- FEAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-12B/A Filing

5E Advanced Materials (FEAM) 10-12B/ARegistration of securities (amended)

Filed: 4 Mar 22, 6:42pm

File No. 001-41279

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1 to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

5E Advanced Materials, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 87-3426517 | |

(State or Other Jurisdiction of Incorporation or Formation) | (I.R.S. Employer Identification Number) | |

19500 State Highway 249, Suite 125 Houston, Texas | 77070 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (346) 439-9656

with copies to:

Paul Weibel Chief Financial Officer 5E Advanced Materials, Inc. 19500 State Highway 249, Suite 125 Houston, Texas 77070 | Craig A. Roeder Baker & McKenzie LLP 300 East Randolph Street Chicago, Illinois 60601 |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class to be registered | Name of each exchange on which each class is to be registered | |

| Common Stock, $0.01 par value | The Nasdaq Stock Market LLC |

Securities to be registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☑ | Smaller reporting company | ☑ | |||

| Emerging growth company | ☑ | |||||

If an emerging growth company, indicate by check mark if the Company has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

5E Advanced Materials, Inc. (the “Company” or “5E”) is filing this General Form for Registration of Securities on Form 10 (this “Registration Statement”) to register its common stock, par value $0.01 per share (“Common Stock”), pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the proposed listing of the Common Stock on The Nasdaq Stock Market LLC (“Nasdaq”). The Company was incorporated in the State of Delaware on September 23, 2021 for the purpose of reorganizing the operations of American Pacific Borates Limited (“ABR”), a public company incorporated under the laws of the state of Western Australia and listed on the Australian Securities Exchange (“ASX”), into a structure whereby the ultimate parent company will be a Delaware corporation. See “Item 1. Description of Business—Corporate History.”

Prior to the effectiveness of this Registration Statement, the Company will receive all of the issued and outstanding shares of ABR pursuant to a statutory Scheme of Arrangement under Australian law (the “Scheme”) under Part 5.1 of the Australian Corporations Act, 2001 (Cth) (the “Corporations Act”). The Scheme was approved by ABR’s shareholders at a general meeting of shareholders held on December 3, 2021. Following shareholder approval, the Scheme was approved by the Federal Court of Australia on February 25, 2022.

As soon as practicable after completion of the Scheme, the Company intends to list its Common Stock on Nasdaq under the symbol “FEAM” and de-list ABR from the ASX.

Throughout this Registration Statement, these transactions are referred to as the “Reorganization.” Pursuant to the Reorganization, the Company will issue to the shareholders of ABR either one share of the Company’s Common Stock for every ten ordinary shares of ABR or one CHESS Depositary Interest over the Company’s Common Stock (a “CDI”) for every one ordinary share of ABR, in each case, as held on the Scheme record date. Eligible shareholders of ABR (those whose residence at the record date of the Scheme is in Australia, New Zealand, Canada, Hong Kong, Ireland, Papua New Guinea, Singapore, Malaysia, Thailand, or the United States) will receive CDIs by default. In order to receive Common Stock, eligible shareholders were required to complete and submit an election form to ABR’s registry no later than 5:00 pm (AEDT) on March 2, 2022. Ineligible shareholders will not receive CDIs or shares of Common Stock but will instead receive the proceeds from the sale of the CDIs to which they would otherwise be entitled by a broker appointed by ABR. The appointed broker will sell the CDIs in accordance with the terms of a sale facility agreement and will remit the proceeds to ineligible shareholders. Additionally, the Company will cancel each of the outstanding options to acquire ordinary shares of ABR and issue replacement options representing the right to acquire shares of the Company’s Common Stock on the basis of one replacement option for every ten existing ABR options held. The Company will maintain an ASX listing for its CDIs, with each CDI representing 1/10th of a share of Common Stock. Holders of CDIs will be able to trade their CDIs on the ASX after implementation of the Scheme and holders of shares of the Company’s Common Stock will be able to trade their shares on Nasdaq.

Upon completion of the Reorganization, we expect that we will have approximately 41,869,315 shares of our Common Stock outstanding held by approximately 4,053 record holders. Based on elections made by holders of ABR ordinary shares in connection with the Reorganization, we expect that approximately 30,106,027 of the Company’s outstanding shares as of the completion of the Reorganization will be represented by CDIs.

The Common Stock issued to ABR shareholders pursuant to the Reorganization will be exempt from registration under Section 3(a)(10) of the Securities Act of 1933 (the “Securities Act”).

Prior to completion of the Reorganization, the Company will have had no business or operations and following completion of the Reorganization, the business and operations of the Company will consist solely of the business and operations of ABR and its subsidiaries. As a result of the Reorganization, the Company will become the parent company of ABR, and for financial reporting purposes the historical financial statements of ABR will become the historical financial statements of the Company as a continuation of the predecessor.

Except as otherwise indicated or unless the context otherwise requires, the information in this Registration Statement assumes and gives effect to the completion of the Reorganization. Unless the context indicates otherwise, all references in this Registration Statement to the “Company,” “we,” “us” and “our” refer to ABR prior to the Reorganization and the Company after the Reorganization.

Upon this Registration Statement becoming effective, the Company will become subject to the requirements of Regulation 13A under the Exchange Act and will be required to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(b) of the Exchange Act. The Company’s executive officers, directors and stockholders beneficially owning more than 10% of its Common Stock will become subject to Section 16 of the Exchange Act and will be required to file Forms 3, 4 and 5 with the U.S. Securities Exchange Commission (the “SEC”). Stockholders beneficially owning more than 5% of the Company’s Common Stock will be required to file Schedules 13D/G with the SEC pursuant to Sections 13(d) or (g) of the Exchange Act.

2

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Registration Statement contains various forward-looking statements relating to the Company’s future financial performance and results, financial condition, business strategy, plans, goals and objectives, including certain projections, business trends and other statements that are not historical facts. These statements constitute forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “estimate,” “plan,” “guidance,” “outlook,” “intend,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect the Company’s beliefs and expectations based on current estimates and projections. While the Company believes these expectations, and the estimates and projections on which they are based, are reasonable and were made in good faith, these statements are subject to numerous risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties and other important factors, which include, but are not limited to, the risks described under the heading “Risk Factor Summary” and “Item 1A. – Risk Factors,” any of which could cause the Company’s actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

These forward-looking statements speak only as of the date of this Registration Statement and, except as required by law, the Company undertakes no obligation to correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required under federal securities laws. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this registration statement.

3

RISK FACTOR SUMMARY

Our business and any investment in our securities involves risks. You should carefully consider the risks described under “Item 1A. – Risk Factors.” The following risks, uncertainties and other important factors, among others, include various forward-looking statements that may cause actual results to be materially different from present expectations or projections. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. Set forth below is a summary of some of the principal risks we face:

| • | Our limited operating history in the borates industry and no sustained revenue from our properties; |

| • | Our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; |

| • | Our status as an exploration stage company with no known mineral reserves and the inherent uncertainty in estimates of mineral resources; |

| • | Our lack of history in mineral production and the risks associated with achieving our downstream processing ambitions; |

| • | We have incurred significant net operating losses to date and we anticipate incurring continued losses for the foreseeable future; |

| • | Risks and uncertainties relating to the development of the Fort Cady project (“Fort Cady” or the “Project”); |

| • | We depend on a single mining project; |

| • | Risks related to our ability to achieve and maintain profitability and to develop positive cash flow from our operating activities; |

| • | Risks related to the demand for end use applications that require borates and related minerals and compounds that we expect to produce; |

| • | Our long-term success is dependent on our ability to enter into and deliver product under supply agreements; |

| • | Risks related to estimates of our total addressable market; |

| • | The costs and availability of natural gas and electricity; |

| • | Uncertain global economic conditions and the impact this may have on our business and plans; |

| • | Risks associated with our ongoing investment in the Project; |

| • | Risks associated with the required infrastructure at the Project site; |

| • | Risks related to the titles of our mineral property interests and related water rights; |

| • | Any restrictions on our ability to obtain, recycle and dispose of water on site; |

| • | Risks related to the portion of the Project that we lease from a third party; |

| • | Risks related to land use restrictions on our properties; |

| • | Risks related to volatility in prices or demand for borates and other minerals; |

| • | Fluctuations in the U.S. dollar relative to other currencies; |

| • | Mineral exploration and development risk; |

| • | Risks related to equipment shortages and supply chain disruptions; |

| • | Risks associated with any of our suppliers not implementing ethical business practices in compliance with applicable laws and regulations; |

| • | Competition from new or current competitors in the mineral exploration and mining industry; |

| • | Risks associated with consolidation in the markets in which we operate and expect to operate; |

| • | Risks related to compliance with environmental and regulatory requirements; |

| • | Risks and costs associated with the generation and disposal of hazardous waste; |

4

| • | Risks related to reclamation requirements; |

| • | Risks related to climate change; |

| • | Risks related to our ability to acquire and maintain necessary mining licenses, permits or access rights; |

| • | Litigation risk; |

| • | Risks related to our main operations being located in the State of California; |

| • | Risks related to our engagement with local communities and other stakeholders; |

| • | Risks relating to our investment in the Salt Wells Projects located in Nevada; |

| • | Our dependence on key management and third parties; |

| • | Risks related to potential acquisitions, joint ventures and other investments; |

| • | Risks related to public health threats, including the novel coronavirus, that may cause disruptions to our operations or may have a material adverse effect on our development plans and financial results; |

| • | Information technology risks; |

| • | Risks and costs relating to the Reorganization, including failure to achieve the expected benefits of the Reorganization; |

| • | Risks related to the possible dilution of our Common Stock; |

| • | Risks related to our stock price and trading volume volatility; |

| • | Risks relating to the development of an active trading market for our Common Stock; |

| • | Risks related to our status as an emerging growth company; and |

| • | Our increased costs as a result of being a U.S. listed public company. |

Many of these factors are macro-economic in nature and are, therefore, beyond the Company’s control. Should one or more of these risks or uncertainties materialize, affect the Company in ways or to an extent that it currently does not expect or consider to be significant, or should underlying assumptions prove incorrect, the Company’s actual results, performance or achievements may vary materially from those described in this Registration Statement as anticipated, believed, estimated, expected, intended, planned or projected.

Finally, the Company’s future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in its other filings with the SEC or under future filings pursuant to the Exchange Act and the Securities Act. For additional information regarding risks and uncertainties, see the Company’s other filings with the SEC. In the event of an inconsistency between any prior or current SEC filing, the most current SEC filing will control.

The Company cautions that the foregoing list of risks, uncertainties and other important factors is not exhaustive. When relying on forward-looking statements to make decisions with respect to the Company, investors should carefully consider the foregoing factors and other uncertainties and events. Moreover, we operate in a competitive and rapidly evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties.

5

CAUTIONARY NOTE REGARDING RESERVES

Unless otherwise indicated, all mineral resource and mineral reserve estimates included in this Registration Statement have been prepared in accordance with, and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”)-based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources,” and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code.” While the SEC now recognizes “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all of the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves.

The following terms, as defined in Regulation S-K 1300, apply within this Registration Statement:

Measured Mineral Resource (“Measured” or “Measured Mineral Resource”) | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. | |

| Indicated Mineral Resource (“Indicated” or “Indicated Mineral Resource”) | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. | |

Inferred Mineral Resource (“Inferred” or “Inferred Mineral Resource”) | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. | |

Probable Mineral Reserve (“Probable” or “Probable Mineral Reserve”) | the economically mineable part of an indicated and, in some cases, a measured mineral resource. | |

Proven Mineral Reserve (“Proven” or “Proven Mineral Reserve”) | the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. | |

The Company retained Millcreek Mining Group to prepare an independent technical report summary on the Project. The purpose of the technical report summary is to support the disclosure of mineral resource estimates for the Project. The summary was prepared in accordance with the SEC’s Mining Disclosure Rules and Regulation S-K 1300 and Item 601(b)(96) (technical report summary) of Regulation S-K. The technical report summary is discussed in “Item 1. Description of Business” and “Item 3. Properties.”

6

UNLESS OTHERWISE EXPRESSLY STATED, NOTHING CONTAINED IN THIS REGISTRATION STATEMENT IS, NOR DOES IT PURPORT TO BE, A TECHNICAL REPORT SUMMARY PREPARED BY A QUALIFIED PERSON PURSUANT TO AND IN ACCORDANCE WITH THE REQUIREMENTS OF SUBPART 1300 OF SECURITIES EXCHANGE COMMISSION REGULATION S-K.

CAUTIONARY NOTE REGARDING EXPLORATION STAGE COMPANIES

The Company is an exploration stage company and does not currently have any known mineral reserves and cannot be expected to have known mineral reserves unless and until an economic feasibility study is completed for the Project that shows proven and probable reserves as defined by Regulation S-K 1300. There can be no assurance that the Project contains such SEC-compliant proven and probable reserves or that, even if such reserves are found, the Company will be successful in economically recovering them.

CAUTIONARY NOTE REGARDING EMERGING GROWTH COMPANY STATUS

Section 102(b)(1) of the Jumpstart Our Business Startups Act (“JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Securities Exchange Act of 1934, as amended) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard, until such time the Company is no longer considered to be an emerging growth company. At times, the Company may elect to adopt a new or revised standard early.

CAUTIONARY NOTE REGARDING INDUSTRY AND MARKET DATA

This Registration Statement includes information concerning the Company’s industry and the markets in which it will operate that is based on information from various sources including public filings, internal company sources, various third-party sources and management estimates. Management estimates regarding the Company’s position, share and industry size are derived from publicly available information and its internal research, and are based on a number of key assumptions made upon reviewing such data and the Company’s knowledge of such industry and markets, which it believes to be reasonable. While the Company believes the industry, market and competitive position data included in this Registration Statement is reliable and is based on reasonable assumptions, such data is necessarily subject to a high degree of uncertainty and risk and is subject to change due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements,” “Item 1A. Risk Factors” and elsewhere in this Registration Statement. These and other factors could cause results to differ materially from those expressed in the estimates included in this Registration Statement. The Company has not independently verified any data obtained from third-party sources and cannot assure you of the accuracy or completeness of such data.

7

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

When this Registration Statement becomes effective, the Company will begin to file reports, proxy statements, information statements and other information with the SEC. You may read and copy this information, for a copying fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on its Public Reference Room. Our SEC filings will also be available to the public from commercial document retrieval services and at the website maintained by the SEC at www.sec.gov. Information contained on any website referenced in this Registration Statement is not incorporated by reference into this Registration Statement.

The Company’s Internet website address is http:/www.5eadvancedmaterials.com. Information contained on the website does not constitute part of this Registration Statement. The Company has included its website address in this Registration Statement solely as an inactive textual reference. When this Registration Statement is effective, the Company will make available on its website electronic copies of the materials it files with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, the Section 16 reports filed by its executive officers, directors and 10% stockholders and amendments to those reports.

8

5E Advanced Materials, Inc.

FORM 10

| Item | Description | Page | ||

Item 1. | 10 | |||

Item 1A. | 28 | |||

Item 2. | 51 | |||

Item 3. | 63 | |||

Item 4. | Security Ownership of Certain Beneficial Owners and Management | 70 | ||

Item 5. | 72 | |||

Item 6. | 78 | |||

Item 7. | Certain Relationships and Related Transactions, and Director Independence | 83 | ||

Item 8. | 84 | |||

Item 9. | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 85 | ||

Item 10. | 87 | |||

Item 11. | 88 | |||

Item 12. | 90 | |||

Item 13. | 92 | |||

Item 14. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 93 | ||

Item 15. | 94 | |||

9

| ITEM 1. | DESCRIPTION OF BUSINESS |

Strategy & Positioning

The Company’s goal is to become a vertically integrated global leader in boron specialty advanced materials with a focus on enabling decarbonization. As a result of major trends including global decarbonization, clean energy transition, proliferation of electric transportation and growing concerns over food security, we believe that there are significant opportunities for the Company to become an important global supplier enabling high-performance, high-tech, and high-margin applications that address these trends and help address current and anticipated global supply challenges.

To achieve our goals, we plan to pursue the following key corporate strategies:

| • | Safely and profitably extract borates, produce sulphate of potash (“SOP”) and other mineral compounds from our Fort Cady asset to ensure the Company controls its supply and has the lowest possible cost position. |

| • | Seek to establish competitive market positions, in high-value, high-technology and high-margin boron specialty advanced material markets, supported by intellectual property. |

| • | Work in collaboration with customers and commercial partners to support their boron specialty advanced material requirements. |

| • | Focus on global decarbonization technologies including energy transition and food security to ensure the Company is helping to address key issues facing society. |

| • | Become a global supplier of choice, helping to address the current global supply duopoly and by providing a new, stable, source of boron. |

Industry Overview

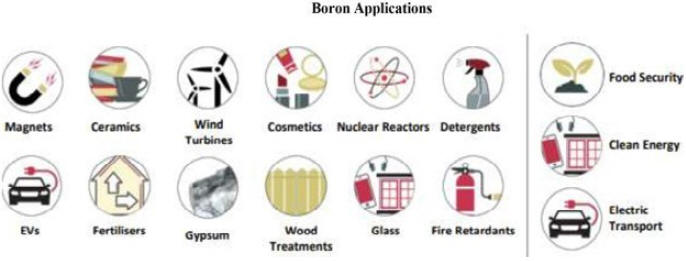

Boron is the fifth element on the periodic table and it is an essential element that pervades modern life. Boron is the lightest of all metalloids and has a unique and highly attractive set of chemical and physical properties that enable its use in high-performance commercial and industrial end use applications, including hardness, low thermal expansion and electric conduction, light weight, reduced corrosion propensity and antimicrobial properties. These attractive chemical and physical properties result in there being very few logical substitutes for boron and boron-based compounds across applications.

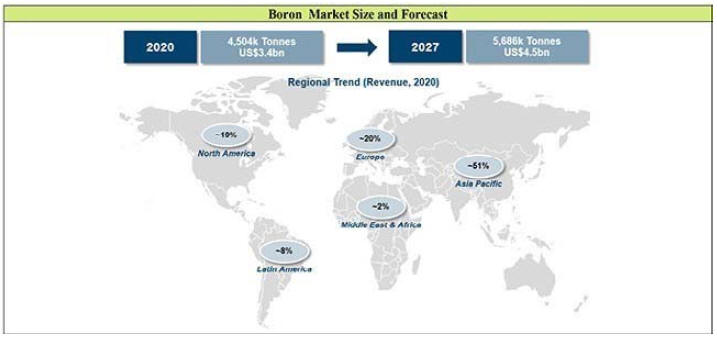

Borates and specialty boron derivatives have a wide range of commercial applications within established industries as well as fast growing sectors. According to Merchant Research & Consulting Ltd., global boron mineral production was 4.7 million tonnes in 2020 and demand is expected to grow rapidly over the years to come, supported by increasing demand from downstream industries such as glass-making, fertilizers, ceramics and electrical capacitors. Historically, the market for boron compounds has demonstrated consistent growth, with production of boron minerals expected to increase to 6.6 million tonnes by 2030. This growth is expected to be driven by population growth, urbanization, increasing demand for high-end fiberglass insulation, rising agricultural nutrient demands, modern high-tech glass products and coatings (used in computers, LEDs, plasma screens, circuit boards and solar panels), and many other industrial manufacturing applications.

Boron is classified as a Strategic Material of Interest by the United States Defense Logistics Agency (“DLA”) for use in military applications. Specifically, the DLA lists uses of boron as a component of composite materials (boron fibers) in advanced aerospace structures, an industrial catalyst for many organic reactions (polymerization), inner plates of ballistic vests, tank armor, and permanent neodymium magnets. Permanent neodymium magnets are a component of electric vehicle drivetrains and form the basis for boron as a contributing component of the movement towards global decarbonization. Based on United States Geology Survey (“USGS”), the glass and ceramics industries remained the leading domestic users of boron products, accounting for 80% of total borates consumption in 2020. World production and reserves are primarily derived from six countries: Turkey, the United States, Russia, Chile, China, and Peru. According to Global Market Insights, Inc., Rio Tinto Borates (“RTB”) and Eti Maden (a state-owned Turkish enterprise) are the major producers currently covering 85% of global boron production. Furthermore, according to a report prepared by Market Watch on downstream boron specialty derivatives, 80% of the global boron carbide market is controlled by China, whereby the top four Chinese manufacturers currently hold over 55% of global market share. While in 2020 the United States was a net exporter of boric acid, anhydrous borax, non-anhydrous borax, colemanite, and ulexite, both elemental boron and boron carbide were net imports.

10

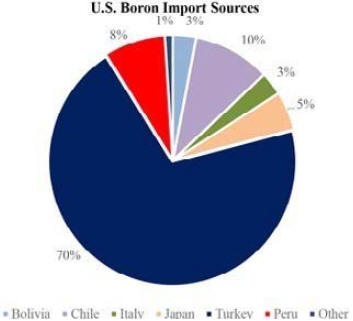

Source: Global Market Insights

Boron, a Component of Decarbonization

Notwithstanding continued use in traditional and commercial industries, boron’s use in clean energy infrastructure, electric vehicle manufacturing and yield enhancing fertilizers continues to grow as climate change has spurred increasing private and public investment in these industries. Government mandates for net zero emissions have supported billions of dollars of research and development in wind, solar photovoltaic and other renewable energy sources. In the United States, according to the U.S. Energy Information Administration (“EIA”), approximately 170 gigawatts of renewable energy generation capacity have been built since 2000 (a compound annual growth rate (“CAGR”) of approximately 4.7% from 2000 to 2020). According to the International Renewable Energy Agency (“IRENA”), global installed wind and solar capacity is expected to grow at a CAGR of 5.8% from 2019 to 2050, while cumulative investments across renewables, electrification and infrastructure, and energy efficiency are expected to total $55 trillion from 2016-2050 under the Planned Energy Scenario. Net zero mandates and consumer demand growth have driven up demand for electric transportation for both private and public consumption, with a majority of original equipment manufacturers (“OEMs”) committing significant portions of their fleets to being fully electric over the next two decades. Climate change and industrial activity may also impact weather patterns, cause unpredictability in rainfall, and reduce the footprint of arable land for agricultural purposes globally, increasing the need for higher quality fertilizers to boost crop yields and support growing populations.

11

Boron is one of the most widely used elements in society, utilized by more than 300 commercial and industrial applications. Though boron use spans a wide array of applications, technological advances push boron towards high-end use applications and contribute towards global decarbonization efforts. Within an electric vehicle, boron applications include high strength glass, permanent magnets for the drivetrain, and insulation. In a 2020 report published by the European Union, rare earth elements—neodymium, dysprosium, and praseodymium—as well as boron are likely to be in a large portion of motors manufactured for electric vehicles (“EVs”). Other decarbonization and clean energy applications include nuclear reactors, wind turbines, fiber-glass insulation, fire retardants, fertilizers and micro-nutrients, and energy storage, among others.

Overview of Boron

Boron is a low-abundance element in the earth’s crust. Pure boron is also produced with difficulty in industrial settings because of contamination by carbon or other elements that resist removal. In its crystalline form, boron is a brittle, dark and lustrous metalloid, while in its amorphous form it is a dark brown powder. Accordingly, boron is rarely consumed in its pure form and instead consumed as a compound, which can be produced through chemical processes. Borates are commercially traded as either borate minerals (containing impurities or other binding minerals), higher quality refined borates, or high-performance boron specialties. Given boron’s established market demand, pricing benchmark and diverse range of end use applications, 5E is primarily targeting the production of boric acid and other high-performance boron specialty compounds.

Boron-Based Minerals | Refined Borates | High-Performance Boron Specialty Compounds | ||

• Colemanite (hydrated calcium borate; 50% B2O3)

• Tincal

• Kernite

• Ulexite | • Boric acid (H3BO3)

• Boron oxide (B2O3)

• Sodium borates | • Boron carbide (B4C)

• Boron nitride (B3N)

• Boron halides (BX3) (X = F, Br or Cl)

• Sodium borohydride (NaBH4) | ||

Boric acid is primarily produced through a chemical process that takes boron-based minerals, such as colemanite or tincal as inputs from hard rock mining or brines. The boron-based minerals are then traditionally processed via acid-based treatment (leaching of hard rock) or evaporation (via brines) to produce boric acid. Alternatively, 5E’s boron-based minerals consist of colemanite, which the Company plans to subject to solution or in-situ mining, via a combination of hydrochloric acid (HCl), reagents, and water, to produce a chemical reaction that results in boric acid production. Many downstream specialty products and high-performance applications utilize boric acid as an input, and there is an established market for the product.

Solution Mining = Green Mining

Unlike open-pit and underground mining, solution mining requires much less land disturbance, poses fewer safety hazards and uses less fossil fuels. Traditional open-pit mines have a large environmental impact and can cause significant land disturbance, in addition to utilizing large machinery that requires the burning of diesel and other fossil fuels. Similarly, underground mines pose significant safety hazards due to their underground tunnels, infrastructure and land disturbance. Remediation is also material for open-pit and underground mining methods. Conversely, solution mining is a much less pervasive mining process whereby small holes are drilled into the earth, piped, and injected via solution. Once the solution contacts the colemanite ore body, a chemical reaction occurs and the solution is either pumped or air lifted to the surface. Though solution mining requires remediation, the process can be less complex, consisting of flushing and rinsing underground wells, adequate testing that meets regulatory requirements, and a systematic plugging and abandonment of wells.

Overview of Sulphate of Potash

SOP is an inorganic compound and specialty fertilizer. SOP is not typically found as an existing compound in nature and therefore must be manufactured, either through the Mannheim Process (reaction with sulphuric acid) or complex salt processing, which removes undesired attached minerals. SOP is a high value fertilizer particularly where crops have a sensitivity to chlorides or in areas where there is minimal rainfall and the build-up of chlorides in the soil is problematic. SOP is also highly preferred over muriate of potash (“MOP”) for additional benefits including lower overall salinity and increased sulphur, which is a critical secondary macro-nutrient in plants.

12

Overview of Other Mineral Compounds

While the Company’s goal is to predominately focus on the production of boric acid, derivative boron specialty products and SOP, it also plans to produce other compounds including lithium, HCl, and gypsum which are expected to provide product diversification and additional revenue opportunities. At the present time, engineering and design has not included a recovery process for lithium and will likely be addressed once recovery of boric acid is operational. We have done some preliminary work to recover SOP, but a determination has not been made as to whether SOP production will be included with initial production of boric acid. Previous process design work has included using the Mannheim process to produce SOP from MOP as a method of acid regeneration for in-situ leaching.

Lithium is a soft, silver-white alkali metal in its native form and has a wide range of energy storage and industrial applications. Lithium is the lightest of all metals and it has highly attractive physical properties including heat capacity, charge density and low thermal expansion. These properties enable high-performance end use applications such as lithium-ion batteries, polymers and ceramics, among others. Lithium is rarely consumed in its pure form and is typically used in either base compounds (lithium carbonate or carbide) or higher-performance compounds (lithium hydroxide). The rise in portable electronics, energy storage devices and other end use applications has led to significant advancements in lithium-based battery technologies and wide-scale adoption. High-end lithium compounds are commonly found in electric vehicles, specialty greases, pharmaceuticals, and other aerospace applications, and are expected to see dramatic market share gains within these spaces. There is significant expected demand growth for lithium, primarily driven by growing demand for lithium-ion batteries in electric vehicles and portable devices. The Company plans on continuing to further define its lithium resource and identify attractive potential market opportunities.

HCl is a colorless solution and a strong inorganic acid, and an important laboratory reagent and chemical with a range of important industrial applications. It is industrially prepared by dissolving hydrogen chloride in water. Strong global demand exists across a variety of industries including food and beverage, steel, oil and gas, chemicals and textiles, among others.

Macro Trends Driving Demand Growth for Boron, SOP and Other Mineral Compounds

While industrial demand for borates continues to grow at a higher rate than general economic or industrial growth, there are several macro trends highlighting the importance of boron, SOP and other mineral compounds that the Company expects to produce, and support demand fundamentals going forward.

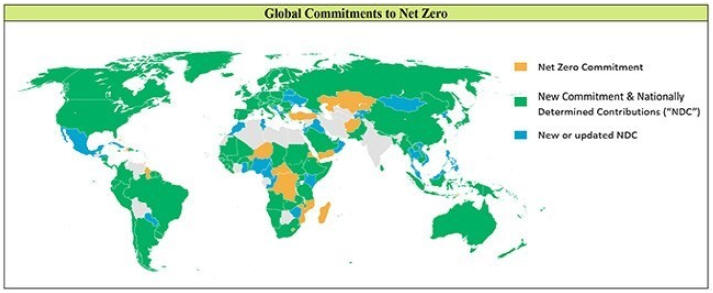

Global Push Toward Clean Energy

As a result of global industrial activity throughout the 20th and early part of the 21st century, carbon dioxide and greenhouse gas levels have risen significantly. Climate scientists have conducted extensive environmental monitoring and have determined that human-driven emissions are directly contributing to rising temperatures which is exacerbating issues around weather instability, changing precipitation patterns, global warming, and rising sea levels. Along with companies, cities, and financial institutions, more than 130 countries across the globe have now set or are considering a target of reducing emissions to net zero by 2050 or sooner. While net zero is a critical long-term goal, steep emissions cuts—especially by the world’s largest greenhouse-gas emitters, China, the United States, and the European Union—are imperative in the next five to ten years to prevent exacerbated global warming and safeguard a livable climate. Furthermore, at the 26th Conference of the Parties to the United Nations Framework Convention on Climate Change (“COP26”) held in November 2021, many nations expressed their commitment to keeping global warming below a 1.5oC increase, which is necessary to moderate the impacts of severe climate change.

13

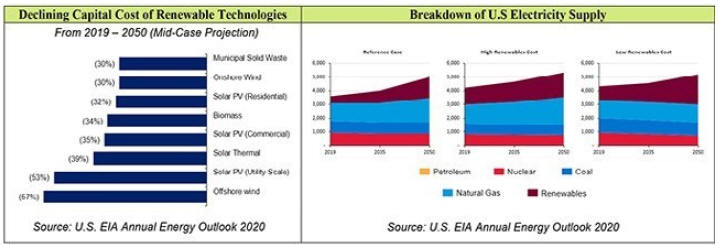

According to the United States Environmental Protection Agency (“EPA”), 25% of all U.S. greenhouse gas emissions were generated from electricity generation, with a further 29% from transportation and 23% from industrial activities. Further, approximately 62% of all electricity in the United States comes from burning fossil fuels, mostly coal and natural gas. Many states have adopted net zero emission targets and have been aggressively pursuing installations of renewable energy infrastructure through their renewable portfolio standard targets. The Biden administration’s $1 trillion infrastructure bill passed in November 2021 earmarked $73 billion for power infrastructure, with a significant portion to be allocated towards renewable energy infrastructure.

As a result of significant investments in solar, wind and other forms of renewable energy, installation and maintenance costs are forecasted to decline materially and support widespread adoption. According to the EIA, the mid-case capital cost per kilowatt for developing onshore wind, offshore wind and utility scale solar photovoltaic capacity are forecasted to decline 30%, 57%, and 53%, respectively, between 2019 and 2050. Accordingly, renewable energy infrastructure is expected to contribute 26% to 50% of all electricity generation in the United States by 2050. Furthermore, according to IRENA’s Planned Energy Scenario, renewable energy share in total final energy consumption is expected to grow to 17% by 2030, and to 25% by 2050.

Boron is strategically positioned to benefit from investments in renewable forms of energy generation given its prevalence in the construction and maintenance of energy infrastructure. Solar and wind energy depend on strong, durable materials consisting of boron compounds. In solar thermal heating applications, borosilicate glass enables the focus and capturing of solar energy. Textile fiberglass made with borate-based compounds is essential to the creation of wind turbines, drivetrains and blades, while high-power boron-based magnets are used in turbine generator systems. Boron supports the strengthening of polymers and other construction materials used in a wide range of supporting infrastructure. Borates have the ability to capture thermal neutrons resulting from the fission reaction of uranium nuclear fuel, which makes them an essential ingredient in the control and safety of nuclear reactors and control rods.

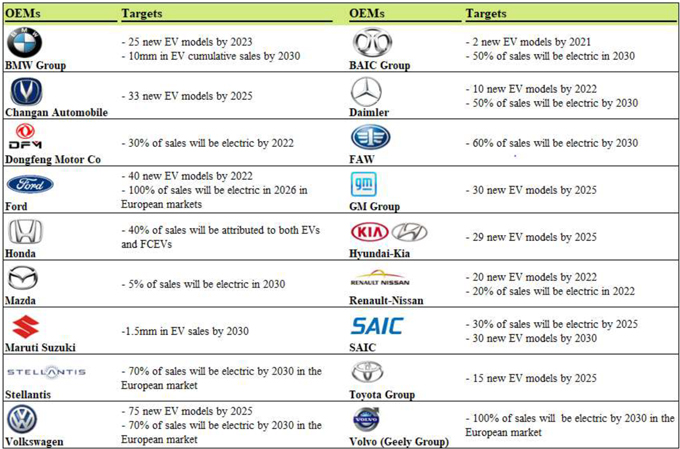

Electric Vehicles Becoming Mainstream

According to the International Energy Agency (“IEA”), the global electric vehicle stock is expected to grow at a CAGR of nearly 30% from 2020 to 2030, from 11 million units to almost 145 million units under the Stated Policies Scenario (reflecting existing policies, ambitions, targets, and legislation as of 2021). Similarly, the outlook in the United States is also expected to improve with 2030 EV stock expected to reach 15% market share for light duty vehicles, 20% for buses and 7% for trucks under the Stated Policies Scenario. New legislation has the potential to accelerate adoption across the globe. The primary drivers of forecasted growth in EV sales are expected to be favorable due to government policies and restrictions on combustion engine sales, widespread product introductions by OEMs, the build out of necessary charging infrastructure, and increasing consumer adoption as acquisition and ownership costs decline.

Governments have taken a multi-pronged approach to encourage investments in EVs. Incentives and other subsidies have spurred additional research and development for OEMs, which has led to a steady decline in the cost of battery technology, electric motors, and other key components. Rebates for consumers on EVs have also reduced the upfront cost to purchase EVs, making them more competitive with traditional combustion engine vehicles. Countries across Asia, North America and Europe have publicly announced targets to phase out combustion engine sales and promote EVs.

14

In response to evolving government policy and requirements, research incentive programs, and greater customer demand, many OEMs have announced their own targets to expand EV penetration across their vehicle fleets with a significant number of product introductions expected during the next five to ten years.

Source: International Energy Agency Global EV Outlook 2021

15

A major factor driving the amount and velocity of EV adoption is the relative competitiveness versus combustion engine vehicles across a number of metrics including upfront purchase cost, cost of ongoing maintenance, range and simplicity. OEMs have been investing in research and development to improve the energy storage capacity, reduce weight and enhance overall performance in order to make EVs more competitive.

Boron and lithium are both strategic elements in the construction of electric vehicles. Neodymium ferro boron magnets are the most powerful commercial magnets available and are used to build permanent magnets (also known as neodymium magnets, or NdFeB) which are used in the overall EV powertrain system. The small size, light weight, strong torque density and overall efficiency of permanent magnet motors relative to induction motors make them a highly attractive alternative in hybrid electric vehicles and EVs, as they enable strong attributes around acceleration, reduced vehicle weight, and enable greater vehicle range. Lithium is a key element in current battery technology that supports a significant percentage of global EV manufacturing. Over the next decade, EVs and battery electric vehicles are expected to become the dominant users of lithium carbonate and battery-grade lithium hydroxide compounds, along with consumer electronics and ceramic applications.

National Security Interests

New uses of boron have emerged which are critical to national security along with decarbonization. In addition to permanent magnets, military vehicles, protective armor, pharmaceuticals, and semi-conductors fall within the boron compound supply chain. In June 2021, President Biden’s administration announced a supply chain disruptions task force to address short-term supply chain discontinuities with a focus to secure end-to-end domestic supply chain for advanced batteries and invest in sustainable domestic and international production and processing of critical materials. Classified as a strategic mineral according to the DLA, the European Union included borates on their list of critical raw materials in 2020. In October 2020, the DLA released annual materials for acquisition and boron carbide, a down-stream compound, was on the list.

Intersection of Population Growth and Climate Change: The Food Security Challenge

As the effects of climate change and weather unpredictability become more pronounced, the complex global food system will be under ever greater threat as it struggles to meet the demands of a growing population. According to the Center for Strategic & International Studies (“CSIS”), more than 800 million people globally—one in nine—were undernourished and experienced moderate to frequent food insecurity or had a food supply that was compromised from a quantity or nourishment perspective. Concurrently, over two billion people around the world are overweight or obese, with one billion suffering from micro-nutrient deficiencies. According to the United Nations, by 2050, the global population is expected to reach 9.7 billion, an increase of over 20% from 2020 levels. As populations continue to grow, the integrity of food supply chains will continue to be tested.

While the millions of acres of industrial cropland have benefited over the 20th century from improved farming techniques and the deployment of mechanical means of cultivation to grow the absolute quantity of food production, the global food supply chain is still highly reliant on natural rainfall and water to support crops, and highly exposed to climate change. Climate change impacts on agriculture vary considerably by geography, but climate change has been linked to reductions in nutritional quality in plants due to both macro and micronutrient deficiencies, increases in soil salinity, and increases in agricultural pests and diseases. Increasing temperatures and rainfall variability directly contribute to reductions in crop yields, and if severe enough can cause outright crop failure. According to CSIS, every 1oC rise in mean temperature causes a 10% decline in crop yield (in equatorial tropics).

16

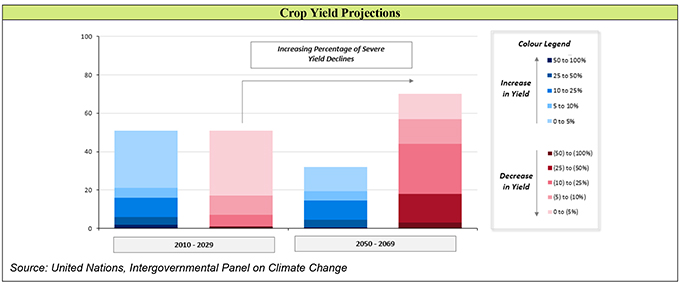

According to the Food and Agriculture Organization (“FAO”) at the United Nations, between 12% and 39% of the world’s land surface is expected to develop novel climates by 2100 as a result of climate change. Further, 40% of total land area globally is used for agricultural production and consumes more than 70% of all freshwater withdrawals putting pressure on already scarce water supplies. According to the Intergovernmental Panel on Climate Change (“IPCC”), by 2050, more than 70% of global crop production is expected to experience yield declines, with more than 40% of productive land realizing severe yield reductions of more than 10%.

Boron and SOP are both highly effective minerals to reverse crop yield declines and preserve the integrity of global food chains. Boron is one of eight essential micro-nutrients or trace elements required by plants. Micro-nutrients like boron serve to increase crop yields by promoting flower production, increasing cell wall integrity and structure, improving photosynthesis, and promoting lateral root development. Key crops with boron sensitivity include rice, potatoes, corn cabbage, and cauliflower, among others. Many global fertilizer firms are developing specialty boron-based fertilizers to improve nutrient uptake, and these are being sold at attractive prices. Sulphur is a key secondary macro nutrient while potassium is an essential mineral found in many plant-based foods consumed by humans. In many parts of the world, agricultural soils are gradually becoming depleted of potash due to years of intensive farming and repeated nutrient removal during harvest. As a result, many fields now require regular inputs of potash and sulphur via fertilizers to maintain productivity and prevent yield declines and crop failure.

Demand for Boron, SOP and Other Mineral Compounds

Balanced Boron Demand Growth from Industrial, Green Energy Infrastructure and Agricultural Uses

According to Merchant Research & Consulting Ltd., the global market for boron compounds has demonstrated consistent growth, with production for boron minerals expected to increase to 6.6 million tonnes by 2030. More balanced longer-term demand growth is expected due to increased usage of borates to support multiple markets enabling global decarbonization, including permanent magnets for electric drive trains, green energy generation and infrastructure, energy storage, energy efficiency (high-tech fiberglass insulation), and high-grade fertilizers. Further research and development could also spur further pockets of demand for borates and increase aggregate demand over time. While China represents the world’s largest end market for consumption of boron-based minerals and derivatives, it possesses minimal low-grade resources and imports of boron are expected to grow accordingly.

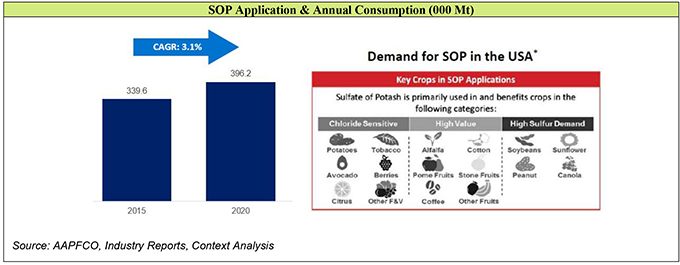

Fertilizer Usage Expected to Drive Demand for Sulphate of Potash

U.S. SOP volumes have grown at an annual rate of 2.5% since 2014 and have experienced growth in recent years as the SOP market has stabilized and commodity markets have improved. Four U.S. states (California, Idaho, Washington, and Wisconsin) account for over 60% of U.S. SOP consumption and there is the potential for further demand growth, in the event of chronic weather instability and nutrient deficiency, as a result of climate change causing disruptions to the global food chain. The majority of the world is materially underapplying SOP relative to its chloride-sensitive crop planted area.

17

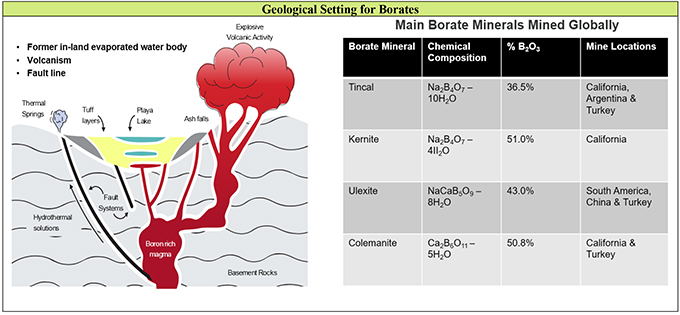

Supply Fundamentals for Borates and SOP

Notwithstanding its prevalent use, global access to mined boron is rare. Boron doesn’t occur in nature in its element state, but instead combines with oxygen and other elements to form boric acid, or inorganic salts called borates. Borates occur only in very rare geological settings, requiring the interaction of a former in-land evaporated water body, seismic fault line and distinct volcanic activity. Borate deposits are typically classified as colemanite, borax (tincal), kernite, and ulexite. Colemanite typically has the highest concentrations of boric acid and is primarily found in California and Turkey.

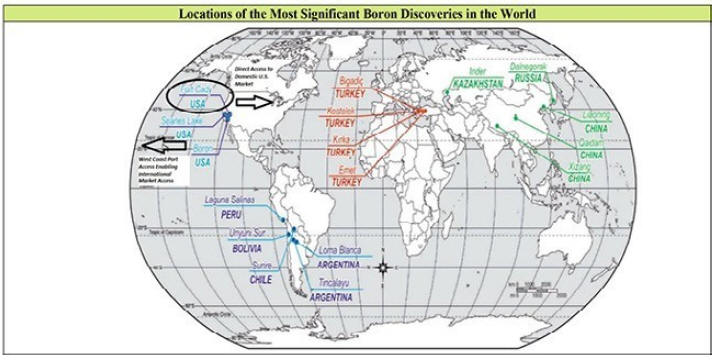

As a result of the unique geological settings required, there are only four regions across the globe where active extraction operations exist including Turkey, the Mojave Desert of the United States, the Alpide belt in Southern Asia, and the Andean belt in South America. The world’s two largest producers of borates are Eti Maden, a state-owned enterprise in Turkey, and RTB, which operates a boron mine in the Mojave Desert less than 100 miles from Fort Cady. These two producers provide over 85% of global borate supply while the remainder of supply is provided by smaller operations across Asia and South America. Eti Maden and RTB maintain integrated operations, spanning from extraction and processing to downstream refined borate production.

18

This supply dynamic creates significant supply concentration risk and creates opportunities for new operations to help further diversify global supply.

Source: US ITC Dataweb

Due to various factors including geopolitical risk, resource quality, supply chain and market access, and regional infrastructure, we believe the U.S.-based resources such as Fort Cady maintain a unique strategic and cost competitive advantage. Based on the latest feasibility study for the Project, the Company expects operating costs to benchmark favorably against production from China and South America, and competitively against those observed at RTB’s nearby asset given the significant by-product credits realized from the sale of SOP, HCl and gypsum.

China is the world’s largest end market for SOP production and is mostly supplied from internal producers making the country largely self-reliant. Compass Minerals harvests and refines brines from the Great Salt Lake in Utah, which does not satisfy the total U.S. demand. As a result of the relatively limited supply and its location relative to the large Californian market, the Company believes it is strategically positioned to be an important player in the domestic SOP market.

Total Demand and Supply Fundamentals for Boron and SOP

There are very few substitutes for borates, especially in high-end applications for energy infrastructure, EVs and the ever-important market of agriculture. In the absence of boron resources across Asian countries, growing demand for glass and ceramics are expected to lead to increasing demand from global producers in Turkey and the United States. While it is expected that China will continue to be a key market for growth, material demand

19

is also expected from the United States. Due to its commercial importance, the United States is taking action to secure domestic sources of key minerals supply and the Company’s goal is to be well positioned to answer these demands with high quality supply. In February 2021, in an effort to ensure that the U.S. is not reliant on other countries such as China, President Biden signed an executive order requiring the United States government to review supply chains for critical minerals and other identified strategic materials. This executive order calls for a review of a broader set of U.S. supply chains covering the defense, health care, information technology, energy, transportation, and agriculture sectors. With strong demand growth and an absence of major announced capacity or production output increases from Eti Maden or RTB, a material supply gap is emerging.

SOP remains a high value specialty fertilizer that is used where crops have a sensitivity to chlorides or in areas where there is minimal rainfall. California’s climate and high level of crop production of almonds, fruits and vegetables account for a meaningful amount of the total U.S. market. The Western United States is currently in a prolonged mega drought, with a severe lack of rainfall impacting traditional agriculture and making high quality fertilizers more important to maintain key nutrients yields, creating a need for domestic and North American supply alternatives.

Business Overview

Corporate History

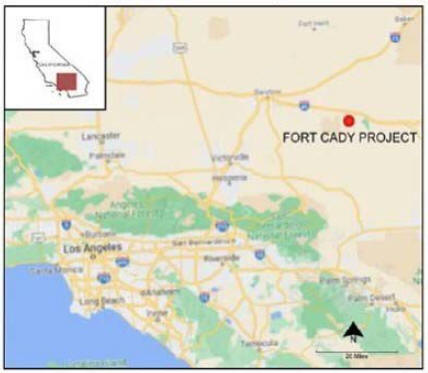

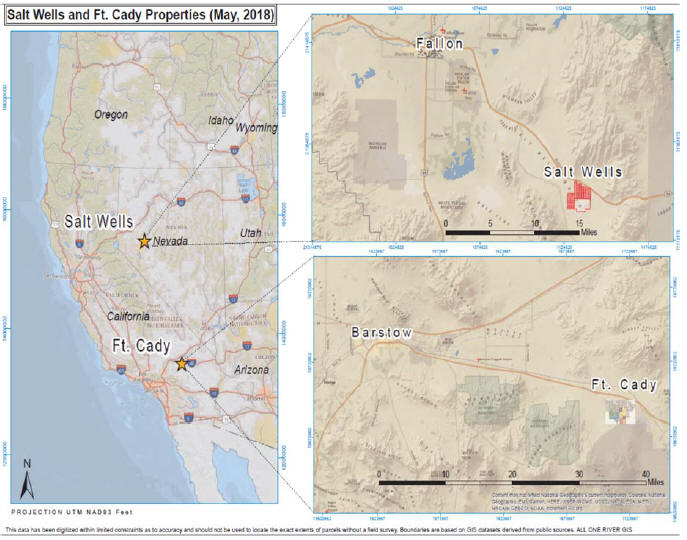

ABR, the former parent company of the Company, was incorporated in October 2016 for the purpose of acquiring the rights in the Project located in the eastern part of the Mojave Desert region of San Bernardino County, California from Atlas Precious Metals, Inc. The acquisition of the Project was completed in May 2017 and ABR’s ordinary shares were subsequently admitted for official quotation on the ASX in July 2017.

The Company was incorporated in the State of Delaware on September 23, 2021, as a wholly-owned subsidiary of ABR for the purposes of effecting the Reorganization. Our principal executive offices are located at 19500 State Highway 249, Suite 125, Houston, Texas, and our telephone number is (346) 439-9656. Additional information can be found on our website address: http:/www.5eadvancedmaterials.com. Information contained on the website does not constitute part of this Registration Statement. The Company has included its website address in this Registration Statement solely as an inactive textual reference.

Prior to the effectiveness of this Registration Statement, the Company will receive all of the issued and outstanding shares of ABR pursuant to a statutory Scheme of Arrangement under Australian law under Part 5.1 of the Corporations Act. The Scheme was approved by ABR’s shareholders at a general meeting of shareholders held on December 3, 2021. Following shareholder approval, the Scheme was approved by the Federal Court of Australia on February 25, 2022.

As soon as practicable after completion of the Scheme, the Company intends to list its Common Stock on Nasdaq under the symbol “FEAM” and de-list ABR from the ASX.

Pursuant to the Reorganization, the Company will issue to the shareholders of ABR either one share of the Company’s Common Stock for every ten ordinary shares of ABR or one CHESS Depositary Interest over the Company’s Common Stock (a “CDI”) for every one ordinary share of ABR, in each case, as held on the Scheme record date. Eligible shareholders of ABR (those whose residence at the record date of the Scheme is in Australia, New Zealand, Canada, Hong Kong, Ireland, Papua New Guinea, Singapore, Malaysia, Thailand, or the United States) will receive CDIs by default. In order to receive Common Stock, eligible shareholders must complete and submit an election form to ABR’s registry no later than 5:00 pm (AEDT) on March 2, 2022. Ineligible shareholders will not receive CDIs or shares of Common Stock but will instead receive the proceeds from the sale of the CDIs to which they would otherwise be entitled by a broker appointed by ABR. The appointed broker will sell the CDIs in accordance with the terms of a sale facility agreement and will remit the proceeds to ineligible shareholders. Additionally, the Company will cancel each of the outstanding options to acquire ordinary shares of ABR and issue replacement options representing the right to acquire shares of the Company’s Common Stock on the basis of one replacement option for every ten existing ABR options held. The Company will maintain an ASX listing for its CDIs, with each CDI representing 1/10th of a share of Common Stock. Holders of CDIs will be able to trade their CDIs on the ASX after implementation of the Scheme and holders of shares of the Company’s Common Stock will be able to trade their shares on Nasdaq.

Following completion of the Reorganization, ABR’s ordinary shares will be de-listed from the ASX and ABR will become a wholly-owned subsidiary of the Company.

Overview of 5E Advanced Materials, Inc.

The Company’s goal is to become a vertically integrated global leader in boron specialty advanced materials with a focus on enabling decarbonization. The Company is classified as an “exploration stage issuer,” in the business of acquiring and developing mineral properties that may contain recoverable deposits of boron in the form of boric acid (H3BO3), lithium in the form of lithium carbonate (LiCO3) and potential by-products of sulphate of potash (K2SO4), gypsum and hydrochloric acid (“HCl”). There are currently a very limited number of domestic U.S. suppliers of borates and SOP, and we plan on developing connections and supply chain capabilities to export our products globally.

20

The Company holds 100% of the rights in the Project through the Company’s wholly-owned subsidiary, Fort Cady (California) Corporation (“FCCC”). The Project is a rare and large colemanite borate deposit and is the largest known global deposit of colemanite not owned by the Turkish Government controlled entity, Eti Maden. Colemanite is a hydrated calcium borate mineral found in evaporite deposits. The deposit hosts a mineral resource where borate specialty materials, boric acid, lithium carbonate and SOP by-product can potentially be produced for the global market.

To date, the Company has invested over $50 million of its own capital in the Project, including license acquisition, permitting activities, drilling and resource estimation, well-testing, metallurgical testing, feasibility studies, pilot plant infrastructure and substantial small-scale commercial operations and test works. The Project has secured a critical Underground Injection Control permit with the EPA, as well as the necessary air permits required for commercial mining operations. The Company is developing the Project in a phased approach, with a smaller scale boron facility being developed to include a solution mine, boron processing plant and specialty production (“SSBF”). The Company expects that the SSBF will integrate mining operations and chemical plant operations, which will facilitate customer qualification and downstream specialty product development. The facility is expected to remain as a permanent asset on the Project site that can be leveraged for continual process innovation, operational efficiency and product refinement. The Company is currently evaluating the preferred development plan for the full scale-up of operations and expects the SSBF, along with further dissolution testing to refine recovery rates, will assist in determining the economic recoverability of mineral resources for the Project in a bankable feasibility study (“BFS”).

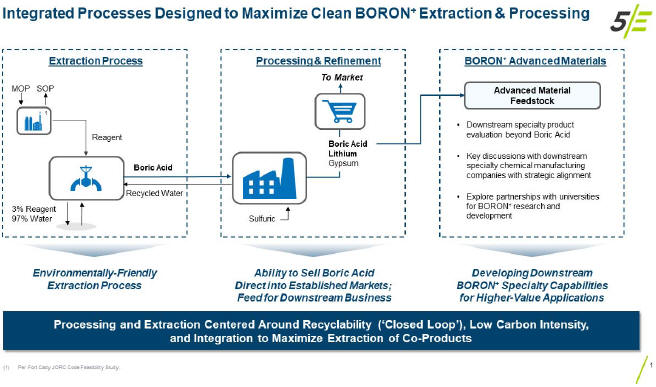

The Company anticipates the proposed mining operation will include the phased construction and operation of a boric acid solution mine and a processing facility with the anticipated capability of eventually producing more than 400,000 tons per annum of boric acid equivalent boron specialty products and meaningful production of lithium carbonate, SOP and gypsum, for a projected life of mine of over 20 years. Synergies exist between the production of boric acid, lithium and SOP, including the production of boron-rich fertilizers, glass, batteries and the potential ability for the Company to capitalize on the generation of the by-products of HCl and gypsum produced during SOP manufacturing. HCl is a key input and reagent used for leaching in the proposed boric acid mine solution. The Company expects that boron specialty products, boric acid, SOP, lithium, gypsum and HCl will be transported in bulk by road or railroad to domestic consumers or to the ports in Los Angeles for export. As part of its feasibility work, the Company has designed an efficient process to maximize extraction, limit the facilities environmental footprint and help ensure sustainability and efficiency across the production lifecycle.

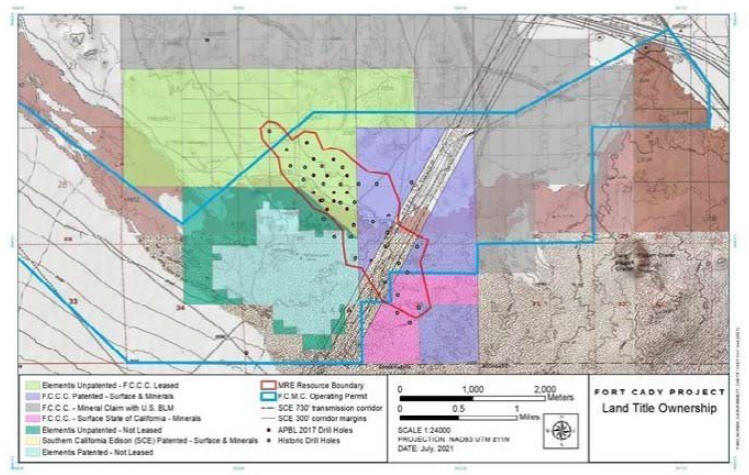

The Project and proposed operation are located in an area with existing sealed roads, a gas pipeline, rail line and power lines. The Company has obtained the key mining, land use and environmental permits for the construction and operation of Phase 1 of the Project (90,000 tons per annum of boric acid), including the Environmental Impact Statement (“EIS”) and Environmental Impact Report for commercial-scale operations, the Air Quality permit (valid through to 270,000 tons per annum of boric acid and 80,000 tons per annum of SOP), the Water Quality permit, the Mining and Reclamation permit and the Underground Injection Control permit, which each remain active and in good standing. Modifications to the Company’s Plan of Operations and certain permits will be required to extend operations beyond Phase 1. It is expected that Phase 2 and Phase 3 of the Project will be advanced as addendums to the existing permits, as needed. Additional permitting that will likely be required for the Project includes (i) a financial assurance cost estimate (a surface disturbance bond) will need to be updated for all new equipment, buildings and ground disturbance, (ii) filing and identification of the chemical inventory, (iii) an EPA ID will be requested when waste streams have been finalized, and (iv) building permits from San Bernardino County must be obtained prior to construction. In July 2021, the Company purchased an exploration target and an additional three parcels of land and associated mineral rights in the south-eastern section of the Fort Cady deposit.

21

In addition to the Project, the Company has an earn-in agreement to acquire a 100% interest in the Salt Wells North project area and the Salt Wells South project area (together, the “Salt Wells Projects”) in the State of Nevada on the incurrence of $3 million in expenditures attributed to the Salt Wells Projects (the “Earn-in Agreement”). In July 2020, the Company renegotiated the Earn-in Agreement expenditure requirements at the Salt Wells Projects. Under the renegotiated Earn-in Agreement, the Company has made funding commitments of $100,000 in fiscal year 2021, $300,000 in fiscal year 2022, $600,000 in fiscal year 2023, $800,000 in fiscal year 2024 and $1,200,000 in fiscal year 2025.

Business Strengths and Key Highlights

Strategically Positioned to Benefit from Substantial Demand Growth as Decarbonization Efforts Intensify

We are currently developing a mineral resource of high-quality borates and other key mineral compounds such as SOP, lithium, HCl and gypsum that are positioned as inputs into key technologies and industries that directly address climate change and support decarbonization, including clean energy infrastructure, electric vehicles, and high-quality fertilizers, among others. Growth in the demand for end use applications like solar and wind energy infrastructure, neodymium-ferro-boron magnets, and lithium-ion batteries is expected to directly impact the need for borates and other advanced materials that the Company plans to produce. We believe the size and quality of the Company’s Fort Cady resource also positions the Company as a long-term supplier.

Expected Low Cost Operations with Plans and Capabilities to Significantly Expand Capacity

The Fort Cady deposit is a rare and large colemanite borate deposit and is the largest known deposit of colemanite outside of Turkey. Effective October 15, 2021, a mineral resources estimate prepared for the Company determined that there were an estimated combined 97.55 million tons of Measured Mineral Resource plus Indicated Mineral Resource at Fort Cady, with a grade of 6.53% for boron oxide (B2O3) and 324 parts per million for lithium. The mineral resource estimate also identified 11.43 million tons of Inferred Mineral Resource with a grade of 6.40% boron oxide and 324 parts per million for lithium. Across the three mineral resource categories there is an estimated 108.98 million tons grading 6.52% for boron oxide and 324 parts per million for lithium. The estimated total contained mineral resource (Regulation S-K 1300 compliant) across all resource categories equals 12.62 million tons of boric acid equivalent.

In February 2021, the Company provided a multi-phased approach to project development envisioning the following phases:

| • | Phase 1 A: 9,000 tons per annum (“pa”) of boric acid with 20,000 tons pa of SOP; |

| • | Phase 1 B: Additional 60,000 tons pa of SOP; |

| • | Phase 1 C: Additional 81,000 tons pa of boric acid; |

| • | Phase 2: Additional 180,000 tons pa of boric acid with an additional 160,000 tons pa of SOP; |

| • | Phase 3: Additional 180,000 tons pa of boric acid with an additional 160,000 tons pa of SOP; and |

| • | End of Phase 3 total production: 450,000 tons pa of boric acid with 400,000 tons pa of SOP. |

The Company retains optionality in Project design to modify the development plan to bring forward production as market dynamics evolve. As a result of the designed processing and extraction process, additional by-products of marketable SOP, HCl and gypsum will also help to reduce the overall cost profile of the asset. The Company continues to advance exploration and resource definition efforts as part of the work relating to the preparation of a BFS which may impact the overall project phasing and output.

Attractive Geographic Location with Market Access and Favorable Operating Backdrop

The Company seeks to be a global supplier of boron specialty advanced materials. As a result of the United States taking action to secure domestic sources of key minerals supply, the Company believes that it has an opportunity to satisfy this demand, which may assist in supporting a constructive and positive regulatory and operating environment. The U.S. is known as a stable market in which to conduct business and the Company’s goal is to supply customers that are currently sourcing second, third and fourth derivative boron products from outside North America, with the hope of being viewed as an attractive commercial partner and key U.S. alternative supplier of choice. Given global supply challenges and the current duopoly between Eti Maden and RTB, the Company believes that it can help support a diversification of global borates supply.

22

Locations of the Most Significant Boron Discoveries in the World

Proven Management Team with Deep Project Execution, Operational and Leadership Capabilities

Our management team is led by our Chief Executive Officer, Henri Tausch, who has over 30 years of international experience developing and growing businesses in mature and emerging regions, and in leading the development of complex projects and services in various industries across mining, power generation, refining, distribution, and chemicals. Henri’s prior roles included Chief Operating Officer of Shawcor, a global infrastructure and energy technology services company, and Vice President and Global Business Leader for Honeywell’s Field Solutions Business.

The senior leadership team also includes Dr. Dinakar Gnanamgari (Chief Commercial Officer and Chief Technical Officer), Tyson Hall (Chief Operating Officer), Paul Weibel (Chief Financial Officer), Chanson Pipitone (Senior Vice President, Head of Corporate Development and Investor Relations), and Chantel Jordan (Senior Vice President, General Counsel, Secretary and Chief People Officer). Both Tyson Hall and Dr. Dinakar Gnanamgari bring a wealth of project delivery, operations, and executive leadership experience, and were instrumental in building Albemarle into a global specialty chemicals business. Dr. Dinakar Gnanamgari’s previous roles include Global Vice President of Lithium Specialties at Albemarle Corporation and other roles within FMC Corporation. Previously, Tyson Hall served as the head of multiple business units within Pilgrim’s Pride Corporation and was the Global Business Director of Performance Materials for Albemarle Corporation from February 2015 to February 2016. Paul Weibel is a licensed U.S. CPA having previously worked for PricewaterhouseCoopers and most recently served as controller and head of operations for Blue Horizon Capital and Genlith Inc. Chanson Pipitone most recently was a Portfolio Manager and Senior Investment Professional at Salient Partners, L.P. and Center Coast Capital Advisors, LP (now Brookfield Asset Management Inc.). As an investment professional, Chanson Pipitone allocated over $10 billion in capital and handled multiple private equity and project finance transactions. Chantel Jordan brings all-round legal and strategic advisor experience, having previous responsibilities as assistant general counsel and assistant corporate secretary for American Bureau of Shipping and was an associate at Polsinelli P.C. Chantel is a member of the state bar of Texas and Missouri and holds a Juris Doctor degree from the University of Notre Dame Law School.

Our Strategy

Develop the Fort Cady Asset and Seek to Become an Important Global Supplier of Borates and Other Minerals

The main objective of the Company is to continue developing the Project and position it for commercial production of boric acid, SOP and other mineral compounds. The BFS, which the Company is progressing, will help in determining the optimal economic recoverability of the mineral resources for the Project and help in the planning for a preferred development and scale-up of operations. Once the asset is fully operational, the Company believes that Fort Cady can be a long-term supplier.

23

Develop Commercial Partnerships to Expand High-Performance Borate Product Capabilities

The Company is seeking to become a vertically integrated global leader in boron specialty advanced materials, and an important supplier to its commercial partners developing high-performance downstream applications in the areas of clean energy infrastructure, electric transportation, and high-grade fertilizers among other end uses. Commercial partnerships are expected to be a key element of embedding the Company within global supply chains and positioning it as an essential supplier of refined borates, SOP and other mineral compounds. As we work with customers to understand their evolving needs, we plan on improving our own abilities to adapt the properties of our products, whether physical or chemical, to meet those needs. This may require us to invest in and potentially acquire new capabilities, hire people or acquire new technical resources.

Diversify Sources of Supply and Expand the Overall Asset Holdings

While the Company is developing the Fort Cady asset, the long-term objective is to develop a sustainable, globally recognized boron specialty products and advanced materials business. We have an earn-in agreement to acquire a 100% interest in the Salt Wells Projects which have the potential to serve as a second pillar of high-quality borates and lithium supply to the Company. We plan on assessing new resources that offer the potential to provide alternative sources of borates or other essential mineral compounds and would look to invest in developing such resources where it makes sense to do so.

Invest in Our People