UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23754

SEI EXCHANGE TRADED FUNDS

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 610-676-1000

Date of fiscal year end: March 31, 2024

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

March 31, 2024

ANNUAL REPORT

SEI Exchange Traded Funds

> | SEI Enhanced U.S. Large Cap Quality Factor ETF |

> | SEI Enhanced U.S. Large Cap Momentum Factor ETF |

> | SEI Enhanced U.S. Large Cap Value Factor ETF |

> | SEI Enhanced Low Volatility U.S. Large Cap ETF |

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

TABLE OF CONTENTS

| Letter to Shareholders | 1 |

| Management’s Discussion and Analysis of Fund Performance | 5 |

| Schedules of Investments | 13 |

| Statements of Assets and Liabilities | 22 |

| Statements of Operations | 23 |

| Statements of Changes in Net Assets | 24 |

| Financial Highlights | 28 |

| Notes to Financial Statements | 29 |

| Report of Independent Registered Public Accounting Firm | 37 |

| Trustees and Officers of the Trust | 39 |

| Disclosure of Fund Expenses | 42 |

| Liquidity Risk Management Program | 43 |

| Board of Trustees Considerations in Approving the Advisory Agreement | 44 |

| Notice to Shareholders | 46 |

Shares are bought and sold at market price (not net asset value) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

March 31, 2024 (Unaudited)

To Our Shareholders:

During the one-year reporting period ending March 31, 2024, global financial markets gyrated in response to concerns about central bank monetary policy, the strength of the global economy, and growing geopolitical tensions. Late in the period, global markets rallied in response to generally positive corporate results and investors’ hopes that the Federal Reserve (Fed) and other global monetary policy-makers would pivot to cutting interest rates as inflation subsided.

The Fed slowed the pace of its interest rate-hiking cycle over the first several months of the reporting period as inflation cooled. The central bank raised the federal funds rate in two 25-basis point (0.25%) increments following its meetings in May and July 2023, to a range of 5.25% to 5.50%. However, the Fed left its benchmark rate unchanged for the remainder of the period, ending a rate-hiking cycle that had begun in March 2022. In a statement announcing its rate decision following its meeting in March 2024, the Federal Open Market Committee (FOMC) noted, “Inflation has eased over the past year but remains elevated. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” The Fed’s so-called dot plot of economic projections, issued in March 2024, indicated a median federal-funds rate of 4.6% at the end of the year, unchanged from its previous estimate issued in December 2023, signaling that the central bank still may reduce the federal-funds rate by roughly 75 basis points—most likely in three increments of 25 basis points—by the end of this year. The dot plot also projected that core personal-consumption-expenditures (PCE) inflation could rise from its most recent annual increase of 2.4% in January to 2.6% by the end of 2024. The PCE price index is the Fed’s preferred gauge of inflation, as it tracks the change in prices paid by or on behalf of consumers for a more comprehensive set of goods and services than that of the consumer-price index (CPI).

Geopolitical Events

The geopolitical news during the reporting period was dominated by the ongoing Russia-Ukraine war, and later, escalating tensions in the Middle East. Russia’s invasion of Ukraine marked its second anniversary on February 24, 2024, with little hope for a resolution in the near term. Republican Party leaders in the U.S. House of Representatives rejected a bipartisan bill approved in the Senate that would have provided $95 billion in military aid for Ukraine, Israel, and Taiwan. In mid-March, the administration of President Joe Biden announced a plan to send $300 million more in ammunition and other weapons to Ukraine while the U.S. Congress debated a new aid package.

Long-simmering tensions in the Middle East escalated to war following a surprise attack on Israel by Hamas in early October 2023. Hamas, a militant Palestinian nationalist group based in the West Bank and Gaza Strip, seeks to establish an independent Islamic state in Palestine. In addition to the casualties resulting from Hamas’ initial incursion into Israel, the militant group and some of its allies abducted more than 200 soldiers and civilians. A one-week ceasefire in the military conflict between Israel and Hamas expired on November 30, 2023, after the two sides could not reach an agreement on an extension. The truce had led to several hostage and prisoner exchanges between Israel and Hamas. Each side blamed the other for the failure to extend the ceasefire, and fighting resumed following the expiration of the truce. Towards the end of the reporting period, 14 of the 15 countries comprising the United Nations Security Council, which is responsible for maintaining international peace and security, approved a resolution calling for another ceasefire between Israel and Hamas. The U.S. abstained from the vote, angering President Benjamin Netanyahu of Israel, a U.S. ally, who opposed the resolution.

In late January 2024, the U.S. and U.K. (with support from Australia, Bahrain, Canada, and the Netherlands) conducted airstrikes on several targets in Yemen. The military action was in response to Houthi rebel attacks on commercial shipping in the Red Sea off the coast of Yemen. The Houthi movement is an Iran-backed militant group that seized Sanaa, Yemen’s capital, in 2014. The group has attacked U.S. military bases in Iraq and Syria, as well as numerous commercial ships in the Red Sea, forcing international shipping companies to reroute their vessels around the Cape of Good Hope in South Africa, putting upward pressure on freight costs. In late January 2024, an Iran-backed militia group conducted a drone attack at a U.S. military base in Jordan, killing three U.S. troops. The coalition subsequently conducted a retaliatory strike on 18 Houthi military targets in Yemen. In late March, the Houthis reached agreements with China and Russia to allow safe passage for their ships through the Red Sea and Gulf of Aden.

SEI Exchange Traded Funds

LETTER TO SHAREHOLDERS (Continued)

March 31, 2024 (Unaudited)

Economic Performance

The U.S. Department of Labor reported that the CPI advanced 0.4% in February 2024, following a 0.3% upturn in January. The 3.2% year-over-year advance in the index modestly exceeded market expectations, and was up slightly from the 3.1% annual increase in January. Housing and gasoline prices accounted for approximately 60% of the month-over-month rise in the CPI. Costs for utility gas services were up 2.3% month-over-month in February, but fell 8.8% over the previous year. Food prices were flat in February and rose 2.2% year-over-year, down from the 2.6% annual upturn in January. The 3.8% rolling 12-month rise in core inflation, as measured by the CPI for all items less food and energy, was down 0.1% from the 3.9% year-over-year increase in January.

According to the third estimate from the Department of Commerce, U.S. gross domestic product (GDP) grew at an annualized rate of 3.4% in the fourth quarter of 2023, slightly higher than the second estimate of 3.2% but down from the 4.9% rise in the third quarter. The U.S. economy expanded by 2.5% for the 2023 calendar year, topping 2022’s 1.9% annual rise, bolstered mainly by increases in consumer spending—which comprises more than two-thirds of U.S. GDP—and nonresidential fixed investment (purchases of both nonresidential structures and equipment and software). The largest contributors to GDP growth for the fourth quarter included consumer spending, state and local government spending, and exports. The government attributed the lower economic growth rate in the fourth quarter relative to the previous three-month period primarily to slowdowns in private inventory investment (a measure of the changes in values of inventories from one time period to the next) and federal government spending.

It appears that the U.K. economy slipped into recession—defined as two consecutive quarters of negative GDP growth—at the end of last year. The Office for National Statistics (ONS) estimated that U.K. GDP fell 0.3% over the fourth quarter of 2023, following a 0.1% dip during the third quarter. However, the economy rebounded somewhat in January 2024, expanding 0.2%. According to Eurostat, eurozone GDP was flat in the fourth quarter of 2023, a slight uptick from the 0.1% decline in the third quarter, and grew 0.5% for the 2023 calendar year. The economies of Denmark, Croatia, and Slovenia were the strongest performers for the fourth quarter, expanding 2.0%, 1.3% and 1.1%, respectively. Conversely, Ireland’s GDP fell 3.4%, while the economies of Estonia and Finland each contracted by 0.7% during the quarter.

Inflation in the U.K. and the eurozone slowed considerably over the reporting period. The ONS reported that inflation in the U.K., as measured by the CPI, rose 3.4% year-over-year in February 2024 (the most recent data available), down sharply from the 9.2% annual increase in February 2023. Core inflation, which excludes volatile food prices, rose at an annual rate of 4.5% in February, down from the 5.1% year-over-year increase in January. Eurostat pegged the inflation rate for the eurozone at 2.6% for the 12-month period ending in February, modestly lower than the 2.8% annual increase in January. Core inflation rose at an annual rate of 3.1% in February, down 0.2% from the 3.3% year-over-year increase in January.

Market Developments

Global equity markets, as measured by the MSCI ACWI Index, gained 23.2% over the reporting period despite numerous bouts of volatility. North America was the top-performing region among the developed markets for the reporting period due mainly to strength in the U.S., while the Far East region benefited largely from a strong rally in Japan. The Pacific ex Japan region posted a relatively small positive return and was the most notable laggard among developed markets over the period, attributable mainly to substantial weakness in Hong Kong and New Zealand. The top performers among emerging markets included Eastern Europe (particularly Hungary, Greece, and Poland) and Europe (mainly Colombia and Peru). Conversely, the Far East region posted a modest gain and was the primary laggard among the emerging markets for the period, attributable to notable weakness in China.

Global fixed-income assets, as represented by the Bloomberg Global Aggregate Bond Index, returned 0.5% for the reporting period. Global high-yield bonds outperformed their investment-grade corporate and government counterparts. In the U.S., high-yield bonds ended the period with substantial gains, outperforming investment-grade corporate bonds, U.S. Treasurys, and mortgage-backed securities (MBS). The U.S. Treasury yield curve remained inverted during the period, as yields on shorter-term bonds exceeded those on longer-dated securities. The yield on the 10-year U.S. Treasury note moved higher for most of the reporting period, crossing 5% in overnight trading on late October—its highest level since July 2007. The 10-year yield subsequently dropped to a low of 3.79% in late December 2023, then rebounded to end the reporting period at 4.20%—up 0.72% year-over-year (bond prices move inversely to interest rates). Yields rose across the Treasury curve over the period. Yields on 2-, 3-, 5- and 10-year

SEI Exchange Traded Funds

Treasury notes rose 0.53%, 0.59%, 0.61%, and 0.72%, respectively, during the period. The yield spread between 10- and 2-year notes narrowed from -0.58% to -0.39% over the period.

Global commodity prices, as measured by the Bloomberg Commodity Total Return Index, dipped 0.6% in U.S. dollar terms during the reporting period. Prices for West Texas Intermediate crude oil and Brent crude moved higher over the period as ongoing geopolitical tensions in the Middle East spurred investors’ worries about a disruption in oil exports. The gold price ended the period in positive territory as the Fed slowed and subsequently paused its rate-hiking cycle. The New York Mercantile Exchange (NYMEX) natural gas price fell over the reporting period due to an increase in inventories and falling demand due to above-average temperatures in the U.S. for much of the winter of 2023-2024. Wheat prices declined during the reporting period, hampered by Russia’s shipments of large quantities of cheaply priced grain. The downturn more than offset a rebound in the wheat price in the fourth quarter of 2023, due mainly to a reduction in exports from Ukraine due to the nation’s ongoing conflict with Russia.

Our View

U.S. interest-rate expectations have converged thus far in 2024, as stubborn inflation data and a mixed employment picture have led investors to back away from predictions of aggressive interest-rate reductions from the Fed. As of the end of the first quarter, roughly three rate cuts were priced in, most likely starting in June, putting market expectations only slightly ahead of our own. Nonetheless, risks to this view are, in our opinion, clearly on the side of fewer rate cuts.

We would not be surprised to see mild weakness in the jobs data seize the attention of policy-makers and serve as a catalyst for the first rate cut in early summer, even if inflation remains above target. We believe inflation will remain stickier than expected on a slower decline in service inflation and a continued rebound in goods inflation.

U.S. equity investors are starting the quarter from what can only be described as “elevated levels” in the market. The S&P 500 Index currently trades at a forward price-to-earnings (P/E) ratio of 21. That is well above the historical average of roughly 16 and a good distance away from the rest of the world at just under 14. While it is true that equity market performance has broadened thus far in 2024—Japanese stocks are enjoying a strong rally and, in the U.S., the Magnificent Seven” mega-cap technology stocks are ending their run in favor of the “Fab Four” or maybe the “Terrific Trio”—quite a bit of good news is already priced into the U.S. market. Starting from here, the bar has been set fairly high for earnings to outperform expectations and drive prices higher. We acknowledge that P/E multiples can still expand from these heights, especially if they’re helped along by a pivot to easier monetary policy via interest-rate cuts from the Fed.

The 10-year U.S. Treasury yield is down from the 16-year high of 5% reached in October 2023, but well above where it started the year. We see additional room for bond yields to move higher, not only on the aforementioned sticky inflation data, but also on the substantial budget funding pressures and the lack of term premium priced into the yield curve. We would not be surprised to see the 10-year Treasury yield retest the 5% level even with the prospect of rate cuts on the horizon.

Sincerely,

James Smigiel

Chief Investment Officer

SEI Exchange Traded Funds

LETTER TO SHAREHOLDERS (Concluded)

March 31, 2024 (Unaudited)

Index Definitions

The MSCI ACWI Index is a market capitalization-weighted index that tracks the performance of over 2,000 companies, and is representative of the market structure of 48 developed and emerging-market countries in North and South America, Europe, Africa, and the Pacific Rim. The index is calculated with net dividends reinvested in U.S. dollars.

The MSCI North America Index tracks the performance of the large- and mid-cap segments of the U.S. and Canada markets. The index covers approximately 85% of the free float-adjusted (i.e., including only shares that are available for public trading) market capitalization in the U.S. and Canada.

The MSCI USA Index tracks the performance of the large- and mid-cap segments of the U.S. equity market. The index’s 624 constituents comprise approximately 85% of the free float-adjusted (i.e., including only shares that are available for public trading) market capitalization in the U.S.

The MSCI Pacific ex Japan Index tracks the performance of large- and mid-cap sticks across four of five developed-market countries in the Pacific region (excluding Japan).

The MSCI Emerging Markets Eastern Europe Index tracks the performance of large- and mid-cap stocks in the Czech Republic, Greece, Hungary, Poland and Turkey.

The MSCI Emerging Markets Latin America Index is a free float-adjusted (i.e., including only shares that are available for public trading) market capitalization-weighted index that tracks the performance of large- and mid-cap stocks across five emerging markets countries in Latin America.

The Bloomberg Global Aggregate Bond Index is a market capitalization-weighted index that tracks the performance of investment-grade (rated BBB- or higher by S&P Global Ratings/Fitch Ratings or Baa3 or higher by Moody’s Investors Service) fixed-income securities denominated in 13 currencies. The index reflects reinvestment of all distributions and changes in market prices.

The Bloomberg Global High Yield Index tracks the performance of U.S. dollar-denominated high-yield, fixed-rate corporate bonds. Securities are classified as high yield if the rating of Moody's, Fitch Ratings, and S&P Global Ratings is Ba1/BB+/BB+ or below.

The Bloomberg Global Aggregate - Corporate Index tracks the performance of global investment- grade, fixed-rate corporate debt.

The Bloomberg Global Treasury Index tracks fixed-rate, local-currency government debt of investment-grade countries, including both developed and emerging markets.

The Bloomberg U.S. Corporate High Yield Bond Index tracks the performance of fixed-rate, publicly issued, non-investment-grade (rated BB+ or lower by S&P Global Ratings and Fitch Ratings or Ba1 or lower by Moody’s Investors Service) bonds.

The Bloomberg U.S. Corporate Investment Grade Index is a broad-based benchmark that tracks the performance of the investment-grade (rated BBB- or higher by S&P Global Ratings and Fitch Ratings or Baa3 or higher by Moody’s Investors Service), fixed-rate, taxable corporate bond market.

The Bloomberg U.S. Treasuries Index tracks the performance of U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

The Bloomberg U.S. Mortgage Backed Securities Index tracks the performance of fixed-rate agency mortgage-backed securities (MBS) guaranteed by the Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA), and Freddie Mac (FHLMC).

The Bloomberg Commodity Total Return Index comprises futures contracts and tracks the performance of a fully collateralized investment in the index. This combines the returns of the index with the returns on cash collateral invested in 13-week (three-month) U.S. Treasury bills.

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Quality Factor ETF

I. Objective

SEI Enhanced U.S. Large Cap Quality Factor ETF (the “Fund”) seeks to provide long-term capital appreciation.

II. Investment Approach

SIMC uses a quantitative-based, active stock selection investment strategy combined with portfolio optimization to construct the Fund’s portfolio. SIMC’s quantitative model evaluates all of the securities in the investment universe of U.S. large-capitalization stocks based on various quality, profitability and risk factors, which may include various sales-based profitability ratios such as profit margins, and investment-based metrics, such as return on assets.

III. Return vs. Benchmark

For the one-year period ending March 31, 2024, the Fund returned 19.60%. The Fund’s primary benchmark–the Russell 1000 Index, which tracks the performance of 1000 of the largest U.S. equity securities based on market capitalization–returned 29.87%.

IV. Fund Attribution

The U.S. large-cap equity market experienced strong performance over the reporting period as investor sentiment rotated from concerns of a high interest-rate environment to one with signs of inflation being brought under control, recession avoided, and interest-rate cuts in the year ahead. Despite persistent geopolitical unrest stemming from the wars in Ukraine and the Middle East, equity markets demonstrated little to no negative repercussions over the period.

The Fund underperformed its benchmark, the Russell 1000 Index, during the reporting period due primarily to a challenging environment for diversified portfolios amid narrow market leadership, as well as headwinds to quality factors.

Bullish investor sentiment generally boosted risk assets, though market leadership for much of the reporting period was narrowly focused in the so-called “Magnificent Seven” mega-cap technology stocks. This concentration created headwinds for actively managed portfolios, the relative performance of which hinged on their exposure—or lack thereof—to these stocks. This was the main contributor to adverse stock selection within the Fund for the period. Among the Magnificent Seven, shares of semiconductor manufacturer Nvidia Corp. more than tripled over the period as a primary beneficiary of artificial intelligence (AI) hype in the market. The Fund had no position

in Nvidia during the period, and had underweight allocations to Meta Platforms Inc. (the parent company of Facebook) and e-commerce giant Amazon.com due to risk considerations. The positive contributions to performance of the Fund’s holdings in Alphabet Inc. (the parent company of Google) and software provider Microsoft Corp. only partially offset the negative impact of the relatively lower exposure to the three other Magnificent Seven stocks as noted.

From the factor perspective, quality underperformed during the reporting as the relatively strong performance of near-term measures of profitability was offset by long-term profitability measures and accounting quality, which lagged amid the “risk-on” market environment. Portfolio characteristics tilted toward stable-quality stocks resulted in a defensive profile, which also detracted from Fund performance in the sharply rising market. These headwinds were insufficiently offset by positive contributors within the consumer discretionary sector, including restaurant chain operator Domino’s Pizza and homebuilder NVR, as both companies benefited from strength in consumer spending in the U.S.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Quality Factor ETF (Concluded)

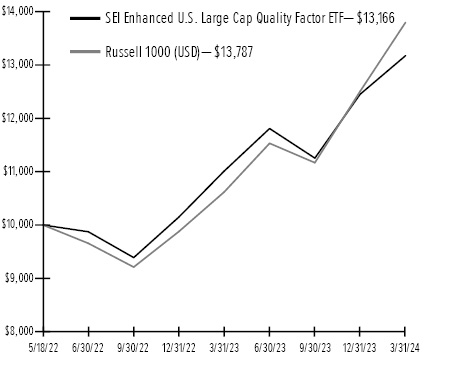

AVERAGE ANNUAL TOTAL RETURN(1) | | | |

| | | | One Year Return | | | Annualized

Inception

to Date | |

SEI Enhanced U.S. Large Cap Quality Factor ETF | | | 19.60% | | | | 15.83% | |

Russell 1000® Index | | | 29.87% | | | | 18.72% | |

Comparison of Change in the Value of a $10,000 Investment in the SEI Enhanced U.S. Large Cap Quality Factor ETF, versus the Russell 1000® Index

1 | For the year ended March 31, 2024. The Fund commenced operations on May 18, 2022. The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. |

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Momentum Factor ETF

I. Objective

SEI Enhanced U.S. Large Cap Momentum Factor ETF (the “Fund”) seeks to provide long-term capital appreciation.

II. Investment Approach

Under normal circumstances, the Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity and equity-related securities (such as convertible bonds, convertible preferred stock, depositary receipts, warrants and rights) issued by large U.S. companies. Momentum investing is a trend-following investment strategy that is based on acquiring assets with recent improvement in their price, earnings or other relevant fundamentals. SIMC uses a quantitative-based, active stock selection investment strategy combined with portfolio optimization to construct the Fund’s portfolio.

III. Return vs. Benchmark

For the one-year period ending March 31, 2024, the Fund returned 27.08%. The Fund’s primary benchmark–the Russell 1000 Index–which tracks the performance of 1000 of the largest U.S. equity securities based on market capitalization–returned 29.87%.

IV. Fund Attribution

The U.S. large-cap equity market experienced strong performance over the reporting period as investor sentiment rotated from concerns of a high interest-rate environment to one with signs of inflation being brought under control, recession avoided, and interest-rate cuts in the year ahead. Despite persistent geopolitical unrest stemming from the wars in Ukraine and the Middle East, equity markets demonstrated little to no negative repercussions over the period.

The Fund’s performance lagged the benchmark Russell 1000 Index for the reporting period due predominantly to poor stock selection and diversification away from large-cap stocks, where the strongest momentum opportunities presented themselves. Momentum investing was generally in favor over the period, though sharp rotations among the strongest-performing stocks made the momentum difficult to capture.

Stock selection in the health care sector and the semiconductor segment of the information technology sector weighed on Fund performance for the reporting period. Amazon.com was one of the largest detractors from Fund performance. In the food and beverages segment of the consumer staples sector, shares of

Hershey Co. declined despite favorable earnings momentum.

Fund performance for the reporting period benefited from stock selection in homebuilders and related companies in the industrials sector which experienced more persistent positive trends underpinned by increased housing demand and a strong underlying economy.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Momentum Factor ETF (Concluded)

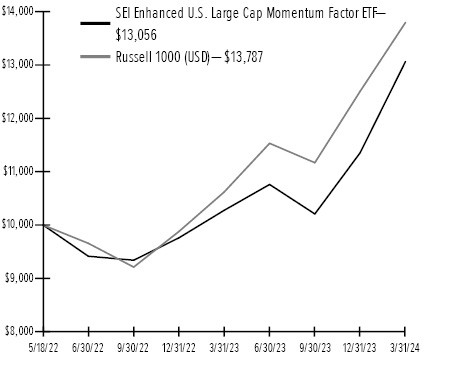

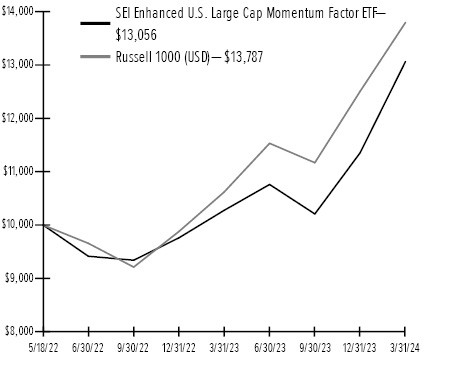

AVERAGE ANNUAL TOTAL RETURN(1) | | | |

| | | | One Year Return | | | Annualized

Inception

to Date | |

SEI Enhanced U.S. Large Cap Momentum Factor ETF | | | 27.08% | | | | 15.32% | |

Russell 1000® Index | | | 29.87% | | | | 18.72% | |

Comparison of Change in the Value of a $10,000 Investment in the SEI Enhanced U.S. Large Cap Momentum Factor ETF, versus the Russell 1000® Index

1 | For the year ended March 31, 2024. The Fund commenced operations on May 18, 2022. The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. |

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Value Factor ETF

I. Objective

SEI Enhanced U.S. Large Cap Value Factor ETF (the “Fund”) seeks to provide long-term capital appreciation.

II. Investment Approach

Under normal circumstances, the Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity and equity-related securities (such as convertible bonds, convertible preferred stock, depositary receipts, warrants and rights) issued by large U.S. companies. Value investing is a mean-reverting investment strategy that is based on acquiring assets at a discount to their fair valuation. SIMC uses a quantitative-based, active stock selection investment strategy to construct the Fund’s portfolio.

III. Return vs. Benchmark

For the one-year period ending March 31, 2024, the Fund returned 31.11%. The Fund’s primary benchmark–the Russell 1000 Index–which tracks the performance of 1000 of the largest U.S. equity securities based on market capitalization–returned 29.87%.

IV. Fund Attribution

The U.S. large-cap equity market experienced strong performance over the reporting period as investor sentiment rotated from concerns of a high interest-rate environment to one with signs of inflation being brought under control, recession avoided, and interest-rate cuts in the year ahead. Despite persistent geopolitical unrest stemming from the wars in Ukraine and the Middle East, equity markets demonstrated little to no negative repercussions over the period.

The Fund outperformed its benchmark, the Russell 1000 Index, over the reporting period despite a difficult backdrop for value investing. Bullish investor sentiment generally boosted riskier growth stocks, with leadership narrowly focused in the so-called “Magnificent Seven” mega-cap technology stocks. This concentration created headwinds, as the relative performance of portfolios hinged on their exposure—or lack thereof—to these stocks over the period.

The Fund’s performance was bolstered by favorable stock selection in other sectors outside of information technology, including positions in homebuilders Pulte Group Inc., Toll Brothers Inc., and Lennar Corp. each of which experienced outsized gains attributable to increased housing demand supported by a strong underlying economy. Stock selection in the health care sector also enhanced Fund performance, most notably

holdings in Cardinal Health Inc., and McKesson Corp. In the utilities sector, shares of the Fund’s holding in Texas-based Vistra Corp. rallied sharply toward the end of the reporting period as investors took a favorable view of the company’s capabilities in nuclear generation and clean energy.

The Fund’s underweight allocation to semiconductor stocks posed a key challenge during the reporting period. In particular, shares of Nvidia Corp. more than tripled over the period, benefiting from increasing interest in artificial intelligence (AI). Given Nvidia’s speculative nature, the Fund did not hold a position in the company during the period, resulting in a significant drag on otherwise favorable Fund performance.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced U.S. Large Cap Value Factor ETF (Concluded)

AVERAGE ANNUAL TOTAL RETURN(1) | | | |

| | | | One Year Return | | | Annualized

Inception

to Date | |

SEI Enhanced U.S. Large Cap Value Factor ETF | | | 31.11% | | | | 14.64% | |

Russell 1000® Index | | | 29.87% | | | | 18.72% | |

Comparison of Change in the Value of a $10,000 Investment in the SEI Enhanced U.S. Large Cap Value Factor ETF, versus the Russell 1000® Index

1 | For the year ended March 31, 2024. The Fund commenced operations on May 18, 2022. The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. |

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

SEI Enhanced Low Volatility U.S. Large Cap ETF

I. Objective

SEI Enhanced Low Volatility U.S. Large Cap ETF (the “Fund”) seeks to provide long-term capital appreciation with lower volatility relative to the broad U.S. large cap equity market.

II. Investment Approach

The Fund seeks to provide long-term capital appreciation by investing primarily in U.S. common stocks, while aiming to experience lower volatility compared to the broad U.S. large cap equity market. SIMC uses a quantitative-based, active stock selection investment process to construct the Fund's portfolio, utilizing a combination of factor scoring model, risk model and optimization.

III. Return vs. Benchmark

For the one-year period ending March 31, 2024, the Fund returned 12.47%. The Fund’s primary benchmark–the Russell 1000 Index–which tracks the performance of 1000 of the largest U.S. equity securities based on market capitalization–returned 29.87%.

IV. Fund Attribution

The U.S. large-cap equity market experienced strong performance over the reporting period as investor sentiment rotated from concerns of a high interest-rate environment to one with signs of inflation being brought under control, recession avoided, and interest-rate cuts in the year ahead. Despite persistent geopolitical unrest stemming from the wars in Ukraine and the Middle East, equity markets demonstrated little to no negative repercussions over the period.

Such market conditions typically are challenging to low-volatility strategies, and the Fund’s performance for the reporting period was broadly consistent with this economic environment. Low-volatility stocks significantly lagged the overall U.S. equity market consequently, the Fund underperformed its benchmark, the Russell 1000 Index, for the period.

Bullish investor sentiment generally boosted risk assets, though market leadership for much of the reporting period was narrowly focused in the so-called “Magnificent Seven” mega-cap technology stocks. This concentration created headwinds for active management, and portfolios’ exposure—or lack thereof—to those stocks was the key determinant of their relative performance over the period.

At the sector level, Fund performance was hampered primarily by stock selection within information technology and communication services, as the Fund did not hold significant positions in the market-leading Magnificent Seven stocks. The Fund’s intentional underweight exposure to these riskier stocks resulted in limited participation in the market rally over the period.

Conversely, the Fund’s overweight positions in defensive sectors such as consumer staples, health care, and utilities saw comparably muted performance over the reporting period. The holding in pharmaceutical firm Pfizer Inc. was the largest detractor from Fund performance due to relatively weak earnings guidance for the company’s 2024 fiscal year on the back of waning COVID-related treatments and vaccines. Fund performance also was hampered by positions in the food and beverage segment of the consumer staples sector, including Hershey Co., General Mills, Inc., and J.M. Smucker Co. Fund performance was further limited by its additional focus on what we viewed as attractively valued securities, which lagged behind those with high valuations and growth.

On a positive note, the Fund implemented meaningful risk reduction while posting a positive total returns over the reporting period, albeit lagging the broader U.S. equity market due to its defensive objective. The Fund is characterized by a below-market beta (a measure of the volatility relative to a benchmark) of approximately .70, and by design, will typically lag capitalization-weighted benchmarks during sharp market upswings.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

SEI Exchange Traded Funds

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2024 (Unaudited)

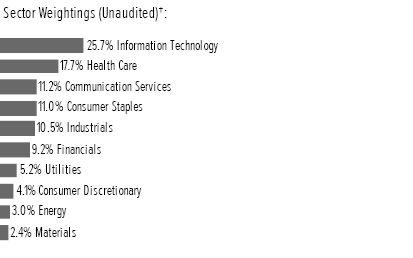

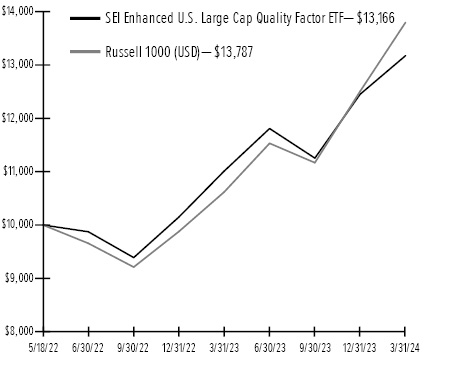

SEI Enhanced Low Volatility U.S. Large Cap ETF (Concluded)

AVERAGE ANNUAL TOTAL RETURN(1) | | | |

| | | | One Year Return | | | Annualized

Inception

to Date | |

SEI Enhanced Low Volatility U.S. Large Cap ETF | | | 12.47% | | | | 8.19% | |

Russell 1000® Index | | | 29.87% | | | | 18.72% | |

Comparison of Change in the Value of a $10,000 Investment in the SEI Enhanced Low Volatility U.S. Large Cap ETF, versus the Russell 1000® Index

1 | For the year ended March 31, 2024. The Fund commenced operations on May 18, 2022. The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. |

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced U.S. Large Cap Quality Factor ETF

†Percentages based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† — 99.5% |

| | | | | | | | | |

Communication Services — 8.9% | | | | |

Alphabet, Cl A * | | | 89,338 | | | $ | 13,484 | |

Alphabet, Cl C * | | | 4,071 | | | | 620 | |

Electronic Arts | | | 25,833 | | | | 3,427 | |

Meta Platforms, Cl A | | | 5,097 | | | | 2,475 | |

| | | | | | | | | |

| | | | | | | | 20,006 | |

Consumer Discretionary — 15.9% | | | | |

Amazon.com * | | | 5,681 | | | | 1,025 | |

AutoZone * | | | 222 | | | | 700 | |

Booking Holdings | | | 1,645 | | | | 5,968 | |

Domino's Pizza | | | 8,421 | | | | 4,184 | |

H&R Block | | | 35,829 | | | | 1,760 | |

Home Depot | | | 1,248 | | | | 479 | |

McDonald's | | | 9,493 | | | | 2,676 | |

NVR * | | | 714 | | | | 5,783 | |

O'Reilly Automotive * | | | 6,394 | | | | 7,218 | |

Ulta Beauty * | | | 2,969 | | | | 1,552 | |

Yum! Brands | | | 33,710 | | | | 4,674 | |

| | | | | | | | | |

| | | | | | | | 36,019 | |

Consumer Staples — 10.9% | | | | |

Altria Group | | | 104,788 | | | | 4,571 | |

Coca-Cola | | | 69,650 | | | | 4,261 | |

Colgate-Palmolive | | | 55,452 | | | | 4,993 | |

Monster Beverage * | | | 20,820 | | | | 1,234 | |

PepsiCo | | | 7,848 | | | | 1,374 | |

Philip Morris International | | | 53,043 | | | | 4,860 | |

Procter & Gamble | | | 20,444 | | | | 3,317 | |

| | | | | | | | | |

| | | | | | | | 24,610 | |

Financials — 11.7% | | | | |

FactSet Research Systems | | | 8,864 | | | | 4,028 | |

Mastercard, Cl A | | | 14,199 | | | | 6,838 | |

Moody's | | | 10,688 | | | | 4,201 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

MSCI, Cl A | | | 8,001 | | | $ | 4,484 | |

Visa, Cl A | | | 24,565 | | | | 6,855 | |

| | | | | | | | | |

| | | | | | | | 26,406 | |

Health Care — 10.4% | | | | |

AbbVie | | | 1,820 | | | | 332 | |

Bristol-Myers Squibb | | | 43,690 | | | | 2,369 | |

Hologic * | | | 40,341 | | | | 3,145 | |

Johnson & Johnson | | | 38,476 | | | | 6,087 | |

Merck & Co | | | 23,085 | | | | 3,046 | |

Mettler-Toledo International * | | | 3,260 | | | | 4,340 | |

Vertex Pharmaceuticals * | | | 9,905 | | | | 4,140 | |

| | | | | | | | | |

| | | | | | | | 23,459 | |

Industrials — 8.2% | | | | |

Fastenal | | | 75,818 | | | | 5,849 | |

Illinois Tool Works | | | 7,157 | | | | 1,920 | |

Paychex | | | 33,942 | | | | 4,168 | |

Robert Half | | | 25,082 | | | | 1,988 | |

Verisk Analytics, Cl A | | | 19,012 | | | | 4,482 | |

| | | | | | | | | |

| | | | | | | | 18,407 | |

Information Technology — 33.5% | | | | |

Adobe * | | | 10,193 | | | | 5,143 | |

Apple | | | 97,402 | | | | 16,703 | |

Autodesk * | | | 6,101 | | | | 1,589 | |

Broadcom | | | 3,035 | | | | 4,023 | |

Cadence Design Systems * | | | 23,247 | | | | 7,236 | |

Cisco Systems | | | 41,970 | | | | 2,095 | |

Dolby Laboratories, Cl A | | | 15,061 | | | | 1,262 | |

Fair Isaac * | | | 3,603 | | | | 4,502 | |

Manhattan Associates * | | | 14,692 | | | | 3,676 | |

Microsoft | | | 50,160 | | | | 21,103 | |

QUALCOMM | | | 16,834 | | | | 2,850 | |

Texas Instruments | | | 8,237 | | | | 1,435 | |

VeriSign * | | | 21,589 | | | | 4,091 | |

| | | | | | | | | |

| | | | | | | | 75,708 | |

Total Common Stock | | | | | | | | |

(Cost $216,105) ($ Thousands) | | | | | | | 224,615 | |

Total Investments in Securities — 99.5% | | | | | | | | |

(Cost $216,105) ($ Thousands) | | $ | 224,615 | |

| | | | | | | | | |

| | | | | | | | | |

| Percentages are based on Net Assets of $225,819 ($ Thousands). |

* | Non-income producing security. |

†† | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

As of March 31, 2024, all of the Fund's investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

See “Glossary” for abbreviations.

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced U.S. Large Cap Quality Factor ETF (Concluded)

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

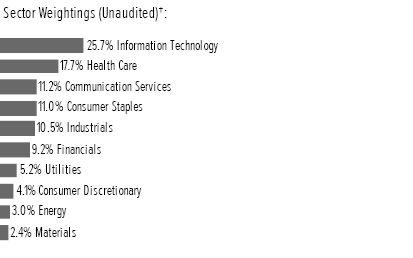

SEI Enhanced U.S. Large Cap Momentum Factor ETF

†Percentages based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† — 99.6% |

| | | | | | | | | |

Communication Services — 5.0% | | | | |

Alphabet, Cl C * | | | 593 | | | $ | 90 | |

Meta Platforms, Cl A | | | 43,945 | | | | 21,339 | |

TKO Group Holdings, Cl A | | | 20,156 | | | | 1,742 | |

| | | | | | | | | |

| | | | | | | | 23,171 | |

Consumer Discretionary — 15.4% | | | | |

Amazon.com * | | | 9,089 | | | | 1,640 | |

AutoZone * | | | 3,648 | | | | 11,497 | |

Chipotle Mexican Grill, Cl A * | | | 1,413 | | | | 4,107 | |

Deckers Outdoor * | | | 11,505 | | | | 10,829 | |

DR Horton | | | 63,756 | | | | 10,491 | |

Lululemon Athletica * | | | 16,906 | | | | 6,604 | |

O'Reilly Automotive * | | | 9,310 | | | | 10,510 | |

PulteGroup | | | 14,387 | | | | 1,735 | |

Toll Brothers | | | 49,571 | | | | 6,413 | |

Ulta Beauty * | | | 4,170 | | | | 2,181 | |

Wingstop | | | 13,822 | | | | 5,065 | |

| | | | | | | | | |

| | | | | | | | 71,072 | |

Consumer Staples — 2.9% | | | | |

General Mills | | | 590 | | | | 41 | |

Lamb Weston Holdings | | | 68,557 | | | | 7,304 | |

Mondelez International, Cl A | | | 84,130 | | | | 5,889 | |

| | | | | | | | | |

| | | | | | | | 13,234 | |

Energy — 0.4% | | | | |

TechnipFMC | | | 77,817 | | | | 1,954 | |

| | | | | | | | | |

| | | | | | | | | |

Financials — 12.2% | | | | |

Aflac | | | 24,773 | | | | 2,127 | |

Apollo Global Management | | | 65,689 | | | | 7,387 | |

Arch Capital Group * | | | 98,612 | | | | 9,116 | |

Blackstone | | | 1,731 | | | | 227 | |

Brown & Brown | | | 44,092 | | | | 3,860 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Cboe Global Markets | | | 44,372 | | | $ | 8,152 | |

Chubb | | | 1,144 | | | | 296 | |

Erie Indemnity, Cl A | | | 12,088 | | | | 4,854 | |

FactSet Research Systems | | | 9,796 | | | | 4,451 | |

Fiserv * | | | 13,810 | | | | 2,207 | |

Shift4 Payments, Cl A * | | | 1,412 | | | | 93 | |

Unum Group | | | 39,764 | | | | 2,134 | |

W R Berkley | | | 70,901 | | | | 6,271 | |

WEX * | | | 21,318 | | | | 5,064 | |

| | | | | | | | | |

| | | | | | | | 56,239 | |

Health Care — 11.4% | | | | |

AbbVie | | | 10,391 | | | | 1,892 | |

Acadia Healthcare * | | | 21,891 | | | | 1,734 | |

Cencora | | | 39,327 | | | | 9,556 | |

Cigna | | | 2,459 | | | | 893 | |

Dexcom * | | | 19,583 | | | | 2,716 | |

Eli Lilly | | | 4,993 | | | | 3,884 | |

Gilead Sciences | | | 94,442 | | | | 6,918 | |

McKesson | | | 20,929 | | | | 11,236 | |

Medpace Holdings * | | | 1,191 | | | | 481 | |

Merck & Co | | | 24,786 | | | | 3,271 | |

Stryker | | | 28,752 | | | | 10,290 | |

| | | | | | | | | |

| | | | | | | | 52,871 | |

Industrials — 17.2% | | | | |

Axon Enterprise * | | | 32,621 | | | | 10,206 | |

Booz Allen Hamilton Holding, Cl A | | | 62,564 | | | | 9,287 | |

Builders FirstSource * | | | 58,200 | | | | 12,138 | |

Clean Harbors * | | | 24,786 | | | | 4,990 | |

General Electric | | | 6,939 | | | | 1,218 | |

Hubbell, Cl B | | | 13,814 | | | | 5,733 | |

nVent Electric | | | 24,782 | | | | 1,868 | |

Parker-Hannifin | | | 21,878 | | | | 12,160 | |

Republic Services, Cl A | | | 52,806 | | | | 10,109 | |

Trane Technologies | | | 21,598 | | | | 6,484 | |

Vertiv Holdings, Cl A | | | 65,138 | | | | 5,320 | |

| | | | | | | | | |

| | | | | | | | 79,513 | |

Information Technology — 33.5% | | | | |

Apple | | | 177,168 | | | | 30,381 | |

Arista Networks * | | | 51,280 | | | | 14,870 | |

Cadence Design Systems * | | | 39,474 | | | | 12,287 | |

Crowdstrike Holdings, Cl A * | | | 31,504 | | | | 10,100 | |

Fair Isaac * | | | 1,339 | | | | 1,673 | |

Guidewire Software * | | | 35,160 | | | | 4,104 | |

Jabil | | | 62,638 | | | | 8,390 | |

Manhattan Associates * | | | 30,834 | | | | 7,716 | |

Microsoft | | | 43,788 | | | | 18,422 | |

NVIDIA | | | 37,922 | | | | 34,265 | |

Palo Alto Networks * | | | 29,948 | | | | 8,509 | |

Synopsys * | | | 7,492 | | | | 4,282 | |

| | | | | | | | | |

| | | | | | | | 154,999 | |

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced U.S. Large Cap Momentum Factor ETF (Concluded)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Materials — 1.6% | | | | |

Packaging Corp of America | | | 38,589 | | | $ | 7,323 | |

Reliance | | | 817 | | | | 273 | |

| | | | | | | | | |

| | | | | | | | 7,596 | |

Total Common Stock | | | | | | | | |

(Cost $425,056) ($ Thousands) | | | | | | | 460,649 | |

Total Investments in Securities — 99.6% | | | | | | | | |

(Cost $425,056) ($ Thousands) | | $ | 460,649 | |

| | | | | | | | | |

| | | | | | | | | |

| Percentages are based on Net Assets of $462,385 ($ Thousands). |

* | Non-income producing security. |

†† | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

As of March 31, 2024, all of the Fund's investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

See “Glossary” for abbreviations.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced U.S. Large Cap Value Factor ETF

†Percentages based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† — 99.5% |

| | | | | | | | | |

Communication Services — 13.5% | | | | |

Alphabet, Cl A * | | | 65,223 | | | $ | 9,844 | |

Alphabet, Cl C * | | | 69,072 | | | | 10,517 | |

AT&T | | | 548,448 | | | | 9,653 | |

Comcast, Cl A | | | 86,340 | | | | 3,743 | |

Meta Platforms, Cl A | | | 30,342 | | | | 14,733 | |

Omnicom Group | | | 21,663 | | | | 2,096 | |

Playtika Holding | | | 9,450 | | | | 67 | |

TripAdvisor * | | | 52,696 | | | | 1,464 | |

Verizon Communications | | | 263,352 | | | | 11,050 | |

| | | | | | | | | |

| | | | | | | | 63,167 | |

Consumer Discretionary — 9.9% | | | | |

Amazon.com * | | | 7,068 | | | | 1,275 | |

eBay | | | 56,074 | | | | 2,960 | |

Ford Motor | | | 202,902 | | | | 2,695 | |

General Motors | | | 217,155 | | | | 9,848 | |

H&R Block | | | 82,353 | | | | 4,044 | |

Lennar, Cl A | | | 18,282 | | | | 3,144 | |

Lennar, Cl B | | | 6,221 | | | | 959 | |

PulteGroup | | | 118,678 | | | | 14,315 | |

Toll Brothers | | | 52,311 | | | | 6,767 | |

| | | | | | | | | |

| | | | | | | | 46,007 | |

Consumer Staples — 7.5% | | | | |

Albertsons, Cl A | | | 80,241 | | | | 1,721 | |

Altria Group | | | 194,288 | | | | 8,475 | |

Bunge Global | | | 39,058 | | | | 4,004 | |

Ingredion | | | 9,388 | | | | 1,097 | |

Kraft Heinz | | | 190,861 | | | | 7,043 | |

Kroger | | | 201,946 | | | | 11,537 | |

Seaboard | | | 76 | | | | 245 | |

Walgreens Boots Alliance | | | 39,386 | | | | 854 | |

| | | | | | | | | |

| | | | | | | | 34,976 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Energy — 1.9% | | | | |

Chesapeake Energy | | | 33,299 | | | $ | 2,958 | |

Chevron | | | 2,305 | | | | 363 | |

Marathon Petroleum | | | 8,912 | | | | 1,796 | |

Occidental Petroleum | | | 6,374 | | | | 414 | |

Southwestern Energy * | | | 70,594 | | | | 535 | |

Valero Energy | | | 17,820 | | | | 3,042 | |

| | | | | | | | | |

| | | | | | | | 9,108 | |

Financials — 14.6% | | | | |

Affiliated Managers Group | | | 19,125 | | | | 3,203 | |

American International Group | | | 128,510 | | | | 10,046 | |

Brighthouse Financial * | | | 34,231 | | | | 1,764 | |

Capital One Financial | | | 79,721 | | | | 11,870 | |

Citigroup | | | 160,238 | | | | 10,134 | |

Corebridge Financial | | | 42,479 | | | | 1,220 | |

Janus Henderson Group | | | 38,407 | | | | 1,263 | |

Jefferies Financial Group | | | 97,862 | | | | 4,316 | |

MGIC Investment | | | 145,055 | | | | 3,244 | |

New York Community Bancorp | | | 323,103 | | | | 1,040 | |

Reinsurance Group of America | | | 17,896 | | | | 3,452 | |

Synchrony Financial | | | 208,400 | | | | 8,986 | |

Unum Group | | | 92,180 | | | | 4,946 | |

Western Union | | | 193,946 | | | | 2,711 | |

| | | | | | | | | |

| | | | | | | | 68,195 | |

Health Care — 14.8% | | | | |

AbbVie | | | 11,675 | | | | 2,126 | |

Bristol-Myers Squibb | | | 63,938 | | | | 3,467 | |

Cardinal Health | | | 114,530 | | | | 12,816 | |

Cigna | | | 11,098 | | | | 4,031 | |

CVS Health | | | 104,396 | | | | 8,327 | |

DaVita * | | | 2,504 | | | | 346 | |

Gilead Sciences | | | 105,684 | | | | 7,741 | |

Henry Schein * | | | 5,225 | | | | 395 | |

Laboratory Corp of America Holdings | | | 3,755 | | | | 820 | |

McKesson | | | 26,194 | | | | 14,062 | |

Pfizer | | | 202,141 | | | | 5,609 | |

Quest Diagnostics | | | 19,147 | | | | 2,549 | |

Viatris, Cl W | | | 560,596 | | | | 6,693 | |

| | | | | | | | | |

| | | | | | | | 68,982 | |

Industrials — 4.6% | | | | |

Allison Transmission Holdings | | | 51,253 | | | | 4,160 | |

American Airlines Group * | | | 301,347 | | | | 4,626 | |

Core & Main, Cl A * | | | 19,740 | | | | 1,130 | |

FedEx | | | 1,588 | | | | 460 | |

ManpowerGroup | | | 5,645 | | | | 438 | |

Owens Corning | | | 31,957 | | | | 5,330 | |

PACCAR | | | 3,916 | | | | 485 | |

Ryder System | | | 20,136 | | | | 2,420 | |

Schneider National, Cl B | | | 26,845 | | | | 608 | |

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced U.S. Large Cap Value Factor ETF (Concluded)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Science Applications International | | | 14,209 | | | $ | 1,853 | |

| | | | | | | | | |

| | | | | | | | 21,510 | |

Information Technology — 26.1% | | | | |

Amdocs | | | 56,383 | | | | 5,095 | |

Apple | | | 92,602 | | | | 15,879 | |

AppLovin, Cl A * | | | 38,945 | | | | 2,696 | |

Arrow Electronics * | | | 33,241 | | | | 4,303 | |

Avnet | | | 44,170 | | | | 2,190 | |

Cisco Systems | | | 30,085 | | | | 1,502 | |

Crane NXT | | | 22,583 | | | | 1,398 | |

Dell Technologies, Cl C | | | 17,205 | | | | 1,963 | |

Dropbox, Cl A * | | | 121,435 | | | | 2,951 | |

DXC Technology * | | | 110,334 | | | | 2,340 | |

F5 * | | | 25,808 | | | | 4,893 | |

Gen Digital | | | 28,735 | | | | 644 | |

Hewlett Packard Enterprise | | | 411,157 | | | | 7,290 | |

HP | | | 299,955 | | | | 9,065 | |

Intel | | | 108,805 | | | | 4,806 | |

International Business Machines | | | 26,884 | | | | 5,134 | |

Jabil | | | 19,205 | | | | 2,573 | |

Microsoft | | | 43,479 | | | | 18,292 | |

NCR Voyix * | | | 18,764 | | | | 237 | |

NetApp | | | 84,882 | | | | 8,910 | |

Oracle | | | 29,716 | | | | 3,733 | |

Skyworks Solutions | | | 72,436 | | | | 7,846 | |

Teradata * | | | 49,080 | | | | 1,898 | |

Vontier | | | 74,432 | | | | 3,376 | |

Zoom Video Communications, Cl A * | | | 43,323 | | | | 2,832 | |

| | | | | | | | | |

| | | | | | | | 121,846 | |

Materials — 2.9% | | | | |

Berry Global Group | | | 57,067 | | | | 3,451 | |

International Paper | | | 80,648 | | | | 3,147 | |

LyondellBasell Industries, Cl A | | | 55,287 | | | | 5,655 | |

Steel Dynamics | | | 8,836 | | | | 1,310 | |

| | | | | | | | | |

| | | | | | | | 13,563 | |

Utilities — 3.7% | | | | |

Consolidated Edison | | | 49,540 | | | | 4,499 | |

National Fuel Gas | | | 40,970 | | | | 2,201 | |

PPL | | | 11,879 | | | | 327 | |

Vistra | | | 144,872 | | | | 10,090 | |

| | | | | | | | | |

| | | | | | | | 17,117 | |

Total Common Stock | | | | | | | | |

(Cost $423,111) ($ Thousands) | | | | | | | 464,471 | |

Total Investments in Securities — 99.5% | | | | | | | | |

(Cost $423,111) ($ Thousands) | | $ | 464,471 | |

| | | | | | | | | |

| | | | | | | | | |

| Percentages are based on Net Assets of $467,011 ($ Thousands). |

| | |

* | Non-income producing security. |

†† | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

As of March 31, 2024, all of the Fund's investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

See “Glossary” for abbreviations.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced Low Volatility U.S. Large Cap ETF

†Percentages based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† — 99.5% |

| | | | | | | | | |

Communication Services — 11.2% | | | | |

Alphabet, Cl A * | | | 3,860 | | | $ | 582 | |

Alphabet, Cl C * | | | 12,336 | | | | 1,878 | |

AT&T | | | 166,480 | | | | 2,930 | |

Comcast, Cl A | | | 53,097 | | | | 2,302 | |

Fox | | | 2,285 | | | | 65 | |

Omnicom Group | | | 27,952 | | | | 2,705 | |

T-Mobile US | | | 4,060 | | | | 663 | |

Verizon Communications | | | 77,144 | | | | 3,237 | |

| | | | | | | | | |

| | | | | | | | 14,362 | |

Consumer Discretionary — 4.1% | | | | |

Amazon.com * | | | 2,019 | | | | 364 | |

AutoZone * | | | 214 | | | | 674 | |

Genuine Parts | | | 3,167 | | | | 491 | |

Grand Canyon Education * | | | 3,874 | | | | 528 | |

H&R Block | | | 22,978 | | | | 1,128 | |

McDonald's | | | 5,989 | | | | 1,689 | |

Service Corp International | | | 1,086 | | | | 81 | |

Yum! Brands | | | 2,028 | | | | 281 | |

| | | | | | | | | |

| | | | | | | | 5,236 | |

Consumer Staples — 11.0% | | | | |

Colgate-Palmolive | | | 18,077 | | | | 1,628 | |

General Mills | | | 28,343 | | | | 1,983 | |

Hershey | | | 7,085 | | | | 1,378 | |

J M Smucker | | | 13,718 | | | | 1,727 | |

Kellanova | | | 5,158 | | | | 296 | |

Mondelez International, Cl A | | | 3,697 | | | | 259 | |

Procter & Gamble | | | 21,592 | | | | 3,503 | |

Walmart | | | 55,466 | | | | 3,337 | |

| | | | | | | | | |

| | | | | | | | 14,111 | |

Energy — 3.0% | | | | |

Chevron | | | 17,953 | | | | 2,832 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Kinder Morgan | | | 45,364 | | | $ | 832 | |

Marathon Petroleum | | | 1,084 | | | | 218 | |

| | | | | | | | | |

| | | | | | | | 3,882 | |

Financials — 9.1% | | | | |

Allstate | | | 4,797 | | | | 830 | |

Berkshire Hathaway, Cl B * | | | 4,788 | | | | 2,013 | |

Chubb | | | 7,759 | | | | 2,011 | |

Loews | | | 3,910 | | | | 306 | |

Markel Group * | | | 1,027 | | | | 1,562 | |

Marsh & McLennan | | | 1,474 | | | | 304 | |

Travelers | | | 5,083 | | | | 1,170 | |

W R Berkley | | | 31,816 | | | | 2,814 | |

White Mountains Insurance Group | | | 382 | | | | 685 | |

| | | | | | | | | |

| | | | | | | | 11,695 | |

Health Care — 17.6% | | | | |

Bristol-Myers Squibb | | | 30,556 | | | | 1,657 | |

Cardinal Health | | | 25,492 | | | | 2,852 | |

Cencora | | | 6,394 | | | | 1,554 | |

Chemed | | | 553 | | | | 355 | |

CVS Health | | | 12,402 | | | | 989 | |

Gilead Sciences | | | 31,445 | | | | 2,303 | |

Johnson & Johnson | | | 22,187 | | | | 3,510 | |

McKesson | | | 5,899 | | | | 3,167 | |

Merck & Co | | | 32,723 | | | | 4,318 | |

Pfizer | | | 27,355 | | | | 759 | |

Quest Diagnostics | | | 8,517 | | | | 1,134 | |

| | | | | | | | | |

| | | | | | | | 22,598 | |

Industrials — 10.4% | | | | |

3M | | | 2,420 | | | | 257 | |

Expeditors International of Washington | | | 18,879 | | | | 2,295 | |

Genpact | | | 7,016 | | | | 231 | |

Landstar System | | | 5,366 | | | | 1,034 | |

MSC Industrial Direct, Cl A | | | 6,305 | | | | 612 | |

Republic Services, Cl A | | | 17,342 | | | | 3,320 | |

Robert Half | | | 6,108 | | | | 484 | |

Snap-on | | | 1,287 | | | | 381 | |

Verisk Analytics, Cl A | | | 9,612 | | | | 2,266 | |

Waste Management | | | 11,653 | | | | 2,484 | |

| | | | | | | | | |

| | | | | | | | 13,364 | |

Information Technology — 25.5% | | | | |

Accenture, Cl A | | | 6,037 | | | | 2,092 | |

Amdocs | | | 18,504 | | | | 1,672 | |

Amphenol, Cl A | | | 7,565 | | | | 873 | |

Apple | | | 26,440 | | | | 4,534 | |

Arrow Electronics * | | | 9,466 | | | | 1,225 | |

Avnet | | | 12,919 | | | | 641 | |

Cisco Systems | | | 56,962 | | | | 2,843 | |

Dolby Laboratories, Cl A | | | 9,227 | | | | 773 | |

Jabil | | | 2,775 | | | | 372 | |

Juniper Networks | | | 26,268 | | | | 974 | |

SEI Exchange Traded Funds

SCHEDULE OF INVESTMENTS

March 31, 2024

SEI Enhanced Low Volatility U.S. Large Cap ETF (Concluded)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Manhattan Associates * | | | 4,151 | | | $ | 1,039 | |

Microsoft | | | 19,352 | | | | 8,142 | |

Motorola Solutions | | | 787 | | | | 279 | |

Oracle | | | 33,512 | | | | 4,209 | |

Roper Technologies | | | 5,543 | | | | 3,109 | |

| | | | | | | | | |

| | | | | | | | 32,777 | |

Materials — 2.4% | | | | |

NewMarket | | | 834 | | | | 529 | |

Reliance | | | 5,797 | | | | 1,937 | |

Silgan Holdings | | | 12,762 | | | | 620 | |

| | | | | | | | | |

| | | | | | | | 3,086 | |

Utilities — 5.2% | | | | |

Atmos Energy | | | 6,344 | | | | 754 | |

CMS Energy | | | 1,120 | | | | 68 | |

Consolidated Edison | | | 27,250 | | | | 2,475 | |

DTE Energy | | | 3,703 | | | | 415 | |

Duke Energy | | | 23,002 | | | | 2,224 | |

National Fuel Gas | | | 12,619 | | | | 678 | |

| | | | | | | | | |

| | | | | | | | 6,614 | |

Total Common Stock | | | | | | | | |

(Cost $121,063) ($ Thousands) | | | | | | | 127,725 | |

Total Investments in Securities — 99.5% | | | | | | | | |

(Cost $121,063) ($ Thousands) | | $ | 127,725 | |

| | | | | | | | | |

| | | | | | | | | |

| Percentages are based on Net Assets of $128,408 ($ Thousands). |

* | Non-income producing security. |

†† | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

As of March 31, 2024, all of the Fund's investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

See “Glossary” for abbreviations.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

Glossary: (abbreviations which may be used in the preceding Schedules of Investments)

Portfolio Abbreviations |

Cl — Class |

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

STATEMENTS OF ASSETS AND LIABILITIES ($ Thousands)

March 31, 2024

| | | SEI Enhanced U.S. Large Cap Quality Factor ETF | | | SEI Enhanced U.S. Large Cap Momentum Factor ETF | | | SEI Enhanced U.S. Large Cap Value Factor ETF | | | SEI Enhanced Low Volatility U.S. Large Cap ETF | |

Assets: | | | | | | | | | | | | | | | | |

Investments, at value† | | $ | 224,615 | | | $ | 460,649 | | | $ | 464,471 | | | $ | 127,725 | |

Cash | | | 979 | | | | 1,642 | | | | 2,045 | | | | 582 | |

Dividends receivable | | | 253 | | | | 148 | | | | 553 | | | | 116 | |

Receivable for fund shares sold | | | — | | | | — | | | | — | | | | 1,388 | |

Foreign tax reclaim receivable | | | — | | | | 4 | | | | — | | | | 1 | |

Total Assets | | | 225,847 | | | | 462,443 | | | | 467,069 | | | | 129,812 | |

Liabilities: | | | | | | | | | | | | | | | | |

Investment advisory fees payable | | | 28 | | | | 58 | | | | 58 | | | | 16 | |

Payable for investment securities purchased | | | — | | | | — | | | | — | | | | 1,388 | |

Total Liabilities | | | 28 | | | | 58 | | | | 58 | | | | 1,404 | |

Net Assets | | $ | 225,819 | | | $ | 462,385 | | | $ | 467,011 | | | $ | 128,408 | |

† Cost of investments | | $ | 216,105 | | | $ | 425,056 | | | $ | 423,111 | | | $ | 121,063 | |

Net Assets: | | | | | | | | | | | | | | | | |

Paid-in capital — (unlimited authorization — no par value) | | $ | 217,327 | | | $ | 429,195 | | | $ | 426,172 | | | $ | 122,016 | |

Total distributable earnings | | | 8,492 | | | | 33,190 | | | | 40,839 | | | | 6,392 | |

Net Assets | | $ | 225,819 | | | $ | 462,385 | | | $ | 467,011 | | | $ | 128,408 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 32.15 | | | $ | 32.11 | | | $ | 30.98 | | | $ | 27.76 | |

| | | | ($225,818,927 ÷ 7,025,000 shares | ) | | | ($462,384,551 ÷ 14,400,000 shares | ) | | | ($467,010,757 ÷ 15,075,000 shares | ) | | | ($128,407,955 ÷ 4,625,000 shares | ) |

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

STATEMENTS OF OPERATIONS ($ Thousands)

For the year ended March 31, 2024

| | | SEI Enhanced U.S. Large Cap Quality Factor ETF | | | SEI Enhanced U.S. Large Cap Momentum Factor ETF | | | SEI Enhanced U.S. Large Cap Value Factor ETF | | | SEI Enhanced Low Volatility U.S. Large Cap ETF | |

Investment income: | | | | | | | | | | | | | | | | |

Dividends | | $ | 670 | | | $ | 680 | | | $ | 2,069 | | | $ | 644 | |

Total investment income | | | 670 | | | | 680 | | | | 2,069 | | | | 644 | |

Expenses: | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 63 | | | | 120 | | | | 120 | | | | 44 | |

Trustee fees | | | — | | | | 1 | | | | 1 | | | | — | |

Total expenses | | | 63 | | | | 121 | | | | 121 | | | | 44 | |

Net investment income | | | 607 | | | | 559 | | | | 1,948 | | | | 600 | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

Investments(1) | | | 773 | | | | (1,702 | ) | | | 695 | | | | 755 | |

Net realized gain (loss) | | | 773 | | | | (1,702 | ) | | | 695 | | | | 755 | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments | | | 7,479 | | | | 34,409 | | | | 41,526 | | | | 6,305 | |

Net change in unrealized appreciation | | | 7,479 | | | | 34,409 | | | | 41,526 | | | | 6,305 | |

Net realized and unrealized gain | | | 8,252 | | | | 32,707 | | | | 42,221 | | | | 7,060 | |

Net increase in net assets resulting from operations | | $ | 8,859 | | | $ | 33,266 | | | $ | 44,169 | | | $ | 7,660 | |

(1) Includes realized gains (losses) as a result of in-kind redemptions (see Note 4 in Notes to Financial Statements). Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

SEI Exchange Traded Funds

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands)

For the year ended March 31, 2024 and the period ended March 31, 2023

| | | SEI Enhanced U.S. Large Cap Quality Factor ETF | |

| | | | 4/1/2023 to

3/31/2024 | | | | 5/18/2022(1) to

3/31/2023 | |

Operations: | | | | | | | | |

Net investment income | | $ | 607 | | | $ | 114 | |

Net realized gain (loss) | | | 773 | | | | (96 | ) |

Net change in unrealized appreciation (depreciation) | | | 7,479 | | | | 1,031 | |

Net increase in net assets resulting from operations | | | 8,859 | | | | 1,049 | |

Distributions | | | (184 | ) | | | (75 | ) |

Capital share transactions: | | | | | | | | |

Proceeds from shares issued | | | 212,940 | | | | 14,549 | |

Cost of shares redeemed | | | (9,389 | ) | | | (1,930 | ) |

Net increase in net assets derived from capital share transactions | | | 203,551 | | | | 12,619 | |

Net increase in net assets | | | 212,226 | | | | 13,593 | |

Net assets: | | | | | | | | |

Beginning of year/period | | | 13,593 | | | | — | |

End of year/period | | $ | 225,819 | | | $ | 13,593 | |

Share Transactions: | | | | | | | | |

Shares issued | | | 6,825 | | | | 575 | |

Shares redeemed | | | (300 | ) | | | (75 | ) |

Increase in net assets derived from share transactions | | | 6,525 | | | | 500 | |

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

SEI Exchange Traded Funds

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands)

For the year ended March 31, 2024 and the period ended March 31, 2023

| | | SEI Enhanced U.S. Large Cap Momentum Factor ETF | |

| | | | 4/1/2023 to

3/31/2024 | | | | 5/18/2022(1) to

3/31/2023 | |

Operations: | | | | | | | | |

Net investment income | | $ | 559 | | | $ | 254 | |

Net realized loss | | | (1,702 | ) | | | (430 | ) |

Net change in unrealized appreciation (depreciation) | | | 34,409 | | | | 1,184 | |

Net increase in net assets resulting from operations | | | 33,266 | | | | 1,008 | |

Distributions | | | (238 | ) | | | (192 | ) |

Capital share transactions: | | | | | | | | |

Proceeds from shares issued | | | 409,639 | | | | 25,408 | |

Cost of shares redeemed | | | (1,329 | ) | | | (5,177 | ) |

Net increase in net assets derived from capital share transactions | | | 408,310 | | | | 20,231 | |

Net increase in net assets | | | 441,338 | | | | 21,047 | |

Net assets: | | | | | | | | |

Beginning of year/period | | | 21,047 | | | | — | |

End of year/period | | $ | 462,385 | | | $ | 21,047 | |

Share Transactions: | | | | | | | | |

Shares issued | | | 13,625 | | | | 1,025 | |

Shares redeemed | | | (50 | ) | | | (200 | ) |

Increase (decrease) in net assets derived from share transactions | | | 13,575 | | | | 825 | |

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

SEI Exchange Traded Funds

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands) (Concluded)

For the year ended March 31, 2024 and the period ended March 31, 2023

| | | SEI Enhanced U.S. Large Cap Value Factor ETF | |

| | | | 4/1/2023 to

3/31/2024 | | | | 5/18/2022(1) to

3/31/2023 | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,948 | | | $ | 411 | |

Net realized gain (loss) | | | 695 | | | | (142 | ) |

Net change in unrealized appreciation (depreciation) | | | 41,526 | | | | (166 | ) |

Net increase in net assets resulting from operations | | | 44,169 | | | | 103 | |

Distributions | | | (593 | ) | | | (281 | ) |

Capital share transactions: | | | | | | | | |

Proceeds from shares issued | | | 423,105 | | | | 25,113 | |

Cost of shares redeemed | | | (20,214 | ) | | | (4,391 | ) |

Net increase in net assets derived from capital share transactions | | | 402,891 | | | | 20,722 | |

Net increase in net assets | | | 446,467 | | | | 20,544 | |

Net assets: | | | | | | | | |

Beginning of year/period | | | 20,544 | | | | — | |

End of year/period | | $ | 467,011 | | | $ | 20,544 | |

Share Transactions: | | | | | | | | |

Shares issued | | | 14,925 | | | | 1,025 | |

Shares redeemed | | | (700 | ) | | | (175 | ) |

Increase (decrease) in net assets derived from share transactions | | | 14,225 | | | | 850 | |

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

SEI Exchange Traded Funds

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands)

For the year ended March 31, 2024 and the period ended March 31, 2023

| | | SEI Enhanced Low Volatility U.S. Large Cap ETF | |

| | | | 4/1/2023 to

3/31/2024 | | | | 5/18/2022(1) to

3/31/2023 | |

Operations: | | | | | | | | |

Net investment income | | $ | 600 | | | $ | 205 | |

Net realized gain (loss) | | | 755 | | | | (112 | ) |

Net change in unrealized appreciation (depreciation) | | | 6,305 | | | | 357 | |

Net increase in net assets resulting from operations | | | 7,660 | | | | 450 | |

Distributions | | | (263 | ) | | | (139 | ) |

Capital share transactions: | | | | | | | | |

Proceeds from shares issued | | | 118,168 | | | | 13,574 | |

Cost of shares redeemed | | | (9,134 | ) | | | (1,908 | ) |

Net increase in net assets derived from capital share transactions | | | 109,034 | | | | 11,666 | |

Net increase in net assets | | | 116,431 | | | | 11,977 | |

Net assets: | | | | | | | | |

Beginning of year/period | | | 11,977 | | | | — | |

End of year/period | | $ | 128,408 | | | $ | 11,977 | |

Share Transactions: | | | | | | | | |

Shares issued | | | 4,500 | | | | 550 | |

Shares redeemed | | | (350 | ) | | | (75 | ) |

Increase (decrease) in net assets derived from share transactions | | | 4,150 | | | | 475 | |

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

SEI Exchange Traded Funds

FINANCIAL HIGHLIGHTS

For the year ended March 31, 2024 and the period ended March 31, 2023.

For a Share Outstanding Throughout Each Year/Period

| | | | Net asset value, beginning of year | | | Net

investment

income(1) | | | Net realized and unrealized gains (losses) on securities | | | Total from

operations | | | Distributions from net investment income | | | Distributions from realized gains | | | Total dividends

and distributions | | | | Net asset value,

end of year | | | Total Return† | | | Net assets,

end of year

($ Thousands) | | | Ratio of

net expenses

to average

net assets | | | Ratio of expenses to average net assets (excluding waivers and reimbursements) | | | Ratio of net investment income to average net assets | | | Portfolio turnover† | |