Fourth Quarter & Full Year 2023 Results Call Enabling America’s �Clean Energy Economy August 30, 2023 : FEAM 5E Advanced Materials : 5EA Exhibit 99.2

Disclaimer FORWARD-LOOKING STATEMENTS The information in this Presentation includes “forward looking statements”. All statements other than statements of historical fact included in this Presentation regarding our business strategy, plans, goals and objectives are forward looking statements. When used in this Presentation, the words “believe”, “project”, “expect”, “anticipate”, “estimate”, “intend”, “budget”, “target”, “aim”, “strategy”, “estimate”, “plan”, “guidance”, “outlook”, “intend”, “may”, “should”, “could”, “will”, “would”, “will be”, “will continue”, “will likely result” and similar expressions are intended to identify forward looking statements, although not all forward looking statements contain such identifying words. These forward looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and the fact that we have not yet realized any revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our ability to obtain, maintain, and renew governmental and environmental permits in order to conduct development and mining operations in a timely manner; our incurrence of significant net operating losses to date and expectations to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the 5E Boron Americas Complex, including our ability to timely and successfully complete Phase 1 of our 5E Boron Americas Complex; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; and other risks. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein. You are cautioned not to place undue reliance on any forward looking statements, which speak only as of the date of this Presentation. Except as otherwise required by applicable law, we disclaim any duty to update and do not intend to update any forward looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Presentation. MARKET AND INDUSTRY DATA This Presentation has been prepared by 5E and includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although 5E believes these third party sources are reliable as of their respective dates for the purposes used herein, neither we nor any of our affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although we believe the sources are reliable, we have not independently verified the accuracy or completeness of data from such sources. Some data is also based on 5E’s good faith estimates, which are derived from our review of internal sources as well as the third party sources described above. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only there can be no assurance that such conditions will actually occur or result in positive returns. CAUTIONARY NOTE REGARDING RESERVES Unless otherwise indicated, all mineral resource estimates included in this Presentation have been prepared in accordance with, and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) - based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code”. While the SEC now recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all of the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves. For additional information regarding these various risks and uncertainties, you should carefully review the risk factors and other disclosures in our Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) on September 28, 2022, as amended by our Form 10-K/A filed on October 31, 2022, as well as our Form 10-Qs filed on November 10, 2022 and February 9, 2023. Additional risks are also disclosed by 5E in its filings with the Securities and Exchange Commission throughout the year, as well as its filings under the Australian Securities Exchange.

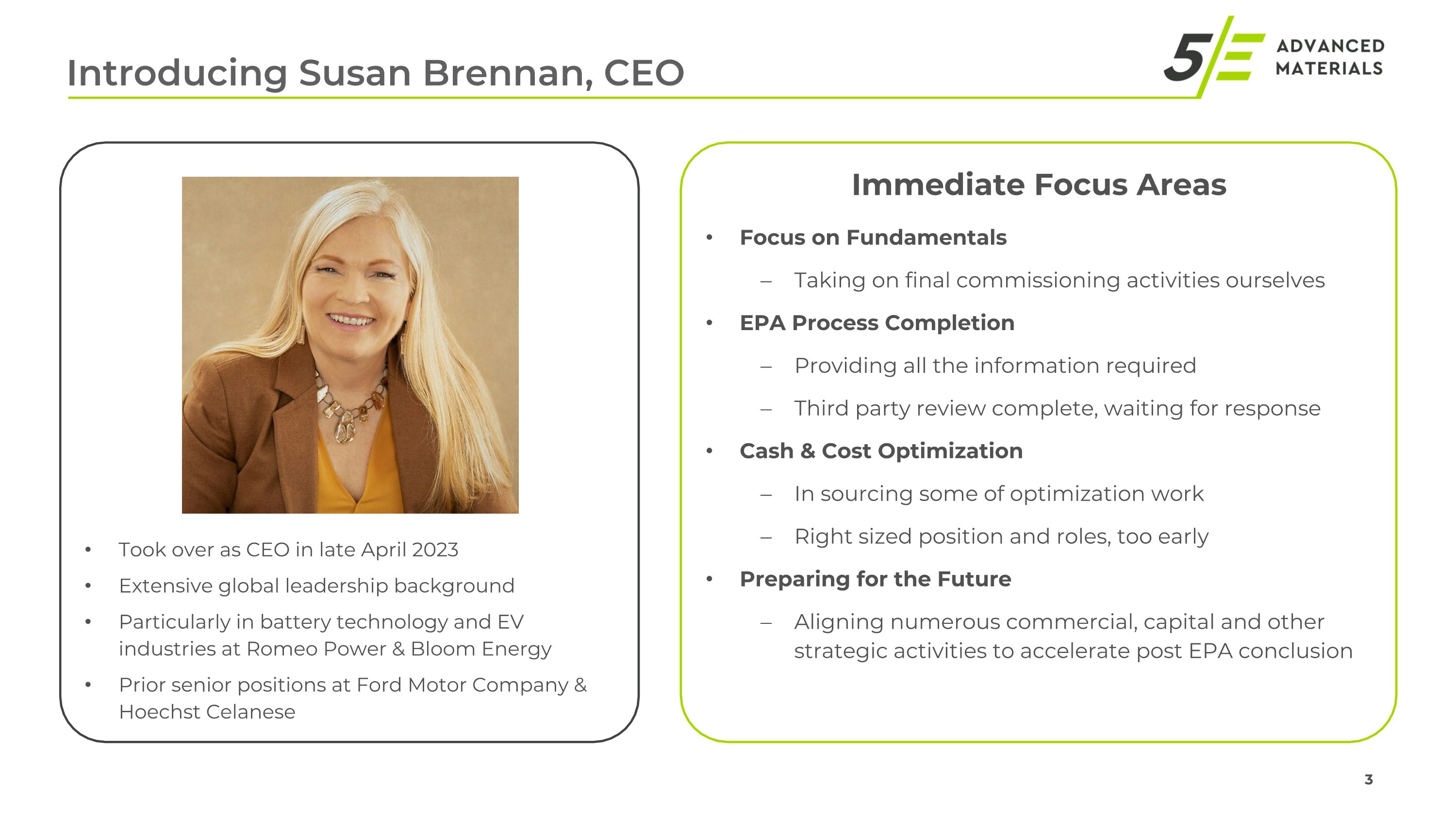

Introducing Susan Brennan, CEO Took over as CEO in late April 2023 Extensive global leadership background Particularly in battery technology and EV industries at Romeo Power & Bloom Energy Prior senior positions at Ford Motor Company & Hoechst Celanese Immediate Focus Areas Focus on Fundamentals Taking on final commissioning activities ourselves EPA Process Completion Providing all the information required Third party review complete, waiting for response Cash & Cost Optimization In sourcing some of optimization work Right sized position and roles, too early Preparing for the Future Aligning numerous commercial, capital and other strategic activities to accelerate post EPA conclusion

5E Boron Americas Complex

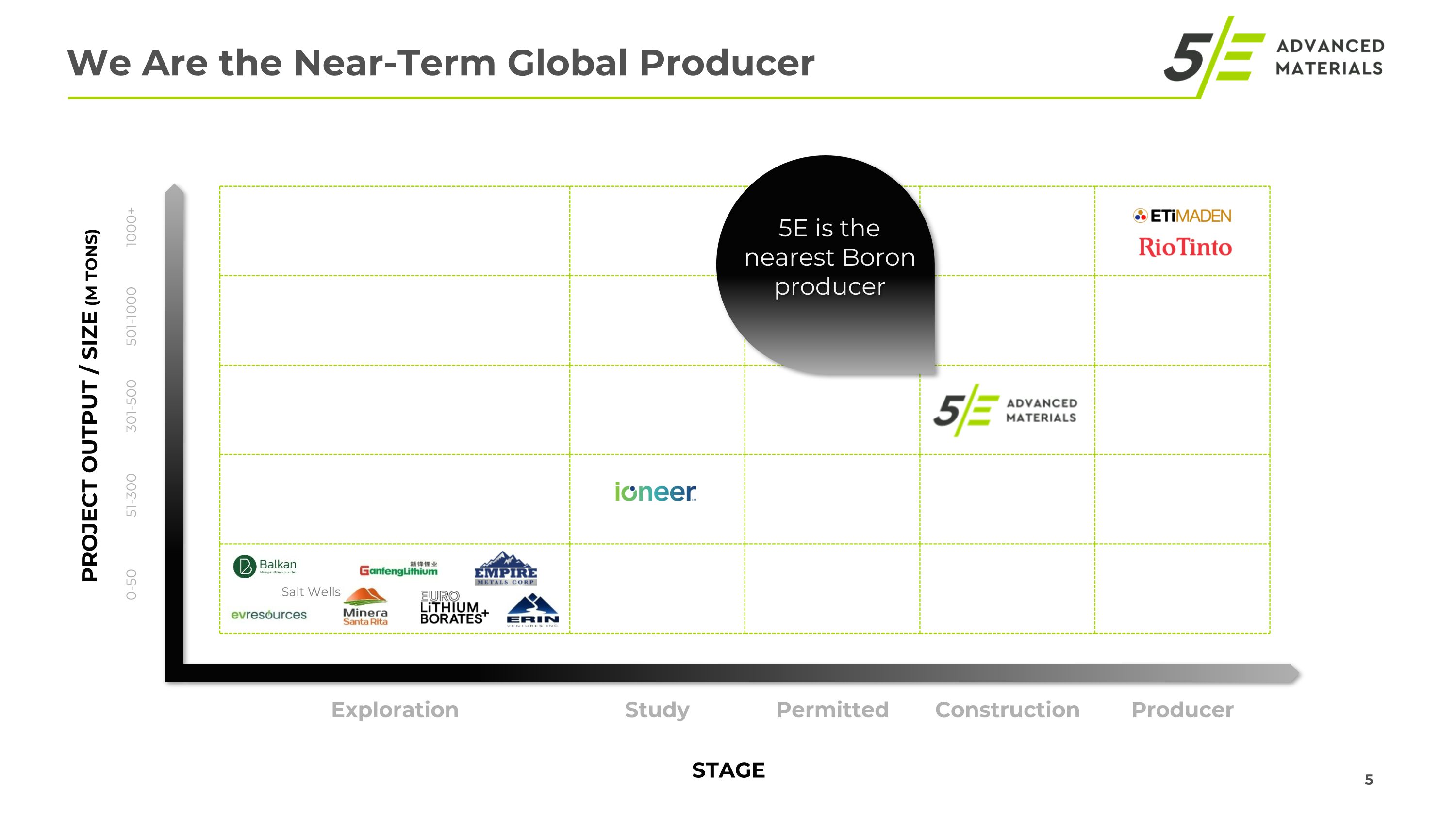

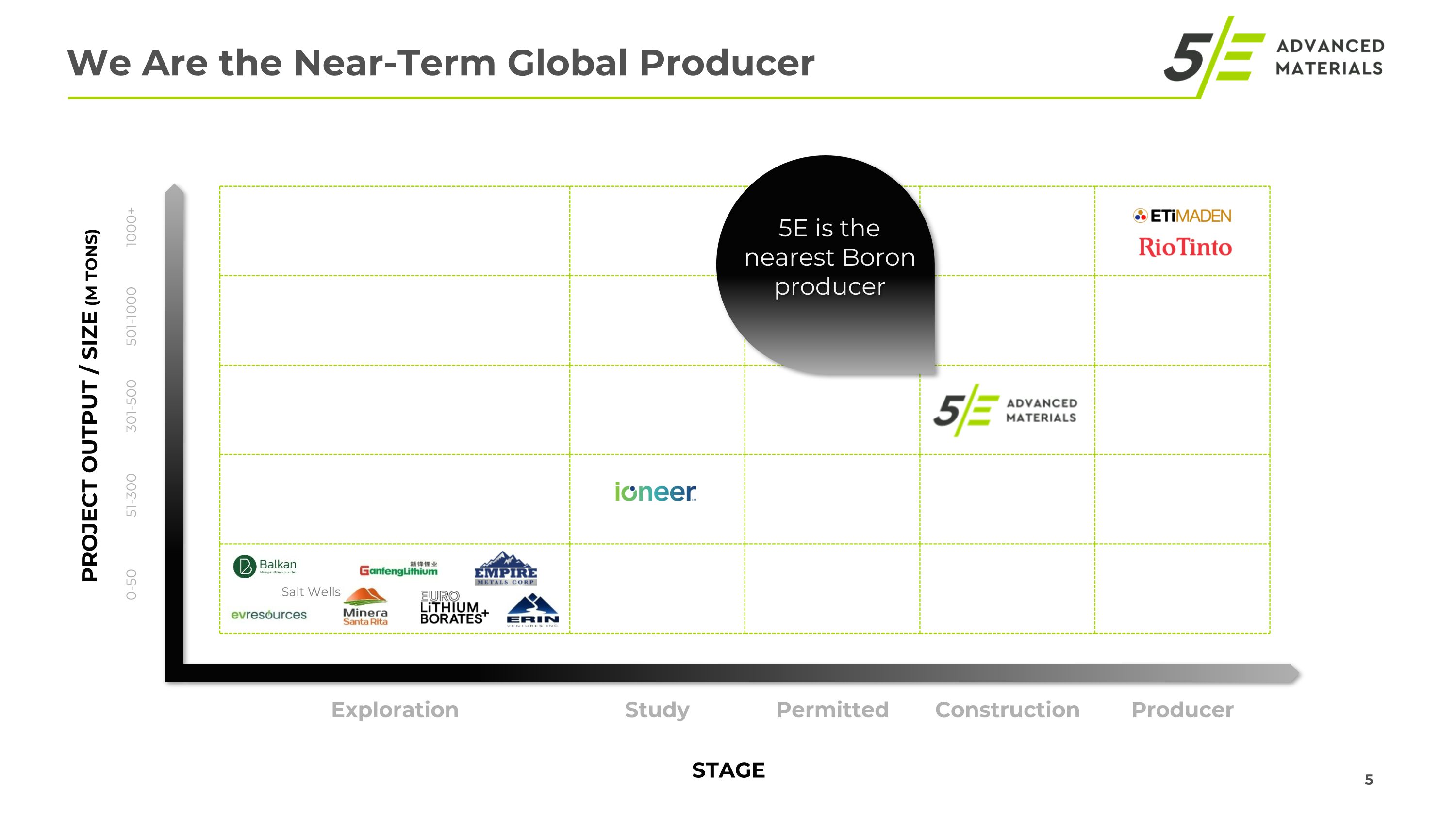

We Are the Near-Term Global Producer Exploration Study Permitted Construction Producer STAGE 1000+ 501-1000 301-500 51-300 0-50 PROJECT OUTPUT / SIZE (M TONS) Salt Wells 5E is the nearest Boron producer

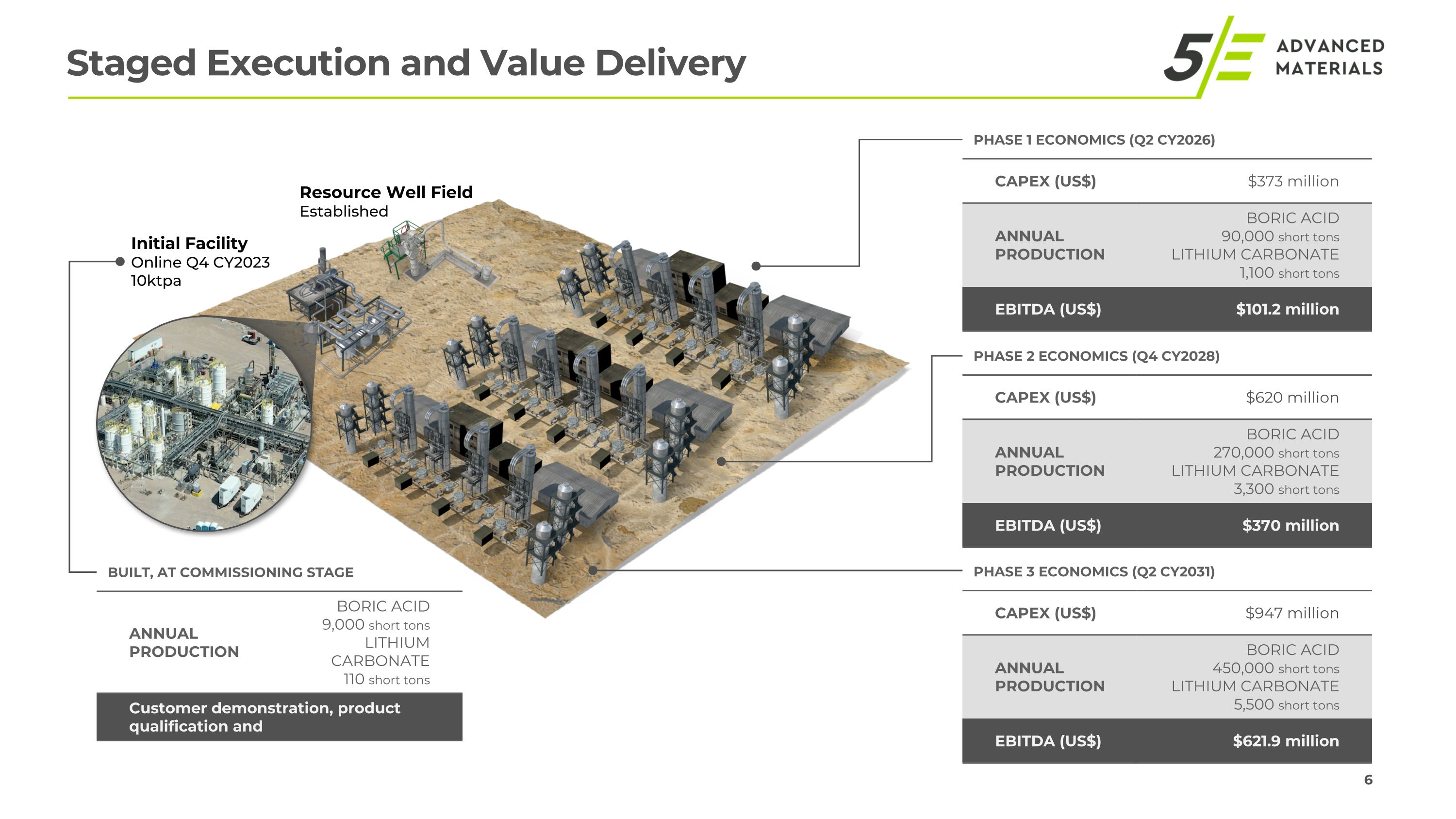

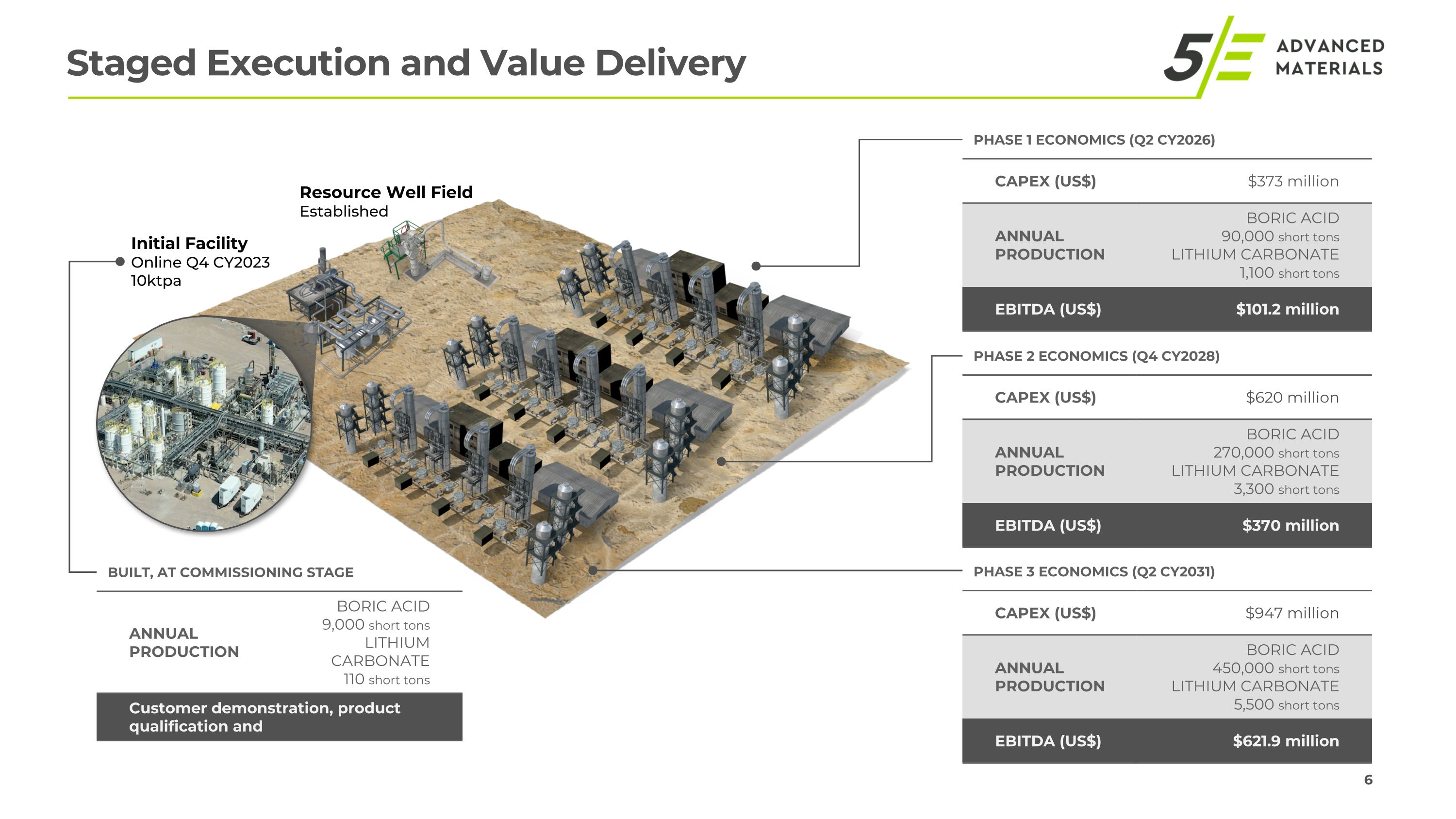

2 Staged Execution and Value Delivery Initial Facility Online Q4 CY2023 10ktpa Resource Well Field Established PHASE 1 ECONOMICS (Q2 CY2026) CAPEX (US$) $373 million ANNUAL PRODUCTION BORIC ACID�90,000 short tons LITHIUM CARBONATE�1,100 short tons EBITDA (US$) $101.2 million PHASE 2 ECONOMICS (Q4 CY2028) CAPEX (US$) $620 million ANNUAL PRODUCTION BORIC ACID�270,000 short tons LITHIUM CARBONATE�3,300 short tons EBITDA (US$) $370 million PHASE 3 ECONOMICS (Q2 CY2031) CAPEX (US$) $947 million ANNUAL PRODUCTION BORIC ACID�450,000 short tons LITHIUM CARBONATE�5,500 short tons EBITDA (US$) $621.9 million BUILT, AT COMMISSIONING STAGE ANNUAL PRODUCTION BORIC ACID�9,000 short tons LITHIUM CARBONATE�110 short tons Customer demonstration, product qualification and $101.2 million

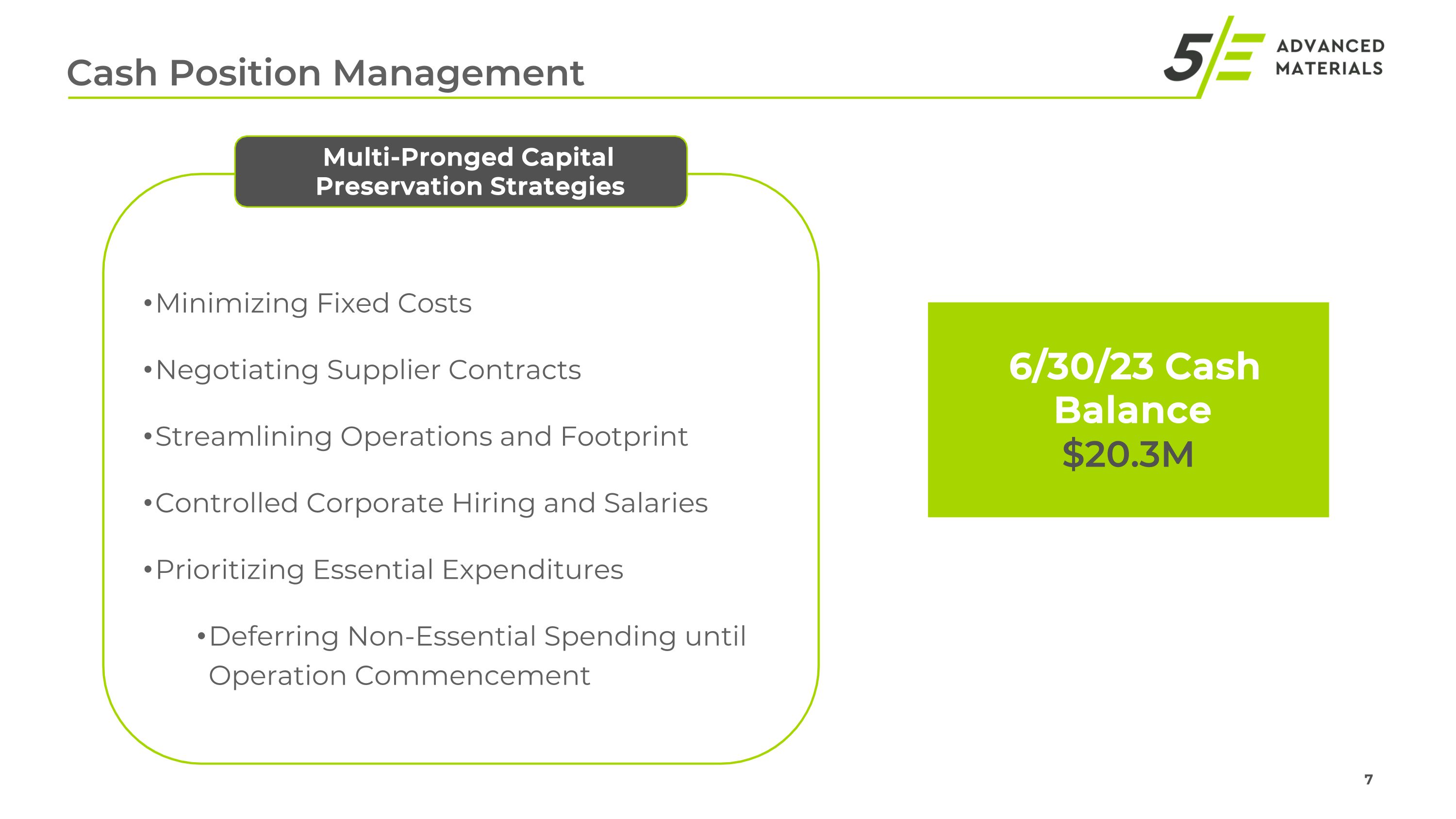

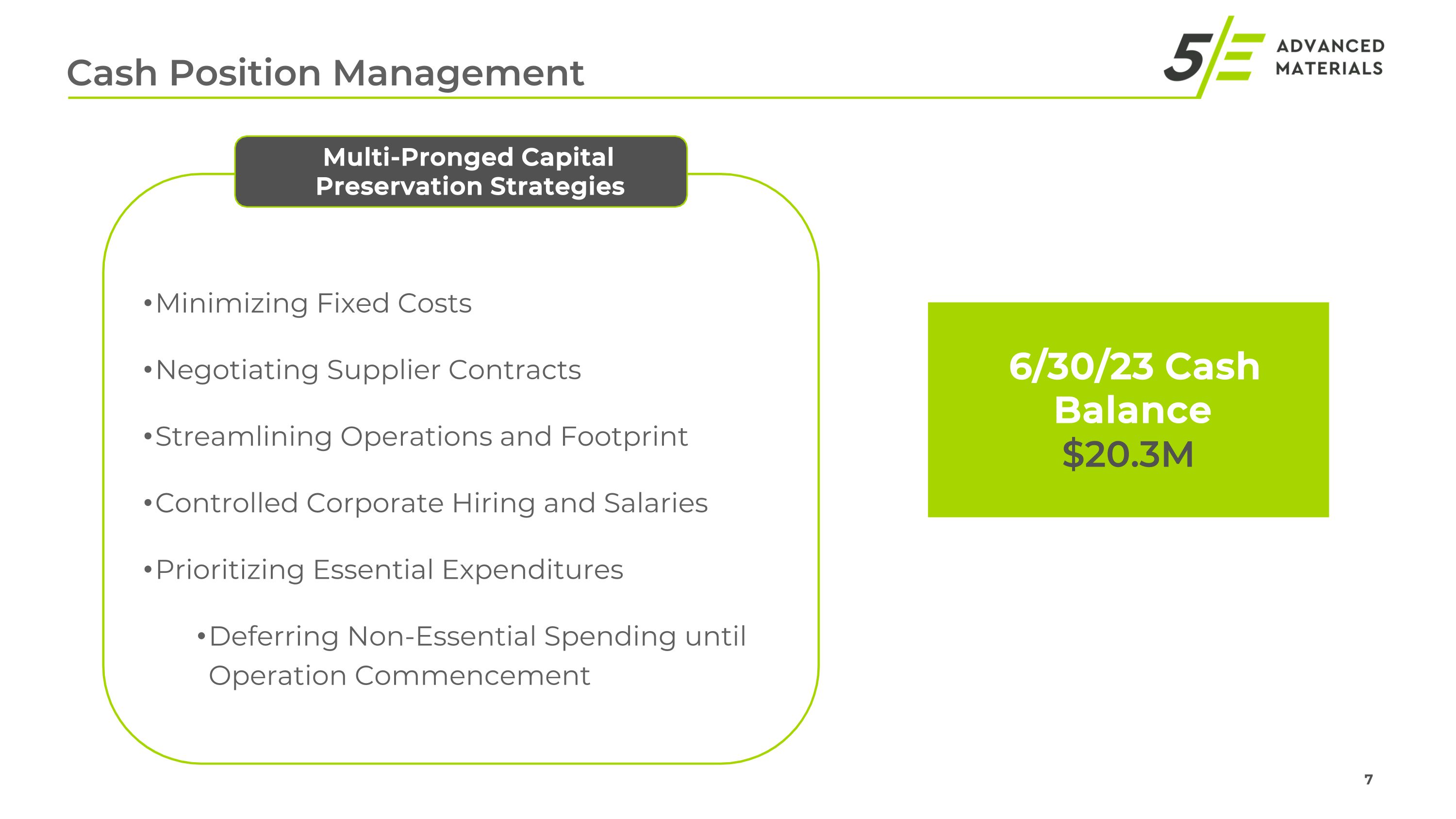

Cash Position Management Minimizing Fixed Costs Negotiating Supplier Contracts Streamlining Operations and Footprint Controlled Corporate Hiring and Salaries Prioritizing Essential Expenditures Deferring Non-Essential Spending until Operation Commencement Multi-Pronged Capital Preservation Strategies 6/30/23 Cash Balance $20.3M

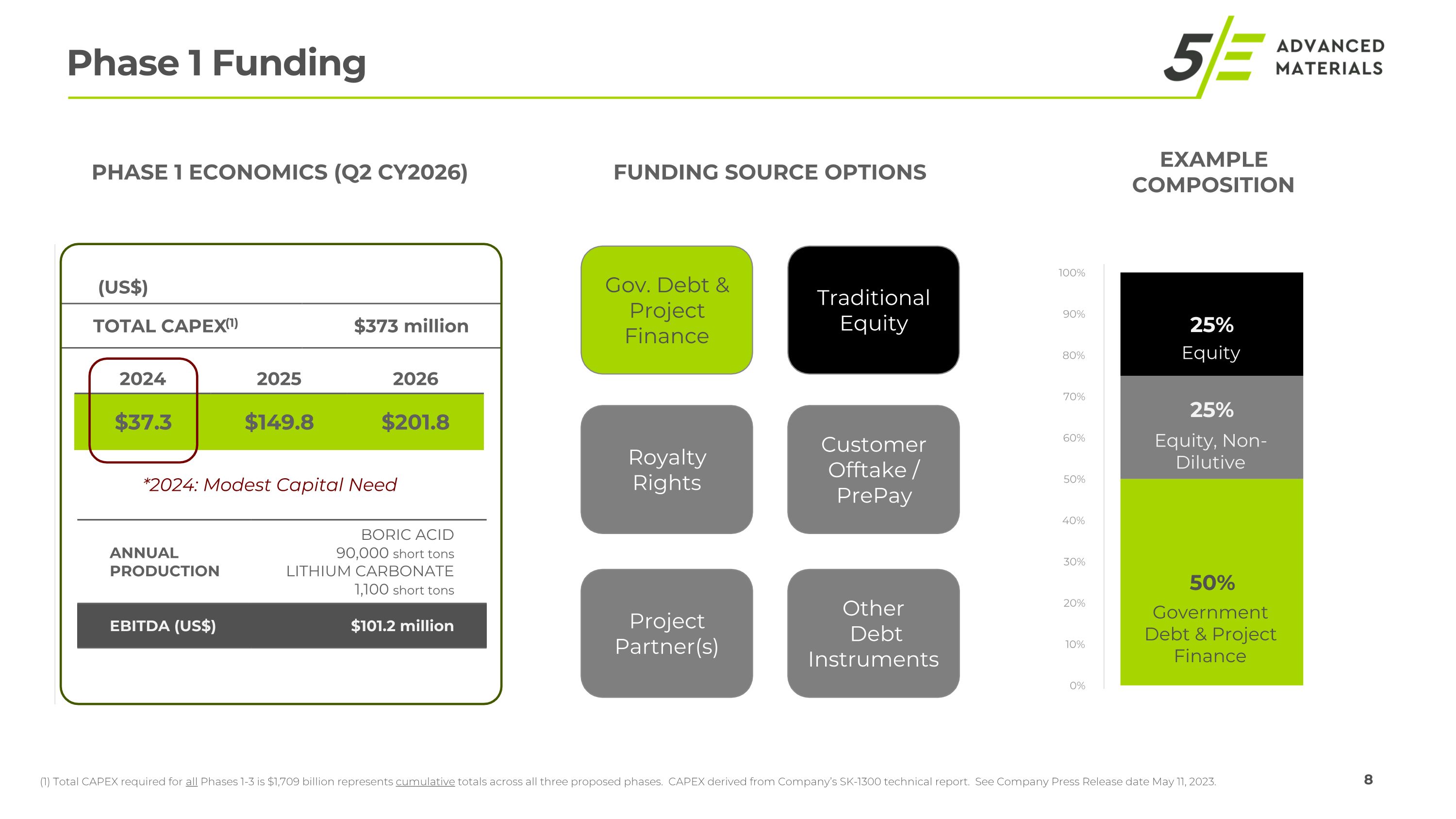

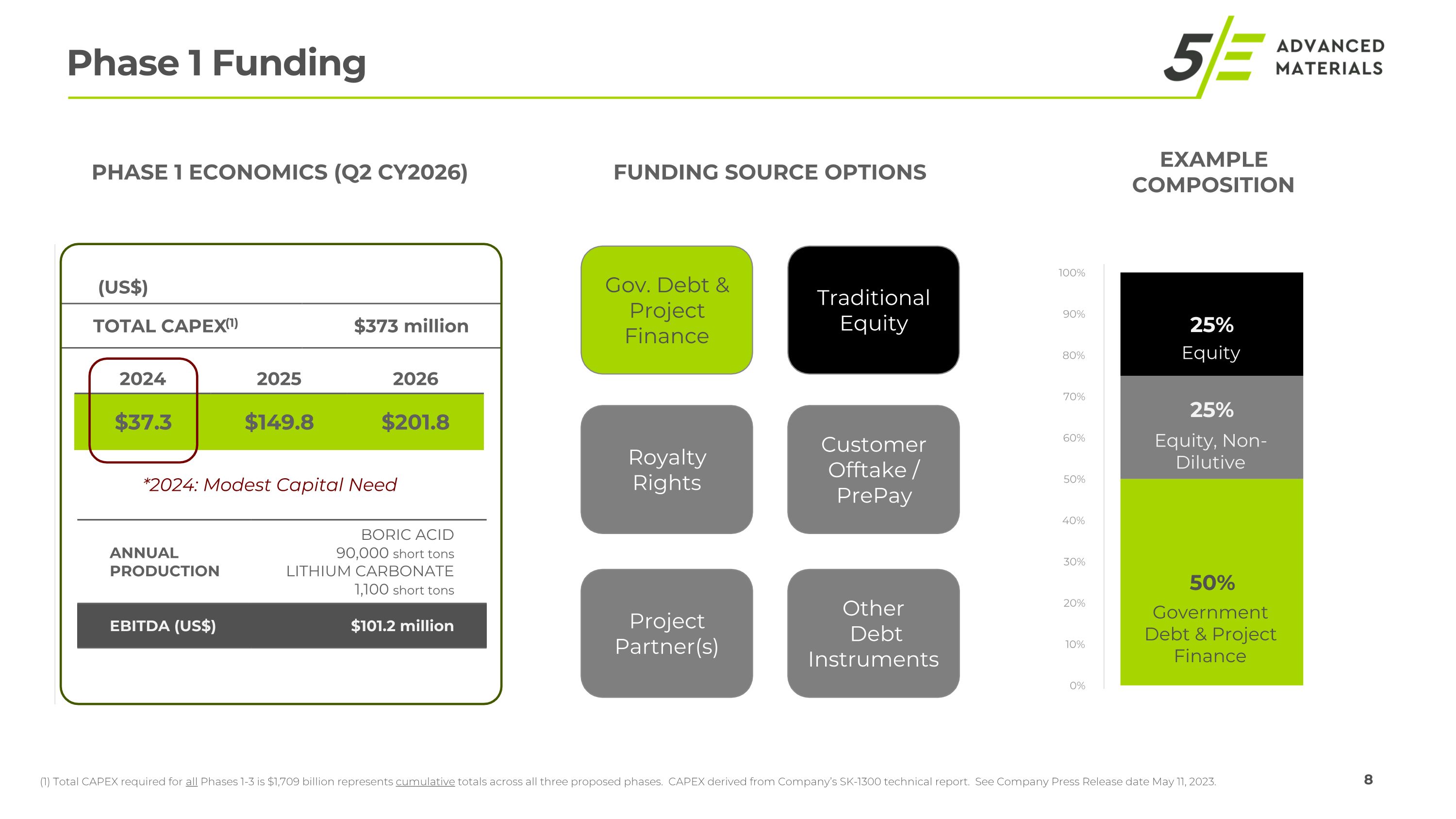

EXAMPLE COMPOSITION Gov. Debt & Project Finance Project Partner(s) Customer Offtake / PrePay Traditional Equity FUNDING SOURCE OPTIONS Government Debt & Project Finance Equity, Non-Dilutive Equity PHASE 1 ECONOMICS (Q2 CY2026) TOTAL CAPEX(1) $373 million (1) Total CAPEX required for all Phases 1-3 is $1,709 billion represents cumulative totals across all three proposed phases. CAPEX derived from Company’s SK-1300 technical report. See Company Press Release date May 11, 2023. Phase 1 Funding Other Debt Instruments Royalty Rights 2024 2025 2026 $37.3 $149.8 $201.8 ANNUAL PRODUCTION BORIC ACID�90,000 short tons LITHIUM CARBONATE�1,100 short tons EBITDA (US$) $101.2 million *2024: Modest Capital Need (US$)

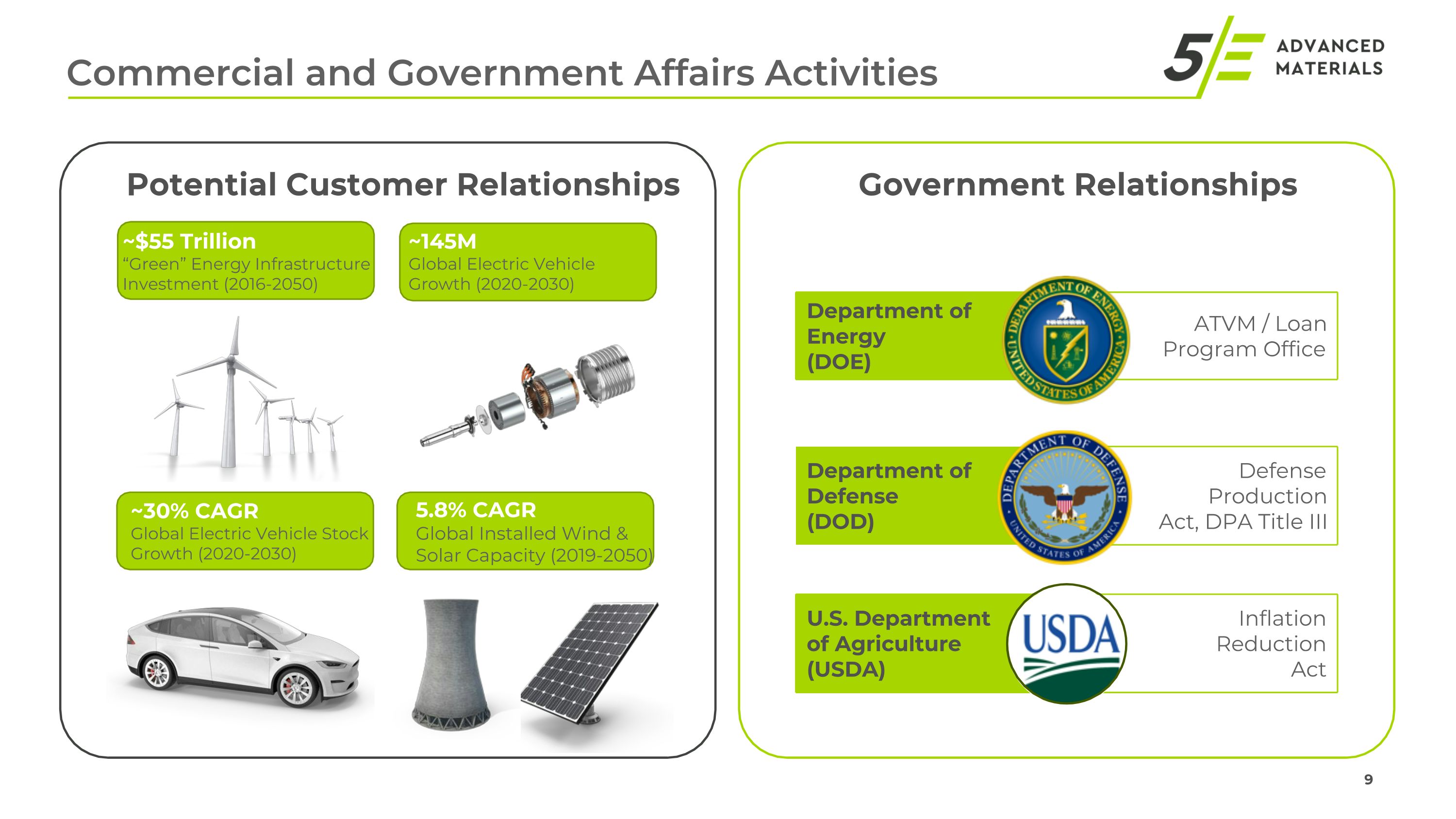

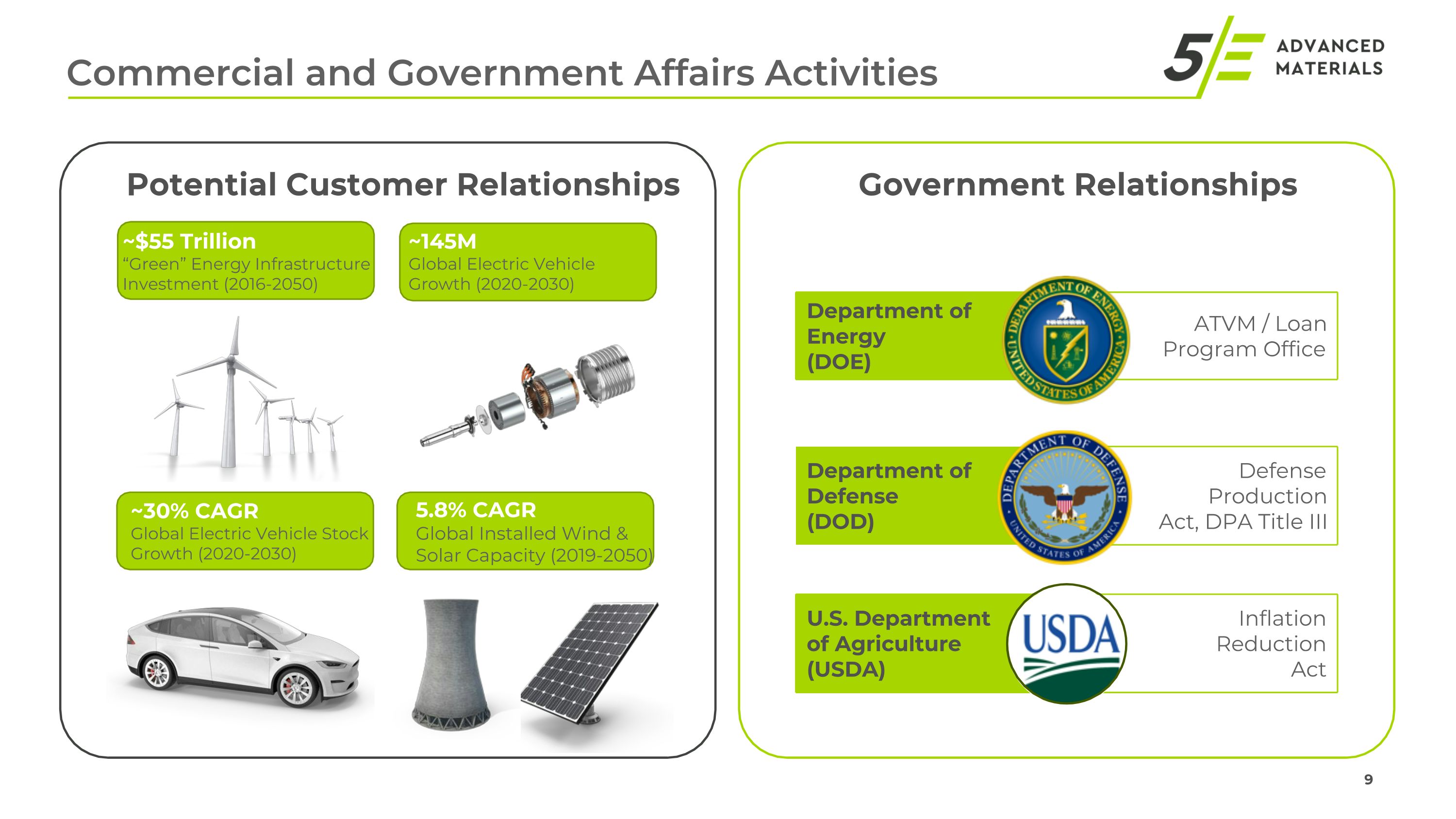

Commercial and Government Affairs Activities ~$55 Trillion “Green” Energy Infrastructure Investment (2016-2050) ~145M Global Electric Vehicle Growth (2020-2030) ~30% CAGR Global Electric Vehicle Stock Growth (2020-2030) 5.8% CAGR Global Installed Wind & Solar Capacity (2019-2050) Department of �Energy (DOE) ATVM / Loan Program Office Department of �Defense (DOD) Defense Production �Act, DPA Title III U.S. Department of Agriculture (USDA) Inflation Reduction �Act Potential Customer Relationships Government Relationships

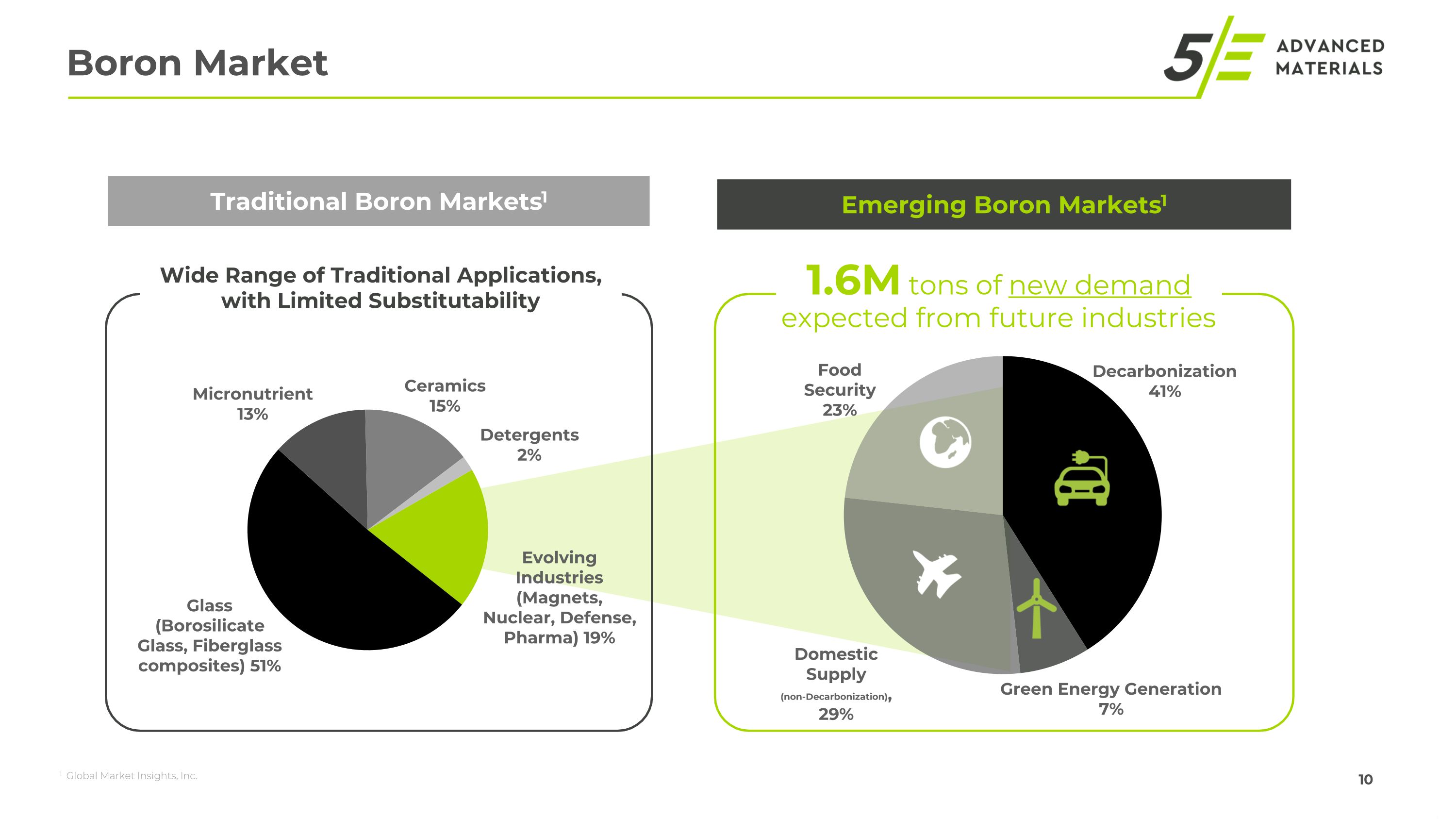

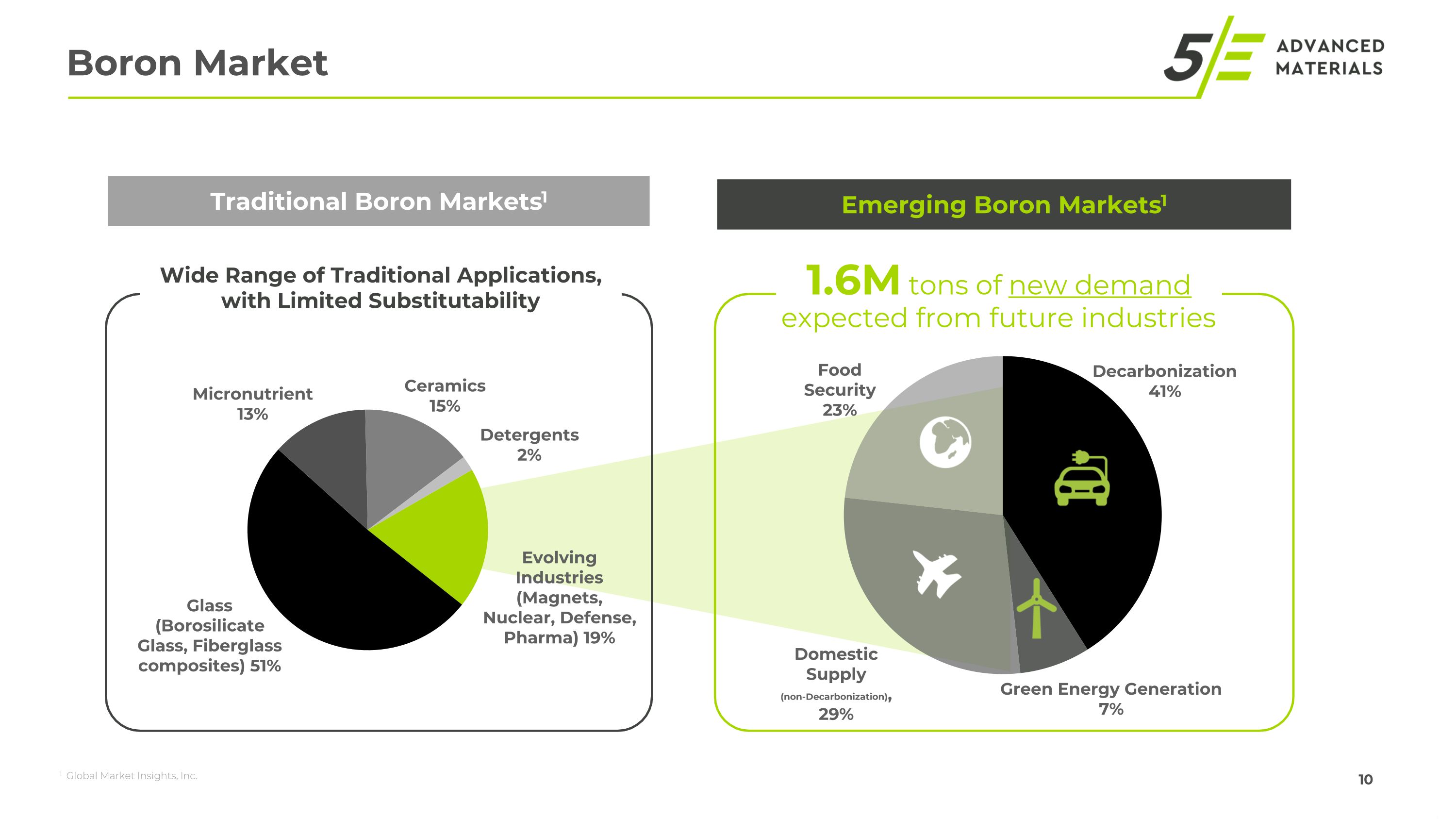

Boron Market Emerging Boron Markets1 Traditional Boron Markets1 1.6M tons of new demand expected from future industries 1 Global Market Insights, Inc. Wide Range of Traditional Applications, �with Limited Substitutability

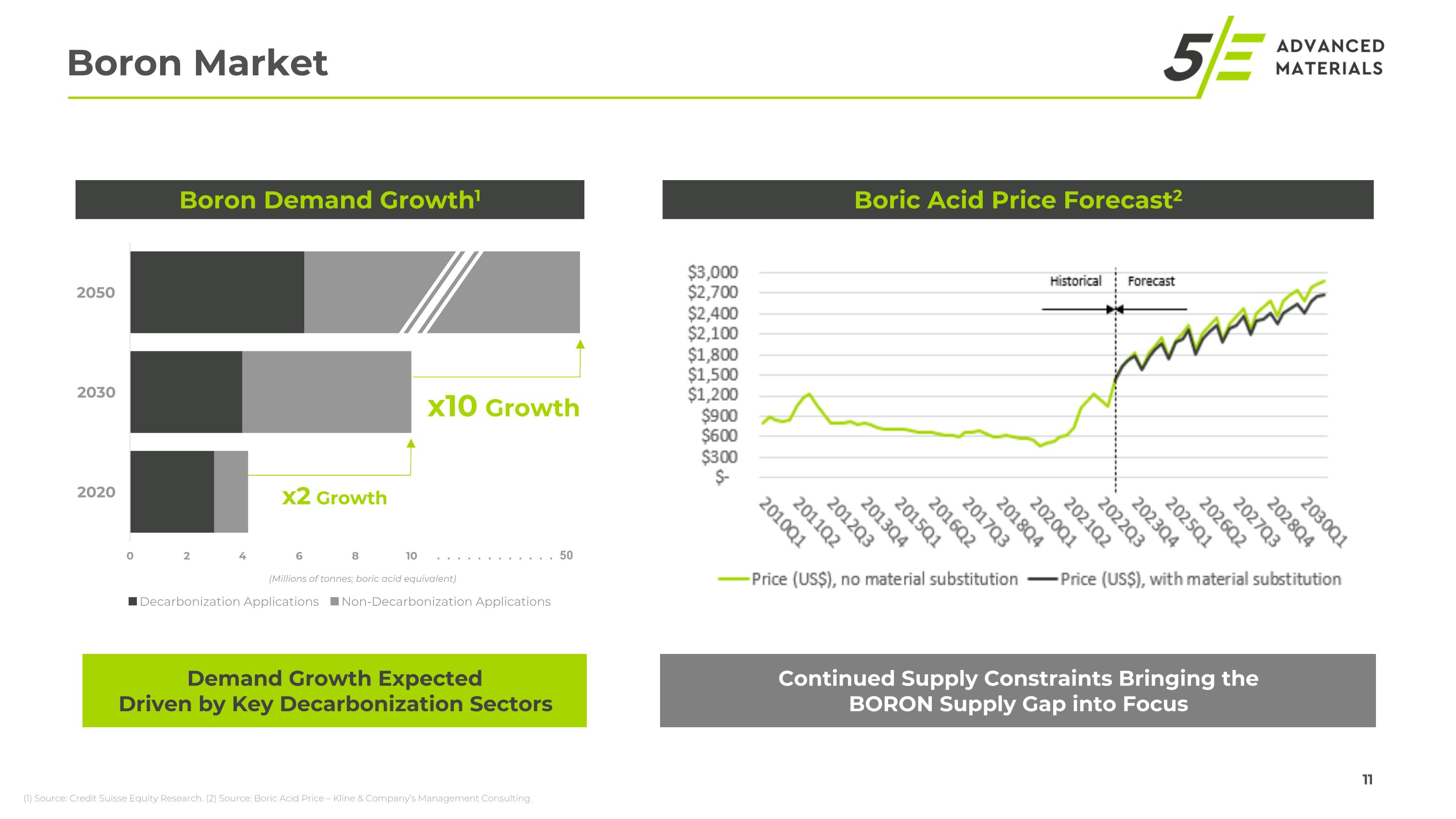

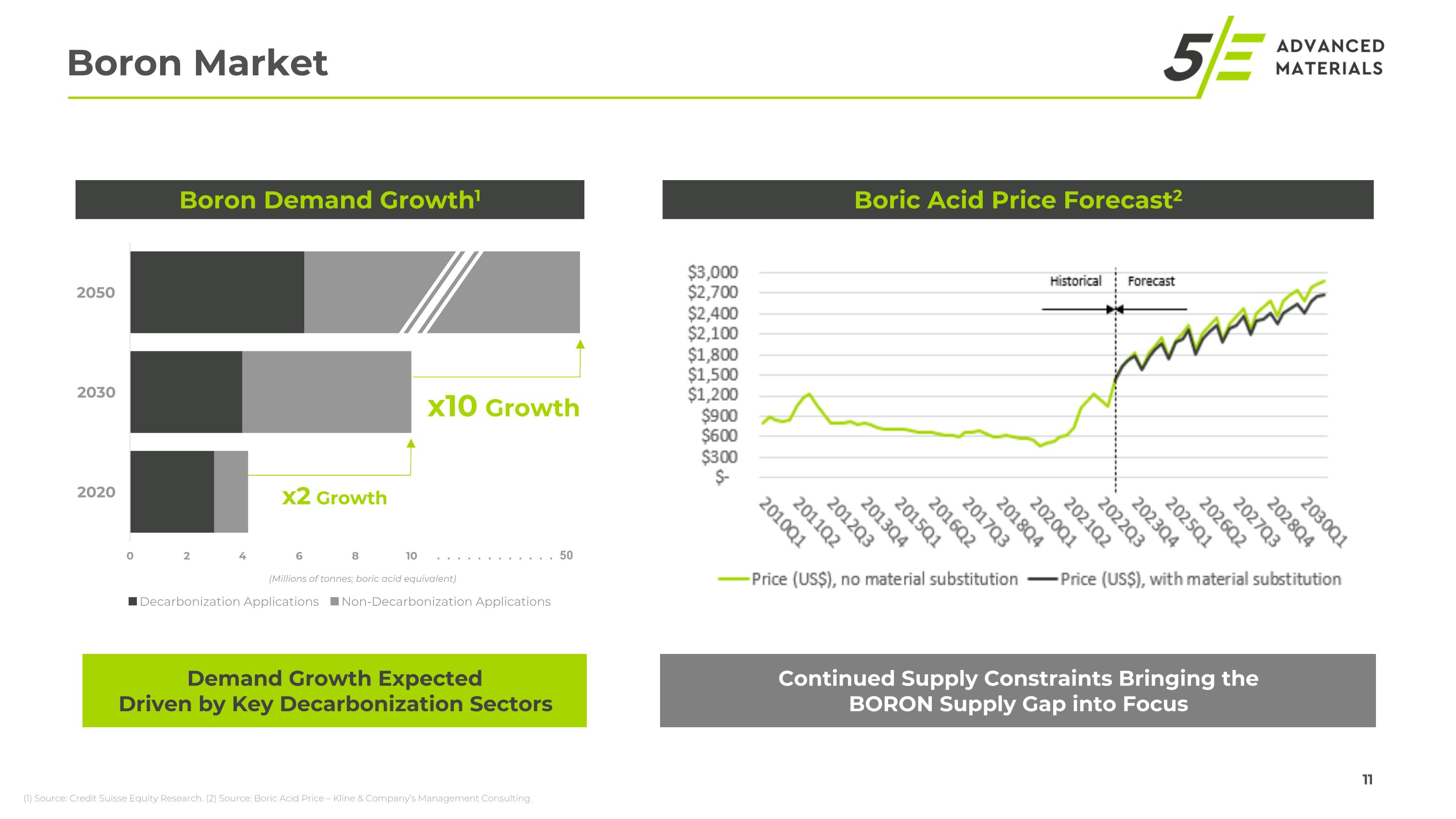

Boron Market Demand Growth Expected �Driven by Key Decarbonization Sectors Continued Supply Constraints Bringing the �BORON Supply Gap into Focus Boron Demand Growth1 Boric Acid Price Forecast2 x2 Growth x10 Growth (Millions of tonnes; boric acid equivalent) . . . . . . . . . . . . 50 (1) Source: Credit Suisse Equity Research. (2) Source: Boric Acid Price – Kline & Company’s Management Consulting.

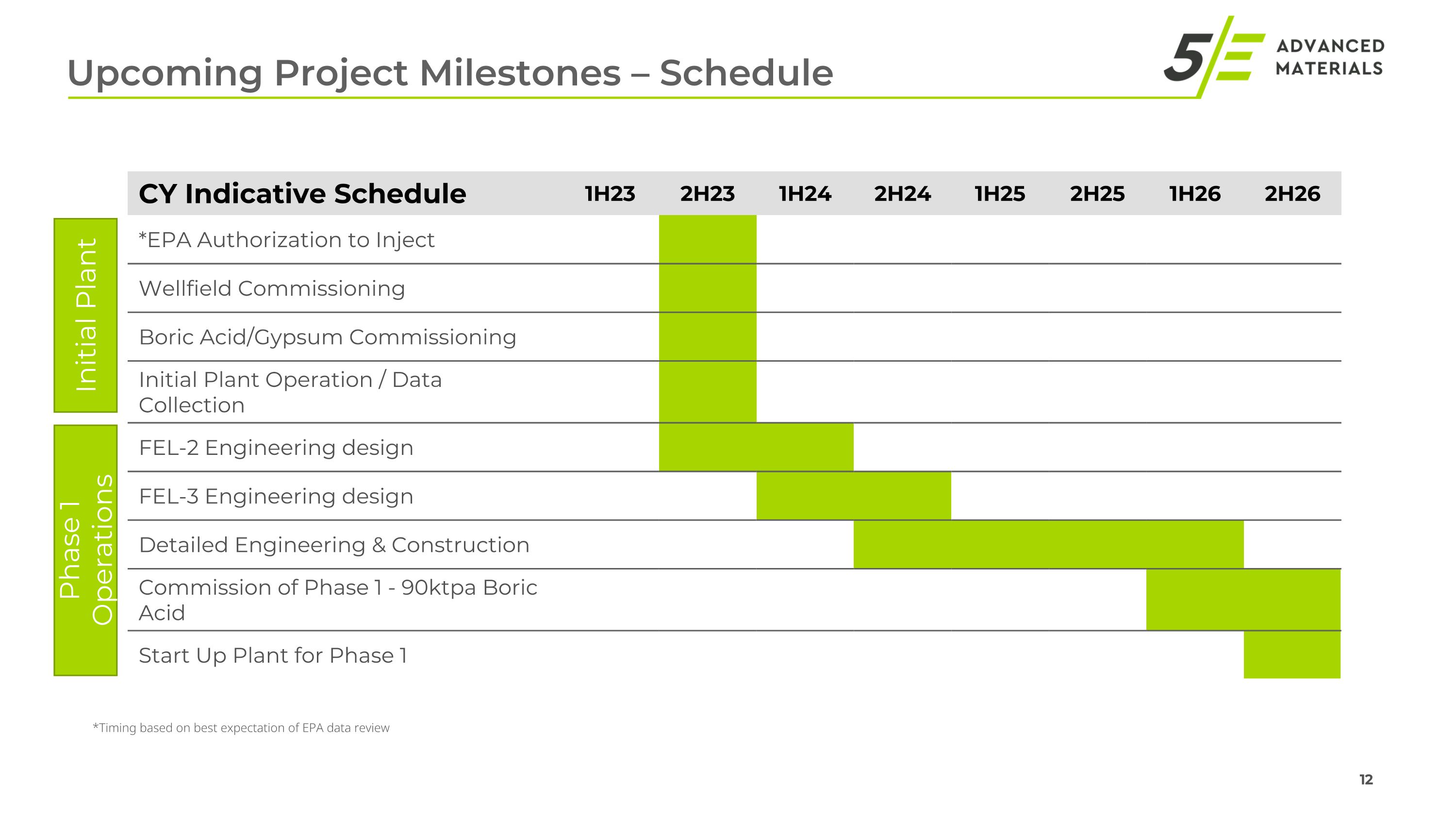

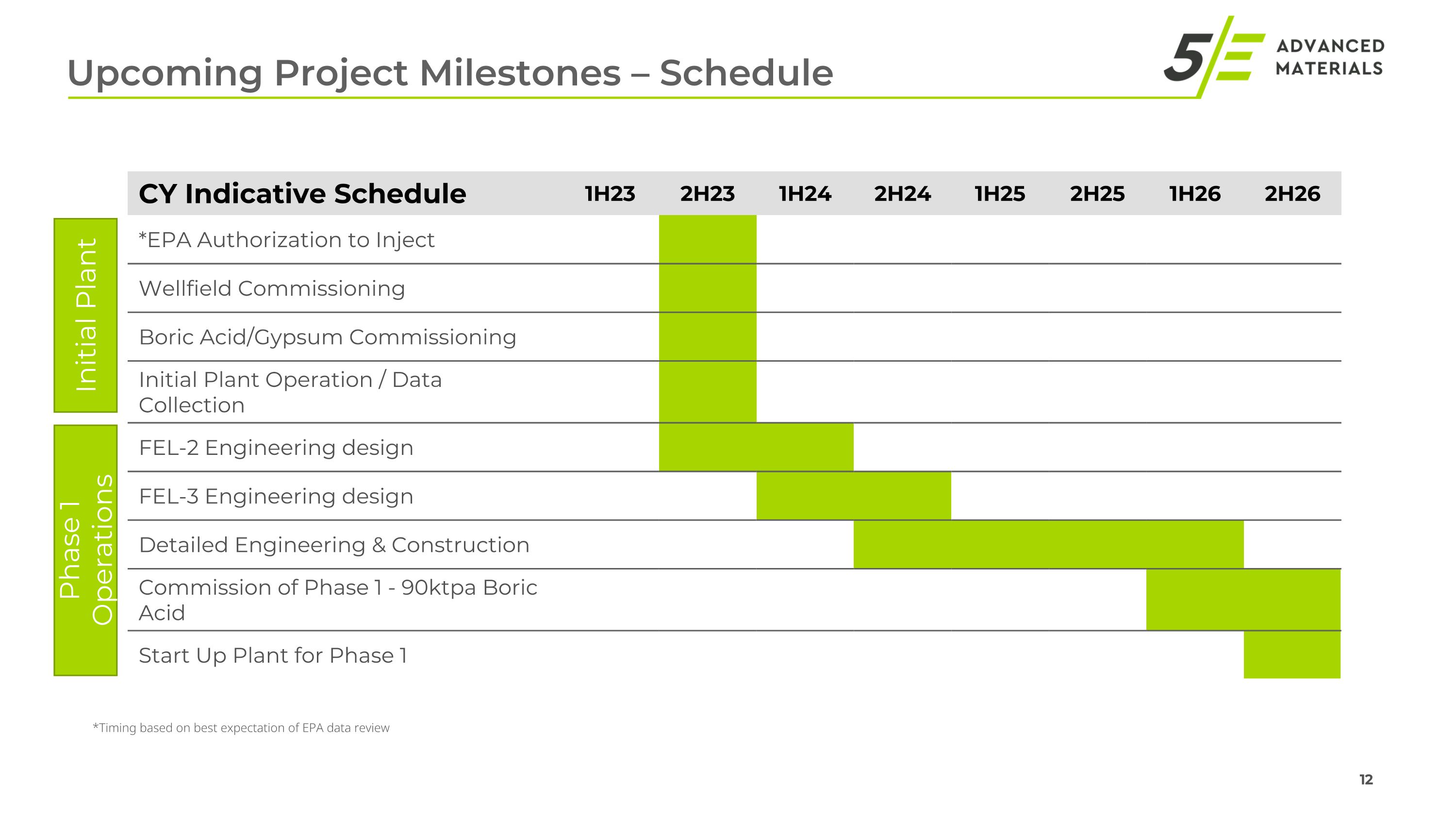

Upcoming Project Milestones – Schedule CY Indicative Schedule 1H23 2H23 1H24 2H24 1H25 2H25 1H26 2H26 *EPA Authorization to Inject Wellfield Commissioning Boric Acid/Gypsum Commissioning Initial Plant Operation / Data Collection FEL-2 Engineering design FEL-3 Engineering design Detailed Engineering & Construction Commission of Phase 1 - 90ktpa Boric Acid Start Up Plant for Phase 1 Initial Plant Phase 1 Operations *Timing based on best expectation of EPA data review

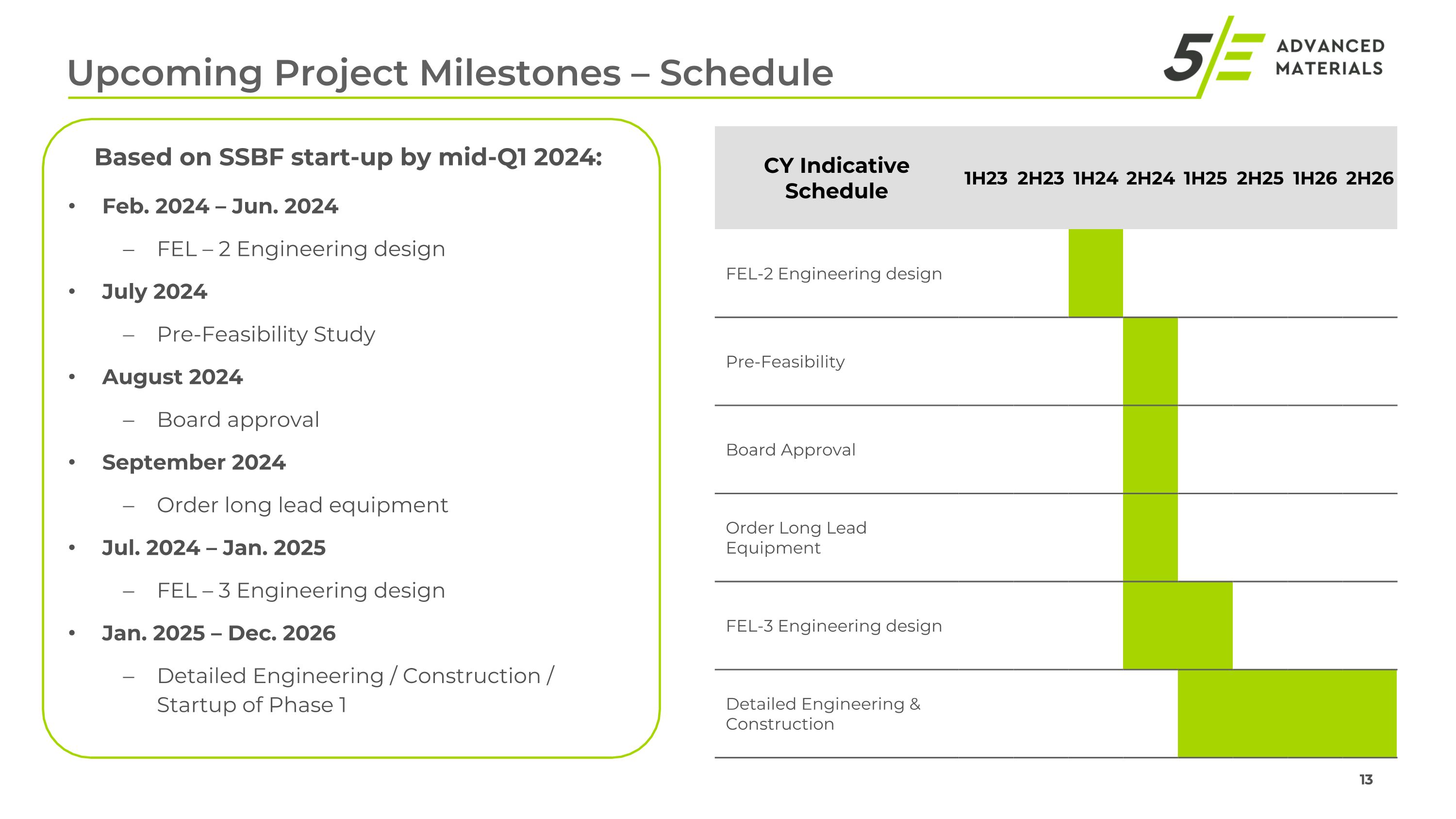

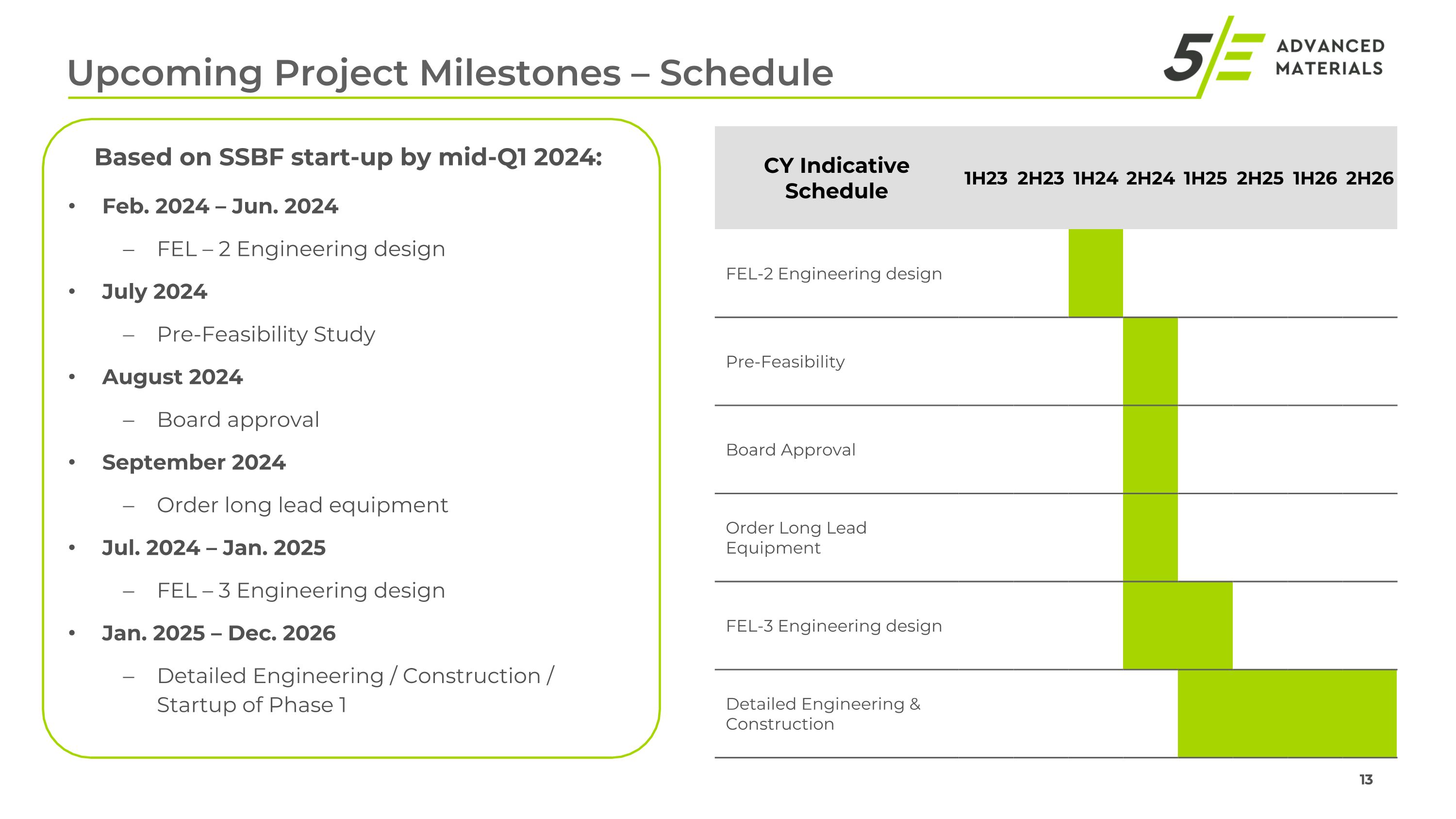

Upcoming Project Milestones – Schedule Based on SSBF start-up by mid-Q1 2024: Feb. 2024 – Jun. 2024 FEL – 2 Engineering design July 2024 Pre-Feasibility Study August 2024 Board approval September 2024 Order long lead equipment Jul. 2024 – Jan. 2025 FEL – 3 Engineering design Jan. 2025 – Dec. 2026 Detailed Engineering / Construction / Startup of Phase 1 CY Indicative Schedule 1H23 2H23 1H24 2H24 1H25 2H25 1H26 2H26 FEL-2 Engineering design Pre-Feasibility Board Approval Order Long Lead Equipment FEL-3 Engineering design Detailed Engineering & Construction

Investment Highlights Exposure to critical materials Boron and Lithium Project is designated Critical Infrastructure by the U.S. Government with broader focus through defense, clean energy and EV markets Initial facility built with near-term production Materials important to U.S. Reshoring, Decarbonization, and Domestic Production required for the Clean Energy Economy Staged Execution and Value Delivery model Globally significant business with forecast annual US$682M EBITDA profile in full production

Investor Contacts: Alpha IR Group Davis Snyder or Joseph Caminiti FEAM@alpha-ir.com (312) 445-2870 Thank You 15