Exhibit 96.1

Amended Initial Assessment Report

(February 2024)

5E Advanced Materials Fort Cady Project

Report Date

May 11, 2023

Revised Report Date

February 2, 2024

Report Effective Date

April 1, 2023

Signature Page

List of Qualified Persons

| | |

| Section(s) | Date |

Louis Fourie, P. Geo., Principal, Terra Modeling Services | 8, 9, 10, 11, 12 | February 2, 2024 |

/s/ Louis Fourie | | |

| | |

Paul Weibel, CPA, 5E Advanced Materials | 1, 2, 16, 19, 21, 22, 23, 24, 25 | February 2, 2024 |

/s/ Paul Weibel | | |

| | |

Dan Palo, P. Eng., P.E., Barr Engineering Co. | 13, 15, 18 | February 2, 2024 |

/s/ Dan Palo | | |

| | |

Steven Kerr, P.G., C.P.G., Principal, Escalante Geological Services LLC | 3, 4, 5, 6, 7, 17, 20 | February 2, 2024 |

/s/ Steven Kerr | | |

| | |

Mike Rockandel, P.E., Mike Rockandel Consulting LLC | 10.3, 14 | February 2, 2024 |

/s/ Mike Rockandel | | |

| | |

Mathew Banta, PH, Confluence Water Resources LLC | 7.3 | February 2, 2024 |

/s/ Mathew Banta | | |

| | |

2

3

4

5

6

List of Figures

| |

Figure 3.1 General Location Map | 15 |

Figure 3.2 Property Ownership | 16 |

Figure 6.1 Surface Geology in the Newberry Springs Area | 22 |

Figure 6.2 Topographic Map with Faults and Infrastructure | 22 |

Figure 6.3 Long-section and Cross-section through the Fort Cady Deposit | 24 |

Figure 6.4 Generalized Lithological Column for the Fort Cady Deposit | 25 |

Figure 7.1 Cross-section Through the Fort Cady Deposit | 28 |

Figure 7.2 Core Photo, 17FTCBL-014 | 28 |

Figure 7.3 Project Area Groundwater Basins and Surrounding Area Wells, Fort Cady Project, San Bernardino, CA | 29 |

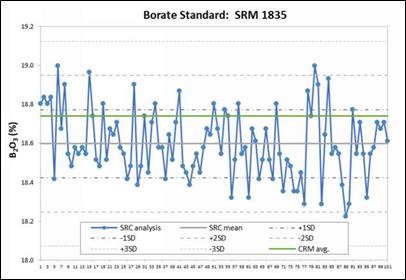

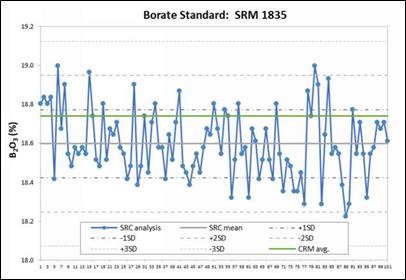

Figure 8.1 Assay Results of Standard SRM1835 | 34 |

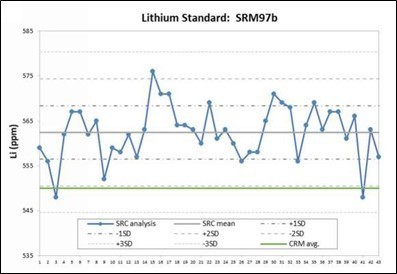

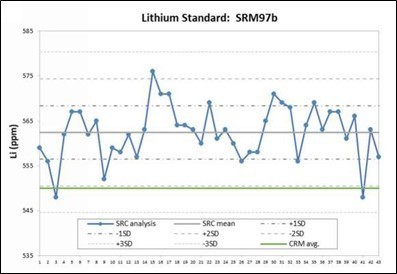

Figure 8.2 Assay Results of Standard SRM97b | 34 |

Figure 8.3 Assay Results for SRC Standard CAR110/BSM | 35 |

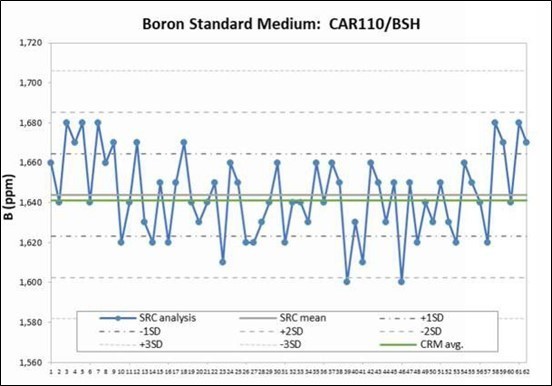

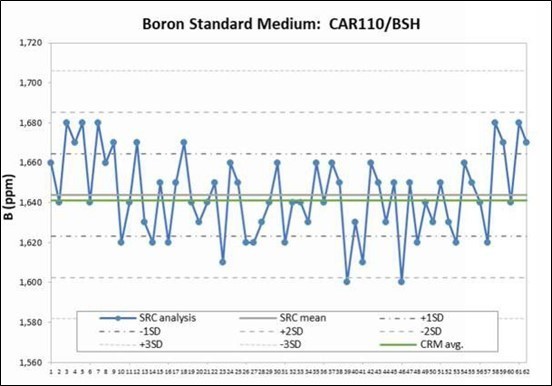

Figure 8.4 Assay Results for SRC Standard CAR110/BSH | 35 |

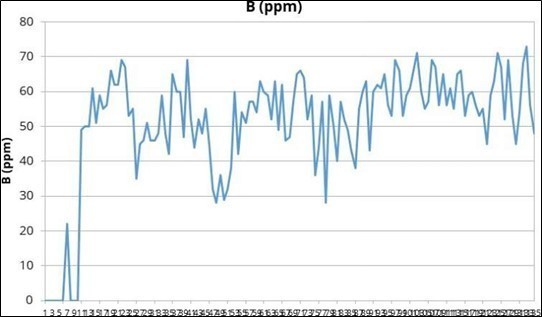

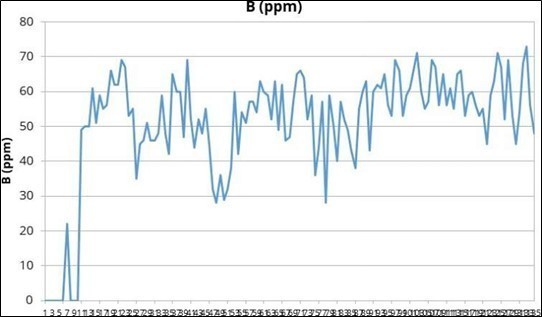

Figure 8.5 Sample Blank Assay Results for Boron | 36 |

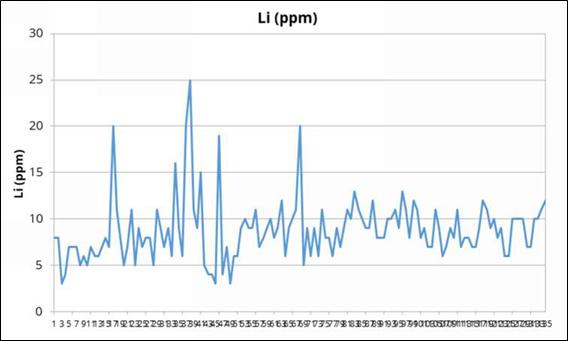

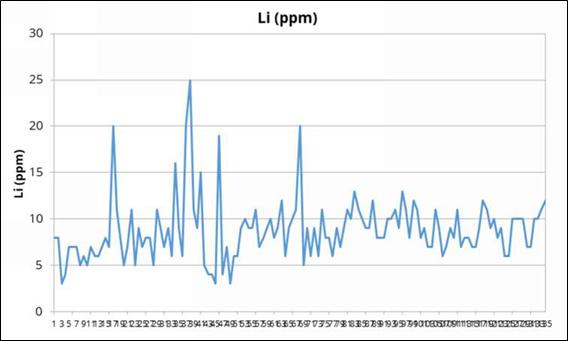

Figure 8.6 Sample Blank Assay Results for Lithium | 37 |

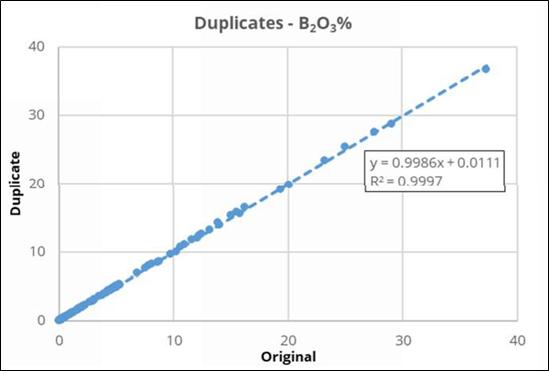

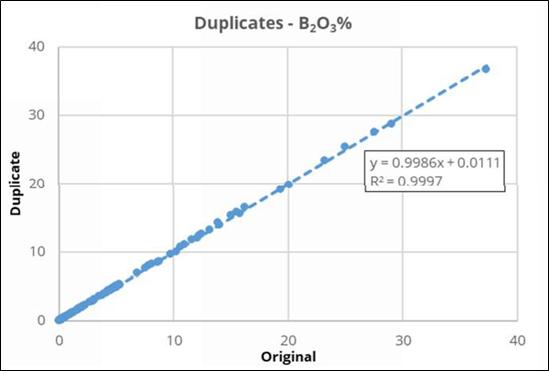

Figure 8.7 Duplicate Sample Results for Boron | 37 |

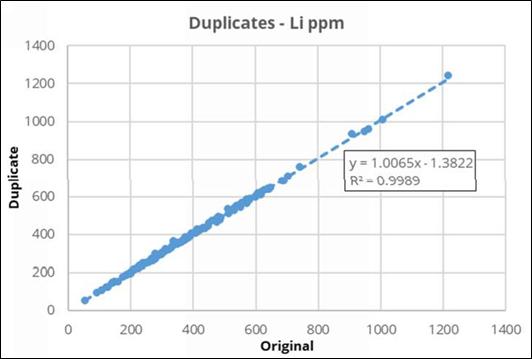

Figure 8.8 Duplicate Sample Results for Lithium | 38 |

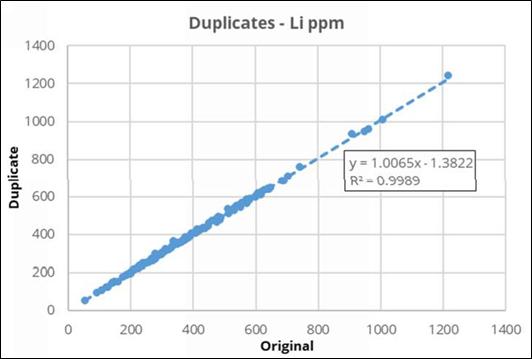

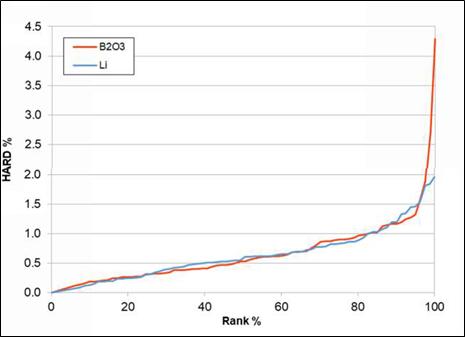

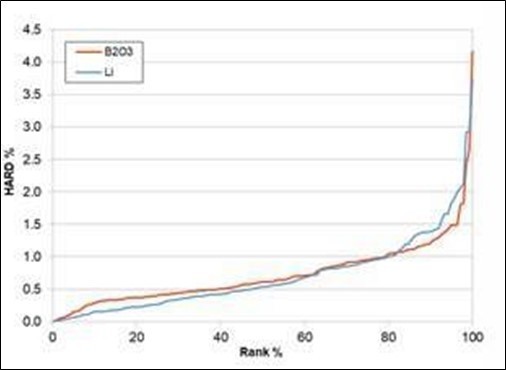

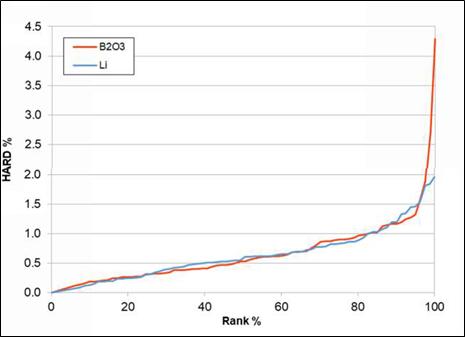

Figure 8.9 HARD Diagram for APBL Duplicate Samples | 39 |

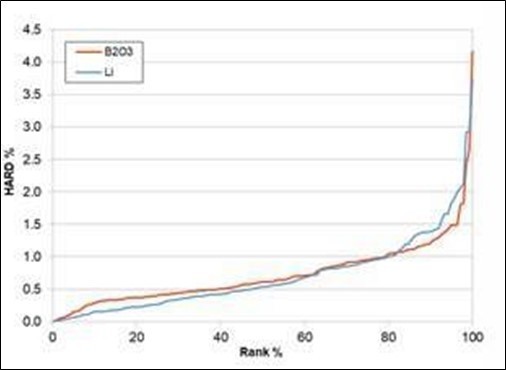

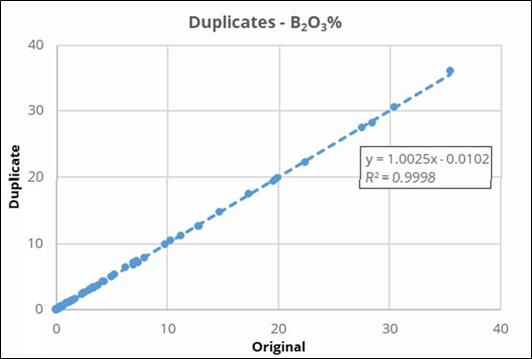

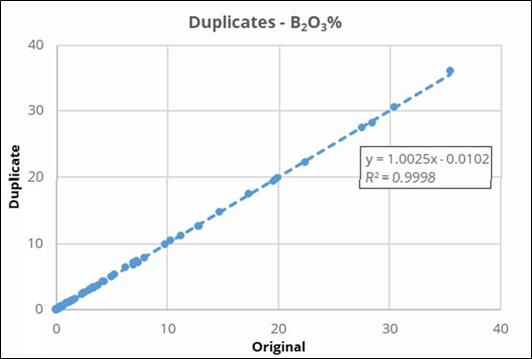

Figure 8.10 SRC Duplicate Results | 40 |

Figure 8.11 SRC Duplicates HARD Diagram | 40 |

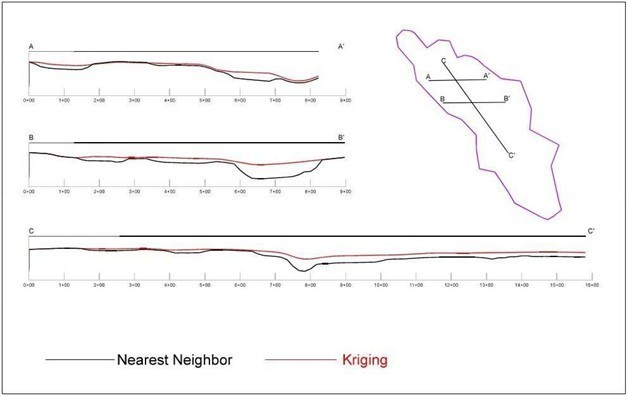

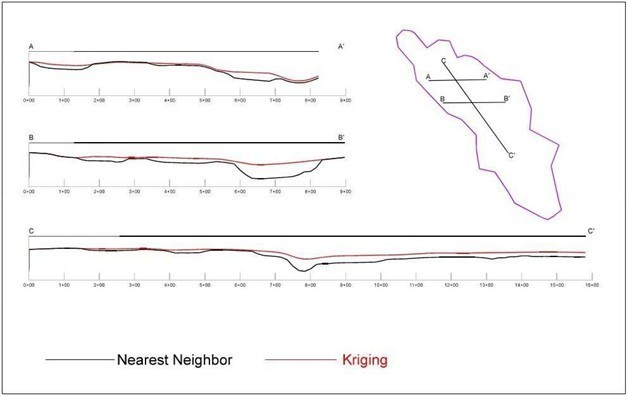

Figure 11.1 Grade Variation Swath | 47 |

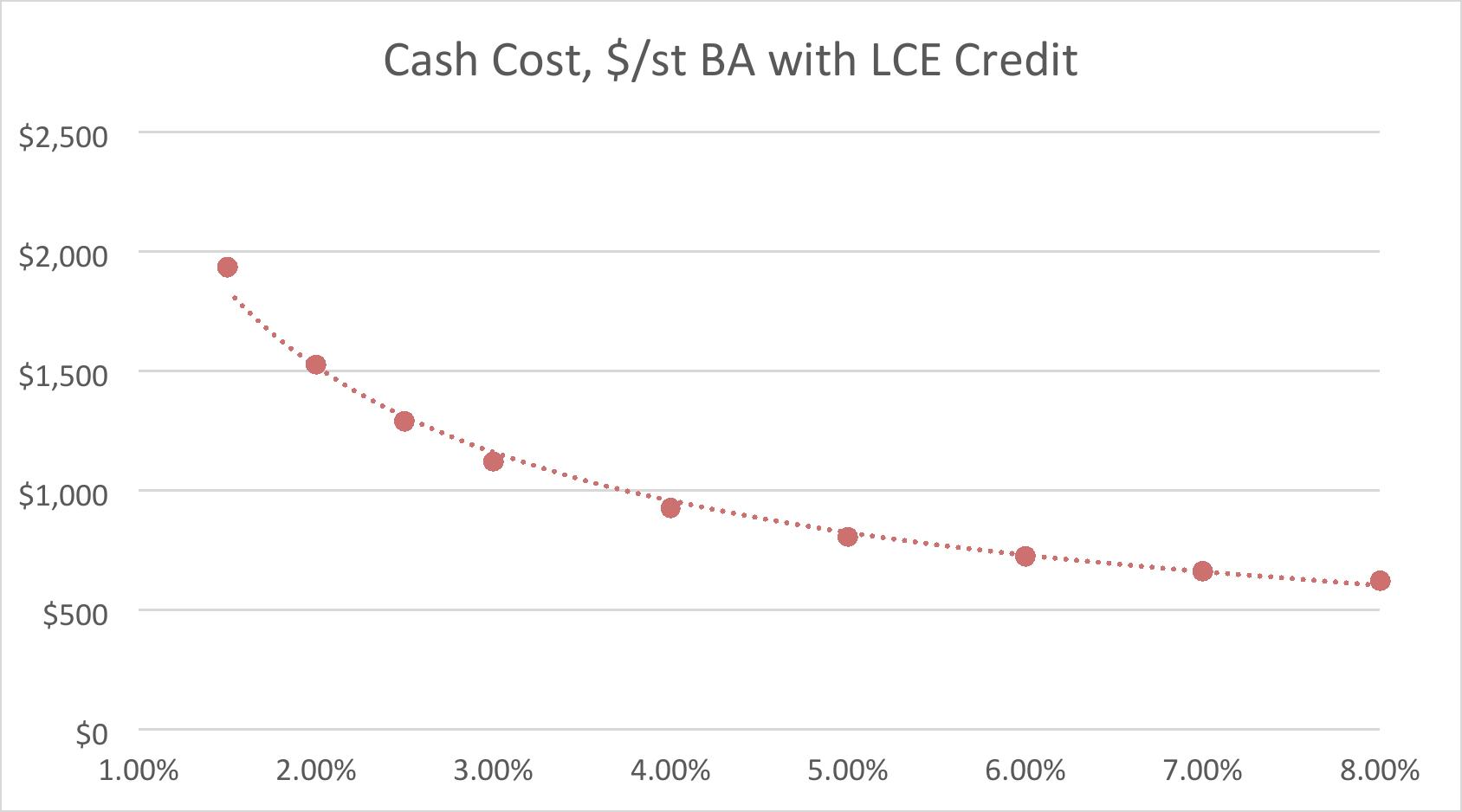

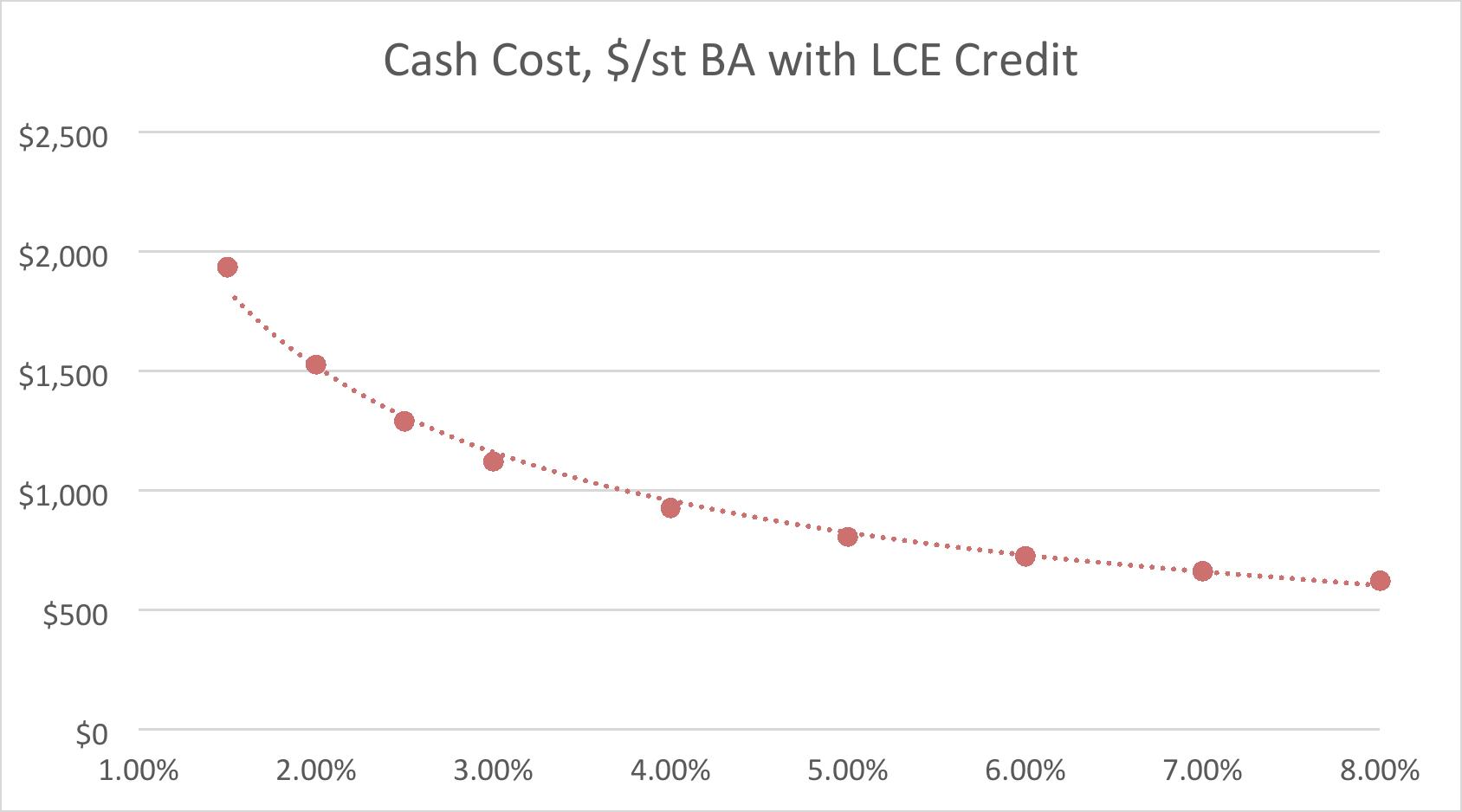

Figure 11.2: Cash cost, $/st of boric acid with LCE credit | 49 |

Figure 13.1 Block 2 Mining Sequence Example | 53 |

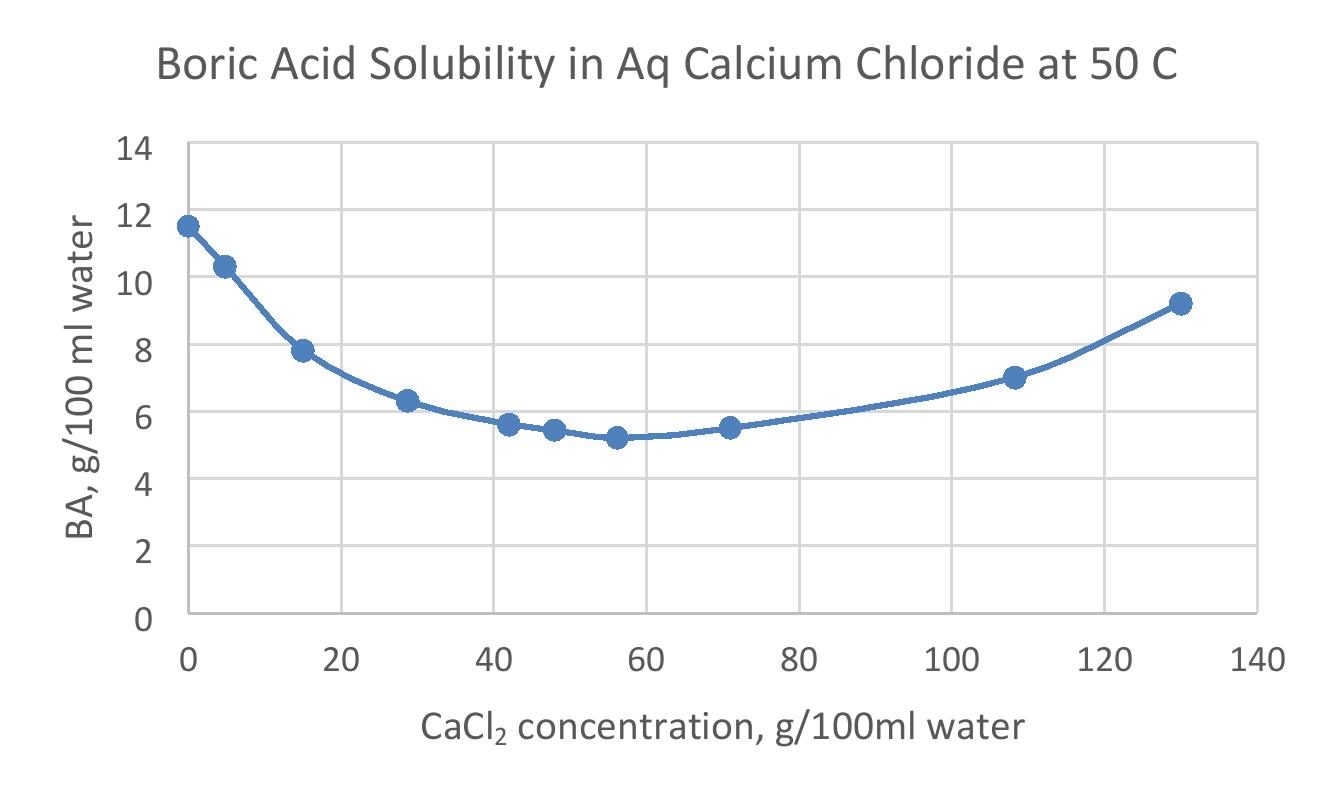

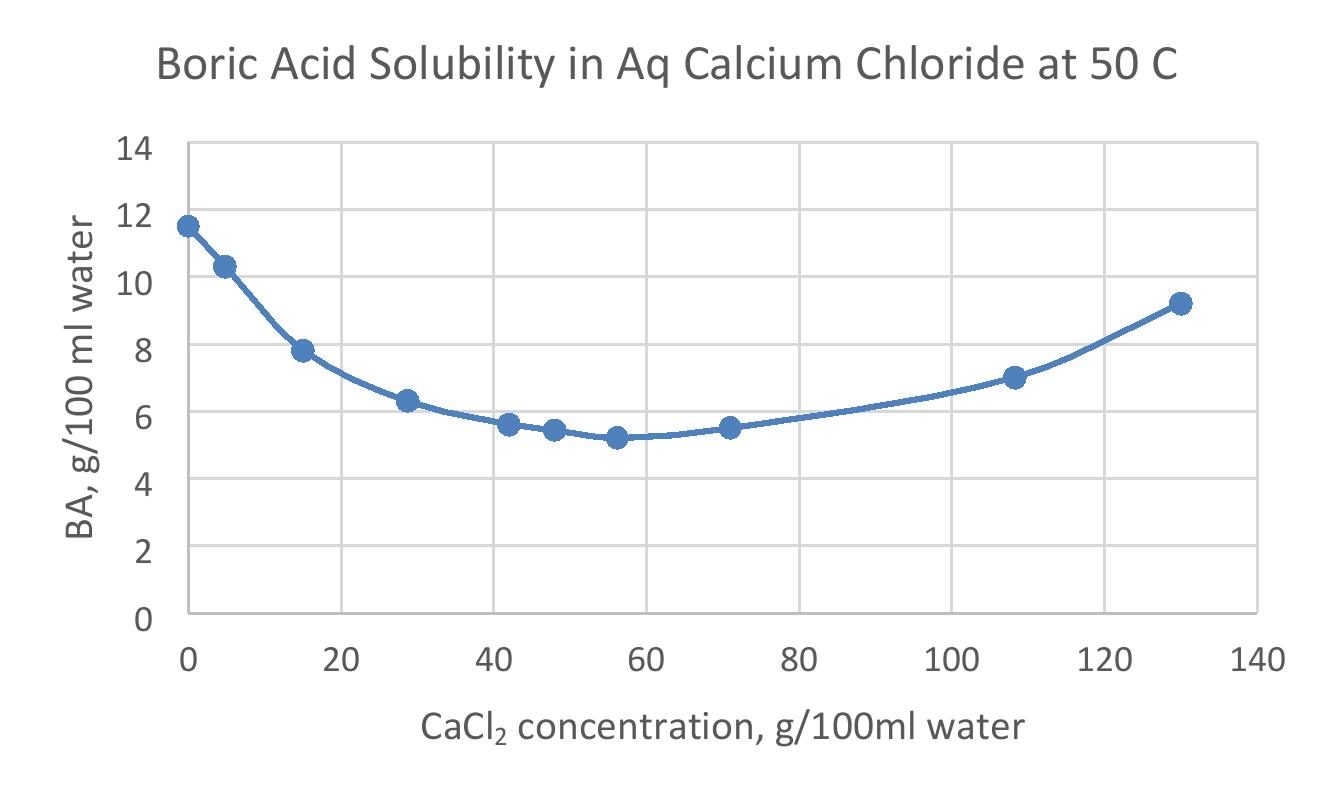

Figure 14.1 Solubility Curve for Boric Acid Crystallizer | 55 |

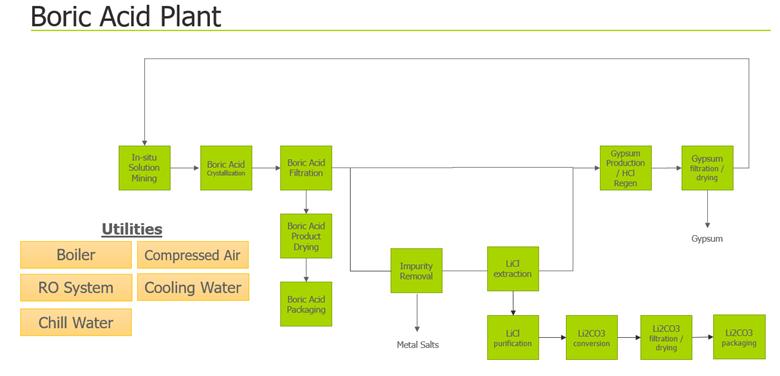

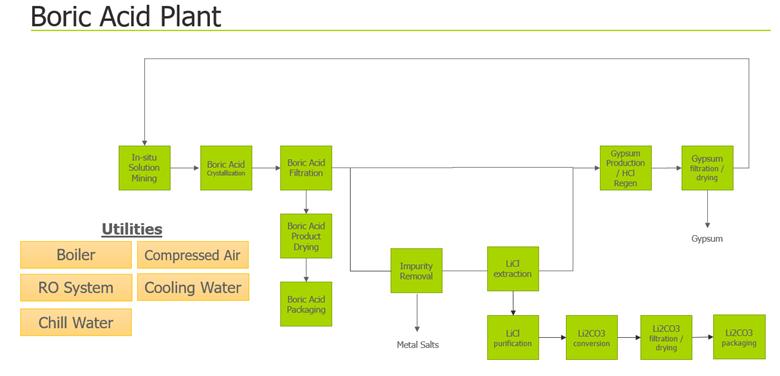

Figure 14.2 Block flow diagram of the Small-Scale Facility | 56 |

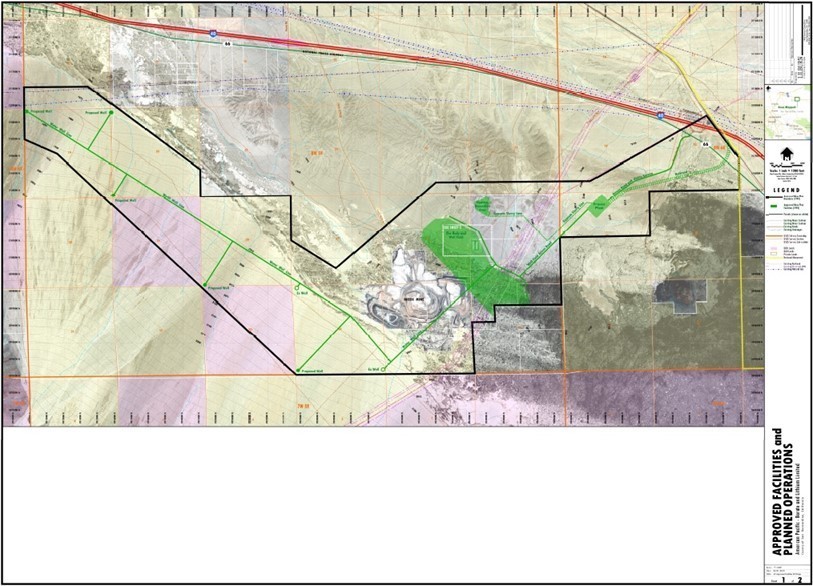

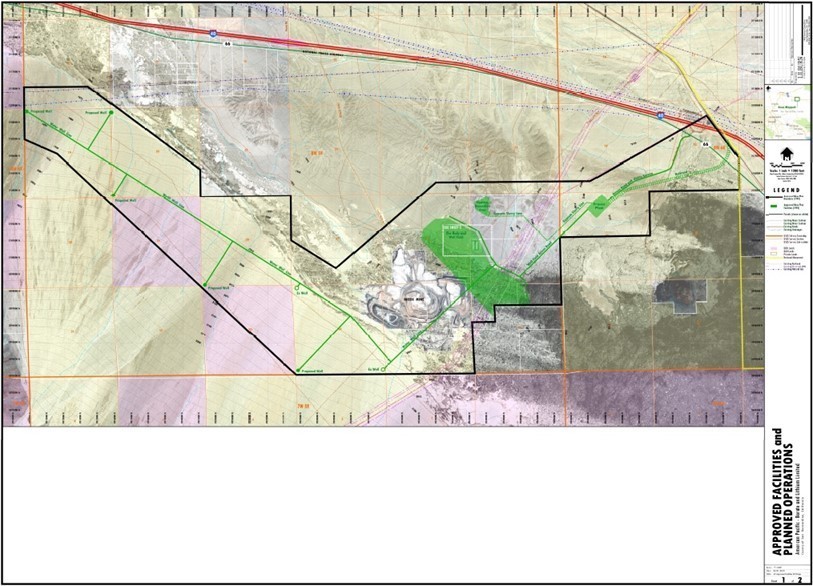

Figure 15.1 Fort Cady Project Infrastructure | 58 |

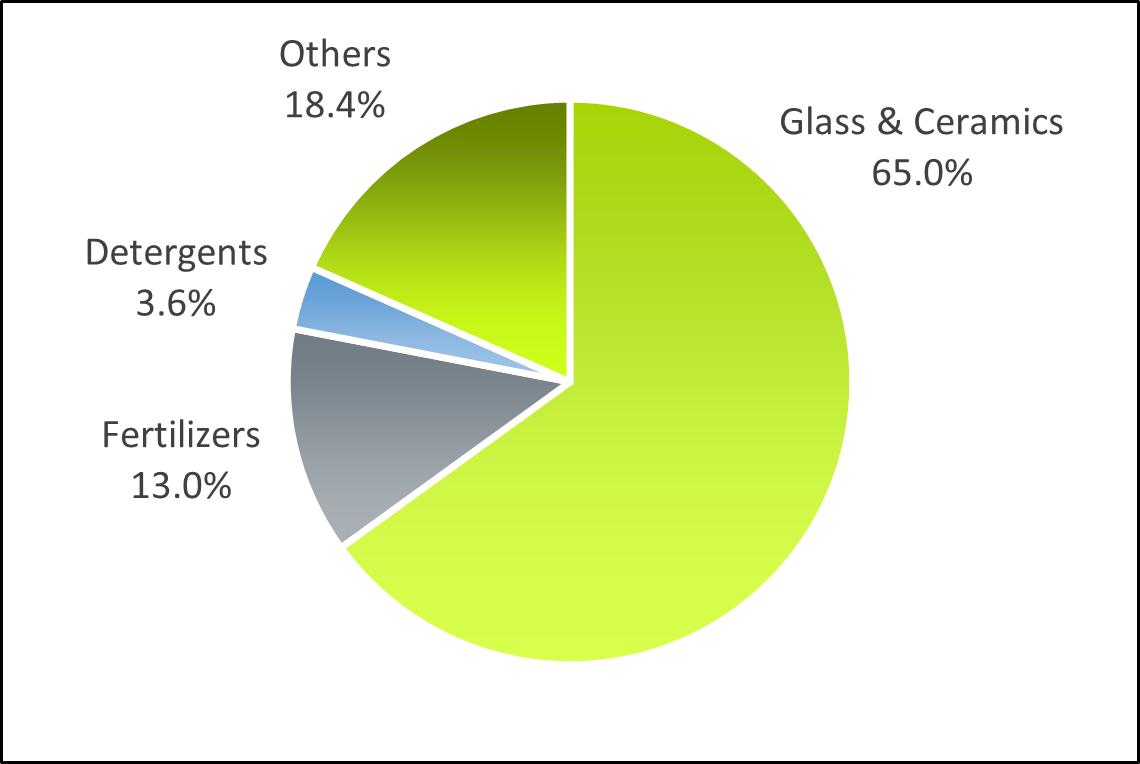

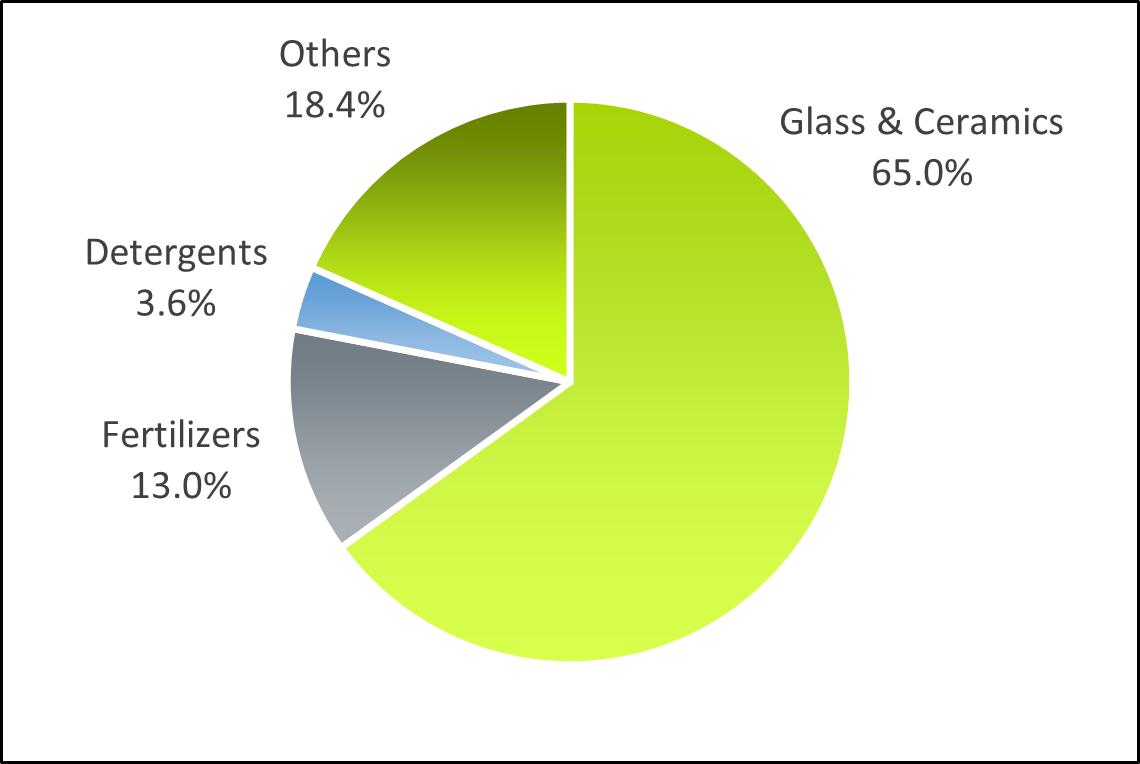

Figure 16.1 2020 Borates Demand by End Use, per GMI | 60 |

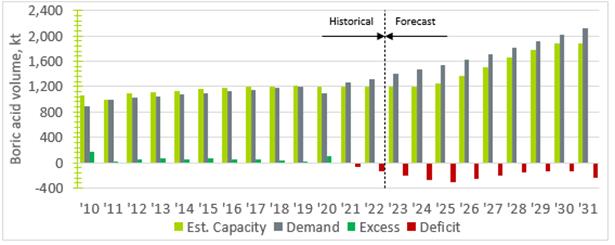

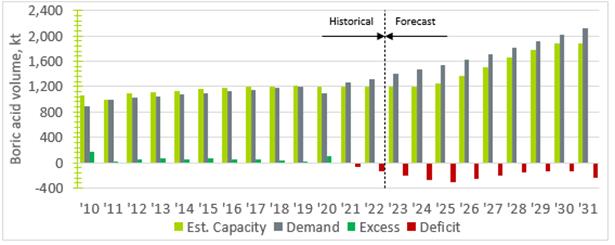

Figure 16.2 Kline projected market capacity vs demand, thousands of tonnes (kt) | 62 |

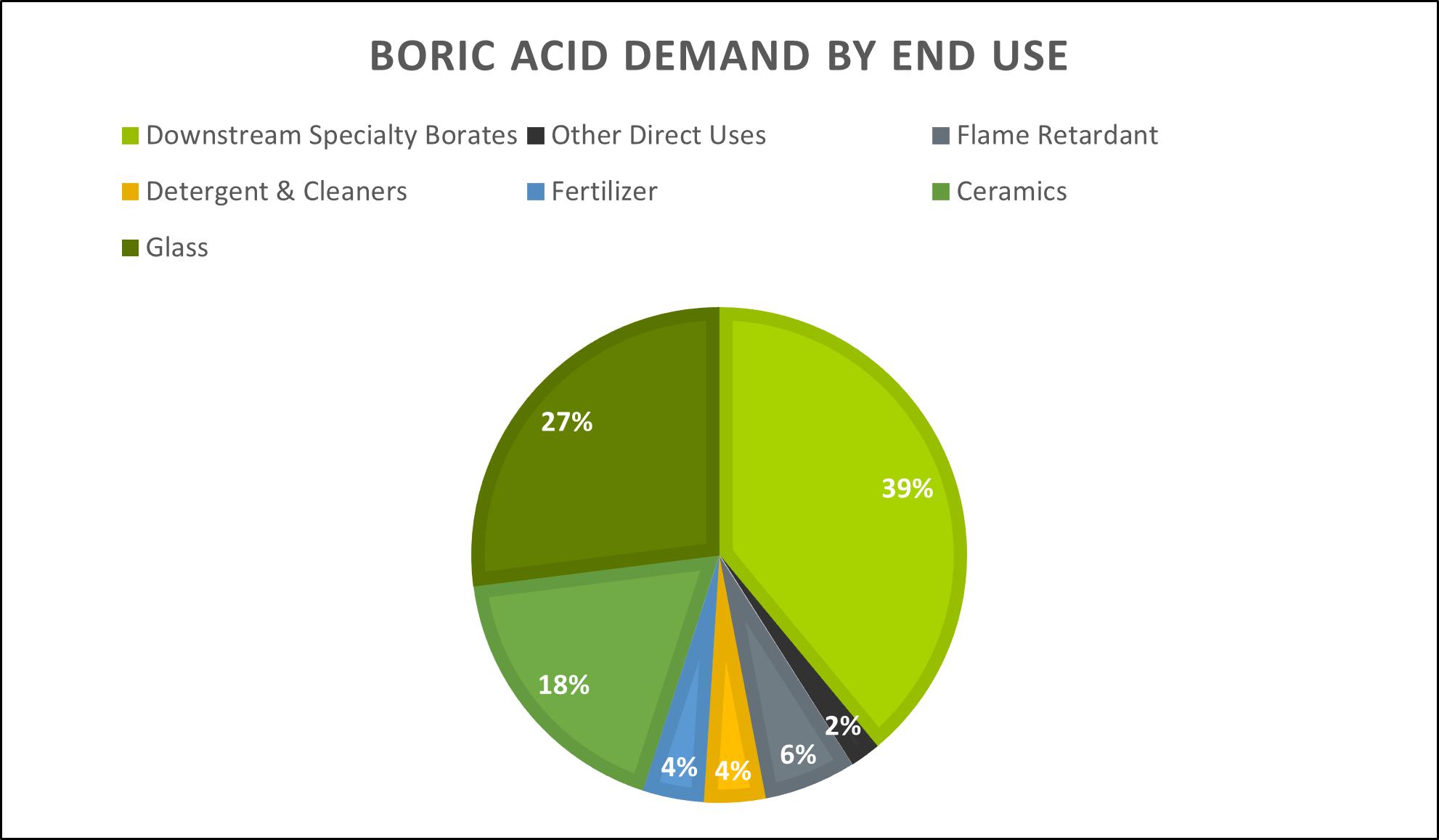

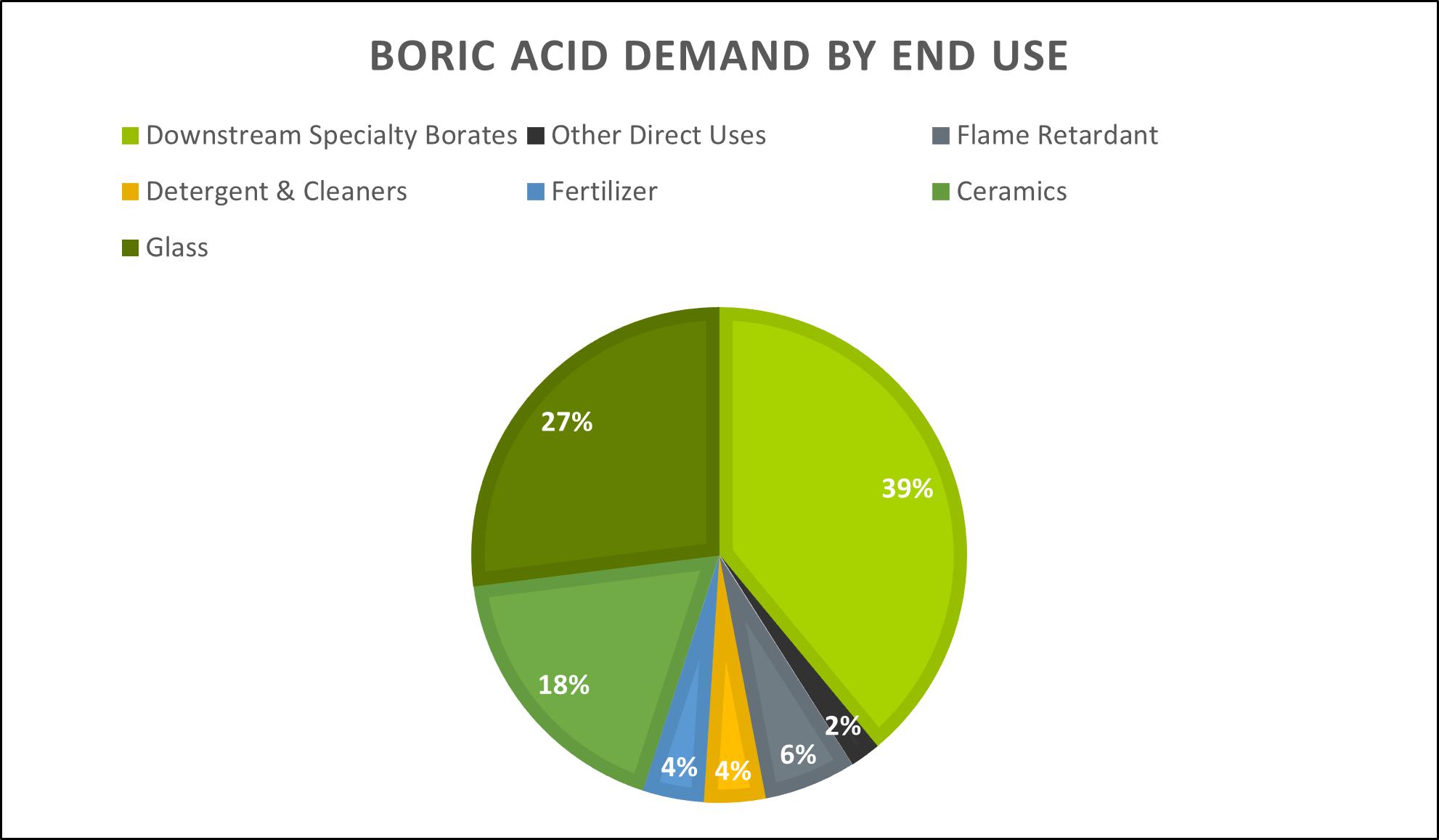

Figure 16.3 2021 Boric Acid Demand by End Use, per Kline | 63 |

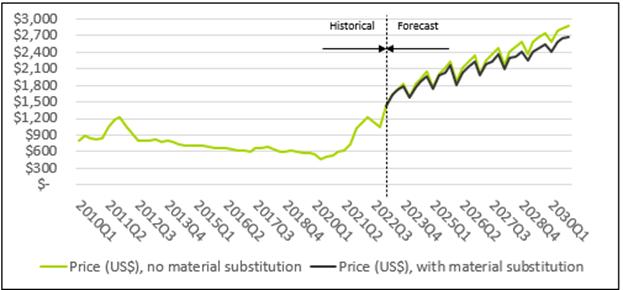

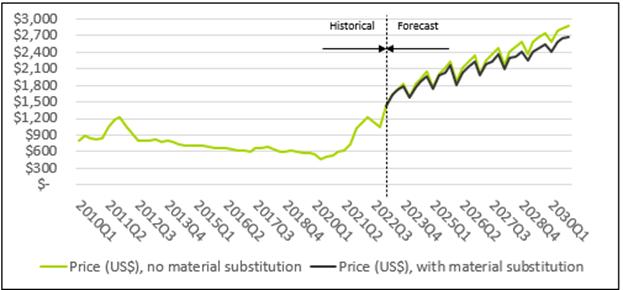

Figure 16.4 Boric Acid Pricing, per Kline | 64 |

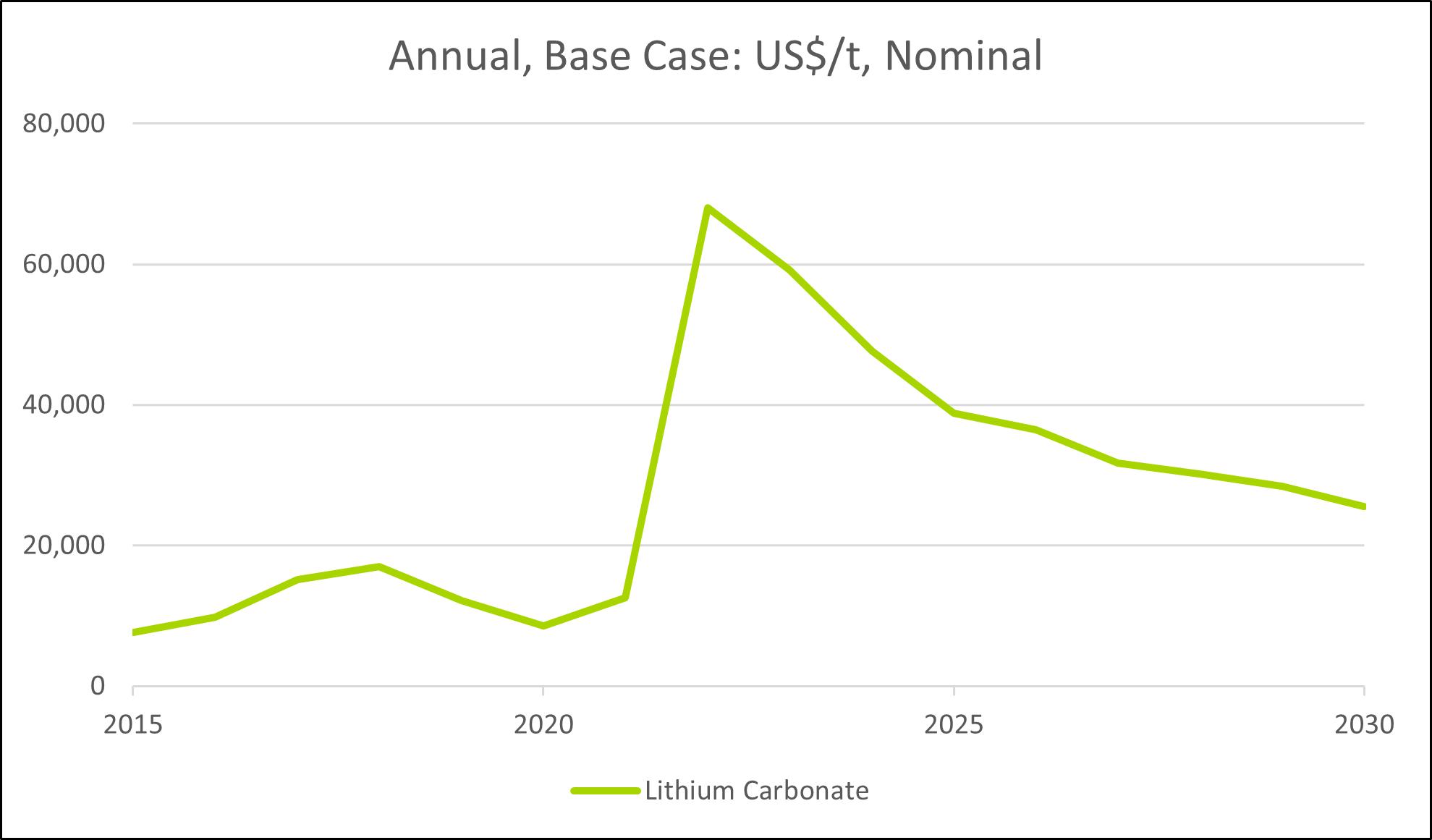

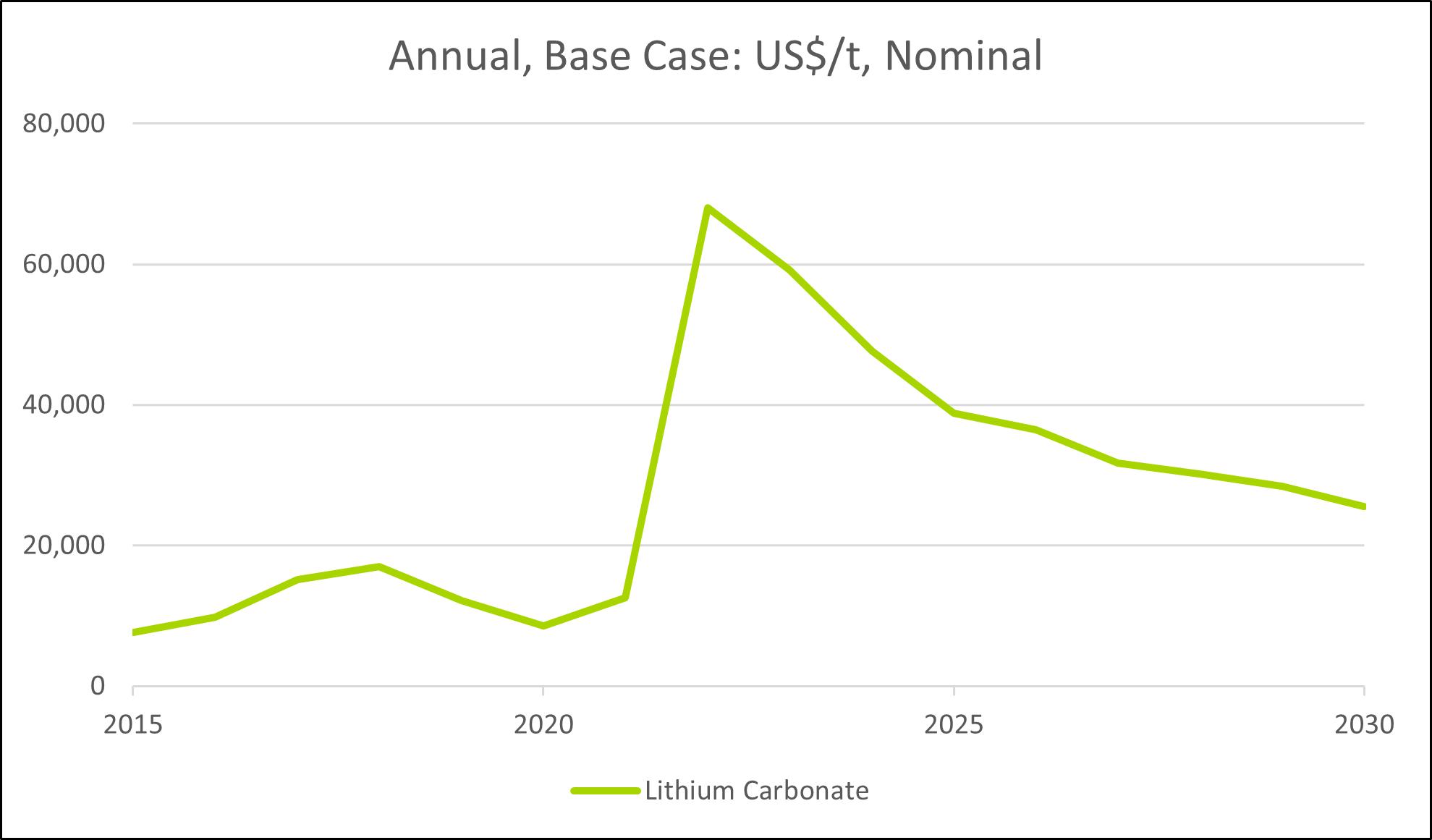

Figure 16.5 BMI Annual Base Case: US$/tonne, Nominal BMI | 65 |

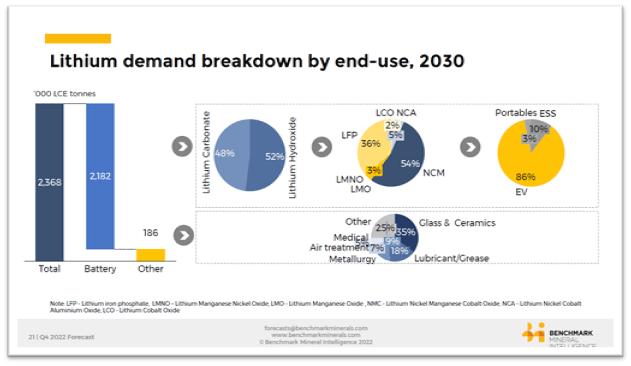

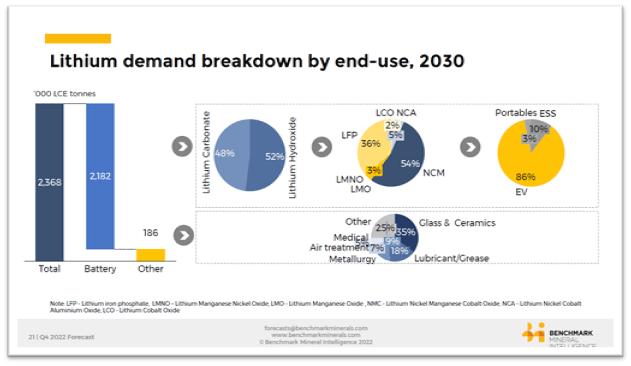

Figure 16.6 Global demand for lithium, LCE basis, per BMI | 66 |

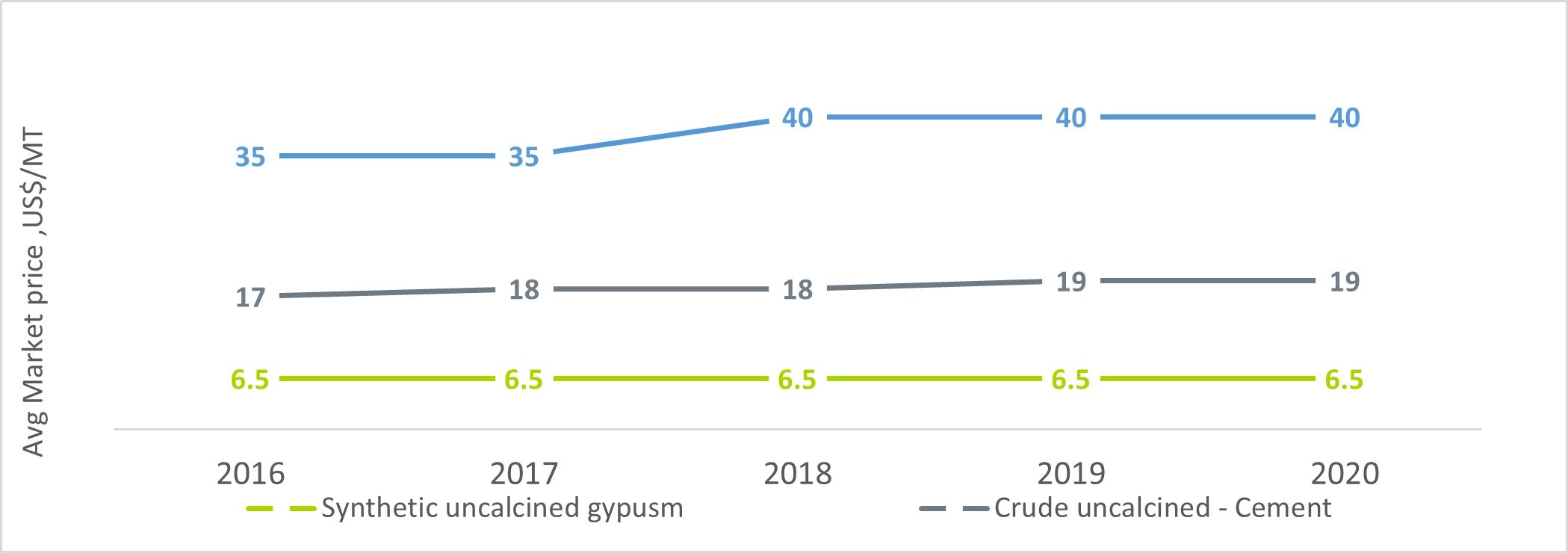

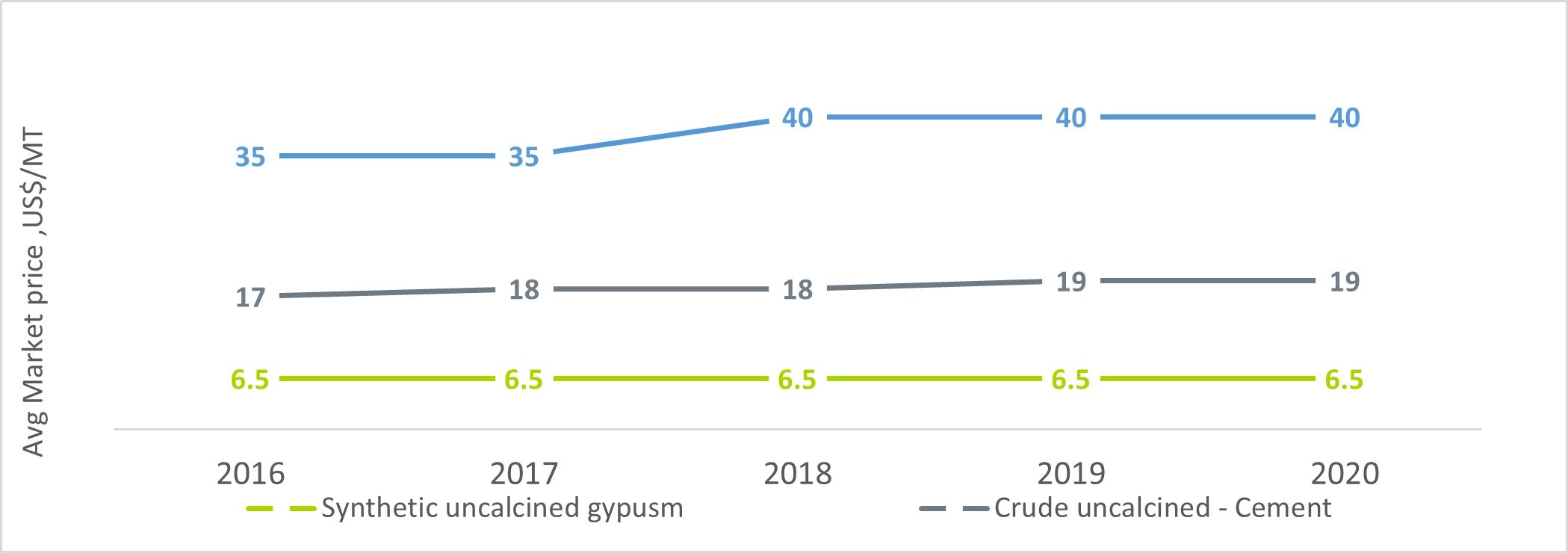

Figure 16.7 Average market price for uncalcined gypsum by grade and application, per Kline | 67 |

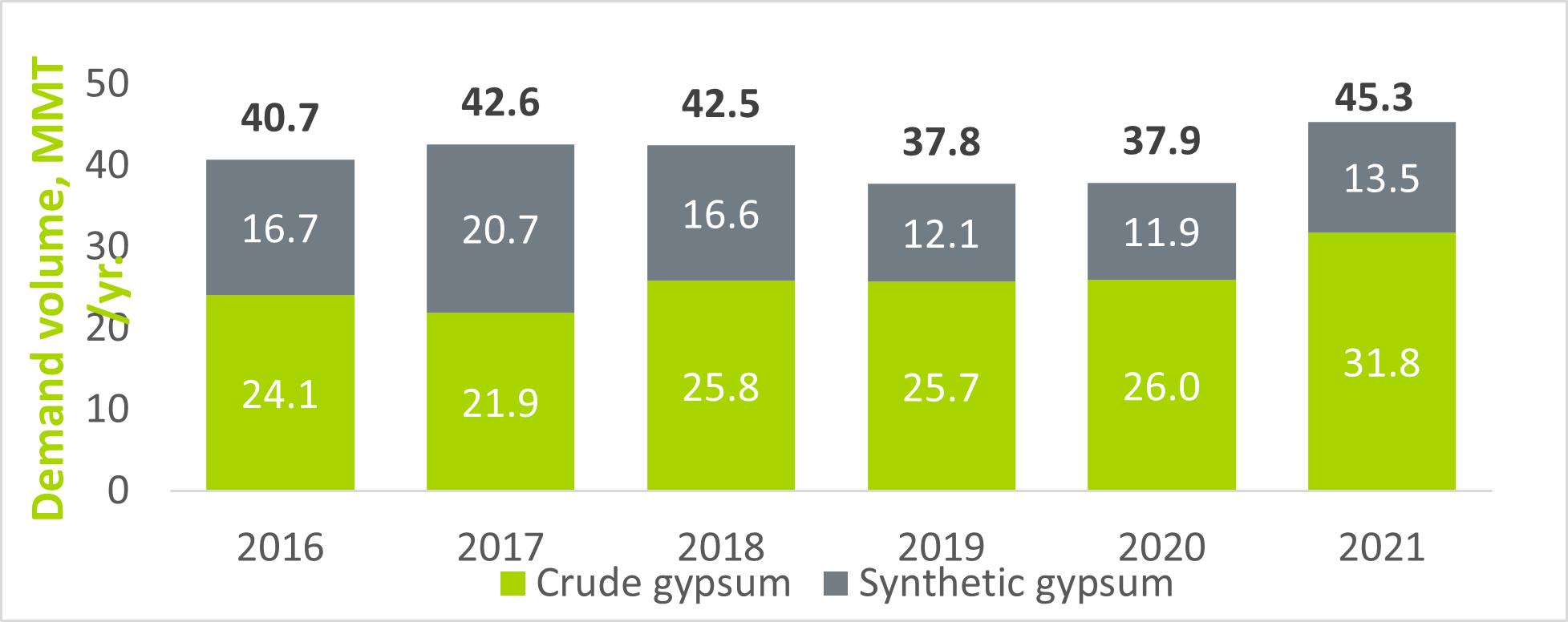

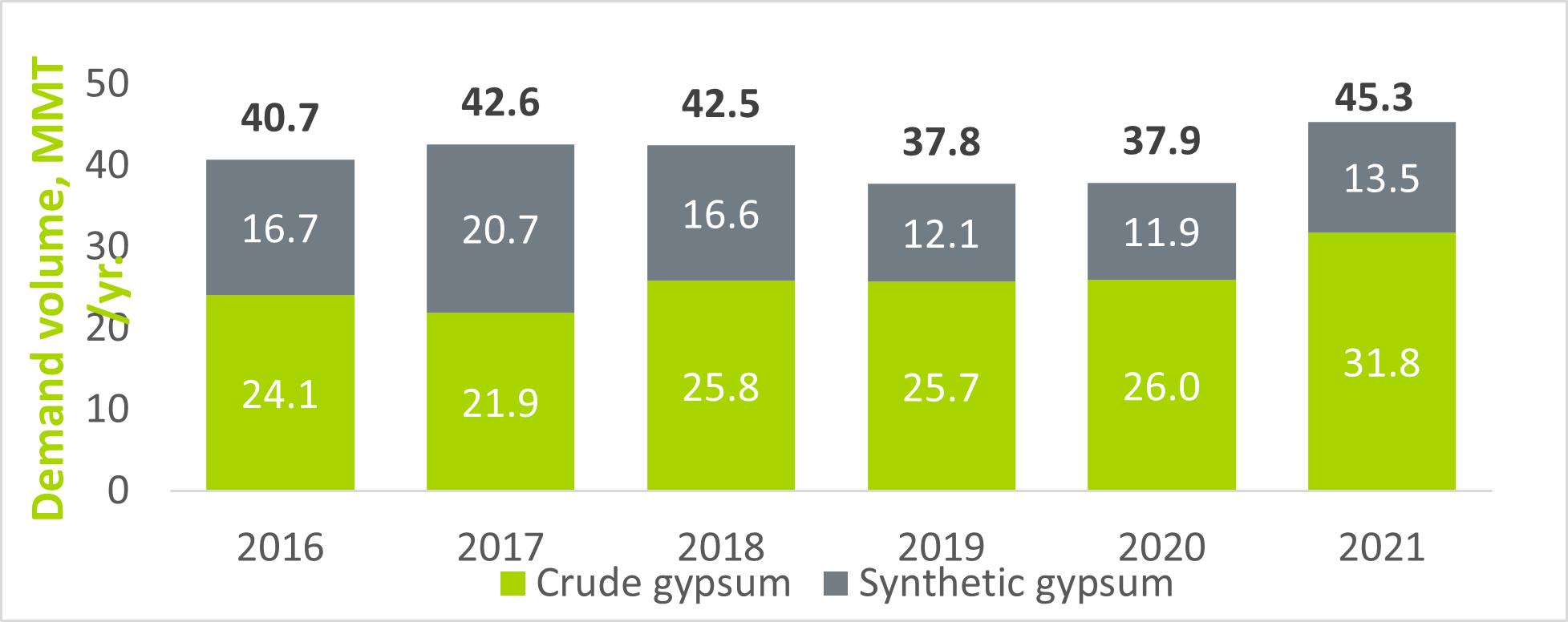

Figure 16.8 Gypsum USA Demand by Source, Million Metric Tonnes 2016-21, per Kline | 68 |

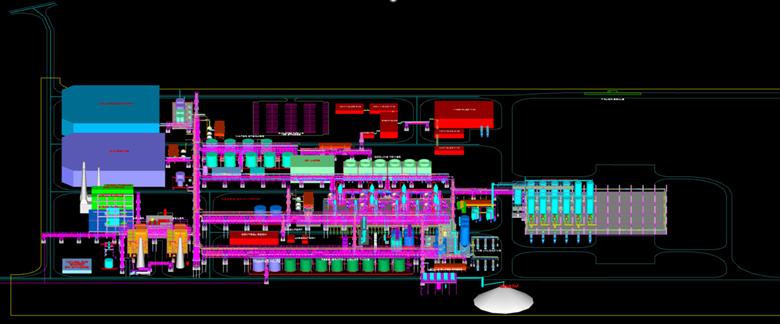

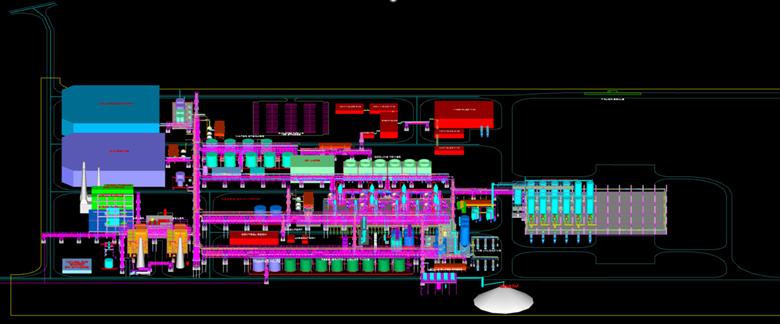

Figure 18.1 3D model for Phase 1 and 2 270kstpa Boric Acid | 72 |

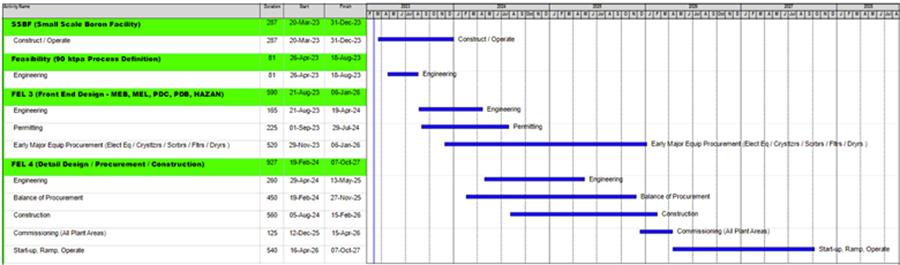

Figure 18.2 Engineering and Construction Schedule - Phase 1 | 73 |

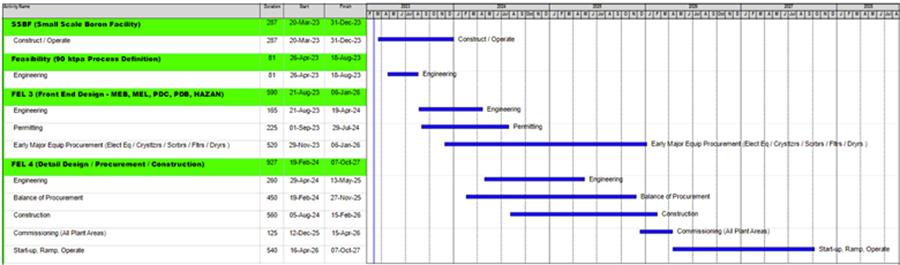

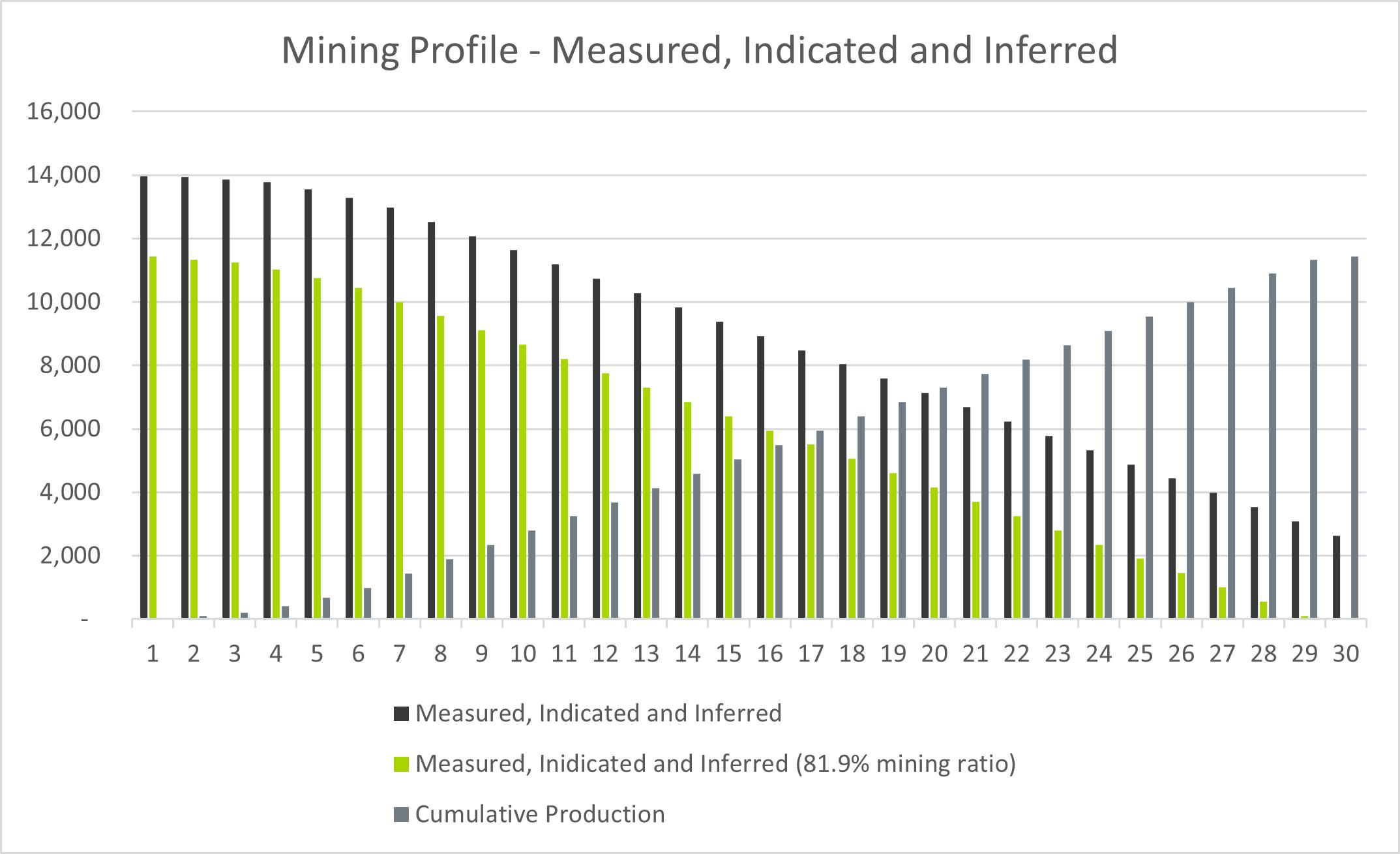

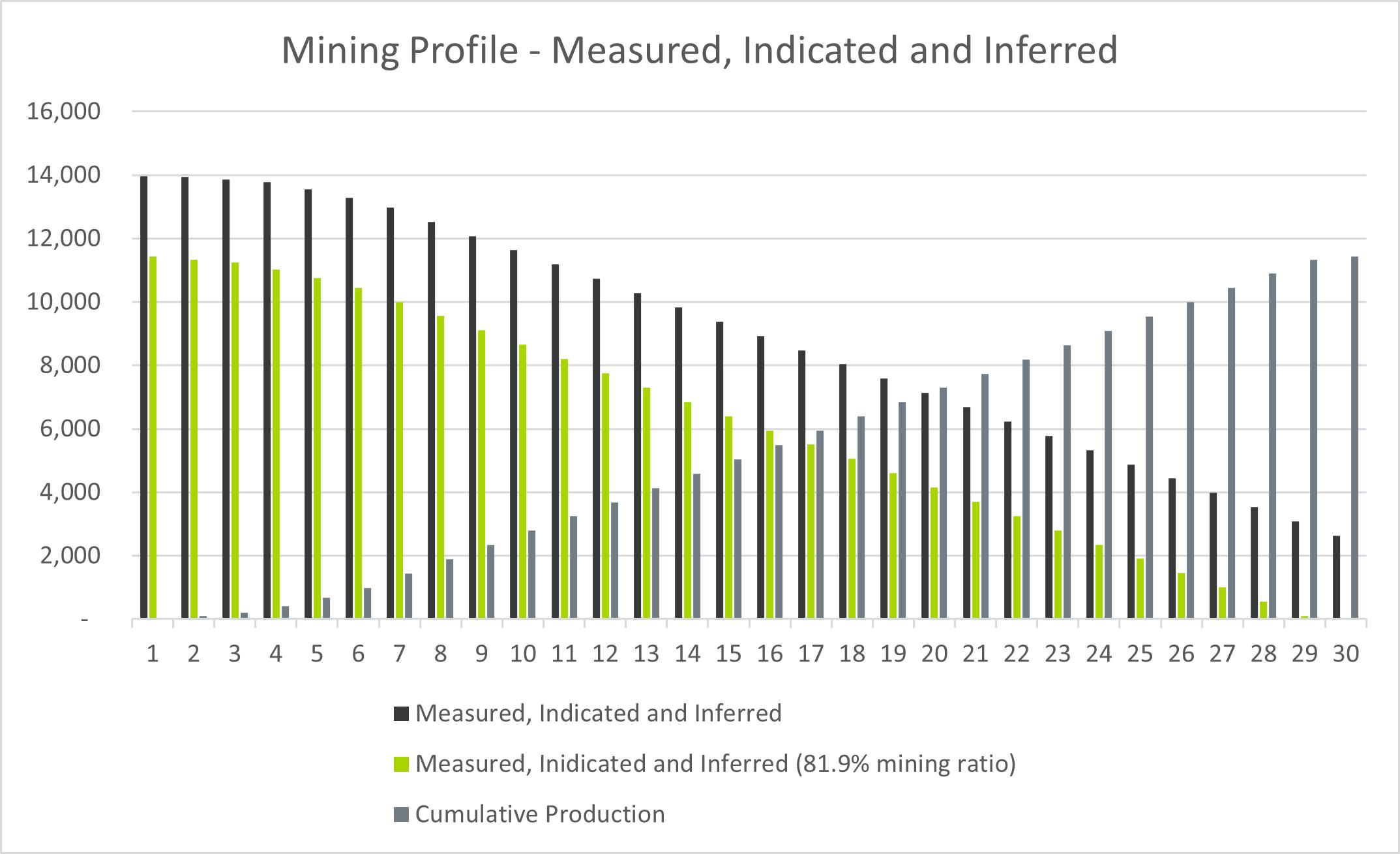

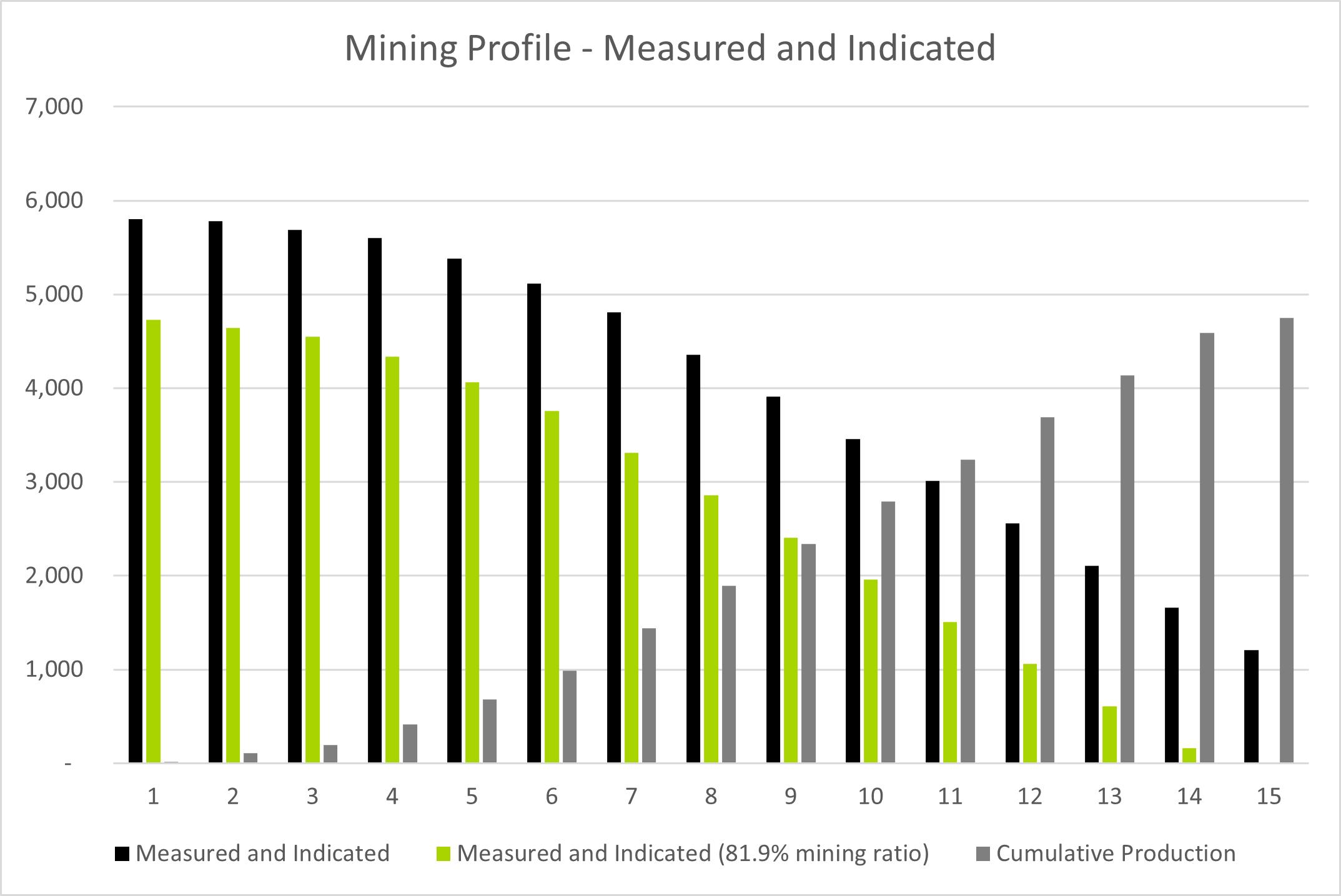

Figure 19.1 Resource Extraction Profile | 79 |

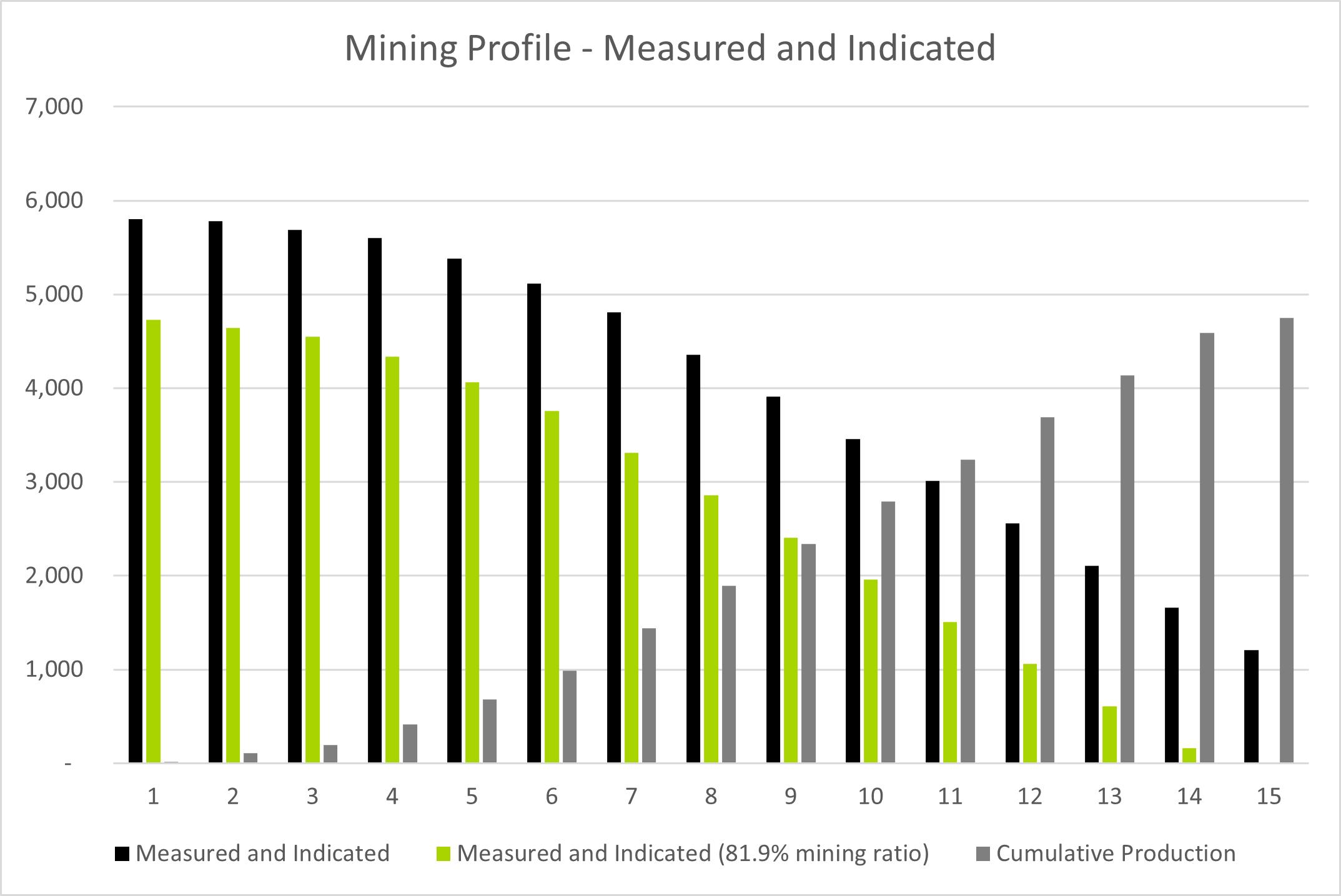

Figure 19.2 Resource Extraction Profile – M & I Only | 80 |

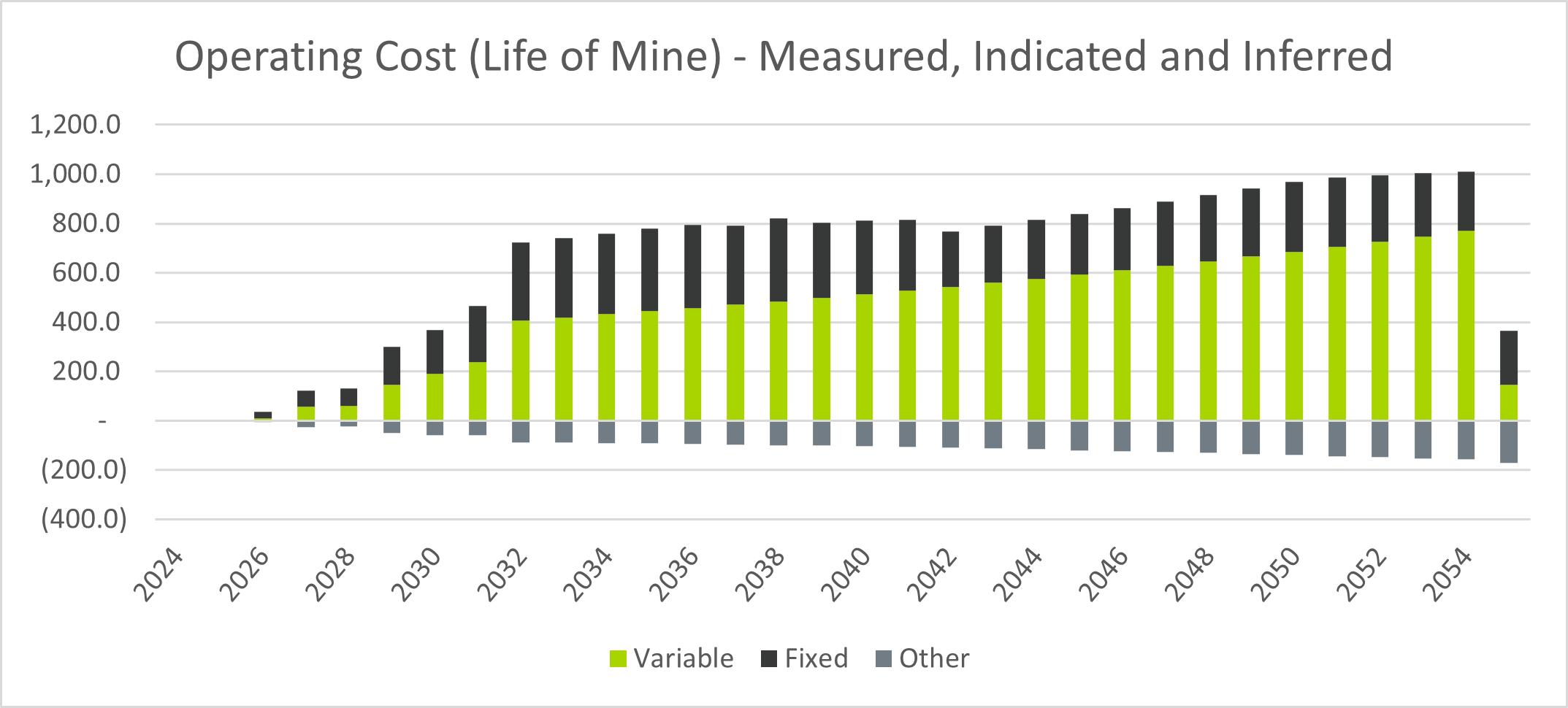

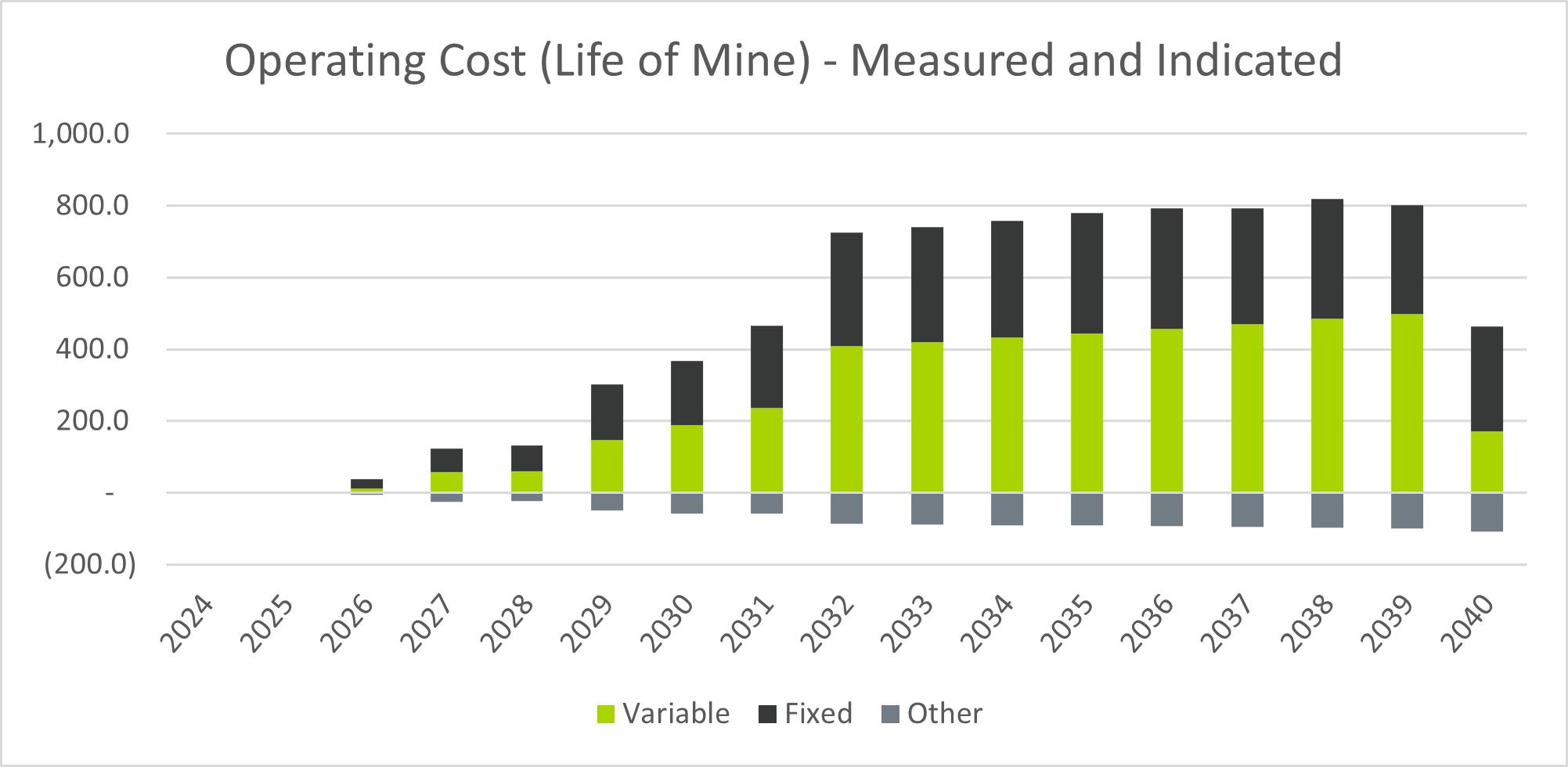

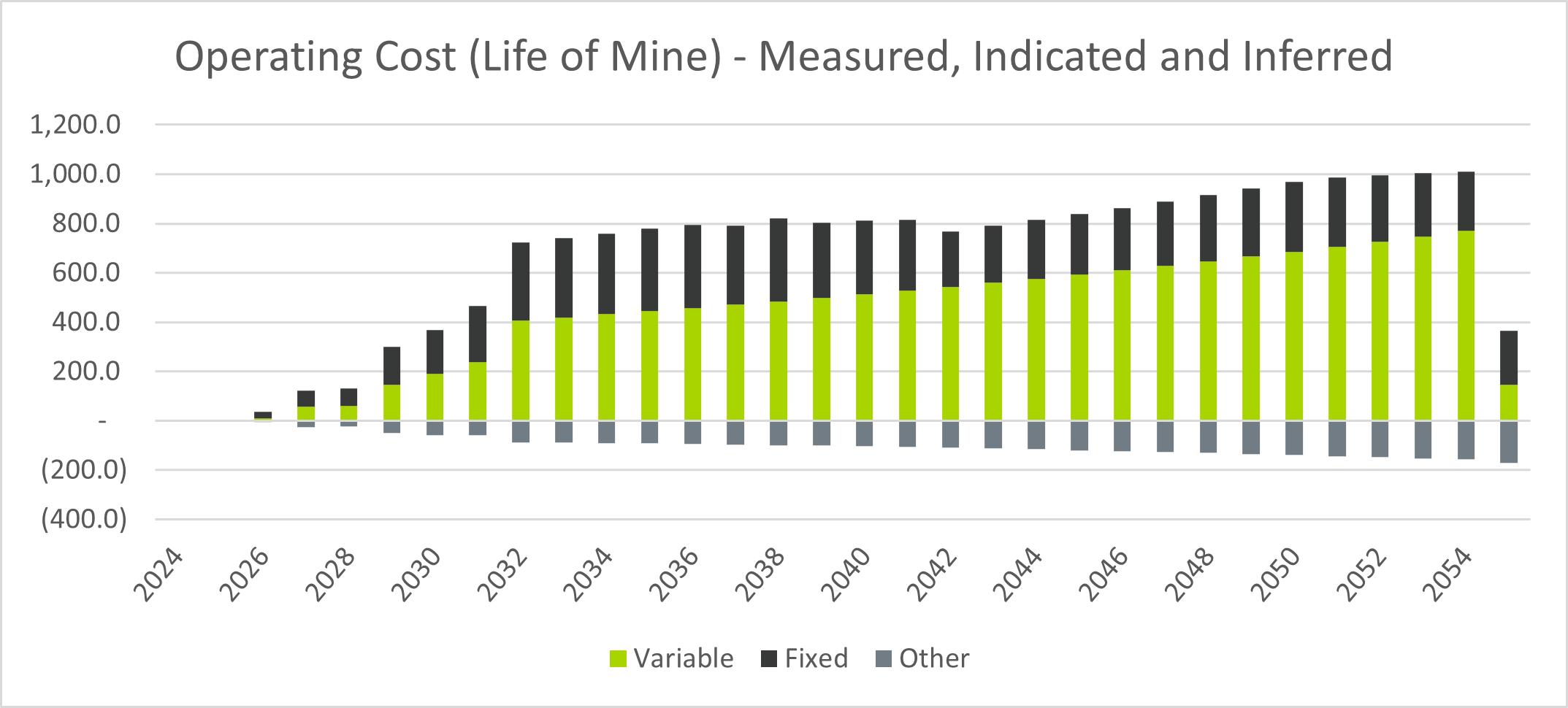

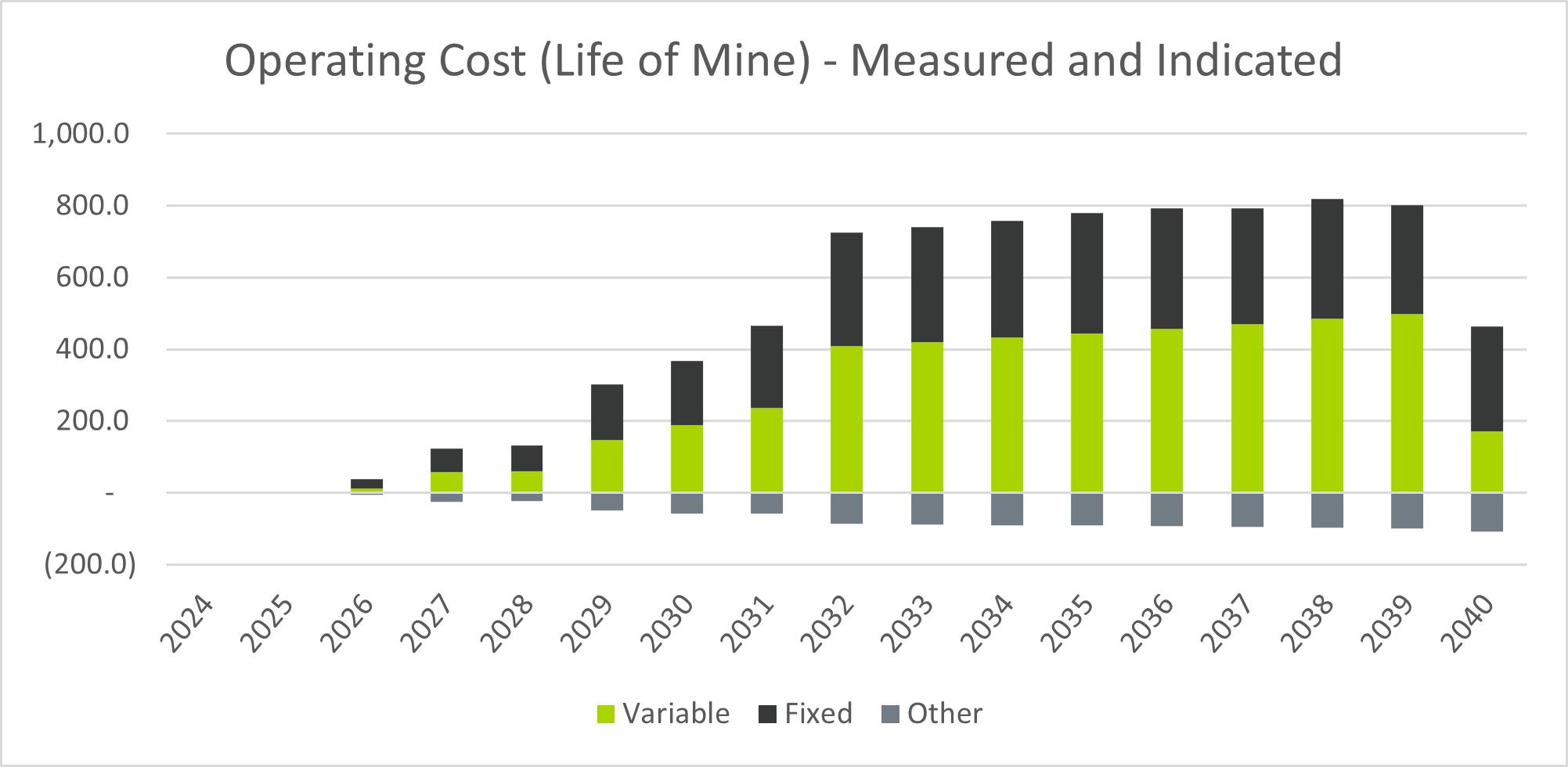

Figure 19.3 Operating costs over the life of the mine | 81 |

Figure 19.4 Operating costs over the life of the mine - M & I Only | 81 |

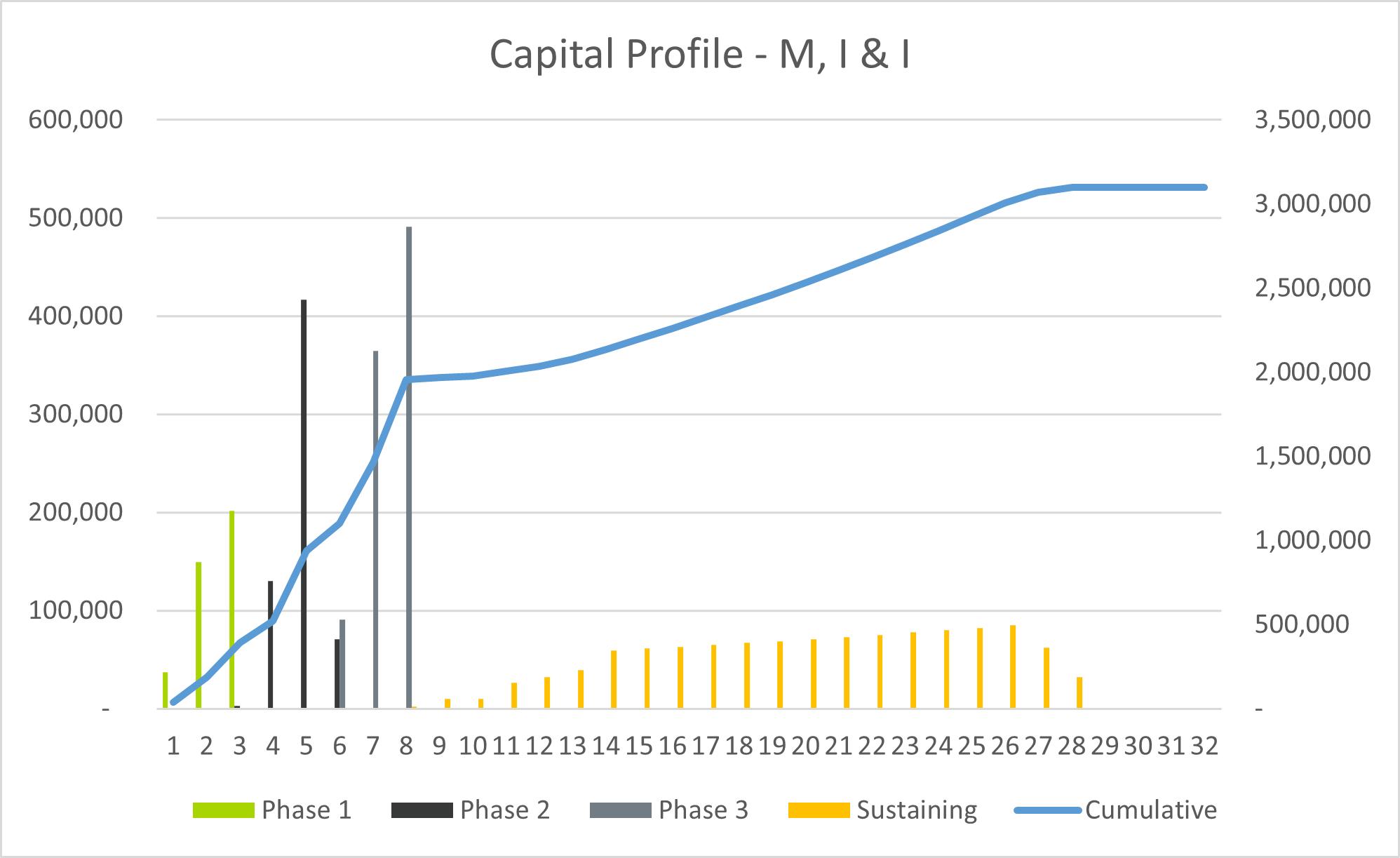

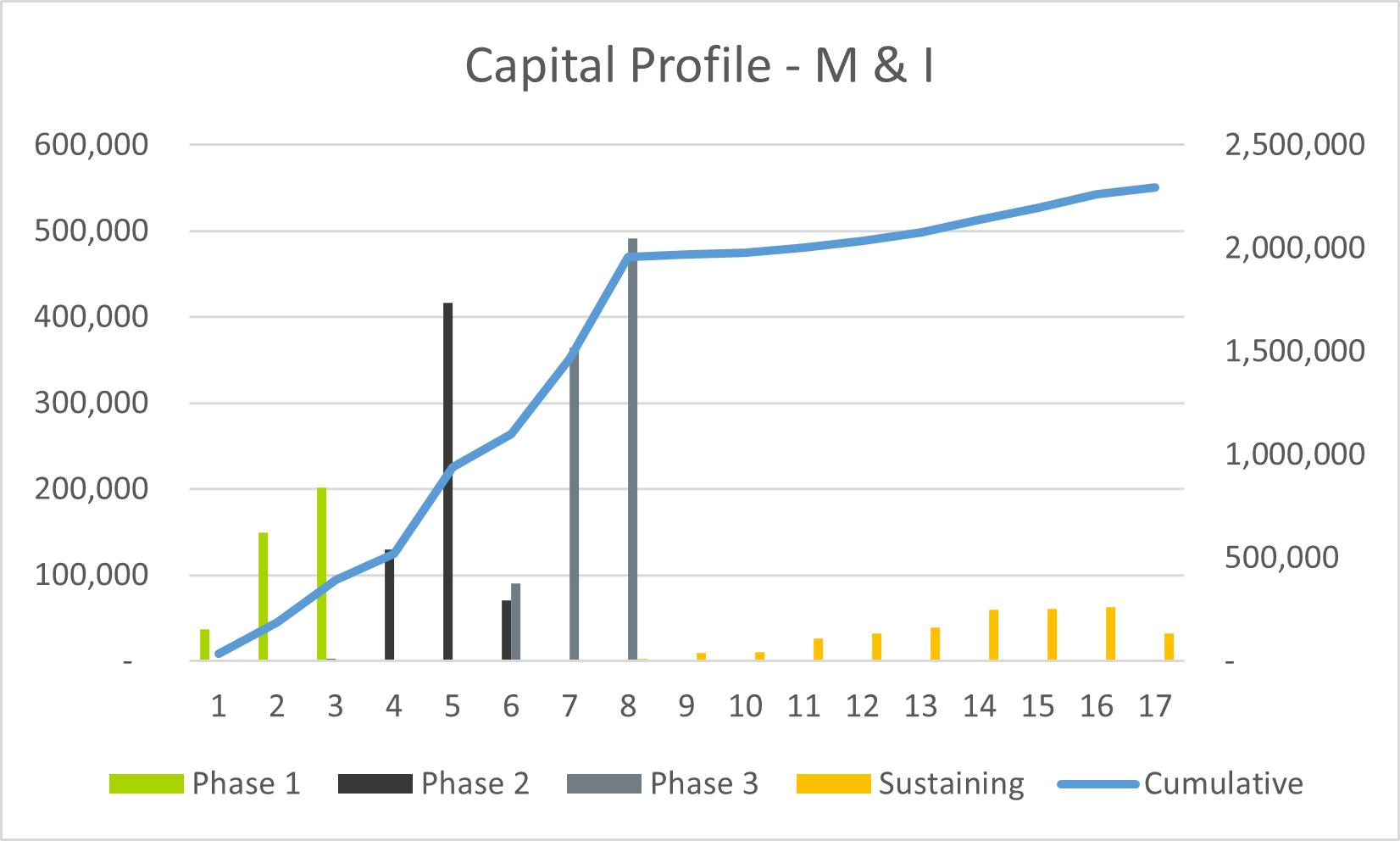

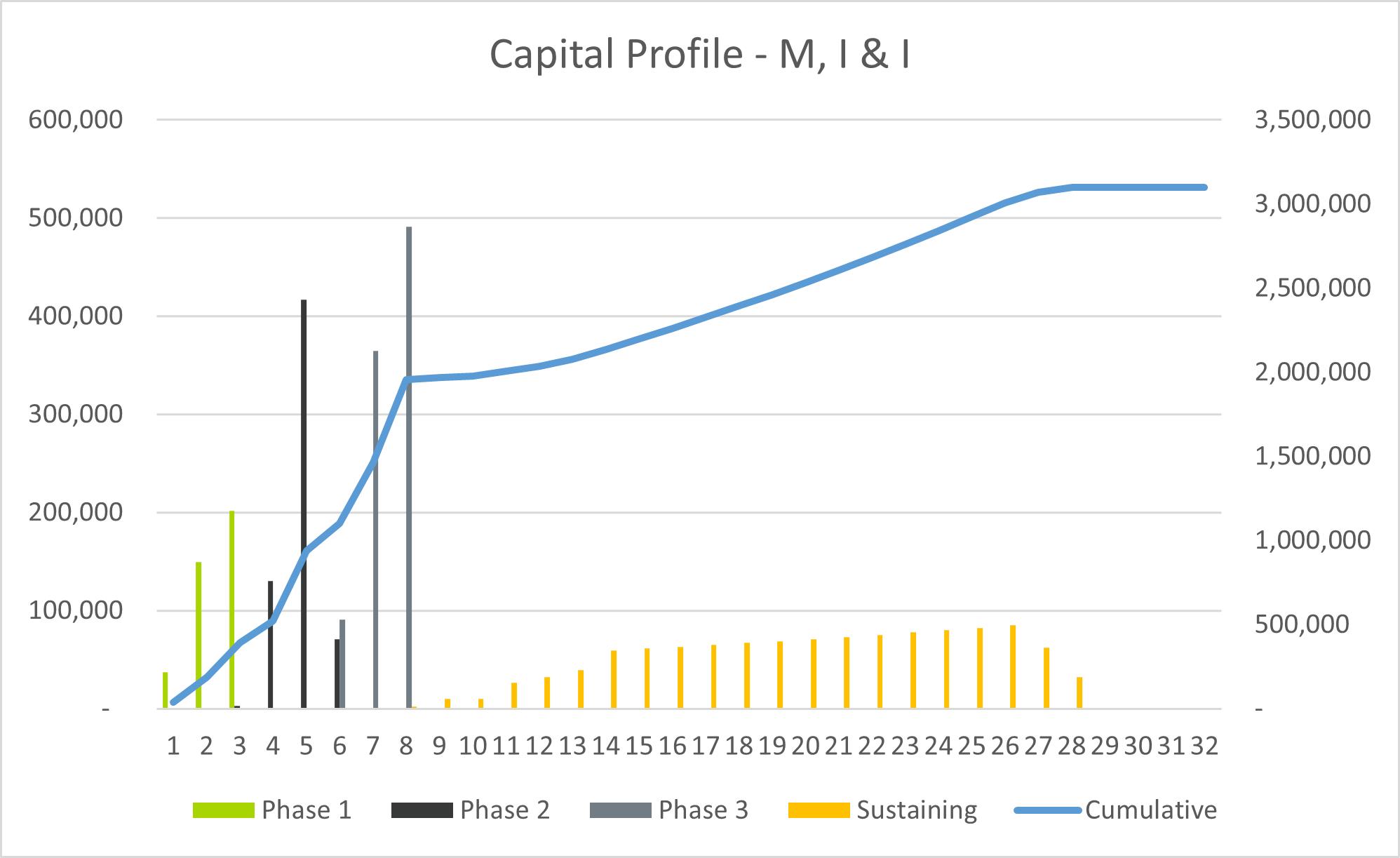

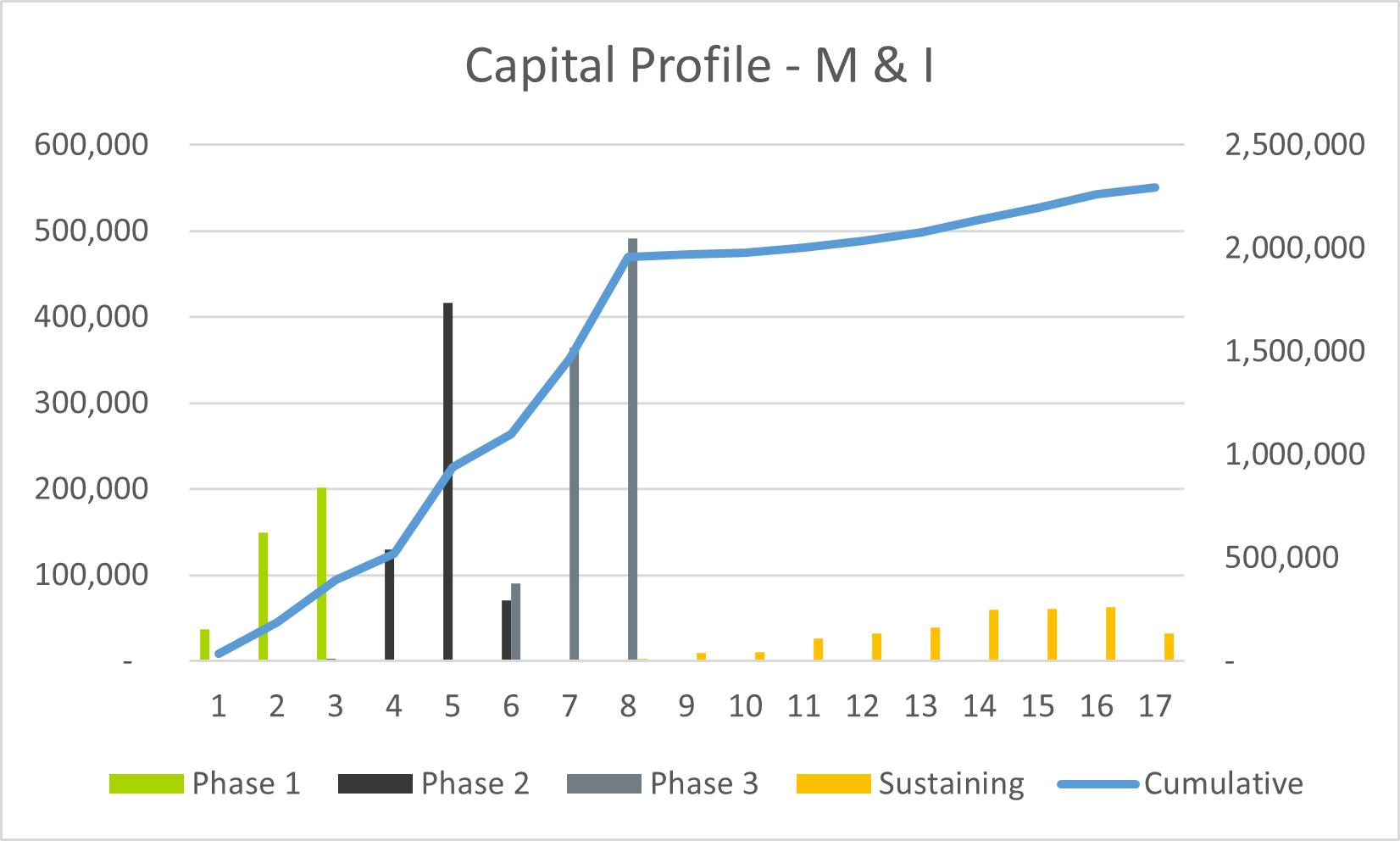

Figure 19.5 Capital profile of the mine | 84 |

Figure 19.6 Capital profile of the mine - M & I only | 84 |

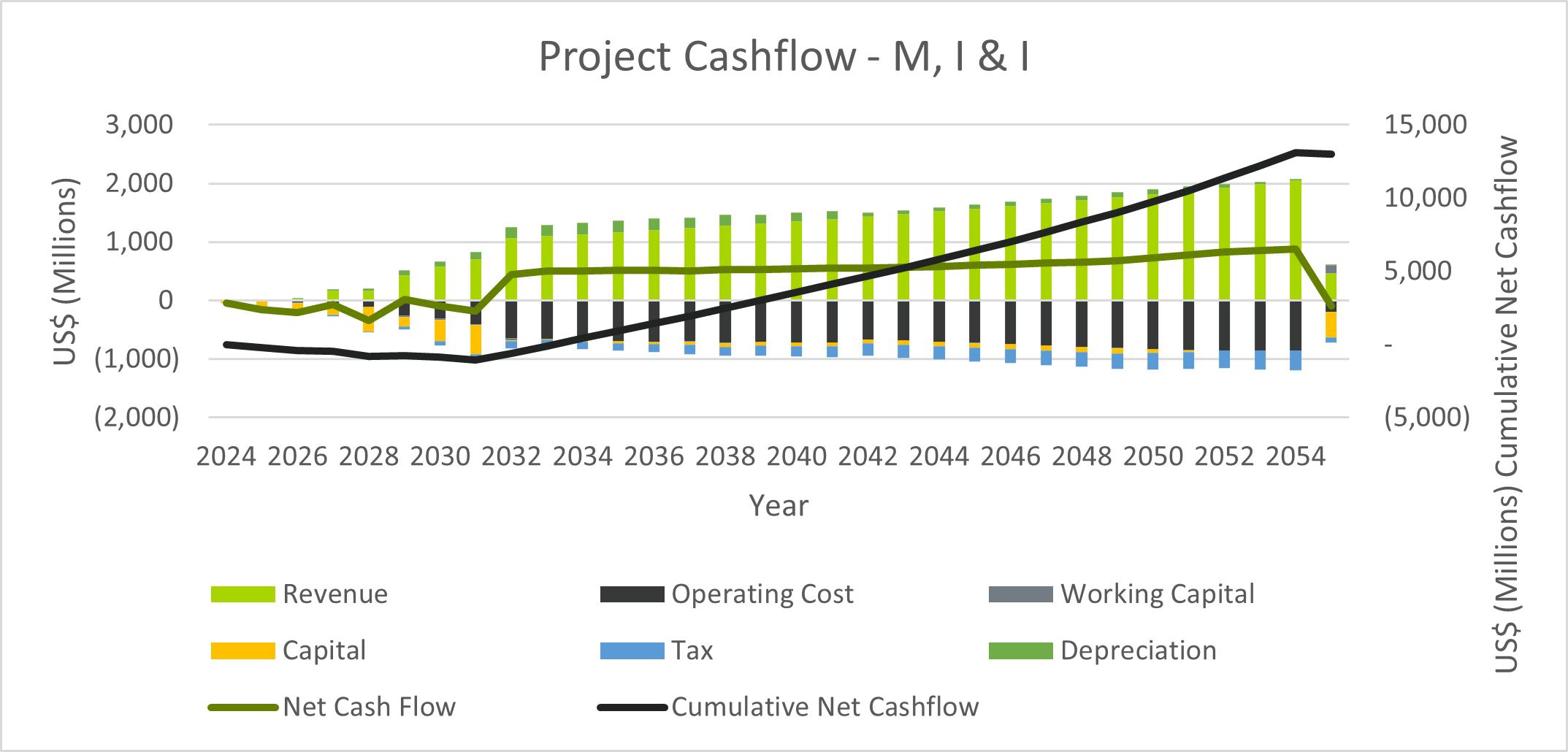

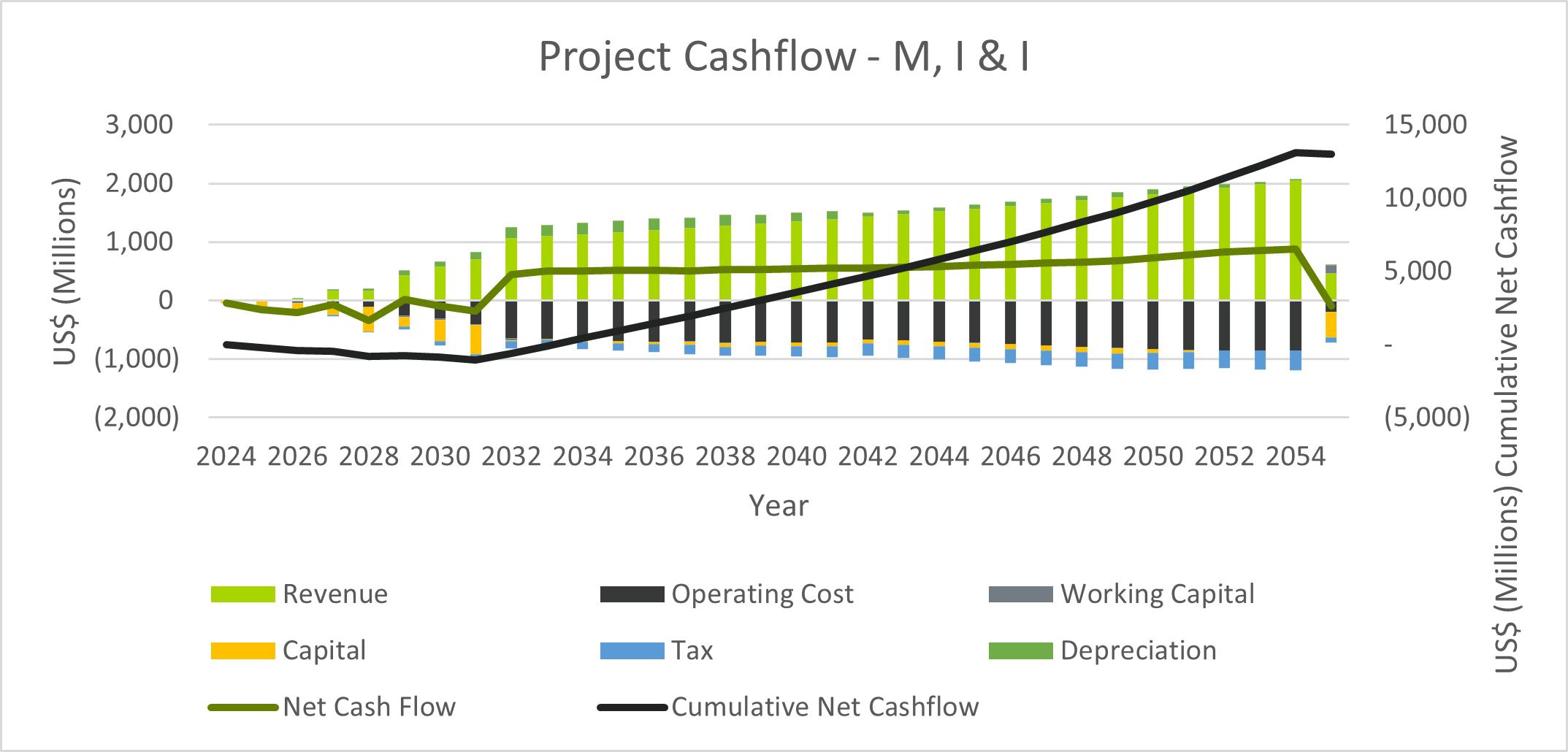

Figure 19.7 Cash flow projection | 85 |

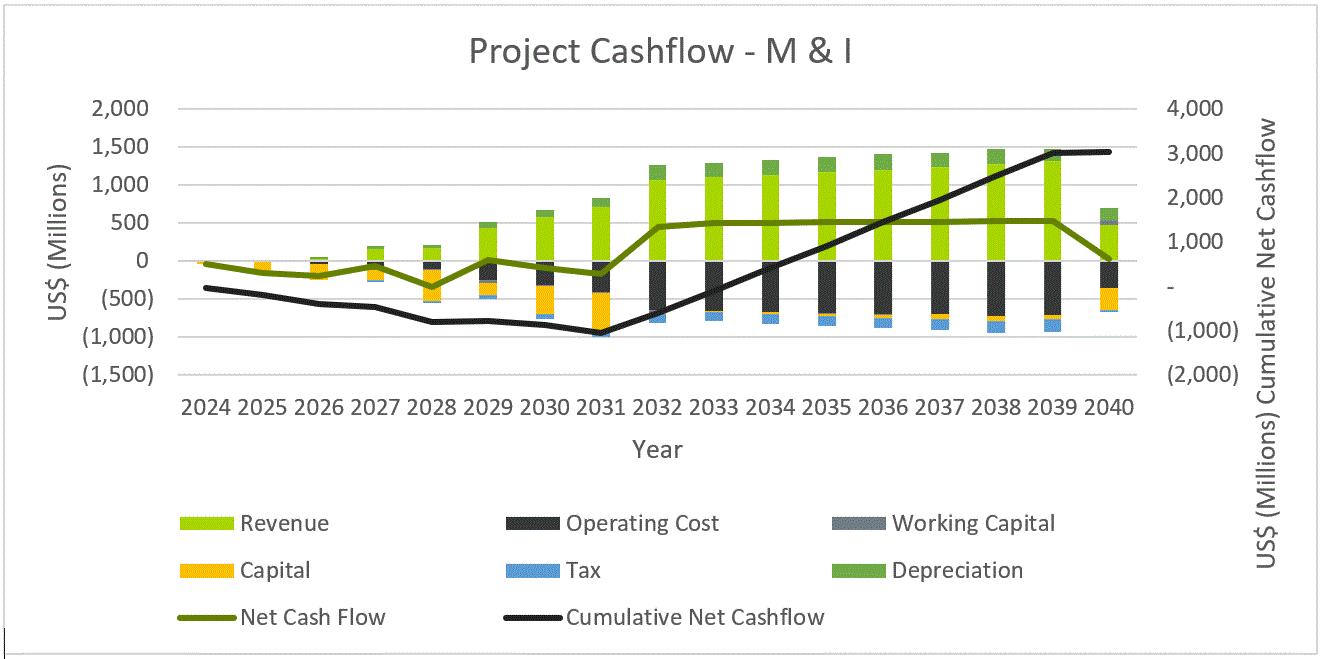

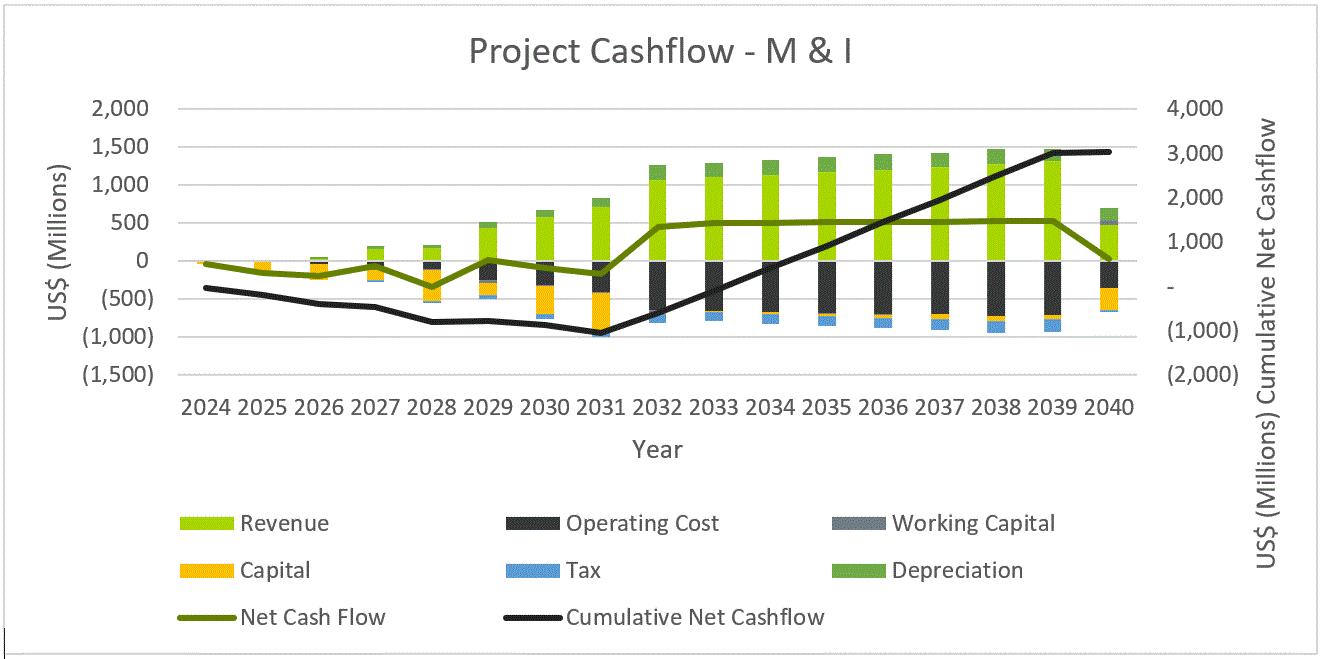

Figure 19.8 Cash flow projection - M & I only | 85 |

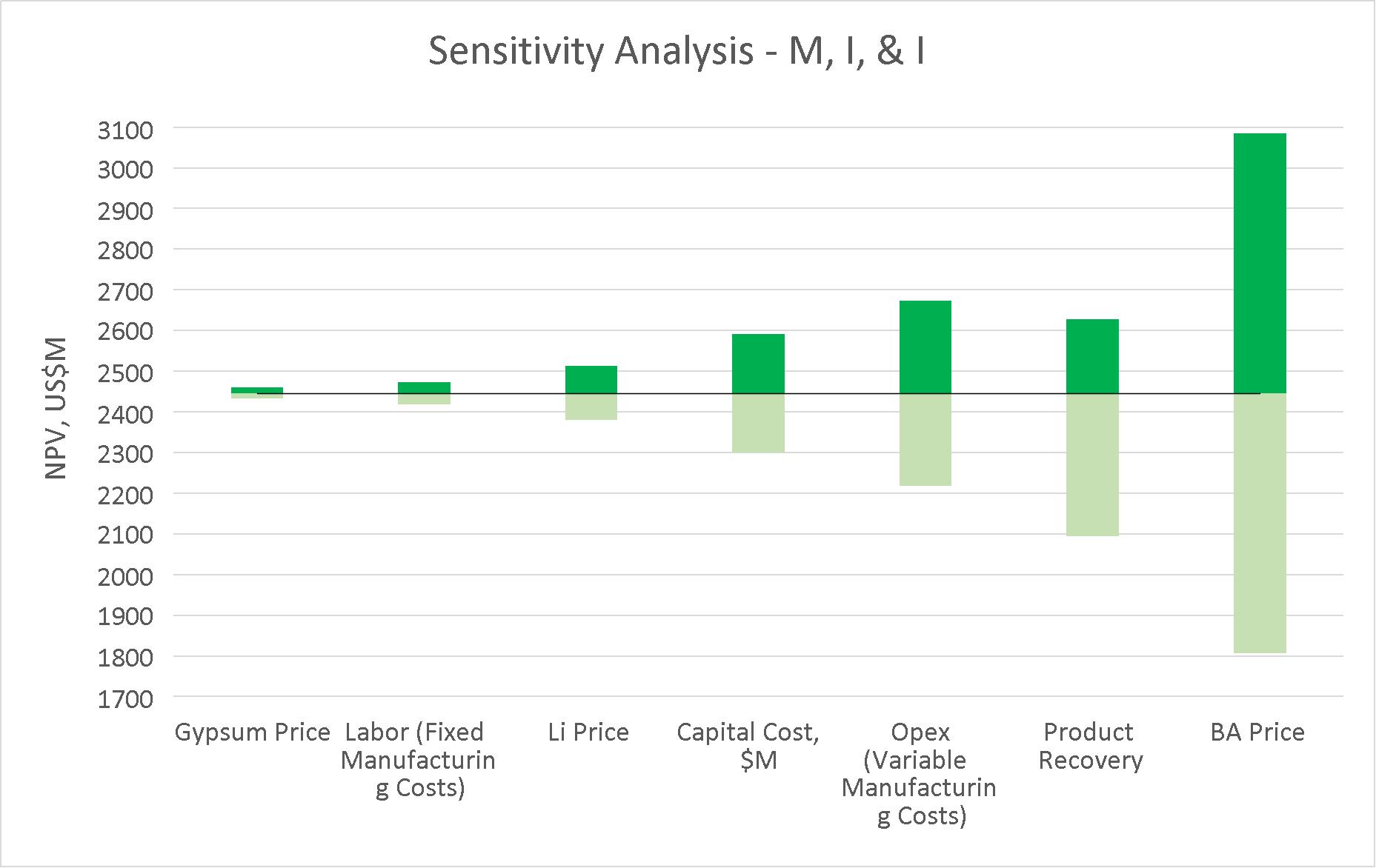

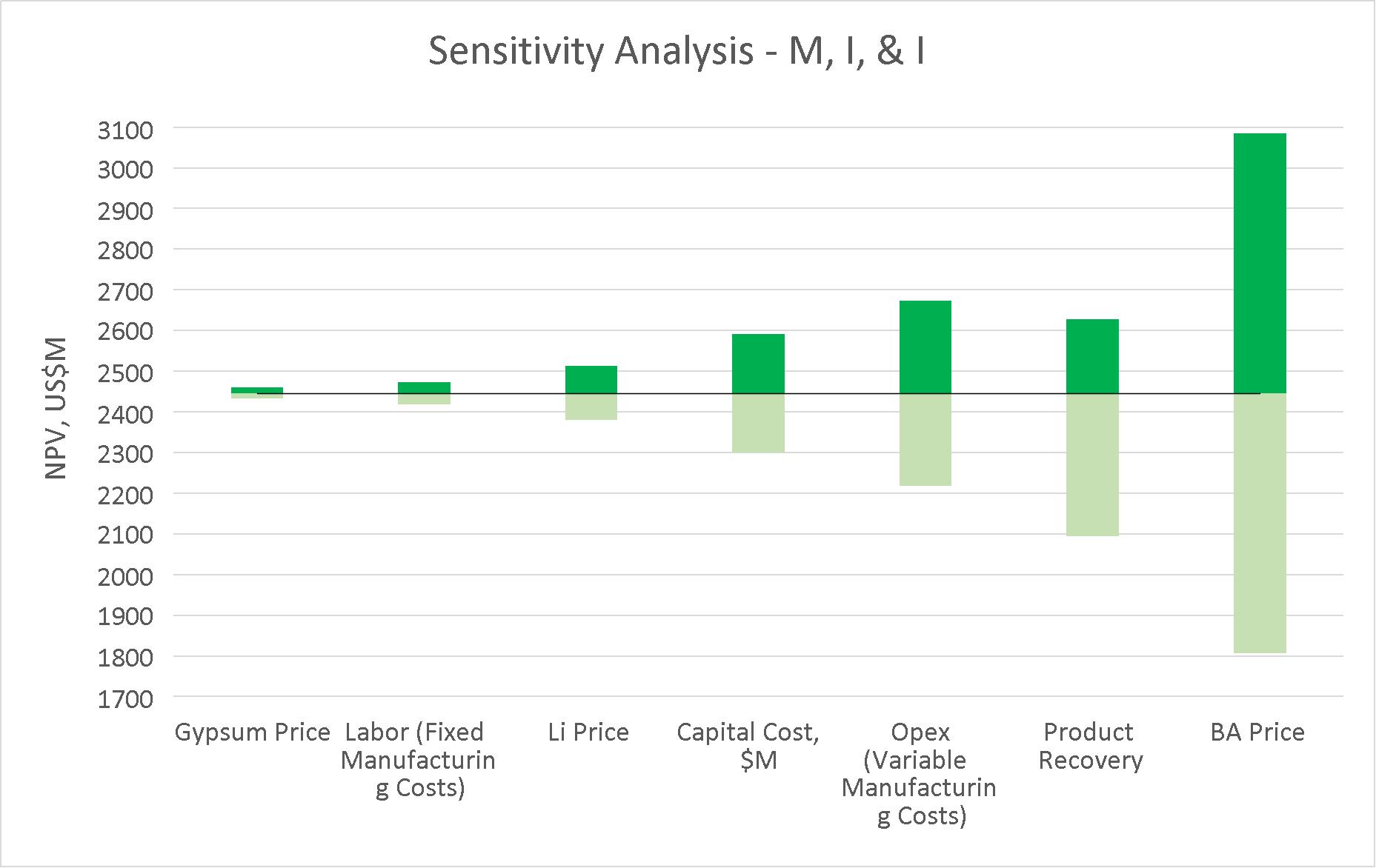

Figure 19.9 Sensitivity Analysis Base Case - Measured, Indicated, and Inferred | 87 |

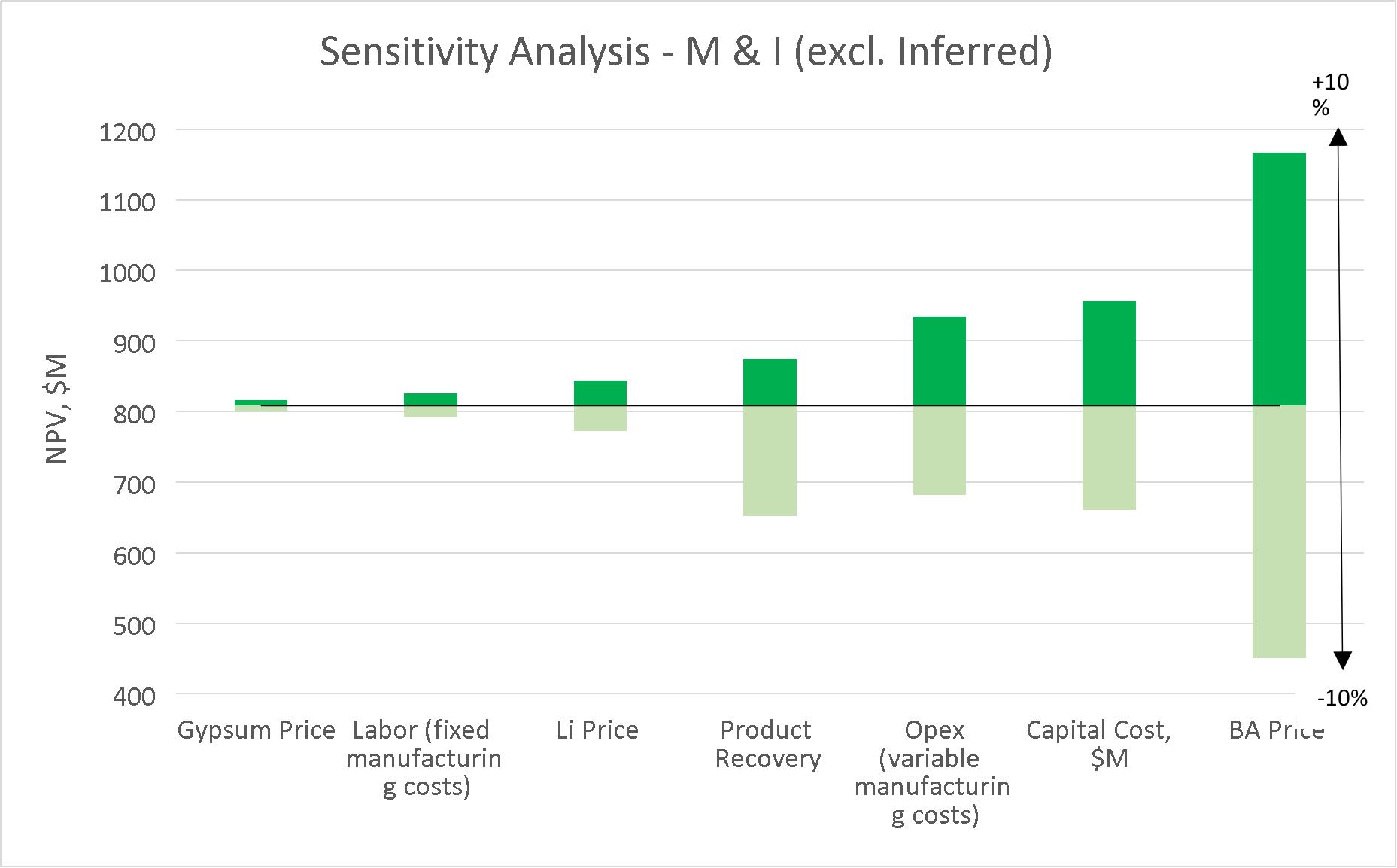

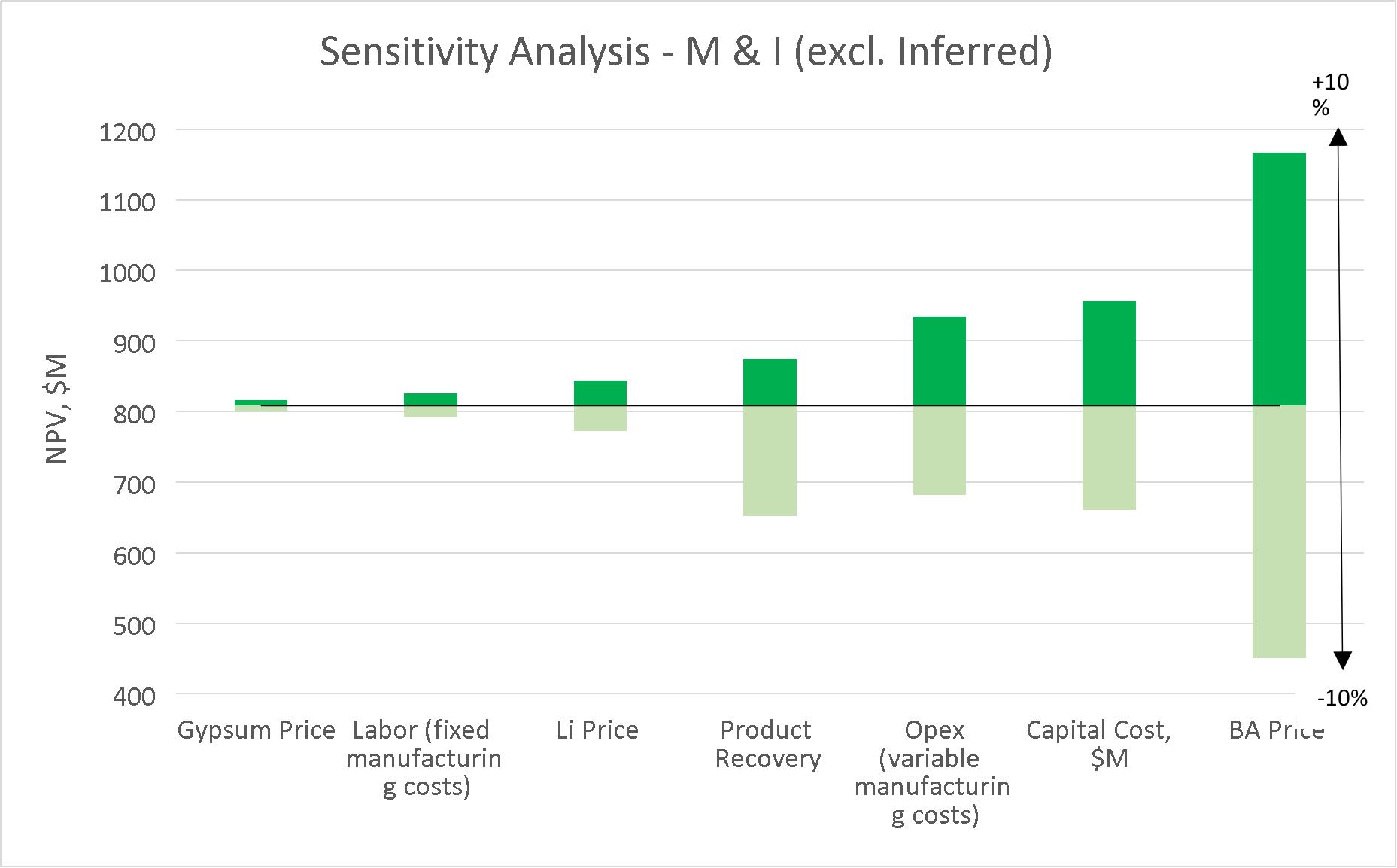

Figure 19.10 Sensitivity Analysis Alternate - Measured and Indicated | 87 |

7

List of Tables

8

Glossary of Terms

| | |

Abbreviation | Definition | |

5E | 5E Advanced Materials, Inc. | |

amsl | Above mean sea level | |

AOR | Area of Review | |

APBL | American Pacific Borate & Lithium | |

BA | Boric acid | |

B2O3 | Boron oxide | |

bgs | Below ground surface | |

BLM | US Bureau of Land Management | |

B2O3 | Boron trioxide (chemical formula) | |

BMI | Benchmark Mineral Intelligence | |

C | Celsius | |

CaCl2 | Calcium Chloride (chemical formula) | |

CAGR | Compound annual growth rate | |

CEQA | California Environmental Quality Act | |

cm/sec | Centimeters per second | |

Duval | Duval Corporation | |

DXF file E | Drawing Interchange Format File East | |

EIR | Environmental Impact Report (California lead) | |

EIS EPA F | Environmental Impact Statement (BLM lead) United States Environmental Protection Agency Fahrenheit | |

FACE | Financial Assurance Cost Estimate | |

FCMC | Fort Cady Mineral Corporation | |

FEL | Front End Loading, a stage gated project management system (with a number to the corresponding stage, eg FEL2) | |

ft | Foot or Feet | |

Gal | Gallon(s) | |

g/l | Gram per liter | |

Gal/min | Gallons per minute | |

gpm | gallons per minute | |

H2SO4 | Sulfuric acid (chemical formula) | |

H3BO3 | Boric acid (chemical formula) | |

B(OH)3 | Boric acid (chemical formula) | |

HCl | Hydrochloric acid (chemical formula) | |

ID2 | Inverse Distance Squared algorithm | |

IRR | Internal Rate of Return | |

ISL | In-Situ Leaching | |

JORC K | Australian Joint Ore Reserves Committee Hydraulic coefficient | |

k | Thousand | |

kg | Kilogram | |

kWh | Kilowatt Hour | |

Kline | Kline & Company, Inc. | |

lb(s) | Pound(s) mass | |

LCE | Lithium carbonate equivalents | |

Li2CO3 | Lithium Carbonate | |

m | Meters(s) | |

9

| | |

mm | Millimeter(s) | |

MDAQCD | Mojave Desert Air Quality Control District | |

MMBTU | Millions of British Thermal Units | |

MSME | Mountain States Mineral Enterprises Inc. | |

Mt | Million tons | |

M | Million | |

N | North | |

NAD 83 | North American Datum 83 is a unified horizontal or geometric datum providing a spatial reference for mapping purposes | |

NEPA | National Environmental Policy Act | |

NN | Nearest neighbor | |

NPV | Net present value | |

pH | Potential Hydrogen – a numeric scale to specify the acidity or alkalinity of an aqueous solution | |

PLS | Pregnant leach solution | |

Ppm | Parts per million | |

psi | Pounds per square inch of pressure | |

QA/QC | Quality Assurance and Quality Control | |

QP | Qualified Person per SK1300 definition | |

ROD | The 1994 Record of Decision for the Fort Cady Project was issued after the EIS/EIR evaluations. | |

S | Storage coefficient | |

SBC-LUP | San Bernardino County Land Use Services Department | |

SBM | San Bernardino Meridian | |

SCE | SoCal Edison | |

SEC | Securities and Exchange Commission | |

SOP | Sulphate of Potash | |

stpa | Short tons per annum | |

tpy | Tons per year | |

UIC | Underground Injection Control Class III Area Permit | |

USDW | Underground source of drinking water | |

US US$ | United States United States dollars | |

UTM | Universal Transverse Mercator coordinate system for mapping | |

XRF | X-Ray Fluorescence Spectrometry | |

| | |

10

1 Executive Summary

This report was prepared as an initial assessment Technical Report Summary in accordance with the Securities and Exchange Commission (SEC) S-K regulations (Title 17, Part 229, Items 601 and 1300 through 1305) for 5E Advanced Materials, Inc. and its subsidiary 5E Boron Americas, LLC, (together 5E or the Company) Fort Cady Project (the Project). The Project described herein is part of 5E’s strategy to become a globally integrated supplier of boric acid, lithium carbonate and advanced boron derivatives. The Project is in the Mojave Desert, near the town of Newberry Springs, California.

Using the volumes, market inputs, and anticipated operating and capital costs, a detailed economic model was created with a forecasted net present value (NPV) of approximately US$2,410M and internal rate of return (IRR) of 22.6% assuming measured, indicated, and inferred resources are mined (approximately US$829M and 18.7% using only measured and indicated resources). Further details, including key model assumptions, are included in Section 19.

The Project includes private land owned by 5E and an electrical transmission corridor runs through the Project where Southern California Edison has surface and subsurface control to a depth of 500 ft. While this limits surface access to the area within the right-of-way of the transmission lines, mineral rights are owned by 5E, and mineralization remains accessible as the ore body occurs at depths more than 1,000 ft. The Project also includes two unpatented lode claims, and 117 unpatented placer claims from the Bureau of Land Management within the U.S. Department of the Interior. On the southwestern side of the Project, 5E owns the surface area and the State of California owns the mineral rights.

There is a history of exploration and mining of the ore body, beginning in 1964 with the resource discovery and includes production of boric acid and synthetic borates by Duval Corporation (Duval) and Fort Cady Mineral Corporation (FCMC). Geologically, the deposit is bounded by faults on both east and west sides and is the site of prior volcanic activity from the Pisgah Crater. Mineralization occurs in a sequence of lacustrine lakebed sediments ranging in depths from 1,300 ft to 1,500 ft below ground surface.

Exploration drilling has led to a geologic interpretation of the deposit as lacustrine evaporite sediments containing colemanite, a hydrated calcium borate mineral. The deposit also contains appreciable quantities of lithium. Geologic modeling based on drilling and sampling results depicts an elongate deposit of lacustrine evaporite sediments containing colemanite. The deposit is approximately 2.1 mi. long (1.5 mi. long within 5E’s mineral holdings) by 0.6 mi. wide and ranging in thickness from 70 to 262 ft. Mineralization has been defined in four distinct horizons defined by changes in lithology and B2O3 analyses.

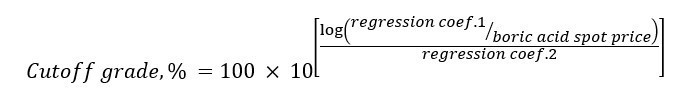

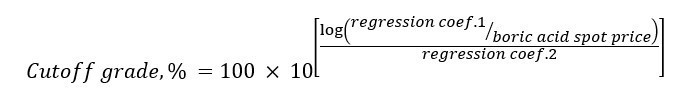

A mineral resource has been estimated and reported using a cut-off grade of 2% B2O3. Measured and Indicated resources for the Project total 74.31 million short tons (Mt), containing 5.80 Mt of boric acid and 0.141 Mt of lithium carbonate equivalent. An inferred resource total 96.9 Mt containing 8.17 Mt of boric acid and 0.166 Mt of lithium carbonate equivalent. There are currently no mineral reserves (as defined).

The accuracy of resource and reserve estimates is, in part, a function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Given the data available at the time this report was prepared, the estimates presented herein are considered reasonable. However, they should be accepted with the understanding that additional data and analysis available after the date of the estimates may necessitate revision. These revisions may be material. There is no guarantee that all or any part of the estimated resources or reserves will be recoverable.

The colemanite resource is to be mined via in-situ leaching (ISL) using a hydrochloric acid solution. The leachate will be processed in the commercial-scale facility to initially produce 90,000 short tons per annum (kstpa) of boric acid along with lithium carbonate and gypsum co-products. A Class 5 or FEL-1 level engineering estimate for the phase 1 plant was developed with input from several major EPC firms. A small-scale facility is currently being constructed on site to confirm key assumptions for mining of the orebody and subsequent optimization of process design.

Global boric acid demand remains robust across established markets and future-facing industries while supply continues to be tight across the industry operating network. A supply deficit is expected to continue to materially worsen in the

11

future and lead to elevated pricing. The overall lithium market, based on well documented market studies, is projected to experience large structural supply deficits through 2040.

Capital cost expectations were determined to be $373M for the first stage, 90,000 stpa boric acid plant (inclusive of coproduct processing) based on thorough review of multiple third-party EPC firm estimates. This estimate includes a 25% contingency. Later expansion phases have been scaled from this figure. Operating costs are built upon detailed process material balances and escalated recent historical pricing of raw materials and utilities.

Operation of the SSF will improve accuracy and optimize operational expenditures as well as sustaining capital estimates based on demonstration of ISL and processing of the resulting brine. Progression to Front End Loading stage 2 Process Design Package (FEL2) engineering will further define the accuracy and optimization of the capital cost estimates for the chemical processing plant and some additional exploration and in-fill drilling can reclassify the inferred resource to measured and indicated resource. Once the SSF is operational, samples of boric acid, lithium carbonate, and gypsum will be utilized to secure bankable offtake agreements for commercialization. Once these steps are completed, the Company is well positioned to update this initial assessment to a prefeasibility study.

2 Introduction

2.1 Registrant for Whom the Technical Report was Prepared

This report was prepared as an initial assessment level Technical Report Summary in accordance with the Securities and Exchange Commission S-K regulations Title 17, Part 229, Items 601 and 1300 through 1305 for 5E Advanced Materials, Inc. and its subsidiary 5E Boron Americas, LLC. The report was prepared by Company management and Qualified Persons (QPs) from third-party independent companies Barr Engineering Co. (Barr), Mike Rockandel Consulting LLC (MRC), Escalante Geological Services LLC (Escalante), Terra Modeling Services (TMS), and Confluence Water Resources LLC (CWR).

2.2 Terms of Reference and Purpose of the Report

The quality of information, conclusions, and estimates contained herein is based on the following:

a)information available at the time of preparation and

b)assumptions, conditions, and qualifications set forth in this report.

This Technical Report Summary is based on initial assessment level engineering. This report is intended for use by 5E Advanced Materials, Inc. and its subsidiary 5E Boron Americas, LLC, subject to the terms and conditions of its agreements with Barr Engineering Co., Mike Rockandel Consulting LLC, Escalante Geological Services LLC, Terra Modeling Services, and Confluence Water Resources LLC and relevant securities legislation. Barr, MRC, Escalante, TMS, and CWR permit 5E to file this report as a Technical Report Summary with the U.S. securities regulatory authorities pursuant to the SEC S-K regulations, more specifically Title 17, Subpart 229.60, Item 601b96 – Technical Report Summary and Title 17, Subpart 229.1300 – Disclosure by Registrants Engaged in Mining Operations. Except for the purposes specified under U.S. securities law, any other uses of this report by any third party are at that party’s sole risk. The responsibility for this disclosure remains with the Company.

The purpose of this Technical Report Summary is to report mineral resources, and inform parties with potential financial interests in 5E and the Project.

2.3 Sources of Information

This report is based in part on external consultant’s expertise and their technical reports, internal Company technical reports, previous technical reports, maps, published government reports, company letters and memoranda, and public information cited throughout this report and listed in Section 25.

Reliance upon information provided by the registrant is listed in Section 25 when applicable.

2.4 Details of Inspection

12

Barr, MRC, Escalante, TMS, and CWR have visited the property, inspected core samples, reviewed relevant intellectual property and reports, and have extensive knowledge of the Project.

2.5 Report Version Update

The user of this document should ensure that this is the most recent Technical Report Summary for the property. This Technical Report Summary is an update of a previously filed Technical Report Summary filed pursuant to 17 CFR §§ 229.1300 through 229.1305 subpart 229.1300 of Regulation S-K. The previously filed Technical Report Summary has a report date of February 7, 2022 and effective date of October 15, 2021.

2.6 Units of Measure

The U.S. System for weights and units has been used throughout this report. Tons are reported in short tons of 2,000 pounds (lb), drilling and resource model dimensions and map scales are in feet (ft). When included, metric tons are referred to as tonnes or mt. All currency is in U.S. dollars (US$) unless otherwise stated.

2.7 Mineral Resource and Mineral Reserve Definition

The terms “mineral resource” and “mineral reserves” as used in this Technical Report Summary have the following definitions below.

2.7.1 Mineral Resources

17 CFR § 229.1300 defines a “mineral resource” as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, considering relevant factors such as cut-off grade, likely mining dimensions, location, or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

A “measured mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve.

An “indicated mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve.

An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource considered when assessing the economic viability of a mining project must be presented along with economic viability excluding inferred resources and may not be converted to a mineral reserve.

13

2.7.2 Mineral Reserves

17 CFR § 229.1300 defines a “mineral reserve” as an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. A “proven mineral reserve” is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. A “probable mineral reserve” is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

2.8 Qualified Persons

This report was compiled by 5E and its management, with contributions from Barr Engineering Co., Mike Rockandell Consulting LLC, Escalante Geological Services LLC, Terra Modeling Services, and Confluence Water Resources LLC. Barr Engineering Co., Mike Rockandell Consulting LLC, Escalante Geological Services LLC, Terra Modeling Services, and Confluence Water Resources LLC are third-party firms comprising mining experts in accordance with 17 CFR § 229.1302b1. 5E has determined that the third-party firms and internal management listed as qualified persons meet the qualifications specified under the definition of a qualified person in 17 CFR § 229.1300.

Terra Modeling Service prepared the following sections of the report:

Sections 8, 9, 10, 11, 12

Barr Engineering Co. prepared the following sections of the report:

Sections 13, 15, 16, 18

Escalante Geological Services LLC prepared the following sections of the report:

Sections 3, 4, 5, 6, 7, 17, 20

Mike Rockandel Consulting LLC prepared the following sections of the report:

Sections 10.3, 14

Confluence Water Resources LLC prepared the following sections of the report:

Section 7.3

The following members of 5E management prepared the following sections of the report:

•Paul Weibel, CPA and Chief Financial Officer

Sections 1, 2, 19, 21, 22, 23, 24, 25

Section 16 Market Studies and Contracts was prepared by 5E. The company engaged Kline and Company, Inc. (Kline) to perform a preliminary market study and pricing forecast for boric acid. Kline was also engaged to perform a preliminary market study and provide historical pricing for gypsum. The company engaged Benchmark Minerals Intelligence (BMI) to perform pricing forecast for lithium carbonate. Forward pricing forecasts obtained from Kline and Company, Inc. and Benchmark Mineral Intelligence were utilized as part of the financial model outlined in Section 19, Economic Analysis, as well as the flat pricing forecast for gypsum. Kline and BMI were not engaged as Qualified Persons; however, 5E has obtained permission to refer to the work they have provided and cite accordingly.

14

3 Property Description and Location

3.1 Property Location

The Project is in the Mojave Desert region in the high desert of San Bernardino County, California. Figure3.1 outlines a map where the Project lies approximately 118 mi northeast of Los Angeles, approximately 36 mi east of Barstow and approximately 17 mi east of Newberry Springs. The approximate center of the Project area is N34°45’25.20”, W116°25’02.02”. The Project is in a similar geological setting as Rio Tinto’s U.S. Borax operations in Boron, CA, and Searles Valley Minerals Operations in Trona, CA, situated approximately 75 mi west-northwest and 90 mi northwest of the Project, respectively.

Figure 3.1 General Location Map

15

3.2 Area of Property

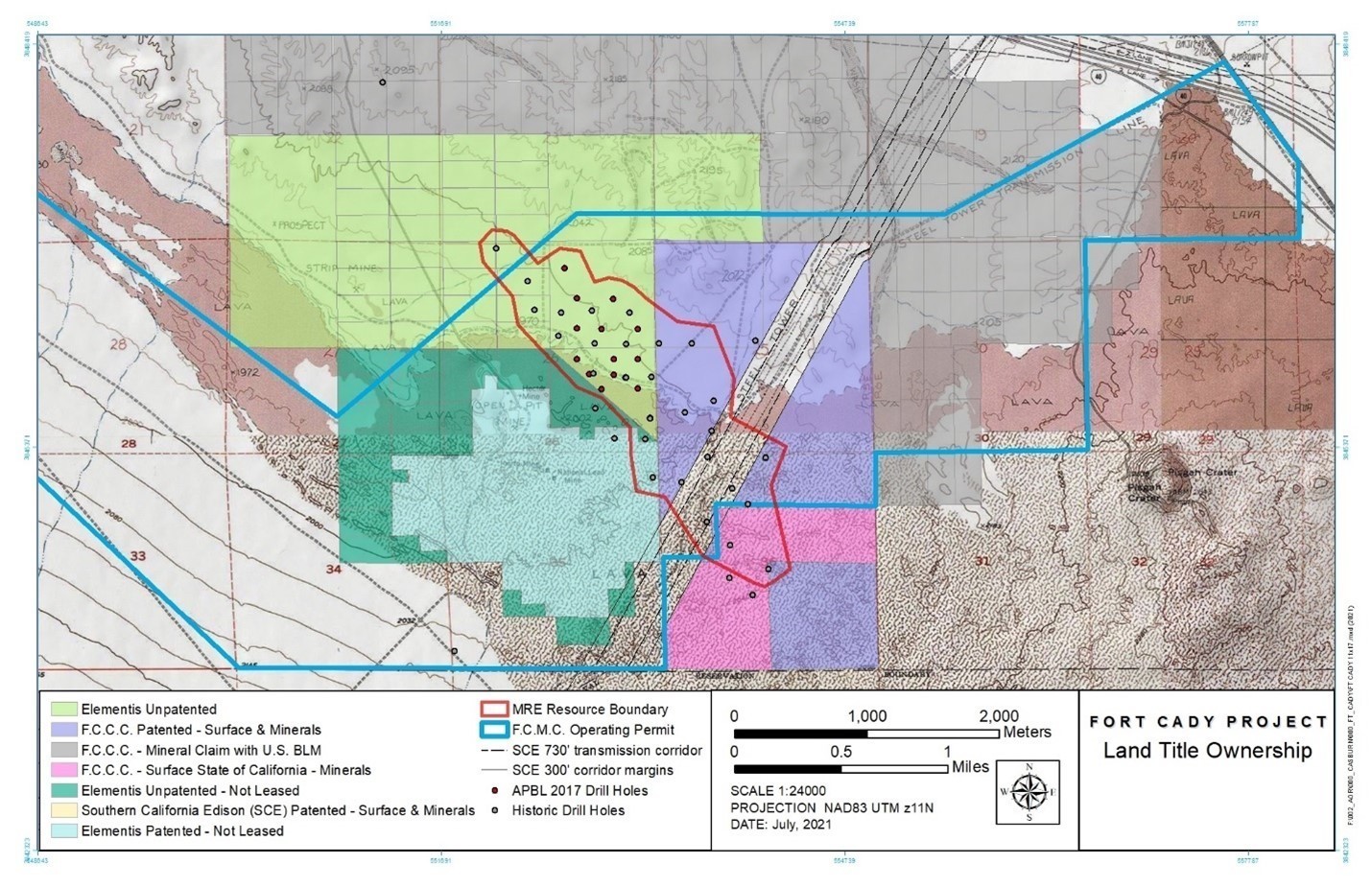

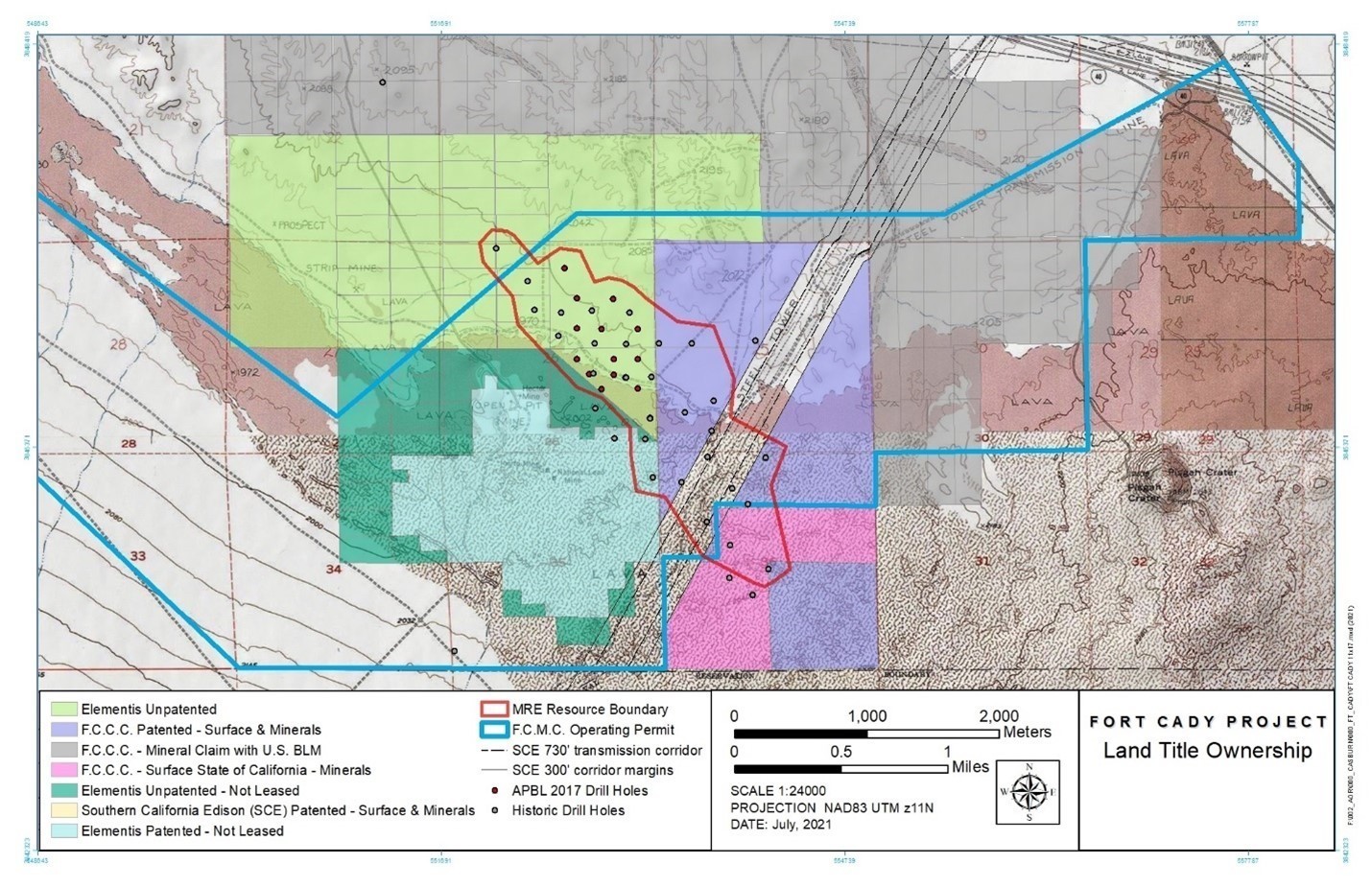

Figure 3.2 shows the 5E property and adjacent properties, further discussed in Section 17.

Figure 3.2 Property Ownership

3.3 Mineral Title

5E owns fee simple (private) lands in Sections 25 and 36, T 8 N, R 5 E, SBM. An electrical transmission corridor, operated by Southern California Edison (SCE), tracts from the northeast to the southwest through the fee lands with SCE having surface and subsurface control to a depth of 500 ft, affecting approximately 91 acres of surface lands in the two sections. While this limits surface access to the land, mineralization remains accessible as the ore body occurs at depths more than 1,000 ft (~ 300 m.)

5E currently holds two 2 unpatented lode claims and 117 unpatented placer claims with the Bureau of Land Management within the U.S. Department of the Interior. Both lode claims were originally filed by Duval Corporation in 1978. Placer claims were filed between October 29, 2016, and February 24, 2017. A review of the US Bureau of Land Management (BLM) Mineral & Land Record System, the Mineral Land Record System (MLRS) database shows claim status as filed with next assessment fees due annually on September 1.

Lastly, in Section 36, T8N, R5E, 272 acres of land in Section 36 are split estate, with the surface estate owned by 5E and the mineral estate is owned by the State of California. These lands are available to 5E through a mineral lease from the California State Lands Commission. The remaining lands are owned by 5E, with the minerals underlying the transmission line available subsurface.

16

3.4 Mineral Rights

5E holds the rights to the mineral estate underlying Sections 25 and 36, except for the portion of the mineral estate held by the State of California in Section 36.

3.5 Incumbrances

5E maintains financial assurance bonds for reclamation and closure for current and planned operations at the Project. Additional information on reclamation and closure liabilities is included in Section 17. The amount of bonds and certificate of deposits posted with the applicable agency is present in Table 3.1.

Table 3.1 Current Financial Assurance Obligations

| | | | | |

Regulatory Authority | Regulatory Obligation | Instrument | Instrument US$ | |

United State Environmental Protection Agency | Groundwater restoration

Groundwater monitoring

Plugging and abandonment of AOR wells | Bond

SU1166406 | $ | 1,514,385 | |

County of San Bernardino | Reclamation and Closure | Certificate of deposits | $ | 308,457 | |

3.5.1 Remediation Liabilities

5E has submitted a Final Reclamation and Closure Plan to the Lahanton Regional Water Quality Control Board for closure of ponds constructed on the property in the 1980’s. The bonding for closure of these ponds is included in the certificate of deposits with San Bernardino County and upon closure of the ponds, the bond will be reduced and a portion of the deposited amount returned to the company.

3.6 Other Significant Risk Factors

The mineral resource estimate (Section 11), excludes BLM land where Elementis Specialties, Inc (Elementis) has active placer claims. 5E previously leased those claims from Elementis, but the lease expired March 31, 2023. The Elementis claims were previously included in the mineral resource estimate; however, due to the expiration of the lease, the resources attributable to the Elementis lease have been removed in the mineral resource estimate provided by this report.

An exploration program to expand the resource is possible in Section 36 on the southeastern portion of the mineralization; however, this would require a mineral lease to be filed and executed with the California State Lands Commission for the State of California held mineral estate.

3.7 Royalties

There are no royalties associated with privately held lands in Section 25 and 36.

4 Accessibility, Climate, Local Resources, Infrastructure, and Physiography

4.1 Topography, Elevation, and Vegetation

The Project area is located on a gentle pediment with elevations ranging from approximately 1,970 ft above mean sea level (amsl) to approximately 2,185 ft amsl. Basalt lava flows cover most of the higher elevations or hilltops with flat ground and drainages covered in pale, gray-brown, silty soils. Basalt lava flows become more dominant south of the Project area with the Lava Bed Mountains located a few miles south of the Project area. The Project area’s vegetation is dominated by burro weed, creosote, cactus, and scattered grasses.

17

4.2 Accessibility and Transportation to the Property

Access to the Project is via U.S. Interstate 40 (I-40), eastbound from Barstow to the Hector Road exit. From the exit, travel south to Route 66, then east approximately 1 mile to County Road 20796 (CR20796). Travel south on CR20796 for 2.2 mi to the unnamed dirt access road bearing east for another 1.1 mi to the Project.

The BNSF Railroad main line from Chicago to Los Angeles runs parallel to I-40. A BNSF rail loadout is in Newberry Springs. There are potential options to develop rail access closer to the Project.

San Bernardino County operates six general aviation airports with the closest airport to the Project being the Barstow-Daggett Airport located approximately 23 mi west of the Project off Route 66. Commercial flight service is available through five airports in the greater Los Angeles area and in Las Vegas, NV. A dedicated cargo service airport is located approximately 65 mi southwest of the Project.

4.3 Climate and Length of Operating Season

The Project is accessible year-round, located in the western Mojave Desert with arid, hot, dry, and sunny summers of low humidity and temperate winters. Based upon climate data from the nearby town of Newberry Springs, the climate over the past 30 years indicates average monthly high temperatures ranging from 55°F in December to 98.2°F in July. Monthly low temperatures range from 40.1°F in December to 74.3°F in August. Extremes range from a record low of 7°F to a record high of 117°F. Maximum temperatures in summer frequently exceed 100°F while cold spells in winter with temperatures below 20°F may occur but seldom last for more than a few days. Average rainfall is generally less than 10 inches per year with most precipitation occurring in the winter and spring.

4.4 Infrastructure Availability and Sources

5E continues to develop operating infrastructure for the Project in support of extraction and processing activities. A manned gate is located on the Project access road and provides required site-specific safety briefings and monitors personnel entry and exit to the site. Personnel are predominantly sourced from the surrounding area including Barstow, CA and Victorville, CA.

The BNSF Railroad main line from Las Vegas, NV to Los Angeles, CA runs parallel to I-40. A rail loadout is located approximately 1.2 mi north of the National Trails Highway on a road that bears north and located 0.4 mi west of CR20796. San Bernardino County operates six general aviation airports with the closest airport to the Project being the Barstow-Daggett Airport located approximately 23 miles west of the Project on the National Trails Highway. Commercial flight service is available through five airports in the greater Los Angeles area and in Las Vegas, NV. A dedicated cargo service airport is located approximately 65 miles southwest of the Project.

Construction of the small-scale facility was performed by a construction contractor with additional local resources supporting contracting, construction materials, energy sources, employees, and housing. The Project has good access to I-40 which connects it to numerous sizable communities between Barstow, CA and the greater Los Angeles area offering excellent access to transportation, construction materials, labor, and housing. The Project currently has limited electrical service that is sufficient for mine office and storage facilities on site but will require upgrade for plant and wellfield facilities. The small-scale facility will operate on liquid natural gas and 5E is currently exploring options for upgrading electrical services to the Project. An electrical transmission corridor operated by SCE extends northeastward through the eastern part of the Project. The Project has two water wells located nearby to support in-situ leaching operations. Currently there is no natural gas connected to the Project, but 5E is negotiating services with two suppliers in the region with three natural gas transmission pipelines running along Interstate 40 near the Project.

18

The plant site currently has a 1,600 ft2 mine office building, a control room, storage buildings, an analytical laboratory, an approximately 20-acre production facility called the small-scale facility, and an intended gypsum storage area occupying 17 acres. Gypsum is a byproduct of past pilot plant production and is intended to be a future byproduct that can be sold to the regional market.

5 History

Discovery of the Project borate deposit occurred in 1964 when Congdon and Carey Minerals Exploration Company found several zones of colemanite, a calcium borate mineral, between the depths of 1,330 ft to 1,570 ft (405m to 487m) below ground surface (bgs) in Section 26, TSN, R5E. Simon Hydro-Search, 1993.

5.1 Prior Ownership and Ownership Changes

In September 1977, Duval initiated land acquisition and exploration activities near Hector, California. By March 1981, Duval had completed 34 exploration holes (DHB holes), plus one 1 potential water well. After evaluation of the exploration holes, Duval considered several mining methods. Subsequent studies and tests performed by Duval indicated that in-situ mining technology was feasible. Duval commenced limited testing and pilot-scale solution mining operations in June 1981 per the Mining and Land Reclamation Plan, Fort Cady Project, 2019.

Mountain States Mineral Enterprises, Inc. (MSME) purchased the project from Duval in 1985 and, in 1986, conducted an additional series of tests. MSME eventually sold the project to Fort Cady Mineral Corporation in 1989. FCMC began the permitting process, which resulted in a 1994 Record of Decision (ROD) from the BLM and approval from San Bernardino County, the California lead agency.

5.2 Exploration and Development Results of Previous Owners

Duval commenced limited-scale solution mining tests in June 1981. Between 1981 and 2001, subsequent owners drilled an additional 17 wells, which were used for a series of injection testing and pilot-scale operations. In July 1986, tests were conducted by MSME, where dilute hydrochloric acid solution was injected into the ore body. The acid dissolved the colemanite and was then withdrawn from the same well.

The first phase of pilot plant operations was conducted between 1987 and 1988. Approximately 550 tons (500 tonnes) of boric acid were produced. The test results were positive; thus, the Project was viewed as commercially viable. In preparation for the permitting process, feasibility studies, detailed engineering and test works were completed with FCMC receiving the required permits for a commercial-scale operation. Final state and local approvals for commercial-scale solution mining and processing was attained in 1994.

A second phase of pilot plant operations occurred between 1996 and 2001, during which approximately 2,200 tons of a synthetic colemanite product, marketed as CadyCal 100, were produced. Commercial- scale operations were not commissioned due to low product prices and other priorities of the controlling entity. For many years, boron was used in traditional applications such as cleaning supplies and ceramics, which never formulated in a strong pull-side demand investment thesis where pricing justified further development of the Project. However, a group of Australian investors, through extensive due diligence identified green shoots that the market dynamics were fundamentally beginning to change.

19

5.3 American Pacific Borates Share Exchange of Atlas Precious Metals

In 2017, a group of Australian investors identified the Project and formed the investment thesis that the boron market had similar dynamics to the lithium market a decade earlier. Like the lithium market ten years prior, the market was dominated by a few companies with a compelling pull-side demand growth story fueled by future-facing applications targeting decarbonization and critical materials. Prior to lithium-ion batteries and electric vehicles, lithium was used in traditional everyday applications like boron’s use in recent years. As a result of the investment thesis that boron is the next lithium, the group of Australian investors formed American Pacific Borates and Lithium Ltd (APBL) and issued shares to Atlas Precious Metals in exchange for the Fort Cady (California) Corporation, the entity holding the mineral and property rights of the Project. In 2017, APBL underwent an initial public offering on the Australian Stock Exchange and progressed exploration and development of the Project. In September 2021, APBL created a subsidiary, 5E, through a corporate reorganization which placed 5E at the top of the corporate structure. Upon 5E becoming the parent company of the organization, in March 2022 5E direct listed on the Nasdaq and became an SEC issuer. Shortly before becoming an SEC issuer, 5E Boron Americas, LLC was designated as Critical Infrastructure by the Department of Homeland Security Cybersecurity and Infrastructure Security Agency.

5.4 Historic Production

Limited historic production data, provided to 5E by previous operators, is summarized in Table 5.1 through Table 5.4. Little other information is available for these tests, the results could not be independently verified.

Table 5.1 Duval Testing Results

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Test No. | | Volume Injected Gal | | | Injection Rate Gal/min | | Pump Pressure PSI | | Acid % | | Volume Recovered Gal | | | Recovery Rate Gal/min | | Average Concentration HBO3 % | | | Maximum Concentration HBO3 % | |

1 | | | 680 | | | 1.5 | | 150 | | 16% HCl | | | 700 | | | 1.0-2.0 | | | 0.3 | | | | |

| | | 1,500 | | | 2 | | 275 | | 5% H2SO4 | | | 1,500 | | | 1.0-2.0 | | | 0.5 | | | | 1.5 | |

| | | 1,400 | | | 1.5-2.0 | | 150 | | 5% H2SO4 | | | 2,000 | | | 1.0-2.0 | | | 1.5 | | | | 4.6 | |

| | | 1,500 | | | 2 | | 275 | | 23% H2SO4 | | | 1,500 | | | 1.0-2.0 | | | 1.0 | | | | 4.0 | |

2 | | | 2,250 | | | 2 | | 300 | | 8% H2SO4 | | | 2,000 | | | 1.5-2.0 | | | 1.5 | | | | 4.0 | |

3 | | | 5,358 | | | 2-2.5 | | 275 | | 6.9% H2SO4 | | | 28,927 | | | 1.0-1.5 | | | 3.0 | | | | 6.9 | |

| | | 6,597 | | | 2-2.5 | | 275 | | 17.5% HCl | | | | | | | | 3.0 | | | | 6.9 | |

4 | | | 19,311 | | | 2-2.5 | | 230-275 | | 6.2% HCl &

2.4% H2SO4 | | | 67,995 | | | 1.0-1.5 | | | 3.0 | | | | 6.5 | |

5 | | | 20,615 | | | 2 | | 290 | | 16% HCL | | | 112,637 | | | 1.0-1.5 | | | 2.5 | | | | 5.2 | |

6 | | | 21,569 | | | 20 | | 275 | | 1.6% HCl | | | 63,460 | | | 1.0-1.5 | | | 1.1 | | | | 1.7 | |

Table 5.2 Mountain States Testing Injection Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Date | | | | | | Gallons | | | Pounds | | | Theoretical HBO3 | |

Series | | From | | To | | Test Nos. | | Wells SMT | | Series | | | ∑ | | | HCl | | | CO2 | | | Series | | | ∑ | |

1 | | 8/4/1986 | | 8/23/1986 | | 1-3 | | 6 & 9 | | | 67,972 | | | | 67,972 | | | | 23,286 | | | | — | | | | 59,540 | | | | 59,540 | |

2 | | 11/4/1986 | | 11/10/1986 | | 4-7 | | 6 | | | 45,489 | | | | 113,461 | | | | 15,500 | | | | — | | | | 39,431 | | | | 98,971 | |

3 | | 12/9/1986 | | 12/18/1986 | | 8-11 | | 6 | | | 53,023 | | | | 166,484 | | | | 15,398 | | | | — | | | | 39,173 | | | | 138,144 | |

4 | | 6/18/1986 | | 6/27/1987 | | 12-15 | | 9 | | | 47,640 | | | | 214,124 | | | | — | | | | 4,313 | | | | 18,184 | | | | 156,328 | |

Total | | | | | | | | | | | 214,124 | | | | 214,124 | | | | 54,184 | | | | 4,313 | | | | 156,328 | | | | 156,328 | |

Table 5.3 Mountain States Testing Recovery Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Date | | | | | | Gallons | | Pounds BA | | % BA in Solution, by

Surge Tank | | Theoretical BA |

Series | | From | | To | | Test Nos. | | Wells SMT | | Series | | | ∑ | | Series | | ∑ | | High | | End | | Avg | | Series | | ∑ |

1 | | 8/7/1986 | | 10/17/1986 | | 1-3 | | 6 & 9 | | | 128,438 | | | | 128,438 | | | 32,608 | | | 32,608 | | | 3.84 | | | 1.56 | | | 2.50 | | | 54.77 | | 54.77 |

2 | | 11/5/1986 | | 11/13/1986 | | 4-7 | | 6 | | | 51,636 | | | | 180,074 | | | 21,223 | | | 53,831 | | | 5.74 | | | 4.05 | | | 4.68 | | | 53.83 | | 54.39 |

3 | | 12/10/1986 | | 1/13/1987 | | 8-11 | | 6 | | | 99,889 | | | | 279,963 | | | 33,386 | | | 87,217 | | | 5.59 | | | 1.93 | | | 4.18 | | | 85.23 | | 63.14 |

4 | | 6/9/1987 | | 7/0/1987 | | 12-15 | | 9 | | | 86,595 | | | | 366,558 | | | 18,973 | | | 106,190 | | | 3.55 | | | 1.81 | | | 2.60 | | | 104.34 | | 67.93 |

Total | | | | | | | | | | | 366,558 | | | | 366,558 | | | 106,190 | | | 106,190 | | | | | | | 3.79 | | | | 67.93 |

In 2017, 5E completed an exploration drilling program to validate previous exploration efforts and expand mineral resources. Post drilling, an Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC) mineral resource estimate was prepared by Terra Modelling Services. TMS updated the JORC mineral resource

20

estimate in December 2018. The 2018 JORC mineral resource estimate identified 4.63 million tonnes of measured resource, 2.24 million tonnes of indicated resource, and 7.07 million tonnes of inferred resource using a B2O3 cut-off grade of 5%.

Table 5.4 Fort Cady Mineral Corporation Production Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Flow to Plant | | | | | | | | | | | | | |

Date | | Total Minutes | | | Gallons | | | Gal/min | | | pH | | | Free Acid g/l | | | Boric Acid % | | | Chloride g/l | | | Sulfate g/l | | | Boric Acid tons | | | B2O3 tons | | | CadyCal 100 tons | |

Jan-01 | | | 7,215 | | | | 258,556 | | | | 35.8 | | | | 5.83 | | | | | | | 2.33 | | | | 12.54 | | | | 3.76 | | | | 15 | | | | 9 | | | | 20 | |

Feb-01 | | | 7,785 | | | | 331,886 | | | | 42.6 | | | | 2.54 | | | | 0.35 | | | | 2.36 | | | | 12.13 | | | | 4.94 | | | | 25 | | | | 14 | | | | 33 | |

Mar-01 | | | 10,470 | | | | 422,922 | | | | 40.4 | | | | 2.41 | | | | 0.23 | | | | 1.90 | | | | 15.84 | | | | 3.23 | | | | 34 | | | | 19 | | | | 45 | |

Apr-01 | | | 10,290 | | | | 393,824 | | | | 38.3 | | | | 1.86 | | | | 2.60 | | | | 5.43 | | | | 42.11 | | | | 8.18 | | | | 41 | | | | 23 | | | | 53 | |

May-01 | | | 7,560 | | | | 296,000 | | | | 39.2 | | | | 2.02 | | | | 2.67 | | | | 5.77 | | | | 44.77 | | | | 8.70 | | | | 31 | | | | 17 | | | | 40 | |

Jun-01 | | | 3,375 | | | | 120,928 | | | | 35.8 | | | | 0.67 | | | | 1.35 | | | | 3.12 | | | | 27.84 | | | | 5.30 | | | | 12 | | | | 7 | | | | 16 | |

Jul-01 | | | 2,385 | | | | 77,157 | | | | 32.4 | | | | 1.19 | | | | 0.31 | | | | 2.00 | | | | 12.74 | | | | 2.60 | | | | 7 | | | | 4 | | | | 9 | |

Aug-01 | | | 3,300 | | | | 142,207 | | | | 43.1 | | | | 4.04 | | | | 0.07 | | | | 3.84 | | | | 19.60 | | | | 3.08 | | | | 15 | | | | 8 | | | | 19 | |

Sep-01 | | | 4,875 | | | | 247,901 | | | | 50.9 | | | | 2.77 | | | | 0.12 | | | | 3.44 | | | | 23.21 | | | | 3.68 | | | | 21 | | | | 12 | | | | 28 | |

Oct-01 | | | 10,035 | | | | 478,723 | | | | 47.7 | | | | 2.03 | | | | 0.35 | | | | 3.00 | | | | 15.54 | | | | 4.60 | | | | 37 | | | | 1 | | | | 49 | |

Nov-01 | | | 9,270 | | | | 371,171 | | | | 40.0 | | | | 1.99 | | | | 0.16 | | | | 2.39 | | | | 14.15 | | | | 4.02 | | | | 23 | | | | 13 | | | | 30 | |

Dec-01 | | | 12,525 | | | | 353,885 | | | | 28.3 | | | | 1.83 | | | | 0.17 | | | | 2.52 | | | | 14.94 | | | | 2.58 | | | | 29 | | | | 16 | | | | 38 | |

01-Total | | | 89,085 | | | | 3,495,160 | | | | 39.2 | | | | 2.44 | | | | 0.73 | | | | 3.19 | | | | 21.37 | | | | 4.74 | | | | 291 | | | | 164 | | | | 381 | |

00-Total | | | 87,255 | | | | 3,142,413 | | | | 36.0 | | | 2.14 | | | | 0.25 | | | | 2.70 | | | | 12.42 | | | | 2.54 | | | | 279 | | | | 157 | | | | 366 | |

99-Total | | | 92,820 | | | | 2,475,770 | | | | 26.7 | | | 1.59 | | | | 0.48 | | | | 2.82 | | | | 10.13 | | | | 6.84 | | | | 201 | | | | 113 | | | | 263 | |

98-Total | | | 111,468 | | | | 2,715,319 | | | | 24.4 | | | 1.24 | | | | 0.91 | | | | 2.85 | | | | 7.78 | | | | 10.19 | | | | 217 | | | | 122 | | | | 284 | |

97-Total | | | 109,040 | | | | 2,692,940 | | | | 24.7 | | | 0.99 | | | | 1.84 | | | | 3.10 | | | | 3.52 | | | | 13.00 | | | | 252 | | | | 142 | | | | 329 | |

96-Total | | | 101,212 | | | | 2,711,044 | | | | 26.8 | | | 1.33 | | | | 1.32 | | | | 3.01 | | | | 2.96 | | | | 5.76 | | | | 244 | | | | 137 | | | | 319 | |

6 Geological Setting, Mineralization and Deposit

6.1 Regional Setting

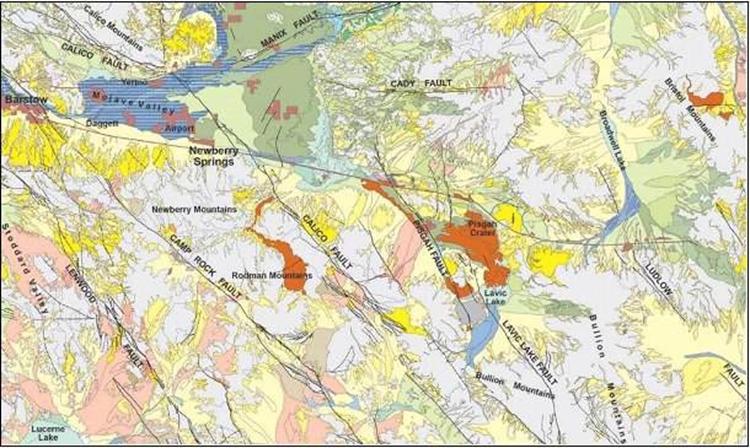

The Project area is in the western Mojave Desert and is part of the Basin and Range Physiographic Province. The region is characterized by narrow faulted mountain ranges and flat valleys and basins, the result of tectonic extension that began approximately 17 million years ago. The Project lies within the Hector Basin of the Barstow Trough and is bounded on the southwest by the San Andreas fault zone and the Transverse Ranges, on the north by the Garlock fault zone, and on the east by the Death Valley and Granite Mountain infrastructure faults. Numerous faults of various orientations are found within the area with various orientations though the predominant trend is to the northwest.

The Barstow Trough, a structural depression, extends northwesterly from Barstow toward Randsburg and to east-southeast toward Bristol. It is characterized by thick successions of Cenozoic sediments, including borate-bearing lacustrine deposits, with abundant volcanism along the trough flanks. The northwest-southeast trending trough initially formed during Oligocene through Miocene times. As the basin was filled with sediments and the adjacent highland areas were reduced by erosion, the areas receiving sediments expanded, and playa lakes, characterized by fine-grained clastic and evaporitic chemical deposition, formed in the low areas at the center of the basins.

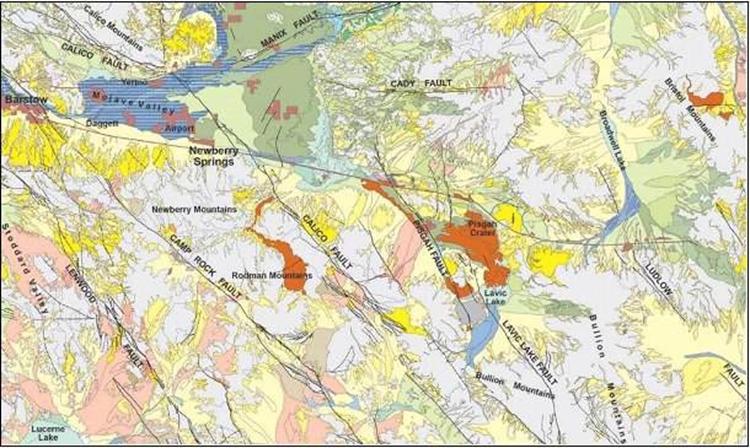

Exposures of fine-grained lacustrine sediments and tuffs, possibly Pliocene in age, are found throughout the Project area. Younger alluvium occurs in washes and overlying the older lacustrine lakebed sediments. Much of the Project area is covered by recent olivine basalt flows from Pisgah Crater, which is located approximately two mi east of the site as shown in Figure 6.1 and Figure 6.2. Thick fine-grained, predominantly lacustrine lakebed mudstones appear to have been uplifted, forming a block of lacustrine sediments interpreted to be floored by an andesitic lava flow.

21

Figure 6.1 Surface Geology in the Newberry Springs Area

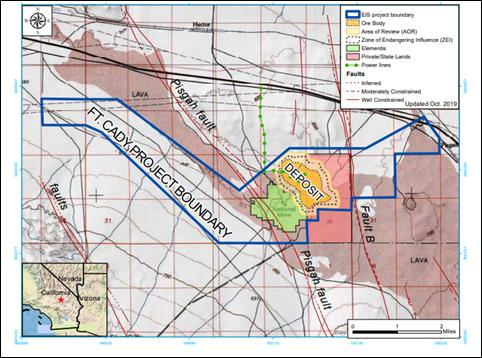

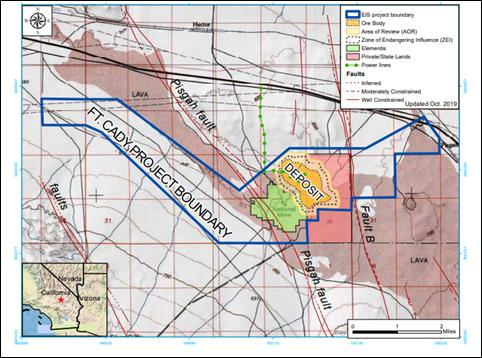

There are three prominent geologic features in the Project area (Figure 6.2):

•Pisgah Fault, which transects the southwest portion of the Project area west of the ore body;

•Pisgah Crater lava flow located approximately 2 mi east of the site: and

•Fault B, located east of the deposit.

Figure 6.2 Topographic Map with Faults and Infrastructure

The Pisgah Fault is a right-lateral slip fault that exhibits at least 250 ft of vertical separation at the Project. The east side of the fault is up-thrown relative to the west side. Fault B is located east of the ore body and also exhibits at least 250 ft of vertical separation; however, at Fault B, the east side is down dropped relative to the west side. The uplifted zone

22

containing the borate ore body the Wedge is situated within a thick area of fine-grained, predominantly lacustrine lakebed mudstones, east of the Pisgah Fault and west of Fault B.

6.1.1 Mineralization

Mineralization occurs in a sequence of lacustrine lakebed sediments ranging in depths from 1,300 ft to 1,500 ft bgs. The mineralization is hosted by a sequence of mudstones, evaporites and tuffs, consisting of variable amounts of colemanite, calcium borate 2CaO • 3B2O3• 5H2O, and lithium. Colemanite and lithium are the target minerals. Colemanite is a secondary alteration mineral formed from borax and ulexite. Colemanite is associated with thinly laminated siltstone, clay and gypsum beds containing an average of 9% calcite, 35% anhydrite plus 10% celestite (SrSO4) per Wilkinson & Krier, 1985. In addition to colemanite and celestite, elevated levels of lithium have been found through chemical analyses of drill samples.

X-ray diffraction analysis of core samples from the deposit indicates the presence of the evaporite minerals anhydrite, colemanite, celestite, and calcite. The mineralogy of the detrital sediments include quartz, illite, feldspars, clinoptilolite, and zeolite. The deposit underlies massive clay beds which appear to encapsulate the evaporite ore body on all sides as well as above and below the deposit. This enclosed setting makes the deposit an ideal candidate for in-situ mining technology affording excellent containment of the leachate solution.

6.2 Mineral Deposit

Boron is believed to have been sourced from regional thermal waters which flowed from hot springs during times of active volcanism. These hot springs vented into the Hector Basin when it contained a large desert lake. Borates were precipitated as the thermal waters entered the lake and cooled or as the lake waters evaporated and became saturated with boron. Colemanite, being the least soluble mineral, would evaporate on the receding margins of the lake. The evaporite-rich sequence forms a consistent zone in which the borate-rich colemanite zone transgresses higher in the section relative to stratigraphic marker beds.

Based on drilling results, the deposit is elliptical in shape, with the long axis trending N40°W to N50°W. extending over an area of about 606-acres at an average depth of approximately 1,300 ft to 1,500 ft bgs. Beds within the colemanite deposit strike roughly N45°W and dip about 10° or less to the southwest. Using an isoline of 5% B2O3, mineralization has an approximate width of 2,800 ft and a length of 11,150 ft with thickness ranging from 70 to 262 ft exclusive of barren interbeds.

The western margin of mineralization appears to be roughly linear, paralleling the Pisgah Fault which lies approximately 1 mi to the west (Figure6.2). Duval geologists consider this boundary to be controlled by facies change from evaporite rich mudstones to carbonate-rich lake beds, because of syn-depositional faulting. The northeast and northwest boundaries of the deposit are controlled by facies changes to more clastic material, reducing both the overall evaporite content and the concentration of colemanite within the evaporites. The southeast end of the deposit is open-ended and additional drilling is necessary to define the southeastern limits of borate deposition per Wilkinson & Krier, 1985.

6.3 Stratigraphic Column

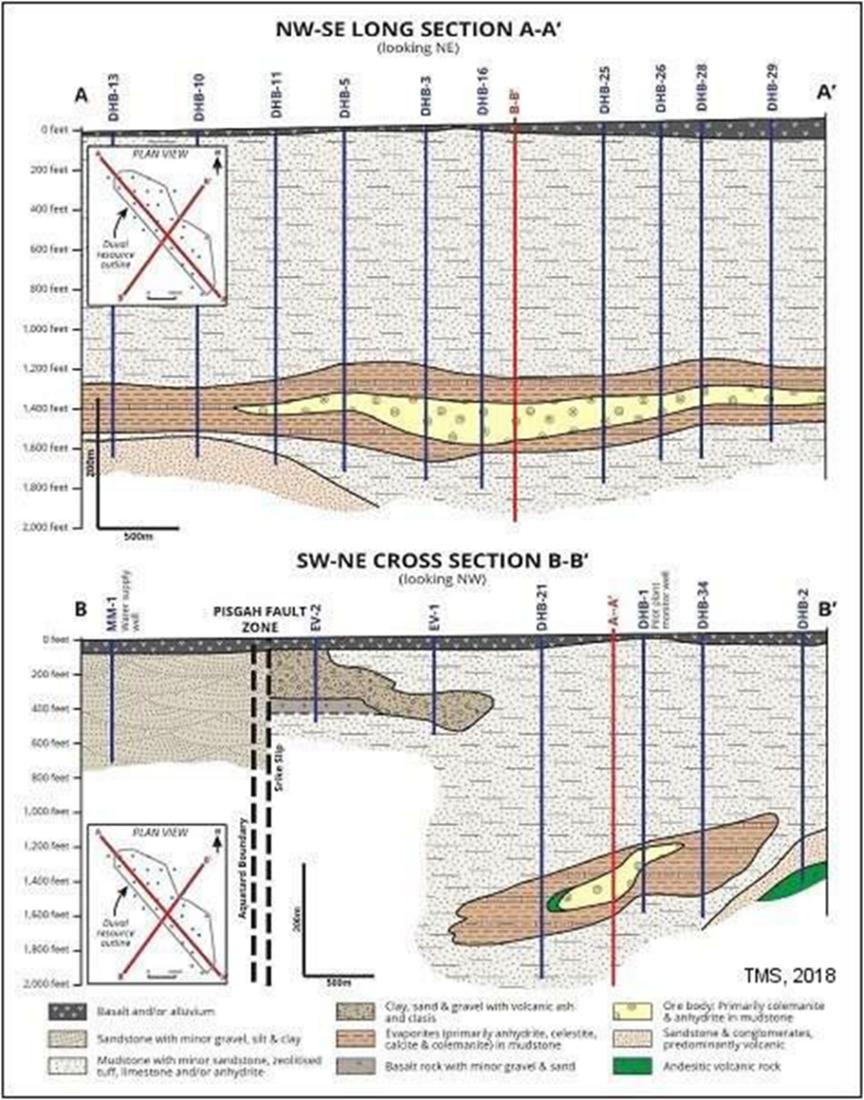

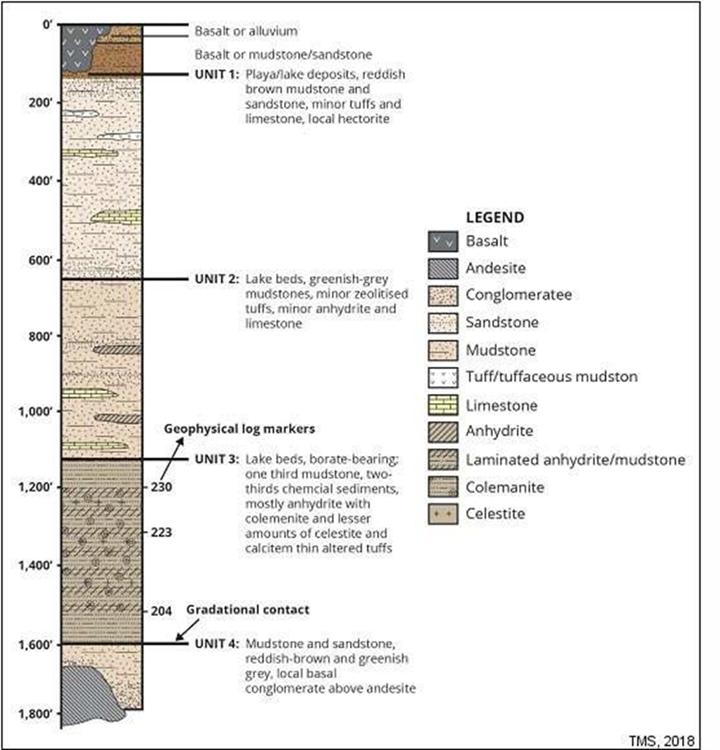

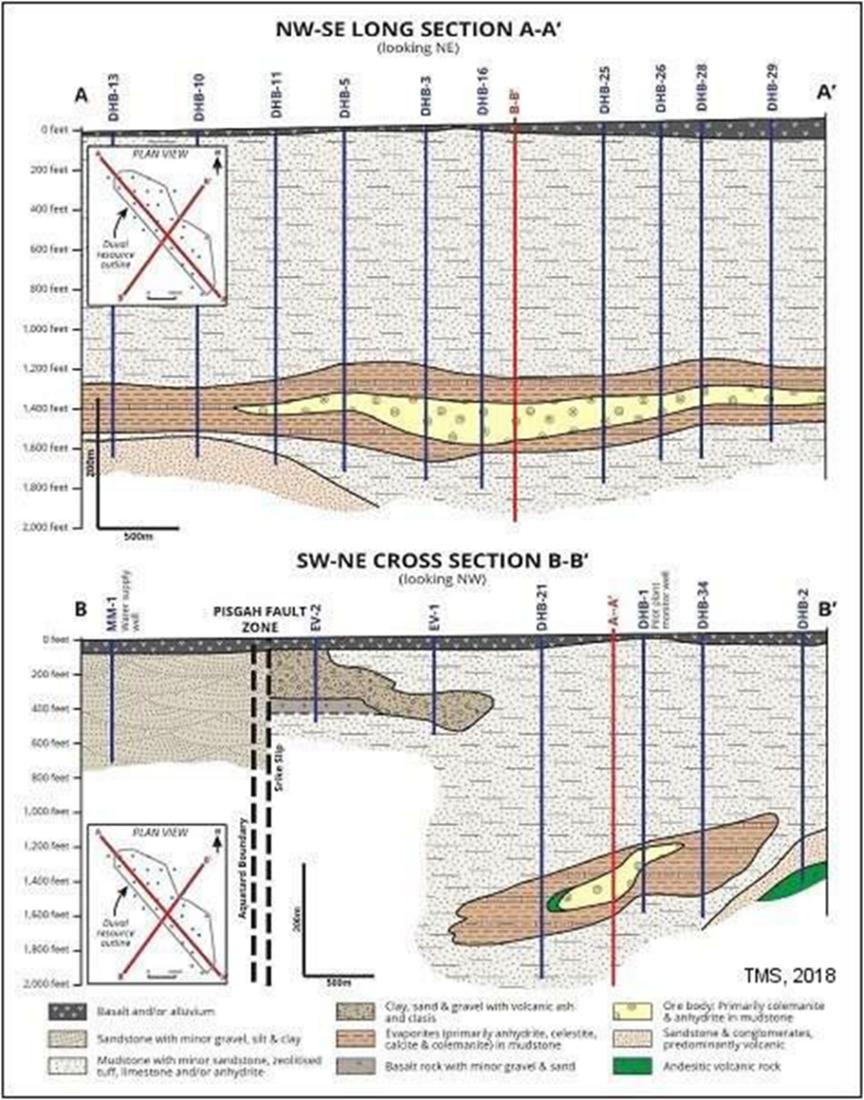

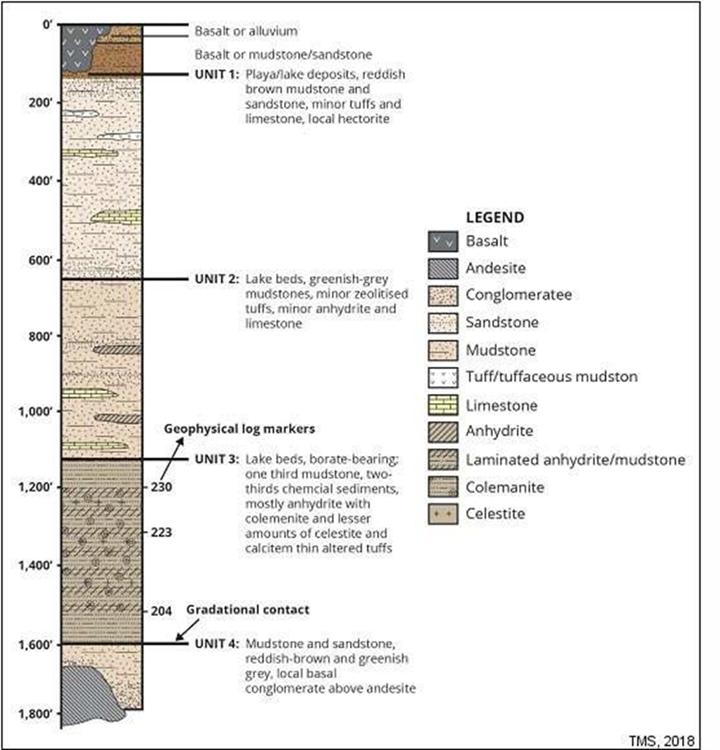

Drilling of the deposit by Duval in the late 1970’s and early 1980’s defined the following lithological sequence (Figure 6.3 and Figure 6.4). Four major units have been identified:

•Unit 1: is characterized by a 490 to 655 ft thick sequence of red-brown mudstones with minor sandstone, zeolitized tuff, limestone, and rarely hectorite clay beds. Unit 1 is located immediately below the alluvium and surface basaltic lavas.

•Unit 2: is a green-grey mudstone that contains minor anhydrite, limestone, and zeolitized tuffs. Unit 2 has a thickness ranging from 330 to 490 ft and is interpreted as lacustrine beds.

•Unit 3: is a 245-to-490-foot thick evaporite section which consists of rhythmic laminations of anhydrite, clay, calcite, and gypsum. Unit 3 contains the colemanite mineralization. Thin beds of air fall tuff are found in the

23

unit which provide time continuous markers for interpretation of the sedimentation history. These tuffs have variably been altered to zeolites or clays. Anhydrite is the dominant evaporite mineral, and the ore deposit itself is made up mostly of an intergrowth of anhydrite, colemanite, celestite, and calcite with minor amounts of gypsum and howlite.

•Unit 4: is characterized by clastic sediments made up of red and grey-green mudstones and siltstones, with locally abundant anhydrite and limestone. The unit is approximately 160 ft thick and rests directly on an irregular surface of andesitic lava flows. Where drilling has intersected this boundary, it has been noted that an intervening sandstone or conglomerate composed mostly of coarse volcanic debris is usually present.

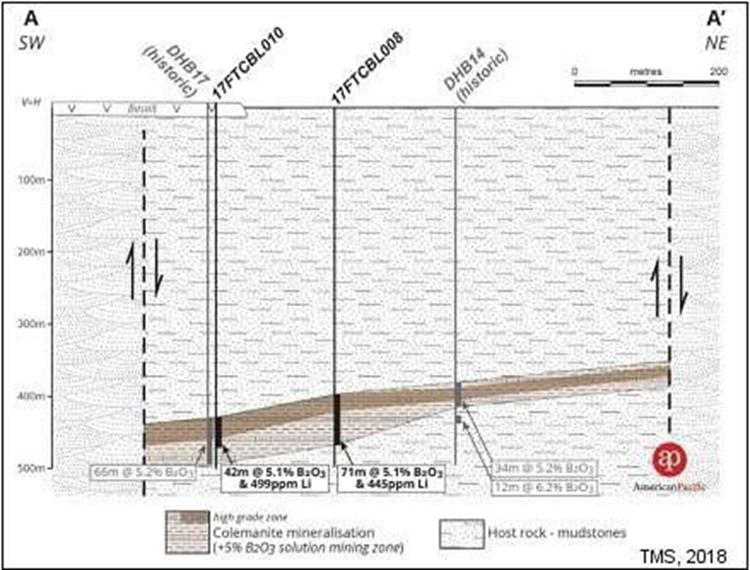

Figure 6.3 Long-section and Cross-section through the Fort Cady Deposit

24

Figure 6.4 Generalized Lithological Column for the Fort Cady Deposit

7 Exploration

7.1 Non-drilling exploration

Non-drilling exploration has not been deemed appropriate for this deposit.

7.2 Drilling

7.2.1 Historic Drilling

As part of their exploration program, Duval completed 35 drill holes between 1979 and 1981. The DHB holes were drilled using a combination of rotary drilling through the overburden followed by core drilling through the evaporite sequence. DHB-32 was drilled as a water well southeast of the Project. Geologic logs of rotary cuttings and core were completed for all holes followed by geochemical analyses of the core. Duval paid particular attention in logging to identifying marker beds ash tuffs for correlation. In addition to geologic logging, down-hole geophysics were completed on 25 holes for gamma ray and neutron. A few holes had additional geophysical logs completed for compensated density, deviation, induction, elastic properties, and caliper.

In 1981 and 1982, after the exploration program, Duval drilled five solution mining test (SMT) wells which were used in injection/recovery tests. Like previous drilling, the wells were rotary drilled through the overburden and cored through the evaporite sequence. Following coring, a 5.5-inch casing was set through the cored interval. All SMT wells were logged, and analytical samples are available from the cored intervals of SMT-1, SMT-2, and SMT-3. Gamma ray and neutron logs were collected from all SMT wells. Caliper, compensated density, and induction logs were run on several,

25

but not all the SMT wells. Three additional SMT wells were established in 1992 and 1993 (SMT-92 & 93 Holes) and these three wells were rotary drilled to full depth and no geologic samples were collected.

FCMC completed two drilling campaigns during their participation in the Project. Additional P-Series holes were completed between 1987 and 1996 as rotary holes for injection/recovery test wells. Cuttings were sampled for analysis at 5-foot intervals for holes P-1, P-2, and P-3. A ten-foot sampling interval was used for sampling on P-4. No geologic samples were collected for holes P-5, P-6, and P-7. FCMC completed three S-Series wells in 1990. All three wells were rotary drilled and no geologic sampling was performed. FCMC completed down-hole geophysics on all the P and S-series wells. Historic drilling completed by Duval and FCMC is summarized in Table 7.1.

Table 7.1 Historic Drilling Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | UTM 83-11 m | | | | | | | | | Rotary Interval ft | | | Cored Interval ft | | | | |

Drill Hole ID | | Easting | | | Northing | | | Collar Elev. ft | | | Depth ft | | | From | | | To | | | From | | | To | | | No. of Samples | |

DHB-01 | | | 553,336 | | | | 3,846,154 | | | | 2,004 | | | | 1,623 | | | | — | | | | 1,090 | | | | 1,090 | | | | 1,623 | | | | 187 | |

DHB-02 | | | 554,062 | | | | 3,846,179 | | | | 2,033 | | | | 1,679 | | | | — | | | | 955 | | | | 955 | | | | 1,443 | | | | — | |

DHB-03 | | | 553,089 | | | | 3,845,899 | | | | 1,980 | | | | 1,773 | | | | — | | | | 940 | | | | 940 | | | | 1,773 | | | | 214 | |

DHB-04 | | | 552,855 | | | | 3,845,669 | | | | 1,981 | | | | 1,708 | | | | — | | | | 1,194 | | | | 1,194 | | | | 1,708 | | | | 178 | |

DHB-05 | | | 552,848 | | | | 3,846,153 | | | | 1,978 | | | | 1,730 | | | | — | | | | 1,043 | | | | 1,043 | | | | 1,730 | | | | 179 | |

DHB-06 | | | 553,115 | | | | 3,846,386 | | | | 2,008 | | | | 1,616 | | | | — | | | | 1,040 | | | | 1,040 | | | | 1,616 | | | | 125 | |

DHB-07 | | | 553,736 | | | | 3,845,492 | | | | 2,000 | | | | 1,735 | | | | — | | | | 1,063 | | | | 1,063 | | | | 1,735 | | | | 181 | |

DHB-08 | | | 552,575 | | | | 3,846,214 | | | | 1,966 | | | | 1,809 | | | | — | | | | 1,072 | | | | 1,072 | | | | 1,809 | | | | 186 | |

DHB-09 | | | 552,391 | | | | 3,846,408 | | | | 1,967 | | | | 1,750 | | | | — | | | | 1,137 | | | | 1,137 | | | | 1,750 | | | | 138 | |

DHB-10 | | | 552,349 | | | | 3,846,631 | | | | 1,980 | | | | 1,655 | | | | — | | | | 1,148 | | | | 1,148 | | | | 1,655 | | | | 86 | |

DHB-11 | | | 552,599 | | | | 3,846,390 | | | | 1,976 | | | | 1,671 | | | | — | | | | 1,150 | | | | 1,150 | | | | 1,671 | | | | 86 | |

DHB-12 | | | 552,824 | | | | 3,846,402 | | | | 1,993 | | | | 1,625 | | | | — | | | | 1,130 | | | | 1,130 | | | | 1,625 | | | | 85 | |

DHB-13 | | | 552,104 | | | | 3,846,877 | | | | 1,978 | | | | 1,661 | | | | - | | | | 1,140 | | | | 1,140 | | | | 1,661 | | | | 70 | |

DHB-14 | | | 553,089 | | | | 3,846,151 | | | | 1,987 | | | | 1,631 | | | | — | | | | 1,105 | | | | 1,105 | | | | 1,631 | | | | 80 | |

DHB-15 | | | 553,580 | | | | 3,846,158 | | | | 2,013 | | | | 1,609 | | | | — | | | | 1,177 | | | | 1,177 | | | | 1,609 | | | | 51 | |

DHB-16 | | | 553,263 | | | | 3,845,595 | | | | 1,985 | | | | 1,845 | | | | — | | | | 1,193 | | | | 1,193 | | | | 1,845 | | | | 138 | |

DHB-17 | | | 552,843 | | | | 3,845,925 | | | | 1,982 | | | | 1,804 | | | | — | | | | 1,178 | | | | 1,178 | | | | 1,804 | | | | 151 | |

DHB-18 | | | 553,238 | | | | 3,845,431 | | | | 1,978 | | | | 1,880 | | | | — | | | | 1,212 | | | | 1,212 | | | | 1,878 | | | | 106 | |

DHB-19 | | | 554,141 | | | | 3,845,287 | | | | 2,034 | | | | 1,460 | | | | — | | | | 1,060 | | | | 1,060 | | | | 1,460 | | | | 74 | |

DHB-20 | | | 553,006 | | | | 3,845,437 | | | | 1,998 | | | | 1,671 | | | | — | | | | 1,207 | | | | 1,207 | | | | 1,671 | | | | — | |

DHB-21 | | | 553,292 | | | | 3,845,143 | | | | 2,011 | | | | 1,752 | | | | — | | | | 1,118 | | | | 1,118 | | | | 1,828 | | | | 39 | |

DHB-22 | | | 553,275 | | | | 3,845,902 | | | | 1,988 | | | | 1,711 | | | | — | | | | 1,196 | | | | 1,196 | | | | 1,711 | | | | 135 | |

DHB-23 | | | 553,508 | | | | 3,845,110 | | | | 2,021 | | | | 1,857 | | | | — | | | | 1,208 | | | | 1,208 | | | | 1,857 | | | | 114 | |

DHB-24 | | | 553,523 | | | | 3,845,637 | | | | 1,994 | | | | 1,780 | | | | — | | | | 1,202 | | | | 1,202 | | | | 1,780 | | | | 119 | |

DHB-25 | | | 553,699 | | | | 3,845,297 | | | | 2,021 | | | | 1,818 | | | | — | | | | 1,248 | | | | 1,248 | | | | 1,818 | | | | 152 | |

DHB-26 | | | 553,891 | | | | 3,845,056 | | | | 2,050 | | | | 1,702 | | | | — | | | | 1,106 | | | | 1,106 | | | | 1,702 | | | | 106 | |

DHB-27 | | | 553,698 | | | | 3,844,803 | | | | 2,043 | | | | 1,795 | | | | — | | | | 1,228 | | | | 1,228 | | | | 1,795 | | | | 95 | |

DHB-28 | | | 554,004 | | | | 3,844,943 | | | | 2,053 | | | | 1,690 | | | | — | | | | 1,185 | | | | 1,185 | | | | 1,690 | | | | 115 | |

DHB-29 | | | 554,164 | | | | 3,844,454 | | | | 2,040 | | | | 1,610 | | | | — | | | | 1,203 | | | | 1,203 | | | | 1,610 | | | | 101 | |

DHB-30 | | | 553,873 | | | | 3,844,630 | | | | 2,050 | | | | 1,720 | | | | — | | | | 1,250 | | | | 1,250 | | | | 1,720 | | | | 83 | |

DHB-31 | | | 553,865 | | | | 3,844,381 | | | | 2,037 | | | | 1,460 | | | | — | | | | 1,195 | | | | 1,195 | | | | 1,625 | | | | 41 | |

DHB-32 | | | 551,770 | | | | 3,843,845 | | | | 2,045 | | | | 870 | | | | — | | | | 870 | | | | — | | | | — | | | | — | |

DHB-33 | | | 554,045 | | | | 3,844,254 | | | | 2,043 | | | | 1,601 | | | | — | | | | 1,124 | | | | 1,124 | | | | 1,860 | | | | 80 | |

DHB-34 | | | 553,746 | | | | 3,845,722 | | | | 2,116 | | | | 1,525 | | | | — | | | | 1,150 | | | | 1,150 | | | | 1,620 | | | | 79 | |

DHB-35 | | | 551,249 | | | | 3,848,166 | | | | 2,068 | | | | 1,449 | | | | — | | | | 1,194 | | | | 1,194 | | | | 1,459 | | | | — | |

P1 | | | 553,093 | | | | 3,845,908 | | | | 1,984 | | | | 1,500 | | | | — | | | | 1,500 | | | | — | | | | — | | | | 20 | |

P2 | | | 553,094 | | | | 3,845,969 | | | | 1,984 | | | | 1,510 | | | | — | | | | 1,510 | | | | — | | | | — | | | | 21 | |

P3 | | | 553,033 | | | | 3,845,902 | | | | 1,981 | | | | 1,510 | | | | — | | | | 1,510 | | | | — | | | | — | | | | 18 | |

P4 | | | 553,033 | | | | 3,845,935 | | | | 1,977 | | | | 1,510 | | | | — | | | | 1,510 | | | | — | | | | — | | | | 34 | |

P5 | | | 553,193 | | | | 3,845,874 | | | | 1,985 | | | | 1,547 | | | | — | | | | 1,547 | | | | — | | | | — | | | | — | |

P6 | | | 553,209 | | | | 3,845,946 | | | | 1,989 | | | | 1,525 | | | | — | | | | 1,525 | | | | — | | | | — | | | | — | |

P7 | | | 553,217 | | | | 3,846,023 | | | | 1,992 | | | | 1,475 | | | | — | | | | 1,475 | | | | — | | | | — | | | | — | |

SMT-1 | | | 553,323 | | | | 3,846,144 | | | | 2,004 | | | | 1,315 | | | | — | | | | 1,235 | | | | 1,235 | | | | 1,315 | | | | 59 | |

SMT-2 | | | 553,310 | | | | 3,846,135 | | | | 2,004 | | | | 1,679 | | | | — | | | | 1,234 | | | | 1,234 | | | | 1,316 | | | | 55 | |

SMT-3 | | | 553,211 | | | | 3,845,897 | | | | 1,988 | | | | 1,679 | | | | — | | | | 1,325 | | | | 1,325 | | | | 1,518 | | | | 69 | |

SMT-6 | | | 553,210 | | | | 3,845,934 | | | | 1,988 | | | | 1,450 | | | | — | | | | 1,341 | | | | 1,341 | | | | 1,450 | | | | — | |

SMT-9 | | | 553,194 | | | | 3,845,837 | | | | 1,985 | | | | 1,497 | | | | — | | | | 1,341 | | | | 1,341 | | | | 1,497 | | | | — | |

This data, along with company drilling discussed in Section 7.2.2 and subsequent analysis discussed in Section 8, form the basis and confirmations for the geologic model.

26

7.2.2 Company Drilling

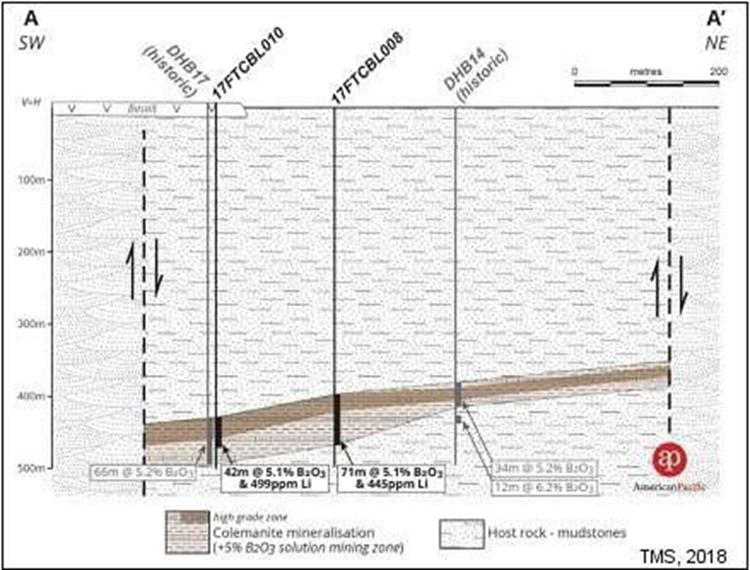

After acquisition of the Project in May 2017, American Pacific Borates and Lithium, Ltd, a predecessor entity to 5E, completed 14 drill holes, which confirmed previous drilling results and expanded the Mineral Resource Estimate. Table 7.2 provides a summary of the 2017 drilling program. A cross-section through the deposit is also displayed in Figure 7.1. Drilling through the overburden sequence was completed using rotary air blast drilling. This was followed by drilling a 2.5-inch core through the evaporite sequence. All drill holes were completed vertically with no greater than five degrees of deviation.

Table 7.2 2017 APBL Drilling Summary and IR-01-01

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | UTM 83-11 m | | | | | | | | | Rotary Interval ft | | | Cored Interval ft | | | | |

Drill Hole ID | | Easting | | | Northing | | | Collar Elev. ft | | | Depth ft | | | From | | | To | | | From | | | To | | | No. of Samples | |

17FTCBL-01 | | | 552,638 | | | | 3,846,716 | | | | 2,006 | | | | 1,569 | | | | — | | | | 1,204 | | | | 1,204 | | | | 1,569 | | | | 82 | |

17FTCBL-02 | | | 552,711 | | | | 3,846,490 | | | | 1,997 | | | | 1,509 | | | | — | | | | 1,208 | | | | 1,208 | | | | 1,509 | | | | 107 | |

17FTCBL-03 | | | 552,981 | | | | 3,846,485 | | | | 2,019 | | | | 1,459 | | | | — | | | | 1,153 | | | | 1,153 | | | | 1,459 | | | | 91 | |

17FTCBL-04 | | | 552,695 | | | | 3,846,268 | | | | 1,978 | | | | 1,738 | | | | — | | | | 1,266 | | | | 1,266 | | | | 1,738 | | | | 162 | |

17FTCBL-05 | | | 552,930 | | | | 3,846,267 | | | | 1,995 | | | | 1,589 | | | | — | | | | 1,237 | | | | 1,237 | | | | 1,589 | | | | 150 | |

17FTCBL-06 | | | 553,145 | | | | 3,846,260 | | | | 2,002 | | | | 1,502 | | | | — | | | | 1,189 | | | | 1,189 | | | | 1,502 | | | | 83 | |

17FTCBL-07 | | | 552,772 | | | | 3,846,041 | | | | 1,977 | | | | 1,775 | | | | — | | | | 1,196 | | | | 1,196 | | | | 1,775 | | | | 207 | |

17FTCBL-08 | | | 552,972 | | | | 3,846,042 | | | | 1,984 | | | | 1,625 | | | | — | | | | 1,202 | | | | 1,202 | | | | 1,625 | | | | 153 | |

17FTCBL-09 | | | 553,179 | | | | 3,846,037 | | | | 1,992 | | | | 1,560 | | | | — | | | | 1,169 | | | | 1,169 | | | | 1,560 | | | | 120 | |

17FTCBL-10 | | | 552,831 | | | | 3,845,939 | | | | 1,989 | | | | 1,647 | | | | — | | | | 1,208 | | | | 1,208 | | | | 1,647 | | | | 176 | |

17FTCBL-11 | | | 553,078 | | | | 3,845,899 | | | | 1,983 | | | | 1,778 | | | | — | | | | 1,332 | | | | 1,332 | | | | 1,778 | | | | 155 | |

17FTCBL-12 | | | 552,963 | | | | 3,845,801 | | | | 1,973 | | | | 1,750 | | | | — | | | | 1,281 | | | | 1,281 | | | | 1,750 | | | | 212 | |

17FTCBL-13 | | | 553,153 | | | | 3,845,818 | | | | 1,992 | | | | 1,769 | | | | — | | | | 1,313 | | | | 1,313 | | | | 1,769 | | | | 155 | |

17FTCBL-14 | | | 553,270 | | | | 3,845,608 | | | | 1,987 | | | | 1,845 | | | | — | | | | 1,328 | | | | 1,328 | | | | 1,845 | | | | 260 | |

IR-01-01 | | | 553,472 | | | | 3,845,807 | | | | 1,991 | | | | 1,551 | | | | — | | | | 1,112 | | | | 1,112 | | | | 1,991 | | | | 135 | |

Core logging was completed on all drill holes and included lithological and geotechnical logging. Downhole geophysical logs included Gam Ray, Induction, and standard caliper, and were completed on all drill holes from surface to total depth except for 17FTCBL009 where adverse hole conditions resulted in only partial geophysical logging. All core is logged and photographed according to industry standard procedures. An example of core photos is shown in Figure 7.2.

A geotechnical drill hole, APBL023, was also completed in 2017. This well was cored for its entire length and a geologic log was completed to define mineralized horizons. No splitting or analytical samples were collected from this hole to preserve the core for subsequent geotechnical testing.

The QP considers the drilling program by APBL to be of sufficient quality to support a Mineral Resource Estimate.

27

Figure 7.1 Cross-section Through the Fort Cady Deposit

Figure 7.2 Core Photo, 17FTCBL-014

28

7.3 Hydrogeology

7.3.1 Hydraulic Setting

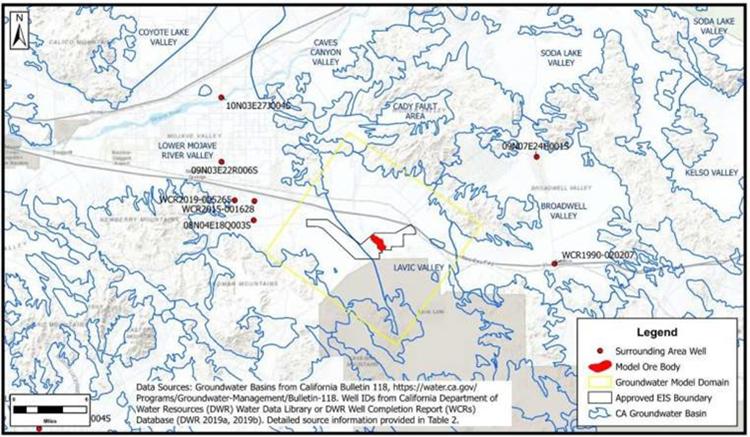

The Project deposit is in the California Hydrologic Unit Basin 12 Lavic Valley, sub-basin 180902081303. There is no name associated with the sub-basin and it is located north and west of the Lavic Lake and town of Lavic hydrologic sub basins. Basin 180902081303 is approximately 39,657 acres (160.48 square kilometers) in area and extends from the Rodman Mountains south and west of the Project in a north direction towards Highway 40, terminating at a topographical divide at the highway. The basin is bound to the south and east by the Pisgah Crater and Lavic Lake Volcanic Field.

The Fort Cady Mountains bind Basin 12 to the north and the Rodman Mountains and Lava Bed Mountains bind Basin 12 to the south of the Project. Groundwater flow in the Lavic Valley basin is poorly defined, and outflow is interpreted to occur to the east of Broadwell Valley, with no localized groundwater discharge such as evapotranspiration or discharge to springs or a river.

The mineral deposit is bounded to the west by the Pisgah Fault and to the east by subordinate faults to include Fault B. See UIC permit application and Confluence Water Resources CWR, 2019 Fault B Program Results, Technical Report.

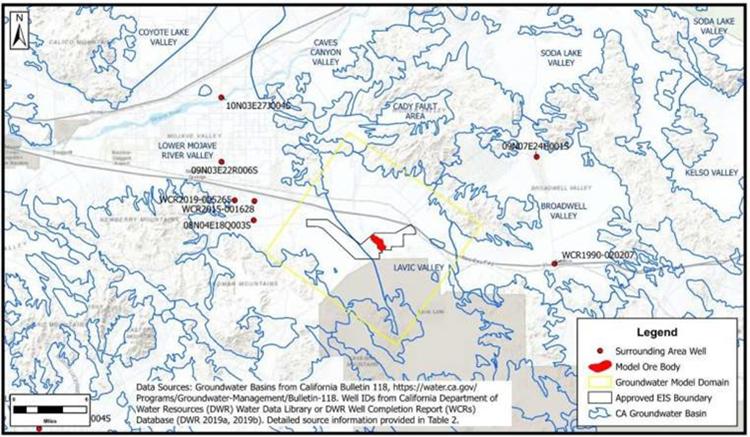

The nearest industrial well, owned by Candeo Lava Products, is located 3.5 miles east of the Project ore body. No other water wells are known to exist within the vicinity of the Project. Water level measurements from the Candeo Lava Products well were not available for this study but are greater than 96 ft bgs based on the CWR investigation in 2018. The next closest water well is located north and west of the Project at the Desert Oasis Highway Rest Stop. The well provides non-potable water to the rest stop facilities. This well is located approximately 7-miles northwest of the Project. Depth to water from the Rest Stop Well, Well 1807, was measured by CWR to be 54.75 ft bgs, approximate elevation of 1,758 ft amsl.

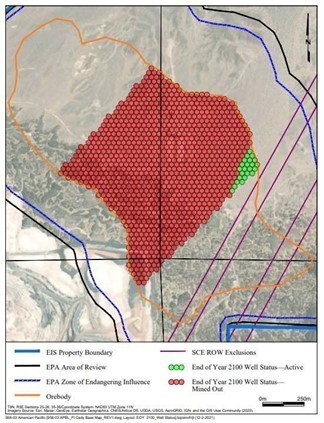

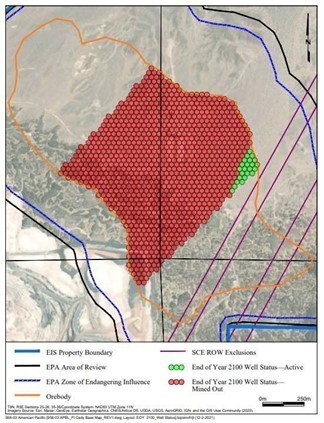

The location of the nearest known industrial groundwater wells in the region surrounding the Project are provided in Figure 7.3.

Figure 7.3 Project Area Groundwater Basins and Surrounding Area Wells, Fort Cady Project, San Bernardino, CA

Private domestic wells are associated with rural residences located greater than 6.5 miles west of the Project on the eastern edge of the town of Newberry Springs. Irrigation wells are located further west, the closest of which is approximately 10 miles west of the Project. The Pisgah Fault separates these residential and irrigation wells from the Project area, such that they are not within the same regional groundwater flow system and are not hydraulically connected.

29

The Project is located within a closed basin, although rarely present in the vicinity of the Project, surface water flows in a northwesterly direction past the Project area from the Rodman Mountains and the Pisgah Crater topographic divide. There are no springs or streams in the vicinity of the Project. There are no perineal surface water features in the vicinity of the ore body. Surface water-related features are seasonal, and ephemeral based on meteorological events. These features consist of unnamed dry washes that may carry water during heavy storm events. These washes generally drain west through the Project area toward the Troy Lake playa in Newberry Springs.

7.3.2 Project Area Wells

The orebody is “wedged” between the Pisgah Fault and Fault B. The static depths to groundwater in the vicinity of the orebody generally range between 240 and 350 ft bgs. The depths to groundwater in the wedge are generally shallower at wells collared at lower elevations and deeper at wells collared at higher topography. The groundwater elevation in the wedge ranges from between approximately 1,681 ft amsl at AOR-7A to 1,763 ft amsl at AOR-3A.

The groundwater elevation outside the wedge, west of the Pisgah Fault in the quaternary alluvial fan sediments of the Lower Mojave River Valley Groundwater Basin is approximately 1,785 ft amsl as measured in Project wells MWW-1, MWW-S1, and MWW-2.

The difference in groundwater elevation between Project wells presents a steepening of gradient from west to east across the Pisgah Fault. There is approximately a 20-foot water level differential on the east and west sides of the Pisgah Fault, which is regionally recognized as a barrier to groundwater flow and forms a groundwater basin boundary.

Groundwater in the vicinity of Fault B at Project wells TW-1, PW-1, and PW-2, is found at depths of approximately 350 to 390 ft bgs in coarser alluvial sediments to the east of Fault B (PW-1 and PW-2) and a mix of alluvial and fine playa sediments to the west of Fault B (TW-1).

No Underground Source of Drinking Water (USDW) aquifer has been encountered in the Wedge for at least 1,700 ft bgs. Monitoring wells drilled in 2021 by 5E as part of permit compliance did not encounter groundwater above the Unit 4 sediments with exception of a perched expression of groundwater localized to fine sand lenses underlaying surficial basalt above the contact with Unit 1. The results of the Shallow Groundwater Characterization Program, CWR, June 2022, Shallow Groundwater Characterization Report on Mining Block 2 Near Pisgah Fault, indicated that the expression of groundwater encountered during drilling of Series 7 wells is of low yield, of poor quality and likely of low storage.

The recharge originates from precipitation occurring in the Lava Bed Mountains, and drainage from Sunshine Peak, located southwest of the Project. The upgradient precipitation drains into the shallow alluvium southwest of the Pisgah Fault. The shallow groundwater flows in a northeast direction through unconsolidated alluvial sediments, then drains under the basalt flow at a gradient of 0.002 into cemented sandstone and mudstone, where it is compartmentalized within the lithology influence by the fault. Interpretation of chip logs for all Series 7 and Series 3 wells, and the WSW and WMW wells, indicate the shallow cemented sandstone is not uniform and decreases in depth to the east of the Project, where the mudstone is encountered higher in most wellbores. Likely, a result of pre-basalt flow topography and/or offset from faulting.

Since shallow groundwater was not encountered or observed through drilling of the Series 3 monitor wells, the Pisgah Fault is interpreted as being a strong influence on flow dynamics of the shallow groundwater system and plausibly influences the groundwater quality in Block 2. The lateral extent of the shallow groundwater system is anticipated to be confined to within the area underlying the surface basalt near the Series 7 wells and the extent of the Pisgah Fault zone northwest of the Project.

The Pisgah Fault is not the source of the shallow groundwater but compartmentalizes its lateral extent to within the western portions of the Project area. The results of the shallow groundwater characterization program do not support the existence of an USDW aquifer based on extremely low permeability, low yield, poor quality, and compartmentalization characteristics.

30

Below Unit 4 is andesite. Groundwater was encountered in the andesite in MW-3B. CWR, March 12, 2023, CWR Technical Memorandum, Results of OW-3A and MW-3B Hydraulic Testing, Fort Cady California Project, describe the results of groundwater testing between Unit 4 and the underlying andesite.

Proven water resources have been deemed acceptable through Phase 2 of the Project, with alternatives discussed in Section 18.

7.3.3 Hydraulic Properties

Testing for hydraulic properties of the colemanite and evaporates/mudstones containing the colemanite have occurred on several occasions. Beginning in 1980, Duval retained Core Laboratories, Inc. to conduct injectivity tests on one-inch cores from SMT-1. The samples were extracted with toluene, leached of salts with cool methanol, and dried in a controlled humidity oven. Permeability to air and Boyle’s Law porosity were determined for each sample. The injectivity tests were performed at the reservoir temperature of (Simulated) formation water which flowed through the core until equilibrium occurred and a minimum of three pore volumes had been injected. The permeability of water was determined by the equipment. Sulfuric acid and hydrochloric acid solutions were injected through the core samples after which permeability to acid solutions was determined. While detailed information on the testing procedures conducted by Core Labs is available, detailed quality assurance and quality control (QA/QC) procedures are not available. Initial permeability was found to range from 1.35 x 10-9 to 2.9 x 10-10 cm/sec in 1990, after In-Situ, Inc. (In-Situ) conducted a multiple well constant rate injection test to determine direction tendencies of hydraulic properties of the mineral deposit.

In-Situ also investigated the effects of previous injection/recovery testing. Using a Badger flow meter, a HEREMIT data logger, and pressure transmitters, water-level responses were measured in the injection well and six nearby observation wells. In-Situ used the Cooper and Jacob method to analyze data from each well and applied the Papadopulos Method to determine directional permeability. In-Situ’s work confirmed earlier work that permeability and transmissivity of the deposit are low.

Hydro-Engineering, 1996, summarized some of the testing and provided interpretations of prior testing conducted in 1981 and 1990. The mineralized sequence of rock transmissivity is estimated at 10 gal/day/ft, or 1.3 ft2/day. Assuming the colemanite mineralized sequence occurs over an approximate 300 ft thickness, then the native hydraulic conductivity (K) over this thickness is estimated at 4.5 x 10-3 ft/day. This K value is of a similar magnitude as estimated by Simon Hydro-Search 1993 of 8.2 x 10-3 to 2.2 x 10- 2 ft/day K converted from millidarcy units. The storage coefficient (S) of the ore body was estimated by Hydro-Engineering 1996 at 2.5 x 10-6.

Increases in transmissivity, hydraulic conductivity and storage coefficient will occur as colemanite is dissolved from the formation. Hydro-Engineering, 1996, estimated the end-point permeability of the ore body formation after colemanite dissolution would be approximately 30 times higher, and a long-term storage coefficient may be approximately 1.1 x 10-5. The end-point hydraulic properties are still low because much of the formation is evaporites, anhydrite, and claystone that will not be dissolved. The end-point porosity of the ore body formation after mining is predicted to be 15%. Core Laboratories, 1981, based on the colemanite content within the sediments and laboratory core analyses.

Injection and pumping tests were conducted in 1981 by Duval, 1986-1987 by MSME, and between 1996-2001 by FCMC. Injection was conducted at 150-300 psi pressures in the 1982 testing, with injection flow rates mostly of 1.5-2.5 gallons-per-minute (gpm), indicative of the hydraulically tight nature of the claystone hosting the deposit. In the 1986-1987 testing, rates of 1.3 to 5.3 gpm were observed over testing periods lasting from 6 to 71 days. The mudstone and claystone sediments above and below the ore body evaporites are also understood to be of very low transmissivity. Pump test results, CWR, 2019, provided an estimate of the hydraulic conductivity in the 10-5 range.

In 2018, CWR was retained by 5E to characterize hydrology east of Fault B, approximately 3,500 ft east of the colemanite deposit. CWR found a significant groundwater resource east of Fault B and that the fault is a barrier to groundwater flow. Stable isotope analytical results were compared against Nevada Meteoric Water Lines appropriate for desert terrains and found that the aquifer east of Fault B and the aquifer west of the Pisgah Fault have different origins and the

31