- FEAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFR14A Filing

5E Advanced Materials (FEAM) DEFR14ARevised proxy

Filed: 10 Jun 24, 6:04am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a‑12

5E ADVANCED MATERIALS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

EXPLANATORY NOTE REGARDING PROXY SUPPLEMENT

On May 20, 2024, 5E Advanced Materials, Inc., a Delaware corporation, (“we,” “us,” “our,” the “Company,” “5E”) filed with the Securities and Exchange Commission (the “SEC”) a proxy statement (the “Proxy Statement”) and its Notice of 2023 Annual Meeting of Stockholders for the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”). On or around May 21, 2024, the Company began distributing the Proxy Statement to stockholders of record as of May 1, 2024 (the “Record Date”) containing instructions on how to access the Proxy Statement and vote.

Recent Developments

Since the distribution of the proxy materials, there have been certain developments at the Company. We are reaching out to you to describe these recent events and to supplement portions of the Proxy Statement as set forth in this Supplement to the Proxy Statement.

On May 28, 2024, the Company entered into a second amendment (“Amendment No. 2”) to its Amended and Restated Note Purchase Agreement, dated as of January 18, 2024 (as amended, the “Existing Note Purchase Agreement”) by and among the Company, BEP Special Situations IV LLC (“Bluescape”), Ascend Global Investment Fund SPC, for and on behalf of Strategic SP (“Ascend” and, together with Bluescape, the “Purchasers”), Meridian Investments Corporation, and Alter Domus (US) LLC, as collateral agent, related to the Company’s outstanding 4.50% senior secured convertible notes (the “Existing Notes”).

Pursuant to Amendment No. 2, the Company agreed, among other things, to (i) issue and sell new senior secured convertible notes in an aggregate principal amount of $6.0 million (the “New Notes” and, collectively with the Existing Notes, the “Notes”) to Bluescape and Ascend, (ii) amend and restate the Existing Note Purchase Agreement in the form attached as Annex A to Amendment No. 2 (the “Amended and Restated Note Purchase Agreement”) and (iii) amend and restate the existing Amended and Restated Investor and Registration Rights Agreement (the “Existing IRRA”) among the Company, the Purchasers and the other parties thereto (as amended, the “Second Amended and Restated IRRA”). The transactions contemplated by Amendment No. 2, including the issuance and sale of the New Notes (the “Closing”), are subject to customary closing conditions set forth in Amendment No. 2. A description of the New Notes, Amended and Restated Note Purchase Agreement, and the Second Amended and Restated IRRA is included in a Current Report on Form 8-K filed on May 28, 2024 with the SEC.

The enclosed Supplement to the Proxy Statement (the “Supplement”) is being made available to stockholders of record as of the Record Date to add a new Proposal Five to approve, for purposes of Nasdaq Listing Rule 5635 and for all other purposes, of the issuance of additional shares of the Company’s common stock upon a Make-Whole Fundamental Change (as defined in Amendment No. 2) and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement, as well as a new Proposal Six to approve the adjournment of the Annual Meeting, if necessary to solicit additional proxies if there are not sufficient votes in favor of Proposal Five.

Except for the Amended Notice of 2023 Annual Meeting of Stockholders (the “Amended Notice of Meeting”), the addition of Proposal Five to submit the approval, for purposes of Nasdaq Listing Rule 5635 and for all other purposes, of the issuance of additional shares of the Company’s common stock upon a Make-Whole Fundamental Change and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement, and the addition of Proposal Six to approve the adjournment of the Annual Meeting, if necessary to solicit additional proxies if there are not sufficient votes in favor of Proposal Five, this Supplement does not modify or supplement any other matter presented for consideration or otherwise set forth in the Proxy Statement. We have, however, for stockholders’ convenience, included summary information regarding voting and the revocability of proxies. This Supplement, Amended Notice of Meeting and proxy card distributed to stockholders of record as of the Record Date should be read in conjunction with the Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended June 30, 2023 (the “2023 Annual Report”), as each contains information that is important to your decisions in voting at the 2023 Annual Meeting.

i

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To be held on June 24, 2024

|

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of 5E Advanced Materials, Inc., a Delaware corporation (the “Company”), will be held on Monday, June 24, 2024, at 10:00 a.m. Pacific time (being 3:00 am AEST Tuesday, June 25, 2024). To increase access for all of our stockholders, the Annual Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote, and submit questions during the Annual Meeting via the live webcast on the Internet at www.meetnow.global/MKL7NXS. You will not be able to attend the Annual Meeting in person, nor will there be any physical location.

Only stockholders of record at the close of business on May 1, 2024, are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. Holders of CHESS Depositary Interests (“CDIs”) of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting. We are committed to ensuring our stockholders have the same rights and opportunities to participate in the Annual Meeting as if it had been held in a physical location. As further described in the proxy materials for the Annual Meeting, you are entitled to attend the Annual Meeting via the live webcast on the Internet at www.meetnow.global/MKL7NXS. You may vote by telephone, Internet, or mail prior to the Annual Meeting. While we encourage you to vote in advance of the Annual Meeting, you may also vote and submit questions relating to meeting matters during the Annual Meeting (subject to time restrictions).

To be admitted to the Annual Meeting at www.meetnow.global/MKL7NXS, you must enter the 15-digit control number found on your proxy card. Holders of CDIs wishing to attend the Annual Meeting will need to do so as guests.

The Annual Meeting will be held for the following purposes:

to serve until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”) and until their respective successors are duly elected and qualified or until such director’s earlier death, resignation, or removal;

(a) 152,439 Restricted Share Units with an effective date of September 15, 2023 and vesting ratably over a three year period; and

(b) 152,439 Performance Share Units with an effective date of September 15, 2023 and a vesting date of September 15, 2026.

1

The foregoing items of business are more fully described in the Proxy Statement made available to stockholders on or about May 20, 2024, except for the addition of Proposal Five and Proposal Six, and additional information with respect thereto is set forth in the enclosed Supplement. The Proxy Statement and Annual Report are available at www.envisionreports.com/FEAM.

| By order of the Board of Directors, |

Hesperia, California | |

/s/ Paul Weibel | |

June 10, 2024 | Paul Weibel Chief Executive Officer and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on June 24, 2024. The Proxy Statement for the Annual Meeting and Annual Report for the fiscal year ended June 30, 2023 are available at www.envisionreports.com/FEAM. Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, and voter instruction form, as applicable) or by completing, signing, and mailing the enclosed proxy card in the enclosed envelope. Holders of CDIs can direct the Depositary Nominee to vote the common stock underlying their CDIs at the Annual Meeting by completing the CDI Voting Instruction Form. |

2

SUPPLEMENT TO PROXY STATEMENT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MONDAY, JUNE 24, 2024 AT 10:00 A.M. PACIFIC TIME (BEING 3:00 AM AEST TUESDAY, JUNE 25, 2024)

The Proxy Statement, this Supplement and the 2023 Annual Report are available at

http://www.envisionreports.com/FEAM

As disclosed in the Company’s Current Report on Form 8-K filed on May 28, 2024 with the Securities and Exchange Commission, on May 28, 2024, the Company entered into a second amendment (“Amendment No. 2”) to its Amended and Restated Note Purchase Agreement, dated as of January 18, 2024 (as amended, the “Existing Note Purchase Agreement”) by and among the Company, BEP Special Situations IV LLC (“Bluescape”), Ascend Global Investment Fund SPC, for and on behalf of Strategic SP (“Ascend” and, together with Bluescape, the “Purchasers”), Meridian Investments Corporation, and Alter Domus (US) LLC, as collateral agent, related to the Company’s outstanding 4.50% senior secured convertible notes (the “Existing Notes”).

Pursuant to Amendment No. 2, the Company agreed, among other things, to (i) issue and sell new senior secured convertible notes in an aggregate principal amount of $6.0 million (the “New Notes” and, collectively with the Existing Notes, the “Notes”) to Bluescape and Ascend, (ii) amend and restate the Existing Note Purchase Agreement in the form attached as Annex A to Amendment No. 2 (the “Amended and Restated Note Purchase Agreement”) and (iii) amend and restate the existing Amended and Restated Investor and Registration Rights Agreement (the “Existing IRRA”) among the Company, the Purchasers and the other parties thereto (as amended, the “Second Amended and Restated IRRA”). The transactions contemplated by Amendment No. 2, including the issuance and sale of the New Notes (the “Closing”), are subject to customary closing conditions set forth in Amendment No. 2.

This Supplement is being made available to stockholders to add a new Proposal Five, pursuant to which the Company will submit for approval, for purposes of Nasdaq Listing Rule 5635 and for all other purposes, the issuance of additional shares of the Company’s common stock upon a Make-Whole Fundamental Change and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement, as well as a new Proposal Six to approve the adjournment of the Annual Meeting, if necessary to solicit additional proxies if there are not sufficient votes in favor of Proposal Five. We are providing you with additional information in this Supplement to allow you to vote on Proposal Five and Proposal Six.

In order to cast your vote for Proposal Five and Proposal Six, you must fill out and submit the enclosed proxy card or otherwise submit updated voting instructions, as described in the Proxy Statement and in this Supplement. The receipt of the enclosed proxy card or updated voting instructions will revoke and supersede any proxy or voting instructions previously submitted. Therefore, if you are submitting the enclosed proxy card or providing updated voting instructions, you should vote on each proposal, including those for which you previously submitted a proxy or voting instructions.

If you have already voted and do not submit the enclosed proxy card or provide updated voting instructions, your previously submitted proxy or voting instructions will be voted at the Annual Meeting with respect to all other proposals, and your shares will not be counted in determining the outcome of Proposal Five and Proposal Six. However, if you submit the enclosed proxy card and do not provide voting instructions or vote only on Proposal Five and Proposal Six, but do not give any directions as to the other proposals, your shares will be voted in favor of each of the other director nominees in Proposal One and “FOR” Proposals Two, Three and Four. Stockholders holding in “street name” should refer to the Proxy Statement for more information about how their shares will be voted in this case.

None of the other agenda items presented in the Proxy Statement are affected by this Supplement. The Board continues to recommend that you vote “FOR” the election of each director nominees named in Proposal One, “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2024, “FOR” the approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, the participation by Susan Brennan and Barry Dick in the Company’s 2022 Equity Compensation Plan, and “FOR” the approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to Susan Brennan of the Company pursuant to the Company’s 2022 Equity Compensation Plan (noting that

3

Susan Brennan abstains from making any recommendation that stockholders vote in favor of Proposals Three and Four, and Barry Dick abstains from making any recommendation that stockholders vote in favor of Proposal Three).

Holders of CHESS Depositary Interests (“CDIs”) of the Company will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting.

4

THE INFORMATION PROVIDED IN THE “QUESTIONS AND ANSWERS” FORMAT BELOW IS FOR YOUR CONVENIENCE AND INCLUDES ONLY A SUMMARY OF CERTAIN INFORMATION CONTAINED IN THE PROXY STATEMENT AND THIS SUPPLEMENT. YOU SHOULD READ THE ENTIRE PROXY STATEMENT AND THIS SUPPLEMENT CAREFULLY.

QUESTIONS AND ANSWERS

How do I vote in advance of the Annual Meeting?

If you are a holder of record of shares of common stock of the Company, you may direct your vote without attending the Annual Meeting by following the instructions on the proxy card to vote by Internet or by telephone, or by signing, dating, and mailing a proxy card.

If you hold your shares in street name via a broker, bank, or other nominee, you may direct your vote without attending the Annual Meeting by signing, dating, and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank, or other nominee for further details.

How do I vote during the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Annual Meeting by entering the 15-digit control number found on your proxy card when you log in to the meeting at www.meetnow.global/MKL7NXS.

Shares held in street name through a brokerage account or by a broker, bank, or other nominee may only be voted at the Annual Meeting by submitting voting instructions to your bank, broker or other nominee or by presenting a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

Even if you plan to attend the Annual Meeting, we recommend that you vote in advance, as described above under “How do I vote in advance of the Annual Meeting?” so that your vote will be counted if you are unable to attend the Annual Meeting.

What do I do if I have not voted yet?

If you have not yet voted, in order to cast your vote, you must fill out and submit the enclosed proxy card or otherwise submit voting instructions, as described in the Proxy Statement and in this Supplement.

What do I do if I have already voted?

Your most recent proxy card or Internet or telephone proxy is the one that is counted. The receipt of the enclosed proxy card or updated voting instructions will revoke and supersede any proxy or voting instructions previously submitted.

5

Can I change my vote or revoke my proxy or CDI Voting Instruction Form?

You may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee. Please note that if your shares are held of record by a bank, broker, or other nominee and you decide to attend and vote at the Annual Meeting, your vote at the Annual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker, or other nominee).

If you are a holder of CDIs and you direct the Depositary Nominee to vote by completing the CDI Voting Instruction Form, you may revoke those instructions by delivering to Computershare Australia a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent, which notice must be received by no later than 7:00 p.m. Pacific time on Wednesday, June 19, 2024 (being 12 noon AEST on Thursday, June 20, 2024).

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote during the Annual Meeting.

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee. Please note that if your shares are held of record by a bank, broker, or other nominee and you decide to attend and vote at the Annual Meeting, your vote at the Annual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker, or other nominee).

6

What vote is required to approve each matter to be considered at the Annual Meeting?

Proposal |

| Matter |

| Vote Required |

| Broker Discretionary Voting Allowed |

| Effect of Broker Nonvotes |

| Effect of Abstentions |

1 |

| Election of each of the seven directors named in this Proxy Statement (1) Susan Brennan; (2) David Jay Salisbury; (3) Stephen Hunt; (4) H. Keith Jennings; (5) Sen Ming (Jimmy) Lim; (6) Graham van’t Hoff; (7) Barry Dick (each as a separate resolution). |

| Majority of Votes Cast |

| No |

| No Effect |

| No Effect |

2 |

| Ratification of the appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the fiscal year ending June 30, 2024. |

| Affirmative Vote of the Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote on the Matter |

| Yes |

| N/A |

| Same as Vote Against |

3 |

| Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by each of (1) Susan Brennan and (2) Barry Dick in the Company’s 2022 Equity Compensation Plan (each as a separate resolution). |

| Affirmative Vote of the Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote on the Matter |

| No |

| No Effect |

| Same as Vote Against |

4 |

| Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to Susan Brennan pursuant to the Company’s 2022 Equity Compensation Plan as follows: |

| Affirmative Vote of the Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote on the Matter |

| No |

| No Effect |

| Same as Vote Against |

|

| (a) 152,439 Restricted Share Units; and |

|

|

|

|

|

|

|

|

|

| (b) 152,439 Performance Share Units; |

|

|

|

|

|

|

|

|

|

| as further detailed in this Proxy Statement. |

|

|

|

|

|

|

|

|

5 |

| Approval, for purposes of Nasdaq Listing Rule 5635 and for all other purposes, of the issuance of additional shares of our common stock upon a Make-Whole Fundamental Change and upon conversion of the New Notes issuable under the Amended and Restated Note Purchase Agreement. |

| Affirmative Vote of the Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote on the Matter |

| No |

| No Effect |

| Same as Vote Against |

6 |

| Approval of the adjournment of the Annual Meeting, if necessary to solicit additional proxies if there are not sufficient votes in favor of Proposal Five. |

| Affirmative Vote of the Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote on the Matter |

| No |

| No Effect |

| Same as Vote Against |

7

Proposal One: Election of Seven Directors Named in This Proxy Statement.

Our Bylaws provide that the election of directors shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal One.

Under our Bylaws, a majority of the votes cast means that the number of shares voted “for” a nominee must exceed the votes cast “against” such nominee. The Nominating and Corporate Governance Committee has established procedures under which a director standing for reelection in an uncontested election must tender a resignation conditioned on the incumbent director’s failure to receive a majority of the votes cast. If an incumbent director who is standing for re-election does not receive a majority of the votes cast, the Nominating and Corporate Governance Committee shall make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors shall act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results.

Proposal Two: Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending June 30, 2024.

The proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year requires approval by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. An abstention on Proposal Two will have the same effect as a vote against. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker nonvotes on Proposal Two.

Proposal Three: Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by each of (1) Susan Brennan and (2) Barry Dick in the Company’s 2022 Equity Compensation Plan.

This proposal shall be determined by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against Proposal Three and broker nonvotes will have no effect on Proposal Three. A voting exclusion applies in respect of the proposal as noted in the Proxy Statement as filed with the SEC on May 20, 2024.

Proposal Four: Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to Susan Brennan pursuant to the Company’s 2022 Equity Compensation Plan.

This proposal shall be determined by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against Proposal Four and broker nonvotes will have no effect on Proposal Four. A voting exclusion applies in respect of the proposal as noted in the Proxy Statement as filed with the SEC on May 20, 2024.

Proposal Five: Approval, for purposes of Nasdaq Listing Rule 5635 and for all other purposes, of the issuance of additional shares of our common stock upon a Make-Whole Fundamental Change and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement.

This proposal shall be determined by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against Proposal Five and broker nonvotes will have no effect on Proposal Five.

8

Proposal Six: Approval of the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal Five.

This proposal shall be determined by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against Proposal Six and broker nonvotes will have no effect on Proposal Six.

The time and place of the Annual Meeting have not changed. The Annual Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote, and submit questions during the Annual Meeting via the live webcast on the Internet at www.meetnow.global/MKL7NXS.

We encourage you to vote so that your shares will be represented at the Annual Meeting.

9

PROPOSAL FIVE

TO APPROVE, FOR PURPOSES OF NASDAQ LISTING RULE 5635 AND FOR ALL OTHER PURPOSES, OF THE ISSUANCE OF additional shares of our Common Stock upon a Make-Whole Fundamental Change and upon conversion of the Convertible Notes ISSUABLE UNDER the amended and restated Note purchase Agreement

The Proposal

In connection with the Company’s out of court restructuring transactions consummated in January 2024, the Company amended and restated its Note Purchase Agreement (the “Existing NPA”). Consistent with the Company’s original note purchase agreement, the Existing NPA contemplated an adjustment to the conversion rate of the outstanding notes (the “Existing Notes”) in connection with certain change of control transactions involving the Company or other specified corporate events such as the failure of the Company’s common stock to be listed or quoted on any of The Nasdaq Global Select Market, The Nasdaq Global Market or The New York Stock Exchange (a “Make-Whole Fundamental Change”). However, at the time the Existing NPA was entered in January 2024, the reference table for calculating the number of additional shares of common stock that would be issuable upon a Make-Whole Fundamental Change (the “Make-Whole Table”) was unavailable, so the Company and the holders of the Existing Notes agreed that the table would be subsequently populated in a form agreeable to the parties using the same methodology as the table that was included in the original note purchase agreement entered in August 2022.

In May 2024, the Company and the holders of the Notes entered into an amendment (“Amendment No. 2”) to the Existing NPA in order to further amend and restate the agreement (“A&R NPA”). Pursuant to the A&R NPA, the Company will, among other things (i) issue and sell new senior secured convertible notes in an aggregate principal amount of $6.0 million (the “New Notes” and together with the Existing Notes and any additional notes paid as interest on the New Notes or the Existing Notes, the “Notes”) and (ii) update the Make-Whole Table (as updated, the “New Make-Whole Table”) as contemplated by the Existing NPA, provided that no shares of common stock would be issuable pursuant to the New Make-Whole Table until approval by the Company’s stockholders. The New Notes will be substantially identical to the Existing Notes, except that the conversion rate applicable to the New Notes will be subject to adjustment if, on or prior to December 31, 2024, the Company sells common stock or any other equity-linked securities at an effective price per share that is less than the conversion price then in effect for the New Notes, subject to certain exemptions (a “Degressive Issuance”). In the event of a Degressive Issuance, the Conversion Rate applicable to the New Notes will be adjusted based on the weighted average issuance price of the securities sold in such Degressive Issuance. Pursuant to the terms of the A&R NPA, the Company will not be permitted to effect any Degressive Issuance that would result in an adjustment to the conversion rate that requires the approval of the Company’s stockholders pursuant to Nasdaq Listing Rules, unless the Company has obtained such stockholder approval before such Degressive Issuance. The transactions contemplated by Amendment No. 2, including the issuance and sale of the New Notes and the execution of the A&R NPA, are subject to customary closing conditions set forth in Amendment No. 2. A copy of Amendment No. 2 and the A&R NPA and a summary of such documents are included in a Current Report on Form 8-K the Company filed with the SEC on May 28, 2024.

The Company’s common stock is listed on the Nasdaq Global Select Market and its CDIs are listed on the ASX, and, as such, the Company is subject to Nasdaq Listing Rules, including Nasdaq Listing Rule 5635, and the ASX Listing Rules.

Pursuant to Nasdaq listing Rule 5635(d), stockholder approval is required prior to the issuance of securities in a transaction, other than a public offering, involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance, at a price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement or (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement for the transaction.

10

In light of this rule, the A&R NPA will provide that no shares of common stock will be issuable pursuant to the New Make-Whole Table until approval by the Company’s stockholders has been obtained. Additionally, the Company is also seeking approval for the issuance of all shares of common stock that may become issuable as a result of the New Notes in order to avoid future possible constraints under Nasdaq Listing Rules on its ability to raise additional capital, as detailed below.

A summary of the shares of Common Stock issuable as a result of Amendment No. 2 and for which the Company seeks approval are as follows:

As announced on May 1, 2024, the Company has sought and received a waiver from ASX Listing Rule 7.1 on an ongoing basis to permit the Company to issue securities without security holder approval under ASX Listing Rule 7.1, subject to certain conditions. Accordingly, in reliance on this waiver, the Company does not intend to seek approval for this Proposal for the purposes of ASX Listing Rule 7.1.

Effect on Current Stockholders if This Proposal is Approved

Each share of common stock issuable upon conversion of the Notes would have the same rights and privileges as each share of the Company’s currently outstanding common stock. The issuance of such shares will not affect the rights of the holders of the Company’s common stock, but such issuances will have a dilutive effect on the existing stockholders, which may be significant, including the voting power and economic rights of the existing stockholders, and may result in a decline in the Company’s stock price or greater price volatility.

Effect on Current Stockholders if This Proposal is Not Approved

The Company is not seeking the approval of its stockholders to authorize its entry into Amendment No. 2, as the Company has already done so, and such documents already are binding obligations of the Company.

If the stockholders do not approve this proposal, the Company may have difficulty raising additional capital necessary to implement its business plans and continue as a going concern. Specifically, in considering a listed company’s compliance with Nasdaq Listing Rule 5635(d), Nasdaq reserves discretion to determine whether shares issued in separate transactions should be aggregated for purposes of calculating whether a company has issued or agreed to issue 20% or more of its common stock. Depending on the timing, structure and other characteristics of any subsequent transaction that the Company may wish to pursue, Nasdaq could determine that a subsequent transaction should be aggregated with the sale of the New Notes, which may materially restrict the Company’s ability to raise additional capital that it needs to implement its business plans and continue as a going concern. The A&R NPA also prohibits the Company from effecting any Degressive Issuance that would result in an adjustment to the conversion rate for the

11

New Notes that requires stockholder approval under the Nasdaq Listing Rules unless the Company has obtained such stockholder approval before such Degressive Issuance, which the Company believes could have a similarly adverse impact on the Company’s ability to raise additional capital.

The Company’s ability to successfully implement its business plans and ultimately generate value for its stockholders is dependent upon its ability to raise capital and satisfy its ongoing business needs. If the Company is unable to raise additional capital due to its obligations under the Nasdaq Listing Rules and the terms of the A&R NPA, it may result in a delay in or modification or abandonment of our business plans, or prevent the Company from continuing as a going concern.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE APPROVAL, FOR PURPOSES OF NASDAQ LISTING RULE 5635 AND FOR ALL OTHER PURPOSES, OF THE ISSUANCE OF additional shares of our Common Stock upon a Make-Whole Fundamental Change and upon conversion of the Convertible Notes ISSUABLE UNDER the Amended and restated Note purchase Agreement.

12

PROPOSAL SIX

TO APPROVE THE ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSAL FIVE

The Proposal

The Board believes that, if the Annual Meeting is convened and a quorum is present, but there are not sufficient votes to approve Proposal Five, it is in the best interests of the shareholders to enable the Company to continue to seek to obtain a sufficient number of additional votes to approve Proposal Five, as applicable.

The Company is requesting that our shareholders authorize the holder of any proxy solicited by our Board to vote in favor of granting discretionary authority to the proxy holders, and each of them individually, to adjourn the Annual Meeting to another time and place, if necessary, to solicit additional proxies in the event there are not sufficient votes to approve Proposal Five. If our shareholders approve this proposal, we could adjourn the Annual Meeting and any adjourned or postponed session of the Annual Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from our shareholders that have previously voted.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSAL FIVE.

13

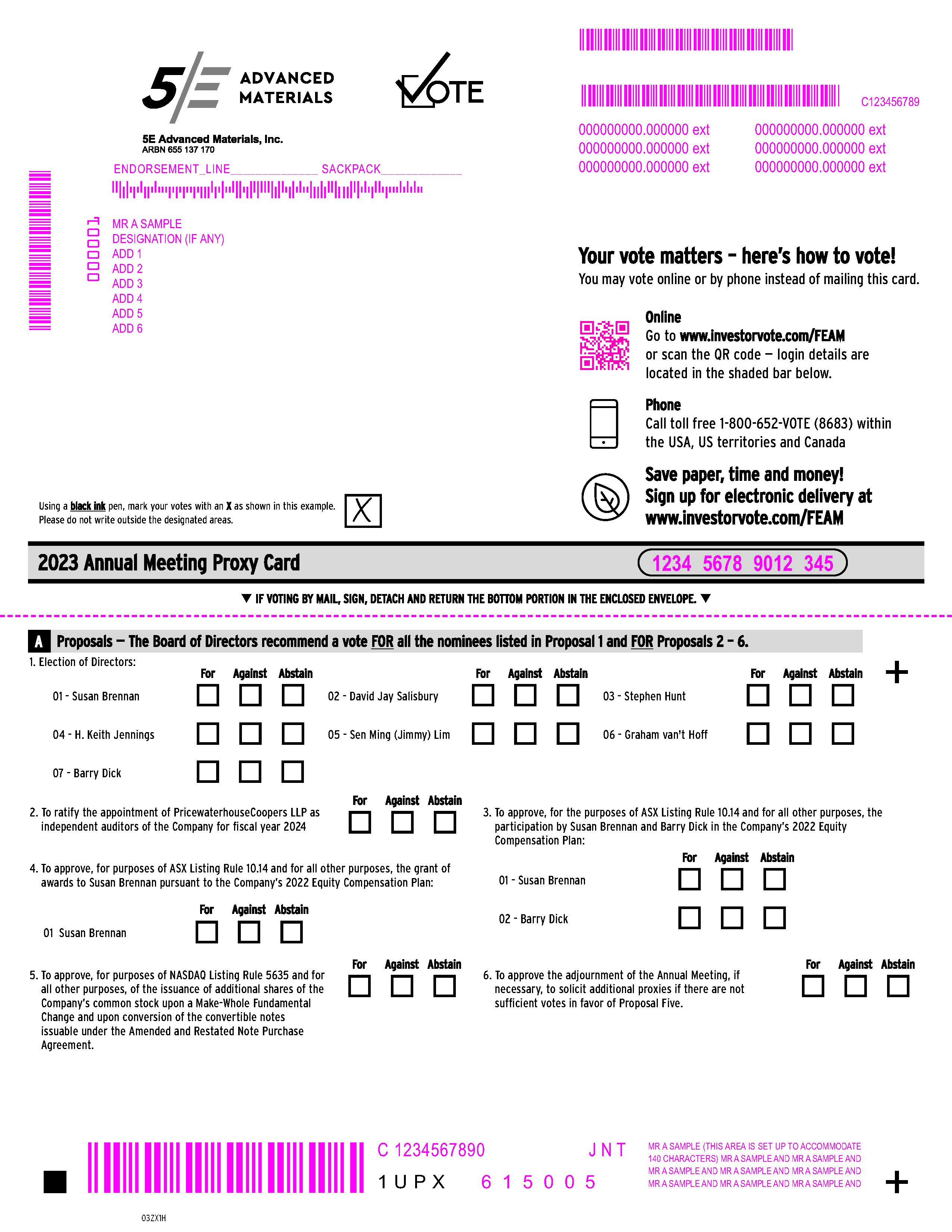

MMMMMMMMMMMM MMMMMMMMMMMMMMM C123456789 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext ENDORSEMENT_LINE______________ SACKPACK_____________ 000000000.000000 ext 000000000.000000 ext MMMMMMMMM 000001 MR ASAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. Your vote matters – here’s how to vote! You may vote online or by phone instead of mailing this card. Online Go to www.investorvote.com/FEAM or scan the QR code — login details are located in the shaded bar below. Phone Call toll free 1-800-652-VOTE (8683) within the USA, US territories and Canada Save paper, time and money! Sign up for electronic delivery at www.investorvote.com/FEAM 2023 Annual Meeting Proxy Card 1234 5678 9012 345 • IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. • Proposals — The Board of Directors recommend a vote FOR all the nominees listed in Proposal 1 and FOR Proposals 2 – 6.A 1. Election of Directors: For Against Abstain For Against Abstain For Against Abstain + 01 - Susan Brennan 02 - David Jay Salisbury 03 - Stephen Hunt 06 - Graham van't Hoff 04 - H. Keith Jennings 05 - Sen Ming (Jimmy) Lim 07 - Barry Dick For Against Abstain 2. To ratify the appointment of PricewaterhouseCoopers LLP as 3. To approve, for the purposes of ASX Listing Rule 10.14 and for all other purposes, the independent auditors of the Company for fiscal year 2024 participation by Susan Brennan and Barry Dick in the Company’s 2022 Equity Compensation Plan: For Against Abstain 4. To approve, for purposes of ASX Listing Rule 10.14 and for all other purposes, the grant of awards to Susan Brennan pursuant to the Company’s 2022 Equity Compensation Plan: 01 - Susan Brennan For Against Abstain 02 - Barry Dick 01 Susan Brennan For Against Abstain For Against Abstain 5. To approve, for purposes of NASDAQ Listing Rule 5635 and for 6. To approve the adjournment of the Annual Meeting, if all other purposes, of the issuance of additional shares of the necessary, to solicit additional proxies if there are not Company’s common stock upon a Make-Whole Fundamental sufficient votes in favor of Proposal Five. Change and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement. MR A SAMPLE (THIS AREA IS SET UPTOACCOMMODATE C 1234567890 JNT 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR ASAMPLE AND MR ASAMPLE AND MR ASAMPLE AND 1UPX 615005 MR ASAMPLE AND MR ASAMPLE AND MR ASAMPLE AND MMMMMMM + 03ZX1H

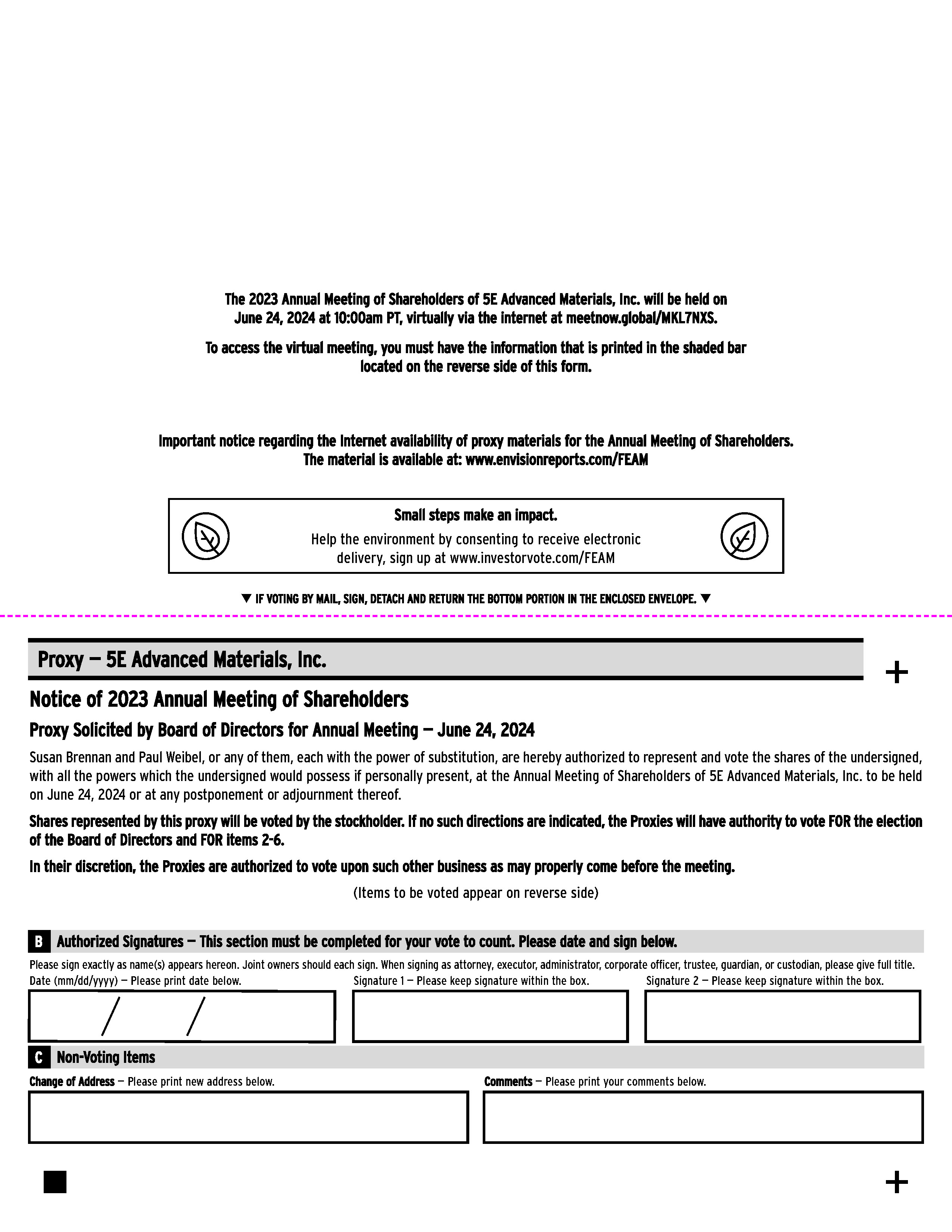

The 2023 Annual Meeting of Shareholders of 5E Advanced Materials, Inc. will be held on June 24, 2024 at 10:00am PT, virtually via the internet at meetnow.global/MKL7NXS. To access the virtual meeting, you must have the information that is printed in the shaded bar located on the reverse side of this form. Important notice regarding the Internet availability of proxy materials for the Annual Meeting of Shareholders. The material is available at: www.envisionreports.com/FEAM Small steps make an impact. Help the environment by consenting to receive electronic delivery, sign up at www.investorvote.com/FEAM • IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. • Notice of 2023 Annual Meeting of Shareholders Proxy Solicited by Board of Directors for Annual Meeting — June 24, 2024 Proxy — 5E Advanced Materials, Inc. + Susan Brennan and Paul Weibel, or any of them, each with the power of substitution, are hereby authorized to represent and vote the shares of the undersigned, with all the powers which the undersigned would possess if personally present, at the Annual Meeting of Shareholders of 5E Advanced Materials, Inc. to be held on June 24, 2024 or at any postponement or adjournment thereof. Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR the election of the Board of Directors and FOR items 2-6. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. (Items to be voted appear on reverse side) Authorized Signatures — This section must be completed for your vote to count. Please date and sign below. B Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. Date (mm/dd/yyyy) — Please print date below. Non-Voting Items C Change of Address — Please print new address below. Comments — Please print your comments below. +

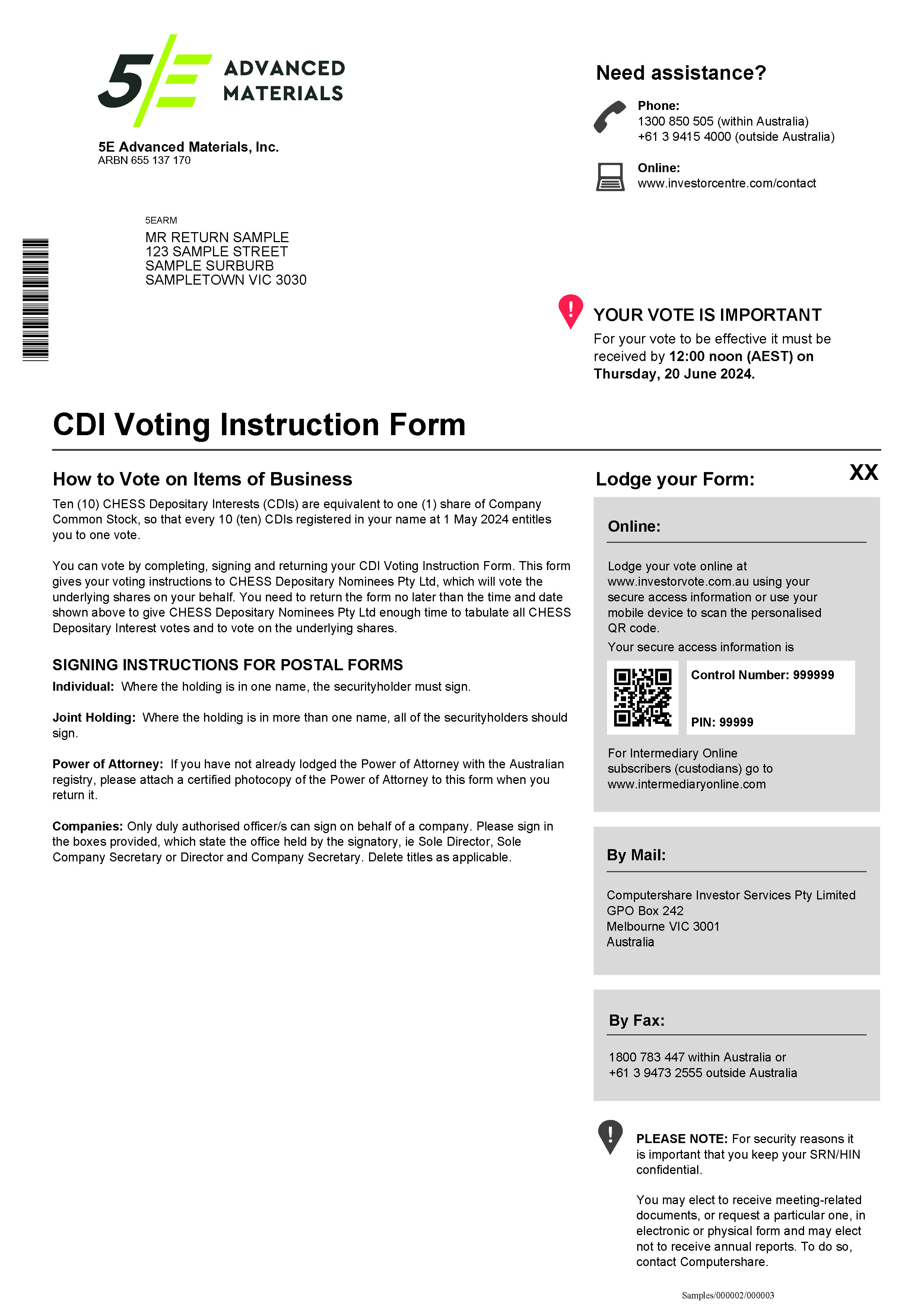

5E Advanced Materials, Inc. ARBN 655 137 170 *L000002* 5EARM MR RETURN SAMPLE 123 SAMPLE STREET SAMPLE SURBURB SAMPLETOWN VIC 3030 CDI Voting Instruction Form Need assistance? Phone: 1300 850 505 (within Australia) +61 3 9415 4000 (outside Australia) Online: www.investorcentre.com/contact YOUR VOTE IS IMPORTANT For your vote to be effective it must be received by 12:00 noon (AEST) on Thursday, 20 June 2024. How to Vote on Items of Business Ten (10) CHESS Depositary Interests (CDIs) are equivalent to one (1) share of Company Common Stock, so that every 10 (ten) CDIs registered in your name at 1 May 2024 entitles you to one vote. You can vote by completing, signing and returning your CDI Voting Instruction Form. This form gives your voting instructions to CHESS Depositary Nominees Pty Ltd, which will vote the underlying shares on your behalf. You need to return the form no later than the time and date shown above to give CHESS Depositary Nominees Pty Ltd enough time to tabulate all CHESS Depositary Interest votes and to vote on the underlying shares. SIGNING INSTRUCTIONS FOR POSTAL FORMS Individual: Where the holding is in one name, the securityholder must sign. Joint Holding: Where the holding is in more than one name, all of the securityholders should sign. Power of Attorney: If you have not already lodged the Power of Attorney with the Australian registry, please attach a certified photocopy of the Power of Attorney to this form when you return it. Companies: Only duly authorised officer/s can sign on behalf of a company. Please sign in the boxes provided, which state the office held by the signatory, ie Sole Director, Sole Company Secretary or Director and Company Secretary. Delete titles as applicable. Lodge your Form: Online: Lodge your vote online at www.investorvote.com.au using your secure access information or use your mobile device to scan the personalised QR code. Your secure access information is Control Number: 999999 PIN: 99999 For Intermediary Online subscribers (custodians) go to www.intermediaryonline.com By Mail: Computershare Investor Services Pty Limited GPO Box 242 Melbourne VIC 3001 Australia By Fax: 1800 783 447 within Australia or +61 3 9473 2555 outside Australia PLEASE NOTE: For security reasons it is important that you keep your SRN/HIN confidential. You may elect to receive meeting-related documents, or request a particular one, in electronic or physical form and may elect not to receive annual reports. To do so, contact Computershare. Samples/000002/000003

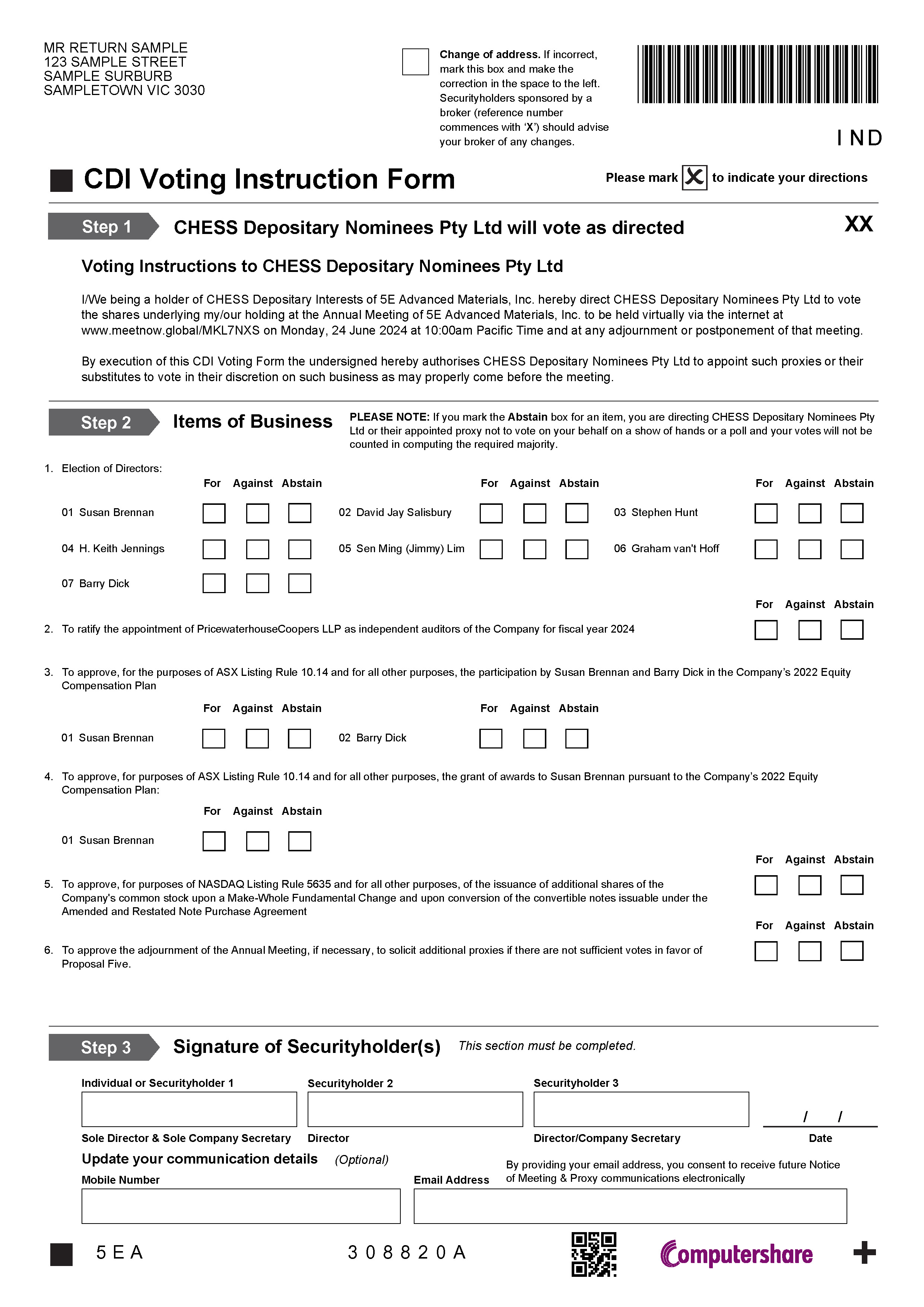

MR RETURN SAMPLE Change of address. If incorrect, 123 SAMPLE STREET mark this box and make the SAMPLE SURBURB correction in the space to the left. SAMPLETOWN VIC 3030 Securityholders sponsored by a broker (reference number commences with ‘X’) should advise your broker of any changes. I ND Please mark to indicate your directions CDI Voting Instruction Form Step 1 CHESS Depositary Nominees Pty Ltd will vote as directed Voting Instructions to CHESS Depositary Nominees Pty Ltd I/We being a holder of CHESS Depositary Interests of 5E Advanced Materials, Inc. hereby direct CHESS Depositary Nominees Pty Ltd to vote the shares underlying my/our holding at the Annual Meeting of 5E Advanced Materials, Inc. to be held virtually via the internet at www.meetnow.global/MKL7NXS on Monday, 24 June 2024 at 10:00am Pacific Time and at any adjournment or postponement of that meeting. By execution of this CDI Voting Form the undersigned hereby authorises CHESS Depositary Nominees Pty Ltd to appoint such proxies or their substitutes to vote in their discretion on such business as may properly come before the meeting. Step 2 PLEASE NOTE: If you mark the Abstain box for an item, you are directing CHESS Depositary Nominees Pty Items of Business Ltd or their appointed proxy not to vote on your behalf on a show of hands or a poll and your votes will not be counted in computing the required majority. 1. Election of Directors: For Against Abstain For Against Abstain For Against Abstain 01 Susan Brennan 02 David Jay Salisbury 03 Stephen Hunt 04 H. Keith Jennings 05 Sen Ming (Jimmy) Lim 06 Graham van't Hoff 07 Barry Dick For Against Abstain 2. To ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for fiscal year 2024 3. To approve, for the purposes of ASX Listing Rule 10.14 and for all other purposes, the participation by Susan Brennan and Barry Dick in the Company’s 2022 Equity Compensation Plan For Against Abstain For Against Abstain 01 Susan Brennan 02 Barry Dick 4. To approve, for purposes of ASX Listing Rule 10.14 and for all other purposes, the grant of awards to Susan Brennan pursuant to the Company’s 2022 Equity Compensation Plan: For Against Abstain 01 Susan Brennan For Against Abstain 5. To approve, for purposes of NASDAQ Listing Rule 5635 and for all other purposes, of the issuance of additional shares of the Company's common stock upon a Make-Whole Fundamental Change and upon conversion of the convertible notes issuable under the Amended and Restated Note Purchase Agreement For Against Abstain 6. To approve the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal Five. Step 3 Signature of Securityholder(s) This section must be completed. Individual or Securityholder 1 Securityholder 2 Securityholder 3 Sole Director & Sole Company Secretary Director Update your communication details (Optional) Mobile Number Email Address / / Director/Company Secretary DateBy providing your email address, you consent to receive future Notice of Meeting & Proxy communications electronically 5EA 308820A