Lead Real Estate Co., Ltd Nasdaq Ticker: LRE March 2023 Investor Presentation Issuer Free Writing Prospectus dat ed March 10 , 2023 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated February 28 , 2023 Registration Statement No. 333 - 266762

Lead Real Estate Co. Ltd Free Writing Prospectus Statement This free writing prospectus relates to the proposed public offering of American Depository Shares (“ADSs”) of Lead Real Esta te Co., Ltd (“LRE,” "we," "us," "our" or the "Company") and should be read together with the Registration Statement we filed with the U.S. Securities and Exchan ge Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link: https://www.sec.gov/Archives/edgar/data/1888980/000110465923026820/tm227558 - 24_f1a.htm The Registration Statement has not yet become effective. Before you invest, you should read the prospectus in the Registratio n S tatement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information abou t u s and the offering. You may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively, we or our underwriter will arrange to send you the prospectus if you contact Network 1 Financial Securities, I nc. via email: adampasholk@netw1.com, or contact us via email: d - takahashi@lead - real.co.jp. This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other tr ansaction with the Company or its affiliates. The information in this presentation is not targeted at the residents of any particular country or jurisdi cti on and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to loc al law or regulation.

Lead Real Estate Co. Ltd This presentation contains forward - looking statements that reflect our current expectations and views of future events, all of w hich are subject to risks and uncertainties. Forward - looking statements give our current expectations or forecasts of future events. You can identify these st atements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of wo rds such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could ,” “may” or other similar expressions in this presentation. These statements are likely to address our growth strategy, financial results and service and development pro grams. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward - looki ng statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are know n a nd some that are not. No forward - looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual resul ts to differ from those discussed in the forward - looking statements include, but are not limited to: assumptions about our future financial and operatin g results, including revenue, income, expenditures, cash balances, and other financial items, our ability to execute our growth strategies, includ ing our ability to meet our goals, current and future economic and political conditions, our capital requirements and our ability to raise any additional fi nancing which we may require, our ability to attract customers and further enhance our brand recognition, our ability to hire and retain qualified ma nagement personnel and key employees in order to enable us to develop our business, trends and competition in the real estate development industry, and oth er assumptions described in this presentation underlying or relating to any forward - looking statements. We describe certain material risks, uncertainties, and assumptions that could affect our business, including our financial co ndi tion and results of operations. We base our forward - looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materiall y f rom what is expressed, implied or forecast by our forward - looking statements. Accordingly, you should be careful about relying on any forward - looking s tatements. The forward - looking statements made in this presentation relate only to events or information as of the date on which the statem ents are made in this presentation. Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of un anticipated events. You should read our prospectus and the documents that we refer to in this presentation and have filed as exhibits to the registra tio n statement completely and with the understanding that our actual future results may be materially different from what we expect. Forward - Looking Statement

Lead Real Estate Co. Ltd Offering Summary Lead Real Estate Co. Ltd Nasdaq / LRE 1,143,000 ADSs, each representing one ordinary share $7.00 - $9.00 per ADS $8.0 – 10.3 million (excluding 15% over - allotment option) Domestic business expansion, development of the Glocaly platform, and general corporate purposes EF Hutton - division of Benchmark Investments, LLC. Issuer: Proposed Exchange/Symbol: Shares Offered: Offering Price: Offering Size: Anticipated Use of Proceeds: Underwriter: Pricing Date: Week of March 13 th , 2023

Lead Real Estate Co. Ltd Contents Part 1 Part 2 Part 3 Part 4 Investment Highlights Business Overview Market Overview Growth Strategies Part 5 Financial Highlights

CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE Investment Highlights CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE

Lead Real Estate Co. Ltd Investment Highlights “ Growing Developer of Luxury Residential Properties in Japan ” • A growing real estate developer in Japan • Revenue increased by approximately 218% in the past 10 years • Received the Good Design Award for our Excellence Building Futako - Tamagawa issued by the Japan Institute of Design Promotion in 2020 Growing Developer of Luxury Residential Properties • Strategically focuses on prime locations in Tokyo and Kanagawa prefecture • Acquires land parcels from private landowners through the introduction by real estate agencies • Good reputation and capabilities and the business relationships built over the years while working with real estate agencies • “Lead Real” brand widely recognized in Tokyo and Kanagawa prefecture Access to Land Parcels • Unlike U.S. homebuilders – LRE sells land and buildings separately. Land is collateralized by short term debt and paid back by customer (<3 months), de - risking ~60% of total contract price • 0 spec inventory, 0% cancellation rates, 0 litigation related to housing defects • No receivables – cash received at handover, 10% down payment/deposits for condominiums Strong Project Oversight and Execution Capabilities • Executive officers having on average over 20 years of experience in the Japanese real estate development industry and considerable strategic planning and business management expertise • Mr. Eiji Nagahara, president, chief executive officer, and representative director, having more than 25 years of relevant experience Experienced Management See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. Experienced Management

CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE Business Overview CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE

About Us We are a growing developer of luxury residential properties, including single - family homes and condominiums, across Tokyo and Kanagawa prefecture . In addition, we operate hotels in Tokyo and lease apartment building units to individual customers in Japan and Dallas, Texas . Transforming Real Estate In Japan Business Vision LRE seeks to leverage its nationally recognized, award - winning luxury homes and its strong market position in the luxury residential property market in Tokyo and Kanagawa prefecture to create a global transaction platform allowing access to prime Japanese condominiums as well as overseas condominiums, including in the U . S . and Hong Kong . Mission Statement Serve the customers by offering stylish, safe and luxurious living, and to adopt the Kaizen (continuous improvement) approach its operations Opening The Door For Tokyo Luxury Real Estate

Lead Real Estate Co. Ltd 90% <6 mo’s delivery % of home orders delivered within 6 months $65 Million (Sold) + $70 Million (For Sale) B2B Building Condominiums $725k Affordable Luxury Average Sale Price Single - family home 17% Profitable Gross Margins** 15% Stable Growth 5 - yr Revenue CAGR Preferred Developer For Luxury Residential*** Tier A Lot Ownership Focus on Azabu, Shibuya, Shinjuku & other premium locations ~$106m FY22 Revenue with Over 1000 Units Delivered * * 1,000 single - family homes and 25 condominiums delivered since inception as of fiscal year ended June 30, 2022. Cancellation ra te <1%. FX ¥ 135.69 / USD **Gross margin target ranges depending on sales mix (made to home units vs. investment condo towers). For past fiscal year en ded June 30, 2022 ***Management opinion based off subjective factors including landowner/seller receptivity, priority given by real estate age nci es and competitive dynamics See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. LRE At a Glance

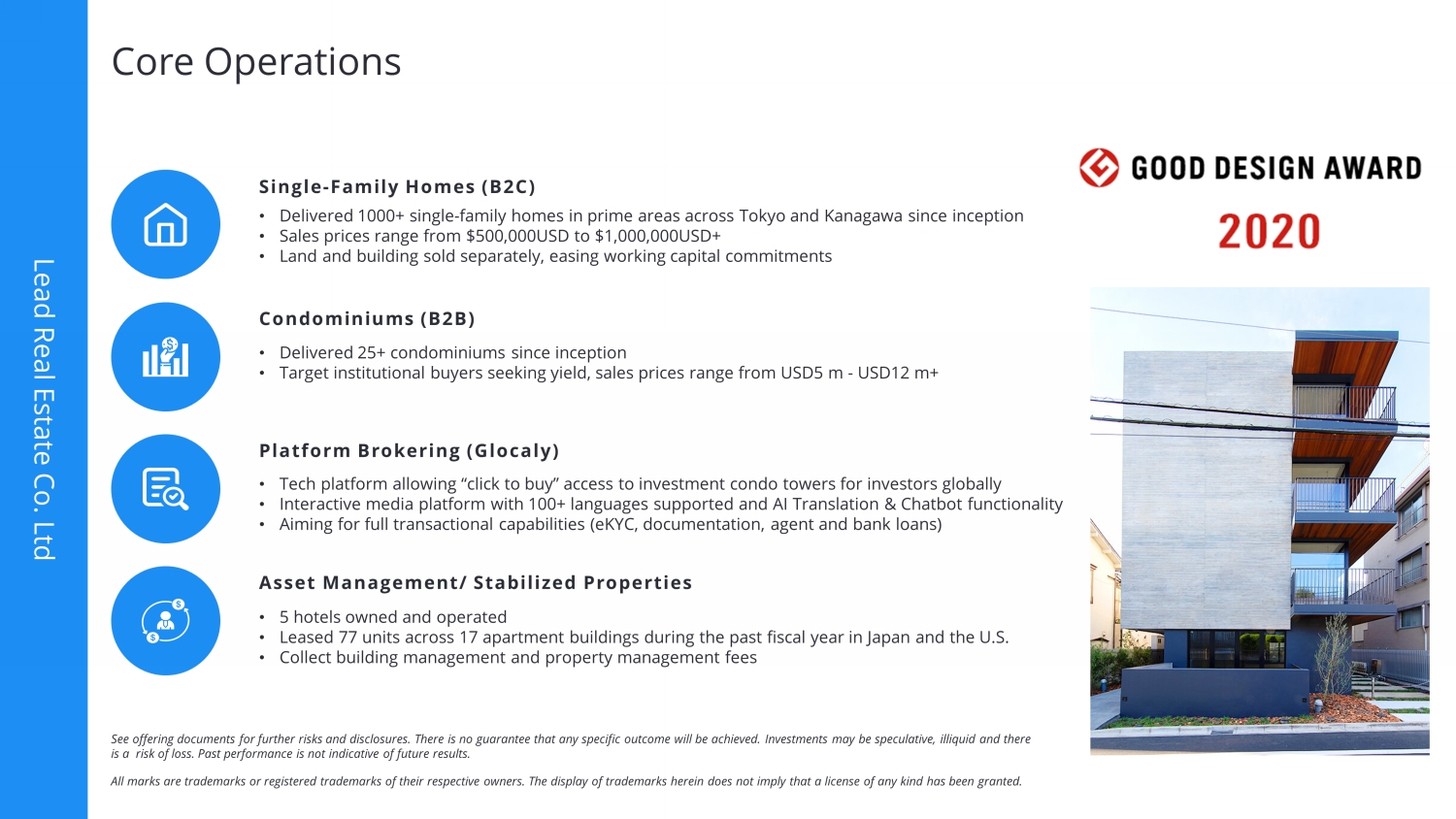

Lead Real Estate Co. Ltd Single - Family Homes (B 2 C) • Delivered 1000+ single - family homes in prime areas across Tokyo and Kanagawa since inception • Sales prices range from $500,000USD to $1,000,000USD+ • Land and building sold separately, easing working capital commitments Condominiums (B 2 B) • Delivered 25+ condominiums since inception • Target institutional buyers seeking yield, sales prices range from USD5 m - USD12 m+ Asset Management/ Stabilized Properties • 5 hotels owned and operated • Leased 77 units across 17 apartment buildings during the past fiscal year in Japan and the U.S. • Collect building management and property management fees Platform Brokering (Glocaly) • Tech platform allowing “click to buy” access to investment condo towers for investors globally • Interactive media platform with 100+ languages supported and AI Translation & Chatbot functionality • Aiming for full transactional capabilities (eKYC, documentation, agent and bank loans) All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not imply th at a license of any kind has been granted. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. Core Operations

Lead Real Estate Co. Ltd Development Process ▪ Introduction by real estate agencies ▪ Identification of land parcels ▪ Identification of customers ▪ Financing ▪ Land acquisitions Opportunity Identification and Land Acquisition Project Planning and Design ▪ Outsourced design ▪ Budgeting ▪ Financial analysis and projections Marketing and Sales ▪ Marketing through real estate agencies ▪ Contracts with customers Project Construction and Management ▪ Outsourced construction work ▪ Construction supervision ▪ Quality control ▪ Complete inspection After – Sale Services and Delivery ▪ Delivery ▪ Registration assistance

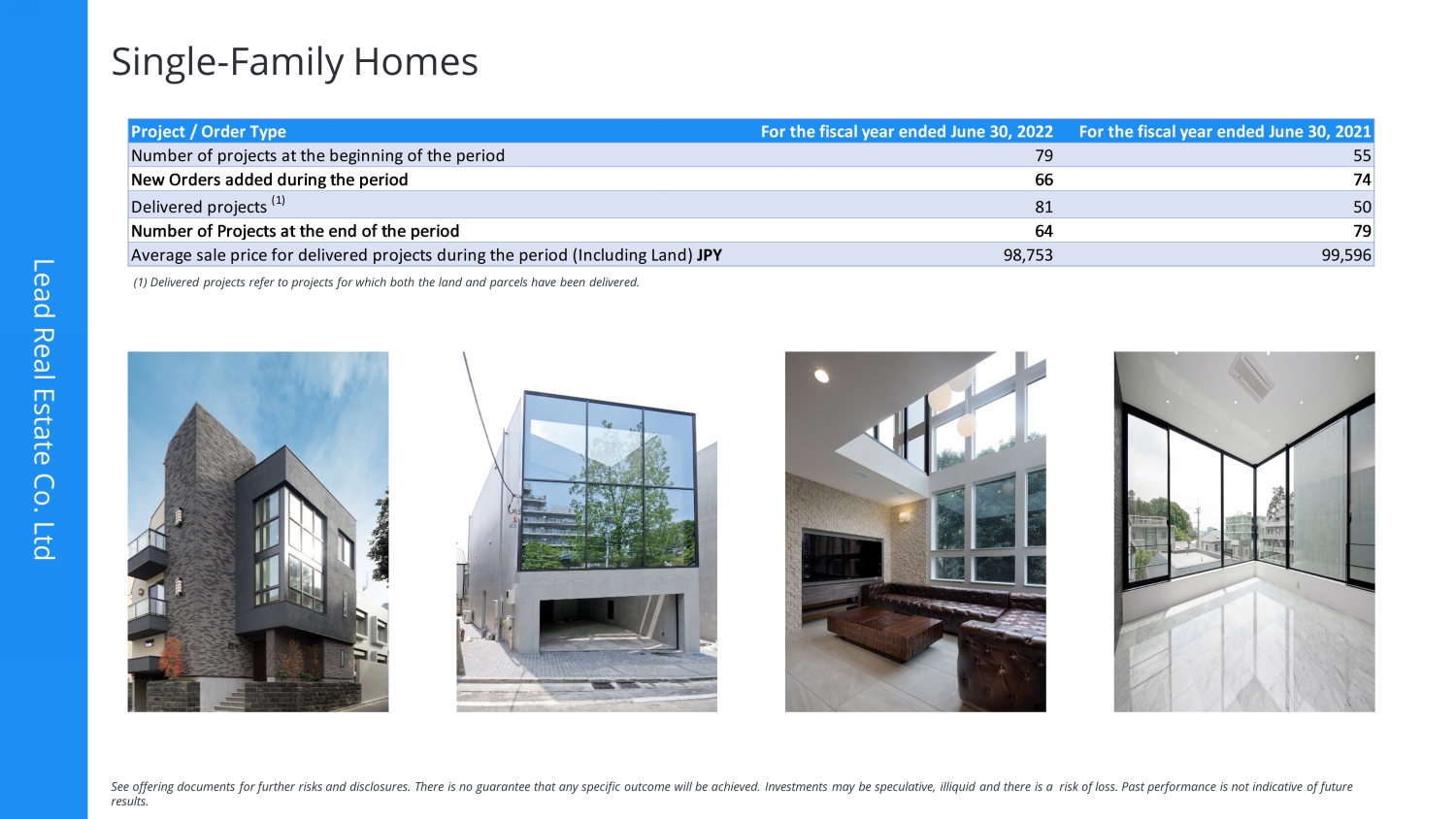

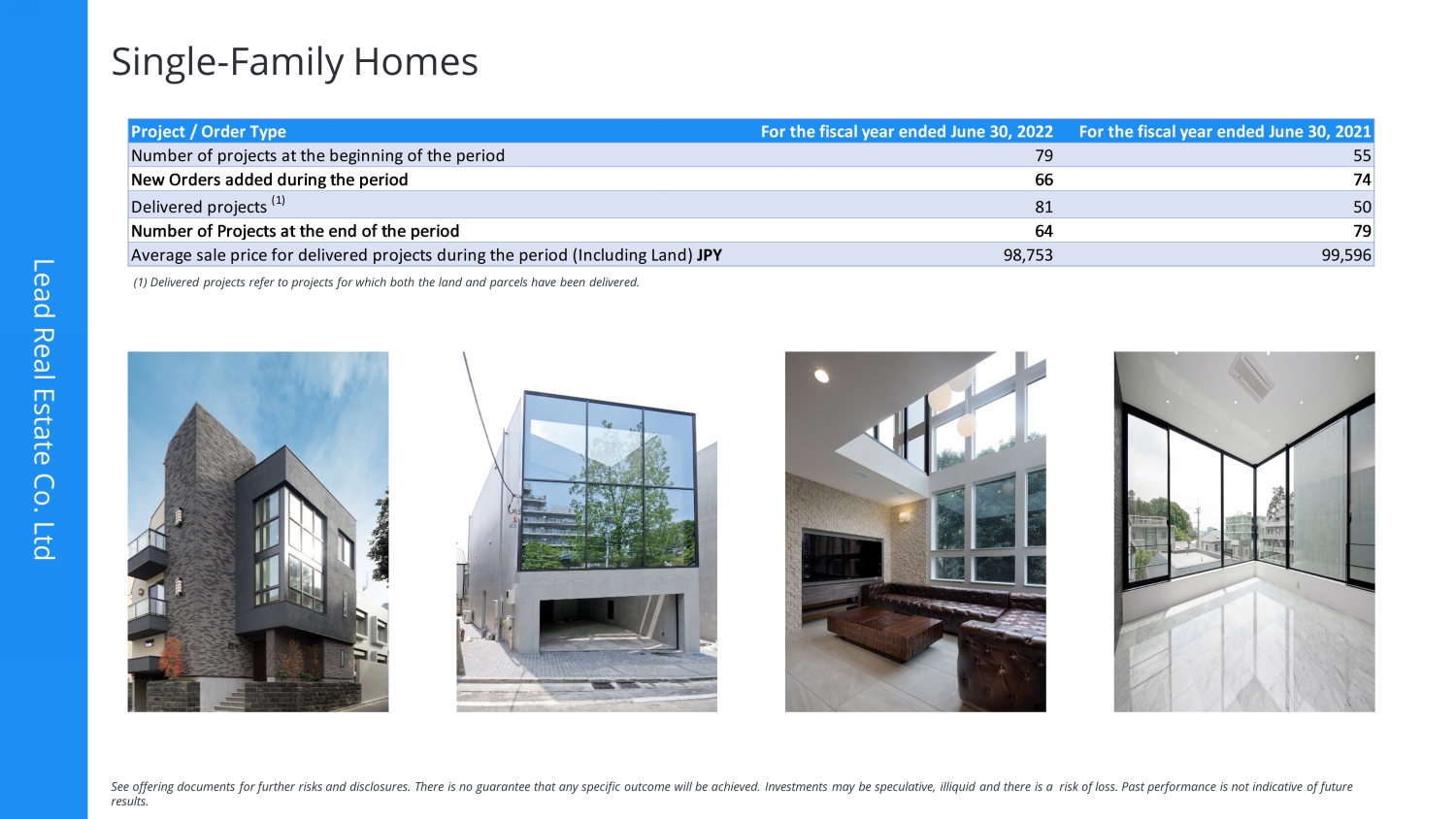

Lead Real Estate Co. Ltd Single - Family Homes See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. Project / Order Type For the fiscal year ended June 30, 2022 For the fiscal year ended June 30, 2021 Number of projects at the beginning of the period 79 55 New Orders added during the period 66 74 Delivered projects (1) 81 50 Number of Projects at the end of the period 64 79 Average sale price for delivered projects during the period (Including Land) JPY 98,753 99,596 (1) Delivered projects refer to projects for which both the land and parcels have been delivered.

Lead Real Estate Co. Ltd Condominiums See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. Project / Order Type For the fiscal year ended June 30, 2022 For the fiscal year ended June 30, 2021 Number of projects at the beginning of the period 2 1 New Orders added during the period 10 5 Delivered projects (1) 9 4 Number of Projects at the end of the period 3 2 Average sale price for delivered projects during the period (Including Land) JPY 470,957 395,911 (1) Delivered projects refer to projects for which both the land and parcels have been delivered.

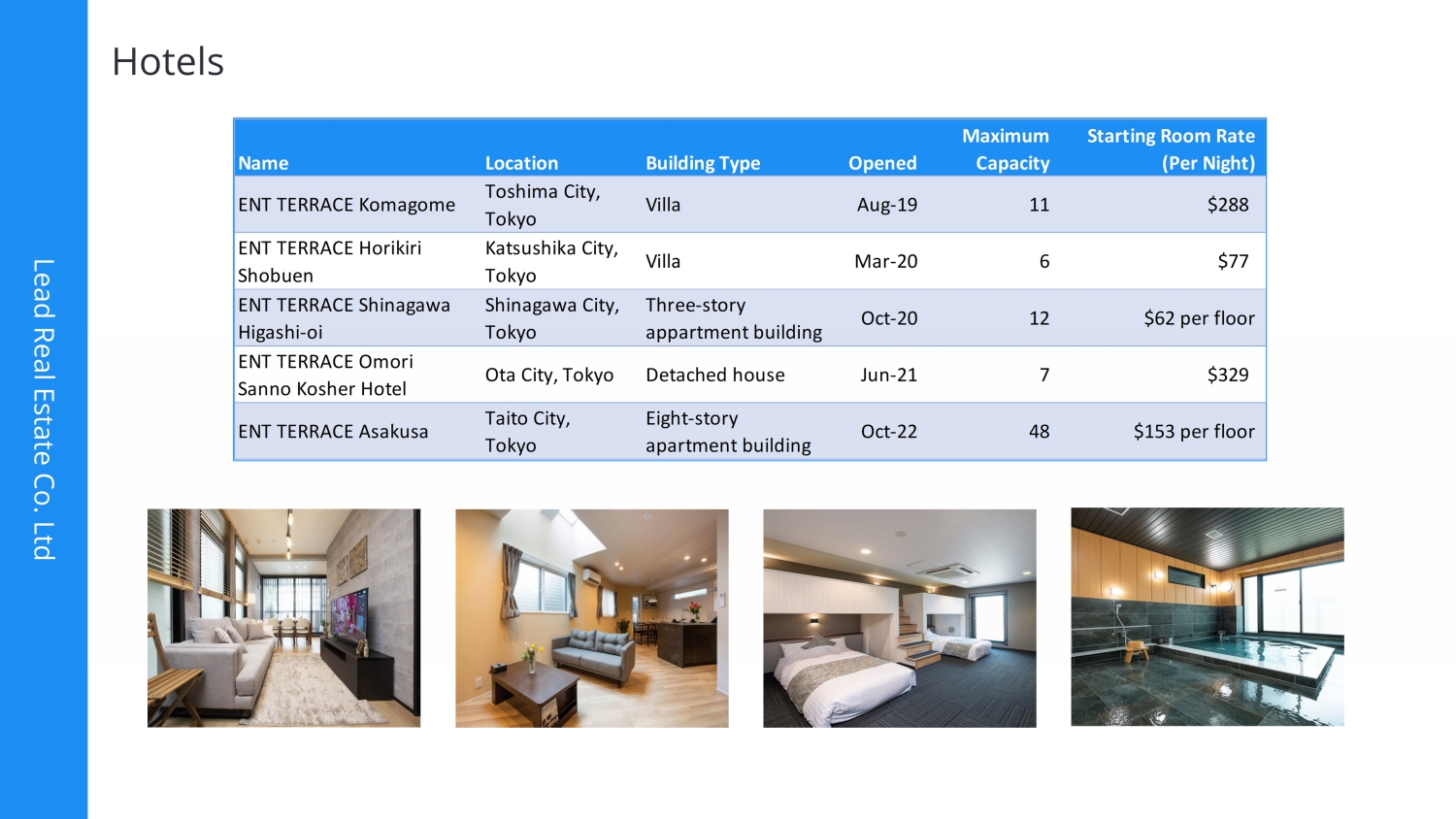

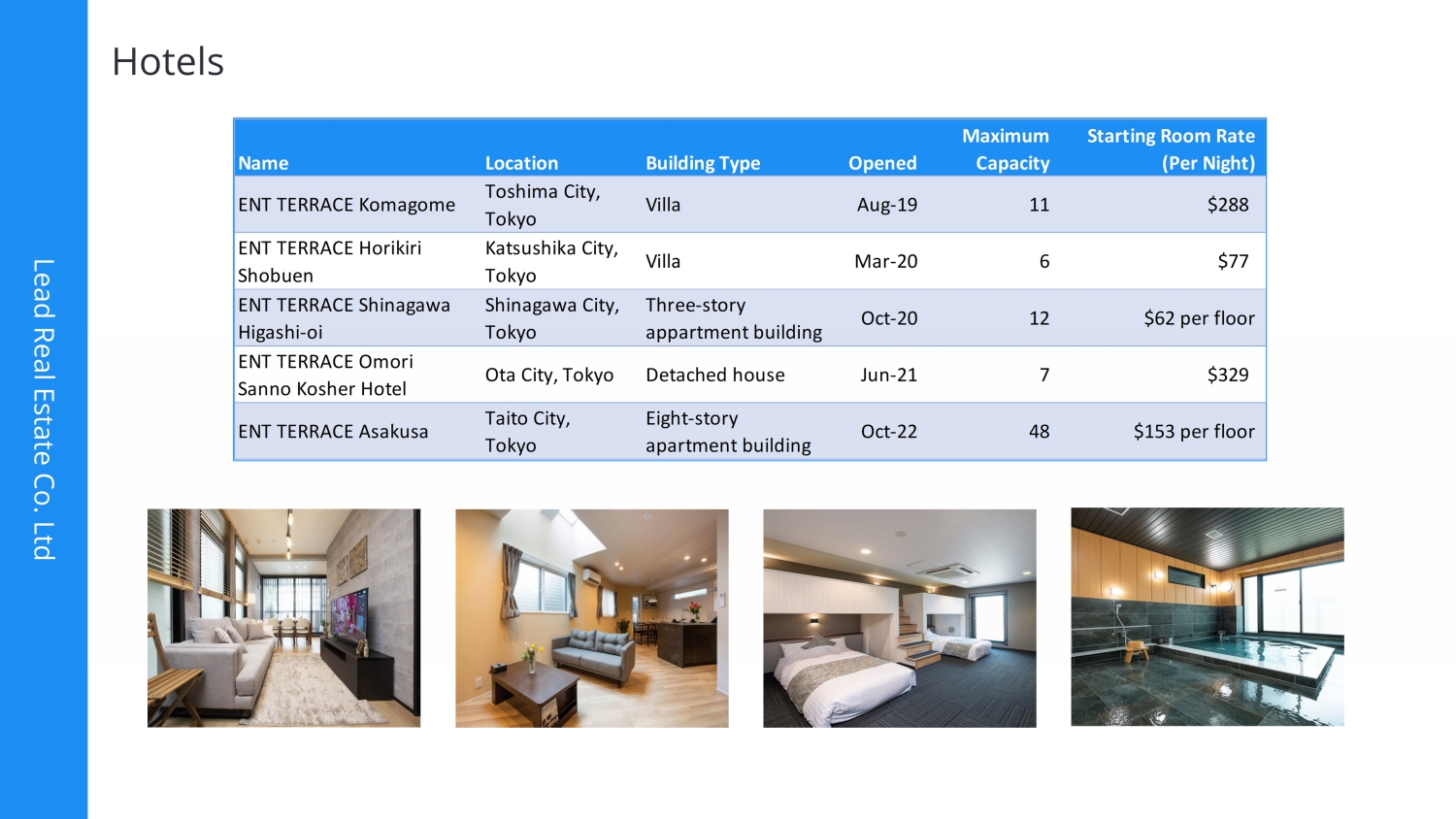

Lead Real Estate Co. Ltd Hotels Name Location Building Type Opened Maximum Capacity Starting Room Rate (Per Night) ENT TERRACE Komagome Toshima City, Tokyo Villa Aug-19 11 $288 ENT TERRACE Horikiri Shobuen Katsushika City, Tokyo Villa Mar-20 6 $77 ENT TERRACE Shinagawa Higashi-oi Shinagawa City, Tokyo Three-story appartment building Oct-20 12 $62 per floor ENT TERRACE Omori Sanno Kosher Hotel Ota City, Tokyo Detached house Jun-21 7 $329 ENT TERRACE Asakusa Taito City, Tokyo Eight-story apartment building Oct-22 48 $153 per floor

Lead Real Estate Co. Ltd 4804 Mannet St., Dallas, Texas U.S. Property

Lead Real Estate Co. Ltd Traditional Search & comparison : Slow, partial site with pictures, physical visits required for views of property Contracting : Face to face, heavy paperwork and procedures Support: Limited language, limited hours Transactional Capability: None Search & comparison : Live pricing, interactive media portal including videos / 360 views of unit. Detailed info available through portal (yield, surrounding schools, convenience stores, subway) Contracting : eKYC, Sales/Purchase Agreement, Disclosure, Deed Transfer done on site Support: Chatbot AI and onsite staff 24/7 Transactional Capability: Buy/Sell Directly from Platform GLOCALY Platform Aiming to Disrupt Real Estate Transactions

Lead Real Estate Co. Ltd Unlocking Prime Japanese Real Estate Buy, Sell, Invest In Japan | Seamlessly Around the World

Lead Real Estate Co. Ltd Mr. Eiji Nagahara President, Chief Executive Officer, and Representative Director • Founder and President since November 2003 and CEO since March 2001 • Worked at multiple real estate companies, including FEC Co., Mibu Co. and Uptown Co. • Certified International Property Specialist Mr. Daisuke Takahashi Chief Financial Officer • Chief Financial Officer since January 2021 • Managing Director and CFO of Japan Card Products Co., Financial Planning and Analysis Manager of Starbucks Coffee Japan, Chief Accountant of Fujita Corporation Co., Chief Consultant of Chuo Sogo Business Consulting Co., and as the Accounting Manager of A.I Global Sun Partners Co. • Passed all four sections of the Uniform CPA Examination • Bachelor’s degree of Marine Science from Hokkaido University Mr. Takahashi Nihei Director and General manager of Development Division • Director since July 2021 and General Manager of development division since February 2006 • Prior, Mr. Nihei worked at I - Deal Co., Kyowajyuhan Co., and La - table • Diploma in Management Business from Tokyo Shoko Gakuin Technical College Mr. Hidekazu Hamagishi Director and General Manager of Accounting Department • Director since July 2021 and General Manager of Accounting since July 2012 • Prior, Mr. Hamagishi worked at Aisei Drug Co., Ibis Consulting Co., First Management Service Co., SME Guarantee Organization Co., Kasuga Publishing Co., and as the chief accountant of S - net Co., Human Design Limited Company, Mr. Hamagishi also worked at Nissan Satio Saitama Co. • Bachelor of Law degree from Daito Bunka University Masahiro Maki Independent Director and Audit and Supervisory Committee Member • Independent Director as well as Audit and Supervisory Committee member • Prior, Mr. Maki worked at Keiyo Co., Chibagin Business Service Co., and Chiba Bank • Bachelor of Economics degree from Chuo University Hiroyuki Saito Independent Director and Audit and Supervisory Committee Member • Independent Director as well as Audit and Supervisory Committee member • Established Saito Certified Public Accountant Office in March 2006 and established Mitsuba Audit Corporation in March 2021 • Mr. Saito worked for Ernst & Young ShinNihon, Ginga Audit Corporation as a senior partner, Minamiaoyama and Audit Corporation as a senior partner • Bachelor of Business Administration degree from Aoyama Gakuin University and Certified Public Accountant in Japan Ryoma Iida Independent Director and Audit and Supervisory Committee Member • Independent Director as well as Audit and Supervisory Committee member • Mr. Iida established Allegro Law Office, worked as a Legal Affairs Specialist for the Kobe City Board of Education, he worked for Umegae Chuo Legal Profession Corporation • Juris Doctor degree from Osaka University Law School Experienced Management Audit and Supervisory Committee

CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE Market Overview CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE

Lead Real Estate Co. Ltd Luxury Residential Market in Tokyo According to research by Savills Research published in March 2022 demand for Tokyo luxury residential remained strong, with luxury condos in particular being attractive for investors 1 . The following factors drove continued strength in the Tokyo luxury residential market in 2020: • Japan remained among the top three countries for ultra - high net worth individuals;’ • Tokyo ranked number three (behind New York and Hong Kong) for cities with the most ultra - high net worth individuals; • Limited supply, particularly in the prestigious areas within the Minato ward, continued to drive higher pricing; and • Japan’s rich culture, rule of law, exceptional customer services, and overall safety and quality of life continued to pull in investor demand. (1) https://pdf.savills.asia/asia - pacific - research/japan - research/japan - residential/jp - ultra - luxury - residential - spotlight - 03 - 202 2.pdf

CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE Growth Strategies CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE

Lead Real Estate Co. Ltd Growth Strategies ▪ Central and Southern Tokyo [Kanto Region] ▪ Leveraging strong brand and relationships Kanto Region Focus Expand Overseas ▪ Dallas development and opportunistic US cities ▪ Southeast Asia partnerships ▪ Integrate through GLOCALY platform Leverage Local Agencies ▪ Local real estate agencies identify land and development sites ▪ Strengthen existing, develop new channels Grow GLOCALY ▪ Multilingual interactive platform ▪ B2B investment focus ▪ eKYC, online contracting and legal documentation

CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE Financial Highlights CONFIDENTIAL – DO NOT DISTRIBUTE OR REPRODUCE

Lead Real Estate Co. Ltd $64 $83 $106 $0 $50 $100 $150 2020 2021 2022 Revenue ($ millions) Fiscal Year Ended June 30 Steady Revenue Growth Revenue $1 $3 $5 $0 $2 $4 $6 2020 2021 2022 Operating Income ($ millions) Fiscal year Ended June 30 Profitability Through Pandemic Operating Income 94 102 $540,000 $550,000 $560,000 $570,000 $580,000 90 95 100 105 2022-06-30 2021-06-30 Single - Family Home Land Deliveries Land deliveries (Homes) - Units Land deliveries (Homes) - Average Sales price ($) 81 50 $150,000 $160,000 $170,000 $180,000 0 50 100 6/30/2022 6/30/2021 Single - Family Home Building Deliveries Home Vertical deliveries - Units Home vertical deliveries- Average Sales price ($) 12 4 $- $1,000,000 $2,000,000 $3,000,000 0 5 10 15 6/30/2022 6/30/2021 Condominium Land Deliveries Land deliveries (Condos) - Units Land deliveries (Condos) - Average Sales price ($) 9 4 $- $500,000 $1,000,000 $1,500,000 0 5 10 6/30/2022 6/30/2021 Condominium Building Deliveries For Sale Condo - Units For Sale Condo - Average Sales price ($) Financial Highlights See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Lead Real Estate Co. Ltd Contacts Address: 6F, MFPR Shibuya Nanpeidai Building 16 - 11 Nampeidai - cho, Shibuya - ku Tokyo, 150 - 0036, Japan Issuer: Lead Real Estate Co., Ltd Email: d - takahashi@lead - real.co.jp Address: 590 Madison Avenue, 39 th Floor New York, NY 10022 Underwriter: EF Hutton division of Benchmark Investments, LLC Email: syndicate @efhuttongroup.com

Lead Real Estate Co. Ltd Exhibit - Corporate Structure *Indicates less than 1% Notes: all percentages reflect the equity interests held by each of our shareholders assuming no exercise of the over - allotment option. (1) Represents an aggregate of 182,607 Ordinary Shares held by 24 shareholders of Lead Real Estate Co., Ltd, each one of whic h h olds less than 5% of our equity interests, as of the date of this prospectus. (2) Mr. Nagahara holds 100% of the equity interests in JP Shuhan Co., Ltd., a joint - stock corporation with limited liability in Japan. (3) Mr. Nagahara holds 100% of the equity interests in Lead Real Estate Cayman Limited, a company limited by shares under the la ws of Cayman Islands. (4) Mr. Nagahara holds 50% of the equity interests in Sojiya Japan Co., Ltd.