The information in this presentation is confidential and proprietary, and may not be used, reproduced or distributed without the express written permission of 5E Advanced Materials, Inc. Corporate Presentation Enabling America’s Clean Energy Economy December 2023 : FEAM : 5EA

Disclaimer FORWARD-LOOKING STATEMENTS The information in this Presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this presentation regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this presentation, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; our ability to obtain, stockholder approval for and successfully implement our currently proposed out of court restructuring transaction (the “Transaction”) as defined and described in the Form 8-K filed with the U.S. Securities and Exchange Commission on December 6, 2023, and related matters on a timely manner or at all; the implementation of and expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Presentation. Except as otherwise required by applicable law, we disclaim any duty to update and do not intend to update any forward looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Presentation. MARKET AND INDUSTRY DATA This Presentation has been prepared by 5E and includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although 5E believes these third party sources are reliable as of their respective dates for the purposes used herein, neither we nor any of our affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although we believe the sources are reliable, we have not independently verified the accuracy or completeness of data from such sources. Some data is also based on 5E’s good faith estimates, which are derived from our review of internal sources as well as the third party sources described above. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only there can be no assurance that such conditions will actually occur or result in positive returns. CAUTIONARY NOTE REGARDING RESERVES Unless otherwise indicated, all mineral resource estimates included in this Presentation have been prepared in accordance with, and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) - based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code”. While the SEC now recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all of the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves. For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K filed on August 30, 2023. Additional risks are also disclosed by 5E in its filings with the U.S. Securities and Exchange Commission throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks (and Form 8-K/As, as applicable), as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

Disclaimer (Continued…) NO OFFER OR SOLICITATION This document is for information purposes only, and is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of a proxy, consent, or authorization in any jurisdiction or any vote or approval in any jurisdiction pursuant to the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offering of securities shall be made except by means of a prospectus in accordance with the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication may be deemed to be solicitation material in respect of the Transactions and certain stockholder approvals required thereby. In connection with the Transaction, the Company filed a definitive proxy statement on Schedule 14A on December 18, 2023, with the Securities and Exchange Commission (the “SEC”) and intends to file other relevant materials with the SEC. The Company has mailed the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY ALL RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED WITH THE SEC, INCLUDING THE COMPANY’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE TRANSACTION. Copies of the proxy statement and other relevant materials and any other documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, stockholders may obtain free copies of the proxy statement and other relevant materials by directing a request to: 5E Advanced Materials, Inc., 9329 Mariposa Road, Suite 210, Hesperia, CA 92344. PARTICPANTS IN PROXY SOLICITATION The Company and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect of the Transaction. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K/A filed with the SEC on October 27, 2023, and the definitive proxy statement filed with the SEC on December 18, 2023, in connection with the Transaction. Other information regarding the persons who may be deemed participants in the proxy solicitations in connection with the Transaction, and a description of any interests that they have in the Transaction, by security holdings or otherwise, are contained in the definitive proxy statement filed with the SEC and any other relevant materials to be filed with the SEC regarding the Transaction when they become available. Stockholders, potential investors, and other interested persons should read the definitive proxy statement carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above. NON-GAAP FINANCIAL MEASURES This Presentation includes forward-looking non-GAAP financial measures. These measures may not be comparable to similar measures presented by other companies and should not be viewed as a substitute for measures reported under U.S. GAAP. These measures are commonly used in the mining industry to provide stockholders and potential investors with additional information regarding the Company’s future performance in its mining operations at projected full-run rates. This presentation contains references to the following: Full Year 1 EBITDA, Full Year 3 EBITDA, Full Year 6 EBITDA and Full Production EBITDA, each of which are forward-looking non-GAAP financial measures that are detailed in the Company’s Regulation S-K 1300 compliant Initial Assessment Report (the “Initial Assessment Report”). EBITDA is defined as net income before interest expenses, income tax expense, and depreciation. The Company has not provided a reconciliation of Full Year 1 EBITDA, Full Year 3 EBITDA, Full Year 6 EBITDA, and Full Production EBITDA to the Company’s future net income, the most comparable financial measure calculated in accordance with GAAP, as such GAAP measure is not available on a forward-looking basis without unreasonable effort. Specifically, the Company could not calculate interest, income taxes, depreciation or the effect of certain corporate level transactions or activities, on a forward-looking basis with any reasonable degree of accuracy, but such items could be significant and have a material impact on the Company’s net income. For more information regarding these forward-looking non-GAAP financial measures, you should read the Company’s Initial Assessment Report included as Exhibit 96.1 to the Company’s Annual Report on Form 10-K/A filed with the SEC on October 27, 2023.

3 We will produce one of the world’s most critical materials that assist in the global energy transition

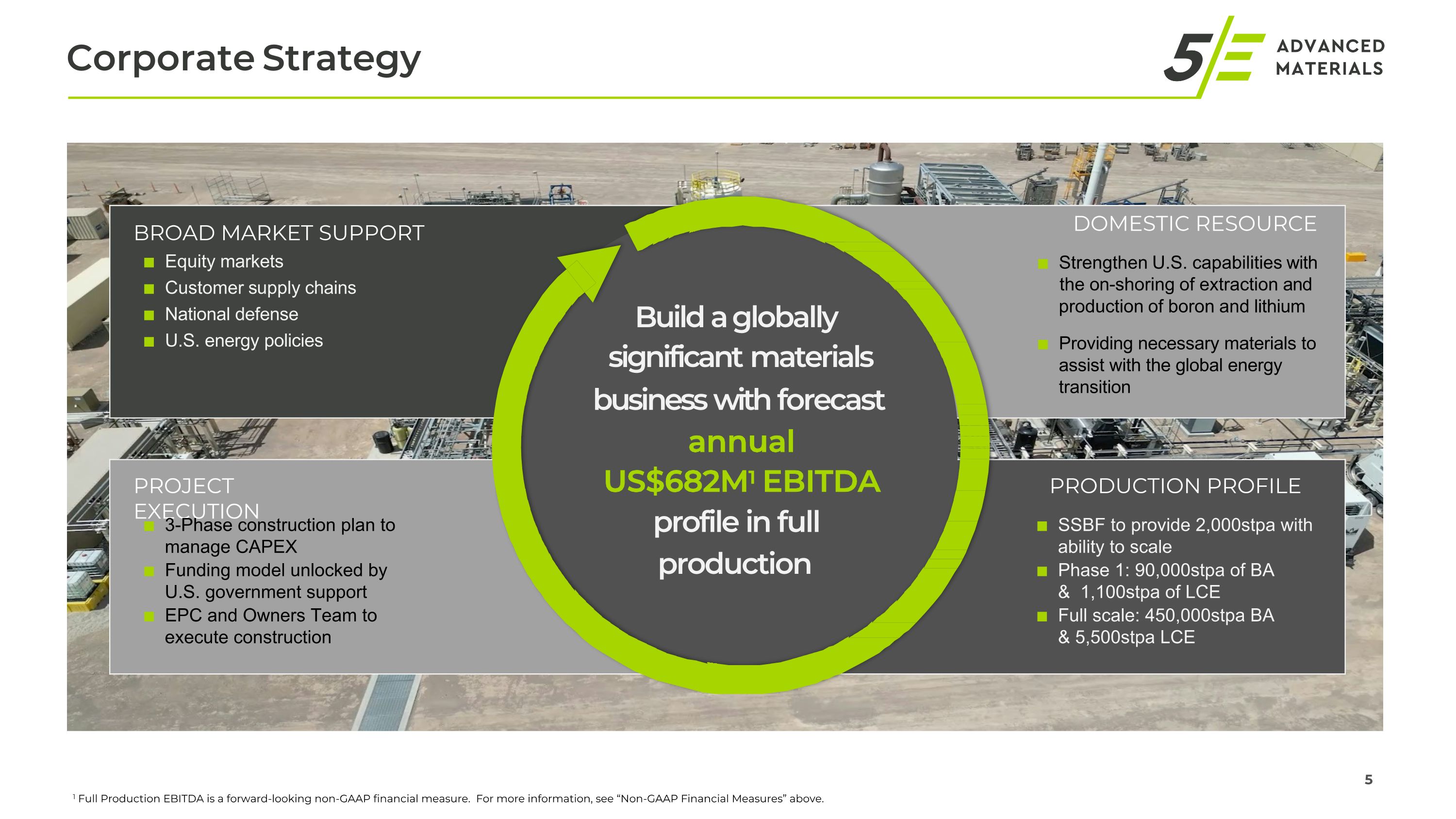

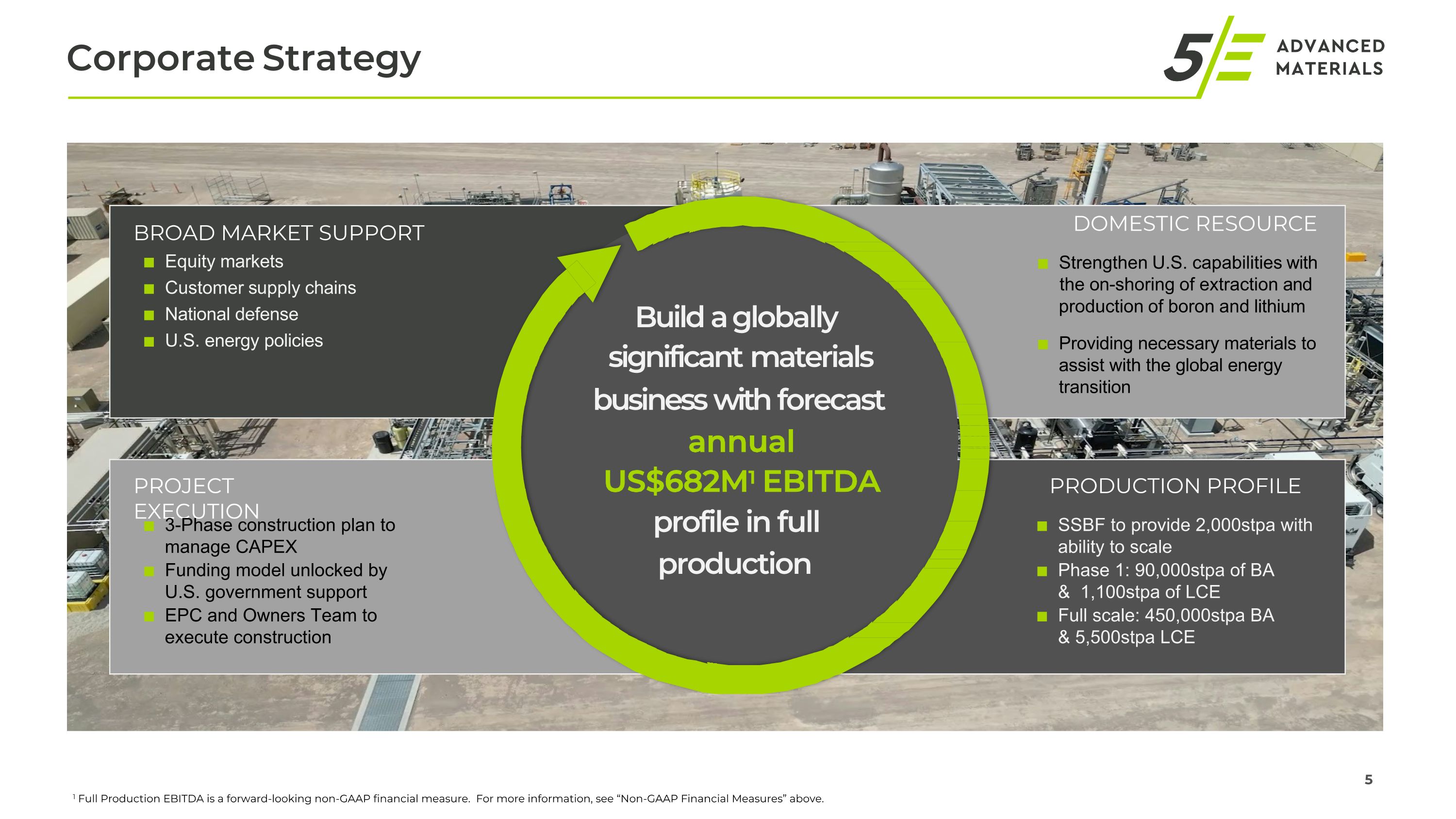

5 Corporate Strategy PRODUCTION PROFILE PROJECT EXECUTION BROAD MARKET SUPPORT Equity markets Customer supply chains National defense U.S. energy policies 3-Phase construction plan to manage CAPEX Funding model unlocked by U.S. government support EPC and Owners Team to execute construction DOMESTIC RESOURCE Strengthen U.S. capabilities with the on-shoring of extraction and production of boron and lithium Providing necessary materials to assist with the global energy transition SSBF to provide 2,000stpa with ability to scale Phase 1: 90,000stpa of BA & 1,100stpa of LCE Full scale: 450,000stpa BA & 5,500stpa LCE Build a globally significant materials business with forecast annual profile in full production 1 Full Production EBITDA is a forward-looking non-GAAP financial measure. For more information, see “Non-GAAP Financial Measures” above. US$682M1 EBITDA

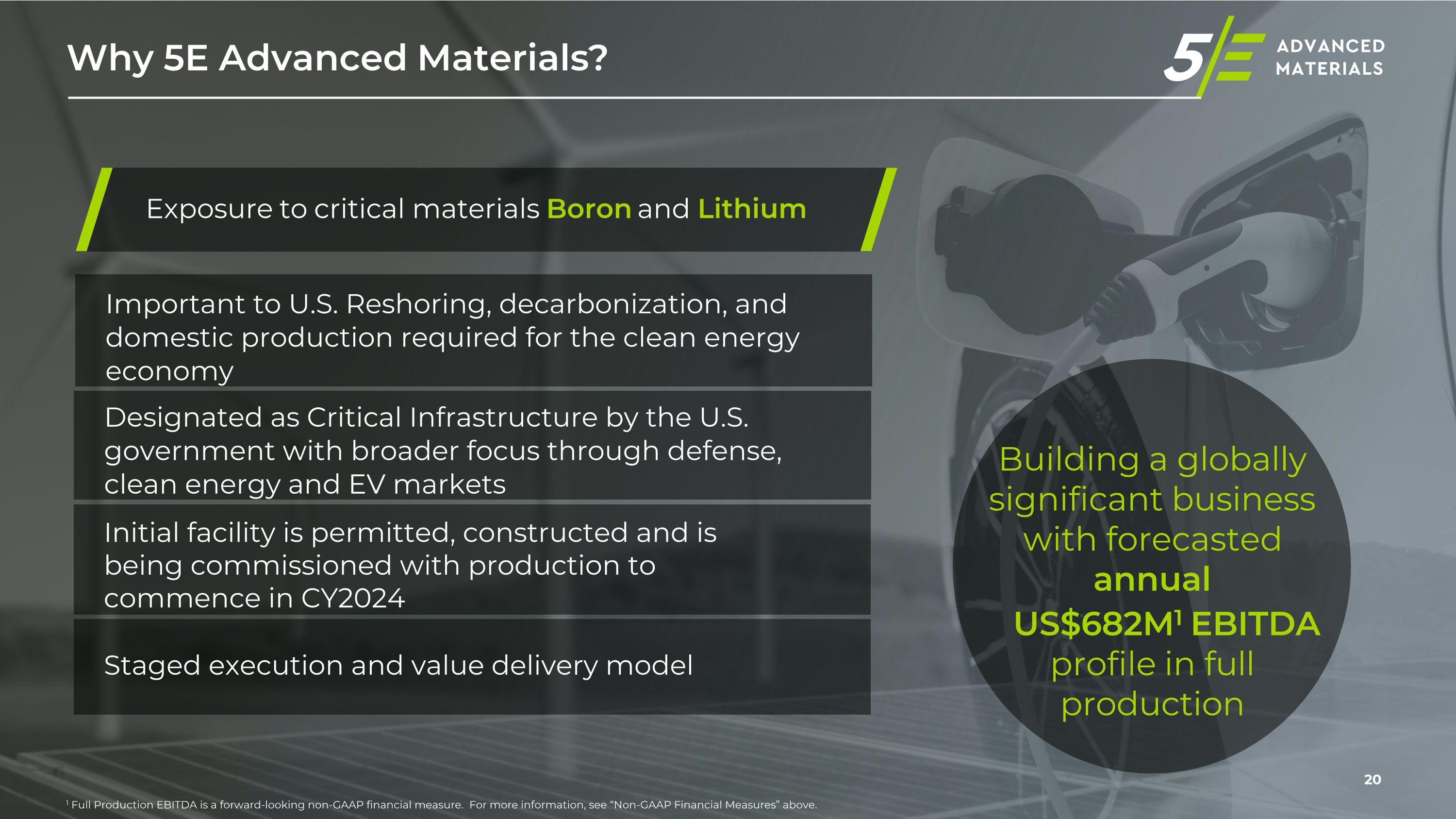

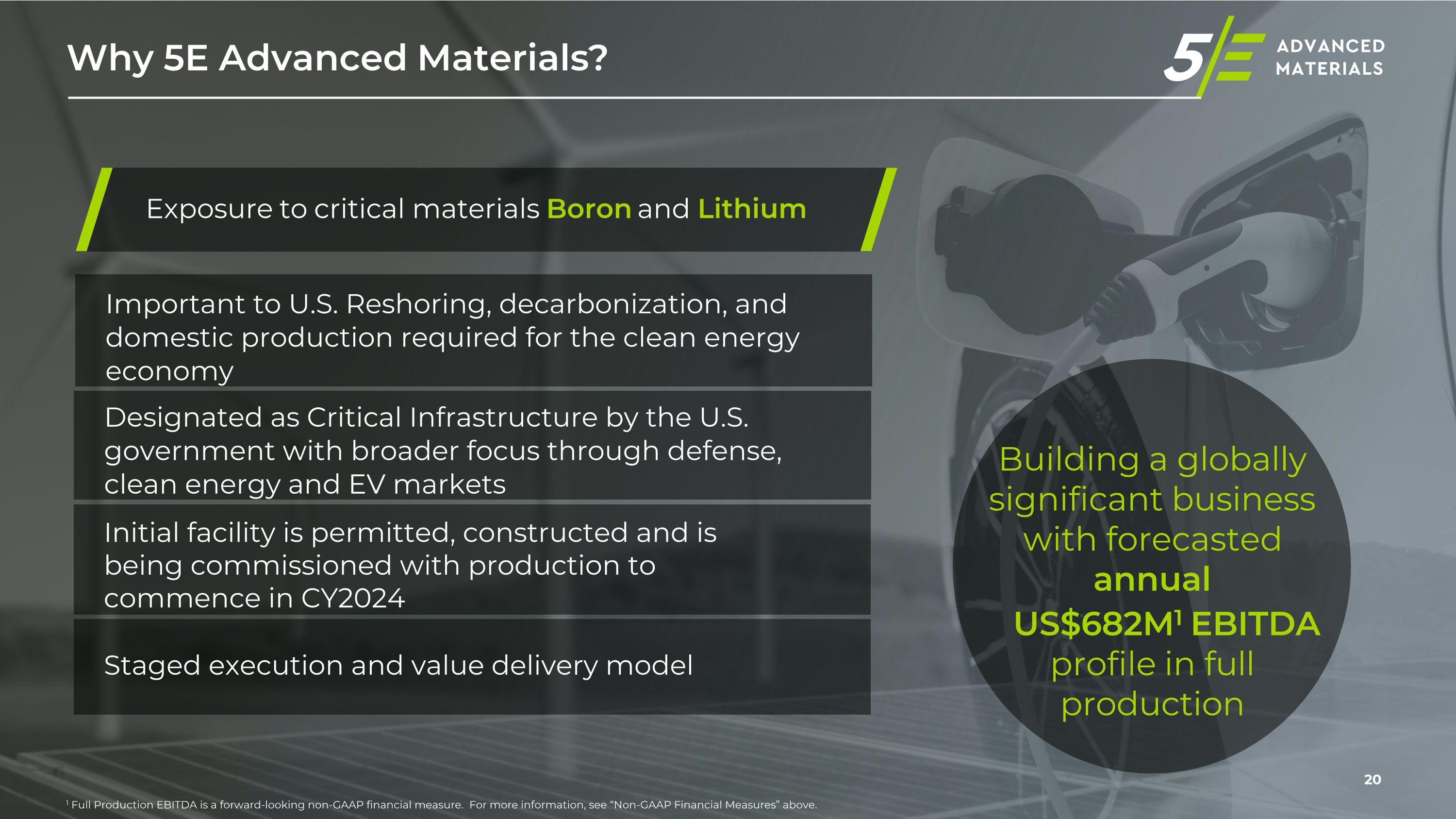

6 Why 5E Advanced Materials? Exposure to critical materials Boron and Lithium Building a globally significant business with forecasted annual US$682M1 EBITDA profile in full production Important to U.S. Reshoring, decarbonization, and domestic production required for the clean energy economy Designated as Critical Infrastructure by the U.S. government with broader focus through defense, clean energy and EV markets Initial facility is permitted, constructed and is being commissioned with production to commence in CY2024 Staged execution and value delivery model 1 Full Production EBITDA is forward-looking non-GAAP financial measure. For more information, see “Non-GAAP Financial Measures” above.

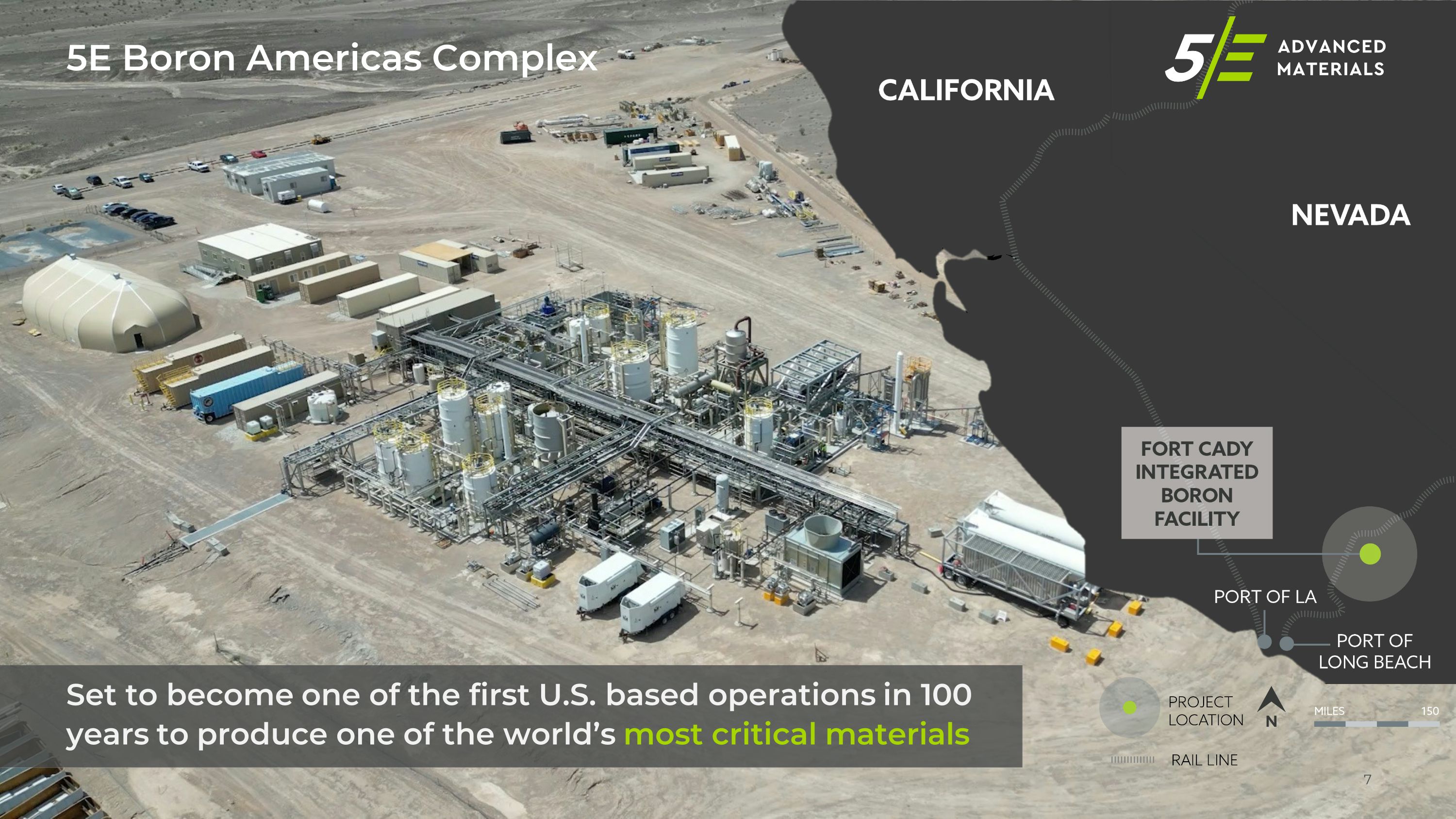

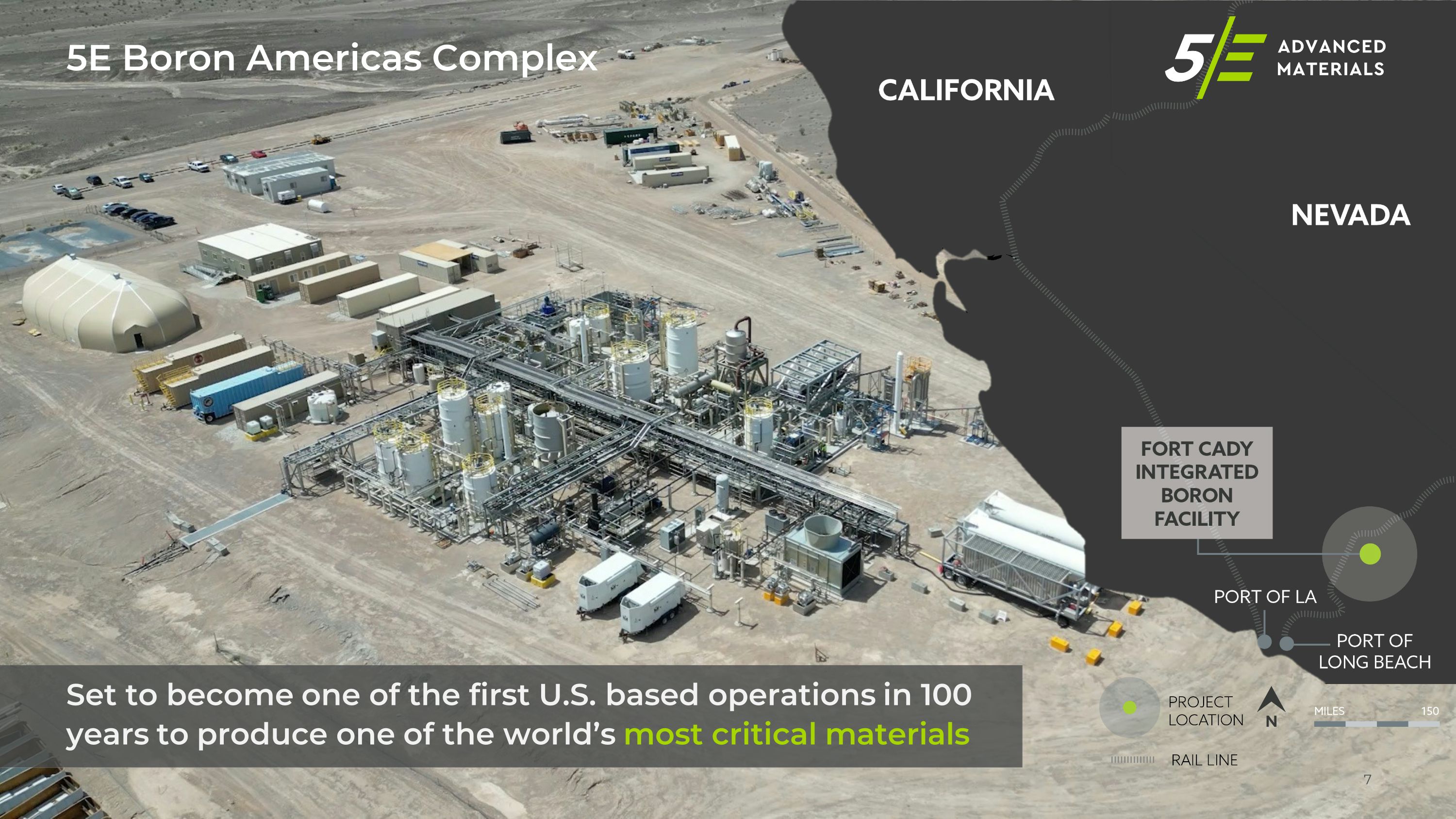

5E Boron Americas Complex 7 Set to become one of the first U.S. based operations in 100 years to produce one of the world’s most critical materials

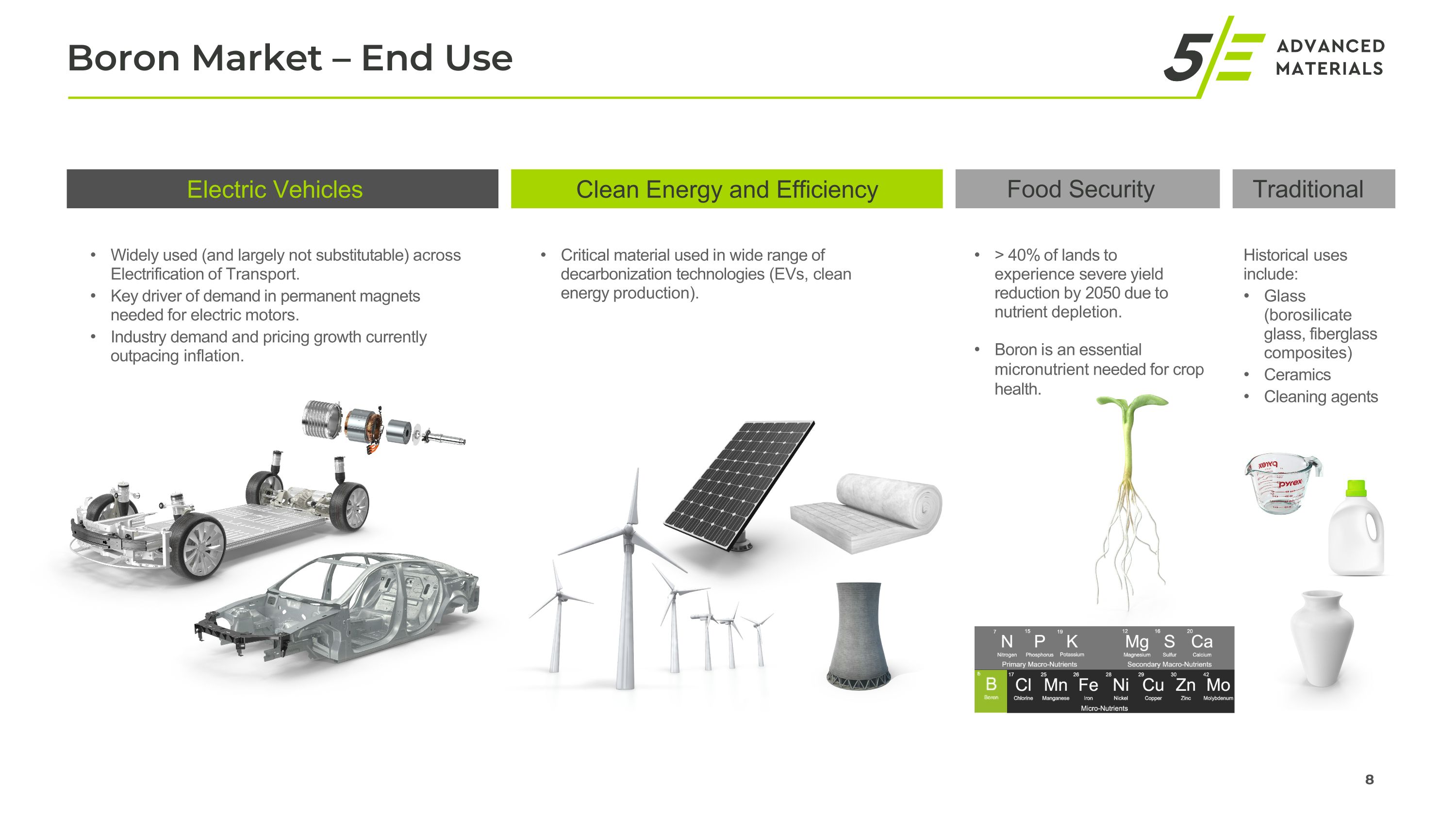

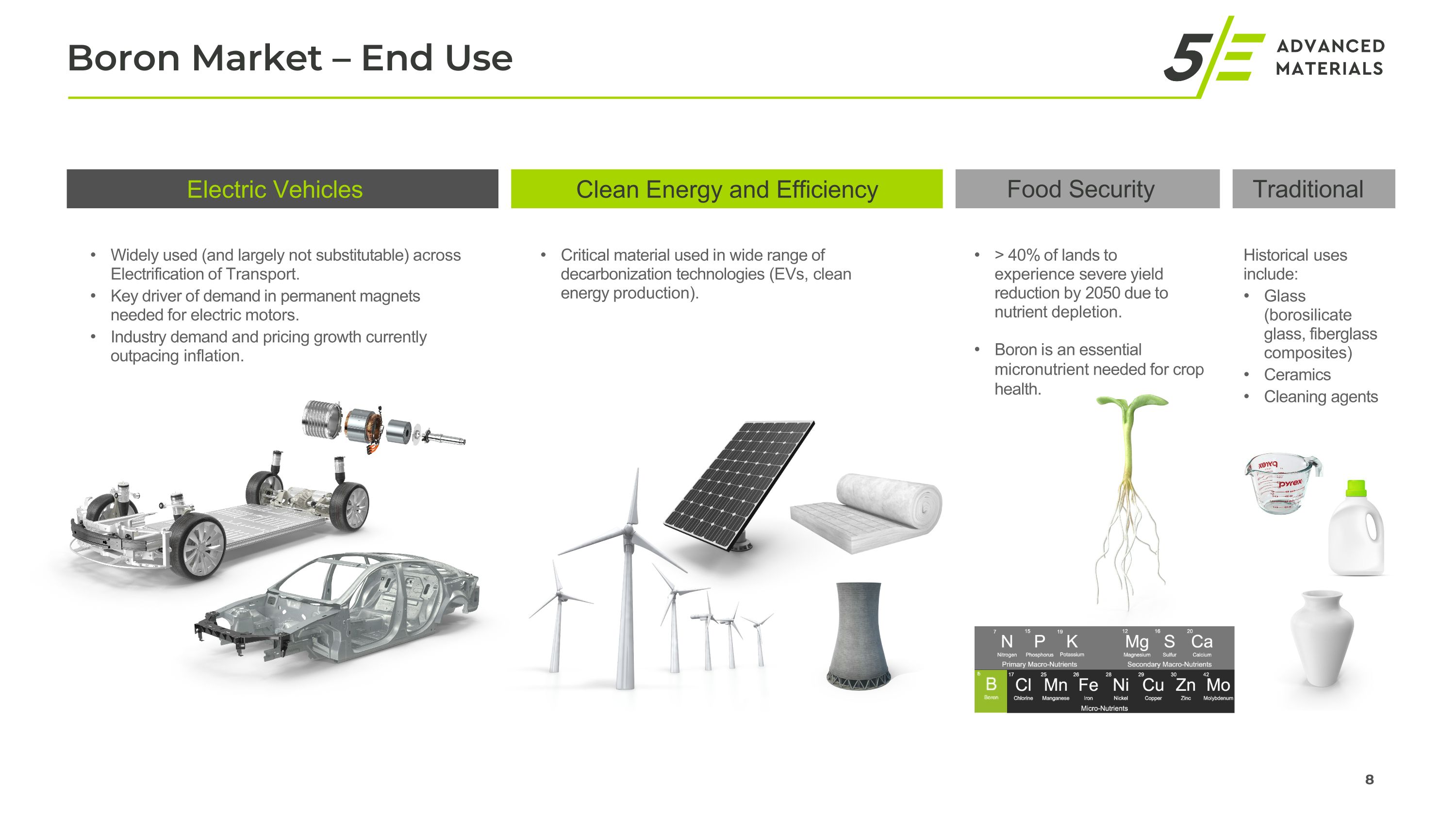

8 Boron Market – End Use Electric Vehicles Clean Energy and Efficiency Food Security Traditional > 40% of lands to experience severe yield reduction by 2050 due to nutrient depletion. Boron is an essential micronutrient needed for crop health. Critical material used in wide range of decarbonization technologies (EVs, clean energy production). Widely used (and largely not substitutable) across Electrification of Transport. Key driver of demand in permanent magnets needed for electric motors. Industry demand and pricing growth currently outpacing inflation. Historical uses include: Glass (borosilicate glass, fiberglass composites) Ceramics Cleaning agents

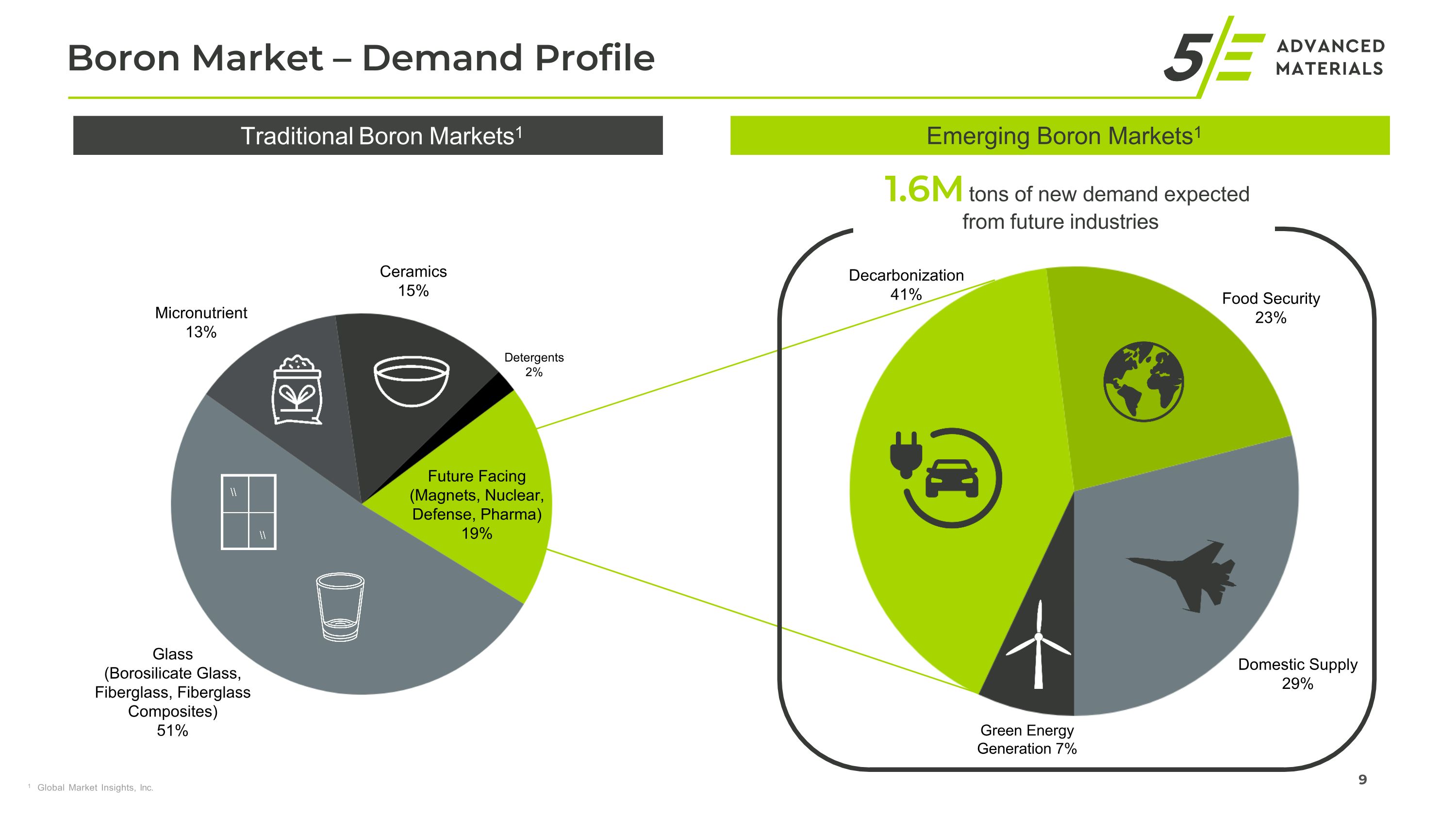

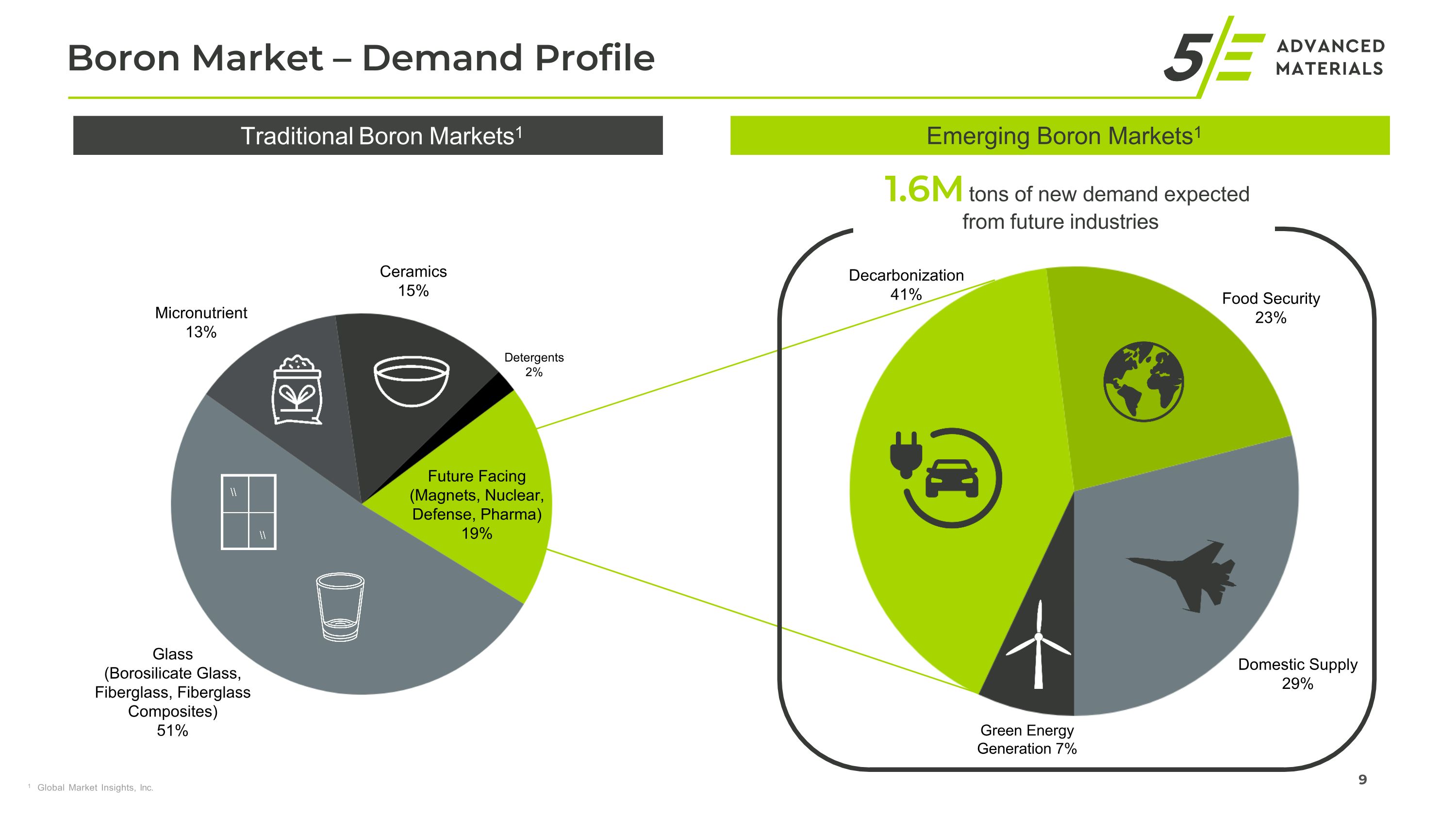

9 Boron Market – Demand Profile Emerging Boron Markets1 1 Global Market Insights, Inc. Traditional Boron Markets1 Future Facing (Magnets, Nuclear, Defense, Pharma) 19% Glass (Borosilicate Glass, Fiberglass, Fiberglass Composites) 51% Ceramics 15% Micronutrient 13% Detergents 2% Green Energy Generation 7% Domestic Supply 29% Food Security 23% Decarbonization 41% 1.6M tons of new demand expected from future industries

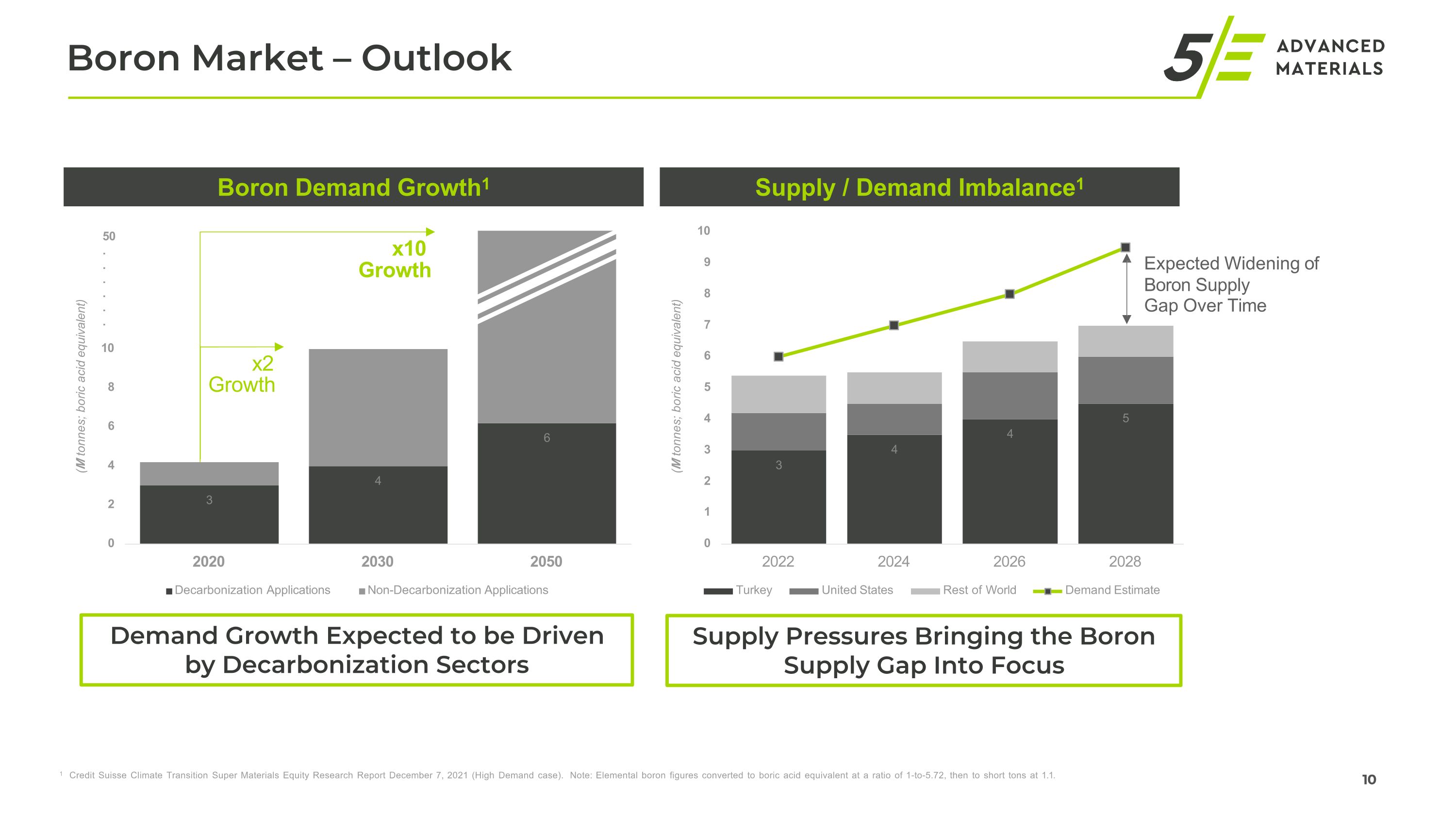

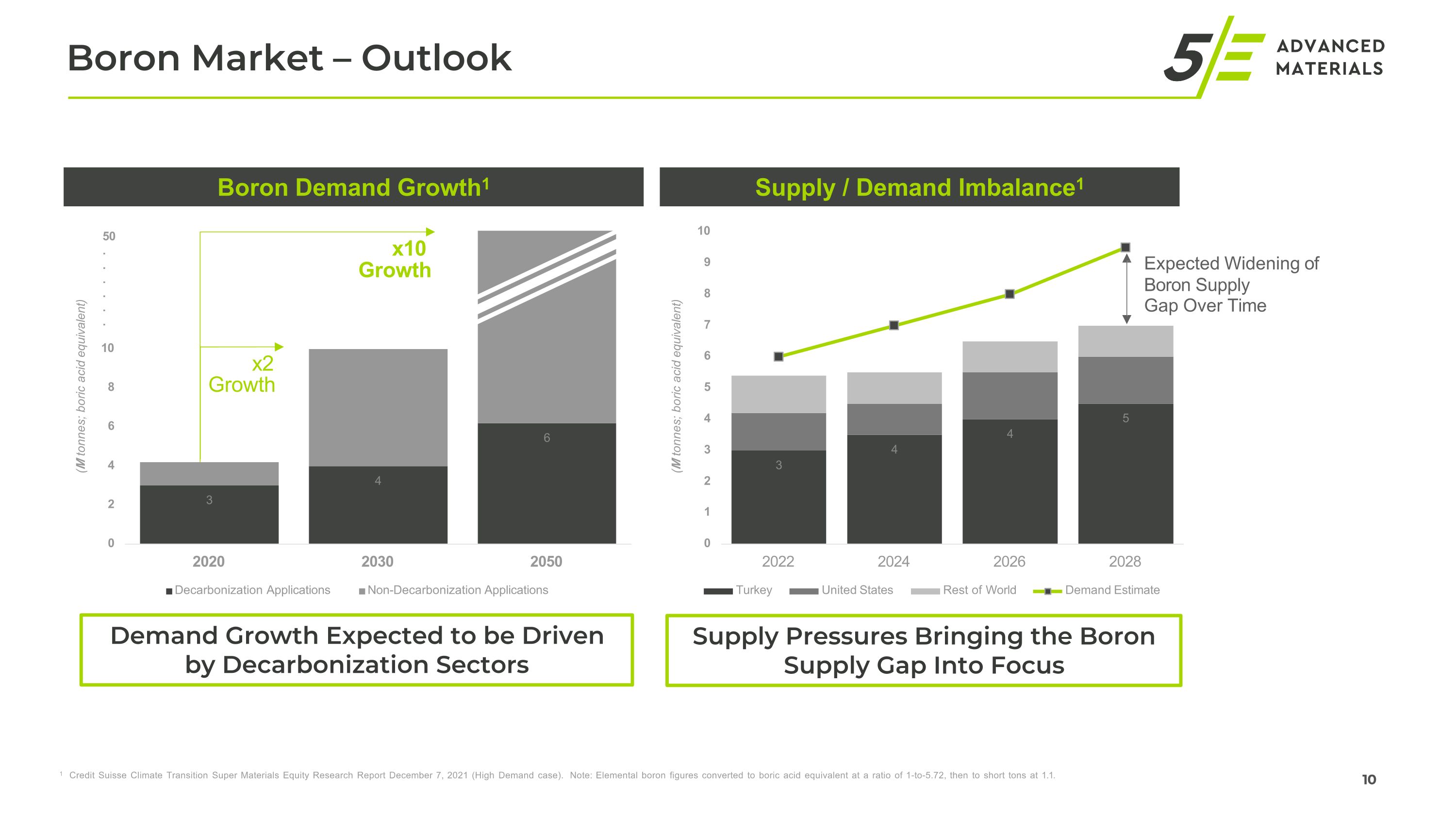

10 Boron Market – Outlook 3 4 6 0 2 4 6 8 10 16 14 12 2020 Decarbonization Applications (M tonnes; boric acid equivalent) 2030 2050 Non-Decarbonization Applications 50 . . . . . . 3 4 4 5 0 1 2 3 4 5 6 7 8 9 10 2022 Turkey 2024 United States 2026 Rest of World 2028 Demand Estimate (M tonnes; boric acid equivalent) Boron Demand Growth1 Supply / Demand Imbalance1 Expected Widening of Boron Supply Gap Over Time x2 Growth x10 Growth 1 Credit Suisse Climate Transition Super Materials Equity Research Report December 7, 2021 (High Demand case). Note: Elemental boron figures converted to boric acid equivalent at a ratio of 1-to-5.72, then to short tons at 1.1. Supply Pressures Bringing the Boron Supply Gap Into Focus Demand Growth Expected to be Driven by Decarbonization Sectors

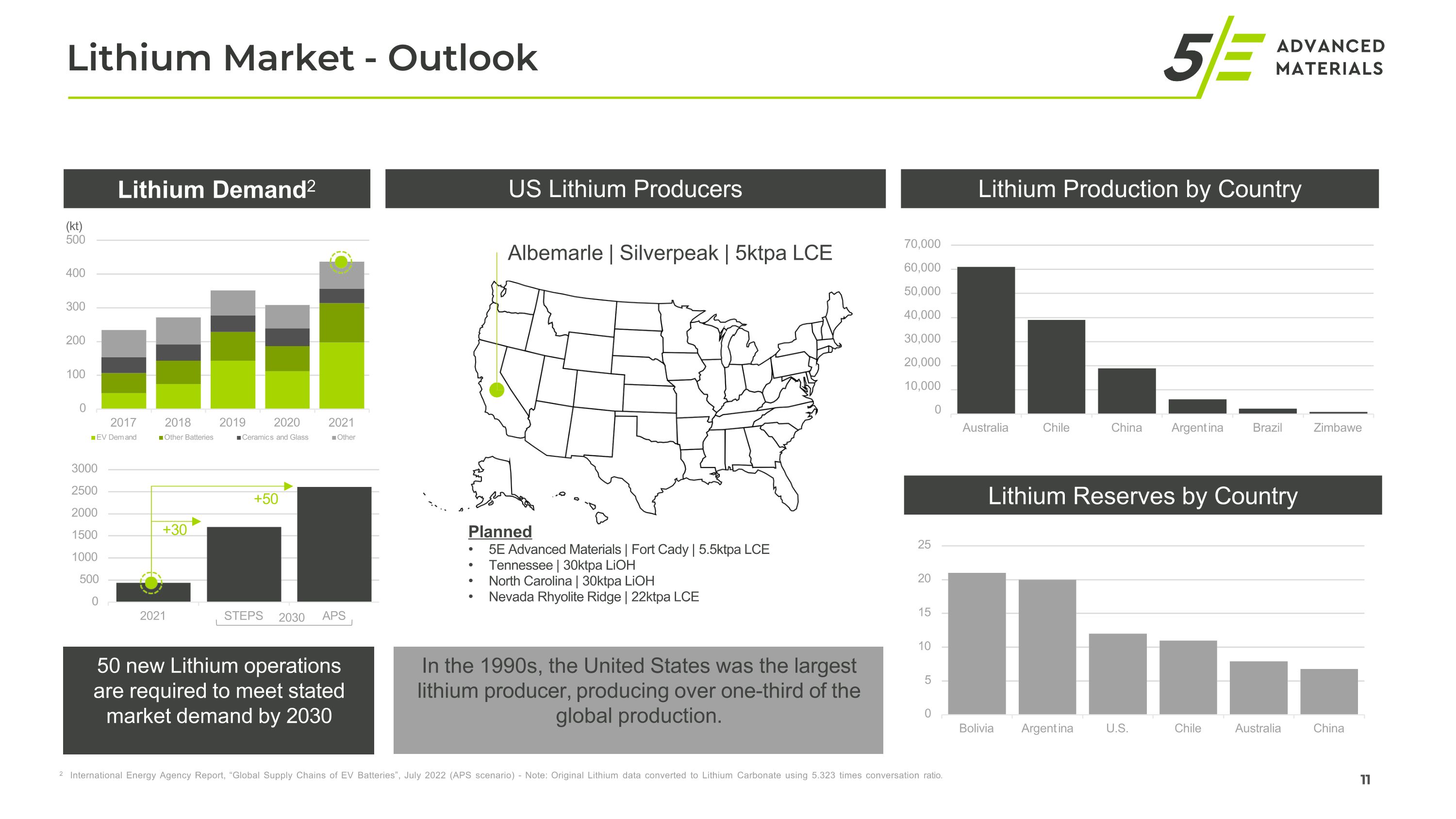

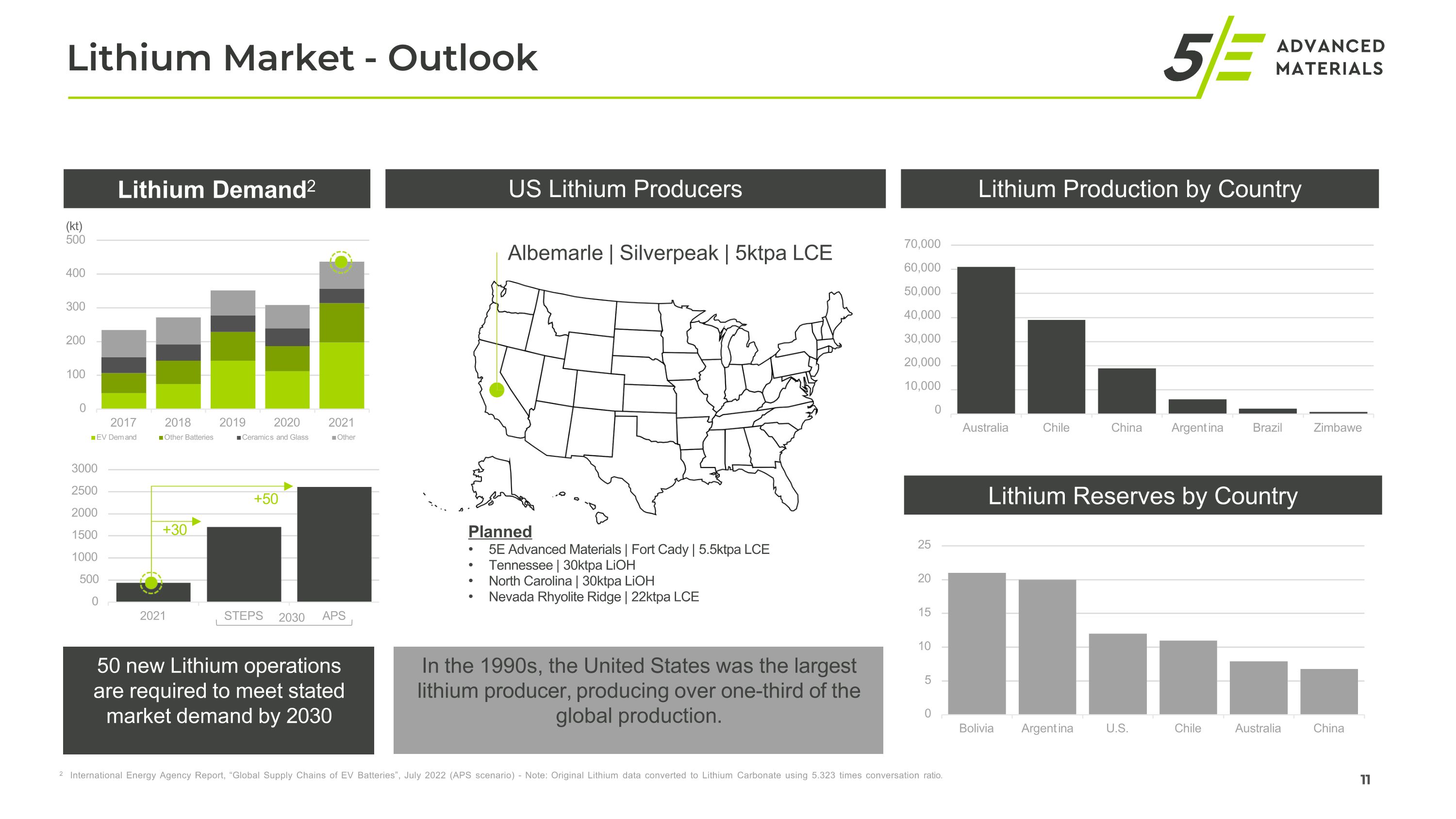

11 Lithium Market - Outlook Lithium Demand2 US Lithium Producers Lithium Production by Country 50 new Lithium operations are required to meet stated market demand by 2030 0 100 200 300 400 (kt) 500 2017 EV Dem and 2018 Other Batteries 2019 2020 Ceramic s and Glass 2021 Other 3000 2500 2000 1500 1000 500 0 2021 STEPS APS +30 +50 2030 2 International Energy Agency Report, “Global Supply Chains of EV Batteries”, July 2022 (APS scenario) - Note: Original Lithium data converted to Lithium Carbonate using 5.323 times conversation ratio. 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Australia Chile China Argent ina Brazil Zimbawe 0 5 10 15 20 25 Bolivia Argent ina U.S. Chile Australia China Lithium Reserves by Country Albemarle | Silverpeak | 5ktpa LCE Planned 5E Advanced Materials | Fort Cady | 5.5ktpa LCE Tennessee | 30ktpa LiOH North Carolina | 30ktpa LiOH Nevada Rhyolite Ridge | 22ktpa LCE In the 1990s, the United States was the largest lithium producer, producing over one-third of the global production.

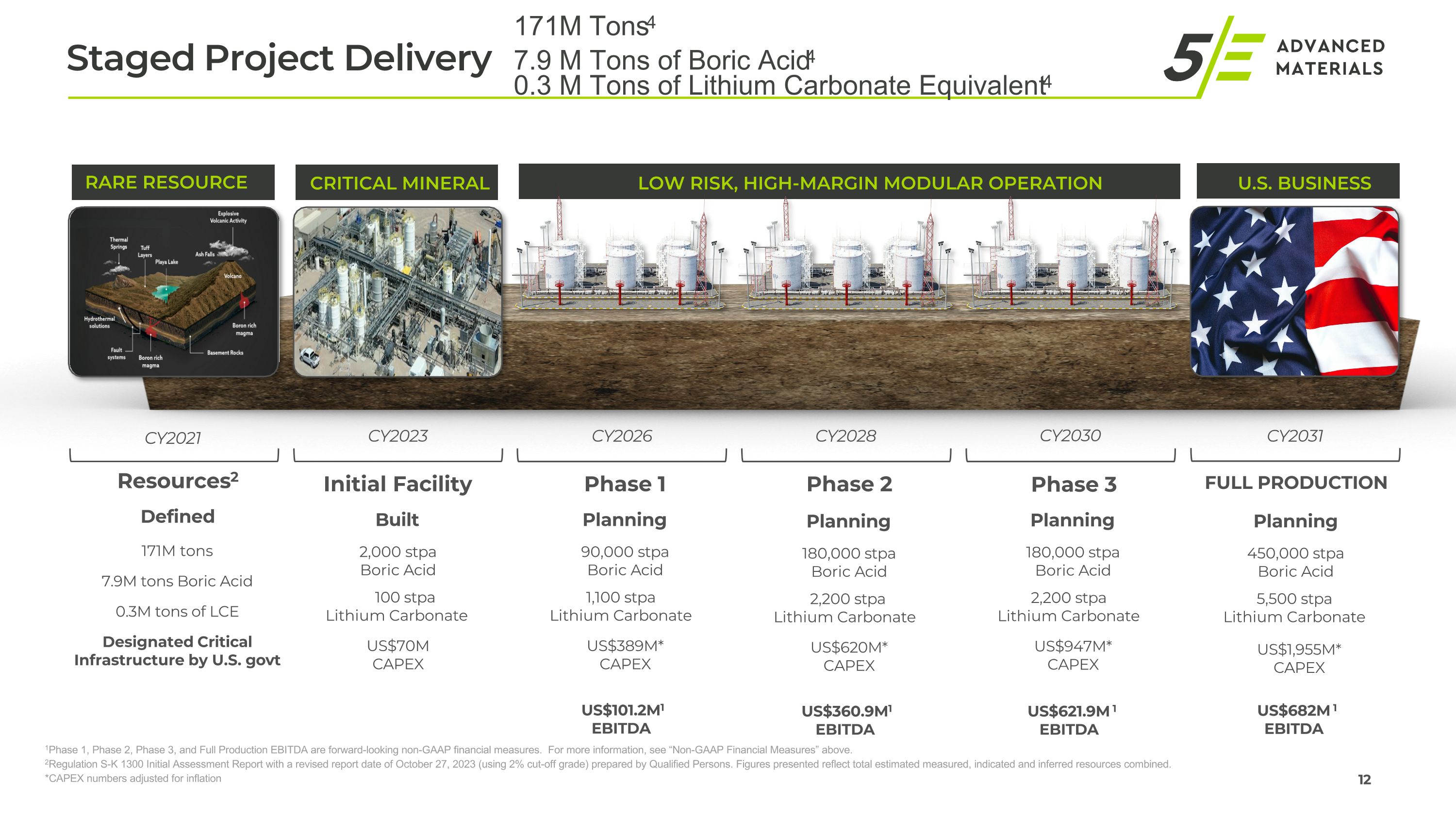

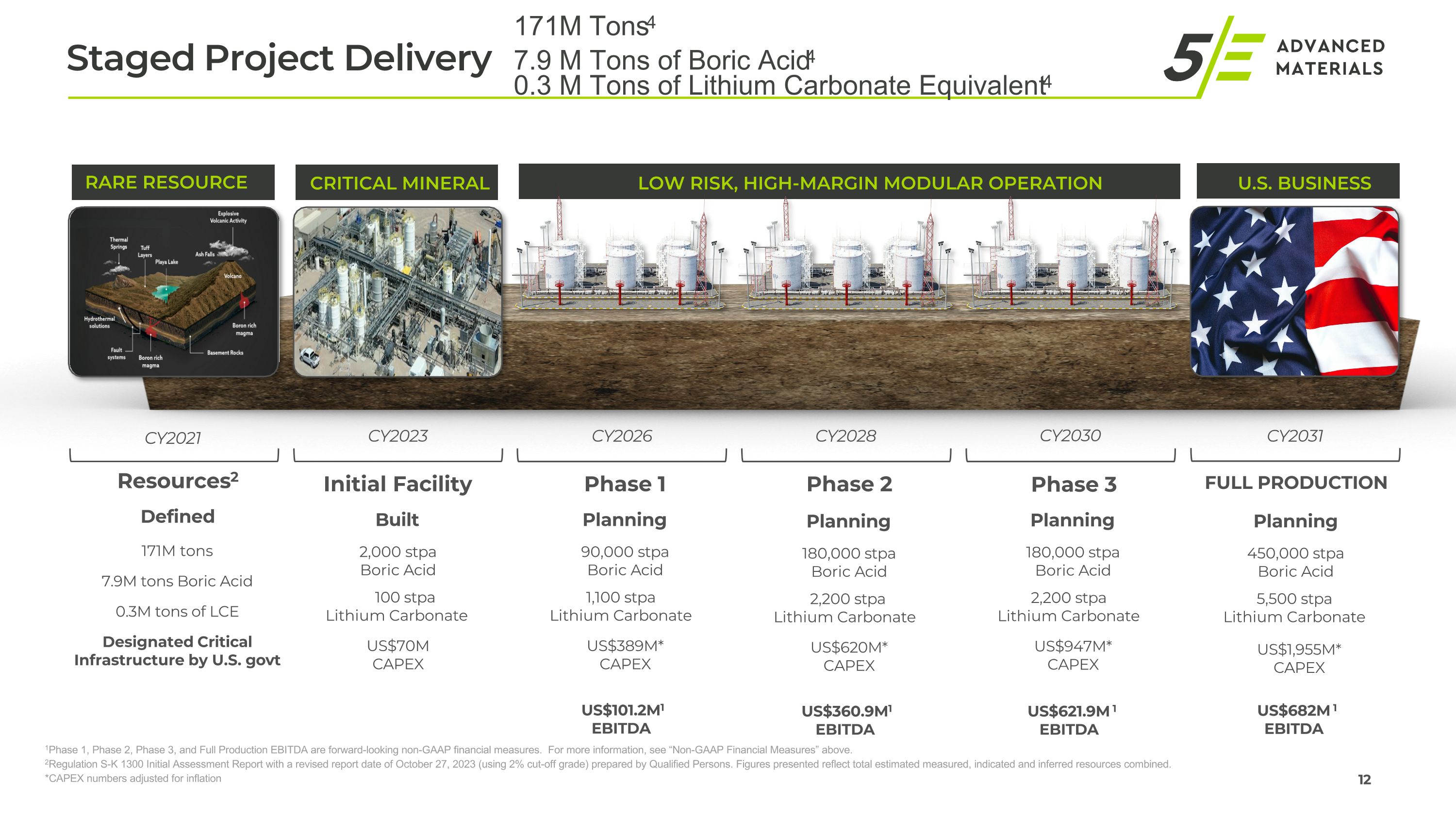

Staged Project Delivery 1Phase 1, Phase 2, Phase 3, and Full Production EBITDA are forward-looking non-GAAP financial measures. For more information, see “Non-GAAP Financial Measures” above. 2Regulation S-K 1300 Initial Assessment Report with a revised report date of October 27, 2023 (using 2% cut-off grade) prepared by Qualified Persons. Figures presented reflect total estimated measured, indicated and inferred resources combined. *CAPEX numbers adjusted for inflation CY2023 CY2026 CY2028 CY2030 CY2021 FULL PRODUCTION Planning 450,000 stpa Boric Acid 5,500 stpa Lithium Carbonate CY2031 Initial Facility Built 2,000 stpa Boric Acid 100 stpa Lithium Carbonate US$70M CAPEX Phase 1 Planning 90,000 stpa Boric Acid 1,100 stpa Lithium Carbonate US$389M* CAPEX Phase 2 Planning 180,000 stpa Boric Acid 2,200 stpa Lithium Carbonate US$620M* CAPEX Phase 3 Planning 180,000 stpa Boric Acid 2,200 stpa Lithium Carbonate US$947M* CAPEX US$101.2M1 EBITDA US$360.9M1 EBITDA US$621.9M 1 EBITDA US$682M 1 EBITDA RARE RESOURCE CRITICAL MINERAL LOW RISK, HIGH-MARGIN MODULAR OPERATION U.S. BUSINESS Resources2 Defined 171M tons 7.9M tons Boric Acid 0.3M tons of LCE Designated Critical Infrastructure by U.S. govt 12 US$1,955M* CAPEX 171M Tons4 7.9 M Tons of Boric Acid4 0.3 M Tons of Lithium Carbonate Equivalent4

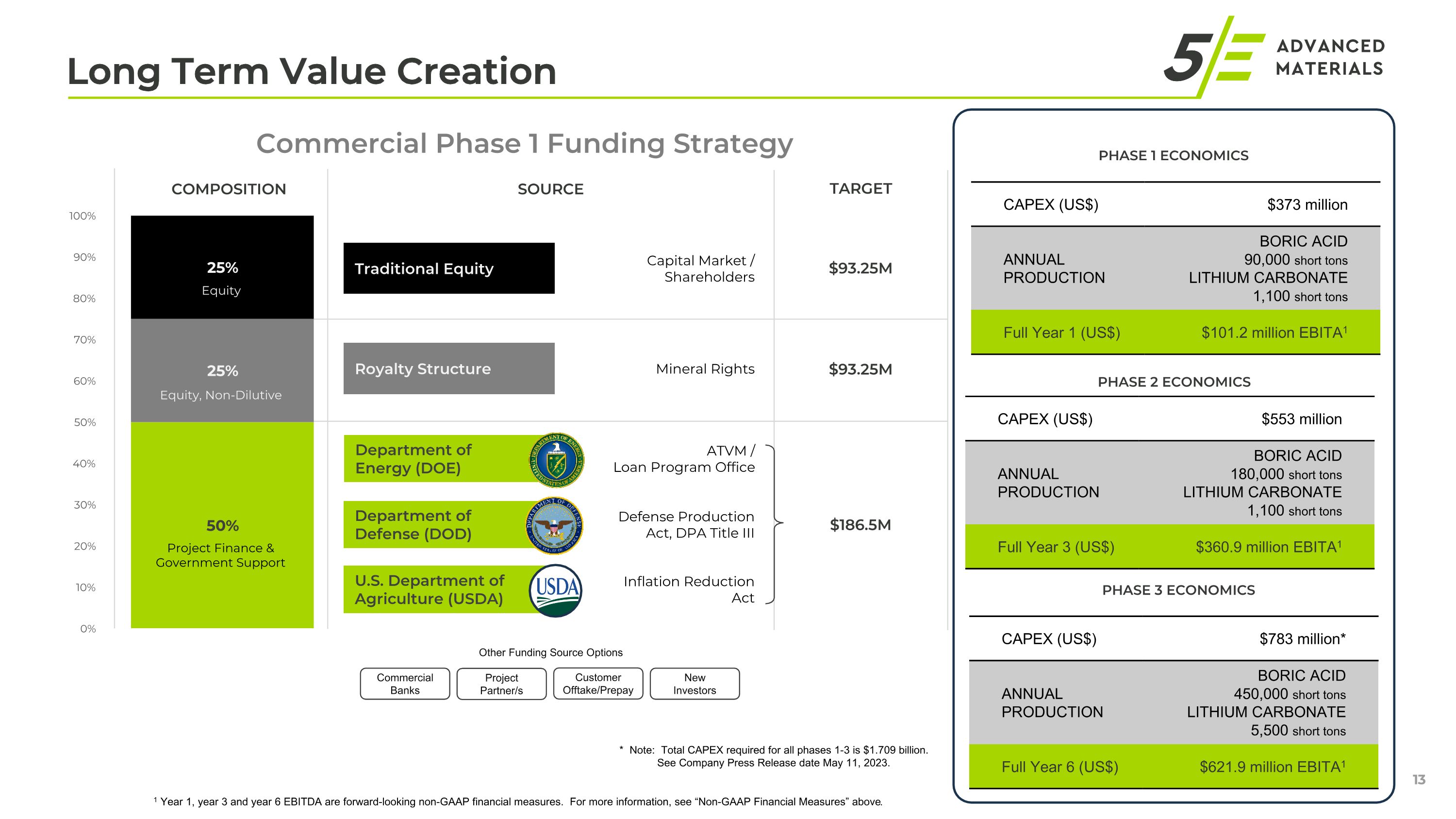

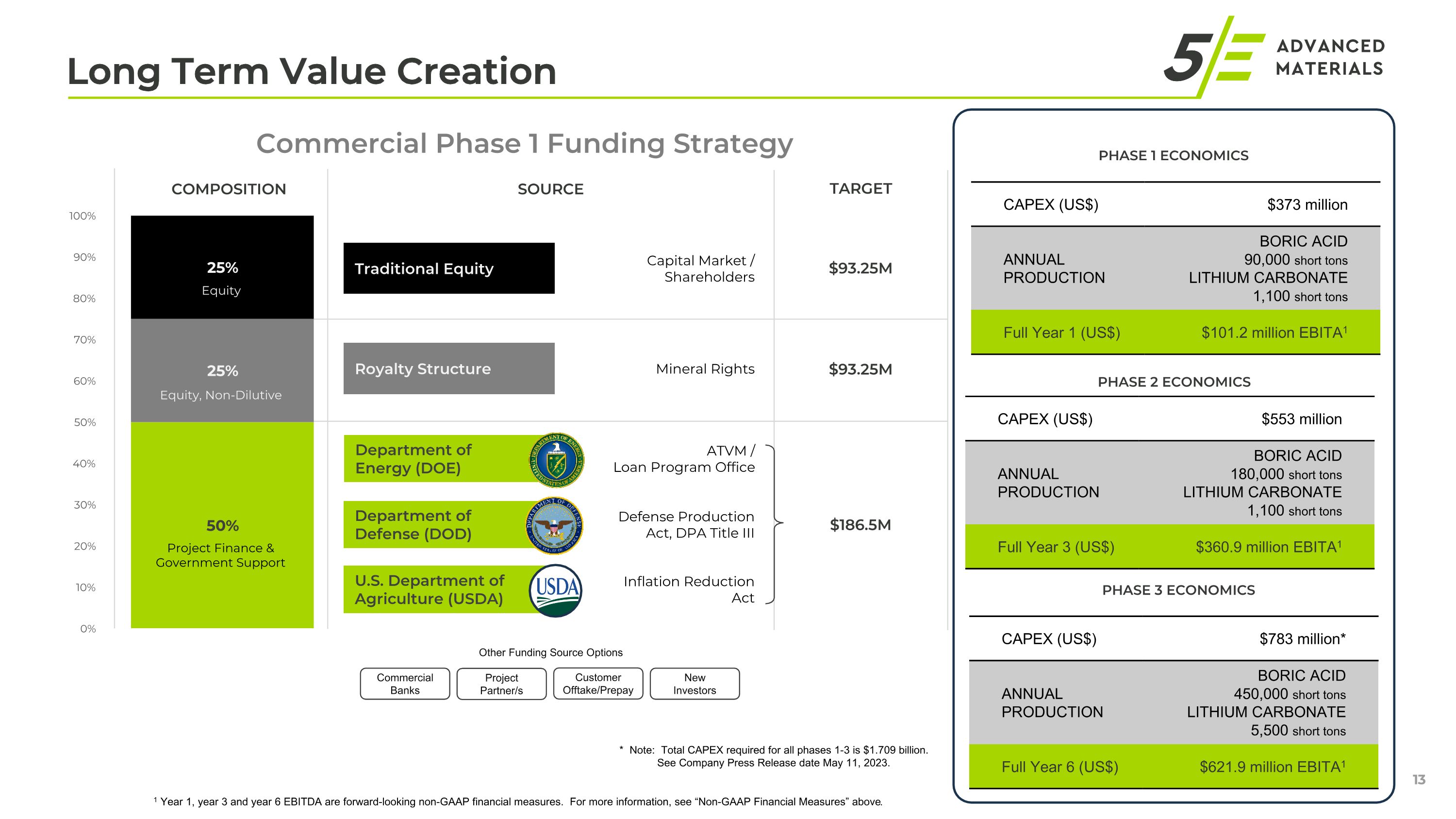

Long Term Value Creation 13 Department of �Energy (DOE) ATVM / �Loan Program Office Department of �Defense (DOD) Defense Production �Act, DPA Title III U.S. Department of Agriculture (USDA) Inflation Reduction �Act Royalty Structure Mineral Rights Traditional Equity Capital Market / Shareholders COMPOSITION SOURCE TARGET $93.25M $93.25M $186.5M Commercial Banks Project Partner/s Customer Offtake/Prepay New Investors Other Funding Source Options Project Finance & Government Support Equity, Non-Dilutive Equity PHASE 1 ECONOMICS CAPEX (US$) $373 million ANNUAL PRODUCTION BORIC ACID�90,000 short tons LITHIUM CARBONATE�1,100 short tons Full Year 1 (US$) $101.2 million EBITA1 PHASE 3 ECONOMICS CAPEX (US$) $783 million* ANNUAL PRODUCTION BORIC ACID�450,000 short tons LITHIUM CARBONATE�5,500 short tons Full Year 6 (US$) $621.9 million EBITA1 * Note: Total CAPEX required for all phases 1-3 is $1.709 billion. See Company Press Release date May 11, 2023. CAPEX (US$) $553 million ANNUAL PRODUCTION BORIC ACID�180,000 short tons LITHIUM CARBONATE�1,100 short tons Full Year 3 (US$) $360.9 million EBITA1 PHASE 2 ECONOMICS Commercial Phase 1 Funding Strategy 1 Year 1, year 3 and year 6 EBITDA are forward-looking non-GAAP financial measures. For more information, see “Non-GAAP Financial Measures” above.

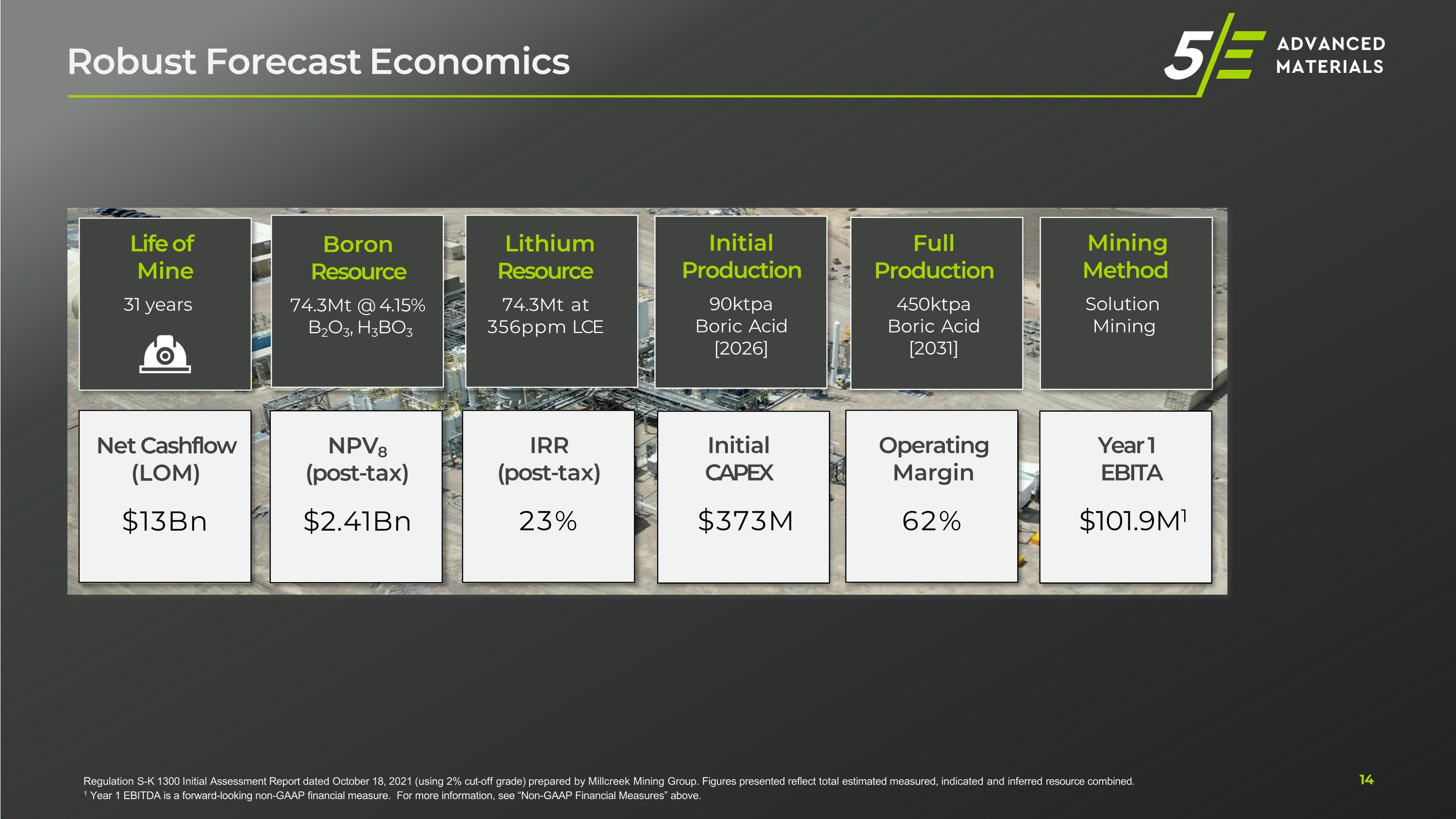

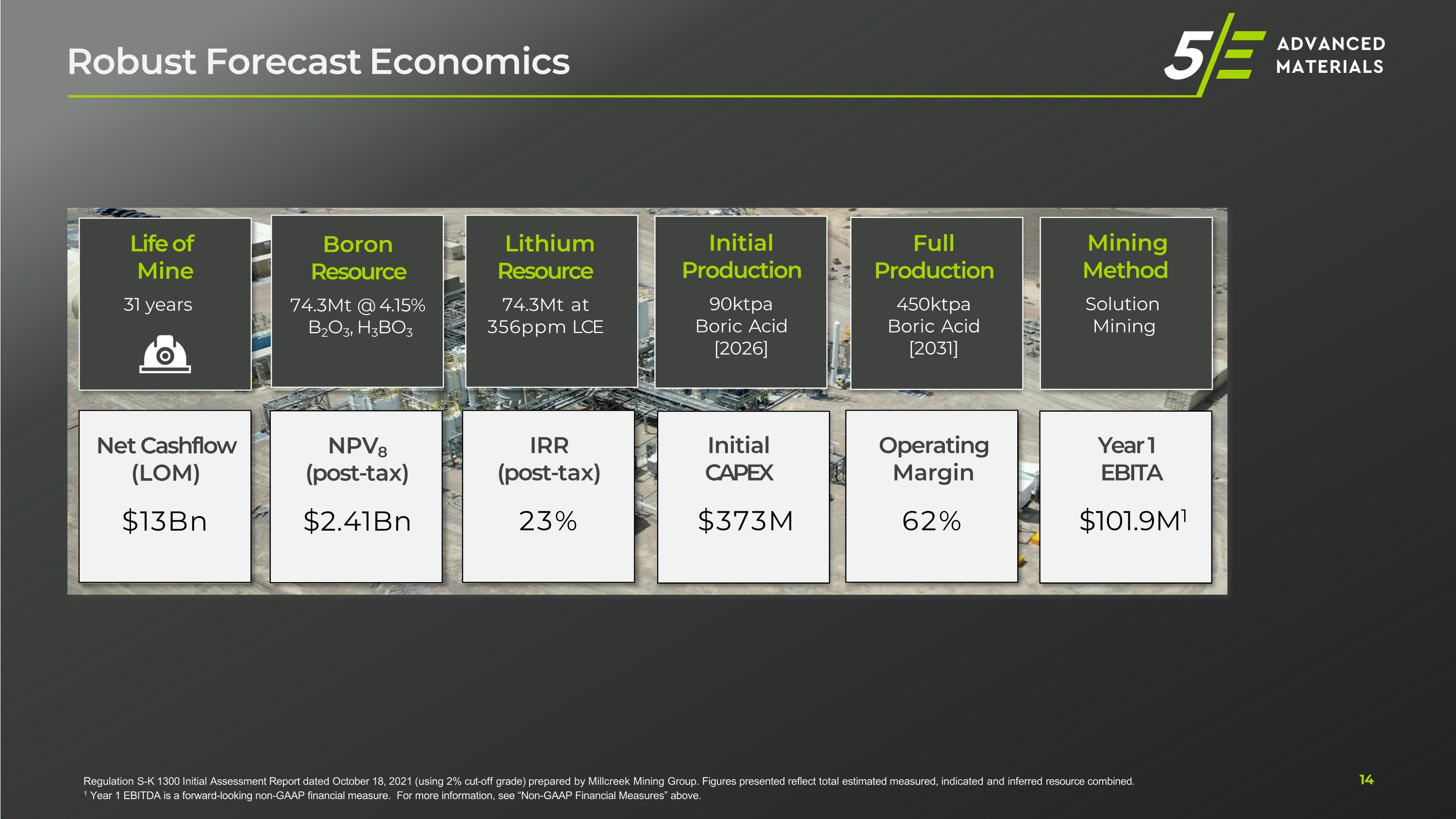

Robust Forecast Economics Regulation S-K 1300 Initial Assessment Report dated October 18, 2021 (using 2% cut-off grade) prepared by Millcreek Mining Group. Figures presented reflect total estimated measured, indicated and inferred resource combined. 1 Year 1 EBITDA is a forward-looking non-GAAP financial measure. For more information, see “Non-GAAP Financial Measures” above. Life of Mine 31 years Operating Margin 62% 14 Mining Method Solution Mining Boron Resource 74.3Mt @ 4.15% B2O3, H3BO3 Initial Production 90ktpa Boric Acid [2026] Full Production 450ktpa Boric Acid [2031] Lithium Resource 74.3Mt at 356ppm LCE Net Cashflow (LOM) $13Bn NPV8 (post-tax) $2.41Bn Initial CAPEX $373M Year 1 EBITA $101.9M1 IRR (post-tax) 23%

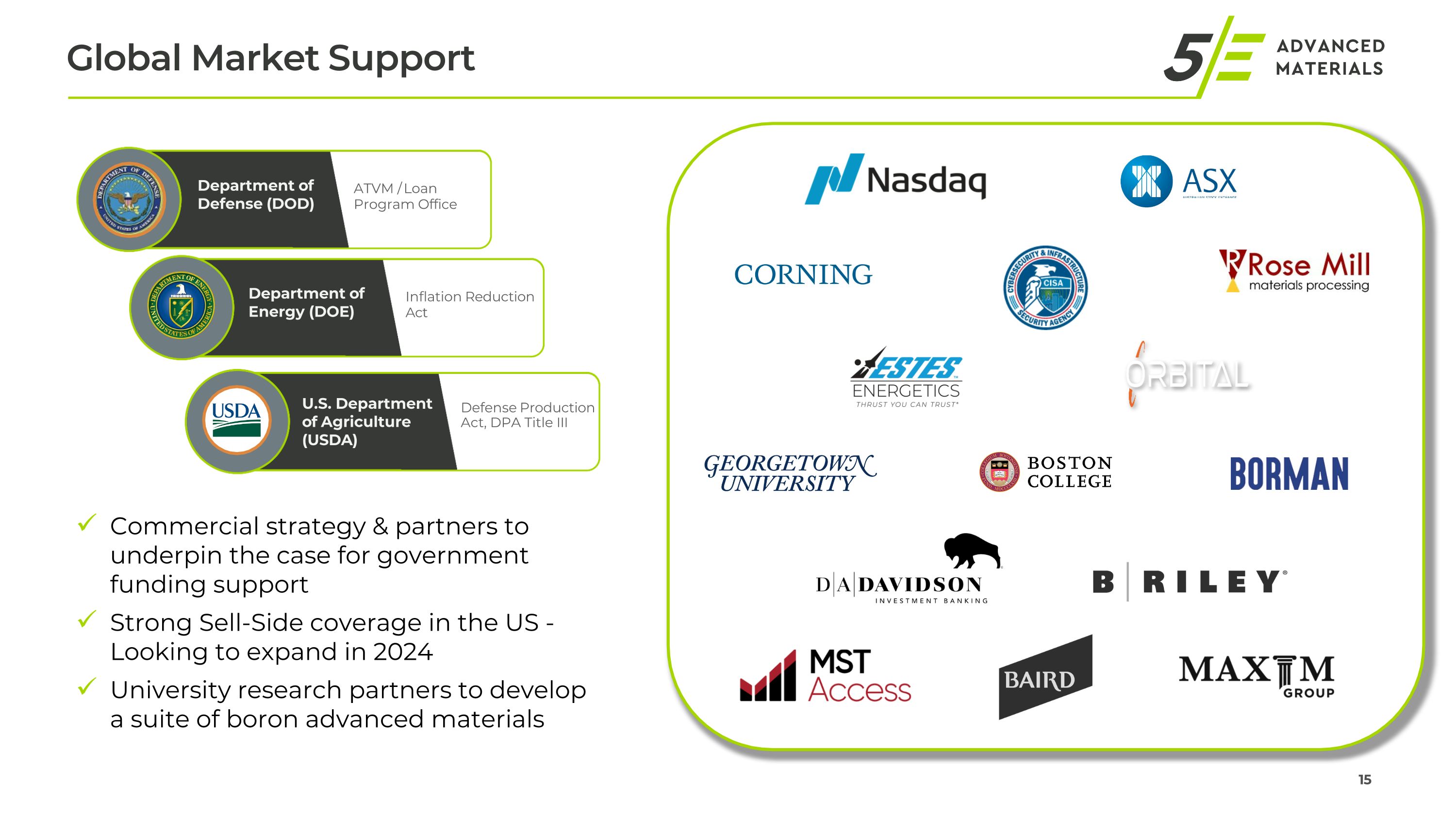

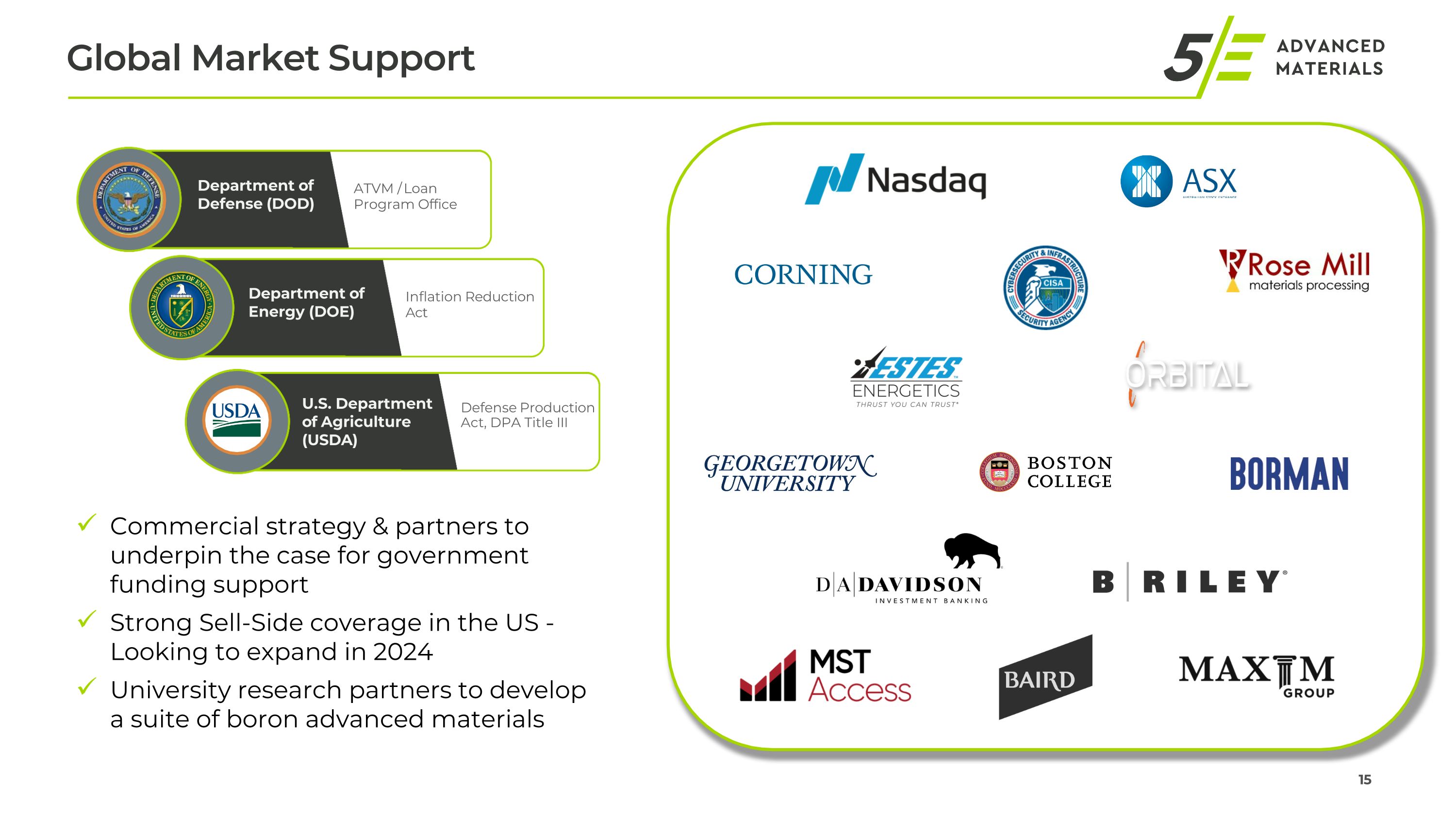

Global Market Support 15 Department of Energy (DOE) ATVM / Loan Program Office Department of Defense (DOD) Defense Production Act, DPA Title III U.S. Department of Agriculture (USDA) Inflation Reduction Act Commercial strategy & partners to underpin the case for government funding support Strong Sell-Side coverage in the US - Looking to expand in 2024 University research partners to develop a suite of boron advanced materials

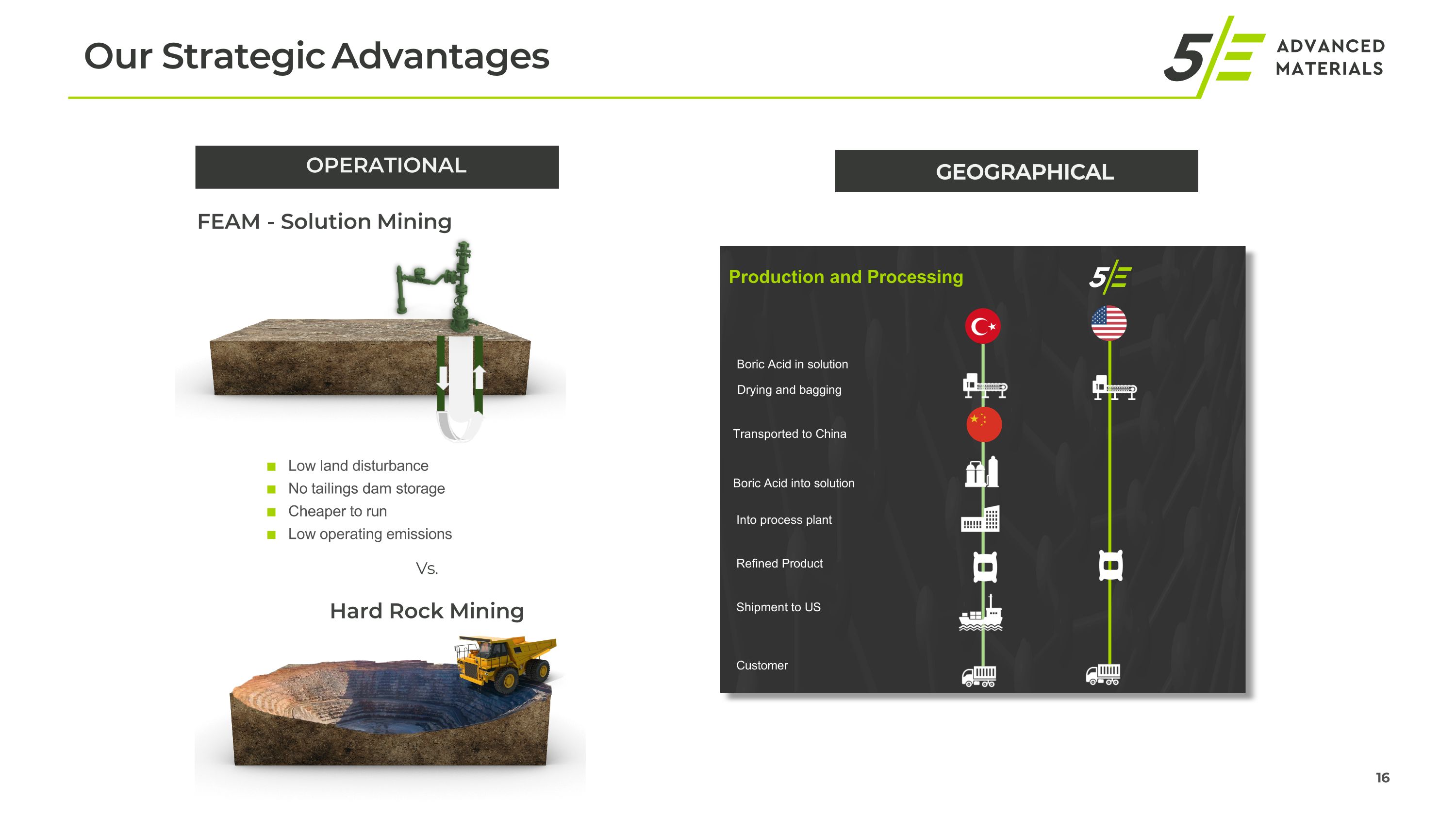

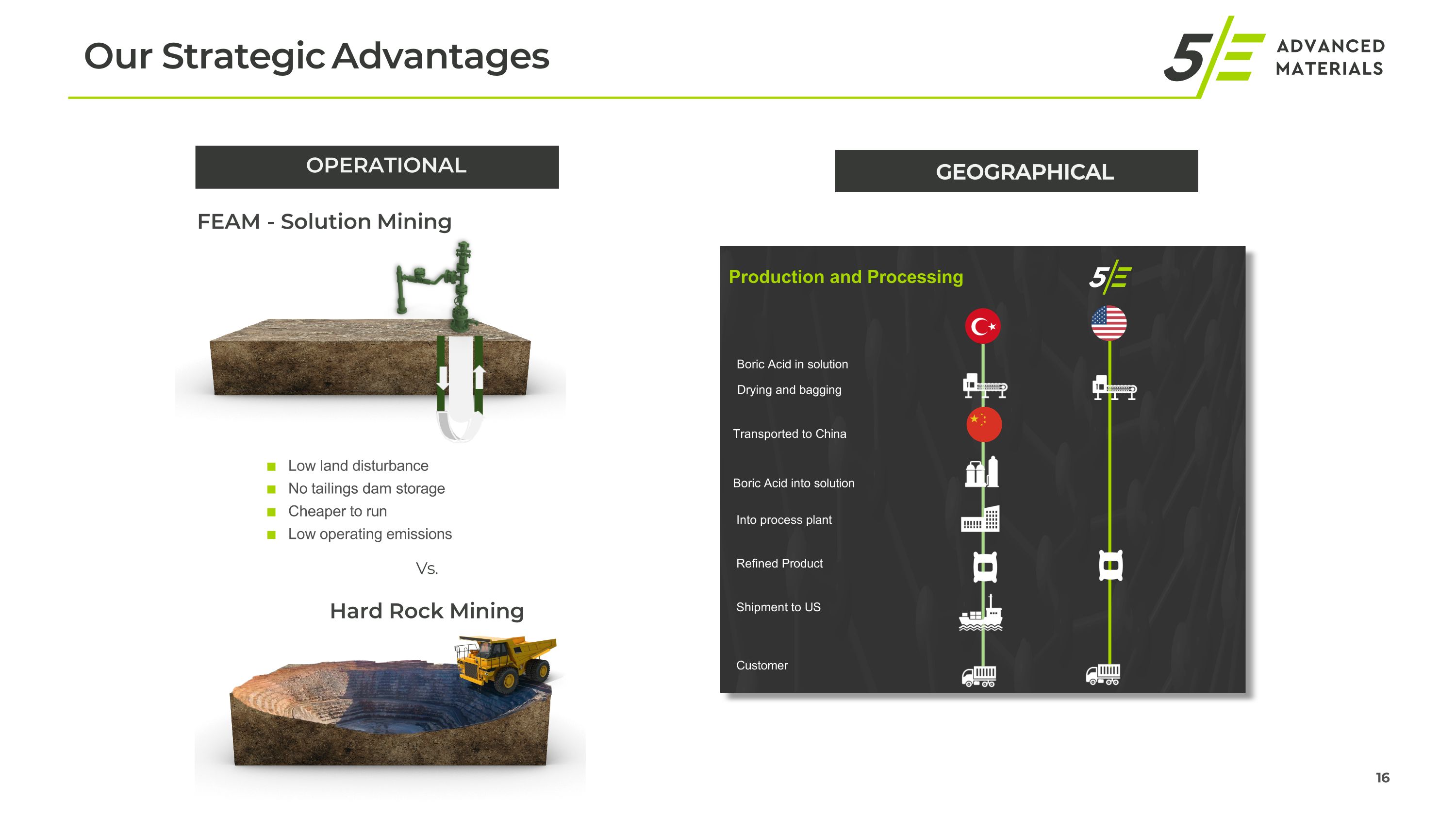

Our Strategic Advantages 16 OPERATIONAL GEOGRAPHICAL Boric Acid in solution Drying and bagging Transported to China Boric Acid into solution Into process plant Refined Product Shipment to US Customer FEAM - Solution Mining Low land disturbance No tailings dam storage Cheaper to run Low operating emissions Vs. Hard Rock Mining Production and Processing

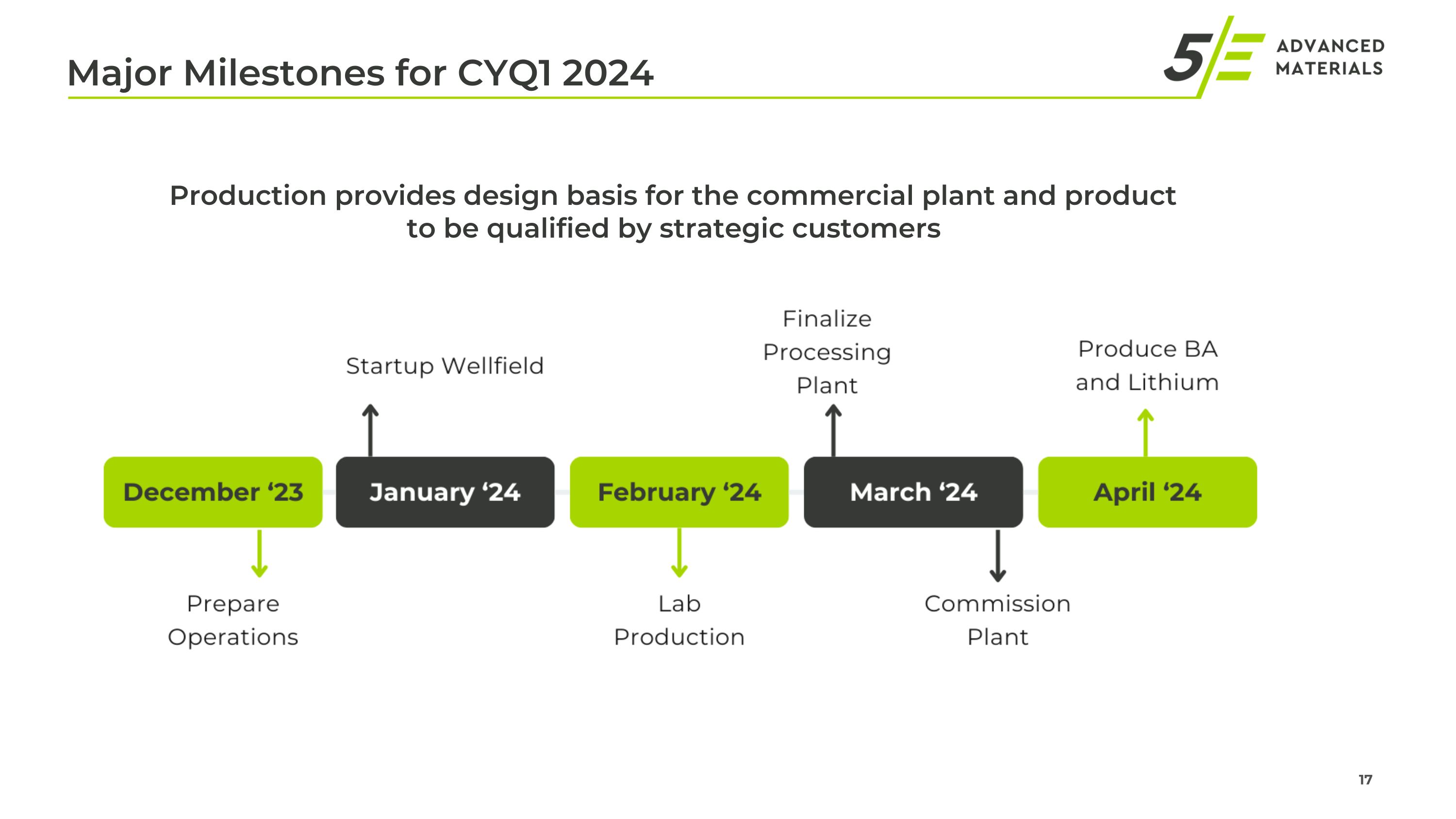

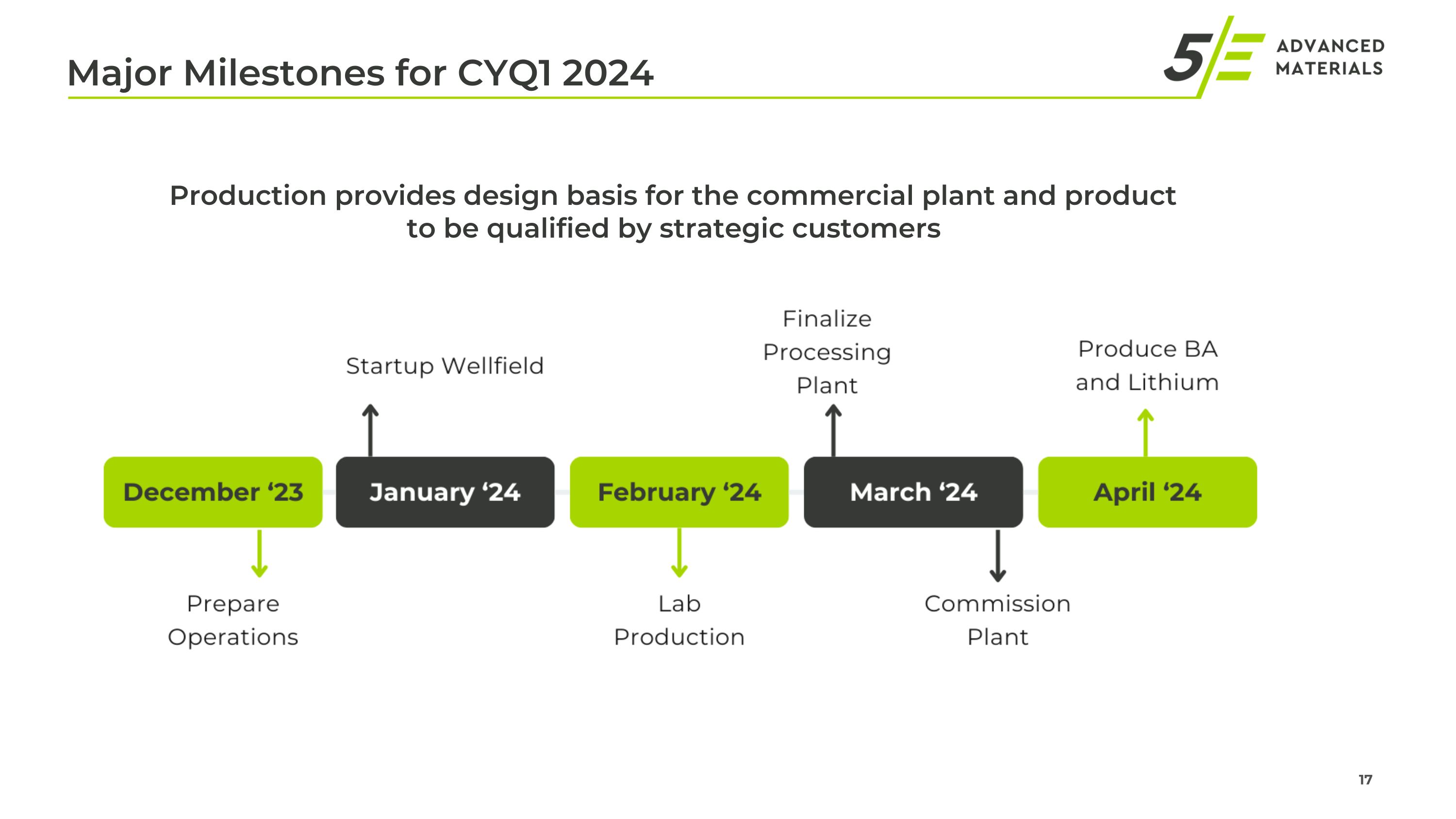

Major Milestones for CYQ1 2024 Production provides design basis for the commercial plant and product to be qualified by strategic customers

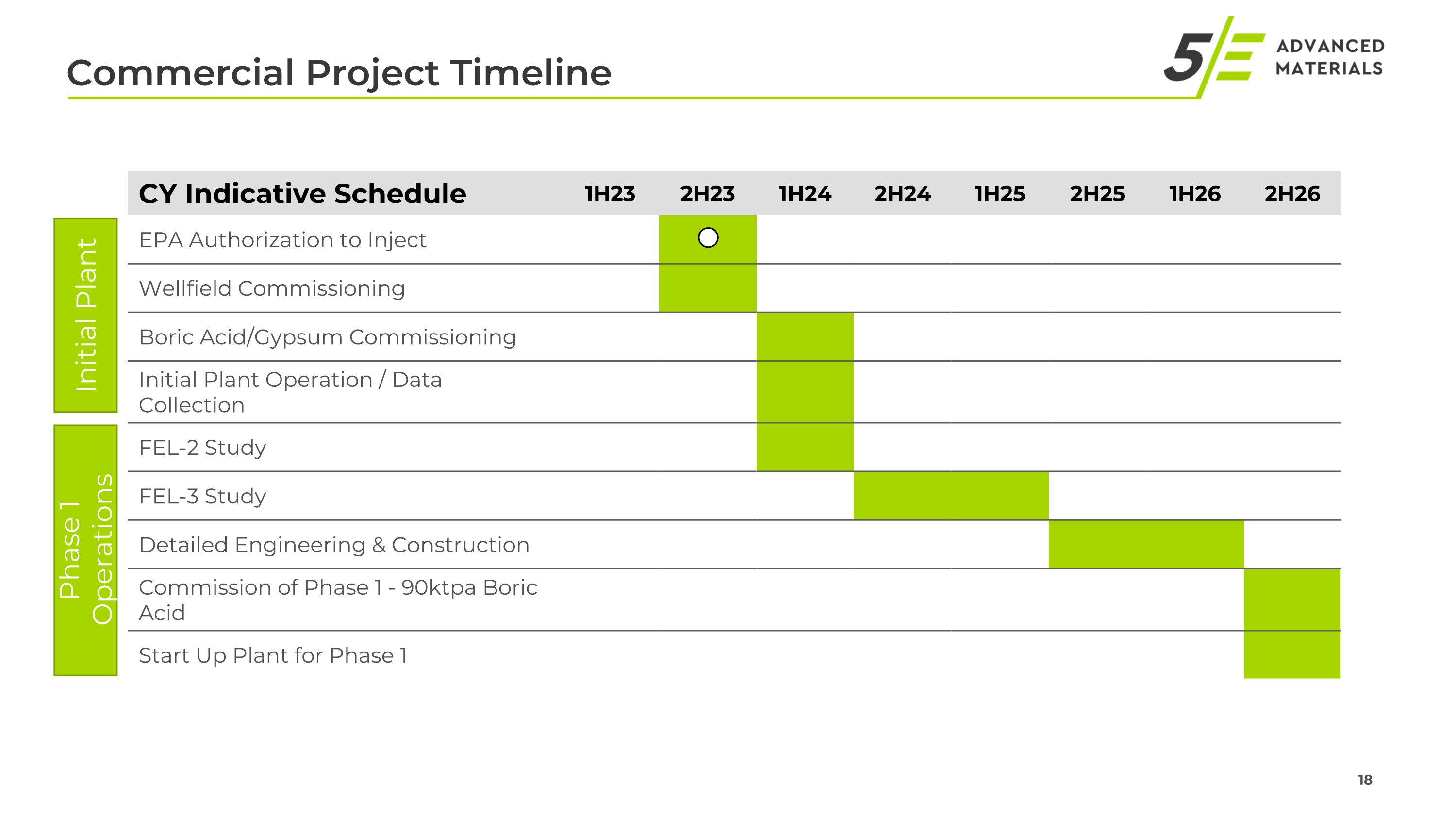

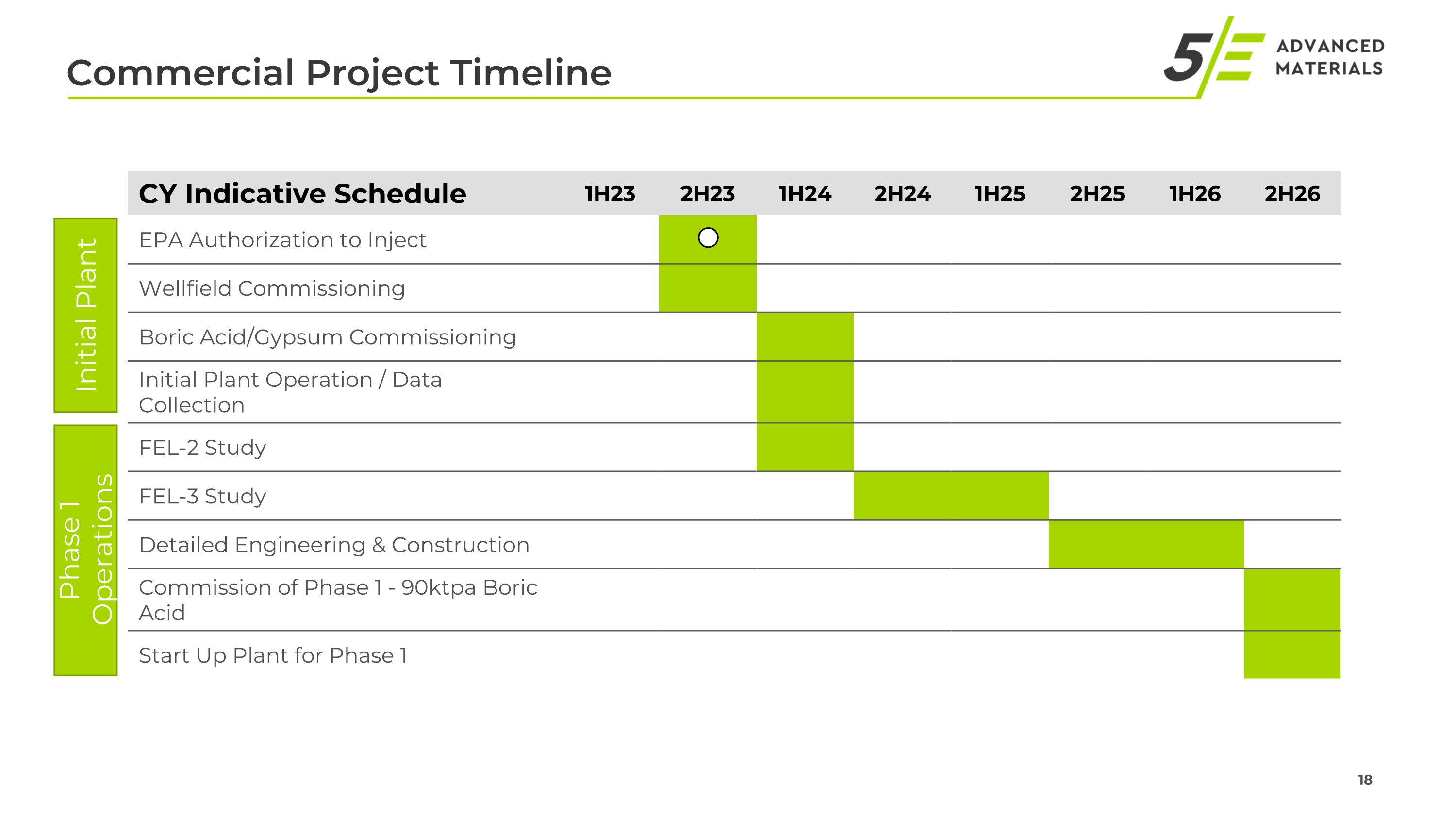

Commercial Project Timeline CY Indicative Schedule 1H23 2H23 1H24 2H24 1H25 2H25 1H26 2H26 EPA Authorization to Inject Wellfield Commissioning Boric Acid/Gypsum Commissioning Initial Plant Operation / Data Collection FEL-2 Study FEL-3 Study Detailed Engineering & Construction Commission of Phase 1 - 90ktpa Boric Acid Start Up Plant for Phase 1 Initial Plant Phase 1 Operations

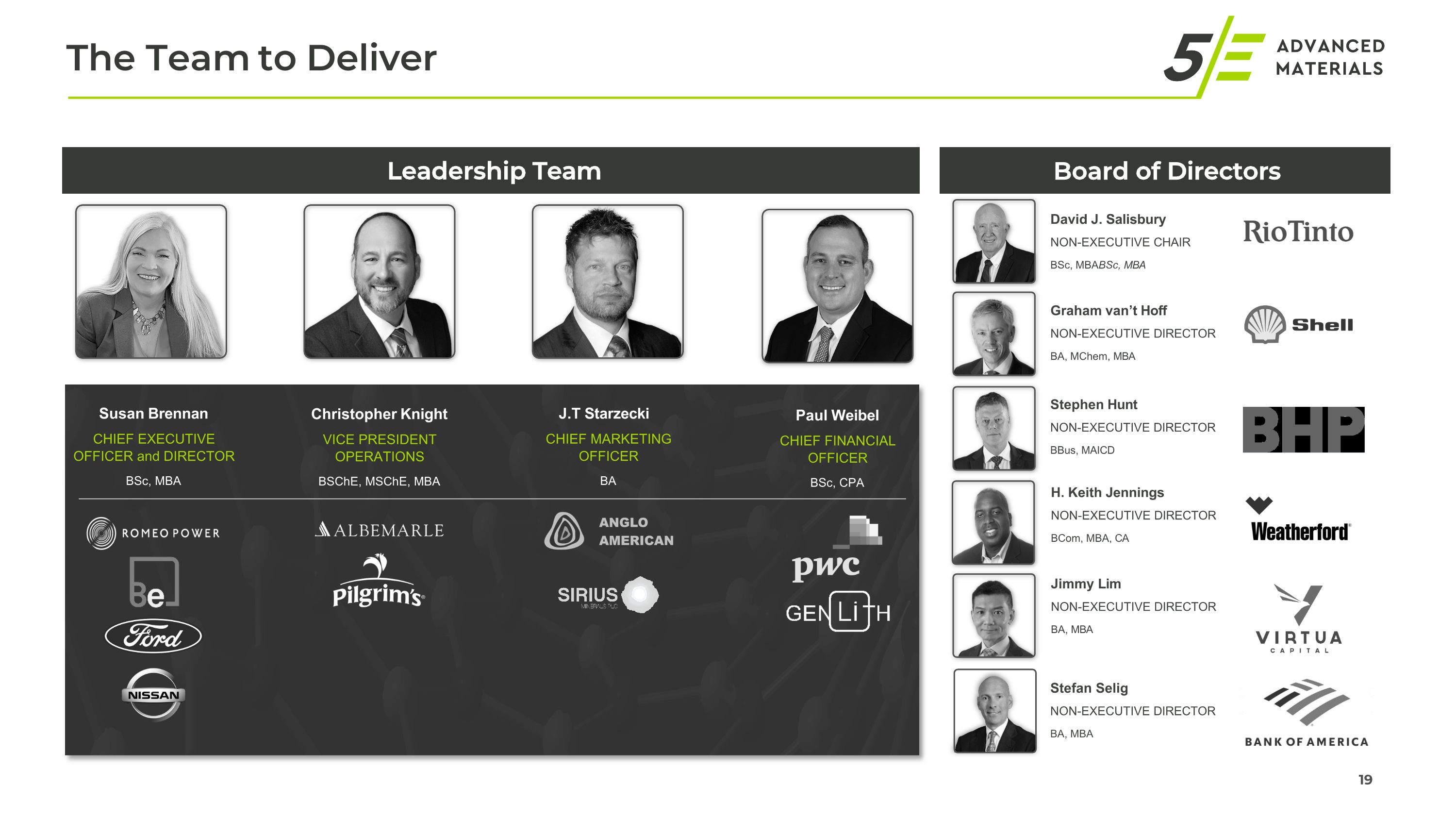

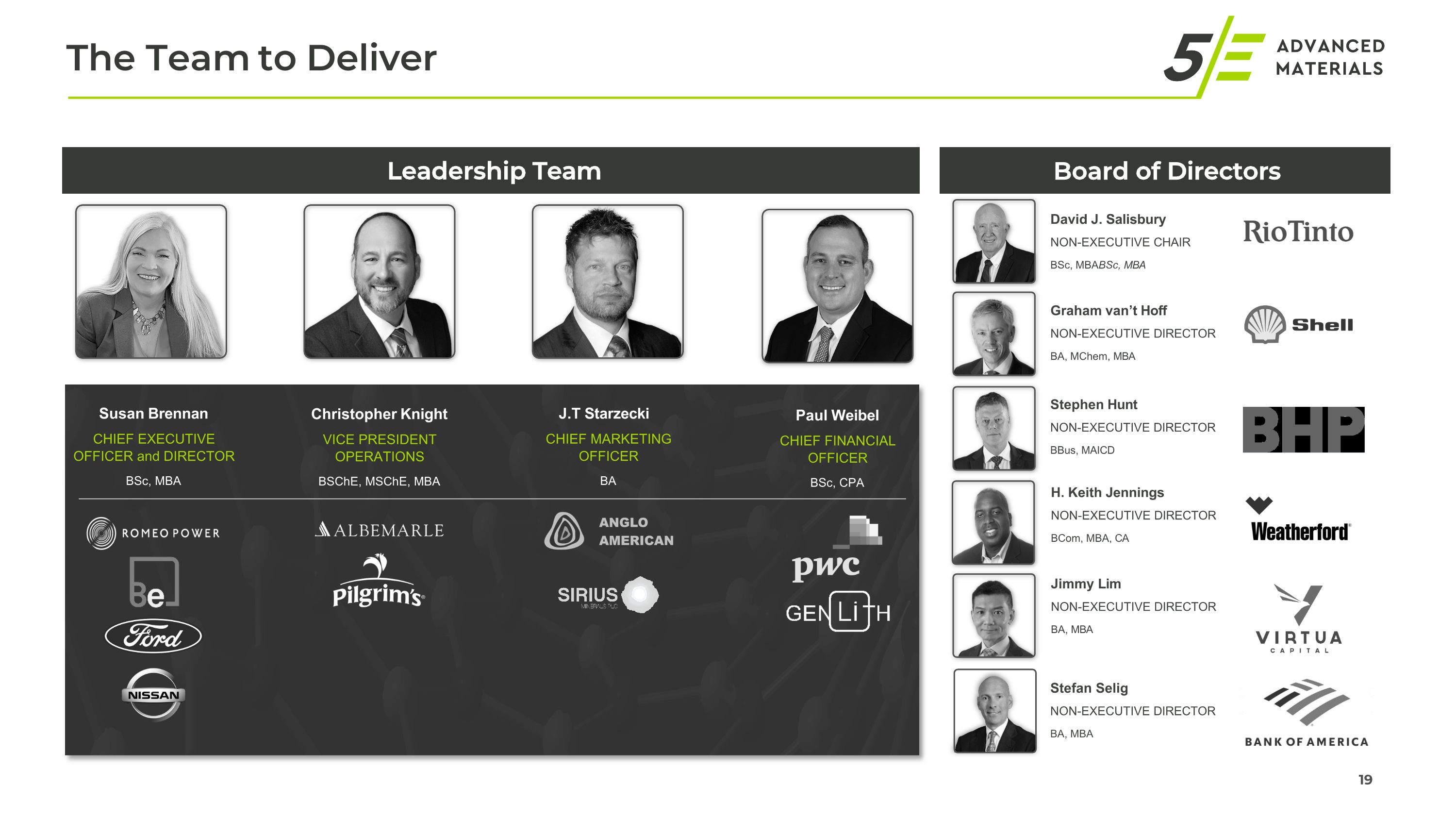

The Team to Deliver Leadership Team Board of Directors Susan Brennan CHIEF EXECUTIVE OFFICER and DIRECTOR BSc, MBA Christopher Knight VICE PRESIDENT OPERATIONS BSChE, MSChE, MBA J.T Starzecki CHIEF MARKETING OFFICER BA Paul Weibel CHIEF FINANCIAL OFFICER BSc, CPA David J. Salisbury NON-EXECUTIVE CHAIR BSc, MBABSc, MBA Graham van’t Hoff NON-EXECUTIVE DIRECTOR BA, MChem, MBA Stephen Hunt NON-EXECUTIVE DIRECTOR BBus, MAICD H. Keith Jennings NON-EXECUTIVE DIRECTOR BCom, MBA, CA Jimmy Lim NON-EXECUTIVE DIRECTOR BA, MBA Stefan Selig NON-EXECUTIVE DIRECTOR BA, MBA 19

20 Why 5E Advanced Materials? Exposure to critical materials Boron and Lithium Building a globally significant business with forecasted annual US$682M1 EBITDA profile in full production Important to U.S. Reshoring, decarbonization, and domestic production required for the clean energy economy Designated as Critical Infrastructure by the U.S. government with broader focus through defense, clean energy and EV markets Initial facility is permitted, constructed and is being commissioned with production to commence in CY2024 Staged execution and value delivery model 1 Full Production EBITDA is a forward-looking non-GAAP financial measure. For more information, see “Non-GAAP Financial Measures” above.

Enabling America’s Clean Energy Economy 23 The information in this presentation is confidential and proprietary, and may not be used, reproduced or distributed without the express written permission of 5E Advanced Materials, Inc. J.T. Starzecki CHIEF MARKETING OFFICER jstarzecki@5eadvancedmaterials.com 22

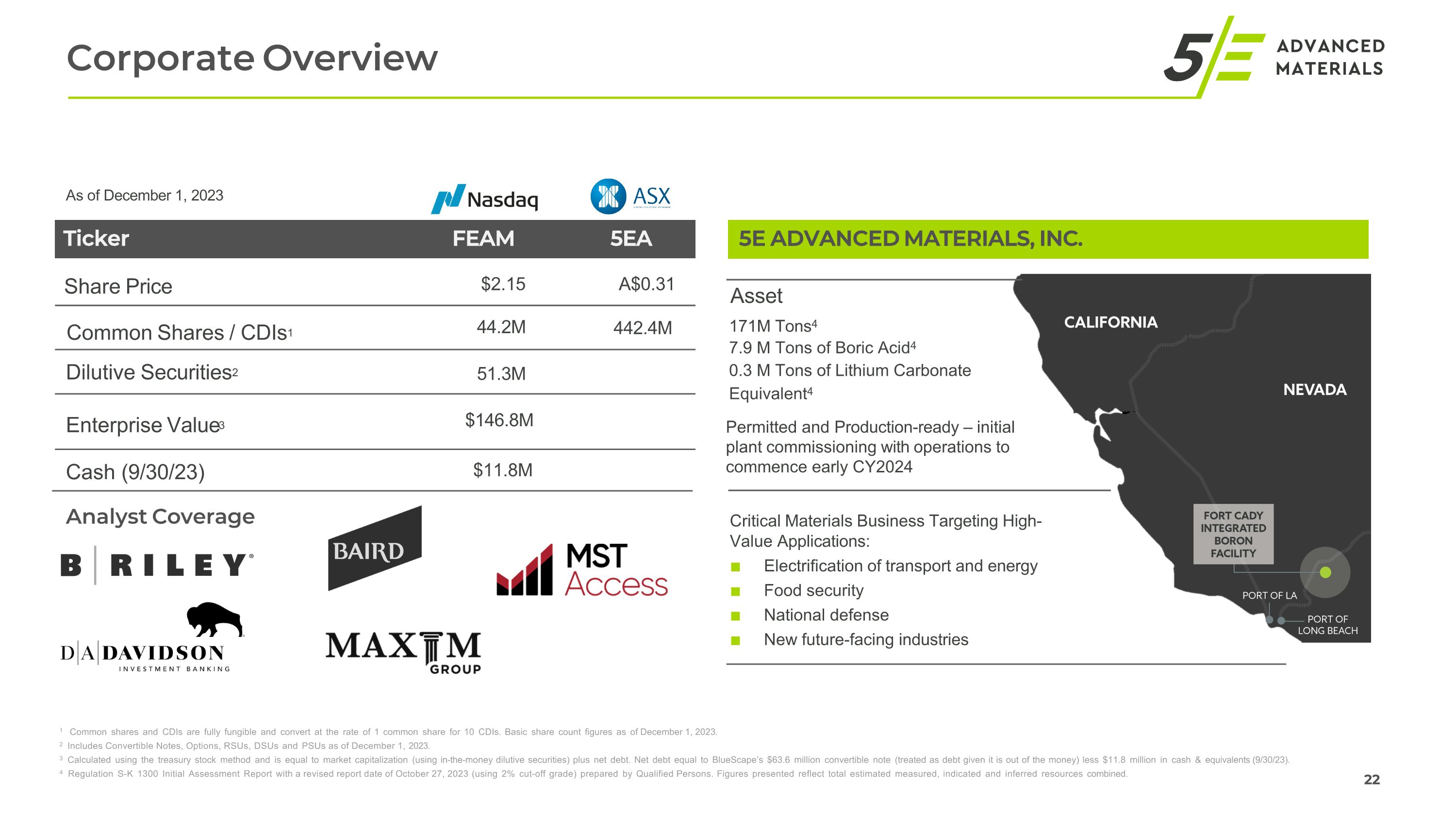

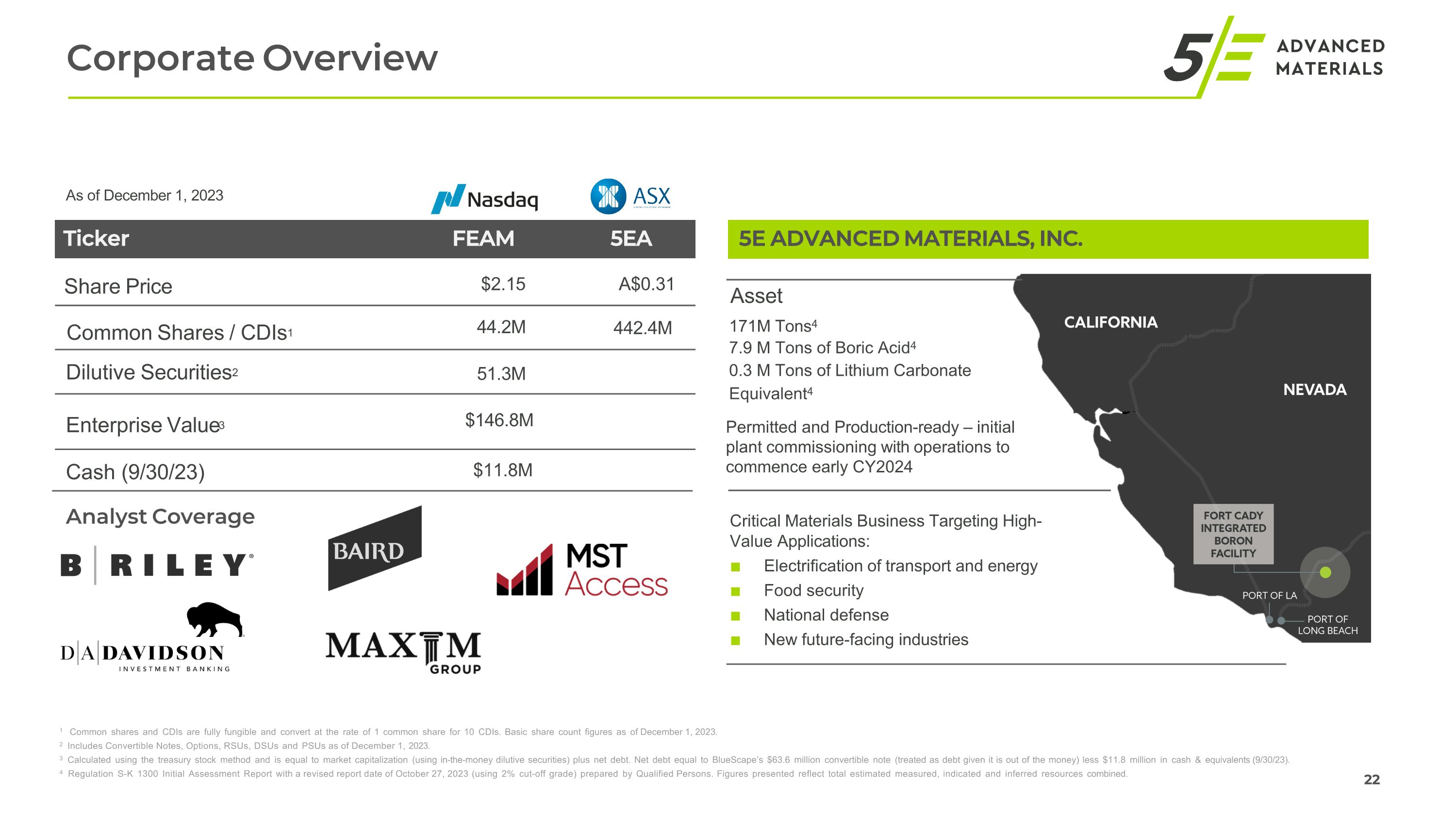

22 1 Common shares and CDIs are fully fungible and convert at the rate of 1 common share for 10 CDIs. Basic share count figures as of December 1, 2023. 2 Includes Convertible Notes, Options, RSUs, DSUs and PSUs as of December 1, 2023. 3 Calculated using the treasury stock method and is equal to market capitalization (using in-the-money dilutive securities) plus net debt. Net debt equal to BlueScape’s $63.6 million convertible note (treated as debt given it is out of the money) less $11.8 million in cash & equivalents (9/30/23). 4 Regulation S-K 1300 Initial Assessment Report with a revised report date of October 27, 2023 (using 2% cut-off grade) prepared by Qualified Persons. Figures presented reflect total estimated measured, indicated and inferred resources combined. As of December 1, 2023 Ticker FEAM 5EA Share Price $2.15 A$0.31 Common Shares / CDIs1 Dilutive Securities2 51.3M Enterprise Value3 Cash (9/30/23) $11.8M Analyst Coverage Corporate Overview 5E ADVANCED MATERIALS, INC. 171M Tons4 7.9 M Tons of Boric Acid4 0.3 M Tons of Lithium Carbonate Equivalent4 Permitted and Production-ready – initial plant commissioning with operations to commence early CY2024 Critical Materials Business Targeting High-Value Applications: Electrification of transport and energy Food security National defense New future-facing industries Asset 44.2M 442.4M $146.8M