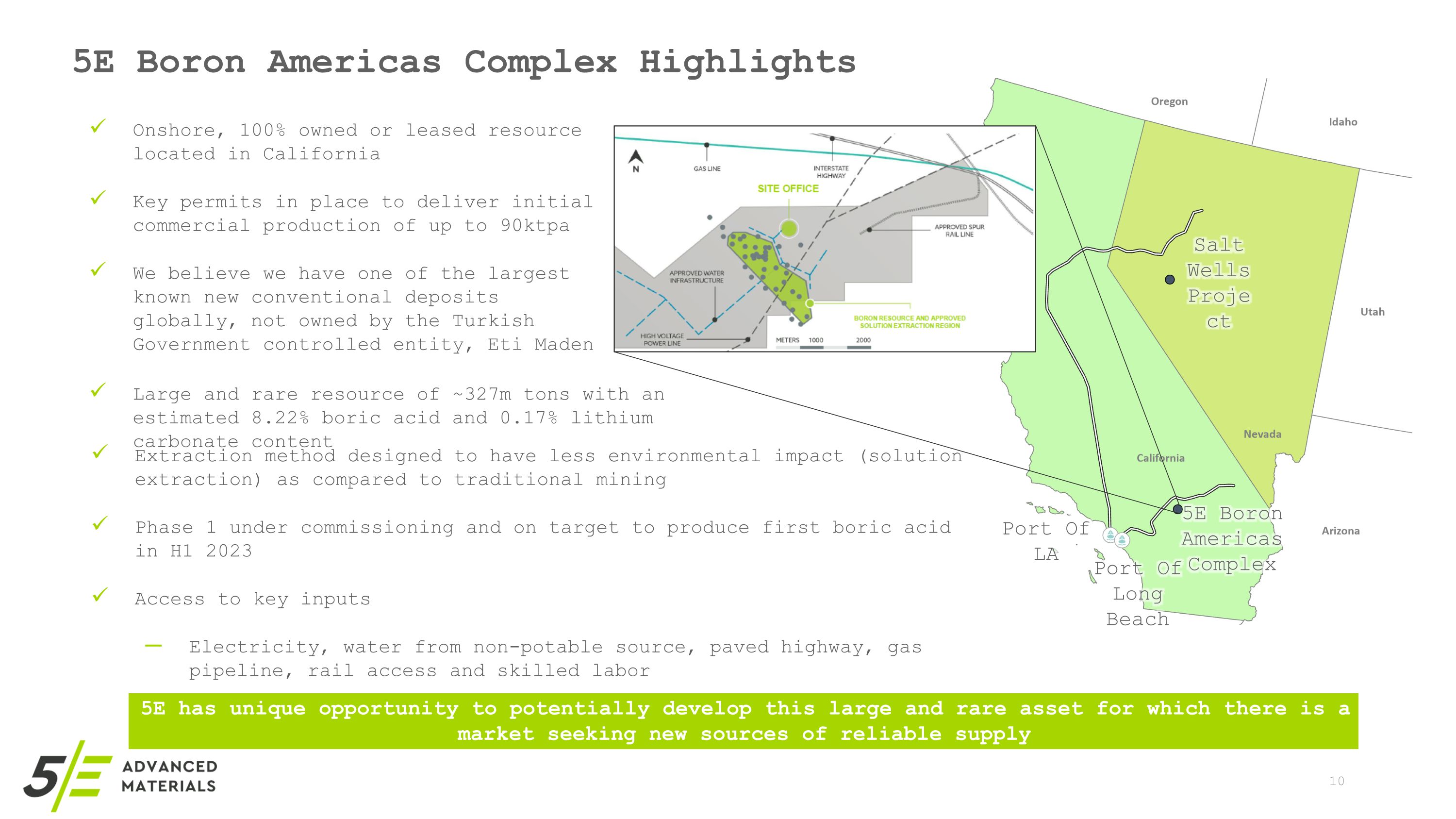

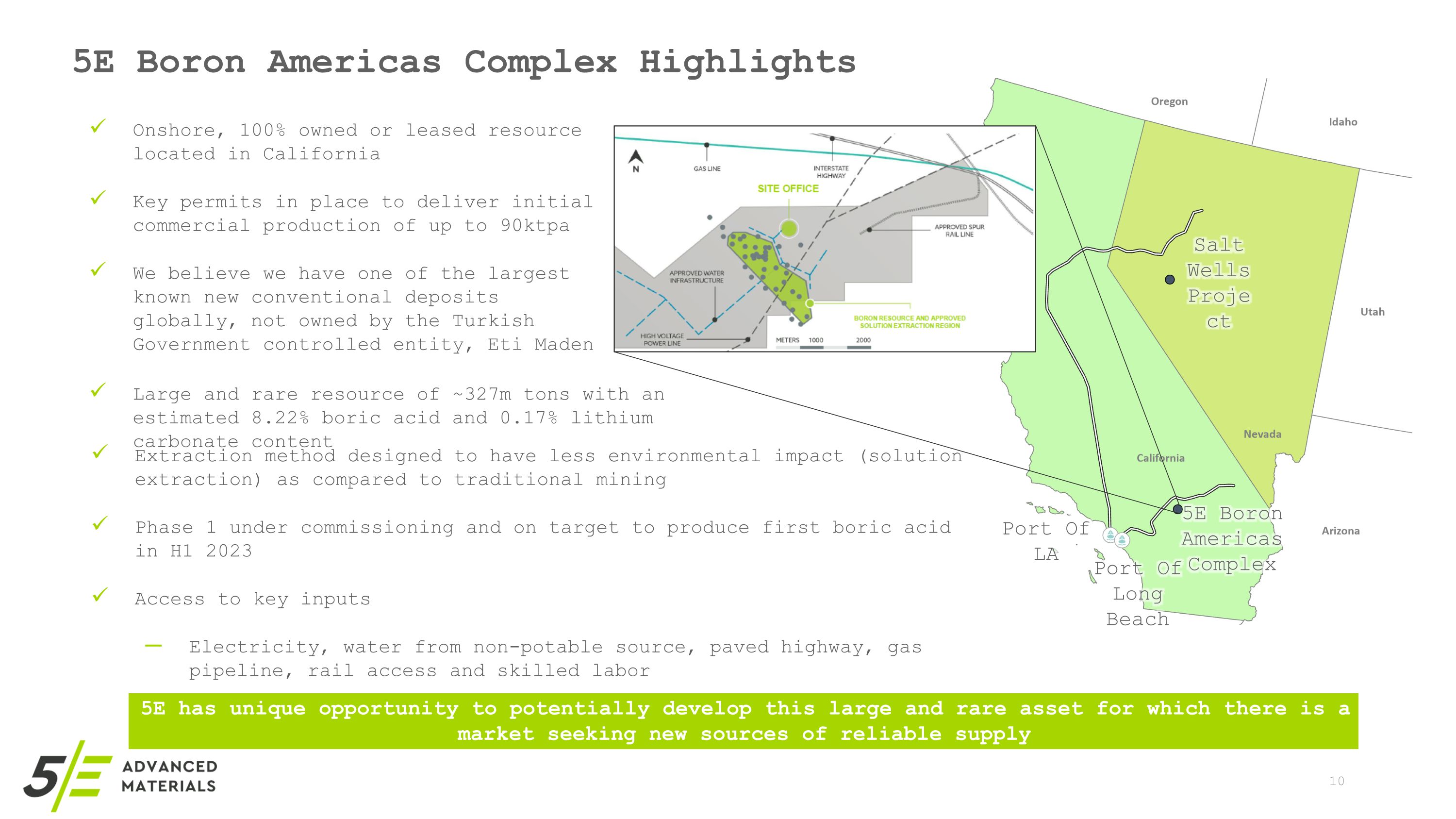

5E Boron Americas Complex Highlights 5E has unique opportunity to potentially develop this large and rare asset for which there is a market seeking new sources of reliable supply 5E Boron Americas Complex Port Of LA Port Of Long Beach Onshore, 100% owned or leased resource located in California Key permits in place to deliver initial commercial production of up to 90ktpa We believe we have one of the largest known new conventional deposits globally, not owned by the Turkish Government controlled entity, Eti Maden Extraction method designed to have less environmental impact (solution extraction) as compared to traditional mining Phase 1 under commissioning and on target to produce first boric acid in H1 2023 Access to key inputs Electricity, water from non-potable source, paved highway, gas pipeline, rail access and skilled labor Salt Wells Project Large and rare resource of ~327m tons with an estimated 8.22% boric acid and 0.17% lithium carbonate content

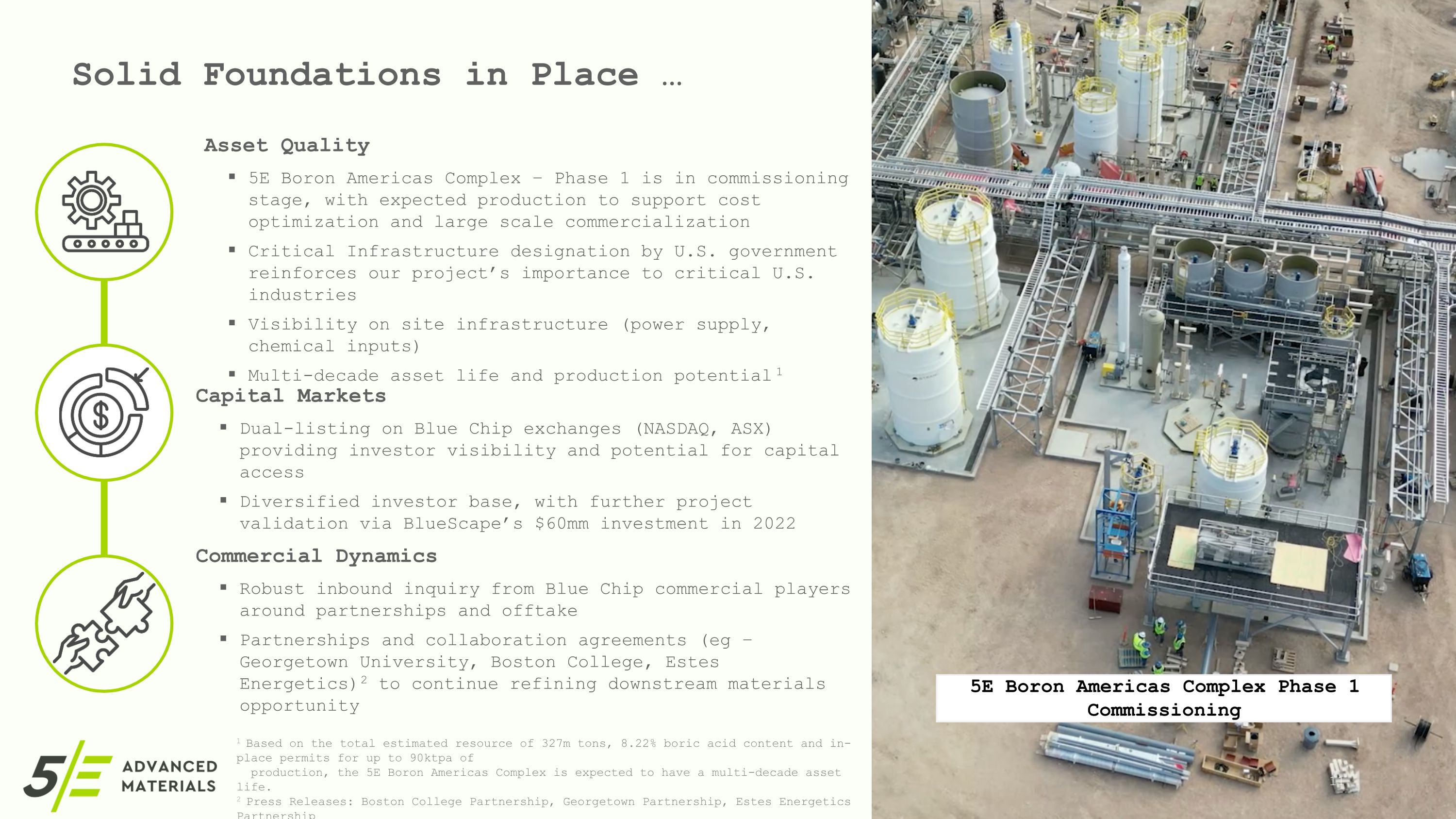

Solid Foundations in Place … Asset Quality 5E Boron Americas Complex – Phase 1 is in commissioning stage, with expected production to support cost optimization and large scale commercialization Critical Infrastructure designation by U.S. government reinforces our project’s importance to critical U.S. industries Visibility on site infrastructure (power supply, chemical inputs) Multi-decade asset life and production potential1 Capital Markets Dual-listing on Blue Chip exchanges (NASDAQ, ASX) providing investor visibility and potential for capital access Diversified investor base, with further project validation via BlueScape’s $60mm investment in 2022 Commercial Dynamics Robust inbound inquiry from Blue Chip commercial players around partnerships and offtake Partnerships and collaboration agreements (eg – Georgetown University, Boston College, Estes Energetics)2 to continue refining downstream materials opportunity 5E Boron Americas Complex Phase 1 Commissioning 1 Based on the total estimated resource of 327m tons, 8.22% boric acid content and in-place permits for up to 90ktpa of � production, the 5E Boron Americas Complex is expected to have a multi-decade asset life. 2 Press Releases: Boston College Partnership, Georgetown Partnership, Estes Energetics Partnership

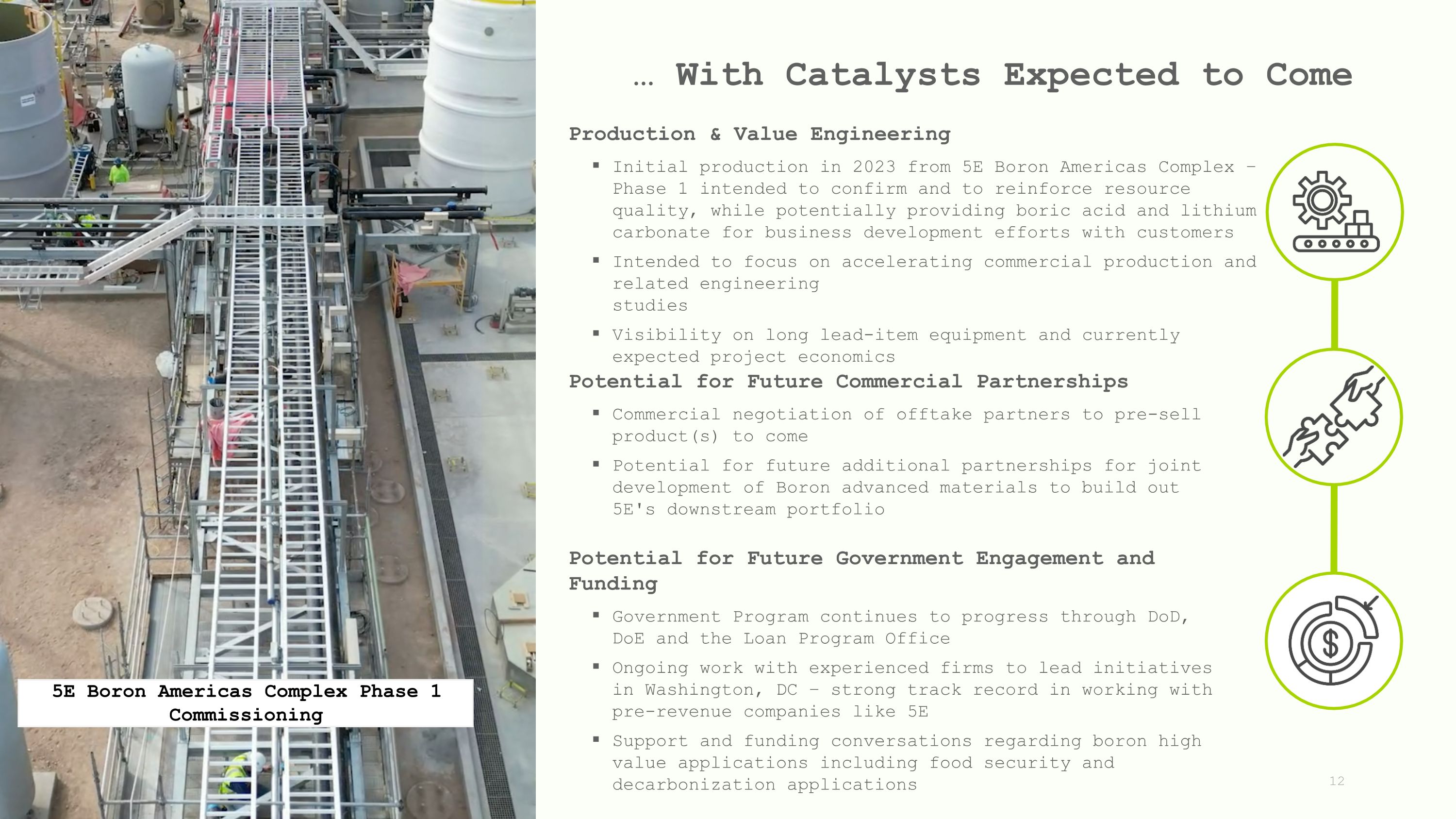

… With Catalysts Expected to Come Production & Value Engineering Initial production in 2023 from 5E Boron Americas Complex – Phase 1 intended to confirm and to reinforce resource quality, while potentially providing boric acid and lithium carbonate for business development efforts with customers Intended to focus on accelerating commercial production and related engineering �studies Visibility on long lead-item equipment and currently expected project economics Potential for Future Commercial Partnerships Commercial negotiation of offtake partners to pre-sell product(s) to come Potential for future additional partnerships for joint development of Boron advanced materials to build out 5E's downstream portfolio Potential for Future Government Engagement and Funding Government Program continues to progress through DoD, DoE and the Loan Program Office Ongoing work with experienced firms to lead initiatives in Washington, DC – strong track record in working with pre-revenue companies like 5E Support and funding conversations regarding boron high value applications including food security and decarbonization applications 5E Boron Americas Complex Phase 1 Commissioning

Defined and Complementary Corporate Strategic Priorities 13 Commercial Initiatives Identify and execute on complementary partnerships; develop our Boron portfolio Commercial �Initiatives Project Execution Lead: Dr. Dino Gnanamgari Bring our 5E Boron Americas Complex to production Project Execution Project Execution Lead: Chris Knight Construct and originate optimal project funding structure Financing & �Government Project Execution Lead: Paul Weibel Intend to build sustainable capital markets profile Equity �Capital Markets Project Execution Lead: J.T. Starzecki Commission and produce from Phase 1 of our project Value engineer and cost optimize our large-scale complex Accelerate commercial production, and economically scale the asset over time Identify and secure Boric Acid and Lithium offtake partners Advance customer-led initiatives for development of downstream advanced materials Continue R&D efforts to support materials portfolio buildout and boron thought leadership Further relationships with non-dilutive capital providers with an aim to support large-scale project funding Build on government relationships with an aim to enable 5E to access potentially advantageous funding options & support Continued education and relationship building with institutional and retail investors Further refinement of 5E’s story Build liquidity on the NASDAQ exchange by expanding institutional reach, and transitioning holders from the ASX exchange

Customer-Driven Evolution in Project Execution Execution expected to be grounded in stakeholder management, with focus on sustainable value creation over time 1 Customers: Increased focus and priority to access reliable, high quality supply as demand continually outpaces future supply 2 Government Agencies: Growing support and funding programs dedicated to accelerating the growth of domestic critical materials supply 3 Investors: Shift in priorities with greater focus on near-term cash flow and project execution 4 Local Stakeholders & Economy: Need for high-quality jobs, and increasingly supportive of projects that achieve sustainable development 1 2 3 4

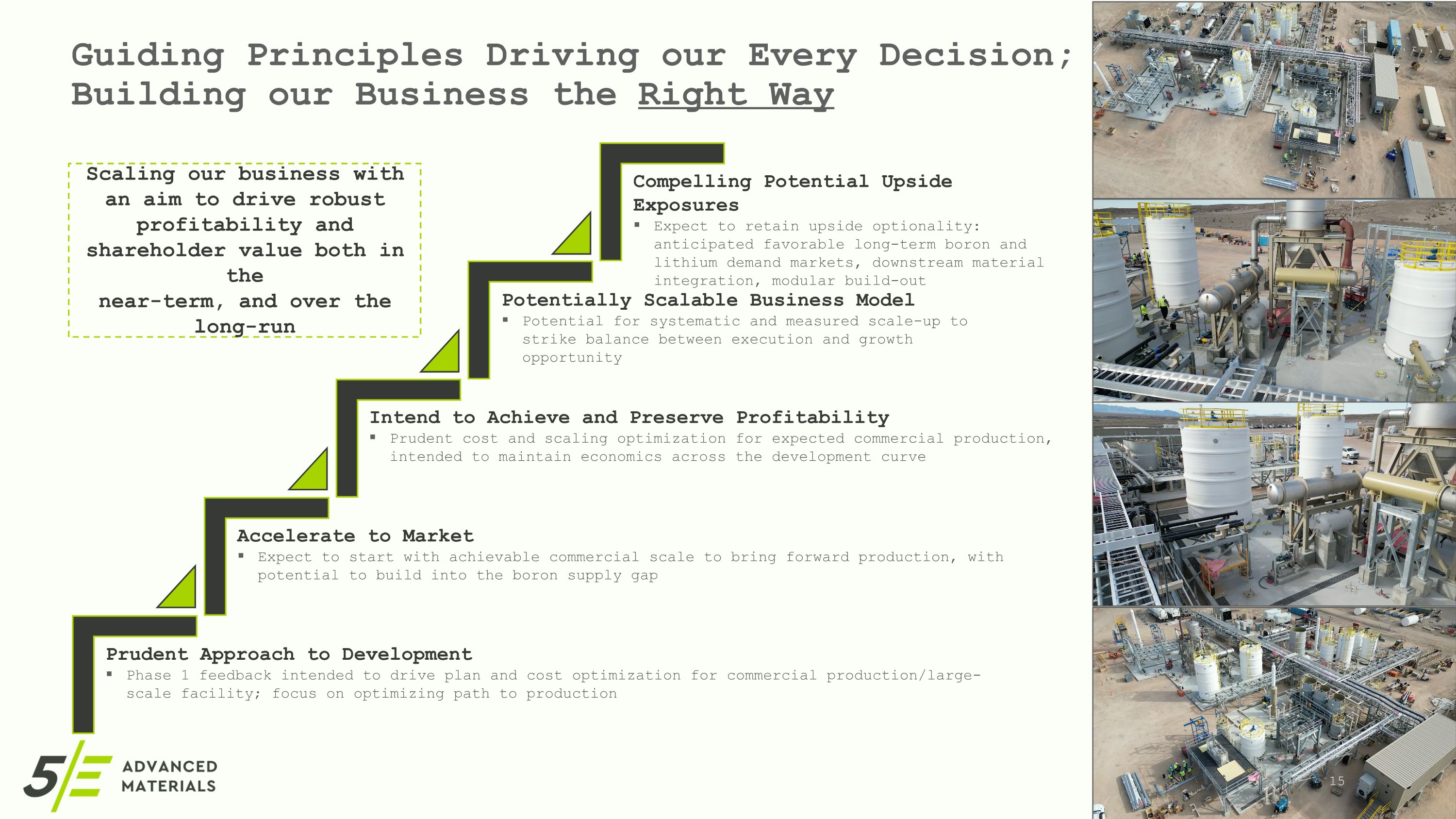

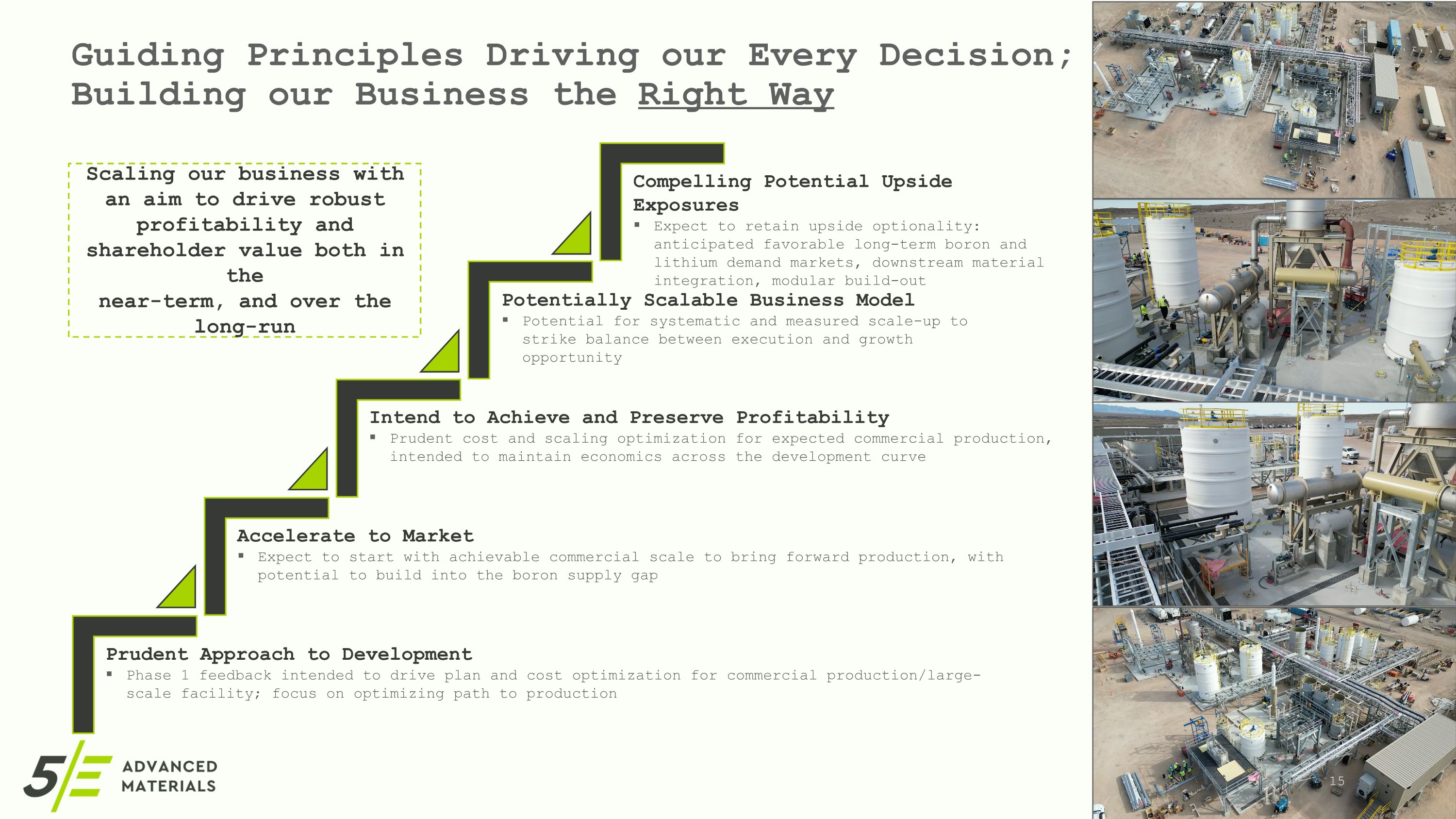

Guiding Principles Driving our Every Decision; �Building our Business the Right Way Prudent Approach to Development Phase 1 feedback intended to drive plan and cost optimization for commercial production/large-scale facility; focus on optimizing path to production Accelerate to Market Expect to start with achievable commercial scale to bring forward production, with potential to build into the boron supply gap Intend to Achieve and Preserve Profitability Prudent cost and scaling optimization for expected commercial production, intended to maintain economics across the development curve Potentially Scalable Business Model Potential for systematic and measured scale-up to strike balance between execution and growth opportunity Compelling Potential Upside Exposures Expect to retain upside optionality: anticipated favorable long-term boron and lithium demand markets, downstream material integration, modular build-out Scaling our business with an aim to drive robust profitability and �shareholder value both in the �near-term, and over the long-run

Leadership Team With Diverse Skillsets and Proven Execution Capabilities Leadership Team Paul Weibel Chief Financial Officer Dr Dinakar (Dino) �Gnanamgari Chief Commercial Officer & Chief Technical Officer Chantel Jordan Senior Vice President, General Counsel and Chief People Officer 5E Board of Directors David Salisbury Non-Executive Chair Jimmy Lim Non-Executive Director Stephen Hunt Non-Executive�Director J.T. Starzecki Chief Marketing Officer Christopher Knight Vice President, Operations H. Keith Jennings Non-Executive Director Graham van’t Hoff Non-Executive Director

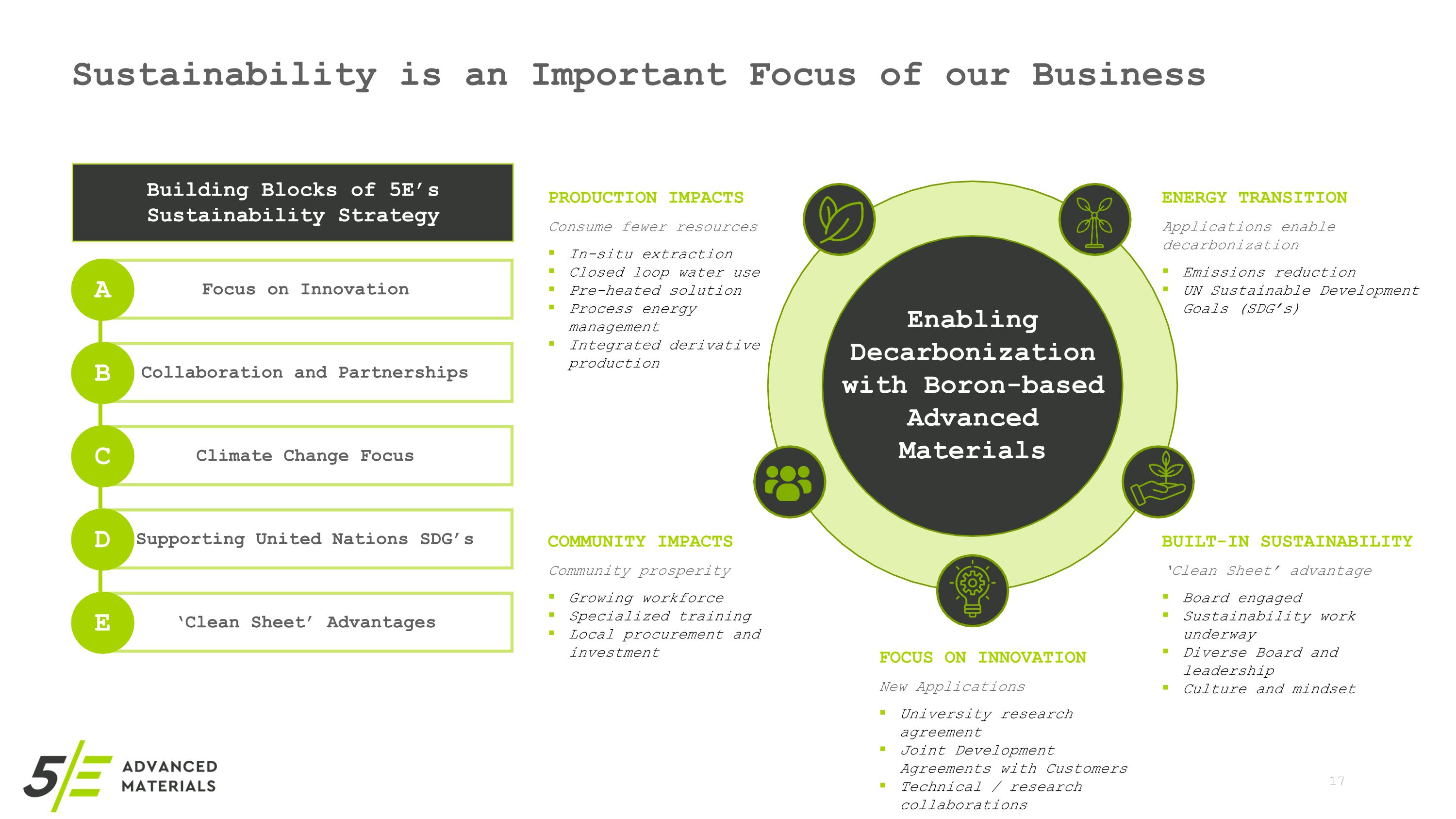

Sustainability is an Important Focus of our Business Building Blocks of 5E’s Sustainability Strategy Focus on Innovation A Collaboration and Partnerships B Climate Change Focus C Supporting United Nations SDG’s D ‘Clean Sheet’ Advantages E Enabling Decarbonization with Boron-based Advanced Materials FOCUS ON INNOVATION New Applications University research agreement Joint Development Agreements with Customers Technical / research collaborations COMMUNITY IMPACTS Community prosperity Growing workforce Specialized training Local procurement and investment PRODUCTION IMPACTS Consume fewer resources In-situ extraction Closed loop water use Pre-heated solution Process energy management Integrated derivative production ENERGY TRANSITION Applications enable decarbonization Emissions reduction UN Sustainable Development Goals (SDG’s) BUILT-IN SUSTAINABILITY ‘Clean Sheet’ advantage Board engaged Sustainability work underway Diverse Board and leadership Culture and mindset

Key Investment Highlights Large and Rare Asset Large and rare mineral resource in a strategic U.S. location designated as critical infrastructure by the U.S. government Anticipated boron supply gap due to lack of new projects and increasing demand Accelerating Demand Growth Strategic with utilities and logistics, key permits in place for initial commercial production1 Strategic Location Potential for growth optionality in upstream volume and downstream margins Catalyst-Rich Potential Lithium co-product has potential to diversify our revenue streams beyond boron Lithium Co-Product Compelling entry point in a multi-decade U.S. critical material story Differentiated Platform and OpportunityEX-99.1 1 All permits have been obtained for the production of up to 90ktpa of boric acid production. 18

5Eadvancedmaterials.com J.T. Starzecki Chief Marketing Officer jstarzecki@5eadvancedmaterials.com Contact Us US Headquarters 19500 State Highway 249, Suite 125�Houston, Texas 77070�USA Telephone: +1 346-439-9656 US Field Office 9329 Mariposa Road, Suite 210�Hesperia, California 92344�USA Telephone: +1 442-221-0225