- FEAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

5E Advanced Materials (FEAM) DEFA14AAdditional proxy soliciting materials

Filed: 14 Jan 25, 4:30pm

Exhibit 10.1

this restructuring support agreement and the documents attached hereto collectively describe a proposed RESTRUCTURING for the company parties that would be EFFECTUATED through the out‑of‑court restructuring or, IF THE CONDITIONS THERETO ARE NOT SATISFIED OR WAIVED, through pre-packaged chapter 11 cases in the bankruptcy court, as further described herein.

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. Nothing contained in thIS RESTRUCTURING SUPPORT AGREEMENT shall be an admission of fact or liability OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED HEREIN, DEEMED BINDING ON ANY OF THE PARTIES HERETO.

THIS RESTRUCTURING SUPPORT AGREEMENT DOES NOT PURPORT TO summarize ALL Of THE TERMS, CONDITIONS, REPRESENTATIONS, WARRANTIES, AND OTHER PROVISIONS WITH RESPECT TO THE TRANSACTION DESCRIBED HEREIN, WHICH TRANSACTIONS WOULD BE SUBJECT TO THE COMPLETION OF CERTAIN DEFINITIVE DOCUMENTS INCORPORATING THE TERMS SET FORTH HEREIN. THE CLOSING OF ANY TRANSACTIONS shall be subject to the terms and conditions set forth in such definitive documents and the approval rights of the parties set forth herein and in such definitive documents.

RESTRUCTURING SUPPORT AGREEMENT

This RESTRUCTURING SUPPORT AGREEMENT (including all exhibits, annexes, and schedules hereto in accordance with Section 14.02, this “Agreement”) is made and entered into as of January 14, 2025 (the “Execution Date”), by and among the following parties (each of the following described in sub-clauses (i) through (iii) of this preamble, collectively, the “Parties”):1

1 Capitalized terms used but not defined in the preamble and recitals to this Agreement have the meanings ascribed to them in Section 1.

RECITALS

WHEREAS, the Company Parties and the Consenting Parties have in good faith and at arms’ length negotiated or been apprised of certain restructuring and recapitalization transactions with respect to the Company Parties’ capital structure on the terms set forth in the term sheet attached as Exhibit B hereto (the “Restructuring Term Sheet” and, such transactions described in this Agreement and the Restructuring Term Sheet, the “Restructuring Transactions”). If all of the conditions to consummation of the Out-of-Court Restructuring are satisfied or waived by the Company Parties and the Consenting Parties on or prior to the Out-of-Court Outside Date (such date as may be amended or otherwise modified in accordance with the terms of this Agreement), then the Restructuring Transactions shall be consummated pursuant to the Out‑of‑Court Restructuring. If all of the conditions to consummation of the Out-of-Court Restructuring are not satisfied or waived by the Company Parties and the Consenting Parties on or prior to the Out-of-Court Outside Date (such date as may be amended or otherwise modified in accordance with the terms of this Agreement), then the Company Parties shall implement the In-Court Restructuring;

WHEREAS, prior to the consummation of the Out-of-Court Restructuring, unless the Company Parties and the Consenting Parties otherwise agree, the Company will hold the Special Meeting of the Company’s stockholders to approve the Out-of-Court Restructuring and the transactions contemplated thereby, including the Placement and the issuance of Company common stock upon conversion of the amended Notes and the Equity Plan Amendment (the “Stockholder Approvals”); and

WHEREAS, the Company Parties intend to implement the Restructuring Transactions through the Out-of-Court Restructuring; provided that the Stockholder Approvals shall be obtained and other conditions to consummation of the Out‑of‑Court Restructuring are satisfied or waived; provided, further, that, if the Company Parties do not obtain the Stockholder Approvals, the Company Parties intend to implement the Restructuring Transactions through the In-Court Restructuring;

WHEREAS, the “Transaction Documents” consist of:

2

WHEREAS, the Parties have agreed to take certain actions in support of the Restructuring Transactions on the terms and conditions set forth in this Agreement, the Transaction Documents, and, in the event of an In-Court Restructuring, the Plan; provided that the In-Court Restructuring is to occur only if the Stockholder Approvals are not obtained or other conditions to consummation of the Out-of-Court Restructuring are not satisfied or waived;

3

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Party, intending to be legally bound hereby, agrees as follows:

AGREEMENT

“Agreement” has the meaning set forth in the preamble to this Agreement and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules hereto in accordance with Section 14.02 (including the Restructuring Term Sheet).

“Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived by the appropriate Party or Parties in accordance with this Agreement.

“Agreement Effective Period” means, with respect to a Party, the period from the Agreement Effective Date to the Termination Date applicable to that Party.

“Alternative Restructuring Proposal” means any plan, inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to a sale, disposition, new-money investment, restructuring, reorganization, merger, amalgamation, acquisition, consolidation, dissolution, debt investment, equity investment, liquidation, asset sale, share issuance, tender offer, recapitalization, plan of reorganization, share exchange, business combination, joint venture, or similar transaction involving any one or more Company Parties or the debt, equity, or other interests in any one or more Company Parties that is an alternative to one or more of the Restructuring Transactions.

“Amended and Restated Investor and Registration Rights Agreement” has the meaning set forth in the recitals to this Agreement.

“Ascend” means Ascend Global Investment Fund SPC.

“Ascend Noteholders” has the meaning set forth in the preamble of this Agreement.

4

“Ascend Notes” means the convertible notes of FEAM held by the Ascend Noteholders in connection with the Amended and Restated Note Purchase Agreement.

“Ascend Notes Claim” means any Claim on account of the Ascend Notes.

“Bankruptcy Code” means title 11 of the United States Code, 11 U.S.C. §§ 101–1532, as amended.

“Bankruptcy Court” means the United States Bankruptcy Court in which the Chapter 11 Cases are commenced or another United States Bankruptcy Court with jurisdiction over the Chapter 11 Cases, which United States Bankruptcy Court shall be determined by the Company, the BEP Noteholders, and the New Equity Group.

“BEP” means BEP Special Situations IV LLC.

“BEP Noteholders” has the meaning set forth in the preamble of this Agreement.

“BEP Notes” means the convertible notes of FEAM held by the BEP Noteholders in connection with the Amended and Restated Note Purchase Agreement.

“BEP Notes Claim” means any Claim on account of the BEP Notes.

“Business Day” means any day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state of New York.

“Causes of Action” means any claims, interests, damages, remedies, causes of action, demands, rights, actions, controversies, proceedings, agreements, suits, obligations, liabilities, accounts, defenses, offsets, powers, privileges, licenses, liens, indemnities, guaranties, and franchises of any kind or character whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, liquidated or unliquidated, secured or unsecured, assertable, directly or derivatively, matured or unmatured, suspected or unsuspected, whether arising before, on, or after the Agreement Effective Date, in contract, tort, law, equity, or otherwise. Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by law or in equity; (b) the right to object to or otherwise contest Claims or Interests; (c) claims pursuant to section 362 or chapter 5 of the Bankruptcy Code; (d) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in section 558 of the Bankruptcy Code; and (e) any avoidance actions arising under chapter 5 of the Bankruptcy Code or under similar local, state, federal, or foreign statutes and common law, including fraudulent transfer laws.

“Chapter 11 Cases” means, in the event of the In-Court Restructuring, the voluntary cases commenced by the Company Parties in the Bankruptcy Court under chapter 11 of the Bankruptcy Code in connection with the In-Court Restructuring.

“Claim” has the meaning ascribed to it in section 101(5) of the Bankruptcy Code.

5

“Company Claims/Interests” means any Claim against, or Equity Interest in, a Company Party, including the Notes Claims.

“Company Parties” has the meaning set forth in the preamble to this Agreement.

“Confidentiality Agreement” means an executed confidentiality agreement, including with respect to the issuance of a “cleansing letter” or other public disclosure of material non-public information agreement, in connection with any proposed Restructuring Transactions.

“Confirmation Order” means, in the event of an In-Court Restructuring, the confirmation order with respect to the Plan entered by the Bankruptcy Court.

“Consenting Parties” has the meaning set forth in the preamble to this Agreement.

“Debtors” means, in the event of the In-Court Restructuring, the Company Parties that commence Chapter 11 Cases.

“Definitive Documents” means the documents listed in Section 3.01.

“Disclosure Statement” means, in the event of the In-Court Restructuring, the related disclosure statement with respect to the Plan.

“Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code.

“Equity Interests” means, collectively, the shares (or any class thereof), common stock, preferred stock, limited liability company interests, and any other equity, ownership, or profits interests of any Company Party, and options, warrants, rights, or other securities or agreements to acquire or subscribe for, or which are convertible into the shares (or any class thereof) of, common stock, preferred stock, limited liability company interests, or other equity, ownership, or profits interests of any Company Party (in each case whether or not arising under or in connection with any employment agreement).

6

“Equity Plan Amendment” means an amendment to the Company’s 2022 equity compensation plan to increase the number of shares of common stock authorized for issuance by 15,831,870 shares (appropriately adjusted to reflect any stock split, stock dividend, stock combination, recapitalization, or the like occurring after the date hereof), or 20,831,870 shares (appropriately adjusted to reflect any stock split, stock dividend, stock combination, recapitalization, or the like occurring after the date hereof) if the proposal to be presented at the Company’s 2024 annual meeting of stockholders to approve an increase to the aggregate number of shares reserved for issuance under the 2022 equity compensation plan by 5,000,000 shares fails to be approved.

“Execution Date” has the meaning set forth in the preamble to this Agreement.

“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction (including the Bankruptcy Court).

7

“Parties” has the meaning set forth in the preamble to this Agreement.

“Permitted Transferee” means each transferee of any Company Claims/Interests who meets the requirements of Section 8.01.

“Petition Date” means the first date that any of the Company Parties commences a Chapter 11 Case.

“Placement” has the meaning set forth in the Restructuring Term Sheet.

“Plan” has the meaning set forth in the recitals to this Agreement.

“Plan Effective Date” means the occurrence of the Effective Date of the Plan according to its terms.

“Plan Supplement” means the compilation of documents and forms of documents, schedules, and exhibits to the Plan that will be filed by the Debtors with the Bankruptcy Court.

“Preliminary Proxy Statement” means the preliminary filing of the Proxy Statement.

“Proxy Statement” has the meaning set forth in the recitals to this Agreement.

“Qualified Marketmaker” means an entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

“Related Party” means each of, and in each case in its capacity as such, current and former directors, managers, officers, committee members, members of any governing body, equity holders (regardless of whether such interests are held directly or indirectly), affiliated investment funds or investment vehicles, managed accounts or funds, predecessors, participants, successors, assigns, subsidiaries, Affiliates, partners, limited partners, general partners, principals, members, management companies, fund advisors or managers, employees, agents, trustees, advisory board members, financial advisors, attorneys (including any other attorneys or professionals retained by any current or former director or manager in his or her capacity as director or manager of an Entity), accountants, investment bankers, consultants, representatives, and other professionals and advisors and any such Person’s or Entity’s respective heirs, executors, estates, and nominees.

“Release Agreement” means the mutual release and agreement that shall be entered into on or about the Effective Date of the Out-of-Court Restructuring, by and between the Company

8

Parties, the Consenting Parties, and any other party that has executed and delivered counterpart signature pages thereto.

“Released Claim” means, with respect to any Releasing Party, any Claim, or Cause of Action that is released by such Releasing Party under Section 13 of this Agreement.

“Released Company Parties” means each of, and in each case in its capacity as such: (a) Company Party; (b) current and former Affiliates of each Entity in clause (a) through the following clause (c); and (c) each Related Party of each Entity in clause (a) through this clause (c).

“Released Consenting Parties” means, each of, and in each case in its capacity as such: (a) Consenting Party; (b) the Trustees; (c) current and former Affiliates of each Entity in clause (a) through the following clause (d); and (d) each Related Party of each Entity in clause (a) through this clause (d).

“Released Parties” means each Released Company Party and each Released Consenting Party.

“Releases” means the releases contained in Section 13 of this Agreement.

“Releasing Parties” means, collectively, each Company Releasing Party and each Consenting Party Releasing Party.

“Restructuring Term Sheet” has the meaning set forth in the recitals to this Agreement.

“Restructuring Transactions” has the meaning set forth in the recitals to this Agreement.

“Reverse Stock Split Proposal” means the proposal to be presented at the Company’s 2024 annual meeting of stockholders to approve amendments to the Company’s amended and restated certificate of incorporation to effect a reverse stock split of the Company’s common stock at a ratio ranging from any whole number between 1-for-10 and 1-for-25, as determined by the board of directors in its discretion.

“Rules” means Rule 501(a)(1), (2), (3), and (7) of the Securities Act.

“SEC” means the Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Security” means any security, as defined in section 2(a)(1) of the Securities Act.

9

“Stockholder Approvals” has the meaning set forth in the recitals to this Agreement.

“Termination Date” means the date on which termination of this Agreement as to a Party is effective in accordance with Sections 11.01, 11.02, 11.03, or 11.04.

“Transaction Documents” has the meaning set forth in the recitals to this Agreement.

“Transfer” means to sell, resell, reallocate, use, pledge, assign, transfer, hypothecate, participate, donate or otherwise encumber or dispose of, directly or indirectly (including through derivatives, options, swaps, pledges, forward sales or other transactions).

“Transfer Agreement” means an executed form of the transfer agreement providing, among other things, that a transferee is bound by the terms of this Agreement and substantially in the form attached hereto as Exhibit L.

“Trustee” means any indenture trustee, collateral trustee, or other trustee or similar entity under the Notes.

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

5E Advanced Materials, Inc.

9329 Mariposa Road, Suite 210

Hesperia, CA 92344

Attention: Paul Weibel, Chief Executive Officer

E-mail address: pweibel@5eadvancedmaterials.com

with copies to:

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, CA 92626

Attention: Drew Capurro

E-mail address: drew.capurro@lw.com

and

Pachulski Stang Ziehl & Jones LLP

919 North Market Street

17th Floor

Wilmington, Delaware 19801

Attention: Laura Davis Jones

E-mail address: ljones@pszjlaw.com

31

Kirkland & Ellis LLP

601 Lexington Avenue

New York, New York 10022

Attention: Brian E. Schartz, P.C. and Allyson B. Smith

E-mail address: brian.schartz@kirkland.com, allyson.smith@kirkland.com

Mehigan LLP

30 Cecil Street

Prudential Tower, #24-01

Singapore 049712

Any notice given by delivery, mail, or courier shall be effective when received.

32

33

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement on the day and year first above written.

34

Company Parties’ Signature Page to

the Restructuring Support Agreement

5E ADVANCED MATERIALS, INC.

By: | /s/ Paul Weibel |

|

Name: | Paul Weibel |

|

Title: | Authorized Signatory |

|

5E BORON AMERICAS, LLC

By: | /s/ Paul Weibel |

|

Name: | Paul Weibel |

|

Title: | President |

|

AMERICAN PACIFIC BORATES PTY LTD

Executed by |

|

|

American Pacific Borates Pty Ltd |

|

|

(ABN 68 615 606 114) |

|

|

in accordance with section 127 of the |

|

|

Australian Corporations Act 2001 (Cth) |

|

|

by a director and director/company secretary: |

|

|

|

|

|

|

|

|

/s/ Paul Weibel |

| /s/ Bryn Jones |

Signature of director |

| Signature of director/ company secretary |

|

|

|

|

|

|

Paul Weibel |

| Bryn Jones |

Name of director (please print) |

| Name of director/ company secretary (please print) |

|

|

|

[Company Parties’ Signature Page to Restructuring Support Agreement]

Consenting Party Signature Page to

the Restructuring Support Agreement

bep special situations iv llc

/s/ Jonathan Siegler |

|

Name: Jonathan Siegler

Title: Managing Director and Chief Financial Officer

Address:

BEP Special Situations IV LLC

300 Crescent Court, Suite 1860

Dallas, TX 75201

E-mail address(es): jasiegler@bluescapegroup.com

Aggregate Amounts Beneficially Owned or Managed on Account of: | |

BEP Notes | 43,031,430 |

[Consenting Party Signature Page to Restructuring Support Agreement]

Consenting Party Signature Page to

the Restructuring Support Agreement

ascend global investment fund spc

for and on behalf of strategic sp

/s/ Mulyadi Tjandra |

|

Name: Mulyadi Tjandra

Title: Director

MERIDIAN INVESTMENTS CORPORATION

/s/ Mulyadi Tjandra |

|

Name: Mulyadi Tjandra

Title: Director

Address:

E-mail address(es):

Aggregate Amounts Beneficially Owned or Managed on Account of: | |

Ascend Notes beneficially owned or managed on account of Ascend | US$21,515,715 |

Ascend Notes beneficially owned or managed on account of Meridian | US$21,515,715 |

|

|

|

[Consenting Party Signature Page to Restructuring Support Agreement]

EXHIBIT A

Company Parties

5E Advanced Materials, Inc.

5E Boron Americas, LLC

American Pacific Borates Pty Ltd.

EXHIBIT B

Restructuring Term Sheet

Term Sheet

Summary

The term sheet (this “Term Sheet”) sets forth a summary of the principal terms that 5E Advanced Materials, Inc. (“FEAM”) and its direct and indirect subsidiaries and affiliates (together with FEAM, the “Company”), BEP Special Situations IV LLC (“BEP”), Meridian Investments Corporation (“Meridian”), and Ascend Global Investment Fund SPC (together with Meridian, “Ascend,” and together with BEP and FEAM, the “Parties”) would consider in connection with a proposed transaction in respect of a capital injection, and an equitization of the current Secured Debt Facility (as defined below).

THIS TERM SHEET IS NOT AN OFFER OR A SOLICITATION WITH RESPECT TO ANY SECURITIES OR DEBT OF THE COMPANY. ANY SUCH OFFER OR SOLICITATION SHALL COMPLY WITH ALL APPLICABLE SECURITIES LAWS.

THIS TERM SHEET IS PROVIDED IN confidence and may be distributed only with the express written consent of THE COMPANY, BEP, AND ASCEND. ThIS Term Sheet is provided in the nature of a settlement proposal in furtherance of settlement discussions. Accordingly, thIS Term Sheet is entitled to the protections of Rule 408 of the Federal Rules of Evidence and any other applicable statutes or doctrines protecting the use or disclosure of confidential information and information exchanged in the context of settlement discussions. Further, nothing in thIS Term Sheet shall be an admission of fact or liability or deemed binding on THE COMPANY, BEP, ASCEND OR ANY OF THEIR RESPECTIVE AFFILIATES.

This term sheet is subject to ongoing review by BEP, the company, ASCEND, and EACH OF their respective professionals, is subject to material change and is being distributed for discussion purposes only. moreover, the treatment set forth in this term sheet remains subject to ongoing discussion among the parties covered hereby.

Strategic Intent

The outstanding indebtedness of, and equity interests in, the Company will be restructured (the “Restructuring”) through either (i) an out-of-court transaction (the “Out of Court Restructuring”) consistent with the terms and conditions described in this Term Sheet or, to the extent the conditions precedent to consummating the Out of Court Restructuring cannot be timely satisfied then, (ii) as voluntary pre‑packaged cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”), to be filed in a United States Bankruptcy Court of competent jurisdiction to be agreed to by BEP and Ascend (the “Bankruptcy Court”) and pursuant to a pre-packaged plan of reorganization (the “Pre-Packaged Chapter 11 Plan”).

If the filing of the Chapter 11 Cases becomes necessary or the Company, BEP and Ascend mutually determine to pursue the Chapter 11 Cases in lieu of the Out of Court Restructuring, the Company and certain of its subsidiaries and affiliates shall file the Chapter 11 Cases in the Bankruptcy Court. The Pre-Packaged Chapter 11 Plan and the disclosure statement describing the Pre-Packaged Chapter 11 Plan shall be filed on the same day as the filing of the Chapter 11 Cases or as soon thereafter as is reasonably practicable, but in no event later than the date set forth in the restructuring support agreement (the “RSA”). The Pre-Packaged Chapter 11 Plan shall be in all material respects consistent with this Term Sheet.

The RSA (i) shall contain a customary “fiduciary out” provision exercisable by the Company that will be subject to the negotiation and agreement by FEAM, BEP and Ascend, (ii) shall allow the Company to engage in a formal marketing process in connection with the Pre-Packaged Chapter 11 Plan contemplated by this Term Sheet so long as BEP and Ascend are provided regular updates and information with respect to such process in a manner satisfactory to BEP and Ascend, (iii) shall contain full releases of BEP, Ascend and their respective affiliates upon signing the RSA, and (iv) shall contain a forbearance of any existing defaults under the Secured Debt Facility.

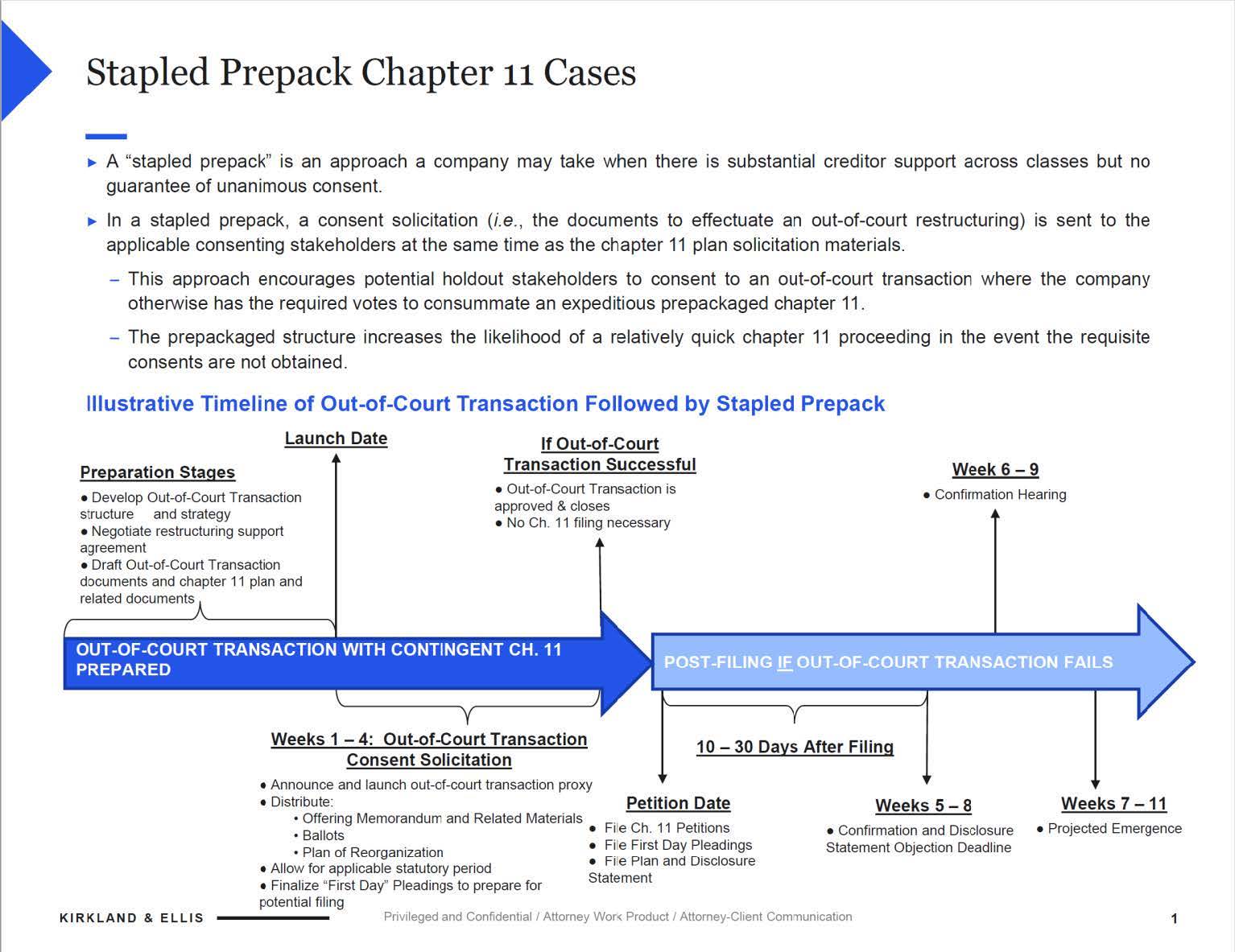

An illustrative example of an Out of Court Restructuring together with a “stapled” Pre-Packaged Chapter 11 Plan is attached as a slide at the end of this Term Sheet.

| PAGE 1 OF 4 |

|

Term Sheet

Principal Terms

Out-of-Court Restructuring | |

Parties: | BEP FEAM Ascend |

Effective Date: | “Effective Date” means the consummation of the Restructuring. |

Secured Debt Facility: | “Secured Debt Facility” shall mean that certain indebtedness under that certain Amended and Restated Note Purchase Agreement, dated as of January 18, 2024 (as modified, amended, or supplemented in accordance with the terms therein), by and between FEAM, as issuer, BEP and Ascend, as purchasers, certain guarantors, and Alter Domus (US) LLC, as collateral agent. “Convertible Notes” shall mean the notes issued under the Secured Debt Facility, including the New Convertible Notes. |

New Convertible Notes Issued: | US$5 million of Convertible Notes (“New Convertible Notes”) with a conversion price of $0.2920 (the “Conversion Price”) issued and sold on a pro rata basis to BEP and Ascend upon signing of the RSA |

Exchange Of Convertible Notes: | Subject to approval by the Company’s shareholders, promptly following approval by the Company’s shareholders, BEP and Ascend shall exchange all of their Convertible Notes for their respective pro rata portion of 312,490,076 newly issued shares of common stock of FEAM (the “Exchange”). |

New Equity Placement: | Subject to approval by the Company’s shareholders, on the seventh trading day following the Exchange (or as reasonably practicable thereafter), BEP and Ascend shall purchase $5 million of newly issued shares of common stock of FEAM on a pro rata basis, at a price per share (the “Placement Price”) equal to the lower of (a) $0.2920 per share and (b) the volume average weighted price for the common stock of FEAM as reported by Bloomberg for the first five trading days following the Exchange (the “Placement”). |

New Warrants: | Concurrently with the closing of the Placement, FEAM shall issue to BEP and Ascend new warrants on a pro rata basis (the “New Warrants”) to purchase up to an aggregate of US$20 million of common stock of FEAM with the number of shares underlying such warrants calculated based on the Price of Equity and with an exercise price equal to the Price of Equity. The New Warrants shall have an expiration date of one year from the Exchange. |

Events of Default During RSA:

| (1) At signing of the RSA, BEP and Ascend to forbear from accelerating the debt or pursuing any other remedies until the Effective Date (not to occur later than March 31, 2025). (2) At signing of the RSA, BEP and Ascend temporarily waive US $7.5 million minimum cash covenant until the Effective Date (not to occur later than March 31, 2025). |

Other: | (1) Short selling prohibition by BEP, Ascend and their respective managers, officers, directors and affiliates. (2) Upon signing of the RSA and through the Effective Date, FEAM to reimburse costs and expenses (including advisor expenses) of Ascend and BEP for the Restructuring.

(3) On and immediately following the Effective Date, the board of directors of FEAM will take all necessary action permitted by applicable law so that the board of directors of FEAM as of the Effective Date (the “New Board”) shall be comprised of 4 directors, 2 nominated by BEP and 2 nominated by Ascend, provided that appointment of any such nominee will be subject to FEAM’s customary due diligence process for directors and New Board must be constituted in a manner that satisfies applicable NASDAQ and SEC requirements.

(4) Prohibition upon signing of the RSA on any securities offerings (including the consummation of a potential future private offering as contemplated by FEAM’s proxy statement for its stockholder meeting set for January 21, 2025) by FEAM without consent of BEP and Ascend.

(5) That certain Third Amended and Restated Investor and Registration Rights Agreement to be amended and restated to require that the shares issued in the Exchange and the Placement and shares underlying the New Warrants be registered for resale by FEAM, among other customary amendments. |

Releases: | All Parties to provide mutual releases, inclusive of directors and executive officers, upon signing of RSA and ratified upon closing of the Conversion. |

| PAGE 2 OF 4 |

|

Term Sheet

Pre-Packaged Chapter 11 Plan | |

Term | Description |

Parties: | BEP FEAM Ascend |

Secured Debt Facility: | “Secured Debt Facility” shall have the meaning as defined in “Out-of-Court Restructuring” |

DIP Facility: | “DIP Facility” shall mean the post-petition superiority financing in an amount to be determined prior to signing of the RSA with BEP’s and Ascend’s consent, to be provided by BEP and Ascend (collectively, the “DIP Lenders”) in connection with the Chapter 11 Cases and pursuant a certain debtor‑in‑possession credit agreement and other definitive documents, as necessary, subject to negotiation and agreement by FEAM and the DIP Lenders. |

Treatment of Existing Equity Interests | All existing equity interests of FEAM shall be extinguished upon the effective date of the Pre-Packaged Chapter 11 Plan. |

DIP Facility and Conversion: | Upon the effective date of the Pre-Packaged Chapter 11 Plan, BEP and Ascend shall each receive their respective pro rata share of 100% of the new common stock of reorganized FEAM issued on account of (i) the Secured Debt Facility Claims and (ii) the outstanding DIP Facility indebtedness on and as of the Effective Date. |

Treatment of All Other Claims: | It is anticipated that all other claims, excluding those arising out of the Secured Debt Facility and the DIP Facility, shall be unimpaired and “ride through” the Chapter 11 Cases, subject to further diligence. |

Petition Date: | The Chapter 11 Cases shall be filed in in the Bankruptcy Court within 4 business days of a negative shareholder vote on the Out‑of‑Court Restructuring |

Releases: | Pursuant to Pre-Packaged Chapter 11 Plan, all Parties to provide mutual releases upon the effective date of the Pre-Packaged Chapter 11 Plan. |

| PAGE 3 OF 4 |

|

Term Sheet

Illustrative Example

| PAGE 4 OF 4 |

|

EXHIBIT C

Subscription Agreement

EXHIBIT D

Plan

IN THE UNITED STATES BANKRUPTCY COURT

FOR the district of delaware

| ) |

|

In re: | ) | Chapter 11 |

| ) |

|

5E ADVANCED MATERIALS, INC., et al.,1 | ) | Case No. 25-_____ (___) |

| ) |

|

Debtors. | ) | (Joint Administration Requested) |

| ) |

|

JOINT CHAPTER 11 PLAN OF REORGANIZATION OF

5E ADVANCED MATERIALS, INC. AND ITS DEBTOR AFFILIATES

THIS CHAPTER 11 PLAN IS BEING SOLICITED FOR ACCEPTANCE OR REJECTION IN ACCORDANCE WITH BANKRUPTCY CODE SECTION 1125 AND WITHIN THE MEANING OF BANKRUPTCY CODE SECTION 1126. THIS CHAPTER 11 PLAN WILL BE SUBMITTED TO THE BANKRUPTCY COURT FOR APPROVAL FOLLOWING SOLICITATION AND THE DEBTORS’ FILING FOR CHAPTER 11 BANKRUPTCY. |

[ ] (pro hac vice pending) |

| Laura Davis Jones (DE Bar No. 2436) |

[ ] (pro hac vice pending) |

| Timothy P. Cairns (DE Bar No. 4228) |

|

|

|

LATHAM & WATKINS LLP |

| PACHULSKI STANG ZIEHL & JONES LLP |

[ADDRESS] |

| 919 North Market Street, 17th Floor |

[CITY, STATE ZIP] |

| P.O. Box 8705 |

Telephone: (___) ___-____ |

| Wilmington, Delaware 19899-8705 (Courier 19801) |

Facsimile: (___) ___-____ |

| Telephone: (302) 652-4100 |

Email: [ ] |

| Facsimile: (302) 652-4400 |

[ ] |

| Email: ljones@pszjlaw.com |

|

| tcairns@pszjlaw.com |

- and - |

|

|

|

|

|

|

|

|

Proposed Co-Counsel to the Debtors and |

| Proposed Co-Counsel to the Debtors and |

Debtors in Possession |

| Debtors in Possession |

|

|

|

Dated: [ ], 2025 |

|

|

|

|

|

1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number are: 5E Advanced Materials, Inc. ([ ]); 5E Boron Americas, LLC ([ ]); American Pacific Borates Pty Ltd. ([ ]); and [ ] ([ ]). The location of the Debtors’ service address in these chapter 11 cases is [ ].

TABLE OF CONTENTS

Article I. DEFINED TERMS, RULES OF INTERPRETATION, COMPUTATION OF TIME, and governing law 1

A. Defined Terms. 1

B. Rules of Interpretation. 13

C. Computation of Time. 14

D. Governing Law. 14

E. Reference to Monetary Figures. 14

F. Reference to the Debtors or the Reorganized Debtors. 14

G. Controlling Document. 14

H. Consent Rights. 14

Article II. ADMINISTRATIVE CLAIMS AND PRIORITY CLAIMS 15

A. Administrative Claims. 15

B. DIP Claims. 15

C. Professional Claims. 15

D. Priority Tax Claims. 16

Article III. CLASSIFICATION AND TREATMENt oF CLAIMS AND INTERESTS 16

A. Classification of Claims and Interests. 16

B. Treatment of Claims and Interests. 17

C. Special Provision Governing Unimpaired Claims. 20

D. Elimination of Vacant Classes. 20

E. Voting Classes, Presumed Acceptance by Non-Voting Classes. 20

F. Intercompany Interests. 20

G. Confirmation Pursuant to Sections 1129(a)(10) and 1129(b) of the Bankruptcy Code. 20

H. Controversy Concerning Impairment. 21

I. Subordinated Claims. 21

Article IV. MEANS FOR IMPLEMENTATION OF THE PLAN 21

A. General Settlement of Claims and Interests. 21

B. Restructuring Transactions. 21

C. Reorganized Debtors. 22

D. Sources of Consideration for Plan Distributions. 22

E. Holders of Working and Similar Interests. 24

F. Corporate Existence. 24

G. Vesting of Assets in the Reorganized Debtors. 24

H. Cancellation of Existing Securities and Agreements. 25

I. Corporate Action. 25

J. New Organizational Documents. 25

K. Indemnification Provisions in Organizational Documents. 26

L. Directors, Managers, and Officers of the Reorganized Debtors. 26

M. Effectuating Documents; Further Transactions. 26

N. Section 1146 Exemption. 26

O. Director and Officer Liability Insurance. 27

P. Management Incentive Plan. 27

Q. Employee and Retiree Benefits. 27

R. Preservation of Causes of Action. 27

S. Indenture Trustee Expenses 28

Article V. TREATMENT OF EXECUTORY CONTRACTS AND UNEXPIRED LEASES 28

A. Assumption and Rejection of Executory Contracts and Unexpired Leases. 28

B. Claims Based on Rejection of Executory Contracts or Unexpired Leases. 28

C. Cure of Defaults for Assumed Executory Contracts and Unexpired Leases. 29

| i |

|

D. Preexisting Obligations to the Debtors Under Executory Contracts and Unexpired Leases. 29

E. Insurance Policies. 30

F. Reservation of Rights. 30

G. Nonoccurrence of Effective Date. 30

H. Employee Compensation and Benefits. 30

I. Contracts and Leases Entered Into After the Petition Date. 31

Article VI. PROVISIONS GOVERNING DISTRIBUTIONS 31

A. Distributions on Account of Claims Allowed as of the Effective Date. 31

B. Disbursing Agent. 31

C. Rights and Powers of Disbursing Agent. 31

D. Delivery of Distributions and Undeliverable or Unclaimed Distributions. 32

E. Manner of Payment. 32

F. Exemption from Registration Requirements. 32

G. Compliance with Tax Requirements. 33

H. Allocations. 33

I. No Postpetition Interest on Claims. 33

J. Foreign Currency Exchange Rate. 33

K. Setoffs and Recoupment. 33

L. Claims Paid or Payable by Third Parties. 34

Article VII. PROCEDURES FOR RESOLVING CONTINGENT, UNLIQUIDATED, AND DISPUTED CLAIMS 34

A. Disputed Claims Process. 34

B. Allowance of Claims. 35

C. Claims Administration Responsibilities. 35

D. Adjustment to Claims or Interests without Objection. 35

E. Disallowance of Claims or Interests. 35

F. No Distributions Pending Allowance. 36

G. Distributions After Allowance. 36

Article VIII. SETTLEMENT, RELEASE, INJUNCTION, AND RELATED PROVISIONS 36

A. Discharge of Claims and Termination of Interests. 36

B. Release of Liens. 36

C. Releases by the Debtors. 37

D. Releases by the Releasing Parties. 38

E. Exculpation. 38

F. Injunction. 39

G. Protections Against Discriminatory Treatment. 39

H. Document Retention. 39

I. Reimbursement or Contribution. 40

Article IX. CONDITIONS PRECEDENT TO CONFIRMATION AND CONSUMMATION OF THE PLAN 40

A. Conditions Precedent to the Effective Date. 40

B. Waiver of Conditions. 41

C. Effect of Failure of Conditions. 41

D. Substantial Consummation 41

Article X. MODIFICATION, REVOCATION, OR WITHDRAWAL OF THE PLAN 41

A. Modification and Amendments. 41

B. Effect of Confirmation on Modifications. 42

C. Revocation or Withdrawal of Plan. 42

Article XI. RETENTION OF JURISDICTION 42

| ii |

|

Article XII. MISCELLANEOUS PROVISIONS 44

A. Immediate Binding Effect. 44

B. Additional Documents. 44

C. Payment of Statutory Fees. 44

D. Statutory Committee and Cessation of Fee and Expense Payment. 44

E. Reservation of Rights. 44

F. Successors and Assigns. 44

G. Notices. 45

H. Term of Injunctions or Stays. 46

I. Entire Agreement. 46

J. Exhibits. 46

K. Nonseverability of Plan Provisions. 46

L. Votes Solicited in Good Faith. 46

M. Closing of Chapter 11 Cases. 47

N. Waiver or Estoppel. 47

| iii |

|

INTRODUCTION

5E Advanced Materials, Inc., 5E Boron Americas, LLC, American Pacific Borates Pty Ltd., and [ ] propose this joint prepackaged chapter 11 plan of reorganization (the “Plan”) for the resolution of the outstanding Claims against, and Interests in, the Debtors. Although proposed jointly for administrative purposes, the Plan constitutes a separate Plan for each Debtor. Holders of Claims or Interests may refer to the Disclosure Statement for a discussion of the Debtors’ history, businesses, assets, results of operations, and historical financial information, risk factors, a summary and analysis of this Plan, the Restructuring Transactions, and certain related matters. The Debtors are the proponents of the Plan within the meaning of section 1129 of the Bankruptcy Code.

ALL HOLDERS OF CLAIMS, TO THE EXTENT APPLICABLE, ARE ENCOURAGED TO READ THE PLAN AND THE DISCLOSURE STATEMENT IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

As used in this Plan, capitalized terms have the meanings set forth below.

| 1 |

|

| 2 |

|

| 3 |

|

| 4 |

|

| 5 |

|

| 6 |

|

| 7 |

|

| 8 |

|

For purposes of this Plan: (1) in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neuter gender shall include the masculine, feminine, and the neuter gender; (2) unless otherwise specified, any reference herein to a contract, lease, instrument, release, indenture, or other agreement or document being in a particular form or on particular terms and conditions means that the referenced document shall be substantially in that form or substantially on those terms and conditions; (3) unless otherwise specified, any reference herein to an existing document, schedule, or exhibit, whether or not Filed, having been Filed or to be Filed shall mean that document, schedule, or exhibit, as it may thereafter be amended, modified, or supplemented; (4) any reference to an Entity as a holder of a Claim or Interest includes that Entity’s successors and assigns; (5) unless otherwise specified, all references herein to “Articles” are references to Articles hereof or hereto; (6) unless otherwise specified, all references herein to exhibits are references to exhibits in the Plan Supplement; (7) unless otherwise specified, the words “herein,” “hereof,” and “hereto” refer to the Plan in its entirety rather than to a particular portion of the Plan; (8) subject to the provisions of any contract, certificate of incorporation, by-law, instrument, release, or other agreement or document entered into in connection with the Plan, the rights and obligations arising pursuant to the Plan shall be governed by, and construed and enforced in accordance with the applicable federal law, including the Bankruptcy Code and Bankruptcy Rules; (9) captions and headings to Articles are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of the Plan; (10) unless otherwise specified herein, the rules of construction set forth in section 102 of the Bankruptcy Code shall apply; (11) any term used in capitalized form herein that is not otherwise defined but that is used in the Bankruptcy Code or the Bankruptcy Rules shall have the meaning assigned to that term in the Bankruptcy Code or the Bankruptcy Rules, as the case may be; (12) all references to docket numbers of documents Filed in the Chapter 11 Cases are references to the docket numbers under the Bankruptcy Court’s CM/ECF system; (13) all references to statutes, regulations, orders, rules of courts, and the like shall mean as amended from time to time, and as applicable to the Chapter 11 Cases, unless otherwise stated; (14) the words “include” and “including,” and variations thereof, shall not be deemed to be terms of limitation, and shall be deemed to be followed by the words “without limitation”; (15) references to “Proofs of Claim,” “holders of Claims,” “Disputed Claims,” and the like shall include “Proofs of Interest,” “holders of Interests,” “Disputed Interests,” and the like, as applicable; (16) any immaterial effectuating provisions may be interpreted by the Reorganized Debtors in such a manner that is consistent with the overall purpose and intent of the Plan all without further notice to or action, order, or approval of the Bankruptcy Court or any other Entity; and (17) all references herein to consent, acceptance, or approval may be conveyed by counsel for the respective parties that have such consent, acceptance, or approval rights, including by electronic mail.

Unless otherwise specifically stated herein, the provisions of Bankruptcy Rule 9006(a) shall apply in computing any period of time prescribed or allowed herein. If the date on which a transaction may occur pursuant to the Plan shall occur on a day that is not a Business Day, then such transaction shall instead occur on the next succeeding Business Day. Any action to be taken on the Effective Date may be taken on or as soon as reasonably practicable after the Effective Date.

Unless a rule of law or procedure is supplied by federal law (including the Bankruptcy Code and Bankruptcy Rules) or unless otherwise specifically stated, the laws of the State of New York, without giving effect to the principles of conflict of laws (other than section 5-1401 and section 5-1402 of the New York General Obligations Law), shall govern the rights, obligations, construction, and implementation of the Plan, any agreements, documents, instruments, or contracts executed or entered into in connection with the Plan (except as otherwise set forth in those agreements, in which case the governing law of such agreement shall control), and corporate governance matters; provided, however, that corporate governance matters relating to the Debtors or the Reorganized Debtors, as applicable, not

| 9 |

|

incorporated in New York shall be governed by the laws of the state of incorporation or formation of the relevant Debtor or the Reorganized Debtors, as applicable.

All references in the Plan to monetary figures shall refer to currency of the United States of America, unless otherwise expressly provided herein.

Except as otherwise specifically provided in the Plan to the contrary, references in the Plan to the Debtors or the Reorganized Debtors shall mean the Debtors and the Reorganized Debtors, as applicable, to the extent the context requires.

In the event of an inconsistency between the Plan and the Disclosure Statement, the terms of the Plan shall control in all respects. In the event of an inconsistency between the Plan and any document or agreement included in the Plan Supplement, the terms of the relevant provision in the Plan Supplement shall control (unless stated otherwise in such Plan Supplement document or in the Confirmation Order). In the event of an inconsistency between the Confirmation Order and any of the Plan, the Disclosure Statement, or the Plan Supplement, the Confirmation Order shall control. For the avoidance of doubt, the Definitive Documents in effect from and after the Effective Date shall control the matters set forth therein in the event of a conflict between any such Definitive Document and any other document.

Any and all consent rights of the parties to the Restructuring Support Agreement set forth in the Restructuring Support Agreement with respect to the form and substance of this Plan, the Definitive Documents, all exhibits to the Plan, and the Plan Supplement, including any amendments, restatements, supplements, or other modifications to such agreements and documents, and any consents, waivers, or other deviations under or from any such documents, shall be incorporated herein by this reference and be fully enforceable as if stated in full herein.

Failure to reference the rights referred to in the immediately preceding paragraph as such rights relate to any document referenced in the Restructuring Support Agreement, as applicable, shall not impair such rights and obligations.

In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Claims, DIP Claims (as applicable), Professional Claims, and Priority Tax Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in Article III hereof.

Unless otherwise agreed to by the holder of an Allowed Administrative Claim and the Debtors or the Reorganized Debtors, as applicable, in consultation with the Required Consenting Parties, each holder of an Allowed Administrative Claim (other than holders of Professional Claims and Claims for fees and expenses pursuant to section 1930 of chapter 123 of title 28 of the United States Code) will receive in full and final satisfaction of its Administrative Claim an amount of Cash equal to the amount of such Allowed Administrative Claim in accordance with the following: (1) if an Administrative Claim is Allowed on or prior to the Effective Date, on the Effective Date, or as soon as reasonably practicable thereafter (or, if not then due, when such Allowed Administrative Claim is due or as soon as reasonably practicable thereafter); (2) if such Administrative Claim is not Allowed as of the Effective Date, no later than thirty (30) days after the date on which an order allowing such Administrative Claim becomes a Final Order, or

| 10 |

|

as soon as reasonably practicable thereafter; (3) if such Allowed Administrative Claim is based on liabilities incurred by the Debtors in the ordinary course of their business after the Petition Date, in accordance with the terms and conditions of the particular transaction giving rise to such Allowed Administrative Claim, without any further action by the holders of such Allowed Administrative Claim; (4) at such time and upon such terms as may be agreed upon by such holder and the Debtors or the Reorganized Debtors, as applicable; or (5) at such time and upon such terms as set forth in an order of the Bankruptcy Court.

On the Effective Date, if the Debtors incur debtor-in-possession financing during the Chapter 11 Cases, each holder of an Allowed DIP Claim shall receive its Pro Rata share of the New Equity DIP Claim Allocation.

As of the Effective Date, the DIP Claims shall be Allowed and deemed to be Allowed Claims in the full amount outstanding under the DIP Documents without the need for the DIP Agent or DIP Lenders to file any Proof of Claim or request for payment.

All requests for payment of Professional Claims for services rendered and reimbursement of expenses incurred prior to the Confirmation Date must be Filed no later than 45 days after the Effective Date. The Bankruptcy Court shall determine the Allowed amounts of such Professional Claims after notice and a hearing in accordance with the procedures established by the Bankruptcy Court. The Reorganized Debtors shall pay Professional Claims in Cash in the amount the Bankruptcy Court allows, including from the Professional Escrow Account, which the Reorganized Debtors will establish in trust for the Professionals and fund with Cash equal to the Professional Amount on the Effective Date.

On the Effective Date, the Reorganized Debtors shall establish and fund the Professional Escrow Account with Cash equal to the Professional Amount, which shall be funded by the Reorganized Debtors. The Professional Escrow Account shall be maintained in trust solely for the Professionals. Such funds shall not be considered property of the Estates of the Debtors or the Reorganized Debtors. The amount of Allowed Professional Claims shall be paid in Cash to the Professionals by the Reorganized Debtors from the Professional Escrow Account as soon as reasonably practicable after such Professional Claims are Allowed. When such Allowed Professional Claims have been paid in full, any remaining amount in the Professional Escrow Account shall promptly be paid to the Reorganized Debtors without any further action or order of the Bankruptcy Court.

Professionals shall reasonably estimate their unpaid Professional Claims and other unpaid fees and expenses incurred in rendering services to the Debtors or the Committee, if any, as applicable before and as of the Effective Date, and shall deliver such estimate to the Debtors no later than five days before the Effective Date; provided, however, that such estimate shall not be deemed to limit the amount of the fees and expenses that are the subject of each Professional’s final request for payment in the Chapter 11 Cases. If a Professional does not provide an estimate, the Debtors or Reorganized Debtors may estimate the unpaid and unbilled fees and expenses of such Professional.

Except as otherwise specifically provided in the Plan, from and after the Confirmation Date, the Debtors shall, in the ordinary course of business and without any further notice to or action, order, or approval of the Bankruptcy Court, pay in Cash the reasonable and documented legal, professional, or other fees and expenses related to implementation of the Plan and Consummation incurred by the Debtors or the Committee, if any, as applicable. The Debtors and Reorganized Debtors, as applicable, shall pay all reasonable and documented fees and expenses of the Noteholders in accordance with the terms and conditions of any applicable agreement with the Debtors (including

| 11 |

|

the Restructuring Support Agreement), and if any such fee and/or expense is unpaid as of the Effective Date, such fee and/or expense shall be paid on the Effective Date. If the Debtors or Reorganized Debtors, as applicable, dispute the reasonableness of any such invoice, the Debtors or Reorganized Debtors, as applicable, or the affected professional may submit such dispute to the Bankruptcy Court for a determination of the reasonableness of any such invoice, and the disputed portion of such invoice shall not be paid until the dispute is resolved. The undisputed portion of such reasonable fees and expenses shall be paid as provided herein. Upon the Confirmation Date, any requirement that Professionals comply with sections 327 through 331, 363, and 1103 of the Bankruptcy Code in seeking retention or compensation for services rendered after such date shall terminate, and the Debtors may employ and pay any Professional in the ordinary course of business without any further notice to or action, order, or approval of the Bankruptcy Court.

Except to the extent that a holder of an Allowed Priority Tax Claim agrees to a less favorable treatment, in full and final satisfaction, settlement, release, and discharge of and in exchange for each Allowed Priority Tax Claim, each holder of such Allowed Priority Tax Claim shall be treated in accordance with the terms set forth in section 1129(a)(9)(C) of the Bankruptcy Code.

This Plan constitutes a separate Plan proposed by each Debtor. Except for the Claims addressed in Article II hereof, all Claims and Interests are classified in the Classes set forth below in accordance with sections 1122 and 1123(a)(1) of the Bankruptcy Code. A Claim or an Interest is classified in a particular Class only to the extent that the Claim or Interest fits within the description of that Class and is classified in other Class(es) to the extent that any portion of the Claim or Interest fits within the description of such other Class(es). A Claim or an Interest also is classified in a particular Class for the purpose of receiving distributions under the Plan only to the extent that such Claim or Interest is an Allowed Claim or Interest in that Class and has not been paid, released, or otherwise satisfied prior to the Effective Date.

The classification of Claims and Interests against the Debtors pursuant to the Plan is as follows:

Class | Claims and Interests | Status | Voting Rights |

Class 1 | Other Secured Claims | Unimpaired | Not Entitled to Vote (Deemed to Accept) |

Class 2 | Other Priority Claims | Unimpaired | Not Entitled to Vote (Deemed to Accept) |

Class 3 | Notes Claims | Impaired | Entitled to Vote |

Class 4 | General Unsecured Claims | Unimpaired | Not Entitled to Vote (Deemed to Accept) |

Class 5 | Intercompany Claims | Unimpaired / Impaired | Not Entitled to Vote (Deemed to Accept or Reject) |

Class 6 | Intercompany Interests | Unimpaired / Impaired | Not Entitled to Vote (Deemed to Accept or Reject) |

Class 7 | Interests in FEAM | Impaired | Not Entitled to Vote (Deemed to Reject) |

| 12 |

|

Each holder of an Allowed Claim or Allowed Interest, as applicable, shall receive under the Plan the treatment described below in full and final satisfaction, settlement, release, and discharge of and in exchange for such holder’s Allowed Claim or Allowed Interest, except to the extent different treatment is agreed to by the Reorganized Debtors and the holder of such Allowed Claim or Allowed Interest, as applicable. Unless otherwise indicated, the holder of an Allowed Claim or Allowed Interest, as applicable, shall receive such treatment on the Effective Date or as soon as reasonably practicable thereafter.

| 13 |

|

| 14 |

|

Except as otherwise provided in the Plan, nothing under the Plan shall affect the Debtors’ or the Reorganized Debtors’ rights regarding any Unimpaired Claim, including, all rights regarding legal and equitable defenses to or setoffs or recoupments against any such Unimpaired Claim.

Any Class of Claims or Interests that does not have a holder of an Allowed Claim or Allowed Interest or a Claim or Interest temporarily Allowed by the Bankruptcy Court as of the date of the Confirmation Hearing shall be deemed eliminated from the Plan for purposes of voting to accept or reject the Plan and for purposes of determining acceptance or rejection of the Plan by such Class pursuant to section 1129(a)(8) of the Bankruptcy Code.

If a Class contains Claims eligible to vote and no holders of Claims eligible to vote in such Class vote to accept or reject the Plan, the holders of such Claims in such Class shall be deemed to have accepted the Plan.

To the extent Reinstated under the Plan, Intercompany Interests shall be Reinstated for purposes of administrative convenience and for the ultimate benefit of the holders of New Equity, and shall receive no recovery or distribution.

Section 1129(a)(10) of the Bankruptcy Code shall be satisfied for purposes of Confirmation by acceptance of the Plan by one or more of the Classes entitled to vote pursuant to Article III.B of the Plan. The Debtors reserve the right to modify the Plan in accordance with Article X hereof to the extent, if any, that Confirmation pursuant to section 1129(b) of the Bankruptcy Code requires modification, including by modifying the treatment applicable to a Class of Claims or Interests to render such Class of Claims or Interests Unimpaired to the extent permitted by the Bankruptcy Code and the Bankruptcy Rules.

If a controversy arises as to whether any Claims or Interests, or any Class of Claims or Interests, are Impaired, the Bankruptcy Court shall, after notice and a hearing, determine such controversy on or before the Confirmation Date.

The allowance, classification, and treatment of all Allowed Claims and Allowed Interests and the respective distributions and treatments under the Plan take into account and conform to the relative priority and rights of the Claims and Interests in each Class in connection with any contractual, legal, and equitable subordination rights relating

| 15 |

|

thereto, whether arising under general principles of equitable subordination, section 510(b) of the Bankruptcy Code, or otherwise. Pursuant to section 510 of the Bankruptcy Code the Reorganized Debtors reserve the right to re-classify any Allowed Claim or Allowed Interest in accordance with any contractual, legal, or equitable subordination relating thereto.

As discussed in detail in the Disclosure Statement and as otherwise provided herein, pursuant to section 1123 of the Bankruptcy Code and Bankruptcy Rule 9019, and in consideration for the classification, distributions, releases, and other benefits provided under the Plan, upon the Effective Date, the provisions of the Plan shall constitute a good faith compromise and settlement of all Claims and Interests and controversies resolved pursuant to the Plan, including (1) any challenge to the amount, validity, perfection, enforceability, priority or extent of the DIP Claims (as applicable) or the Notes Claims and (2) any claim to avoid, subordinate, or disallow any DIP Claim (as applicable) or Notes Claim, whether under any provision of chapter 5 of the Bankruptcy Code, on any equitable theory (including equitable subordination, equitable disallowance, or unjust enrichment), or otherwise. The Plan shall be deemed a motion to approve the good faith compromise and settlement of all such Claims, Interests, and controversies pursuant to Bankruptcy Rule 9019, and the entry of the Confirmation Order shall constitute the Bankruptcy Court’s approval of such compromise and settlement under section 1123 of the Bankruptcy Code and Bankruptcy Rule 9019, as well as a finding by the Bankruptcy Court that such settlement and compromise is fair, equitable, reasonable and in the best interests of the Debtors and their Estates. Subject to Article VI hereof, all distributions made to holders of Allowed Claims in any Class are intended to be and shall be final.

On or before the Effective Date, the applicable Debtors or the Reorganized Debtors shall enter into and shall take any actions as may be necessary or appropriate to effect the Restructuring Transactions, including as set forth in the Restructuring Transactions Memorandum. The actions to implement the Restructuring Transactions may include: (1) the execution and delivery of appropriate agreements or other documents of merger, amalgamation, consolidation, restructuring, conversion, disposition, transfer, arrangement, continuance, dissolution, sale, purchase, or liquidation containing terms that are consistent with the terms of the Plan and the Restructuring Transactions Memorandum, and that satisfy the requirements of applicable law and any other terms to which the applicable Entities and parties may agree; (2) the execution and delivery of appropriate instruments of transfer, assignment, assumption, or delegation of any asset, property, right, liability, debt, or obligation on terms consistent with the terms of the Plan and the Restructuring Transactions Memorandum, and having other terms for which the applicable Entities and parties agree; (3) the filing of appropriate certificates or articles of incorporation, formation, reincorporation, merger, consolidation, conversion, amalgamation, arrangement, continuance, or dissolution pursuant to applicable state or provincial law; and (4) all other actions that the applicable Entities and parties determine to be necessary, including making filings or recordings that may be required by applicable law in connection with the Plan and the Restructuring Transactions Memorandum. The Confirmation Order shall, and shall be deemed to, pursuant to sections 363 and 1123 of the Bankruptcy Code, authorize, among other things, all actions as may be necessary or appropriate to effect any transaction described in, contemplated by, or necessary to effectuate the Plan.

Notwithstanding anything herein to the contrary, the Debtors shall consult with the Required Consenting Parties to determine whether to engage in the Restructuring Transactions in accordance with the structure contemplated by the Restructuring Transactions Memorandum, and the Debtors or Reorganized Debtors may not engage in the Restructuring Transactions in accordance with the structure contemplated by the Restructuring Transactions Memorandum without the prior reasonable written consent of the Required Consenting Parties. The Debtors shall, subject to any limitations imposed on distribution by professionals (including, for the avoidance of doubt, any requirement such professionals have in the way of non-reliance and/or access letters, as the case may be), provide the Required Consenting Parties with reasonable access to materials in the Debtors’ (or their agents’) possession reasonably necessary for the Required Consenting Parties to evaluate whether to engage in the Restructuring Transactions in accordance with the structure contemplated by the Restructuring Transactions

| 16 |

|

Memorandum. The Debtors shall cooperate on a reasonable basis with the Required Consenting Parties in connection with proposals by any of the Required Consenting Parties.

On the Effective Date, the New Board shall be established consistent with the Restructuring Support Agreement, and the Reorganized Debtors shall adopt their New Organizational Documents. The Reorganized Debtors shall be authorized to adopt any other agreements, documents, and instruments and to take any other actions contemplated under the Plan as necessary to consummate the Plan, including making payments under or entry into a key employee incentive or retention program. Cash payments to be made pursuant to the Plan will be made by the Debtors or Reorganized Debtors. The Debtors and Reorganized Debtors will be entitled to transfer funds between and among themselves as they determine to be necessary or appropriate to enable the Debtors or Reorganized Debtors, as applicable, to satisfy their obligations under the Plan. Except as set forth herein, any changes in intercompany account balances resulting from such transfers will be accounted for and settled in accordance with the Debtors’ historical intercompany account settlement practices and will not violate the terms of the Plan.

From and after the Effective Date, the Reorganized Debtors, subject to any applicable limitations set forth in any post-Effective Date agreement, shall have the right and authority without further order of the Bankruptcy Court to raise additional capital and obtain additional financing as the boards of directors or managers of the applicable Reorganized Debtors deem appropriate.

The Debtors and the Reorganized Debtors, as applicable, shall fund distributions under the Plan with: (1) Cash on hand, including Cash from operations and (2) the New Equity.

All Interests in FEAM shall be cancelled on the Effective Date and, subject to the Restructuring Transactions, Reorganized FEAM shall issue or transfer the New Equity to holders of Claims entitled to receive such New Equity pursuant to the Plan and the Restructuring Support Agreement. The issuance or transference of the New Equity pursuant to the Plan shall be duly authorized without the need for any further corporate action and without any further action by the Debtors or Reorganized Debtors, or by any of their equity holders, members, directors, managers, officers, or employees, as applicable, or by any holders of any Claims or Interests, as applicable. All New Equity issued or transferred under the Plan shall be duly authorized, validly issued, fully paid, and non-assessable (as applicable), and, to the extent Reorganized FEAM is a corporation, the holders of New Equity shall be deemed as a result of having received distributions of New Equity pursuant to the Plan to have accepted the New Organizational Documents (solely in their capacity as members of Reorganized FEAM) without further action or signature. The New Organizational Documents shall be effective as of the Effective Date and, as of such date, shall be deemed to be valid, binding, and enforceable in accordance with its terms, and each holder of New Equity shall be bound thereby (without any further action or signature) in all respects, whether or not such holder has executed the New Organizational Documents.

The New Equity will be issued or transferred under the Plan as follows, and as consistent with the Restructuring Support Agreement and Restructuring Transactions Memorandum: on the Effective Date, the New Equity will be allocated pro rata between the New Equity Note Claim Allocation (based on the aggregate outstanding notional amount of the Notes - which shall include the complete principal amount plus any payment in kind - as of the Effective Date) and the New Equity DIP Claim Allocation (based on the aggregate complete principal amount plus any payment in kind interest as of the Effective Date), and each holder of an Allowed Notes Claim shall receive its Pro Rata share of the New Equity Note Claim Allocation and each holder of an Allowed DIP Claim shall receive its Pro Rata share of the New Equity DIP Claim Allocation.

At the election of the Noteholders, the New Equity may be subject to a stockholders’ agreement and/or the holders of New Equity will be provided with registration rights, in each case, on the terms and conditions that are mutually acceptable to the Reorganized Debtors and the Noteholders.

| 17 |

|

Except as otherwise provided in the Plan or any agreement, instrument, or other document incorporated in the Plan or the Plan Supplement, each Debtor shall continue to exist after the Effective Date as a separate corporate entity, limited liability company, partnership, or other form of entity, as the case may be, with all the powers of a corporation, limited liability company, partnership, or other form of entity, as the case may be, pursuant to the applicable law in the jurisdiction in which each applicable Debtor is incorporated or formed and pursuant to the respective certificate of incorporation and bylaws (or other formation documents and agreements) in effect prior to the Effective Date, except to the extent such certificate of incorporation and bylaws (or other formation documents and agreements) are amended under the Plan or otherwise and to the extent such documents are amended, such documents are deemed to be amended pursuant to the Plan and require no further action or approval (other than any requisite filings required under applicable state, provincial, or federal law). After the Effective Date, the respective certificate of incorporation and bylaws (or other formation documents or agreements) of one or more of the Reorganized Debtors may be amended or modified without supervision or approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules. After the Effective Date, one or more of the Reorganized Debtors may be disposed of, dissolved, wound down, merged, converted, liquidated, etc. without supervision or approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules.

Except as otherwise provided in the Plan (including, for the avoidance of doubt, the Restructuring Transactions Memorandum) or any agreement, instrument, or other document incorporated in, or entered into in connection with or pursuant to, the Plan or Plan Supplement, on the Effective Date, all property in each Estate, all Causes of Action, and any property acquired by any of the Debtors pursuant to the Plan shall vest immediately and completely in each respective Reorganized Debtor, free and clear of all Liens, Claims, charges, or other encumbrances. On and after the Effective Date, except as otherwise provided in the Plan, each Reorganized Debtor may operate its business and may operate, use, acquire, exchange, or dispose of property and compromise or settle any Claims, Interests, or Causes of Action without supervision or approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules.

On the Effective Date, except to the extent otherwise provided in the Plan, all notes, instruments, certificates, credit agreements, indentures, and other instruments or documents directly or indirectly evidencing Claims or Interests shall be cancelled, and the obligations of the Debtors thereunder or in any way related thereto shall be deemed satisfied in full, cancelled, discharged, and of no further force or effect whatsoever. Holders of or parties to such cancelled instruments, Securities, and other documentation will have no rights arising from or relating to such instruments, Securities, and other documentation, or the cancellation thereof, except the rights provided for pursuant to this Plan.

Upon and after the Effective Date, all actions contemplated under the Plan and the Restructuring Transactions Memorandum shall be deemed authorized and approved by the Bankruptcy Court in all respects without any further corporate, board, manager, or equity holder action, including: (1) adoption or assumption, as applicable, of the Compensation and Benefit Programs; (2) selection of the directors, managers, and officers for the Reorganized Debtors; (3) the issuance and distribution of the New Equity; (4) implementation of the Restructuring Transactions; (5) all other actions contemplated under the Plan (whether to occur before, on, or after the Effective Date); (6) adoption, execution, and/or filing of the New Organizational Documents; (7) the rejection, assumption, or assumption and assignment, as applicable, of Executory Contracts and Unexpired Leases; and (8) all other acts or actions contemplated or reasonably necessary or appropriate to promptly consummate the Restructuring Transactions contemplated by the Plan (whether to occur before, on, or after the Effective Date). All matters provided for in the Plan involving the corporate structure of the Debtors or the Reorganized Debtors, and any corporate, partnership, limited liability company, or other governance action required by the Debtors or the Reorganized Debtors, as applicable, in connection with the Plan shall be deemed to have occurred and shall be in effect, without any requirement of further corporate or other action by any Security holders, members, managers, directors, or officers of

| 18 |

|

the Debtors or the Reorganized Debtors, as applicable. On or (as applicable) prior to the Effective Date, the appropriate officers of the Debtors or the Reorganized Debtors, as applicable, shall be (or shall be deemed to have been) authorized and (as applicable) directed to issue, execute, and deliver the agreements, documents, Securities, and instruments contemplated under the Plan (or necessary or desirable to effect the transactions and the Restructuring Transactions contemplated under the Plan and the Restructuring Transactions Memorandum) in the name of and on behalf of the Reorganized Debtors, including the New Equity, the New Organizational Documents, and any and all other agreements, documents, Securities, and instruments relating to the foregoing. The authorizations and approvals contemplated by this Plan and the Restructuring Transactions Memorandum shall be effective notwithstanding any requirements under non-bankruptcy law.

On the Effective Date, the New Organizational Documents shall be adopted automatically by the applicable Reorganized Debtors and shall be amended or amended and restated, as applicable, as may be required to be consistent with the provisions of the Plan, the Restructuring Support Agreement, and the Restructuring Transactions Memorandum. To the extent required under the Plan or applicable non-bankruptcy law, each of the Reorganized Debtors will file its New Organizational Documents with the applicable Secretary of State and/or other applicable authorities in its respective state, province or country of organization if and to the extent required in accordance with the applicable laws of the respective state, province or country of organization. The New Organizational Documents will authorize the issuance of the New Equity and will prohibit the issuance of non-voting equity Securities, to the extent required under section 1123(a)(6) of the Bankruptcy Code. After the Effective Date, the Reorganized Debtors may amend and restate their respective New Organizational Documents in accordance with the terms thereof and in compliance with the laws of their jurisdiction or organization, and the Reorganized Debtors may file such amended certificates or articles of incorporation, bylaws, or such other applicable formation documents, and other constituent documents as permitted by the laws of the respective states, provinces, or countries of incorporation and the New Organizational Documents.

As of the Effective Date, the New Organizational Documents of each Reorganized Debtor shall, to the fullest extent permitted by applicable law, provide for the indemnification, defense, reimbursement, exculpation, and/or limitation of liability of, and advancement of fees and expenses to, current and former managers, directors, officers, employees, or agents at least to the same extent as the Indemnification Provisions in the certificate of incorporation, bylaws, or similar organizational document of each of the respective Debtors on the Petition Date, against any claims or causes of action whether derivative, liquidated or unliquidated, fixed, or contingent, disputed or undisputed, matured or unmatured, known or unknown, foreseen or unforeseen, asserted or unasserted.

In addition, all other Indemnification Provisions, consistent with applicable law, currently in place shall be reinstated and remain intact and irrevocable, and shall survive the Effective Date on terms no less favorable to such current and former managers, directors, officers, employees, and agents of, or acting on behalf of, the Debtors than the Indemnification Provisions in place prior to the Effective Date.

As of the Effective Date, the term of the current members of the board of directors or managers of FEAM shall expire, and all of the managers for the initial term of the New Board shall be appointed in accordance with the New Organizational Documents and each other constituent document of each Reorganized Debtor. To the extent known, the identity of the members of the New Board will be disclosed in the Plan Supplement or prior to the Confirmation Hearing, consistent with section 1129(a)(5) of the Bankruptcy Code, in accordance with the terms of the Restructuring Support Agreement. Each director or manager of the Reorganized Debtors shall serve from and after the Effective Date pursuant to the terms of the applicable New Organizational Documents, other constituent documents, and applicable laws of the respective Reorganized Debtors’ jurisdiction of formation.

| 19 |

|