Exhibit 99.1

The Gateway to Bitcoin Financial Services July 2024 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc

Strictly Private & Confidential. Do Not Distribute. © Fold, Inc 2 [ ] Disclaimer About this Presentation This investor presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist int erested parties in making their own evaluation with respect to a potential business combination (the “Business Combination”) bet ween Fold Inc. (the “Company”) and FTAC Emerald Acquisition Corp. (“Emerald”) and related transactions and for no other purpose. The information con tained herein does not purport to be all - inclusive and none of Emerald, the Company or their respective representatives or a ffi liates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation does not constitute ( i ) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchas e a ny securities. No such offering of securities shall be made except by means of a prospectus meeting the requirements of secti on 10 of the Securities Act of 1933, as amended, or an exemption therefrom. You should not construe the contents of this Presentation as legal, tax, account ing or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and r el ated matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the in for mation contained herein to make any decision. The distribution of this Presentation may also be restricted by law and persons in to whose possession this Presentation comes should inform themselves about and observe any such restrictions. The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a compa ny from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securitie s Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will ne ither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Ex cha nge Act, including, without limitation, Rule 10b - 5 thereunder. This Presentation and information contained herein constitutes confidential informatio n and is provided to you on the condition that you agree that you will hold it in strict confidence and not reproduce, disclos e, forward or distribute it in whole or in part without the prior written consent of the Company and is intended for the recipient hereof only. Forward Looking Statements This Presentation contains certain forward - looking statements within the meaning of the federal securities laws with respect to the proposed Business Combination. Forward - looking statements generally relate to future events or the Company’s future financial or operating performance. For example, statements regarding anticipated growth in the industry in which the Company operates and anticipat ed growth in demand for the Company’s products and services, the satisfaction of closing conditions to the Business Combination and the timing of the completion of the Business Combination are forward - looking statements. In some cases, you can identify forward - looking state ments by terminology such as “pro forma”, “may”, “should”, “could”, “might”, “plan”, “possible”, “project”, “strive”, “budget ”, “forecast”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of th ese terms or variations of them or similar terminology. Such forward - looking statements are subject to risks, uncertainties, and ot her factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward - looking st atements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, as the ca se may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are n ot limited to: competition, the ability of the Company to grow and manage growth, maintain relationships with customers and reta in its management and key employees; costs related to the Business Combination; changes in applicable laws or regulations; the possibility that the Co mpany may be adversely affected by other economic, business or competitive factors; the Company’s estimates of expenses and p rofi tability; the evolution of the markets in which the Company competes; the ability of the Company to implement its strategic initiatives and co ntinue to innovate its existing products and services. Nothing in this Presentation should be regarded as a representation by an y person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking sta tements will be achieved. You should not place undue reliance on forward - looking statements, which speak only as of the date the y are made. The Company undertakes no duty to update these forward - looking statements. Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X. Such infor mation and data may not be included in, may be adjusted in or may be presented differently in the registration statement to b e fi led relating to the Business Combination and the proxy statement/prospectus contained therein. Industry and Market Data In this Presentation, the Company relies on and refer to certain information and statistics obtained from third - party sources wh ich the Company believes to be reliable. The Company has not independently verified the accuracy or completeness of any such t hir d - party information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the propert y o f their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the ri ghts of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Important Information for Investors and Stockholders This Presentation relates to a proposed transaction between Emerald and the Company. This Presentation does not constitute an of fer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of s ecu rities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any suc h jurisdiction. Emerald intends to file a registration statement on Form S - 4 with the U.S. Securities and Exchange Commission (t he “SEC”), which will include a document that serves as a prospectus and proxy statement of Emerald, referred to as a proxy statement/prospectus. A pr oxy statement/prospectus will be sent to all Emerald stockholders. Emerald also will file other documents regarding the propo sed Business Combination with the SEC. Before making any voting decision, investors and security holders of Emerald are urged to read the reg istration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed Business Combination as they become available because they will contain important information about the proposed Bus ine ss Combination. Investors and security holders will be able to obtain free copies of the registration statement, the proxy st ate ment/prospectus and all other relevant documents filed or that will be filed with the SEC by Emerald through the website maintained by the SE C a t www.sec.gov. Participants in the Solicitation Emerald and the Company and their respective directors and executive officers may be deemed to be participants in the solicit ati on of proxies from Emerald’s stockholders in connection with the proposed Business Combination. A list of the names of the di rec tors and executive officers of Emerald and information regarding their interest in the Business Combination will be contained in the proxy state men t/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, soli cit ation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction.

3 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Sponsor Overview | Industry Leading Sponsors, Backed by a Prominent Team 1) Return on units based on acquisition consideration paid by First Data of $15.00 per share of CCN common stock and $3.99 per C CN warrant (assumes warrants were issued within 30 days of acquisition closing), per tender offer statements filed by CCN and First Data with the SEC on 06.07.2020 2) Return based on IMXI common stock closing price as of 07.17.2024. For each whole warrant, reflects 0.201 shares of IMXI commo n s tock and $1.12 in cash issued to warrant holders pursuant to IMXI’s Offer to Exchange Warrants filed on Form S - 4 with the SEC on 3.28.2019 3) Return based on PWP common stock closing price as of 07.17.2024 +90% return 1 From IPO to sale to First Data in July 2017 +108% return 2 Since IPO $250mm+ Upsized PIPE $300mm Upsized PIPE +84% return 3 Since IPO Select Portfolio Companies Experienced Team Summary Brace Young CEO & President, FTAC Emerald Betsy Cohen Chairman of the Board, FTAC Emerald Amanda Abrams CEO, Cohen Circle Daniel Cohen Co - Founder, Cohen Circle Impressive Track Record Strong reputation with institutions for partnering with quality companies Experienced Team Operational & financial expertise with an investor lens to complement Fold Leader in the SPAC Market A pioneer in the evolution of the SPAC structure & unlocking significant value Strong Strategic Partner Sponsor team brings deep expertise in payments & financial services

4 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Introductions Today’s Presenters Will Reeves CEO & Co - Founder Wolfe Repass VP of Finance Jonathan Kirkwood Co - Founder, Ten31

5 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc 3 9 25 59 115 210 354 465 596 760 923 1,071 1,241 7 10 20 39 72 116 180 272 389 490 647 758 889 Bitcoin Users Internet Users 2011 1992 2012 1993 2013 1994 2014 1995 2015 1996 2016 1997 2017 1998 2018 1999 2019 2000 2020 2001 2021 2002 2022 2003 2023 2004 Bitcoin Overview A Fast - Growing Brand & Rapid Adoption Trends The internet launched in 1983, while bitcoin, introduced in 2009, has shown a notably faster adoption rate. Comparing adoption across their existence highlights bitcoin's accelerated growth Among the Best Performing Assets of Last Decade 1 1,400%+ Since January 2019 2 Bitcoin vs the Internet Adoption: Total customers (Millions) 3 1) Forbes, bitcoin Price History 2009 to 2022, 04.16.2024 2) Market data from 01.01.2019 to 07.15.2024 3) Our World In Data, Glassnode . Total number of bitcoin addresses used as proxy for the number of bitcoin users

6 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Company Overview Fold is a Gateway to Bitcoin - Based Financial Services for an Expanding Network 1,000+ Bitcoin Holdings 3 2019 Year Founded Company Highlights Strategic Partners $50M+ In Monthly Volume 574K Accounts Created $2B+ In Total Volume $40M+ Rewards Distributed $9.44 Customer Acquisition Cost Customer Highlights 4 64% Customers Want Bitcoin Financial Services #1 Bitcoin Rewards Card 1 Top 6 Public Bitcoin Treasury 2 1) Forbes, Best Crypto Rewards Cards of July 2024 2) Bitcoin holdings as of 07.19.2024. Excludes bitcoin mining companies and exchanges 3) Bitcoin holdings as of 07.19.2024 4) Based on historical company data & customer surveys from 2022 – 2024. Period of data collection may vary across the different st atistics

7 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Products Overview Fold’s Current Product Offerings Insured Bitcoin Custody & Trading □ Buy bitcoin with zero fees □ Withdraw bitcoin instantly □ Set amount to buy daily, weekly, or monthly □ Bitcoin purchases via Round - Ups on every Fold Card transaction ` ` Rewards Network □ Bitcoin rewards on all transactions □ Expansive merchant rewards network □ Customers can win up to 1 full bitcoin per spending transaction □ Up to 20% bitcoin rewards at 100M+ top merchants Debit Card & FDIC Cash Account □ Visa Prepaid Debit Card for spending and bitcoin rewards □ Checking Account (FDIC) for direct deposit & bills □ Up to 1.5% back in bitcoin on top spending categories, mortgage, rent and bills □ ~2x higher rewards than the leading cash back debit card

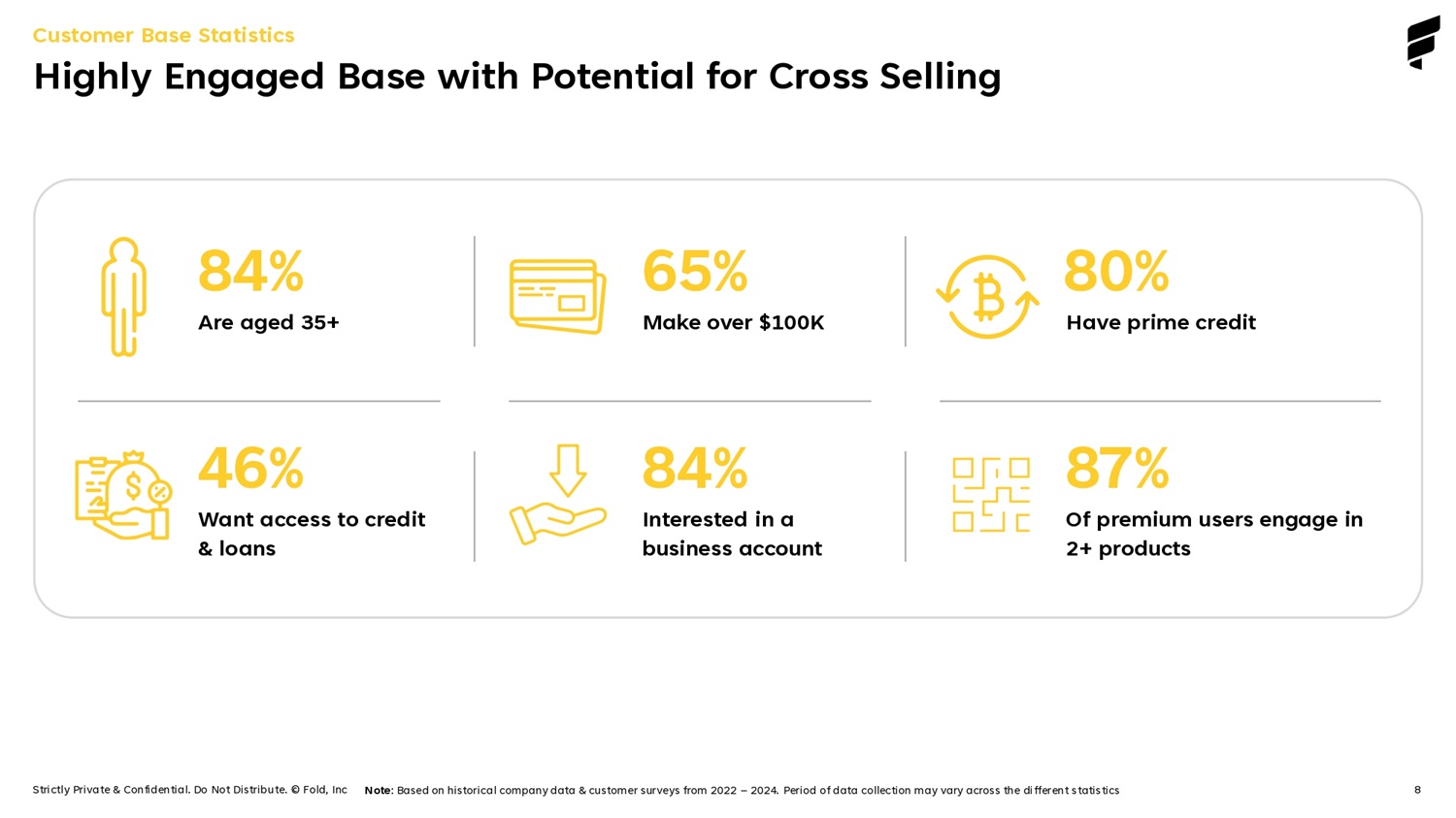

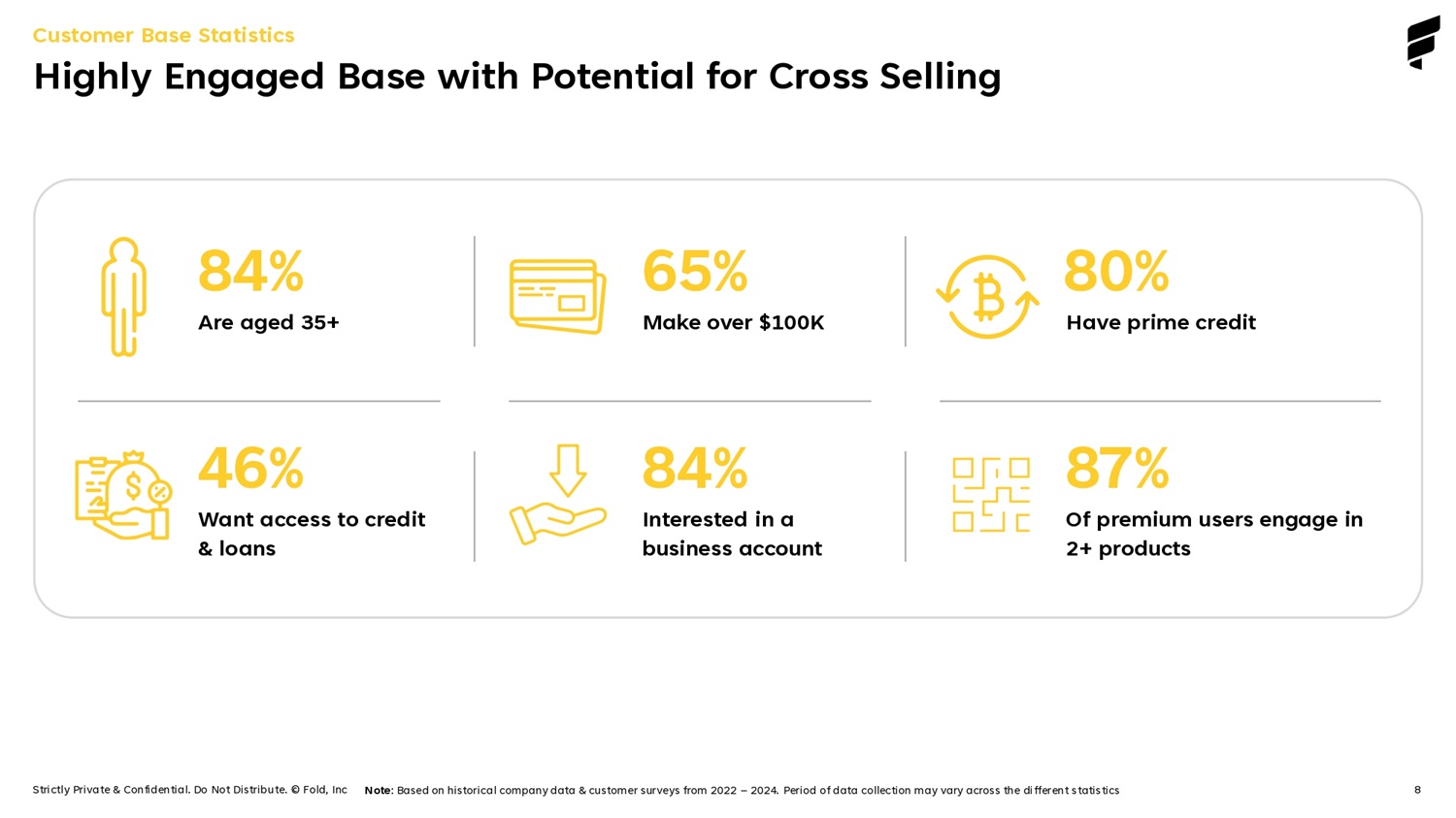

8 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Customer Base Statistics Highly Engaged Base with Potential for Cross Selling 84% Are aged 35+ 46% Want access to credit & loans 65% Make over $100K 84% Interested in a business account 80% Have prime credit 87% Of premium users engage in 2+ products Note : Based on historical company data & customer surveys from 2022 – 2024. Period of data collection may vary across the different statistics

9 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Product Roadmap Comprehensive Financial Services Driven by High Customer Engagement Merchant Rewards Banking & Debit Card Custody & Trading Credit Card Loans Business Accounts Strong Customer Involvement 1 Bill Pay 1) Based on historical company data & customer surveys from 2022 – 2024 Deep Customer Penetration

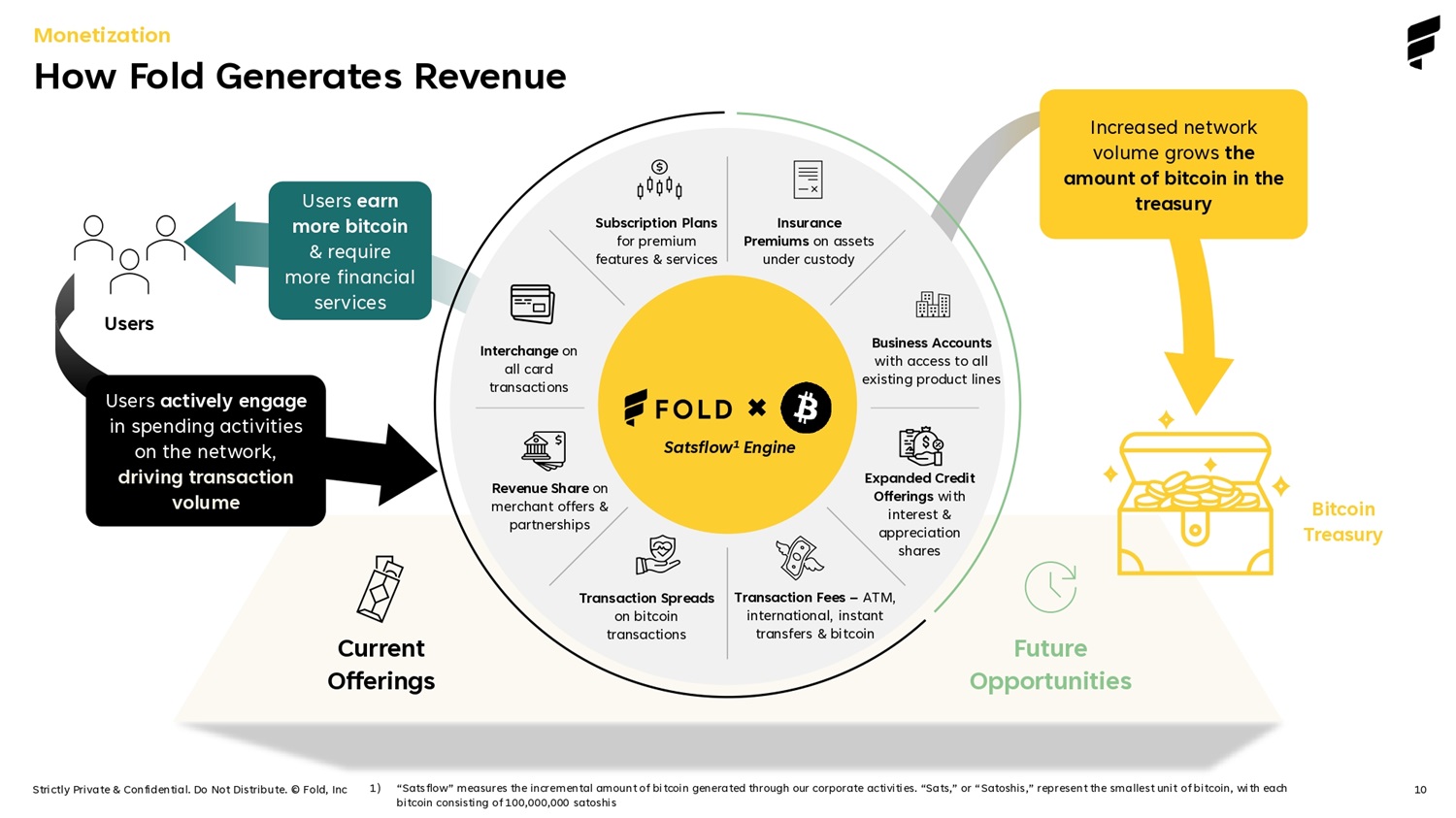

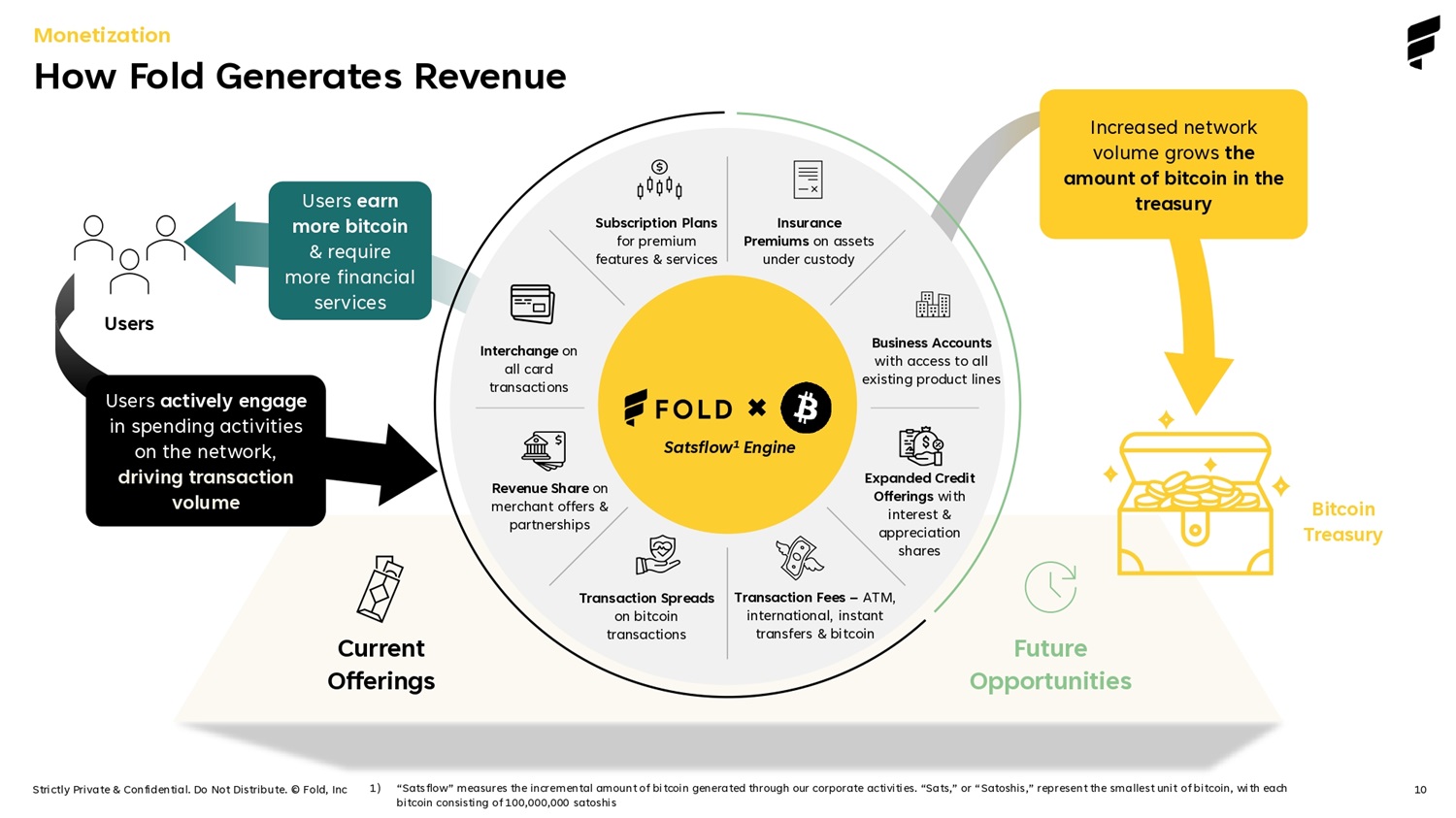

10 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Monetization How Fold Generates Revenue Users Current Offerings Future Opportunities Increased network volume grows the amount of bitcoin in the treasury Interchange on all card transactions Revenue share on merchant offers & partnerships Transaction spreads on Bitcoin transactions Subscription plans for premium features & services Transaction Fees – ATM, International, Instant Transfers & Bitcoin Expanded Credit offerings with interest and appreciation shares Insurance Premiums on Assets under custody Business Accounts with access to all existing product lines Users earn more bitcoin & require more financial services Users actively engage in spending activities on the network, driving transaction volume Bitcoin Treasury Interchange on all card transactions Revenue Share on merchant offers & partnerships Transaction Spreads on bitcoin transactions Transaction Fees – ATM, i nternational, instant t ransfers & bitcoin Expanded Cr edit Offerings with interest & appreciation shares Insurance Premiums on assets under custody Business Accounts with access to all existing product lines 1) “ Satsflow ” measures the incremental amount of bitcoin generated through our corporate activities. “Sats,” or “ Satoshis ,” represent the smallest unit of bitcoin, with each bitcoin consisting of 100,000,000 satoshis Subscription Plans for premium features & services Satsflow 1 Engine

Bitcoin as a Treasury Reserve Asset Fold has Amassed 1,000+ Bitcoin in Our Corporate Treasury Bitcoin is an Additional Lever to Accrue Value Fold is tracking to be the first publicly traded pure play bitcoin financial services company 1) Yahoo Finance, Top 20 companies with the most cash reserves, 02.16.2024 2) Per b itcoin whitepaper the total supply of bitcoin is limited to 21 million and per Certified EO there are 33 million total U.S co mpa nies . The total number of companies that can own 1K bitcoin would be (21 million / 1000) / 33 million or <0.1% of total U.S companies 3) Data as of 07.19.2024 11 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc x US public companies have $6.9 trillion in cash reserves 1 . Yet only <0.1% of US companies can o wn 1K+ bitcoin on balance sheet due to supply limitations 2 x Fold plans to be the first public company to debut with 1,000+ bitcoin treasury 3 x MicroStrategy is up 1,100%+ over last 5 years, outperforming bitcoin by ~2x 3

12 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Customer Benefits Promoting Access to Value Appreciation for Fold's Customers 50% of Americans have no savings or less savings than prior years . 1 Fold democratizes wealth creation by aiming to make bitcoin accessible to everyone. Since Q3’19, our b itcoin rewards have outpaced inflation and typical credit card perks 54% of bitcoin ecosystem is powered by renewable energy sources . 2 Fold seeks to be a fintech leader by spearheading efforts in clean energy adoption within the bitcoin ecosystem 60% of Americans believe the American Dream is no longer possible . 3 Every purchase empowers customers to take ownership of their financial future and reinvigorate the American dream Q3 Note : Graph shows relative value of cash rewards versus bitcoin rewards using the aggregate Fold rewards as a case study 1) Nasdaq, Americans Do Not Have Enough Savings, 01.02.2023 2) Yahoo Finance, Bitcoin mining’s green mile, 01.18.2024 3) House.gov, No Wonder 59% Say American Dream Is Out Of Reach, 07.10.2014 $20.1M $43.5M 2019 2020 2021 2022 2023 2024 Cash Value of Rewards BTC Value of Rewards 116%+ Value of Fold’s Bitcoin Rewards Compared to Cash Rewards

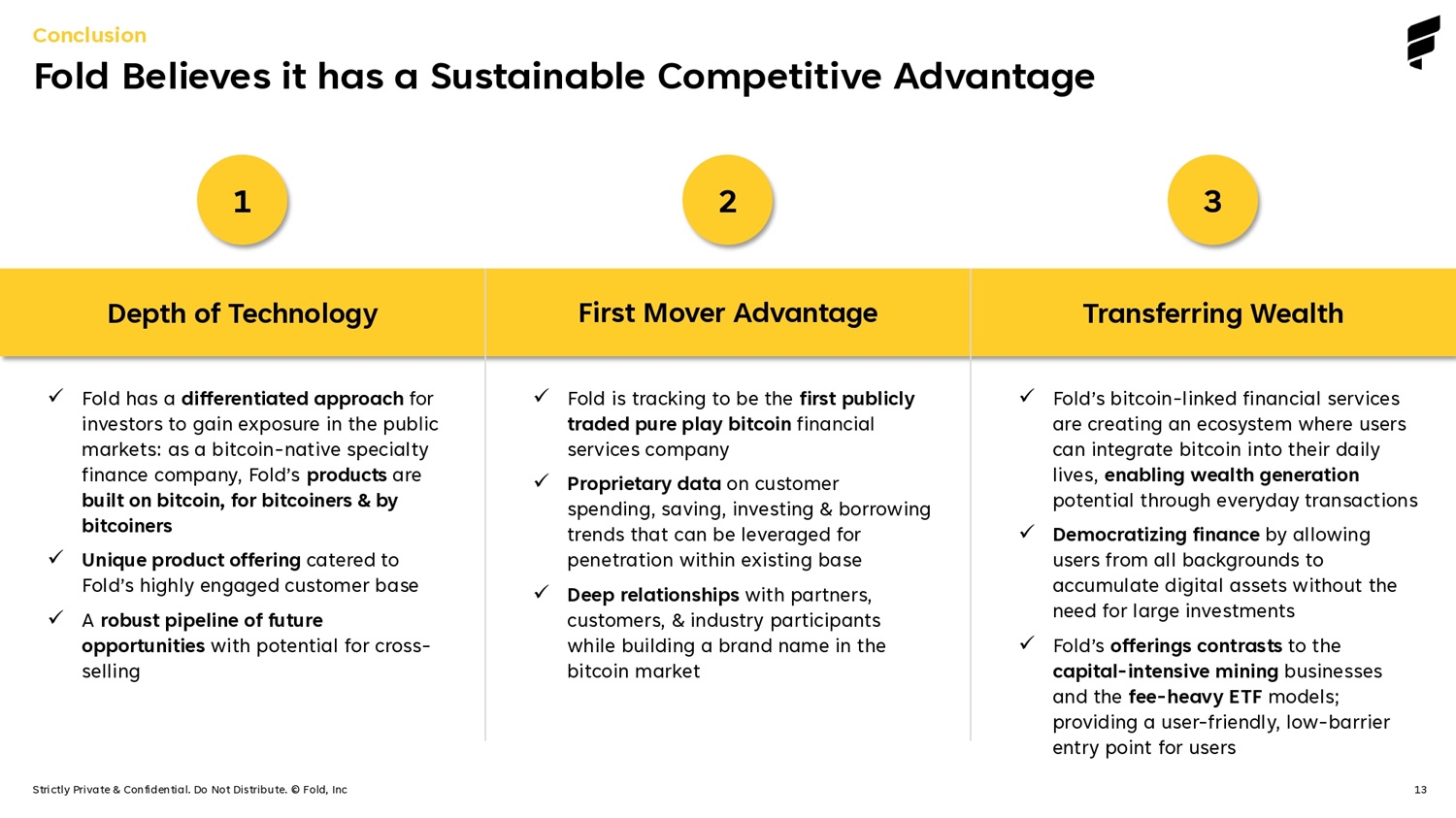

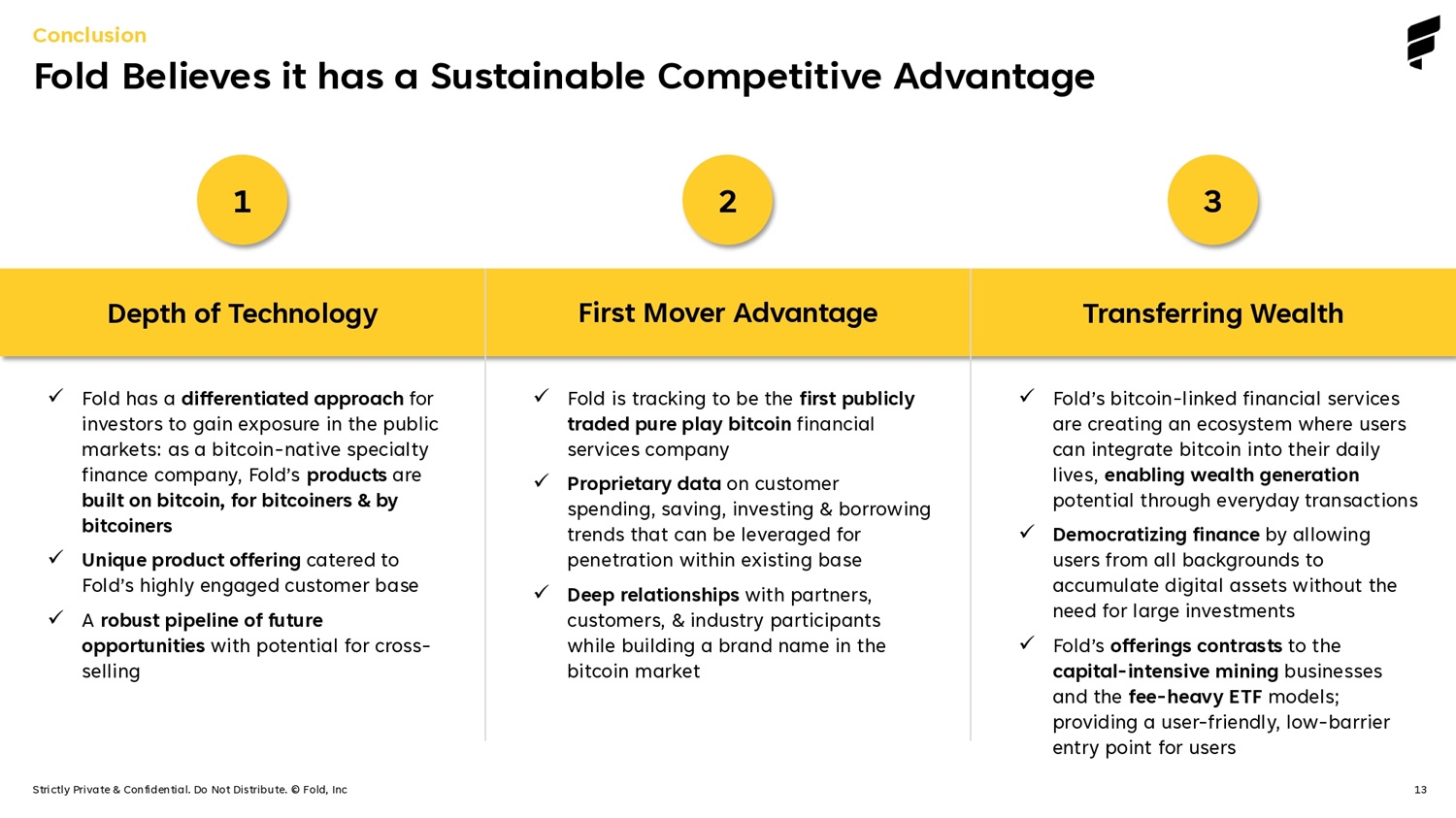

13 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Conclusion Fold Believes it has a Sustainable Competitive Advantage First Mover Advantage Depth of Technology Transferring Wealth x Fold is tracking to be the first publicly traded pure play bitcoin financial services company x Proprietary data on customer spending, saving, investing & borrowing trends that can be leveraged for penetration within existing base x Deep relationships with partners, customers, & industry participants while building a brand name in the bitcoin market x Fold has a differentiated approach for investors to gain exposure in the public markets: as a bitcoin - native specialty finance company, Fold’s products are built on bitcoin, for bitcoiners & by bitcoiners x Unique product offering catered to Fold’s highly engaged customer base x A robust pipeline of future opportunities with potential for cross - selling x Fold’s bitcoin - linked financial services are creating an ecosystem where users can integrate bitcoin into their daily lives, enabling wealth generation potential through everyday transactions x Democratizing finance by allowing users from all backgrounds to accumulate digital assets without the need for large investments x Fold’s offerings contrasts to the capital - intensive mining businesses and the fee - heavy ETF models; providing a user - friendly, low - barrier entry point for users 1 2 3

14 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Illustrative Transaction Summary Capitalization (in $M except for share data) $493.8 Implied Market Capitalization 1 $(112.5) ( - ) Net Cash / Bitcoin $381.3 Enterprise Value Key Highlights $M Sources $365 Fold Rollover Equity 20 Cash in Trust 2 25 PIPE 3 $410 Total Sources Sources and Uses $M Uses $365 Equity to Fold Shareholders 32.5 Cash to Balance Sheet 12.5 Transaction Expenses 4 $410 Total Uses Pro Forma Ownership 2,3 Pro Forma Valuation 7 • $381M enterprise value 7 • Implied pre - money equity value of $365M 7 • Implied pro forma equity value of $494M • $113M of cash held on the pro forma balance sheet • Including $80M held as bitcoin on the pro forma balance sheet at close • Fold shareholders are rolling 100% of their equity and will own ~71.2% of the combined company Fold Rollover Equity PIPE Public Shareholders Sponsor Shares 5 Private Placement Shares Extension Shares 6 1) Implied market capitalization and pro forma ownership are based on $10.72 per share. Actual per share price to be based on redemption value in final S - 4. Includes 3,545,094 million founder shares and 976,081 private placement shares. Excludes the 1,772,547 founder shares that are locked up until the earlier of 90 days following closing or stock price closing above $17.00, for 20 out of 30 consecutive trading days during the 10 years following closing. Excludes the dilutive impact of warrants, management equity plan and employee stock purchase plan. 2) Assumes 60% redemptions from ~$50M cash in trust. SPAC cash amount subject to change depending on actual redemption levels and interest earned in trust 3) Assumes $25M PIPE raised at $10.72 estimated share price 4) Reflects an estimate of transaction expenses; actual transaction expenses may vary 5) 1/3rd of Sponsor Shares are locked up until earlier of $12.00 or 6 months; 1/3rd of Sponsor Shares are locked up until earlie r o f $15.00 or 2 years; 1/3 rd of Sponsor Shares are locked up until earlier of $17.00 or 10 years. For all tranches, the applicable 30 - day trading period must end at least 90 days following the closing 6) Reflects sponsor shares allocated to certain SPAC investors in September 2023 and January 2024 to extend the lifespan of the SPA C 7) The transaction contains an adjustment in respect of BTC price movement, generally as follows: If the 60 - day VWAP of Bitcoin as of the day immediately prior to the Closing Date is equal to or greater than $90,000, the pre - money equity value shall be increased by an amount equal to: (A) (1) 20% multiplied by (2) the product of (x) 1001 (representing the number of bitcoins in treasury at si gning) multiplied by (y) the 60 - day VWAP of Bitcoin immediately prior to Closing, less (B) an amount equal (x) 1001 multiplied by (y) the 60 - day VWAP of Bitcoin immediately prior to signing. Such adjustment ( i ) is subject to a cap on the total amount of the adjustment and (ii) subject to adjustment in the event any treasury BTC are sold between signing and closing 71.2% 4.9% 3.9% 11.1% 2.0% 6.9%

[ ] Appendix

16 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Management Team Visionary Leadership for Fold’s Next Growth Phase Nikki Gonclaves VP of Risk and Compliance • 10+ years of experience in Fraud & Risk and Compliance across TradFi and DeFi • Built out global GRC policies and procedures for Metallicus Sean McGowan Controller • CPA with 10+ years experience in public and private accounting & finance roles • Supported Robinhood through its IPO as an accounting manager • Spent 5 years at PwC working on publicly traded Fortune 500 clients Ammaarah Khan Senior Product Manager • Served as a product manager at J.P Morgan & Notables – a white label NFT marketplace • Facilitated Goldman Sachs branching into consumer business via Marcus Will Reeves CEO & Co - Founder • Extensive background across payments, blockchain & venture • Previously, Head of Payments at Thesis & a Venture Lead at A3 Ventures Tom Dickman CTO • Deep technical background that spans across industries and verticals • Worked in software engineering roles at both RetailMeNot & Northrop Grumman Wolfe Repass VP of Finance • CPA with 15+ years experience in public and private accounting & finance roles • Spent 10 years at PwC focused on Fortune 250 SEC filers • Established all finance and accounting processes at Fold

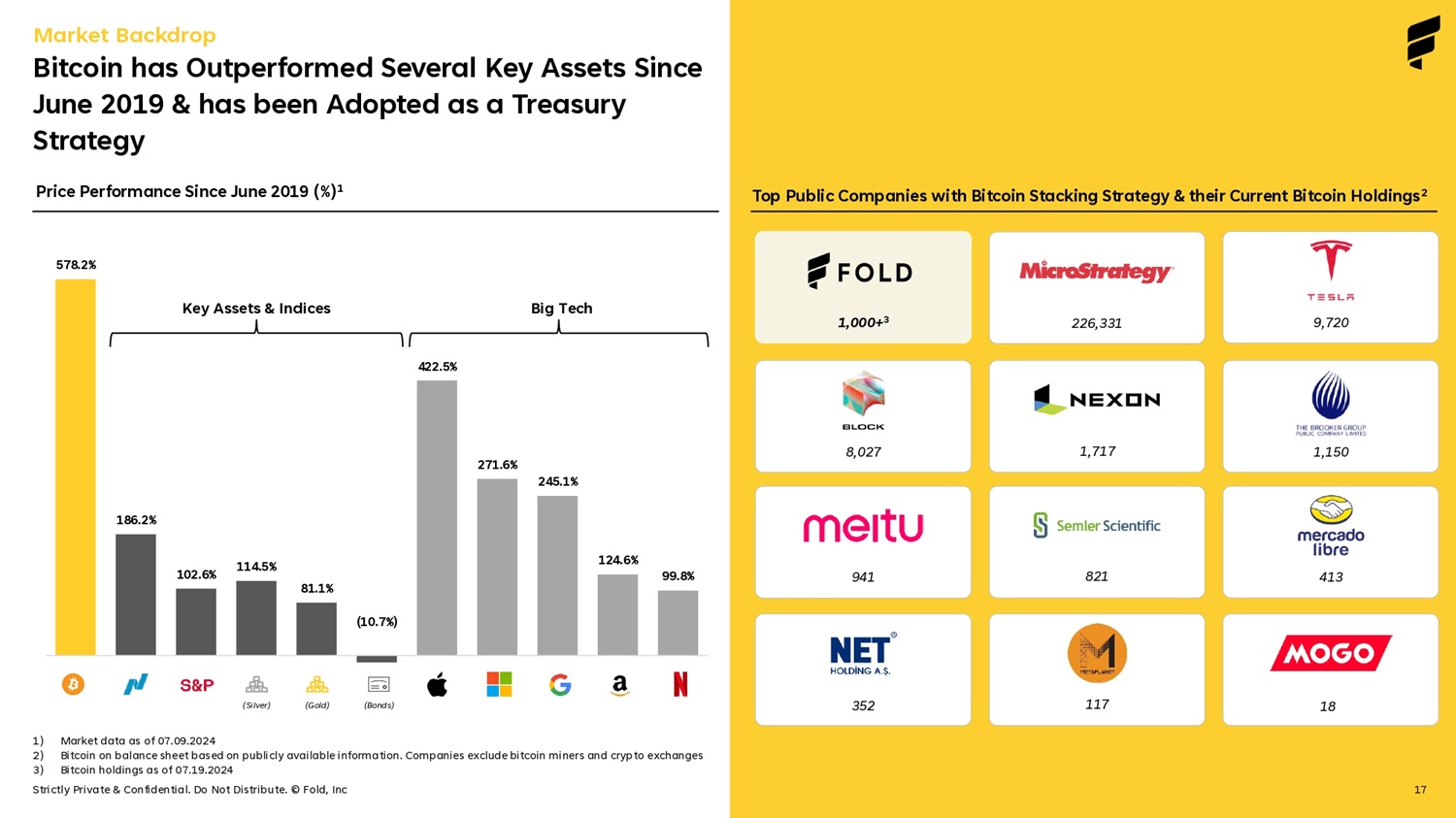

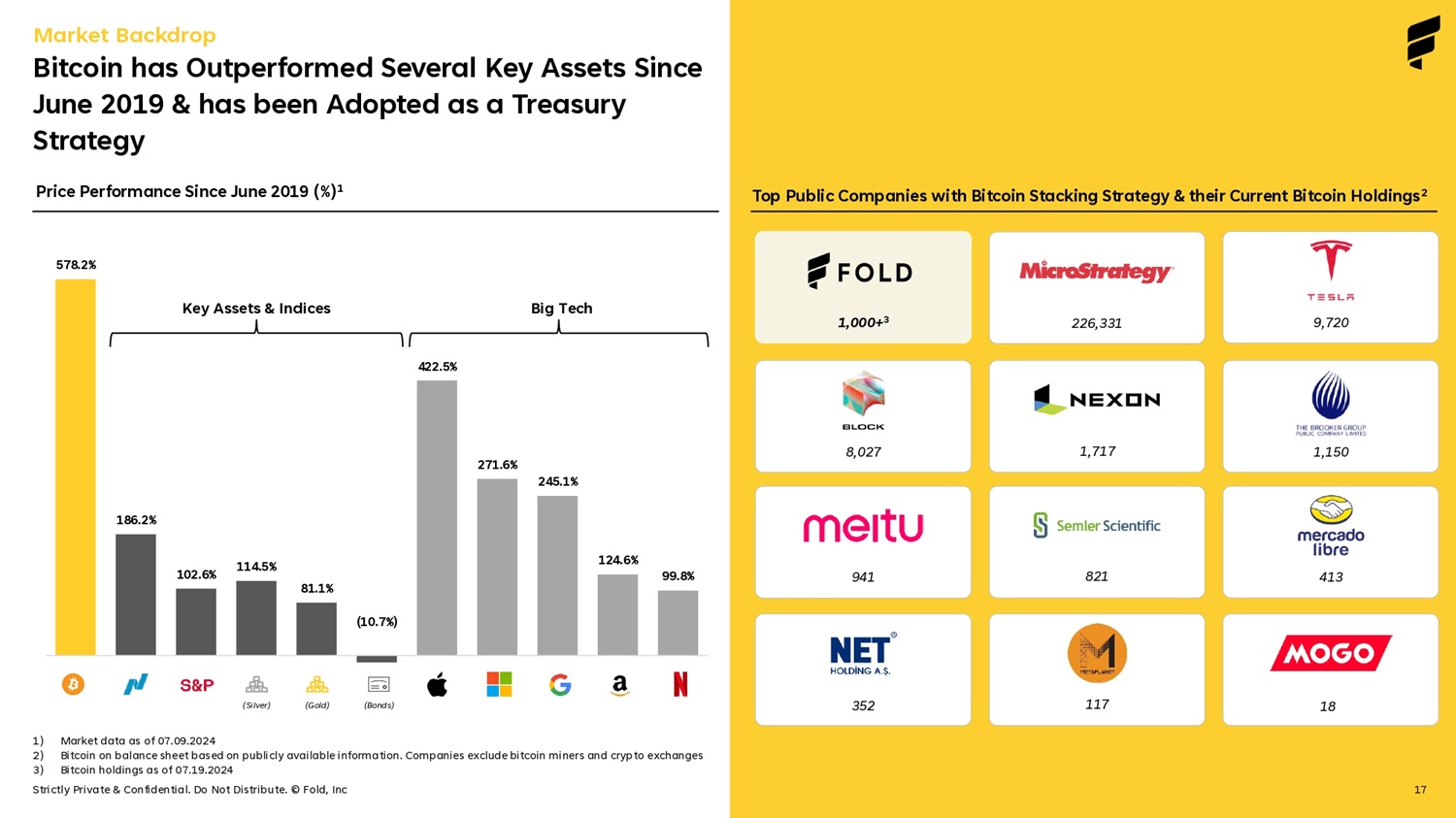

17 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc 578.2% 186.2% 102.6% 114.5% 81.1% (10.7%) 422.5% 271.6% 245.1% 124.6% 99.8% 1) Market data as of 07.09.2024 2) Bitcoin on balance sheet based on publicly available information. Companies exclude bitcoin miners and crypto exchanges 3) Bitcoin holdings as of 07.19.2024 Bitcoin has Outperformed Several Key Assets Since June 2019 & has been Adopted as a Treasury Strategy Market Backdrop Price Performance Since June 2019 (%) 1 Top Public Companies with Bitcoin Stacking Strategy & their Current Bitcoin Holdings 2 Key Assets & Indices Big Tech (Gold) (Silver) (Bonds) 226,331 1,717 941 117 9,720 1,150 821 8,027 413 18 1,000+ 3 352

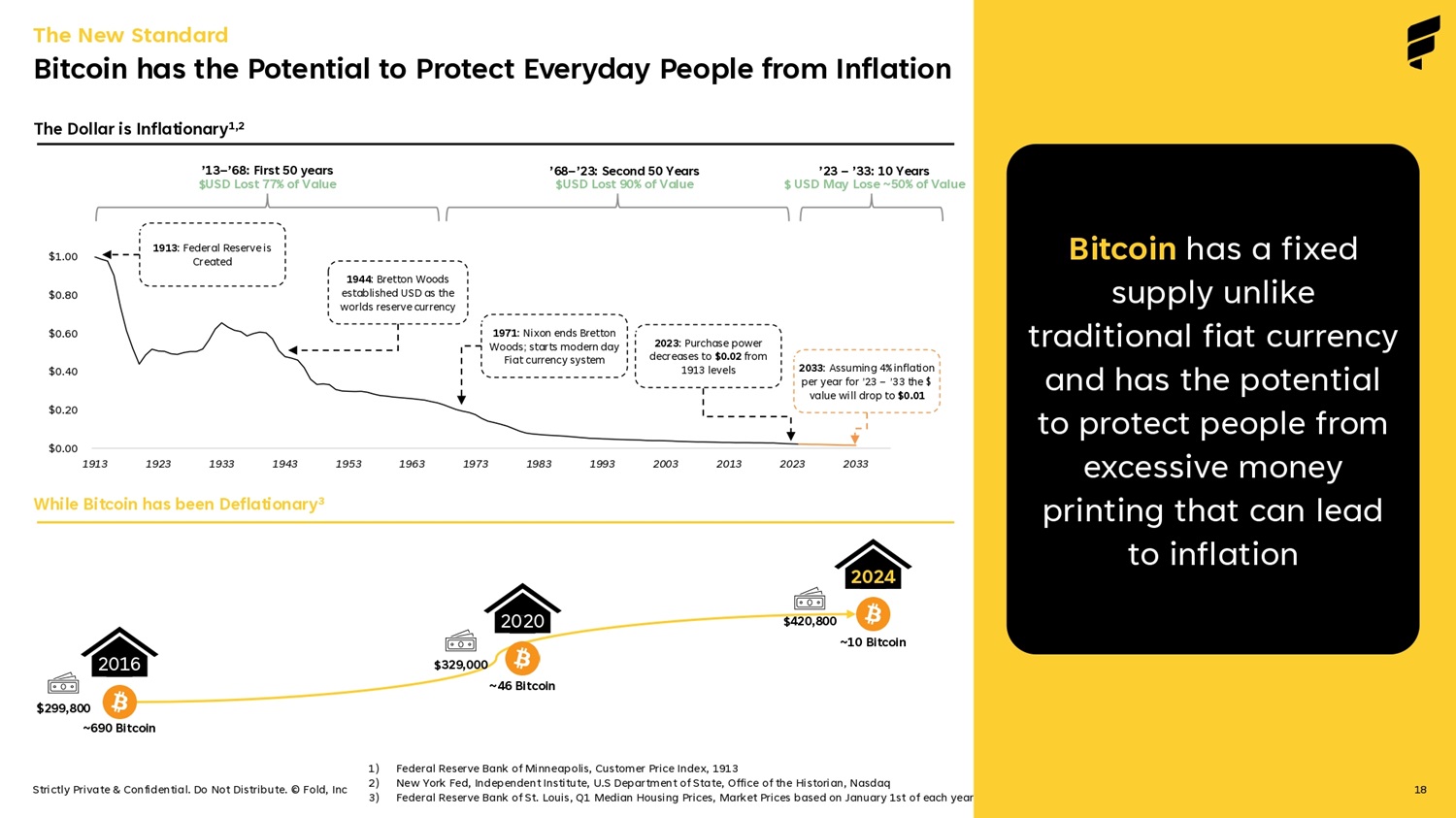

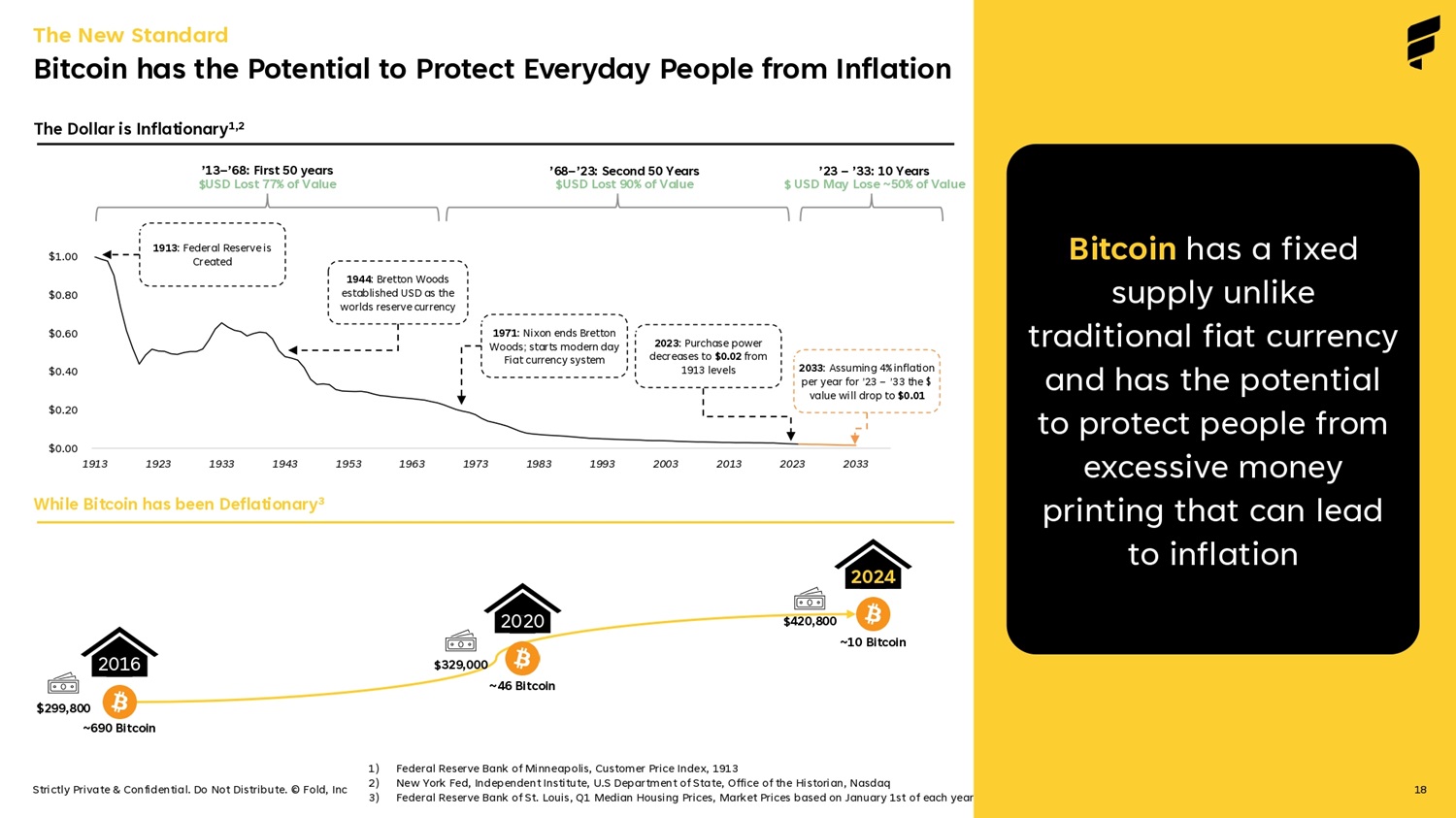

18 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Bitcoin has a fixed supply unlike traditional fiat currency and has the potential to protect people from excessive money printing that can lead to inflation B itcoin has the Potential to Protect Everyday People from Inflation $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 1913 1923 1933 1943 1953 1963 1973 1983 1993 2003 2013 2023 2033 1971 : Nixon ends Bretton Woods; starts modern day Fiat currency system 1913 : Federal Reserve is Created 1944 : Bretton Woods established USD as the worlds reserve currency The New Standard 1) Federal Reserve Bank of Minneapolis, Customer Price Index, 1913 2) New York Fed, Independent Institute, U.S Department of State, Office of the Historian, Nasdaq 3) Federal Reserve Bank of St. Louis, Q1 Median Housing Prices, Market Prices based on January 1st of each year While B itcoin has been Deflationary 3 $420,800 ~10 Bi tcoin 2024 $329,000 ~46 B itcoin 2020 $ 299,800 ~690 B itcoin 2016 The Dollar is Inflationary 1,2 2033 : Assuming 4% inflation per year for ’23 – ’33 the $ value will drop to $0.01 ’13 – ’68: First 50 years $USD Lost 77% of Value ’68 – ’23: Second 50 Years $USD Lost 90% of Value 2023 : Purchase power decreases to $0.02 from 1913 levels ’23 – ’33: 10 Years $ USD May Lose ~50% of Value

19 Strictly Private & Confidential. Do Not Distribute. © Fold, Inc Platform Highlights A Compelling Opportunity Within Consumer Finance Bitcoin financial services platform that seamlessly integrates dollars with bitcoin & making way for powerful new financial products Financial Automations enable automatic paycheck conversion to bitcoin, recurring investment and round - ups on purchases Fold’s Merchant Offers are among the most extensive rewards networks with card - linked offers, gift cards and affiliate offers Debit Card & FDIC Insured Cash Account allows customers to spend on everyday goods and pay monthly bills, earning bitcoin rewards on each transaction Insured bitcoin Custody and Zero Fee Trading allows customers to save money on trading commissions and take control of their financial stability Bitcoin Treasury & Accumulation strategy increases potential bitcoin exposure for both Fold and our customers 01 02 04 03 06 05