UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 4)

☒ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended________________________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from_________ to _________

Commission file number: __________________

ADASTRA HOLDINGS LTD.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

5451 - 275 Street

Langley, British Columbia V4W 3X8

Canada

(Address of principal executive offices)

Michael Forbes

5451 - 275 Street

Langley, British Columbia V4W 3X8, Canada

Telephone: 778-715-5011

Facsimile: 844-874-9893

Michael@adastraholdings.ca

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Trading

Symbols(s) | Name of each exchange on which registered |

Not Applicable | Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.: Not Applicable

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.: Not applicable.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☐ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☐ Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "large accelerated filer, "accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated Filer | ☐ | Non-accelerated filer | ☒ |

| | | | Emerging Growth Company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☒ | Other | ☐ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☐ No

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This registration statement contains forward-looking statements. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intend", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, including the risks in the section entitled "Risk Factors", uncertainties and other factors, which may cause our company's or our industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

ABOUT THIS REGISTRATION STATEMENT

As used in this registration statement, the terms "we", "us" and "our" refer to Adastra Holdings Ltd., a British Columbia corporation, and its direct and indirect subsidiaries, unless otherwise specified.

Our financial statements and other financial information are prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, or "IFRS", in Canadian dollars. None of our consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles, and our financial statements may therefore not be comparable to financial statements of United States companies.

In this registration statement, the terms "dollar", "$" or "CAD$" refer to Canadian dollars and the term, "US$" refers to United States dollars.

The share and per share information in this registration statement, other than in our consolidated financial statements and the notes thereto, or where referred to as "pre-consolidated", reflects a consolidation of our issued and outstanding common shares on the basis of one new common share for three old common shares which was completed on April 9, 2021.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

The following table sets forth the names, business addresses and functions of our directors and senior management:

Name | Business Address | Function |

Michael Forbes | 275 Street, Langley, British Columbia, Canada | As our Chief Executive Officer and Chairman of the board of directors, Mr. Forbes is responsible for strategic planning and operations, as well as managing our relations with our lawyers, regulatory authorities and investor community; as a director, Mr. Forbes supervises our management and helps to ensure compliance with our corporate governance policies and standards. Mr. Forbes is a member of our audit committee. |

Oliver Foeste | 275 Street, Langley, British Columbia, Canada | As our Chief Financial Officer, Mr. Foeste is responsible for the management and supervision of all financial aspects of our business. Mr. Foeste assists in strategic planning, oversees capital planning and capital raising, budgeting, financial reporting and risk management. In performing his duties, Mr. Foeste maintains relationships with our auditors, legal counsel, banks, and other stakeholders. |

Donald Dinsmore | 275 Street, Langley, British Columbia, Canada | As our Chief Operating Officer, Mr. Dinsmore is responsible for the execution of strategic plans and operations management of the business, Mr. Dinsmore assists in strategic planning, supervises production, quality, sales, marketing, and regulatory compliance. In the fulfilment of his duties, he maintains relationships with suppliers, customers, legal counsel, and other stakeholders. As our Corporate Secretary, Mr. Dinsmore is responsible for maintaining our corporate records. As a director, Mr. Dinsmore supervises our management and helps to ensure compliance with our corporate governance policies and standards. |

George Routhier | 759 Highway 511, Perth, Ontario, Canada | As an independent director, Mr. Routhier supervises our management and helps to ensure compliance with our corporate governance policies and standards. Mr. Routhier is a member of our audit committee. |

Paul Morgan | 100 388 Harbour Road, Victoria, British Columbia, Canada | As an independent director, Mr. Morgan supervises our management and helps to ensure compliance with our corporate governance policies and standards. Mr. Morgan is a member of our audit committee. |

B. Advisors

Not applicable.

C. Auditors

Our auditors are Davidson & Company LLP, located at 1200 - 609 Granville Street, Vancouver, British Columbia V7Y 1G6, Canada. Davidson & Company LLP is registered with both the Canadian Public Accountability Board and the U.S. Public Company Accounting Oversight Board.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. [Reserved]

B. Capitalization and Indebtedness

The table below sets forth our capitalization and indebtedness as of September 30, 2021. You should read this table in conjunction with our audited and unaudited consolidated financial statements, together with the accompanying notes and the other information appearing under the heading "Item 5. Operating and Financial Review and Prospects".

| September 30, 2021 (Unaudited) $ |

Cash | 1,207,688 |

Total Current Assets | 4,867,598 |

Total Assets | 40,638,028 |

Current Liabilities (Unsecured) | 1,884,738 |

Current Liabilities (Secured) | 3,498,728 |

Non-Current Liabilities (Unsecured) | 84,240 |

Non-Current Liabilities (Secured) | - |

Share Capital | 41,833,128 |

Reserves | 5,461,270 |

Subscriptions received | 135,000 |

Deficit | (12,259,076) |

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our common shares involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this registration statement in evaluating our company and our business before purchasing our common shares. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are not the only ones facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

Our activities are subject to regulation by governmental authorities.

Our activities are subject to regulation by governmental authorities. Achievement of our business objectives are contingent, in part, upon compliance with regulatory requirements enacted by these governmental authorities and obtaining all regulatory approvals, where necessary, for the sale of our products and services. We cannot predict the time required to secure all appropriate regulatory approvals for our products and services, or the extent of testing and documentation that may be required by governmental authorities. Any delays in obtaining, or failure to obtain regulatory approvals would significantly delay the development of markets and products and services and could have a material adverse effect on our business, results of operations and financial condition.

Doing business in the cannabis industry leaves our company subject to possible regulatory risks.

The cannabis industry is a new industry which is highly regulated, highly competitive and evolving rapidly and psychedelics are illegal substances other than when used for scientific or medical purposes. As such, new risks may emerge, and management may not be able to predict all such risks or be able to predict how such risks may result in actual results differing from the results contained in any forward-looking statements.

Psychedelics are Schedule III substances under the Controlled Drugs and Substances Act for which the extraction of raw materials from, or involvement in production activities are regulated federally in Canada. In order to develop our business and undertake research and development, the Company is applying for a dealer license for psychedelics which, if obtained, will allow the Company to possess and formulate psychedelics. While we anticipate being successful in this application, there is no guarantee that we will obtain a dealer license to possess and formulate psychedelics. If we are successful in this application there remain uncertainties with respect to how government regulations will impact our business with respect to psychedelics. The Company is in the process of assessing this impact. At present a dealer license holder can only trade with another individual who has the same license. Their activities are limited in trade and they cannot provide substances to individuals or companies as Health Canada has yet to approve psychedelics as a drug and it is currently illegal to possess psychedelics in Canada without a dealer license or other exemption. We are confident that our application will be successful, however, if in the unlikley event we are unable to obtain a dealer license, this will serverly limit our ability to undertake research and development in psychedelics.

These industries are subject to extensive controls and regulations, which may significantly affect the financial condition of market participants. The plain packaging requirements and restrictions on promotion of cannabis and the restrictions on promotion of illegal substances in Canada may limit the ability to effectively advertise and promote our products and business. The marketability of any product may also be affected by numerous factors that are beyond the control of the investee companies and which cannot be predicted, such as changes to government regulations, including those relating to taxes and other government levies which may be imposed. Changes in government levies, including taxes, could reduce the investee companies' earnings and could make future capital investments or the investee companies' operations uneconomic. The cannabis industry is also subject to numerous legal challenges, which may significantly affect the financial condition of market participants, and which cannot be reliably predicted.

The impact of various legislative regimes on our business plans and operations is uncertain. There is no guarantee that the applicable legislation regulating the manufacture, distribution, sale and promotion of cannabis will create or allow for the growth opportunities we currently anticipate.

Acquisitions or other consolidating transactions in our industry could have adverse effects on our company.

Acquisitions or other consolidating transactions in our industry could have adverse effects on our company. We could lose strategic relationships if our partners are acquired by or enter into agreements with a competitor, causing us to lose access to distribution, content and other resources. The relationships between our company and our strategic partners may deteriorate and cause an adverse effect on the business. We could lose customers if competitors or user of competing technology consolidate with our current or potential customers. Furthermore, our current competitors could become larger players in the market or new competitors could form from consolidations. Any of the foregoing events could put our company at a competitive disadvantage, which could cause our company to lose customers, revenue, and market share. Consolidation in the industry could also force our company to divert greater resources to meet new or additional competitive threats, which could harm our operating results.

COVID-19 Pandemic has and will continue to affect our business.

COVID-19 outbreak continues to rapidly evolve and is causing business disruptions across the entire global economy and society. We have taken various measures to prioritize the health and safety of our employees, customers and partners, including restricted work travel and site access; improved safety & hygiene; and the requirement of nonessential staff members to work remotely. As a manufacturer of consumable and medicinal products, our practice is always to operate to global pharma-quality standards to the best of our abilities with strict hygiene practices and mandated personal protective equipment. The extent of the impact on COVID-19 on our operational and financial performance will depend on various developments, including the duration and magnitude of the outbreak, and the impact on customers, employees and vendors, all of which are uncertain and cannot be predicted at this point.

We could have issues of conflicts of interest with our directors and officers.

Certain of the directors and officers of our company are also directors and officers of other companies, and conflicts of interest may arise between their duties as officers and directors of our company and as officers and directors of such other companies.

Global economic conditions could materially adversely impact demand for our products and services.

Our operations and performance depend significantly on economic conditions. The COVID-19 global pandemic and resulting government health regulations have resulted in significant reductions in global economic output and have negatively impacted global economic conditions. The ultimate impact and duration of current negative global economic conditions are highly uncertain. Uncertainty about global economic conditions could result in customers postponing purchases of our products and services in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values and other macroeconomic factors, which could have a material negative effect on demand for our products and services and, accordingly, on our business, results of operations or financial condition.

We have ongoing need for financing.

Our ability to continue operations will be largely reliant on our continued attractiveness to equity investors. We are expected to incur operating losses as we continue to expend funds to develop our business operations. Our continued development will require substantial additional financing. The failure to raise such capital could result in the delay or indefinite postponement of current business objectives or the going out of business. The primary source of funding available to our company will consist of equity financing. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable. In addition, from time to time, we may enter into transactions to acquire assets or the shares of other corporations. These transactions may be financed wholly or partially with debt, which may temporarily increase our debt levels above industry standards.

We lack business diversification.

The prospects for our success are dependent upon the future performance and market acceptance of our facilities, products, processes, and services. Unlike certain entities that have the resources to develop and explore numerous product lines, operating in multiple industries or multiple areas of a single industry, we do not have the ability to immediately diversify or benefit from the possible spreading of risks or offsetting of losses. Again, the prospects for our success are dependent upon the development or market acceptance of a very limited number of facilities, products, processes or services.

We may encounter issues with managing growth.

Any expansion of our business may place a significant strain on our financial, operational and managerial resources. There can be no assurance that we will be able to implement and subsequently improve our operations and financial systems successfully and in a timely manner in order to manage any growth we experience. There can be no assurance that we will be able to manage growth successfully. Any ability of our company to manage growth successfully could have a material adverse effect on our business, financial condition and results of operations.

We rely on key consultants.

There can be no assurance that any of our consultants will remain with our company or that, in the future, they will not organize competitive businesses or accept opportunities with companies competitive with us. We depend on a number of key officers and directors the loss of any one of whom could have an adverse effect on our company.

We may become subject to litigation.

We may be forced to litigate, enforce, or defend our intellectual property rights, protect our trade secrets, or determine the validity and scope of other parties' proprietary rights. Such litigation would be a drain on the financial and management resources of our company which may affect our operations and business. Furthermore, because the content of most of our intellectual property concerns cannabis and other activities that are not legal in some state jurisdictions, we may face additional difficulties in defending our intellectual property rights. We may become party to litigation from time to time in the ordinary course of business which could adversely affect our business. Should any litigation in which we become involved in be determined against our company such a decision could adversely affect our ability to continue operating and the market price for our common shares and could use significant resources. Even if we are involved in litigation and wins, litigation can redirect significant company resources.

We may be subject to product recalls.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labelling disclosure. If any of our products are recalled due to an alleged product defect or for any other reason, we could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection with the recall. We may lose a significant amount of sales and may not be able to replace those sales at an acceptable margin or at all. In addition, a product recall may require significant management attention. Although we have detailed procedures in place for testing our products, there can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if we are subject to a recall, the image of our company could be harmed. A recall for any of the foregoing reasons could lead to decreased demand for our products and could have a material adverse effect on our results of operations and financial condition. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management attention, potential loss of applicable licenses and potential legal fees and other expenses.

We could have issues with product liability due to the nature of the Company's products.

As a distributor of products designed to be ingested by humans, our company faces an inherent risk of exposure to product liability claims, regulatory action and litigation if our products are alleged to have caused significant loss or injury. In addition, the sale of our products involves the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Previously unknown adverse reactions resulting from human consumption of our products alone or in combination with other medications or substances could occur. We may be subject to various product liability claims, including, among others, that our products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning possible side effects or interactions with other substances. A product liability claim or regulatory action against our company could result in increased costs, could adversely affect our company's reputation with clients and consumers generally, and could have a material adverse effect on our business, prospects, financial condition and results of operations. There can be no assurances that we will be able to obtain or maintain product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive and may not be available in the future on acceptable terms, or at all. The inability to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims could have a material adverse effect on our business, prospects, financial condition and results of operations.

We rely on third party relationships.

We are dependent on several third-party relationships and their related costs, including raw materials and supplies related to their growing operations, as well as electricity, water and other utilities. Any significant interruption or negative change in the availability or economics of the supply chain from third-party relationships could materially impact our financial condition and operating results. Any inability to secure required supplies and services or to do so on appropriate terms could have a materially adverse impact on our business, financial condition and operating results.

The third parties with which we do business may perceive that they are exposed to reputational risks as a result of our cannabis business activities, Failure to establish or maintain business relationships could have a material adverse effect on our company.

Our advertising and promotional expenditures may not be effective or efficient.

Our future growth and profitability will depend on the effectiveness and efficiency of advertising and promotional expenditures, including our ability to (i) create greater awareness of its products; (ii) determine the appropriate creative message and media mix for future advertising expenditures; and (iii) effectively manage advertising and promotional costs in order to maintain acceptable operating margins. There can be no assurance that advertising and promotional expenditures will result in revenues in the future or will generate awareness of our technologies or services. In addition, no assurance can be given that we will be able to manage our advertising and promotional expenditures on a cost-effective basis.

Being a public company requires significant obligations.

Our Company incurs significant legal, accounting, insurance and other expenses as a result of being a public Company, which may negatively impact our performance and could cause our results of operations and financial condition to suffer. Compliance with applicable securities laws in Canada and the rules and policies of the Canadian Securities Exchange constitutes a significant expense, including legal and accounting costs, and makes some activities more time-consuming and costly. Reporting obligations as a public company and our anticipated growth may place a strain on our financial and management systems, processes and controls, as well as on personnel.

Our company may rely on intellectual property.

Our success may depend in part on the ability to protect ideas and technology. Even if we move to protect technology with trademarks, patents, copyrights or by other means, we are not assured that competitors will not develop similar technology, business methods or that they will be able to exercise their legal rights. Other countries may not protect intellectual property rights to the same standards as does Canada. Actions taken to protect or preserve intellectual property rights may require significant financial and other resources such that said actions have a meaningfully impact the ability to successfully grow our business.

Fraudulent or illegal activity could occur within our company.

Our Company is exposed to the risk that its employees, independent contractors and consultants may engage in fraudulent or other illegal activity. Misconduct by these parties could include intentional, reckless and/or negligent conduct or disclosure of unauthorized activities to our company that violates: (i) government regulations; (ii) manufacturing standards; (iii) federal and provincial healthcare fraud and abuse laws and regulations; or (iv) laws that require the true, complete and accurate reporting of financial information or data. It is not always possible for our company to identify and deter misconduct by its employees and other third parties, and the precautions taken by our company to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting our company from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against our company, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business, including the imposition of civil, criminal and administrative penalties, damages, monetary fines, contractual damages, reputational harm, diminished profits and future earnings, and curtailment of the Issuer's operations, any of which could have a material adverse effect on our business, financial condition and results of operations.

We cannot ensure product viability.

If the products our company sells are not perceived to have the effects intended by the end user, our business may suffer. Many of our products contain innovative ingredients or combinations of ingredients. There is little long-term data with respect to efficacy, unknown side effects and/or interaction with individual human biochemistry. Moreover, there is little long-term data with respect to efficacy, unknown side effects and/or its interaction with individual animal biochemistry. As a result, our products could have certain side effects if not taken as directed or if taken by an end user that has certain known or unknown medical conditions.

We rely on the success of our quality control systems.

The quality and safety of our products are critical to the success of our business and operations. As such, it is imperative that our (and our service provider's) quality control systems operate effectively and successfully. Quality control systems can be negatively impacted by the design of the quality control systems, the quality training program, and adherence by employees to quality control guidelines. Although we strive to ensure that all of our service providers have implemented and adhere to high caliber quality control systems, any significant failure or deterioration of such quality control systems could have a material adverse effect on our business and operating results.

The cannabis industry and market are relatively new in Canada and this industry and market may not continue to exist or grow as anticipated.

Our company operates its business in a relatively new industry and market. In addition to being subject to general business risks, we must continue to build brand awareness in this industry and market through significant investments in its strategy, its production capacity, quality assurance and compliance with regulations. In addition, there is no assurance that the industry and market will continue to exist and grow as currently estimated or anticipated or function and evolve in the manner consistent with management's expectations and assumptions. Any event or circumstance that adversely affects the cannabis industry and market could have a material adverse effect of our business, financial conditions and results of operations.

The cannabis industry is difficult to quantify, and investors will be reliant on their own estimates of the accuracy of market data.

Because the cannabis industry is in an emerging stage with uncertain boundaries, there is a lack of information about comparable companies available for potential investors to review in deciding about whether to invest in our company and, few, if any, established companies whose business model our company can follow or upon whose success our company can build. Accordingly, investors will have to rely on their own estimates in deciding about whether to invest in our company. There can be no assurance that our estimates are accurate or that the market size is sufficiently large for our business to grow as projected, which may negatively impact our financial results.

The cannabis industry is very competitive.

The marijuana production industry is competitive in all of its phases. We face strong competition from other companies in connection with such matters. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain our operations or develop them as currently proposed, on terms we consider acceptable or at all. Consequently, the revenues, operations and financial condition of our company could be materially adversely affected.

Because of early stage of the industry in which we operate, we may face additional competition from new entrants. If the number of users of marijuana in Canada increases, the demand for products will increase and we expect that competition will become more intense, as current and future competitors begin to offer an increasing number of diversified products. To remain competitive, we will require a continued high level of investment in research and development, marketing, sales and client support. We may not have sufficient resources to maintain research and development, marketing, sales and client support efforts on a competitive basis which could materially and adversely affect the business, financial condition and results of operations.

Consolidation that may intensify competition.

The cannabis industry is undergoing rapid growth and substantial change, which has resulted in an increase in competitors, consolidation and formation of strategic relationships. Acquisitions or other consolidating transactions could harm our company in a number of ways, including by losing strategic partners if they are acquired by or enter into relationships with a competitor, losing customers, revenue and market share, or forcing our company to expend greater resources to meet new or additional competitive threats, all of which could harm our operating results.

The processing of cannabis includes risks inherent in an agricultural business including the risk of crop loss, sudden changes in environmental conditions, equipment failure, product recalls and others.

Our business will be subject to the risks inherent in the agricultural business, such as insects, plant diseases and similar agricultural risks. There can be no assurance that natural elements will not have a material adverse effect on our products.

The cannabis industry could be subject to negative customer perception.

We believe the cannabis industry is highly dependent upon consumer perception regarding the medical benefits, safety, efficacy and quality of the cannabis distributed for medical purposes to such consumers. Consumer perception can be significantly influenced by scientific research or findings, regulatory investigations, litigation, political statements both in Canada and in other countries, media attention and other publicity (whether or not accurate or with merit) regarding the consumption of cannabis products for medical or recreational purposes, including unexpected safety or efficacy concerns. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the medical cannabis market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that are perceived as less favorable than, or that question, earlier research reports, findings or publicity could have a material adverse effect on the demand for cannabis and the business, results of operations and financial condition of our company. Our dependence upon consumer perceptions means that adverse scientific research reports, findings, regulatory proceedings, litigation, media attention or other publicity (whether or not accurate or with merit), could have an adverse effect on any demand for our services and products which could have a material adverse effect on our business, financial condition and results of operations. Further, adverse publicity reports or other media attention regarding the safety, efficacy and quality of cannabis for medical purposes in general, or associating the consumption of cannabis with illness or other negative effects or events, could have such a material adverse effect. Such adverse publicity reports or other media attention could arise even if the adverse effects associated with such products resulted from consumers' failure to consume such products legally, appropriately or as directed.

The mushroom and mushroom-derived products could be subject to negative customer perception.

We are dependent upon consumer perception of mushrooms and mushroom-derived products. The public may associate our mushrooms and mushroom-derived products with illegal psychoactive mushrooms, which are prohibited substances, which may negatively impact our future revenues once we obtain the necessary licensing.

General healthcare regulation may affect our businesses.

Healthcare service providers in Canada are subject to various governmental regulation and licensing requirements and, as a result, our businesses operate in an environment in which government regulations and funding play a key role. The level of government funding directly reflects government policy related to healthcare spending, and decisions can be made regarding such funding that are largely beyond the businesses' control. Any change in governmental regulation, delisting of services, and licensing requirements relating to healthcare services, or their interpretation and application, could adversely affect the business, financial condition and results of operations of these business units. In addition, we could incur significant costs in the course of complying with any changes in the regulatory regime. Non‐compliance with any existing or proposed laws or regulations could result in audits, civil or regulatory proceedings, fines, penalties, injunctions, recalls or seizures, any of which could adversely affect the reputation, operations or financial performance of our company.

We rely on physicians and other healthcare professionals.

We rely on the availability of physicians and other healthcare professionals to provide services at our facilities. If physicians and other healthcare professionals were unable or unwilling to provide these services in the future due to any sort of reason, this would cause interruptions in our business until mitigated accordingly. As such, vacancies and disabilities relating to our current medical staff may cause interruptions in our business and result in lower revenues.

As we expand our operations, we may encounter difficulty in securing the necessary professional medical and skilled support staff to support our expanding operations. There is currently a shortage of certain medical physicians in Canada and this may affect our ability to hire physicians and other healthcare practitioners in adequate numbers to support our growth plans, which may adversely affect the business, financial condition and results of operations.

Security breaches and other disruptions to our information technology networks and systems could substantially interfere with our operations and could compromise the confidentiality of our proprietary information.

We rely upon information technology systems and networks, some of which are managed by third parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including supply chain management, manufacturing, invoicing and collection of payments from our customers. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information, the proprietary business information of our suppliers, as well as personally identifiable information of our employees, in data centers and on information technology systems. The secure operation of these information technology systems, and the processing and maintenance of this information, is critical to our business operations and strategy. Despite security measures and business continuity plans, our information technology systems and networks may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to errors or malfeasance by employees, contractors and others who have access to our networks and systems, or other disruptions during the process of upgrading or replacing computer software or hardware, hardware failures, software errors, third-party service provider outages, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise our systems and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations and reduce the competitive advantage we hope to derive from our investment in technology. Our insurance coverage may not be available or adequate to cover all the costs related to significant security attacks or disruptions resulting from such attacks.

If consumers elect to produce cannabis for their own purposes under the cannabis regulations it could reduce the addressable market for our products.

Under the Cannabis regulations, three options are available for an individual to obtain cannabis for medical purposes: (i) registering with a holder of a license to sell for medical purposes and purchasing products from that entity; (ii) register with Health Canada to produce a limited amount of cannabis for their own medical purposes; or (iii) designate someone else to produce cannabis for them. In addition, the Cannabis Act (as defined herein) permits households to grow a maximum of four cannabis plants for recreational purposes. Subject to further regulation by provincial and municipal governments it is possible that production of cannabis by consumers for medical or recreational purposes could significantly reduce the addressable market for our products and could have a material adverse effect on our business, financial condition or results of operations.

We face competition from illicit dispensaries and the illicit market.

We also face competition from illicit dispensaries and the illicit market more broadly. Participants in these markets are unlicensed and unregulated. They may be selling cannabis and cannabis products with higher concentrations of active ingredients and using classes of cannabis that are not yet regulated for sale in Canada. Various Canadian cities have seen an influx in the number of illicit dispensaries. Any inability or unwillingness of law enforcement authorities to enforce existing laws prohibiting the unlicensed cultivation and sale of cannabis and cannabis products could result in the perpetuation of the illicit market for cannabis and/or have a material adverse effect on the perception of cannabis use. Any or all these events could have a material adverse effect on our business, prospects, financial condition and results of operations.

Risks Related to Our Company

We may need to raise additional funds to support our business operations or to finance future acquisitions, including through the issuance of equity or debt securities, which could have a material adverse effect on our ability to grow our business.

If we do not generate sufficient cash from operations or do not otherwise have sufficient cash and cash equivalents to support our business operations or to finance future acquisitions, we may need to raise additional capital through the issuance of debt or equity securities. We may not be able to raise cash in future financing on terms acceptable to us, or at all.

Financings, if available, may be on terms that are dilutive to our shareholders, and the prices at which new investors would be willing to purchase our securities may be lower than the current price of our common shares. The holders of new securities may also receive rights, preferences or privileges that are senior to those of existing holders of our common shares. If new sources of financing are required but are insufficient or unavailable, we would be required to modify our plans to the extent of available funding, which could harm our ability to grow our business.

The report of our independent registered public accounting firm for the year ended December 31, 2020 includes a "going concern" explanatory paragraph.

The report of our independent registered public accounting firm on our consolidated financial statements as of and for the year ended December 31, 2020 includes an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern. If we are unable to raise sufficient capital when needed, our business, financial condition and results of operations will be materially and adversely affected, and we will need to significantly modify our operational plans to continue as a going concern. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our consolidated financial statements. The inclusion of a going concern explanatory paragraph by our auditors, our lack of cash resources and our potential inability to continue as a going concern may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

We have no operating experience as a publicly traded company in the U.S.

We have no operating experience as a publicly traded company in the U.S. Although the individuals who now constitute our management team have experience managing a publicly traded company, there is no assurance that the past experience of our management team will be sufficient to operate our company as a publicly traded company in the United States, including timely compliance with the disclosure requirements of the Securities and Exchange Commission. These requirements will place significant strain on our management team, infrastructure and other resources. In addition, our management team may not be able to successfully or efficiently manage our company as a U.S. public reporting company that is subject to significant regulatory oversight and reporting obligations.

We lack operating history.

We have only started to carry on our current business since 2019. We are therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources. Our failure to meet any of these conditions could have a materially adverse effect on our company and may force us to reduce, curtail, or discontinue operations. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of success must be considered in light of the early stage of operations. We may not successfully address all of the risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common shares, resulting in a loss to shareholders. Even if we accomplish these objectives, we may not generate the anticipated positive cash flows or profits. No assurance can be given that we can or will ever be successful in our operations and operate profitably.

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of British Columbia, Canada. Some of our directors and officers, and the experts named in this registration statement, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, it may be difficult for holders of our common shares who reside in the United States to effect service within the United States upon our directors and officers who are not residents of the United States. It may also be difficult for holders of our common shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors and officers under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or our directors or officers predicated upon the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or our directors or officers predicated upon the United States federal securities laws or any such state securities or "blue sky" laws.

As a foreign private issuer, we are not subject to certain United States securities law disclosure requirements that apply to a domestic United States issuer, which may limit the information that would be publicly available to our shareholders.

As a foreign private issuer, we will be exempt from certain rules under the Securities Exchange Act of 1934 that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Securities Exchange Act of 1934. In addition, our officers, directors and principal shareholders will be exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Securities Exchange Act of 1934. Moreover, we are not required to file periodic reports and financial statements with the Securities and Exchange Commission as frequently or as promptly as a company that files as a U.S. domestic issuer whose securities are registered under the Securities Exchange Act of 1934, nor are we generally required to comply with the Securities and Exchange Commission's Regulation FD, which restricts the selective disclosure of material non-public information. For as long as we are a "foreign private issuer" we intend to file our annual financial statements on Form 20-F and furnish our quarterly interim financial statements on Form 6-K to the Securities and Exchange Commission. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a U.S. domestic issuer.

Risks Related to Our Common Shares

Because we can issue additional common shares, our shareholders may experience dilution in the future.

We are authorized to issue an unlimited number of common shares without par value. Our board of directors has the authority to cause us to issue additional common shares without consent of our shareholders. The issuance of any such securities may result in a reduction of the book value or market price of our common shares. Given the fact that we have not achieved profitability or generated positive cash flow historically, and we operate in a capital-intensive industry with significant working capital requirements, we may be required to issue additional common equity or securities that are dilutive to existing common shares in the future in order to continue its operations. Our efforts to fund our intended business plan may result in dilution to existing shareholders. Further, any such issuances could result in a change of control or a reduction in the market price for our common shares.

Volatility in our common share price may subject us to securities litigation.

The market for our common shares may have, when compared to seasoned issuers, significant price volatility, and we expect that our share price may continue to be more volatile than that of a seasoned issuer for the foreseeable future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources away from the day-to-day business operations.

The market price of our common shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our common shares are listed on the Canadian Securities Exchange. Trading of shares on the Canadian Securities Exchange is often characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects.

The volume of trading in our common shares has been low and the share price has fluctuated significantly. This volatility could depress the market price of our common shares for reasons unrelated to operating performance. The market price of our common shares could decline due to the impact of any of the following factors upon the market price of our common shares:

● sales or potential sales of substantial amounts of our common shares;

● announcements about us or about our competitors;

● litigation and other developments relating to our company or those of our suppliers or our competitors;

● conditions in the automobile industry;

● governmental regulation and legislation;

● variations in our anticipated or actual operating results;

● change in securities analysts' estimates of our performance, or our failure to meet analysts' expectations;

● change in general economic conditions or trends;

● changes in capital market conditions or in the level of interest rates; and

● investor perception of our industry or our prospects.

Many of these factors are beyond our control. The stock markets in general, and the market price of shares of companies in the cannabis industries, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our common shares, regardless of our actual operating performance.

A prolonged and substantial decline in the price of our common shares could affect our ability to raise further working capital, thereby adversely impacting our ability to continue operations.

A prolonged and substantial decline in the price of our common shares could result in a reduction in the liquidity of our common shares and a reduction in our ability to raise capital. Because we plan to acquire a significant portion of the funds, we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common shares could be detrimental to our liquidity and our operations because the decline may cause investors not to choose to invest in our shares. If we are unable to raise the funds, we require for all our planned operations and to meet our existing and future financial obligations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and we may go out of business.

Because we do not intend to pay any cash dividends on our common shares in the near future, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

Our common shares are subject to penny stock rules. Trading of our common shares may be restricted by the Securities and Exchange Commission's penny stock regulations, which may limit a shareholder's ability to buy and sell our common shares.

Our common shares are penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than US$5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of US$5,000,000 or individuals with a net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the common shares that are subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common shares.

The Financial Industry Regulatory Authority sales practice requirements may also limit a shareholder's ability to buy and sell our common shares.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority or FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our shares.

We may be classified as a "passive foreign investment company," which may have adverse U.S. federal income tax consequences for U.S. shareholders.

Generally, for any taxable year in which 75% or more of our gross income is passive income, or at least 50% of the average quarterly value of our assets (which may be determined in part by the market value of our common shares, which is subject to change) are held for the production of, or produce, passive income, we would be characterized as a passive foreign investment company ("PFIC") for U.S. federal income tax purposes. Our status as a PFIC is a fact-intensive determination made on an annual basis, and we cannot provide any assurance regarding our PFIC status for the taxable year ending December 31, 2020 or for future taxable years.

If we are a PFIC for any year during a non-corporate U.S. shareholder's holding period of our common shares, then such non-corporate U.S. shareholder generally will be required to treat any gain realized upon a disposition of our common shares, or any so-called "excess distribution" received on our common shares, as ordinary income, rather than as capital gain, and the preferential tax rate applicable to dividends received on our common shares would not be available. Interest charges would also be added to the taxes on gains and distributions realized by all U.S. holders.

A U.S. shareholder may avoid these adverse tax consequences by making a timely and effective "qualified electing fund" election ("QEF election"). A U.S. shareholder who makes a QEF election generally must report, on a current basis, its share of our ordinary earnings and net capital gains, whether or not we distribute any amounts to our shareholders. The QEF election is available only if our company characterized as a PFIC provides a U.S. shareholder with certain information regarding its earnings and capital gains as required under applicable U.S. Treasury regulations. In the event we become a PFIC, U.S. Holders should be aware that we might not satisfy the recordkeeping requirements that apply to a QEF or supply U.S. Holders with information such U.S. Holders require to report under the QEF rules in the event that our company is a PFIC for any tax year.

A U.S. shareholder may also mitigate the adverse tax consequences by timely making a mark-to-market election. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the increase in the fair market value of the common shares and deduct from gross income the decrease in the value of such shares during each of its taxable years. A mark-to-market election may be made and maintained only if our common shares are regularly traded on a qualified exchange. Whether our common shares are regularly traded on a qualified exchange is an annual determination based on facts that, in part, are beyond our control. Accordingly, a U.S. shareholder might not be eligible to make a mark-to-market election to mitigate the adverse tax consequences if we are characterized as a PFIC.

Each U.S. shareholder should consult their own tax advisors with respect to the possibility of making these elections and the U.S. federal income tax consequences of the acquisition, ownership and disposition of our common shares. This paragraph is qualified in its entirety by the discussion in the section of this registration statement entitled "Certain Material United States Federal Income Tax Considerations." In addition, our PFIC status may deter certain U.S. investors from purchasing our common shares, which could have an adverse impact on the market price of our common shares.

Item 4. Information on the Company

A. History and Development of the Company

We are a corporation incorporated under the Business Corporations Act (British Columbia) in British Columbia, Canada under the name "Adastra Holdings Ltd." with an authorized share structure of unlimited number of common shares without par value. Our principal place of business is located at 5451 - 275 Street, Langley, British Columbia V4W 3X8, Canada and our telephone number is (778) 715-5011. Our registered and records office is located at 800 - 885 West Georgia Street, Vancouver, British Columbia V6C 3H1, Canada.

We are an extraction and processing solutions company. Our mission is to develop and deploy large-scale cannabis and hemp extraction technologies and provide turn-key processing solutions to help licensed standard and micro-cultivators maximize the value of every harvest. We are also applying for a dealers licence for mushroom and mushroom-derived products in preparation for licencing of psychedelics in Canada, and operate a research-based multidisciplinary centre with physicians and healthcare professionals providing medical cannabis therapies.

History of the Company

Our Company was incorporated under the laws of the province of British Columbia on October 14, 1987. On December 19, 2019, our company changed its name to "Adastra Labs Holdings Ltd." from "Arrowstar Resources Ltd." (our company prior to this change of name, "Arrowstar"). On March 19, 2021, our company changed its name to "Phyto Extractions Inc." from "Adastra Labs Holdings Ltd.". On April 9, 2021, our company completed a consolidation of its common shares (on the basis of one (1) post consolidated common share for every three (3) pre-consolidation shares). On September 1, 2021, our company changed its name to "Adastra Holdings Ltd." from "Phyto Extractions Inc.".

On December 20, 2019, Arrowstar acquired all of the issued and outstanding common shares of Adastra Labs Holdings (2019) Ltd. ("Adastra"), a private British Columbia cannabis extraction and processing solutions company incorporated on June 18, 2018. The transaction was accounted for as a reverse acquisition, with Adastra being identified as the accounting acquirer and the net assets of Arrowstar at the date of the transaction are deemed to have been acquired by Adastra. At the time of the transaction, we changed our financial year end from April 30 to December 31.

On August 31, 2021, we acquired all of the issued and outstanding common shares of 1225140 B.C. Ltd., doing business as PerceiveMD, (“PerceiveMD”), pursuant to the terms of a share purchase agreement dated August 10, 2021. PerceiveMD owns a private British Columbia research-based multidisciplinary center for medical cannabis and other therapies. We intend to employ physicians and other healthcare professionals at our clinics related to the operations of PerceiveMD who will provide consultations to patients regarding the benefits of using cannabis-based products. Patients will be seen by a licensed physician and prescribed cannabis-based products.

At this time, we cannot fulfill any prescriptions ourselves as we do not hold the medical licence required from Health Canada and the College of Physicians and Surgeons. Instead, the prescription will be fulfilled by a licensed producer. We are preparing documents for the medical licence application, which will be submitted shortly, and we expect this to be approved in approximately three months. We are confident that our application will be successful, however, if, in the unlikely event, we are unsuccessful in this application we will continue to operate under our current model with prescriptions fulfilled by a licensed producer.

On September 17, 2021, we acquired all of the issued and outstanding common shares of 1204581 B.C. Ltd. ("1204581BC") pursuant to the terms of a share purchase agreement dated September 15, 2021. 1204581BC is the owner of intellectual property rights for the Phyto Extractions Brand.

Development of the Company

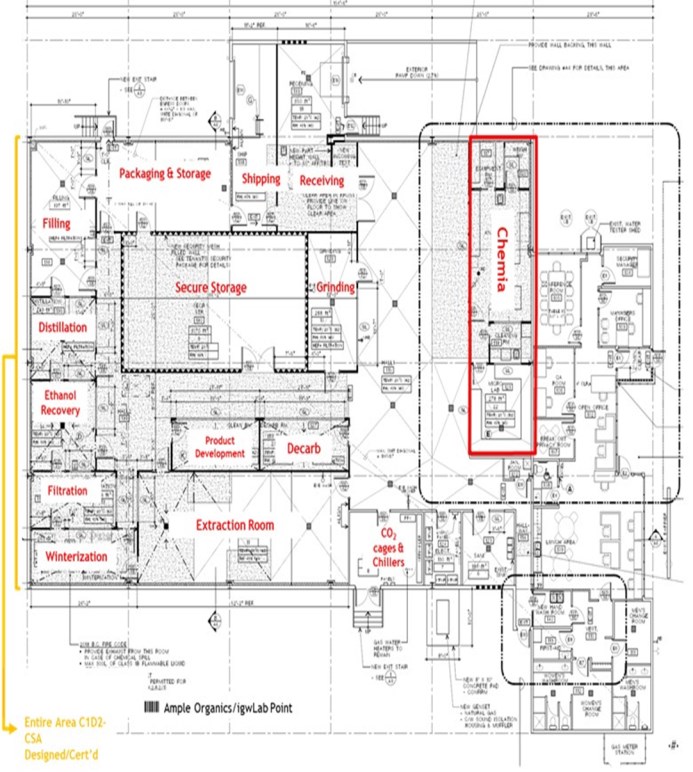

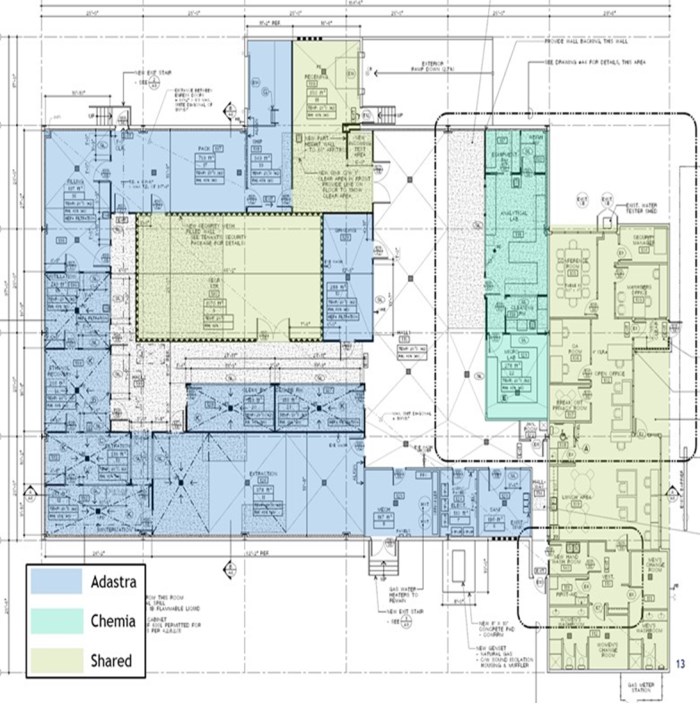

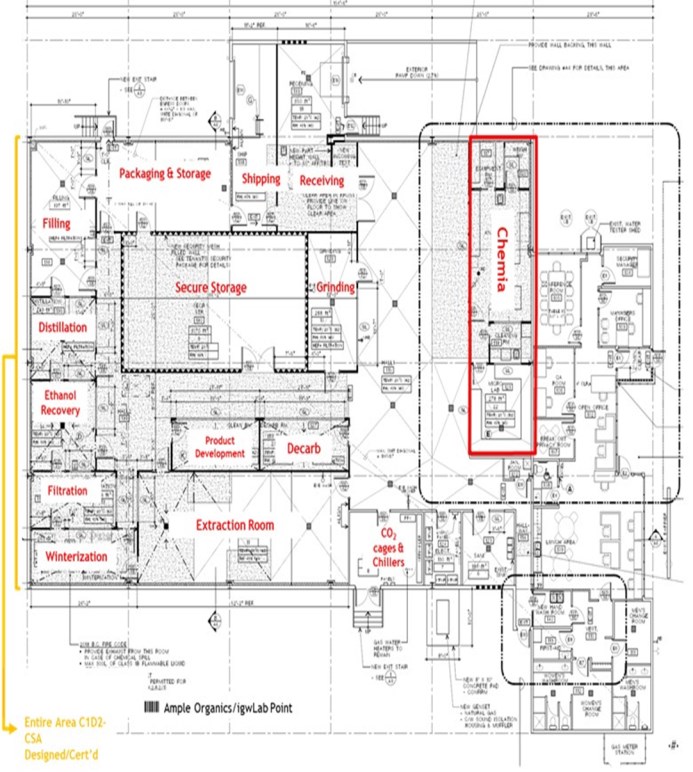

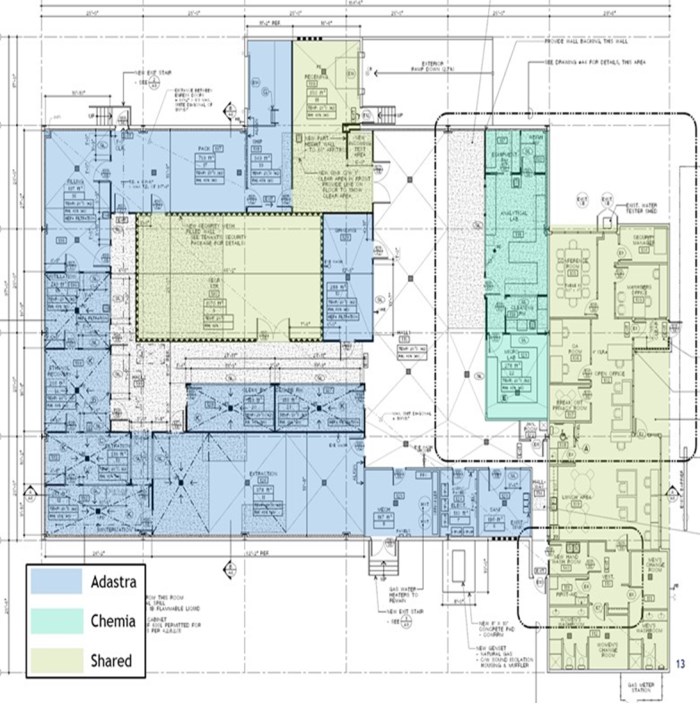

On October 18, 2018, Adastra submitted applications with Health Canada for the licenses under "An Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts" (the "Cannabis Act"), which licenses will designate Adastra and Chemia Analytics Inc. ("Chemia"), a wholly owned subsidiary of Adastra, as a licensed processor and a licensed cannabis tester, respectively.

On January 9, 2019, Adastra entered into a lease agreement with 1178562 B.C. Ltd., the holder of the property. On June 12, 2019, Adastra acquired all of the shares of 1178562 B.C. Ltd.

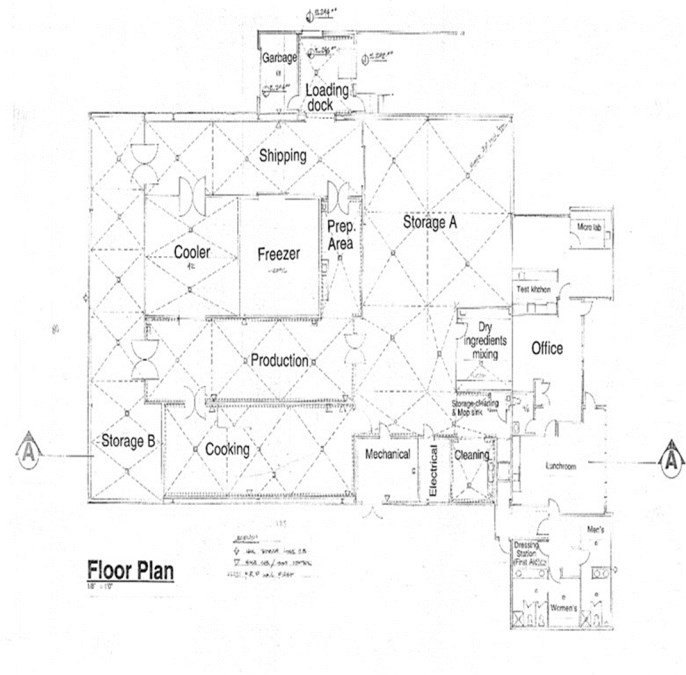

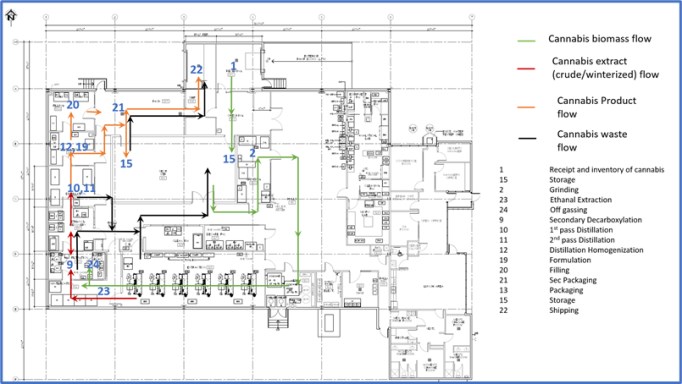

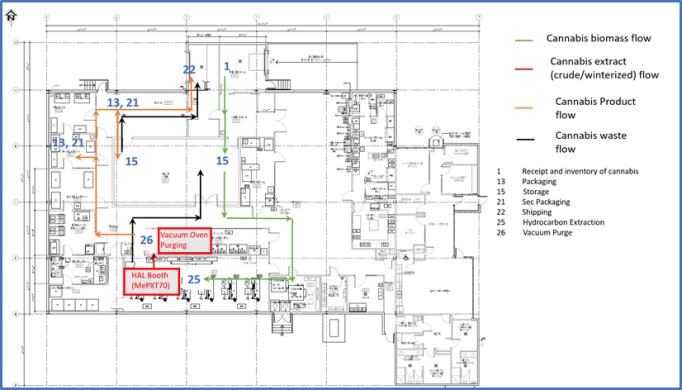

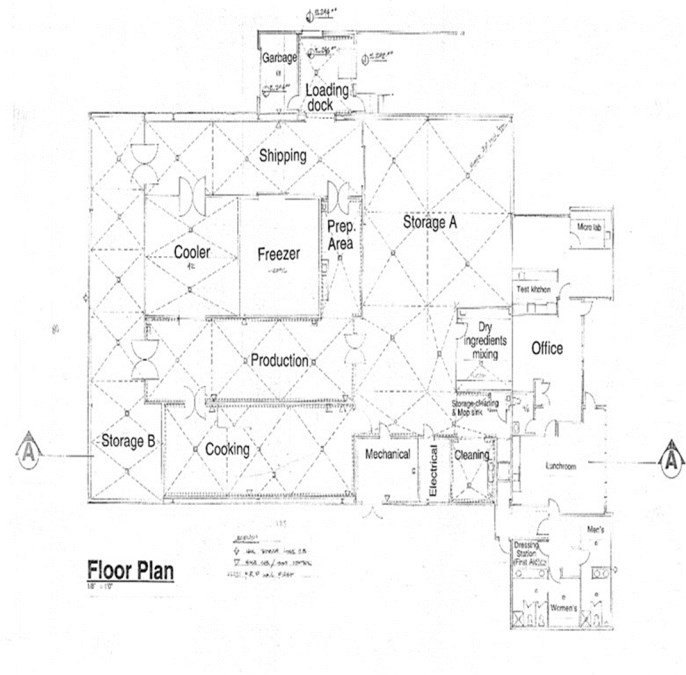

In mid-February 2019, Adastra finalized its plans for the retrofit of the building located at 5451 275th Street, Langley, British Columbia V4W 3X8, Canada (the "Facility"). In late February/early March 2019, Adastra submitted materials to the Township of Langley for re-zoning and commenced the retrofit of the Facility. On March 15, 2019, Adastra completed demolition and re-insulation of the Facility. On April 14, 2019, Adastra received unanimous Township of Langley Council approval to proceed with rezoning of the Facility. On May 10, 2019, Adastra received a status letter from Health Canada advising that there are no critical concerns at this time. On May 27, 2019, Adastra received final approval from the Township of Langley for re-zoning of the Facility. On June 10, 2019, Adastra had commenced the post-demolition portion of the retrofit of the Facility. In late November 2019, Adastra completed the retrofit of the Facility and on December 2, 2019, Adastra submitted its evidence package for its Cannabis (processing, sales) license application to Health Canada.

On October 25, 2019, Chemia received its analytical testing license from Health Canada. On March 16, 2020, Health Canada issued a Standard Processing License on the Facility to Adastra. Health Canada issued an Analytical Testing License to our facility owned by Chemia. The license became effective March 17, 2020. We received an amendment to our Standard Processing License authorizing the sale of cannabis extract, cannabis edibles and cannabis topicals on March 13, 2021, and our research license for organoleptic testing on April 16, 2021.

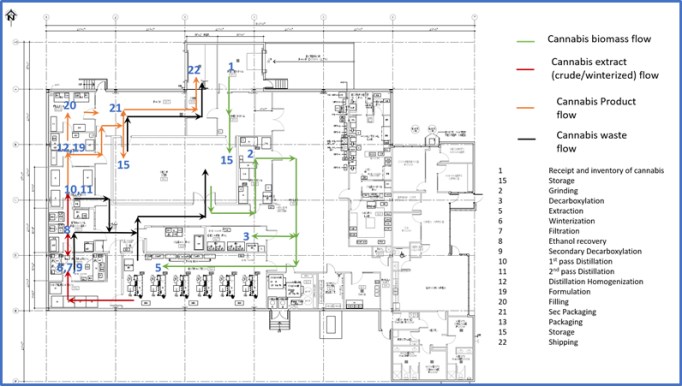

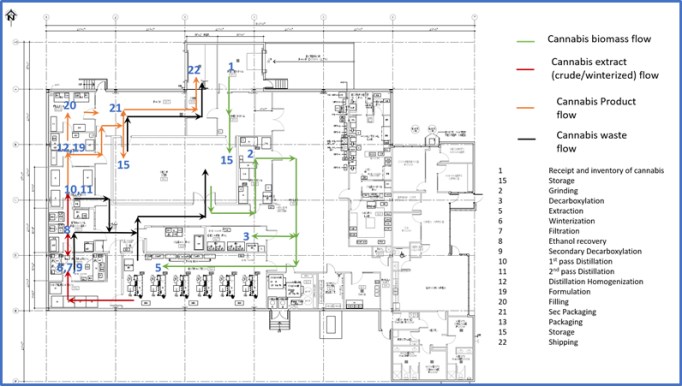

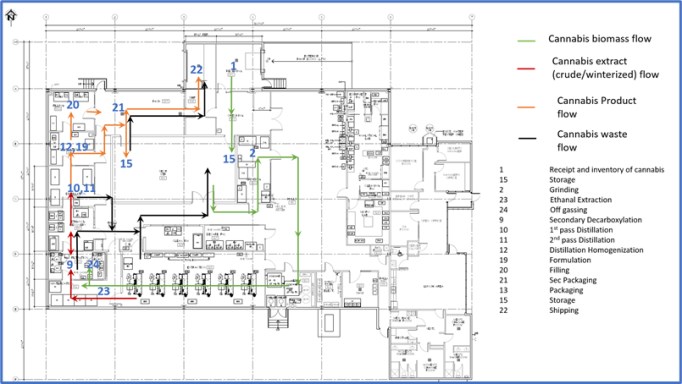

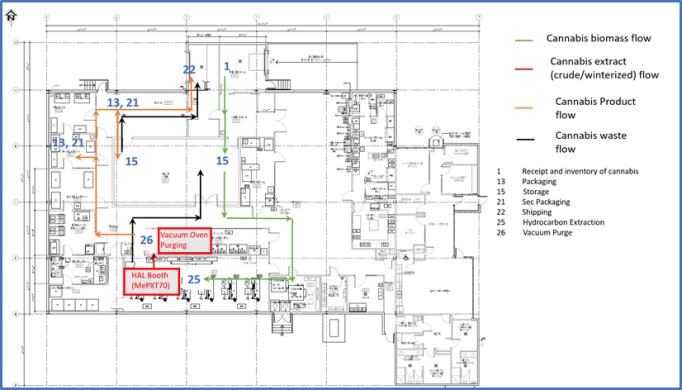

B. Business Overview

We are an integrated Canadian cannabis company focused on extraction and associated analytical testing. We, through one of our wholly owned subsidiaries, have a license to produce cannabis extracts under the Cannabis Act (LIC-SRIM66H586-2020). In addition, we, through one of our wholly owned subsidiaries, have been granted a license by Health Canada to conduct analytical testing for the cannabis industry (LIC-WOUX7802CE-2019). The Facility is a purpose-built facility with a view to be in compliance with European Union ("EU") Good Manufacturing Practices ("GMP") standards, which will allow us, subject to obtaining any necessary permits to export the products from the Facility to international destinations where cannabis is nationally legal for medical or adult usage purposes. We intend to export only to authorized recipients / countries - initially the EU for medical cannabis extracts once GMP accredited. There will be no US exports unless there is a change in US federal law. The Facility was completed in the quarter ended March 31, 2020 and became operational in April 2020.

Cannabis

The terms cannabis and marijuana are used interchangeably in Canada. The two main types of cannabis/marijuana are the Sativa and Indica plants, with hybrid strains being created when the genetics of each are crossed. Within each type of cannabis, there are hundreds of different phytochemical compounds, including many different cannabinoids (the most common being detla-9-tetrahydrocannabinol ("THC")), which is the psychoactive ingredient, and cannabidiol ("CBD"), which is responsible for many of the non-psychoactive effects of medical marijuana.

Cannabis can be used for either recreational or medicinal purposes and typically comes in the form of dried plant, powder form, resin or oil. Cannabis for medical use was legalized in Canada in 2001. Cannabis for recreational use was legalized in Canada in 2018.

Regulatory Framework

Cannabis was legalized in Canada for medicinal use in 2001 and has been a commonly prescribed medication since then. The production, distribution and sale of medicinal and adult-use cannabis is tightly controlled by the Canadian federal government. In 2013, Health Canada introduced the commercial cannabis licensed producer program under the Marijuana for Medical Purposes Regulations ("MMPR") program. In 2015, the Supreme Court of Canada found certain elements of the MMPR unconstitutional which led to the development of the "ACMPR" (Access to Cannabis for Medical Purposes Regulations), specifically medical cannabis patients having the right to use oils and derivative forms of cannabis. In August 2016, the MMPR was replaced by the ACMPR. The ACMPR program as it relates to commercial production is very similar to the MMPR.

The Canadian federal Cannabis Act came into force on October 17, 2018, to create a new legal regime for non-medicinal, or recreational, cannabis and to continue the legal regime for medicinal cannabis. Medicinal cannabis continues to be subject to different rules than recreational cannabis. The production and sale of medicinal cannabis is governed strictly by the federal government, whereas the regime for recreational cannabis is created by federal, provincial and municipal regulations.

The federal government regulates cannabis through the Cannabis Act, and governs the rules and regulations regarding:

● Minimum legal age requirement for recreational cannabis customers.

● Types of cannabis products available for sale. The sale of certain amounts of dried cannabis, fresh cannabis, cannabis oils, cannabis plants and cannabis plant seeds are legal as of October 17, 2018. Edibles containing cannabis and cannabis concentrates became legally available for sale October 17, 2019.

● Packaging and labelling requirements for products.

● Restrictions on promotional activities, displays and dispensing.

● Legalization of possession in public of 30 grams or less of dried cannabis, or the equivalent amount of other legal types of cannabis products, for someone 18 years of age or older, while maintaining a criminal offence for possession of more than that amount.

● Legalization of growing up to four cannabis plants in a private residence, while maintaining offences for having more than that or having them in a public place.

● Creating a licensing regime and requirements for the commercial production of cannabis and its wholesale sale to provincial and territorial distributors.

● Authorizing the provinces and territories to each legislate to create a new regulatory regime in their respective jurisdictions for the distribution and sale of recreational cannabis to persons 18 years of age or older.

● Maintaining offences for production, distribution or selling of cannabis outside of the newly regulated cannabis industry (with some exceptions).

● Continuing the separate legal regime for growing and selling medicinal cannabis to medical patients.

Under the regime created by the Cannabis Act, the federal government licenses and regulates the growing, processing and production of cannabis products for commercial purposes, and each province and territory controls the distribution and sale of recreational cannabis in their jurisdiction. Each jurisdiction is adopting unique legislation to address these issues. Only cannabis products that are grown or produced by a federally licensed producer may be sold or purchased in the provinces and territories. The distribution model of each province will not adversely affect our company as a business-to-business provider.

Each provincial or territorial government is responsible for its own regime for the distribution and sale of recreational cannabis in its jurisdiction. For example, in Saskatchewan, retail cannabis is sold by private retailers, in Quebec, by a government-operated public entity and, in British Columbia, by a combination of public and private retailers. Each province and territory also has the power to add, within its jurisdiction, more restrictive regulations from some of those in the federal legislation, including:

● Lowering the limit of cannabis permissible for personal recreational possession and consumption.

● Adding any rules and regulations to those for home grown recreational cannabis.

● Restricting the consumption of recreational cannabis in public spaces.

● Raising the minimum age for possession and consumption of cannabis.