INTRODUCTION

In this Annual Report on Form 20-F (the "Annual Report"), "KWESST," "Company," "we," "us" and "our" refer to KWESST Micro Systems Inc. and its consolidated subsidiaries.

Information contained in this Annual Report is given as of September 30, 2024, the fiscal year end of Company, unless otherwise specifically stated.

Market and industry data used throughout this Annual Report was obtained from various publicly available sources. Although the Company believes that these independent sources are generally reliable, the accuracy and completeness of such information are not guaranteed and have not been verified due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and the limitations and uncertainty inherent in any statistical survey of market size, conditions and prospects.

Statements made in this Annual Report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we file any of these documents as an exhibit to this Annual Report, you may read the document itself for a complete description of its terms.

Unless otherwise indicated, all references in this Annual Report to “dollars” or “CAD” or “$” are to Canadian dollars and all references to “USD”, “US$” or “USD$” are to United States dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at various times.

| Canadian Dollars to U.S. Dollars | | Year Ended September 30, 2024 | | Year Ended September 30, 2023 |

| High for period | | 0.7573 | | 0.7617 |

| Low for period | | 0.7207 | | 0.7217 |

| Average rate for period | | 0.7349 | | 0.7416 |

| Rate at end of period | | 0.7408 | | 0.7396 |

The daily average exchange rate on December 23, 2024 as reported by the Bank of Canada for the conversion of USD into CAD was USD$1.00 equals CAD$1.4395.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian and United States securities laws (together, "forward-looking statements"). Such forward-looking statements include, but are not limited to, information with respect to our objectives and our strategies to achieve these objectives, as well as statements with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. These forward-looking statements may be identified by the use of terms and phrases such as "may", "would", "should", "could", "expect", "intend", "estimate", "anticipate", "plan", "foresee", "believe", or "continue", the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking statements contain these terms and phrases. Forward-looking statements are provided for the purposes of assisting the reader in understanding us, our business, operations, prospects and risks at a point in time in the context of historical and possible future developments and therefore the reader is cautioned that such information may not be appropriate for other purposes.

Forward-looking statements relating to us include, among other things, statements relating to:

• our expectations regarding our business, financial condition, results of operations and future capital raises;

• the future state of the legislative and regulatory regimes, both domestic and foreign, in which we conduct business and may conduct business in the future;

• our expansion into domestic and international markets;

• our ability to attract customers and clients;

• our marketing and business plans and short-term objectives;

• our ability to obtain and retain the licenses and personnel we require to undertake our business;

• our ability to deliver under contracts with customers;

• anticipated revenue from professional service contracts with customers;

• our strategic relationships with third parties;

• our anticipated trends and challenges in the markets in which we operate;

• governance of us as a public company; and

• expectations regarding future developments of products and our ability to bring these products to market.

Forward-looking statements are based upon a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the following risk factors:

• limited operating history;

• failure to realize growth strategy;

• failure to complete transactions or realize anticipated benefits;

• reliance on key personnel;

• regulatory compliance;

• competition;

• changes in laws, regulations and guidelines;

• demand for our products;

• fluctuating prices of raw materials;

• pricing for products;

• ability to supply sufficient product;

• potential cancellation or loss of customer contracts if we are unable to meet contract performance requirements;

• expansion to other jurisdictions;

• damage to our reputation;

• operating risk and insurance coverage;

• negative operating cash flow;

• management of growth;

• product liability;

• product recalls;

• environmental regulations and risks;

• ownership and protection of intellectual property;

• constraints on marketing products;

• reliance on management;

• fraudulent or illegal activity by our employees, contractors and consultants;

• breaches of security at our facilities or in respect of electronic documents and data storage and risks related to breaches of applicable privacy laws;

• government regulations regarding public or employee health and safety regulations, including public health measures in the event of pandemics or epidemics;

• regulatory or agency proceedings, investigations and audits;

• additional capital requirements to support our operations and growth plans, leading to further dilution to shareholders;

• the terms of additional capital raises;

• conflicts of interest;

• litigation;

• risks related to United States' and other international activities, including regional conflicts that may impact our operations;

• risks related to security clearances;

• risks relating to the ownership of our securities, such as potential extreme volatility in the price of our securities;

• risks related to our foreign private issuer status;

• risks related to our emerging growth company status;

• risks related to our failure to meet the continued listing requirements of Nasdaq Capital Market (“Nasdaq”), particularly the minimum bid price requirements within the second extension period;

• risks related to shareholder vote required for a share consolidation to remediate our current Nasdaq minimum bid price deficiency;

• risks related to the liquidity of our common shares (the “Common Shares”); and

• significant changes or developments in U.S. trade policies and tariffs may have a material adverse effect on our business and financial statements.

Although the forward-looking statements contained in this Annual Report are based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking statements. Certain assumptions were made in preparing the forward-looking statements concerning availability of capital resources, business performance, market conditions and customer demand.

Consequently, all of the forward-looking statements contained in this Annual Report are qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking statements contained in this Annual Report are provided as of the date hereof, and we do not undertake to update or amend such forward-looking statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

STATUS AS AN EMERGING GROWTH COMPANY

We are an "emerging growth company" as defined in Section 3(a) of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act") by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We will continue to qualify as an "emerging growth company" until the earliest to occur of: (a) the last day of the fiscal year during which we had total annual gross revenues of USD$1,235,000,000 (as such amount is indexed for inflation every 5 years by the United States Securities and Exchange Commission ("SEC")) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of equity securities pursuant to an effective registration statement under the United States Securities Act of 1933, as amended (the "Securities Act"); (c) the date on which we have, during the previous 3-year period, issued more than USD$1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer", as defined in Exchange Act Rule 12b-2. We expect to continue to be an emerging growth company for the immediate future.

Generally, a registrant that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an "accelerated filer" or a "large accelerated filer" (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report on management's assessment of internal controls over financial reporting in its annual reports filed under the Exchange Act, even if we were to qualify as an "accelerated filer" or a "large accelerated filer". In addition, Section 103(a)(3) of the Sarbanes-Oxley Act of 2002 (the "SOX") has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

FOREIGN PRIVATE ISSUER FILINGS

We are considered a "foreign private issuer" pursuant to Rule 405 promulgated under the Securities Act. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information. For as long as we are a "foreign private issuer" we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Exchange Act. However, the information we file or furnish may not be the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for United States domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by United States residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are United States citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. If we lose our "foreign private issuer status" we would be required to comply with Exchange Act reporting and other requirements applicable to United States domestic issuers, which are more detailed and extensive than the requirement for foreign private issuers.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Reserved.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The Company's operations and financial performance are subject to the normal risks of its industry and are subject to various factors which are beyond the control of the Company. Certain of these risk factors are described below. The risks described below are not the only ones facing the Company. Additional risks not currently known to the Company, or that it currently considers immaterial, may also adversely impact the Company's business, operations, financial results or prospects, should any such other events occur.

Risks Relating to Our Business

We are an early-stage company.

We are an early-stage company and as such, we are subject to many risks including under-capitalization, cash shortages, and limitations with respect to personnel, financial and other resources and the lack of revenue. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of success must be considered in light of our early stage of operations. Our prospects must be considered speculative in light of the risks, expenses, and difficulties frequently encountered by companies in their early stages of operations, particularly in the highly competitive and rapidly evolving markets in which we operate. To attempt to address these risks, we must, among other things, successfully implement our business plan, marketing, and commercialization strategies, respond to competitive developments, and attract, retain, and motivate qualified personnel. A substantial risk is involved in investing in us because, as a smaller commercial enterprise that has fewer resources than an established company, our management may be more likely to make mistakes, and we may be more vulnerable operationally and financially to any mistakes that may be made, as well as to external factors beyond our control.

We currently have negative operating cash flows.

Since inception, we have generated significant negative cash flow from operations, financed in great part through equity financing. There can be no certainty that we will ever achieve or sustain profitability or positive cash flow from our operating activities. In addition, our working capital and funding needs may vary significantly depending upon a number of factors including, but not limited to:

• progress of our manufacturing, licensing, and distribution activities;

• collaborative license agreements with third parties;

• opportunities to license-in beneficial technologies or potential acquisitions;

• potential milestone or other payments that we may make to licensors or corporate partners;

• technological and market consumption and distribution models or alternative forms of proprietary technology for game-changing applications in the military and homeland security market that affect our potential revenue levels or competitive position in the marketplace;

• the level of sales and gross profit;

• costs associated with production, labor, and services costs, and our ability to realize operation and production efficiencies;

• fluctuations in certain working capital items, including product inventory, short-term loans, and accounts receivable, that may be necessary to support the growth of our business; and

• expenses associated with litigation.

There is no guarantee that we will ever become profitable. To date, we have generated limited revenues and a large portion of our expenses are fixed, including expenses related to facilities, equipment, contractual commitments and personnel. With the anticipated commercialization for certain of our product offerings during our fiscal year ending September 30, 2024 ("Fiscal 2024"), we expect our net losses from operations will improve. Our ability to generate additional revenues and potential to become profitable will depend largely on the timely productization of our products, coupled with securing timely, cost-effective outsourced manufacturing arrangements and marketing our products. There can be no assurance that any such events will occur or that we will ever become profitable. Even if we achieve profitability, we cannot predict the level of such profitability. If we sustain losses over an extended period of time, we may be unable to continue our business.

Global inflationary pressure may have an adverse impact on our gross margins and our business.

Since December 31, 2021, we have experienced increases in global inflation, resulting in an increase in cost for some of the raw materials (batons / custom chemicals and casings) that we source to manufacture the ammunition for our ARWEN launchers. However, this increase in cost had a small negative impact to the overall gross margin earned from the sales of ARWEN ammunition.

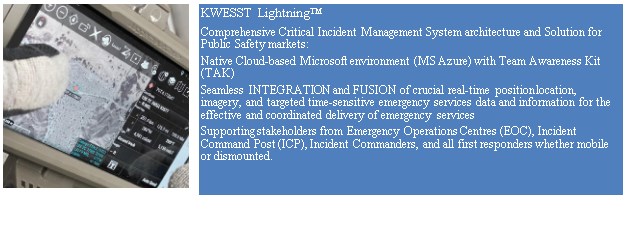

As we are not yet in the production phase for digitization and counter-threat business lines, we do not currently procure large volume of raw materials and therefore the current inflation is negligible for these business lines except for labor costs relating to research and development ("R&D") activities. During our Fiscal 2024, we incurred significant payroll cost increases for some of our employees in order to retain and hire engineers given the strong local demand for experienced software and hardware engineers. While we believe we will be able to pass on this inflation cost to our prospect military customers, there is no assurance that we will succeed. Accordingly, continued inflationary pressure may have an adverse impact on our gross margins and could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We may not be able to successfully execute our business plan.

The execution of our business plan poses many challenges and is based on a number of assumptions. We may not be able to successfully execute our business plan. If we experience significant cost overruns, or if our business plan is more costly than we anticipate, certain activities may be delayed or eliminated, resulting in changes or delays to our current plans. Also, we may be compelled to secure additional funding (which may or may not be available or available at conditions unfavorable to us) to execute our business plan. We cannot predict with certainty our future revenues or results from our operations. If the assumptions on which our revenues or expenditures forecasts are based change, the benefits of our business plan may change as well. In addition, we may consider expanding our business beyond what is currently contemplated in our business plan. Depending on the financing requirements of a potential business expansion, we may be required to raise additional capital through the issuance of equity or debt. If we are unable to raise additional capital on acceptable terms, we may be unable to pursue a potential business expansion.

A significant portion of our revenues are non-recurring.

A significant portion of our revenue for Fiscal 2024 is prior to commercialization of our significant projects and is considered to be non-recurring. We have significantly reduced our reliance on non-recurring revenues during Fiscal 2024 with the ARWEN business line, the staffing of Directorate Land Command Systems Program Management Software Engineering Facility ("DSEF") and the land command, control, communications, computers, intelligence, surveillance and reconnaissance ("Land C4ISR") resources, the ramp-up of the PARA OPS division and the monthly Ground Search and Rescue ("GSAR") resources.

There is uncertainty with respect to our revenue growth.

There can be no assurance that we can generate substantial revenue growth, or that any revenue growth that is achieved can be sustained. Revenue growth that we have achieved or may achieve may not be indicative of future operating results. In addition, we may further increase our operating expenses in order to fund higher levels of R&D, increase our sales and marketing efforts and increase our administrative resources in anticipation of future growth. To the extent that increases in such expenses precede or are not subsequently followed by increased revenues, our business, operating results and financial condition will be materially adversely affected.

We may not be able to fully develop our products, which could prevent us from ever becoming profitable.

If we experience difficulties in the development process, such as capacity constraints, quality control problems or other disruptions, we may not be able to fully develop market-ready commercial products at acceptable costs, which would adversely affect our ability to effectively enter the market. A failure by us to achieve a low-cost structure through economies of scale or improvements in manufacturing processes would have a material adverse effect on our commercialization plans and our business, prospects, results of operations and financial condition.

We may experience delays in product sales due to marketing and distribution capabilities.

In order to successfully commercialize our products, we must continue to develop our internal marketing and sales force with technical expertise and with supporting distribution capabilities or arrange for third parties to perform these services. In order to successfully commercialize any of our products, we must have an experienced sales and distribution infrastructure. The continued development of our sales and distribution infrastructure will require substantial resources, which may divert the attention of our management and key personnel and defer our product development and commercialization efforts. To the extent that we enter into marketing and sales arrangements with other companies, our revenues will depend on the efforts of others.

Additionally, in marketing our products, we would likely compete with companies that currently have extensive and well-funded marketing and sales operations. Despite marketing and sales efforts, we may be unable to compete successfully against these companies. We may not be able to do so on favorable terms.

In the event we fail to develop substantial sales, marketing and distribution channels, or to enter into arrangements with third parties for those purposes, we will experience delays in product sales, which could have a material adverse effect on prospects, results of operations, financial condition and cash flows.

There is no assurance that our products will be accepted in the marketplace or that we will turn a profit or generate immediate revenues.

There is no assurance as to whether our products will be accepted in the marketplace. While we believe our products address customer needs, the acceptance of our products may be delayed or not materialize. We have incurred and anticipate incurring substantial expenses relating to the development of our products, the marketing of our products and initial operations of our business. Our revenues and possible profits will depend upon, among other things, our ability to successfully market our products to customers. There is no assurance that revenues and profits will be generated.

Strategic alliances may not be achieved or achieve their goals.

To achieve a scalable operating model with minimal capital expenditures, we plan to rely upon strategic alliances with original equipment manufacturers ("OEMs") for the manufacturing and distribution of our products. There can be no assurance that such strategic alliances can be achieved or will achieve their goals.

We are dependent on key suppliers for our ARWEN product line.

We are only able to purchase certain key components of our products from a limited number of suppliers for our ARWEN product line within our less-lethal business line. As of the date of this Annual Report, we do not have any commercial or financial contracts with any key suppliers who we have procured raw materials from. Procurement is done in the form of individual, non-related standard purchase orders. As a result, there is no contract in place to ensure sufficient quantities are available timely on favorable terms and consequently this could result in possible lost sales or uncompetitive product pricing.

We may incur higher costs or unavailability of components, materials and accessories.

As we expect to commercialize certain of our product lines in our fiscal year ending September 30, 2025 ("Fiscal 2025"), we may depend on certain domestic and international suppliers for the delivery of components and materials used in the assembly of our products and certain accessories including ammunition, used with our products. Further, any reliance on third-party suppliers may create risks related to our potential inability to obtain an adequate supply of components or materials and reduced control over pricing and timing of delivery of components and materials. We currently have no long-term agreements with any of our suppliers and there is no guarantee the supply will not be interrupted.

In light of the current global supply chain challenges caused by Russia's invasion of Ukraine, components used in the manufacture of our products may be delayed, become unavailable or discontinued. Any delays may take weeks or months to resolve. Further, parts obsolescence may require us to redesign our product to ensure quality replacement components. While we have not been impacted significantly from the above events to date, there is no assurance that we will not experience significant setback in operations if the global supply chain challenges worsen or continue to persist for a longer period of time. Accordingly, supply chain delays could cause significant delays in manufacturing and loss of sales, leading to adverse effects significantly impacting our financial condition or results of operations.

Additionally, our shipping costs and the timely delivery of our products could be adversely impacted by a number of factors which could reduce the profitability of our operations, including: higher fuel costs, potential port closures, customs clearance issues, increased government regulation or changes for imports of foreign products into Canada, delays created by terrorist attacks or threats, public health issues and pandemics and epidemics, national disasters or work stoppages, and other matters. Any interruption of supply for any material components of our products could significantly delay the shipment of our products and have a material adverse effect on our revenues, profitability, and financial condition.

We rely upon a limited number of third parties for manufacturing, shipping, transportation, logistics, marketing and sales of our products.

We rely on third parties to ship, transport, and provide logistics for our products. Further, we plan on relying on third parties to manufacture, market and sell our PARA OPS system products. Our dependence on a limited number of third parties for these services leaves us vulnerable due to our need to secure these parties' services on favorable terms. Loss of, or an adverse effect on, any of these relationships or failure of any of these third parties to perform as expected could have a material and adverse effect on our business, sales, results of operations, financial condition, and reputation.

We may be subject to product liability proceedings or claims.

We may be subject to proceedings or claims that may arise in the ordinary conduct of the business, which could include product and service warranty claims, which could be substantial. Product liability for us is a major risk as some of our products will be used by military personnel in theaters-of-war (for the Tactical and Counter-Threat product offerings) and by consumers and law enforcement (for the less-lethal systems). The occurrence of product defects due to non-compliance of our manufacturing specifications and the inability to correct errors could result in the delay or loss of market acceptance of our products, material warranty expense, diversion of technological and other resources from our product development efforts, and the loss of credibility with customers, manufacturers' representatives, distributors, value-added resellers, systems integrators, OEMs and end-users, any of which could have a material adverse effect on our business, operating results and financial conditions. To mitigate product liability risk, our products will be sold with a liability disclaimer for misuse of the product.

If we are unable to successfully design and develop or acquire new products, our business may be harmed.

To maintain and increase sales we must continue to introduce new products and improve or enhance our existing products or new products. The success of our new and enhanced products depends on many factors, including anticipating consumer preferences, finding innovative solutions to consumer problems or acquiring new solutions through mergers and acquisitions, differentiating our products from those of our competitors, and maintaining the strength of our brand. The design and development of our products as well as acquisitions of other businesses.

Our business could be harmed if we are unable to accurately forecast demand for our products or our results of operations.

To ensure adequate inventory supply, we forecast inventory needs and often place orders with our manufacturers before we receive firm orders from our retail partners or customers. If we fail to accurately forecast demand, we may experience excess inventory levels or a shortage of products.

If we underestimate the demand for our products, we or our suppliers may not be able to scale to meet our demand, and this could result in delays in the shipment of our products and our failure to satisfy demand, as well as damage to our reputation and retail partner relationships. If we overestimate the demand for our products, we could face inventory levels in excess of demand, which could result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would harm our gross margins. In addition, failures to accurately predict the level of demand for our products could cause a decline in sales and harm our results of operations and financial condition.

In addition, we may not be able to accurately forecast our results of operations and growth rate. Forecasts may be particularly challenging as we expand into new markets and geographies and develop and market new products for which we have no or limited historical data. Our historical sales, expense levels, and profitability may not be an appropriate basis for forecasting future results. Our lack of historical data related to new products makes it particularly difficult to make forecasts related to such products. These effects are expected to last through the remainder of the pandemic. Pandemic related variances require a very quick pivot and adjustments to the supply chain, production and marketing. If we are unable to make these changes quickly or at all our inventory, production and sales may be materially affected.

Failure to accurately forecast our results of operations and growth rate could cause us to make poor operating decisions that we may not be able to correct in a timely manner. Consequently, actual results could be materially different than anticipated. Even if the markets in which we compete expand, we cannot assure you that our business will grow at similar rates, if at all.

Undetected flaws may be discovered in our products.

There can be no assurance that, despite testing by us, flaws will not be found in our products and services, resulting in loss of, or delay in, market acceptance. We may be unable, for technological or other reasons, to introduce products and services in a timely manner or at all in response to changing customer requirements. In addition, there can be no assurance that while we are attempting to finish the development of our technologies, products and services, a competitor will not introduce similar or superior technologies, products and services, thus diminishing our advantage, rendering our technologies, products and services partially or wholly obsolete, or at least requiring substantial re-engineering in order to become commercially acceptable. Failure by us to maintain technology, product and service introduction schedules, avoid cost overruns and undetected errors, or introduce technologies, products and services that are superior to competing technologies, products and services would have a materially adverse effect on our business, prospects, financial condition, and results of operations.

We will be reliant on information technology systems and may be subject to damaging cyber-attacks.

We use third parties for certain hardware, software, telecommunications and other information technology ("IT") services in connection with our operations. Our operations depend, in part, on how well we and our suppliers protect networks, equipment, IT systems and software against damage from a number of threats, including, but not limited to, cable cuts, damage to physical plants, natural disasters, intentional damage and destruction, fire, power loss, hacking, computer viruses, vandalism and theft. Our operations also depend on the timely maintenance, upgrade and replacement of networks, equipment, IT systems and software, as well as pre-emptive expenses to mitigate the risks of failures. Any of these and other events could result in information system failures, delays and/or increase in capital expenses. The failure of information systems or a component of information systems could, depending on the nature of any such failure, adversely impact our reputation and results of operations. Moreover, failure to meet the minimum cybersecurity requirements for defense contracts may disqualify us from participating in the tendering process. To date, we have not experienced any losses relating to cyber-attacks or other information security breaches, but there can be no assurance that we will not incur such losses in the future. Our risk and exposure to these matters cannot be fully mitigated because of, among other things, the evolving nature of these threats. As a result, cybersecurity and the continued development and enhancement of controls, processes and practices designed to protect systems, computers, software, data and networks from attack, damage or unauthorized access is a priority. As cyber threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance protective measures or to investigate and remediate any security vulnerabilities.

In certain circumstances, our reputation could be damaged.

Damage to our reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. Reputational risk for us is a major risk as some of our products will be used by military personnel in theaters-of-war or by law enforcement personnel. The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views regarding us and our activities, whether true or not. Although we believe that we operate in a manner that is respectful to all stakeholders and that we take care in protecting our image and reputation, we do not ultimately have direct control over how we are perceived by others. Reputational loss may result in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects, thereby having a material adverse impact on financial performance, financial condition, cash flows and growth prospects.

Our results of operations are difficult to predict and depend on a variety of factors.

There is no assurance that the production, technology acquisitions, and the commercialization of proprietary technology for game-changing applications in the military, security forces and personal defense markets will be managed successfully. Any inability to achieve such commercial success could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects. In addition, the comparability of results may be affected by changes in accounting guidance or changes in our ownership of certain assets. Accordingly, the results of operations from year to year may not be directly comparable to prior reporting periods. As a result of the foregoing and other factors, the results of operations may fluctuate significantly from period to period, and the results of any one period may not be indicative of the results for any future period.

Protecting and defending against intellectual property claims may have a material adverse effect on our business.

Our ability to compete depends, in part, upon successful protection of our intellectual property. While we have some patents and trademarks, we also rely on trade secrets to protect our technology, which is inherently risky. Going forward, we will attempt to protect proprietary and intellectual property rights to our technologies through available copyright and trademark laws, patents and licensing and distribution arrangements with reputable international companies in specific territories and media for limited durations. Despite these precautions, existing copyright, trademark and patent laws afford only limited practical protection in certain countries where we distribute our products. As a result, it may be possible for unauthorized third parties to copy and distribute our products or certain portions or applications of our intended products, which could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects.

Litigation may also be necessary to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others or to defend against claims of infringement or invalidity. Any such litigation, infringement or invalidity claims could result in substantial costs and the diversion of resources and could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects.

We face risks from doing business internationally.

Our commercialization strategies for our products include sales efforts outside Canada and deriving revenues from international sources. As a result, our business is subject to certain risks inherent in international business, many of which are beyond our control.

These risks may include:

• laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes, and changes in these laws;

• anti-corruption laws and regulations such as the Foreign Corrupt Practices Act that impose strict requirements on how we conduct our foreign operations and changes in these laws and regulations;

• changes in local regulatory requirements, including restrictions on content and differing cultural tastes and attitudes;

• international jurisdictions where laws are less protective of intellectual property and varying attitudes towards the piracy of intellectual property;

• financial instability and increased market concentration of buyers in foreign markets;

• the instability of foreign economies and governments;

• fluctuating foreign exchange rates;

• the spread of communicable diseases in such jurisdictions, which may impact business in such jurisdictions; and

• war and acts of terrorism.

Events or developments related to these and other risks associated with international trade could adversely affect our revenues from non-Canadian sources, which could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects. Protection of electronically stored data is costly and if our data is compromised in spite of this protection, we may incur additional costs, lost opportunities, and damage to our reputation.

We maintain information in digital form as necessary to conduct our business, including confidential and proprietary information and personal information regarding our employees.

Data maintained in digital form is subject to the risk of intrusion, tampering, and theft. We develop and maintain systems to prevent this from occurring, but it is costly and requires ongoing monitoring and updating as technologies change and efforts to overcome security measures become more sophisticated. Moreover, despite our efforts, the possibility of intrusion, tampering, and theft cannot be eliminated entirely, and risks associated with each of these acts remain. In addition, we provide confidential information, digital content and personal information to third parties when it is necessary to pursue business objectives. While we obtain assurances that these third parties will protect this information and, where appropriate, monitor the protections employed by these third parties, there is a risk that data systems of these third parties may be compromised. If our data systems or data systems of these third parties are compromised, our ability to conduct our business may be impaired, we may lose profitable opportunities, or the value of those opportunities may be diminished, and we may lose revenue as a result of unlicensed use of our intellectual property. A breach of our network security or other theft or misuse of confidential and proprietary information, digital content or personal employee information could subject us to business, regulatory, litigation, and reputation risk, which could have a materially adverse effect on our business, financial condition, and results of operations.

Our success depends on management and key personnel.

Our success depends largely upon the continued services of our executive officers and other key employees. From time to time, there may be changes in our executive management team resulting from the hiring or departure of executives, which could disrupt our business. If we are unable to attract and retain top talent, our ability to compete may be harmed. Our success is also highly dependent on our continuing ability to identify, hire, train, retain and motivate highly qualified personnel. Competition for highly skilled executives and other employees is high in our industry, especially from larger and better capitalized defense and security companies. We may not be successful in attracting and retaining such personnel. Failure to attract and retain qualified executive officers and other key employees could have a material adverse effect on our business, prospects, financial condition, results of operations, and cash flows.

Our directors, officers or members of management may have conflicts of interest.

Certain of our directors, officers, and other members of management serve (and may in the future serve) as directors, officers, and members of management of other companies and therefore, it is possible that a conflict may arise between their duties as one of our directors, officers or members of management and their duties as a director, officer or member of management of such other companies. Our directors and officers are aware of the existence of laws governing accountability of directors and officers for corporate opportunity and requiring disclosures by directors of conflicts of interest and we will rely upon such laws in respect of any directors' and officers' conflicts of interest or in respect of any breaches of duty by any of our directors or officers. All such conflicts will be disclosed by such directors or officers in accordance with the BCBCA and they will govern themselves in respect thereof to the best of their ability in accordance with the obligations imposed upon them by law.

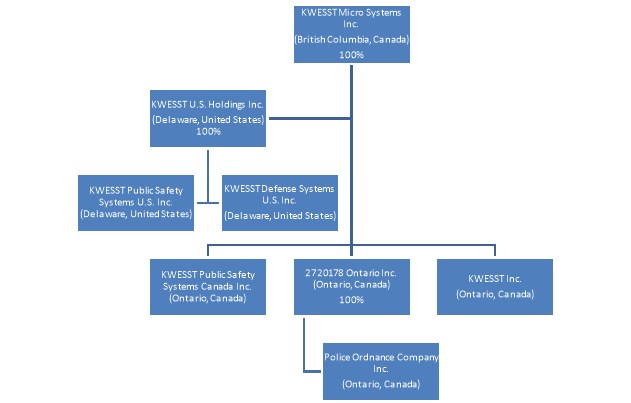

It may not be possible for foreign investors to enforce actions against us, and our directors and officers.

We are a corporation organized under the laws of the Province of British Columbia and our Canadian subsidiaries are organized under the laws of the Province of Ontario and our United States subsidiaries are organized under the laws of Delaware. All of our directors and executive officers reside principally in Canada. Because all or a substantial portion of our assets and the assets of these persons are located in Canada, it may not be possible for foreign investors, including United States investors, to effect service of process from outside of Canada upon us or those persons, or to realize in the United States upon judgments of United States courts predicted upon civil liabilities under the Exchange Act or other United States laws. Furthermore, it may not be possible to enforce against us foreign judgments obtained in courts outside of Canada based upon the civil liability provisions of the securities laws or other laws in those jurisdictions.

The loss of services of members of our management team may have a material adverse effect on our business, financial condition, and results of operations.

Our success depends in large part upon the continued service of key members of our management team. Because we do not maintain "key person" life insurance on any of our executive officers, employees or consultants, any delay in replacing such persons, or an inability to replace them with persons of similar expertise, may have a material adverse effect on our business, financial condition, and results of operations.

Our internal computer systems are vulnerable to damage and failure.

Despite the implementation of security measures and backup storage, our internal computer systems are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war, and telecommunication and electrical failure. Any system failure, accident or security breach that causes interruption in our operations could result in a material disruption of our projects. To the extent that any disruption or security breach results in a loss or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we may incur liability as a result. In addition, our technology program may be adversely affected, and the further development of our technology may be delayed. We may also incur additional costs to remedy the damages caused by these disruptions or security breaches.

Business interruptions could adversely affect our operations.

Our operations are vulnerable to outages and interruptions due to fire, floods, power loss, telecommunications failures, and similar events beyond our control. Although we have developed certain plans to respond in the event of a disaster, there can be no assurance that they will be effective in the event of a specific disaster. Any losses or damages incurred by us could have a material adverse effect on our business and results of operations.

We are subject to risks associated with possible acquisitions, licensing, business combinations, or joint ventures.

While to date we have mainly focused on developing our own products, from time to time, we could be engaged in discussions and activities with respect to possible business and/or technology acquisitions or licensing, sale of assets, business combinations, or joint ventures with the view of either complementing or expanding our internally developed products. These acquisitions and licensing activities are not crucial to our long-term business success. The anticipated benefit from any of the transactions we may pursue may not be realized as expected. Regardless of whether any such transaction is consummated, the negotiation of a potential transaction and the integration of the acquired business or technology, acquired or licensed, could incur significant costs and cause diversion of management's time and resources. Any such transaction could also result in impairment of goodwill and other intangibles, development write-offs, and other related expenses. Such transactions may pose challenges in the consolidation and integration of IT, accounting systems, personnel, and operations. We may have difficulty managing the combined entity in the short term if we experience a significant loss of management personnel during the transition period after a significant acquisition. We may also have difficulty managing the product development and commercialization following a technology acquisition or licensing. No assurance can be given that expansion, licensing or acquisition opportunities will be successful, completed on time, or that we will realize expected operating efficiencies, cost savings, revenue enhancements, synergies or other benefits. Any of the foregoing could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects.

Claims against us relating to any acquisition, licensing or business combination may necessitate seeking claims against the seller for which the seller may not indemnify us or that may exceed the seller's or licensor's indemnification obligations.

There may be liabilities assumed in any technology acquisition or licensing or business combination that we did not discover or that we underestimated in the course of performing our due diligence. Although a seller or licensor generally will have indemnification obligations to us under a licensing, acquisition or merger agreement, these obligations usually will be subject to financial limitations, such as general deductibles and maximum recovery amounts, as well as time limitations. There is no assurance that our right to indemnification from any seller or licensors will be enforceable, collectible or sufficient in amount, scope or duration to fully offset the amount of any undiscovered or underestimated liabilities that we may incur. Any such liabilities could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects.

Growth may cause pressure on our management and systems.

Our future growth may cause significant pressure on our management, and our operational, financial, and other resources and systems. Our ability to manage our growth effectively will require that we implement and improve our operational, financial, manufacturing, and management information systems, hire new personnel and then train, manage, and motivate these new employees. These demands may require the hiring of additional management personnel and the development of additional expertise within the existing management team. Any increase in resources devoted to production, business development, and distribution efforts without a corresponding increase in our operational, financial, and management information systems could have a material adverse effect on our business, financial condition, and results of operations.

We may infringe on the intellectual property rights of third parties.

For certain of our product lines, we have elected to protect our technology and products as trade secrets as opposed to seeking patent protection. We may, in future, elect to seek patent protection for some of our future products. While we believe that our products and other intellectual property do not infringe upon the proprietary rights of third parties, our commercial success depends, in part, upon us not infringing on the intellectual property rights of others. A number of our competitors and other third parties have been issued or may have filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those utilized by us. Some of these patents may grant very broad protection to the owners of the patents. While we have engaged external intellectual property legal counsels to undertake an extensive review of existing third-party patents and prepare our patent applications for some of our products (see Item 4.B. - Business Overview), there is no assurance that their reviews and conclusion will not prevail if challenged by a third party of an alleged infringement of their intellectual properties. We may become subject to claims by third parties that our technology infringes their intellectual property rights due to the growth of products in our target markets, the overlap in functionality of those products and the prevalence of products. We may become subject to these claims either directly or through indemnities against these claims that we provide to end-users, manufacturer's representatives, distributors, value-added resellers, system integrators and OEMs. Litigation may be necessary to determine the scope, enforceability and validity of third-party proprietary rights or to establish our proprietary rights. Some of our competitors have, or are affiliated with companies having, substantially greater resources than we and these competitors may be able to sustain the costs of complex intellectual property litigation to a greater degree and for a longer period of time than us. Regardless of their merit, any such claims could be time consuming to evaluate and defend, result in costly litigation, cause product shipment delays or stoppages, divert management's attention and focus away from the business, subject us to significant liabilities and equitable remedies, including injunctions, require that we enter into costly royalty or licensing agreements and require that we modify or stop using infringing technology.

We may be prohibited from developing or commercializing certain technologies and products unless we obtain a license from a third party. There can be no assurance that we will be able to obtain any such license on commercially favorable terms or at all. If we do not obtain such a license, we could be required to cease the sale of certain of our products.

Significant changes or developments in U.S. laws or policies, including changes in U.S. trade policies and tariffs and the reaction of other countries thereto, may have a material adverse effect on our business and financial statements.

Significant changes or developments in U.S. laws and policies, such as laws and policies surrounding international trade, foreign affairs, manufacturing and development and investment in the territories and countries where we or our customers operate, can materially adversely affect our business and financial statements. President-elect Donald Trump has indicated that he intends to impose tariffs, including a 60% tariff on goods imported from China and a 25% on all other U.S. imports, which could result in a trade war. Similar trade restrictions in the future may have a material adverse effect on our business and financial statements.

Risks Relating to Our Industry

The following risks relate specifically to Digitization and Counter-Threat business lines:

We are subject to extensive government regulation in the United States for our products designed for the military market.

Our customers in the United States are global defense contractors and they are subject to various United States government regulations which some may be passed on to us in order for them to be compliant. The most significant regulations and regulatory authorities that may affect our future business include the following:

• the Federal Acquisition Regulations and supplemental agency regulations, which comprehensively regulate the formation and administration of, and performance under, United States government contracts;

• the Truth in Negotiations Act, which requires certification and disclosure of all factual cost and pricing data in connection with contract negotiations;

• the False Claims Act and the False Statements Act, which impose penalties for payments made on the basis of false facts provided to the government and on the basis of false statements made to the government, respectively;

• the Foreign Corrupt Practices Act, which prohibits United States companies from providing anything of value to a foreign official to help obtain, retain or direct business, or obtain any unfair advantage; and

• laws, regulations and executive orders restricting the use and dissemination of information classified for national security purposes or determined to be "controlled unclassified information" and the exportation of certain products and technical data.

Our failure to comply with applicable regulations, rules and approvals; changes in the United States government's interpretation of such regulations, rules and approvals as have been and are applied to our contracts, proposals or business or misconduct by any of our employees could result in the imposition of fines and penalties, the loss of security clearances, a decrease in profitability, or the loss of our subcontract contracts with United States defense contractors generally, any of which could harm our business, financial condition and results of operations.

A decline in the United States and other government budgets, changes in spending or budgetary priorities, or delays in contract awards may significantly and adversely affect our future revenue.

For the years ended September 30, 2024, 2023 and 2022, 10%, 3%, and 54%, respectively, of the Company's revenue was denominated in U.S. dollar driven by contracts with U.S. prime contractors in the defense sector. Our results of operations could be adversely affected by government spending caps or changes in government budgetary priorities, as well by delays in the government budget process, program starts, or the award of contracts or orders under existing contracts. As a result, the market for our military solution may be impacted due to shifts in the political environment and changes in the government and agency leadership positions under the new United States administration. If annual budget appropriations or continuing resolutions are not enacted timely, we could face United States government shutdown, which could adversely impact our business and our ability to receive indirectly timely payment from United States government entities on future contracts.

United States government contracts are generally not fully funded at inception and contain certain provisions that may be unfavorable to us.

We have entered into defense contracts with United States prime defense contractors, which it in turns transact directly with the United States government.

United States government contracts typically involve long lead times for design and development and are subject to significant changes in contract scheduling. Congress generally appropriates funds on a fiscal year basis even though a program may continue for several years. Consequently, programs are often only partially funded initially, and additional funds are committed only as Congress makes further appropriations. The termination or reduction of funding for a government program would result in a loss of anticipated future revenue attributable to that program. In addition, United States government contracts generally contain provisions permitting termination, in whole or in part, at the government's convenience or for contractor default.

The actual receipt of revenue on future awards subcontracted to us may never occur or may change because a program schedule could change or the program could be cancelled, or a contract could be reduced, modified or terminated early.

While we had no outstanding United States government contracts (directly or indirectly) as of the date of this Annual Report, we are exposed to the above risk for future United States government related contracts.

We may not be able to comply with changes in government policies and legislation.

The manufacture, sale, purchase, possession and use of weapons, ammunitions, firearms, and explosives are subject to federal, provincial and foreign laws. If such regulation becomes more expansive in the future, it could have a material adverse effect on our business, operating results, financial condition, and cash flows. New legislation, regulations, or changes to or new interpretations of existing regulation could impact our ability to manufacture or sell our products and our projectiles, or limit their market, which could impact our cost of sales and demand for our products. Similarly changes in laws related to the domestic or international use of chemical irritants by civilians or law enforcement could impact both our cost of sales and the size of our reachable market.

We may be subject, both directly and indirectly, to the adverse impact of existing and potential future government regulation of our products, technology, operations, and markets. For example, the development, production, exportation, importation, and transfer of our products and technology is subject to Canadian and provincial laws. Further, as we plan to conduct business in the United States, we will also be subject to United States and foreign export control, sanctions, customs, import and anti-boycott laws and regulations, including the Export Administration Regulations (the "EAR") (collectively, the "Trade Control Laws"). If one or more of our products or technology, or the parts and components we buy from others, is or become subject to the International Traffic in Arms Regulations (the "ITAR") or national security controls under the EAR, this could significantly impact our operations, for example by severely limiting our ability to sell, export, or otherwise transfer our products or technology, or to release controlled technology to foreign person employees or others in the United States or abroad. We may not be able to retain licenses and other authorizations required under the applicable Trade Control Laws. The failure to satisfy the requirements under the Trade Control Laws, including the failure or inability to obtain necessary licenses or qualify for license exceptions, could delay or prevent the development, production, export, import, and/or in-country transfer of our products and technology, which could adversely affect our revenues and profitability.

Failure by us, our employees, or others working on our behalf to comply with the applicable government policies and regulations could result in administrative, civil, or criminal liabilities, including fines, suspension, debarment from bidding for or performing government contracts, or suspension of our export privileges, which could have a material adverse effect on us.

The following risk relates specifically to PARA OPS business line:

We will be subject to regulation in the United States for our less-lethal systems.

While our PARA OPS devices are less-lethal (based on the kinetic energy of our projectiles), these are automatically classified as a form of firearm under the United States Bureau of Alcohol, Tobacco and Firearms ("ATF") rules and regulations because we use pyrotechnic based primers in our proprietary ammunition cartridges. We have therefore self-classified our .67 caliber PARA OPS single shot device as not only a firearm, but a "destructive device" in accordance with the ATF regulations. We intend to self-classify our other PARA OPS devices as a form of a firearm under ATF regulations until such time we have found an alternative for primers (i.e., a non-pyrotechnic gas generator) to launch our projectiles, and therefore be subject to ATF regulations. We are currently reviewing an alternative to replace the primer with actuator technology that is in the developmental phase and accordingly, there is no assurance that we will succeed and consequently the replacement of the primer may adversely affect our future revenues and related results of operations, business, prospects, and financial condition. Further, in the event we have implemented an alternative to replace the primer and then self-classify our PARA OPS devices as "non-firearm", there is no assurance that the ATF may not contest our self-classification, which could result in discontinuing sales to consumers with no firearm license where required by state law. Accordingly, this could also adversely affect our future revenues and related results of operations, business, prospects, and financial condition.

Because our business model relies on outsourced production, we have no plans of becoming a firearm manufacturer in the United States but rather to continue to partner with a federal firearms license ("FFL") manufacturer for the production and distribution of our PARA OPS products. Accordingly, post commercialization in the United States the burden to comply with ATF rules and regulations applicable to the manufacturing and distribution process will be with our FFL business partners. Our primary risk of governmental interruption of manufacturing and distribution therefore lies within the operations and attendant internal control environment of our FFL business partners.

Furthermore, with respect to transfers to end users (government, military, or consumer), the obligation to comply with ATF rules and regulations and any applicable state laws resides with the downstream FFL wholesaler/distributor/retailer and any penalties levied upon such parties do not flow up the distribution chain.

See Item 4.B. - Business Overview - Government Regulations - Less-Lethal for a summary of relevant regulation in the United States for our less-lethal business line.

The following risks apply to all business lines:

Rapid technological development could result in obsolescence or short product life cycles of our products.

The markets for our products are characterized by rapidly changing technology and evolving industry standards, which could result in product obsolescence or short product life cycles. Accordingly, our success is dependent upon our ability to anticipate technological changes in the industries we serve and to successfully identify, obtain, develop and market new products that satisfy evolving industry requirements. There can be no assurance that we will successfully develop new products or enhance and improve our existing products or that any new products and enhanced and improved existing products will achieve market acceptance. Further, there can be no assurance that competitors will not market products that have perceived advantages over our products, or which render the products currently sold by us obsolete or less marketable.

We must commit significant resources to developing, testing and demonstrating new products before knowing whether our investments will result in products the market will accept. To remain competitive, we may be required to invest significantly greater resources than currently anticipated in R&D and product enhancement efforts, and result in increased operating expenses.

Our industry is highly competitive.

The industry for military and security forces and personal defense is highly competitive and composed of many domestic and foreign companies. We have experienced and expect to continue to experience substantial competition from numerous competitors whom we expect to continue to improve their products and technologies. Competitors may announce and introduce new products, services or enhancements that better meet the needs of end-users or changing industry standards, or achieve greater market acceptance due to pricing, sales channels or other factors. With substantially greater financial resources and operating scale than we do currently, certain competitors may be able to respond more quickly than us to changes in end-user requirements and devote greater resources to the enhancement, promotion and sale of their products. Such competition could adversely affect our ability to win new contracts and sales.

Since we operate in evolving markets, our business and future prospects may be difficult to evaluate.

Our technological solutions are in new and rapidly evolving markets. The military, civilian public safety, professional and personal defense markets we target are in early stages of customer adoption. Accordingly, our business and future prospects may be difficult to evaluate. We cannot accurately predict the extent to which demand for our products and services will develop and/or increase, if at all. The challenges, risks and uncertainties frequently encountered by companies in rapidly evolving markets could impact our ability to do the following:

• generate sufficient revenue to obtain and/or maintain profitability;

• acquire and maintain market share;

• achieve or manage growth in operations;

• develop and renew contracts;

• attract and retain additional engineers and other highly-qualified personnel;

• successfully develop and commercially market products and services;

• adapt to new or changing policies and spending priorities of governments and government agencies; and

• access additional capital when required or on reasonable terms.

If we fail to address these and other challenges, risks and uncertainties successfully, our business, results of operations and financial condition would be materially harmed.

Uncertainty related to exportation could limit our operations in the future.

We must comply with Canadian federal and provincial laws regulating the export of our products. In some cases, explicit authorization from the Canadian government is needed to export certain products. The export regulations and the governing policies applicable to our business are subject to change. We cannot provide assurance that such export authorizations will be available for our products in the future. To date, compliance with these laws has not significantly limited our operations but could significantly limit them in the future. Noncompliance with applicable export regulations could potentially expose us to fines, penalties and sanctions. If we cannot obtain required government approvals under applicable regulations, we may not be able to sell our products in certain international jurisdictions, which could adversely affect our business, prospects, financial condition and results of operations.

Global economic turmoil and regional economic conditions in the United States could adversely affect our business.

Global economic turmoil may cause a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, levels of intervention from the United States federal government and other foreign governments, decreased consumer confidence, overall slower economic activity, and extreme volatility in credit, equity, and fixed income markets. A decrease in economic activity in the United States or in other regions of the world in which we do business could adversely affect demand for our products, thus reducing our revenues and earnings. A decline in economic conditions could reduce sales of our products.

Risks Relating to Our Financial Condition

We face substantial capital requirements and financial risk.

To be successful, our business requires a substantial investment of capital. The production, acquisition, and distribution of proprietary technology for game-changing applications in the military and security forces and personal defense markets require substantial capital. A significant amount of time may elapse between our expenditure of funds and the receipt of revenues. This may require a significant portion of funds from equity, credit, and other financing sources to fund the business. There can be no assurance that these arrangements will continue to be successfully implemented or will not be subject to substantial financial risks relating to the production, acquisition, and distribution of proprietary technology for game-changing applications in the military and security forces and personal defense markets. In addition, if demand increases through internal growth or acquisition, there may be an increase to overhead and/or larger up-front payments for production and, consequently, these increases bear greater financial risks. Any of the foregoing could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects.

We may require additional capital which may result in dilution to existing shareholders.

We may need to engage in additional equity or debt financings to secure additional funds to fund our working capital requirement and business growth. If we raise additional funds through further issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of the Common Shares. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters, which might make it more difficult for us to obtain additional capital and to pursue business opportunities.

We can provide no assurance that sufficient debt or equity financing will be available on reasonable terms or at all to support our business growth and to respond to business challenges and failure to obtain sufficient debt or equity financing when required could have a material adverse effect on our business, prospects, financial condition, results of operations, and cash flows.

Over the short-term, we expect to incur operating losses and generate negative cash flow until we can produce sufficient revenues to cover our costs. We may never become profitable. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future. There are substantial uncertainties associated with our ability to achieving and sustaining profitability. We expect our current cash position will be reduced due to future operating losses and working capital requirements, and we cannot provide certainty as to how long our cash position will last or that we will be able to access additional capital if and when necessary.

Exercise of options or warrants or vesting of restricted stock units will have a dilutive effect on your percentage ownership and will result in a dilution of your voting power and an increase in the number of Common Shares eligible for future resale in the public market, which may negatively impact the trading price of our Common Shares.

We may need to divest assets if there is insufficient capital.

If sufficient capital is not available, we may be required to delay, reduce the scope of, eliminate or divest one or more of our assets or products, any of which could have a material adverse effect on our business, financial condition, prospects, or results of operations.

We have broad discretion over the use of net proceeds from future capital raises.

We will have broad discretion over the use of the net proceeds from any future capital raises. Because of the number and variability of factors that will determine our use of such proceeds, the ultimate use might vary substantially from the planned use. Investors may not agree with how we allocate or spend the proceeds from future capital raises. We may pursue collaborations that ultimately do not result in an increase in the market value of the Common Shares and that instead increase our losses.

Currency fluctuations may have a material effect on us.

Fluctuations in the exchange rate between the United States dollar, other currencies and the Canadian dollar may have a material effect on our results of operations. To date, we have not engaged in currency hedging activities. To the extent that we may seek to implement hedging techniques in the future with respect to our foreign currency transactions, there can be no assurance that we will be successful in such hedging activities.

Unavailability of adequate director and officer insurance could make it difficult for us to retain and attract qualified directors and could also impact our liquidity.

We have directors and officers liability ("D&O") insurance we believe to be adequate to cover risk exposure for us and our directors and officers, who we indemnify to the full extent permitted by law, there is no guaranty that such coverage will be adequate in the event of litigation.